Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Labelbox, a provider of services to create, manage and maintain data sets for machine learning applications, has raised $10 million in a new round of funding.

The financing came from Gradient Ventures, Google’s AI-focused venture fund, with participation from previous investors Kleiner Perkins, First Round Capital and Sumon Sadhu, an angel investor.

Labelbox manages the process of outsourcing data labeling for organizations and provides toolkits for companies or organizations to manage the data they’re receiving and ensuring the quality of that data, according to chief executive Manu Sharma.

For the Labelbox founders — Sharma; Dan Rasmuson, the company’s chief technology officer; and Brian Rieger, the chief operating officer — the tools they developed are simply an extension of the services they’d needed at their previous employers — companies like DroneDeploy, Planet Labs and Boeing.

Financing from the round will be used to double the size of its team from 11 employees to 22, and build out its sales and marketing teams.

Labelbox counts around 50 customers for its service and charges them based on the volume of data that companies upload and the breadth of services they use, Sharma said. Some named customers include FLIR Systems, Lytx, Airbus, Genius Sports and KeepTruckin.

As we’d reported when Labelbox launched from stealth last year, anyone can use the company’s toolkit for free. Companies are charged once they hit a certain usage threshold. Lytx, for instance, uses Labelbox for its DriveCam, a system installed on half a million trucks with cameras that use AI to detect unsafe driver behavior so they can be coached to improve. And the media and publishing giant Conde Nast is using Labelbox to match runway fashion to related items in their archive of content.

“Labelbox substantially reduces model development times and empowers data science teams to build great machine learning applications,” said Sharma in a statement. “With the new funding, Labelbox will continue to double down on bringing data labeling infrastructure to the machine learning teams with powerful automation, collaboration, and enterprise-grade features.”

Gradient Ventures was interested enough in the technology to invest, and sees promise in the company’s ability to support the development of machine learning tools globally.

“Labelbox is well-positioned to fuel the industrialization of machine learning across many sectors, such as manufacturing, transportation and healthcare. In doing so, they will unlock the potential of AI for companies across the globe,” said Anna Patterson, founder and managing partner at Gradient Ventures.

Powered by WPeMatico

Jumbo could be a nightmare for the tech giants, but a savior for the victims of their shady privacy practices.

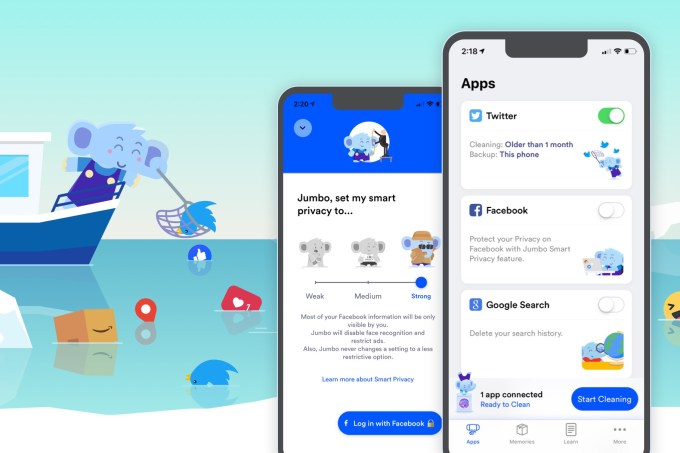

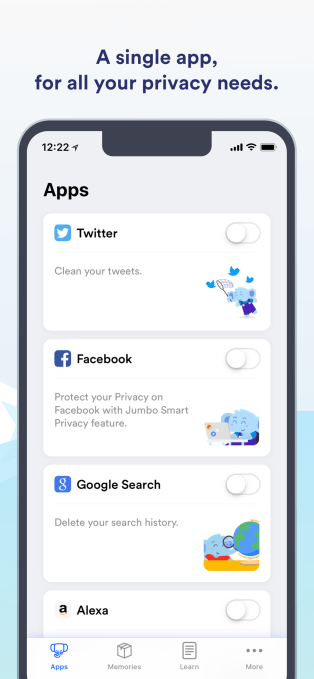

Jumbo saves you hours as well as embarrassment by automatically adjusting 30 Facebook privacy settings to give you more protection, and by deleting your old tweets after saving them to your phone. It can even erase your Google Search and Amazon Alexa history, with clean-up features for Instagram and Tinder in the works.

The startup emerges from stealth today to launch its Jumbo privacy assistant app on iPhone (Android coming soon). What could take a ton of time and research to do manually can be properly handled by Jumbo with a few taps.

The question is whether tech’s biggest companies will allow Jumbo to operate, or squash its access. Facebook, Twitter and the rest really should have built features like Jumbo’s themselves or made them easier to use, since they could boost people’s confidence and perception that might increase usage of their apps. But since their business models often rely on gathering and exploiting as much of your data as possible, and squeezing engagement from more widely visible content, the giants are incentivized to find excuses to block Jumbo.

The question is whether tech’s biggest companies will allow Jumbo to operate, or squash its access. Facebook, Twitter and the rest really should have built features like Jumbo’s themselves or made them easier to use, since they could boost people’s confidence and perception that might increase usage of their apps. But since their business models often rely on gathering and exploiting as much of your data as possible, and squeezing engagement from more widely visible content, the giants are incentivized to find excuses to block Jumbo.

“Privacy is something that people want, but at the same time it just takes too much time for you and me to act on it,” explains Jumbo founder Pierre Valade, who formerly built beloved high-design calendar app Sunrise that he sold to Microsoft in 2015. “So you’re left with two options: you can leave Facebook, or do nothing.”

Jumbo makes it easy enough for even the lazy to protect themselves. “I’ve used Jumbo to clean my full Twitter, and my personal feeling is: I feel lighter. On Facebook, Jumbo changed my privacy settings, and I feel safer.” Inspired by the Cambridge Analytica scandal, he believes the platforms have lost the right to steward so much of our data.

Valade’s Sunrise pedigree and plan to follow Dropbox’s bottom-up freemium strategy by launching premium subscription and enterprise features has already attracted investors to Jumbo. It’s raised a $3.5 million seed round led by Thrive Capital’s Josh Miller and Nextview Ventures’ Rob Go, who “both believe that privacy is a fundamental human right,” Valade notes. Miller sold his link-sharing app Branch to Facebook in 2014, so his investment shows those with inside knowledge see a need for Jumbo. Valade’s six-person team in New York will use the money to develop new features and try to start a privacy moment.

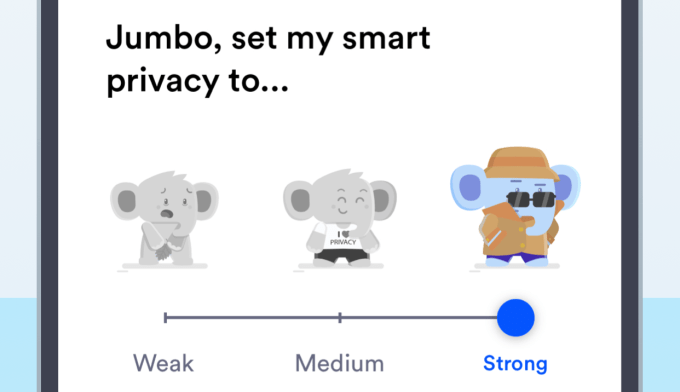

First let’s look at Jumbo’s Facebook settings fixes. The app asks that you punch in your username and password through a mini-browser open to Facebook instead of using the traditional Facebook Connect feature. That immediately might get Jumbo blocked, and we’ve asked Facebook if it will be allowed. Then Jumbo can adjust your privacy settings to Weak, Medium, or Strong controls, though it never makes any privacy settings looser if you’ve already tightened them.

Valade details that since there are no APIs for changing Facebook settings, Jumbo will “act as ‘you’ on Facebook’s website and tap on the buttons, as a script, to make the changes you asked Jumbo to do for you.” He says he hopes Facebook makes an API for this, though it’s more likely to see his script as against policies.

.

For example, Jumbo can change who can look you up using your phone number to Strong – Friends only, Medium – Friends of friends, or Weak – Jumbo doesn’t change the setting. Sometimes it takes a stronger stance. For the ability to show you ads based on contact info that advertisers have uploaded, both the Strong and Medium settings hide all ads of this type, while Weak keeps the setting as is.

The full list of what Jumbo can adjust includes Who can see your future posts?, Who can see the people?, Pages and lists you follow, Who can see your friends list?, Who can see your sexual preference?, Do you want Facebook to be able to recognize you in photos and videos?, Who can post on your timeline?, and Review tags people add to your posts the tags appear on Facebook? The full list can be found here.

For Twitter, you can choose if you want to remove all tweets ever, or that are older than a day, week, month (recommended), or three months. Jumbo never sees the data, as everything is processed locally on your phone. Before deleting the tweets, it archives them to a Memories tab of its app. Unfortunately, there’s currently no way to export the tweets from there, but Jumbo is building Dropbox and iCloud connectivity soon, which will work retroactively to download your tweets. Twitter’s API limits mean it can only erase 3,200 tweets of yours every few days, so prolific tweeters may require several rounds.

Its other integrations are more straightforward. On Google, it deletes your search history. For Alexa, it deletes the voice recordings stored by Amazon. Next it wants to build a way to clean out your old Instagram photos and videos, and your old Tinder matches and chat threads.

Across the board, Jumbo is designed to never see any of your data. “There isn’t a server-side component that we own that processes your data in the cloud,” Valade says. Instead, everything is processed locally on your phone. That means, in theory, you don’t have to trust Jumbo with your data, just to properly alter what’s out there. The startup plans to open source some of its stack to prove it isn’t spying on you.

While there are other apps that can clean your tweets, nothing else is designed to be a full-fledged privacy assistant. Perhaps it’s a bit of idealism to think these tech giants will permit Jumbo to run as intended. Valade says he hopes if there’s enough user support, the privacy backlash would be too big if the tech giants blocked Jumbo. “If the social network blocks us, we will disable the integration in Jumbo until we can find a solution to make them work again.”

But even if it does get nixed by the platforms, Jumbo will have started a crucial conversation about how privacy should be handled offline. We’ve left control over privacy defaults to companies that earn money when we’re less protected. Now it’s time for that control to shift to the hands of the user.

Powered by WPeMatico

There’s been a huge increase in the last decade of applications and services that rely on real-time notifications and other alerts as a core part of how they operate, and today one of the companies that powers those notifications is announcing a growth round. PubNub — an infrastructure-as-a-service provider that provides a real-time network to send and manage messaging traffic between companies, between companies and apps and between internet-of-things devices — has raised $23 million in a Series D round of funding to ramp up its business internationally, with an emphasis on emerging markets.

The round adds another strategic investor to PubNub’s cap table: Hewlett Packard Enterprise is coming on as an investor, joining in this round previous backers Sapphire Ventures (backed by SAP), Relay Ventures, Scale Venture Partners, Cisco Investments, Bosch and Ericsson.

Todd Greene, the CEO of PubNub (who co-founded it with Stephen Blum), said the startup is not disclosing its valuation with this round except to say that “we are happy with it, and it’s a solid increase on where we were the last time.” That, according to PitchBook, was just under $155 million back in 2016 in a small extension to its Series C round. The company has raised around $70 million to date.

PubNub’s growth — along with that of competing companies and technologies, which includes the likes of Pusher, RabbitMQ, Google’s Firebase and others — has come alongside the emergence of a number of use cases built on the premise of real-time notifications. These include a multitude of apps; for example, for on-demand commerce (e.g. ride hailing and online food ordering), medical services, entertainment services, IoT systems and more.

That’s pushed PubNub to a new milestone of enabling some 1.3 trillion messages per month for customers that include the likes of Peloton, Atlassian, athenahealth, JustEat, Swiggy, Yelp, the Sacramento Kings and Gett, who choose from some 70 SDKs to tailor what kinds of notifications and actions are triggered around their specific services.

Greene said that while some of the bigger services in the world have largely built their own messaging platforms to manage their notifications — Uber, for example, has taken this route — that process can result in “death by 1,000 paper cuts,” in Greene’s words. Others will opt for a PubNub-style alternative from the start.

“About 50 percent of our customers started by building themselves and then got to scale, and then decided to turn to PubNub,” Greene said.

It’s analogous to the same kind of decision businesses make regarding public cloud infrastructure: whether it makes sense to build and operate their own servers, or turn to a third-party provider — a decision that PubNub itself ironically is also in the process of contemplating.

Today the company runs its own business as an overlay on the public cloud, using a mixture of AWS and others, Greene said — the company has partnerships with Microsoft Azure, AWS, and IBM Watson — but “every year we evaluate the benefits of going into different kinds of data centres and interesting opportunities there. We are evaluating a cost and performance calculation,” he added.

And while he didn’t add it, that could potentially become an exit opportunity for PubNub down the line, too, aligning with a cloud provider that wanted to offer messaging infrastructure-as-a-service as an additional feature to customers.

The strategic relationship with its partners, in fact, is one of the engines for this latest investment. “Edge computing and realtime technologies will be at the heart of the next wave of technology innovation,” commented Vishal Lall, COO of Aruba, a Hewlett Packard Enterprise company, said in a statement. “PubNub’s global Data Stream Network has demonstrated extensive accomplishments powering both enterprise and consumer solutions. HPE is thrilled to be investing in PubNub’s fast-growing success, and to accelerate the commercial and industrial applications of PubNub’s real time platform.”

Powered by WPeMatico

The San Francisco-based startup Branch International, which makes small personal loans in emerging markets, has raised $170 million and announced a partnership with Visa to offer virtual, pre-paid debit cards to Branch client networks in Africa, South-Asia and Latin America.

Branch — which has 150 employees in San Francisco, Lagos, Nairobi, Mexico City and Mumbai — makes loans starting at $2 to individuals in emerging and frontier markets. The company also uses an algorithmic model to determine credit worthiness, build credit profiles and offer liquidity via mobile phones.

“We’ll use [the money] to deepen existing business in Africa. Later this year we’ll announce high-yield savings accounts…in Africa,” says Branch co-founder and chief executive Matt Flannery.

The $170 million round from Foundation Capital and its new debit card partner, Visa, will support Branch’s international expansion, which could include Brazil and Indonesia, according to Flannery. Branch launched in Mexico and India within the last year. In Africa, it offers its services in Kenya, Nigeria and Tanzania.

A potential Branch customer

The Branch-Visa partnership will allow individuals to obtain virtual Visa accounts with which to create accounts on Branch’s app. This gives Branch larger reach in countries such as Nigeria — Africa’s most populous country with 190 million people — where cards have factored more prominently than mobile money in connecting unbanked and underbanked populations to finance.

Founded in 2015, Branch started operating in Kenya, where mobile money payment products such as Safaricom’s M-Pesa (which does not require a card or bank account to use) have scaled significantly. M-Pesa now has 25 million users, according to sector stats released by the Communications Authority of Kenya. Branch has more than 3 million customers and has processed 13 million loans and disbursed more than $350 million, according to company stats.

Branch has one of the most downloaded fintech apps in Africa, per Google Play app numbers combined for Nigeria and Kenya, according to Flannery.

Already profitable, Branch International expects to reach $100 million in revenues this year, with roughly 70 percent of that generated in Africa, according to Flannery.

In addition to Visa and Foundation Capital, the $170 Series C round included participation from Branch’s existing investors Andreessen Horowitz, Trinity Ventures, Formation 8, the IFC, CreditEase and Victory Park, while adding new investors Greenspring, Foxhaven and B Capital.

Branch last raised $70 million in 2018. The company’s overall VC haul and $100 million revenue peg register as pretty big numbers for a startup focused primarily on Africa. Pan-African e-commerce startup Jumia, which also announced its NYSE IPO last month, generated $140 million in revenue (without profitability) in 2018.

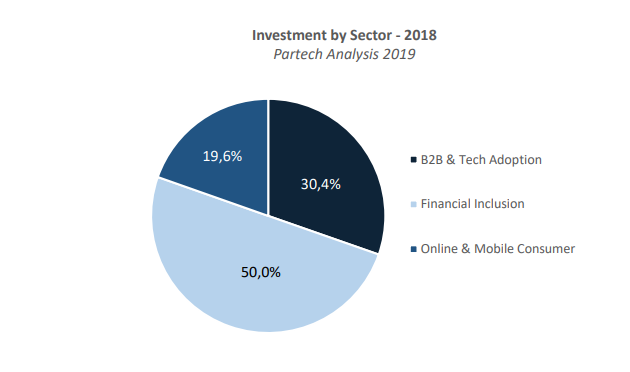

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Branch’s recent round and plans to add countries internationally also tracks a trend of fintech-related products growing in Africa, then expanding outward. This includes M-Pesa, which generated big numbers in Kenya before operating in 10 countries around the world. Nigerian payments startup Paga announced its pending expansion in Asia and Mexico late last year. And payment services such as Kenya’s SimbaPay have also connected to global networks like China’s WeChat.

Powered by WPeMatico

Tonal is today announcing its Series C financing that it hopes will allow the company to bring its at-home gym to even more homes. The funding round shows investors’ excitement around the new generation of personal exercise equipment that combines on-demand training with smart features. Tonal, like Peloton, offers features previously unavailable outside of gyms, and with this injection of capital, the company expects to build new personal features and invest in marketing and retail experiences.

L Catterton’s Growth Fund led the $45 million Series C round, which included investments from Evolution Media, Shasta Ventures, Mayfield, Sapphire Sport and others. This financing round brings the total amount raised to $90 million.

Tonal is based out of San Francisco and was founded by Aly Orady in 2015. The company launched its strength-training product in 2018. The wall-mounted Tonal uses electromagnetism to simulate and control weight, allowing the slender device to replicate (and replace) a lot of weight-lifting machines.

The Tonal machine costs $2,995, and for $49 a month, Tonal offers members access to personal training sessions, recommended programs and workouts. Since launching, CEO Orady tells TechCrunch there have been virtually no returns. He says their customer care teams proactively work with members to ensure a good experience.

Orady is excited to have L Catterton participating in this financing round, saying their deep network and unparalleled experience building premium fitness brands globally is an incredibly exciting new resource for the company. The Connecticut-based investment firm helped fund Peloton, ThirdLove, ClassPass and The Honest Company.

“As the fitness landscape continues to evolve, we have seen a clear shift toward personalized, content-driven, at-home workout experiences,” said Scott Dahnke, Global co-CEO of L Catterton in a released statement. “Tonal is the first connected fitness brand focused on strength training and represents an opportunity to invest behind an innovative concept with tremendous growth potential. We look forward to leveraging our deep knowledge of consumer behavior and significant experience in the connected fitness space to bring Tonal’s dynamic technology and content platform to more homes across the country.”

Tonal shares a market with Peloton, and Orady says a significant amount of Tonal owners also own Peloton equipment. Yet, feature-by-feature, Peloton and Tonal are different. While they’re both in-home devices that offer on-demand instructors, Peloton targets cardiovascular exercises while Tonal is a strength-training machine. Orady states his customers find the two companies offer complementary experiences.

“The common thread with our members is that they understand the value of investing in their fitness and overall health,” said Aly Orady, “All of our members are looking to take their fitness to the next level with strength training. Tonal offers the ability to strength train at home by providing a comprehensive, challenging full body workout without having to sacrifice quality for convenience.”

This is an enormous market he says the company can rely on for years to come. The majority of Tonal’s customers are between 30 and 55 years old and live in, or adjacent to, the top 10 major metro U.S. markets. There’s an even split, he says, between male and female members.

Tonal is similar to Mirror, another at-home, wall-mounted exercise device that costs $1,495. While Tonal focuses on strength training through resistance, Mirror offers yoga, boxing, Pilates and other exercises and activities with on-demand instruction and real-time stats. Mirror also launched in 2018 and the company has raised $40 million.

Going forward, Tonal expects to expand its software to provide new personalization features to its members. The hope is to build experiences that motivate users while serving up real-time feedback. This includes building new workout categories and additional fitness experiences, even when users travel and don’t have access to their Tonal machine.

The company sees it expanding its retail and marketing presence. Right now, just eight months after the product’s debut, customers have very limited access to try the Tonal machine. It’s only on display at Tonal’s flagship San Francisco store and is coming to a pop-up store in Newport Beach, Calif.

Orady tells TechCrunch the company needs new talent to help the company achieve its mission. Tonal is hiring and looking to hire in hardware, software, design, video production and marketing.

At-home exercise equipment is a massive market, and Tonal offers a unique set of features and advantages that should allow it to stand apart from competitors. This isn’t just another treadmill. Tonal is a strength-training super machine the size of a thick HDTV. Challenges abound, but the company seemingly has a solid plan to utilize its latest round of financing that should allow it to reach more customers and show them why the Tonal machine is worth the cost.

Powered by WPeMatico

We profiled HyperSciences in February, when the team had just successfully completed a launch milestone for a small business grant with NASA. The last time we checked in, the hypersonic drilling company had raised about $5 million as part of an untraditional Reg A offering. By the end of March, HyperSciences rounded out its first major round with $9.6 million from 3,552 individual investors on SeedInvest in the equity crowdfunding platform’s second largest raise to date.

The heart of HyperSciences’ work is its hypersonic propulsion system that can fire a projectile at five times the speed of sound. At its most simplistic, HyperSciences’ hypersonic engine can fire upward to power suborbital space launches (HyperDrone) and point downward to penetrate deep pockets of geothermal energy, for example (HyperDrill).

Rather than going the normal venture capital route, HyperSciences decided to raise from regular people who believed in its vision. The way the company sees it, traditional VC would have likely forced HyperSciences to narrow its mission.

“Reg A lets everyone who cares about our planned hypersonic future vote with their checkbook,” HyperSciences founder and CEO Mark Russell told TechCrunch. “I think that’s important.” Russell comes from a family-run mining business and is no stranger to the challenges of a public company.

“I’ve learned a lot from running ops in the back offices,” Russell said. “Based on our public company experiences, we do like that the SEC Reg A process has a clear path to taking your company to the public markets as the next step in the process.”

With infusions of $125,000 from NASA’s Small Business Innovation Research grant and $1 million from Shell’s Global’s GameChanger program, HyperSciences is happy to bounce between research grants with a boost from the Reg A’s special form of “mini-IPO” in order to maintain its autonomy for the time being.

Russell explained that the Reg A’s intensive SEC process requires a fair level of maturity from a company — and enough capital to jump through all the hoops. “You’re not typically a seller of t-shirts in Reg A crowd financing,” Russell said.

HyperSciences’ next milestone will come in May when the company will demo its drilling tech in a field test for Shell. The company plans to leverage its new funding for additional future field testing, pushing its existing business plan forward and moving toward sustainability.

“Our investors are more like smart ‘crowd VCs.’ They’re generally are pretty savvy and see that we went through a stringent process to get here,” Russell said. “We’ve provided them with enough information to make a great decision.”

Powered by WPeMatico

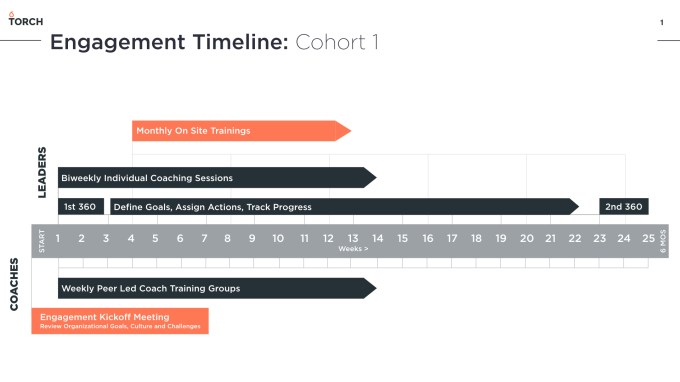

When everyone always tells you “yes,” you can become a monster. Leaders especially need honest feedback to grow. “If you look at rich people like Donald Trump and you neglect them, you get more Donald Trumps,” says Torch co-founder and CEO Cameron Yarbrough about our gruff president. His app wants to make executive coaching (a polite word for therapy) part of even the busiest executive’s schedule. Torch conducts a 360-degree interview with a client and their employees to assess weaknesses, lays out improvement goals and provides one-on-one video chat sessions with trained counselors.

“Essentially we’re trying to help that person develop the capacity to be a more loving human being in the workplace,” Yarbrough explains. That’s crucial in the age of “hustle porn,” where everyone tries to pretend they’re working all the time and constantly “crushing it.” That can leave leaders facing challenges feeling alone and unworthy. Torch wants to provide a private place to reach out for a helping hand or shoulder to cry on.

Now Torch is ready to lead the way to better management for more companies, as it’s just raised a $10 million Series A round led by Norwest Venture Partners, along with Initialized Capital, Y Combinator and West Ventures. It already has 100 clients, including Reddit and Atrium, but the new cash will fuel its go-to market strategy. Rather than trying to democratize access to coaching, Torch is doubling-down on teaching founders, C-suites and other senior executives how to care… or not care too much.

“I came out of a tough family myself and I had to do a ton of therapy and a ton of meditation to emerge and be an effective leader myself,” Yarbrough recalls. “Philosophically, I care about personal growth. It’s just true all the way down to birth for me. What I’m selling is authentic to who I am.”

Torch’s co-founders met when they were in grad school for counseling psychology degrees, practicing group therapy sessions together. Yarbrough went on to practice clinically and start Well Clinic in the Bay Area, while Keegan Walden got his PhD. Yarbrough worked with married couples to resolve troubles, and “the next thing I know I was working with high-profile startup founders, who like anybody have their fair share of conflicts.”

Torch co-founders (from left): Cameron Yarbrough and Keegan Walden

Coaching romantic partners to be upfront about expectations and kind during arguments translated seamlessly to keep co-founders from buckling under stress. As Yarbrough explains, “I was noticing that they were consistently having problems with five different things:

1. Communication – Surfacing problems early with kindness

2. Healthy workplace boundaries – Making sure people don’t step on each others’ toes

3. How to manage conflict in a healthy way – Staying calm and avoiding finger-pointing

4. How to be positively influential – Being motivational without being annoying or pushy

5. How to manage one’s ego, whether that’s insecurity or narcissism – Seeing the team’s win as the first priority

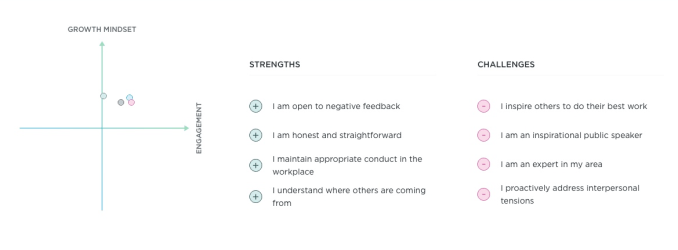

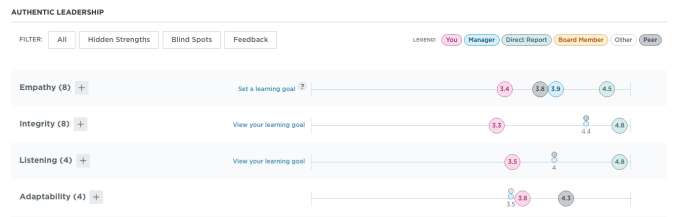

To address those, companies hire Torch to coach one or more of their executives. Torch conducts extensive 360-degree interviews with the exec, as well as their reports, employees and peers. It seeks to score them on empathy, visionary thinking, communication, conflict, management and collaboration, Torch then structures goals and improvement timelines that it tracks with follow-up interviews with the team and quantifiable metrics that can all be tracked by HR through a software dashboard.

To make progress on these fronts, execs do video chat sessions through Torch’s app with coaches trained in these skills. “These are all working people with by nature very tight schedules. They don’t have time to come in for a live session so we come to them in the form of video,” Yarbrough tells me. Rates vary from $500 per month to $1,500 per month for a senior coach in the U.S., Europe, APAC or EMEA, with Torch scoring a significant margin. “We’re B2B only. We’re not focused on being the most affordable solution. We’re focused on being the most effective. And we find that there’s less price sensitivity for senior leaders where the cost of their underperformance is incredibly high to the organization.” Torch’s top source of churn is clients’ going out of business, not ceasing to want its services.

Here are two examples of how big-wigs get better with Torch. “Let’s say we have a client who really just wants to be liked all the time, so much so that they have a hard time getting things done. The feedback from the 360 would come back like ‘I find that Cameron is continually telling me what I want to hear but I don’t know what the expectations are of me and I need him to be more direct,’ ” Yarbrough explains. “The problem is those leaders will eventually fire those people who are failing, but they’ll say they had no idea they weren’t performing because he never told them.” Torch’s coaches can teach them to practice tough-love when necessary and to be more transparent. Meanwhile, a boss who storms around the office and “is super-direct and unkind” could be instructed on how to “develop more empathic attunement.”

Yarbrough specifically designed Torch’s software to not be too prescriptive and leave room for the relationship between the coach and client to unfold. And for privacy, coaches don’t record notes and HR only sees the performance goals and progress, not the content of the video chats. It wants execs to feel comfortable getting real without the worry their personal or trade secrets could leak. “And if someone is bringing in something about trauma or that’s super-sensitive about their personal life, their coach will refer them out to psychotherapists,” Yarbrough assures me.

Torch’s direct competition comes from boutique executive coaching firms around the world, while on the tech side, BetterUp is trying to make coaching scale to every type of employee. But its biggest foe is the stubborn status quo of stiff-upper-lipping it.

The startup world has been plagued by too many tragic suicides, deep depression and paralyzing burnout. It’s easy for founders to judge their own worth not by self-confidence or even the absolute value of their accomplishments, but by their status relative to yesterday. That means one blown deal, employee quitting or product delay can make an executive feel awful. But if they turn to their peers or investors, it could hurt their partnership and fundraising prospects. To keep putting in the work, they need an emotional outlet.

“We ultimately have to create this great software that super-powers human beings. People are not robots yet. They will be someday, but not yet,” Yarbrough concludes with a laugh. IQ alone doesn’t make people succeed. Torch can help them develop the EQ, or emotional intelligence quotient, they need to become a boss that’s looked up to.

Powered by WPeMatico

Pixeom, a startup that offers a software-defined edge computing platform to enterprises, today announced that it has raised a $15 million funding round from Intel Capital, National Grid Partners and previous investor Samsung Catalyst Fund. The company plans to use the new funding to expand its go-to-market capacity and invest in product development.

If the Pixeom name sounds familiar, that may be because you remember it as a Raspberry Pi-based personal cloud platform. Indeed, that’s the service the company first launched back in 2014. It quickly pivoted to an enterprise model, though. As Pixeom CEO Sam Nagar told me, that pivot came about after a conversation the company had with Samsung about adopting its product for that company’s needs. In addition, it was also hard to find venture funding. The original Pixeom device allowed users to set up their own personal cloud storage and other applications at home. While there is surely a market for these devices, especially among privacy-conscious tech enthusiasts, it’s not massive, especially as users became more comfortable with storing their data in the cloud. “One of the major drivers [for the pivot] was that it was actually very difficult to get VC funding in an industry where the market trends were all skewing towards the cloud,” Nagar told me.

At the time of its launch, Pixeom also based its technology on OpenStack, the massive open-source project that helps enterprises manage their own data centers, which isn’t exactly known as a service that can easily be run on a single machine, let alone a low-powered one. Today, Pixeom uses containers to ship and manage its software on the edge.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

What sets Pixeom apart from other edge computing platforms is that it can run on commodity hardware. There’s no need to buy a specific hardware configuration to run the software, unlike Microsoft’s Azure Stack or similar services. That makes it significantly more affordable to get started and allows potential customers to reuse some of their existing hardware investments.

Pixeom brands this capability as “software-defined edge computing” and there is clearly a market for this kind of service. While the company hasn’t made a lot of waves in the press, more than a dozen Fortune 500 companies now use its services. With that, the company now has revenues in the double-digit millions and its software manages more than a million devices worldwide.

As is so often the case in the enterprise software world, these clients don’t want to be named, but Nagar tells me they include one of the world’s largest fast food chains, for example, which uses the Pixeom platform in its stores.

On the software side, Pixeom is relatively cloud agnostic. One nifty feature of the platform is that it is API-compatible with Google Cloud Platform, AWS and Azure and offers an extensive subset of those platforms’ core storage and compute services, including a set of machine learning tools. Pixeom’s implementation may be different, but for an app, the edge endpoint on a Pixeom machine reacts the same way as its equivalent endpoint on AWS, for example.

Until now, Pixeom mostly financed its expansion — and the salary of its more than 90 employees — from its revenue. It only took a small funding round when it first launched the original device (together with a Kickstarter campaign). Technically, this new funding round is part of this, so depending on how you want to look at this, we’re either talking about a very large seed round or a Series A round.

Powered by WPeMatico

There’s no shortage of so-called femtech startups raising money right now, and little wonder why.

Aside from the growing market opportunity — the global fertility services market is expected to reach $31 billion by 2023, says the consultancy Allied Market Research, nearly double where it stood in 2016 — more women are clamoring for information about their reproductive health, and 15-minute doctor visits aren’t doing the trick.

The newest recipient of venture dollars: NextGen Jane, a 4.5-year-old, Oakland, Calif.-based company that’s hoping to use blood wrung from tampons to find early markers of endometriosis and, later, if all goes well, cervical cancer and other disorders.

The company disclosed just today that it has secured $9 million in Series A funding led by Material Impact, a new fund focused on materials technology that we reported on last November. Other participants in the round include Access Industries, Viking Global Investors, Liminal Ventures and numerous notable angels, including PhDs from Harvard Medical School and Stanford University.

Its approach is far more palatable than the option women have long suffered, which is to have a small camera inserted into their pelvic cavity in search of endometrial cells. (Note: Women typically wind up in this position only after enduring bewildering pain that drives them to see their doctors.) The idea with NextGen Jane instead is for a custom-made tampon to be worn for roughly two hours, placed inside a test tube as part of a home kit and sent to a lab for further analysis.

Of course, it needs to work first, and the technology hasn’t been approved by the FDA. In fact, it hasn’t been proven at all.

The funding could, potentially, make the difference. In an interview with Technology Review last month, NextGen CEO and co-founder Ridhi Tariyal said that a clinical trial is designed and ready to go, but that NextGen Jane needed capital to run a trial on roughly 800 women in order to establish the diagnostic efficacy of menstrual blood. With funding, she’d said, it would take the company about two years to collect a meaningful amount of data.

Reproductive specialists seem torn generally on the trend of startups producing home kits aimed at helping women understand their fertility. While they see some value in the information they provide, they also fear that even home kits that have already been proven to accomplish their intended goal, such as measuring anti-Müllerian hormone, or AMH, may confuse women as much as they help them.

NextGen Jane had previously raised $2.3 million in funding. Meanwhile, TechCrunch has been reporting extensively on the broader uptick in femtech investing. You can find a much deeper dive regarding who has raised what lately and why right here.

Powered by WPeMatico

Despite not being Brazilian and having their first exposure to the country only a few years ago, the two co-founders of Escale have managed to raise $22.6 million for their company, which provides customer acquisition services to companies in telecommunications and healthcare across Brazil.

Their secret? A knowledge of search engine optimization technologies honed through side businesses the two ran back in the United States.

The state of online marketing and digital sales was so woefully bad in Brazil that co-founders Matthew Kligerman and Ken Diamond had a green field in front of them on which to build Brazil’s first true online customer acquisition service, according to Diamond.

“We fell in love with Brazil for its warm culture and natural beauty, but as consumers, we had terrible experiences acquiring the most fundamental products and services for our new lives: internet, cell phone plans, health insurance and basic banking needs,” Kligerman said in a statement.

The company’s largest customer, according to Diamond, is NET, the Brazilian cable and telecom operator. NET was the first company to sign on for Escale’s customer acquisition services, but the company’s roster of clients now includes some of Brazil’s largest companies, including Bradesco, Sul America, Claro, GNDI and Amil.

It’s that marquee client list that attracted QED Investors and Invus Opportunities to co-lead the $22.6 million round that Escale just closed. The company’s previous investors, Kaszek Ventures, Rocket Internet’s GFC and Redpoint e.Ventures, also participated in the funding.

Latin America is in the throes of a startup renaissance at the moment, with Brazilian companies like Nubank and iFood and the Colombian company Rappi reaching billion-dollar valuations. Meanwhile investors are committing more capital to the region. SoftBank, for instance, is committing $5 billion to a new Latin American-focused fund.

With the new funding, Escale intends to move deeper into the development of customer acquisition platforms across verticals like consumer finance, insurance and education with comparison shopping sites and informational services (à la Credit Karma in the U.S.).

“With millions of web and cloud voice interactions every month, Escale can transform each of those interactions into data points, and continually improve its proprietary acquisition platform, ‘EscaleOS,’ to create highly-intelligent, customized marketing and sales funnels, helping consumers at the right moment connect with the products and services they need,” says Nicolas Berman, a partner at Kaszek Ventures. “The more consumer interactions they have, the faster Escale’s data flywheel spins.”

Powered by WPeMatico