Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The internet is often lauded for the potential to increase the impact of a range of primary services in emerging markets, including education, commerce, banking and healthcare. While many of those platforms are now being built, a few are finding that a hybrid approach combining online and offline is advantageous.

That’s exactly what Jio Health, a “full stack” (forgive the phrase) healthcare startup is bringing to consumers in Southeast Asia, starting in Vietnam.

The company started as a U.S.-based venture that worked with healthcare providers around the “Obamacare” initiative, before sensing the opportunity overseas and relocating to Vietnam, the Southeast Asian market of 95 million people and a fast-growing young population.

Today, it operates an online healthcare app and a physical facility in Saigon; it also has licenses for prescriptions and over the counter drug sales. The serviced launched nearly a year ago; already the company has some 130 staff, including 70 caregivers — including doctors — and a tech team of 30.

The idea is to offer services digitally, but also provide a physical location for when it is needed. Therein, the company ensures that “every element of that journey” is controlled and of the required standard; that’s in contrast to services that partner with hospitals or other care centers.

The scope of Jio Health’s services range from pediatrics to primary care, chronic disease management and ancillary services, which will soon cover areas like eye care, dermatology and cancer.

“Our initial research [before moving] found that healthcare in Vietnam was unlike the U.S.,” Raghu Rai, founder and CEO of Jio Health, told TechCrunch in an interview. “Spending is primarily driven by the consumer (out of pocket) and there’s no real digital infrastructure to speak of.”

Rai — a U.S. citizen — said doctors typically “have minutes per patient” and get through “hundreds” of consultations in every morning shift. That gave him an idea to make things more efficient.

“We can probably address north of 80 percent of consumers’ health needs,” he said of Jio Health,” but we also have referral partnerships with certain hospitals.”

Raghu Rai is CEO and founder of Jio Health

The process begins when a consumer downloads the Jio Health app and inputs primary information. A representative is then dispatched to visit the consumer in person, potentially within “hours” of the submission of information, according to Rai.

He believes that Jio Health can save its users money and time by using remote consultancy for many diagnoses. The company also works with health insurance companies for areas like annual checkups, and Rai said that McDonald’s and 7-Eleven are among the corporations that offer Jio Health among the providers for their staff; they’re not exclusive.

This week, Jio Health announced that it has closed a $5 million Series A funding from Southeast Asia’s Monk’s Hill Ventures . Rai said the company plans to use the capital for expansion. In particular, he said, the company is adding new care categories this month — including eye care and dermatology — and it is working toward expanding its brand through marketing.

Further down the line, Rai said the company hopes to expand to Hanoi before the end of this year. While there is interest in moving into other markets within Southeast Asia, that isn’t about to happen soon.

“We have begun to investigate other markets, but at this point feel the market in Vietnam is substantial in itself,” he told TechCrunch. “It’s very plausible that we’d be looking at international expansion plans in 2020… we’re going to be focused on Southeast Asia.”

Powered by WPeMatico

After years of fierce competition as private companies, Uber and Lyft are going public on U.S. markets. Scooter service providers, the transportation trend du jour, raised hundreds of millions of dollars to scatter scooters on city sidewalks (to the chagrin of residents and regulators alike) throughout 2017 and 2018. On the other side of the Pacific, Grab and Go-Jek are raising gobs of cash as they continue to scale upward and outward.

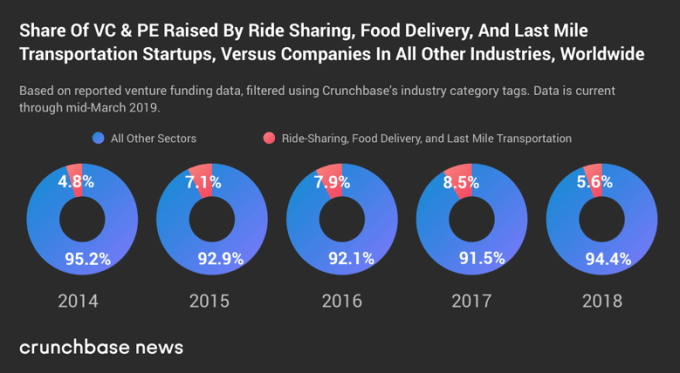

Of all the seed, early and late-stage venture funding raised over the past couple of years, how much of the total went to companies in the ride-hailing, food delivery and last-mile transportation categories (which encompasses bikes and scooters)? Probably not as much as you’d think.

Taken together, companies in these sectors raised less than 10 percent of the total venture dollar volume reported for each of the past five full calendar years.

We’ve charted it out based on yearly totals. Take a peek:

To be sure, we’re still talking about a lot of money here. Companies in these three categories raised more than $22 billion in venture funding rounds (not including private equity) in 2017 and more than $18 billion in 2018.

Ventures in the transportation space loom large in the media, and how could they not? It’s a forbiddingly capital-intensive market to play in, requiring companies to raise massive sums, which make for good headlines.

In its early years, competition between on-demand, point-to-point transportation marketplace companies rewarded brashness and speed with early scale and the long-term structural advantages conferred to first the firms which grew the fastest.

But those advantages may not have been as stiff as first expected. Lyft beat Uber to the public markets, raised its valuation during its IPO roadshow, priced at the top of its extended range and then popped 21 percent when it started trading.

That success means that the red chunks of our above chart weren’t all fool’s bets. Instead, a good chunk of the equity represented is now liquid. Of course, there’s a lot more work to do for literally every other ride-hailing, ridesharing, scooter-renting and other wheels-providing unicorns in the world: They still have to go public.

Powered by WPeMatico

Restaurant sales hit $825 billion last year in the U.S., but with margins averaging at only three to five percent per business, they’re always looking for an edge on efficiency and just generally running things in a smarter way. A startup called Toast, which has built a popular platform for restaurant management, has closed a hefty round of funding to double down on that opportunity to do that.

The company has raised $250 million on a valuation of $2.7 billion, money that it will use to invest in building technology to help restaurants with marketing, recruitment and operational efficiency, as well as start to think about expanding to more territories outside the U.S.

The basics of the funding were flagged earlier today by Prime Unicorn Index and we reached out to the company to confirm. It is being led by TCV and Tiger Global Management, with participation from Bessemer Venture Partners and T. Rowe Price Associates funds and other existing investors.

This Series E is a big bump up for the company: in its previous round in July 2018, the company was valued at $1.4 billion — partly the result of strong growth at the company. While it’s not disclosing revenue numbers or whether it is yet profitable, Toast currently serves tens of thousands of businesses — covering a range of sizes from independent venues to smaller chains — and in the last year tallied up transactions in the tens of billions of dollars, seeing growth of some 148 percent in its revenues, according to CFO Tim Barash.

The restaurant business represents a big opportunity for e-commerce companies, but there have been some notable stumbles where ambitions have not been met with success. Groupon, which spent several years acquiring and organically building a point of sale and restaurant management business, first drastically cut down and then finally called it quits and sold off its efforts, called Breadcrumb, in 2016. Amazon also pulled out of point of sale services (aimed at more than restaurants) and has in certain regions also pulled back on other restaurant efforts like its order management and delivery platform.

Barash said in an interview that he thinks the key to why Toast has steadily grown its business through all that is because a large proportion of its own employees — some 70 percent — have worked in the food service industry themselves.

“I was first a busboy, and then I worked in pizza delivery for years,” he said. “Seventy percent of our employees have worked at restaurants, including those in our product leadership, and that helps us understand the problem.”

Restaurants, as Barash points out, are complicated. “They are essentially manufacturers and retailers at the same time, all in one small physical footprint,” and so the key to building products for them is to understand that and the challenges they face in building and running those businesses.

And that’s before you consider the many other factors that can make restaurants a dicey game, from changing cuisine tastes, to changing eating habits — many get food delivered today — to the precariousness of the commercial real estate market and so much more.

The aim of Toast is to build tools to apply data science and orderly IT processes to address whichever of those variables that can be controlled by the restaurant.

Today, Toast’s products include point of sale services as well as reporting and analytics; display systems for kitchens; online ordering and delivery interfaces; and loyalty programs. It also builds its own hardware, which includes handheld order pads, payment and ordering terminals, self-service kiosks and displays for guests. It also offers links through to a network of some 100 partners, such as Grubhub for takeout food, when a restaurant does not cover those services or functions directly, to help stitch together services to work on its platform.

Tomorrow, the plan is to use the funding to enhance all of those with more advanced features that speak to some of the bigger issues and concerns Barash said its customers are voicing today.

That will include better and more services aimed at guest engagement and retention; better ways to recruit and keep people in an industry that has a high turnover of employees; and of course more tools to address how efficiently a business is operating to make it more profitable. The company has committed some $1 billion in the next five years to R&D to build more hardware and software.

Having access to this kind of tech and platform is a big deal, especially for independently owned places that hope to compete against bigger chains without having to compromise on their core competency: making unique and delicious food.

In the meantime, Barash said that while Toast itself is no stranger to approaches from larger players itself — he declined to say who but said many who have ambitions to do more business with the restaurant industry had approached it over the years — the company’s long-term vision is to grow bigger and remain its own boss.

It’s an ambition that has hit the spot with investors that have an appetite for high-growth businesses.

“At TCV, we invest in companies that have the potential to reshape entire industries. By providing restaurants of all sizes with access to innovative technology, Toast is leveling the playing field and leading the industry’s transition to the cloud,” said David Yuan, general partner at TCV, in a statement, who is joining the board with this round. “Our investment will enable Toast to extend their platform beyond point-of-sale and guest-facing technology, and in doing so, create a powerful SaaS platform with a superlative business model. We’re excited to partner with Toast as they accelerate the growth of the community they serve.”

Powered by WPeMatico

1stdibs began pushing the antiques business into the 21st century long ago. Apparently, investors think it can push further and faster with $76 million in new funding. That’s how much the now-18-year-old, New York-based company says it just closed on for its Series D round, led by T. Rowe Price Associates, with participation from earlier backers Index Ventures, Benchmark and Spark Capital.

The company now boasts a valuation of well over $500 million, it tells the WSJ. Other investors in the new round include Sofina Group, Foxhaven Asset Management, and Allen & Company, as well as Michael Zeisser, who is the former chairman of U.S. Investments for Alibaba Group, and Groupe Artémis, which owns the auction house Christie’s.

1stdibs has always been an interesting startup, one that’s both loved by the antiques dealers who use it, and, apparently, feared. When, in 2016, 1stdibs became heavier-handed about enforcing the commissions from each sale on its platform — and on which it relies for revenue — more than 30 dealers reportedly met at a design store in lower Manhattan to grouse about the development, complaining that the company had begun prizing revenue growth over its relationships.

Of course, with venture-capital funding — and the company has now collected $170 million altogether — comes expectations. And despite pushback from dealers, they’ve apparently stuck with the platform. 1stdibs says an average of 50 items sell for more than $5,000 on its platform daily, and that 15 of these are items that sell for more than $10,000. (A quick scan suggests a very wide range of prices, with many vintage items priced at $5,000 or less, but plenty with far richer tags, like a three-carat ruby and diamond ring available right now on the site for a cool $200,000, and a chandelier dating back to roughly 1870 and selling, someone is hoping, for more than $300,000.)

With venture funding comes competition, too. Though 1stdibs may be the doyen of the online antiques market, other, newer companies eyeing its traction have since emerged on the scene, many of which have also since raised venture funding and are also growing fast, including The RealReal, which was founded in 2011 and is reportedly weighing a public offering; and Chairish, founded in 2013, which sells vintage and used decor.

Chairish has raised just $16.7 million from investors to date. The RealReal has raised $288 million.

In fact, a fight for brand recognition in what’s become an increasingly crowded playing field as the U.S. population ages (and more antiques are dispersed into the world) may ultimately lead 1stdibs to follow a growing number of formerly online-only marketplaces now extending their reach into the offline world.

Though the company already has a New York location, in a block-long, late-19th-century warehouse called the Terminal Stores building, CEO David Rosenblatt tells the WSJ that using its new funding, more brick-and-mortar showrooms may be in its future.

Powered by WPeMatico

If you took the photos and videos out of pornography, could it appeal to a new audience? Caroline Spiegel’s first startup Quinn aims to bring some imagination to adult entertainment. Her older brother, Snapchat CEO Evan Spiegel, spent years trying to convince people his app wasn’t just for sexy texting. Now Caroline is building a website dedicated to sexy text and audio. The 22-year-old college senior tells TechCrunch that on April 13th she’ll launch Quinn, which she describes as “a much less gross, more fun Pornhub for women.”

TechCrunch checked out Quinn’s private beta site, which is pretty bare bones right now. Caroline tells us she’s already raised less than a million dollars for the project. But given her brother’s success spotting the next generation’s behavior patterns and turning them into beloved products, Caroline might find investors are eager to throw cash at Quinn. That’s especially true given she’s taking a contrarian approach. There will be no imagery on Quinn.

Caroline explains that “There’s no visual content on the site — just audio and written stories. And the whole thing is open source, so people can submit content and fantasies, etc. Everything is vetted by us before it goes on the site.” The computer science major is building Quinn with a three-woman team of her best friends she met while at Stanford, including Greta Meyer, though they plan to relocate to LA after graduation.

The idea for Quinn sprung from a deeply personal need. “I came up with it because I had to leave Stanford my junior year because I was struggling with anorexia and sexual dysfunction that came along with that,” Caroline tells me. “I started to do a lot of research into sexual dysfunction cures. There are about 30 FDA-approved drugs for sexual dysfunction for men but zero for women, and that’s a big bummer.”

She believes there’s still a stigma around women pleasuring themselves, leading to a lack of products offering assistance. Sure, there are plenty of porn sites, but few are explicitly designed for women, and fewer stray outside of visual content. Caroline says photos and videos can create body image pressure, but with text and audio, anyone can imagine themselves in a scene. “Most visual media perpetuates the male gaze … all mainstream porn tells one story … You don’t have to fit one idea of what a woman should look like.”

That concept fits with the startup’s name “Quinn,” which Caroline says one of her best guy friends thought up. “He said this girl he met — his dream girl — was named ‘Quinn.’ ”

Caroline took to Reddit and Tumblr to find Quinn’s first creators. Reddit stuck to text and links for much of its history, fostering the kinky literature and audio communities. And when Tumblr banned porn in December, it left a legion of adult content makers looking for a new home. “Our audio ranges from guided masturbation to overheard sex, and there’s also narrated stories. It’s literally everything. Different strokes for different for folks, know what I mean?” Caroline says with a cheeky laugh.

To establish its brand, Quinn is running social media influencer campaigns where “The basic idea is to make people feel like it’s okay to experience pleasure. It’s hard to make something like masturbation cool, so that’s a little bit of a lofty goal. We’re just trying to make it feel okay, and even more okay than it is for men.”

As for the business model, Caroline’s research found younger women were embarrassed to pay for porn. Instead, Quinn plans to run ads, though there could be commerce opportunities too. And because the site doesn’t bombard users with nude photos or hardcore videos, it might be able to attract sponsors that most porn sites can’t.

Until monetization spins up, Quinn has the sub-$1 million in funding that Caroline won’t reveal the source of, though she confirms it’s not from her brother. “I wouldn’t say that he’s particularly involved other than he’s one of the most important people in my life and I talk to him all the time. He gives me the best advice I can imagine,” the younger sibling says. “He doesn’t have any qualms, he’s very supportive.”

Quinn will need all the morale it can get, as Caroline bluntly admits, “We have a lot of competitors.” There’s the traditional stuff like Pornhub, user-generated content sites like Make Love Not Porn and spontaneous communities like on Reddit. She calls $5 million-funded audio porn startup Dipsea “an exciting competitor,” though she notes that “we sway a little more erotic than they do, but we’re so supportive of their mission.” How friendly.

Quinn’s biggest rival will likely be outdated but institutionalized site Literotica, which SimilarWeb ranks as the 60th most popular adult website, 631st most visited site overall, showing it gets 53 million hits per month. But the fact that Literotica looks like a web 1.0 forum yet has so much traffic signals a massive opportunity for Quinn. With rules prohibiting Quinn from launching native mobile apps, it will have to put all its effort into making its website stand out if it’s going to survive.

But more than competition, Caroline fears that Quinn will have to convince women to give its style of porn a try. “Basically, there’s this idea that for men, masturbation is an innate drive and for women it’s a ‘could do without it, could do with it.’ Quinn is going to have to make a market alongside a product and that terrifies me,” Caroline says, her voice building with enthusiasm. “But that’s what excites me the most about it, because what I’m banking on is if you’ve never had chocolate before, you don’t know. But once you have it, you start craving it. A lot of women haven’t experienced raw, visceral pleasure before, [but once we help them find it] we’ll have momentum.”

Most importantly, Quinn wants all women to feel they have rightful access to whatever they fancy. “It’s not about deserving to feel great. You don’t have to do Pilates to use this. You don’t have to always eat right. There’s no deserving with our product. Our mission is for women to be more in touch with themselves and feel fucking great. It’s all about pleasure and good vibes.”

Powered by WPeMatico

Drake’s latest collaboration isn’t with Kanye or Kendrick, it’s with Marissa Mayer.

The rap superstar has joined a bevy of Silicon Valley investors, including Strauss Zelnick, Comcast, Macro Ventures, Canaan, RRE, Courtside and Marissa Mayer, to fund Players’ Lounge, an esports startup looking to pit gamers against each other in their favorite titles with some friendly wagers on the line.

The startup has just announced that it closed $3 million in funding.

The company, which has been around for five years, got its start as an esports startup looking to organize real-life matches at bars in New York City to play FIFA. That’s obviously not the most scalable business of all time, but last year after joining Y Combinator, the company really dove into a new model that looked to create an online hub for gamers to battle each other in titles of their choosing, with money on the line.

The company has a heavy emphasis on sports titles, like FIFA 19, NBA 2K19 and Madden 19, but there are also some heavy hitters like Fortnite, Apex Legends and Super Smash Bros. Ultimate.

Gamers can set a match or join one in head-to-head challenges or in massive 500-person tournaments. The wagers are often a buck or two but can swell much higher. Players’ Lounge takes 10 percent of the bets as a fee. Because it’s a game of skill, not chance, there aren’t many issues with gambling regulations, though a few states still don’t allow the service, the company says.

The startup plans to use their new cash to beef up their library of playable games and add to their development team.

Powered by WPeMatico

Kong, the open core API management and life cycle management company previously known as Mashape, today announced that it has raised a $43 million Series C round led by Index Ventures. Previous investors Andreessen Horowitz and Charles River Ventures (CRV), as well as new investors GGV Capital and World Innovation Lab, also participated. With this round, Kong has now raised a total of $71 million.

The company’s CEO and co-founder Augusto Marietti tells me the company plans to use the funds to build out its service control platform. He likened this service to the “nervous system for an organization’s software architecture.”

Right now, Kong is just offering the first pieces of this, though. One area the company plans to especially focus on is security, in addition to its existing management tools, where Kong plans to add more machine learning capabilities over time, too. “It’s obviously a 10-year journey, but those two things — immunity with security and machine learning with [Kong] Brain — are really a 10-year journey of building an intelligent platform that can manage all the traffic in and out of an organization,” he said.

In addition, the company also plans to invest heavily in its expansion in both Europe and the Asia Pacific market. This also explains the addition of World Innovation Lab as an investor. The firm, after all, focuses heavily on connecting companies in the U.S. with partners in Asia — and especially Japan. As Marietti told me, the company is seeing a lot of demand in Japan and China right now, so it makes sense to capitalize on this, especially as the Chinese market is about to become more easily accessible for foreign companies.

Kong notes that it doubled its headcount in 2018 and now has more than 100 enterprise customers, including Yahoo! Japan, Ferrari, SoulCycle and WeWork.

It’s worth noting that while this is officially a Series C investment, Marietti is thinking of it more like a Series B round, given that the company went through a major pivot when it moved from being Mashape to its focus on Kong, which was already its most popular open-source tool.

“Modern software is now built in the cloud, with applications consuming other applications, service to service,” said Martin Casado, general partner at Andreessen Horowitz . “We’re at the tipping point of enterprise adoption of microservices architectures, and companies are turning to new open-source-based developer tools and platforms to fuel their next wave of innovation. Kong is uniquely suited to help enterprises as they make this shift by supporting an organization’s entire service architecture, from centralized or decentralized, monolith or microservices.”

Powered by WPeMatico

Direct-to-consumer mattress business Casper has secured a $100 million Series D investment from existing investors Target, NEA, IVP and Norwest Venture Partners.

The fresh infusion of capital values Casper at $1.1 billion, Bloomberg first reported and Casper confirmed.

“We are in the very early chapters of our growth story as demand for Casper products continues to expand across the globe,” Casper chief executive officer and co-founder Philip Krim said in a statement. “Today’s financing accelerates Casper’s vision to become the world’s largest end-to-end sleep company. Our growth will continue to be catalyzed by state-of-the-art sleep products, best-in-class customer experiences, and world-class leadership.”

Casper posted $373 million in net revenue in 2018, according to leaked financials published by The Information this week. In a press release issued today, however, Casper said 2018 revenue topped $400 million. The company, of course, isn’t profitable, with losses reaching $64 million last year, again per The Information. According to Casper’s projections, it will become profitable on an EBITDA basis in 2019 and is expecting revenues of $556 million this year.

Casper has previously raised $240 million in equity funding from celebrity investors Leonardo DiCaprio and 50 Cent, as well as institutional investors, including Lerer Hippeau .

Founded in 2014, the New York business will use the latest investment to expand overseas and open additional brick-and-mortar stores. Competing with other well-funded startups in the business of sleep, like the publicly traded Purple and the VC-backed Leesa Sleep, Casper has taken to physical retail to augment its following. The company opened its first store in New York City in 2018 and has detailed additional plans to open another 200 stores.

An initial public offering is likely the next step for the sleep products retailer, which sells pillows and an $89 sleep-friendly light, in addition to mattresses. Per a recent Reuters report, Casper is in the process of hiring underwriters for its IPO.

Powered by WPeMatico

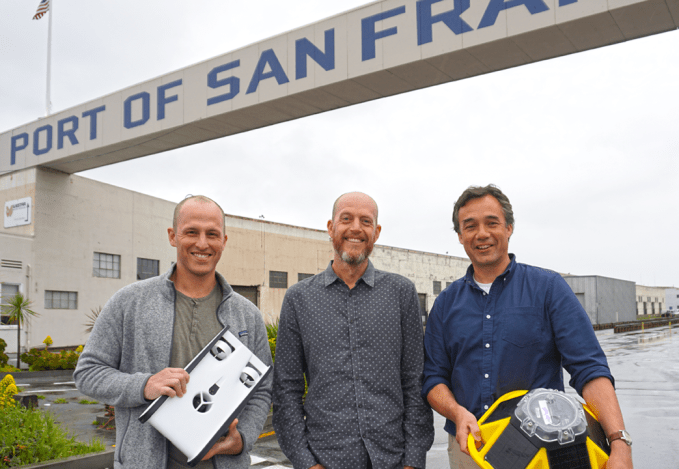

What lies beneath the murky depths? SolarCity co-founder Peter Rive wants to help you and the scientific community find out. He’s just led a $7 million Series A for Sofar Ocean Technologies, a new startup formed from a merger he orchestrated between underwater drone maker OpenROV and sea sensor developer Spoondrift. Together, they’re teaming up their 1080p Trident drone and solar-powered Spotter sensor to let you collect data above and below the surface. They can help you shoot awesome video footage, track waves and weather, spot fishing and diving spots, inspect boats or infrastructure for damage, monitor acquaculture sites or catch smugglers.

Sofar’s Trident drone (left) and Spotter sensor (right)

“Aerial drones give us a different perspective of something we know pretty well. Ocean drones give us a view at something we don’t really know at all,” former Spoondrift and now Sofar CEO Tim Janssen tells me. “The Trident drone was created for field usage by scientists and is now usable by anyone. This is pushing the barrier towards the unknown.”

But while Rive has a soft spot for the ecological potential of DIY ocean exploration, the sea is crowded with competing drones. There are more expensive professional research-focused devices like the Saildrone, DeepTrekker and SeaOtter-2, as well as plenty of consumer-level devices like the $800 Robosea Biki, $1,000 Fathom ONE and $5,000 iBubble. The $1,700 Sofar Trident, which requires a cord to a surface buoy to power its three hours of dive time and two meters per second speed, sits in the middle of the pack, but Sofar co-founder David Lang things Trident can win with simplicity, robustness and durability. The question is whether Sofar can become the DJI of the water, leading the space, or if it will become just another commoditized hardware maker drowning in knock-offs.

From left: Peter Rive (chairman of Sofar), David Lang (co-founder of OpenROV) and Tim Janssen (co-founder and CEO of Sofar)

Spoondrift launched in 2016 and raised $350,000 to build affordable ocean sensors that can produce climate-tracking data. “These buoys (Spotters) are surprisingly easy to deploy, very light and easy to handle, and can be lowered in the water by hand using a line. As a result, you can deploy them in almost any kind of conditions,” says Dr. Aitana Forcén-Vázquez of MetOcean Solutions.

OpenROV (it stands for Remotely Operated Vehicle) started seven years ago and raised $1.3 million in funding from True Ventures and National Geographic, which was also one of its biggest Trident buyers. “Everyone who has a boat should have an underwater drone for hull inspection. Any dock should have its own weather station with wind and weather sensors,” Sofar’s new chairman Rive declares.

Spotter could unlock data about the ocean at scale

Sofar will need to scale to accomplish Rive’s mission to get enough sensors in the sea to give us more data on the progress of climate change and other ecological issues. “We know very little about our oceans since we have so little data, because putting systems in the ocean is extremely expensive. It can cost millions for sensors and for boats,” he tells me. We gave everyone GPS sensors and cameras and got better maps. The ability to put low-cost sensors on citizens’ rooftops unlocked tons of weather forecasting data. That’s more feasible with Spotter, which costs $4,900 compared to $100,000 for some sea sensors.

Sofar hardware owners do not have to share data back to the startup, but Rive says many customers are eager to. They’ve requested better data portability so they can share with fellow researchers. The startup believes it can find ways to monetize that data in the future, which is partly what attracted the funding from Rive and fellow investors True Ventures and David Sacks’ Craft Ventures. The funding will build up that data business and also help Sofar develop safeguards to make sure its Trident drones don’t go where they shouldn’t. That’s obviously important, given London’s Gatwick airport shutdown due to a trespassing drone.

Spotter can relay weather conditions and other climate data to your phone

“The ultimate mission of the company is to connect humanity to the ocean as we’re mostly conservationists at heart,” Rive concludes. “As more commercialization and business opportunities arise, we’ll have to have conversations about whether those are directly benefiting the ocean. It will be important to have our moral compass facing in the right direction to protect the earth.”

Powered by WPeMatico

You know how kings used to have trumpeters heralding their arrival wherever they went? Proxy wants to do that with Bluetooth. The startup lets you instantly unlock office doors and reserve meeting rooms using Bluetooth Low Energy signal. You never even have to pull out your phone or open an app. But Proxy is gearing up to build an entire Bluetooth identity layer for the world that could invisibly hover around its users. That could allow devices around the workplace and beyond to instantly recognize your credentials and preferences to sign you into teleconferences, pay for public transit or ask the barista for your usual.

Today, Proxy emerges from stealth after piloting its keyless, badgeless office entry tech with 50 companies. It’s raised a $13.6 million Series A round led by Kleiner Perkins to turn your phone into your skeleton key. “The door is a forcing function to solve all the hard problems — everything from safety to reliability to the experience to privacy,” says Proxy co-founder and CEO Denis Mars. “If you’re gonna do this, it’s gonna have to work right, and especially if you’re going to do this in the workplace with enterprises where there’s no room to fix it.”

But rather than creepily trying to capitalize on your data, Proxy believes you should own and control it. Each interaction is powered by an encrypted one-time token so you’re not just beaming your unprotected information out into the universe. “I’ve been really worried about how the internet world spills over to the physical world. Cookies are everywhere with no control. What’s the future going to be like? Are we going to be tracked everywhere or is there a better way?” He figured the best path to the destiny he wanted was to build it himself.

Mars and his co-founder Simon Ratner, both Australian, have been best buddies for 10 years. Ratner co-founded a video annotation startup called Omnisio that was acquired by YouTube, while Mars co-founded teleconferencing company Bitplay, which was bought by Jive Software. Ratner ended up joining Jive where the pair began plotting a new startup. “We asked ourselves what we wanted to do with the next 10 or 20 years of our lives. We both had kids and it changed our perspective. What’s meaningful that’s worth working on for a long time?”

They decided to fix a real problem while also addressing their privacy concerns. As he experimented with Internet of Things devices, Mars found every fridge and light bulb wanted you to download an app, set up a profile, enter your password and then hit a button to make something happen. He became convinced this couldn’t scale and we’d need a hands-free way to tell computers who we are. The idea for Proxy emerged. Mars wanted to know, “Can we create this universal signal that anything can pick up?”

Most offices already have infrastructure for badge-based RFID entry. The problem is that employees often forget their badges, waste time fumbling to scan them and don’t get additional value from the system elsewhere.

So rather than re-invent the wheel, Proxy integrates with existing access control systems at offices. It just replaces your cards with an app authorized to constantly emit a Bluetooth Low Energy signal with an encrypted identifier of your identity. The signal is picked up by readers that fit onto the existing fixtures. Employees can then just walk up to a door with their phone within about six feet of the sensor and the door pops open. Meanwhile, their bosses can define who can go where using the same software as before, but the user still owns their credentials.

“Data is valuable, but how does the end user benefit? How do we change all that value being stuck with these big tech companies and instead give it to the user?” Mars asks. “We need to make privacy a thing that’s not exploited.”

Mars believes now’s the time for Proxy because phone battery life is finally getting good enough that people aren’t constantly worried about running out of juice. Proxy’s Bluetooth Low Energy signal doesn’t suck up much, and geofencing can wake up the app in case it shuts down while on a long stint away from the office. Proxy has even considered putting inductive charging into its sensors so you could top up until your phone turns back on and you can unlock the door.

Opening office doors isn’t super exciting, though. What comes next is. Proxy is polishing its features that auto-reserve conference rooms when you walk inside, that sign you into your teleconferencing system when you approach the screen and that personalize workstations when you arrive. It’s also working on better office guest check-in to eliminate the annoying iPad sign-in process in the lobby. Next, Mars is eyeing “Your car, your home, all your devices. All these things are going to ask ‘can I sense you and do something useful for you?’ ”

After demoing at Y Combinator, thousands of companies reached out to Proxy, from hotel chains to corporate conglomerates to theme parks. Proxy charges for its hardware, plus a monthly subscription fee per reader. Employees are eager to ditch their keycards, so Proxy sees 90 percent adoption across all its deployments. Customers only churn if something breaks, and it hasn’t lost a customer in two years, Mars claims.

The status quo of keycards, competitors like Openpath and long-standing incumbents all typically only handle doors, while Proxy wants to build an omni-device identity system. Now Proxy has the cash to challenge them, thanks to the $13.6 million from Kleiner, Y Combinator, Coatue Management and strategic investor WeWork. In fact, Proxy now counts WeWork’s headquarters and Dropbox as clients. “With Proxy, we can give our employees, contractors and visitors a seamless smartphone-enabled access experience they love, while actually bolstering security,” says Christopher Bauer, Dropbox’s physical security systems architect.

The cash will help answer the question of “How do we turn this into a protocol so we don’t have to build the other side for everyone?,” Mars explains. Proxy will build out SDKs that can be integrated into any device, like a smoke detector that could recognize which people are in the vicinity and report that to first responders. Mars thinks hotel rooms that learn your climate, wake-up call and housekeeping preferences would be a no-brainer. Amazon Go-style autonomous retail could also benefit from the tech.

When asked what keeps him up at night, Mars concludes that “the biggest thing that scares me is that this requires us to be the most trustworthy company on the planet. There is no ‘move fast, break things’ here. It’s ‘move fast, do it right, don’t screw it up.’ “

Powered by WPeMatico