Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Linear Labs, a startup developing an electric motor for cars, scooters, robots, wind turbines and even HVAC systems, has raised $4.5 million in a seed round led by Science Inc. and Kindred Ventures.

Investors Chris and Crystal Sacca, Ryan Graves of Saltwater Ventures, Dynamic Signal CEO Russ Fradin, Masergy executive chairman and former-CEO Chris MacFarland, as well as Ustream co-founder Gyula Feher also participated in the round.

The four-year-old company was founded by Brad and Fred Hunstable, who say they have invented a lighter, more flexible electric motor. The pair came up with the motor they’ve dubbed the Hunstable Electric Turbine (HET) while working to design a device that could pump clean water and provide power for small communities in underdeveloped regions of the world.

Linear Labs currently has 50 filed patents, 21 of which are issued, with 29 patents pending.

The founders come with a background in entrepreneurship and electrical engineering. Brad Hunstable is former CEO and founder of Ustream, the live-video-streaming service that sold to IBM in 2016 for $150 million. Fred Hunstable, who comes with a background in electrical engineering and nuclear power, led Ebasco and Walker Engineering’s efforts in designing, upgrading and completing electrical infrastructure, environmental and enterprise projects as well as safety and commercial-grade evaluation programs.

The HET uses multiple rotors that can adapt to varying conditions, according to the company. It also produces twice as much torque density and three times the power density than permanent magnet motors. Linear Labs says its motor produces two times the output per given motor size, and minimum 10 percent more range.

The HET design makes it ideally suited for mobility applications such as electric vehicles because it produces high levels of torque without the need for a gearbox. This helps cut production cuts, the company contends.

“The holy grail in electric motors has always been high torque and no gearbox, and the HET achieves both in a smaller, lighter and more efficient package that is more powerful than traditional motors,” Linear Labs CTO Fred Hunstable said in a statement.

The upshot could be electric vehicles with better range and more powerful electric scooters.

The commercialization of the electric motor will result in substantial leaps in terms of energy savings, reliability enhancement, and low-cost manufacturing, according to Babak Fahimi, founding director of the Renewable Energy and Vehicular Technology (REVT) Laboratory at the University of Texas at Dallas.

The company plans to use the seed funding to market its invention to customers. It’s also hiring talent and recently added new people to its leadership team, including John Curry as their president and Jon Hurry as vice president. Curry comes from KLA-Tencor and NanoPhotonics. Hurry has held positions at Tesla and Faraday Future.

Powered by WPeMatico

Innoviz, the Israel-based startup developing solid-state lidar sensors and perception software for autonomous vehicles, has raised $132 million in a Series C funding round that includes major Chinese financial institutions.

The round, which makes Innoviz one of the better capitalized lidar startups, includes China Merchants Capital (SINO-BLR Industrial Investment Fund, L.P.), Shenzhen Capital Group and New Alliance Capital. Israeli institutional investors Harel Insurance Investments and Financial Services and Phoenix Insurance Company also participated.

The Series C round will remain open for a second closing to be announced in the coming months, the company said.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles. Innoviz is developing solid-state lidar, which proponents of this technology say is more reliable over time because of the lack of moving parts.

Like so many startups with fresh capital, Innoviz plans to use the funds to scale up the company.

For Innoviz, this means increasing production of its lidar sensors and expanding its manufacturing capacity. Innoviz is focused on expanding in important automotive markets, including the U.S., Europe, Japan and China. Innoviz has been pushing into China over the past year through a partnership with the Chinese automotive supplier HiRain Technologies, a global supplier to some of China’s largest automakers.

That company has half of its business coming from China and has won nine of its supplier agreements with different automakers in the country through its HiRain partnership, according to people with knowledge of the company.

The company’s aim is to enable high-volume delivery of its automotive-grade lidar system called InnovizOne. This product can be produced and sold at a 90 percent lower cost than its first-generation system, according to Innoviz.

Innoviz said it also plans to expand its research and development efforts by investing in the buildout of next-generation products and software that will feature more cost reductions and improved performance.

Innoviz’s strategy has been to partner with a number of OEMs and Tier 1 suppliers such as Magna, HARMAN, HiRain Technologies and Aptiv and to package perception software with its lidar sensors and offer it as a complete unit for companies developing autonomous vehicle technology.

Innoviz has locked in several key customers, notably BMW. The automaker picked Innoviz’s tech for series production of autonomous vehicles starting in 2021.

In March, Lyft announced a partnership with Magna to help get its self-driving tech into various automakers, as well as implement the ride-hailing service into future autonomous cars. Innoviz raised $65 million in Series B funding in 2017, from strategic partners and leading auto industry suppliers Delphi Automotive and Magna International, along with other investors.

Powered by WPeMatico

Ouster has raised $60 million as the San Francisco-based lidar startup opens a new facility that will have the capacity to assemble and ship several thousand sensors a month by the end of 2019.

The new factory, which will have a grand opening ceremony March 28, currently produces hundreds of sensors per month. Ouster says at full capacity, the factory will produce $25 million to $50 million in inventory per month.

Lidar measures distance using laser light to generate highly accurate 3D maps of the world around the car. It’s considered by most in the self-driving car industry a key piece of technology required to safely deploy robotaxis and other autonomous vehicles (although not everyone agrees). However, the sensors are also useful in other industries — and this is where Ouster’s business model is targeted.

Ouster has cast a wider net for customers than some of its rivals. Unlike others vying solely for automotive customers working on the development of autonomous vehicles, Ouster is selling sensors to other industries. Ouster is selling its light detection and ranging radar sensors to robotics, drones, mapping, defense, building security, mining and agriculture companies.

The strategy has appeared to pay off. Ouster says it has 400 customers from 15 industries.

The $60 million in additional funding follows a Series A raise of $27 million announced back in 2017 as Ouster came out of stealth mode. In the years since, the company led by Angus Pacala has grown to more than 100 employees and announced four lidar sensors, with resolutions from 16 to 128 channels, and two product lines, the OS-1 and OS-2. The startup expects to nearly double its headcount in the coming year to support further product line development.

The $60 million in equity and debt funding includes investments from Runway Growth Capital and Silicon Valley Bank, as well as additional funding from Series A participants Cox Enterprises, Constellation Tech Ventures, Fontinalis Partners, Carthona and others.

Ouster said the additional investment has helped to develop Ouster’s product lines, including the launch of the OS-1 128 lidar sensor, and fund the expansion of its production facilities.

The company also announced the appointment of Susan Heystee, senior VP for OEM business at Verizon Connect, to its board of directors.

Waymo, the self-driving car company under Google’s Alphabet, could be a new competitor to the company. Waymo announced this month it will start selling its custom lidar sensors to companies outside of self-driving cars. Waymo will initially target robotics, security and agricultural technology. The sales will help the company scale its autonomous technology faster, making each sensor more affordable through economies of scale, Simon Verghese, head of Waymo’s lidar team, wrote in a Medium post at the time.

Powered by WPeMatico

There’s nothing like a niche language to create a sort of lock-in for a startup, and that’s exactly what’s happened with Gjirafa. Focusing exclusively on Albanian-speaking countries, co-founder and CEO Mergim Cahani started out developing an Albanian language search engine and then literally digitizing the country’s information, from bus timetables to a database of local businesses and venues, and beyond.

Investors were attracted to this “emerging-market approach” and put in a $2 million Series A three years ago to “grow the Balkans’ internet economy” by digitizing and indexing information in Albania and Kosovo, thus making Gjirafa the regional leader in search, e-commerce and online advertising.

Today it claims 3 million monthly unique users across its services and has now raised a Series B round of $6.7 million from Rockaway Capital, which has been backing the company since 2016. The new funding is intended for scaling the current products regionally.

The Series B will allow the company to double their current team (currently at 70 full-time, and about 100 in total with part-time), scale with the existing products regionally and deliver other digital services that aren’t available in the region.

Dušan Zábrodský, investment partner at Rockaway, says: “Mergim Cahani and his team validated our trust and truly succeeded in building a centrepiece of innovation for the whole region. Thanks to this very positive experience we are committed to build up a digital economy in the region and we actively explore new investment opportunities where we can use our knowledge to digitalize traditional industries.”

He says Rockaway group’s investment is long-term and strategic because they think Gjirafa could become an entire platform/network of additional services that will be used throughout the region.

Using the same strategy, Rockaway previously found success in the DACH region, where it built up an online travel group under the Invia Group brand, and in the field of e-commerce through Mall Group, which operates on seven markets in the CEE region. These groups have contributed significantly to Rockaway’s revenues, which crossed the threshold of €2 billion in 2018.

Gjirafa has become the largest e-commerce player in the region, having a leading OTT product: GjirafaVideo and GjirafaStudio, equivalent to Hulu and Netflix; producing its own content it currently has about 1 million minutes of video consumed a day (and growing double-digits on monthly basis) and more than 80 live channels online.

Gjirafa, Inc., is the fastest-growing company in the region, and the growth is impressive at 314 percent CAGR. To put it in perspective: when GDP indicators are normalized for the Balkans region versus the U.S., it has an equivalent revenue growth as Google had between 2001-2004 and continuing on the same path.

Powered by WPeMatico

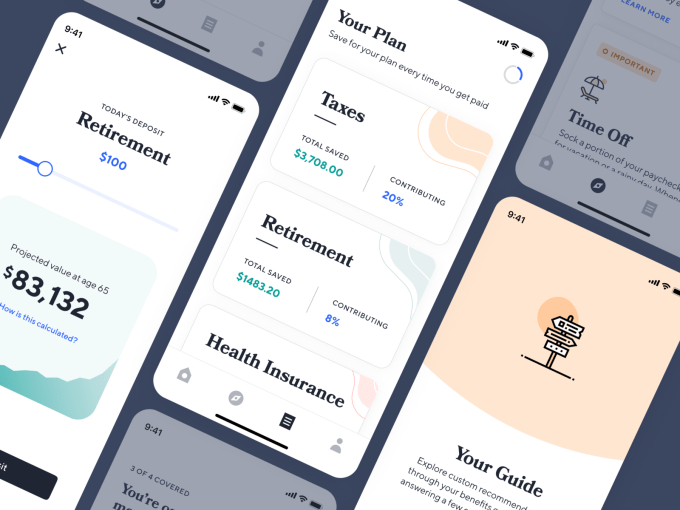

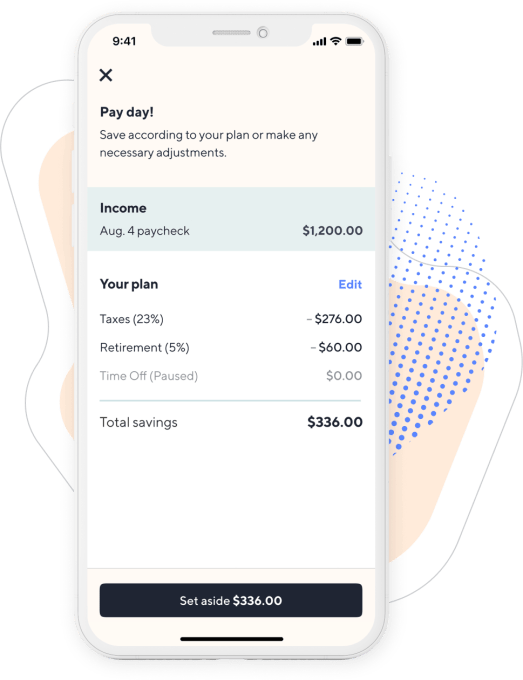

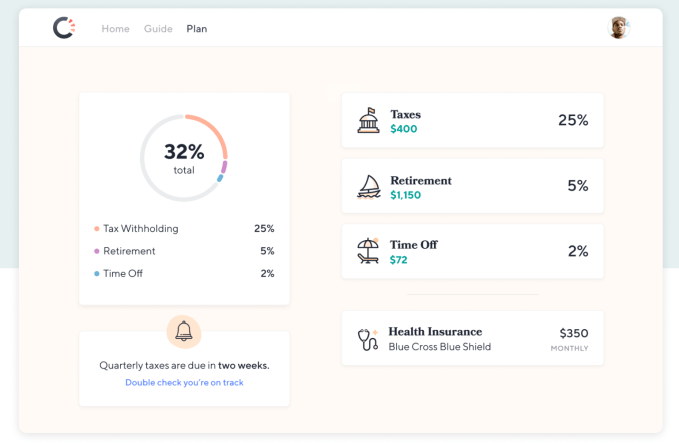

One of the hottest Y Combinator startups just raised a big seed round to clean up the mess created by Uber, Postmates and the gig economy. Catch sells health insurance, retirement savings plans and tax withholding directly to freelancers, contractors, or anyone uncovered. By building and curating simplified benefits services, Catch can offer a safety net for the future of work.

“In order to stay competitive as a society, we need to address inequality and volatility. We think Catch is the first step to offering alternatives to the mandate that benefits can only come from an employer or the government,” writes Catch co-founder and COO Kristen Tyrrell. Her co-founder and CEO Andrew Ambrosino, a former Kleiner Perkins design fellow, stumbled onto the problem as he struggled to juggle all the paperwork and programs companies typically hire an HR manager to handle. “Setting up a benefits plan was a pain. You had to become an expert in the space, and even once you were, executing and getting the stuff you needed was pretty difficult.” Catch does all this annoying but essential work for you.

Now Catch is getting its first press after piloting its product with tens of thousands of users. TechCrunch caught wind of its highly competitive seed round closing, and Catch confirms it has raised $5.1 million at a $20.5 million post-money valuation co-led by Khosla Ventures, Kindred Ventures, and NYCA Partners. This follow-up to its $1 million pre-seed will fuel its expansion into full heath insurance enrollment, life insurance and more. Catch is part of a growing trend that sees the best Y Combinator startup fully funded before Demo Day even arrives.

“Benefits, as a system built and provided by employers, created the mid-century middle class. In the post-war economic boom, companies offering benefits in the form of health insurance and pensions enabled familial stability that led to expansive growth and prosperity,” recalls Tyrrell, who was formerly the director of product at student debt repayment benefits startup FutureFuel.io. “Emboldened by private-sector growth (and apparent self-sufficiency), the 1970s and 80s saw a massive shift in financial risk management from the government to employers. The public safety net contracted in favor of privatized solutions. As technological advances progressed, employers and employees continued to redefine what work looked like. The bureaucratic and inflexible benefits system was unable to keep up. The private safety net crumbled.”

That problem has ballooned in recent years with the advent of the on-demand economy, where millions become Uber drivers, Instacart shoppers, DoorDash deliverers and TaskRabbits. Meanwhile, the destigmatization of remote work and digital nomadism has turned more people into permanent freelancers and contractors, or full-time employees without benefits. “A new class of worker emerged: one with volatile, complex income streams and limited access to second-order financial products like automated savings, individual retirement plans, and independent health insurance. We entered the new millennium with rot under the surface of new opportunity from the proliferation of the internet,” Tyrrell declares. “The last 15 years are borrowed time for the unconventional proletariat. It is time to come to terms and design a safety net that is personal, portable, modern and flexible. That’s why we built Catch.”

Catch co-founders Andrew Ambrosino and Kristen Tyrrell

Currently Catch offers the following services, each with their own way of earning the startup revenue:

These and the rest of Catch’s services are curated through its Guide. You answer a few questions about which benefits you have and need, connect your bank account, choose which programs you want and get push notifications whenever Catch needs your decisions or approvals. It’s designed to minimize busy work so if you have a child, you can add them to all your programs with a click instead of slogging through reconfiguring them all one at a time. That simplicity has ignited explosive growth for Catch, with the balances it holds for tax withholding, time off and retirement balances up 300 percent in each of the last three months.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

If any of this sounds boring, that’s kind of the point. Instead of sorting through this mind-numbing stuff unassisted, Catch holds your hand. Its benefits Guide is available on the web today and it’s beta testing iOS and Android apps that will launch soon. Catch is focused on direct-to-consumer sales because “We’ve seen too many startups waste time on channels/partnerships before they know people truly want their product and get lost along the way,” Tyrrell writes. Eventually it wants to set up integrations directly into where users get paid.

Catch’s biggest competition is people haphazardly managing benefits with Excel spreadsheets and a mishmash of healthcare.gov and solutions for specific programs. Twenty-one percent of Americans have saved $0 for retirement, which you could see as either a challenge to scaling Catch or a massive greenfield opportunity. Track.tax, one of its direct competitors, charges a subscription price that has driven users to Catch. And automated advisors like Betterment and Wealthfront accounts don’t work so well for gig workers with lots of income volatility.

So do the founders think the gig economy, with its suppression of benefits, helps or hinders our species? “We believe the story is complex, but overall, the existing state of the gig economy is hurting society. Without better systems to provide support for freelance/contract workers, we are making people more precarious and less likely to succeed financially.”

When I ask what keeps the founders up at night, Tyrrell admits “The safety net is not built for individuals. It’s built to be distributed through HR departments and employers. We are very worried that the products we offer aren’t on equal footing with group/company products.” For example, there’s a $6,000/year IRA limit for individuals while the corporate equivalent 401k limit is $19,000, and health insurance is much cheaper for groups than individuals.

To surmount those humps, Catch assembled a huge list of angel investors who’ve built a range of financial services, including NerdWallet founder Jake Gibson, Earnest founders Louis Beryl and Ben Hutchinson, ANDCO (acquired by Fiverr) founder Leif Abraham, Totem founder Neal Khosla, Commuter Club founder Petko Plachkov, Playable (acquired by Stripe) founder Tad Milbourn and Synapse founder Bruno Faviero. It also brought on a wide range of venture funds to open doors for it. Those include Urban Innovation Fund, Kleiner Perkins, Y Combinator, Tempo Ventures, Prehype, Loup Ventures, Indicator Ventures, Ground Up Ventures and Graduate Fund.

Hopefully the fact that there are three lead investors and so many more in the round won’t mean that none feel truly accountable to oversee the company. With 80 million Americans lacking employer-sponsored benefits and 27 million without health insurance and median job tenure down to 2.8 years for people ages 25 to 34 leading to more gaps between jobs, our workforce is vulnerable. Catch can’t operate like a traditional software startup with leniency for screw-ups. If it can move cautiously and fix things, it could earn labor’s trust and become a fundamental piece of the welfare stack.

Powered by WPeMatico

Want to star in your favorite memes and movie scenes? Upload a selfie to Morphin, choose your favorite GIF and your face is grafted in to create a personalized copy you can share anywhere. Become Tony Stark as he suits up like Iron Man. Drop the mic like Obama, dance like Drake or slap your mug on Fortnite characters.

Now after three years in stealth developing image-mapping technology, Morphin is ready to launch its put-you-in-a-GIF maker. While it might look like just a toy, investors see real business potential. Morphin raised $1 million last summer from Betaworks, the incubator that spawned Giphy, plus Founders Fund, Precursor, Shrug Capital and Boost.vc’s accelerator.

Elon Musk as Iron Man

“We believe in the future you’ll be able to be the main character in your own film. Imagine a super hero movie where you’re the main protagonist?,” co-founder Loic Ledoux asks. “That sounded like science fiction a few years ago and now with AI and computer vision we definitely see our tech going there.”

Ledoux also wants to reclaim faceswaps as something fun rather than a weapon for misinformation. “Deepfakes brought something pretty negative to computer vision. But it’s not all bad. It’s about how you use the tech to give people a new tool for self expressions and storytelling.” And since Morphin re-generates the whole clip from scratch with CGI animation, they look right at a glance, but clearly aren’t manipulated copies of the original video designed to fool anyone.

Kanye performs magic

Morphin started three years ago with the intention to build personalized avatars for games and VR so you could be a FIFA soccer player or Skyrim knight. Ledoux had started a 3D printing company to explore opportunities in scanning and modeling when he saw a chance to connect your real and virtual faces. He teamed up with his co-founder Nicholas Heriveaux, who’d spent 13 years working on 3D tech while modding games like Grand Theft Auto to insert his avatar and assets.

What they quickly recognized was that “People were just reacting to themselves on the screen,” ignoring the gameplay, Ledoux recalls. “Being able to see yourself as a hero was the underlying sentiment, so we focused on video completely.” Recognizable GIFs became its preferred medium, as they combine familiarity and the ability to convey complex emotions with a template that’s easy to personalize so they stand out.

Morphin’s tech no longer requires 3D scanning hardware and it works with just a regular selfie. You just snap a headshot, select a GIF from its iOS or Android app’s library and a few seconds later you have a CGI version of yourself in the scene (with no watermark) that you can export and post. “We wanted it to be super straightforward because we wanted people to relate to the content,” Ledoux notes. Over 1 million scenes have been created by 50,000 beta users, and each time a celebrity shares one of the GIFs Morphin has been sending them for marketing, scores of their followers demand to know which app they were using.

Morphin’s nine-person French team will have to keep innovating to stay ahead of avatar-making competitors like the ubiquitous Snapchat Bitmoji, Genies, Moji Edit and Mirror AI. Facebook, Microsoft and Google all have launched or are building their own avatar creators. But these typically live as 2D stickers or 3D AR animations you overlay on the real world. By using GIFs as a canvas, Morphin takes the pressure off your visage looking perfect and instead emphasizes the message you’re trying to get across.

The challenge will be for Morphin to become a consistent part of people’s communication stack. It’s easy to imagine playing with it and posting a few GIFs. But iconic new GIFs don’t emerge each day and without a social network to stay for, Morphin is at risk of becoming merely a forgotten tool. The app might need TikTok-style challenges like submitting the best personalized GIF to match a prompt or a GIF browsing feed to keep people coming back.

Turning Donald Glover into Jay Gatsby

Morphin isn’t racing to monetize yet, but sees a chance to sell longer premium video scenes à la carte or as an unlimited subscription. Ledoux eventually hopes to unlock new forms of storytelling beyond existing GIFs. There’s also a chance for Morphin to highlight sponsored clips from upcoming movies or TV shows. “In the long-term we’re more interested in the analogy of Lil Miquela and how people are interacting with digital characters,” Ledoux explains, citing a virtual pop star whose developer Brud recently raised at a $125 million valuation.

One of the most exciting things about Morphin is that it will allow people to take the spotlight no matter how they look. Often times certain races, genders and looks are unfairly excluded from starring in today’s most popular media. But Morphin could let the underrepresented take their rightful place as stars of the screen.

Your faithful author Josh Constine dropping the mic like Obama

Powered by WPeMatico

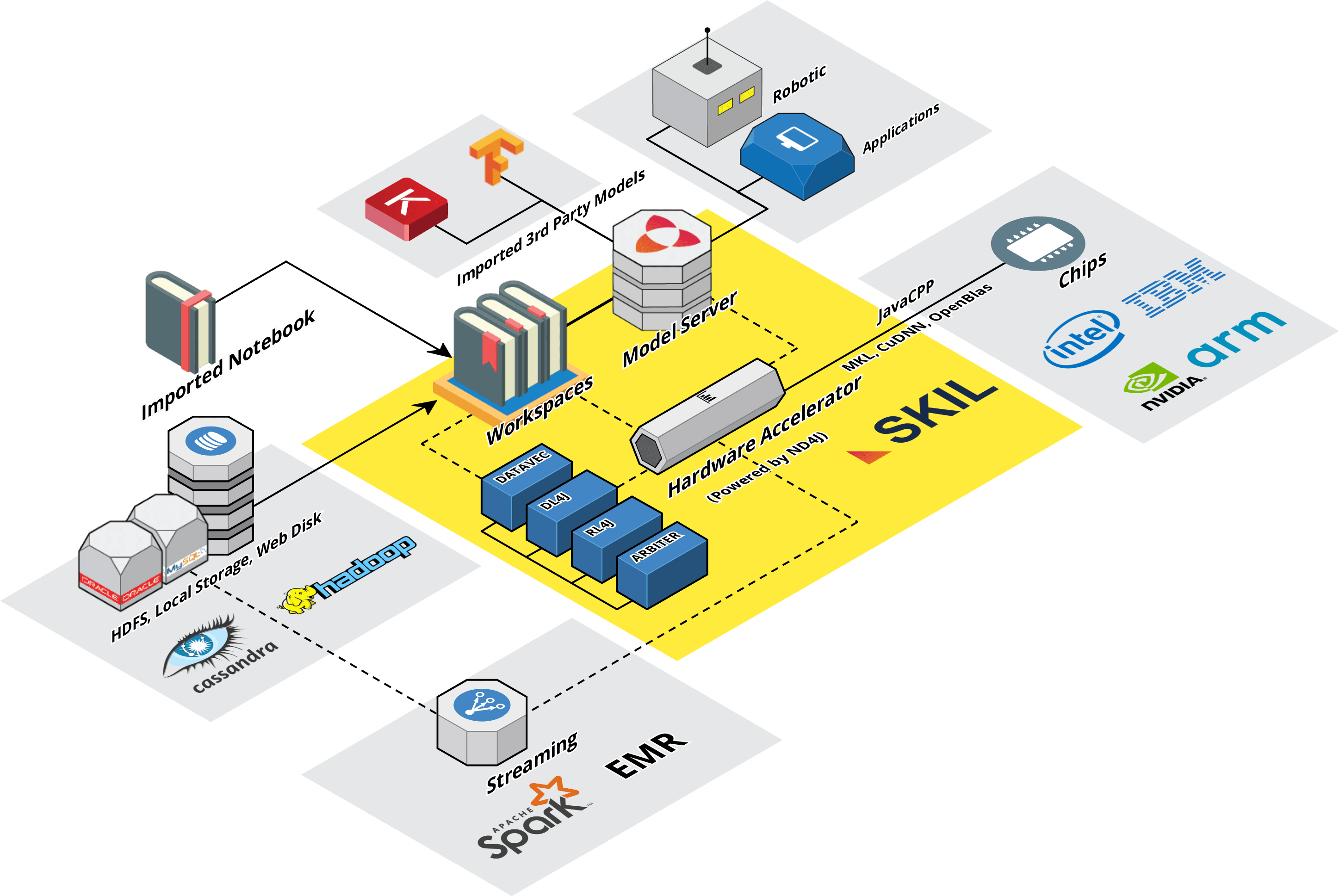

Skymind, a Y Combinator-incubated AI platform that aims to make deep learning more accessible to enterprises, today announced that it has raised an $11.5 million Series A round led by TransLink Capital, with participation from ServiceNow, Sumitomo’s Presidio Ventures, UpHonest Capital and GovTech Fund. Early investors Y Combinator, Tencent, Mandra Capital, Hemi Ventures, and GMO Ventures, also joined the round/ With this, the company has now raised a total of $17.9 million in funding.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

“TransLink is the perfect lead for this round, because they know how to make connections between North America and Asia,” Skymind CEO Chris Nicholson told me. “That’s where the most growth is globally, and there are a lot of potential synergies. We’re also really excited to have strategic investors like ServiceNow and Sumitomo’s Presidio Ventures backing us for the first time. We’re already collaborating with ServiceNow, and Skymind software will be part of some powerful new technologies they roll out.”

It’s no secret that enterprises know that they have to adapt AI in some form but are struggling with figuring out how to do so. Skymind’s tools, including its core SKIL framework, allow data scientists to create workflows that take them from ingesting the data to cleaning it up, training their models and putting them into production. The promise here is that Skymind’s tools eliminate the gap that often exists between the data scientists and IT.

“The two big opportunities with AI are better customer experiences and more efficiency, and both are based on making smarter decisions about data, which is what AI does,” said Nicholson. “The main types of data that matter to enterprises are text and time series data (think web logs or payments). So we see a lot of demand for natural-language processing and for predictions around streams of data, like logs.”

Current Skymind customers include the likes of ServiceNow and telco company Orange, while some of its technology partners that integrate its services into their portfolio include Cisco and SoftBank .

It’s worth noting that Skymind is also the company behind Deeplearning4j, one of the most popular open-source AI tools for Java. The company is also a major contributor to the Python-based Keras deep learning framework.

Powered by WPeMatico

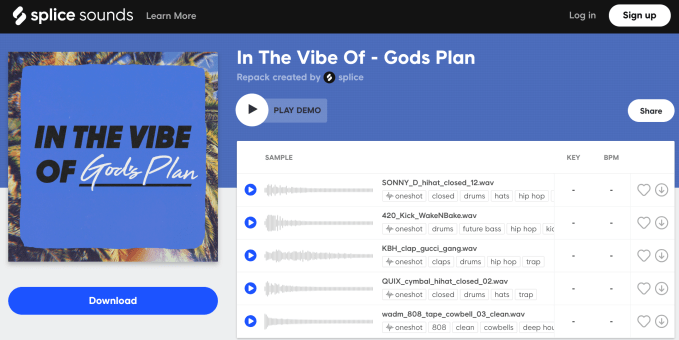

Tech has a bad reputation for pulling money out of musicians’ pockets, but Splice is changing that. The audio sample marketplace and music production collaboration tool has now paid out $15 million to artists since 2013, doubling in the last year. Splice lets musicians sell their sounds for royalty-free use, and songs by Eminem, Ariana Grande and Marshmello that were powered by those samples have topped the charts. Splice charges $7.99 per month for unlimited access to its array of 3 million synthesizers, drum hits, vocal flares and other sounds. Despite being designed for serious musicians, Splice’s suite of tools now has 2.5 million users, up from 1.5 million a year ago.

Steve Martocci

“Music is going through a beautiful moment,” says Steve Martocci, Splice’s co-founder and CEO who formerly built and sold GroupMe. “The tailwinds from the success of streaming are great. As more people realize how big the market it, how much people want to create music, there’s a huge opportunity here.”

Now Union Square Ventures and True Ventures are seizing on that opportunity, co-leading a $57.5 million Series C for Splice. “It’s all about scale,” Martocci tells me. “We’re investing in ourselves. Continuing to build new products. Continuing to work with bigger artists. We think there’s so much about the creative process and ecosystem of musicians that needs to be fixed. We want to diversify the content available so all artists in all genres feel like we have what they need.”

The round, which includes DFJ Growth, Flybridge, Lerer Hippeau, Liontree, Founders Circle Capital and Matt Pincus, brings Splice to $104.5 million in total funding. Splice wouldn’t disclose the valuation, but using the industry standard of selling 20 percent equity for a Series C, Splice could be valued in the ballpark of $285 million. That would make it one of the top music startups that isn’t selling streaming, tickets or hardware. Its success has also begun to draw competition from companies like Native Instruments, which launched its Sounds.com marketplace last year.

Splice’s subscription revenue is pooled and then doled out to artists based on whose samples got the most downloads. Creators range from bedroom tinkerers to Drake’s Grammy-winning producer Boi-1da. Martocci confirms that artists receive the majority of Splice’s sample marketplace revenue, saying, “they’re very favorable deals.” That’s especially great for the music production industry, because a lot of Splice’s sample creators aren’t celebrity DJs; Martocci says they’re audio engineers and other “people behind the scenes getting an opportunity to step into the light with an amazing revenue opportunity, but also an opportunity to be seen for their creative contributions.”

Splice began with a eureka moment at a concert. A friend asked Martocci why there weren’t great tools for producing music like there are for building software like GroupMe. After eventually leaving his chat app that Skype acquired, Martocci connected with Splice co-founder Matt Aimonetti and discovered he’d been an audio engineer for half of his life. They saw a chance to build a GitHub for music, with version control and admin permissions for making saving and collaborating on productions simple. By 2015 Splice had launched its Sounds subscription library, and the next year began selling rent-to-own software synthesizers to make avoiding piracy affordable for creators.

Fast-forward and Martocci tells me prioritization across Splice’s different product lines will be one of its big challenges. Luckily, he has a new crew of lieutenants to help. Former product lead for Apple Music and Beats by Dre VP Ryan Walsh has joined as chief product officer because, Martocci says, “he felt like his mission in music was unfinished.” Former chief financial officer of Marvel Entertainment Chris Acquaviva is now Splice’s CFO, who offers deep licensing expertise. And bringing the creator community vibe, MakerBot’s former CHRO, Kavita Vora, has become Splice’s chief people officer.

In an era when tech public image has been tested by non-stop scandals from the industry giants, Splice is pulling in ace talent that want to work on something unequivocally positive. Martocci tells me parents tell him that their kids spend all their time playing Fortnite and making music on Splice, but the latter is screen time they’re happy to encourage.

Powered by WPeMatico

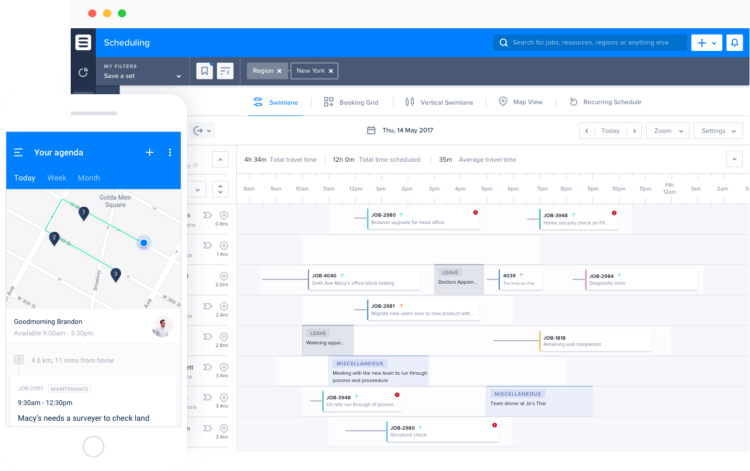

Skedulo, a service that helps businesses manage their mobile employees, today announced that it has raised a $28 million Series B funding round led by M12, Microsoft’s venture fund. Existing investors Blackbird and Castanoa Ventures also participated in this round.

The company’s service offers businesses all the necessary tools to manage their mobile employees, including their schedules. A lot of small businesses still use basic spreadsheets and email to do this, but that’s obviously not the most efficient way to match the right employee to the right job, for example.

“Workforce management has traditionally been focused on employees that are sitting at a desk for the majority of their day,” Skedulo CEO and co-founder Matt Fairhurst told me. “The overwhelming majority — 80 percent — of workers will be deskless by 2020 and so far, there has been no one that has addressed the needs of this growing population at scale. We’re excited to help enterprises confront these challenges head-on so they can compete and lean into rapidly changing customer and employee expectations.”

At the core of Skedulo, which offers both a mobile app and web-based interface, is the company’s so-called “Mastermind” engine that helps businesses automatically match the right employee to a job based on the priorities the company has specified. The company plans to use the new funding to enhance this tool through new machine learning capabilities. Skedulo will also soon offer new analytics tools and integrations with third-party services like HR and financial management tools, as well as payroll systems.

The company also plans to use the new funding to double its headcount, which includes hiring at least 60 new employees in its Australian offices in Brisbane and Sydney.

As part of this round, Priya Saiprasad, principal of M12, will join Skedulo’s board of directors. “We found a strong sense of aligned purpose with Priya Saiprasad and the team at M12 — and their desire to invest in companies that help reduce cycles in a person’s working day,” Fairhurst said. “Fundamentally, Skedulo is a productivity company. We help companies, the back-office and mobile workforce, reduce the number of cycles it takes to get work done. This gives them time back to focus on the work that matters most.”

Powered by WPeMatico

Atlanta-based Movius, a company that allows companies to assign a separate business number for voice calls and texting to any phone, today announced that it has raised a $45 million Series D round led by JPMorgan Chase, with participation from existing investors PointGuard Ventures, New Enterprise Associates and Anschutz Investment company. With this, the company has now raised a total of $100 million.

In addition to the new funding, Movius also today announced that it has brought on former Adobe and Sun executive John Loiacono as its new CEO. Loiacono was also the founding CEO of network analytics startup Jolata.

“The Movius opportunity is pervasive. Almost every company on planet Earth is mobilizing their workforce but are challenged to find a way to securely interact with their customers and constituents using all the preferred communication vehicles – be that voice, SMS or any other channel they use in their daily lives,” said Loiacono. “I’m thrilled because I’m joining a team that features highly passionate and proven innovators who are maniacally focused on delivering this very solution. I look forward to leading this next chapter of growth for the company.”

Sanjay Jain, the chief strategy officer at Hyperloop Transportation Technologies, and Larry Feinsmith, the head of JPMorgan Chase’s Technology Innovation, Strategy & Partnerships office, are joining the company’s board.

Movius currently counts more than 1,400 businesses as its customers, and its carrier partners include Sprint, Telstra and Telefonica. What’s important to note is that Movius is more than a basic VoIP app on your phone. What the company promises is a carrier-grade network that allows businesses to assign a second number to their employees’ phones. That way, the employer remains in charge, even as employees bring their own devices to work.

Powered by WPeMatico