Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Cookie-cutter corporate housing turns people into worker drones. When an employee needs to move to a new city for a few months, they’re either stuck in bland, giant apartment complexes or Airbnbs meant for shorter stays. But Zeus lets any homeowner get paid to host white-collar transient labor. Through its managed ownership model, Zeus takes on all the furnishing, upkeep, and risk of filling the home while its landlords sit back earning cash.

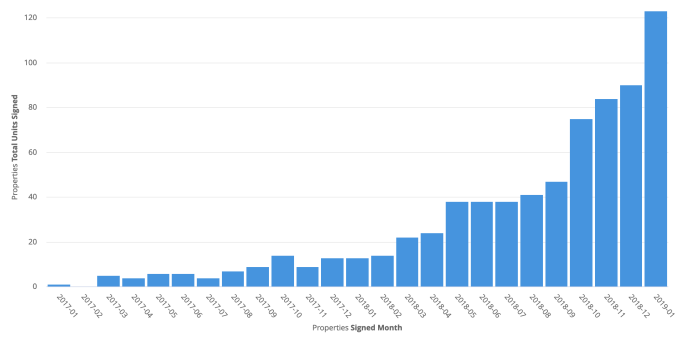

Zeus has quietly risen to a $45 million revenue run rate from renting out 900 homes in 23 cities. That’s up 5X in a year thanks to Zeus’ 150 employees. With a 90 percent occupancy rate, it’s proven employers and their talent want more unique, trustworthy, well-equipped multi-month residences that actually make them feel at home.

Now while Airbnb is distracted with its upcoming IPO, Zeus has raised $24 million to steal the corporate housing market. That includes a previous $2.5 million seed round from Bowery, the new $11.5 million Series A led by Initialized Capital whose partner Garry Tan has joined Zeus’ board, and $10 million in debt to pay fixed costs like furniture. The plan is to roll up more homes, build better landlord portal software, and hammer out partnerships or in-house divisions for cleaning and furnishing.

“In the first decade out of school people used to have two jobs. Now it’s four jobs and it’s trending to five” says Zeus co-founder and CEO Kulveer Taggar. “We think in 10 years, these people won’t be buying furniture.” He imagines they’ll pay a premium for hand-holding in housing, which judging by the explosion in popularity of zero-friction on-demand services, seems like an accurate assessment of our lazy future. Meanwhile, Zeus aims to be “the quantum leap improvement in the experience of trying to rent out your home” where you just punch in your address plus some details and you’re cashing checks 10 days later.

“When I sold my first startup, I bought a home for my mom in Vancouver” Taggar recalls. It was payback for when she let him remortgage her old house while he was in college to buy a condo in Mumbai he’d rent out to earn money. “Despite not having much growing up, my mom was a travel agent and we got to travel a lot” which Taggar says inspired his goal to live nomadically in homes around the world. Zeus could let other live that dream.

Zeus co-founder and CEO Kulveer Taggar

After Oxford and working as an analyst at Deutsche Bank, Taggar built student marketplace Boso before moving to the United States. There, he co-founded auction tool Auctomatic with his cousin Harjeet Taggar and future Stripe co-founder Patrick Collison, went through Y Combinator, and sold it to Live Current Media for $5 million just 10 months later. That gave him the runway to gift a home to his mom and start tinkering on new ideas.

With Y Combinator’s backing again, Taggar started NFC-triggered task launcher Tagstand, which pivoted into app settings configurer Agent, which pivoted into automatic location sharing app Status. But when his co-founder Joe Wong had to move an hour south from San Francisco to Palo Alto, Taggar was dumbfounded by how distracting the process was. Listing and securing a new tenant was difficult, as was finding a medium-term rental without having to deal with exhorbitant prices or sketchy Cragislist. Having seen his former co-founder go on to great success with Stripe’s dead-simple payments integration, Taggar wanted to combine that vision with OpenDoor’s easy home sales to making renting or renting out a place instantaneous. That spawned Zeus.

To become a Zeus landlord, you just type in your address, how many bedrooms and bathrooms, and some aesthetic specs, and you get a monthly price quote for what you’ll be paid. Zeus comes in and does a 250-point quality assessment, collects floor plans, furnishes the property, and handles cleaning and maintenance. It works with partners like Helix mattresses, Parachute sheets, and Simple Human trash cans to get bulk rates. “We raised debt because we had these fixed investments into furniture. It’s not as dilutive as selling pure equity” Taggar explains.

Zeus quickly finds a tenant thanks to listings in Airbnb and relationships with employers like Darktrace and ZS Associates with lots of employees moving around. After passing background checks, tenants get digital lock codes and access to 24/7 support in case something doesn’t look right. The goal is to get someone sleeping there in just 10 days. “Traditional corporate housing is $10,000 a month in SF in the summer or at extended stay hotels. Airbnb isn’t well suited [for multi-month stays]. ” Taggar claims. “We’re about half the price of traditional corporate housing for a better product and a better experience.”

Zeus signs minimum two-year leases with landlords and tries to extend them to five years when possible. It gets one free month of rent as is standard for property managers, but doesn’t charge an additional rate. For example, Zeus might lease your home for $4,000 per month but gets the first month free, and rent it out for $5,000 so it earns $60,000 but pays you $44,000. That’s a tidy margin if Zeus can get homes filled fast and hold down its upkeep costs.

“Zeus has been instrumental for my company to start the process of re-location to the Bay Area and to host our visiting employees from abroad now that we are settled” writes Zeus client Meitre’s Luis Caviglia. “I particularly like the ‘hard truths’ featured in every property, and the support we have received when issues arose during our stays.”

There’s no shortage of competitors chasing this $18 billion market in the US alone. There are the old-school corporations and chains like Oakwood and Barbary Coast that typically rent out apartments from vast, generic complexes at steep rates. Stays over 30 days made up 15 percent of Airbnb’s business last year, but the platform wasn’t designed for peace-of-mind around long-term stays. There are pure marketplaces like UrbanDoor that don’t always take care of everything for the landlord or provide consistent tenant experiences. And then there are direct competitors like $130 million-funded Sonder, $66 million-funded Domio, recently GV-backed 2nd Address, and European entants like MagicStay, AtHomeHotel, and Homelike.

Zeus’ property unit growth

There’s plenty of pie, though. With 330,000 housing units in SF alone, Zeus has plenty of room to grow. The rise of remote work means companies whose employee typically didn’t relocate may now need to bring in distant workers for a multi-month sprint. A recession could make companies more expense-cautious, leading them to rethink putting up staffers in hotels for months on end. Regulatory red tape and taxes could scare landlords away from short-term rentals and towards coprorate housing. And the need to expand into new businesses could tempt the big vacation rental platforms like Airbnb to make acquisitions in the space — or try to crush Zeus.

Winners will be determined in part by who has the widest and cheapest selection of properties, but also by which makes people most comfortable in a new city. That’s why Taggar is taking a cue from WeWork by trying to arrange more community events for its tenants. Often in need of friends, Zeus could become a favorite by helping people feel part of a neighborhood rather than a faceless inmate in a massive apartment block or hotel. That gives Zeus network effect if it can develop density in top markets.

Taggar says the biggest challenge is that “I feels like I’m running five startups at once. Pricing, supply chain, customer service, B2B. We’ve decided to make everything custom — our own property manager software, our own internal CRM. We think these advantages compound, but I could be wrong and they could be wasted effort.”

The benefits of Zeus‘ success would go beyond the founder’s bank account. “I’ve had friends in New York get great opportuntiies in San Francisco but not take them because of the friction of moving” Taggar says. Routing talent where it belongs could get more things built. And easy housing might make people more apt to live abroad temporarily. Taggar concludes, “I think it’s a great way to build empathy.”

Powered by WPeMatico

You’ve probably noticed: Design has become central for many businesses that might have once considered it an afterthought. Indeed, with sales and marketing so thoroughly optimized at this point — and companies wondering how else to trounce the competition — there’s now a race afoot for numerous startups looking to become the Salesforce of design.

InVision is one of them. Just three months ago, the design collaboration startup raised $115 million in Series F funding at a $1.9 billion valuation. More recently, Figma, another design player, sealed up $40 million in Series C funding in a round that brings its total funding to $82.9 million and a valuation of $440 million.

Still, if the venture firm Benchmark has its way, Sketch — a seven-year-old, 42-person, Europe-based company — is going to win this race. Truth be told, Benchmark jumped at the chance to back Sketch founders Emanuel Sá and Pieter Omvlee when they reached out to the firm, says Chetan Puttagunta, the newest general partner at Benchmark. “We’d definitely known of Sketch and once we got a look at the company, we were blown away by it. There’s so much potential of what this could be that things moved fast. There wasn’t much of a negotiation. We were like, ‘What do you guys want to do? Let’s do it.’ ”

It helps that Sketch — which has a completely distributed workforce, with designers and other employees based around Europe and the U.S. — has been profitable from the outset, and that one million people have already paid $99 for a perpetual license (with one year of free updates).

Also impressive: those sales are entirely organic, and they are directly from Sketch’s site. Though its design tools were formerly available in the Mac App Store — Apple once gave it a design award and it routinely topped the Mac App Store charts — Sketch parted ways with the company back in 2015, including owing to Apple’s guidelines about what a Mac app can and can’t do, and the time Apple takes to approve app updates, among other things.

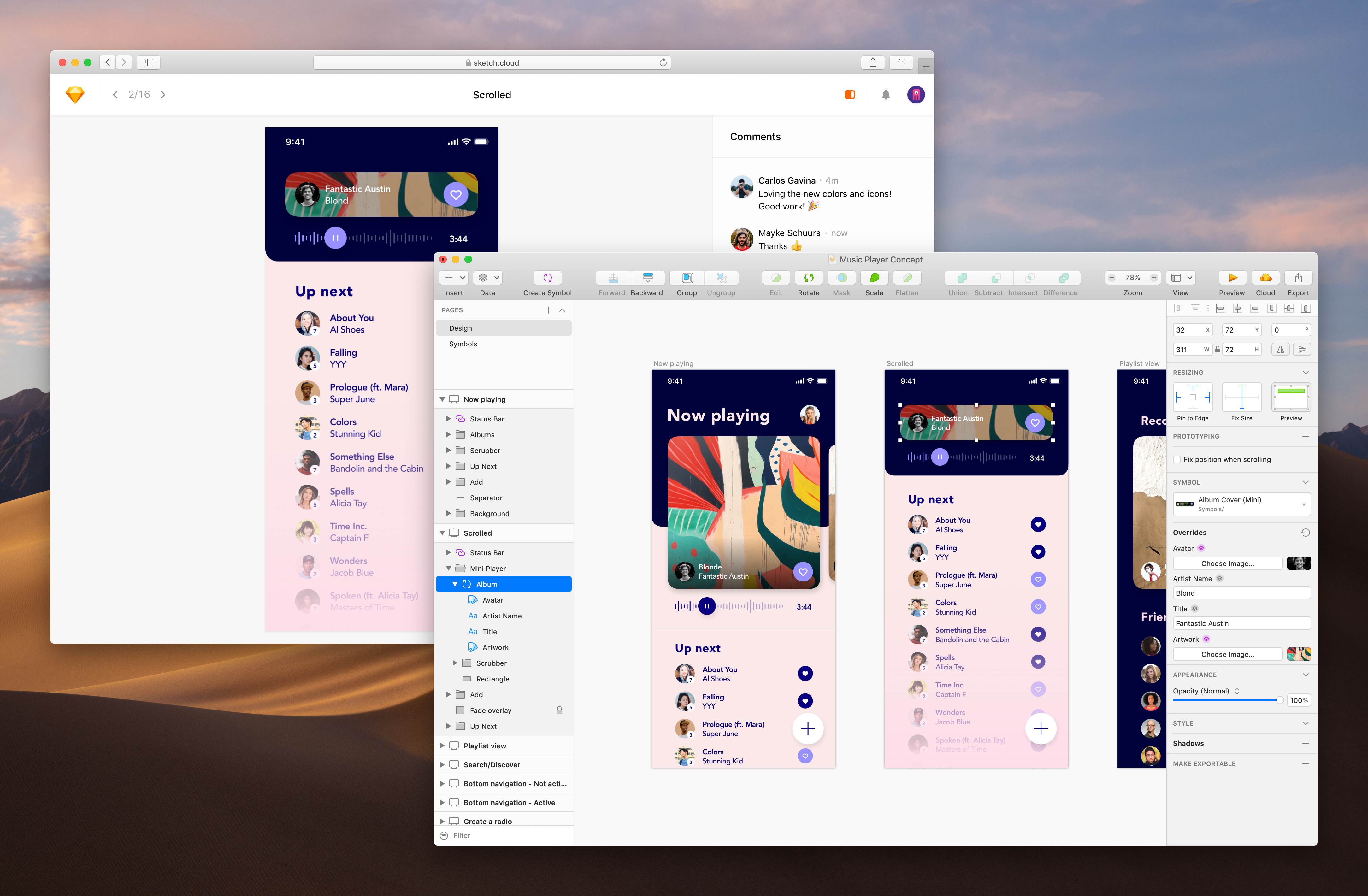

Benchmark — which isn’t sharing Sketch’s post-money valuation or how much of the company that $20 million is buying the venture firm — also sees a future wherein Sketch moves beyond its roots as a prototyping tool for both highly experienced and novice designers to build out their experience without the help of coders. The idea is for it to become a tool that teams big and small can gather around. In other words, like InVision and Figma (and Adobe and Autodesk), Sketch is going after the enterprise now, too.

In fact, Sketch is already planning some big upgrades that will be available this summer, as Sá and Omvlee told us yesterday from their respective offices in Portugal and The Netherlands. One major offering around the corner that builds on its existing cloud offering is team collaboration, via a tool called Sketch for Teams. As the two tell us, Sketch wants to be where all documents live and it will allow teams to make annotations and comments in the app.

Sketch is also bringing its tools to the browser starting later this year so users can render an entire document, add developer hand-off and allow editing along with collaboration, all without the need to leave the browser.

All of these features will be made available to anyone who downloads Sketch. In other words, then, as now, everyone gets the same functionality. Asked if there may eventually be features for enterprises that are not available to Sketch’s loyal base of current customers, Puttagunta says it’s a possibility, but that “at the moment, there’s no plan to bifurcate anything. Different modules, different charges — that’s all speculation at this point.”

Sá and Omvlee echo the point, telling us candidly that much remains to be seen. “We need to define a strategy,” says Sá. “So far, we’ve been focused on developing the product, but when the time comes, we’ll discuss [more of these business particulars] with Benchmark and the rest of the team and come up with the best solution.”

What won’t change, says Omvlee, is its focus on creating a product that users love so much that they tell others about it. “Our focus all along has been on making design available to pretty much anyone out there, and then get out of the way.”

Powered by WPeMatico

Stash, the fintech startup and app that aims to introduce new people to the world of investing, is unveiling some interesting new services while also announcing that it has raised more funding to expand its business. The company is introducing mobile-based banking accounts from Green Dot Bank, and, alongside it, a new rewards program called “Stock-Back.” When users spend money using their Stash accounts, they get “points” — which are either stocks in the companies where they are buying goods, or shares in ETFs approved by Stash. On top of that, Stash also said it raised a Series E of $65 million that it will be using to grow its business on the back of these two launches.

A spokesperson for the company said that Stash is not disclosing the full round of investors in this round. For context, Stash was valued at $350 million post-money in its Series D, according to figures from PitchBook, and a source says the valuation is now “much higher” than $400 million.

But from the looks of it, the $65 million appears to include participation from Breyer Capital, a previous investor whose founder Jim Breyer has heartily endorsed the new Stock-Back service and accompanying loyalty program that’s tied in with it, which was tested early with companies like Netflix, T-Mobile and Chipotle all offering stock when people used their Stash accounts to pay for goods and services at the companies.

“I have invested in and served on the Board of many leading companies, and it’s clear how a program like Stock-Back can power immense brand loyalty,” he said in a statement today. “The early data shows unequivocally that share ownership drives increased sales and customer appreciation. This innovative new technology from STASH will have CEOs and CMOs knocking on their door.”

From what we understand, the round was led by a private institutional investor and includes 40 percent existing and 60 percent new investors. Previous backers in addition to Breyer include Union Square Ventures, Coatue Management, Entree, Goodwater and Valar. “We’re really excited and proud to be working with this incredible group of VCs,” the spokesperson noted.

The Green Dot-powered banking service comes with the core features that will sound familiar to those who have used or looked at next-generation banking services before. It will include a debit card-based account, no overdraft or monthly maintenance fees, access to a network of ATMs that can be used for free and direct deposit services, as well as “personal guidance” for their financial planning activities, from saving to investing.

Stash is part of a wave of fintech startups — others include the likes of Robinhood, Acorns, YieldStreet, Revolut and many others — that have tapped into the popularity of apps and the advent of new financial services technology to democratise how individuals can save, spend, invest, borrow and lend money, moving many of those operations and transactions out of the hands of the big incumbent players who used to control them.

The average age of a Stash user is 29 and average income is less than $50,000 per year, and tying in transactions made using Stash’s banking service — by way of reward points that are being picked up incidentally — will make it even more seamless for these users to take some of their money and invest with it, while at the same time demystifying some of the process and making it more likely that those users will choose to invest even more down the line.

The idea of tying investments to what you are actually purchasing is a clever one. For a startup whose user base includes no-nonsense professionals from fields like teaching, nursing and retail, this is the embodiment of putting your money where your mouth is — literally speaking, as the investments can include things like shares in Chipotle each time you buy food there, and T-Mobile every time you pay your phone bill for all the talking you do.

Stash is positioning Stock-Back as a rewards program, with the percentages varying by business or brand and going as high as five percent in Stock-Back in some cases — as is the case, at launch, when people use their Stash debit cards to pay their Spotify and Netflix dues.

Ultimately, the aim of this is to present a way for ordinary, modestly-salaried people not only to potentially make money, but to be better engaged in how financial systems work, and how their daily actions impact that — the idea being that this knowledge can only help them in the long run.

“80% of Americans are living paycheck-to-paycheck. Stock-Back is our way of utilizing STASH’s smart, patent-pending technology to help people build better financial habits and invest in their future,” said co-founder and president, Ed Robinson, in a statement. “Our ability to give customers the opportunity to save and build portfolios that mirror their spending behavior and preferences is incredibly powerful.”

Powered by WPeMatico

Crypto represent a “border-less” asset that anyone can own, but actually getting hold of it isn’t easy for everyone. Amun, a company that wants to make buying crypto as easy as stock, has pulled in $4 million in funding to offer more established channels for crypto ownership.

The startup currently offers punters an ETP (exchange-traded product) on the Swiss Stock Exchange that pulls together five of the most popular crypto assets: Bitcoin, Ethereum, Bitcoin Cash, XRP and Litecoin. HODL — as it is called after “holding” crypto rather than selling it (LOL) — can be purchased just like any stock.

That five-crypto basket is just the start for Amun, which is developing ETPs for other crypto assets individually. The first one is for Bitcoin — ABTC — with others planned to come soon; you’d imagine the usual suspects such as Ethereum and co will follow. Indeed, Amun has licenses to the five crypto assets in HODL as well as EOS.

While the products are ETP and not covered by Collective Investment Schemes Act (CISA), they are protected in custody and by insurance. They are collateralized and backed by an identical amount of crypto assets.

Personally, I’ve been able to buy crypto — just base tokens like Bitcoin and Ethereum rather than company-specific ICO tokens — but it certainly is true that it takes some learning. While, speaking for me and likely many others, exchange-based products aren’t easier to me, it does appeal to more institutionally minded individuals or companies for whom holding an account with an exchange or a crypto wallet isn’t feasible. That’s the target that Amun has in mind, as well as outlier cases, too.

Amun CEO and co-founder Hany Rashwan told TechCrunch that growing up in Egypt, he saw the government ban Bitcoin despite the fact that it offered an alternative to the Egyptian pound, which saw its valuation tank massively in 2016. He believes that products like Amun allow anyone to take part in crypto even when they face local restrictions, as was the case in Egypt and other countries.

“We want to make investing in crypto as easy as buying a stock. Institutional investors around the world are looking for a secure, easy and regulated way of accessing the crypto asset class. Amun’s products do that at a low price in one of the most reputable financial hubs in the world,” Rashwan told TechCrunch.

Investors share his optimism and those who took part in this round include Boost VC founder Adam Draper — son of outspoken pro-Bitcoin VC Tim Draper — Graham Tuckwell, founder of ETFS Capital who built ETF products for gold, and Greg Kidd, co-founder of investment firm Hard Yaka. Four undisclosed family offices also took part.

One reason for their optimism is the fact that Amun is developing technology that could, in theory, be licensed out to allow others to develop their own ETFs.

“We invest a ton of resources in both our product development and underlying tech infrastructure. This allows us to come up with innovative but professional and safe ways of accessing the crypto asset class, as well as do all this on a tech platform that can be used by not just us, but any issuer that wishes to do the same as well,” Rashwan said.

“The world needs a company like Amun to make crypto as easy as buying a stock. Now that they were the first to do that, they can now provide the toolset and be the de facto platform for anyone else looking to take their crypto assets/securities to the public markets,” Draper added.

Still, just giving people access doesn’t guarantee returns — that’s on the crypto market itself.

Last year was a dud across the board in terms of pricing, as Bitcoin, for example, plummeted from a record high of nearly $20,000 at the end of 2017 to $3,930-ish at the time of writing. Plenty in the industry are optimistic that will change as genuine value comes out of blockchain technology.

HODL itself debuted at $15.64 last November; today it is at $12.83

Note: The author owns a small amount of cryptocurrency. Enough to gain an understanding, not enough to change a life.

Powered by WPeMatico

Alison Johnston didn’t plan to build a startup around death. An early employee at Q&A app Aardvark that was bought by Google, she’d founded tutoring app InstaEDU and sold it to Chegg. She made mass market consumer products. But then, “I had a family member who was diagnosed with terminal cancer and I thought about how she’d be remembered” she recalls. Inventing the next big social app suddenly felt less consequential.

“I started looking into the funeral industry and discovered that there were very few resources to support and guide families who had recently experienced a death. It was difficult to understand and compare options and prices (which were also much higher than I ever imagined), and there weren’t good tools to share information and memories with others” Johnston tells me. Bombarded by options and steep costs that average $9,000 per funeral in the US, families in crisis become overwhelmed.

Ever Loved co-founder and CEO Alison Johnston

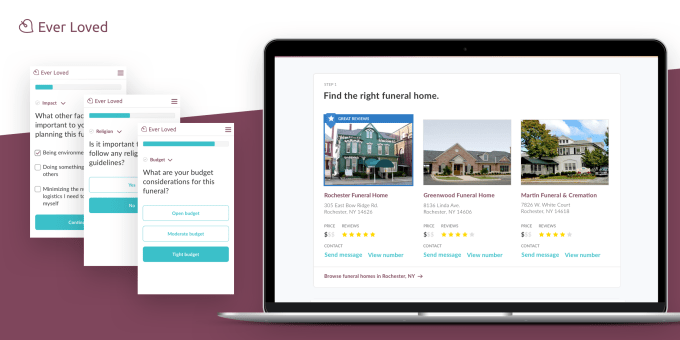

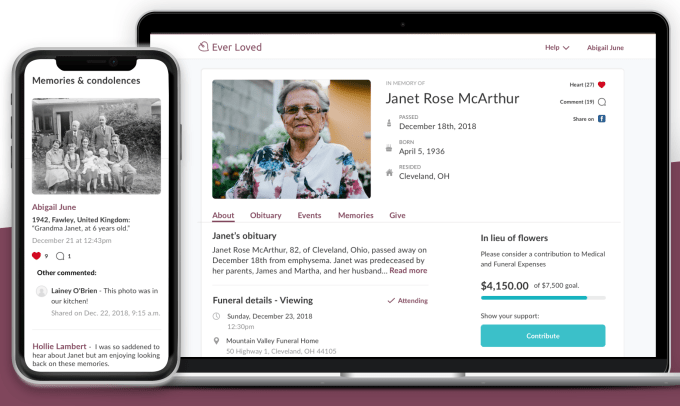

Johnston’s startup Ever Loved wants to provide peace of mind during the rest-in-peace process. It’s a comparison shopping and review site for funeral homes, cemeteries, caskets, urns, and headstones. It offers price guides and recommends top Amazon funeral products and takes a 5 percent affiliate fee that finances Ever Loved’s free memorial site maker for sharing funeral details plus collecting memories and remembrances. And families can even set up fundraisers to cover their costs or support a charity.

The startup took seed funding from Social Capital and a slew of angel investors about a year ago. Now hundreds of thousands of users are visiting Ever Loved shopping and memorial sites each month. Eventually Ever Loved wants to build its own marketplace of funeral services and products that takes a 10 percent cut of purchases, while also selling commerce software to funeral homes.

“People don’t talk about death. It’s taboo in our society and most people don’t plan ahead at all” Johnston tells me. Rushing to arrange end-of-life logistics is enormously painful, and Johnston believes Ever Loved can eliminate some of that stress. “I wanted to explore areas where fewer people in Silicon Valley had experience and that weren’t just for young urban professionals.”

There’s a big opportunity to modernize this aging industry with a sustainable business model and empathy as an imperative. 86 percent of funeral homes are independent, Johnston says, so few have the resources to build tech products. One of the few big companies in the space, the $7 billion market cap public Service Corporation International, has rolled up funeral homes and cemeteries but has done little to improve pricing transparency or the user experience for families in hardship. Rates and reviews often aren’t available, so customers can end up overpaying for underwhelming selection.

On the startup side, there’s direct competitors like FuneralWise, which is focused on education and forums but lacks robust booking features or a memorial site maker. Funeral360 is Ever Loved’s biggest rival, but Ever Loved’s memorial sites looked better and it had much deeper step-by-step pricing estimates and information on funeral homes.

Johnston wants to use revenue from end-of-life commerce to subsidize Ever Loved’s memorial and fundraiser features so they can stay free or cheap while generating leads and awareness for the marketplace side. But no one has hit scale and truly become wedding site The Knot but for funerals.

I’ve known Johnston since college, and she’s always had impressive foresight for what was about to blow up. From an extremely early gig at Box.com to Q&A and on-demand answers with Aardvark to the explosion of online education with InstaEDU, she’s managed to get out in front of the megatrends. And tech’s destiny to overhaul unsexy businesses is one of the biggest right now.

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.

Amazon has made us expect to see prices and reviews up front, so Ever Loved has gathered rate estimates for about two-thirds of US funeral homes and is pulling in testimonials. You can search for 4-star+ funeral homes nearby and instantly get high-quality results. Meanwhile, funeral homes can sign up to claim their page and add information.

Facebook popularized online event pages. But its heavy-handed prerogatives, generalist tone, and backlash can make it feel like a disrespectful place to host funeral service details. And with people leaving their hometowns, newspapers can’t spread the info properly. Ever Loved is purpose-built for these serious moments, makes managing invites easy, and also offers a place to collect obituaries, photos, and memories.

Rather than having to click through a link to a GoFundMe page that can be a chore, Ever Loved hosts fundraisers right on its memorial sites to maximize donations. That’s crucial since funerals cost more than most people have saved. Ever Loved only charges a processing fee and allows visitors to add an additional tip, so it’s no more expensive that popular fundraising sites.

Next, “the two big things are truly building out booking through our site and expanding into some of the other end of life logistics” Johnstone tells me. Since the funeral is just the start of the post-death process, Ever Loved is well positioned to move into estate planning. “There are literally dozens of things you have to do after someone passes away — contacting the social security office, closing out bank accounts and Facebook profiles…”

Johnston reveals that 44 percent of families say they had arguments while divvying up assets — a process that takes an average of 560 hours aka 3 months of full-time work. As the baby boomer era ends over the next 30 years, $30 trillion in assets are expected to transfer through estates, she claims. Earning a tiny cut of that by giving mourners tools outlining popular ways to divide estates could alleviate disagreements could make Ever Loved quite lucrative.

“When I first started out, I was pretty awkward about telling people about this. We’re death averse, and that hinders us in a lot of ways” Johnston concludes. My own family struggled with this, as an unwillingness to accept mortality kept my grandparents from planning for after they were gone. “But I quickly learned was this was a huge conversation starter rather than a turn off. This is a topic people want to talk about more and educate themselves more on. Tech too often merely makes life and work easier for those who already have it good. Tech that tempers tragedy is a welcome evolution for Silicon Valley.”

Powered by WPeMatico

Blueground, the startup providing turnkey flexible rental apartments, has raised $20 million in a round led by Athens-based VentureFriends, with participation from Endeavor Catalyst, Dubai’s Jabbar Internet Group and serial entrepreneur Kevin Ryan. Ryan — who helped found MongoDB, Gilt Groupe, Zola and others — will also join Blueground’s board of directors.

It’s no secret that remote work and frequent business travel are becoming more and more commonplace. As a result, a growing number of people are shying away from lengthy rental or lease commitments and are instead turning to companies like Blueground for more flexible short-term solutions.

Blueground is trying to be the go-to option for individuals moving or traveling to a city for as little as a month, or any duration longer. Similar to flexible office space providers, Blueground partners with major property owners to sign long-term leases for units it then furnishes and rents out with more flexible terms.

Users can rent listings for anywhere between one month to five years, and rates are set on a monthly basis, which can often lead to more favorable prices over medium-to-long-term stays relative to the short-term pricing structures commonly used by hospitality companies.

CEO Alex Chatzieleftheriou is intimately familiar with the value flexible leasing can unlock. Before founding Blueground, Chatzieleftheriou worked as a consultant for McKinsey, where he was frequently sent off to projects in far-off cities for months at a time — living in 15 cities over just seven years.

However, no matter how much time Alex logged in hotels, he constantly felt the frustration and mental strain of not having a stable personal living arrangement.

“I spent so much time in hotels but they never really resembled a home. They didn’t have enough space or enough privacy,” Chatzieleftheriou told TechCrunch. “But renting an apartment can be a huge pain in these cities. They can be hard to find, they usually have a minimum rental term of a year or more, and you usually have to deal with filling out paperwork and buying furniture.”

Knowing there were thousands of people at his company alone dealing with the same frustrations, Alex launched what would become Blueground, beginning with a handful of apartments in his home city of Athens, Greece.

Chatzieleftheriou and his team structured the platform to make the rental process as seamless as possible for the needs of flexible renters like himself. Through a quick plug-and-play checkout flow — more similar to the booking process for a hotel or Airbnb — renters can lock down an apartment without having to deal with the painful, costly and time-consuming traditional rental process. Tenants are also able to switch to any other Blueground listing during their rental period if their preferences change or if they want to explore different locations during their stay.

Every Blueground listing also comes completely furnished by the company’s design team, so renters don’t have to deal with buying, transporting — and eventually selling — furniture. And each apartment comes outfitted with digital and connected infrastructure so that tenants can monitor their apartment and arrange maintenance, housekeeping and other services directly through Blueground’s mobile app.

The value proposition is also fairly straightforward for the landlords Blueground partners with, as they avoid costs related to marketing and coordinating with fragmented brokers to fill open units, while also benefiting from steady rental payments, tenant vetting and free property management.

The offering certainly seems to be compelling for renters — while Chatzieleftheriou initially focused on serving business travelers and those moving for work, he quickly realized the market for flexible leasing was in fact much bigger. Blueground’s sales have tripled over the past three years and after its expansion in the U.S. last year, Blueground now hosts 1,700 listings in 10 cities across three continents.

“The trend of flexible and seamless real estate is bigger and is happening everywhere,” Chatzieleftheriou said. “A lot of people throughout the real estate sector really want this seamless, turnkey, furnished solution.”

To date, Blueground has raised a total of $28 million and plans to use funds from the latest round for additional hiring and to help the company reach its goal of growing its portfolio to 50,000 units over the next five years.

Powered by WPeMatico

Paris-based Shift Technology has raised another $60 million funding round. Bessemer Venture Partners is leading the round and existing investors Accel, General Catalyst, Iris Capital and Elaia Partners are also participating.

Shift Technology is all about detecting fraudulent insurance claims. There are 70 insurance companies around the world relying on its product, such as MACIF in France, Axa in Spain, and CNA and HyreCar in the U.S. And given the size of those companies, it means that Shift Technology is processing a ton of claims every day.

It’s easy to sell this kind of product, as fraudulent claims cost a ton of money. If Shift Technology can help you catch more fraudulent claims, you can spend a bit of money to save a lot of money.

The startup has already grown quite a lot since its previous funding round. They now have 200 employees, and customers all around the globe. In addition to its headquarters in Paris, Shift Technology also has offices in Boston, London, Hong Kong, Madrid, Singapore and Zurich.

With today’s funding round, the company plans to hire more people in Boston, including data scientists and developers. The company is also playing around with an automated claim-processing solution.

Shift Technology is creating a strong barrier to entry. Thanks to its huge data set, it can create an AI-powered detection model that is getting more and more accurate. A new company would have a hard time catching up.

Powered by WPeMatico

A Chinese startup that’s taking a dorm-like approach to urban housing just raised $500 million as its valuation jumped over $2 billion. Danke Apartment, whose name means “eggshell” in Chinese, closed the Series C round led by returning investor Tiger Global Management and newcomer Ant Financial, Alibaba’s e-payment and financial affiliate controlled by Jack Ma.

Four years ago, Beijing-based Danke set out with a mission to provide more affordable housing for young Chinese working in large urban centers. It applies the co-working concept to housing by renting apartments that come renovated and fully furnished, a model not unlike that of WeWork’s WeLive. The idea is by slicing up a flat designed for a family of three to four — the more common type of urban housing in China — into smaller units, young professionals can afford to live in nicer neighborhoods as Danke takes care of hassles like housekeeping and maintenance. To date, the startup has set foot in 10 major Chinese cities.

With the new funds, Danke plans to upgrade its data processing system that deals with rental transactions. Housing prices are set by AI-driven algorithms that take into account market forces such as locations rather than rely on the hunches of a real estate agent. The more data it gleans, the smarter the system becomes. That layout is the engine of the startup, which believes an internet platform play is a win-win for both homeowners and tenants because it provides greater transparency and efficiency while allowing the company to scale faster.

“We are focused on business intelligence from day one,” Danke’s angel investor and chairman Derek Shen told TechCrunch in an interview. Shen was the former president of LinkedIn China and was instrumental in helping the professional networking site enter the country. “By doing so we are eliminating the need to set up offline retail outlets and are able to speed up the decision-making process. What landlords normally care is who will be the first to rent out their property. The model is also copyable because it requires less manpower.”

“We’ve proven that the rental housing business can be decentralized and done online,” added Shen.

Photo: Danke Apartment via Weibo

Danke doesn’t just want to digitize the market it’s after. Half of the company’s core members have hailed from Nuomi, the local services startup that Shen founded and was sold to Baidu for $3.2 billion back in 2015. Having worked for a business whose mission was to let users explore and hire offline services from their connected devices, these executives developed a propensity to digitize all business aspects, including Danke’s day-to-day operations, a scheme that will also take up some of the new funds. This will allow Danke to “boost operational efficiency and cut costs” as it “actively works with the government to stabilize rental prices in the housing market,” the company says.

The rest of the proceeds will go toward improving the quality of Danke’s apartment amenities and tenant experiences, a segment that Shen believes will see great revenue potential down the road, akin to how WeWork touts software services to enterprises. The money will also enable Danke, which currently zeroes in on office workers and recent college graduates, to explore the emerging housing market for blue-collar workers.

Other investors from the round include new backer Primavera Capital and existing investors CMC Capital, Gaorong Capital and Joy Capital.

China’s rental housing market has boomed in recent years as Beijing pledges to promote affordable apartments in a country where few have the money to buy property. As President Xi Jinping often stresses, “houses are for living in, not for speculation.” As such, investors and entrepreneurs have been piling into the rental flat market, but that fervor has also created unexpected risks.

One much-criticized byproduct is the development of so-called “rental loans.” It goes like this: Housing operators would obtain loans in tenants’ names from banks or other lending institutions allegedly by obscuring relevant details from contracts. So when a tenant signs an agreement that they think binds them to rents, they have in fact agreed to take on loans and their “rent” payments become monthly loan repayments.

Housing operators are keen to embrace such practices because the loans provide working capital for renovation and their pipeline of properties. On the other hand, the capital allows companies like Danke to lower deposits for cash-strapped young tenants. “There’s nothing wrong with the financial instrument itself,” suggested Shen. “The real issue is when the housing operator struggles to repay, so the key is to make sure the business is well-functioning.”

Danke, alongside competitors Ziroom and 5I5J, has drawn fire for not fully informing tenants when signing contracts. Shen said his company is actively working to increase transparency. “We will make it clear to customers that what they are signing are loans. As long as we give them enough notice, there should be little risk involved.”

Powered by WPeMatico

Figure, a 13-month-old, San Francisco-based company that says it uses blockchain technology to provide home equity loans online in as little as five days, has raised a whole lot of money in not a lot of time: $120 million to date, including $65 million in fresh funding from RPM Ventures and partners at DST Global, with participation from DCG, Nimble Ventures, Morgan Creek and earlier investors Ribbit Capital and DCM.

The money isn’t entirely surprising, given who founded the company — Mike Cagney, who founded SoFi and built it into a major player in student loan refinancing in the U.S. before leaving amid allegations of sexual harassment and an anything-goes corporate culture that saw at least two former employees sue the company.

Today, SoFi has moved on under the leadership of CEO Anthony Noto, a former Twitter executive who is working to reshape SoFi from a lending company into more of a full-fledged financial services company, with savings and checking accounts, as well as exchange-traded funds, all with the aim of making its platform stickier than in the past.

It may be a bigger endeavor than Noto had realized. Though Cagney once predicted the company would IPO in 2018 or 2019, SoFi isn’t even considering a public offering this year, Noto told reporters earlier this week.

Cagney has meanwhile moved on, too, though he still seems set on taking on traditional banks. Indeed, while Figure is providing home loans today — it says it has provided more than 1,500 home equity lines to date — it’s also moving to diversify into new areas, including wealth management, unsecured consumer loans and checking accounts offered (for now) in partnership with an existing bank.

Interestingly, Figure, which employs 100 people, is targeting a very different demographic than did SoFi, as Cagney told American Banker recently. Whereas SoFi marketed to young people earning high salaries, Figure is going after older customers who may not be seeing much in the way of income but have much of their wealth tied up in their homes instead.

Given that older Americans are projected to outnumber children for the first time in history by 2030, according to U.S. census data, Cagney clearly sees the writing on the wall.

Unsurprisingly, he’s not the only one. Other startups trying to make it easier for Americans to borrow against their homes include Point, a roughly four-year-old startup that lends capital to people and receives partial ownership in their homes in return.

Cagney co-founded Figure with his wife, June Ou, who is the company’s chief operating officer. She was previously chief technology officer at SoFi.

As for its culture and lingering questions that customers and potential partners may have about what happened at SoFi, Cagney — who has said he had consensual sexual relationships with female subordinates at SoFi — insists that Figure is benefiting from lessons learned.

At SoFi, he told American Banker, “[W]e grew so fast and we never really understood what we were going to grow into, and culture never took a front seat.” Figure meanwhile has a “very clear adherence to a no-asshole policy.”

Powered by WPeMatico

SoftBank’s Vision Fund is taking a bet on China’s auto market after it agreed to pour $1.5 billion into online car trading group Chehaoduo, which literally means “many cars” in Chinese.

The Beijing-based company operates two main sites — peer-to-peer online marketplace Guazi for used vehicles, and Maodou, which retails new sedans through direct sales and financial leasing. (These sub-brands are more subtly named; they translate to “sunflower seeds” and “edamame,” respectively.)

Chehaoduo said it will deploy the proceeds on technology investments as well as the development of new products and services. It also plans to ramp up its marketing efforts and continue to open brick-and-mortar stores, an omnichannel move it believes can enhance trust in consumers used to meeting dealers in person and differentiate it from peers with an exclusively online focus. Chehaoduo currently runs 600 offline stores nationwide supporting new and used car dealing along with after-sales services.

The sizable funding round arrived at a time when China’s softening economy is sapping consumer confidence, but the company’s two-pronged strategy makes sure it covers a broad range of consumer demands. New passenger car sales in China — the world’s largest auto market — fell for the first time since the 1990s to 23.7 million units last year, according to a report by China’s Association of Automobile Manufacturers, the country’s top auto association.

On the other hand, used cars became a more economical choice in a consumer culture that, unlike many countries in the west, has been slow to embrace second-hand goods. But that mindset is shifting as people feel the heat of the Chinese economic downturn: Secondhand car sales were up 13 percent during the first 11 months of 2018, data from China’s Automobile Dealers Association show.

“China’s used car market is growing rapidly but online penetration remains low and auto financing is underutilized compared to developed markets. In just three years, Chehaoduo Group, through the Guazi brand, has leveraged the latest innovations in data-driven technology to establish China’s leading car trading platform,” says Eric Chen, partner at SoftBank’s Investment Advisers, in a statement.

The Japanese investment group has been a prolific backer in the mobility industry through a variety of affiliated companies with Vision Fund being one. SoftBank’s massive portfolio includes the likes of Uber, Didi Chuxing and Grab .

Chehaoduo counts Uxin and Renrenche as its most serious rivals. Uxin raised $225 million from a U.S. initial public offering last June while Renrenche lured Goldman Sachs in a $300 million funding round last year that also saw participation from Didi and Tencent.

Powered by WPeMatico