Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

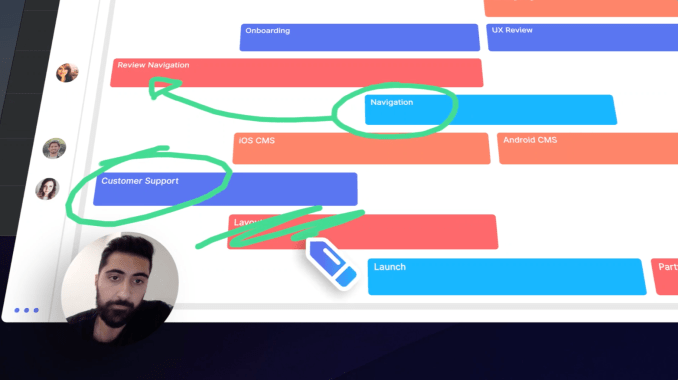

If a picture is worth a thousand words, how many emails can you replace with a video? As offices fragment into remote teams, work becomes more visual and social media makes us more comfortable on camera, it’s time for collaboration to go beyond text. That’s the idea behind Loom, a fast-rising startup that equips enterprises with instant video messaging tools. In a click, you can film yourself or narrate a screenshare to get an idea across in a more vivid, personal way. Instead of scheduling a video call, employees can asynchronously discuss projects or give “stand-up” updates without massive disruptions to their workflow.

In the 2.5 years since launch, Loom has signed up 1.1 million users from 18,000 companies. And that was just as a Chrome extension. Today Loom launches its PC and Mac apps that give it a dedicated presence in your digital work space. Whether you’re communicating across the room or across the globe, “Loom is the next best thing to being there,” co-founder Shahed Khan tells me.

Now Loom is ready to spin up bigger sales and product teams thanks to an $11 million Series A led by Kleiner Perkins . The firm’s partner Ilya Fushman, formally Dropbox’s head of product and corporate development, will join Loom’s board. He’ll shepherd Loom through today’s launch of its $10 per month per user Pro version that offers HD recording, calls-to-action at the end of videos, clip editing, live annotation drawings and analytics to see who actually watched like they’re supposed to.

“We’re ditching the suits and ties and bringing our whole selves to work. We’re emailing and messaging like never before, but though we may be more connected, we’re further apart,” Khan tells me. “We want to make it very easy to bring the humanity back in.”

Loom co-founder Shahed Khan

But back in 2016, Loom was just trying to survive. Khan had worked at Upfront Ventures after a stint as a product designer at website builder Weebly. He and two close friends, Joe Thomas and Vinay Hiremath, started Opentest to let app makers get usability feedback from experts via video. But after six months and going through the NFX accelerator, they were running out of bootstrapped money. That’s when they realized it was the video messaging that could be a business as teams sought to keep in touch with members working from home or remotely.

Together they launched Loom in mid-2016, raising a pre-seed and seed round amounting to $4 million. Part of its secret sauce is that Loom immediately starts uploading bytes of your video while you’re still recording so it’s ready to send the moment you’re finished. That makes sharing your face, voice and screen feel as seamless as firing off a Slack message, but with more emotion and nuance.

“Sales teams use it to close more deals by sending personalized messages to leads. Marketing teams use Loom to walk through internal presentations and social posts. Product teams use Loom to capture bugs, stand ups, etc.,” Khan explains.

Loom has grown to a 16-person team that will expand thanks to the new $11 million Series A from Kleiner, Slack, Cue founder Daniel Gross and actor Jared Leto that brings it to $15 million in funding. They predict the new desktop apps that open Loom to a larger market will see it spread from team to team for both internal collaboration and external discussions from focus groups to customer service.

Loom will have to hope that after becoming popular at a company, managers will pay for the Pro version that shows exactly how long each viewer watched. That could clue them in that they need to be more concise, or that someone is cutting corners on training and cooperation. It’s also a great way to onboard new employees. “Just watch this collection of videos and let us know what you don’t understand.” At $10 per month though, the same cost as Google’s entire GSuite, Loom could be priced too high.

Next Loom will have to figure out a mobile strategy — something that’s surprisingly absent. Khan imagines users being able to record quick clips from their phones to relay updates from travel and client meetings. Loom also plans to build out voice transcription to add automatic subtitles to videos and even divide clips into thematic sections you can fast-forward between. Loom will have to stay ahead of competitors like Vidyard’s GoVideo and Wistia’s Soapbox that have cropped up since its launch. But Khan says Loom looms largest in the space thanks to customers at Uber, Dropbox, Airbnb, Red Bull and 1,100 employees at HubSpot.

“The overall space of collaboration tools is becoming deeper than just email + docs,” says Fushman, citing Slack, Zoom, Dropbox Paper, Coda, Notion, Intercom, Productboard and Figma. To get things done the fastest, businesses are cobbling together B2B software so they can skip building it in-house and focus on their own product.

No piece of enterprise software has to solve everything. But Loom is dependent on apps like Slack, Google Docs, Convo and Asana. Because it lacks a social or identity layer, you’ll need to send the links to your videos through another service. Loom should really build its own video messaging system into its desktop app. But at least Slack is an investor, and Khan says “they’re trying to be the hub of text-based communication,” and the soon-to-be-public unicorn tells him anything it does in video will focus on real-time interaction.

Still, the biggest threat to Loom is apathy. People already feel overwhelmed with Slack and email, and if recording videos comes off as more of a chore than an efficiency, workers will stick to text. And without the skimability of an email, you can imagine a big queue of videos piling up that staffers don’t want to watch. But Khan thinks the ubiquity of Instagram Stories is making it seem natural to jump on camera briefly. And the advantage is that you don’t need a bunch of time-wasting pleasantries to ensure no one misinterprets your message as sarcastic or pissed off.

Khan concludes, “We believe instantly sharable video can foster more authentic communication between people at work, and convey complex scenarios and ideas with empathy.”

Powered by WPeMatico

Redis Labs, a startup that offers commercial services around the Redis in-memory data store (and which counts Redis creator and lead developer Salvatore Sanfilippo among its employees), today announced that it has raised a $60 million Series E funding round led by private equity firm Francisco Partners.

The firm didn’t participate in any of Redis Labs’ previous rounds, but existing investors Goldman Sachs Private Capital Investing, Bain Capital Ventures, Viola Ventures and Dell Technologies Capital all participated in this round.

In total, Redis Labs has now raised $146 million and the company plans to use the new funding to accelerate its go-to-market strategy and continue to invest in the Redis community and product development.

Current Redis Labs users include the likes of American Express, Staples, Microsoft, Mastercard and Atlassian . In total, the company now has more than 8,500 customers. Because it’s pretty flexible, these customers use the service as a database, cache and message broker, depending on their needs. The company’s flagship product is Redis Enterprise, which extends the open-source Redis platform with additional tools and services for enterprises. The company offers managed cloud services, which give businesses the choice between hosting on public clouds like AWS, GCP and Azure, as well as their private clouds, in addition to traditional software downloads and licenses for self-managed installs.

Redis Labs CEO Ofer Bengal told me the company’s isn’t cash positive yet. He also noted that the company didn’t need to raise this round but that he decided to do so in order to accelerate growth. “In this competitive environment, you have to spend a lot and push hard on product development,” he said.

It’s worth noting that he stressed that Francisco Partners has a reputation for taking companies forward and the logical next step for Redis Labs would be an IPO. “We think that we have a very unique opportunity to build a very large company that deserves an IPO,” he said.

Part of this new competitive environment also involves competitors that use other companies’ open-source projects to build their own products without contributing back. Redis Labs was one of the first of a number of open-source companies that decided to offer its newest releases under a new license that still allows developers to modify the code but that forces competitors that want to essentially resell it to buy a commercial license. Ofer specifically notes AWS in this context. It’s worth noting that this isn’t about the Redis database itself but about the additional modules that Redis Labs built. Redis Enterprise itself is closed-source.

“When we came out with this new license, there were many different views,” he acknowledged. “Some people condemned that. But after the initial noise calmed down — and especially after some other companies came out with a similar concept — the community now understands that the original concept of open source has to be fixed because it isn’t suitable anymore to the modern era where cloud companies use their monopoly power to adopt any successful open source project without contributing anything to it.”

Powered by WPeMatico

Darktrace helped pave the way for using artificial intelligence to combat malicious hacking and enterprise security breaches. Now a new U.K. startup founded by an ex-Darktrace executive has raised some funding to take the use of AI in cybersecurity to the next level.

Senseon, which has pioneered a new model that it calls “AI triangulation” — simultaneously applying artificial intelligence algorithms to oversee, monitor and defend an organization’s network appliances, endpoints and “investigator bots” covering multiple microservices — has raised $6.4 million in seed funding.

David Atkinson — the startup’s CEO and founder who had previously been the commercial director for Darktrace and before that helped pioneer new cybersecurity techniques as an operative at the U.K.’s Ministry of Defense — said that Senseon will use the funding to continue to expand its business both in Europe and the U.S.

The deal was co-led by MMC Ventures and Mark Weatherford, who is chief cybersecurity strategist at vArmour (which itself raised money in recent weeks) and previously Deputy Under Secretary for Cybersecurity, U.S. Department of Homeland Security. Others in the round included Amadeus Capital Partners, Crane Venture Partners and CyLon, a security startup incubator in London.

As Atkinson describes it, triangulation was an analytics concept first introduced by the CIA in the U.S., a method of bringing together multiple vectors of information to unearth inconsistencies in a data set (you can read more on triangulation in this CIA publication). He saw an opportunity to build a platform that took the same kind of approach to enterprise security.

There are a number of companies that are using AI-based techniques to help defend against breaches — in addition to Darktrace, there is Hexadite (a remediation specialist acquired by Microsoft), Amazon is working in the field and many others. In fact I think you’d be hard-pressed to find any IT security company today that doesn’t claim to or actually use AI in its approach.

Atkinson claims, however, that many AI-based solutions — and many other IT security products — take siloed, single-point approaches to defending a network. That is to say, you have network appliance security products, endpoint security, perhaps security for individual microservices and so on.

But while many of these work well, you don’t always get those different services speaking to each other. And that doesn’t reflect the shape that the most sophisticated security breaches are taking today.

As cybersecurity breaches and identified vulnerabilities continue to grow in frequency and scope — with hundreds of millions of individuals’ and organizations’ data potentially exposed in the process, systems disabled, and more — we’re seeing an increasing amount of sophistication on the part of the attackers.

Yes, those malicious actors employ artificial intelligence. But — as described in this 2019 paper on the state of cybersecurity from Symantec — they are also taking advantage of bigger “surface areas” with growing networks of connected objects all up for grabs; and they are tackling new frontiers like infiltrating data in transport and cloud-based systems. (In terms of examples of new frontiers, mobile networks, biometric data, gaming networks, public clouds and new card-skimming techniques are some of the specific areas that Experian calls out.)

Senseon’s antidote has been to build a new platform that “emulates how analysts think,” said Atkinson. Looking at an enterprise’s network appliance, an endpoint and microservices in the cloud, the Senseon platform “has an autonomous conversation” using the source data, before it presents a conclusion, threat, warning or even breach alert to the organization’s security team.

“We have an ability to take observations and compare that to hypothetical scenarios. When we tell you something, it has a rich context,” he said. Single-point alternatives essentially can create “blind spots that hackers manoeuvre around. Relying on single-source intelligence is like tying one hand behind your back.”

After Senseon compiles its data, it sends out alerts to security teams in a remediation service. Interestingly, while the platform’s aim is to identify malicious activity in a network, another consequence of what it’s doing is to help organizations identify “false positives” that are not actually threats, to cut down on time and money that get wasted on investigating those.

“Organisations of all sizes need to get better at keeping pace with emerging threats, but more importantly, identifying the attacks that require intervention,” said Mina Samaan of MMC Ventures in a statement. “Senseon’s technology directly addresses this challenge by using reinforcement learning AI techniques to help over-burdened security teams better understand anomalous behaviour through a single holistic platform.”

Although Senseon is only announcing seed funding today, the company has actually been around since 2017 and already has customers, primarily in the finance and legal industries (it would only give out one customer reference, the law firm of Harbottle & Lewis).

Powered by WPeMatico

Thanks to environmentally conscious young buyers, throwaway culture is dying not only in the U.S., but also in Latin America — and startups are poised to jump in with services to help people recycle used clothing.

GoTrendier, a peer-to-peer fashion marketplace operative in Mexico and Colombia, has raised $3.5 million USD to do just that. And investors are eyeing the startup as the digital fashion marketplace growth leader in Spanish-speaking countries.

GoTrendier, founded by Belén Cabido, is a platform that lets users buy and sell secondhand clothing. Cabido tells me that the new capital will enable GoTrendier to expand deeper into Mexico and Colombia, and launch in a new country: Chile.

GoTrendier enables users to buy and sell used items through the GoTrendier site and app. The platform categorizes users as either salespeople or buyers. Salespeople create their own stores by uploading photos of garments along with a description and sale price. Buyers browse the platform for deals and once a buyer bites, the seller is given a prepaid shipping label.

Sound familiar? Businesses like Poshmark and GoTrendier have no actual inventory, which allows the companies to take on less of a risk by having smaller overhead costs. In turn, the company acts as more of a social community for fashion exchanges.

In order to make money, Poshmark takes a flat commission of $2.95 for sales under $15. For anything more than that, the seller keeps 80 percent of their sale and Poshmark takes a 20 percent commission. Poshmark also owes its success to the socially connected shopping experience it created and the audience building features available to sellers — as detailed in this Harvard Business School study. GoTrendier has a similar commission pricing strategy, taking 20 percent off plus an additional nine pesos (about 48 cents in U.S. currency) for all purchases. The service also takes advantage of social media and sharing features to help connect and engage its fashion-loving community.

But these companies are also largely venture-backed. In the case of GoTrendier, the round gave shareholder entry to Ataria, a Peruvian fund that invests in early-stage tech companies with high earning potential. Existing investors Banco Sabadell and IGNIA reinforced their position, along with Barcelona-based investors Antai Venture Builder, Bonsai Venture Capital and Pedralbes Partners.

GoTrendier amassed a user base of 1.3 million buyers and sellers throughout its four years of existence. The service operates in Mexico and Colombia, and will use its newest capital to launch in Chile — another market Cabido says is experiencing high demand for a secondhand fashion buying and selling service.

Online marketplace companies are growing in Latin America as smartphone adoption and digital banking services multiply in the region. But international expansion has proven to be an issue. Enjoei, a similar fashion marketplace that owns the market share in Brazil, had a botched attempt at expanding to Argentina due to Portugese-Spanish language barriers and eventually determined that Brazil was a large enough market in which to build its business — thus carving out an opportunity for companies like GoTrendier that offer the same services to dominate the surrounding Spanish-speaking markets in Latin America.

Many have remarked that Latin America’s tech scene is filled with copycats — or companies that emulate the business models of American or European startups and bring the same service to their home market. In order to secure bigger foreign investment checks, founders from growing tech regions like Latin America certainly must invent proprietary technologies. Yet there’s still value — and capital — in so-called copycat businesses. Why? Because the users are there and in some cases it’s just easier to start up.

According to investor Sergio Pérez of Sabadell Venture Capital, “The volume of the market for buying and selling second-hand clothes in the world was 360 million transactions in 2017 and is expected to reach 400 million in 2022.” A 2018 report from ThredUp also claimed that the size of the global secondhand market is set to hit $41 billion by 2022. The “throwaway” culture is disappearing thanks to environmentally conscious millennial buyers. As designer Stella McCartney famously said, “The future of fashion is circular – it will be restorative and regenerative by design and the clothes we love never end up as waste.” By buying on GoTrendier, the company claims its users have been able to save USD $12 million and have avoided more than 1,000 tons of CO2 emissions.

Founders building companies in Latin America aren’t necessarily as capital-hungry as Silicon Valley-based founders, (where a Series A can now equate to $68 million, apparently). Cabido tells me her company is able to fulfill operations and marketing needs with a lean staff of 30, noting that there’s a lot of natural demand for buying and selling used clothing in these regions, thus creating organic growth for her business. She wasn’t looking to raise capital, but investors had their eye on her. “[Investors] saw the tension of the marketplace, and we demonstrated that GoTrendier’s user base could be bigger and bigger,” she says. With sights set on new markets like Chile and Peru, Cabido decided to move forward and close the round.

Poshmark, which benefits from indirect and same-side network effects, has raised $153 million to date from investors like Temasek Holdings, GGV and Menlo Ventures. Just like GoTrendier, Poshmark’s Series A was also a $3.5 million round.

Who’s to say that that amount of capital can’t boost a network effects growth model in Latin America too? The users are certainly waiting.

Powered by WPeMatico

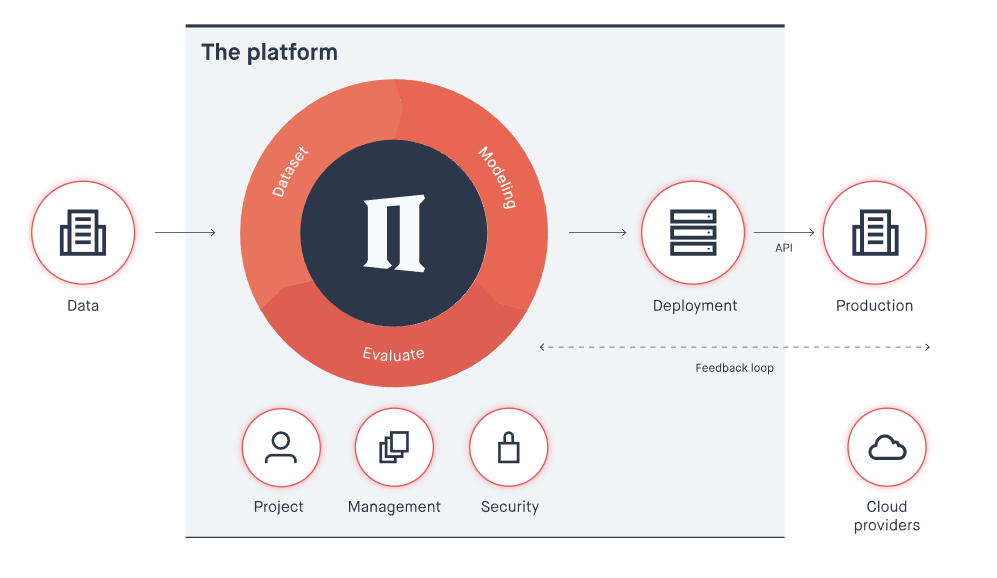

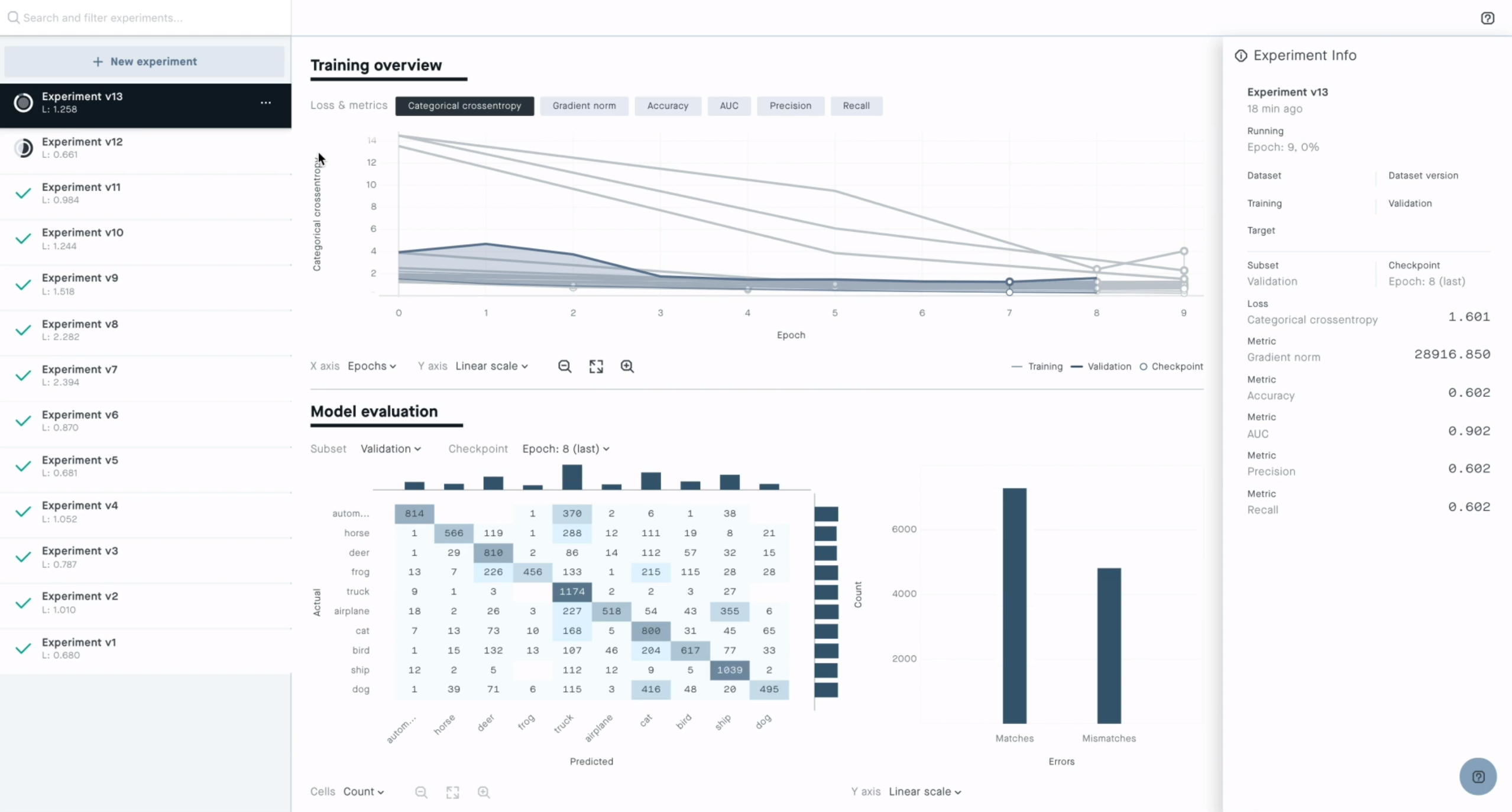

Peltarion, a Swedish startup founded by former execs from companies like Spotify, Skype, King, TrueCaller and Google, today announced that it has raised a $20 million Series A funding round led by Euclidean Capital, the family office for hedge fund billionaire James Simons. Previous investors FAM and EQT Ventures also participated, and this round brings the company’s total funding to $35 million.

There is obviously no dearth of AI platforms these days. Peltarion focus on what it calls “operational AI.” The service offers an end-to-end platform that lets you do everything from pre-processing your data to building models and putting them into production. All of this runs in the cloud and developers get access to a graphical user interface for building and testing their models. All of this, the company stresses, ensures that Peltarion’s users don’t have to deal with any of the low-level hardware or software and can instead focus on building their models.

“The speed at which AI systems can be built and deployed on the operational platform is orders of magnitude faster compared to the industry standard tools such as TensorFlow and require far fewer people and decreases the level of technical expertise needed,” Luka Crnkovic-Friis, of Peltarion’s CEO and co-founder, tells me. “All this results in more organizations being able to operationalize AI and focusing on solving problems and creating change.”

In a world where businesses have a plethora of choices, though, why use Peltarion over more established players? “Almost all of our clients are worried about lock-in to any single cloud provider,” Crnkovic-Friis said. “They tend to be fine using storage and compute as they are relatively similar across all the providers and moving to another cloud provider is possible. Equally, they are very wary of the higher-level services that AWS, GCP, Azure, and others provide as it means a complete lock-in.”

Peltarion, of course, argues that its platform doesn’t lock in its users and that other platforms take far more AI expertise to produce commercially viable AI services. The company rightly notes that, outside of the tech giants, most companies still struggle with how to use AI at scale. “They are stuck on the starting blocks, held back by two primary barriers to progress: immature patchwork technology and skills shortage,” said Crnkovic-Friis.

The company will use the new funding to expand its development team and its teams working with its community and partners. It’ll also use the new funding for growth initiatives in the U.S. and other markets.

Powered by WPeMatico

After two years of development, Medivis, a New York-based company developing augmented reality data integration and visualization tools for surgeons, is bringing its first product to market.

The company was founded by Osamah Choudhry and Christopher Morley who met as senior residents at NYU Medical Center.

Initially a side-project, the two residents roped in some engineers to help develop their first prototypes and after a stint in NYU’s Summer Launchpad program the two decided to launch the company.

Now, with $2.3 million in financing led by Initialized Capital and partnerships with Dell and Microsoft to supply hardware, the company is launching its first product, called SurgicalAR.

In fact, it was the launch of the HoloLens that really gave Medivis its boost, according to Morley. That technology pointed a way toward what Morley said was one of the dreams for technology in the medical industry.

“The Holy Grail is to be able to holographically render a patient,” he said.

For now, Medivis is able to access patient data and represent it visually in a three-dimensional model for doctors to refer to as they plan surgeries. That model is mapped back to the patient to give surgeons a plan for how best to approach an operation.

“The interface between medical imaging and surgical utility from it is really where we see a lot of innovation being possible,” says Morley.

So far, Medivis has worked with the University of Pennsylvania and New York University to bring their prototypes into a surgical setting.

The company is integrating some machine learning capabilities to be able to identify the most relevant information from patients’ medical records and diagnostics as they begin to plan the surgical process.

“What we’ve been working on over this time is developing this really disruptive 3D pipeline,” says Morley. “What we have seen is that there is a distinct lack of 3D pipelines to allow people to directly interface… very quickly try to automate the entire rendering process.”

For now, Medivis is selling a touchscreen monitor, display and a headset. The device plugs into a hospital network and extracts medical imaging to display from their servers in about 30 seconds, according to Choudhry.

“That’s where we see this immediately being useful in that pre-surgical planning stage,” Choudhry says. “The use in surgical planning and being able to extend this through surgical navigation… Streamline the process that requires a large amount of pieces and components and setups so you only need an AR headset to localize pathology and make decisions off of that.”

Already the company has performed 15 surgeries in consultation with the company’s technology.

“When we first met Osamah and Chris, we immediately understood the magnitude of the problem they were out to solve. Medical imaging as it relates to surgical procedures has largely been neglected, leaving patients open to all sorts of complications and general safety issues,” said Eric Woersching, general partner, Initialized Capital, in a statement. “We took one look at the Medivis platform and knew they were poised to transform the operating room. Not only was their hands-free approach to visualization meeting a real need for greater surgical accuracy, but the team has the passion and expertise in the medical field to bring it all to fruition. We couldn’t be more thrilled to welcome Medivis to the Initialized family.”

Powered by WPeMatico

When we interact with computers today we move the mouse, we scroll the trackpad, we tap the screen, but there is so much that the machines don’t pick up on — what about where we’re looking, the subtle gestures we make and what we’re thinking?

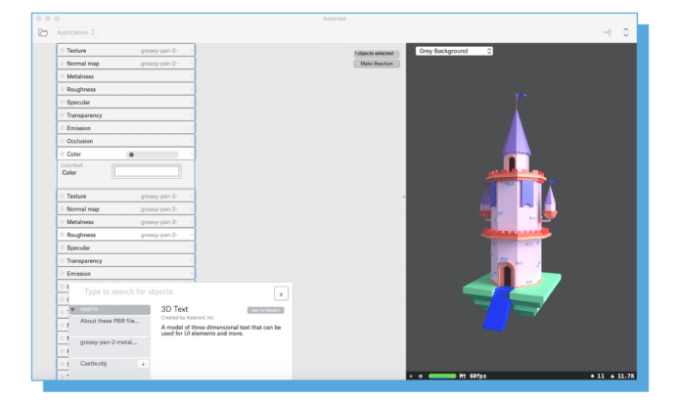

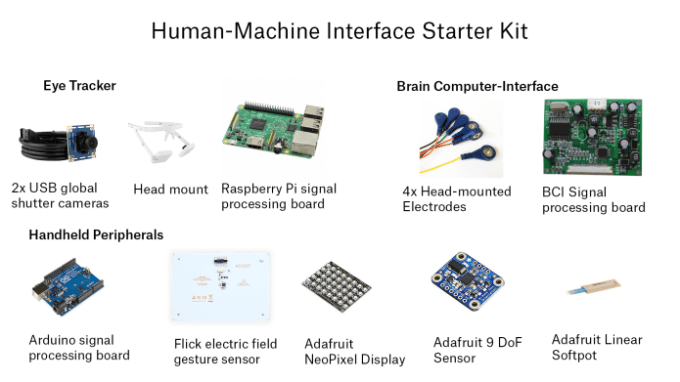

Asteroid is looking to get developers comfortable with the idea that future interfaces are going to take in much more biosensory data. The team has built a node-based human-machine interface engine for macOS and iOS that allows developers to build interactions that can be imported into Swift applications.

“What’s interesting about emerging human-machine interface tech is the hope that the user may be able to ‘upload’ as much as they can ‘download’ today,”Asteroid founder Saku Panditharatne wrote in a Medium post.

To bring attention to their development environment, they’ve launched a crowdfunding campaign that gives a decent snapshot of the depth of experiences that can be enabled by today’s commercially available biosensors. Asteroid definitely doesn’t want to be a hardware startup, but their campaign is largely serving as a way to expose developers to what tools could be in their interaction design arsenal.

There are dev kits and then there are dev kits, and this is a dev kit. Developers jumping on board for the total package get a bunch of open hardware, i.e. a bunch of gear and cases to build out hacked-together interface solutions. The $450 kit brings capabilities like eye-tracking, brain-computer interface electrodes and some gear to piece together a motion controller. Backers can also just buy the $200 eye-tracking kit alone. It’s all very utility minded and clearly not designed to make Asteroid those big hardware bucks.

“The long-term goal is to support as much AR hardware as we can, we just made our own kit because I don’t think there is that much good stuff out there outside of labs,” Panditharatne told TechCrunch.

The crazy hardware seems to be a bit of a labor of love for the time being, while a couple of AR/VR devices have eye-tracking baked-in, it’s still a generation away from most consumer VR devices, and you’re certainly not going to find too much hardware with brain-computer interface systems built-in. The startup says their engine will do plenty with just a smartphone camera and a microphone, but the broader sell with the dev kit is that you’re not building for a specific piece of hardware, you’re experimenting on the bet that interfaces are going to grow more closely intertwined with how we process the world as humans.

Panditharatne founded the company after stints at Oculus and Andreessen Horowitz where she spent a lot of time focusing on the future of AR and VR. Panditharatne tells us that Asteroid has raised more than $2 million in funding, but that they’re not detailing the source of that cash quite yet.

The company is looking to raise $20,000 from their Indiegogo campaign, but the platform is the clear sell here, exposing people to their human-machine interaction engine. Asteroid is taking sign-ups to join the waiting list for the product on their site.

Powered by WPeMatico

Donde Search has just closed a $6 million Series A investment led by Matrix Partners, with participation from previous investors such as senior leaders from AliExpress, Google and Waze.

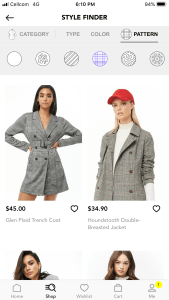

Donde first launched in 2014 as a consumer-facing app that helped users search and discover apparel items based on visual characteristics rather than text-based searches. In early 2018, the company pivoted to the enterprise space, helping retailers power suggestions and related items on their websites.

Here’s how it works:

Retailers partnered with Donde hand over their product catalog and run it through the Donde algorithm, which identifies all the visual features associated with each product. Retailers can then add a widget to their site to let users search based on those features (like sleeve length or type, color or material).

As users interact with the products, the website adapts to that behavior to offer personalized product recommendations and related items.

As users interact with the products, the website adapts to that behavior to offer personalized product recommendations and related items.

Moreover, Donde offers an analytics dashboard that not only provides insights on the customer’s own website, but a look into trends being featured on competing e-commerce websites to understand the industry in general.

Donde was founded by Liat Zakay, who previously served as a software engineer and R&D team manager in the Israeli intelligence unit 8200. Using her technical expertise, she built Donde to solve her own problem of not having the time or energy to go through the tedious process of online shopping.

Zakay told TechCrunch that Donde is focused on apparel for now, but that the technology can be applied to almost any vertical.

“One of the interesting pieces about Donde is that it’s language agnostic,” said Zakay. “You don’t need to know what it’s called and it doesn’t matter what language you speak, you can still find what you want based on visual features. Which makes us extremely relevant to global retailers.”

The new funding, which will be used to expand the product and the team, came shortly after the announcement of Donde’s partnership with Forever 21. The fast-fashion retailer tested out the Donde platform on its mobile app and, after a month, saw a 20 percent increase in average purchase value and higher conversions. Forever 21 has now expanded the program, putting Donde on the web, as well.

Donde said it is working on pilot programs with several other retailers across the U.S. and Europe.

Fast fashion, in particular, represents a big opportunity for Donde. Because product turnover is so fast, retailers rarely have reliable data around a certain SKU, with the website being run on outdated data from last “season.”

This latest round brings Donde’s total funding to $9.5 million, with backing from UpWest, Afterdox and Golden Seeds.

Powered by WPeMatico

Just days after Postmates filed confidential paperwork for an initial public offering, the latest news in the on-demand delivery space is that competitor DoorDash is in the process of raising a $500 million round, The Wall Street Journal reports. The round would reportedly value DoorDash at more than $6 billion and possibly up to $7 billion.

According to the WSJ, Temasek Holdings Pte., Singapore’s state investment firm, is expected to lead the round.

Last year, DoorDash raised a $250 million round of financing that valued the company at $4 billion. In total, DoorDash has raised nearly $1 billion in funding from investors like SoftBank, Sequoia, DST Global, Kleiner Perkins and others.

Earlier this year, the food-delivery startup became the first startup to operate in all 50 states. Meanwhile, similar to Instacart, DoorDash has also reportedly been subsidizing worker pay with tips from customers, but DoorDash still has yet to respond to TechCrunch regarding the practice.

I’ve reached out to DoorDash and will update this story if I hear back.

Powered by WPeMatico

Last week TechCrunch reported that Reddit was raising $150 million from Chinese tech giant Tencent and up to $150 million more in a Series D that would value the company at $2.7 billion pre-money or $3 billion post-money. After no-commenting on our scoop, today Reddit confirmed it has raised $300 million at $3 billion post-money, with $150 million from Tencent.

The deal makes for an odd pairing between one of the architects of China’s Great Firewall of censorship and one of America’s most lawless free-speech forums. Some Redditors are already protesting the funding by trying to post content that would rile Chinese’s internet watchdogs, like imagery from Tiananmen Square and Winnie the Pooh memes mocking Chinese President Xi Jinping’s appearance.

The round brings the Conde Nast-majority owned Reddit to $550 million in total funding. Beyond Tencent, the rest of the round came from previous investors potentially including Andreessen Horowitz, Sequoia and Fidelity. Apparently frustrated that we had disrupted its PR plan, Reddit today handed confirmation of the round to CNBC, which re-reported our scoop without citation. While CNBC reported in June 2018 that Reddit would top $100 million in revenue, a reliable source tells us Reddit only brought in $85 million in 2018 revenue.

Reddit’s CEO Steve Huffman has had his own problems with attribution after the exec was caught editing users’ comments to mislead viewers into thinking they were insulting their Subreddit’s moderators. Huffman managed to get off with just an apology and vow not to do it again, though he seemed to laugh off and excuse the abuse of power by saying “I spent my formative years as a young troll on the Internet.”

Reddit will have to compete for ad dollars with the Google-Facebook duopoly despite having less information about its users, who are often anonymous. Reddit sees 330 million users per month across its Subreddit forums for discussing everything from news and entertainment to niche types of pornography, conspiracy theories and other highly brand-unsafe content. Meanwhile, users may be concerned that Reddit’s policy views could be tightened as it cosies up to Tencent.

Reddit has struggled with staff departures and user revolts over the years as it tries to balance freedom of expression with civility. The hope is the cash could help it pay for experienced leaders and more moderation staff to maintain that balance. But without proper oversight, the cash could simply scale up Reddit and its problems along with it.

Powered by WPeMatico