Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Cars are now essentially computers on wheels — and like every computer, they are susceptible to attacks. It’s no surprise then that there’s a growing number of startups that are working to protect a car’s internal systems from these hacks, especially given that the market for automotive cybersecurity could be worth mor $900 billion by 2026.

One of these companies is Israel’s C2A Security, which offers an end-to-end security platform for vehicles, which today announced that it has raised a $6.5 million Series A funding round.

The round was led by Maniv Mobility, which previously invested in companies like Hailo, drive.ai and Turo, and ICV, which has invested in companies like Freightos and Vayyar. OurCrowd’s Labs/02 also participated in this round.

Like most companies at the Series A stage, C2A plans to use the new funding to grow its team, especially on the R&D side, and help support its customer base. Sadly, C2A does not currently talk about who its customers are.

The promise of C2A is that it offers a full suite of solutions to detect and mitigate attacks. The team behind the company has an impressive security pedigree, with the company’s CMO Nat Meron being an alumn of Israel’s Unit 8200 intelligence unit, for example. C2A founder and CEO Michael Dick previously co-founded NDS, a content security solution, which Cisco acquired for around $5 billion in 2012 (and then recently sold on to Permira, also for $5 billion).

“We are extremely proud to receive the support of such outstanding investors, who will bring tremendous value to the company,” said Dick. “Maniv’s expertise in autotech and strong network across the industry coupled with ICV’s rich experience in cybersecurity brings the perfect combination of skills to the table.”

Powered by WPeMatico

Rebag, an online resale marketplace for luxury handbags, is getting another infusion of capital as it prepares to expand its offline retail operations. The company this week announced $25 million in Series C funding, in a round led by private equity firm Novator, with participation from existing investors General Catalyst and FJ Labs.

The round brings Rebag’s total raise to date to $52 million.

Rebag competes with other luxury goods resellers, like TheRealReal, and to some extent with broader resale marketplaces like ThredUP or Poshmark, which also attract shoppers looking to buy quality pre-owned items. And it exists alongside large marketplaces like eBay, as well as rental shops like Rent the Runway, which offers an alternative to a site focused only on handbags.

In fact, Rebag founder and CEO Charles Gorra spent a brief period at Rent the Runway before leaving to start Rebag in 2014. At the time, he said he saw an immediate opportunity to not just rent the items, but to actually resell them on a secondary market.

Today, Rebag’s shop sells bags from more than 50 designer brands, including all the majors, like Chanel, Louis Vuitton, Hermes, Gucci and others.

However, in the years following Rebag’s launch, the company has expanded its offerings beyond just online resale to include brick-and-mortar retail and, more recently, a service called Rebag Infinity, which allows shoppers to turn in any Rebag handbag purchase within six months in exchange to receive a credit of at least 70 percent off their next purchase.

Last year, Rebag made headlines in the fashion world for selling the rare Hermès White Crocodile Himalayan Birkin collectible — typically a bag that costs more than $100,000 — for “just” $70,000, to celebrate the opening of its 57th Street and Madison Avenue store, its second Manhattan flagship location.

With the new funding, Rebag will expand its offline footprint, it says. The company currently operates five stores in New York and L.A. but plans to launch 30 more locations in the “medium term.” This will include both standalone storefronts, as well as presences within luxury malls.

With the new funding, Rebag will expand its offline footprint, it says. The company currently operates five stores in New York and L.A. but plans to launch 30 more locations in the “medium term.” This will include both standalone storefronts, as well as presences within luxury malls.

It’s common for resale marketplaces these days to take their wares to offline shoppers. TheRealReal, Rent the Runway, ThredUP and others all today offer real-world locations, where shoppers can browse in person instead of just online.

Rebag says since it opened its retail stores last year, it moved from being a 100 percent digital operation to 80 percent digital and 20 percent offline. Its sourcing network also grew to include more than 20,000 stylists, partners, shoppers and sales associates.

With the funding, Rebag adds it will also refine its pricing and handbag evaluation tools aimed at standardizing the resale process, something that could represent another business for the brand (or make it attractive to an acquirer).

“We are a technology company first,” noted founder and CEO Charles Gorra, in a statement. “Our goal is to become the standard for the luxury resale industry, just like Kelley Blue Book is the main resource for the auto industry.”

The company plans to triple its team of 100, which today includes newer hires CTO Jay Winters (Delivery.com, Goldman Sachs) and CMO Elizabeth Layne (Bonobos, Appear Here).

Rebag doesn’t share its hard numbers about sales, revenues, valuation, customer base or others, but told us it has tripled revenues since its Series B.

Powered by WPeMatico

Fertility services are raising venture cash left and right. Last week, it was Dadi, a sperm storage startup that nabbed a $2 million seed round. This week, it’s Extend Fertility, which helps women preserve their fertility through egg freezing.

Headquartered in New York, the business has secured a $15 million Series A investment from Regal Healthcare Capital Partners to expand its fertility services, which also include infertility treatments, such as in vitro and intrauterine insemination. The company has also appointed Anne Hogarty, the former chief business officer at Prelude Fertility and vice president of international business at BuzzFeed, to the role of chief executive officer. Hogarty replaces Extend Fertility co-founder Ilaina Edison, who had held the C-level title since the business launched in 2016. Edison will remain on the startup’s board of directors.

Extend Fertility, in its New York cryopreservation and embryology lab and treatment center, completed 1,000 egg-freezing cycles in 2018.

“A lot of amazing things have happened for women over the last century,” Hogarty told TechCrunch earlier this week. “Now, women are permitted and encouraged to seek higher education, pursue a career, follow their dreams and end up with a partner who’s the right partner, not just any partner. Doing all those things has pushed the window for when women want to start a family from their 20s to their 30s and unfortunately, one thing that has not changed in that time is the biological clock.”

Hogarty explained Extend’s fertility services are more affordable than other options because the service was built specifically with egg freezing in mind, and the company later expanded to offer infertility treatments, whereas other services were established to provide IVF and other infertility treatments and integrated cryopreservation tools later.

“We are really purpose-built to be an egg-freezing-first company, where many legacy institutions that were providing infertility services have legacy costs that come with … inefficiencies bred over decades and outmoded technology in their labs that may not be the most efficient and effective,” she said. “We have a state of the art lab with the latest equipment.”

“It’s the classic innovator dilemma,” she added. “Infertility services are extraordinarily expensive and reproductive endocrinology is a new area of medicine. There are a lot of people and institutions that have been taking inordinate amounts of money for their infertility services so they weren’t looking to serve this population of women looking to preserve their fertility.”

One egg-freezing cycle with Extend costs women $5,500, and additional cycles come at a sticker price of $4,000. Each cycle includes a fertility assessment, private consultation, anesthesia and any monitoring a patient may need during their cycle. The costs don’t include medication, however. Extend can prescribe medications — which typically cost between $2,000 and $5,000 for fertility patients — but they still need to go through a third party to get their prescriptions filled and paid for.

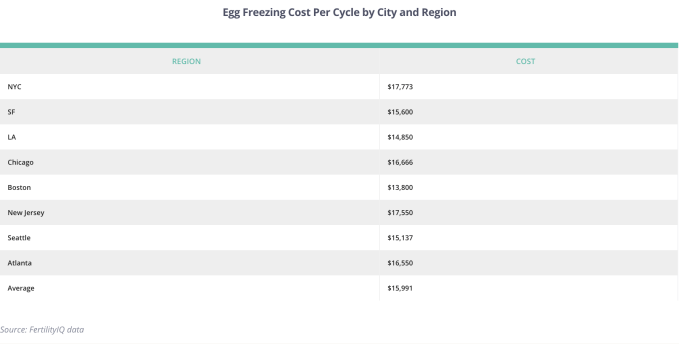

For reference, FertilityIQ, an online platform for researching fertility care providers and treatments, says the typical cost per cycle for egg freezing is more than $17,000 in New York City or $15,600 in San Francisco. Most egg-freezing services, including Extend, do not accept insurance, as most insurance providers don’t cover the steep costs of fertility or infertility treatments.

Some companies, however, are beginning to offer benefits that cover these costs. Facebook and Apple, for example, began subsidizing egg-freezing procedures for employees in 2014. Spotify and eBay, for their part, will pay for an unlimited number of IVF cycles.

Hogarty said Extend’s price point makes it one of the lowest-cost players in the market.

“We want as many women as possible to benefit from the advances from egg-freezing technology,” she said.

Extend Fertility, which has previously raised $10 million, plans to use the latest investment to open labs in new markets and expand its infertility services.

Powered by WPeMatico

Lime just announced it has raised a $310 million Series D round. Led by Bain Capital Ventures, Andreessen Horowitz, Fidelity Ventures, GV and IVP, the round values Lime at $2.4 billion.

“This new investment demonstrates the fundamental strength of our business and the increasingly rapid adoption of Lime,” Lime CEO Toby Sun wrote in a blog post. “The new funds will give us the ability to expand into new markets, enhance our technology, strengthen the team and pilot new opportunities. We will also continue investing in two critical areas: rider safety and city collaboration.”

In May, Lime partnered with Segway to launch its next generation of electric scooters. These Segway-powered Lime scooters were designed to be safer, longer-lasting via battery power and more durable for what the sharing economy requires, Sun told TechCrunch last year.

But this partnership hasn’t been without its issues. In October, Lime recalled some of its scooters due to battery fire concerns. The next month, Lime put $3 million toward a new safety initiative called “Respect the Ride.” Safety, in general, is a major concern. In September, someone lost their life after a scooter accident.

This brings Lime’s total funding north of $800 million. Lime, which got its beginnings as a bike-share company, has deployed its scooters and bikes in more than 100 cities in the U.S. and 27 international cities. Since June, Lime has more than doubled the number of cities where it operates in the U.S. Lime has also partnered with Uber to offer Lime scooters within the Uber app.

Powered by WPeMatico

As more organizations move to cloud-based IT architectures, a startup that’s helping them secure that data in an efficient way has raised some capital. vArmour, which provides a platform to help manage security policies across disparate public and private cloud environments in one place, is announcing today that it has raised a growth round of $44 million.

The funding is being led by two VCs that specialise in investments into security startups, AllegisCyber and NightDragon.

CEO Tim Eades said that also participating are “two large software companies” as strategic investors that vArmour works with on a regular basis but asked not to be named. (You might consider that candidates might include some of the big security vendors in the market, as well as the big cloud services providers.) This Series E brings the total raised by vArmour to $127 million.

When asked, Eades said the company would not be disclosing its valuation. That lack of transparency is not uncommon among startups, but perhaps especially should be expected at a business that operated in stealth for the first several years of its life.

According to PitchBook, vArmour was valued at $420 million when it last raised money, a $41 million round in 2016. That would put the startup’s valuation at $464 million with this round, if everything is growing at a steady pace, or possibly more if investors are keen to tap into what appears to be a growing need.

That growing need might be summarised like this: We’re seeing a huge migration of IT to cloud-based services, with public cloud services set to grow 17.3 percent in 2019. A large part of those deployments — for companies typically larger than 1,000 people — are spread across multiple private and public clouds.

This, in turn, has opened a new front in the battle to secure data amid the rising threat of cybercrime. “We believe that hybrid cloud security is a market valued somewhere between $6 billion and $8 billion at the moment,” said Eades. Cybercrime has been estimated by McAfee to cost businesses $600 billion annually worldwide. Accenture is even more bullish on the impact; it puts the impact on companies at $5.2 trillion over the next five years.

The challenge for many organizations is that they store information and apps across multiple locations — between seven and eight data centers on average for, say, a typical bank, Eades said. And while that may help them hedge bets, save money and reach some efficiencies, that lack of cohesion also opens the door to security loopholes.

“Organizations are deploying multiple clouds for business agility and reduced cost, but the rapid adoption is making it a nightmare for security and IT pros to provide consistent security controls across cloud platforms,” said Bob Ackerman, founder and managing director at AllegisCyber, in a statement. “vArmour is already servicing this need with hundreds of customers, and we’re excited to help vArmour grow to the next stage of development.”

vArmour hasn’t developed a security service per se, but it is among the companies — Cisco and others are also competing with it — that are providing a platform to help manage security policies across these disparate locations. That could either mean working on knitting together different security services as delivered in distinct clouds, or taking a single security service and making sure it works the same policies across disparate locations, or a combination of both of those.

In other words, vArmour takes something that is somewhat messy — disparate security policies covering disparate containers and apps — and helps to hand it in a more cohesive and neat way by providing a single way to manage and provision compliance and policies across all of them.

This not only helps to manage the data but potentially can help halt a breach by letting an organization put a stop in place across multiple environments.

“From my experience, this is an important solution for the cloud security space,” said Dave DeWalt, founder of NightDragon, in a statement. “With security teams now having to manage a multitude of cloud estates and inundated with regulatory mandates, they need a simple solution that’s capable of continuous compliance. We haven’t seen anyone else do this as well as vArmour.”

Eades said that one big change for his company in the last couple of years has been that, as cloud services have grown in popularity, vArmour has been putting in place a self-service version of the main product, the vArmour Application Controller, to better target smaller organizations. It’s also been leaning heavily on channel partners (Telstra, which led its previous round, is one strategic of this kind) to help with the heavy lifting of sales.

vArmour isn’t disclosing revenues or how many customers it has at the moment, but Eades said that it’s been growing at 100 percent each year for the last two and has “way more than 100 customers,” ranging from hospitals and churches through to “8-10 of the largest service providers and over 25 financial institutions.”

At this rate, he said the plan will be to take the company public in the next couple of years.

Powered by WPeMatico

Reddit is raising $150 million to $300 million to keep the front page of the internet running, multiple sources tell TechCrunch. The forthcoming Series D round is said to be led by Chinese tech giant Tencent at a $2.7 billion pre-money valuation. Depending on how much follow-on cash Reddit drums up from Silicon Valley investors and beyond, its post-money valuation could reach an epic $3 billion.

As more people seek esoteric community and off-kilter entertainment online, Reddit continues to grow its link-sharing forums. Indeed, 330 million monthly active users now frequent its 150,000 Subreddits. That warrants the boost to its valuation, which previously reached $1.8 billion when it raised $200 million in July 2017. As of then, Reddit’s majority stake was still held by publisher Conde Nast, which bought in back in 2006 just a year after the site launched. Reddit had raised $250 million previously, so the new round will push it to $400 million to $550 million in total funding.

It should have been clear that Reddit was on the prowl after a month of pitching its growth to the press and beating its own drum. In December Reddit announced it had reached 1.4 billion video views per month, up a staggering 40 percent from just two months earlier after first launching a native video player in August 2017. And it made a big deal out of starting to sell cost-per-click ads in addition to promoted posts, cost per impression and video ads. A 22 percent increase in engagement and 30 percent rise in total view in 2018 pushed it past $100 million in revenue for the year, CNBC reported.

The exact details of the Series D could fluctuate before it’s formally announced, and Reddit and Tencent declined to comment. But supporting and moderating all that content isn’t cheap. The company had 350 employees just under a year ago, and is headquartered in pricey San Francisco — though in one of its cheaper but troubled neighborhoods. Until Reddit’s newer ad products rev up, it’s still relying on venture capital.

Tencent’s money will give Reddit time to hit its stride. It’s said to be kicking in the first $150 million of the round. The Chinese conglomerate owns all-in-one messaging app WeChat and is the biggest gaming company in the world thanks to ownership of League of Legends and stakes in Clash of Clans-maker Supercell and Fortnite developer Epic. But China’s crackdown on gaming addiction has been rough for Tencent’s valuation and Chinese competitor ByteDance’s news reader app Toutiao has grown enormous. Both of those facts make investing in American newsboard Reddit a savvy diversification, even if Reddit isn’t accessible in China.

Reddit could seek to fill out its round with up to $150 million in additional cash from previous investors like Sequoia, Andreessen Horowitz, Y Combinator or YC’s president Sam Altman. They could see potential in one of the web’s most unique and internet-native content communities. Reddit is where the real world is hashed out and laughed about by a tech-savvy audience that often produces memes that cross over into mainstream culture. And with all those amateur curators toiling away for internet points, casual users are flocking in for an edgier look at what will be the center of attention tomorrow.

Reddit has recently avoided much of the backlash hitting fellow social site Facebook, despite having to remove 1,000 Russian trolls pushing political propaganda. But in the past, the anonymous site has had plenty of problems with racist, misogynistic and homophobic content. In 2015 it finally implemented quarantines and shut down some of the most offensive Subreddits. But harassment by users contributed to the departure of CEO Ellen Pao, who was replaced by Steve Huffman, Reddit’s co-founder. Huffman went on to abuse that power, secretly editing some user comments on Reddit to frame them for insulting the heads of their own Subreddits. He escaped the debacle with a slap on the wrist and an apology, claiming “I spent my formative years as a young troll on the Internet.”

Investors will have to hope Huffman has the composure to lead Reddit as it inevitably encounters more scrutiny as its valuation scales up. Its policy choice about what constitutes hate speech and harassment, its own company culture and its influence on public opinion will all come under the microscope. Reddit has the potential to give a voice to great ideas at a time when flashy visuals rule the web. And as local journalism wanes, the site’s breed of vigilante web sleuths could be more in demand, for better or worse. But that all hinges on Reddit defining clear, consistent, empathetic policy that will help it surf atop the sewage swirling around the internet.

Powered by WPeMatico

Nayeem Islam spent nearly 11 years with chipmaker Qualcomm, where he founded its Silicon Valley-based R&D facility, recruited its entire team and oversaw research on all aspects of security, including applying machine learning on mobile devices and in the network to detect threats early.

Islam was nothing if not prolific, developing a system for on-device machine learning for malware detection, libraries for optimizing deep learning algorithms on mobile devices and systems for parallel compute on mobile devices, among other things.

In fact, because of his work, he also saw a big opportunity in better protecting enterprises from cyberthreats through deep neural networks that are capable of processing every raw byte within a file and that can uncover complex relations within data sets. So two years ago, Islam and Saumitra Das, a former Qualcomm engineer with 330 patents to his name and another 450 pending, struck out on their own to create Blue Hexagon, a now 30-person Sunnyvale, Calif.-based company that is today disclosing it has raised $31 million in funding from Benchmark and Altimeter.

The funding comes roughly one year after Benchmark quietly led a $6 million Series A round for the firm.

So what has investors so bullish on the company’s prospects, aside from its credentialed founders? In a word, speed, seemingly. According to Islam, Blue Hexagon has created a real-time, cybersecurity platform that he says can detect known and unknown threats at first encounter, then block them in “sub seconds” so the malware doesn’t have time to spread.

The industry has to move to real-time detection, he says, explaining that four new and unique malware samples are released every second, and arguing that traditional security methods can’t keep pace. He says that sandboxes, for example, meaning restricted environments that quarantine cyberthreats and keep them from breaching sensitive files, are no longer state of the art. The same is true of signatures, which are mathematical techniques used to validate the authenticity and integrity of a message, software or digital document but are being bypassed by rapidly evolving new malware.

Only time will tell if Blue Hexagon is far more capable of identifying and stopping attackers, as Islam insists is the case. It is not the only startup to apply deep learning to cybersecurity, though it’s certainly one of the first. Critics, some who are protecting their own corporate interests, also worry that hackers can foil security algorithms by targeting the warning flags they look for.

Still, with its technology, its team and its pitch, Blue Hexagon is starting to persuade not only top investors of its merits, but a growing — and broad — base of customers, says Islam. “Everyone has this issue, from large banks, insurance companies, state and local governments. Nowhere do you find someone who doesn’t need to be protected.”

Blue Hexagon can even help customers that are already under attack, Islam says, even if it isn’t ideal. “Our goal is to catch an attack as early in the kill chain as possible. But if someone is already being attacked, we’ll see that activity and pinpoint it and be able to turn it off.”

Some damage may already be done, of course. It’s another reason to plan ahead, he says. “With automated attacks, you need automated techniques.” Deep learning, he insists, “is one way of leveling the playing field against attackers.”

Powered by WPeMatico

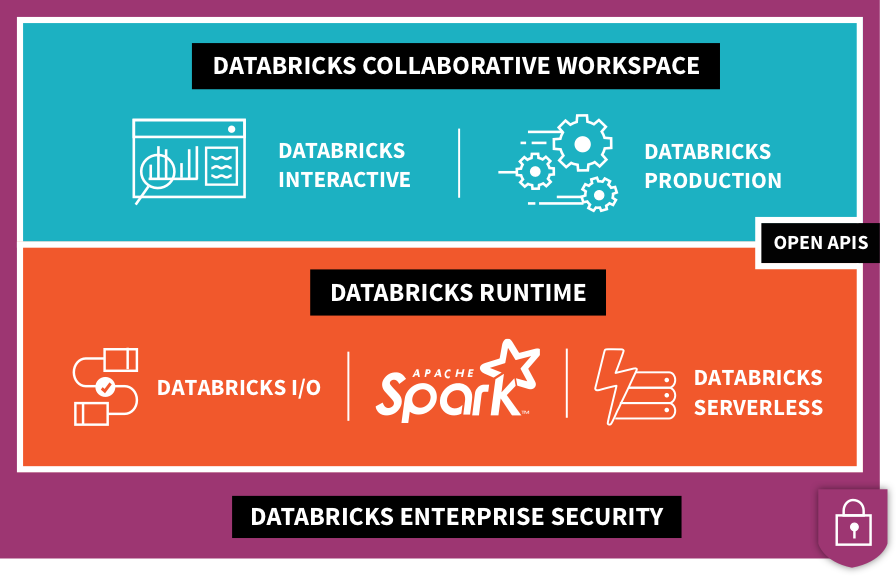

Databricks, the company founded by the original team behind the Apache Spark big data analytics engine, today announced that it has raised a $250 million Series E round led by Andreessen Horowitz. Coatue Management, Green Bay Ventures, Microsoft and NEA, also participated in this round, which brings the company’s total funding to $498.5 million. Microsoft’s involvement here is probably a bit of a surprise, but it’s worth noting that it also worked with Databricks on the launch of Azure Databricks as a first-party service on the platform, something that’s still a rarity in the Azure cloud.

As Databricks also today announced, its annual recurring revenue now exceeds $100 million. The company didn’t share whether it’s cash flow-positive at this point, but Databricks CEO and co-founder Ali Ghodsi shared that the company’s valuation is now $2.75 billion.

Current customers, which the company says number around 2,000, include the likes of Nielsen, Hotels.com, Overstock, Bechtel, Shell and HP.

While Databricks is obviously known for its contributions to Apache Spark, the company itself monetizes that work by offering its Unified Analytics platform on top of it. This platform allows enterprises to build their data pipelines across data storage systems and prepare data sets for data scientists and engineers. To do this, Databricks offers shared notebooks and tools for building, managing and monitoring data pipelines, and then uses that data to build machine learning models, for example. Indeed, training and deploying these models is one of the company’s focus areas these days, which makes sense, given that this is one of the main use cases for big data, after all.

On top of that, Databricks also offers a fully managed service for hosting all of these tools.

“Databricks is the clear winner in the big data platform race,” said Ben Horowitz, co-founder and general partner at Andreessen Horowitz, in today’s announcement. “In addition, they have created a new category atop their world-beating Apache Spark platform called Unified Analytics that is growing even faster. As a result, we are thrilled to invest in this round.”

Ghodsi told me that Horowitz was also instrumental in getting the company to re-focus on growth. The company was already growing fast, of course, but Horowitz asked him why Databricks wasn’t growing faster. Unsurprisingly, given that it’s an enterprise company, that means aggressively hiring a larger sales force — and that’s costly. Hence the company’s need to raise at this point.

As Ghodsi told me, one of the areas the company wants to focus on is the Asia Pacific region, where overall cloud usage is growing fast. The other area the company is focusing on is support for more verticals like mass media and entertainment, federal agencies and fintech firms, which also comes with its own cost, given that the experts there don’t come cheap.

Ghodsi likes to call this “boring AI,” since it’s not as exciting as self-driving cars. In his view, though, the enterprise companies that don’t start using machine learning now will inevitably be left behind in the long run. “If you don’t get there, there’ll be no place for you in the next 20 years,” he said.

Engineering, of course, will also get a chunk of this new funding, with an emphasis on relatively new products like MLFlow and Delta, two tools Databricks recently developed and that make it easier to manage the life cycle of machine learning models and build the necessary data pipelines to feed them.

Powered by WPeMatico

Solar installations are becoming a no-brainer for anyone with a roof in much of the country. But getting an estimate on how much it would cost and how much juice it would generate can be complicated and time-consuming. Aurora Solar has made an automated process for doing this, and attracted $20 million in funding as a result.

A big part of the uncertainty anyone has about getting solar installed is the upfront cost and return on investment. An on-site visit may cost hundreds, or thousands for a commercial property, or that cost may be rolled up into the overall charge. But why send someone out when all the data you need can be acquired in bulk from the air?

Aurora uses lidar data for this — but not the kind of lidar where you have to fly a drone with the instrument over the house. That would hardly be less expensive and time-consuming than a normal visit. Instead they use lidar collected by small aircraft making low-altitude passes over the city.

The resulting data (you can see it above) produces detailed 3D models of the terrain and all the buildings on it; the exact size and slope of a roof can be determined with high precision. It’s actually similar in a way to how archaeologists used it to map out an ancient Mayan metropolis.

There are some programs and services out there that do virtual site visits, but many just estimate your roof area and orientation by looking at satellite imagery. That’s good for a basic estimate, but Aurora uses multiple sources of data to create a detailed 3D map of your roof, and it’s proud of its results.

“From the get-go, we have been very ambitious about the way we address the problem, probably since we faced the same issues our clients face ourselves,” said co-founder Christopher Hopper in an email to TechCrunch. That would have been in 2012, when he and co-founder Samuel Adeyemo experienced significant friction with a solar install in East Africa. The installation itself was a snap, they found, but the planning and design of the system took months.

“Aurora pioneered the concept of ‘remote site visits,’ which enables solar installers to precisely calculate how many solar panels fit on a property, and how much energy they produce without traveling to the site,” Hopper said. “We have a large dataset of LIDAR data pre-loaded in the application that’s accessible to our users. We estimate that that covers about 2/3 of the US population.”

This and other data lets Aurora create a detailed CAD model of the building in just a few minutes, and generate a basic plan for solar cell placement as well that accounts for slope, exposure, and any shade-producing obstacles like chimneys or trees nearby. (Shade reports are usually done in person, and are necessary to receive certain rebates.)

From there users can go straight into the sales and financing process, even including line diagrams for the electrical system you’ll be building. And theoretically it could all take less than an hour, which is probably how much time you’d spend on the phone trying to get a local solar installer to come out.

The A round was led by Energize Ventures, whose managing director Amy Francetic will be joining the board, with S28 and seed investor Pear also contributing.

Once nice thing about companies relying on data and automation: they scale well. So Aurora won’t need to buy a thousand new trucks to get its next few thousand customers — it needs to hire engineers, sales and support people, which is exactly what it plans to do.

“We expect to expand all of the functions in our organization,” said Hopper. “We are particularly excited about all of the things we can do on the product side and in customer success. And finally, this funding means that we are here to stay. For companies [i.e. Aurora’s clients] that rely on a software provider for their day-to-day operations this is an important factor.”

Adeyemo notes in the press release announcing the funding that “the solar professional” is the “fastest growing occupation in the U.S.” Hopefully making things easier for the customer will keep it that way for a while.

Disclosure: Former TechCruncher Rahul Nihalani now works for Aurora. Rahul’s great, but this does not affect our coverage.

Powered by WPeMatico

Nine years after launching its online magazine, and three years after diversifying into the subscription box business, FabFitFun has raised $80 million in a growth round of funding, led by Kleiner Perkins, with participation from its previous investors Upfront Ventures and NEA.

The Los Angeles-based company has steadily expanded its retail and lifestyle empire through subscription boxes, video… and even an augmented reality app.

Last year the company crossed $200 million in revenue and managed to net more than 1 million subscribers for the service.

In a statement the company said the new financing would be used to expand FabFitFun membership offerings and consolidate its position as a marketing partner and platform for brands.

As a result of the investment, Kleiner Perkins general partners Mood Rowghani and Mary Meeker will join as board member and observer, respectively.

It’s been a long ride for co-founders Daniel and Michael Broukhim and Katie Rosen Kitchens. From a newsletter and blog to the subscription box to the launch of live programming last year.

For brands, the pitch is a new way to find customers and engage with them. The seasonally curated boxes and special exclusive co-branded box opportunities with Los Angeles’ pool of influencers results in hundreds of millions of targeted impressions, according to the company.

“FabFitFun has emerged into an exciting and entirely new distribution channel that brings retail to the platforms where consumers are most engaged,” said Mood Rowghani, a general partner at Kleiner Perkins, in a statement. “The company’s personalized connection with its community allows brands to better understand and interact with consumers – establishing a long-term relationship rather than simply a transaction.”

Powered by WPeMatico