Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Knotch announced yesterday that it has raised $25 million in Series B funding.

The round was led by New Enterprise Associates, with NEA’s Hilarie Koplow-McAdams joining the Knotch board of directors. Rob Norman, the former chief digital officer of ad giant GroupM is also joining the board.

“Brands have a desire to understand the effectiveness of their digital content across all channels, a gap that hadn’t been filled before Knotch,” Koplow-McAdams said in a statement. “Our conviction around the Knotch platform and team is driven by their impressive traction and comprehensive product offerings. We’re thrilled to partner with Knotch as they continue their growth trajectory, providing transformative marketing intelligence at scale.”

When we first wrote about Knotch back in 2012, it was a consumer product where people could share their opinions using a color scale. It might seem like a stretch go from that to a marketing and data company, but in fact Knotch still collects data using its color-based feedback system — now, it’s using that system to ask consumers about their response to sponsored content.

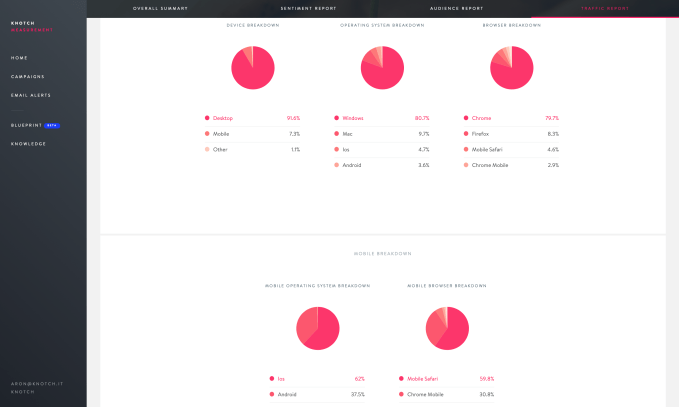

In addition, Knotch offers a competitive intelligence product, as well as Blueprint, which helps marketers find the best publishers for their sponsored content.

“As [brands are building] their own content hubs and recognizing content as a really key piece of their marketing stack, as they’re turning to this space, there’s not a lot of great options for them to turn to and say, ‘Here’s a way to know in advance which creative themes and topics and formats [are going to resonate].’ Here’s how we optimize this content, here’s a way to benchmark what you’re doing,” founder and CEO Anda Gansca told me.

And it sounds like Gansca’s vision goes beyond sponsored content.

“In this convoluted landscape, you need a partner that is going to be your Switzerland of data, who’s aligned with you, collecting transparent digital performance data across paid and own channels,” she said.

Knotch has now raised a total of $34 million. Customers include JP Morgan Chase, AT&T, Ally Bank, Ford, Calvin Klein and Salesforce.

Powered by WPeMatico

Darkstore, a technology-driven fulfillment solution for companies like Nike and others, has raised a $7.5 million Series A round. With the additional funding in hand, Darkstore plans to expand its fulfillment center into more categories.

Currently, Darkstore fulfills products for brands in the areas of footwear, home and consumer electronics. With the funding, Darkstore will expand into lifestyle, health and beauty and athletic leisure, Darkstore founder and CEO Lee Hnetinka told TechCrunch over the phone.

“There are other categories where we get inbound and turn it down,” Hnetinka said. Down the road, Hnetinka said he envisions additional categories, including groceries and perishables.

Darkstore works by exploiting excess capacity in storage facilities, malls and bodegas and enables them to be fulfillment centers with just a smartphone. The idea is that brands without local inventory can store it in a Darkstore and then ship out same-day. Darkstore charges brands across three areas: fulfillment, storage and delivery.

“Up until now, Darkstore has really been behind the scenes,” Hnetinka said. “We want to continue to do that and to be a superpower to our brands. Our mission is to enable the brands to be direct to consumer and we believe we can help them do that even better by creating what we call a branded movement.”

Specifically, Darkstore envisions creating a badge for brands to place on their websites to signal that it offers same-day delivery via Darkstore. Brands currently see Darkstore as a competitive advantage, Hnetinka said, so they’re unwilling to promote its use of Darkstore, but he hopes to change that. That change would ideally help brands to increase trust with its customers, while also undoubtedly providing more visibility and therefore more business for Darkstore.

Also on the docket for 2019 is to explore a new giving initiative. Tentatively called Darkstore Giving, the idea is to make it easier for brands to reduce return-driven waste. Instead of throwing away lightly used items, Darkstore could facilitate the donation of those items to nonprofit organizations.

Darkstore first launched in 2016, counting mattress startup Tuft & Needle as one of its first customers. To date, Darkstore has raised almost $10 million in funding.

Powered by WPeMatico

What could Google’s parent company Alphabet, and the wealth management office of the likes of Jack Dorsey, Mark Zuckerberg and Sheryl Sandberg, understand better than the need for a service to manage all the data their companies are collecting?

As regulations in Europe begin to take effect (and European regulators show their teeth), companies like Collibra, which just raised $100 million at a valuation of more than $1 billion from new investor CapitalG (the growth equity investment fund from Alphabet) and returning backers like Iconiq (the family office of Dorsey, Zuckerberg, et al.), are only going to become more important.

Indeed, the recent $57 million fine from France’s data protection watchdog is only a taste of what could be in store for companies like Facebook and Google for non-compliance with new privacy laws. Companies like Collibra and its competitors like Alation, Adaptive Insights, Datum and Informatica are reaping the benefits of this by providing software to oversee how the data that companies are collecting is handled.

The company got its first big boost back in 2008 in the wake of the financial crisis when big banks were confronted with a whole new slew of regulations. Collibra is used to track what data is stored where and how, and to ensure that the data is being processed in ways that align with laws on the books.

Collibra’s new round is something of a victory lap for the company — which is coming off a record revenue year, according to a statement.

The company said it would use the new funding to add new products and push sales and marketing.

“Collibra is putting organizations back in control of their data, helping them comply with changing legislation, embrace emerging technologies and capture the information that will enable them to design services and solutions built for the future,” said Derek Zanutto of CapitalG. “We look forward to partnering with Collibra and marrying Google and Alphabet’s machine learning and AI expertise with Collibra’s leadership in data collaboration, workflow management and risk management.”

Collibra says it has more than 300 customers across industries like financial services, healthcare, retail and technology.

Powered by WPeMatico

Kite, a San Francisco-based startup that uses machine learning to build what is essentially a very smart code-completion tool, today announced that it has raised a $17 million funding round. The round was led by Trinity Ventures, with personal participation from now-GitHub CEO Nat Friedman. In addition to the funding, Kite also today announced that its tools are now significantly smarter and that developers can run them locally on their machines, even if they don’t have an internet connection.

As Kite founder and CEO Adam Smith told me, the idea for Kite is based on the simple fact that a lot of programming is repetitive. “That’s why [developers] spend so much time on Stack Overflow. That’s why they spend so much time debugging really basic errors and looking up documentation, but not so much time looking at how the solution should work,” he said. “We thought we can use machine learning to fix that.”

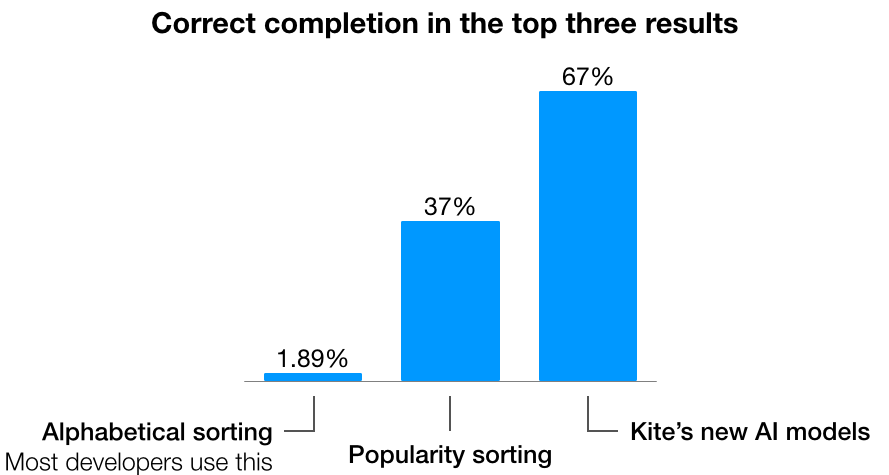

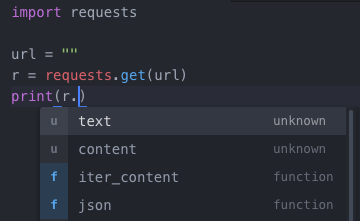

Standard code completion tools often still use alphabetical sorting, while Kite uses AI to infer what a developer is likely trying to do (though, to be fair, the likes of IntelliSense and others are also starting to get smarter). In its first iteration, Kite, which sadly still only works for Python code right now, sorted its hints by popularity. Unsurprisingly, that was already more useful than alphabetical sorting, and the right answer appeared in the top three results 37 percent of the time.

What’s interesting here is that if you can predict the next part of a line of code with high accuracy, you can start predicting a few more words ahead, too. And that’s exactly what Kite is starting to do now.

To do this, the team had to build its own machine learning models that worked well for code. As Smith told me, Kite first looked at using standard natural language processing (NLP) models, but it turns out that those don’t really work well for code, which has a different structure. As training data, Kite fed the system all the Python code on GitHub .

Looking ahead, what Smith really wants to achieve is what he calls “fully automated programming.” “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.”

Looking ahead, what Smith really wants to achieve is what he calls “fully automated programming.” “It’s that Star Trek vision of where you tell computers in a high-level language what to do,” he said. “If it’s ambiguous, the computer will ask questions.”

It’ll take a few more breakthroughs in AI to realize that vision, but for the time being, Kite’s tools are freely available and come with editor plugins for Atom, Sublime Text3, VS Code, Vim, PyCharm and IntelliJ. Currently, about 30,000 Python developers use its tools.

With today’s release, developers can also use these models locally, without the need for an internet connection. That’s a sign of how efficient the models are, but as Smith also acknowledged, running the model locally means his company doesn’t have to manage a complex cloud infrastructure either. This should also make the tool more appealing to more developers — especially in larger corporations — given that the original tool would send all of your code to Kite’s servers (and in that context, it’s worth noting the company managed to create its own little scandal around some open-source contributions that favored its auto-completion engine).

The company plans to use the new funding to build out the team, which mostly consists of engineers. It’ll also build out its product, with a special focus on supporting more languages.

As for its business model, it’s worth noting that Kite did test a subscription service last year, but as Smith argues, that was mostly to test if the company could monetize the service. “Now we want to optimize for growth,” he said and noted that the focus of the company’s monetization strategy will be on enterprise users. Indeed, that’s a common refrain I hear from startups that focus on developers. It’s very hard to sell subscriptions to individual developers, it seems, so most start to focus on enterprises sooner or later.

Powered by WPeMatico

San Jose cannabis company Caliva is proving that weed’s still hot, even as some markets cool off.

The company is announcing a $75 million round of investment that includes participation from former Yahoo CEO Carol Bartz and football legend Joe Montana . If that pair seems unlikely, it just goes to show that cannabis attracts an eclectic mix.

With what the company itself refers to as a “war chest,” Caliva intends to expand its portfolio of products as well as ramping up its efforts courting cannabis users in California through a combination of branded brick and mortar stores, direct to consumer sales and sales to distributors. While state regulations slowed the overall market over the last year, Caliva grew its revenues by 350 percent, growing its company to 440 workers.

A general partner at Liquid 2 Ventures, Montana isn’t new to cannabis investing. In 2017, the former quarterback participated in a seed round for Herb, a cannabis-focused media company. Given the extreme toll pro sports take on the human body, it’s not uncommon for former athletes to get involved in the cannabis business, particularly with CBD products.

“As an investor and supporter, it is my opinion that Caliva’s strong management team will successfully develop and bring to market quality health and wellness products that can provide relief to many people and can make a serious impact on opioid use or addiction,” Montana said of his interest in the cannabis industry.

Caliva currently operates a popular retail location situated conveniently for Silicon Valley’s droves of weed acolytes, but the company is more than just a well-liked dispensary. Beyond just carrying popular brands, Caliva sells its own products at its own stores — everything from vape pen oil cartridges to pre-rolls — in addition to operating a distribution center nearby.

“I know great opportunities when I see them,” said Bartz, who will also join the company’s board.

Powered by WPeMatico

People are increasingly interested in finding a way to participate in the cannabis industry, and for good reason. It’s growing like a weed (yes, we said it). According to a San Francisco-based research company, Grand View Research, the global legal marijuana market is expected to reach $146.4 billion by the end of 2025.

Still, it isn’t easy for potential recruits to know where to look for both temporary and permanent jobs, and it’s just as challenging for companies to find candidates who understand their business. Enter Vangst, a now three-year-old, Denver-based startup that just raised $10 million in Series A funding from earlier backers Casa Verde Capital and Lerer Hippeau to become the go-to recruiting platform for the industry, even while going up against several older entrants, including Seattle-based Viridian Staffing and Ganjapreneur, in Bellingham, Wash.

Yesterday, we with chatted with the CEO and founder of the now 70-person company, Karson Humiston, about launching the platform in college, and why she isn’t so worried about the competition. She also shared some interesting stats around how much cannabis jobs pay.

TC: Some people launch startups in college. Not many of them grow them into sustainable companies. How did Vangst get going?

KH: I went to St. Lawrence [University] and while there, I’d started a student travel company and compiled a database of students and recent grads — people who’d gone on trips through the startup or expressed an interest in going on trips. The spring of my senior year, in 2015, I sent an email to all of them asking what jobs they were interested in, and more than 70 percent said the cannabis industry.

TC: Wow, interesting.

KH: That was my reaction, but living in upstate New York where recreational cannabis isn’t yet legal, I didn’t know a lot about it. So I took a weekend off from school to go to a trade show in Colorado, where I saw everything from cultivation to extraction to retail to ancillary businesses. And when I asked what jobs they were looking to fill, they said, essentially, everything: a director of cultivation, retail dispensary store managers, HR, marketing. They all said it was their top pain point because if they posted on a traditional jobs board — and remember, this was 2015 — the listing would often get taken down. Meanwhile, there was no industry-specific resource because [marijuana] is federally illegal.

TC: So you dropped the travel startup idea and pursued this. Where did you start?

KH: First, I rushed back to St. Lawrence and made an inexpensive site on Wix and started connecting people in my database with summer internships. I’d told the companies I’d met with that I could find them employees for $500 and I called this new company Graduana, [with the tagline] green jobs for grads. My thought was, I’ll go to Colorado and do Graduana for six months and see where the industry really is.

By the spring of 2016, I realized that demand far exceeded interns and recent grads and that we needed to find recruiters who know what they’re doing. We brought on recruiters who were just focused on cultivation, for example, and who know the difference between someone who can grow cannabis in the garage and someone who has done large-scale agricultural growing. They they started pulling in people from the tomato and tulip and big commercial ag who’ve grown [plants] in big state-of-the-art greenhouses and could bring important skills to the table. We also brought in recruiters to just focus on the retail side of things.

It became this profitable, 25-person, boutique staffing agency. But we also saw an opportunity for on-demand labor, because of the seasonality of the industry. Cannabis grows, then it needs to be trimmed and packaged. . .

TC: So it was time for venture capital?

KH: When you’re talking about temporary staffing, it’s really been done manually in this industry, so we wanted to build a platform that would notify candidates that a certain company needs 20 trimmers and is willing to pay $12 an hour and where, meanwhile, employers could see that someone has trimmed for 2,000 hours. And each could rate each other. So we needed to hire engineering and a customer success team and legal, and our revenue wasn’t going to cover those costs.

Thankfully, a founder friend in the space, Ryan Smith of LeafLink, introduced us to Lerer Hippeau when he heard were raising a seed round. We received a warm intro to Casa Verde, too. And both have been amazingly helpful to us.

TC: Are you still doing high-end hiring, too?

KH: We are. Revenue from that piece of our business, where we’re helping companies find maybe COOs or a director of cultivation or extraction, more than doubled last year and continues to be profitable. We get 1,000 resumes some days. We now have 200,000 job candidates on the platform.

TC: Obviously, you’re charging employers different amounts depending on the the type of role that you’re filling. Can you share some specifics?

KH: Right. On the direct hire side, we take a percentage of their first year’s salary. On the gig side, a company tells us how much they’d like to pay for gig workers, and there’s a mark-up on that that we keep.

TC: No matter how long that person works for your client?

KH: It’s usually for a matter of weeks. If it’s longer than that, we charge them a buyout fee [to step out of the relationship].

TC: I take it you’re marketing the service to college students largely.

KH: We market the service through career fairs that we throw in different states, and at trade shows in and out of the industry. We also spend time going to college campuses. But our acquisition costs have been relatively low. Everyone who gets placed with us is known as an original Vangster and we do Vangster nights, where anyone in our network can bring a friend and we can help turn them into employees, too.

TC: More states are legalizing recreational cannabis; how are you drumming up workforces in different places?

KH: We have a team now in Denver, in Santa Monica and a small team in Oakland, and as we launch additional cities for Vangst gigs, we’re hiring managers and people who can do client outreach and candidate vetting and onboarding. We just hired an early employee of Uber, Will Zinsmeister, who helped oversee the launch of cities in Texas for Uber, so we’re excited to have Will and others thinking through supply-and-demand issues as we launch more widely.

TC: Out of curiosity, how much do cannabis jobs pay, and how many people work in the industry right now — do you have any idea?

KH: I think there’s more than 160,000 employees across the cannabis industry right now, and by 2022, the industry is expected to grow to around 340,000 full-time employees.

We did survey 1,500 people to put together a salary guide and one of the questions we asked was how much of their labor needs are seasonable versus otherwise, and they said about 30 percent.

As for the salaries, the on-demand jobs are very in line with other industries. When it comes to full-time jobs, outside sales jobs pay on average a salary of $73,000, which is in line with other outside sales jobs. On the higher end, a compliance manager can make $149,000, a director of extraction makes on average $191,000, and a director of cultivation on the high end can make $250,000.

TC: I think that’s more than people might have imagined. Who is landing these higher-end jobs other than people with backgrounds in traditional large-scale farming?

KH: You’re seeing people graduating with a degree in botany who’ve maybe worked for a cannabis company for six years and are seen as having very unique experience. We’re seeing a lot of clients in Maryland and other places saying they want candidates from Colorado.

Powered by WPeMatico

What if instead of just accepting Uber rides, gig workers could pick from higher-paying skilled tasks around town like stocking shelves, checking inventory or driving a forklift at a local grocer? When they work quickly and accurately or learn new trades, they get to choose between more complex jobs. That’s the idea that’s racked up $400 million in staffing contracts for Jyve, an on-demand labor platform that’s coming out of stealth today after 3.5 years. It already has 6,000 workers doing tasks for 4,000 stores across the country.

“I believe the skill economy is way bigger than the gig economy,” says Jyve CEO and founder Brad Oberwager. He sees Uber driving as just the low-expertise beginning of a massive new job type where people with specializations or experience are efficiently matched to retail work. Jyve’s secret sauce is the work quality review system built into its app for managers and stores that lets it know who got the job done right and deserves even better opportunities.

Jyve’s potential to become the skilled labor marketplace has quietly attracted $35 million in funding across a seed and Series A round raised over the past few years, led by SignalFire and joined by Crosscut Ventures and Ridge Ventures. “Jyve is one of the fastest-growing companies we’ve seen, having already reached $400 million in bookings in three short years,” writes Chris Farmer, CEO of SignalFire. “They are creating a new economic class.”

It’s all because Safeway hasn’t touched a bag of Doritos in 50 years, Oberwager tells me. Grocery stores have long outsourced the shelving and arrangement of products to the big brands that make them, which is why the retail consumer packaged good industry employs 10 million people in the U.S., or more than 10 percent of the country’s workforce. But instead of relying on one person to drive goods to the store, load them in and shelve them, Jyve can cut costs and divide those tasks and match them to nearby people with sufficient skills.

“Retail isn’t dying, it’s changing, and brands that are thriving are the ones investing in their in-store experience as well as owning their e-commerce initiatives,” observed Oberwager. “The question we must ask then is how do we fill this labor shortage and also enable people to refine special skills that are multi-dimensional and rewarding.”

Oberwager knows the tribulations of grocery shelving well. He built online drugstore More.com before the dot-com boom, then started making his own food products. He created True Fruit Cups, one of the country’s largest importer of grapefruit, and founded and sold his Bare apple chips company. Competing for shelf space with big brands paying workers to set up elaborate displays in grocery stores, he saw a chance to reimagine retail labor.

But it was when his daughter got sick and he realized the surgeon who performed the operation was essentially a high-skilled mercenary that he seized on the opportunity beyond grocers. “He walks in, does the surgery, walks out. He’s a gig worker, but it’s a skill I’m willing to pay a lot for,” says Oberwager.

He created Jyve to aggregate the demand from different stores and the skills from different workers. When someone signs up for Jyve, they start with easier tasks like moving boxes in the backroom. If they do that well, they could unlock higher-paying shelf stocking and display arrangement, then product ordering and brand ambassadorship. At each step, they take photos and leave comments about their work that are reviewed by a combination of store and brand managers, as well as Jyve’s machine vision algorithms and human quality-control team. It can quickly tell if someone puts the Cheerios box on the shelf the wrong way, and won’t give them public-facing tasks if they don’t improve

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

“Seventy percent of our market managers were originally drivers, and they become W-2 workers,” Oberwager says proudly. Jyve even makes it easy for brands and retailers to hire its top giggers for full-time jobs. Why would the startup allow that? “I want to put it on a billboard, ‘Work hard, get promoted,’ ” he tells me. The fact that Oberwager’s last name could be interpreted as “higher wages” in German makes Jyve seem like his destiny.

But to fulfill that prophecy, Jyve will have to out-tech old-school staffing firms like Acosta, Advantage and Crossmark. It’s also hoping to ween grocers off of Instacart by bringing shopping for online orders back to stores’ in-house staff — provided by Jyve. A worker could be stocking shelves, then use that knowledge to quickly pick up all the items for an online order and give them to a curbside driver, then return to their task.

Keeping work quality up to snuff will be a challenge, but by dangling higher wages, Jyve aligns its incentives with its workers. The bigger hurdle may be convincing big brands and retail institutions to change the way they’ve done staffing forever. Oberwager professes that it takes a long time to onboard, but also a long time to offboard, so it could build a solid moat if it’s the first to win this market. Jyve is now in more than 1,200 cities across the U.S.., and a real-time map showed a plethora of gigs available around San Francisco during the demo.

Oberwager admits the unskilled gig economy is “a little dehumanizing. It makes people a cog in a machine.” But he hopes each “Jyver,” as he calls them, can become more like a circuit — a complex machine of its own that powers something bigger.

Powered by WPeMatico

Humio, a startup that provides a real-time log analysis platform for on-premises and cloud infrastructures, today announced that it has raised a $9 million Series A round led by Accel. It previously raised its seed round from WestHill and Trifork.

The company, which has offices in San Francisco, the U.K. and Denmark, tells me that it saw a 13x increase in its annual revenue in 2018. Current customers include Bloomberg, Microsoft and Netlify .

“We are experiencing a fundamental shift in how companies build, manage and run their systems,” said Humio CEO Geeta Schmidt. “This shift is driven by the urgency to adopt cloud-based and microservice-driven application architectures for faster development cycles, and dealing with sophisticated security threats. These customer requirements demand a next-generation logging solution that can provide live system observability and efficiently store the massive amounts of log data they are generating.”

To offer them this solution, Humio raised this round with an eye toward fulfilling the demand for its service, expanding its research and development teams and moving into more markets across the globe.

As Schmidt also noted, many organizations are rather frustrated by the log management and analytics solutions they currently have in place. “Common frustrations we hear are that legacy tools are too slow — on ingestion, searches and visualizations — with complex and costly licensing models,” she said. “Ops teams want to focus on operations — not building, running and maintaining their log management platform.”

To build this next-generation analysis tool, Humio built its own time series database engine to ingest the data, with open-source tools like Scala, Elm and Kafka in the backend. As data enters the pipeline, it’s pushed through live searches and then stored for later queries. As Humio VP of Engineering Christian Hvitved tells me, though, running ad-hoc queries is the exception, and most users only do so when they encounter bugs or a DDoS attack.

The query language used for the live filters is also pretty straightforward. That was a conscious decision, Hvitved said. “If it’s too hard, then users don’t ask the question,” he said. “We’re inspired by the Unix philosophy of using pipes, so in Humio, larger searches are built by combining smaller searches with pipes. This is very familiar to developers and operations people since it is how they are used to using their terminal.”

Humio charges its customers based on how much data they want to ingest and for how long they want to store it. Pricing starts at $200 per month for 30 days of data retention and 2 GB of ingested data.

Powered by WPeMatico

When we think of the AI platforms that are shaping how we use voice to interact with phones, home devices and other services, we tend to think of Amazon’s Alexa, Apple’s Siri, Google and Microsoft’s Cortana. But there are other players that may prove to have a compelling value proposition of their own. Sherpa.ai, a voice assistant out of Spain that also provides predictive recommendations with a focus on the Spanish language, today is announcing that it has expanded its Series A by $8.5 million to $15 million as it passes 5 million active users of its app.

Investors include Mundi Ventures, a Spanish VC fund focused on AI, and Alex Cruz, the chairman and CEO of British Airways.

In a still-heated tech climate where startups are raising tens and sometimes hundreds of millions of dollars in rounds that sometimes happen only months apart, Sherpa’s Series A has been a comparatively slow burn: the startup first announced a Series A of $6.5 million nearly three years ago.

Apart from the fact that European startups do tend to raise and spend more conservatively, Xabi Uribe-Etxebarria, the startup’s founder and CEO, says that it chose to extend this Series A now while it’s still working on closing its Series B for later this year, which will be in the region of $20 million, which will include new investors and likely more detail on how it plans to evolve the business.

“We’re announcing several agreements with big OEMs in the next few months,” he said. “I spoke with our investors and they thought it would be better to get a small amount of capital now to launch those deals to use the momentum to get a better valuation on our Series B.”

The company is already working with Porsche to bring its assistant and recommendation service into its vehicles, and Uribe-Etxebarria said future partnerships, along a similar B2B2C model, will be with “other automakers, telcos and other device manufacturers of smart speakers and PCs.” From what I have heard, Sherpa has been approached by a number of others that have been building voice assistants, as well as the companies building the hardware and other objects that will be housing them. Uribe-Etxebarria would not comment, except to say that he is under NDA with several companies.

“Sherpa.ai has experienced tremendous growth and is poised to become the most advanced conversational and predictive AI OS in the industry,” said Rajeev Singh-Molares, partner at Mundi Ventures and former president of Alcatel-Lucent Asia-Pacific, in a statement. “Sherpa has shown phenomenal potential and amazing growth since the first close of the Series A. By increasing our investment in this company, we are able to accelerate Sherpa.ai on its journey.”

At a time when Amazon’s Alexa alone has passed the 100 million-mark in terms of devices that have been sold that are powered by its voice assistant, and Google, Microsoft and Apple appear to be quickly playing catch-up by integrating into a number of third-party and their own devices themselves, Uribe-Etxebarria says he believes Sherpa stands apart from these for a couple of reasons.

One is the spectre of competition, and possibly the history of how things played out in mobile, where carriers really lost their way with users and value-added services with the rise of apps.

“The companies we are working with don’t always want agreements with companies that also compete with them,” he said. “Take the telco we’re working with. It has its own video and music offerings, its own retail operation. At the end, they would be competing with the likes of Apple or Amazon, so they don’t want to give them access to their users. Car manufacturers might feel the same way.”

The second reason, he says, has to do with Sherpa’s technology.

When the company launched several years ago, voice-based personal assistants were still relatively new, and all the biggies were launching in English. These days, they all have Spanish versions, so this is no longer a unique selling point. (Of the company’s 5 million users, between 80-90 percent of those are using Sherpa’s Spanish content.) And even if it were, Sherpa’s basic speech recognition and text-to-speech are powered by third-party technology, which Uribe-Etxebarria calls “commodities.”

What is more unique, he says, is the company’s predictive recommendations, which is built in-house by his team of natural language and other AI specialists. It covers more than 30 different specialist categories, spanning areas like automotive, entertainment, news, travel and so on, and analyzes 100,000 parameters per user to be able to predict what information a user needs before a question is even asked, whether it’s news or whatever it is that you first do with your phone when you wake up, which emails you will need to see first or what you might want to know when you arrive at a particular location.

“This is what our competitors are very interested in,” he said. “We are at least two or three years ahead of others on this front.”

Sherpa had a significant boost across the Spanish-speaking world when Samsung hooked up with the company to preload the app on all of its devices sold across those countries. That changed after Samsung launched Bixby, its own assistant, but Uribe-Etxebarria said that their partnership is not quite over yet.

“We are still speaking because Bixby can be improved a lot,” he said.

Powered by WPeMatico

Despite its “unsexy” reputation, the logistics industry is attracting massive investment from venture capitalists.

With a fresh $97 million in Series C funding, NEXT joins a fleet of heavily funded logistics platforms, including Flexport, Huochebang and Convoy. The company, which connects shippers and carriers through an online marketplace, raised the capital from Brookfield Ventures, with participation from Sequoia Capital and logistics solutions provider GLP. NEXT declined to disclose the valuation or whether its latest financing included debt.

In 2018, global logistics startups collected more than $6 billion in VC funding, nearly double the $3.2 billion invested in the space the year prior, according to PitchBook. A significant portion of the 2018 capital went to Chinese ventures at about 40 percent. U.S. logistics businesses raised 19 percent, or about $1.2 billion, across 114 deals.

“The logistics space is under more pressure than ever before — with more shipments coming into our ports than drivers and warehouses have the capacity to manage,” NEXT co-founder and chief executive officer Lidia Yan said in a statement.

NEXT was founded in 2015 by Yan and her husband Elton Chung. The round brings the business’s total raised to $125 million, including a $21 million round in January 2018.

Headquartered in Lynwood, California, NEXT plans to use the investment to fill 150 positions in 2019, as well as complete the launch of Relay, a new service targeting the “systemic congestion” at shipping ports.

“NEXT continues to address the critical issues that face logistics management in the U.S. — from the nationwide driver shortage to congestion and operations at our busiest ports,” Sequoia partner Omar Hamoui said in a statement. “We’ve been impressed with NEXT’s ability to execute, and the introduction of Relay proves they have the team and expertise to continue innovating in ways that will ease the pain points of carriers and shippers.”

Powered by WPeMatico