Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Andela, the company that connects Africa’s top software developers with technology companies from the U.S. and around the world, has raised $100 million in a new round of funding.

The new financing from Generation Investment Management (the investment fund co-founded by former Vice President Al Gore) puts the valuation of the company at somewhere between $600 million and $700 million, based on data available from PitchBook on the company’s valuation following its previous $40 million funding.

Previous investors from that financing, including the Chan Zuckerberg Initiative, GV, Spark Capital and CRE Venture Capital, also participated.

“It’s increasingly clear that the future of work will be distributed, in part due to the severe shortage of engineering talent,” says Jeremy Johnson, co-founder and CEO of Andela. “Given our access to incredible talent across Africa, as well as what we’ve learned from scaling hundreds of engineering teams around the world, Andela is able to provide the talent and the technology to power high-performing teams and help companies adopt the distributed model faster.”

The company now has more than 200 customers paying for access to the roughly 1,100 developers Andela has trained and manages.

Since its founding in 2014, Andela has seen more than 130,000 applicants for those 1,100 slots. After a promising developer is onboarded and goes through a six-month training bootcamp at one of the company’s coding campuses in Nigeria, Kenya, Rwanda or Uganda, they’re placed with an Andela customer to work as a remote, full-time employee.

Andela receives anywhere from $50,000 to $120,000 per developer from a company and passes one-third of that directly on to the developer, with the remainder going to support the company’s operations and cover the cost of training and maintaining its facilities in Africa. Coders working with Andela sign a four-year commitment (with a two-year requirement to work at the company), after which they’re able to do whatever they want.

Even after the two-year period is up, Andela boasts a 98 percent retention rate for developers, according to a person with knowledge of the company’s operations.

With the new cash in hand, Andela says it will double in size, hiring another thousand developers, and invest in new product development and its own engineering and data resources. Part of that product development will focus on refining its performance monitoring and management toolkit for overseeing remote workforces.

“We believe Andela is a transformational model to develop software engineers and deploy them at scale into the future enterprise,” says Lilly Wollman, co-head of Growth Equity at Generation Investment Management, in a statement. “The global demand for software engineers far exceeds supply, and that gap is projected to widen. Andela’s leading technology enables firms to effectively build and manage distributed engineering teams.”

Powered by WPeMatico

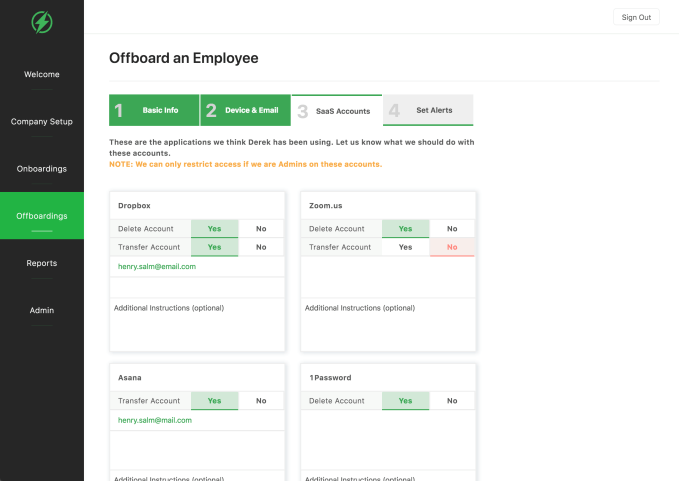

Electric.ai, the New York-based startup that offers chat-based IT support, has announced the close of a $25 million Series B round led by GGV. As part of the deal, partner Jeff Richards will be joining the board.

Founder Ryan Denehy launched Electric in 2016. Previously, he’d run two startups that were sold to USA Today Sports and Groupon, respectively, where he realized that all of the simplicity that came with using a service like Zenefits simply didn’t exist in the IT world.

“It was all local service providers, and they all charge way too much money,” said Denehy. “I thought ‘this is so nuts!’ Companies are using more and more technology every day.”

With his second startup, Swarm, he saw even more clearly how big of a problem this was as the company sold a product that required hardware installation at retailers.

“We were building a company on top of local IT providers, and I saw up close and personal how difficult it was and how fragmented the industry was.”

And so, Electric was born.

The premise is relatively simple. Most of IT’s tasks focus on administration, distribution and maintenance of software programs, meaning that the individual IT specialist doesn’t necessarily need to be desk-side troubleshooting a hardware issue.

Companies using Electric simply install its software on every corporate laptop, giving the top IT employee or the org’s decision-maker a bird’s-eye view of the lay of the land. They can grant and revoke permissions, assign roles and make sure everyone’s software is up to date. By integrating with the APIs of the top office software programs, like Dropbox and G Suite, most of the day-to-day tasks of IT can be handled through Electric’s dashboard.

This leaves IT professionals time to focus on actual troubleshooting, hardware installation, etc.

For startups that haven’t yet hired an IT person, Electric connects startups that need help with installation or in-person troubleshooting with local vendors.

Electric says it has automated around 40 percent of IT tasks, with plans to automate 80 percent of IT tasks over 2019.

The company currently has around 300 customers, which rounds out to about 10,000 total users, and serves 10 U.S. markets, including New York, San Francisco, Boston, Chicago and Austin, among others.

The new funding brings Electric’s total funding amount to $37.3 million.

Powered by WPeMatico

Desktop Metal announced this morning that it has raised $160 million. That Series E brings the Burlington, Mass.-based metal 3D printing company up to a whopping $438 million. The startup’s tagline says the company “is reinventing the way design and manufacturing teams print with metal” — and now it undoubtedly has the money to do so.

Koch Disruptive Technologies (yes, that Koch) led the round, joined by GV, Panasonic and Techtronic Industries. The latest round follows $65 million last March, which found Ford investing in the technology, which has applications for both prototyping and manufacturing. Big names like BMW and Lowe’s have also pumped money into Desktop’s impressive additive manufacturing technology.

The company will be investing the massive funding back into its technology. “This new funding will fuel the continued development of our metal 3D printing technology and rich product roadmap, the scaling of operations to meet a growing demand of orders, and the financing of major new research and development initiatives,” co-founder and CEO Ric Fulop said in a press release tied to the news.

Desktop Metal’s technology clearly represents a bright spot in the world of 3D printing/additive manufacturing — at least so far as investors are concerned. Much of that is due to the speed and durability of the printing process, which is helping it move from simple prototyping to real-world product manufacturing.

Powered by WPeMatico

I’m not allowed to tell you exactly how Anchorage keeps rich institutions from being robbed of their cryptocurrency, but the off-the-record demo was damn impressive. Judging by the $17 million Series A this security startup raised last year led by Andreessen Horowitz and joined by Khosla Ventures, #Angels, Max Levchin, Elad Gil, Mark McCombe of Blackrock and AngelList’s Naval Ravikant, I’m not the only one who thinks so. In fact, crypto funds like Andreessen’s a16z crypto, Paradigm and Electric Capital are already using it.

They’re trusting in the guys who engineered Square’s first encrypted card reader and Docker’s security protocols. “It’s less about us choosing this space and more about this space choosing us. If you look at our backgrounds and you look at the problem, it’s like the universe handed us on a silver platter the Venn diagram of our skill set,” co-founder Diogo Monica tells me.

Today, Anchorage is coming out of stealth and launching its cryptocurrency custody service to the public. Anchorage holds and safeguards crypto assets for institutions like hedge funds and venture firms, and only allows transactions verified by an array of biometrics, behavioral analysis and human reviewers. And because it doesn’t use “buried in the backyard” cold storage, asset holders can actually earn rewards and advantages for participating in coin-holder votes without fear of getting their Bitcoin, Ethereum or other coins stolen.

The result is a crypto custody service that could finally lure big-time commercial banks, endowments, pensions, mutual funds and hedgies into the blockchain world. Whether they seek short-term gains off of crypto volatility or want to HODL long-term while participating in coin governance, Anchorage promises to protect them.

Anchorage’s story starts eight years ago when Monica and his co-founder Nathan McCauley met after joining Square the same week. Monica had been getting a PhD in distributed systems while McCauley designed anti-reverse engineering tech to keep U.S. military data from being extracted from abandoned tanks or jets. After four years of building systems that would eventually move more than $80 billion per year in credit card transactions, they packaged themselves as a “pre-product acqui-hire” Monica tells me, and they were snapped up by Docker.

As their reputation grew from work and conference keynotes, cryptocurrency funds started reaching out for help with custody of their private keys. One had lost a passphrase and the $1 million in currency it was protecting in a display of jaw-dropping ignorance. The pair realized there were no true standards in crypto custody, so they got to work on Anchorage.

“You look at the status quo and it was and still is cold storage. It’s the same technology used by pirates in the 1700s,” Monica explains. “You bury your crypto in a treasure chest and then you make a treasure map of where those gold coins are,” except with USB keys, security deposit boxes and checklists. “We started calling it Pirate Custody.” Anchorage set out to develop something better — a replacement for usernames and passwords or even phone numbers and two-factor authentication that could be misplaced or hijacked.

This led them to Andreessen Horowitz partner and a16z crypto leader Chris Dixon, who’s now on their board. “We’ve been buying crypto assets running back to Bitcoin for years now here at a16z crypto. [Once you’re holding crypto,] it’s hard to do it in a way that’s secure, regulatory compliant, and lets you access it. We felt this pain point directly.”

Andreessen Horowitz partner and Anchorage board member Chris Dixon

It’s at this point in the conversation when Monica and McCauley give me their off-the-record demo. While there are no screenshots to share, the enterprise security suite they’ve built has the polish of a consumer app like Robinhood. What I can say is that Anchorage works with clients to whitelist employees’ devices. It then uses multiple types of biometric signals and behavioral analytics about the person and device trying to log in to verify their identity.

But even once they have access, Anchorage is built around quorum-based approvals. Withdrawals, other transactions and even changing employee permissions requires approval from multiple users inside the client company. They could set up Anchorage so it requires five of seven executives’ approval to pull out assets. And finally, outlier detection algorithms and a human review the transaction to make sure it looks legit. A hacker or rogue employee can’t steal the funds even if they’re logged in because they need consensus of approval.

That kind of assurance means institutional investors can confidently start to invest in crypto assets. That swell of capital could help replace the retreating consumer investors who’ve fled the market this year, leading to massive price drops. The liquidity provided by these asset managers could keep the whole blockchain industry moving. “Institutional investing has had centuries to build up a set of market infrastructure. Custody was something that for other asset classes was solved hundreds of years ago, so it’s just now catching up [for crypto],” says McCauley. “We’re creating a bigger market in and of itself,” Monica adds.

With Anchorage steadfastly handling custody, the risk these co-founders admit worries them lies in the smart contracts that govern the cryptocurrencies themselves. “We need to be extremely wide in our level of support and extremely deep because each blockchain has details of implementation. This is inherently a very difficult problem,” McCauley explains. It doesn’t matter if the coins are safe in Anchorage’s custody if a janky smart contract can botch their transfer.

There are plenty of startups vying to offer crypto custody, ranging from Bitgo and Ledger to well-known names like Coinbase and Gemini. Yet Anchorage offers a rare combination of institutional-since-day-one security rigor with the ability to participate in votes and governance of crypto assets that’s impossible if they’re in cold storage. Down the line, Anchorage hints that it might serve clients recommendations for how to vote to maximize their yield and preserve the sanctity of their coin.

They’ll have crypto investment legend Chris Dixon on their board to guide them. “What you’ll see is in the same way that institutional investors want to buy stock in Facebook and Google and Netflix, they’ll want to buy the equivalent in the world 10 years from now and do that safely,” Dixon tells me. “Anchorage will be that layer for them.”

But why do the Anchorage founders care so much about the problem? McCauley concludes that, “When we look at what’s potentially possible with crypto, there a fundamentally more accessible economy. We view ourselves as a key component of bringing that future forward.”

Powered by WPeMatico

French startup Mooncard raised a $5.7 million funding round (€5 million) from Raise Ventures, Aglaé Ventures and business angels. The company provides a service to track and manage your company’s expenses with the help of good old plastic cards.

Corporate credit cards aren’t as widespread in France as in the U.S. and other countries. That’s why fintech startups have been trying to find a way to streamline expenses for French startups.

Mooncard lets you get as many cards as you want for your team. Managers can set different kinds of rules with different limits and validation processes.

Every time you pay with your card, you get a text message with a link. When you tap on the link, you can take a photo of the receipt, add details and submit your expense. Your accounting team can see expenses in real time and share reports with accountants.

Behind the scenes, companies create a specific account for expenses and top up that account. Mooncard works with Wirecard for the banking integration.

So far, 1,000 companies are using Mooncard, such as Air France, Vinci, Virtuo, Ledger and others. Companies pay between €13 and €15 per user per month, and Mooncard plans to have 200,000 users within three years.

Powered by WPeMatico

When it comes to reaching would-be customers today, one of the biggest investments that brands and retailers will make is in advertising, to the tune of nearly $630 billion globally. Now, a startup called Dosh, which offers cash back on purchases, is announcing that it has raised $40 million to take on the advertising industry, with the pitch that its app provides a more targeted and guaranteed way of getting consumers to bite.

The funding — $20 million in equity and $20 million in venture debt — is led by Goodwater Capital and Western Technology Investment. Previous investor PayPal, along with new investors BAM Capital and Anthem Venture Partners, also participated. Sources close to the company confirm that the funding was done on approximately a $300 million valuation. It has raised $96 million in total, including both equity and debt.

“Instead of taking all in equity we decided to split because of the strength of the company at the moment,” said Ryan Wuerch, Dosh’s founder and CEO, in an interview, who said the funding would be used for hiring, business development and technology investment. “We want to be opportunistic.”

It was only nine months ago that Dosh last raised dosh; $44 million on a $241 million valuation. In the interim, the startup has been on a roll — at one point, in the holiday spending period, hitting No. 1 among U.S. shopping apps and clocking in some $50 million in cash back to its users, doubling those returns since last April. It now has 3 million card-linked subscribers and more than 150,000 retailers and brands signed up to its platform.

Up to now, Dosh’s business model has been to forge deals with retailers and brands — partners include Nike, Toms, Gap, Walgreens, Walmart, Jack in the Box and more — and payment card providers like Visa and Mastercard. When a user links up a card, and she or he buys something from the retailers and brands connected with Dosh, the user gets money back. That money can in turn be paid into your bank account, your PayPal account, toward further purchases or to charity. Dosh itself makes money by taking a cut on each transaction, although it does not provide details of its percentage.

Going forward, the idea will be to continue to expand its business along the same lines by building more technology into the platform to make the offers you are getting more targeted to what you might be most likely to buy, and to use the same tech to increase rewards to entice you to buy things that you may be less likely to naturally buy.

The company’s viewpoint is that a direct cash reward is a much stronger driver for retail intent than advertising can ever be, and because of how Dosh links up with card providers, it’s much easier to see how an offer is linked to an actual purchase.

“When you think about advertising over the years, at first all you had was radio and TV and print with little attribution,” Wuerch said. “Now digital gives you clicks and impressions, but true attribution is when you get to the consummation of the purchase, which is what we are able to show. The tech that we built and continue to build enables us to understand consumers.”

Given the billions that are spent on advertising today, even moving the needle a little to get more retailers working with Dosh on more deals could prove very lucrative to the company… and its investors.

“Dosh’s mission is to put billions of dollars of wasted advertising spend directly into consumers’ pockets,” said Chi-Hua Chien, co-founder and managing partner at Goodwater Capital, which is leading its investment in Dosh. “They are the clear leader in the rapidly growing card-linked offers market and we are confident this latest round of funding will accelerate their achievement of that mission.” (And to be clear, there are many others in the same space of offering cash back on purchases, such as Drop and Ebates.)

Offers are specific to people on the platform. As Wuerch explained it, he and I might both get offers for Sam’s Club cash back, but because he visited the store three days ago and is a very regular visitor, whereas I never go there, we may have very different cashback offers on the table.

Loyalty programs have become a strong driver for how people purchase goods and services. Amazon Prime is perhaps the strongest example of how that is being played out in e-commerce: To keep people using Amazon, under one umbrella, Amazon is offering users free and fast shipping on a range of items, plus access to services that ordinary customers will not get, all for a single monthly fee.

Dosh is taking a very different approach, in that it has “no plans” said Wuerch to sell items directly on its app, instead focusing on leading consumers to physical (or online) retail experiences.

“Our goal is to drive consumers into stores, and we have found that the cash stimulus really does create a change in consumer behavior,” he said.

Today, Dosh is only in the U.S., and Wuerch said that international expansion is likely to come in 2020. Whether that will come by way of organic growth or acquisition remains to be seen. In the U.K., for example, Quidco provides a similar cashback experience to users.

Powered by WPeMatico

Most founders don’t walk away from their startup after raising $32 million and reaching 1000 clients. But Roger Dickey’s heart is in consumer tech, and his company Gigster had pivoted to doing outsourced app development for enterprises instead of scrappy entrepreneurs.

So today Dickey announced that he’d left his role as Gigster CEO, with former VMware VP Christopher Keane who’d sold it his startup WaveMaker coming in to lead Gigster in October. Now, Dickey is launching Untitled Labs, a “search lab” designed to test multiple consumer tech ideas in “social and professional networking, mobility, personal finance, premium services, health & wellness, travel, photography, and dating” before building out one

Untitled Labs is starting off with $2.8 million in seed funding from early Gigster investors and other angels including Founders Fund, Felicis Ventures, Caffeinated Capital, Joe Montana’s Liquid Ventures, Ashton Kutcher, Nikita Bier of TBH (acquired by Facebook), and Zynga co-founder Justin Waldron.

Untitled Labs is starting off with $2.8 million in seed funding from early Gigster investors and other angels including Founders Fund, Felicis Ventures, Caffeinated Capital, Joe Montana’s Liquid Ventures, Ashton Kutcher, Nikita Bier of TBH (acquired by Facebook), and Zynga co-founder Justin Waldron.

Investors lined up after seeing the success of Dickey’s last two search labs. In 2007, his Curiosoft lab revamped classic DOS game Drugwars as a Facebook game called Dopewars and sold it to Zynga where it became the wildly popular Mafia Wars. He did it again in 2014, building Gigster out of Liquid Labs and eventually raising $32 million for it in rounds led by Andreessen Horowitz and Redpoint. Dickey had proven he wasn’t just dicking around and his search labs could experiment their way to an A-grade startup.

“I loved learning about B2B but over the years I realized my true passions were in consumer and I kinda got the itch to try something new” Dickey tells me. “These things happen in the life-cycle of a company. The person who starts it isn’t always the same person to take it to an IPO. Gigster’s doing incredibly well. It was just a really vanilla separation in the best interest of all parties.”

Gigster co-founders (from left): Debo Olaosebikan and Roger Dickey

Gigster’s remaining co-founder and CTO Debo Olaosebikan will stay with the startup, but tells me he’ll be “moving away from a lot of the day-to-day management.” He’ll be in a more public facing role, evangelizing the vision of digital transformation to big clients hoping Gigster can equip them with the apps their customers demand. “We’ve gotten to a really good place on the backs of the founders and to get it to the next level inside of enterprise, having people who’ve done this, lived this, worked in enterprise for a long time makes sense for the company.”

Olaosebikan and Dickey both confirm there was no misconduct or other funny business that triggered the CEO’s departure, and he’ll stay on the Gigster board. Dickey tells me that Gigster’s business managing teams of freelance product managers, engineers, and designers to handle product development for big clients has grown revenue every quarter. It now has 1200 clients including almost 10% of Fortune 500 companies. Olaosebikan says “We have a great repeatable sales model. We can grow profitably and then we can figure out financing. We’re not in a hurry to raise money.”

Since leaving Gigster, Dickey has been meeting with investors and entrepreneurs to noodle on what’s in their “idea shelf” — the product and company concepts these techies imagine but are too busy to implement themselves. Meanwhile, he’s seeking a few elite engineers and designers to work through Untitled’s prospects.

Dickey said he came up with the “search labs” definition since he and others had found success with the strategy that no one had formalized. The search labs model contrasts with three other ways people typically form startups:

Dickey tells me that after 80 angel investments, going to every recent Y Combinator Demo Day, and talking with key players across the industry, the search lab method was the best way to hone in on his best idea rather than just going on a hunch. Given that approach, he went with “Untitled” so he could save the branding work for when the right product emerges. Dickey concludes “We’re trying to keep it really barebones. We don’t have an office, don’t have a logo, and we’re not going to make swag. We’re just going to find the next business as efficiently as possible.”

Powered by WPeMatico

Tom Griffiths has founded four companies, two of which “weren’t much to write home about,” he jokes. The third captured the world’s attention: FanDuel, the fantasy sports company that was routinely in the press — not always for desirable reasons — from nearly the day it launched, to its near merger with rival DraftKings, to its ultimate sale last May to the European betting giant Paddy Power Betfair in a deal that reportedly saw FanDuel’s founders, along with its employees, walk away with almost nothing at the end of their roller coaster ride.

Little wonder that Griffith’s new, fourth company, Hone, is targeting the comparatively undramatic world of workforce training. Specifically, Hone and his small team have built a platform for modern and distributed teams, inspired largely by FanDuel’s experience of becoming a unicorn at one point in just six years’ time, and growing its team from 5 to 500 people in the process. Looking back, says Griffiths, “We really didn’t have the manager training we wanted or needed.”

In fact, Griffiths had already left the company by the time it was acquired, around his 10th anniversary last year, to “go back to the start.” It was time, he says. FanDuel had grown like a weed. He was exhausted by the many regulators wrestling with whether FanDuel provided a legally acceptable form of gambling. He knew he wanted to work in education, too. “My mom was a teacher,” he offers simply.

Enter Griffith’s newest act, which is just 10 months old at this point. The goal of the San Francisco-based company is to improve people’s skills around leadership management and people management, specifically at companies that already have hundreds of employees and that are dealing with increasingly distributed and diverse teams.

Hone is obviously not the first company tackling the remote management training or team building. The market already attracts tens of billions of dollars each year. But he insists it will be one of the best, including because it’s unlike a lot of what’s available currently. For one thing, Hone is very anti-traditional workshop. Hone also eschews pre-recorded video, working instead with qualified professional coaches who have to audition for Hone and who are already teaching a growing number of customers 12 different modules, typically in online class sizes of eight to a dozen people.

A company simply signs up, chooses from the programs (these include an intensive manager bootcamp, for example, as well as a manager 101 program), then embarks on what are 60- to 90-minute sessions each week for seven weeks.

The idea, in part, is for the learnings to stick. According to Griffiths, trainees forget 70 percent of what they are taught within 24 hours of a training experience. Instilling new lessons and reiterating old ones produces a greater return on investment for Hone’s customers, he suggests.

Hone’s underlying platform is also a differentiator, he says. It contains a reporting interface, so companies can not only see who is in attendance, but they can measure learner feedback through students who are asked afterward to provide the company with details about what they’ve learned. Hone’s software can also track how many questions were asked to assess engagement.

The self-learning platform gives Hone an easier way to assess how successful, or not, a particular module proves to be, and it allows Hone to continue sharpening its products. In fact, Griffiths says that by working with early, paying customers that include WeWork, Clear, App Annie, Dashlane, Omada Health, SoulCycle and others, Hone has already learned much that it intends to bake into future products,.

“We were in pilot mode last year to get product-market fit.” Now, the company is ready for its close-up, he suggests.

Some new funding should help. In addition to taking the wraps off Hone and opening more widely for business, the company just raised $3.6 million in seed funding led by Cowboy Ventures and Harrison Metal. Other participants in the round include Slack Fund, Reach Capital, Rethink Education, Day One Ventures, Entangled Ventures and numerous relevant angel investors, like Masterclass CEO David Rogier and Guild Education CEO Rachel Carlson.

What the 10-month-old company isn’t sharing publicly just yet is its pricing, which may remain flexible in any case. Says Griffiths, “We work with customers to diagnose their needs, then we create a package, one that’s far more reasonable than classroom training. There’s no travel. No instructor having to come to you.”

Griffiths is more forthcoming when it comes to lessons learned at FanDuel. Among these is aligning one’s self with investors who share a company’s values. He points to Cowboy Ventures founder Aileen Lee, calling her a “towering pillar of progressive values, equality, inclusion and diversity.” What he saw at FanDuel, he says, is that “investors can influence culture. So from the board down, you want people who share your same values.”

Griffiths also stresses the “importance of establishing a strong culture and a vision from the start, and to live that every day as you grow.

“It’s something we did well at FanDuel at some times,” he says, “and not so well at other times.”

Hone founders, left to right: Savina Perez, who was formerly a VP of marketing at CultureIQ, a platform that aims to helps companies strengthen their culture; Tom Griffiths; and Jeremy Hamel, who was formerly the head of product at CultureIQ.

Powered by WPeMatico

Sony’s venture capital arm has invested in what3words, the startup that has divided the entire world into 57 trillion 3-by-3 meter squares and assigned a three-word address to each one.

Financial details were not disclosed.

The startup’s novel addressing system isn’t the whole story. The ability to integrate what3words into voice assistants is what has piqued the interest and investment from Sony and others.

“what3words have solved the considerable problem of entering a precise location into a machine by voice. The dramatic rise in voice-activated systems calls for a simple voice geocoder that works across all digital platforms and channels, can be written down and spoken easily,” Sony Corporation’s senior vice president Toshimoto Mitomo said in a statement.

Last year, Daimler took a 10 percent stake in what3words, following an announcement in 2017 to integrate the addressing system into Mercedes’ new infotainment and navigation system — called the Mercedes-Benz User Experience, or MBUX. MBUX is now in the latest Mercedes A-Class and B-Class cars and Sprinter commercial vehicles. Owners of these new Mercedes-Benz vehicles are now able to navigate to an exact destination in the world by just saying or typing three words into the infotainment system.

Other companies are keen to follow Daimler’s lead. TomTom and ride-hailing services like Cabify recently announced plans to enable what3words navigation to precise locations.

And more could follow. The startup says it plans to use the investment from Sony to focus on more initiatives in the automotive space.

Powered by WPeMatico

Bianca Gates is a first-generation American, her parents having immigrated to the U.S. from Latin America. As such, she says, after graduating from UC Irvine, she was expected to get a safe job with a 401(k) plan and to live with her parents until she was married.

Things haven’t gone exactly that way, but one can imagine Gates’s parents feeling pretty satisfied with their daughter’s trajectory nevertheless. The reason: Gates, along with cofounder Marisa Sharkey, are the cofounders of Birdies, a four-year-old, San Francisco-based footwear brand that has made it chic to step out in shoes like look like elegant slippers, and which just raised $8 million in Series A funding led by Norwest Venture Partners, with participation from Slow Ventures and earlier investor Forerunner Ventures.

Sure, another e-commerce brand, why should you care? Actually, if haven’t seen the shoes out in the wild, there’s a high likelihood that will change soon, including because one of the company’s biggest advocates to date has been Meghan Markle, the actress turned Duchess of Sussex, whose fashion choices are copiously detailed by entertainment sites around the world, copied by their readers, then picked up by readers’ friends.

Interestingly, Markle was never meant to step outside in the slippers. But let’s back up a bit first, to Gates’s earlier career, a familiar story that underscores the value of grit — as well as the importance of making the right connections.

As Gates tells it from Birdie’s offices on Union Street, a kind of yuppie haven in San Francisco, “My family was living in Santa Ana and I was commuting every day to Irvine and I just wanted to spread my wings and move to a big city with a lot of diversity after graduating.” Thanks partly to her fluency in Spanish, she landed a job with the broadcast giant Univision as an account executive. After more than three years, and “realizing I didn’t want to be typecast as an Hispanic person working for Hispanic TV,” she left for Viacom, where Gates fell for a colleague.

He landed soon after at Stanford Business School, and after plenty of cross-country flights, the two married and moved to San Francisco to start their family, with Gates opening up an office for Viacom’s MTV in the process. But she was soon feeling antsy again. “It was really convenient for me, but I [felt] after having my first chid and working out of a satellite office that I was out of the action. I wanted to be closer to people.”

As it happens, she caught a 2011 commencement speech that Facebook COO Sheryl Sandberg delivered to Barnard College students and decided to apply to Facebook. Six months of interviews later, she landed a job leading retail partnerships, where she helped sales organizations understand what was then a new platform to them.

She also made powerful friends, including Priti Youssef Choksi, a Facebook colleague who was striking corporate and business development deals and who Gates befriended over a series of events at the home of Sandberg, who quietly hosted employees who Sandberg identified as eager to do more with their careers. “You didn’t photograph yourself there or talk about [the dinners], but it helped Priti and I form a deeper friendship,” recalls Gates.

The friendship — and Sandberg’s support — would eventually help get Birdies off the ground.

So did Gates’s obsession with finding post-work, pre-slipper-type shoes, which she says dates back a decade. “I just found that more and more, I was being asked to take off my shoes in friends’ homes and I was asking people to do the same. I thought that stylish shoes for indoors made a lot of sense,” but she wasn’t sure if there was a void in the market, or if she just imagined one.

She decided to pursue the idea while recognizing that she couldn’t do it alone. She still had that big job at Facebook that she loved. She also had two young kids at home at this point. So Gates texted her friend, Marisa Sharkey, a former Ross Stores executive who’d moved from Manhattan to Sacramento with her own family and was feeling restless. “I texted her and said, ‘I have this crazy idea; I’ll call you tomorrow.’ Marisa texted back immediately and said, ‘Tell me what it is.’” Within no time at all, Sharkey was fully committed, putting $50,000 into the venture, alongside Gates, who also put $50,000 into the venture.

What they got for their money? Shoes that today give them both “PTSD,” jokes Gates, but that became the starting point of Birdies.

It wasn’t so easy, but some key connections made the difference, one of which surfaced through good-old-fashioned outreach. “We became so obsessed with our idea that we asked everyone we talked with whether they could help. Through degrees of separation, we were connected to someone who’d just retired from the footwear business in L.A and knew some factories in China and agreed to help introduce us to them.”

It was a game changer, even if what the factories were left working with wasn’t exactly pretty. Think shoes torn apart, their innards — including their memory foam inserts — reassembled on construction paper.

“The shoe industry is very small and it’s really hard to get into a factory unless you know someone,” says Gates. “It isn’t like making apparel, where you can go to a factory in South San Francisco and make 24 dresses and see how it goes. With footwear, you can’t try in small doses.”

It was one of many learnings yet to come, including the realization they had nowhere to store the 1,800 pairs of shoes they’d had to order — and which arrived sooner than expected outside of Sharkey’s home. (They wound up housed in her garage.)

Gates also began worrying about losing her full-time job, eventually writing Sandberg to explain that she was responsible for a garage piled high with slipper shoes that she hoped to sell — then fretting about what the return email would say. As it happens, Sandberg “couldn’t have been more supportive. I even forwarded her note to my manager, saying, look, Sheryl is cool with this,” says Gates, laughing.

Fast forward several years, and Birdies is now a a legitimate, if surprisingly small, operation, one with just six employees but a big and fast-growing base of customers.

Its very first customer, Gate’s Facebook friend, Choksi, wound up being an important champion. Choksi left Facebook last year to become a venture capitalist. And as a partner with Norwest Venture Partners, she just led the firm into Birdie’s competitive Series A round, a development about which she sounds excited. “Even that first pair — they didn’t look like the random shoes I was putting on with what I was wearing at home,” recalls Choksi. “I could also get the mail and do quick errands.”

She still has them, she says. “They’re fairly worn out, but I keep them to taunt Bianca.”

Meanwhile, Meghan Markle helped put the company on the map. A short lifestyle piece about Birdies in the SF Chronicle got the ball rolling. “We started to gain traction,” and with that came the nascent attention of fashion editors and celebrity stylists, says Gates. But the company still had very limited resources. It had to choose one celebrity on which to focus and it zeroed in on Markle, then an actor starring in a show called “Suits.”

“We just loved her casual elegance,” says Gates of Markle, whose courtship with with Prince Harry was on no one’s radar at the time. “We loved that she often wore simple button-downs and jeans and casual loafers. We also liked that she was this humanitarian.” Birdies sent Markle a complimentary pair of shoes, and to its great delight, Markle took to them. In fact, she began wearing them all them time and tagging them on Instagram, too.

There was just one problem. Markle was wearing them everywhere other than indoors. “It was this amazing, frustrating moment for the brand, because they were made for entertaining in the home.” They might have stewed longer, but a quick call with Bonobos founder Andy Dunn — who’d attended Stanford with Gates’s husband — soon set Gates and Sharkey straight. “He basically said, ‘You just fell into a much bigger opportunity.’”

A thicker rubber sole followed, and the rest is history in the making. Not that it’s all been a walk in the park. The company has at times had waitlists of up to 30,000 people — an enviable but very real problem it hopes its new round of funding will help solve.

As happens with many new brands, it’s also wrestling with price points, offering several limited edition shoes in partnership with designer Ken Fulk last fall that “brought in a whole new customer” but were also priced at $165, roughly 30 percent more than most of its slippers, says Gates. (Birdies more recently introduced a “resort” slipper that’s priced at $95, and Gates says the company hopes to introduce other, more affordable designs down the line.)

There’s also the challenge of figuring out which new markets to chase while simultaneously hiring, fast. Choksi and Norwest, which has reach into many consumer brands, is helping on the latter front. Meanwhile, Gates says to expect more in the way of bridesmaids’ slippers, as well as other new designs coming this spring and summer.

Like another e-commerce footwear startup that’s taking off — Rothy’s — which has filed a patent infringement suit against a rival, Birdies also seems poised to see more copycat designs.

Asked about this, Gates doesn’t seem terribly concerned, not yet. “We’ve had friends tell us that Target is offering a similar slipper at a different price point. Everybody copies everybody,” she says. “It’s our job to create a brand beyond the silhouette of a slipper, because that can be knocked off, it’s not defensible. What is defensible is why [a customer] is buying Birdies, and why she is telling her friends to shop us. It’s our job to give her more than a product, to lift her up.”

Birdies has now raised roughly $10 million altogether, including $2 million in seed funding led by Forerunner in the fall of 2017.

Above, left to right, cofounders Bianca Gates and Marisa Sharkey. Photo courtesy of Birdies.

Powered by WPeMatico