Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

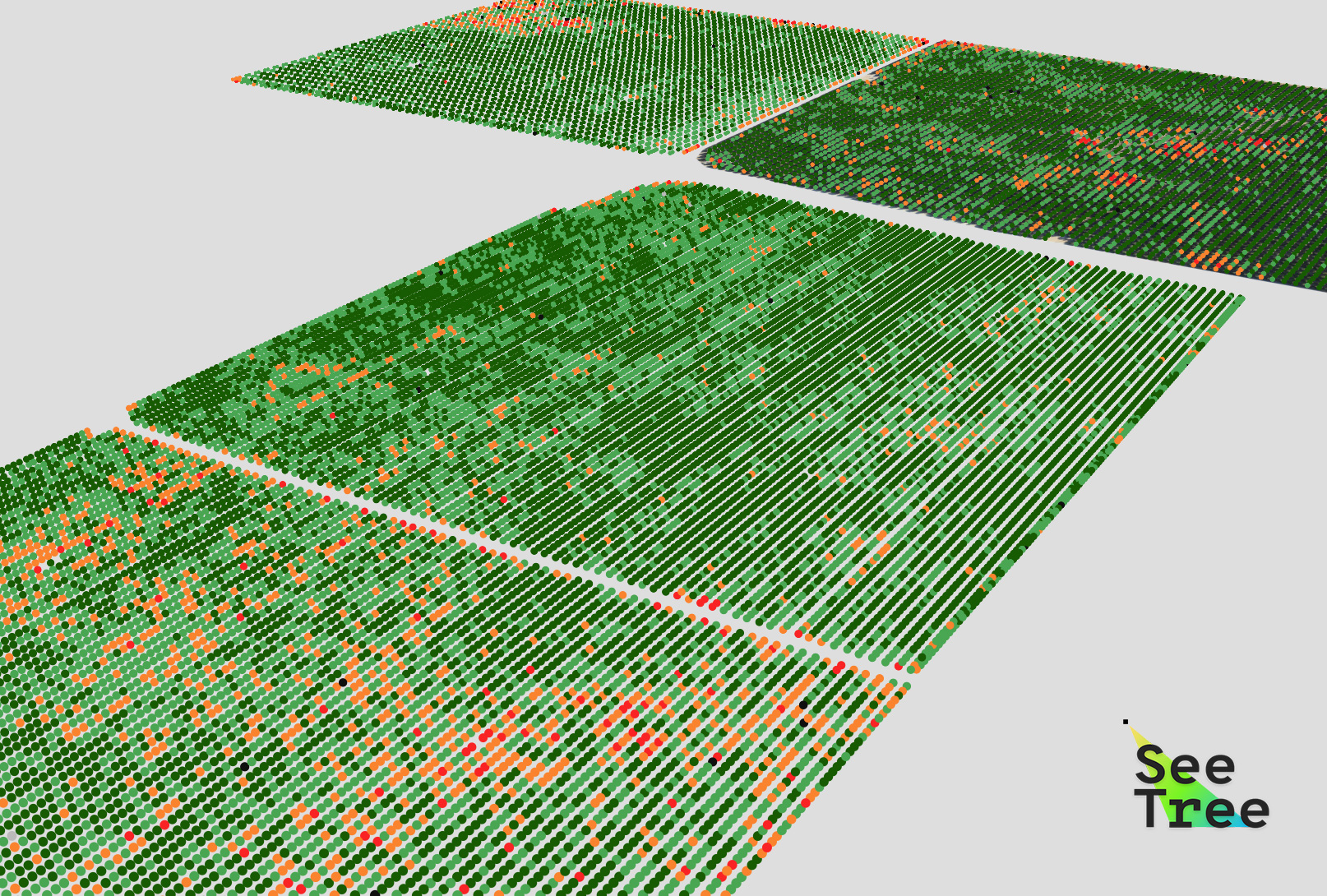

SeeTree, a Tel Aviv-based startup that uses drones and artificial intelligence to bring precision agriculture to their groves, today announced that it has raised an $11.5 million Series A funding round led by Hanaco Ventures, with participation from previous investors Canaan Partners Israel, Uri Levine and his investors group, iAngel and Mindset. This brings the company’s total funding to $15 million.

The idea behind the company, which also has offices in California and Brazil, is that in the past, drone-based precision agriculture hasn’t really lived up to its promise and didn’t work all that well for permanent crops like fruit trees. “In the past two decades, since the concept was born, the application of it, as well as measuring techniques, has seen limited success — especially in the permanent-crop sector,” said SeeTree CEO Israel Talpaz. “They failed to reach the full potential of precision agriculture as it is meant to be.”

He argues that the future of precision agriculture has to take a more holistic view of the entire farm. He also believes that past efforts didn’t quite offer the quality of data necessary to give permanent crop farmers the actionable recommendations they need to manage their groves.

SeeTree is obviously trying to tackle these issues and it does so by offering granular per-tree data based on the imagery gathered from drones and the company’s machine learning algorithms that then analyze this imagery. Using this data, farmers can then decide to replace trees that underperform, for example, or map out a plan to selectively harvest based on the size of a tree’s fruits and its development stages. They can then also correlate all of this data with their irrigation and fertilization infrastructure to determine the ROI of those efforts.

“Traditionally, farmers made large-scale business decisions based on intuitions that would come from limited (and often unreliable) small-scale testing done by the naked eye,” said Talpaz. “With SeeTree, farmers can now make critical decisions based on accurate and consistent small and large-scale data, connecting their actions to actual results in the field.”

SeeTree was founded by Talpaz, who like so many Israeli entrepreneurs previously worked for the country’s intelligence services, as well as Barak Hachamov (who you may remember from his early personalized news startup my6sense) and Guy Morgenstern, who has extensive experience as an R&D executive with a background in image processing and communications systems.

Powered by WPeMatico

Pro.com is basically a general contractor for the age of Uber and Prime Now. While the company started as a marketplace for hiring home improvement professionals, it has now morphed into a general contractor and serves Denver, Phoenix, San Francisco, San Jose and Seattle. Today, Pro.com announced that it has raised a $33 million Series B round led by WestRiver Group, Goldman Sachs and Redfin. Previous investors DFJ, Madrona Venture Group, Maveron and Two Sigma Ventures also participated.

WestRiver founder Erik Anderson, Redfin CEO Glenn Kelman and former Microsoft exec Charlotte Guyman are joining the Pro.com board.

“Many of Redfin’s customers struggle to get professional renovation services, so we know firsthand that Pro.com’s market opportunity is massive,” writes Redfin’s Kelman. “Pro.com and Redfin share a commitment to combining technology and local, direct services to best take care of customers.”

The company tells me that the round caps off a successful 2018, where Pro.com saw its job bookings grow by 275 percent over 2017, a number that was also driven by its expansion beyond the Seattle market (as well as the good economic climate that surely helped in driving homeowners to tackle more home improvement projects). The company now has 125 employees.

With this funding round, Pro.com has now raised a total of $60 million. It’ll use the funding to enter more markets, with Portland, Oregon being next on the list, and expand its team as it goes along.

It’s no secret that the home improvement market could use a bit of a jolt. The market is extremely local and fragmented — and finding the right contractor for any major project is a long and difficult process, where the outcome is never quite guaranteed. The process has enough vagaries that many people never get around to actually commissioning their projects. Pro.com wants to change that with a focus on transparency and technology. That’s a startup that’s harder to scale than the marketplace the company started out with, but it also gives the company a chance to establish itself as one of the few well-known brands in this space.

Powered by WPeMatico

Acorn Biolabs wants consumers to pay them to store genetic material in a bet that the increasing advances in targeted genetic therapies will yield better healthcare results down the line.

The company’s pitch is to “Save young cells today, live a longer, better, tomorrow.” It’s a gamble on the frontiers of healthcare technology that has managed to net the company $3.3 million in seed financing from some of Canada’s busiest investors.

For the Toronto-based company, the pitch isn’t just around banking genetic material — a practice that’s been around for years — it’s about making that process cheaper and easier.

Acorn has come up with a way to collect and preserve the genetic material contained in hair follicles, giving its customers a way to collect full-genome information at home rather than having to come in to a facility and getting bone marrow drawn (the practice at one of its competitors, Forever Labs) .

“We have developed a proprietary media that cells are submerged in that maintains the viability of those cells as they’re being transported to our labs for processing,” says Acorn Biolabs chief executive Dr. Drew Taylor.

“Rapid advancements in the therapeutic use of cells, including the ability to grow human tissue sections, cartilage, artificial skin and stem cells, are already being delivered. Entire heart, liver and kidneys are really just around the corner. The urgency around collecting, preserving and banking youthful cells for future use is real and freezing the clock on your cells will ensure you can leverage them later when you need them,” Taylor said in a statement.

Typically, the cost of banking a full genome test is roughly $2,000 to $3,000, and Acorn says they can drop that cost to less than $1,000. Beyond the cost of taking the sample and storing it, Acorn says it will reduce to roughly $100 a year the fees to store such genetic materials.

It’s important to note that healthcare doesn’t cover any of this. It’s a voluntary service for those neurotic enough or concerned enough about the future of healthcare and their potential health.

There’s also no services that Acorn will provide on the back end of the storage… yet.

“What people do need to realize is that there is power with that data that can improve healthcare. Down the road we will be able to use that data to help people collect that data and power studies,” says Taylor.

The $3.3 million the company raised came from Real Ventures, Globalive Technology, Pool Global Partners and Epic Capital Management and other undisclosed investors.

“Until now, any live cell collection solutions have been highly expensive, invasive and often painful, as well as being geographically limited to specialized clinics,” said Anthony Lacavera, founder and chairman at Globalive. “Acorn is an industry-leading example of how technology can bring real innovation to enable future healthcare solutions that will have meaningful impact on people’s wellbeing and longevity, while at the same time — make it easy, affordable and frictionless for everyone.”

Powered by WPeMatico

A slew of banks are coming together to back a new roll-up strategy for the Los Angeles-based mobile gaming studio Jam City and giving the company $145 million in new funding to carry that out.

There’s no word on whether the new money is in equity or debt, but what is certain is that JPMorgan Chase Bank, Bank of America Merrill Lynch and syndicate partners, including Silicon Valley Bank, SunTrust Bank and CIT Bank, are all involved in the deal.

“In a global mobile games market that is consolidating, Jam City could not be more proud to be working with JPMorgan, Bank of America Merrill Lynch, Silicon Valley Bank, SunTrust Bank and CIT Group to strategically support the financing of our acquisition and growth plans,” said Chris DeWolfe, co-founder and CEO of Jam City. “This $145 million in new financing empowers Jam City to further our position as a global industry consolidator. As we grow our global business, we are honored to be working alongside such prestigious advisers who share Jam City’s mission of delivering joy to people everywhere through unique and deeply engaging mobile games.”

The new money comes after a few years of speculation on whether Jam City would be the next big Los Angeles-based startup company to file for an initial public offering. It also follows a new agreement with Disney to develop mobile games based on intellectual property coming from all corners of the mouse house — a sweet cache of intellectual property ranging from Pixar, to Marvel, to traditional Disney characters.

Jam City is coming off a strong year of company growth. The Harry Potter: Hogwarts Mystery game, which launched last year, became the company’s fastest title to hit $100 million in revenue.

Add that to the company’s expansion into new markets with strategic acquisitions to fuel development and growth in Toronto and Bogota and it’s clear that the company is looking to make more moves in 2019.

Jam City already holds intellectual property for a new game built on Disney’s “Frozen 2,” the company’s newly acquired Fox Studio assets like “Family Guy” and the Harry Potter property. Add that to its own Cookie Jam and Panda Pop properties and it seems like the company is ready to make moves.

Meanwhile, games are quickly becoming the go-to revenue driver for the entertainment industry. According to data collected by Newzoo, mobile games revenue reached a record $63.2 billion worldwide in 2018, representing roughly 47 percent of the total revenue for the gaming industry in the year. That number could reach $81.3 billion by 2020, the Newzoo data suggests.

Roughly half of the U.S. plays mobile games, and they’re spending significant dollars on those games in app stores. App Annie suggests that roughly 75 percent of the money spent in app stores over the past decade has been spent on mobile games. And consumers are expected to spend roughly $129 billion in app stores over the next year. The data and analytics firm suggests that mobile gaming will capture some 60 percent of the overall gaming market in 2019, as well.

All of that bodes well for the industry as a whole, and points to why Jam City is looking to consolidate. And the company isn’t the only mobile games studio making moves.

The publicly traded games studio Zynga, which rose to fame initially on the back of Facebook’s gaming platform, recently expanded its European footprint with the late-December acquisition of the Helsinki-based gaming studio Small Giant Games.

Powered by WPeMatico

While there have been a few massive surveillance startups in China that have raised funds on the back of computer vision advances, there’s seemed to be less fervor outside of that market. Tel Aviv-based AnyVision is aiming to leverage its computer vision chops in tracking people and objects to create some pretty clear utility for the enterprise world.

After announcing a $28 million Series A in mid-2018, the computer vision startup is bringing Lightspeed Venture Partners into the raise, closing out the round at $43 million.

“When you have a company with the technology AnyVision has, and the market need that I’m hearing from across industries, what you need to do is push the gas pedal and build an organization which can monetize and take on this opportunity to grow massively,” Lightspeed partner Raviraj Jain told TechCrunch.

Right now the 200-person company has its eyes on the security and identity markets as it aims to bring its computer vision technology into more industry-tailored solutions.

The company’s “Better Tomorrow” product delivers camera-agnostic surveillance insights from its object and human-tracking tech. “Sesame” is the company’s consumer-facing play for bringing mobile banking authentication to hundreds of millions of phones. The company is still looking to release a retail analytics platform to customers, as well.

Powered by WPeMatico

WeWork CEO Adam Neumann has been described as an avid surfer, one who has been known to grab his board and go, both in the Hamptons in Long Island, where he reportedly owns a home, as well as in Hawaii.

Maybe it’s no surprise, then, that WeWork is now also investing in a so-called superfood company that was created several years ago by big wave surf star Laird Hamilton, who Neumann was apparently surfing alongside just last week. In a video call with Neumann on Monday, a Fast Company reporter noted that Neumann is currently sporting a cast on one of his fingers, having broken it during the outing.

How much WeWork is investing in the startup, Laird Superfood, is not being disclosed, but according to the food company, the money will be used to fuel product development, acquisitions and to hire more employees. A press release that was published without fanfare earlier today also notes that Laird Superfood products will be made available to WeWork members and employees at select locations soon.

Some of those offerings are certainly interesting, including “performance mushrooms” that it says “harnesses the benefits” of Chaga, a fungus believed by some to stimulate the immune system; Cordyceps, another fungus that’s been used for kidney disorders and erectile dysfunction; and Lion’s Mane, yet another fungus believed by some to stimulate nerve growth in the brain.

The company suggests adding one teaspoon of the mushrooms each day to one’s coffee, tea or health shake.

Laird Superfood also sells beet- and turmeric-infused powdered coconut waters, “ultra-caffeinated” coffee and a variety of coffee creamers, including a mint-flavored creamer and a turmeric-flavored number.

It’s for a very specific consumer, in other words — presumably one who really likes turmeric, for example. Then again, what works for Laird Hamilton will undoubtedly work for a lot of people who’ve watched his decades-long career with amazement.

Hamilton seems to be selling what he actually ingests, too. As he told The Guardian last spring of his own diet: “I love espresso. You could give me five shots of espresso, a quarter stick of butter, a quarter stick of coconut oil and other fat, and I’ll drink that. I could go for five or six hours and not be hungry, because I’m burning fat.”

Organic food startups have been raising money left and right in recent years, including from traditional food companies, as well as from venture investors, who’ve poured billions of dollars into healthy snacks and drinks, with mixed results.

For WeWork’s part, the investment isn’t the first that has seemed somewhat far afield for the company. In one of its more surprising bets to date, WeWork invested in a maker of wave pools in 2016. The size of that funding was also undisclosed.

Powered by WPeMatico

Postmates, one of the earlier entrants to the billion-dollar food delivery wars, has raised an additional $100 million in equity funding at a $1.85 billion valuation, as first reported by Recode and confirmed to TechCrunch by Postmates. The round comes four months after the eight-year-old startup drove home a $300 million investment that finally knocked it into “unicorn” territory.

New investor BlackRock has joined the funding round alongside Tiger Global, which served as the lead investor of Postmates’ September financing. Led by co-founder and chief executive officer Bastian Lehmann, the company has garnered a total of $681 million in venture capital funding from investors, including Spark Capital, Founders Fund, Uncork Capital and Slow Ventures.

In line with several other tech unicorns, Postmates has begun prep for an initial public offering that could come this year, including tapping JPMorgan to advise the float. As Recode pointed out, the $100 million capital infusion was probably less of a necessary funding event but rather an opportunity for existing investors to liquidate stock ahead of an exit.

Postmates, which completes 3.5 million deliveries per month, reportedly expected to record $400 million in revenue in 2018 on food sales of $1.2 billion. The company has not confirmed that figure nor disclosed any other 2018 revenue numbers. The company currently operates in more than 500 cities, recently tacking on another 100 markets to reach an additional 50 million customers.

It will be interesting to see how Wall Street responds to a Postmates public listing. Though it was an early player in what has become an extremely crowded market, Postmates never emerged as the leader in food delivery. Now, with supergiants like Uber dominating via Uber Eats and SoftBank funneling loads of capital into Postmates competitor DoorDash, it shouldn’t count on an oversubscribed IPO.

Powered by WPeMatico

Electric scooter startup Bird is said to be nearing a deal to extend its Series C funding with an additional $300 million led by cross-over investor Fidelity, according to an Axios report. Bird declined to comment.

Fidelity has not previously invested in Bird and is reportedly doing so at a flat pre-money valuation of $2 billion, which Bird earned with a $300 million Sequoia-led financing in June. Santa Monica-based Bird has raised more than $400 million in venture capital funding to date from investors, including Accel, CRV, Greycroft, Index Ventures, Upfront Ventures, Craft Ventures and Tusk Ventures.

The investment comes at a time when many investors are losing faith in scooter startups’ claims to be the solution to the problem of last-mile transportation, as companies in the space display poor unit economics, faulty batteries and a general air of undependability. Lime, Bird’s biggest e-scooter competitor, has at least expanded its suite of micro-mobility offerings from bikes and scooters to LimePods, a line of shareable vehicles available in Seattle, to peak investor interest. San Francisco-based Lime has been seen pitching to investors in Silicon Valley recently, too, with reports indicating it’s looking for a $400 million investment at a $3 billion valuation — more than three times the valuation it garnered with a $335 million round in July.

Powered by WPeMatico

Bowery Valuation, a New York-based company that we told you about last year, has raised $12 million in Series A funding for its tech-enabled real estate appraisal platform. The 3.5-year-old company raised the capital from Corigin Ventures, Camber Creek, Navitas Capital, Fika Ventures and Builders.

Bowery caught our attention initially because, like a lot of real estate technology companies, it’s tackling some clunky processes that you might imagine would have been solved long ago. For example, its mobile app enables appraisers to tick off items, rather than write everything down. It automatically pulls in public record data so that appraisers needn’t surf the web to find what they need. It enables passive databasing, meaning that rental and sales comps that are often lost today can be found via a map-based search. It also uses natural language generation to help its appraiser clients produce reports.

What has changed since we last talked: the company was beginning to sell a white-label version of its app to customers, and it has since shifted toward focusing its entire product and engineering team on its own internal software.

It has also expanded its footprint more slowly than it thought it might. Though the company is currently licensed and working throughout New York, New Jersey, Pennsylvania and Connecticut, it hasn’t reached numerous farther-flung cities that continue to remain in its sights, including L.A. and Chicago.

Both are “still our first two choices for expansion,” says co-founder and CEO Noah Isaacs, adding that Bowery’s goal is now to “be in at least one of those two markets within the next nine to 12 months, with the other to follow shortly. We held off on expanding into new geographies prematurely, as we felt we had a lot more room to grow just in the tri-state area.” (Isaacs says the company has more than tripled its customer base and revenue since we last talked with the company last March.)

Though Bowery today focuses on multi-family and mixed-use assets, it also plans to expand to other commercial properties this year, says Isaacs.

Isaacs and his best childhood friend, John Meadows, founded Bowery in 2015 after working together at the same appraisal firm in New York and seeing plenty about the business on which they could improve. After bringing aboard as CTO Cesar Devars, a Princeton grad who’d studied economics and worked on several startups after graduating, the three got to work, applying and gaining acceptance shortly afterward to MetaProp NYC, a local accelerator program that focuses exclusively on real estate.

Bowery, where Meadows and Isaacs are co-CEOs, has since raised $18.8 million altogether, including from real estate giant Cushman & Wakefield.

Powered by WPeMatico

Managed by Q, the office management platform that launched back in 2013, has today revealed that it raised an additional $25 million as a part of its Series C, led by existing investors RRE and Google Ventures, with participation from new investors DivCo West, Oxford Properties and others. The fresh capital brings the total round to $55 million.

Managed by Q launched as an all-encompassing platform for office management, offering IT support, supply inventory management, cleaning and equipment repair. Since, the company has added a full-fledged marketplace, allowing office managers to choose vendors for various needs around the office.

But for 2019, the company is focused on tools and services.

“We want to spend 2019 putting even greater focus on the tools used by our vendors and workplace management teams, like task management tools,” said co-founder and CEO Dan Teran . “We want to build the first set of collaboration tools for the workplace team, the same way that designers use InVision and engineers use GitHub and salespeople use Salesforce. Something purposely built for the workplace team.”

Teran described tools that would allow for employee requests, work orders, task management, inventory management and budgeting to all live on the same platform.

The company hasn’t shared much by way of revenue or customer growth, but Teran told TechCrunch that the marketplace business has been doubling since it launched and is on track to continue on that trajectory. He also wrote in a company blog post that Managed by Q’s top five vendor partners have done more than $1 million in business on the Managed by Q platform, and more than 30 partners will have earned over $100,000 on the platform in 2018.

The NY-based startup also brokered a partnership with Staples to provide office supplies to clients, and acquired Hivy and NVS to further fill out their office management suite of products.

Managed by Q has raised a total of $128.25 million, according to Crunchbase.

Powered by WPeMatico