Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

At the heart of the lightweight augmented reality glasses that you’ve been promised is a display engine that a handful of tech companies are racing to improve.

WaveOptics is one such startup looking to expand the capabilities and shrink the form factor of waveguide displays.

The U.K.-based company has just raised $26 million in what it’s calling the “first stage” of its Series C. The money is coming from Octopus Ventures as well as IP Group, Robert Bosch Venture Capital, Gobi Partners, Goertek and Optimas Capital Partners.

Late last month, Sunnyvale-based DigiLens announced they has raised new funding from Mitsubishi and Niantic. The increased movement comes just months after it was reported that Apple had acquired a waveguide display manufacturer, Akonia Holographics.

For so many of the companies, the mass market promise of AR is that they can eventually deliver something that everyday consumers can use as a replacement for their smartphones.

Here’s a rundown of waveguides from WaveOptics:

The backbone of these AR systems are the increasingly shrinking waveguide displays. The display engines are incredibly complex and they’re both the most expensive component for most of today’s hardware and the piece of tech that is driving the bulky form factors we’re seeing today.

There will be some more iterative executions of the tech on the consumer side before things shrink down too much, but there are also quite a few existing industries where this tech already makes sense, particularly in the automative and enterprise workforce spaces where fashion is a distant second to utility.

While a lot of the players in the AR display race have been pushing up against the same shortcomings of this display type, there was some uncertainty for a bit as so much excitement rallied around Magic Leap and the giant leaps forward that they were talking about with fiberoptic scanning light field photonic chips and all.

Turns out it was mostly smoke and mirrors in terms of what appeared in the first-gen product, though Magic Leap has promised more advances are on the way for subsequent releases. Nevertheless, the looming presence subsiding is probably welcome news to more skirmish investors who want to be sure they’re backing the right horse.

Powered by WPeMatico

Chatbots and other AI-based tools have firmly found footing in the world of customer service, used either to augment or completely replace the role of a human responding to questions and complaints, or (sometimes, annoyingly, at the same time as the previous two functions) sell more products to users.

Today, an Israeli startup called TechSee is announcing $16 million in funding to help build out its own twist on that innovation: an AI-based video service, which uses computer vision, augmented reality and a customer’s own smartphone camera to provide tech support to customers, either alongside assistance from live agents, or as part of a standalone customer service “bot.”

Led by Scale Venture Partners — the storied investor that has been behind some of the bigger enterprise plays of the last several years (including Box, Chef, Cloudhealth, DataStax, Demandbase, DocuSign, ExactTarget, HubSpot, JFrog and fellow Israeli AI assistance startup WalkMe), the Series B also includes participation from Planven Investments, OurCrowd, Comdata Group and Salesforce Ventures. (Salesforce was actually announced as a backer in October.)

The funding will be used both to expand the company’s current business as well as move into new product areas like sales.

Eitan Cohen, the CEO and co-founder, said that the company today provides tools to some 15,000 customer service agents and counts companies like Samsung and Vodafone among its customers across verticals like financial services, tech, telecoms and insurance.

The potential opportunity is big: Cohen estimates there are about 2 million customer service agents in the U.S., and about 14 million globally.

TechSee is not disclosing its valuation. It has raised around $23 million to date.

While TechSee provides support for software and apps, its sweet spot up to now has been providing video-based assistance to customers calling with questions about the long tail of hardware out in the world, used for example in a broadband home Wi-Fi service.

In fact, Cohen said he came up with the idea for the service when his parents phoned him up to help them get their cable service back up, and he found himself challenged to do it without being able to see the set-top box to talk them through what to do.

So he thought about all the how-to videos that are on platforms like YouTube and decided there was an opportunity to harness that in a more organised way for the companies providing an increasing array of kit that may never get the vlogger treatment.

“We are trying to bring that YouTube experience for all hardware,” he said in an interview.

The thinking is that this will become a bigger opportunity over time as more services get digitised, the cost of components continues to come down and everything becomes “hardware.”

“Tech may become more of a commodity, but customer service does not,” he added. “Solutions like ours allow companies to provide low-cost technology without having to hire more people to solve issues [that might arise with it.]”

The product today is sold along two main trajectories: assisting customer reps; and providing unmanned video assistance to replace some of the easier and more common questions that get asked.

In cases where live video support is provided, the customer opts in for the service, similar to how she or he might for a support service that “takes over” the device in question to diagnose and try to fix an issue. Here, the camera for the service becomes a customer’s own phone.

Over time, that live assistance is used in two ways that are directly linked to TechSee’s artificial intelligence play. First, it helps to build up TechSee’s larger back catalogue of videos, where all identifying characteristics are removed with the focus solely on the device or problem in question. Second, the experience in the video is also used to build TechSee’s algorithms for future interactions. Cohen said there are now “millions” of media files — images and videos — in the company’s catalogue.

The effectiveness of its system so far has been pretty impressive. TechSee’s customers — the companies running the customer support — say they have on average seen a 40 percent increase in customer satisfaction (NPS scores), a 17 percent decrease in technician dispatches and between 20 and 30 percent increase in first-call resolutions, depending on the industry.

TechSee is not the only company that has built a video-based customer engagement platform: others include Stryng, CallVU and Vee24. And you could imagine companies like Amazon — which is already dabbling in providing advice to customers based on what its Echo Look can see — might be interested in providing such services to users across the millions of products that it sells, as well as provide that as a service to third parties.

According to Cohen, what TechSee has going for it compared to those startups, and also the potential entry of companies like Microsoft or Amazon into the mix, is a head start on raw data and a vision of how it will be used by the startup’s AI to build the business.

“We believe that anyone who wants to build this would have a challenge making it from scratch,” he said. “This is where we have strong content, millions of images, down to specific model numbers, where we can provide assistance and instructions on the spot.”

Salesforce’s interest in the company, he said, is a natural progression of where that data and customer relationship can take a business beyond responsive support into areas like quick warranty verification (for all those times people have neglected to do a product registration), snapping fender benders for insurance claims and of course upselling to other products and services.

“Salesforce sees the synergies between the sales cloud and the service cloud,” Cohen said.

“TechSee recognized the great potential for combining computer vision AI with augmented reality in customer engagement,” said Andy Vitus, partner at Scale Venture Partners, who joins the board with this round. “Electronic devices become more complex with every generation, making their adoption a perennial challenge. TechSee is solving a massive problem for brands with a technology solution that simplifies the customer experience via visual and interactive guidance.”

Powered by WPeMatico

SoftBank continues to invest in the future of transportation — this time in ParkJockey, a startup that has built a technology platform aimed at monetizing parking lots. And ParkJockey, which was founded in 2013, is already using that capital to scale up.

Along with the SoftBank investment news, ParkJockey also announced that it was acquiring two of the largest parking operators in North America. The startup, with help from Abu Dhabi-based Mubadala Capital and debt financing from Owl Rock, said it had reached an agreement to acquire Imperial Parking Corporation, a North American-based parking management company often referred to as Impark. The agreement follows ParkJockey’s acquisition of parking management operator Citizens Parking Inc.

The investment puts the ParkJockey valuation to more than $1 billion, reported Miami Herald.

Miami-based ParkJockey developed a parking management platform that helps commercial property owners better monetize parking lots as well as handle operations at large venues and stadiums. The company’s platform offers features like automatic license plate recognition and pay-by-app, among others. The company’s app also can be used by drivers to find parking spaces more efficiently.

Financial terms of the SoftBank investment or the acquisitions weren’t disclosed. The announcement follows an Axios article last week that reported SoftBank was backing the startup.

The Impark transaction is subject to regulatory approvals. The acquisition is expected to close in the first half of 2019, ParkJockey said.

SoftBank’s investment in parking might seem rather, well, pedestrian. It’s actually a bet on an automated future from present-day parking management issues like electric vehicle charging, designated areas for ride-hailing and automatic pay, as well as a day when vehicles are fully autonomous.

Powered by WPeMatico

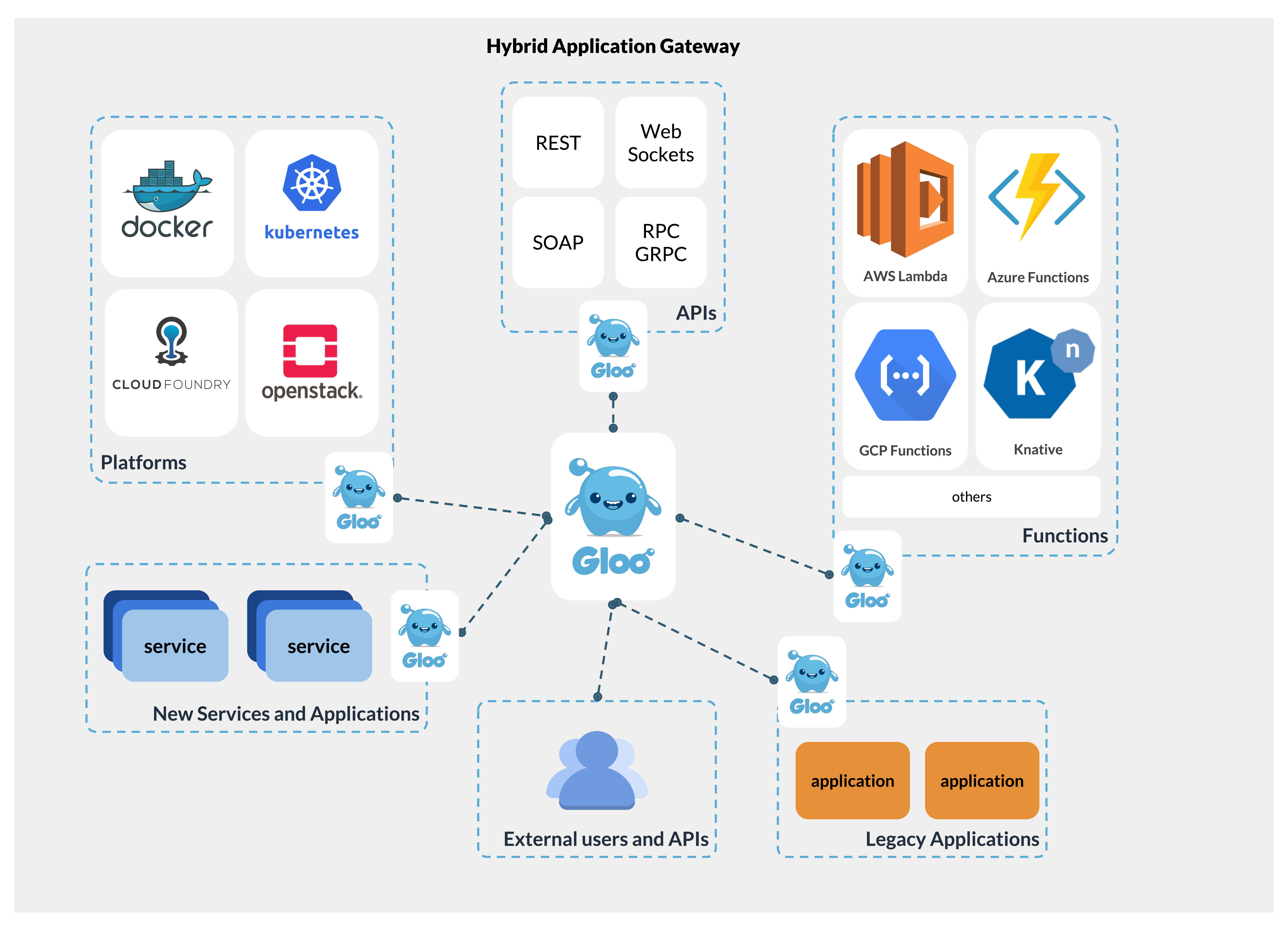

Solo.io, a Cambridge, Mass-based startup that helps enterprises adopt cloud-native technologies, is coming out of stealth mode today and announcing both its Series A funding round and the launch of its Gloo Enterprise API gateway.

Redpoint Ventures led the $11 million Series A round, with participation from seed investor True Ventures . Like most companies at the Series A state, Solo.io plans to use the money to invest in the product development of its enterprise and open-source tools, as well as to grow its sales and marketing teams.

Solo.io offers a number of open-source tools, like the Gloo function gateway, the Sqoop GraphQL server and the SuperGloo (see a theme here?) service mesh orchestration platform. In addition, the team has also, among others, open-sourced its Kubernetes debugger, a tool for building and running unikernels.

Its first commercial offering, though, is an enterprise version of the Gloo function gateway. Built on top of the Envoy proxy, Gloo can handle the routing necessary to connect incoming API requests to microservices, serverless applications (on the likes of AWS Lambda) and traditional monolithic applications behind the proxy. Gloo handles the load balancing and other functions necessary to aggregate the incoming API requests and route them to their destinations.

“Costumers who use Gloo to connect between microservices and serverless found that invocation of [AWS] Lambda is 350ms faster than the AWS API Gateway,” Idit Levine, the founder and CEO of Solo.io, told me. “Gloo also offers them direct money saving, since AWS bills per invocation. In general, Gloo offers money saving because it allows our clients to use the less expensive technologies — like their legacy apps, and sometimes containers — whenever they can, and limit the use of more expensive stuff to whenever it’s necessary.”

The enterprise version adds features like audit controls, single sign-on and more advanced security tools to the platform.

In addition to broadening its customer base, the company plans to invest heavily into its customer success and support teams, as well as its evangelism and education efforts, Levine tells me.

“Helping enterprises easily adopt innovative technologies like microservices, serverless and service mesh is our goal at Solo.io,” Levine in today’s announcement. “Melding different technologies into one coherent environment, by supplying a suite of tools to route, debug, manage, monitor and secure applications, lets organizations focus on their software without worrying about the complexity of the underlying environment.”

Powered by WPeMatico

Nigerian trucking logistics startup Kobo360 has raised $6 million to upgrade its platform and expand operations to Ghana, Togo and Cote D’Ivoire.

The company — with an Uber -like app that connects truckers and companies with freight needs — gained the equity financing in an IFC-led investment. The funding saw participation from others, including TLcom Capital and Y Combinator.

With the investment, Kobo360 aims to become more than a trucking transit app.

“We started off as an app, but our goal is to build a global logistics operating system. We’re no longer an app, we’re a platform,” founder Obi Ozor told TechCrunch.

In addition to connecting truckers, producers and distributors, the company is building that platform to offer supply chain management tools for enterprise customers.

“Large enterprises are asking us for very specific features related to movement, tracking and sales of their goods. We either integrate other services, like SAP, into Kobo or we build those solutions into our platform directly,” said Ozor.

Kobo360 will start by developing its API and opening it up to large enterprise customers.

“We want clients to be able to use our Kobo dashboard for everything; moving goods, tracking, sales and accounting…and tackling their challenges,” said Ozor.

Kobo360 will also build more physical presence throughout Nigeria to service its business. “We’ll open 100 hubs before the end of 2019…to be able to help operations collect proof of delivery, to monitor trucks on the roads and have closer access to truck owners for vehicle inspection and training,” said Ozor.

Kobo360 will add more warehousing capabilities, “to support our reverse logistics business” — one of the ways the company brings prices down by matching trucks with return freight after they drop their loads, rather than returning empty, according to Ozor.

Kobo360 will also use its $6 million investment to expand programs and services for its drivers, something Ozor sees as a strategic priority.

“The day you neglect your drivers you are not going to have a company, only issues. If Uber were more driver-focused it would be a trillion-dollar company today,” he said.

The startup offers drivers training and group programs on insurance, discounted petrol and vehicle financing (KoboWin). Drivers on the Kobo360 app earn on average of approximately $5,000 per month, according to Ozor.

Under KoboCare, Kobo360 has also created an HMO for drivers and an incentive-based program to pay for education. “We give school fee support, a 5,000 Naira bonus per trip for drivers toward educational expenses for their kids,” said Ozor.

Kobo360 will complete limited expansion into new markets Ghana, Togo and Cote D’Ivoire in 2019. “The expansion will be with existing customers, one in the port operations business, one in FMCG and another in agriculture,” said Ozor.

Ozor thinks the startup’s asset-free, digital platform and business model can outpace traditional long-haul 3PL providers in Nigeria by handling more volume at cheaper prices.

“Owning trucks is just too difficult to manage. The best scalable model is to aggregate trucks,” he told TechCrunch in a previous interview.

With the latest investment, IFC’s regional head for Africa Wale Ayeni and TLcom senior partner Omobola Johnson will join Kobo360’s board. “There’s a lot of inefficiencies in long-haul freight in Africa…and they’re building a platform that can help a lot of these issues,” said Ayeni of Kobo360’s appeal as an investment.

The company has served 900 businesses, aggregated a fleet of 8,000 drivers and moved 155 million kilograms, per company stats. Top clients include Honeywell, Olam, Unilever, Dangote and DHL.

MarketLine estimated the value of Nigeria’s transportation sector in 2016 at $6 billion, with 99.4 percent comprising road freight.

Logistics has become an active space in Africa’s tech sector, with startup entrepreneurs connecting digital to delivery models. In Nigeria, Jumia founder Tunde Kehinde departed and founded Africa Courier Express. Startup Max.ng is wrapping an app around motorcycles as an e-delivery platform. Nairobi-based Lori Systems has moved into digital coordination of trucking in East Africa. And U.S.-based Zipline — which launched drone delivery of commercial medical supplies in partnership with the government of Rwanda and support of UPS — is in “process of expanding to several other countries,” according to a spokesperson.

Kobo360 has plans for broader Africa expansion but would not name additional countries yet.

Ozor said the company is profitable, though the startup does not release financial results. Wale Ayeni also wouldn’t divulge revenue figures, but confirmed IFC’s did full “legal and financial due diligence on Kobo’s stats,” as part of the investment.

Ozor named Lori Systems as Kobo360’s closest African startup competitor.

On the biggest challenge to revenue generation, it’s all about service delivery and execution, according to Ozor.

“We already have volume and demand in the market. The biggest threat to revenues is if Kobo360’s platform doesn’t succeed in solving our client’s problems and bringing reliability to their needs,” he said.

Powered by WPeMatico

Contentful, a Berlin- and San Francisco-based startup that provides content management infrastructure for companies like Spotify, Nike, Lyft and others, today announced that it has raised a $33.5 million Series D funding round led by Sapphire Ventures, with participation from OMERS Ventures and Salesforce Ventures, as well as existing investors General Catalyst, Benchmark, Balderton Capital and Hercules. In total, the company has now raised $78.3 million.

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

It’s been less than a year since the company raised its Series C round and, as Contentful co-founder and CEO Sascha Konietzke told me, the company didn’t really need to raise right now. “We had just raised our last round about a year ago. We still had plenty of cash in our bank account and we didn’t need to raise as of now,” said Konietzke. “But we saw a lot of economic uncertainty, so we thought it might be a good moment in time to recharge. And at the same time, we already had some interesting conversations ongoing with Sapphire [formerly SAP Ventures] and Salesforce. So we saw the opportunity to add more funding and also start getting into a tight relationship with both of these players.”

The original plan for Contentful was to focus almost explicitly on mobile. As it turns out, though, the company’s customers also wanted to use the service to handle its web-based applications and these days, Contentful happily supports both. “What we’re seeing is that everything is becoming an application,” he told me. “We started with native mobile application, but even the websites nowadays are often an application.”

In its early days, Contentful focused only on developers. Now, however, that’s changing, and having these connections to large enterprise players like SAP and Salesforce surely isn’t going to hurt the company as it looks to bring on larger enterprise accounts.

Currently, the company’s focus is very much on Europe and North America, which account for about 80 percent of its customers. For now, Contentful plans to continue to focus on these regions, though it obviously supports customers anywhere in the world.

Contentful only exists as a hosted platform. As of now, the company doesn’t have any plans for offering a self-hosted version, though Konietzke noted that he does occasionally get requests for this.

What the company is planning to do in the near future, though, is to enable more integrations with existing enterprise tools. “Customers are asking for deeper integrations into their enterprise stack,” Konietzke said. “And that’s what we’re beginning to focus on and where we’re building a lot of capabilities around that.” In addition, support for GraphQL and an expanded rich text editing experience is coming up. The company also recently launched a new editing experience.

Powered by WPeMatico

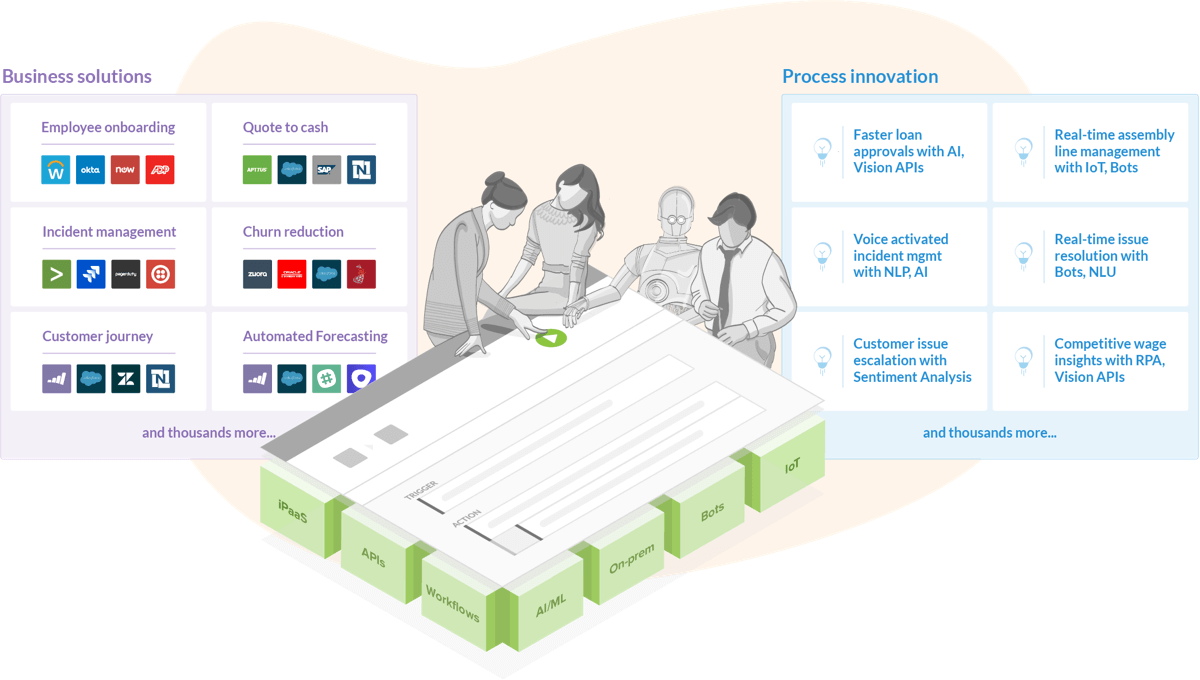

Workato, a startup that offers an integration and automation platform for businesses that competes with the likes of MuleSoft, SnapLogic and Microsoft’s Logic Apps, today announced that it has raised a $25 million Series B funding round from Battery Ventures, Storm Ventures, ServiceNow and Workday Ventures. Combined with its previous rounds, the company has now received investments from some of the largest SaaS players, including Salesforce, which participated in an earlier round.

At its core, Workato’s service isn’t that different from other integration services (you can think of them as IFTTT for the enterprise), in that it helps you to connect disparate systems and services, set up triggers to kick off certain actions (if somebody signs a contract on DocuSign, send a message to Slack and create an invoice). Like its competitors, it connects to virtually any SaaS tool that a company would use, no matter whether that’s Marketo and Salesforce, or Slack and Twitter. And like some of its competitors, all of this can be done with a drag-and-drop interface.

What’s different, Workato founder and CEO Vijay Tella tells me, is that the service was built for business users, not IT admins. “Other enterprise integration platforms require people who are technical to build and manage them,” he said. “With the explosion in SaaS with lines of business buying them — the IT team gets backlogged with the various integration needs. Further, they are not able to handle all the workflow automation needs that businesses require to streamline and innovate on the operations.”

Battery Ventures’ general partner Neeraj Agrawal also echoed this. “As we’ve all seen, the number of SaaS applications run by companies is growing at a very rapid clip,” he said. “This has created a huge need to engage team members with less technical skill-sets in integrating all these applications. These types of users are closer to the actual business workflows that are ripe for automation, and we found Workato’s ability to empower everyday business users super compelling.”

Tella also stressed that Workato makes extensive use of AI/ML to make building integrations and automations easier. The company calls this Recipe Q. “Leveraging the tens of billions of events processed, hundreds of millions of metadata elements inspected and hundreds of thousands of automations that people have built on our platform — we leverage ML to guide users to build the most effective integration/automation by recommending next steps as they build these automations,” he explained. “It recommends the next set of actions to take, fields to map, auto-validates mappings, etc. The great thing with this is that as people build more automations — it learns from them and continues to make the automation smarter.”

The AI/ML system also handles errors and offers features like sentiment analysis to analyze emails and detect their intent, with the ability to route them depending on the results of that analysis.

As part of today’s announcement, the company is also launching a new AI-enabled feature: Automation Editions for sales, marketing and HR (with editions for finance and support coming in the future). The idea here is to give those departments a kit with pre-built workflows that helps them to get started with the service without having to bring in IT.

Powered by WPeMatico

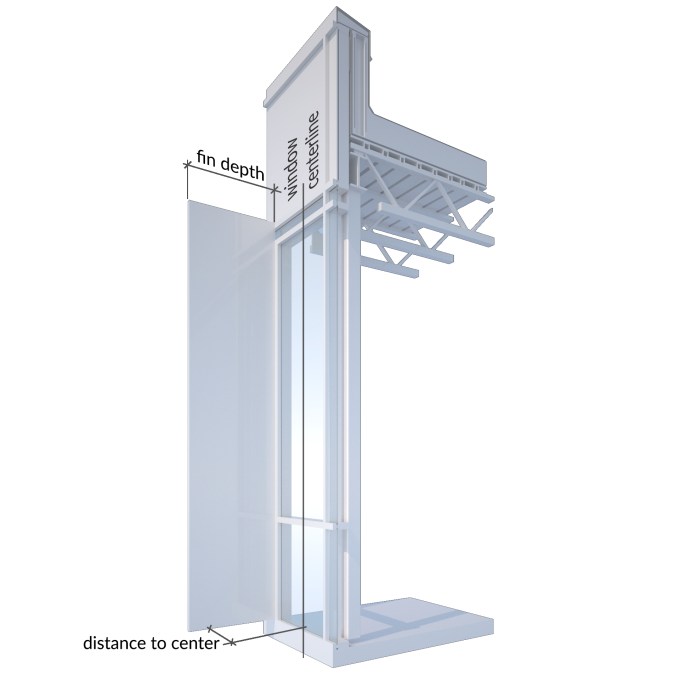

As the fight against climate change heats up, Cove.Tool is looking to help tackle carbon emissions one building at a time.

The Atlanta-based startup provides an automated big-data platform that helps architects, engineers and contractors identify the most cost-effective ways to make buildings compliant with energy efficiency requirements. After raising an initial round earlier this year, the company completed the final close of a $750,000 seed round. Since the initial announcement of the round earlier this month, Urban Us, the early-stage fund focused on companies transforming city life, has joined the syndicate comprised of Tech Square Labs and Knoll Ventures.

Cove.Tool software allows building designers and managers to plug in a variety of building conditions, energy options, and zoning specifications to get to the most cost-effective method of hitting building energy efficiency requirements (Cove.Tool Press Image / Cove.Tool / https://covetool.com).

In the US, the buildings we live and work in contribute more carbon emissions than any other sector. Governments across the country are now looking to improve energy consumption habits by implementing new building codes that set higher energy efficiency requirements for buildings.

However, figuring out the best ways to meet changing energy standards has become an increasingly difficult task for designers. For one, buildings are subject to differing federal, state and city codes that are all frequently updated and overlaid on one another. Therefore, the specific efficiency requirements for a building can be hard to understand, geographically unique and immensely variable from project to project.

Architects, engineers and contractors also have more options for managing energy consumption than ever before – equipped with tools like connected devices, real-time energy-management software and more-affordable renewable energy resources. And the effectiveness and cost of each resource are also impacted by variables distinct to each project and each location, such as local conditions, resource placement, and factors as specific as the amount of shade a building sees.

With designers and contractors facing countless resource combinations and weightings, Cove.Tool looks to make it easier to identify and implement the most cost-effective and efficient resource bundles that can be used to hit a building’s energy efficiency requirements.

Cove.Tool users begin by specifying a variety of project-specific inputs, which can include a vast amount of extremely granular detail around a building’s use, location, dimensions or otherwise. The software runs the inputs through a set of parametric energy models before spitting out the optimal resource combination under the set parameters.

For example, if a project is located on a site with heavy wind flow in a cold city, the platform might tell you to increase window size and spend on energy efficient wall installations, while reducing spending on HVAC systems. Along with its recommendations, Cove.Tool provides in-depth but fairly easy-to-understand graphical analyses that illustrate various aspects of a building’s energy performance under different scenarios and sensitivities.

Cove.Tool users can input granular project-specifics, such as shading from particular beams and facades, to get precise analyses around a building’s energy performance under different scenarios and sensitivities.

Traditionally, the design process for a building’s energy system can be quite painful for architecture and engineering firms.

An architect would send initial building designs to engineers, who then test out a variety of energy system scenarios over the course a few weeks. By the time the engineers are able to come back with an analysis, the architects have often made significant design changes, which then gets sent back to the engineers, forcing the energy plan to constantly be 1-to-3 months behind the rest of the building. This process can not only lead to less-efficient and more-expensive energy infrastructure, but the hectic back-and-forth can lead to longer project timelines, unexpected construction issues, delays and budget overruns.

Cove.Tool effectively looks to automate the process of “energy modeling.” The energy modeling looks to ease the pains of energy design in the same ways Building Information Modeling (BIM) has transformed architectural design and construction. Just as BIM creates predictive digital simulations that test all the design attributes of a project, energy modeling uses building specs, environmental conditions, and various other parameters to simulate a building’s energy efficiency, costs and footprint.

By using energy modeling, developers can optimize the design of the building’s energy system, adjust plans in real-time, and more effectively manage the construction of a building’s energy infrastructure. However, the expertise needed for energy modeling falls outside the comfort zones of many firms, who often have to outsource the task to expensive consultants.

The frustrations of energy system design and the complexities of energy modeling are ones the Cove.Tool team knows well. Patrick Chopson and Sandeep Ajuha, two of the company’s three co-founders, are former architects that worked as energy modeling consultants when they first began building out the Cove.Tool software.

After seeing their clients’ initial excitement over the ability to quickly analyze millions of combinations and instantly identify the ones that produce cost and energy savings, Patrick and Sandeep teamed up with CTO Daniel Chopson and focused full-time on building out a comprehensive automated solution that would allow firms to run energy modeling analysis without costly consultants, more quickly, and through an interface that would be easy enough for an architectural intern to use.

So far there seems to be serious demand for the product, with the company already boasting an impressive roster of customers that includes several of the country’s largest architecture firms, such as HGA, HKS and Cooper Carry. And the platform has delivered compelling results – for example, one residential developer was able to identify energy solutions that cost $2 million less than the building’s original model. With the funds from its seed round, Cove.Tool plans further enhance its sales effort while continuing to develop additional features for the platform.

The value proposition Cove.Tool hopes to offer is clear – the company wants to make it easier, faster and cheaper for firms to use innovative design processes that help identify the most cost-effective and energy-efficient solutions for their buildings, all while reducing the risks of redesign, delay and budget overruns.

Longer-term, the company hopes that it can help the building industry move towards more innovative project processes and more informed decision-making while making a serious dent in the fight against emissions.

“We want to change the way decisions are made. We want decisions to move away from being just intuition to become more data-driven.” The co-founders told TechCrunch.

“Ultimately we want to help stop climate change one building at a time. Stopping climate change is such a huge undertaking but if we can change the behavior of buildings it can be a bit easier. Architects and engineers are working hard but they need help and we need to change.”

Powered by WPeMatico

A flurry of digital-first insurers are betting they can surpass industry incumbents with a little help from technology and a lot of help from venture capitalists.

The latest to land a massive check is Bright Health, a Minneapolis-headquartered provider of affordable individual, family and Medicare Advantage healthcare plans in Alabama, Arizona, Colorado, New York City, Ohio and Tennessee. The company, founded by the former chief executive officer of UnitedHealthcare Bob Sheehy; Kyle Rolfing, the former CEO of UnitedHealth-acquired Definity Health; and Tom Valdivia, another former Definity Health executive, has brought in a $200 million Series C.

The funding values Bright Health at $950 million, according to PitchBook — more than double the $400 million valuation it garnered with its $160 million Series B in June 2017. Sheehy, Bright Health’s CEO, declined to comment on the valuation. New investors Declaration Partners and Meritech Capital participated in the round, with backing from Bessemer Venture Partners, Greycroft, NEA, Redpoint Ventures and others. Bright Health has raised a total of $440 million since early 2016.

VCs have deployed significantly more capital to the insurance technology (insurtech) space in recent years. Startups in the industry, long-known for a serious dearth of innovation, have raked in nearly $3 billion in private capital this year. U.S.-based insurtech startups have raised $2 billion in 2018, a record year for the sector and more than double last year’s total.

Deal count, meanwhile, is swelling. In 2016, there were 72 deals conducted in the space, followed by 86 in 2017 and 94 so far this year, again, according to PitchBook’s data.

Oscar Health, the health insurance provider led by Josh Kushner, is responsible for about 25 percent of the capital invested in U.S. insurtech startups this year. The company has raised a total of $540 million across two notable deals in 2018. The first saw Oscar pulling in $165 million at a $3 billion valuation and the second, announced in August, had Alphabet investing a whopping $375 million. Devoted Health, a Waltham, Mass.-based Medicare Advantage startup, followed up with a massive round of its own. The company nabbed $300 million and announced that it would begin enrolling members to its Medicare Advantage plan in eight Florida counties. Devoted is led by Todd Park, the co-founder of Athenahealth and Castlight Health.

Bright Health co-founders Bob Sheehy, CEO; Tom Valdivia, chief medical officer; and Kyle Rolfing, president

VC’s interest in insurtech isn’t limited to healthcare.

Hippo, which sells home insurance plans at lower premiums, officially launched in 2017 and has brought in $109 million to date. Earlier this month the company announced a $70 million Series C funding round led by Felicis Ventures and Lennar Corporation. Lemonade, which is similarly an insurer focused on homeowners, raised $120 million in a SoftBank-led round late last year. And Root Insurance, an app-based car insurance company founded in 2015, itself raised a $100 million Series D led by Tiger Global Management in August. The financing valued the company at $1 billion.

Together, these companies have raised well over $1 billion this year alone. Why? Because building a health insurance platform is incredibly cash-intensive and particularly difficult given the breadth of incumbents like Aetna or UnitedHealth. Sheehy, considering his 20-year tenure at UnitedHealthcare, may be especially well-positioned to disrupt the industry.

The opportunity here for investors and startups alike is huge; the health insurance market alone is forecasted to be worth more than $1 trillion by 2023. Companies that can leverage technology to create consumer-friendly, efficient and, most importantly, reasonably priced insurance options stand to win big.

As for Bright Health, the company plans to use its $200 million infusion to rapidly expand into new markets, planning to triple its geographic footprint in 2019.

“Bright Health has continued to execute at a fast pace towards our goal of disrupting the old health care model that places insurers at odds with providers,” Sheehy said in a statement. “[Its] current high re-enrollment rate shows that consumers are ready for this improved healthcare experience – especially when it is priced competitively.”

Powered by WPeMatico

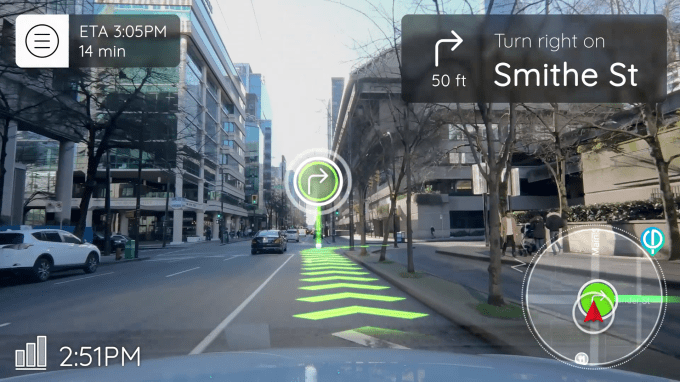

Augmented reality is a very buzzy space, but the fundamental technologies underpinning it are pushing boundaries across a lot of other verticals. Machine learning, object recognition and visual mapping tech are the pillars of plenty of new ventures, enabling there to be companies that thrive in the overlap.

Phiar (pronounced fire) is building an augmented reality navigation app for drivers, but the same tech it’s built to help drivers easily pinpoint where they need to make their next turn also helps them build up rich mapping data that can give partners like autonomous car startups the high-quality data they so deeply need.

The SF-based company has just closed a $3 million seed deal led by Norwest Venture Partners and The Venture Reality Fund. Other investors include Anorak Ventures, Mayfield Fund, Zeno Ventures, Cross Culture Ventures, GFR Fund, Y Combinator, Innolinks Ventures and Half Court Ventures.

While phone and headset-based AR have received a lot of the broader media attention, the automotive industry is a central focus for a lot of augmented reality startups attracted by the proposition of a mobile environment that can showcase and integrate bulky tech. There certainly have been quite a few heads-up display startups looking to take advantage of a car’s windshield real estate, and prior to joining Y Combinator, Phiar was actually looking to build some of this hardware themselves before deciding on a more software-focused route for the company.

Unlike a lot of phone AR apps built on top of Apple or Google’s developer platforms, Phiar’s use case doesn’t quite work with the limitations of these systems, which understandably weren’t built with the idea a user would be moving at 60 miles per hour. As a result, the company has had to build tech to greater understand the geometry of a quickly updating world through a single camera while ensuring that it’s not just some ugly directional overlay, using techniques like real-time occlusion to ensure that the digital and physical worlds interact nicely.

While the startup’s big consumer-facing play is the free AR mobile app, Phiar is really just an augmented reality company on the surface; its real sell is what it can do with the data and insights gathered from an always-on dash camera. The same object recognition tech that will allow the app to seamlessly toss AR animations onto the scene in front of you is also analyzing that environment and uploading metadata to build up its mapping insights.

In addition, the app saves up to 30 minutes of footage from each ride, offering users the utility of a free dash cam in case they get in an accident and need video for an insurance claim, while providing some rich anonymized data for the company to build up high-quality mapping data it can sell to partners.

This kind of data is incredibly useful to companies building autonomous car tech, ridesharing companies and a lot of entities that are interested in access to quickly updating map data. The challenge for Phiar will be building up enough users so their map data is as rich as their partners will demand.

CEO Chen-Ping Yu says that the startup is in talks with partners in the automotive space to integrate their tech and is also working to bring what they’ve built to companies in the ridesharing space. Yu says the company plans to release their consumer app in mid-2019.

Powered by WPeMatico