Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

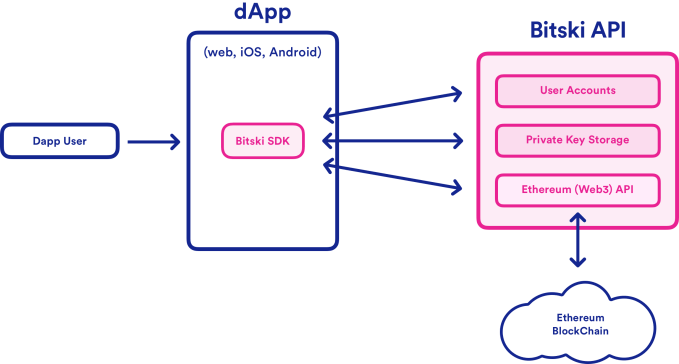

The mainstream will never adopt blockchain-powered decentralized apps (dApps) if it’s a struggle to log in. They’re either forced to manage complex security keys themselves, or rely on a clunky wallet-equipped browser like MetaMask. What users need is for signing in to blockchain apps to be as easy as Login with Facebook. So that’s what Bitski built. The startup emerges from stealth today with an exclusive on TechCrunch about the release of the developer beta of its single sign-on cryptocurrency wallet platform.

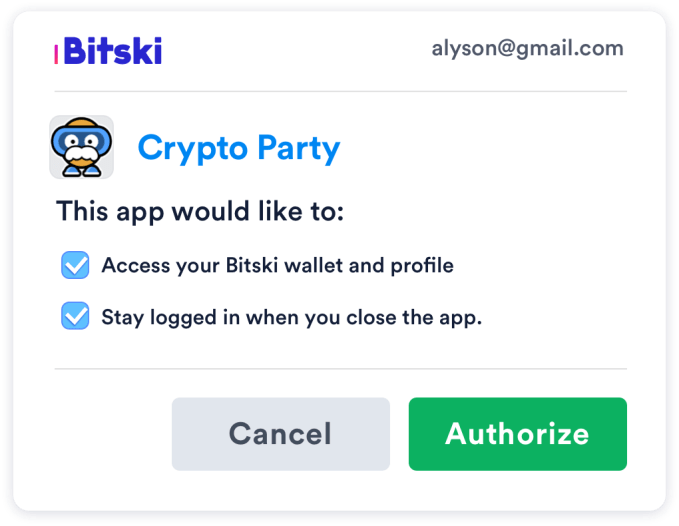

Ten projects, including 7 game developers, are lined up to pay a fee to integrate Bitski’s SDK. Then, whenever they need a user’s identity or to transact a payment, their app pops open a Bitski authorization screen, where users can grant permissions to access their ID, send money or receive items. Users sign up just once with Bitski, and then there’s no more punching in long private keys or other friction. Using blockchain apps becomes simple enough for novices. Given the recent price plunge, the mainstream has been spooked about speculating on cryptocurrencies. But Bitski could unlock the utility of dApps that blockchain developers have been promising but haven’t delivered.

“One of the great challenges for protocol teams and product companies in crypto today is the poor UX in dApps, specifically onboarding, transactions, and sign-in/password recovery,” says co-founder and CEO Donnie Dinch. “We interviewed a ton of dApp developers. The minute they used a wallet, there was a huge drop-off of folks. Bitski’s vision is to solve user onboarding and wallet usability for developers, so that they can in-turn focus on creating unique and useful dapps.”

The scrappy Bitski team raised $1.5 million in pre-seed capital from Steve Jang’s Kindred Ventures, Signia, Founders Fund, Village Global and Social Capital. They were betting on Dinch, a designer-as-CEO who’d built concert discovery app WillCall that he sold to Ticketfly, which was eventually bought by Pandora. After 18 months of rebranding Ticketfly and overhauling its consumer experience, Dinch left and eventually recruited engineer Julian Tescher to come with him to found Bitski.

Bitski co-founder and CEO Donnie Dinch

After Riff failed to hit scale, the team hung up its social ambitions in late 2017 and “started kicking around ideas for dApps. We mocked up a Venmo one, a remittance app…but found the hurdle to get someone to use one of these products is enormous,” Dinch recalls. “Onboarding was a dealbreaker for anyone building dApps. Even if we made the best crypto Venmo, to get normal people on it would be extremely difficult. It’s already hard enough to get people to install apps from the App Store.” They came up with Bitski to let any developer ski jump over that hurdle.

Looking across the crypto industry, the companies like Coinbase and Binance with their own hosted wallets that permitted smooth UX were the ones winning. Bitski would bring that same experience to any app. “Our hosted wallet SDK lets developers drop the Bitski wallet into their apps and onboard users with standards web 2.0 users have grown to know and love,” Dinch explains.

Imagine an iOS game wants to reward users with a digital sword or token. Users would have to set up a whole new wallet, struggle with their credentials or use another clumsy solution. They’d have to own Ethereum already to pay the Ethereum “gas” price to power the transaction, and the developer would have to manually approve sending the gift. With Bitski, users can approve receiving tokens from a developer from then on, and developers can pay the gas on users’ behalf while triggering transactions programmatically.

Magik is an AR content platform that’s one of Bitski’s first developers. Magik’s founders tell me, “We’re building towards reaching millions of mainstream consumers, and Bitski is the only wallet solution that understands what we need to reach users at that scale. They provide a dead-simple, secure and familiar interface that addresses every pain point along the user-onboarding journey.”

Bitski will offer a free tier, priced tiers based on transaction volume or a monthly fee and an enterprise version. In the future, the company is considering doubling-down on premium developer services to help them build more on top of the blockchain. “We will never, ever monetize user data. We’ve never had any intent at looking at it,” Dinch vows. The startup hopes developers will seize on the network effects of a cross-app wallet, as once someone sets up Bitski to use one product, all future sign-ins just require a few clicks.

In August, Coinbase acquired a startup called Distributed Systems that was building a similar crypto identity platform called the Clear Protocol. A “login with Coinbase” feature could be popular if launched, but the company’s focus is to spread a ton of blockchain projects. “If [login with Coinbase] launched tomorrow, they wouldn’t be able to support games or anything with a unique token. We’re a lockbox, they’re a bank,” Dinch claims.

The spectre of single sign-on’s biggest player, Facebook, looms, as well. In May it announced the formation of a blockchain team we suspect might be working on a crypto login platform or other ways to make the decentralized world more accessible for mom and pop. Dinch suspects that fears about how Facebook uses data would dissuade developers and users from adopting such a product. Still, Bitski’s haste in getting its developer platform into beta just a year after forming shows it’s eager to beat them to market.

Building a centralized wallet in a decentralized ecosystem comes with its own security risks. But Dinch assures me Bitski is using all its own hardware with air-gapped computers that have been stripped of their Wi-Fi cards, and it’s taking other secret precautions to prevent anyone from snatching its wallets. He believes cross-app wallets will also deliver a future where users actually own their virtual goods instead of just relying on the good will of developers not to pull them away or shut them down.” The idea of we’ve never been able to provably own unique digital assets is crazy to me,” Dinch notes. “Whether it’s a skin in Fortnite or a movie on iTunes that you purchase, you don’t have liquidity to resell those things. We think we’ll look back in 5 to 10 years and think it’s nuts that no one owned their digital items.”

While the crypto prices might be cratering and dApps like Cryptokitties have cooled off, Dinch is convinced the blockchain startups won’t fade away. “There is a thriving developer ecosystem hellbent on bringing the decentralized web to reality; regardless of token price. It’s a safe assumption that prices will dip a bit more, but will eventually rise whenever we see real use cases for a lot of these tokens. Most will die. The ones that succeed will be outcome-oriented, building useful products that people want.” Bitski’s a big step in that direction.

Powered by WPeMatico

Knack, a peer tutoring platform aimed at college students, is taking a different approach than some online tutoring marketplaces have in the past. As a result, the Florida-based startup has raised a $1.5 million seed round co-led by Charles Hudson’s Precursor Ventures and Tampa Bay Lighting owner and Fenway Sports Group Partner, Jeff Vinik.

Other investors in the round include Bisk Ventures, the corporate venture-arm of Bisk Education; Arizona State University Enterprise Partners; Doug Feirstein, founder of Hired, uSell, and LiveOps; former State of Florida CFO Alex Sink; Tom DiBenedetto of Fenway Sports Group; PAR Inc.; and Elysium Venture Capital.

While many tutoring marketplaces have focused on only connecting students with others who could help them with their studies, Knack has instead also been focusing on adding institutional partners as its customers.

Today, it works with more than 50 colleges across the U.S., like seed investor ASU, which is licensing Knack to modernize their student support services and increase access to supplemental help for students.

“Although most universities already have on-campus tutoring centers,” explains company co-founder and CEO Samyr Qureshi, “Knack partners with institutions as a technology-enabled supplemental solution, filling in the gaps by increasing course and topical coverage for nuanced courses that campus learning centers may not be able to cover due to budgetary and resource constraints,” he says.

In addition, Knack is also now working with corporate employer sponsors like PwC and ConnectWise, which want to engage with high-potential students from Knack’s campus networks.

“We’re focusing on the full life cycle of learning from ‘I need some help on Knack’ to ‘I can offer help through Knack’ to ‘my skills built and showcased through Knack helped me land a job,’” notes Qureshi.

The CEO says he was inspired to work in the edtech space because, as a first-generation immigrant, education has been at the forefront of his life. His mother brought Qureshi and his sister to the U.S. to allow them to pursue college degrees.

During his own time in school, Qureshi both sought tutoring and provided tutoring, which led him to believe that one of the best ways to learn was from a peer.

In 2016, the startup applied to the University of Florida’s Business Plan Competition and took home first place, winning a $25,000 cash prize. That opened the door to venture capital, and its first pre-seed round of funding.

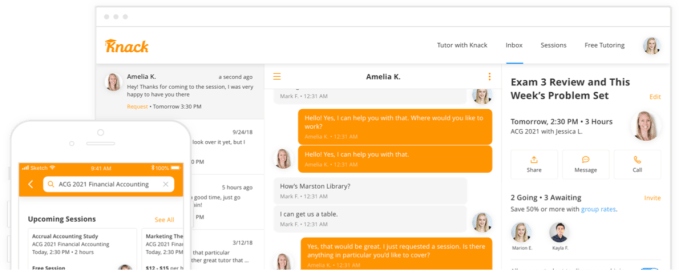

While institutions and businesses are the focus in terms of monetization, Knack still caters directly to students today. Those who need help with their coursework can use Knack to book tutoring, and those who want to offer their skills can create a tutoring profile with basic info, like their bio, courses, rates and availability.

The platform then handles all the logistics, including searching, matching, scheduling, tracking, billing and rating and reviewing.

Knack takes a 20 percent service fee on this tier of its service. University partners are on a SaaS-based annual platform, and Employer partners are charged a sponsorship amount depending on their targeting criteria.

The team of eight is based in Tampa, Florida and plans to use the seed funding for sales and marketing, as well as making some key engineering hires, the CEO says.

Powered by WPeMatico

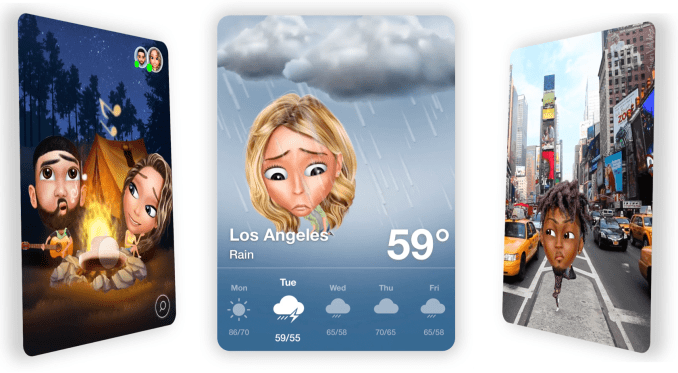

Genies is emerging as the top competitor to Snapchat’s wildly popular Bitmoji as Facebook, Apple and Google have been slow to get serious about personalized avatars. More than one million people have customized dozens of traits to build a realistic digital lookalike of themselves from over a million possible permutations.

When Genies launched a year ago after raising $15 million in stealth, it misstepped by trying to show people’s Genies interpreting a few weekly news stories and seasonal moments. Now the startup has figured out users want more control, so it’s shifting its iOS and Android apps to let you chat through your avatar, which acts out keywords and sentiments in reaction to what you type, which you can then share elsewhere. And Genies is launching a software developer kit that charges other apps to let you create avatars and use them for chat, stickers, games, animations and augmented reality.

Genies’ SDK puts its avatars in other apps

To power these new strategies and usher in what CEO Akash Nigam calls “the next wave of communication through avatars where people feel comfortable expressing themselves,” Genies has raised $10 million more. The party round comes from a wide range of investors, from institutional firms like NEA and Tull Co. to angels like Tinder’s Sean Rad, Raya’s Jared Morgenstern and speaker Tony Robbins; athletes like Carmelo Anthony, Kyrie Irving and Richard Sherman; and musicians, including A$AP Rocky, Offset from Migos, The Chainsmokers and 50 Cent. Some like Offset have even used their Genie to stand in for them for brand sponsorships, so their avatar poses for photos instead of them.

“We’ve transitioned from being an app to an avatar services company,” Nigam tells me. The son of WebMD’s co-founder, Nigam build a string of failed apps while at University of Michigan and worked with Genies co-founders Evan Rosenbaum and Matt Geiger on a startup called Blend that raised some money. Watching Snapchat-owned Bitmoji stay glued atop the app download charts inspired them to see more opportunity in the avatar space. Genies has had some talent issues, though. Nigam says it fired co-founder and president Matt Geiger, and a source tells me there were company culture issues that led to issues with the content writers it hired to create scenes for Genies to act out. Now it’s getting out of that scripted content creation business to focus on algorithmic suggestions of animations.

Genies in-app chat

The revamped Genies app lets you chat with up to six friends through your avatar. As you type, Genies detects actions, places, things and emotions, and offers you corresponding animations your avatar acts out with a tap. Given people already have plenty of place to chat, it might be tough to get people to move real conversations inside Genies for more than a quick hit of novelty. But that functionality is also coming to Facebook Messenger, WhatsApp and iMessage’s keyboards, where the expressive animations could naturally augment your threads.

Gucci paid to let Genies users add its luxury clothes to their avatars

With the Genies SDK, the startup is ready to challenge Snapchat’s new Snap Kit that lets apps build Bitmoji into their keyboards. But for $100,000 to $1 million in licensing fees, Genies allows apps to develop much deeper avatar features. Beyond creating keyboard stickers, games can plaster your Genies’ face over your character’s head, and utilities apps can have your Genie act out the weather or celebrate transactions. And since Genies is still taking off, partners can create experiences that feel fresh rather than just a repurposing of Bitmoji’s already-established cartoony avatars. Users spent an average of 19 minutes creating their Genie, so the SDK could add significant engagement to these apps. Genies has also launched its first official brand deal, where Gucci has created a wheel in the Genies creator so you can deck out your mini-you with luxury clothing.

The Avatar Wars (from left): Facebook Avatars, Google Gboard Mini Stickers, Apple Memoji

Despite Bitmoji’s years of success, it’s yet to have a scaled competitor. TechCrunch broke the news that Facebook is working on a “Facebook Avatars” feature, but seven months later it’s still not publicly testing and the prototype looks childish. Google’s Gboard just added the ability to create avatars based on a selfie, but they’re bland, low on detail and far from fun looking. And Apple’s latest mobile operating system lets you create a Memoji, though they too look generic like actual emoji rather than something instantly identifiable as you. By designing avatars that not only look like you but like a cooler version of you, Genies could capture the hearts and faces of millions of teens and the influencers they follow.

Powered by WPeMatico

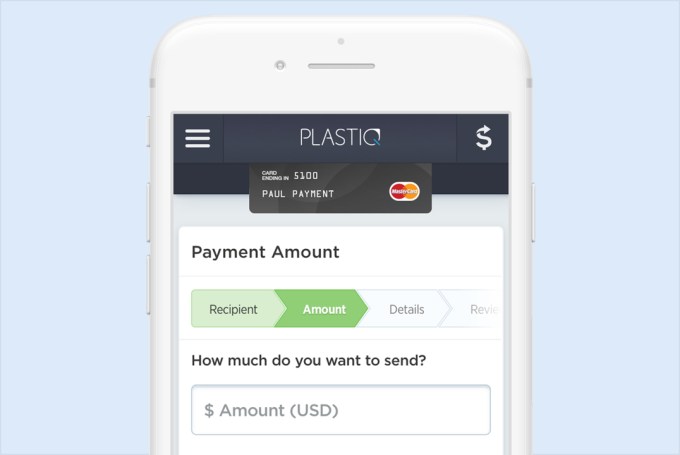

“I wasn’t asking to pay in Bitcoin!” Plastiq CEO and co-founder Eliot Buchanan recalls with a laugh. “I went to pay part of my tuition at Harvard and I was told that they didn’t (and never would) accept credit cards. It was inconvenient and seemed odd. Credit cards had been around for 50 years.” That set off the a light bulb in his head. “Why couldn’t I use a credit card to pay for this important bill? So, I set out to solve my own problem.”

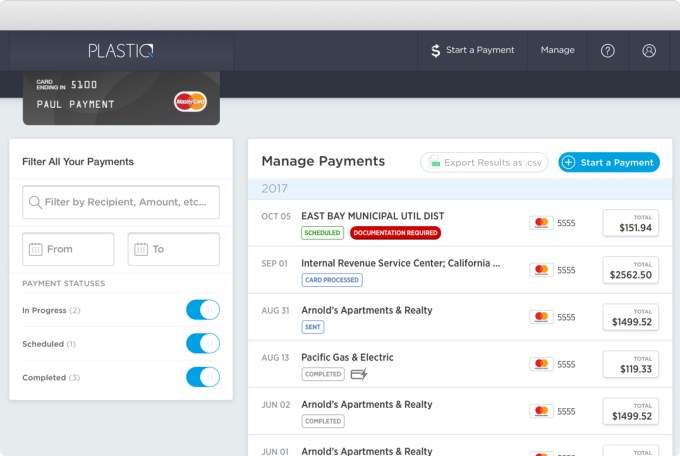

Whether you’re trying to pay your rent or tuition on credit, or you have a business and want to invest in a new opportunity or get a better rate by paying vendors up front, Plastiq can help. For a flat 2.5 percent fee, you pay Plastiq through your credit card, and it issues the proper wire transfer, check or deposit for up to $500,000, or even more, on your behalf to whomever you owe.

Now with more than 1 million clients, growth-stage VCs are taking notice. Kleiner Perkins has just led a $27 million Series C for Plastiq with partner Ilya Fushman joining the board. A source says the raise that also comes from DST Global between doubles and triples Plastiq’s valuation over its 2017 Series B-1 rounds of $11 million and $16 million. Now with $73 million in total funding, it plans to add 100 people to its current team of 60, while building out its small business product and bank partnerships.

“As tens of thousands of business owners started using Plastiq actively for billions of dollars in payments, we realized we had this incredible opportunity to serve as the hub/platform on which they (SMBs) could run all their payments. The very fabric of America’s economy — and certainly much of the world — is run by rising or aspiring small business owners,” Buchanan tells me. He says that’s “the main reason that seeded this Kleiner financing and our renewed vision to ‘accelerate how small businesses grow.’ [Helping people pay with credit cards] is merely the entry point to a much broader play where we are central to how a small business runs.”

For example, if a small business wants to ramp up production of something it’s selling, it’d typically have to pay up front for manufacturing, but wait months until the stuff is shipped and sold to recoup its investment. That can put a major squeeze on the company’s operating capital. With Plastiq, the business can pay with credit up front so they don’t have to worry about being in danger of running out of money in the meantime. Plastiq also lets businesses accept credit card payments, which can win them favor with partners.

Plastiq co-founders (from left): Eliot Buchanan and Dan Choi

Specialty medical clinic chain Metro Vein pays vendors who don’t take credit with Plastiq instead. “I was able to invest in a new line of business that has enabled me to more than double our revenues in the last 10 months,” said CEO Dmitri Ivanov. And thanks to tax write-offs, business users of Plastiq can push its realized fee down to 2 percent.

Buchanan claims Plastiq doesn’t have any direct competitors that allow SMBs to pay for all their bills via credit. It does carry platform risk, though. “Like any payments business, we rely heavily on Visa, MasterCard and American Express. A challenge or risk factor is that you’re relying on very large companies that are very successful. You have to learn to work hand in hand with those partners instead of ‘disrupt them.’” He says Plastiq’s relationships with them are positive right now since it’s driving new revenue for them and helping their customers spend in new areas.

There’s also the risk that people misuse Plastiq to procrastinate on actually paying their personal bills or get in over their head investing in their business. But Plastiq’s new board member Fushman calls the service “this elegant way for businesses to tap into credit they’ve been issued but they haven’t been able to utilize before.” For many who are happy to pay though just need some time and flexibility, Plastiq can pitch in.

Powered by WPeMatico

The only sure things in this life, according to Ben Franklin, are death and taxes. And a new startup called Visor has just raised $9 million in financing to make one of them as painless as possible.

Unlike Nectome, Visor won’t kill anyone, but it may ring the death knell for the high-end tax advisors that most Americans can’t even access to get help filing and paying their taxes. It’s like having a personalized accountant for the cost of a high-end do-it-yourself tax-prep service.

The $9 million Visor raised came from the venture capital firm Defy, with participation from Unusual Ventures, SVB Capital and existing investors like Obvious Ventures, Fika Ventures and Boxgroup, which had put a previous $6.5 million into the company.

The idea for the company had been percolating for co-founder and chief executive Gernot Zacke since he settled in the U.S.

Growing up in Sweden, Zacke was exposed to a much different process for paying taxes. “The experience of filing taxes in Sweden is that you receive a message from the government that stated how much you made and how much you were withholding. That’s it,” said Zacke. “Taxes should be as easy as ordering a cab.”

That’s the service that Visor aims to provide.

“If you think about the market there are two ways to get your taxes done. There’s the DIY space and then there are other online services but it requires the tax payer to fill out the forms and it leaves the tax payer with a little bit of anxiety,” said Zacke. “We’re delivering the CPA experience through the convenience of a web app and a mobile app.”

On average, Americans spend about 13 hours each year dealing with taxes, and the average American doesn’t have the benefits of a professional advisor who can help optimize the process. That’s what Visor wants to provide.

“You provide the same amount of information you provide to a CPA or TurboTax… we make sure that that information is filed securely on AWS and shared between the docs and the backend,” said Zacke.

The target customers for Zacke’s services are folks who have had a change to their tax situation — whether moving, buying a home or any other life event; or folks who have had a CPA and don’t want to pay the higher fees, he said.

Visor currently has an operations team of around 34 people split between San Francisco and Atlanta.

For Zacke, the pain point he’s solving with the Visor service is very real. A former employee of the European investment firm Atomico, Zacke bounced between the U.S. and Europe — eventually running U.S. investments for the firm before leaving to launch Visor.

Other co-founders and senior executives hail from the tax advisory world, and from employee benefits outsourcing services company Zenefits, along with former Venmo and Square developers.

“Taxpayers spend $20 billion a year to get their taxes prepared and are stuck between spending hours filling out DIY tax software and hiring an expensive CPA,” said Zacke, in a statement. “

Powered by WPeMatico

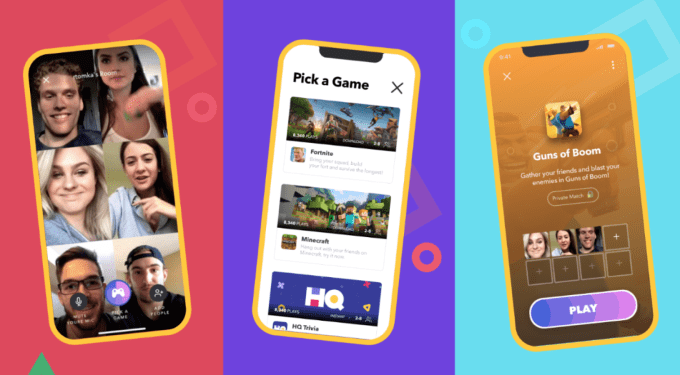

The best parts of gaming are the jokes and trash talk with friends. Whether it was four-player Goldeneye or linking up PCs for Quake battles in the basement, the social element keeps video games exciting. Yet on mobile we’ve lost a lot of that, playing silently by ourselves even if we’re in a squad with friends somewhere else. Bunch wants to bring the laughter back to mobile gaming by letting you sync up with friends and video chat while you play. It already works with hits like Fortnite and Roblox, and developers of titles like Spaceteam are integrating Bunch’s SDK to inspire longer game sessions.

Bunch is like Discord for mobile, and the chance to challenge that gaming social network unicorn has attracted a $3.8 million seed round led by London Venture Partners and joined by Founders Fund, Betaworks, Shrug Capital, North Zone, Streamlined Ventures, 500 Startups and more. With Bunch already cracking the top 100 social iOS app chart, it’s planning a launch on Android. The cash will go to adding features like meeting new people to game with or sharing replays, plus ramping up user acquisition and developer partnerships.

“I and my co-founders grew up with LAN parties, playing games like Starcraft and Counter Strike — where a lot of the fun is the live banter you have with friends,” Bunch co-founder and CEO Selcuk Atli tells me. “We wanted to bring this kind of experience to mobile; where players could play with friends anytime, anywhere.”

Bunch team

Atli was a venture partner at 500 Startups after co-founding and selling two adtech companies: Manifest Commerce to Rakuten, and Boostable to Metric Collective. But before he got into startups, he co-founded a gaming magazine called Aftercala in Turkey at age 12, editing writers twice his age because “on the internet, nobody knows you’re a dog,” he tells me. Atli teamed up with Google senior mobile developer Jason Liang and a senior developer from startups like MUSE and Mox named Jordan Howlett to create Bunch.

“Over a year ago, we built our first prototype. The moment we tried it ourselves, we saw it was nothing like what we’ve experienced on our phones before,” Atli tells me. The team raised a $500,000 pre-seed round and launched its app in March. “Popular mobile games are becoming live, and live games are coming to mobile devices,” says David Lau-Kee, general partner at London Venture Partners. “With this massive shift happening, players need better experiences to connect with friends and play together.”

“Over a year ago, we built our first prototype. The moment we tried it ourselves, we saw it was nothing like what we’ve experienced on our phones before,” Atli tells me. The team raised a $500,000 pre-seed round and launched its app in March. “Popular mobile games are becoming live, and live games are coming to mobile devices,” says David Lau-Kee, general partner at London Venture Partners. “With this massive shift happening, players need better experiences to connect with friends and play together.”

When you log on to Bunch’s iOS app you’ll see which friends are online and what they’re playing, plus a selection of games you can fire up. Bunch overlays group voice or video chat on the screen so you can strategize or satirize with up to eight pals. And if developers build in Bunch’s SDK, they can do more advanced things with video chat, like pinning friends’ faces to their in-game characters. It’s a bit like OpenFeint or iOS Game Center mixed with Houseparty.

For now, Bunch isn’t monetizing, as it hopes to reach massive scale first, but Atli thinks they could sell expression tools like emotes, voice and video filters, and more. Growing large will require beating Discord at its own game. The social giant now has over 130 million users across PCs, consoles and mobile. But it’s also a bit too hardcore for some of today’s casual mobile gamers, requiring you to configure your own servers. “I find that execution speed will be most critical for our success or failure,” Atli says. Bunch’s sole focus on making mobile game chat as easy as possible could win it a mainstream audience seduced by Fortnite, HQ Trivia and other phenomena.

Research increasingly shows that online experiences can be isolating, and gaming is a big culprit. Hours spent playing alone can leave you feeling more exhausted than fulfilled. But through video chat, gaming can transcend the digital and become a new way to make memories with friends — no matter where they are.

Powered by WPeMatico

RideCell, a transportation software startup, has doubled its previously announced Series B funding round to $60 million, a sign that investors believe demand for cloud-based mobility platforms will grow as more companies try to scale up car-sharing, ride-hailing and even robotaxi businesses.

The company, which has developed a platform designed to help car-sharing, ride-sharing and autonomous technology companies manage their vehicles, announced it raised $28 million in May.

Activate Capital led this round; its co-founder and managing director Raj Atluru has joined RideCell’s board. Reinsurance group Munich Re’s ERGO fund, LG Technology Ventures, BNP Paribas, Sony Innovation Fund, Ally Ventures and Khosla Ventures joined this extended round. Denso also upped its investment in the Series B round.

Nearly half a dozen other companies had already invested in the Series B round, including Cox Automotive, Initialized Capital, Denso, Penske, Deutsche Bahn and Mitsui.

“Investor interest in cloud-based mobility platforms and autonomous vehicles increases almost daily as the disruptive potential of these new technologies are realized,” RideCell CEO Aarjav Trivedi said in a statement.

The company recently received a permit from the California Department of Motor Vehicles to test its Auro autonomous vehicles on public roads. RideCell acquired self-driving car company Auro in October 2017. Auro initially developed and operated driverless shuttles for private geo-fenced locations such as corporate and university campuses. The company has since expanded its focus to include passenger vehicle models and minivans, although it still plans to target low-speed urban use cases focused on solving last-mile transportation.

The company’s real-world trials will start on Ford Fusion vehicle platforms equipped with Auro’s autonomous driving system.

Powered by WPeMatico

WeWork has picked up another $3 billion in financing from SoftBank Corp, not to be confused with SoftBank Vision Fund. The deal comes in the form of a warrant, allowing SoftBank to pay $3 billion for the opportunity to buy shares before September 2019 at a price of $110 or higher, ultimately valuing WeWork at $42 billion minimum.

In August, SoftBank Corp invested $1 billion in WeWork in the form of a convertible note.

According to the Financial Times, SoftBank will pay WeWork $1.5 billion on January 15, 2019 and another $1.5 billion on April 15.

SoftBank is far and away WeWork’s biggest investor, with SoftBank Vision Fund having poured $4.4 billion into the company just last year.

The real estate play out of WeWork is just one facet of the company’s strategy.

More than physical land, WeWork wants to be the central connective tissue for work in general. The company often strikes deals with major service providers at “whole sale” prices by negotiating on behalf of its 300,000 members. Plus, WeWork has developed enterprise products for large corporations, such as Microsoft, who tend to sign longer, more lucrative leases. In fact, these types of deals make up 29 percent of WeWork’s revenue.

The biggest issue is whether or not WeWork can sustain its outrageous growth, which seems to have been the key to its soaring valuation. After all, WeWork hasn’t yet achieved profitability.

Can the vision become a reality? SoftBank seems willing to bet on it.

Powered by WPeMatico

Cognigo, a startup that aims to use AI and machine learning to help enterprises protect their data and stay in compliance with regulations like GDPR, today announced that it has raised an $8.5 million Series A round. The round was led by Israel-based crowdfunding platform OurCrowd, with participation from privacy company Prosegur and State of Mind Ventures.

The company promises that it can help businesses protect their critical data assets and prevent personally identifiable information from leaking outside of the company’s network. And it says it can do so without the kind of hands-on management that’s often required in setting up these kinds of systems and managing them over time. Indeed, Cognigo says that it can help businesses achieve GDPR compliance in days instead of months.

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

To do this, the company tells me, it’s using pre-trained language models for data classification. That model has been trained to detect common categories like payslips, patents, NDAs and contracts. Organizations can also provide their own data samples to further train the model and customize it for their own needs. “The only human intervention required is during the systems configuration process, which would take no longer than a single day’s work,” a company spokesperson told me. “Apart from that, the system is completely human-free.”

The company tells me that it plans to use the new funding to expand its R&D, marketing and sales teams, all with the goal of expanding its market presence and enhancing awareness of its product. “Our vision is to ensure our customers can use their data to make smart business decisions while making sure that the data is continuously protected and in compliance,” the company tells me.

Powered by WPeMatico

Today, Real Estate Technology Ventures (RET Ventures) announced the final close of $108 million for its first fund. RET focuses on early-stage investments in companies that are primarily looking to disrupt the North American multifamily rental industry, with the firm boasting a roster of LPs made up of some of the largest property owners and operators in the multifamily space.

RET is one of the latest in a rising number of venture firms focused on the real estate sector, which by many accounts has yet to experience significant innovation or technological disruption.

The firm was founded in 2017 by managing director John Helm, who possesses an extensive background as an operator and investor in both real estate and real estate technology. Helm’s real estate journey began with a position right out of college and eventually led him to the commercial brokerage giant Marcus & Millichap, where he worked as CFO before leaving to build two venture-backed real estate technology companies. After successfully selling both companies, Helm worked as a venture partner at Germany-based DN Capital, where he invested in companies such as PurpleBricks and Auto1.

Speaking with investors and past customers, John realized there was a need for a venture fund specifically focused on the multifamily rental sector. RET points out that while multifamily properties have traditionally fallen under the commercial real estate umbrella, operators are forced to deal with a wide set of idiosyncratic dynamics unique to the vertical. In fact, outside of a select group, most of the companies and real estate investment trusts that invest in multifamily tend to invest strictly within the sector.

Now, RET has partnered with leading multifamily owners to help identify innovative startups that can help the LPs better run their portfolios, which account for nearly a million units across the country in aggregate. With its deep sector expertise and its impressive LP list, RET believes it can bring tremendous value to entrepreneurs by providing access to some of the largest property owners in the U.S., effectively shortening a notoriously lengthy sales cycle and making it much easier to scale.

Photo: Alexander Kirch/Shutterstock

One of the first companies reaping the benefits of RET’s deep ties to the real estate industry is SmartRent, the startup providing a property analytics and automation platform for multifamily property managers and renters. Today, SmartRent announced it had closed $5 million in series A financing, with seed investor RET providing the entire round.

SmartRent essentially provides property managers with many of the smart home capabilities that have primarily been offered to consumers to date, making it easier for them to monitor units remotely, avoid costly damages and streamline operations, all while hopefully enhancing the resident experience through all-in-one home controls.

By combining connected devices with its web and mobile platform, SmartRent hopes to provide tools that can help identify leaks or faulty equipment, eliminate energy waste and provide remote access control for door locks. The functions provided by SmartRent are particularly valuable when managing vacant units, in which leaks or unnecessary energy consumption can often go unnoticed, leading to multimillion-dollar damage claims or inflated utility bills. SmartRent also attempts to enhance the leasing process for vacant units by pre-screening potential renters that apply online and allowing qualified applicants to view the unit on their own without a third-party sales agent.

Just like RET, SmartRent is the brainchild of accomplished real estate industry vets. Founder and CEO Lucas Haldeman was still the CTO of Colony Starwood’s single-family portfolio when he first rolled out an early version of the platform in around 26,000 homes. Haldeman quickly realized how powerful the software was for property managers and decided to leave his C-suite position at the publicly traded REIT to found SmartRent.

According to RET, the strong industry pedigree of the founding team was one of the main drivers behind its initial investment in SmartRent and is one of the main differentiators between the company and its competitors.

With RET providing access to its leading multifamily owner LPs, SmartRent has been able to execute on a strong growth trajectory so far, with the company on pace to complete 15,000 installations by the end of the year and an additional 35,000 apartments committed for 2019. And SmartRent seems to have a long runway ahead. The platform can be implemented in any type of rental property, from retrofit homes to high rises, and has only penetrated a small portion of the nearly one million units owned by RET’s LPs alone.

SmartRent has now raised $10 million to date and hopes to use this latest round of funding to ramp growth by broadening its sales and marketing efforts. Longer-term, SmartRent hopes to permeate throughout the entire multifamily industry while continuing to improve and iterate on its platform.

“We’re so early on and we’ve made great progress, but we want to make deep penetration into this industry,” said Haldeman. “There are millions of apartment units and we want to be over 100,000 by year one, and over a million units by year three. At the same time, we’re continuing to enhance our offering and we’re focused on growing and expanding.”

As for RET Ventures, the firm hopes the compelling value proposition of its deep LP and industry network can help RET become the go-to venture firm startups looking to disrupt the real estate rental sector.

Powered by WPeMatico