Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Selling equity to buy Facebook and Google ads is a bad deal for startups. Clearbanc offers a fundraising alternative. For fast-growing businesses reliably earning sales from their marketing spend, Clearbanc offers funding from $5,000 to $10 million in exchange for a steady revenue share of their earnings until it’s paid back plus a 6 percent fee. Clearbanc picks which merchants qualify by developing tech that scans their Stripe, Facebook ads and other accounts to assess financial health and momentum. It’s already doled out $100 million this year.

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

“As a business successfully scales, we continue to provide them ongoing capital,” co-founder and CEO Andrew D’Souza tells me. “Our goal is to be the first and last backer of a successful business and save the entrepreneur from having to take hundreds of pitch meetings to keep their company funded.”

After largely flying under the radar since being found in 2015, now Clearbanc has some big funding news of its own. It’s now raised $70 million from a seed and new Series A round from Emergence Capital, Social Capital, CoVenture, Founders Fund, 8VC and more, with Emergence’s Santi Subotovsky joining the board.

“Venture capital has shifted. Instead of funding true research and development, today 40 percent of venture capital goes directly to buying Google and Facebook ads,” D’Souza claims (that may be true for some e-commerce startups, but TechCrunch could not verify that stat for all startups). “Equity is the most expensive way to fund digital ad spend and repeatable growth. So we created something new.”

Clearbanc emerged from an angel investing alliance between two serial entrepreneurs. D’Souza built Andreessen Horowitz-funded social recruiting site Top Prospect, USV-backed education tech company Top Hat and Mastercard portfolio biometric authentication wearable startup Nymi. He helped raise more than $300 million in venture after a stint at McKinsey, when he began co-investing with Michele Romanow, a VC from Canada’s version of the TV show Shark Tank called Dragons’ Den. She’d bootstrapped shopping hub Buytopia that acquired 10 other e-commerce companies, and discount-finder SnapSaves that she sold to Groupon in 2014.

“We started investing together in some of the deals we would see from Dragons’ Den and often found that an equity investment wasn’t the right structure for these consumer product companies. They had great economics and had found a niche of customers, but often didn’t want to exit the business at any point,” D’Souza recalls. “They needed money to acquire more customers, scale up their marketing efforts and online ad spend. So we started to do these revenue share deals.”

Both engineers, they built tech to automate the due diligence and find companies with healthy unit economics and customer acquisition costs. The partnership blossomed into Clearbanc, and romance. “We’re also a couple, so we spend a lot of time together,” D’Souza writes. Inter-startup dating can be problematic, but so far seems to be working for Clearbanc.

Clearbanc’s team

Now Clearbanc has poured over $100 million into 500 companies in 2018, like Vinebox. The subscription wine box company used Clearbanc to grow its membership numbers while raising a Series A for developing new products. Clearbanc’s companies pay out 5 percent in revenue share until the investment plus 6 percent is paid back. That’s a great deal for companies that are already proven moneymakers, like Hunt A Killer, a murder mystery game subscription box that had raised $10,000 and was selling swiftly. Derisked, it didn’t need venture, and has now taken $8 million from Clearbanc to ramp its business.

Clearbanc co-founders Andrew D’Souza and Michele Romanow

Clearbanc is rising up at a time when organic growth channels are shutting down. The ruthless optimization of algorithmic feeds by Facebook, Instagram and Twitter suppress marketing content unless businesses are willing to pay. Without free virality opportunities, companies must rely on venture funding or loans just to turn around and pay that money to big ad platforms. With the new cash, which also comes from iNovia Capital, Real Ventures, Portag3, Precursor, WTI, Berggruen and FJ Labs, Clearbanc plans to expand abroad after doing deals in the U.S. and Canada. It’s also going to invest in building awareness as well as its data science capabilities.

D’Souza and Romanow must have confidence in their tech, as a wrong investment means they might never get their cash back. “We pay a lot of attention to our underwriting and decision-making process because if we make a mistake, we can lose a lot of money. Unlike a VC, we don’t expect the majority of our companies to fail and have the winners make up for the losses,” says D’Souza. One big misstep could wipe out the gains from a bunch of other investments.

Meanwhile, it has to break the norms of how businesses find funding. Startups immediately seek traditional venture or debt financing that can depend on the flashy names already on their cap table, while merchants turn to exploitative online lenders that require a personal guarantee and base their decisions on the founders’ own credit history instead of the business.

While riskier hard-tech startups that will take years to get to market will still need venture, a new crop of direct-to-consumer products and other fast-monetizing startups that are already humming can avoid diluting their team and investors by using Clearbanc. D’Souza concludes, “We’ve spent our entire careers as entrepreneurs and wanted to build a new asset class to help entrepreneurs grow.”

Powered by WPeMatico

Datacoral aims to make it easier for enterprises to build data products by abstracting away all of the complex infrastructure to organize and process data. The company today announced that it has raised a $10 million Series A financing round led by Madrona Venture Group, with participation from Social Capital, which also led its $4 million seed round in 2017.

Datacoral CEO Raghu Murthy tells me that the company plans to use the new funding to grow its business team in order to be able to reach more potential customers and to expand its engineering team.

The promise of Datacoral is to offer enterprises an end-to-end data infrastructure that will allow businesses and their data scientists to focus on generating insights over having to manage and integrate their data sources. Because nobody wants to move large amounts of data between clouds — and take the performance hit that comes with that — Datacoral sits right inside a company’s AWS systems. It’s still a fully managed service, though, but the data is encrypted and never leaves a customer’s virtual private cloud.

“As companies look to their data to deliver value – data practitioners are finding that configuring and managing their own data infrastructure is a time-consuming job that is expensive and fraught with errors,” said Murthy. “We have built a platform that easily and automatically brings together data from different applications and databases, organizes that data in any query engine and acts on insights that are critical to running their business. A crucial component is that it works securely and privately within the customer’s cloud, instead of us ingesting data from their systems.”

Murthy was an early engineer at Facebook and part of the team that was in charge of scaling that company’s data infrastructure and ran a part of the engineering team at Bebop, Diane Greene’s startup that was later acquired by Google.

To scale Datacoral, the team is betting on a serverless platform itself. It’s making extensive use of AWS Lambda and other PaaS solutions on Amazon’s cloud computing platform. That doesn’t mean Datacoral plans to only support AWS, though. Murthy tells me that Azure support is next. “We plan to work across all of the top cloud providers by leveraging their unique services and provide a consistent ‘data-centric interface’ to our customers — essentially be ‘cloud best’ instead of ‘cloud agnostic.’”

Current Datacoral users include Greenhouse, Front, Ezetap, Swing Education, mPharma and Mason Finance.

Powered by WPeMatico

Transit, a company that built a mobile app designed to help people in cities live without cars, has raised $17.5 million from two automakers in a Series B round.

The round was led by RenaultNissan-Mitsubishi’s joint investment arm Alliance Ventures. InMotion Ventures, Jaguar Land Rover’s venture capital fund, also joined the round, as well as two past investors, Accel and Real Ventures.

RenaultNissan-Mitsubishi and Jaguar Land Rover’s investment would have seemed counterintuitive five years ago. But this is 2018. It’s the year of the scooter wars and micro-mobility; it’s also a time of transition for automakers that are looking to diversify their traditional business of building and selling cars.

Founded in 2012, Transit started as an app to help people check departure times for buses and trains. It’s grown into a mobile app platform that enables multi-modal transportation, integrating public transit, ride hailing, bike sharing and scooter sharing. The mobile app, which provides real-time data from transit agencies with user crowdsourcing, gives users notifications from their ride. The app then tracks the real-time location of the vehicle and notifies the user when to leave for their stop, when to disembark. and sends adjusted ETAs. Transit is now used by transit agencies, including Boston’s MBTA, Baltimore’s MDOT MTA, Silicon Valley’s VTA, Tampa Bay’s PSTA and Montreal’s STM.

The company wants to be transit and company agnostic, so, it’s a big proponent of open APIs. Montreal, where the company is based, is a model of what Transit wants to be everywhere. In Montreal, people can use the app for car sharing, bike sharing, to order an Uber or use public transit, COO Jake Sion explained.

Transit, which operates in 175 cities globally, will use the injection of capital to scale operations and improve the platform by integrating various services and payment methods on the app.

“This investment, which will advance Transit’s efforts to make mobility seamless and accessible in cities, fits with the Alliance 2022 strategy to become a leader in robo-vehicle ride-hailing mobility services and a provider of vehicles for public transit use and car-sharing,” François Dossa, Alliance Global vice president of ventures and open innovation, said in a statement.

Powered by WPeMatico

Amazon, one of the world’s largest companies, has transformed the face of commerce in part because it has managed at once to be “The Everything Store” but still with a route into its sea of products that, for most users, surfaces what they might most want to see (and importantly buy or consume). That kind of personalisation has become a goal not just for e-commerce companies, but for any organization running a digital business: users are constantly distracted, and when their attention is caught, they do not want to spend time figuring out what they most want.

Not every business is Amazon, though, so we are seeing a crop of startups emerging that are working on ways to help the rest of the digital world be just as optimised and personalised as Amazon. Now one of them, an Israeli startup called Dynamic Yield, has raised more money as it continues to expand its business, both to more platforms and to more geographies.

The startup’s Series D has now closed off at $38 million, with the inclusion of a $5 million strategic investment from Naver, Korea’s “Google” (it’s the country’s top search portal) that is also behind messaging apps Line and Snow. The plan is for Naver to help bring Dynamic Yield to Korea and Japan, by incorporating its tech into its own services and those of others that work with Naver.

(Personalisation and aggregators are strong magnets for users in Asia and thus big magnets for funding: ByteDance, which provides news aggregation among other services, was recently valued at $75 billion.)

Naver is not the only search engine that has caught sight of Dynamic Yield over the years. Previous investors include Baidu (“the Google of China”), and we’ve heard that when the startup was younger — it was founded in 2011 — Google had tried to acquire it (Dynamic Yield rejected the offer, and it’s been approached for acquisitions numerous times since then).

Other strategic investors include The New York Times and Deutsche Telekom, alongside other backers like Innovation Endeavors, Bessemer Venture Partners, Marker Capital and more.

Dynamic Yield has raised $85 million to date and is now valued at “hundreds of millions of dollars,” but less than $500 million, a source at the company said, after seeing a strong expansion of its services.

Dynamic Yield says it works with more than 220 global brands, and its tech reaches 600 million unique users each month, across 10 billion page views and 600 billion “events” on those pages. It claims its AI-based personalisation technology can lift revenues (or other engagement metrics) by 10-15 percent.

“It makes us an effective tool for surviving in a market where customer acquisition cost keeps getting more expensive,” co-founder and CEO Liad Agmon said in an interview.

Dynamic Yield doesn’t talk about many of its customers on the record — most don’t like to reveal to rivals who they work with, Agmon said.

But they include a number of big brands across e-commerce, travel, finance, media and other segments that use its tech not just to show more targeted products to prospective shoppers, but to help power advertising, recommend content and position the same information to different people in different ways depending on who is viewing it (for example with different headlines).

There are a lot of personalisation and A/B analytics companies in the market today — others include Adobe, Marketo (which is becoming a part of Adobe), Optimizely and many more. Indeed, I’d be very surprised if Amazon is not working on ways of productising its own personalisation tech in a way that is not intrinsically linked to its own marketplace (because some will never want to sell there, and because personalisation can be used for so much more than just e-commerce).

Dynamic Yield, however, claims that it has an edge over these because of how it works.

Agmon says that the tech sits on top of whichever CMS or other backend server that a site is using and is activated by way of a small amount of code. It uses machine learning to both “read” what is in a site, and matches that up against specific visitors and its own trove of experience.

Agmon added that when a business already has information about that visitor, that is the primary data that is used; otherwise it also incorporates other data sources like Acxiom and others — much the way that other marketing tech does — to form a stronger picture of your tastes.

It then runs this data through its own machine learning algorithms both to recommend content and to help a marketing manager figure out better customer segmentation overall. There is an “autopilot” version of the product where everything is automated based on Dynamic Yield’s algorithms; or options to use the data sources to set up specific marketing campaigns; or (as is common) a combination of the two.

Going forward, Agmon said the plan is to work across an increasing number of interfaces where customers are going today to discover and buy goods and services. Indeed, we’ve described how some of the newest e-commerce startups have eschewed any website or app of their own and work exclusively in third-party messaging apps to acquire customers and sell goods.

But it’s not just these new digital platforms that are becoming targets for personalisation startups like Dynamic Yield.

Agmon said that his company is also working with a major retailer that is using its tech at its in-person payment points. When — for example — a customer comes to order a latte, instead of generic upselling to the latest seasonal flavour, the person taking the order will now know if the customer ever orders a sweet injection, or if she/he is more of a savoury snack sort of person. The cashier will then know what to recommend to eat with that drink that is more likely to be purchased.

The mom-and-pop shop with its reputation for knowing the regulars and what they like might have found its dystopian (but useful) heir.

Powered by WPeMatico

The past decade in retail has been the golden age of direct-to-consumer (D2C) and digitally native vertical brands (DNVBs) that use the internet to communicate with customers, execute transactions, handle distribution and offer better economics.

But as small independent startups have scaled into unicorn territory and as countless brands have saturated digital channels, customer acquisition has gotten harder and costlier. Companies are now trying to meet customers with different purchase habits by developing physical stores.

However, building an effective brick-and-mortar presence can be expensive and risky for DNVBs, requiring resources outside their core competencies. Chicago-based startup Leap is hoping to make it easier for digital brands to grow physical retail footprints without the typical risks of store development by taking care of the entire process for them.

Leap offers a full-service platform covering the complete life cycle of a brand’s brick-and-mortar launch. In addition to owning the lease and the financial commitments that come with it, Leap covers everything from staffing, experiential design, tech integration and even day-to-day operations.

(Photo by Alexander Scheuber/Getty Images)

Less than a year since its founding, Leap announced today the launch of its first store and the close of a $3 million seed round, led by Costanoa Ventures, with participation from Equal Ventures and Brand Foundry Ventures.

The debut store will act as the first Chicago location for Koio, the high-end D2C sneaker brand backed by headline-grabbing names like the Winklevoss twins, director Simon Kinberg and actor Miles Teller.

Instead of paying a monthly lease fee, along with all the other variable costs associated with operating a physical store, companies like Koio pay Leap on a percent of sales basis, effectively minimizing risk and incentivizing performance.

On top of minimizing development expense for brands, Leap believes its customer insights and intelligent logistics platform can help improve shopper engagement, increase customer traffic and drive brand lift. If the startup’s thesis proves true, brands can improve both sides of their brick-and-mortar unit economics by reducing customer acquisition costs and amplifying customer value.

At its core, Leap simplifies a DNVB’s physical retail operations into a single line item on its P&L, allowing the company to focus on brand building and supply chain rather than retail strategy, while also allowing them to scale faster.

With the latest fundraise, the company hopes to build out its team and continue new location expansion. Longer-term, Leap’s co-founders hope to build a vast network of sites that can help provide intelligence around new store development and shopper preference.

“We want to be the platform to help brands go to market in the offline space”, said co-founder Amish Tolia. “We want to help brands build direct-to-consumer relationships in local neighborhoods across the country and enable them to focus on what they’re best at. Enable them to focus on product innovation, supply chain management, great marketing and brand building.”

While Leap’s value proposition is straightforward, its business model points to a bigger trend in the world of retail.

By opting to sell its software and brick-and-mortar services rather than creating its own brands, Leap effectively acts as a “retail-as-a-service” platform. The as-a-service strategy is already quietly growing in popularity in the retail space, with companies like b8ta, the Internet of Things gadget retailer, launching its hardware-oriented “Built by b8ta” platform earlier this year.

Though likely heavy in upfront capital costs, retail-as-a-service businesses don’t have the same constant concern around supply chain, manufacturing, consumer acquisition and marketing spend. And in certain pricing models based on a monthly fee or percent of square footage basis, platforms can see more stable revenues relative to pure retail startups.

From a brand perspective, DNVBs have been looking for ways to extend growth runways while minimizing the cost and uncertainty that deterred them from physical stores in the first place. The as-a-service model can make brick-and-mortar retail a much more scalable engine, possibly even cooling rising concern around bubbling consumer valuations.

As more of the young digitally born D2C giants resort to as-a-service companies to find marginal customers, we may see the rise of a new set of startups fighting to establish themselves as the platform on which brands operate.

If the last decade was defined by retail online, it’s possible that the next decade will be defined by retail-as-a-service.

And if you find yourself in Chicago, feel free to check out the Leap-enabled Koio Store at 924 W Armitage in Lincoln Park.

Powered by WPeMatico

Local newspapers may be shuttering and people may be consuming most news on social media, but don’t tell Alex Mather that a subscription news publication can’t grow like a unicorn startup. His 2-year-old sports publisher The Athletic has gained over 100,000 paid subscribers (60 percent under age 34) and has a 90 percent retention rate.

Having already raised $30 million in its short life, the company announced a new $40 million Series C yesterday, led by Founders Fund and Bedrock Capital. It reportedly values The Athletic around $200 million.

I interviewed Alex Mather (The Athletic’s CEO) and Eric Stomberg (partner at Bedrock Capital) to understand what’s behind the breakout success, and why they think this publishing startup can scale to become a multi-billion dollar company.

EP: Bedrock makes concentrated, contrarian bets. Explain how The Athletic fits that.

ES: I first met Alex and Adam in 2016 during Y Combinator. The popular view then, as it remains now, was that people just aren’t willing to pay for content online and that to win in media you have to put out a high volume of free articles on social.

The Athletic took the opposite approach. It’s a narrative violation. Everything is part of a paid subscription, with the belief that instead of writers needing to post 3-4 pieces per day, they should focus on deeper stories that add value to paid subscribers over time. That worldview resonated with us. If you can create content at scale that people are willing to pay for, that’s a powerful economic engine.

There’s so much sports coverage already out there, by professionals and amateurs alike, so why are people willing to pay for The Athletic?

AM: While there appears to be an abundance of content, most of it is aggregated, shallow content for a broad audience. We produce fewer stories and target a diehard fan. Our subscribers consistently tell us that no one else produces the same depth on a daily basis.

How did you determine the $60/year price point?

AM: We think of $60/year ($5/month) as less than the average NBA ticket. It’s a meaningful price but not prohibitive, especially when we do discounts in the first year. Like all subscription companies, whether we like it or not, we have to consider how our pricing stacks up against Netflix. For $10/month, you can subscribe to Netflix which is spending $8 billion per year in content.

Is The Athletic profitable?

AM: We expand by launching in local markets. We are in 47 thus far. The operational focus is on building a local team and becoming profitable in each local market. I can tell you that most markets are profitable in the first year — currently all of our markets over one year old are profitable and most of those over 6 months old are profitable.

(Photo by Thearon W. Henderson/Getty Images)

Explain your growth strategy in terms of coverage: Which sports did you start with and at which level (local versus national)?

AM: Direct-to-consumer businesses have to really work to earn their subscribers’ hard-earned money. We have to obsess over where we can be different. In the beginning, that was with hockey and baseball, because those have been de-prioritized by the bigger players. That shifted as we gained more subscribers: we needed to become comprehensive. We hired folks to cover the NBA, to cover the NFL, to cover soccer.

Do subscribers usually come just for one local sport or for the broader bundle?

AM: We’ve built a powerful bundle. A local newspaper has local politics, local restaurants, and then local sports. We have just the sports, but add a national perspective and a nationwide bundle. Most of our subscribers are “super bundlers,” meaning they subscribe to content from multiple cities plus at least one national product and usually a college product that’s not local. We provide all that for significantly less than competitors.

Eric — as a VC looking for multi-billion-dollar exits, how are you analyzing the potential scale of a subscription publication like this? Even most people who are bullish on subscriptions believe it’s a choice of going for a niche audience and staying small.

ES: There are two things we look for in a subscription business: retention and a positive flywheel.

Retention. In any subscription business, the key question is: can they maintain their subscribers over time? Most of them don’t. Spotify does, Netflix does, and The Athletic does as well. The Athletic is off the charts, which sets it up for scale. You want to see deep engagement over a very, very long period of time — years.

A positive flywheel. The more you build your subscriber base, the more you build your revenue base. That allows you to get better content, to hire unique writers, to build greater depth. In doing so, you attract people who weren’t ready to subscribe in the early days but now you have writers they follow and content they want. Technology is important here too: as you build a bigger platform with more content, serving the right content at the right time to each user is a key advantage. When this flywheel is working it’s actually quite hard to put a ceiling on the business.

Most publishers did a so-called “pivot to video” over the last couple of years. You’re anchored in writing. Why not more video at the start?

AM: We’re obsessed with the consumer and all our research in the beginning said that people still like to read books and articles. Advertising with text may not be as good as with video, which may be why so many other companies “pivoted to video,” but we think the written word is still the best way to convey certain types of stories. It’s straightforward, it doesn’t require headphones.

There’s an incredible amount of talent out there that can produce these stories and that has been cast aside by many entities. We saw it as an opportunity to give them great jobs and bring value to our subscribers. That has paid off for us.

What are your plans for video or other content formats in the future?

AM: We raised this Series C with audio and video in mind. We can tell even more stories when we add in audio and video possibilities. Our goal is to serve the subscriber: some love to read, some love to listen, others prefer to watch. We look up to things like The Ringer, Andre the Giant on HBO, VICE News, Gimlet, and The Daily by The New York Times all as incredible storytelling, and we ask ourselves “how can we do sports versions of those?”

Why focus on hiring experienced, full-time writers rather than a stable of contributors or curating from the vast pool of content by fans? Lots of amateurs pay close attention to sports.

AM: What’s really important to us is a growth mentality — that by Day 100 on our team a writer is thinking very differently. We’re providing lots of data, lots of feedback. We invest in great people who will figure this out with us over time. Also, scaling so quickly from 0 to 300 editorial staff was possible because we recruited experienced talent who know what to do already.

We do have about 400 contributors as well. These are folks who may be lawyers or accountants but are passionate about the teams they cover. We are a way for them to reach a premium audience. We can pay them really well and give them world-class editors formerly with Sports Illustrated and ESPN.

How are you acquiring your subscribers?

AM: When we expand into a new market, we gain new subscribers by hiring writers who have a following already and by word of mouth from existing subscribers. Then like any direct-to-consumer brand, we are acquiring subscribers through Google, Facebook and Twitter.

You financially incentivize your writers based on them acquiring new subscribers through their articles or by promoting The Athletic with their followers online. That is very uncommon in publishing. Explain that strategy.

AM: It ties back to our focus on building for the long term and investing in talent that will grow with us. We like to assign incentives that give us the best chance of building a sustainable business and we think about compensation in that way. We give our team equity in the company and for many, we tie a portion of their comp to the performance of their team, sport, city. It’s a great way to share in the responsibility and success of the business.

At the bottom of articles, you ask readers to rate each story as “Meh,” “Solid,” or “Awesome.” I wish every publisher did this. How do you use this data? How do a writer’s scores impact them?

AM: It’s about feedback loops. Our writers gauge feedback when they share on Twitter. This is another data point. It helps paint a more complete picture. NPS alone isn’t enough of course though. We look at whether articles drive new subscribers, drive deep engagement, drive comments, etc. We don’t use pageviews, but we certainly use metrics. Usually, this results in a writer producing very different work on Day 100 than they were on Day 0.

Explain the interaction between subscribers. It’s not unique to have a comments section: there are bad comments sections, good comments sections and comments sections that go unused. At a tactical level, how do you think about building community?

AM: My co-founder and I met at Strava, the social network for endurance athletes. I ran the product team and we were obsessed with community. We see an incredible connection between community engagement and subscriber retention. The question that drives us is how can we connect users in an authentic way, how can we connect users to our staff in an authentic way, how can we connect users to athletes in an authentic way. We’re doing a lot of experimentation here. We have a distinct opportunity because of our paywall: most of the comments on The Athletic are saying substantive things.

Powered by WPeMatico

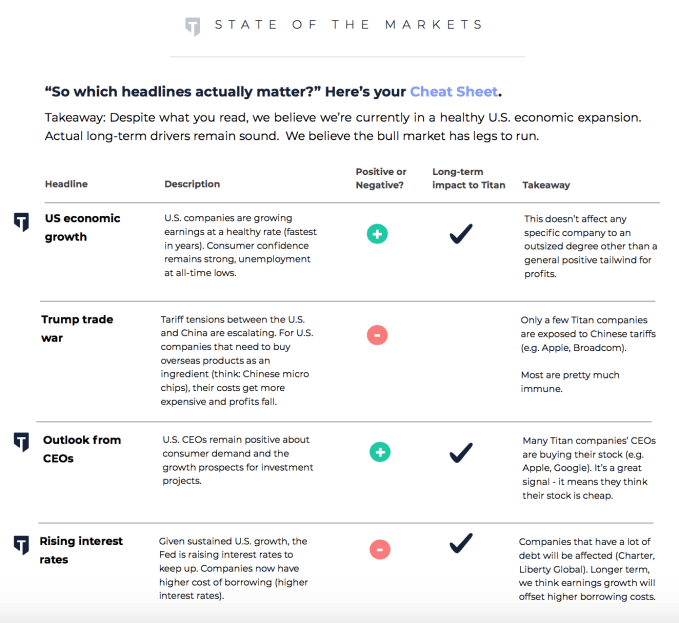

Titan could put an end to stock market FOMO. The app chooses the best 20 stocks by scraping top hedge fund data, adds some shorts based on your personal risk profile and puts your money to work. No worrying about market fluctuations or constantly rebalancing your portfolio. You don’t have to do anything, but can get smarter about stocks thanks to its in-app explanations and research reports. Titan wants to be the easiest way to invest in stocks for a mobile generation that wants an affordable coach to guide them through the market themselves.

“Our goal is to take things that aren’t accessible [in wealth management] and make them accessible, starting with hedge funds,” says Titan co-founder Joe Percoco. That potential to democratize one of the keys to financial mobility has won Titan a $2.5 million seed round from Y Combinator’s co-founder Paul Graham, president Sam Altman and partners including Gmail creator Paul Bucheit. The rest of the capital comes from Maverick Ventures, BoxGroup and Liquid2 Ventures.

“Titan is where investing meets virality,” says Graham. “Those are two very powerful forces.” Since TechCrunch broke the news of Titan’s launch in August, it’s doubled its assets under management to $20 million and hired its first non-founder engineer.

Now it’s launching in-app educational videos so stock market dummies can get up to speed if they want to understand where their money’s going amidst a swirling see of financial news. “There are so many different headlines telling so many different narratives,” Percoco tells me. “Everyone is searching for explanations in a voice they trust. An ‘ETF’ can’t talk back. Sometimes a human face is better than writing. A video can really help people make choices.” Here’s its two-minute video about Facebook’s Q2 earnings a few months ago, explaining why the share price crashed 25 percent:

Percoco and Clayton Gardner met on their first day of Wharton business school, while their third co-founder was earning a hedge fund patent and studying computer science at Stanford. They went on to work at hedge funds and private equity firms like Goldman Sachs, but got fed up just growing the fortunes of the already rich.

So they started Titan to invent a modern, mobile version of BlackRock, the investment giant founded in the 1980s. Titan uses the public disclosures of hedge funds to find consensus around the 20 best performing stocks. With as little as $1,000, users can let Titan robo-manage their investments for a 1 percent fee on assets. Users provide some info on how big they want to gamble, and Titan personalizes their portfolio with more or less conservative shorts to hedge their bets.

Titan’s simplicity combined with the sense of participation could help it grow quickly. It sits between do-it-yourself options like Robinhood or E*Trade, where you’re basically left to fend for yourself, and totally passive options like Wealthfront and Betterment, where you’re so divorced from your portfolio that you’re not learning. Managed hedge funds and fellow active investment vehicles like BlackRock with a human advisor can require a $100,000 minimum investment that’s too steep for millennials.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

“Even the best hedge fund in the world is only going to send you a PDF every 90 days,” Percoco explains. But Titan doesn’t want you nervously checking your portfolio non-stop. “Our median user checks the app once per day.” That seems like a healthy balance between awareness and sanity. It thinks its education and informative push notifications make it worth a higher required investment and fees than Wealthfront charges.

Essentially, Titan is a stock trading auto-pilot merged with a flight simulator so you improve your finance skills without having to fear a crash. Percoco tells me the sense of accomplishment that engenders is why clients say they’re telling friends about Titan. “When I invest, I look for companies that are growing quickly and making a huge positive impact on the world. Titan is one of those companies,” investor Altman says. “I think they could improve the financial well-being of an entire generation.”

Powered by WPeMatico

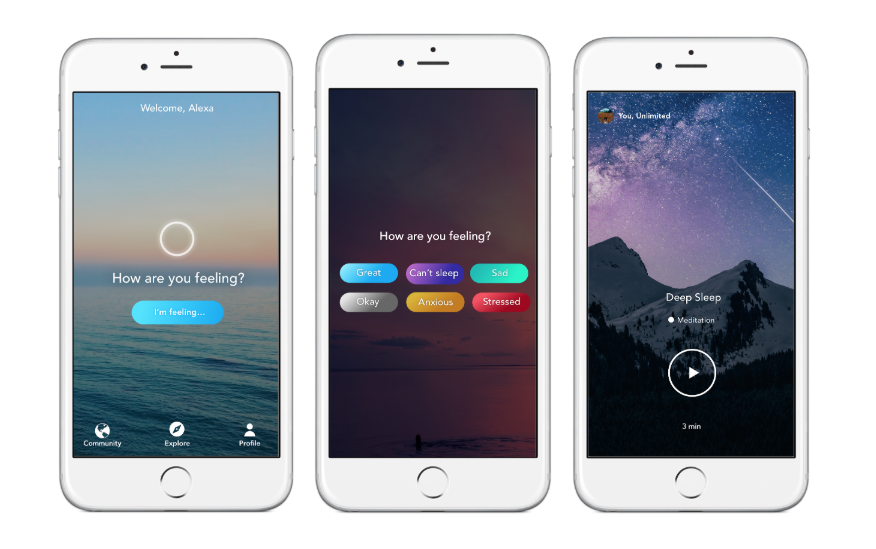

Aura, an app for emotional well-being, has raised a $2.7 million seed round co-led by Cowboy Ventures and Reach Capital, with participation from others.

When Aura first launched a couple of years ago, its bread and butter was short, three-to-seven-minute meditations based on your current mood — be that stressed, anxious, happy or sad. Since then, co-founders Steve and Daniel Lee say the company has grown to a few million users.

“We’ve since grown to become everyone’s emotional wellness assistant,” Steve told me. “We ask how people are feeling right now and then offer content to help them feel better.”

Aura works with therapists, coaches and meditation teachers to offer a variety of content to help people get the type of help they’re looking for. In addition to meditation, Aura offers life coaching, music and inspirational stories.

Premium users, who pay $60 per year, have unlimited access to content, while free users are limited to three minutes of wellness content once every two hours. Aura is not currently sharing how many paid customers it has.

“At Reach, we often ask how we can empower people to achieve at their fullest potential,” Reach Capital Partner Wayee Chu said in a statement. “We are thrilled to be supporting two founders who are not only deeply driven by their own personal narrative in living with a family member with a mental illness, but who have committed themselves in building a world-class technology and tool to empower others in building a regular mental health and wellness practice.”

With the funding in tow, Aura has plans to expand its base of content creators and grow its team — which currently consists just of the Lee brothers. Down the road, Aura envisions integrating the app with wearable devices and their respective sensors to detect mood automatically. That way, Aura would be able to serve up what you need before you know you need it. The company also plans to become more than just a content platform by building additional tools on top of the core service.

Powered by WPeMatico

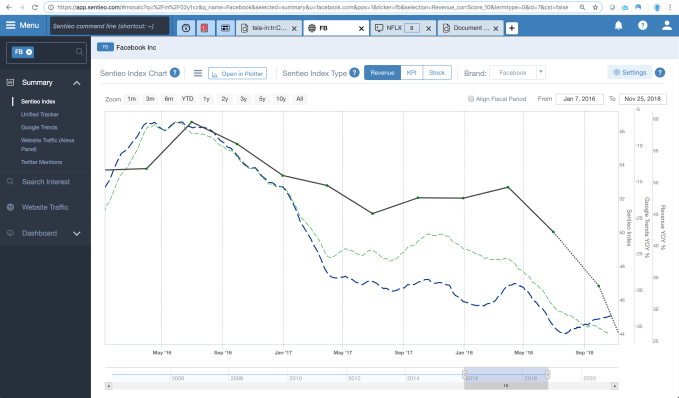

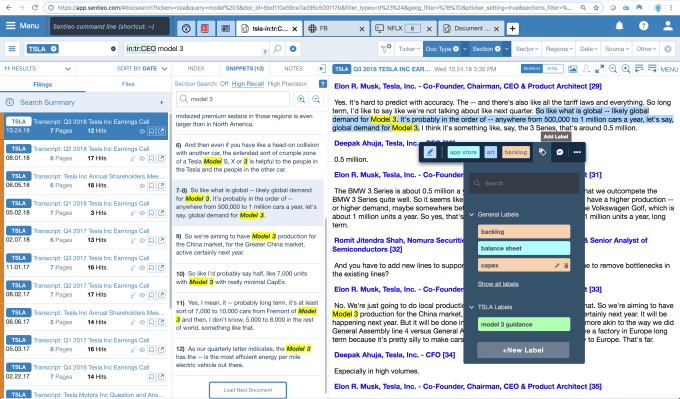

To get an edge on the market, investors must look beyond traditional financial info like revenue and profits. Our every online activity generates data exhaust, like web traffic, Twitter mentions, app downloads and search trends. It’s the ability to overlay the old and new data sets to spot surprising trends that will set the best traders apart. Sentieo wants to be their tool.

Sentieo is an investment research software suite that uses AI to scan financial documents, analyze alternative data sets and create visualizations. The fintech SAAS startup now has 700 customers, including top hedge funds plus mutual funds, Fortune 500s and investment banks that pay around $500 to $1,000 per month per license. That’s a lot cheaper than a $21,000 yearly Bloomberg Terminal subscription. [Correction: Sentieo charges $500 to $1000 per month, not per year.]

Now Sentieo is ready to crank up its name recognition with a sales and marketing blitz fueled by a new $19 million Series A round led by Centana, a $250 million growth equity firm focused on fintech SAAS. Now with $30 million in total funding, the 160-person startup plans to “Educate [traders] that ‘hey, this product is built by people who sat in your seats,’” says CEO Alap Shah.

Sentieo charts Search Trends data and Sentieo Index data on Facebook versus the social network’s revenue.

Ten years ago, Shah was making the Wall Street rounds after graduating from Harvard in economics. He was an analyst in consulting at Novantas, private equity at Castanea, and worked for hedge funds Viking Global and Citadel. “It became clear that there were some really big holes in my process where software wasn’t meeting my needs. Importantly, there was a hole around search,” Shah tells me. “We’ve grown accustomed to going to Google. But unfortunately that’s just not the way the old-school financial data programs are structured.”

Sentieo co-founder and CEO Alap Shah

So he built his own. “I used all the financial tools out there: Capital IQ, FactSet, Bloomberg — each had their strengths and weaknesses. But they were all over 20 years old, so they pre-date the cloud, pre-date SAAS, pre-date mobile!” With Sentieo, he wanted to develop a tool that could understand the nuances of business momentum before it showed up in the balance sheets.

Sentieo does have a traditional financial equity data terminal with real-time pricing. But there’s also a machine learning and natural language processing-powered document search tool that can sort through SEC documents, earnings call transcripts, press releases and more. It taps Alexa web traffic data, Apptopia app download rates and Twitter chatter, as well as Thomson Reuters analyst estimates and fundamentals. Customers can annotate files, organize ideas, generate visualizations and share their insights through Sentieo’s Notebook.

For example, Sentieo could look through all of Tesla’s earnings calls and financial documents for mentions of guidance on Model 3 production volume. It could highlight them all, analyze the sentiment of those mentions and chart them against Tesla’s share price. Or you could search for all the companies starting to list President Trump as a risk factor for their business, which would surface how the medical cannabis companies are concerned about Attorney General Jeff Sessions’ stance on legalization.

Sentieo’s synonym library allows it to hunt down different ways of saying the same thing with the goal of not forcing investors — or their dutiful analysts — to read through 100-page 10-Q documents manually. “You can get the same information at 10x the speed with something like Sentieo,” Shah claims. It wants to a be a “research management system,” like a Salesforce CRM for tracking investment ideas.

But Sentieo’s 65-person India-based engineering must keep data from all 50 feeds, 25 million documents and 64,000 equities flowing to keep customers satisfied. There are a ton of moving parts, and Sentieo is competing with much bigger companies. Beyond Bloomberg, there are lots of alternative data providers out there. And Microsoft’s software suite also has plenty of info management tools.

Sentieo’s hope is to emerge as an aggregator of information sources and an annotation tool that benefits from being purposefully designed for what analysts need. If Robinhood is on one side of the spectrum making investing easy for novice traders, Sentieo is on the other end making investing smarter for experts. “It’s really at the bleeding edge of how you get the data today,” Shah concludes. “For every company driven by consumer demand, there are all these little breadcrumbs being left all over the internet.”

[Disclosure: I briefly rented a room in an apartment where Shah lived five years ago and I know him from the San Francisco social scene frequented by many Silicon Valley figures.]

Powered by WPeMatico

NBA legend Michael Jordan is playing the esports game now, leading a $26 million round of funding for the ownership group aXiomatic.

For Jordan and new co-investor Declaration Capital — the family office investing the personal wealth of David Rubenstein, who co-founded and serves as co-executive chairman of the multi-billion-dollar private equity firm, The Carlyle Group — investing in esports looks like a slam dunk.

The company announced the investment from Jordan, Declaration Capital and Curtis Polk, the managing partner and alternate governor of Hornets Sports & Entertainment, and manager of the financial and business affairs of Michael Jordan and his related companies, earlier today. Bloomberg reported the $26 million figure.

As owners of the TeamLiquid esports franchise, which Forbes estimates as the second most valuable gaming team in the industry, aXiomatic has a solid base in the budding world of esports — an increasingly lucrative market.

Indeed, the most successful esports company, Cloud9, just raised $53.6 million in a new round of funding, according to documents filed with the Securities and Exchange Commission.

“I’m excited to expand my sports equity portfolio through my investment in aXiomatic. Esports is a fast-growing, international industry and I’m glad to partner with this great group of investors,” said Jordan, in a statement.

Athletes and owners of professional sports teams have flooded into the esports industry, plunking down $20 million to own teams in the officially sanctioned Overwatch League and placing similar-sized and smaller bets on companies developing services for the esports ecosystem.

The Philadelphia 76ers were among the first NBA teams to dip their toe in the esports waters when they acquired Team Dignitas in a deal that was rumored to be worth up to $15 million at the time. Earlier this year, Dignitas brought home a world championship in RocketLeague for the Sixers.

Now, the Golden State Warriors, Cleveland Cavaliers and Houston Rockets are all backing esports teams in Riot Games’ League of Legends tournaments, according to a recent report in Bloomberg.

“The next generation of sports fans are esports fans,” said Ted Leonsis, co-executive chairman of aXiomatic and the founder, chairman, chief executive and majority owner of Monumental Sports & Entertainment (which owns the Washington Wizards, Capitals and the WNBA Mystics franchise), in a statement. “Esports is the fastest-growing sector in sports and entertainment, and aXiomatic is at the forefront of that growth. We are thrilled to welcome Michael and Declaration Capital to aXiomatic and look forward to working together on some truly cutting-edge opportunities.”

Powered by WPeMatico