Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Tizeti, the Nigerian internet service provider behind the brand Wifi.com.ng, has raised $3 million in a new round of funding as it expands its unlimited internet service into Ghana.

The new financing was led by 4DX Ventures, a new, Africa-focused fund that’s been deploying capital at an incredibly fast clip since its launch earlier this year. Its portfolio includes Sokowatch, a startup connecting local African retailers to international suppliers; the outsourced programmer placement and apprenticeship service, Andela; and the integrated pharmacy supplier and operator, mPharma.

For Walter Baddoo, one of 4DX Ventures co-founders and a new addition to the Tizeti board, the value in a company that operates as “the Comcast of Africa” was clear.

“If you take the efficiency of point to multipoint wireless technology and you add to that solar infrastructure, you leap-frog a generation of infrastructure. That makes getting cheap data to the hands of customers much easier,” Baddoo says.

Tizeti does exactly that. Using solar energy to power its wireless towers, the company provides residences, businesses, events and conferences with unlimited high-speed broadband internet access, which now covers more than 70 percent of Lagos. Since its launch from Y Combinator’s winter 2017 batch, the company has installed over 7,000 public Wi-Fi hotspots in Nigeria with 150,000 users.

Tizeti co-founders Ifeanyi Okonkwo and Kendall Ananyi

In November, the company partnered with Facebook to offer Express Wi-Fi and roll out hundreds of hotspots across the Nigerian capital of Abuja.

Now, with the new funding, Tizeti is expanding its operations outside of Nigeria, launching a new brand — Wifi.Africa — and pushing its service into Ghana.

“Tizeti was built to tackle poor internet connectivity not only in Nigeria, but on the continent as a whole, by developing a cost-effective solution from inception to delivery, for reliable and uncapped internet access for potentially millions of Africans,” said Kendall Ananyi, the co-founder and chief executive of Tizeti.

The company’s unlimited internet packages cost $30 per-month, a price it’s able to achieve through the use of cheap solar electricity to power its towers.

“Reducing the cost of data in Africa is a critical step in accelerating the pace of internet adoption across the continent,” Baddoo said in a statement. “Tizeti makes it easier and cheaper to connect Africa to the global digital economy and we are excited to partner with Kendall and his team on this mission.”

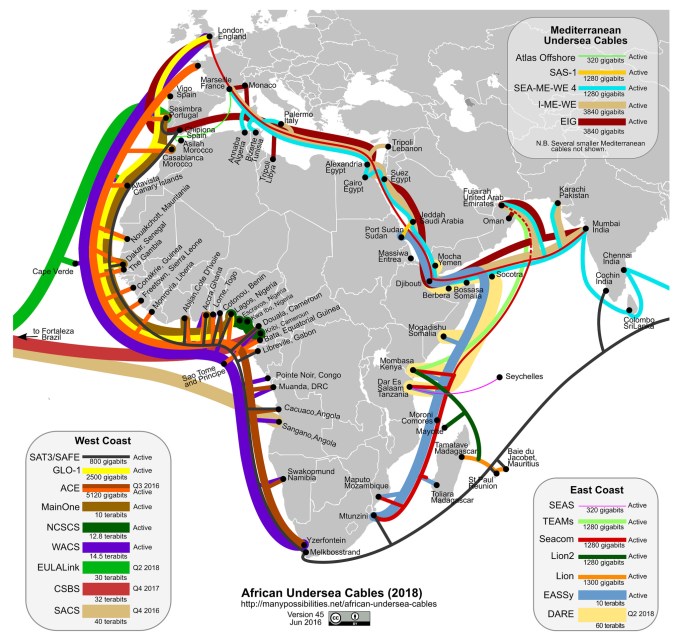

All of this is being powered by a network of new undersea cables stretching along the ocean floor that is bringing connectivity to the continent.

“There’s a ton of capacity going to 16 submarine cables [coming into Africa],” Ananyi told us back in 2017. “The problem is getting the internet to the customers. You have balloons and drones and that will work in the rural areas but it’s not effective in urban environments. We solve the internet problem in a dense area.”

It’s not a radical concept, and it’s one that has netted the company 3,000 subscribers already and nearly $1.2 million in annual recorded revenue in its first months of operations, Ananyi told us at the time.

“There are 1.2 billion people in Africa, but only 26 percent of them are online and most get internet over mobile phones,” says Ananyi. Perhaps only 6 percent of that population has an internet subscription, he said.

Photo courtesy of Flickr/Steve Song

Powered by WPeMatico

Rappi, the Colombian on-demand delivery startup, has brought in a new round of funding at a valuation north of $1 billion, as first reported by Axios and confirmed to TechCrunch by a source close to the company. DST Global has led the more than $200 million financing, with participation from Andreessen Horowitz and Sequoia — all of which were existing investors in the company.

Rappi kicked off its business delivering beverages and has since expanded into meals, groceries and even tech and medicine. You can, for example, have a pair of AirPods delivered to you using Rappi’s app. The company also has a popular cash withdrawal feature that allows users to pay with credit cards and then receive cash from one of Rappi’s delivery agents.

Rappi charges $1 per delivery. To help keep costs efficient, the company’s fleet of couriers use only motorcycles and bikes.

Simón Borrero, Sebastian Mejia and Felipe Villamarin launched the company in 2015, graduating from Y Combinator the following year. From there, Rappi quickly captured the attention of American venture capitalists. A16z’s initial investment in July 2016 was the Silicon Valley firm’s first investment in Latin America.

The new capital will likely be used to help Rappi compete with Uber Eats, which is active across Latin America.

The round for Rappi is notable for a Latin American company, as is its new unicorn status. Only one other Latin American startup, Nubank, has surpassed a billion-dollar valuation with new venture capital funding so far in 2018. São Paulo-based Nubank makes a no-fee credit card and is also backed by DST.

Investment in Latin American tech continues to reach new highs. In the first quarter of 2018, more than $600 million was invested. That followed a record 2017, which was the first time VCs funneled more than $1 billion into the continent’s tech ecosystem during a 12-month period.

The rise in investment is mostly due to sizable fundings for companies like Rappi and Nubank, as well as Brazil-based 99, which sold to fellow ride-hailing business Didi Chuxing in a deal worth $1 billion earlier this year.

Powered by WPeMatico

Venture capitalists are still hungry for food delivery startups.

Foodsby, the provider of a lunch delivery service based out of Minneapolis, has raised a $13.5 million Series B led by Piper Jaffray Merchant Banking. Greycroft Partners, Corazon Capital and Rally Ventures also participated. With the new capital, Foodsby plans to expand to 15 to 25 new markets. The round brings Foodsby’s total raised to $21 million.

“We have established a successful model for new market entry with a tried and true combination of talent and technology,” Foodsby founder and CEO Ben Cattoor said in a statement. “We look forward to building on our early successes and learnings to deliver continued growth for our investors and our team.”

Founded in 2012, the company connects employees in office buildings in 15 cities with local restaurants. How it works: A hungry worker uses Foodsby to pre-order a meal from a restaurant in its network, Foodsby aggregates all the orders it receives, sends the orders to the restaurants and the restaurants then make all the deliveries at once, streamlining what can be a logistically complicated process.

That strategy, the company says, sets Foodsby apart from competitors. Because Foodsby only works with businesses and has restaurants make the deliveries rather than its own fleet of delivery agents, the overall costs of the operation are lower. It’s free to join the Foodsby network as both a company that wants to provide the service to its employees and as a restaurant. Deliveries cost $1.99 per person.

While continued VC support may give the company a vote of confidence, the food delivery space is crowded and competitive. Foodsby is not unlike Peach, a Seattle-based office lunch delivery service that shed one-third of its staff in March. Peach had also landed VC support, raising about $11 million from Madrona and others. Munchery, another similar meal delivery service, also looks to be in hot water, laying off 30 percent of its workforce in May and ceasing operations in Los Angeles, Seattle and New York.

Food delivery startups are hit or miss, but VCs continue to flock to investment rounds in hopes of betting on the next Uber of food delivery — though Uber itself is really the Uber of food delivery, its food delivery service is reportedly the most profitable arm of the ride-hailing giant. And Uber, much like Amazon, is not a company you want to be going head-to-head with.

Powered by WPeMatico

Back in January, we told you about a young, Austin, Tex.-based startup that fights online disinformation for corporate customers. Turns out we weren’t alone in finding it interesting. The now four-year-old, 40-person outfit, New Knowledge, just sealed up $11 million in new funding led by the cross-border venture firm GGV Capital, with participation from Lux Capital. GGV had also participated in the company’s $1.9 million seed round.

We talked yesterday with co-founder and CEO Jonathon Morgan and the company’s director of research, Renee DiResta, to learn more about its work, which appears to be going well. (They say revenue has grown 1,000 percent over last year.) Our conversation, edited for length, follows.

TC: A lot of people associate coordinated manipulation by bad actors online with trying to disrupt elections here in the U.S. or with pro-government agendas elsewhere, but you’re working with companies that are also battling online propaganda. Who are some of them?

JM: Election interference is just the tip of the iceberg in terms of social media manipulation. Our customers are a little sensitive about being identified, but they are Fortune 100 companies in the entertainment industry, as well as consumer brands. We also have national security customers, though most of our business comes from the private sector.

TC: Renee, just a few weeks ago, you testified before the Senate Intelligence Committee about how social media platforms have enabled foreign-influence operations against the United States. What was that like?

RD: It was a great opportunity to educate the public on what happens and to speak directly to the senators about the need for government to be more proactive and to establish a deterrent strategy because [these disinformation campaigns] aren’t impacting just our elections but our society and American industry.

TC: How do companies typically get caught up in these similar practices?

JM: It’s pretty typical for consumer-facing brands, because they are so high-profile, to get involved in quasi-political conversations, whether or not they like it. Communities that know how to game the system will come after them over a pro-immigration stance for example. They mobilize and use the same black market social media content providers, the same tools and tactics that are used by Russia and Iran and other bad actors.

TC: In other words, this is about ideology, not financial gain.

JM: Where we see this more for financial gain is when it involves state intelligence agencies trying to undermine companies where they have nationalized an industry that competes with U.S. institutions like oil and gas and agriculture companies. You can see this is the promotion of anti-GMO narratives, for example. Agricultural tech in the U.S. is a big business, and on the fringes, there’s some debate about whether GMOs are safe to eat, even though the scientific community is clear that they’re completely safe.

Meanwhile, there are documented examples of groups aligned with Russian intelligence using purchased social media to circulate conspiracy theories and manipulate the public conversation about GMOs. They find a grain of truth in a scientific article, then misrepresent the findings through quasi-legitimate outlets, Facebook pages and Twitter accounts that are in turn amplified by social media automation.

TC: So you’re selling software-as-a-service that does what exactly?

JM: We have a SaaS product and a team of analysts who come out of the intelligence community and who help customers understand threats to their brand. It’s an AI-driven system that detects subtle social signs of manipulation across accounts. We then help the companies understand who is targeting them, why, and what they can do about it.

TC: Which is what?

JM: First, they can’t be blindsided. Many can’t tell the difference between real and manufactured public outcry, so they don’t even know about it when it’s happening. But there’s a pretty predictable set of tactics that are used to create false public perception. They plant a seed with accounts they control directly that can look quasi-legitimate. Then they amplify it via paid automation, and they target specific individuals who may have an interest in what they have to say. The thinking is that if they can manipulate these microinfluencers, they’ll amplify the message by sharing it with their followers. By then, you can’t put the cat back in the bag. You need to identify [these campaigns] when they’ve lit the match, but haven’t yet started a fire.

At the early stage, we can provide information to social media platforms to determine if what’s going on is acceptable within their policies. Longer term, we’re trying to find consensus between governments and also social media platforms themselves over what is and what isn’t acceptable — what’s aggressive conversation on these platforms and what’s out of bounds.

TC: How can you work with them when they can’t even decide on their own policies?

JM: First, different platforms are used for different reasons. You see peer-to-peer disinformation, where a small group of accounts drives a malicious narrative on Facebook, which can be problematic at the very local level. Twitter is the platform where media gets its pulse on what’s happening, so attacks launched on Twitter are much more likely to be made into mainstream opinion. There are also a lot of disinformation campaigns on Reddit, but those conversations are less likely to be elevated into a topic on CNN, even while they can shape the opinions of large numbers of avid users. Then there are the off-brand platforms like 4chan, where a lot of these campaigns are born. They are all susceptible in different ways.

The platforms have been very receptive. They take these campaigns much more seriously than when they first began looking at election integrity. But platforms are increasingly evolving from more open to more closed spaces, whether it’s WhatsApp groups or private Discord channels or private Facebook channels, and that’s making it harder for the platforms to observe. It’s also making it harder for outsiders who are interested in how these campaigns evolve.

Powered by WPeMatico

A fund affiliated with the Singaporean government has a great interest in making sure that American consumers are getting the tech support they need.

Temasek, the multi-billion-dollar investment fund associated with the government in Singapore, has led a $50 million round for Puls Technologies, Inc., a San Francisco-based company aiming to be the tech support for American homes and offices.

Current investors Sequoia Capital, Red Dot Capital Partners, Samsung NEXT and Viola Ventures all participated in the new financing, alongside additional new investors Hanaco Ventures and Hamilton Lane.

Founded only three years ago, Puls pitches a service that can match consumers with the appropriate technician in a little over an hour, any day of the week.

The company has built a network of 2,500 technicians in the top 50 cities in the United States, and will provide same-day installation and repair of over 200 products.

Some things the company’s technicians can service include smartphones, televisions, antennas, garage door openers and smart home devices like voice-activated speakers, video doorbells, keyless locks, AI cameras, thermostats and security systems.

It’s the full circle of consumer electronics crap.

“As consumers depend on electronic devices for every aspect of daily life, the world needs a new service model,” said Eyal Ronen, Puls co-founder and CEO, in a statement. “No one should have to drive across town and stand in line to speak to an expert, or wait hours at home for a local repair van to show up.”

With the new funding, the company said it’s poised to take a large chunk of the $50 billion in home automation services around the world. By the end of 2018, the company predicts there will be 11 billion connected devices globally (although that statistic likely includes connected equipment in factories and other technologies related to the Internet of Things that may not have a place in the home).

The company’s projections are also based on a forecast that predicts an average household will have 50 connected devices (to which I can only say… bless their hearts).

“We’re delighted to have Temasek leading this round,” said Ronen in a statement. “As investors in global online leaders, Temasek brings incredible expertise to our board. It’s a huge vote of confidence in our vision, team and execution, as we accelerate our direct-to-consumer business and expand strategic partnerships with big name retailers, insurance companies, and hardware OEMs.”

Puls raised a $25 million round last year as it completed its rebrand from the cell phone servicing business it had been running under the CellSavers brand.

Powered by WPeMatico

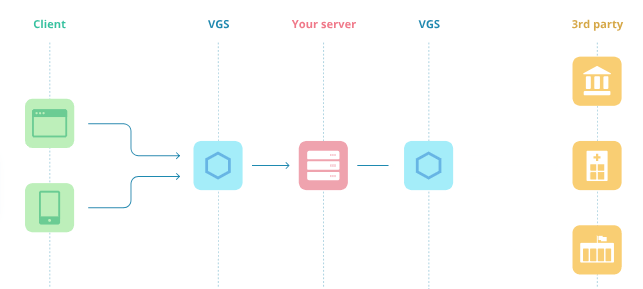

“You can’t hack what isn’t there,” Very Good Security co-founder Mahmoud Abdelkader tells me. His startup assumes the liability of storing sensitive data for other companies, substituting dummy credit card or Social Security numbers for the real ones. Then when the data needs to be moved or operated on, VGS injects the original info without clients having to change their code.

It’s essentially a data bank that allows businesses to stop storing confidential info under their unsecured mattress. Or you could think of it as Amazon Web Services for data instead of servers. Given all the high-profile breaches of late, it’s clear that many companies can’t be trusted to house sensitive data. Andreessen Horowitz is betting that they’d rather leave it to an expert.

That’s why the famous venture firm is leading an $8.5 million Series A for VGS, and its partner Alex Rampell is joining the board. The round also includes NYCA, Vertex Ventures, Slow Ventures and PayPal mafioso Max Levchin. The cash builds on VGS’ $1.4 million seed round, and will pay for its first big marketing initiative and more salespeople.

“Hey! Stop doing this yourself!,” Abdelkader asserts. “Put it on VGS and we’ll let you operate on your data as if you possess it with none of the liability.” While no data is ever 100 percent unhackable, putting it in VGS’ meticulously secured vaults means clients don’t have to become security geniuses themselves and instead can focus on what’s unique to their business.

“Privacy is a part of the UN Declaration of Human Rights. We should be able to build innovative applications without sacrificing our privacy and security,” says Abdelkader. He got his start in the industry by reverse-engineering games like StarCraft to build cheats and trainer software. But after studying discrete mathematics, cryptology and number theory, he craved a headier challenge.

Abdelkader co-founded Y Combinator-backed payment system Balanced in 2010, which also raised cash from Andreessen. But out-muscled by Stripe, Balanced shut down in 2015. While transitioning customers over to fellow YC alumni Stripe, Balanced received interest from other companies wanting it to store their data so they could be PCI-compliant.

Very Good Security co-founder and CEO Mahmoud Abdelkader

Now Abdelkader and his VP from Balanced, Marshall Jones, have returned with VGS to sell that as a service. It’s targeting startups that handle data like payment card information, Social Security numbers and medical info, though eventually it could invade the larger enterprise market. It can quickly help these clients achieve compliance certifications for PCI, SOC2, EI3PA, HIPAA and other standards.

VGS’ innovation comes in replacing this data with “format preserving aliases” that are privacy safe. “Your app code doesn’t know the difference between this and actually sensitive data,” Abdelkader explains. In 30 minutes of integration, apps can be reworked to route traffic through VGS without ever talking to a salesperson. VGS locks up the real strings and sends the aliases to you instead, then intercepts those aliases and swaps them with the originals when necessary.

“We don’t actually see your data that you vault on VGS,” Abdelkader tells me. “It’s basically modeled after prison. The valuables are stored in isolation.” That means a business’ differentiator is their business logic, not the way they store data.

For example, fintech startup LendUp works with VGS to issue virtual credit card numbers that are replaced with fake numbers in LendUp’s databases. That way if it’s hacked, users’ don’t get their cards stolen. But when those card numbers are sent to a processor to actually make a payment, the real card numbers are subbed in last-minute.

VGS charges per data record and operation, with the first 500 records and 100,000 sensitive API calls free; $20 a month gets clients double that, and then they pay 4 cent per record and 2 cents per operation. VGS provides access to insurance too, working with a variety of underwriters. It starts with $1 million policies that can be much larger for Fortune 500s and other big companies, which might want $20 million per incident.

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Obviously, VGS has to be obsessive about its own security. A breach of its vaults could kill its brand. “I don’t sleep. I worry I’ll miss something. Are we a giant honey pot?,” Abdelkader wonders. “We’ve invested a significant amount of our money into 24/7 monitoring for intrusions.”

Beyond the threat of hackers, VGS also has to battle with others picking away at part of its stack or trying to compete with the whole, like TokenEx, HP’s Voltage, Thales’ Vormetric, Oracle and more. But it’s do-it-yourself security that’s the status quo and what VGS is really trying to disrupt.

But VGS has a big accruing advantage. Each time it works with a clients’ partners like Experian or TransUnion for a company working with credit checks, it already has a relationship with them the next time another clients has to connect with these partners. Abdelkader hopes that, “Effectively, we become a standard of data security and privacy. All the institutions will just say ‘why don’t you use VGS?’”

That standard only works if it’s constantly evolving to win the cat-and-mouse game versus attackers. While a company is worrying about the particular value it adds to the world, these intelligent human adversaries can find a weak link in their security — costing them a fortune and ruining their relationships. “I’m selling trust,” Abdelkader concludes. That peace of mind is often worth the price.

Powered by WPeMatico

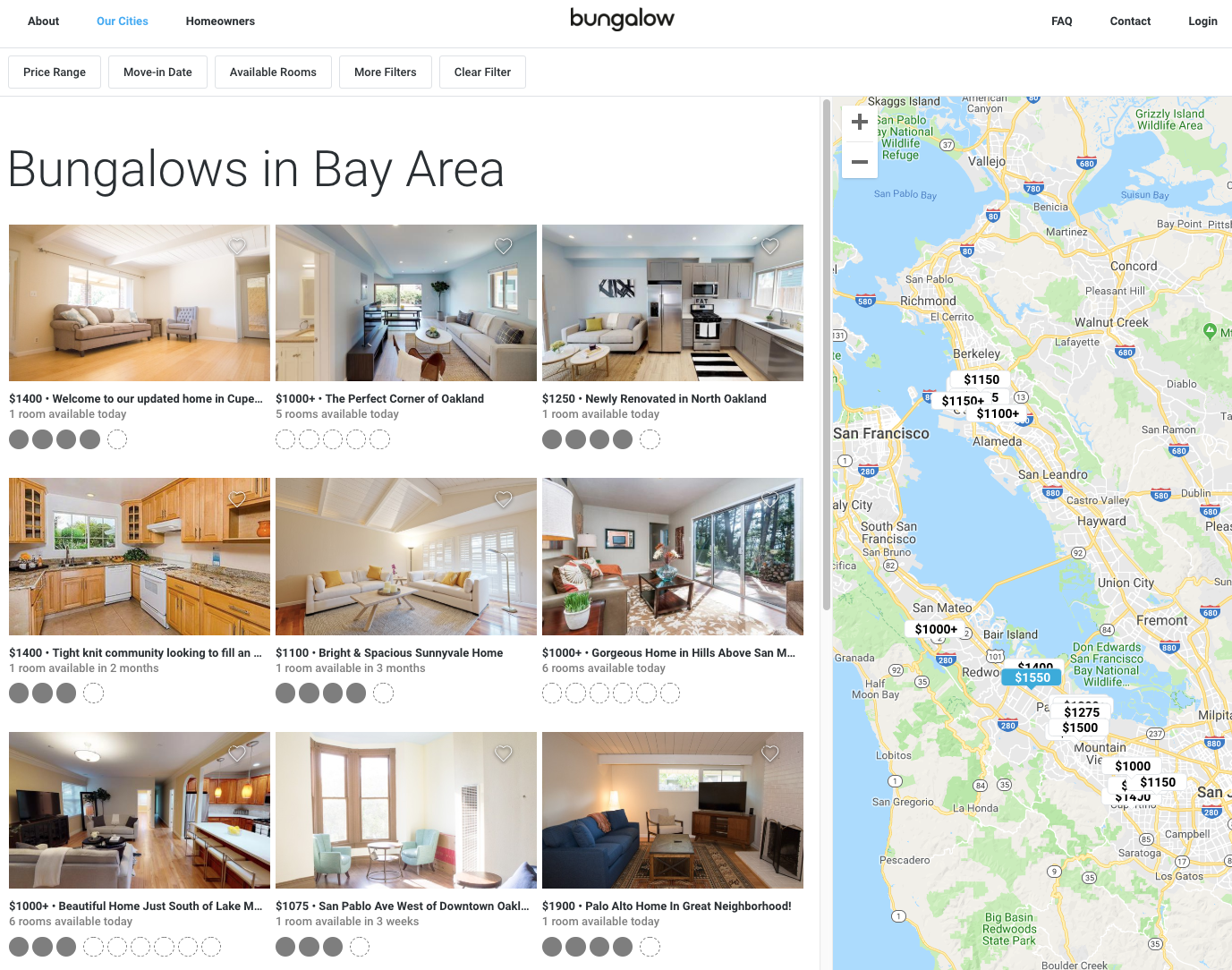

Moving to a new city can be tough for a number of reasons, but what’s arguably hardest about moving is a competitive and expensive housing market, and lack of a pre-existing social support network. That’s the problem startup Bungalow is trying to solve.

Bungalow, which just raised a $14 million Series A round led by Khosla Ventures with participation from Founders Fund, Atomic VC, Cherubic Ventures and Wing Ventures, offers people relatively affordable places to live with others who have been vetted by Bungalow’s platform. As part of the round, Keith Rabois of Khosla will join Bungalow’s board of directors. Bungalow also raised a $50 million debt facility to fuel its home growth costs. Bungalow had previously raised a $7 million seed round.

Bungalow, which joins the likes of WeLive, OpenDoor, Common, Roam and so many others, aims to be cheaper than getting your own studio or one-bedroom apartment, and offer a better experience than finding a roommate via Craigslist. Bungalow works with homeowners to lease their homes as the master tenant for three years at time. From there, Bungalow rents out the property on a room-by-room basis while guaranteeing occupancy to the homeowners.

“There aren’t as many families that are looking for these four, five, six-bedroom homes and so the incremental additional cost for those additional bedrooms is not commensurate with the individual rate at which we can lease out those individual bedrooms,” Bungalow co-founder and CEO Andrew Collins told me. “And so we were able to therefore basically create value out of that and then with scale that margin that we’re able to create within those given homes in an incredibly profitable and exciting coupling.”

For the renter, Bungalow says it’s about 30-40 percent cheaper than a studio. Depending on the market, of course, the prices can vary. Bungalow also furnishes shared common spaces, provides utilities, Wi-Fi and housekeeping in the monthly rental cost. In addition to what’s provided inside the space, Bungalow hosts monthly events for members in its properties to meet each other within a given market.

Bungalow currently operates 200 properties across seven markets, including the San Francisco Bay Area, Los Angeles, New York City, Portland, San Diego, Seattle and Washington, D.C. In total, there are 750 people residing in a Bungalow-leased property. All residents first must go through credit and background checks, as well as interviews with any existing residents before moving in. But that process can happen very fast, the company said. Some people have moved in same-day, but on average people look about 10 to 20 days ahead of when they’re trying to move.

While Bungalow’s current model is leasing assets from homeowners, it’s set up to operate any type of asset, Collins said, whether that’s a joint-venture or independently owned by Bungalow. Within the next six to 12 months, Bungalow is looking to launch in up to 12 new markets in the U.S. Next year, Bungalow hopes to expand its offering outside of the U.S.

Powered by WPeMatico

Autonomous vehicles need more than a brain to operate safely in a world filled with obstacles. They need maps. Or more specifically, self-driving vehicles need maps that constantly refresh and can deliver important information — like that sudden lane closure due to construction or a double-parked vehicle — so they can take the safest and most efficient route possible.

This specific need has provided an opening for startups in what once looked like a locked-up mapping market dominated by a few giants.

Carmera, a New York-based mapping and data analytics startup, is one of them. The company, which came out of stealth two years ago, has now raised $20 million in a Series B funding round led by GV, formerly known as Google Ventures. Carmera previously raised $6.5 million.

The company announced the funding raise Thursday along with a few other updates, including a new feature on its autonomous mapping product and a partnership with New York City. The capital will be used to hire more talent and expand.

“We’ll be doing the most aggressive hiring we’ve ever done this next year,” Carmera co-founder and CEO Ro Gupta told TechCrunch, adding that the company will mostly focus on building out its New York and Seattle offices. Carmera, which has about 25 employees, plans to have more than 50 by the end of next year.

“The money also allows us to be more prospective than simply reacting to customer needs,” Gupta added.

In other words, Carmera can move into new markets where it suspects there will be a need in the future, not just wait for a call from their customers. One of those customers is Voyage, the autonomous driving startup that currently operates self-driving cars in retirement communities.

Carmera has an interesting business model, and one that’s likely attractive to investors looking for startups with a present-day revenue stream. The company describes itself as a street intelligence platform for autonomy. Its main product is the Carmera autonomous map, a high-definition map for autonomous vehicle customers like automakers, suppliers and robotaxis.

The twist here is that the company uses data gleaned from its other product — a fleet-monitoring service used by commercial customers with vehicles driven by humans — to keep those AV maps fresh. The fleet product is a telematics and video monitoring service used by professional fleets that want to manage risk with their vehicles and drivers.

These fleets of camera-equipped human-driven vehicles deliver new information to the autonomous map as they go about their daily business in cities. Carmera calls this a “pro-sourcing” swarm.

The startup has now added a real-time events and change-management engine to its autonomous map that Gupta contends is a major leap forward because it not only provides more detailed information to self-driving vehicles, it gives these driverless vehicles a suggested path.

In some mapping products, there’s generally a base map and then a dynamic overlay. The problem, Gupta explains, is that when things change, like a lane closure, the dynamic map only flags it, leaving it up to the vehicle to figure out what to do next.

“That works fine when humans are driving, it just doesn’t go far enough for AVs,” Gupta said. “What they need to know is how do I path plan around it?”

Carmera’s real-time events and change-management feature

The map will detect a change in milliseconds, classify it within seconds and then validate and redraw the base map within minutes, according to Carmera. The company is giving companies deploying autonomous vehicles API access to this data at every stage.

Carmera also has a “site intelligence product,” a jargon term that means the company provides spatial data and street analytics (like how pedestrians move within a particular intersection) to urban planners.

Carmera announced Thursday it will begin sharing data such as historical pedestrian analytics and real-time construction detection with New York City’s Department of Transportation. Carmera will get access to key city data sets in return. The partnership with NYC DOT follows an earlier-data sharing initiative with the Downtown Brooklyn Partnership.

Powered by WPeMatico

The vast majority of environmental experts say that avoiding meat and dairy is the single most important, and most impactful action, you can take to reduce your personal impact on Earth. Why? Because of the sheer amount of carbon pumped into the atmosphere from the process of meat production. Many would agree it’s also pretty good for your health. But when most of us have been brought up with animal protein in the middle of our plates, it often feels pretty hard to achieve. At the same time, fast food delivery has been taking off, but we’re still eating the same thing: meat.

So a Danish startup has come along to try to solve this. Simple Feast delivers sustainable food to people’s homes in biodegradable boxes, and it’s now raised a $12 million series A funding round led by Balderton Capital in London, with participation from 14W in New York. Existing investors Sweet Capital and ByFounders are also re-investing the round.

Simple Feast offers what it describes as ready-to-eat plant-based food that is “sustainably produced, organic, and delivered straight to the doorstep” in biodegradable boxes every week. The meal solution delivers weekly boxes with three prepared plant-based and 100 percent organic meals ready to serve in 10 minutes.

In this respect it’s not unlike other startups, such as HelloFresh, with the main difference being that all the food is plant-based.

Jakob Jønck, CEO and co-founder of Simple Feast, says: “Climate change is real. There is no Planet B and we are facing what is arguably the biggest challenge in human history. This is a big investment for a small company, but it’s a drop in the ocean considering the challenge at hand, the politicians and industries we are up against.”

He and Thomas Ambus, co-founder/CTO, started thinking more deeply about Simple Feast when Under Armour acquired Endomondo and MyFitnessPal, their previous startups, in the spring of 2015 and got serious about it in 2016. “Ever since founding Endomondo and heading up International Operations for MyFitnessPal, I always felt a missing link when trying to move towards a healthy, sustainable diet — an actual product that didn’t compromise on taste, nor convenience, but solved the huge challenges involved with embarking on this journey towards eating plants first and foremost,” says Jønck.

Daniel Waterhouse, a partner at Balderton Capital, says: “With a global transition towards plant-based food, we believe Simple Feast is uniquely positioned to change the way we eat and create awareness about the impact of our food choices.”

The main target is families, with the parents in their 30s and 40s. “We find that women are still predominantly the decision maker when it comes to food for the family. Our most typical customers are women in a relationship in their 30s with one or two kids. Our customers are also politically interested, above the average,” says Jønck.

They are competing with restaurants, meal kits and take-away. “We are disrupting both the restaurant and the meal kit industry. Nobody has ever taken the challenge of creating climate-friendly, plant-based food seriously while serving it directly to consumers. We don´t make compromises on taste, nor convenience, and we don´t believe that we have seen that before,” he told me.

Powered by WPeMatico

The Sill, a startup that sells potted plants online and in physical stores, announced this weekend that it has raised $5 million in Series A funding led by Raine Ventures.

The company was founded in 2012 and has now raised a total of $7.5 million. It was bootstrapped until last year, when it raised seed funding from Brand Foundry Ventures, Halogen Ventures, BBG Ventures, Tuesday Capital, Blueseed and The Chernin Group. (BBG Ventures is backed by TechCrunch’s parent company Oath.)

That seems like a long time for a startup to go without outside funding, and indeed, CEO Eliza Blank acknowledged that she “probably waited too long to go out and raise.” Still, she said those first few years also gave her time to find the right business model (like focusing “exclusively on the direct-to-consumer business,” rather than selling to offices as well).

And while it’s easy to group The Sill among all the startups using the internet to build a consumer business around a traditional category of retail, Blank said her vision is bigger than “just putting plants online and being another direct-to-consumer brand.”

After all, there are plenty of people (myself included) who are interested in owning plants but don’t really know how to care for them properly. And our casual interest level probably isn’t going to get us to the local horticultural society to learn more.

Blank said she founded the company in response to her own experience wanting to buy plants, and realizing how limited the resources were for learning “how to approach the category as a newbie.”

So The Sill doesn’t just sell you a plant (along with basic care instructions). It also allows you to ask questions of the company’s plant experts — and with the opening of its first brick-and-mortar stores in New York City, it also offers weekly workshops.

“We have a much longer relationship than a typical transaction business,” Blank said. “Making the purchase is almost like the start — or maybe the middle — of a conversation.”

The company says it sold more than 75,000 products in the last six months, with sales up 500 percent year-over-year, and anticipated revenue for the year of more than $10 million.

Powered by WPeMatico