Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Real estate platform Nestio is getting new funding as it continues to expand its footprint beyond New York City into other large U.S. markets. The startup’s software gives real estate owners and managers a hub to handle things like leasing and marketing.

The round, which they announced today, was led by Camber Creek and Trinity Ventures, with participation from other real estate firms, including Rudin Ventures, Currency M, The Durst Organization, LeFrak Ventures and Torch Venture Capital. The startup has raised around $16 million to date.

Nestio is building up its unit count in new markets, including Boston, Chicago, Houston and Dallas, and is seeking to expand operations with existing customers in NYC. The startup says that it’s grown the amount of units on its platform by 250 percent in the past 12 months.

“We now have hundreds of thousands of listings on the platform that people are now managing,” Nestio CEO Caren Maio told TechCrunch. “Part of that growth is net new logos, but also expansion. So we’ve seen a lot of growth — particularly in New York — although I think the same behavior will replicate itself once we have some longevity in some of those other cities.”

The company says they will use this new capital and strategic partnerships to “deliver advanced leasing and marketing solutions even faster.”

Powered by WPeMatico

As consumers become more discerning about the food they are eating, a wave of startups has emerged that are catering to that demand with convenient alternatives to the more ubiquitous options that are available today. One of these, GrubMarket — which sources organic and healthy food directly from producers and then delivers it to other businesses (Whole Foods is a customer) as well as consumers at a discount of 20-60 percent over other channels — is today announcing a $32 million round to grow its already profitable business, including making acquisitions and expanding on its own steam as it eyes a public listing.

“We are looking to buy companies to make more revenues ahead of an upcoming IPO,” said Mike Xu, the founder and CEO. He said GrubMarket is “in proactive steps” to expand from its home base in California to the East Coast, starting in New York and New Jersey, by October this year. The plan, he said, will be to file with the SEC sometime between the end of this year and early 2019, with the IPO taking place in the second half of 2019.

E-commerce, and in particular food-related businesses with perishable items and associated waste, can be tricky when it comes to margins, and indeed, there have been many casualties in the world of food startups. Xu said in an interview that GrubMarket is already profitable and working at a $100 million run rate.

One of the reasons it’s profitable may also be the same reason you may have never heard of GrubMarket. Currently, between 60 and 70 percent of its business is in the B2B space. Xu says that customers number in the thousands and include offices, grocery stores and restaurants across the San Francisco Bay Area, Los Angeles, Orange County and San Diego.

And so, if you don’t know GrubMarket, you might know some of its customers, which include all WeWorks between San Diego and San Francisco, Whole Foods, Blue Apron, Hello Fresh and Chipotle. GrubMarket has also cornered some very specific niches: It has become the biggest mushroom supplier in all of Northern California, and it’s the biggest supplier of Hawaiian farm produce in the Bay Area.

Another point in the company’s favor is the technology it uses. Working directly with farmers and other producers, GrubMarket has built apps that allow it and its partners to manage the logistics of the business in an efficient way. The idea will be to bring more AI to the platform over time: for example, to be able to run better modelling to figure out how much fruit and veg might sell during a given season, and how to price items.

GrubMarket also is dabbling in areas that you might not normally associate with a grocery-on-demand delivery company: it built an educational app called Farmbox, which — when you play it — can be used to collect points to spend on GrubMarket; and it’s also exploring how blockchain technology can be used in a “next-generation open platform for direct farm-to-table.”

Xu says that as the company continues to grow, it will shift more into direct-to-consumer deliveries to complement its wholesale business.

This latest round is a mixture of equity and debt and is being led by GGV with other previous investors Fusion Fund (formerly New Gen Capital) and Great Oaks Venture Capital participating, along with new investors Max Ventures, Castor Ventures, Bascom Ventures, Millennium Technology Value Partner, Trinity Capital Investment, Investwide Capital and others. The company is not publicly disclosing its valuation; it has raised around $64 million to date.

Many eyes are on Amazon these days, and what moves it might make next in groceries after acquiring Whole Foods, ramping up its own Pantry offerings, courting restaurants for delivery and making its own meal kits. This is not a question that keeps up Xu at night, however.

“Food is the largest and biggest opportunity in e-commerce,” he said, estimating that today the total value for the global food and agricultural industry is around $9 trillion (versus $8 trillion in 2017), with only about one percent of buying done online. “That’s a big enough opportunity to have a few giant companies, and not just Amazon.”

It’s also an opportunity that could sustain some slightly smaller companies, too: One of my favorite e-commerce businesses in England is a service that I’ve been using for years, an organic grocery delivery called Abel & Cole that brings us a box of organic fruit and vegetables (and whatever else I order on top of that) each week. Like GrubMarket, it’s working directly with smaller producers who might have otherwise found it hard-going to find a way of selling their produce directly to buyers (and buyers would have found it hard-going to ever buy directly from these producers). Unlike GrubMarket, it takes a more modest approach that doesn’t involve eventually becoming a leviathan itself. May they all be around for years to come.

Powered by WPeMatico

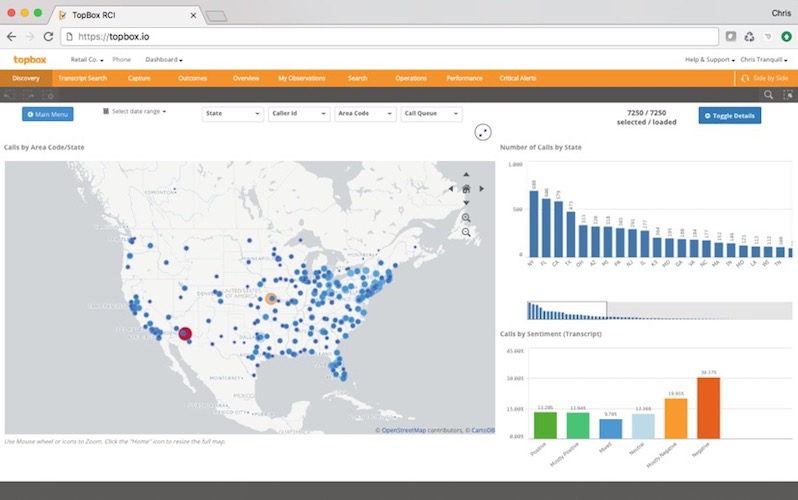

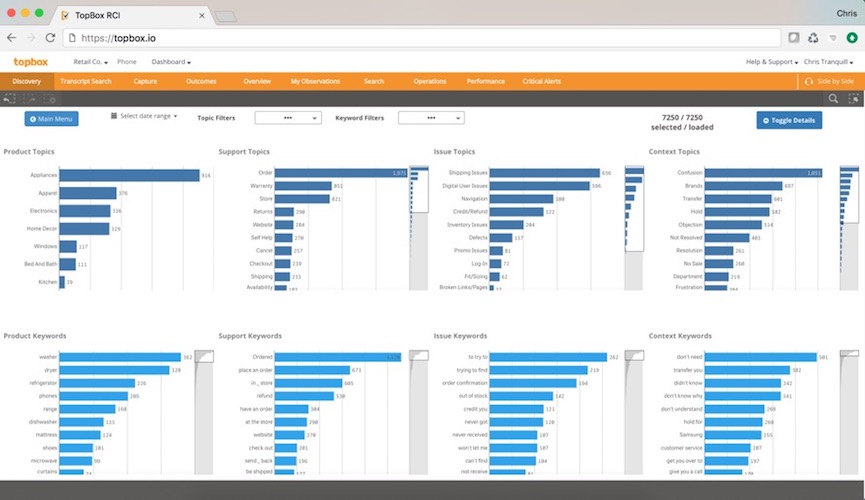

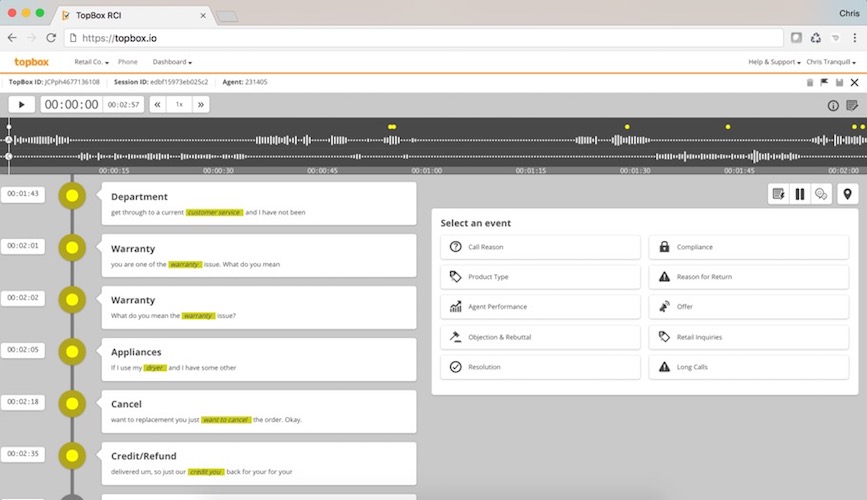

Topbox helps businesses understand how their customers experience their products and where they run into issues by analyzing voice and text chats to surveys, social media posts and online reviews. Today, the company announced it has raised a $5 million funding round led by Telescope Partners, with participation from Cascade Angels, Flyover Capital and the Maryland Venture Fund.

Topbox CEO Chris Tranquill told me he first experienced the problem he’s trying to solve when he was running call centers with thousands of agents. All of the companies that contracted his services faced the same problem: understanding the friction points their customers were experiencing.

“We always had this vision that being able to really understand those friction points with deep context — that’s what the key is — but really getting to that granular level of detail so that you can have that context to support a decision,” Tranquill said. Say you want to understand what issues customers are having with a new shoe. Ideally, Topbox will aggregate all of the data across all channels about that shoe and help the company understand who the wearers are and what issues they are experiencing.

Theoretically, companies could do this on their own, but all of this data exists in various silos and combining those disparate data sets is a major challenge. Topbox uses its technology to ingest this data (and it’s pretty agnostic about where it comes from) and then runs it through its classification models. Indeed, as Tranquill told me, it’s this model that’s the secret sauce behind the company’s ability to classify data.

It’s not just about getting a high-level overview of your customer’s reactions, though. Tranquill stressed that users can go deeper. “The big thing for us is granularity,” he told me. “I can find high-level data all day long, but can I find the root cause?” With a few clicks, any Topbox user should be able to understand what issues their customers are facing, no matter whether that’s a product issue, a shipping problem or something else.

Current Topbox customers include the likes of Orvis, Bed Bath & Beyond and Western Union. With this new round, Topbox expects to build out its go-to-market strategy and continue to develop its product. Currently, the company focuses on a number of verticals where its model works best (retailers, mobile telcos, cable and broadband providers and healthcare companies), and Tranquill tells me this is where it will focus its energy for now. The company will also soon launch a new user interface and bring on more machine learning experts as it looks to provide its users deeper insights into their data.

Powered by WPeMatico

Felicity Conrad and Kristen Sonday were on very different paths until three years ago. Conrad was an associate at the powerhouse law firm Skadden Arps. Meanwhile, Sonday, a Princeton grad and the first person in her family to go to college, was reflecting on the several years she’d spent with the U.S. Department of Justice in Mexico City, working to extradite fugitives.

As it happens, both were coming to similar conclusions about the U.S. legal system, including that it’s especially challenging for people who don’t speak English. For Conrad, an opportunity to litigate a pro bono asylum case would set her on a path of wanting to do more for people fleeing persecution from their own countries. For Sonday, the experience of working with foreign governments had a similar impact.

Perhaps it’s no wonder that soon after they were introduced by a mutual friend, they decided to create Paladin, a New York-based SaaS business that today helps legal teams sign up for pro bono opportunities, enables coordinators to track the lawyers’ work, and which captures some of the stories and impact that the lawyers are making through their efforts. This last piece is particularly important, as the software helps legal departments see the return on investment for their attorneys’ donated time.

The company’s offering is timely, including for legal departments like that of Verizon, which has 900 attorneys and a global pro bono program that it uses Paladin to help manage. (Verizon owns AOL, which owns TechCrunch.) Lyft, a newer client, has a 50-person legal department and recently launched its own pro bono team.

Given how quickly immigration and other policies are being changed under the Trump administration and uneven guidance from Attorney General Jeff Sessions, the need for legal help is growing by the day.

For example, Lyft — which is among a long line of tech companies to speak out in support of immigrants’ rights — is committing some of its lawyers to reuniting families that have been separated at the southern U.S. border, says Conrad.

One question is how scalable Paladin’s offering is. The biggest challenge for the outfit right now would seem to be that few corporate lawyers do the kind of pro bono work that’s often most needed but involves litigation matters outside the scope of what they practice, including around immigration laws, social security benefits and criminal and domestic abuse matters.

Sonday says Paladin has the solution to that, explaining that the seven-person company has raised $1.1 million from investors — Mark Cuban, Hyde Park Ventures, Backstage Capital, R2 Ventures, MergeLane and Chaac Ventures, among them — toward that end.

What it plans to build, exactly: infrastructure that connects organizations on the ground with legal services and law firms all over the world, no matter their size. Basically, it will begin acting as a matchmaker for legal departments, helping lawyers find the pro bono work about which they feel most passionately.

Ultimately, Conrad and Sonday are betting that anything that makes the process of finding pro bono work a lot easier than it is today will increase the numbers of attorneys who give back to society. They also think that when law firms can better track the impact their employees are making, we’ll see more, and bigger, pro bono programs.

Says Sonday, “Right now, just 10 to 20 percent of law firms have someone in-house to manage that pro bono work. If we can help the other 80 to 90 percent of lawyers” connect with the people who need them most — and who they feel good about helping — it’s a win-win all around.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week we were back in the studio with Connie Loizos and myself hanging out with Jai Das, a managing director at Sapphire Ventures. Our beloved Matthew Lynley was off this week, but he’ll be back for the next episode.

This week we had an excellent list of things to get to, first of which was Lyft’s latest shopping run. This time Lyft accreted to itself Motivate, a bike-sharing company that operates various programs in cities like New York City and San Francisco.

The context for the transaction is threefold. First, Lyft just raised a bundle of money for effectively diddly dilution. Second, Uber bought Jump and there is no FOMO in the market today like ridesharing FOMO. And third, scooters now lurk in the background of any and every ridesharing conversation, so the big shops are on a bit of defense.

The sum is that Uber and Lyft now own bike companies, which feels a bit 2017.

But moving along Unicorn Row we quickly found ourselves at the door of Airbnb, which is prepping for a 2019-2020 IPO and a change to its personnel comp cadence, the latter due to its age and a market trend that Das noted concerned employee comp and shareholder dilution.

In other news, Airbnb needs a CFO, so if you are in the market, that’s who to call.

Next up was Automation Anywhere’s epic $250 million Series A, which brought the software process-automation company to a valuation of $1.8 billion. The firm helps companies execute repetitive software tasks at a fraction of the cost of having humans click the buttons.

And we wrapped with Juul, everyone’s favorite e-cigarette company that has simply beautiful financials. Whether it’s ethical is something that we spent a moment talking about.

So fire up your vape or just hit play and we’ll be right back in seven days.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Planck Re, a startup that wants to simplify insurance underwriting with artificial intelligence, announced today that it has raised a $12 million Series A. The funding was led by Arbor Ventures, with participation from Viola FinTech and Eight Roads. Co-founder and CEO Elad Tsur tells TechCrunch that the capital will be used to expand Planck Re’s product line into more segments, including retail, contractors, IT and manufacturing, and grow its research and development team in Israel and North American sales team.

The Tel Aviv and New York-based startup plans to focus first on its business in the United States, where it has already launched pilot programs with several insurance carriers. Tsur says that Planck Re’s clients generally use it to help underwrite insurance for small to medium-sized businesses, including business owner policies, which cover property and liability risks, and workers’ compensation.

Founded in 2016 by Tsur, Amir Cohen and David Schapiro, Planck Re poses its technology as a more efficient and accurate alternative to the lengthy risk assessment questionnaire insurers ask clients to fill out. Its platform crawls the internet for publicly available data, including images, text, videos, social media profiles and public records, to build profiles of SMBs seeking insurance coverage. Then it analyzes that data to help carriers figure out their potential risk.

Before launching Planck Re, Tsur and Cohen founded Bluetail, a data mining startup that was acquired by Salesforce in 2012, where it served as the base technology for Salesforce Einstein. Schapiro was previously CEO of financial analytics company Earnix.

There are already a handful of startups, including SoftBank-backed Lemonade, Trōv, Cover, Hippo and Swyfft, that use algorithms to make picking and buying insurance policies easier for consumers, but AI-based underwriting is still a nascent category. One example is Flyreel, which focuses on underwriting property insurance and recently signed a deal with Microsoft to accelerate its go-to-market strategy.

Tsur says Planck Re is developing more dedicated algorithms to meet the evolving needs of insurance providers. For example, many underwriters now want to know if clients in photography use aerial imaging equipment, so Planck Re’s imaging process capabilities automatically check images for that information.

He adds that being able to automate underwriting enables carriers to find new distribution channels, including allowing customers to apply for insurance online without needing to fill out any forms. Planck Re also continues to monitor and underwrite policies, which means if a customer’s risk profile changes, insurers can react quickly.

In a statement, Arbor Ventures vice president and head of Israel Lior Simon said, “We are excited to partner with Planck Re and the driven, entrepreneurial team. Insurance companies are thirsty for actionable data, to assess risk, gain real time insights and enhance customer understanding. Planck Re aims to empower them through a streamlined digital approach, which we believe will truly alter the insurance industry.”

Powered by WPeMatico

Airwallex, a three-year-old fintech startup focused on international payments for SMEs and businesses, is putting itself on the map after it raised an $80 million Series B round.

Based out of Melbourne, but with six offices in Asia and other parts of the world, Airwallex’s new funding round is the second-largest financing deal for an Australian startup in history. The round was led by existing investors Tencent, the $500 billion Chinese internet giant, and Sequoia China. Other participants included China’s Hillhouse, Horizons Ventures — the fund from Hong Kong’s richest man, Li Ka-Shing — Indonesia-based Central Capital Ventura (BCA) and Australia’s Square Peg, a firm from Paul Bassat, who took recruitment firm Seek to IPO and is one of Australia’s highest-profile founders.

The financing takes Airwallex to $102 million raised. Tencent led a $13 million Series A in May 2017, while Square Peg added $6 million more via a Series A+ in December. Mastercard is also a backer; the finance giant uses Airwallex to handle its “Send” product, while Tencent uses the service to power an overseas remittance service for its WeChat app.

Airwallex handles cross-border transactions for companies that do business in multiple countries using international currencies. So it’s not unlike a TransferWise-style service for SMEs that lack the capital to develop a sophisticated (and expensive) international banking system of their own.

The service uses wholesale FX rates to route overseas payments back to a client’s domestic bank and is capable of processing “thousands of transactions per second,” according to the company. A use case example might include helping a China-based seller return money earned in the U.S. or Europe via Amazon or other e-commerce services, or route sales revenue back directly from their own website.

Airwallex CEO Jack Zhang (far right) onstage at TechCrunch Shenzhen in 2017

China is a key market for Airwallex — which was started by four Australian-Chinese founders — as well as the wider Asian region, and in particular Australia, Hong Kong and Southeast Asia. With this new capital, Airwallex co-founder and CEO Jack Zhang said the company will increase its focus on Hong Kong and Southeast Asia, whilst also extending its business in Europe (where it has a London-based office) and pushing into North America.

Product R&D is shared across Melbourne and Shanghai, while Hong Kong accounts for business development, compliance and more, Zhang explained. However, Airwallex’s locations in London and San Francisco are likely to account for most of the upcoming headcount growth planned following this funding. Right now, Airwallex has around 100 staff, according to Zhang.

The company is also aiming to expand its product range.

The firm is in the process of applying for a virtual banking license in Hong Kong, a third-party payment license in mainland China and a cross-border Chinese yuan license. One goal, Zhang revealed, is to offer working capital loans to SMEs to help them scale their businesses to the next level. Airwallex is working with an undisclosed partner to underwrite deals in the future. Zhang explained that the company sees a gap in the market since banks don’t have access to critical data on clients for loan assessments.

More generally, he’s bullish for the future, despite Brexit and the ongoing trade war between the U.S. and China.

“The trade war gives the Chinese yuan a lot of vitality, and we’ve seen more demand in the market. China’s belt road initiative has really taken off, too, and we’re seeing the impact in many, many of our payment corridors,” he explained. “Business has been booming, especially as traditional offline SMEs start to move online and go from domestic to global.”

“We want to be the backbone to support these new opportunities for businesses,” Zhang added.

Powered by WPeMatico

Cashify, a company that buys and sells used smartphones, is the latest India startup to raise capital from Chinese investors after it announced a $12 million Series C round.

Chinese funds CDH Investments and Morningside led the round, which included participation from Aihuishou, a China-based startup that sells used electronics in a similar way to Cashify and has raised more than $120 million. Existing investors, including Bessemer Ventures and Shunwei, also took part in the round.

This new capital takes Cashify to $19 million raised to date.

The business was started in 2013 by co-founders Mandeep Manocha (CEO), Nakul Kumar (COO) and Amit Sethi (CTO) initially as ReGlobe. The business gives consumers a fast way to sell their existing electronics; it deals mainly in smartphones but also takes laptops, consoles, TVs and tablets.

“When we began we saw a lot of transaction for phone sales moving from offline to online,” Manocha told TechCrunch in an interview. “But consumer-to-consumer [for used devices] is highly opaque on price discovery and you never know if you’re making the right decision on price and whether the transaction will take place in the timeframe.”

These days, the company estimates that the average upgrade cycle has shifted from 20 months to 12 months, and now it is doubling down.

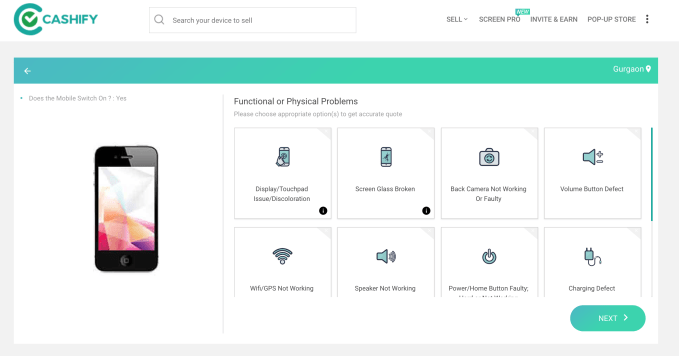

With Cashify, sellers simply fill out some details online about their device, then Cashify dispatches a representative who comes to their house to perform diagnostic checks and gives them cash for the device that day. The startup also offers an app which automatically carries out the checks — for example ensuring the camera, Bluetooth module, etc. all work — and offers a higher cash payment for the user since Cashify uses fewer resources.

A sample of the Cashify Q&A for selling a device

Beyond its website and app, Cashify gets devices from trade-in programs for Samsung, Xiaomi and Apple in India, as well as e-commerce companies like Flipkart, Amazon and Paytm Mall.

Used device acquired, what happens next is interesting.

The startup has built out a network of offline merchants who specialize in selling used phones. Each phone it acquires is then sold (perhaps after minor refurbishments) to that network, so it might pop up for sale anywhere in India.

With this new money, Cashify CEO Manocha said the company will develop an online resale site that will allow anyone to buy a used phone from the company’s network. Devices sold by Cashify online will be refurbished with new parts where needed, and they’ll include a box and six-month warranty to give a better consumer experience, Manocha added.

Today, Cashify claims to handle 100,000 smartphones a month, but it is planning to grow that to 200,000 by the end of this year. Cashify said its devices are typically low-end, those that retail for sub-$300 when new. A large part of that push comes from the online site, but the startup is also enlarging its offline merchant network and working to reach more consumers who are actually selling their device. That’s where Manocha said he sees particular value in working with Aihuishou.

Cashify is also developing other services. It recently started offering at-home repairs for customers and Manocha said that adding Chinese investors — and Aihuishou in particular — will help it with its sourcing of components for the repairs service and general refurbishments.

Cashify estimates that the used smartphone market in India will see 90 million phones sold this year, with as many as 120 million trading by 2020. That’s close to the 124 million shipments that analysts estimate India saw in 2017, but with surprisingly higher margins.

A reseller can make 10 percent profit on a device, Manocha explained, and Cashify’s own price elasticity — the difference between what it buys from consumers at and what it sells to resellers for — is typically 30-35 percent, he added. That’s more than most OEMs, but that doesn’t take into account costs on the Cashify side, which bring that number down.

“When I sell to a reseller, the margins aren’t that exciting, which is why we want to sell direct to consumers,” the Cashify CEO said.

The startup has plenty going on at home in India, but already it is considering overseas possibilities.

“We will focus on India for at least the next 12 months, but we have had discussions on markets that would make sense to enter,” Manocha said, explaining that the Middle East and Southeast Asia are early frontrunners.

“We are working very closely with one of the Chinese players and figuring out if we can do some business in Hong Kong because that’s the hub for second-hand phones in this part of the world,” he added.

Note: The original version of this article was updated to correct that Amit Sethi is CTO not CFO.

Powered by WPeMatico

And there we have it: Bird, one of the emerging massively hyped Scooter startups, has roped in its next pile of funding by picking up another $300 million in a round led by Sequoia Capital.

The company announced the long-anticipated round this morning, with Sequoia’s Roelof Botha joining the company’s board of directors. This is the second round of funding that Bird has raised over the span of a few months, sending it from a reported $1 billion valuation in May to a $2 billion valuation by the end of June. In March, the company had a $300 million valuation, but the Scooter hype train has officially hit a pretty impressive inflection point as investors pile on to get money into what many consider to be the next iteration of resolving transportation at an even more granular level than cars or bikes. New investors in the round include Accel, B Capital, CRV, Sound Ventures, Greycroft and e.ventures; previous investors Craft Ventures, Index Ventures, Valor, Goldcrest, Tusk Ventures and Upfront Ventures are also in the round. (So, basically everyone else who isn’t in competitor Lime.)

Scooter mania has captured the hearts of Silicon Valley and investors in general — including Paige Craig, who actually jumped from VC to join Bird as its VP of business — with a large amount of capital flowing into the area about as quickly as it possibly can. These sort of revolving-door fundraising processes are not entirely uncommon, especially for very hot areas of investment, though the scooter scene has exploded considerably faster than most. Bird’s round comes amid reports of a mega-round for Lime, one of its competitors, with the company reportedly raising another $250 million led by GV, and Skip also raising $25 million.

“We have met with over 20 companies focused on the last-mile problem over the years and feel this is a multi-billion dollar opportunity that can have a big impact in the world,” CRV’s Saar Gur, who did the deal for the firm, said. “We have a ton of conviction that this team has original product thought (they created the space) and the execution chops to build something extremely valuable here. And we have been long-term focused, not short-term focused, in making the investment. The ‘hype’ in our decision (the non-zero answer) is that Bird has built the best product in the market and while we kept meeting with more startups wanting to invest in the space — we kept coming back to Bird as the best company. So in that sense, the hype from consumers is real and was a part of the decision. On unit economics: We view the first product as an MVP (as the company is less than a year old) — and while the unit economics are encouraging, they played a part of the investment decision but we know it is not even the first inning in this market.”

There’s certainly an argument to be made for Bird, whose scooters you’ll see pretty much all over the place in cities like Los Angeles. For trips that are just a few miles down wide roads or sidewalks, where you aren’t likely to run into anyone, a quick scan of a code and a hop on a Bird may be worth the few bucks in order to save a few minutes crossing those considerably long blocks. Users can grab a bird that they see and start going right away if they are running late, and it does potentially alleviate the pressure of calling a car for short distances in traffic, where a scooter may actually make more sense physically to get from point A to point B than a car.

There are some considerable hurdles going forward, both theoretical and in effect. In San Francisco, though just a small slice of the United States metropolitan area population, the company is facing significant pushback from the local government, and scooters for the time being have been kicked off the sidewalks. There’s also the looming shadow of what may happen regarding changes in tariffs, though Gur said that it likely wouldn’t be an issue and “the unit economics appear to be viable even if tariffs were to be added to the cost of the scooters.” (Xiaomi is one of the suppliers for Bird, for example.)

Powered by WPeMatico

What does brand loyalty even mean anymore? App downloads, points, stars and other complex reward systems have not just spawned their own media empires trying to decipher them, they have failed at their most basic objective: building a stronger bond between a brand and its consumers.

Bumped wants to reinvent the loyalty space by giving consumers shares of the companies they patronize. Through Bumped’s app, consumers choose their preferred retailer in different categories (think Lowe’s versu The Home Depot in home improvement), and when they spend money at that store using a linked credit card, Bumped will automatically give them ownership in that company.

The startup, which is based in Portland and was founded in March 2017, announced the beta launch of its service today, as well as a $14.1 million Series A led by Dan Ciporin at Canaan Partners, along with existing seed investors Peninsula Ventures, Commerce Ventures and Oregon Venture Fund.

Bumped is a brokerage, and the company told me that it has passed all FINRA and SEC licensing. When consumers spend money at participating retailers, they receive bona fide shares in the companies they shop at. Each retailer determines a loyalty percentage rate, which is a minimum of 1 percent and can go up to 5 percent. Bumped then buys shares off the public market to reward consumers, and in cases where it needs to buy fractional shares, it will handle all of those logistics.

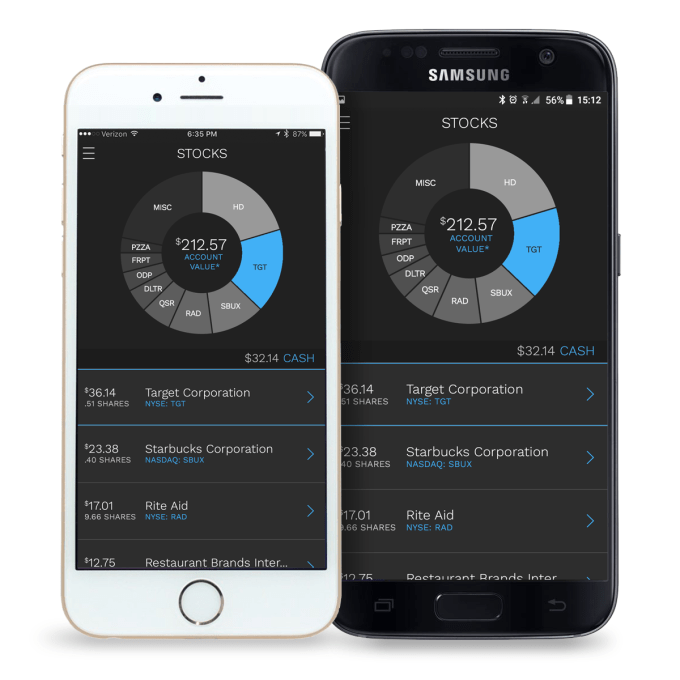

Bumped’s app allows users to track their shares

For founder and CEO David Nelsen, the startup doesn’t just make good business sense, it can have a wider social impact of democratizing access to the public equity markets. “A lot of brands need to build an authentic relationship with the customers,” he explained to me. “The brands that have a relationship with consumers, beyond price, are thriving.” With Bumped, Nelsen’s goal is to “align the interests of a shareholder and consumer, and everybody wins.”

His mission is to engage more Americans into the equity markets and the power of ownership. He notes that far too many people fail to set up their 401k, and don’t invest regularly in the stock market, citing a statistic that only 13.9 percent of people directly own a share of stock. By offering shares, he hopes that Bumped engages consumers to think about their relationship to companies in a whole new way. As Nelsen put it, “we are talking about bringing a whole new class of shareholders into the market.”

This isn’t the first time that Nelsen has built a company in the loyalty space. He previously was a co-founder and CEO of Giftango, a platform for prepaid digital gift cards that was acquired by InComm in late 2012.

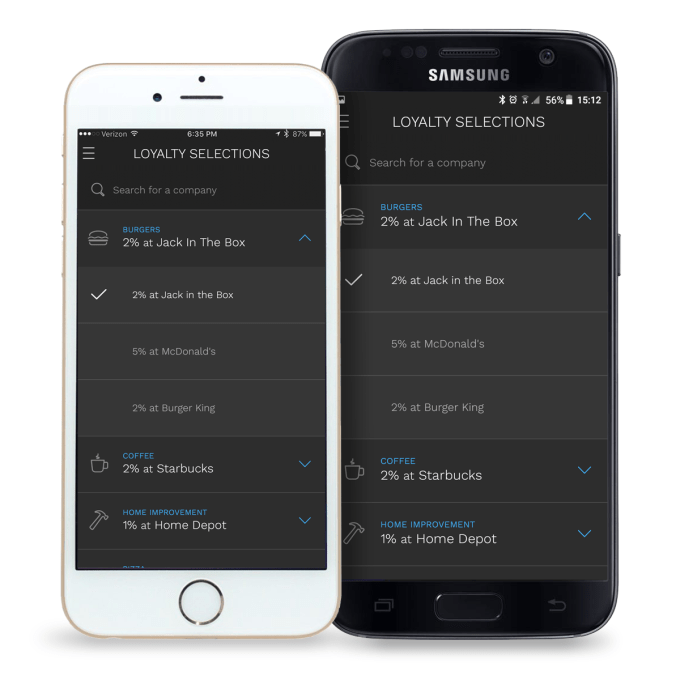

Consumers will have to choose their Bumped loyalty partner in each category, like burgers

That previous experience has helped the company build an extensive roster for launch. Bumped has 19 brands participating in the beta, including Chipotle, Netflix, Shake Shack, Walgreens and The Home Depot. Another six brands are currently papering contracts with the firm.

Ciporin of Canaan said that he wanted to fund something new in the loyalty space. “There has been just a complete lack of innovation in the loyalty space,” he explained to me. “I think about it as Robinhood meets airline points programs.” One major decider for Ciporin in making the investment was academic research, such as this paper by Jaakko Aspara, showing that becoming a shareholder in a company tended to make consumers significantly more loyal to those brands.

In the short run, Bumped heads into a crowded loyalty space that includes companies like Drop, which I have covered before on TechCrunch. Nelsen believes that the stock ownership model is “an entirely different mechanism” in loyalty, and that makes it “hard to compare” to other loyalty platforms.

Longer term, he hints at exploring how to offer this sort of equity loyalty model to small and medium businesses, a significantly more complex challenge given the lack of liquid markets for their equity. Today, the company is exclusively focused on publicly traded companies.

Bumped today has 14 people, and is targeting a team size of around 20 employees.

Powered by WPeMatico