Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

DevOps — the branch of enterprise IT that involves both products and best-practices for developers to build, test and run apps and other software — is on track to be worth nearly $13 billion by 2025. Now, a startup that is building DevOps tools is announcing a significant funding round to capitalize on that opportunity. Portland, Oregon-based Puppet (formerly Puppet Labs) has raised $42 million in funding in a venture round with a number of strategic and key financial investors.

The funding was led by Cisco, with Kleiner Perkins, True Ventures, Singapore’s EDBI and VMware also participating.

The company isn’t readily disclosing its valuation — although we are trying to find out — but according to PitchBook, its last disclosed valuation was in 2014, when it raised $40 million and was valued at $652 million post-money.

But Puppet has grown more than two-fold in the last four years: back then, it had 18,000 customers, including the likes of Google, Twitter, Salesforce and AT&T. Now, it says it has more than 40,000 companies as customers, “including more than 75 percent of the Fortune 100” using both its open source and commercial products — and it’s expanded internationally and has made a couple of acquisitions (including the startup Reflect earlier this month).

All this would imply that Puppet, which now has raised $150 million to date, is likely valued at significantly more than $700 million, and may well be approaching the $1 billion-mark.

“Our rapid growth and international expansion is a testament to the rising demand for DevOps transformation, software automation and the pressing need for enterprises to navigate the new world of software delivery. That’s why we’ve been so focused on expanding our product portfolio—to empower customers to discover, deliver and operate software across their cloud and containerized environments,” said Sanjay Mirchandani, CEO, Puppet, in a statement. “I’m thrilled by the momentum we’re experiencing. It helps us better support our customers’ journey to pervasive automation.”

The growth of cloud services, and the ubiquity of digitization, have led to a wide slate of functions in a business falling under the category of developer-led operations.

This has, in turn, driven a bigger demand for better processes to run these operations and the infrastructure that they touch. Puppet is not the only company in this area: in addition to large players like Cisco and CA Technologies and EMC, there are startups like Docker, Chef and more.

Puppet’s solutions cover applications, cloud services, containerized services and networking devices, and that mix is part of what is attractive about the company, as many businesses today are not all-in on modern architectures, but are grappling with hybrids of old and new, cloud and on-premises, and so on. (Indeed, the “Puppet” name is a reference to how it works: developers can control the actions of the their applications over the network as puppeteers control puppets, without being seen).

“ServiceChannel has an aggressive technology roadmap. One that not only takes advantage of cloud native capabilities and containerized applications, but also requires modernization of existing, critical systems. Automation is necessary to help us deliver on that roadmap within the constraints of business—safely and at scale,” said Mark Trumpbour, VP of DevOps at ServiceChannel, in a statement.

Investors Cisco and VMware are themselves already key players in the area of DevOps (and Cisco and VMWare, both previous investors, already work with Puppet), while another backer, EDBI, holds investments in a number of companies that are potential customers for the startup.

“Businesses put increasingly massive pressure on enterprise IT—so, it’s important that those IT organizations partner with technology providers with compelling innovation, world-class support and a global community of experts. Puppet has a track record of empowering its customers with all of these critical elements,” said Rob Salvagno, VP of Corporate Development and Cisco Investments, in a statement. “We look forward to working even more with Puppet as the global demand for automation technology and innovation continues to accelerate.”

“In today’s digital age, companies face increasing complex IT challenges dealing with their dynamic and diverse IT infrastructure. Puppet’s automation and management platform transforms how companies manage and improve the efficiency of their IT assets and can help companies in Singapore realize productivity gains while ensuring compliance,” said Swee-Yeok CHU, CEO and president EDBI, in an additional statement. “Leveraging our network, we look forward to helping Puppet scale up its local talent pool to address the region’s opportunities through its APAC Regional HQ in Singapore and to augment Singapore’s digital transformation strategy.”

Powered by WPeMatico

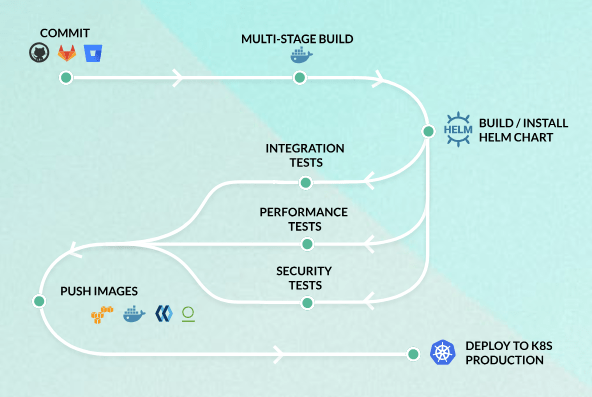

Codefresh, a continuous integration and delivery platform built for the Kubernetes container ecosystem, today announced that it has raised an $8 million Series B round led by M12, Microsoft’s venture fund. Viola Ventures, Hillsven and CEIF also participated in this round, which brings the company’s total funding to $15.1 million.

In a market where there are seemingly more CI/CD platforms every day, Codefresh sets itself apart thanks to its focus on Kubernetes, which is now essentially the de facto standard for container orchestration services and which is seeing a rapid growth in adoption. The service promises it can help developers automate their application deployments to Kubernetes and that teams will see “up to 24X faster development times.” That number seems a bit optimistic, but the whole point of adopting Kubernetes and CI/CD is obviously to speed up the development and deployment process.

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.”

“The meteoric rise of Kubernetes is happening so fast that most toolchains haven’t kept up, and M12 knows it,” said Raziel Tabib, Codefresh co-founder and CEO. “With this latest round of funding we’re going to aggressively accelerate our roadmap and expand our customer base.”

The Codefresh platform hit general availability in 2017 and the company currently claims about 20,000 users, including the likes Giphy.

Powered by WPeMatico

ZenProspect, a startup that emerged from the Y Combinator Winter 2016 class to help companies use data and intelligence to increase sales, announced today that it was rebranding as Apollo. It also announced a $7 million Series A investment.

The round was led by Nexus Venture Partners. Social Capital and Y Combinator also participated. Apparently Y Combinator liked what they saw enough to continue to invest in the company.

Apollo helps customers connect their sales people with the right person at the right time. That is typically a customer that is most likely to buy the product. It does this by combining a number of tools including a rules engine to automate prospect routing, a lead scoring tool and analytics to measure results at a granular level, among others.

Apollo analytics. Photo: Apollo

The company also uses data they have collected from 200 million contacts at 10 million companies to match sellers to buyers along with the information in the user’s own CRM tools — typically Salesforce. Apollo is making this vast database of company and contact data available for customers to use themselves for free starting today.

Apollo CEO and founder Tim Zheng says the company was born out of a need at a previous venture. He was working at a startup that was floundering and sales had flatlined. When they couldn’t find a product on the market to help them, they decided to build it and saw the number of users increase from 5000 to 150,000 users in just five weeks. That eventually reached a million users. As he spoke to friends at other Bay area companies about what his company had done, he heard a lot of interest, and decided to turn that sales tool into a company.

The company launched as ZenProspect in 2015 and went through Y Combinator in 2016. They were the third fastest growing company in that YC batch, generating $1 million in annual recurring revenue (ARR) during their tenure. In fact, they were profitable out of the gate, using their own software to sell the product.

Zheng points out that there are thousands of sales tools out there, but he said, even if you bought every one of them and stitched them together you still wouldn’t have a great sales process. Zheng says his company has figured out how to solve that problem and provide that structure to deliver the best prospects to sales people to close deals.

The company works closely with Salesforce as 80 percent of its customers are using data inside of Salesforce in conjunction with the Apollo tool. It’s worth noting, however, that Apollo is not built on top of Salesforce platform. It just integrates with it.

They target both early stage startups looking to increase sales and established enterprise customers with huge sales teams. So far it’s been working. Today, Apollo has 500 customers and 50 employees. With the current influx of money, they expect to get to 120 in the next 12 -18 months.

Powered by WPeMatico

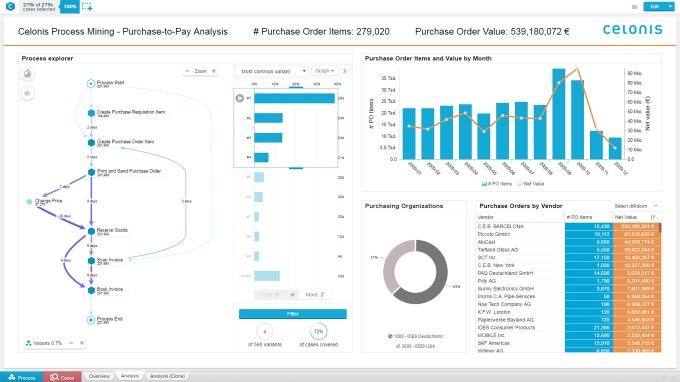

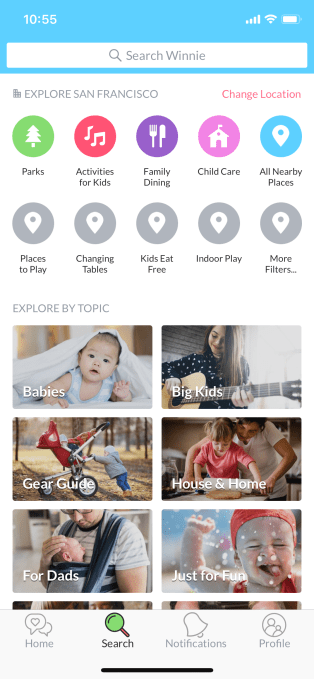

In the age of digital transformation, it’s important to understand your business processes and find improvements quickly, but it’s not always easy to do without bringing in expensive consultants to help. Celonis, a New York City enterprise startup, created a sophisticated software solution to help solve this problem, and today it announced a $50 million Series B investment from Accel and 83North on a $1 billion valuation.

It’s not typical for an enterprise startup to have such a lofty valuation so early in its funding cycle, but Celonis is not a typical enterprise startup. It launched in 2011 in Munich with this idea of helping companies understand their processes, which they call process mining.

“Celonis is an intelligent system using logs created by IT systems such as SAP, Salesforce, Oracle and Netsuite, and automatically understands how these processes work and then recommends intelligently how they can be improved,” Celonis CEO and co-founder Alexander Rinke explained.

The software isn’t magic, but helps customers visualize each business process, and then looks at different ways of shifting how and where humans interact with the process or bringing in technology like robotics process automation (RPA) when it makes sense.

Celonis process flow. Photo: Celonis

Rinke says the software doesn’t simply find a solution and that’s the end of the story. It’s a continuous process loop of searching for ways to help customers operate more efficiently. This doesn’t have to be a big change, but often involves lots incremental ones.

“We tell them there are lots of answers. We don’t think there is one solution. All these little things don’t execute well. We point out these things. Typically we find it’s easy to implement, ” he said.

Screenshot: Celonis

It seems to be working. Customers include the likes of Exxon-Mobile, 3M, Merck, Lockheed-Martin and Uber. Rinke reports deals are often seven figures. The company has grown an astonishing 5,000 percent in the past 4 years and 300 percent in the past year alone. What’s more, it has been profitable every year since it started. (How many enterprise startups can say that?)

The company currently has 400 employees, but unlike most Series B investments, they aren’t looking at this money to grow operationally. They wanted to have the money for strategic purposes, so if the opportunity came along to make an acquisition or expand into a new market, they would be in a position to do that.

“I see the funding as a confirmation and commitment, a sign from our investors and an indicator about what we’ve built and the traction we have. But for us it’s more important, and our investors share this, what they really invested in was the future of the company,” Rinke said. He’s sees an on-going commitment to help his customers as far more important than a billion valuation.

But that doesn’t hurt either as it moves rapidly forward.

Powered by WPeMatico

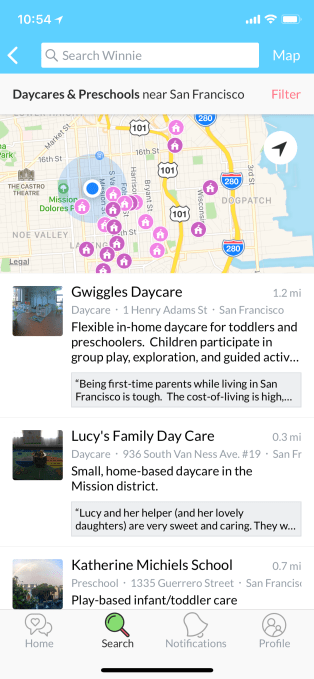

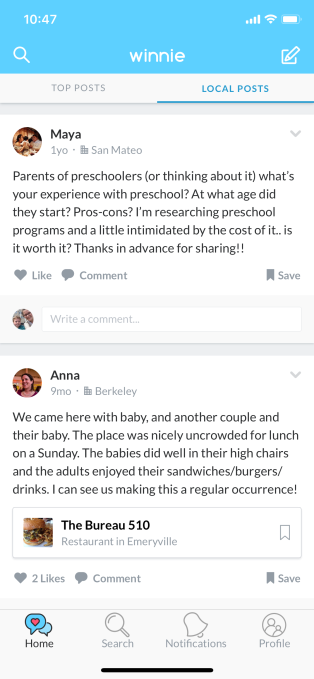

An app that has the needs of modern-day parents in mind, Winnie, has now raised $4 million in additional seed funding in a round led by Reach Capital. Other investors in the new round include Rethink Impact, Homebrew, Ludlow Ventures, Afore Capital, and BBG Ventures, among others. With the new funds, Winnie has raised $6.5 million to date.

The San Francisco-based startup, which begun its life as a directory of kid-friendly places largely serving the needs of newer parents, has since expanded to become a larger platform for parents.

Winnie was founded by Bay Area technologists, Sara Mauskopf, who spent time at Postmates, Twitter, YouTube and Google, and Anne Halsall, also from Postmates and Google, as well as Quora and Inkling.

As new parents themselves, they built Winnie out a personal need to find the sort of information parents crave – details you can’t easily dig up in Google Maps or Yelp.

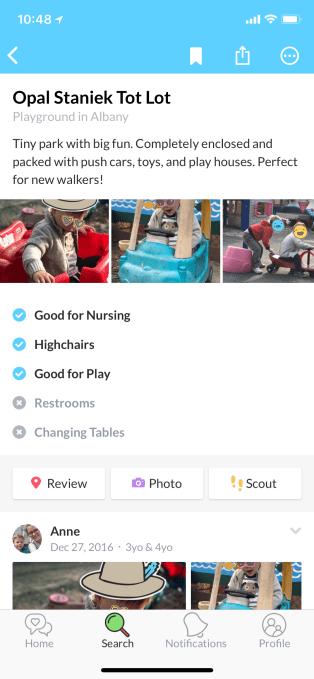

For example, you can use Winnie to find nearby kid-friendly destinations like museums or parks, as well as those that welcome children with features like changing tables in restrooms, wide aisles in stores for stroller access, areas for nursing, and other things.

“Babies are people too, and they deserve a designated clean bathroom space just like the rest of us.”

https://t.co/Ps8egQcDLL

— Winnie (@Winnie) June 5, 2018

Winnie serves as a good example of what investing in women can achieve. Somehow, the young, 20-something men that receive the lion’s share of VC funding had never thought up the idea of app that helps new parents navigate the world. (I know, shocking, right?) And yet, the kind of questions that Winnie tries to answer are those that all parents, at some point, are curious about.

The data on Winnie is crowd-sourced, with details, ratings and reviews coming from other real parents. Listings in San Francisco may be more fleshed out than elsewhere, as that’s where Winnie got its start. However, the app is now available in 10,000 cities across the U.S., and has just surpassed over a million users.

In more recent months, Winnie has been working to expand beyond being a sort of “Yelp for parents,” and now features an online community where parents can ask questions and participate in discussions.

“The crowdsourced directory of family-friendly businesses is still a huge component of what we do…and this has grown to over 2 million places across the United States,” notes Winnie co-founder and CEO Sara Mauskopf. “But we also have these real-time answers to any parenting question from this authentic, supportive community,” she says, referring to Winnie’s online discussions.

The idea is that parents will be searching the web for answers to questions about toddler sleep issues or good local preschools or breastfeeding help, and Winnie’s answers will come up in search results, similar to other Q&A sites like Quora or Yahoo Answers.

“A lot of younger millennial parents are turning to Google to find answers to these questions,” adds Winnie co-founder and CPO Anne Halsall. “So we want to have the answer to these questions at the ready, and we want to have the best page. That’s an example of something that’s yield a lot of traffic for us, just because no one else had that data before Winnie,” she says.

Related to this expansion, Winnie is also serving this data across platforms, including – obviously – the web, in addition to its native app on iOS and Android. The hope is that, with the growth, business owners will come in to claim their pages on Winnie.com, too, and update their information.

In the near-term, the founders say they’ll put the funding to use building out more personalization features.

“As a technology company, we have a unique opportunity to give you this really tailored experience that grows with your family over time – so as your children are getting older, and you’re entering new phases of development, our product’s adapting and putting relevant information in front of you,” Halsall says.

Data on businesses serving the needs of parents with older kids – like summer camps or driver’s ed classes, for example – are the kind of things Winnie will focus on as it grows to include information for more parents, instead of just those with younger children and babies.

Winnie will also use the funds to hire additional engineers to help it scale its platform.

Esteban Sosnik from Reach Capital joined Hunter Walk from Homebrew on Winnie’s board as a result of the funding.

The app is a free download for iOS and Android, and is available on the web at Winnie.com.

Powered by WPeMatico

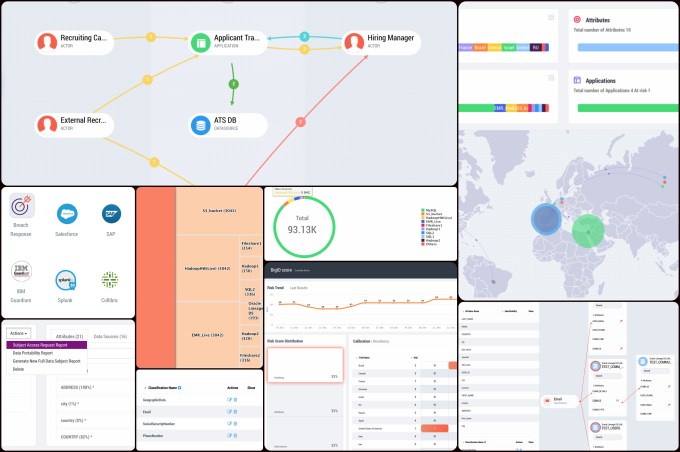

BigID announced a big $30 million Series B round today, which comes on the heels of closing their $14M A investment in January. It’s been a whirlwind year for the NYC data security startup as GDPR kicked in and companies came calling for their products.

The round was led by Scale Venture Partners with participation from previous investors ClearSky Security, Comcast Ventures, Boldstart Ventures, Information Venture Partners and SAP.io.

BigID has a product that helps companies inventory their data, even extremely large data stores, and identify the most sensitive information, a convenient feature at a time where GDPR data privacy rules, which went into effect at the end of May, require that companies doing business in the EU have a grip on their customer data.

That’s certainly something that caught the eye of Ariel Tseitlin from Scale Venture Partners. “We talked to a lot of companies, how they feel more specifically about GDPR, and more broadly about how they think about data within in their organizations, and we got a very strong signal that there is a lot of concern around the regulation and how to prepare for that, but also more fundamentally, that CIOs and chief data officers don’t have a good sense of where data resides within their organizations,” he explained.

Dimitri Sirota, CEO and co-founder, says that GDPR is a nice business driver, but he sees the potential to grow the data security market much more broadly than simply as a way to comply with one regulatory ruling or another. He says that American companies are calling, even some without operations in Europe because they see getting a grip on their customer data as a fundamental business imperative.

BigID product collage. Graphic: BigID

The company plans to expand their partner go-to market strategy in the coming the months, another approach that could translate to increased sales. That will include global systems integrators. Sirota says to expect announcements involving the usual suspects in the coming months. “You’ll see over the next little bit, several announcements with many of the names that you’re familiar with in terms of go-to market and global relationships,” he said.

Finally there are the strategic investors in this deal, including Comcast and SAP, which Sirota thinks will also ultimately help them get enterprise deals they might not have landed up until now. The $30 million runway also gives customers who might have been skittish about dealing with a young-ish startup, more confidence to make the deal.

BigID seems to have the right product at the right time. Scale’s Tseitlin, who will join the board as part of the deal, certainly sees the potential of this company to scale far beyond its current state.

“The area where we tend to spend a lot of time, and I think is what attracted Dimitri to having us as an investor, is that we really help with the scaling phase of company growth,” he said. True to their name, Scale tries to get the company to that next level beyond product/market fit to where they can deliver consistently and continually grow revenue. They have done this with Box and DocuSign and others and hope that BigID is next.

Powered by WPeMatico

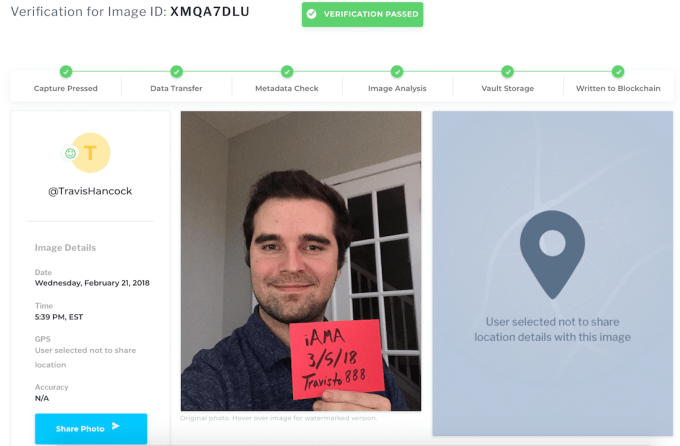

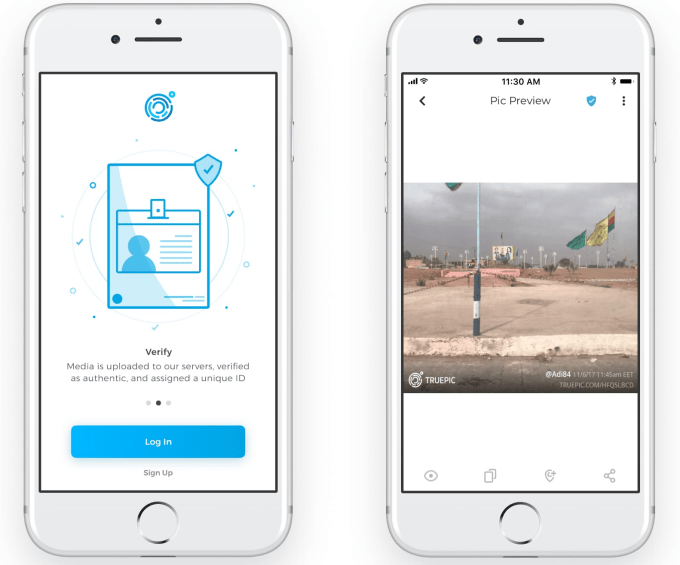

How can you be sure an image wasn’t Photoshopped? Make sure it was shot with Truepic. This startup makes a camera feature that shoots photos and adds a watermark URL leading to a copy of the image it saves, so viewers can compare them to ensure the version they’re seeing hasn’t been altered.

Now Truepic’s technology is getting its most important deployment yet as the way Reddit will verify that Ask Me Anything Q&As are being conducted live by the actual person advertised — oftentimes a celebrity.

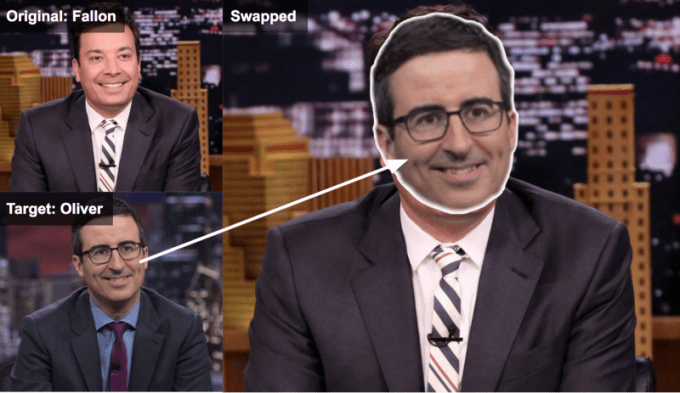

But beyond its utility for verifying AMAs, dating profiles and peer-to-peer e-commerce listings, Truepic is tackling its biggest challenge yet: identifying artificial intelligence-generated Deepfakes. These are where AI convincingly replaces the face of a person in a video with someone else’s. Right now the technology is being used to create fake pornography combining an adult film star’s body with an innocent celebrity’s face without their consent. But the big concern is that it could be used to impersonate politicians and make them appear to say or do things they haven’t.

The need for ways to weed out Deepfakes has attracted a new $8 million round for Truepic. The cash comes from untraditional startup investors, including Dowling Capital Partners, former Thomson Financial (which become Reuters) CEO Jeffrey Parker, Harvard Business school professor William Sahlman and more. The Series A brings Truepic to $10.5 million in funding.

“We started Truepic long before manipulated images impacted democratic elections across the globe, digital evidence of atrocities and human rights abuses were regularly undermined, or online identities were fabricated to advance political agendas — but now we fully recognize its impact on society,” says Truepic founder and COO Craig Stack. “The world needs the Truepic technology to help right the wrongs that have been created by the abuse of digital imagery.”

Here’s how Truepic works:

For example, Reddit’s own Wiki recommends that AMA creators use the Truepic app to snap a photo of them holding a handwritten sign with their name and the date on it. “Truepic’s technology allows us to quickly and safely verify the identity and claims for some of our most eccentric guests,” says Reddit AMA moderator and Lynch LLP intellectual property attorney Brian Lynch. “Truepic is a perfect tool for the ever-evolving geography of privacy laws and social constructs across the internet.”

The abuses of image manipulation are evolving, too. Deepfakes could embarrass celebrities… or start a war. “We will be investing in offline image and video analysis and already have identified some subtle forensic techniques we can use to detect forgeries like deepfakes,” Truepic CEO Jeff McGregor tells me. “In particular, one can analyze hair, ears, reflectivity of eyes and other details that are nearly impossible to render true-to-life across the thousands of frames of a typical video. Identifying even a few frames that are fake is enough to declare a video fake.”

This will always be a cat and mouse game, but from newsrooms to video platforms, Truepic’s technology could keep content creators honest. The startup has also begun partnering with NGOs like the Syrian American Medical Society to help it deliver verified documentation of atrocities in the country’s conflict zone. The Human Rights Foundation also trained humanitarian leaders on how to use Truepic at the 2018 Freedom Forum in Oslo.

Throwing shade at Facebook, McGregor concludes that “The internet has quickly become a dumpster fire of disinformation. Fraudsters have taken full advantage of unsuspecting consumers and social platforms facilitate the swift spread of false narratives, leaving over 3.2 billion people on the internet to make self-determinations over what’s trustworthy vs. fake online… we intend to fix that by bringing a layer of trust back to the internet.”

Powered by WPeMatico

Nginx, the commercial company behind the open source web server, announced a $43 million Series C investment today led by Goldman Sachs Growth Equity.

NEA, which has been on board as an early investor is also participating. As part of the deal, David Campbell, managing director at Goldman Sachs’ Merchant Banking Division will join the Nginx board. Today’s investment brings the total raised to $103 million, according to the company.

The company was not willing to discuss valuation for this round.

Nginx’s open source approach is already well established running 400 million websites including some of the biggest in the world. Meanwhile, the commercial side of the business has 1,500 paying customers, giving those customers not just support, but additional functionality such as load balancing, an API gateway and analytics.

Nginx CEO Gus Robertson was pleased to get the backing of such prestigious investors. “NEA is one of the largest venture capitalists in Silicon Valley and Goldman Sachs is one of the largest investment banks in the world. And so to have both of those parceled together to lead this round is a great testament to the company and the technology and the team,” he said.

The company already has plans to expand its core commercial product, Nginx Plus in the coming weeks. “We need to continue to innovate and build products that help our customers alleviate the complexity of delivery of distributed or micro service based applications. So you’ll see us release a new product in the coming weeks called Controller. Controller is the control plane on top of Nginx Plus,” Robertson explained. (Controller was launched in Beta last fall.)

But with $43 million in the bank, they want to look to build out Nginx Plus even more in the next 12-18 months. They will also be opening new offices globally to add to its international presence, while expanding its partners ecosystem. All of this means an ambitious goal to increase the current staff of 220 to 300 by the end of the year.

The open source product was originally created by Igor Sysoev back in 2002. He introduced the commercial company on top of the open source project in 2011. Robertson came on board as CEO a year later. The company has been growing 100 percent year over year since 2013 and expects to continue that trajectory through 2019.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast where we unpack the numbers behind the headlines.

This week was something of a first for the crew, twice. First, we had two guests on the show, and, also, we only made it through two and a half topics. The former is good, the latter is, well, we’ll see.

So, this week Matthew Lynley and I were joined by David Chao, co-founder and general partner at DCM, and Steve Vassallo, a general partner at Foundation Capital. Points to both for being guinea pigs.

Heading into our first topic I’m sorry to inform you that, at least in terms of Equity, scooters are the new Uber. So, we wound up talking about both this week. We started with the fact that Bird is raising new capital at an even more staggering valuation than before ($2 billion!), and that Lime is working to raise a truckload of capital itself. (Reports vary, but it’s probably a $250 million equity round at around a $750 million valuation. There may also be some debt in the mix for Lime. More when we lock that down.)

And, as Chao’s firm is an investor in the space, we had even more to chew on.

Next up we dug into the massive new Opendoor round. The firm’s new $325 million puts it into a solid position to help people sell their houses. Which markets are the best fit was something for us to unspool, along with public market comps, such as they are. But most critical, at least in my view, was the idea of risk. On that point Vassallo made a reasonable argument regarding stress testing. We’ll see.

And finally, we touched on Meituan’s impending IPO, and how it came to be.

Thanks for sticking with Equity after all this time. We’ll be back next week with another round of chatter about the latest, greatest and dumbest that tech has to offer.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Ethos, the company that bills itself as making life insurance accessible, affordable and simple, has officially come out of stealth with an $11.5 million investment led by one of the world’s top venture firms, Sequoia Capital, and additional participation from the family offices of Hollywood’s biggest stars and an NBA all-star.

Jay Z’s Roc Nation, and the family funds of Kevin Durant, Robert Downey Jr. and Will Smith, all participated in the new round for Ethos, and Sequoia Partner Roelof Botha is taking a seat on the company’s board. Because nothing says star power like a life insurance startup.

The life insurance market is one that’s been attracting interest from venture investors for a little over a year now. Companies like England’s Anorak, HealthIQ, Ladder, Mira Financial, and France’s Alan, which is backed by Partech Investments (among others), Fabric and Quilt, are all pitching life insurance products as well.

Ethos is licensed in 49 states, which is pretty comparable to the offering from providers like Haven Life, the Mass Mutual-backed life insurance product.

What has made the life insurance market interesting for investors is the fact that consumers’ interest in it continues to decline. Whether it’s because no one trusts insurers to actually pay out, or because Americans are putting their faith in the anti-aging technologies from funds like the Longevity Fund, folks just aren’t buying insurance products the way they used to.

So when investors see the numbers of users of a formerly ubiquitous product decline from 77 percent in 1989 to below 60 percent in 2018, the assumption is that there’s room for new companies to come in and provide better service.

Scads of investors have taken the same bet, which makes Ethos a marketing play as much as anything else. In the company’s press release it touts the fast, easy and inexpensive process for getting a quote.

The initial process requires only four questions to get a quote and a 10 minute survey to get a policy (in most cases). The company says 99 percent of its applicants don’t need a medical exam or blood test to get a policy.

What may have been most interesting to investors is the pedigree of the company’s co-founders. Peter Colis and Lingke Wang have both worked in the insurance industry before. They previously co-founded a life insurance marketplace called, Ovid Life.

“Life insurance is critical for families, but the process is broken for those who want and need it,” said Peter Colis. “We are consumer advocates, intensely focused on expanding life insurance accessibility to the millions of U.S. families who have college debt, mortgages, spouses and children to care for, and who want to be financially empowered to live their lives without worry.”

Ethos founders Lingke Wang and Peter Colis

Powered by WPeMatico