Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Creating a salad-making robot is pretty good, as far as tech company hooks go, but Chowbotics is looking to expand. The Bay Area company just raised $11 million in a “Series A-1” led by the Foundry Group and Techstars.

The big plan for the money largely involves extending the company’s selection of foodstuffs beyond leafy greens, where Sally the Salad Robot has made its mint. At the top of the list are grain bowls, breakfast bowls, poke bowls, açai bowls and yogurt bowls. If it’s food served in a bowl, Chowbotics seems interested.

Seems pretty straightforward, really. After all, at its core, Sally is a kind of vending machine, dropping different ingredients into the same bowl. Apparently it’s a bit more complicated than that, especially when you start mixing in things like yogurts and berry purees. “The major challenges are finding special technical solutions for dispensing different shapes and sizes of ingredients,” founder/CEO Deepak Sekar told TechCrunch.

The company is also using the funding to add a whole bunch of senior roles. Per the press release:

Warren Manzer, who was President of Foodservice at Clipper and Senior Vice President at Crown Brands, joined Chowbotics as Vice President of Foodservice Sales. Rory Bevins, who was Senior Vice President at La Bottega Americas and Global Vice President at Molton Brown, joined Chowbotics as Vice President of Hospitality. Lee Greer, who was Chief Marketing Officer at Jason’s Deli, joined Chowbotics as Vice President of its Off-Premise Kitchen Business Unit. Shelley Janes, who was Head of Partnerships at CarDash and CEO of SideDoor, joined Chowbotics as Director of Sales, responsible for the western region of the United States. Nolan Schachter, who was Director of Sales and Marketing at TeaBot, joined Chowbotics as Director of Sales, responsible for Canada.

The funding follows a $5 million Series A in March of last year.

Powered by WPeMatico

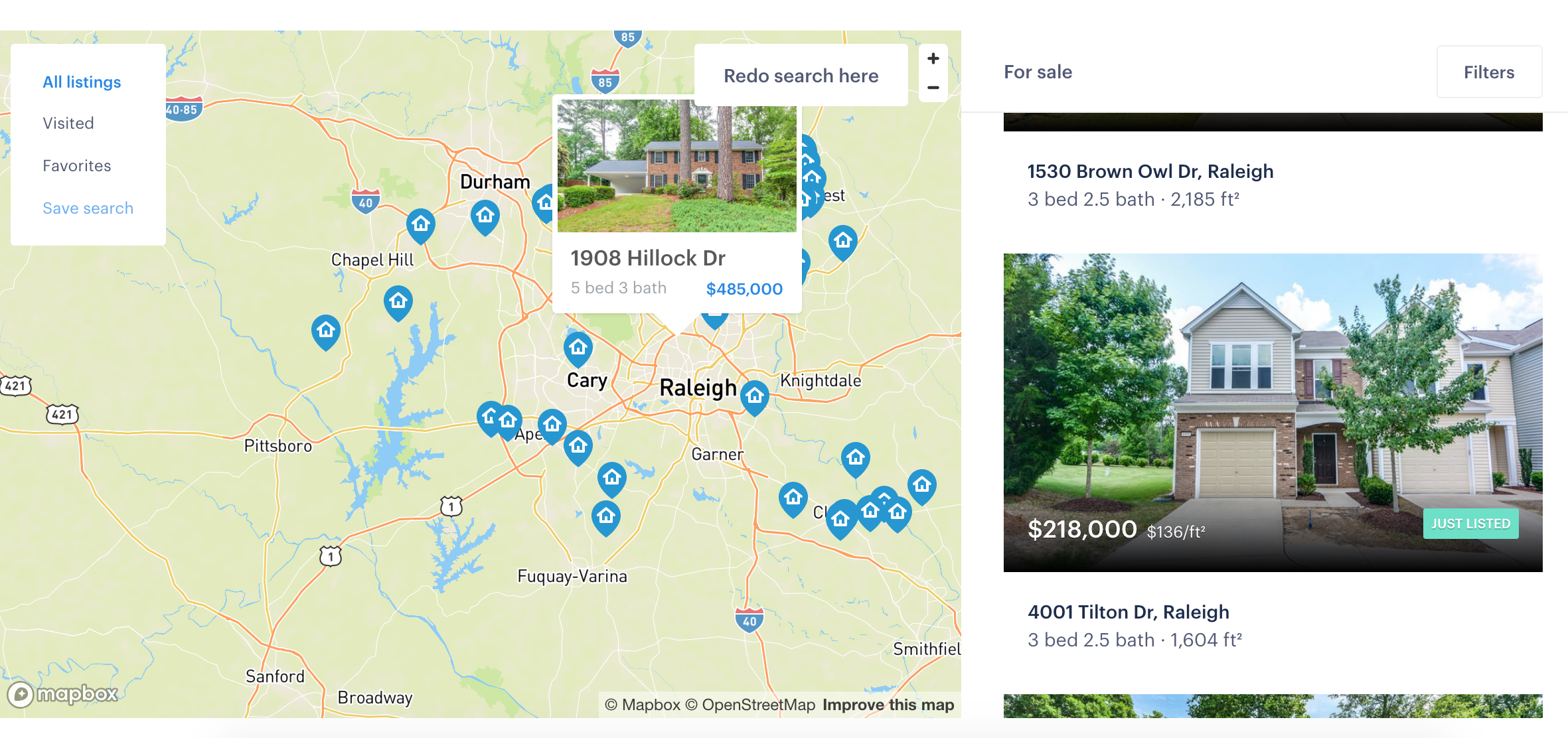

Investors are placing another huge bet on a startup looking to reinvent a decades-old process into something that’s near instant, this time pouring $325 million into Opendoor — a company that wants to bring the complex operation of buying or selling a home down to something similarly as simple as hailing a Lyft.

The idea of Opendoor is one not so dissimilar from a consumer theory that’s blossomed into companies worth tens of billions of dollars — consumers hate complex processes and are willing to hand off those processes to technology companies if they can make it even a little simpler. Home-buying and selling can be one of the more intense ones, requiring a lot of moving pieces and coordinating multiple time tables and schedules. Opendoor’s theory is that it can create a sizable business by dropping that time and energy cost to zero and effectively create a new technology-powered business model in the process, just like Uber or Airbnb.

Opendoor says it hopes to expand to 50 markets by the end of 2020 with this additional financing. It is in 10 markets right now, and also says it now purchases more than $2.5 billion in homes on an annual run rate. The company says it has raised a $325 million financing round co-led by General Atlantic, Access Technology Ventures and Lennar Corporation. Andreessen Horowitz, Coatue Management, 10100 Fund and Invitation Homes also participated, as well as existing investors Norwest Venture Partners, Lakestar, GGV Capital, NEA and Khosla Ventures. Opendoor has in total raised $645 million in equity and $1.5 billion in debt.

“What I realized was that there’s a lot of tailwinds with people wanting to transact with their mobile device,” CEO Eric Wu said. “We see this with Uber and Lyft and Amazon. I believe the future of real estate will be on demand and that’s the centerpiece of Opendoor’s thesis, making the transaction real time and instant. I realized there were going to be tailwinds, and that real estate was in need of being transformed.”

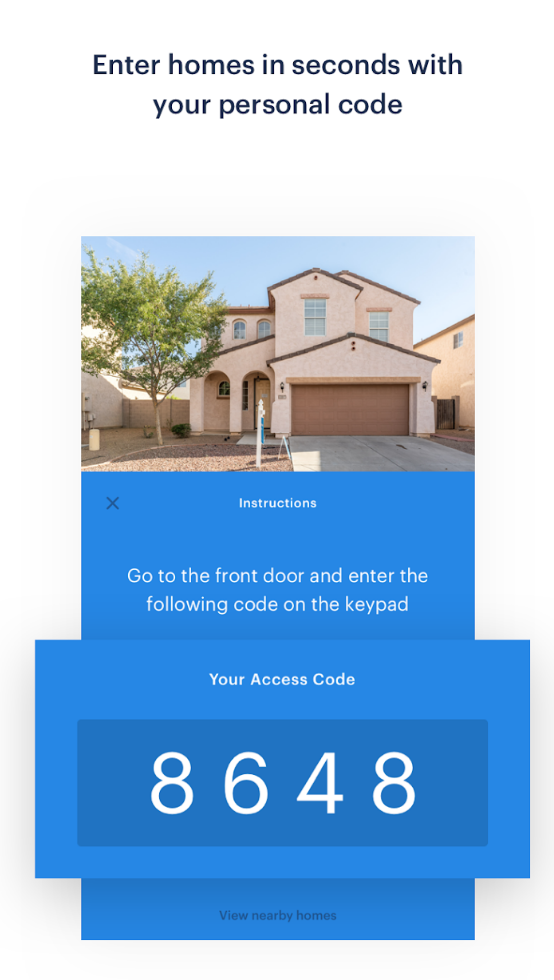

Opendoor has also sought to expand its efforts to make viewing those homes just as seamless. The company enables potential customers to check out a home by opening it with the app seven days a week. Wu said that most potential buyers go to the house each of the seven days up to the transaction, and then seven days after the transaction happens. Given that it’s such a significant step for any home owner, it makes sense that a lot of planning and consideration would go into the process. The next step is to create a sort of trade-up system, where Opendoor works to create a streamlined way to turn around an existing home for a new home.

Still, buying (or selling) a home is one of the single-largest transactions a consumer can do — especially if they are in a major metropolitan area where houses can quickly hit the $1 million-plus range. So it’s still a hurdle to convince consumers that they should press a few buttons to make a transaction in the hundreds of thousands of dollars. Wu said that the challenge there was to build enough trust with customers that they realize the process should be as seamless and powered by transparent data.

“It’s something we faced early on when we launched the service,” Wu said. “We were asking sellers to sell their home online to a tech company. A lot of the things we’ve done — such as lowering the fees and being transparent about pricing — which helped us build trust. Since it’s one of the largest financial transactions anyone makes, we had to build a world-class pricing model, be transparent about how we got to the quote, make it a low-fee service, and provide a certainty around the process.”

To try to do all this, Opendoor says it’s built a robust data set that will help best model potential prices for homes and be more transparent about that information. Wu said Opendoor currently employs around 650 people and hopes to double that by the end of next year, and the company is investing a significant amount of capital in growing out its data science team. The challenge is to understand the dynamics of the housing market — and any potential chaos — in order to best assess how to buy and sell those homes. Opendoor acquires some risk by purchasing some homes and holding them for a period of time, so ensuring that the company knows how the market performs will be one of its biggest challenges.

Opendoor is certainly not the only player in this area, as some competitors like Knock and OfferPad are starting to raise additional capital. Knock picked up $32 million in January last year with a similar bet: simplify the home-buying process and handle all of the details behind the scenes. If anything, it’s shown that there’s an appetite among the venture community (especially one where the numbers just keep getting bigger) for models that look to tap the same consumer demand of simplifying overly complex processes to just a few inputs on a smart app powered by data science.

Powered by WPeMatico

Even as AI assistants delve deeper into consumer hardware, companies still seem a bit reticent to bring them deep into their office software workflows.

Jane.ai is aiming to bring natural language processing and intelligence into an employee-facing solution that lets people query a digital assistant to give them information about documents, meetings and general company knowledge.

The St. Louis startup announced today that it is raising an $8.4 million Series A from private investors to power this vision.

Jane lives inside apps like Slack and Skype for Business (in addition to its own web app) where users are already chatting with co-workers and may need to surface information quickly that they don’t have ready access to. With Jane, employees can just message the assistant directly and the system will comb through information and apps that were uploaded and connected to the system in order to find answers. You can ask for a file by name and quickly get a link. You can ask for a specific department’s phone number and Jane will slack it to you.

The startup currently supports integrations with Office 365, Slack, Salesforce and Zenefits, and has more partnerships “on the horizon.”

The big focus will be outsourcing some of the more basic questions that you would ordinarily ask HR or IT so you don’t have to bombard the same person’s email to get the latest phone number for the workaround for a particular problem.

The Jane.ai team

The basic goal of the system is to learn over time and give appointed admins the ability to be called on to answer certain questions when Jane doesn’t have an answer so that Jane will learn from the company experts and get more informed over time.

“Pitting humans against machines is one of the big design flaws of a lot of AI systems,” Jane.ai CEO David Karandish told TechCrunch.

The startup will also have a general knowledge base where users can call on some quickly available info that will also grow over time. It takes time for these solutions to gather the information to be accessible enough to turn to, but Jane.ai is hoping that by ensuring that data is cleaned up for every customer, a lot of employees’ frequent questions are answered on day 1.

Powered by WPeMatico

Byton, a Chinese electric car startup, has secured a $500 million Series B funding round to fuel the development of smart, connected cars. Investors include FAW Group, Tus-Holdings and CATL. Byton also announced the opening of a new HQ in Nanjing, China. This is on top of Byton’s research and development center in Santa Clara, Calif.

“By combining our expertise in R&D and traditional car-making with innovative Internet technologies, we aspire to pioneer a smart mobility revolution,” Byton CEO and co-founder Dr. Carsten Breitfeld said in a statement.

At the Consumer Electronics Show, Byton unveiled its all-electric SUV concept. Earlier this year, Byton also announced a partnership with self-driving car startup Aurora. The terms of the partnership entail Aurora powering Byton’s autonomous driving features via a pilot deployment in the next couple of years. Byton plans to roll out its first batch of prototypes in April 2019 with the goal of Q4 2019 for the launch of a mass-produced model.

Powered by WPeMatico

Logtrust is now known as Devo in one of the cooler name changes I’ve seen in a long time. Whether they intended to pay homage to the late 70s band is not clear, but investors probably didn’t care, as they gave the data operations startup a bushel of money today.

The company now known as Devo announced a $25 million Series C round led by Insight Venture Partners with participation from Kibo Ventures. Today’s investment brings the total raised to $71 million.

The company changed its name because it was about much more than logs, according to CEO Walter Scott. It offers a cloud service that allows customers to stream massive amounts of data — think terabytes or even petabytes — relieving the need to worry about all of the scaling and hardware requirements processing this amount of data would require. That could be from logs from web servers, security data from firewalls or transactions taking place on backend systems, as some examples.

The data can live on prem if required, but the processing always gets done in the cloud to provide for the scaling needs. Scott says this is about giving companies this ability to process and understand massive amounts of data that previously was only in reach of web scale companies like Google, Facebook or Amazon.

But it involves more than simply collecting the data. “It’s the combination of us being able to collect all of that data together with running analytics on top of it all in a unified platform, then allowing a very broad spectrum of the business [to make use of it],” Scott explained.

Devo dashboard. Photo: Devo

Devo sees Sumo Logic, Elastic and Splunk as its primary competitors in this space, but like many startups they often battle companies trying to build their own systems as well, a difficult approach for any company to take when you are dealing with this amount of data.

The company, which was founded in Spain is now based in Cambridge, Massachusetts, and has close to 100 employees. Scott says he has the budget to double that by the end of the year, although he’s not sure they will be able to hire that many people that rapidly

Powered by WPeMatico

It’s scooters all the way down this morning, with Lime also reportedly raising $250 million in a funding after a new Delaware filing this morning indicated that competitor Bird authorized the sale of up to $200 million in shares.

GV (formerly Google Ventures) is leading this round, according to the report by Axios, as the massive land grab for a stake in the scooter wars continues to heat up — whether that’s funding or actual scooters piling up on the sidewalk. Both companies have faced pushback from some city regulators (probably on the basis of tripping over them and falling on your face), but it still means the venture community is still salivating over potentially the next major mode of metropolitan transportation. Most venture investors in the Valley argue scooters make sense for short trips throughout areas that are just too far to be considered a trek, but too close that it would be a waste of time and money to call a rideshare like Uber or Lyft.

Given that Uber exposed a massive hole for easier transportation in major metropolitan areas — and potentially replacing cars in those areas — getting into the next big transportation revolution is more than tempting enough for firms like GV (which is also an investor in Uber). Lime was previously reported to be seeking up to $500 million in funding and was taking meetings with some major firms in Silicon Valley over the past few weeks. It might not get that, but a $250 million influx might be plenty to try to continue to ramp up its business and get more rides on board. Axios is reporting that Lime has told investors users have taken 4.2 million rides and each scooter gets 8 to 12 rides per day.

Still, while it’s not $500 million, there’s plenty of interest in the on-demand scooter business — challenges of keeping them charged and intact included — that Bird has authorized the sale of up to $200 million in new shares at a $1 billion valuation just months after its previous round. So it might not be surprising if this, too, ends up as kind of a rolling process where Lime eventually gets all the capital it sought.

Powered by WPeMatico

Coffee Meets Bagel scored a $12 million Series B this week. The round, led by U.K. VC firm Atami Capital, brings the popular dating app’s total up to just under $20 million since launching back in 2012.

The San Francisco-based dating app has worked to distinguish itself from competitors like Bumble and Tinder by limiting the number of matches it offers during a 24-hour window. Late last year, it expanded its offering with a video feature, to add an extra dimension to profiles. This month, it introduced additional CMB Experiences to bring users together in the real world.

Of course, Coffee Meets Bagel is battling a juggernaut in the form of the billion-dollar Match Group, which currently owns OkCupid, Tinder, PlentyofFish and Match, among others. According to the company, this latest round will drive investments into more CMB Experiences along with international expansion for the service, along with other “product innovation.”

Co-CEO Arum Kang also notes that the Series B brings a number of VC firms with “prominent female investors,” including Gingerbread Capital. “We’re excited for the next phase of Coffee Meets Bagel, and are pleased to have some wonderful international and female investors on board,” Kang says in a release tied to the news. “Given our focus on female experience, it was very important that we have a female perspective at the investor level.”

Powered by WPeMatico

Uber’s CEO is in Paris this week meeting with the French president to talk tech in Europe and expanding its insurance coverage in the region, but back in the U.S. the company is moving ahead on another kind of expansion.

TechCrunch has learned and confirmed that Uber is raising another secondary round of funding of up to $600 million, on a valuation of $62 billion. The fundraising development comes at the same time that Uber is also releasing its Q1 financials — which indicate that the company pulled in $2.5 billion in net revenues, with a net loss of $601 million, and negative EBIDTA of $304 million on a pro forma basis.

Raising between $400 million and $600 million on a valuation of $62 billion (at $40 per share) would indicate that while Uber is recovering from the drop in valuation from its last round with SoftBank at the end of 2017 — another round with secondary components that valued the company at $48 billion — it’s still not back up (or higher than) its loftiest valuation of $69 billion.

From what we understand, investors participating in the offering, which has yet to close, include Coatue, Altimeter and TPG. Uber employees with at least 1,000 shares can also participate in the financing. According to the terms of offer, no one can sell more than $10 million worth of shares.

That general upward trend is also being reflected in Uber’s financials.

An investor presentation that was shared with TechCrunch indicated that the company’s $2.5 billion in net revenues was a seven percent quarter over quarter increase, and a 67 percent increase year over year. Uber’s $304 million losses, meanwhile, were about half the amount they were last year: in Q1 2017, Uber’s adjusted losses were $597 million. Gross bookings — the total taken for all of Uber’s transportation services — was $11.3 billion in Q1, a 55 percent increase compared to $7.5 billion a year ago. At the end of Q1, Uber had $6.3 billion in gross cash.

GAAP numbers indicated net revenues of $2.6 billion with a GAAP profit nearly as big: $2.456 billion. “We had $3 billion of income on a GAAP basis because of the ‘gain’ from the Yandex and Grab deals,” a spokesperson said. “That’s why we prefer to focus on EBITDA as the best number to show our underlying business in the quarter.”

“We are off to a terrific start in 2018, with our rides business beating internal plan and continuing to grow at healthy rates, while we significantly reduce our losses and maintain our leadership position around the world,” Uber CEO Dara Khosrowshahi said in a statement. “Given the size of the opportunity ahead of us and our goal of making Uber a true mobility platform, we plan to reinvest any over-performance even more aggressively this year, both in our core business as well as in big bets like Uber Eats globally.”

In other words, that could mean losses might get worse in the short-term as Uber continues to invest money in businesses like Eats and JUMP, the bike-share service it acquired for about $200 million earlier this year to expand them into more markets. As with many tech companies, Uber appears to be focused more on growth than profitability, even as it eyes up an IPO, possibly as soon as next year.

Uber has raised over $21 billion in funding to date.

Powered by WPeMatico

GUN is an open-source decentralized database service that allows developers to build fast peer-to-peer applications that will work, even when their users are offline. The company behind the project (which should probably change its name and logo…) today announced that it has raised just over $1.5 million in a seed round led by Draper Associates. Other investors include Salesforce’s Marc Benioff through Aloha Angels, as well as Boost VC, CRCM and other angel investors.

As GUN founder Mark Nadal told me, it’s been about four years since he started working on this problem, mostly because he saw the database behind his early projects as a single point of failure. When the database goes down, most online services will die with it, after all. So the idea behind GUN is to offer a decentralized database system that offers real-time updates with eventual consistency. You can use GUN to build a peer-to-peer database or opt for a multi-master setup. In this scheme, a cloud-based server simply becomes another peer in the network (though one with more resources and reliability than a user’s browser). GUN users get tools for conflict resolution and other core features out of the box and the data is automatically distributed between peers. When users go offline, data is cached locally and then merged back into this database once they come online.

Nadal built the first prototype of GUN back in 2014, based on a mix of Firebase, MySQL, MongoDB and Cassandra. That was obviously a bit of a hack, but it gained him some traction among developers and enough momentum to carry the idea forward.

Today, the system has been used to build everything from a decentralized version of Reddit (which isn’t currently working) that can handle a few million uniques per month and a similarly decentralized YouTube clone.

Nadal also argues that his system has major speed advantages over some of the incumbents. “From our initial tests we find that for caching, our product is 28 times faster than Redis, MongoDB and others. Now we are looking for partnerships with companies pioneering technology in gaming, IoT, VR and distributed machine learning,” he said.

The Dutch Navy is already using it for some IoT services on its ships and a number of other groups are using it for their AI/ML services. Because its use cases are similar to that of many blockchain projects, Nadal is also looking at how he can target some of those developers to take a closer look at GUN.

Powered by WPeMatico

Fueled by last year’s greed-inducing visions of a cryptocurrency boom and a stock market largely untethered from classical economics, TradingView, a developer of social networking and data analysis tools for financial markets, has raised millions in new venture funding.

The New York-based company just scored $37 million in funding led by the growth-stage investment firm Insight Venture Partners .

TradingView has developed a proprietary, JavaScript-based programming language called PineScript, which lets anyone develop their own customized financial analysis tools. The company “freemium” software as a service model that lets most users connect and exchange trading tips and tricks for free, but begins charging when customers want access to more charts, data and real-time server-side alerts.

There are three payment plans beginning at $15, with a mid-tier at $30 and a high-end $60 per-month premium option.

The company had previously boosted its growth by offering its charting software for free to partner websites like SeekingAlpha, Bitfinex and the Nasdaq. That strategy helped it grow to 8 million monthly active users with around 61 percent coming from direct traffic as of March of this year.

These days the company derives nearly 75 percent of its revenue from those monthly subscription plans to individual traders. TradingView’s executives think the company still has an opportunity to expand its footprint among those retail investors, but it’s also planning to make a push to serve more institutional clients with its toolkit.

For the past seven years the company has enjoyed consistent growth, according to TradingView co-founder and chief operations officer, Stan Bokov.

For Paul Szurek, a vice-president at Insight Venture Partners, the investment in TradingView is building off of broad consumer interest in amateur speculative trading. Looking at RobinHood, Bux and eToro as gateways for new investors who eventually move on to more sophisticated tools, Szurek said that TradingView was often their next step into market investing.

“The rise of cryptocurrencies… and trading those assets… has flywheeled into a broader interest in investing across asset classes,” Szurek said.

While TradingView was never crypto-focused, according to Bokov, the company was supportive from the beginning and it’s been a boon to the broader business. “They came for crypto. They stayed for the other stuff,” Bokov said.

And crypto might just be the gateway drug for younger speculative traders to start investing in financial markets more broadly, according to Szurek. “October to January, during the real core of the crypto boom here, there were a lot of users coming in starting out researching that asset class broadly. Eighty percent move on to research other asset classes,” he said. “As TradingView kind of pushed through the [first quarter], trends in growth really diverged from what we were seeing in purely crypto-focused business and that’s a testament to users leveraging this one-stop-shop component of the platform.”

Additional investors in the new TradingView include DRW Venture Capital and Jump Capital. The company was a graduate of the 2013 Techstars Chicago batch and was seeded by Irish Angels, Techstars, iTech Capital and undisclosed angel investors.

“TradingView was built for non-professional traders, but its accessible trading tools and powerful-yet-intuitive charting capabilities have attracted the attention of institutional investors,” said Kimberly Trautmann, head of DRW Venture Capital, in a statement. “As an investor, we are excited about the diverse cross section of the industry that TradingView has reached and its rapid growth. As a proprietary trading firm on an institutional level, we’re looking forward to leveraging the platform and contributing to its further development.”

Powered by WPeMatico