Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Compound wants to let you borrow cryptocurrency, or lend it and earn an interest rate. Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets do. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coins you think will sink. It plans to launch its first five for Ether, a stable coin, and a few others, by October.

Today, Compound is announcing some ridiculously powerful allies for that quest. It’s just become the first-ever investment by crypto exchange juggernaut Coinbase’s new venture fund. It’s part of an $8.2 million seed round led by top-tier VC Andreessen Horowitz, crypto hedge fund Polychain Capital and Bain Capital Ventures — the startup arm of the big investment bank.

While right now Compound deals in cryptocurrency through the Ethereum blockchain, co-founder and CEO Robert Leshner says that eventually he wants to carry tokenized versions of real-world assets like the dollar, yen, euro or Google stock. That’s because Leshner tells me “My thesis is that almost every crypto asset is bullshit and not worth anything.”

Here’s how Compound tells me it’s going to work. It’s an “overnight” market that permits super-short-term lending. While it’s not a bank, it is centralized, so you loan to and borrow from it directly instead of through peers, alleviating you from negotiation. If you loan, you can earn interest. If you borrow, you have to put up 100 percent of the value of your borrow in an asset Compound supports. If prices fluctuate and your borrow becomes worth more than your collateral, some of your collateral is liquidated through a repo agreement so they’re equal.

To set the interest rate, Compound acts kind of like the Fed. It analyzes supply and demand for a particular crypto asset to set a fluctuating interest rate that adjusts as market conditions change. You’ll earn that on what you lend constantly, and can pull out your assets at any time with just a 15-second lag. You’ll pay that rate when you borrow. And Compound takes a 10 percent cut of what lenders earn in interest. For crypto-haters, it offers a way to short coins you’re convinced are doomed.

“Eventually our goal is to hand-off responsibility [for setting the interest rate] to the community. In the short-term we’re forced to be responsible. Long-term we want the community to elect the Fed,” says Leshner. If it gets the interest rate wrong, an influx of lenders or borrowers will drive it back to where it’s supposed to be. Compound already has a user interface prototyped internally, and it looked slick and solid to me.

“We think it’s a game changer. Ninety percent of assets are sitting in people’s cold storage, or wallets, or exchanges. They aren’t being used or traded,” says Leshner. Compound could let people interact with crypto in a whole new way.

Compound is actually the third company Leshner and his co-founder and CTO Geoff Hayes have started together. They’ve been teamed up for 11 years since going to college at UPenn. One of their last companies, Britches, created an index of CPG inventory at local stores and eventually got acquired by Postmates. But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. A true economics nerd, he’s the chair of the SF bond oversight committee, and got into crypto five years ago.

Compound co-founder and CEO Robert Leshner

Sitting on coins, Leshner wondered, “Why can’t I realize the time value of the cryptocurrency I possess?” Compound was born in mid-2017, and came out of stealth in January.

Now with $8.2 million in funding that also came from Transmedia Capital, Compound Ventures, Abstract Ventures and Danhua Capital, Compound is pushing to build out its product and partnerships, and “hire like crazy” beyond its seven current team members based in San Francisco’s Mission District. Partners will be crucial to solve the chicken-and-egg problem of getting its first lenders and borrowers. “We are planning to launch with great partners — token projects, hedge funds and dedicated users,” says Leshner. Having hedge funds like Polychain should help.

“We shunned an ICO. We said, ‘let’s raise venture capital.’ I’m a very skeptical person and I think most ICOs are illegal,” Leshner notes. The round was just about to close when Coinbase announced Coinbase Ventures. So Leshner fired off an email asking if it wanted to join. “In 12 hours they researched us, met our team, diligenced it and evaluated it more than almost any investor had to date,” Leshner recalls. Asked if there’s any conflict of interest given Coinbase’s grand ambitions, he said, “They’re probably our favorite company in the world. I hope they survive for 100 years. It’s too early to tell they overlap.”

There are other crypto lending platforms, but none quite like Compound. Centralized exchanges like Bitfinex and Poloniex let people trade on margin and speculate more aggressively. But they’re off-chain, while Leshner says Compound is on-chain, transparent and can be built on top of. That could make it a more critical piece of the blockchain finance stack. There’s also a risk of these exchanges getting hacked and your coins getting stolen.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Meanwhile, there are plenty of peer-to-peer crypto lending protocols on the Ethereum blockchain, like ETHLend and Dharma. But interest rates, no need for slow matching, flexibility for withdrawing money and dealing with a centralized party could attract users to Compound.

Still, the biggest looming threat for Compound is regulation. But to date, the SEC and regulators have focused on ICOs and how people fundraise, not on what people are building. People aren’t filing lawsuits against actual products. “All the operations have flown beneath the radar and I think that’s going to change in the next 12 months,” Leshner predicts. How exactly they’ll treat Compound is up in the air.

One source in the crypto hedge fund space told me about forthcoming regulation: “You’re either going to get annihilated and have to disgorge profits or dissolve. Or you pay a fine and you’re among the first legal funds in the space. This is the gamble you take before asset classes get baptized.” As Leshner confirmed, “That’s the number one risk, period.”

Money markets are just one piece of the financial infrastructure puzzle that still needs to emerge around blockchain. Custodians, auditors, administrators and banks are still largely missing. When those get hammered out to make the space safer, the big money hedge funds and investment banks could join in. For Compound, getting the logistics right will require some serious legal ballet.

Yet Leshner is happy to dream big despite all of the crypto world’s volatility. He concludes, “We want to be like Black Rock with a trillion under management, and we want to have 25 employees when we do that. They probably have [tens of thousands] of employees. Our goal is to be like them with a skeleton team.”

Powered by WPeMatico

As we increasingly hear about automation, artificial intelligence and robots taking away industrial jobs, Parsable, a San Francisco-based startup sees a different reality, one with millions of workers who for the most part have been left behind when it comes to bringing digital transformation to their jobs.

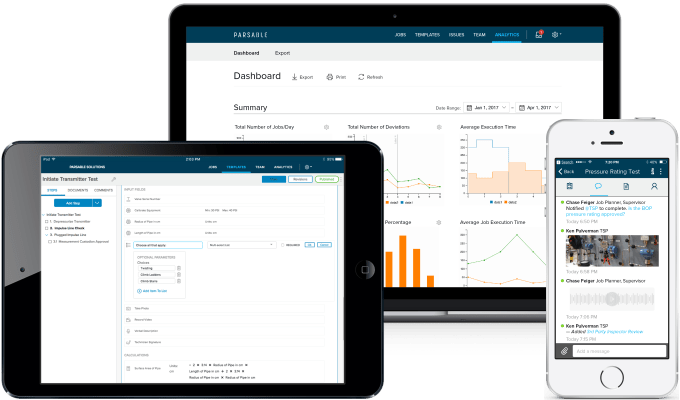

Parsable has developed a Connected Worker platform to help bring high tech solutions to deskless industrial workers who have been working mostly with paper-based processes. Today, it announced a $40 million Series C cash injection to keep building on that idea.

The round was led by Future Fund with help from B37 and existing investors Lightspeed Venture Partners, Airbus Ventures and Aramco Ventures. Today’s investment brings the total to nearly $70 million.

The Parsable solution works on almost any smartphone or tablet and is designed to enter information while walking around in environments where a desktop PC or laptop simply wouldn’t be practical. That means being able to tap, swipe and select easily in a mobile context.

Photo: Parsable

The challenge the company faced was the perception these workers didn’t deal well with technology. Parsable CEO Lawrence Whittle says the company, which launched in 2013, took its time building its first product because it wanted to give industrial workers something they actually needed, not what engineers thought they needed. This meant a long period of primary research.

The company learned, it had to be dead simple to allow the industry vets who had been on the job for 25 or more years to feel comfortable using it out of the box, while also appealing to younger more tech-savvy workers. The goal was making it feel as familiar as Facebook or texting, common applications even older workers were used to using.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

“What we are doing is getting rid of [paper] notebooks for quality, safety and maintenance and providing a digital guide on how to capture work with the objective of increasing efficiency, reducing safety incidents and increasing quality,” Whittle explained.

He likens this to the idea of putting a sensor on a machine, but instead they are putting that instrumentation into the hands of the human worker. “We are effectively putting a sensor on humans to give them connectivity and data to execute work in the same way as machines,” he says.

The company has also made the decision to make the platform flexible to add new technology over time. As an example they support smart glasses, which Whittle says accounts for about 10 percent of its business today. But the founders recognized that reality could change and they wanted to make the platform open enough to take on new technologies as they become available.

Today the company has 30 enterprise customers with 30,000 registered users on the platform. Customers include Ecolab, Schlumberger, Silgan and Shell. They have around 80 employees, but expect to hit 100 by the end of Q3 this year, Whittle says.

Powered by WPeMatico

MemSQL, a company best known for the real-time capabilities of its eponymous in-memory database, today announced that it has raised a $30 million Series D round, bringing the company’s overall funding to $110 million. The round was led by GV (the firm you probably still refer to as Google Ventures) and Glynn Capital. Existing investors Accell, Caffeinated Capital, Data Collective and IA Ventures also participated.

The MemSQL database offers a distributed, relational database that uses standard SQL drivers and queries for transactions and analytics. Its defining feature is the combination of its data ingestions technology that allows users to push millions of events per day into the service while its users can query the records in real time. The company recently showed that its tools can deliver a scan rate of over a trillion rows per second on a cluster with 12 servers.

The database is available for deployments on the major public clouds and on-premises.

MemSQL recently announced that it saw its fourth-quarter commercial booking hit 200 percent year-over-year growth — and that’s typically the kind of growth that investors like to see, even as MemSQL plays in a very competitive market with plenty of incumbents, startups and even open-source projects. Current MemSQL users include the likes of Uber, Akamai, Pinterest, Dell EMC and Comcast.

“MemSQL has achieved strong enterprise traction by delivering a database that enables operational analysis at unique speed and scale, allowing customers to create dynamic, intelligent applications,” said Adam Ghobarah, general partner at GV, in today’s announcement. “The company has demonstrated measurable success with its growing enterprise customer base and we’re excited to invest in the team as they continue to scale.”

Powered by WPeMatico

In an effort to tie the top gamers and streamers more directly with their fans, a new company called Quarterback has just raised $2.5 million to create and manage fan-based leagues for the superstars of the esports and streaming world.

The company raked in its seed round from investors led by Bitkraft Esports, which is quickly building one of the most complete portfolios of gaming-related startups in the industry. Additional investors include Crest Capital Ventures, Deep Space Ventures, UpWest Labs and angel investors.

Essentially, it’s a platform for creating gaming leagues and content driven not by game publishers, leagues, or existing streaming sites like Twitch, but by the gamers themselves. It gives streamers and players a new way to reach their audience, the company claims.

Founded by serial entrepreneur Jonathan Weinberg, who acted as the chief executive for Round Robin and held a leadership role in the mobile game studio Spartonix, Quarterback is the latest attempt to get more revenue into the hands of gamers.

Leagues created on Quarterback can host daily challenges, give away prizes and compete against fan clubs devoted to other top players.

Esports streamers and gamers are among the most bankable influencers, pitching to a new generation of consumers that don’t track traditional media sources. The ability to host and own their own channels gives these streamers an ability to create their own game libraries, cultivate a next generation of talent and encourage one-to-one interactions on platforms they control.

“Most streamers and pros struggle to monetize their fan-base and lose touch with their audience when the fans break away to play their own games,” says Jens Hilgers, a founding partner of Bitkraft Esports Ventures. “Quarterback solves this problem in a unique way by helping streamers become an integral part of their fan’s game-play.”

Powered by WPeMatico

Auth0, a startup based in Seattle, has been helping developers with a set of APIs to build authentication into their applications for the last five years. It’s raised a fair bit of money along the way to help extend that mission, and today the company announced a $55 million Series D.

This round was led by led by Sapphire Ventures with help from World Innovation Lab, and existing investors Bessemer Venture Partners, Trinity Ventures, Meritech Capital and K9 Ventures. Today’s investment brings the total raised to $110 million. The company did not want to share its valuation.

CEO Eugenio Pace said the investment should help them expand further internationally. In fact, one of the investors, World Innovation Lab, is based in Japan and should help with their presence there. “Japan is an important market for us and they should help explain to us how the market works there,” he said.

The company offers an easy way for developers to build in authentication services into their applications, also known as Identification as a Service (IDaaS). It’s a lot like Stripe for payments or Twilio for messaging. Instead of building the authentication layer from scratch, they simply add a few lines of code and can take advantage of the services available on the Auth0 platform.

That platform includes a range of service such as single-sign on, two-factor identification, passwordless log-on and breached password detection.

They have a free tier, which doesn’t even require a credit card, and pay tiers based on the types of users — regular versus enterprise — along with the number of users. They also charge based on machine-to-machine authentication. Pace reports they have 3500 paying customers and tens of thousands of users on the free tier.

All of that has added up to a pretty decent business. While Pace would not share specific numbers, he did indicate the company doubled its revenue last year and expected to do so again this year.

With a cadence of getting funding every year for the last three years, Pace says this round may mark the end of that fundraising cycle for a time. He wasn’t ready to commit to the idea of an IPO, saying that is likely a couple of years away, but he says the company is close to profitability.

With the new influx of money, the company does plan to expand its workforce as moves into markets across the world . They currently have 300 employees, but within a year he expects to be between 400 and 450 worldwide.

The company’s last round was a $30 million Series C last June led by Meritech Capital Partners.

Powered by WPeMatico

A lot of money — about $140 billion — is lost every year in the U.S. healthcare system thanks to inefficient management of basic internal operations, according to a study from the Journal of the American Medical Association.

While there are many factors that contribute to the woeful state of healthcare in the U.S., with greed chief among them, the 2012 study points to one area where hospitals have nothing to lose and literally billions to gain by improving their patient flows.

The problem, according to executives and investors in the startup Qventus, is that hospitals can’t invest in new infrastructure to streamline the process that’s able to work with technology systems that are in some cases decades old — and with an already overtaxed professional staff.

That’s why the founders of Qventus decided to develop a software-based service that throws out dashboards and analytics tools and replaces it with a machine learning-enhanced series of prescriptions for hospital staff to follow when presented with certain conditions.

Qventus’ co-founder and chief executive Mudit Garg started working with hospitals 10 years ago and found the experience “eye-opening.”

“There are lots and lots of people who really really care about giving the best care to every patient, but it depends on a heroic effort from all of those individuals,” Garg said. “It depended on some amazing manager going above and beyond and doing some diving catch to make things work.”

As a software engineer, Garg thought there was a simple solution to the problem — applying data to make processes run more effectively.

In 2012 the company started out with a series of dashboards and data management tools to provide visibility to the hospital administrators and operators about what was happening in their healthcare facilities. But, as Garg soon discovered, when doctors and nurses get busy, they don’t love a dashboard.

From the basic analytics, Garg and his team worked to make the data more predictive — based on historical data about patient flows, the system would send out notifications about how many patients a facility could expect to come in at almost any time of day.

But even the predictive information wasn’t useful enough for the hospitals to act on, so Garg and company went back to the drawing board.

What they finally came up with was a solution that used the data and predictive capabilities to start suggesting potential recipes for dealing with situations in hospitals. Rather than saying that a certain number of patients were likely to be admitted to the hospital, the software suggests actions for addressing the likely scenarios that could occur.

For instance, if there are certain times when the hospital is getting busier, nurses can start discharging patients in anticipation of the need for new capacity in an ICU, Garg said.

Photo courtesy of Paul Burns

That product, some six years in the making, has garnered the attention of a number of top investors in the healthcare space. Mayfield Fund and Norwest Venture Partners led the company’s first round, and Qventus managed to snag a new $30 million round from return investors and new lead investor, Bessemer Venture Partners. Strategic backer New York Presbyterian Ventures, the investment arm of the famed New York hospital system, also participated.

So far, Qventus has raised $43 million for its service.

As a result of the deal, Stephen Kraus, a partner at Bessemer, will take a seat on the company’s board of directors.

“Hospitals are under tremendous pressure to increase efficiency, improve margins and enhance patient experience, all while reducing the burden on frontline teams, and they currently lack tools to use data to achieve operational productivity gains,” said Kraus, in a statement.

For Kraus, the application of artificial intelligence to operations is just as transformative for a healthcare system, as its clinical use cases.

“We’ve been looking at this space broadly… AI and ML to improve healthcare… image interpretation, pathology slide interpretation… that’s all going to take a longer time because healthcare is slow to adapt.” said Kraus. “The barriers to adoption in healthcare is frankly the physicians themselves…the average primary care doc is seeing 12 to 20 patients a day… they barely want to adopt their [electronic medical health records]… The idea that they’re going to get comfortable with some neural network or black box technology to change their clinical workflow vs. Qventus which is clinical workflow to strip out cost… That’s lower hanging fruit.”

Powered by WPeMatico

Gamalon wants to change the game when it comes to understanding text-based customer communications. Instead of using neural networks to learn about a vast corpus of information, the startup takes a different approach, putting the text in a database and building decision trees to very rapidly train the data to arrive at the required information. Today, it announced a $20 million Series A investment led by Intel Capital.

Other participants in the round included .406 Ventures and Omidyar Technology Ventures along with existing investors Boston Seed Capital, Felicis Ventures and Rivas Capital. Today’s investment brings the total raised by the company since inception in 2013 to $32 million including backing from DARPA in earlier rounds.

Gamalon CEO Ben Vigoda says they developed a new approach to analyzing customer interactions because the state of the art in AI and machine learning was too much of a black box.

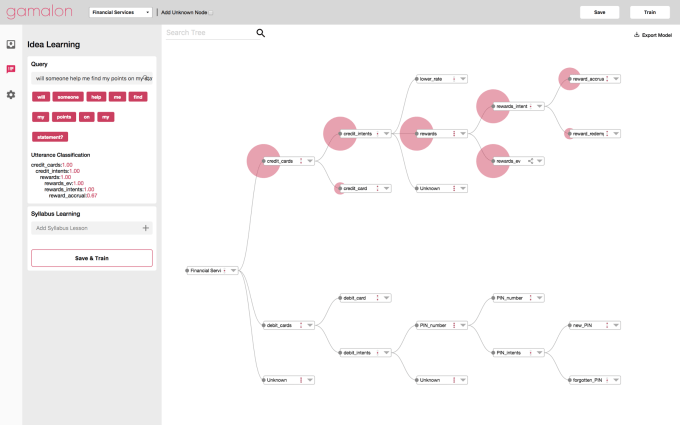

His company wants to change that by making the whole process much more interactive. To that end Gamalon also released a new tool called Idea Studio, a product that can automatically build learning trees to help users arrive at answers extremely fast or allow a business analyst or data scientists to simply enter a series of queries and build a decision tree on the fly based on the text. With neural networks, Vigoda says, the user has no control over the end result, but with Idea Studio you can edit the trees and refine the results immediately.

Gamalon Idea Studio decision tree. Photo: Gamalon

The product still needs a way to review all of the text-based content, of course, but instead of having humans categorize it all manually, with Gamalon you import your data into a database, do analytics on it and then make it available for rapid categorization and response.

This could have multiple utilities, whether for customer service agents to find answers very quickly or customers to interact with bots and find answers much faster. Analysts could use it to locate answers to business issues, and it’s sophisticated enough for data scientists to build machine learning projects based on a large corpus of data.

You can build a learning tree by entering related text to train it. GIF: Gamalon

Naveen Rao, corporate vice president and general manager in the Artificial Intelligence Products Group at Intel Corporation says they like how Gamalon puts machine learning into hands of many different employees around the customer information use case. “We want enterprises of all levels of AI capability to take full advantage of this growing volume and complexity of data. Gamalon’s unique approach can help users better understand billions of customer communications, customize individual responses, and take action to better serve those customers,” Rao explained in a statement.

The company is based in Cambridge, MA and has 23 employees. They have six large customers including Avaya.

Powered by WPeMatico

Going to the dentist can be anxiety-inducing. Unfortunately, it was no different for me last week when I went to discuss Uniform Teeth’s recent $4 million seed funding round from Lerer Hippeau, Refactor Capital, Founder’s Fund and Slow Ventures.

Uniform Teeth is a clear teeth aligner startup that competes with the likes of Invisalign and Smile Direct Club. The startup takes a One Medical-like approach in that it provides real, licensed orthodontists to see you and treat your bite.

“For us, we’re really focused on transforming the orthodontic experience,” Uniform Teeth CEO Meghan Jewitt told me at the startup’s flagship dental office in San Francisco. “There are a lot of health care companies out there that are taking areas that aren’t very customer-centric.”

Jewitt, who spent a couple of years at One Medical as director of operations, pointed to One Medical, Oscar Insurance and 23andMe as examples of companies taking a very customer-centric approach.

“We are really interested in doing the same for the orthodontics space,” she said.

Ahead of the first visit, patients use the Uniform app to take photos of their teeth and their bite. During the initial visit, patients receive a panoramic scan and 3D imaging to confirm what type of work needs to be done.

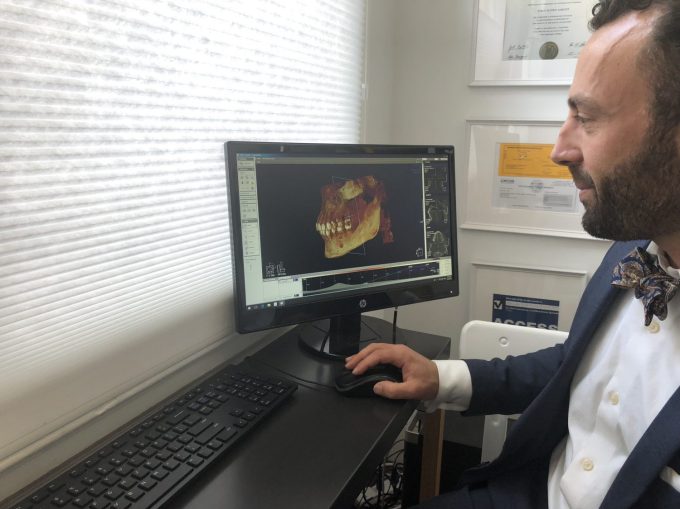

Last week during my visit, Jewitt and Uniform Teeth co-founder Dr. Kjeld Aamodt showed me the technology Uniform uses for its patient evaluations.

In the GIF above, you can see I received a 3D panoramic X-ray. The process took about 10 seconds and it’s about the same exposure to X-rays as a flight from San Francisco to Los Angeles, Dr. Aamodt said.

“With that information, we’re able to see the health of your roots, your teeth, the bone, your jaw joints, check for anything that could get worse during treatment,” Dr. Aamodt said.

Below, you can see the 3D scan.

Next is looking in-between the teeth. From here, the idea is to get a much more holistic view, Dr. Aamodt said. This is where things got interesting.

If you look at the bottom left of the photo, under my back bottom tooth, you can see a dark circle below the tooth. Dr. Aamodt gently pointed that out to me.

“That tells me there’s bacteria living inside of your jaw,” he explained. “A lot of people have this. It’s pretty common so don’t beat yourself up for it.”

This is when he told me I’d likely need to get a root canal to get rid of it. Mild panic ensued.

Dr. Aamodt went on to explain that, if I were a patient of his looking to get my teeth straightened, he would recommend that I first get the root canal before any teeth movement. That’s because, he explained, moving teeth at that point could potentially result in further infection.

“The concern about that is when we move a tooth with that, the infection will get worse and you could risk losing that tooth,” he told me.

Although I was freaking out internally, I continued to move ahead with the process. Next up was the 3D scan, which results in something fancy called a 3D Cone Beam Computed Tomography. This, Dr. Aamodt said, is what really sets Uniform Teeth apart in precision tooth movement.

This process takes the place of dental impressions, which are made by biting into a tray with gooey material. I didn’t feel like getting my bottom teeth scanned, but below is what the top looks like.

At this point Uniform Teeth would share its recommendations with the patient. My personal recommendation was to go see my dentist and, if I’m interested in straightening my teeth, come back once my roots are in a healthy enough state.

From there, I’d receive a custom treatment plan that combines the X-ray plus 3D scan to predict how my teeth will move. After receiving the clear aligners in a couple of weeks, I’d check in with Dr. Aamodt every week via the mobile app. If something were to come up, I could always set up an in-person appointment. Most people average about two to three visits in total, Jewitt said. All of that would add up to about $3,500.

The reason Uniform Teeth requires in-office visits is because 75 percent or more of the cases require additional procedures. For example, some people require small, tooth-colored attachments to be placed onto the clear aligners. Those attachments can help move teeth in a more advanced way, Dr. Aamodt said.

“If you don’t have these, then you can tip some teeth but you can’t do all of the things to help improve the bite, to create a really lasting, beautiful, healthy smile,” he explained.

Uniform Teeth currently treats patients in San Francisco, but intends to open additional offices nationwide next year. As the company expands, the plan is to bring on board more full-time orthodontists.

“Right now, we’re an employment-based model and we’d really like to continue that because it allows us to control the experience and deliver a really high-quality service,” Jewitt said.

A lot of companies say they care about the customer when, in reality, they just care about making money. But I genuinely believe Uniform Teeth does care. After I left with my tail between my legs that day, I called my dentist to set up an appointment. The following day, my dentist confirmed what Dr. Aamodt found and proceeded to set me up to get a root canal. A few days later, Dr. Aamodt checked in with me via the mobile app to ask me how I was doing and to make sure I was getting it treated. I was pleased to let him know, as Olivia Pope likes to say, “It’s handled.”

Powered by WPeMatico

Printify, a startup all the way from Riga, Latvia, has raised $1 million in seed funding led by Google AdSense pioneer Gokul Rajaram as it looks to expand its services in the U.S. and build out its team in Latvia.

Today, roughly 50,000 e-commerce stores use Printify’s services for printing-on-demand, according to the company.

Together with Lumi, which can handle packaging for consumer-facing startups, Printify is making the notion of becoming a brand as seamless as possible by taking much of a vendor’s legwork out of the equation.

The company keeps its customers’ billing information on file and links with the back-end ordering system of almost any e-commerce platform.

When an order comes in, Printify gets an API notification to begin working on a product. The company then sends print-ready files to an on-demand manufacturer that can print a design and ship a product within 24 hours.

Printify founder James Berdigans came up with the idea for the company after starting a business making accessories for Apple products.

“We wanted to print custom phone cases and we thought we’d find an on-demand manufacturer and it would be easy,” says Berdigans. That’s when Printify was born.

The company first integrated through Shopify and began to see some traction in November 2015, but because the company didn’t own its own manufacturing, quality became a concern.

In 2016, Berdigans pivoted to the marketplace model because he saw demand coming from a growing number of small business owners like himself that needed access to a selection of quality printing houses.

New direct-to-garment printing and digital printing on t-shirts is going to grow very rapidly over the next few years, according to Berdigans.

A graduate from the 500 Startups accelerator program, the company is already profitable and hoping to capitalize on its success with this new funding to expand its engineering team.

“In just two years, Printify has become profitable and is growing at a rapid pace. With this

investment, we plan to double our Riga team in 2018. That will create at least 30 new jobs,

most of which will be in programming, design, and customer support,” said Printify co-founder

Artis Kehris in a statement.

Powered by WPeMatico

Shenzhen-based home robotics company UBTECH announced this week that it has closed a massive $820 million Series C. The round, led by Tencent and a whole slew of other investors, follows a $100 million Series B and $20 million Series C.

The bipedal robotics maker certainly isn’t a household name here in the States — though the company’s taken a few baby steps over here, including a walking Stormtrooper robot released alongside The Last Jedi. It also debuted a “robotic butler” with a tablet face back at CES in January that seemed more proof of concept than shipping product — though UBTECH has promised a broad 2019 release date.

CEO James Zhou has promised the company will use this huge backing to accelerate its vision of bringing robots into the home.

“As technology evolves to include more voice and touch capabilities, people need new devices that communicate and interact more naturally and intuitively at home, at school and at work,” he said in a release tied to the announcement. “While trends in robots and robotics are developing, no company has yet stepped forward with the resources, vision and products ecosystem to transform robot fantasy and fiction into robot reality. UBTECH is bringing this reality to life by expanding the possibilities for innovation.”

The company says the funding will go into R&D, hires and expanding its global footprint. UBTECH is one of a number of companies pushing home robotics beyond the Roomba, including a rumored upcoming device from Amazon. The technology has been a tough nut to crack in the preceding decades, but an $820 million investment certainly couldn’t hurt.

Powered by WPeMatico