Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Massachusetts-based Soft Robotics announced this week that it’s raised $20 million in funding, courtesy of Scale Venture Partners, Calibrate Ventures, Honeywell Ventures and Tekfen Ventures, along with existing investors like robotics giant, ABB. The round follows a $5 million Series A the company closed back in late-2015.

The investment interest is pretty clear on this one. Picking and placing is the de rigueur industrial robotics challenge at the moment, and the company’s soft, air-filled hands offer a novel approach to the issue. The rubbery materials that comprise the company’s robotic grippers make them much more compliant and therefore more capable of picking up a variety of objects with minimal pre-programming and on-board vision systems.

Thus far, Soft has primarily found a spot for itself in the food industry, serving factories with delicate products like produce and pizza dough. It’s also been adopted by Just Born Quality Confections, the people who bring you Peeps.

According to the company, the new round will help push Soft even further into the food and beverage categories, along with a larger presence in retail and logistics. The involvement of Honeywell and Yamaha’s investment wings could also signal interest from those companies’ own warehouses. With the right air pressure applied, the system should be strong enough to pick up more solid objects.

Warehouse fulfillment has become increasingly strained in recent years, due to expectations from companies like Amazon, opening a space for robotics companies to address fast-paced but repetitive jobs like moving product onto and off of conveyor belts. Late last month, Soft showed off a low-cost, AI-driven warehouse system designed to retrieve products from bins to sort and fulfill retail orders with little oversight from its human counterparts.

Powered by WPeMatico

The massage-on-demand service Soothe seems to be rubbing investors the right way with the close of a new $31 million round of funding.

The Series C round from late-stage and growth capital investment firm, The Riverside Company, caps a busy first quarter for the massage service. It also relocated from Los Angeles to Las Vegas; named a new chief executive; and announced new geographies where its massage booking platform is now available.

As part of the new round, chief executive and founder Merlin Kauffman is stepping down from the role and assuming the mantle of executive chairman. Current chief financial officer Simon Heyrick is stepping into the chief executive role.

The former CFO of MarketShare, Heyrick has helped the company expand to more than 11,000 massage therapists in its network.

The company said the new round would help keep massage therapists in its network with pricing that can be up to three times more than those therapists would make in their local markets.

Beyond the new financing and a new boss, Soothe also is heading to new markets, launching services in Manchester, U.K.; Australia’s Gold Coast, Pittsburgh and Hartford, Conn. (some of those places are not like the others).

Soothe isn’t the only player in the massage marketplace. New York-based Zeel also has an offering for folks who want to book massages on the fly. Zeel claims a geographic reach of 85 U.S. cities, while Soothe claims roughly 60 cities worldwide.

Powered by WPeMatico

The venture investment arm of massive meat manufacturer Tyson Foods is continuing its push into potential alternative methods of poultry production with a new investment in the Israeli startup Future Meat Technologies.

The backer of companies like the plant-based protein-maker Beyond Meat, and cultured-meat company Memphis Meats, Tyson Ventures’ latest investment is also tackling technology development to create mass-produced meat in a lab — instead of on the farm.

Future Meat Technologies is working to commercialize a manufacturing technology for fat and muscle cells that was first developed in the laboratories of the Hebrew University of Jerusalem.

“It is difficult to imagine cultured meat becoming a reality with a current production price of about $10,000 per kilogram,” said Yaakov Nahmias, the company’s founder and chief scientist, in a statement. “We redesigned the manufacturing process until we brought it down to $800 per kilogram today, with a clear roadmap to $5-10 per kg by 2020.”

The deal marks Tyson’s first investment in an Israeli startup and gives the company another potential horse in the race to develop substitutes for the factory slaughterhouses that provide most of America’s meat.

“This is definitely in the Memphis Meats… in the lab-based meat world,” says Justin Whitmore, executive vice president of corporate strategy and chief sustainability officer of Tyson Foods.

Whitmore takes pains to emphasize that Tyson is continuing to invest in its traditional business lines, but acknowledges that the company believes “in exploring additional opportunities for growth that give consumers more choices,” according to a statement.

While startups like Impossible Foods are focused on developing plant-based alternatives to the proteins that give meat its flavor, Future Meat Technologies and Memphis Meats are trying to use animal cells themselves to grow meat, rather than basically harvesting it from dead animals.

Chef Uri Navon mixing ingredients with FMT’s cultured meat

According to Nahmias, animal fat produces the flavors and aromas that stimulate taste buds, and he says that his company can produce the fat without harvesting animals and without genetic modification.

For Whitmore, what separates Future Meat Technologies and Memphis Meats is the scale of the bioreactors that the companies are using to make their meat. Both companies — indeed all companies on the hunt for a meat replacement — are looking for a way around relying on fetal bovine serum, which is now a crucial component for any lab-cultured meats.

“I want my children to eat meat that is delicious, sustainable and safe,” said Nahmias, in a statement, “this is our commitment to future generations.”

The breadth of backgrounds among the investors that have come together to finance the $2.2 million seed round for Future Meat Technologies speak to the market opportunity that exists for getting a meat manufacturing replacement right.

“Global demand for protein and meat is growing at a rapid pace, with an estimated worldwide market of more than a trillion dollars, including explosive growth in China. We believe that making a healthy, non-GMO product that can meet this demand is an essential part of our mission,” said Rom Kshuk, the chief executive of Future Meat Technologies, in a statement.

One of the company’s first pilot products is lab-grown chicken meat that chefs have already used in some recipes.

FMT’s first cultured chicken kebab on grilled eggplant with tahini sauce

In addition to Tyson Ventures, investors in the Future Meat Technologies seed round included the Neto Group, an Israeli food conglomerate; Seed2Growth Ventures, a Chicago-based fund backed by Walmart wealth; BitsXBites, a Chinese food technology fund; and Agrinnovation, an Israeli investment fund founded by Yissum, the Technology Transfer Company of The Hebrew University,

“Hebrew University, home to Israel’s only Faculty of Agriculture, specializes in incubating applied research in such fields as animal-free meat sources. Future Meat Technologies’ innovations are revolutionizing the sector and leading the way in creating sustainable alternative protein sources,” said Dr. Yaron Daniely, president and CEO of Yissum.

Powered by WPeMatico

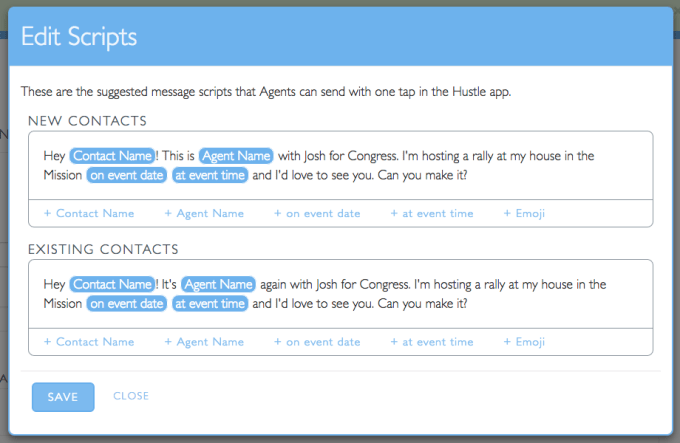

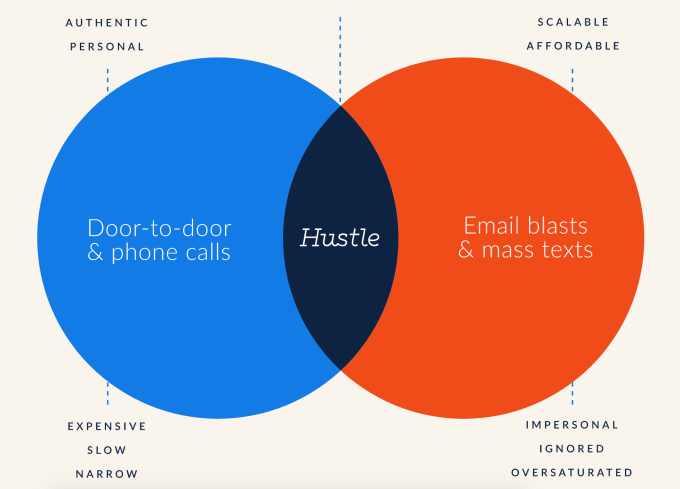

Hustle 20X’d its annual revenue run rate in 15 months by denying clients that contradict its political views. It’s a curious, controversial, yet successful strategy for the startup whose app lets activists and marketers text thousands of potential supporters or customers one at a time. Compared to generic email blasts and robocalls, Hustle gets much higher conversion rates because people like connecting with a real human who can answer their follow-up questions.

The whole business is built around those relationships, so campaigns, non-profits, and enterprises have to believe in Hustle’s brand. That’s why CEO Roddy Lindsay tells me “We don’t sell to republican candidates or committees. What it’s allowed us to do is build trust with the Democratic party and progressive organizations. We don’t have to worry about celebrating our clients’ success and offending other clients.”

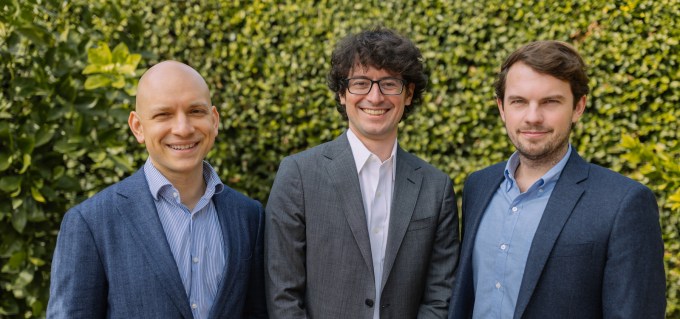

Hustle execs from left: COO Ysiad Ferreiras, CEO Roddy Lindsay, CTO Tyler Brock

Investors agree. Tempted by Hustle’s remarkable growth to well over a $10 million run rate and 85 million conversations started, Insight Venture Partners has led a $30 million Series B for the startup that’s joined by Google’s GV and Salesforce Ventures.

The round comes just 10 months after Hustle’s $8M Series A when it was only doing $3 million in revenue. Lindsay says he was impressed with Insight’s experience with communication utilities like Cvent and non-profit tools like Ministry Brands. Its managing director Hilary Gosher who specializes in growing sales teams will join Hustle’s board, which is a great fit since Hustle is hiring like crazy.

Founded in late 2014, Hustle’s app lets organizers write MadLibs-style text message scripts and import contact lists. Their staffers or volunteers send out the messages one by one, with the blanks automatically filled in to personalize the calls to action. Recipients can respond directly with the sender ready with answers to assuage their fears until they’re ready to donate, buy, attend, or help. Meanwhile, organizers can track their conversions, optimize scripts, and reallocate assignments so they can reach huge audiences with an empathetic touch.

The Hustle admin script editor

The app claims to be 77X faster than making phone calls and 5.5X more engaging than email, which has won Hustle clients like LiveNation’s concert empire, NYU, and the Sierra Club. Clients pay $0.30 per contact uploaded into Hustle, with discounts for bigger operations. Now at $41 million in total funding, Hustle plans to push further beyond its core political and non-profit markets and deeper into driving alumni donations for universities, sales for enterprises, and attendance for event promoters.

Hustle will be doing that without one of its three co-founders, Perry Rosenstein, who left at the end of 2017. [Disclosure: I know Lindsay from college and once worked on a short-lived social meetup app with Rosenstein called Signal.] Lindsay says Rosenstein’s “real excellence was about early stage activities and problems”. Indeed, in my experience he was more attuned to underlying product-market fit than the chores of scaling a business. “It was Perry’s decision, it was a departure we celebrated, and he’s still involved as an informal adviser to me and the company” Lindsay concluded.

Hustle is growing so fast, this recent photo is already missing a third of the team

Hustle has over 100 other employees in SF, NYC, and DC to pick up the torch, though. That’s up from just 12 employees at the start of 2017. And it’s perhaps one of the most diverse larger startups around. Lindsay says his company is 51 percent women, 48 percent people of color, and 21 percent LGBT. This inclusive culture attracts top diverse talent. “We see this as a key differentiator for us. It allows us to hire incredible people” Lindsay says. “It’s something we took seriously from day one and the results show.”

What started as a favored tool of the Bernie Sanders campaign has blossomed into a new method of communicating at scale. “We’re massively humanizing the way these organizations communicate” Lindsay said. “Humans really matter, no matter if what you care about is getting lots of people to come to events, vote, or renew a season ticket package. Having a relationship with another person can cut through the noise. That’s different than your interactions with bots or email marketing campaigns or things where it’s dehumanized.”

Lindsay felt the frustration of weak relationships when after leaving Facebook where he worked for six years as one of its first data scientists, he volunteered for Mark Zuckerberg’s Fwd.us immigration reform organization. Its email got just a 1 percent conversion rate. He linked up with Obama’s former Nevada new media director Rosenstein and CTO Tyler Brock to fix that with Hustle.

Working with Bernie aligned with the team’s political sentiments, but they were quickly faced with whether they wanted to fuel both sides of the aisle — which would mean delivering fringe conservative campaign messages they couldn’t stomach. Hustle still has no formal policy about declining Republican money, and a spokesperson said they point potential clients to TechCrunch’s previous article mentioning the stance. Meanwhile, Hustle is growing its for-profit client base to make shunning the GOP feel like less of a loss. Having Salesforce as a strategic investor also creates a bridge to a potential exit option.

Focusing on the left is working for now. Over 25 state Democratic parties are clients. Hustle sent 2.5 million messages and reached over 700,000 voters — 1 in 5 total — during the Alabama special election, helping Democrat Doug Jones win the Senate seat.

“Let’s build this great business for the Democratic party. Let’s let someone else take the Republicans” Lindsay explains. A stealth startup called OpnSesame is doing just that, Lindsay mentions. But he says “we don’t actually see them as competitive. We see them as potential allies that advocate for the power of p2p texting in getting everyone included in our democracy.” Instead, Lindsay sees the potential for Hustle to lose its sense of purpose and drive as it rapidly hires as its biggest threat.

Long-term, Hustle hopes to propel the right side of history by sticking to the left. Lindsay concludes, “You can really just put on your business hat and see this is a good choice.”

Powered by WPeMatico

Solving complex data-driven problems requires a lot of teamwork. But, of course, teamwork is typically restricted to companies where everyone is working under the same roof. While distributed teams have become commonplace in tech startups, taking that to the next level by linking up disparate groups of people all working on the same problem (but not in the same company) has been all but impossible. However, in theory, you could use a blockchain to do such a thing, where the work generated was constantly accounted for on-chain.

That’s in theory. In practice, there’s now a startup that claims to have come up with this model. And it’s raised funding.

Covee, a startup out of Berlin, has raised a modest €1.35 million in a round led by LocalGlobe in London, with Atlantic Labs in Berlin and a selection of angels. Prior to this, the company was bootstrapped by CEO Dr. Marcel Dietsch, who left his job at a London-based hedge fund, and his long-time friend, Dr. Raphael Schoettler, COO, who had previously worked for Deutsche Bank. They are joined by Dr. Jochen Krause, CTO, an early blockchain investor and bitcoin miner, and former quant developer and data scientist, respectively, at Scalable Capital and Valora.

What sort of things could this platform be used for? Well, it could be used to bring together people to use machine learning algorithms to improve cancer diagnosis through tumor detection, or perhaps develop a crypto trading algorithm.

There are obvious benefits to the work of scientists. They could work more flexibly, access a more diverse range of projects, choose their teammates and have their work reviewed by peers.

The platform also means you could be rewarded fairly for your contribution.

The upside for corporates is that they can use distributed workers where there is no middleman platform to pay and no management consultancy fees, and access a talent pool (data engineers, statisticians, domain experts), which is difficult to bring inside the firm.

Now, there are indeed others doing this, including Aragon (decentralized governance for everything), Colony (teamwork for everything) and Upwork (freelance jobs platform for individuals). All are different and have their limitations, of course.

Covee plans to make money by having users pay a transaction fee for using the network infrastructure. They plan to turn this into a fully open-source decentralized network, with this transaction fee attached. But Covee will also offer this as a service if clients prefer not to deal with blockchain tokens and the platform directly.

Dietsch says: “Covee was founded in the first half of 2017 in Berlin and relocated to Zurich, Switzerland late 2017 where we incorporated Covee Network. Moving to Switzerland was important for us because it has one of the oldest and strongest blockchain ecosystems in the world and an excellent pipeline of talent from institutions such as ETH Zurich and the University of Zurich. The crypto-friendly stance of the country means it has all the necessary infrastructure as well as clear regulations for token economies.”

Powered by WPeMatico

Mike Cagney, who was ousted last summer from the lending company he founded, is back with a new startup and a whole lot of funding from at least one of his previous investors.

According to a new report in Bloomberg, Cagney, who earlier this year formed a new lending startup called Figure, has raised $50 million to grow the company, which plans to use the blockchain to facilitate loan approvals in minutes instead of days.

According to the company’s site, its lending products will include home equity lines of credit, home improvement loans and home buy-lease back offerings for retirement.

The round was led by DCM Ventures and Ribbit Capital and included participation from Mithril Capital Management, Cagney confirmed to Bloomberg.

Ribbit Capital in Palo Alto, Calif., has been leading investments in the world of fintech and digital currencies since its founding nearly six years ago. Others of its many bets include the online consumer lending company Affirm, and Point, a startup that buys equity in U.S. homes.

Mithril, co-founded by Peter Thiel, prides itself on funding companies that take time to build, with funds that have longer investing timelines than do most traditional venture vehicles.

The cross-border firm DCM Ventures, meanwhile, is perhaps the most interesting participant in this round. The reason: Back in 2012, DCM began investing in Social Finance, or SoFi, the company that Cagney founded previously.

It isn’t uncommon for VCs to invest in founders with whom they’ve worked before, of course. And SoFi has grown by leaps and bounds since its August 2011 launch. Though it initially focused on refinancing student loans, today it provides personal and mortgage loans and wealth management services, and it appears to be pushing further into other bank-like services.

But Cagney was forced out of the company last summer, not long after a sexual harassment lawsuit was filed by a former employee who claimed he’d witnessed female employees being harassed by managers and was fired after he reported it.

Another former employer who’d been stationed at SoFi’s office in Healdsburg, Calif., told The New York Times that her work environment had been akin to a “frat house,” with employees “having sex in their cars and in the parking lot.” That same story, based on conversations with 30 then-current and former employees, also reported that Cagney himself had raised questions with staff because of his own behavior, including bragging about his sexual conquests.

Evidently, DCM and Figure’s other backers were able to brush aside concerns about anything of the sort happening again at Figure. (We’ve reached out to Cagney and Figure’s investors for more information.)

Employees are also flocking for Figure with the belief, ostensibly, that Cagney is well-positioned to create another financial services juggernaut. According to Bloomberg, the company has already quietly assembled a team of 56 people. Among its new hires is the former chief risk officer of LendingHome, Cynthia Chen, and the former chief legal counsel of PeerStreet, Sara Priola.

Powered by WPeMatico

Few people get into coding because they enjoy debugging, but since there’s no such thing as perfect code, issues inevitably pop up. Israeli startup Rookout is tackling one aspect of this by helping developers track down issues in production code without forcing developers to do any additional coding to write additional tests and re-deploy their apps. As the company announced today, it has raised $4.2 million in seed funding from TLV Partners and Emerge.

Rookout co-founders Or Weis and Liran Haimovitch told me that their own experience in writing code led them to starting this project. Weis, who has taken the CEO role, with Haimovitch being the CTO, noted that only a few years ago, your code would run in its own box and you’d have full control over it. These days, however, your code may run in multiple locations and it’s virtually impossible to get access to the entire state of an application. So when bugs pop up in production — as they often do, despite all of the testing that happens throughout the development process — debugging becomes a real pain point.

Rookout’s solution for this is to instrument the code with “breakpoints that don’t break.” To make this work, you connect Rookout’s online IDE with your code repository on GitHub, Bitbucket or another git hosting service (or with your local file system). The IDE will pull in the code and let you browse it. Developers typically have a hunch about where a bug may be, so when you get to the suspect file, you use Rookout’s visual rule editor to set your virtual breakpoint. Once the production code runs again, all of the data is automatically pushed into the IDE so that you can examine the entire stack trace up to where you set the breakpoint.

All of this works for code that was written in Python and Node.js, as well as for Java virtual machine (JVM) languages like Scala or Kotlin. As for environments, the service currently works for code that’s deployed on AWS, Azure, Google Cloud and local servers, where it can be used with both serverless and containerized applications, too.

While Rookout focuses on collecting data, the team was pretty clear about the fact that Rookout doesn’t want to be an application performance monitoring tool. You can, however, forward your Rookout data to these kind of tools.

Weis and Haimovitch tell me the company now has 14 employees and “dozens” of customers in the pipeline. Looking ahead, the team plans to add support for Go and other languages as the requests come in, and gradually add more IDE support, too.

Like at many a startup, the founders are still working out their pricing model. The current plan is to focus it around the number of hosts that a company is using, though that could still change.

Powered by WPeMatico

Etleap is a play on words for a common set of data practices: extract, transform and load. The startup is trying to place these activities in a modern context, automating what they can and in general speeding up what has been a tedious and highly technical practice. Today, they announced a $1.5 million seed round.

Investors include First Round Capital, SV Angel, Liquid2, BoxGroup and other unnamed investors. The startup launched five years ago as a Y Combinator company. It spent a good 2.5 years building out the product, says CEO and founder Christian Romming. They haven’t required additional funding until now because they have been working with actual customers. Those include Okta, PagerDuty and Mode, among others.

Romming started out at adtech startup VigLink and while there he encountered a problem that was hard to solve. “Our analysts and scientists were frustrated. Integration of the data sources wasn’t always a priority and when something broke, they couldn’t get it fixed until a developer looked at it.” That lack of control slowed things down and made it hard to keep the data warehouse up-to-date.

He saw an opportunity in solving that problem and started Etleap . While there were (and continue to be) legacy solutions like Informatica, Talend and Microsoft SQL Server Integration Services, he said when he studied these at a deeply technical level, he found they required a great deal of help to implement. He wanted to simplify ETL as much as possible, putting data integration into the hands of much less technical end users, rather than relying on IT and consultants.

One of the problems with traditional ETL is that the data analysts who make use of the data tend to get involved very late after the tools have already been chosen, and Romming says his company wants to change that. “They get to consume whatever IT has created for them. You end up with a bread line where analysts are at the mercy of IT to get their jobs done. That’s one of the things we are trying to solve. We don’t think there should be any engineering at all to set up an ETL pipeline,” he said.

Etleap is delivered as managed SaaS or you can run it within your company’s AWS accounts. Regardless of the method, it handles all of the managing, monitoring and operations for the customer.

Romming emphasizes that the product is really built for cloud data warehouses. For now, they are concentrating on the AWS ecosystem, but have plans to expand beyond that down the road. “We want to help more enterprise companies make better use of their data, while modernizing data warehousing infrastructure and making use of cloud data warehouses,” he explained.

The company currently has 15 employees, but Romming plans to at least double that in the next 12-18 months, mostly increasing the engineering team to help further build out the product and create more connectors.

Powered by WPeMatico

When it comes to the promises of persistent location hyper-awareness, the promises of mobile have largely fallen flat. While this has been a bummer for consumers looking for more contextual services from the apps they have installed, this also has been a pain for marketers keen to get their hands on more quality user data.

Bluedot Innovation wants to tackle this by building out tech that can zero-in on smartphone users’ locations in the background. Bluedot announced today they have raised $5.5 million in Series A funding led by a major toll road company, Transurban. The Melbourne startup has raised $13 million to date.

The startup’s tech focuses on dialing-in user location data to just a few meters so that companies utilizing the API can tell whether their marketing efforts are actually turning into consumers visiting physical locations. There are no shortage of players in this space; what makes Bluedot unique, the company insists, is their focus on R&D to develop more precise, low-power solutions that rely on networks and a variety of sensors in the phone to deliver data insightful enough that customers can distinguish what users are doing in tighter urban areas and how they’re getting around.

Bluedot had initially focused its efforts entirely on developing a service that could make mobile payments for toll roads, the idea being that rather than having to install something on your windshield, you could just download an app, allowing persistent location access so whenever you drove through a tollway that had been mapped within the app, you’d make a payment without any friction.

The startup’s ambitions have certainly expanded since then, particularly through a partnership with Salesforce, though given the fact that this round was led by a toll road company it suffices to say that this use case is still firmly within their sights. In November, the startup released the LinktGO app with Transurban, which allows Australian users to make toll road payments from their phone.

The startup says it’s using this latest fund raise to build out its U.S. office in San Francisco and its Melbourne HQ, where it plans to double its current staff of 30 employees.

Powered by WPeMatico

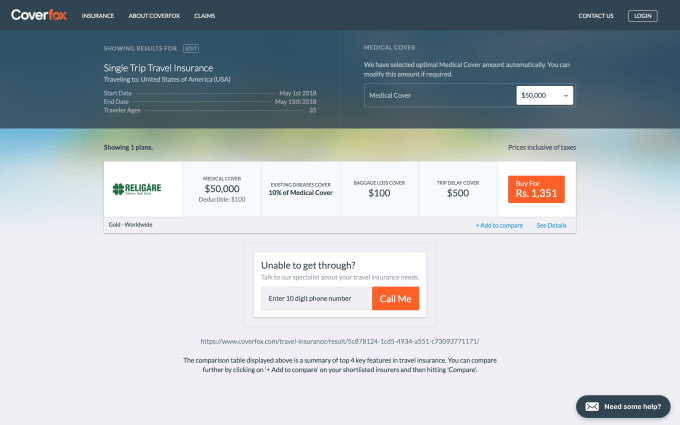

Coverfox, one of a handful of companies aiming to digitize insurance in India, has landed fresh funding via a $22 million Series C round that will be used to push into more rural parts of the country.

The investment is led by IFC, a sister organization of World Bank, and U.S. insurance firm Transamerica, with participation from existing investors SAIF Partners, Accel and Catamaran Ventures, the fund from Infosys co-founder Narayana Murthy. The company confirmed the round was actually closed in two phases, which explains why media reports around the Transamerica investment surfaced last June.

Based in Mumbai, Coverfox is a digital platform that aggregates insurance options. Currently, it works with 35 partners to offer some 150-plus packages that span health, car, bike, life and travel insurance policies in India.

Today’s announcement takes Coverfox, which was founded in 2013, to $39 million raised from investors.

Many of those same Coverfox backers have also funded digital insurance firm Acko, which was started by Coverfox co-founder Varun Dua last year. Acko and Dua made headlines when, nearly a year ago, the startup announced a $30 million seed investment round that came in before a product had even hit the market.

Acko got its license from the Insurance Regulatory & Development Authority of India (IRDAI) in September to go into business, and it again attracted headlines for its relationship with Amazon. The e-commerce firm was said to be in talks to invest (no deal has been announced) while Dua himself said the company was planning to develop products for the e-commerce giant, and potentially others of that scale too.

To date, though, Coverfox isn’t working with Acko, according to its CEO Premanshu Singh.

“We don’t work with Acko at all, and we don’t plan to work for next three to six months at least,” he said in an interview with TechCrunch, explaining that the company is going after larger insurance providers initially.

He also dismissed the potential for consolidation between the two despite the common investor base.

“Both entities are very different, with separate teams and different office locations. We can’t visualize anything strategic coming up,” Singh added.

Coverfox itself said it has seen “impressive momentum and scale” lately, which Singh clarified as four-fold revenue growth over the past year, although he declined to give specific figures. The company plans to double down on growth and use the new money to expand into India’s tier-two and tier-three cities, where it said that insurance coverage is 35 percent lower than in urban areas, while coverage among women is lower still at 40 percent below that of men.

The company also plans to put additional capital behind its Coverdrive app for Android, which is designed to equip insurance sales staff, who previously worked almost entirely offline, with digital-first materials to help grow their business using the Coverfox platform.

Coverdrive is a smart addition because it helps the company tackle the long tail of rural India without initial investment upfront. Instead, insurers use its service to boost their own business, thereby growing Coverfox sales at the same time.

Singh said Coverdrive accounts for around one-quarter of Coverfox sales. But that isn’t its only focus in tier-two and tier-three markets, where the company will roll out its own staff and focus on listing related policies.

Citing the growth of mobile data usage in rural India and a growth in digital as internet banking chips away at the bank assurance model used by most insurance brands, Singh said that rural India is better positioned for expansion than in previous years.

Coverfox isn’t yet looking at overseas options despite Singh explaining that there has been a considerable volume of inbound requests.

“It’s going to happen for sure [but] we haven’t decided where to go first,” he said.

Likewise, the model isn’t decided on either. Beyond a straight-up expansion, Coverfox could move into new markets via partnership or franchise.

Powered by WPeMatico