Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As more consumers embrace plant-based diets and sustainable food practices, Rise Gardens is giving anyone the ability to have a green thumb from the comfort of their own home.

The Chicago-based indoor, smart hydroponic company raised $9 million in an oversubscribed Series A round, led by TELUS Ventures, with existing investors True Ventures and Amazon Alexa Fund and new investor Listen Ventures joining in. The company has a total of $13 million in venture-backed investments since Rise was founded in 2017, founder and CEO Hank Adams told TechCrunch.

Though he began in 2017, Adams, who has a background in sports technology, said he spent a few years working on prototypes before launching the first products in 2019. Rise’s IoT-connected systems are designed to grow vegetables, herbs and microgreens year-round.

Customers can choose between three system levels and get started with their first garden for about $300.

There is a “kind of joyousness” in being able to grow something, but people are looking for assistance because they don’t want to get into a hobby that will become demanding or stressful, Adams said. As a result, Rise’s accompanying mobile app monitors water levels and plant progress, then alert users when it’s time to water, fertilize or care for their plants.

“People are paying attention to food, and they care about what they eat,” he added. “Then the global pandemic played a part in this, with people leaning into growing their own food.”

In fact, customers leaned into growing food so much that Rise Gardens saw its sales eclipse seven figures in 2020, and gardens sold out three times during the year. Customers purchased close to 100,000 plants and have harvested 50,000.

The company estimates it helped keep more than 2,000 pounds of food from being wasted and saved 250,000 gallons of water since launching in 2019.

The concept of an indoor farm is not new. Incumbents include AeroGarden, AeroGrow, which was acquired by Scotts-Miracle Gro last November, and Click & Grow. Rise is among a new crop of startups that have raised funds that include Gardyn.

However, Rise Gardens is differentiating itself from those competitors by making its gardens from powder-coated metals and glass and are designed to be a focal point in the room. It is also offering ways for people to experiment with their gardens.

“We wanted something that would be flexible because once you have mastered a hobby, you will get bored,” he added. “You can start at one level and they swap out tray lids to grow more densely. We have a microgreens kit you can add, or add plant supports for tomatoes and peppers. You can also build a trellis to vine snap peas.”

Adams will focus the Series A dollars into product development, inventory, manufacturing, expansion into new markets and building up the team, especially in the areas of customer service and marketing. Rise has about 25 employees and plans to bring on another eight this year.

In addition, Rise Gardens’ products will soon be available on Amazon — its first channel outside of its website. The company is also expanding into schools in what Adams calls “version 2.0” of the school garden.

When Rich Osborn, president and managing partner of TELUS Ventures, evaluated the indoor garden space, he told TechCrunch that Adams and his team rose to the top of the list because of their background, data experience and syndication with Amazon.

Not only was consumer demand there for these kinds of products, but the sustainability and social impact created from these kinds of investments couldn’t be overemphasized, he said.

Nishan Majarian, co-founder and CEO of TELUS Agriculture, said he sees a future where there is a spectrum of food growth, and crop management will be at the plant level.

“Ever since Climate Corp. was acquired by Monsanto, there has been a massive influx into agriculture to get to the next billion-dollar exit,” Majarian added. “Agrifood is the last segmented supply chain. Every crop is different, every market is different. That makes it local, complex and fertile soil — pun intended — for startups who get capital to solve those issues and scale.”

Powered by WPeMatico

Visualping, a service that can help you monitor websites for changes like price drops or other updates, announced that it has raised a $6 million extension to the $2 million seed round it announced earlier this year. The round was led by Seattle-based FUSE, a relatively new firm with investors who spun out of Ignition Partners last year. Prior investors Mistral Venture Partners and N49P also participated.

The Vancouver-based company is part of the current Google for Startups Accelerator class in Canada. This program focuses on services that leverage AI and machine learning, and, while website monitoring may not seem like an obvious area where machine learning can add a lot of value, if you’ve ever used one of these services, you know that they can often unleash a plethora of false alerts. For the most part, after all, these tools simply look for something in a website’s underlying code to change and then trigger an alert based on that (and maybe some other parameters you’ve set).

Earlier this week, Visualping launched its first machine learning-based tools to avoid just that. The company argues that it can eliminate up to 80% of false alerts by combining feedback from its more than 1.5 million users with its new ML algorithms. Thanks to this, Visualping can now learn the best configuration for how to monitor a site when users set up a new alert.

“Visualping has the hearts of over a million people across the world, as well as the vast majority of the Fortune 500. To be a part of their journey and to lead this round of financing is a dream,” FUSE’s Brendan Wales said.

Visualping founder and CEO Serge Salager tells me that the company plans to use the new funding to focus on building out its product but also to build a commercial team. So far, he said, the company’s growth has been primarily product led.

As a part of these efforts, the company also plans to launch Visualping Business, with support for these new ML tools and additional collaboration features, and Visualping Personal for individual users who want to monitor things like ticket availability for concerts or to track news, price drops or job postings, for example. For now, the personal plan will not include support for ML. “False alerts are not a huge problem for personal use as people are checking two-three websites but a huge problem for enterprise where teams need to process hundreds of alerts per day,” Salager told me.

The current idea is to launch these new plans in November, together with mobile apps for iOS and Android. The company will also relaunch its extensions around this time, too.

It’s also worth noting that while Visualping monetizes its web-based service, you can still use the extension in the browser for free.

Powered by WPeMatico

Yummy, a Venezuela-based delivery app on a mission to create the super app for the country, announced Friday it raised $4 million in funding to expand its dark store delivery operations across Latin America.

Funding backers included Y Combinator, Tinder co-founder Justin Mateen, Canary, Hustle Fund, Necessary Ventures and the co-founders of TaskUs. The total investment includes pre-seeding capital raised in 2020.

“This appears to be a contrarian bet, but Yummy has quickly become the No. 1 super app in Venezuela and proven that the team can scale the business in a difficult territory,” Mateen said in a statement. “Now Vicente and the rest of the Yummy team will expand into more traditional markets with the necessary experience and support to overcome inevitable challenges that they will face.”

Vicente Zavarce, Yummy’s founder and CEO, launched the company in 2020 and is currently part of Y Combinator’s summer 2021 cohort. Born in Venezuela, Zavarce came to the U.S. for school and stayed to work in growth marketing at Postmates, Wayfair and Getaround before starting Yummy. Zavarce was a remote CEO over the past year, stuck in the U.S. due to travel restrictions, but said he is making the most of it.

Yummy’s app can be downloaded for free, and the company charges a delivery fee or merchant fee. In contrast to some of his food delivery competitors, Zavarce told TechCrunch Yummy’s fees are “the lowest in the market” so they do not affect the merchant’s ability to use the app.

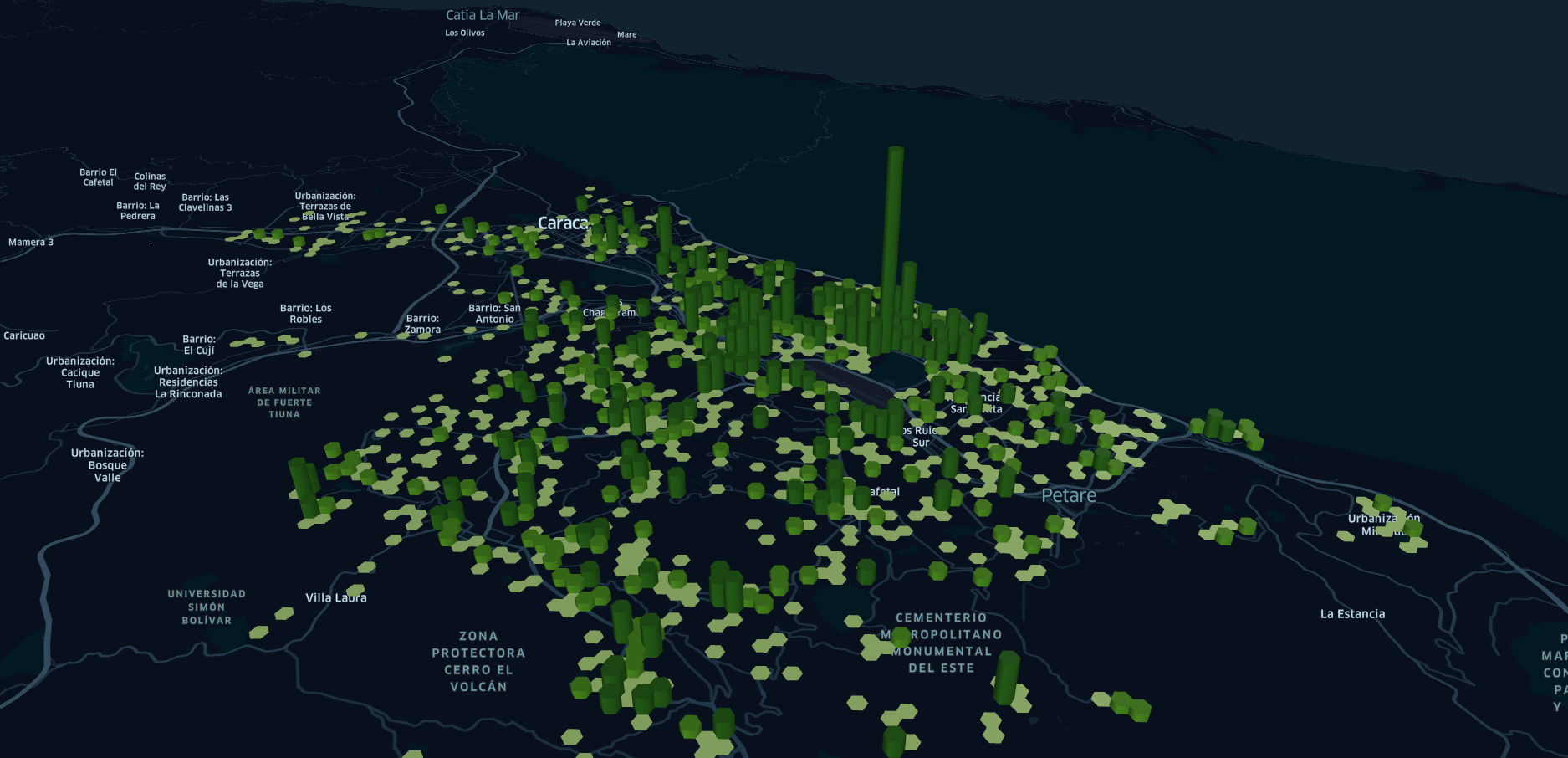

Yummy order heat map. Image Credits: Yummy

The company is pulling together additional key components for its super app strategy, which includes launching a ridesharing vertical this year. Yummy has already connected more than 1,200 merchants with hundreds of thousands of customers.

And, over the past year the company completed more than 600,000 deliveries of food, groceries, alcohol and shopping. It reached $1 million in monthly gross merchandise volume while also growing 38% in revenue month over month.

Over the past eight years, the political and economic challenges faced by the country have led to its recent adoption of the U.S. dollar, Zavarce said. In some cases up to 70% of transactions are happening in dollars on the ground. He said this has protected the business against hyperinflation and ultimately created the opportunity for startups to begin operating in Venezuela.

Because of that, combined with more consumer technology innovation over the past decade, Zavarce said there is no reason why Venezuela should not have the best last-mile logistics. It’s there that Yummy has an opportunity to connect multiple vertices into a super app with little to no competition.

“Eventually, other players will enter, but because we have a super app, we already have an amazing frequency of usage,” he added. “We also already have exclusivity with 60% of the food delivery marketplace, which has enabled us to build a moat around the market. We believe we are the right people to execute on this and feel it is our responsibility to do it.”

Plans for the new funding include user acquisition — the company has close to 200,000 registered users already — and to expand in Peru and Chile by August. At the same time, Zavarce will spend some of that capital to attract more users across Venezuela. He also expects to be in Ecuador and Bolivia by the end of the year.

Powered by WPeMatico

Halla wants to answer the question of how people decide what to eat, and now has $4.5 million in fresh Series A1 capital from Food Retail Ventures to do it.

Headquartered in New York, Halla was founded in 2016 by Gabriel Nipote, Henry Michaelson and Spencer Price to develop “taste intelligence,” using human behavior to steer shoppers to food items they want while also discovering new ones as they shop online. This all results in bigger basket orders for stores. SOSV and E&A Venture Capital joined in on the round, which brings Halla’s total capital raised to $8.5 million, CEO Price told TechCrunch.

The company’s API technology is a plug-and-play platform that leverages more than 100 billion shopper and product data points and funnels it into three engines: Search, which takes into account a shopper’s preferences; Recommend, which reveals relevant complementary products as someone shops; and Substitute, which identifies replacement options.

Halla’s Substitute product was released earlier this year as an answer to better recommendations for out-of-stock items that even retailers like Walmart are creating technology to solve. Price cited a McKinsey report that found 20% of grocery shoppers sought out competitors following a negative outcome from bad substitutions.

Halla Substitute. Image Credits: Halla

None of these data points are linked to any shoppers’ private data, just the attributes around the shopping itself. The APIs, rather, are looking for context to return relevant recommendations and substitutions. For example, Halla’s platform would take into account the way someone adds items to their cart and suggest next ones: if you added turkey and then bread, the platform may suggest cheese and condiments.

“It’s also about personalization when it comes to grocery shopping and food,” Price said. “When you want organic eggs from a specific brand and it is out of stock, it is often up to your personal shopper’s discretion. We want to lead them to the right substitutions, so you can still cook the meal you intended instead of ‘close enough.’ ”

Halla’s technology is now live in more than 1,100 e-commerce storefronts. The new funding gives Halla some fuel for the fire Price said is happening within the company, including plans to double the number of stores it supports across accounts. He also expects to double employees to 30 in order to support growth and customer base, admitting there is “more inbound interest that we can handle.” Halla has been busy fast-tracking big customers for pilots, and at the same time, wants to expand internationally with additional product lines over the next 18 months.

The company is also seeing “a near infinite increase in recurring revenue,” as it attracts six- and seven-figure contracts that push the company closer to cash flow positivity. All of that growth is positioning Halla for a Series B if it needs it, Price said.

Meanwhile, as part of the investment, Food Retail Ventures’ James McCann will join Halla’s board of directors.

McCann, who only invests in food and retail technology, told TechCrunch that grocery stores need a way to inspire shoppers, that Halla is doing that and in a better way than other intelligence versions he has seen.

“Their technology is miles ahead of everyone else,” he added. “They have a terrific team and a terrific product. They are seeing huge uplifts in terms of suggestions and what people are buying, and their measurements are out of this world.”

Photo includes Halla co-founders, from left, Spencer Price (CEO), Henry Michaelson (CTO & President) and Gabriel Nipote (COO).

Powered by WPeMatico

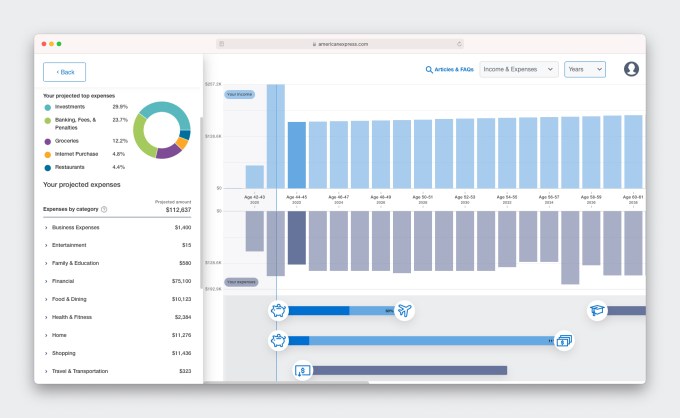

American Express is branching out into financial planning, with a little help from a seven-person startup called BodesWell.

This week, the credit card giant launched a pilot of its first self-service digital financial planning tool, dubbed “My Financial Plan (MFP).” The six-month pilot kicked off on July 11 with about 25,000 select Amex cardmembers.

American Express quietly invested in BodesWell in late 2020 via its venture arm, Amex Ventures. Since then, the financial services behemoth teamed up with the tiny startup to develop the financial planning tool for its users. The new product is designed to give users a complete picture of their financial health and help them make and achieve major life goals, such as buying a house or retirement.

TechCrunch talked with Amex Ventures’ Julia Huang, who led the investment and strategy around the new product, and BodesWell co-founder and CEO Matthew Bellows to learn more details.

The pair actually met while serving on a panel together in 2019.

“I was drawn to the fact that it was not a round-up savings tool, but rather a holistic tool to understand your full financial picture that could be used to plan for the financial impact of your life decisions,” Huang told TechCrunch.

Before deciding to invest in BodesWell, Huang says Amex Ventures — which over time has backed more than 70 startups — had “evaluated the space quite extensively.”

Huang introduced Bellows and his staff to Amex’s Digital Labs team and they embarked on jointly developing a specialized offering for Amex customers. (While Bellow is based in Boston, he says the startup is “globally distributed.”)

“Our goal is to democratize financial planning with our cardmembers by providing detailed insights and forecasts to help them with their holistic planning,” she told TechCrunch.

Image Credits: Amex Ventures

Bellows started BodesWell in early 2019 with the goal of empowering clients and customers to build their own financial plan.

“So much of financial planning software is aimed at financial advisors, and requires them to run it,” he said. “So, most people can’t get the benefits of financial planning…Our hope is to expand benefits to a lot more people.”

BodesWell will guide users in setting up a financial plan and will work even better if they sync with their other financial information via Plaid so it can “update in real time,” Huang said.

The tool “takes into account income, assets, expenses and liabilities — what cash flow looks like holistically so that users can drag & drop to plan life events,” Bellow said.

An estimated 85 million American households don’t have a financial, planner for a variety of reasons — including mistrust of a planner’s intentions or just feeling overwhelmed by the process.

The product is free during the pilot phase and American Express hasn’t yet determined if it will charge for it afterwards.

“We’re gauging first for engagement and the power of the product for our customers,” Huang told TechCrunch. “We want to make sure the product resonates and that we iterate on the product to make sure it’s good for the broader population. Our primary goal is that our customers use it and find it valuable.”

Amex Ventures has formed “some level of partnership” with more than two-thirds of its portfolio companies, she added.

“We try to engage with our portfolio in that way, to provide value with our startup ecosystem,” Huang said.

For its part, BodesWell had previously raised about $1.5 million from investors such as Cleo Capital, Ex Ventures, Riot.vc, GritCapital and Argon Capital and angels like HubSpot CEO Brian Halligan and Kintent CEO Sravish Sridhar.

Powered by WPeMatico

The need for more affordable housing has never been more urgent as a shortage in the U.S. housing market persists.

Startups attempting to help address the shortage in a variety of ways abound. One such startup, Abodu, has raised $20 million in a Series A funding round led by Norwest Venture Partners. Previous backer Initialized Capital also participated in the financing, along with Redfin CEO Glenn Kelman, former Stockton, California Mayor Michael Tubbs, GGV investor Hans Tung and Paradox Capital’s Kyle Tibbitts.

The California legislature changed laws in 2017 to make it easier to build Accessory Dwelling Units (ADUs). Then on January 1, 2020, the state of California made it dramatically easier to add extra housing units to single-family home sites. Cities and local agencies have to quickly approve or deny ADU projects within 60 days of receiving a permit application. The state also now prevents cities from imposing minimum lot size requirements, maximum ADU dimensions or off-street parking requirements.

Redwood City, California-based Abodu, which builds prefabricated ADUs, was founded in 2018 to serve as a “one-stop shop” for building an ADU, or as some describe it, a home in a backyard.

Image Credits: Co-founders John Geary and Eric McInerney / Abodu

What sets the company apart from others in the space, its execs claim, is that it not only builds and installs the units, it helps homeowners with the painful process of getting permits. Abodu says it pre-approves its structural engineering with California state-level agencies to ensure its units can be built statewide and works with local agencies to pre-approve its foundation systems to ensure projects can proceed on predictable timelines.

It also claims to offer a cheaper and faster process than if one were to build an ADU from start to finish. Specifically, the startup claims that one of its backyard homes can be installed in just 10% of the time it would take for a traditional ADU to be built.

Abodu has been active in the market, selling and building its ADUs since the fall of 2019. Since then, it has put “dozens and dozens” of units in the ground, and has multiple dozen units in production on top of that, according to CEO and co-founder John Geary. So far, it’s operating in the Bay Area, Los Angeles and Seattle. The company claims it can deliver an ADU in as little as 30 days in San Jose and Los Angeles thanks to the cities’ pre-approval process. In other cities in California and Washington, turnaround is “as little as 12 weeks.” But a standard bespoke project takes 4-5 months from start to finish, according to Geary.

The startup’s three products include a 340-square foot studio; a 500-square foot one bedroom, one bath, and a 610-square foot two bedroom unit. All have kitchens and living space.

Pricing starts at $190,000, but the average project cost across all sizes is around $230,000, Geary said, inclusive of permits and site work.

There are a variety of use cases for ADUs, the most popular of which is to house family and for rental income.

“During the pandemic, multigenerational living has been at an all-time high. There are acute family needs that people are trying to solve for,” Geary said. “In addition, folks are earning extra money by renting them out to members of the community such as teachers or fireman, a single person or younger couple.”

Next, Abodu is eyeing the San Diego market.

Earlier this week, we covered the recent raise of Mighty Buildings, another Bay Area-based startup building ADUs and other housing. The biggest difference between the two companies, according to Geary, is that Mighty Buildings is focused on innovation in construction with its 3D-printed method.

“We decided early on that we didn’t want to reinvent the wheel from the construction standpoint,” Geary said. “Instead, we looked at ‘how can we solve for speed and ease?’ ”

Abodu operates with an asset-light model, and doesn’t own any factories. Instead, it has built a network of factory “partners” across the Western U.S. that builds its units depending on how their capacities look at any given time.

Naturally, the company’s investors are bullish on the company’s business model.

Jeff Crowe, managing partner of Norwest Venture Partners, believes that Abodu’s “beautifully crafted units” are just one of the company’s selling points.

“John, Eric, and their team manage the end-to-end process of permitting, building, and installing on behalf of their customers,” he told TechCrunch. “And with the expedited permitting that Abodu has been granted in over two dozen cities, it has faster time-to-installation than other ADU market participants. The result has been very high levels of customer satisfaction and rapid growth.”

Former Stockton Mayor Tubbs said Abodu is tackling two of California’s most consequential issues: the statewide housing shortage and its impacts on racial and economic segregation in our neighborhoods.

“By making it fast and accessible for normal homeowners to build high-quality backyard housing units, Abodu’s success will mean integrating options for both renters and homeowners in the same neighborhoods, while supporting small landlords and property owners in building equity in their homes,” he wrote via email.

Powered by WPeMatico

It seems like everything is being pushed online now, but network procurement stubbornly has remained an in-person or phone-based negotiation. Lightyear, an early-stage New York City startup, decided to change that last year, and the company announced a $13.1 million Series A today.

The round was led by Ridge Ventures with participation from Zigg Capital and a slew of individual investors. Today’s investment comes on the heels of a $3.7 million seed round last October, bringing the total raised to $16.8 million.

CEO and co-founder Dennis Thankachan says that the company has been able to gain customers by offering a new way to procure network resources, which was a great improvement over manual negotiating.

“Last year we launched Lightyear, which was the first tool for buying your telecom infrastructure on the web. And although changing behaviors and the way that enterprises have done things for years is difficult, the status quo in telecom has been zero transparency, no web-based ways to do things, and oftentimes interfacing with really, really large vendors where you have no negotiating leverage even if you’re a big enterprise. That experience was so poor that a lot of enterprises were extremely happy to see what we put in the market,” he said.

What Lightyear offers is an online marketplace where companies can interact with vendors and get a range of price quotes to make a more informed buying decision. The company spent a lot of time improving the product since last October when you could configure some basic stuff, get a price quote and Lightyear would help you buy it.

Now Thankachan says that the solution covers the full life cycle of services including configuring a bigger array of services, helping manage the installation of the services and helping reduce the amount of delays and errors in installs. Finally, they help track and manage network inventory and can automate renewal for a whole group of services.

That has resulted in 4X growth in just nine months since the last round. In addition, the company had relationships with 400 vendors in October and has grown that to mid-500 vendors today. The startup has also doubled the number of employees to around 20.

Thankachan says that as a person of color he is particularly cognizant about building a diverse and inclusive culture. “I’m a person of color, who has been a minority in different work environments in the past, and I know how that feels and how frustrating that can be for a person who feels like their voice is not heard. […] So I think we can start to build a culture that is not necessarily the norm in [the telecommunications industry] by trying to give opportunities to [underrepresented] people,” he said.

Yousuf Khan, a partner at Ridge Ventures, who is leading the round and will be joining the board under the terms of the deal, says that as a former CIO he found Lightyear’s approach quite appealing.

“As a former CIO and someone who has led global technology operations, it’s refreshing to see Lightyear transforming the way business infrastructure gets bought…I wish Lightyear existed during my years as a CIO,” Khan said in a statement.

Powered by WPeMatico

The gamification of payments is not a new concept.

A number of companies are attempting to combine gamification and payments in creative ways. And today, one such company, Play2Pay, has raised $13 million in a Series A round of funding.

The Miami-based startup has a straightforward mission. It wants to give consumers a way to reduce their bills — it claims by an average of 30%! — by playing games, watching videos and completing daily challenges, offers and surveys.

Play2Pay was bootstrapped for the first five years of its life, raising its first external capital in June of 2020 — a $7.5 million seed round from individual angel investors. Telesoft Partners led its Series A round, which included participation from Harbor Spring Capital and individual investors including former AT&T vice chairman Ralph de la Vega, former Reuters CEO Tom Glocer, Madison Dearborn Partners co-founder and senior advisor Jim Perry and Virtusa founder and former CEO, Kris Canekeratne.

The alternative payment platform says it brokers a “value exchange” between brands and consumers, converting attention and engagement into a currency, which can be redeemed for bill payment. Meanwhile, brands get a new way to promote their products and services.

Play2Pay founder and CEO Brian Boroff started the company in 2015 based on a vision that prepaid mobile phone users should have an alternative way to pay for their mobile phone service and that wireless carriers would adopt an ad-funded commercial model.

Today, the company claims to be positioned to be the world’s first “ad supported payment rail” directly integrated into payments platforms of major service providers and financial institutions. It also claims to be the only company that converts user engagement directly into bill payment.

Image Credits: Play2Pay

The “opt-in” offering is currently available to more than 100 million mobile subscribers across the United States, United Kingdom, Mexico, Brazil and Indonesia through partnerships with telecom companies such as AT&T Mexico, Cricket in the U.S., TIM in Brazil, lndosat Ooredoo in Indonesia and U.K.-based Lycamobile.

The rewarding approach seems to be resonating with users. From June 2020 to June 2021, the startup saw its ARR (annual recurring revenue) spike by nearly 300%, according to Boroff, a telecom veteran.

Among the users engaged on the platform, about 25% generated revenue daily, he said. And service providers realized up to 17% revenue expansion as a result of subscriber engagement on the Play2Pay platform, according to Boroff.

“Our distribution model is B2B2C, with Tier-1 service providers worldwide directly integrating our bill payment capability. We’re growing our audience through promotion of the service to their customer base,” he told TechCrunch.

End users, he added, can share their targeting preferences in exchange for value, giving mobile app developers and brands more information when promoting their own products and services to Play2Pay’s audience.

The platform is free for service providers and merchants, meaning the payment does not have costs or fees from interchange, acquirers, chargebacks or gateways.

Instead, Play2Pay generates revenue from mobile app developers and brands. Those developers and brands pay to access Play2Pay’s mobile audience in order to promote their products and services. For example, a mobile gaming company might pay Play2Pay $100 for every user that downloads their app from the Play2Pay app and plays the game for a period of time (such as two hours). Through its technology and partner network, Play2Pay has attribution tracking to ensure that the end user and mobile gaming company both know how much progress has been made toward completing that goal. Other formats include watching videos, completing surveys and more conventional native advertising in some areas.

Powered by WPeMatico

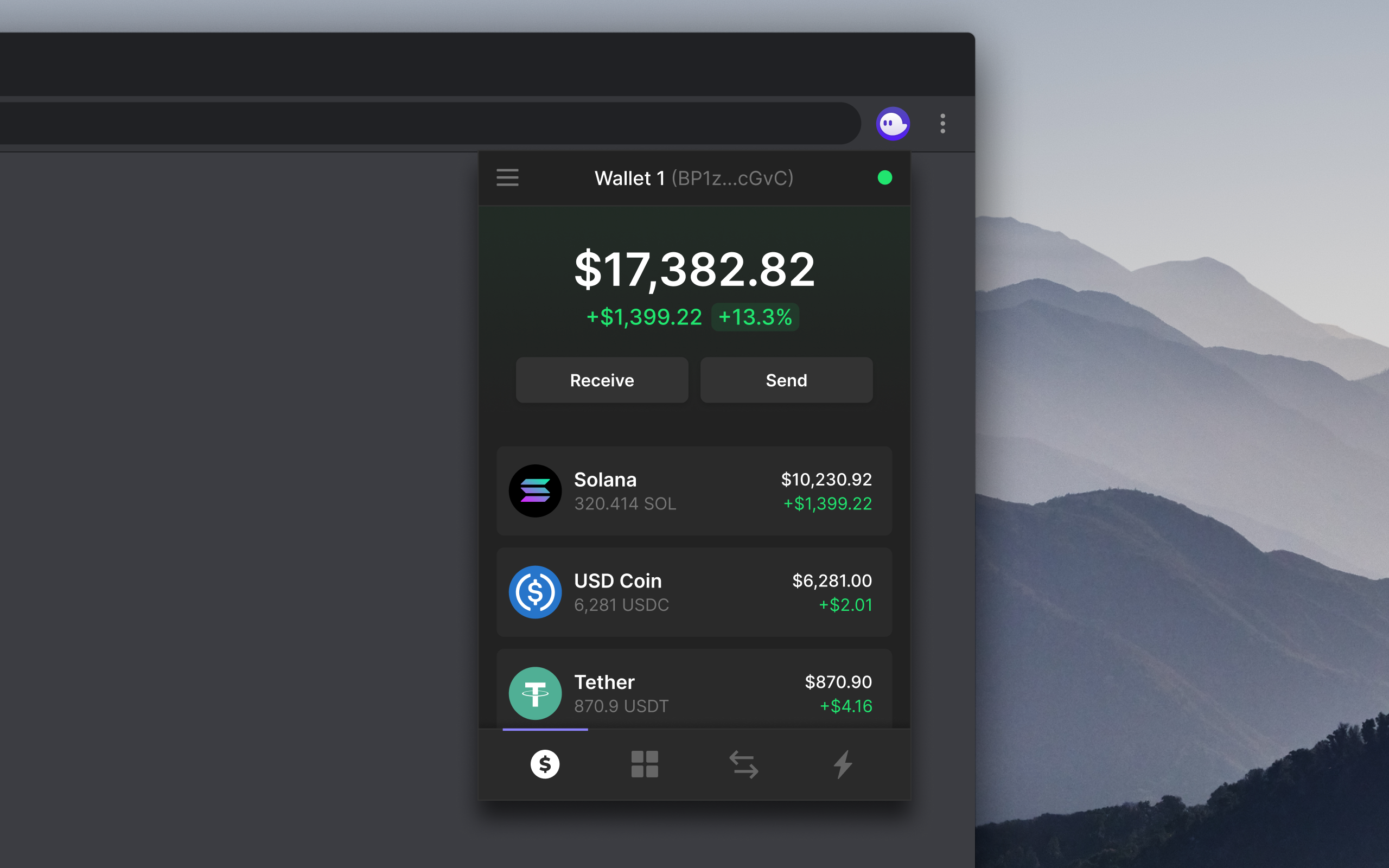

While retail investors grew more comfortable buying cryptocurrencies like Bitcoin and Ethereum in 2021, the decentralized application world still has a lot of work to do when it comes to onboarding a mainstream user base.

Phantom is part of a new class of crypto startups looking to build infrastructure that streamlines blockchain-based applications and provides a more user-friendly UX for navigating the crypto world, something that can make the entire space more approachable to a non-developer audience. Users can download the Phantom wallet to their browsers to interact with applications, swap tokens and collect NFTs.

The crypto wallet startup has banked a $9 million Series A round led by Andreessen Horowitz (a16z), with Variant Fund, Jump Capital, DeFi Alliance, Solana Foundation and Garry Tan also participating. The round, which closed earlier this summer, comes as some venture capital firms embrace a crypto future even as volatility continues to envelop the broader market. Last month, a16z announced a whopping 2.2 billion crypto fund, the firm’s largest vertical-specific investment vehicle ever.

Image via Phantom

The co-founding team of CEO Brandon Millman, CPO Chris Kalani and CTO Francesco Agosti all come aboard from crypto infrastructure startup 0x.

At the moment, Phantom is best-known among the Solana community, where it has become the go-to wallet for applications on that blockchain. The startup’s ambition is to interface with more and more networks, currently building out compatibility with Ethereum and looking to embrace other blockchains, aiming to be a product built for a “multichain world,” Millman tells TechCrunch.

Alongside building out support for other networks, Phantom wants to build more sophisticated DeFi mechanisms right into their wallet, allowing users to stake cryptocurrencies and swap more tokens inside the wallet.

The startup says they have some 40,000 users of their existing wallet product.

Building out a presence on the popular Ethereum blockchain, which already has a handful of popular wallet providers, will be a challenge, but Phantom’s broadest challenge is helping a new breed of crypto-curious users interface with a network of apps that still have a long way to go when it comes to being mainstream-friendly.

“The entire space is kind of stuck in this ‘built by developers for other developers mode,’ ” Millman says. “This bar has been kind of stuck there, and no one is really stepping up to push the bar up higher.”

Powered by WPeMatico

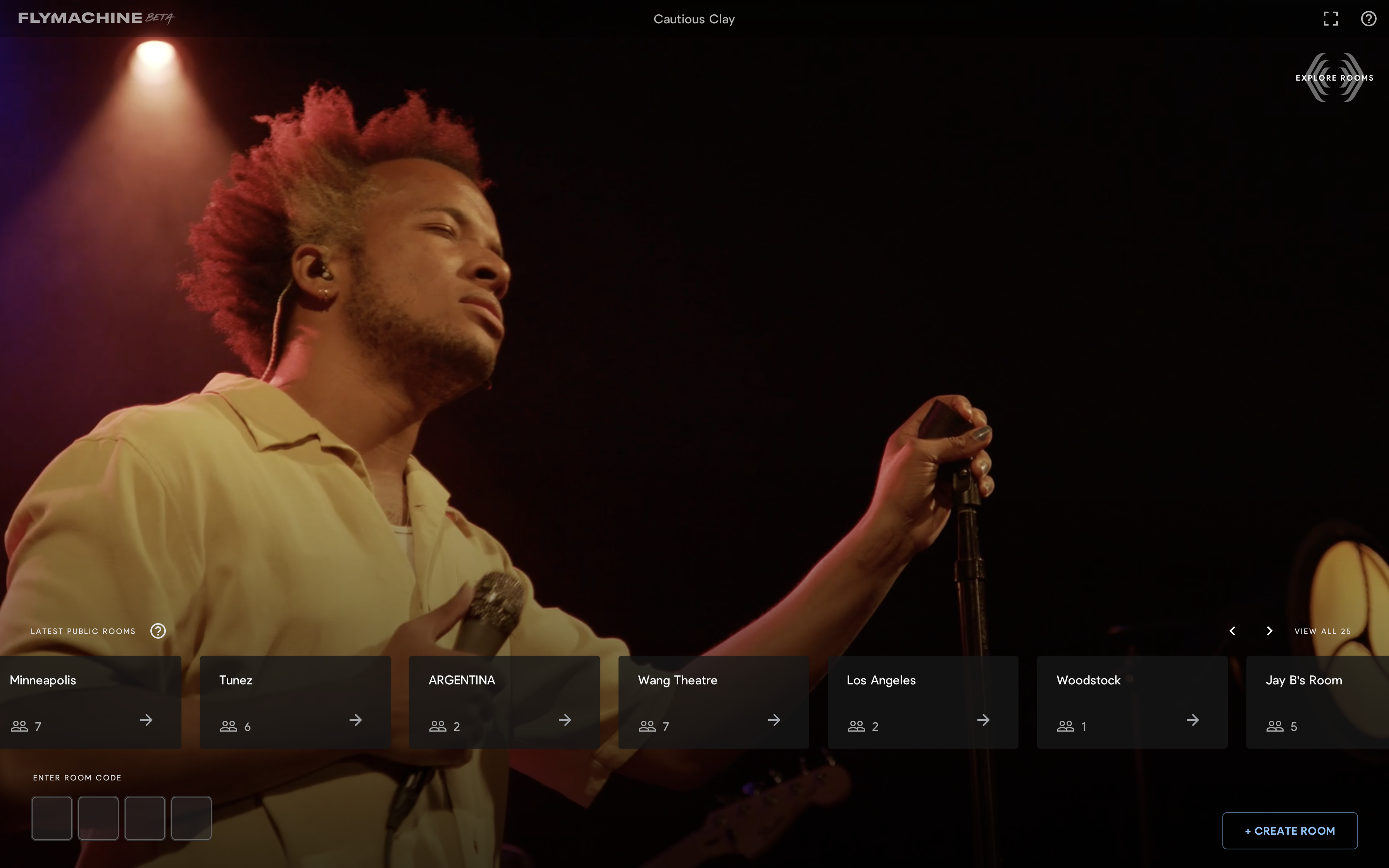

As concerts and live events return to the physical world stateside, many in the tech industry have wondered whether some of the pandemic-era opportunities around virtualizing these events are lost for the time being.

San Francisco-based Flymachine is aiming to seek out the holy grail of the digital music industry, finding a way to capture some of the magic of live concerts and performances in a livestreamed setting. The startup hopes that pandemic-era consumer habits around video chat socialization combined with an industry in need of digital diversification can push their flavor of virtual concerts into the lives of music fans.

The startup’s ambitions aren’t cheap, Flymachine tells TechCrunch it has raised $21 million in investor funding to bankroll its plans. The funding has been led by Greycroft Partners and SignalFire, with additional participation from Primary Venture Partners, Contour Venture Partners, Red Sea Ventures and Silicon Valley Bank.

The virtual concert industry didn’t have as big of a lockdown moment as some hoped for. Spotify experimented with virtual events. Meanwhile, startups like Wave raised huge bouts of VC funding to turn real performers into digital avatars in a bid to create more digital-native concerts. And while some smaller artists embraced shows over Zoom or worked with startups like Oda, which created live concert subscriptions, there were few mainstream hits among bigger acts.

To make Flymachine’s brand of virtual concerts a thing, the startup isn’t trying to convert potential in-person attendees of a show into virtual participants, instead hoping to create an attractive experience for the folks who would normally have to skip the show. Whether those virtual attendees were too far from a venue, couldn’t get a babysitter for the night or just aren’t jazzed about a mosh pit scene anymore, Flymachine is hoping there are enough potential attendees on the bubble to sustain the startup as they try to blur the lines between “a night in and a night out,” CEO Andrew Dreskin says.

The startup’s strategy centers on building up partnerships with name brand concert venues around the U.S. — Bowery Ballroom in New York City, Bimbo’s 365 Club in San Francisco, The Crocodile in Seattle, Marathon Music Works in Nashville and Teragram Ballroom in Los Angeles, among them — and livestreaming some of the shows at those venues to at-home audiences. Flymachine’s team has deep roots in the music industry; Dreskin founded Ticketfly (acquired by Pandora) while co-founder Rick Farman is also the co-founder of Superfly, which puts on the Bonnaroo and Outside Lands music festivals.

Image Credits: Flymachine

In terms of actual experience — and I had the chance to experience one of the shows (pictured above) before writing this — Flymachine has done their best to recreate the experience of shouting over the tunes to talk with your buddies nearby. In Flymachine’s world this is attending the show in a “private room” with your other friends livestreaming in video chat bubbles from their homes. It’s well done and doesn’t distract too much from the actual concert, but you can adjust the sound levels of your friends and the music when the time calls for it.

Flymachine’s platform launch earlier this year, arriving as many Americans have been vaccinated and many concert-goers are preparing to return to normal, might have been considered a bit late to the moment, but the founding team sees a long-term opportunity that COVID only further highlighted.

“We weren’t in a mad dash to get the product out the door while people were sequestered in their homes because we knew this would be part of the fabric of society going forward,” Dreskin tells TechCrunch.

Powered by WPeMatico