Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

What if there’s a drug that already exists that could treat a disease with no known therapies, but we just haven’t made the connection? Finding that connection by exhaustively analyzing complex biomechanics within the body — with the help of machine learning, naturally — is the goal of ReviveMed, a new biotech startup out of MIT that just raised $1.5 million in seed funding.

Around the turn of the century, genomics was the big thing. Then, as the power to investigate complex biological processes improved, proteomics became the next frontier. We may have moved on again, this time to the yet more complex field of metabolomics, which is where ReviveMed comes in.

Leila Pirhaji, ReviveMed’s founder and CEO, began work on the topic during her time as a postgrad at MIT. The problem she and her colleagues saw was the immense complexity of interactions between proteins, which are encoded in DNA and RNA, and metabolites, a class of biomolecules with even greater variety. Hidden in these innumerable interactions somewhere are clues to how and why biological processes are going wrong, and perhaps how to address that.

“The interaction of proteins and metabolites tells us exactly what’s happening in the disease,” Pirhaji told me. “But there are over 40,000 metabolites in the human body. DNA and RNA are easy to measure, but metabolites have tremendous diversity in mass. Each one requires its own experiment to detect.”

As you can imagine, the time and money that would be involved in such an extensive battery of testing have made metabolomics difficult to study. But what Pirhaji and her collaborators at MIT decided was that it was similar enough to other “big noisy data set” problems that the nascent approach of machine learning could be effective.

As you can imagine, the time and money that would be involved in such an extensive battery of testing have made metabolomics difficult to study. But what Pirhaji and her collaborators at MIT decided was that it was similar enough to other “big noisy data set” problems that the nascent approach of machine learning could be effective.

“Instead of doing experiments,” Pirhaji said, “why don’t we use AI and our database?” To that end she founded ReviveMed with her PhD advisor, Ernest Fraenkel, and shortly afterwards was joined by data scientist Demarcus Briers and biotech veteran Richard Howell.

Pharmaceutical companies and research organizations already have a mess of metabolites masses, known interactions, suspected but unproven effects and disease states and outcomes. Plenty of experimentation is done, but the results are frustratingly vague owing to the inability to be sure about the metabolites themselves or what they’re doing. Most experimentation has resulted in partial understanding of a small proportion of known metabolites.

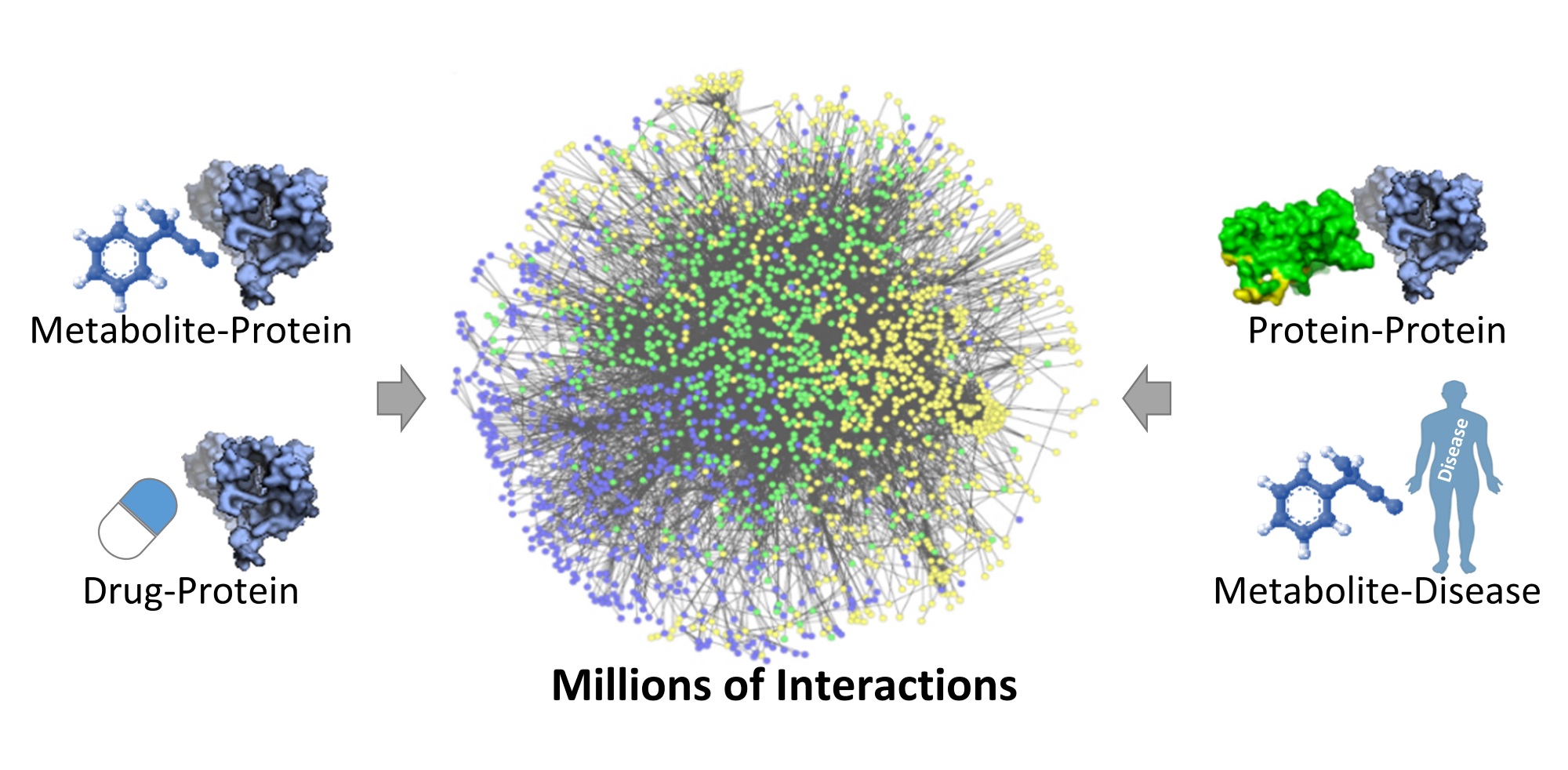

That data isn’t just a few drives’ worth of spreadsheets and charts, either. Not only does the data comprise drug-protein, protein-protein, protein-metabolite and metabolite-disease interactions, but they’re including data that’s essentially never been analyzed: “We’re looking at metabolites that no one has looked at before.”

The information is sitting in an archive somewhere, gathering dust. “We actually have to go physically pick up the mass spectrometry files,” Pirhaji said. (“They’re huge,” she added.)

Once they got the data all in one place (Pirhaji described it as “a big hairball with millions of interactions,” in a presentation in March), they developed a model to evaluate and characterize everything in it, producing the kind of insights machine learning systems are known for.

The “hairball.”

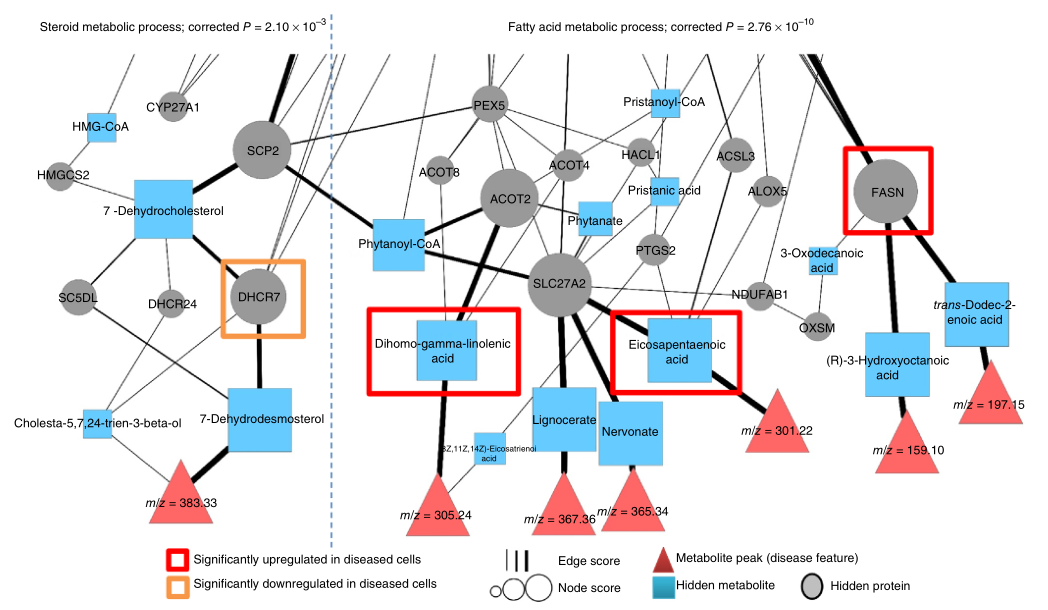

The results were more than a little promising. In a trial run, they identified new disease mechanisms for Huntington’s, new therapeutic targets (i.e. biomolecules or processes that could be affected by drugs) and existing drugs that may affect those targets.

The secret sauce, or one ingredient anyway, is the ability to distinguish metabolites with similar masses (sugars or fats with different molecular configurations but the same number and type of atoms, for instance) and correlate those metabolites with both drug and protein effects and disease outcomes. The metabolome fills in the missing piece between disease and drug without any tests establishing it directly.

At that point the drug will, of course, require real-world testing. But although ReviveMed does do some verification on its own, this is when the company would hand back the results to its clients, pharmaceutical companies, which then take the drug and its new effect to market.

In effect, the business model is offering a low-cost, high-reward R&D as a service to pharma, which can hand over reams of data it has no particular use for, potentially resulting in practical applications for drugs that already have millions invested in their testing and manufacture. What wouldn’t Pfizer pay to determine that Robitussin also prevents Alzheimer’s? That knowledge is worth billions, and ReviveMed is offering a new, powerful way to check for such things with little in the way of new investment.

This is the kind of web of molecules and effects that the system sorts through.

ReviveMed, for its part, is being a bit more choosy than that — its focus is on untreatable diseases with a good chance that existing drugs affect them. The first target is fatty liver disease, which affects millions, causing great suffering and cost. And something like Huntington’s, in which genetic triggers and disease effects are known but not the intermediate mechanisms, is also a good candidate for which the company’s models can fill the gap.

The company isn’t reliant on Big Pharma for its data, though. The original training data was all public (though “very fragmented”) and it’s that on which the system is primarily based. “We have a patent on our process for getting this metabolome data and translating it into insights,” Pirhaji notes, although the work they did at MIT is available for anyone to access (it was published in Nature Methods, in case you were wondering).

But compared with genomics and proteomics, not much metabolomic data is public — so although ReviveMed can augment its database with data from clients, its researchers are also conducting hundreds of human tests on their own to improve the model.

The business model is a bit complicated, as well — “It’s very case by case,” Pirhaji told me. A research hospital looking to collaborate and share data while sharing any results publicly or as shared intellectual property, for instance, would not be a situation where a lot of cash would change hands. But a top-5 pharma company — two of which ReviveMed already has dealings with — that wants to keep all the results for itself and has limitless coffers would pay a higher cost.

I’m oversimplifying, but you get the idea. In many cases, however, ReviveMed will aim to be a part of any intellectual property it contributes to. And of course the data provided by the clients goes into the model and improves it, which is its own form of payment. So you can see that negotiations might get complicated. But the company already has several revenue-generating pilots in place, so even at this early stage those complications are far from insurmountable.

Lastly there’s the matter of the seed round: $1.5 million, led by Rivas Capital along with TechU, Team Builder Ventures and WorldQuant. This should allow them to hire the engineers and data scientists they need and expand in other practical ways. Placing well in a recent Google machine learning competition got them $200,000 worth of cloud computing credit, so that should keep them crunching for a while.

ReviveMed’s approach is a fundamentally modern one that wouldn’t be possible just a few years ago, such is the scale of the data involved. It may prove to be a powerful example of data-driven biotech as lucrative as it is beneficial. Even the early proof-of-concept and pilot work may provide help to millions or save lives — it’s not every day a company is founded that can say that.

Powered by WPeMatico

According to Parsley Health, the average adult spends 19 minutes with their physician every year. Seventy percent of the time, these short visits result in the prescription of a medication.

“According to the CDC, 70% of diseases in our country are chronic and lifestyle-driven,” said Parsley Health founder and CEO Dr. Robin Berzin. “And yet instead of addressing the root causes of health problems, medicine’s toolkit is limited to prescriptions and procedures, driving up costs while the average person gets sicker. The answer isn’t just another pill.”

Parsley Health, an annual membership service ($150/month), reimagines what medicine can be. The company focuses on the cause of an illness rather than simply throwing Band-Aids at the problem. But in order to do this, your doctor needs far more than 19 minutes of your time each year.

Today, Parsley announced the close of a $10 million Series A funding led by FirstMark Capital, with participation from Amplo, Trail Mix Ventures, Combine and The Chernin Group. Individual investors such as Dr. Mark Hyman, M.D., director of the Cleveland Clinic Center for Functional Medicine; Nat Turner, CEO of Flatiron Health; Neil Parikh, co-founder of Casper; and Dave Gilboa, co-founder of Warby Parker, also invested in the round.

As part of the financing, FirstMark Capital partner Catherine Ulrich will join the board.

Here’s how Parsley works:

When a user first signs up online, they enter in a wide range of data about themselves, from family health history to past procedures to symptoms and lifestyle. The user then schedules their first visit with their new doctor, which will last for 75 minutes, during which time the doctor will exhaustively go through that information to download a full picture of that patient’s health.

After that visit, the user has full transparency into their medical data and the doctor’s notes. The patient also leaves with a health plan, including lifestyle nutritional advice, and access to their own health coach. Parsley also writes prescriptions, when necessary, and refers patients to top-of-the-line specialists, if needed.

Membership includes five annual visits with their doctors (which rounds out to about four hours), as well as five sessions with their certified health coach. These coaches help patients stay on their health plan, whether it’s advice on physical exercise or getting better sleep or finding take-out places and menu items near their office to eat healthier meals.

Throughout a patient’s membership, they have full access to their medical data and doctor’s notes online, as well as unlimited direct messaging with their doctor. At Parsley, there is always a doctor on call to answer questions about semi-urgent issues like a UTI or a sinus infection.

All of Parsley’s doctors and health coaches are full-time employees at Parsley, and Dr. Berzin told TechCrunch that the company sees a lot of inbound from doctors who want to spend more time with patients and help solve the root of their problems.

Parsley also trains their doctors in functional medicine, which uses a systems-biology approach to better resolve and manage modern chronic disease, as part of Parsley’s clinical fellowship, where they are trained in evaluating thousands of biomarkers to diagnose and treat diseases at their origin.

Parsley is not the first in the space. Forward and One Medical also look to change the way that healthcare is provided in this country, while NextHealth Technologies is focused on supplemental treatments like IV treatments and cryo.

“When I tell people about Parsley, they say ‘wow! That’s what medicine should be’,” said Dr. Berzin. “People are really searching for something better than feeling like they’re paying more and more for healthcare while getting less and less. People are excited to invest in their health and wellness and to have a team that’s working to care for them.”

Parsley has clinics in San Francisco, New York and Los Angeles.

Editor’s Note: An earlier version of this article incorrectly stated that Parsley Health costs $150/year.

Powered by WPeMatico

In November, we told you about Farmers Business Network, a social network for farmers that invites them to share their data, pool their know-how and bargain more effectively for better pricing from manufacturing companies. At the time, FBN, as it’s known, had just closed on $110 million in new funding in a round that brought its funding to roughly $200 million altogether.

That kind of financial backing might dissuade newcomers to the space, but a months-old startup called AgVend has just raised $1.75 million in seed funding on the premise that, well, FBN is doing it wrong. Specifically, AgVend’s pitch is that manufacturers aren’t so crazy about FBN getting between their offerings and their end users — in large part because FBN is able to secure group discounts on those users’ behalf.

AgVend is instead planning to work directly with manufacturers and retailers, selling their goods through its own site as well as helping them develop their own web shops. The idea is to “protect their channel pricing power,” explains CEO Alexander Reichert, who previously spent more than four years with Euclid Analytics, a company that helps brands monitor and understand their foot traffice. AgVend is their white knight, coming to save them from getting disrupted out of business. “Why cut them out of the equation?” he asks.

Whether farmers will go along is the question. Those who’ve joined FBN can ostensibly save money on seeds, fertilizers, pesticides and more by being invited to comparison shop through FBN’s own online store. It’s not the easiest sell, though. FBN charges farmers $600 per year to access its platform, which is presumably a hurdle for some.

AgVend meanwhile is embracing good-old-fashioned opacity. While it invites farmers to search for products at its own site based on the farmers’ needs and location, it’s only after someone has purchased something that the retailer who sold the items is revealed. The reason: retailers don’t necessarily want to put all of their pricing online and be bound to those numbers, explains Reichert.

Naturally, AgVend insists that it’s not just better for retailers and the manufacturers standing behind them. For one thing, says Reichert, AgVend’s farming customers are sometimes offered rebates. Customers are also better informed about the products they’re buying because the information is coming from the retailers and not a third party, he insists. “When a third party like FBN comes in and tries going around the retailers, the manufacturers can’t guarantee that FBN is giving the right guidance about their products.”

In the end, its customers will decide. But the market looks big enough to support a number of players if they figure out how to play it. According to USDA data from last year, U.S. farms spent an estimated $346.9 billion in 2016 on farm production expenditures.

That’s a lot of feed and fertilizer. It’s no wonder that founders, and the VCs who are writing them checks, see fertile ground. This particular deal was led by 8VC and included the participation of Precursor Ventures, Green Bay Ventures, FJ Labs and House Fund, among others.

Powered by WPeMatico

Elon Musk’s tunneling startup The Boring Company has raised $113 million to fund its vision of the near/distant future of transportation, according to newly filed SEC docs first spotted by CNBC.

The startup, which is centered around the goal of creating underground tunnels, plays a central part in Musk’s integrated view of urban transportation that he hopes will shape how the public moves about in a quick and efficient way. Last month, Musk announced that the company would be adjusting its plans to prioritize pedestrian traffic over vehicles.

A major part of the company’s early efforts have been in fighting for permits and contracts with city governments. Though Musk has indicated that he hopes to use the company to alleviate the problems of LA traffic, the company is also currently actively engaged in working with cities across the U.S.

Today’s documents don’t offer much insight into the details of the round beyond the cash amount and the fact that there were 31 undisclosed participants in the equity funding. The company has gotten some press for its less than conventional “fundraising methods” so far, where it has sold pre-orders of branded hats and, yes, flamethrowers.

Powered by WPeMatico

The city of Glendale, Calif. seems like an unlikely place to grow one of the next billion-dollar startups in the booming Los Angeles tech ecosystem.

Located at the southeastern tip of the San Fernando Valley, the Los Angeles suburb counts its biggest employers as the adhesive manufacturer Avery Dennison; the Los Angeles industrial team for the real estate developer CBRE; the International House of Pancakes; Disney Consumer Products; DreamWorks Studios; Walt Disney Animation and Univision. “Silicon Beach” this ain’t.

But it’s here in the (other) Valley’s southernmost edge that investors have found a startup they consider to be the next potential billion-dollar “unicorn” that will come out of Los Angeles. The company is ServiceTitan, and its market… is air conditioners.

More specifically, it’s the contractors that service equipment like the heating, ventilation and cooling systems at commercial and residential properties across the U.S.

Founded by Ara Mahdessian and Vahe Kuzoyan in 2012, ServiceTitan is very much an up-and-coming billion-dollar business that’s a family (minded) affair.

Mahdessian and Kuzoyan met on a ski trip organized by the Armenian student associations at Stanford and the University of Southern California back when both men were in college.

Both programmers, the two reconnected after doing stints as custom developers during and after college, and then when they were developing tools for their families’ businesses as residential contractors in the Los Angeles suburb of Glendale.

The two men built a suite of services to help contractors like their fathers manage their businesses. Now following a $62 million round of funding led by Battery Ventures last month, the company is worth roughly $800 million, according to people with knowledge of the investment, and is on its way to becoming Los Angeles’ next billion-dollar business.

Battery isn’t the only marquee investor to find value in ServiceTitan’s business developing software managing day labor.

Iconiq Capital, the investment firm managing the wealth of some of Silicon Valley’s most successful executives (the firm counts Facebook chief executive Mark Zuckerberg, and senior staff like Dustin Moskovitz and Sheryl Sandberg; Twitter chief Jack Dorsey; and LinkedIn founder and chief executive Reid Hoffman among its clients, according to a 2014 Forbes article), has also taken a shine to the now-gargantuan startup from Glendale.

It was Iconiq that put a whopping $80 million into ServiceTitan just last year — and while the 2017 cash infusion may have been larger, the company’s valuation has continued to rise.

That’s likely due to a continually expanding toolkit that now boasts a customer relationship management system, efficient dispatching and routing, invoice management, mobile applications for field professionals and marketing analytics and reporting tools.

“ServiceTitan’s incredibly fast growth is a testament to the brisk demand for new mobile and cloud-based technology that is purpose-built for the tradesmen and women in our workforce,” said Battery Ventures general partner Michael Brown — who’s taking a seat on the ServiceTitan board.

What distinguishes the ServiceTitan business from other point solutions is that they’ve taken to targeting not mom-and-pop small businesses but franchises like Mr. Rooter and George Brazil. Gold Medal Service, John Moore Services, Hiller Plumbing, Casteel Air, Baker Brothers Plumbing and Air Conditioning and Bonney may not be household names, but they’re large providers of contractors who work under those brands.

The company counts 400 employees on staff, and will look to use the money to continue to grow out its suite of products and services, according to a March statement announcing the funding.

And as Battery Ventures investor Sanjiv Kalevar noted in a blog post last year, the opportunity for software companies serving blue-collar workers is huge.

For people sitting at our desks and working behind laptops on programs like Microsoft Office, it can be easy to overlook the large, sometimes forgotten, workforce out there in construction, manufacturing, transportation, hospitality, retail and many other multi-billion dollar industries. Indeed, more than 60% of U.S. workers and even more globally fall into these “blue collar” industries.

By and large, these workers have not benefitted much from recent technology improvements available to office-based workers—think new email and workplace-collaboration technologies, or advanced sales and HR systems. Never mind the long-term opportunities for companies in these sectors from technologies like artificial intelligence, drones, and virtual or augmented reality; hourly and field workers are dealing with much more basic on-the-job challenges, like finding work, getting their jobs done on time and getting paid. These more basic needs can be solved with seemingly simple technologies—software for billing, scheduling, navigation and many other business workflows. These kinds of technologies, unlike AI, don’t automate away workers. Instead, they empower them to be more efficient and productive.

Powered by WPeMatico

Fleetsmith, a startup that wants to make it easier for companies to manage their Apple devices, announced a $7.7 million Series A round today led by Upfront Ventures.

Seed investors Index Ventures and Harrison Metal also participated in the round. The company has raised a total of $11 million. They also announced that Luke Kanies, founder and former CEO of Puppet has joined their advisory board.

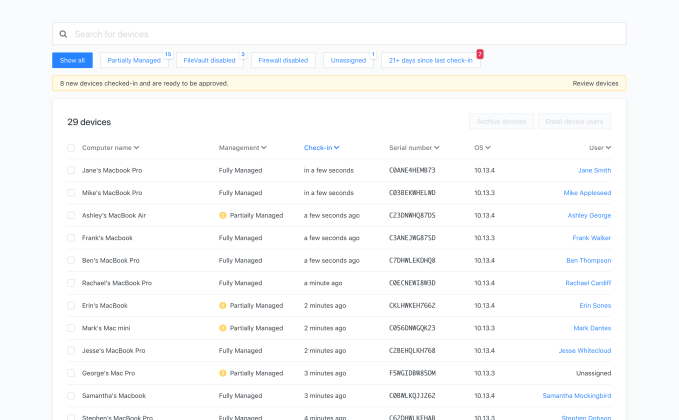

Fleetsmith wants to help SMBs provision and manage Apple devices whether that’s computers, phones, iPads or Apple TVs. Trying to provision these devices manually is a time-consuming process, one that larger organizations no longer have to deal with because of other commercial options or in-house solutions, but Fleetsmith puts that same kind of efficient device management within reach of smaller organizations by offering it as a cloud service.

Two of the co-founders, Zack Blum and Jesse Endahl, who came from Dropbox and Fandom, were both in positions where they needed to buy and deploy Apple devices and couldn’t find a good way for a small company to do that on the market.

“How do you manage a fleet of Macs and secure them through the internet? We looked around when we were in a build/buy position and saw a lot to be done. We are democratizing what companies like Google and Facebook have with their own [home-grown] internal Mac management tools,” CEO Blum told TechCrunch.

Fleetsmith device admin console. Photo: Fleetsmith

The company takes advantage of the Device Enrollment Program, a business device management service offered by Apple to simplify provisioning of Apple products. As long as the IT administrator is enrolled in DEP, you can use Fleetsmith for zero touch deployment, Blum explained. An employee can then order a laptop (or any device), and when they connect to WiFi, it connects to Fleetsmith, which configures the device automatically.

“The really cool thing about how DEP integrates into our feature set is that as soon as the employee connects to WiFi, it take care of deployment. The account is created, software gets installed, the drive gets encrypted. It makes installing and enrolling new people really simple,” he said. Once you’re setup with everything you need installed, the admin can force critical updates, but the system will give you several warnings before installing the update.

“Fleetsmith is automation applied perfectly, handing all of the menial work to the computer so the people do less firefighting and more strategic work. This is especially important in the mid-market because the teams are leaner and every computer counts,” new advisory board member Kanies said in a statement.

The service costs is just $99 per year per device to access the cloud service. They offer a freemium version to manage up to 10 devices at no cost. The company launched in 2016 and currently has 20 employees. Customers include HackerOne, Robinhood and Nuna.

Powered by WPeMatico

Over the course of the last few years, the Holberton School of Witchcraft and Wizardry Engineering has made a name for itself as one of the more comprehensive coding schools. The two-year program trains full-stack engineers with a focus on the basics of engineering and sees itself as an alternative to a traditional college experience. Today, the San Francisco-based school announced that it has raised an $8.2 million Series A round that will help it expand its programs.

The funding round was led by current investors daphni and Trinity Ventures. The Omidyar Network joined as a new investor. With this, the school has now raised a total of $13 million.

Holberton is currently teaching about 200 students (who have to pass a pretty rigorous entry exam) and the plan is to scale the program to 1,000 students per year. That’s a larger cohort than the computer science programs taught at even the biggest schools currently. Past students have found jobs at companies like Apple, IBM, Tesla, Docker and Dropbox. Instead of charging tuition, the school takes a 17 percent cut of its graduates’ salary for the first three years after they get their jobs.

To enable its expansion to 1,000 students, the team recently moved into a far larger space in San Francisco that can handle about 500 students. As the team has repeatedly told me, part of its mission is to bring in a diverse group of students — and one that isn’t held back by the prospect of student loans. In its recent classes, about 40 percent of the students were women, for example, and a slight majority of students were minorities. That’s sadly still quite unusual in Silicon Valley.

“Everyone deserves a first-rate education. Students at Holberton come from all walks of life, from cashiers to musicians to poker players (as well as right out of high school) without the money, background and education needed to be ‘Ivy League material,’” said Julien Barbier, co-founder and CEO of Holberton. “With Holberton, they now have the same opportunity as the more fortunate and they leave with skills to learn for a lifetime. Our students compete (sometimes after only 9-12 months) with Ivy League graduates and get the jobs.”

Powered by WPeMatico

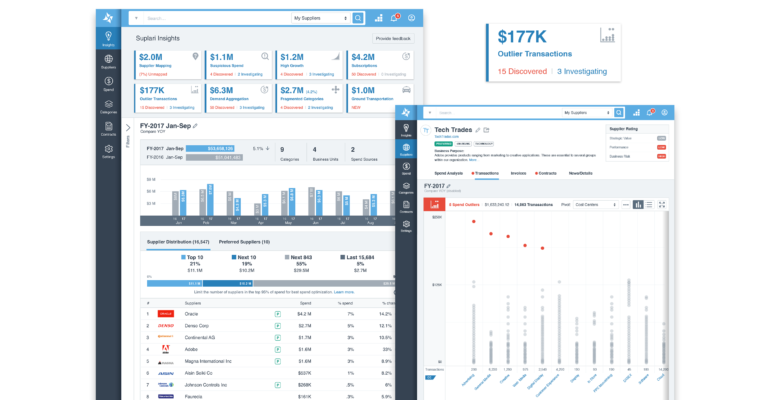

Procurement isn’t the most exciting topic in the world, but for large businesses, it’s an area where inefficiencies can quickly affect the bottom line. Simply getting a complete view of all of the products and services that a company buys is a challenge in itself, though, which in turn makes it hard to find savings, ensure compliance with company policy or government regulations or detect potential fraud. Suplari wants to change this by bringing its AI systems to bear on this problem.

The company today announced that it has raised a $10.3 million Series A round led by Shasta Ventures. Existing investors Madrona Ventures and Amplify Partners also joined this round, as well as new investors Two Sigma Ventures and Workday Ventures.

“Suplari uses advanced artificial intelligence on top of existing enterprise systems to proactively uncover the highest-value opportunities to pursue and empower the CFO or Chief Procurement Officer to unlock savings and profit that can be invested in growth, innovation, and their people,” said Suplari CEO and co-founder Nikesh Parekh in today’s announcement.

The company’s cloud-based service allows businesses to analyze all of their procurement data across platforms and formats. This data can include contracts, purchasing data, product usage information and data from corporate credit card accounts.

A number of Fortune 1000 customers have already signed up for the service and Supplari argues that it has helped its customers save software licensing fees by 33 percent and consolidate $200 million in professional service and temporary labor suppliers.

Powered by WPeMatico

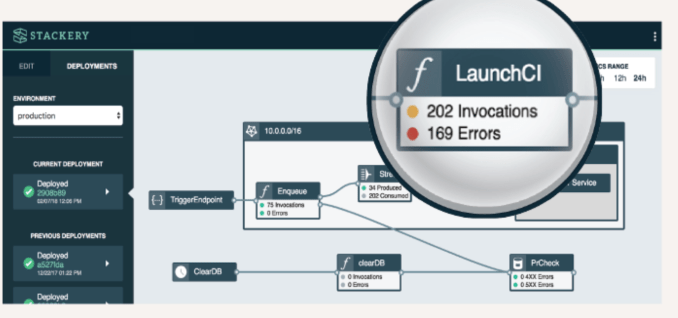

When Stackery’s founders were still at New Relic in 2014, they recognized there was an opportunity to provide instrumentation for the emerging serverless tech market. They left the company after New Relic’s IPO and founded Stackery with the goal of providing a governance and management layer for serverless architecture.

The company had a couple of big announcements today starting with their $5.5 million round, which they are calling a “seed plus” — and a new tool for tracking serverless performance called the Health Metrics Dashboard.

Let’s start with the funding round. Why the Seed Plus designation? Company co-founder and CEO Nathan Taggart says they could have done an A round, but the designation was a reflection of the reality of where their potential market is today. “From our perspective, there was an appetite for an A, but the Seed Plus represents the current stage of the market,” he said. That stage is still emerging as companies begin to see the benefits of the serverless approach.

HWVP led the round. Voyager Capital, Pipeline Capital Partners, and Founders’ Co-op also participated. Today’s investment brings the total raised to $7.3 million since the company was founded in 2016.

Serverless computing like AWS Lambda or Azure Functions is a bit of a misnomer. There is a server underlying the program, but instead of maintaining a dedicated server for your particular application, you only pay when there is a trigger event. Like cloud computing that came before, developers love it because it saves them a ton of time configuring (or begging) for resources for their applications.

But as with traditional cloud computing — serverless is actually a cloud service — developers can easily access it. If you think back to the Consumerization of IT phenomenon that began around 2011, it was this ability to procure cloud services so easily that resulted in a loss of control inside organizations.

As back then, companies want the advantages of serverless technology, but they also want to know how much they are paying, who’s using it and that it’s secure and in compliance with all the rules of the organization. That’s where Stackery comes in.

As for the new Health Metrics Dashboard, that’s an extension of this vision, one that fits in quite well with the monitoring roots of the founders. Serverless often involves containers, which can encompass many functions. When something goes wrong it’s hard to trace what the root cause was.

Stackery Health Metrics Dashboard. Photo: Stackery

“We are showing architecture-wide throughput and performance at each resource point and [developers] can figure out where there are bottlenecks, performance problems or failure.

The company launched in 2016. It is based in Portland, Oregon and currently has 9 employees, of which five are engineers. They plan to bring on three more by the end of the year.

Powered by WPeMatico

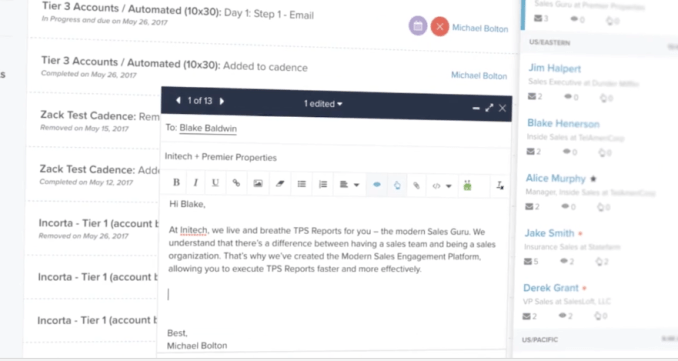

SalesLoft, an Atlanta-based startup that helps companies manage the contact phase of the sales process, announced a $50 million Series C today.

Insight Venture Partners was lead investor with participation from LinkedIn and Emergence Capital, which also participated in the company’s A and B rounds. Today’s investment brings the total raised to $75 million, so this was a significant capital infusion.

What attracted investors was that SalesLoft has concentrated on an area of the sales pipeline called ‘sales engagement.’ It provides a framework for sales people around how to contact potential customers, how often and with what language. It is significant enough that it caught the attention of Jeff Horing, co-founder and managing director at Insight Venture Partners, who was willing to write a big check.

He sees sales engagement an emerging and fast-growing area of the sales stack. “SalesLoft consistently helps customers increase their pipelines, but also strengthen their relationships with buyers — that’s a huge differentiator,” Horing said in a statement.

Kyle Porter, co-founder and CEO at SalesLoft says that what his company does is essentially create a contact workflow for the sales team. It provides a framework or blueprint, while applying a measurable structure to the process for management. Whether the sale is successful or not, there is an audit trail of all the interactions and what the software recommended for actions and what actions the sales person took.

That involves providing the sales team with the next best actions, which could be an email, a phone call or even a handwritten note.”The suggested email content and phone scripts come from experience with buyers. Here’s the right way to communicate,” Porter said. “At the end of the day, we are enabling our customers to deliver better sales experience,” he added.

The software can recommend the best person to email next with suggested text. Photo: SalesLoft

Machine learning will play an increasing role in building that workflow, as the system learns what types of interactions work best for certain types of customers, it will learn from that, and the system’s recommendations should improve over time.

It appears to be working. The company, which launched in 2011, currently has 230 employees and over 2000 customers including Square, Cisco, Alteryx, Dell and MuleSoft (which Salesforce bought last month for $6.5 billion.) The company reported that they have increased revenue over the last two years by 800 percent (yes, 800 percent).

Porter says this money sets them up to really scale the company with plans to reach 350 employees by the end of the year. In fact, they have more than 40 openings at the moment.

Powered by WPeMatico