Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Telehealth platform Eucalyptus raised a $22.3 million Series B round of funding to build a digital health portfolio for primary care in Australia.

NewView Capital led the round with participation from existing investors Blackbird Ventures and W23, and new investor AirTree Ventures. As part of the investment, Ravi Viswanathan, NewView founder and managing partner, will be joining the Eucalyptus board.

The new round gives the Sydney-based company a total of $32.8 million raised since it was founded in 2019 by Tim Doyle, Benny Kleist, Alexey Mitko and Charlie Gearside.

Australia’s healthcare system is a two-payer model, where most of the care is paid for by the government, and there is a smaller insurance coverage that is owned by individuals. Eucalyptus fits into these models as a private-pay option selling directly to consumers. In some cases, the company is able to charge lower copays for care than the average $25 per doctor visit, Doyle told TechCrunch.

He touts the company as the “largest vertically integrated telehealth platform in Australia,” serving more than 200,000 patients across four demographic-focused brands: contraception and fertility, skincare, men’s health and sexual wellness. Each brand has its own core platform of healthcare providers, patient data repository, remote monitoring tools and partnerships with pathology labs and pharmacies.

All of that results in a higher touch and higher quality relationship between doctor and patient, Doyle said.

“We are seeing an opportunity to shorten the amount of time between identification of a condition and diagnosis,” he added. “We also want to go more in-depth into diabetes, heart conditions and mental health. People are dropping out of diabetes and mental care because there are not enough touch points that are easy to use. If we can build a hub, it will make it easier to treat those conditions.”

In addition to product development, the new funding enables Eucalyptus to build toward being a major player in the telehealth industry. The company will introduce new brands in the next year around chronic care like behavioral health, weight management and diabetes.

Eucalyptus grew its revenue between 200% to 300% year over year since 2019, Doyle said. This is not unlike other startups in the digital health sector, where 2020 saw another record year for venture capital investment. He expects similar growth in 2021, including adding about 20 employees to be over 100 by the end of the year.

Meanwhile, Doyle said he is excited to work with NewView, especially with Viswanathan and principal Christina Fa, who said Eucalyptus is proving that Australia can lead in digital healthcare.

“The team is impressive in terms of clarity of vision and execution, especially in the way they brought in people to manage the brands,” she told TechCrunch. “It is unique being based in Australia where they don’t have Teledoc and other digital health companies. Instead, Eucalyptus had to build all of that in-house and do the hard work upfront. In addition, they curated a network of health providers and four brands, each with their own personalities. This allows them to be fully vertically integrated and own the customer journey.”

Powered by WPeMatico

AttackIQ, a cybersecurity startup that provides organizations with breach and attack simulation solutions, has raised $44 million in Series C funding as it looks to ramp up its international expansion.

The funding round was led by Atlantic Bridge, Saudi Aramco Energy Ventures (SAEV) and Gaingels, with existing vendors — including Index Ventures, Khosla Ventures, Salesforce Ventures and Telstra Ventures — also participating. The round brings the company’s total funding raised to date to $79 million.

AttackIQ was founded in 2013 and is based out of San Diego, California. It provides an automated validation platform that runs scenarios to detect any gaps in a company’s defenses, enabling organizations to test and measure the effectiveness of their security posture and receive guidance on how to fix what’s broken. Broadly, AttackIQ’s platform helps an organization’s security teams anticipate, prepare and hunt for threats that may impact their business, before hackers get there first.

Its Security Optimization Platform platform, which supports Windows, Linux and macOS across public, private and on-premises cloud environments, is based on the MITRE ATT&CK framework, a curated knowledge base of known adversary threats, tactics and techniques. This is used by a number of cybersecurity companies also building continuous validation services, including FireEye, Palo Alto Networks and Cymulate.

AttackIQ says this latest round of funding, which comes more than two years after its last, arrives at a “dynamic time” for the company. Not only has cybersecurity become more of a priority for organizations as a result of a major uptick in both ransomware and supply-chain attacks, the company also recently accelerated its international expansion efforts through a partnership with technology distributor Westcon.

The startup says it’s planning to use these new funds to further expand internationally through its newfound partnership with Atlantic Bridge, which will also see Kevin Dillon, the company’s co-founder and managing director, join the AttackIQ board of directors.

“AttackIQ has established itself as a category leader with a formidable enterprise customer base that includes four of the Fortune 20,” said Dillon. “We believe deeply in the company’s vision and potential to become the next billion-dollar cybersecurity software company and look forward to helping the company turn early traction in Europe and the Middle East into robust, long-term expansion.”

Brett Galloway, CEO of AttackIQ, said the round “reaffirms the strength” of its platform.

As well as enabling organizations to review the robustness of their security defenses, the startup also runs the AttackIQ Academy, which provides free entry-level and advanced cybersecurity training. It has accumulated 17,200 registered students to date across 176 countries.

Powered by WPeMatico

Sourcegraph, a late-stage startup that wants to bring the power of search to code, announced a $125 million Series D investment today on a $2.625 billion valuation, a 3x growth from its previous valuation in December 2020, according to the company.

The round was led by Andreessen Horowitz, with participation from Insight Partners, Geodesic Capital and other existing investors. The company has now raised almost $225 million, according to Crunchbase data.

Company CEO and co-founder Quinn Slack says that we know by now that every company is building software, and as they do, they are generating tons of code. “They’re all drowning in code, and we help solve that. Our product is universal code search, which helps developers search, understand and automate code,” Slack explained.

He says that companies use Sourcegraph to find problems and vulnerabilities they might not otherwise see. Developers and site reliability engineers may see that there’s a problem, but getting to the specific part of the code where it’s happening requires a specialized tool, he says. Some of the large companies might build their own tools for this purpose, but most companies don’t have the resources and this puts code search within reach of many more developers.

“Universal code search that we built — and we spent a lot of time building it — is the first kind of code search that actually understands code as code and all the connections, that graph of code. And that means that if you’re a developer, you can get to that answer of how do I do this thing or how do I fix this or if I change this what’s going to break, in way less time and that’s why you need a purpose-built code search tool,” he said.

He says that the company was founded in 2013, but it took almost five years to build a product of this sophistication. The startup was able to get funding initially based on the potential of a tool like this. Now investors are seeing the traction they envisioned early on.

They have 800,000 developers using the product over the last 12 months, and Slack says that they have indexed over 54 billion lines of code. Paying customers include Plaid, Uber, GE and Atlassian. The company has around 160 employees and expects to increase that to 250 by the end of the year with all of this new capital.

The company made the fortunate decision to go fully remote in January of 2020 just a couple of months before offices shut down in the U.S., and his plan is to continue to be remote even after offices fully reopen.

Slack doesn’t shy away from the IPO question, saying it’s definitely something they think about. “We want to be a public company eventually, so that we can show that we’re going to be around forever. This funding certainly shows that we are growing, and that we are going to stick around and we’re going to be vendor independent, so you know that’s definitely an important part of our strategy.”

Powered by WPeMatico

Oakland-based Mighty Buildings, which is on a quest to build homes using 3D printing, robotics and automation, has raised a $22 million extension to its Series B round of funding.

The additional capital builds upon a $40 million raise the company announced earlier this year, bringing its total funding since its 2017 inception to $100 million.

Mighty Building’s self-proclaimed mission is to create “beautiful, sustainable and affordable” homes.

The company claims to be able to 3D print structures “two times as quickly with 95% less labor hours and 10-times less waste” than conventional construction. For example, it says it can 3D print a 350-square-foot studio apartment in just 24 hours.

Execs say the new capital will go toward making supply chain improvements and moving up research and development timelines. The money will also go toward helping it achieve a new goal of achieving Net-Zero carbon neutrality by 2028 — which it says is 22 years ahead of the construction industry overall.

“As a founding team, we have long been passionate about solving productivity for construction in a sustainable way,” said co-founder and CEO Slava Solonitsyn. “We have spent four years figuring out what it takes to achieve that. We believe that we have a master plan now that can work.”

Since its launch, the company has produced and installed a number of accessory dwelling units (ADUs).

Sam Ruben, co-founder and chief sustainability officer of Mighty Buildings, said the new funds will also go toward kicking off development of the startup’s multistory offering. The multistory efforts will likely initially focus on two to three-story single family homes and townhouses with an eye toward expanding into low-rise apartment buildings. The company hopes to have at least a prototype multistory offering in late 2022 or early 2023, according to Ruben.

“Along with the sustainability improvements already captured by our new formula, this will allow us to develop our next-generation material to get us even closer to our goal of being carbon neutral by 2028,” Ruben said. “It will also give us opportunities to implement improvements in our existing design by reducing the impact of our foundations and other, nonprinted elements.”

Specifically, Mighty Buildings plans to speed up its carbon neutrality roadmap by building “high-throughput, sustainable” micro factories, forming strategic supply chain partnerships, accelerating “blue skies” technology research and developing new composite materials produced from recycled or bio-based feedstock.

The micro factories, according to the company, will be able to produce 200 to 300 homes per year in locations where housing gaps exist. Mighty Buildings plans to create single-family residential developments with its panelized “Mighty Kit System.”

Mighty Buildings has seen quarter over quarter growth in sales, Ruben said, with the company seeing a record of over $7 million in total contracted revenue in the second quarter.

The company is also excited about its new fiber-reinforced printing material, which is currently undergoing testing with certification expected to be completed later this year. Mighty Buildings claims that its new formula shows “over 50% improvement” in embodied carbon from its original material and a strength profile similar to reinforced concrete, with more than four times less weight.

The round extension was supported by a few new and existing investors including ArcTern Ventures, Core Innovation Capital, Decacorn Capital, Gaingels, Khosla Ventures, Klaff Realty, MicroVentures, Modern Venture Partners, Polyvalent Capital, Vibrato Capital and others.

Powered by WPeMatico

Cadoo, a US-startup that’s gamifying fitness by turning it into a betting opportunity, using the prospect of winning (or losing) cold hard cash to motivate people to get off the couch, has collected $1.5 million in seed funds from Sam & Max Altman’s Apollo VC and the student-focused Dorm Room Fund.

The app itself has been around since 2018 but in March 2020 it launched a “challenge model” that lets users stake money to join a challenge related to a specific fitness goal — be it running 10 miles in 10 days, or walking three miles in three days.

Participants who achieve the challenge goal get their stake back and a pro-rata share of losers’ staked entry fees.

A range of fitness levels are catered to by Cadoo’s challenges (“from daily steps to marathon training”), with some 50 public challenges hosted per week.

It’s also adding private challenges this month — which will enable users to host and configure fitness challenges for themselves/family and friends, or larger groups, such as companies, clubs, or schools.

Challenge-related activity is verified by the app via API data from activity trackers and fitness apps. (Which hopefully means Cadoo is smart enough to detect if someone has attached their Fitbit to their dog… )

The app has support for a number of third party fitness services, including Strava, Fitbit and Apple Health.

CEO and founder Colm Hayden describes the startup as “DraftKings for your own fitness goals”.

“Our audience consists of 25-50 year old fitness fanatics’ who use Cadoo to stay committed to their monthly/weekly fitness goals,” he told TechCrunch, adding: “When people are serious about a goal they are trying to reach, they want intense motivation to back their ambitions.”

He says the app has attracted around 7,000 wager-loving users so far.

Cadoo’s business model is based on taking a fee from challenge losers before their entry fee stakes are distributed to challenge winners — which does potentially give the business an incentive to set harder challenges than users are able to complete.

But of course it’s up to users to pick which challenges to enter and thereby commit their hard earned cash to.

It also claims that 90% of users who sign up for Cadoo challenges successfully complete them.

Hayden says it has future plans to expand monetization potential by offering winners fitness products — and taking a margin on those products. And also by expanding into other types of verifiable goals, not just running/walking.

“We are working to build a motivation platform that enables anybody to reach their goals,” he says. “Financial incentives is an intense motivator, and 90% of users who sign up for Cadoo challenges reach their fitness goals. We are making Cadoo much bigger than just running goals, and in the future incentivizing almost any goal verifiable on the internet.”

While the app is US-based payments are processed by PayPal and Hayden says it’s able to support participation internationally — at least everywhere where PayPal is available.

Commenting on the seed raise in a statement, Apollo VC’s Altman brothers added: “Cadoo makes it easy to motivate users to stay active with financial incentives. We believe the motivation industry that Cadoo is pioneering will be an important digital money use-case.”

Before the seed round, Cadoo says it had raised $350,000 via an angel round from Tim Parsa’s Cloud Money Ventures Angel Syndicate, Wintech Ventures, and Daniel Gross’s Pioneer.

Of course gamification of health is nothing new — given the data-fuelled quantification and goal-based motivation that’s been going on around fitness for years, fuelled by wearables that make it trivially easy to track steps, distances, calories burned etc.

But injecting money into the mix adds another competitive layer that may be helpful for motivating a certain type of person to get or stay fit.

Cadoo isn’t the only fitness-focused startup to be taking this tack, either, though — with a number of apps that pay users to lose weight or otherwise be active (albeit, sometimes less directly by paying them in digital currency that can be exchanged for ‘rewards’). Others in the space include the likes of HealthyWage (a TC50 company we covered all the way back in 2009!); Runtopia and StepBet, to name a few.

Powered by WPeMatico

Endgame, enabling software companies to turn customer observations into go-to-market strategies, announced Tuesday it raised a total of $17 million in back-to-back seed and Series A funding rounds.

The $12.25 million Series A was led by Menlo Ventures, while the $5 million seed round was led by Upfront Ventures. Also participating in the round are a group of investors including Todd and Rahul’s Fund, Liquid 2 Ventures and Gainsight CEO Nick Mehta.

Los Angeles-based Endgame was founded in 2020 and provides a self-service look at what’s happening in a software trial so that a sales team can prioritize accounts based on user behavior signals and act on them faster without having to be a data scientist or engineer.

Company CEO Alex Bilmes told TechCrunch that the concepts of product-led sales and product-led growth have taken over the sale of software. Today’s customers sign up for a trial, and if they like it, they invite their friends to try it.

However, at a certain point, some sales pressure is needed to close the deal. That’s where Endgame comes in: It shows who is doing what, and what features are being used — data that is typically opaque to sales and revenue teams.

Traditional customer relationship management systems are designed to be rep-driven, meaning the sales rep is responsible for adding notes. It’s simpler if a rep only has a few accounts, but across tens of millions of users, Endgame analyzes the data and identifies which accounts are most likely to convert, who are the users to engage, what makes a good customer and how to take action with the right people.

Endgame is not competing against other companies so much as in-house developers that are cobbling a bunch of apps together in efforts to create a system that works for them, Bilmes said.

“Most of this is solved with do-it-yourself,” he added. “I have built Endgame a number of times at other companies using databases and other piece-meals to put together something so I could mash data from lots of places and build subscriptive views for revenue teams. We compete with those data scientists and internal teams stitching together horizontal tools.”

Endgame is pre-revenue and is already catering to a group of beta customers like Figma, Loom, Airtable, Clubhouse, Mode, Retool and Algolia that are looking for a dedicated software platform to capture product-led value.

Bilmes said the customer relationship management market, both huge and fast-growing at 35% annually, is expected to reach $114 billion by 2027. To meet demand, he intends to use the new funds to continue hiring aggressively. He has already tripled the size of the team to nine in the past few months, and expects to double that in the coming year. In addition, funds will go toward R&D and to further define the product-led sales landscape.

Growth over the next year will be customer-focused as Endgame works to get into the hands of the right customers and making it as accessible as possible for people to begin doing product-led motions.

“Our efforts are product-focused,” Bilmes said. “We’ve seen more demand than we can possibly hope to fill given the problem is so real for so many.”

As part of the investment, Upfront Ventures Partner Kara Nortman and Menlo Ventures Partner Naomi Ionita will join Endgame’s board of directors. Sandhya Hegde, partner at Unusual Ventures, which also participated in both rounds, joins as a board observer to create an all-women investor board.

When Endgame was raising its seed fund, it wanted to work with Nortman, who has expertise in applying consumer concepts to enterprise, Bilmes said. When it came to the Series A, Bilmes said he felt Ionita was the perfect partner due to her similar background to Bilmes and expertise in teaching salespeople how to engage.

Ionita told TechCrunch she learned about Endgame from Nortman, with whom she has invested in other startups. The company understands the pain point and is for companies that offer a self-service version for the “why and how.”

“This intelligence doesn’t exist, and I know that because I lived it — building in-house or seeing companies flying blind,” she added. “Alex just gets this, and I see Endgame being the system of record and intelligence for bridging self-serve. They will be the final bridge that needs to exist between product teams and product-facing sales reps for which accounts to address and why.”

Powered by WPeMatico

For many of us, going to work these days no longer means going into a specific office like it used to; and today one of the startups that’s built a platform to help cater to that new, bigger world of employment — wherever talent might be — is announcing a major round of funding on the back of strong demand for its tools.

Remote, which provides tools to manage onboarding, payroll, benefits and other services for tech and other knowledge workers located in remote countries — be they contractors or full-time employees — has raised $150 million. Job van der Voort, the Dutch-based CEO and co-founder of New York-based Remote, confirmed in an interview that funding values Remote at over $1 billion.

Accel is leading this Series B, with participation also from previous investors Sequoia, Index Ventures, Two Sigma, General Catalyst and Day One Ventures.

The funding will be used in a couple of areas. First and foremost, it will go toward expanding its business to more markets. The startup has been built from the ground up in a fully integrated way, and in contrast to a number of others that it competes with in providing Employer of Record services, Remote fully owns all of its infrastructure. It now provides its HR services, as fully operational legal entities, for 50 countries (it has a target of growing that to 80 by the end of this year). The platform is also set to be enhanced with more tools around areas like benefits, equity incentive planning, visa and immigration support and employee relocation.

“We are doubling down on our approach,” van der Voort said. “We try to fully own the entire stack: entity, operations, experts in house, payroll, benefits and visa and immigration — all of the items that come up most often. We want to to build infrastructure products, foundational products because those have a higher level of quality and ultimately a lower price.”

In addition, Remote will be using the funding to continue building more tools and partnerships to integrate with other providers of services in what is a very fragmented human resources market. Two of these are being announced today to coincide with the funding news: Remote has launched a Global Employee API that HR platforms that focus on domestic payroll can integrate to provide their own international offering powered by Remote. HR platform Rippling (Parker Conrad’s latest act) is one of its first customers. And Remote is also getting cosier with other parts of the HR chain of services: applicant tracking system Greenhouse is now integrating with it to help with the onboarding process for new hires.

Indeed, $150 million at a $1 billion+ valuation is a very, very sizable Series B, even by today’s flush-market standards, but it comes after a bumper year for the company, and in particular since November last year when it raised a Series A of $35 million. In the last nine months, customer numbers have grown seven-fold, with users on the platform increasing 10 times. Most interestingly, perhaps, is that Remote’s revenues — its packages start at $149 per month but go up from there — have increased by a much bigger amount: 65x, the company said. That basically points to the fact that engagement from those users — how much they are leaning on Remote’s tech — has skyrocketed.

Although there are a lot of competitors in the same space as Remote — they include a number of more local players alongside a pretty big range of startups like Oyster (which announced $50 million in funding in June), Deel, which is now valued at $1.25 billion; Turing; Papaya Global (now also valued at over $1 billion); and many more — the opportunity they are collectively tackling is a massive one that, if anything, appears to be growing.

Hiring internationally has always been a costly, time-consuming and organizationally challenged endeavor, so much so that many companies have opted not to do it at all, or to reserve it for very unique cases. That paradigm has drastically shifted in recent years, however.

Even before COVID-19 hit, there was a shortage of talent, resulting in a competitive struggle for good people, in companies’ home markets, which encouraged companies to look further afield when hiring. Then, once looking further afield, those employers had to give consideration to employing those people remotely — that is, letting them work from afar — because the process of relocating them had also become more expensive and harder to work through.

Then COVID-19 happened, and everyone, including people working in a company’s HQ, started to work remotely, changing the goalposts yet again on what is expected by workers, and what organizations are willing to consider when bringing on a new person, or managing someone it already knows, just from a much farther distance.

While a lot of that has played out in the idea of relocating to different cities in the same country — Miami and Austin getting a big wave of Silicon Valley “expats” being two examples of that — it seems just a short leap to consider that now that sourcing and managing is taking on a much more international slant. A lot of new hires, as well as existing employees who are possibly not from the U.S. to begin with, or simply want to see another part of the world, are now also a part of the mix. That is where companies like Remote are coming in and lowering the barriers to entry by making it as easy to hire and manage a person abroad as it is in your own city.

“Remote is at the center of a profound shift in the way that companies hire,” said Miles Clements, a partner at Accel, in a statement. “Their new Global Employee API opens up access to Remote’s robust global employment infrastructure and knowledge map, and will help any HR provider expand internationally at a speed impossible before. Remote’s future vision as a financial services provider will consolidate complicated processes into one trusted platform, and we’re excited to partner with the global leader in the quickly emerging category of remote work.”

And it’s interesting to see it now partnering with the likes of Rippling. It was a no-brainer that as the latter company matured and grew, it would have to consider how to handle the international component. Using an API from Remote is an example of how the model that has played out in communications (led by companies like Twilio and Sinch) and fintech (hello, Stripe) also has an analogue in HR, with Remote taking the charge on that.

And to be clear, for now Remote has no plans to build a product that it would sell directly to individuals.

“Individuals are reaching out to us, saying, ‘I found this job and can you help me and make sure I get paid?’ That’s been interesting,” van der Voort said. “We thought about [building a product for them] but we have so much to do with employers first.” One thing that’s heartening in Remote’s approach is that it wouldn’t want to provide this service unless it could completely follow through on it, which in the case of an individual would mean “vetting every major employer,” he said, which is too big a task for it right now.

In the meantime, Remote itself has walked the walk when it comes to remote working. Originally co-founded by two European transplants to San Francisco, the pair had firsthand experience of the paradoxical pains and opportunities of being in an organization that uses remote workforces.

Van der Voort had been the VP of product for GitLab, which he scaled from five to 450 employees working remotely (it’s now a customer of Remote’s); and before co-founding Remote, CTO Marcelo Lebre had been VP of engineering for Unbabel — another startup focused on reducing international barriers, this time between how companies and global customers communicate.

Today, not only is the CEO based out of Amsterdam in The Netherlands, with the CTO in Lisbon, Portugal, but New York-based Remote itself has grown to 220 from 50 employees, and this wider group has also been working remotely across 47 countries since November 2020.

“The world is looking very different today,” van der Voort said. “The biggest change for us has been the size of the organization. We’ve gone from 50 to more than 200 employees, and I haven’t met any of them! We have tried to follow our values of bringing opportunity everywhere so we hire everywhere as we solve that for our customers, too.”

Powered by WPeMatico

As financial crime has become significantly more sophisticated, so too have the tools that are used to combat it. Now, Quantexa — one of the more interesting startups that has been building AI-based solutions to help detect and stop money laundering, fraud and other illicit activity — has raised a growth round of $153 million, both to continue expanding that business in financial services and to bring its tools into a wider context, so to speak: linking up the dots around all customer and other data.

“We’ve diversified outside of financial services and working with government, healthcare, telcos and insurance,” Vishal Marria, its founder and CEO, said in an interview. “That has been substantial. Given the whole journey that the market’s gone through in contextual decision intelligence as part of bigger digital transformation, was inevitable.”

The Series D values the London-based startup between $800 million and $900 million on the heels of Quantexa growing its subscriptions revenues 108% in the last year.

Warburg Pincus led the round, with existing backers Dawn Capital, AlbionVC, Evolution Equity Partners (a specialist cybersecurity VC), HSBC, ABN AMRO Ventures and British Patient Capital also participating. The valuation is a significant hike up for Quantexa, which was valued between $200 million and $300 million in its Series C last July. It has now raised over $240 million to date.

Quantexa got its start out of a gap in the market that Marria identified when he was working as a director at Ernst & Young tasked with helping its clients with money laundering and other fraudulent activity. As he saw it, there were no truly useful systems in the market that efficiently tapped the world of data available to companies — matching up and parsing both their internal information as well as external, publicly available data — to get more meaningful insights into potential fraud, money laundering and other illegal activities quickly and accurately.

Quantexa’s machine learning system approaches that challenge as a classic big data problem — too much data for a human to parse on their own, but small work for AI algorithms processing huge amounts of that data for specific ends.

Its so-called “Contextual Decision Intelligence” models (the name Quantexa is meant to evoke “quantum” and “context”) were built initially specifically to address this for financial services, with AI tools for assessing risk and compliance and identifying financial criminal activity, leveraging relationships that Quantexa has with partners like Accenture, Deloitte, Microsoft and Google to help fill in more data gaps.

The company says its software — and this, not the data, is what is sold to companies to use over their own data sets — has handled up to 60 billion records in a single engagement. It then presents insights in the form of easily digestible graphs and other formats so that users can better understand the relationships between different entities and so on.

Today, financial services companies still make up about 60% of the company’s business, Marria said, with seven of the top 10 U.K. and Australian banks and six of the top 14 financial institutions in North America among its customers. (The list includes its strategic backer HSBC, as well as Standard Chartered Bank and Danske Bank.)

But alongside those — spurred by a huge shift in the market to rely significantly more on wider data sets, to businesses updating their systems in recent years, and the fact that, in the last year, online activity has in many cases become the “only” activity — Quantexa has expanded more significantly into other sectors.

“The Financial crisis [of 2007] was a tipping point in terms of how financial services companies became more proactive, and I’d say that the pandemic has been a turning point around other sectors like healthcare in how to become more proactive,” Marria said. “To do that you need more data and insights.”

So in the last year in particular, Quantexa has expanded to include other verticals facing financial crime, such as healthcare, insurance, government (for example in tax compliance) and telecoms/communications, but in addition to that, it has continued to diversify what it does to cover more use cases, such as building more complete customer profiles that can be used for KYC (know your customer) compliance or to serve them with more tailored products. Working with government, it’s also seeing its software getting applied to other areas of illicit activity, such as tracking and identifying human trafficking.

In all, Quantexa has “thousands” of customers in 70 markets. Quantexa cites figures from IDC that estimate the market for such services — both financial crime and more general KYC services — is worth about $114 billion annually, so there is still a lot more to play for.

“Quantexa’s proprietary technology enables clients to create single views of individuals and entities, visualized through graph network analytics and scaled with the most advanced AI technology,” said Adarsh Sarma, MD and co-head of Europe at Warburg Pincus, in a statement. “This capability has already revolutionized the way KYC, AML and fraud processes are run by some of the world’s largest financial institutions and governments, addressing a significant gap in an increasingly important part of the industry. The company’s impressive growth to date is a reflection of its invaluable value proposition in a massive total available market, as well as its continued expansion across new sectors and geographies.”

Interestingly, Marria admitted to me that the company has been approached by big tech companies and others that work with them as an acquisition target — no real surprises there — but longer term, he would like Quantexa to consider how it continues to grow on its own, with an independent future very much in his distant sights.

“Sure, an acquisition to the likes of a big tech company absolutely could happen, but I am gearing this up for an IPO,” he said.

Powered by WPeMatico

Jake Rothstein is the co-founder of Papa, a Miami-based company that offers care and companionship to seniors. The business, which pairs elderly Americans with uncertified-yet-vetted pals, helps offer casual services, such as technology support, grocery delivery or even a fun conversation. It has raised upwards of $91 million in venture capital to date.

While Rothstein left day to day responsibilities at Papa in 2017, his experience there gave him a deeper look into the priorities of older adults and families as they go through the aging journey. While Papa was about meeting the elderly where they are, the co-founder began to think of a more complex question: What if “where they are” isn’t as supportive as it should be 24/7?

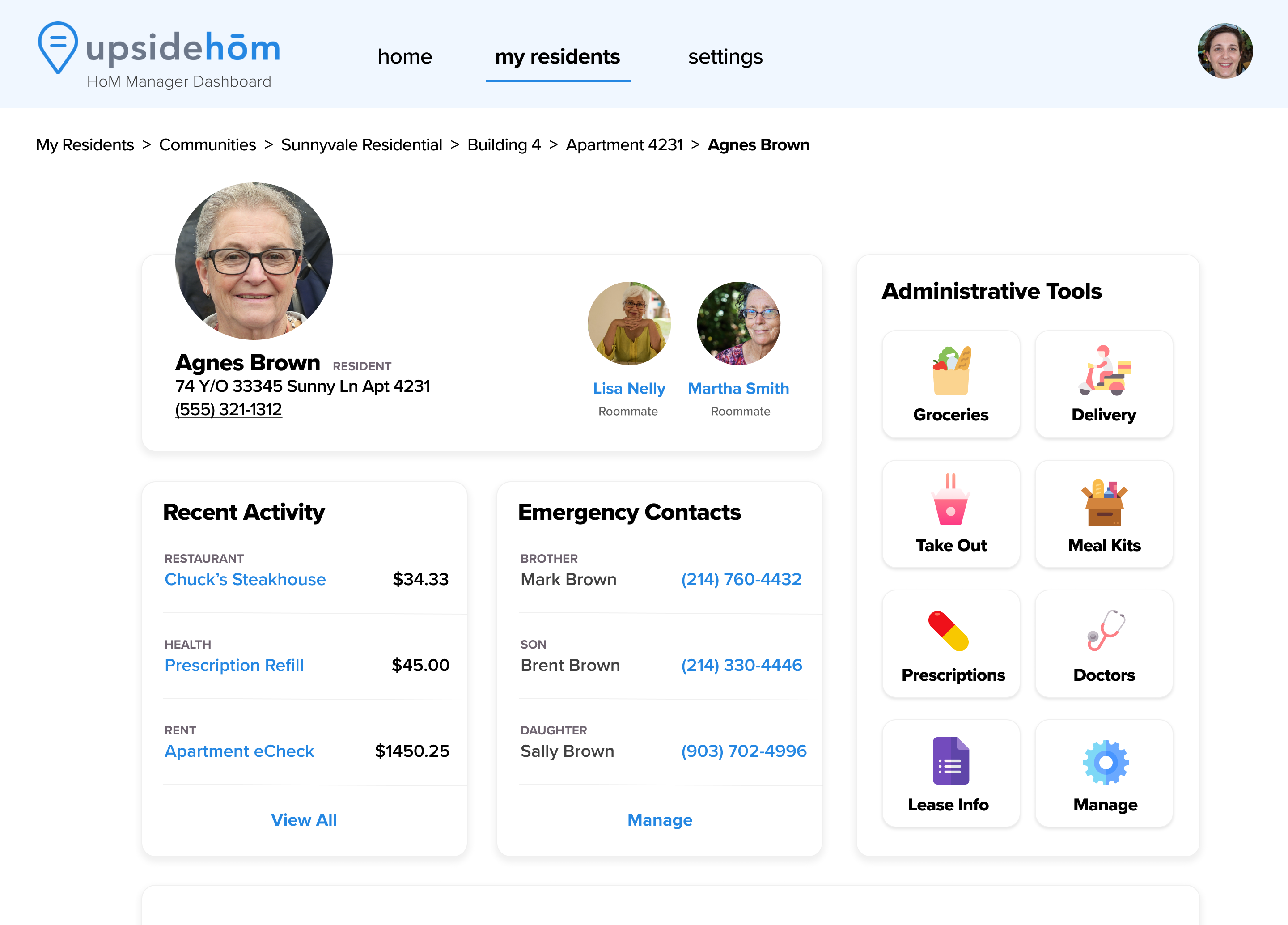

After a stint at another tech company, Rothstein launched a more modern take on senior living communities in January 2020, alongside co-worker turned co-founder Peter Badgley. UpsideHōM is a fully managed, tech-enabled living space for older adults in the United States. After a year of beta testing, the duo announced today that they have raised a $2.25 million seed round for UpsideHōM, led by Triple Impact Capital and Freestyle Capital, with participation from Techstars.

Alongside the funding, UpsideHōM announced its next big bet, dubbed a relaunch, that will sit atop furnished and furnished apartments that sit throughout Raleigh, Atlanta, Jacksonville, Tampa and South Florida: a software platform to take out all the clutter from move-in and maintenance. The platform will give residents one spot to chat with their house manager, pay bills and access perks such as on-demand tech support, house-keeping and companion visits thanks to a partnership with Papa. The company also offers add-on services and amenities, including freshly prepared meals, grocery delivery, fitness programming and accompanied transportation.

Image Credits: UpsideHōM

Part of UpsideHōM’s focus is in creating personalized solutions. Elders are diverse in age, needs and financial circumstances — which means the turnkey solution needs to be easily adaptable to service needs when they pop up. The company needs to be careful though: It can’t offer traditional caregiver services due to state by state compliance; instead Rothstein describes the offerings as supportive services, not in replacement of health assistant caregivers.

Image Credits: UpsideHoM

When the company first launched, it was betting on a more unconventional idea.

“I thought, let’s solve loneliness even more completely than what Papa is doing by building in companionship,” Rothstein said, instead of letting people order it on demand. The company decided to offer roommate matching services for elders as one of its core services, alongside the aforementioned supported living characteristics. It didn’t fully stick. Over half of inbound participants responded to the marketing efforts by saying that they liked the idea, but didn’t want to share the space. Today, 50% of UpsideHōM’s business covers individuals or people with spouses or significant others; the other half covers those looking to share units.

The synergies between UpsideHōM and Papa, Rothstein’s previous company, are clear beyond an overlapping customer base. Papa offered up to and almost including actual care, stopping at traditional care-giving services, which require their own vetting and compliance measures. UpsideHōM offers up to and almost including traditional senior living services, but gives supportive services instead of assisted living services, which similarly have their own logistic hurdles to figure out.

As for why Rothstein didn’t just launch supportive living services as a new product vertical within his earlier company, he chalked it up to the “tremendous” opportunity in the former, which warranted it’s own company. He also said that customer acquisition looks different between the two companies.

“At Papa, what we found was that acquiring customers in this space was incredibly challenging [so we went through] the Medicare Advantage route,” he said. “But senior living is a completely different segment.”

The millions in new venture capital money are coming as UpsideHōM prepares for aggressive growth. While the company did not disclose revenue or total residents, it did say it has hit 1,000% in new resident headcount in the first half of 2021 as a vague proxy. As the startup prepares for its next phase of growth, the co-founders will need to focus heavily on sustainable customer acquisition.

Rothstein thinks that downsizing elders into homes that work for them is a simple argument to make.

“You can age in place for as long as it’s practical, but there’s going to be a day and time when it’s not [going to] be practical,” Rothstein said. “Why would you want to make this decision after you’ve broken your hip, after you run out of money or after your spouse died?”

Editor’s note: A previous version of this story wrote that Rothstein had spent six years scaling Papa. This is incorrect. He left in 2017 but remains an investor in the company.

Powered by WPeMatico

Last year, during the pandemic, a free browser extension called Netflix Party gained traction because it enabled people trapped in their homes to connect with far-flung friends and family by watching the same Netflix TV shows and movies simultaneously. It also enabled them to dish about the action in a side bar chat.

Yet that company — later renamed Teleparty — was just the beginning, argue two young companies that have raised seed funding. One, a year-old upstart in London that launched in December, just closed its round this week led by Craft Ventures. The other, a four-year-old, Bay Area-based startup, has raised $3 million in previously undisclosed seed funding, including from 500 Startups.

Both believe that while investors have thrown money at virtual events and edtech companies, there is an even bigger opportunity in developing a kind of multiplayer browsing experience that enables people to do much more together online. From watching sports to watching movies to perhaps even reviewing X-rays with one’s doctor some day, both say more web surfing together is inevitable, particularly for younger users.

The companies are taking somewhat different approaches. The startup on which Craft just made a bet, leading its $2.2 million seed round, is Giggl, a year-old, London-based startup that invites users of its web app to tap into virtual sessions. It calls these “portals” to which they can invite friends to browse content together, as well as text chat and call in. The portals can be private rooms or switched to “public” so that anyone can join.

Giggl was founded by four teenagers who grew up together, including its 19-year-old chief product officer, Tony Zog. It only recently graduated from the LAUNCH accelerator program. Still, it already has enough users — roughly 20,000 of whom use the service on an active monthly basis — that it’s beginning to build its own custom server infrastructure to minimize downtime and reduce its costs.

The bigger idea is to build a platform for all kinds of scenarios and to charge for these accordingly. For example, while people can chat for free while web surfing or watching events together like Apple Worldwide Developers Conference, Giggl plans to charge for more premium features, as well as to sell subscriptions to enterprises that are looking for more ways to collaborate. (You can check out a demo of Giggl’s current service below.)

Hearo.live is the other “multiplayer” startup — the one backed by 500 Startups, along with numerous angel investors. The company is the brainchild of Ned Lerner, who previously spent 13 years as a director of engineering with Sony Worldwide Studios and a short time before that as the CTO of an Electronic Arts division.

Hearo has a more narrow strategy in that users can’t browse absolutely anything together as with Giggl. Instead, Hearo enables users to access upwards of 35 broadcast services in the U.S. (from NBC Sports to YouTube to Disney+), and it relies on data synchronization to ensure that every user sees the same original video quality.

Hearo has also focused a lot of its efforts on sound, aiming to ensure that when multiple streams of audio are being created at the same time — say users are watching the basketball playoffs together and also commenting — not everyone involved is confronted with a noisy feedback loop.

Indeed, Lerner says, through echo cancellation and other “special audio tricks” that Hearo’s small team has developed, users can enjoy the experience without “noise and other stuff messing up the experience.” (“Pretty much we can do everything Clubhouse can do,” says Lerner. “We’re just doing it as you’re watching something else because I honestly didn’t think people just sitting around talking would be a big thing.”)

Like Giggl, Hearo Lerner envisions a subscription model; it also anticipates an eventual ad revenue split with sports broadcasters and says it’s already working with the European Broadcasting Union on that front. Like Giggl, Hearo’s users numbers are conservative by most standards, with 300,000 downloads to date of its app for iOS, Android, Windows, and macOS, and 60,000 actively monthly users.

It begs the question of whether “watching together online” is a huge opportunity, and the answer doesn’t yet seem clear, even if Hearo and Giggl have more compelling tech and viable paths to generating revenue.

The startups aren’t the first to focus on watch-together type experiences. Scener, an app founded by serial entrepreneur Richard Wolpert, says it has 2 million active registered users and “the best, most active relationship with all the studios.” But it markets itself a virtual movie theater, which is a slightly different use case.

Rabbit, a company founded in 2013, enabled people to more widely browse and watch the same content simultaneously, as well as to text and video chat. It’s closer to what Giggl is building. But Rabbit eventually ran aground.

Lerner says that’s because the company was screen-sharing other people’s copyrighted material and so couldn’t charge for its service. (“Essentially,” he notes, “you can get away with some amount of piracy if it’s not for your personal financial benefit.”) But it’s probably fair to wonder if there will ever be massive demand for services like his, particularly as the coronavirus fades into the distance and people reengage more actively in the physical world.

For his part, Lerner isn’t worried. He points to a generation that is far more comfortable watching video on a phone than elsewhere. He also notes that screen time has become “an isolating thing,” and predicts it will eventually become “an ideal time to hang out with your buddies,” akin to watching a game on the couch together.

There is a precedent, in his mind. “Over the last 20 years, games went from single player to multiplayer to voice chats showing up in games so people can actually hang out,” he says. “Because mobile is everywhere and social is fun, we think the same is going to happen to the rest of the media business.”

Zog thinks the trends play in Giggl’s favor, too. “It’s obvious that people are going to meet up more often” as the pandemic winds down, he says. But all that real-world socializing “isn’t really going to be a substitute” for the kind of online socializing that’s already happening in so many corners of the internet.

Besides, he adds Giggl wants to “make it so that being together online is just as good as being together in real life. That’s the end goal here.”

Powered by WPeMatico