Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Netskope, focused on Secure Access Service Edge architecture, announced Friday a $300 million investment round on a post-money valuation of $7.5 billion.

The oversubscribed insider investment was led by ICONIQ Growth, which was joined by other existing investors, including Lightspeed Venture Partners, Accel, Sequoia Capital Global Equities, Base Partners, Sapphire Ventures and Geodesic Capital.

Netskope co-founder and CEO Sanjay Beri told TechCrunch that since its founding in 2012, the company’s mission has been to guide companies through their digital transformation by finding what is most valuable to them — sensitive data — and protecting it.

“What we had before in the market didn’t work for that world,” he said. “The theory is that digital transformation is inevitable, so our vision is to transform that market so people could do that, and that is what we are building nearly a decade later.”

With this new round, Netskope continues to rack up large rounds: it raised $340 million last February, which gave it a valuation of nearly $3 billion. Prior to that, it was a $168.7 million round at the end of 2018.

Similar to other rounds, the company was not actively seeking new capital, but that it was “an inside round with people who know everything about us,” Beri said.

“The reality is we could have raised $1 billion, but we don’t need more capital,” he added. “However, having a continued strong balance sheet isn’t a bad thing. We are fortunate to be in that situation, and our destination is to be the most impactful cybersecurity company in the world.

Beri said the company just completed a “three-year journey building the largest cloud network that is 15 milliseconds from anyone in the world,” and intends to invest the new funds into continued R&D, expanding its platform and Netskope’s go-to-market strategy to meet demand for a market it estimated would be valued at $30 billion by 2024, he said.

Even pre-pandemic the company had strong hypergrowth over the past year, surpassing the market average annual growth of 50%, he added.

Today’s investment brings the total raised by Santa Clara-based Netskope to just over $1 billion, according to Crunchbase data.

With the company racking up that kind of capital, the next natural step would be to become a public company. Beri admits that Netskope could be public now, though it doesn’t have to do it for the traditional reasons of raising capital or marketing.

“Going public is one day on our path, but you probably won’t see us raise another private round,” Beri said.

Powered by WPeMatico

As companies look for ways to respond to incidents in their complex microservices-driven software stacks, SREs — site reliability engineers — are left to deal with the issues involved in making everything work and keeping the application up and running. Rootly, a new early-stage startup wants to help by building an incident-response solution inside of Slack.

Today the company emerged from stealth with a $3.2 million seed investment. XYZ Venture Capital led the round with participation from 8VC, Y Combinator and several individual tech executives.

Rootly co-founder and CEO Quentin Rousseau says that he cut his SRE teeth working at Instacart. When he joined in 2015, the company was processing hundreds of orders a day, and when he left in 2018 it was processing thousands. It was his job to make sure the app was up and running for shoppers, consumers and stores even as it scaled.

He said that while he was at Instacart, he learned to see patterns in the way people responded to an issue and he had begun working on a side project after he left looking to bring the incident response process under control inside of Slack. He connected with co-founder JJ Tang, who had started at Instacart after Rousseau left in 2018, and the two of them decided to start Rootly to help solve these unique problems that SREs face around incident response.

“Basically we want people to manage and resolve incidents directly in Slack. We don’t want to add another layer of complexity on top of that. We feel like there are already so many tools out there and when things are chaotic and things are on fire, you really want to focus quickly on the resolution part of it. So we’re really trying to be focused on the Slack experience,” Rousseau explained.

The Rootly solution helps SREs connect quickly to their various tools inside Slack, whether that’s Jira or Zendesk or DataDog or PagerDuty, and it compiles an incident report in the background based on the conversation that’s happening inside of Slack around resolving the incident. That will help when the team meets for an incident post-mortem after the issue is resolved.

The company is small at the moment with fewer than 10 employees, but it plans to hire some engineers and sales people over the next year as they put this capital to work.

Tang says that they have built diversity as a core component of the company culture, and it helps that they are working with investor Ross Fubini, managing partner at lead investor XYZ Venture Capital. “That’s also one of the reasons why we picked Ross as our lead investor. [His firm] has probably one of the deepest focuses around [diversity], not only as a fund, but also how they influence their portfolio companies,” he said.

Fubini says there are two main focuses in building diverse companies including building a system to look for diverse pools of talent, and then building an environment to help people from underrepresented groups feel welcome once they are hired.

“One of our early conversations we had with Rootly was how do we both bring a diverse group in and benefit from a diverse set of people, and what’s going to both attract them, and when they come in make them feel like this is a place that they belong,” Fubini explained.

The company is fully remote right now with Rousseau in San Francisco and Tang in Toronto, and the plan is to remain remote whenever offices can fully reopen. It’s worth noting that Rousseau and Tang are members of the current Y Combinator batch.

Powered by WPeMatico

Opaque, a new startup born out of Berkeley’s RISELab, announced a $9.5 million seed round today to build a solution to access and work with sensitive data in the cloud in a secure way, even with multiple organizations involved. Intel Capital led today’s investment with participation by Race Capital, The House Fund and FactoryHQ.

The company helps customers work with secure data in the cloud while making sure the data they are working on is not being exposed to cloud providers, other research participants or anyone else, says company president Raluca Ada Popa.

“What we do is we use this very exciting hardware mechanism called Enclave, which [operates] deep down in the processor — it’s a physical black box — and only gets decrypted there. […] So even if somebody has administrative privileges in the cloud, they can only see encrypted data,” she explained.

Company co-founder Ion Stoica, who was a co-founder at Databricks, says the startup’s solution helps resolve two conflicting trends. On one hand, businesses increasingly want to make use of data, but at the same time are seeing a growing trend toward privacy. Opaque is designed to resolve this by giving customers access to their data in a safe and fully encrypted way.

The company describes the solution as “a novel combination of two key technologies layered on top of state-of-the-art cloud security—secure hardware enclaves and cryptographic fortification.” This enables customers to work with data — for example to build machine learning models — without exposing the data to others, yet while generating meaningful results.

Popa says this could be helpful for hospitals working together on cancer research, who want to find better treatment options without exposing a given hospital’s patient data to other hospitals, or banks looking for money laundering without exposing customer data to other banks, as a couple of examples.

Investors were likely attracted to the pedigree of Popa, a computer security and applied crypto professor at UC Berkeley and Stoica, who is also a Berkeley professor and co-founded Databricks. Both helped found RISELabs at Berkeley where they developed the solution and spun it out as a company.

Mark Rostick, vice president and senior managing director at lead investor Intel Capital says his firm has been working with the founders since the startup’s earliest days, recognizing the potential of this solution to help companies find complex solutions even when there are multiple organizations involved sharing sensitive data.

“Enterprises struggle to find value in data across silos due to confidentiality and other concerns. Confidential computing unlocks the full potential of data by allowing organizations to extract insights from sensitive data while also seamlessly moving data to the cloud without compromising security or privacy,” Rostick said in a statement

He added, “Opaque bridges the gap between data security and cloud scale and economics, thus enabling inter-organizational and intra-organizational collaboration.”

Powered by WPeMatico

Cloverly, an Atlanta-based, early-stage startup, has developed an API that helps companies measure and then offset their carbon emissions. Today the company announced a $2.1 million seed round.

TechSquare Ventures led the round with participation from SoftBank Opportunity Fund and Panoramic Ventures along with Circadian Ventures, Knoll Ventures and SaaS Ventures .

While it was at it, the company announced that founder Anthony Oni has stepped back from running the company day-to-day, but will remain on the board as advisor. The company has hired former eBay exec Jason Rubottom as CEO in his place.

“We’re a Sustainability as a Service company that helps other companies measure and reduce their carbon footprint. Our API measures the carbon emissions from various activities or processes within a business and allows that business or its customers to offset those emissions. And then it provides comprehensive reporting on that,” Rubottom explained.

Rudy Krehbiel, who runs operations for the company, says that the API is designed to be flexible to meet the needs of each company accessing the services, but once developers create an application, it works automatically to measure emissions and purchase the offsets. “The solution itself is automated. Most of the work happens up front, and once we get integrated it becomes a fully productized and operationalized ongoing measurement and offsetting solution,” he said.

As customers build solutions using the tool, they can then offset their carbon usage by buying carbon offsets from the public markets, and this can be automated based on the usage of a given company. Cloverly monitors the offset market to ensure that the sources are credible and are adding new ones as they develop.

The company is working with over 600 brands, which have offset over 55 million pounds of carbon to this point. The API was originally conceived by Oni when he was working at the Southern Company and spun out as a startup on Earth Day in 2019.

Oni, who is Black, is moving away from day-to-day operations as he hands the baton to Rubottom, but he recognizes the significance of this funding from a diversity perspective.

“As a Black tech founder of a climate tech company, it’s incredibly validating to have TechSquare Ventures and SoftBank’s Opportunity Fund as investors. It will take diverse people and teams to find solutions to create a more sustainable future,” he said.

Powered by WPeMatico

Part of the complex process that turns raw materials into finished products like detergents, cosmetics and flavors relies on enzymes, which facilitate chemical transformations. But finding the right enzyme for a new or proposed drug or additive is a drawn out and almost random process — which Allozymes aims to change with a remarkable new system that could set a new standard in the industry, and has raised a $5 million seed round to commercialize.

Enzymes are chains of amino acids, the “building blocks of life” among the many things encoded in DNA. These large, complex molecules bind to other substances in a way that facilitates a chemical reaction, say turning sugars in a cell into a more usable form of energy.

One also finds enzymes in the world of manufacturing, where major companies have identified and isolated enzymes that perform valuable work like taking some cheap base ingredients and making them combine into a more useful form. Any company that sells or needs lots of any particular chemical that doesn’t appear abundantly in nature probably has enzymatic processes to aid in creating more of it.

But it’s not like there’s just an enzyme for everything. When you’re inventing new molecules from scratch, like a novel drug or flavoring, there’s no reason why there should be a naturally occurring enzyme that reacts with or creates it. No animal synthesizes allergy medicine in its cells, so companies must find or create new enzymes that do what’s needed. The problem is that enzymes are generally at least 100 units long, and there are 20 amino acids to choose from, meaning for even the simplest novel enzyme you’re looking at uncountably numerous variations.

By starting with known enzymes and systematically working through variations that seem intuitively like they might work, researchers have been able to find new and useful enzymes, but the process is complex and slow even when fully automated: at most a couple hundred a day, and that’s if you happen to have a top-of-the-line robotic lab.

So when Allozymes comes in with a claim that it can screen up to ten million per day, you can imagine the level of change that represents.

Allozymes was founded by Peyman Salehian (CEO) and Akbar Vahidi (CTO), two Iranian chemical engineers who met while pursuing their PhDs at the National University of Singapore. The three years of research leading up to the commercial product also occurred at NUS, which holds the patent and exclusively licenses it to the company.

“The state of the art hasn’t changed in 20 years,” said Salehian. “When we talk with big pharma, they have whole departments for this, they have $2 million robots, and it still takes a year to get a new enzyme.”

The Allozymes platform will speed up the process by several orders of magnitude, while decreasing the cost by an order of magnitude, Salehian said. If these estimates bear out, it effectively trivializes the enzyme search and obsoletes billions in investments and infrastructure. Why pay more to get less?

Traditionally, enzymes are isolated and selected over a multi-step process that involves introducing DNA templates into cells, which are cultured to create the target enzymes, which once a certain growth state is achieved, are analyzed robotically. If there are promising results, you go down that road with more variations, otherwise you start again from the beginning. There’s a lot of picking and placing little dishes, waiting for enough cells to produce enough of the stuff, and so on.

The process, designed by Vahidi and other researchers at NUS, is fully contained with a benchtop device, and generates almost no waste. Instead of using culture dishes, the device puts the necessary cells, substrate, and other ingredients in a tiny droplet in a microfluidic system. The reactions occur inside this little drop, which is incubated, tracked, and eventually collected and tested in a fraction of the time a larger sample would take.

Allozymes isn’t selling the device, though. It’s enzyme engineering as a service, and for now their partners and customers seem content with that. Its primary service is cut-to-size, depending on the needs of the project. For instance, maybe a company has a working enzyme already and just wants a variant that’s easier to synthesize or less dependent on certain expensive additives. With a solid starting point and flexible goal that might be a project on the smaller side. Another company may be looking to completely replace hard chemistry processes in their manufacturing, know the start and the end of the process but need an enzyme to fill in the gaps; that might be a more wide ranging and expensive project.

Vahidi explained that the goal is not to “democratize” enzyme engineering. It’s still expensive and large-scale enough that it will primarily be done by large companies, but now they can get a hundred thousand times more out of their R&D dollar. The speed and value put them above the competition, said Salehian, with companies like Codexis, Arzeda, and Ginkgo Bioworks also doing enzyme bioengineering but at lower rates and with different priorities.

Occasionally the company might strike a bargain to take part ownership of an IP or product, but that’s not really the business model, Salehian said. Some early work consisted of actually making the final compound, but ultimately the core product is expected to be the service. (Still, a million-dollar order is nothing to sneeze at.)

It may have occurred to you that in the process of doing a job, Allozymes might sort through hundreds of millions of enzymes. Rest assured, they are well aware of the value these may represent. The service transitions seamlessly into the inevitable data play.

“If you have a big data set that shows ‘if you change this amino acid this will be the function,’ you don’t even need to engineer it, you can eliminate it [i.e. from consideration]. You can even design enzymes if you know enough,” Salehian said.

The company’s recent $5 million seed round was led by Xora Innovation (from Temasek, Singapore’s sovereign fund), with participation from SOSV’s HAX, Entrepreneur First and TI Platform Management. Salehian explained that they planned to incorporate in the U.S. following interest from American venture firms, but Temasek’s early-stage investor convinced them to stay.

“Biotransformation is in huge demand on this side of the world,” Salehian said. “Chemical, agriculture, and food companies need to do it, but no platform company can deliver these services. So we tried to fill that gap.”

Powered by WPeMatico

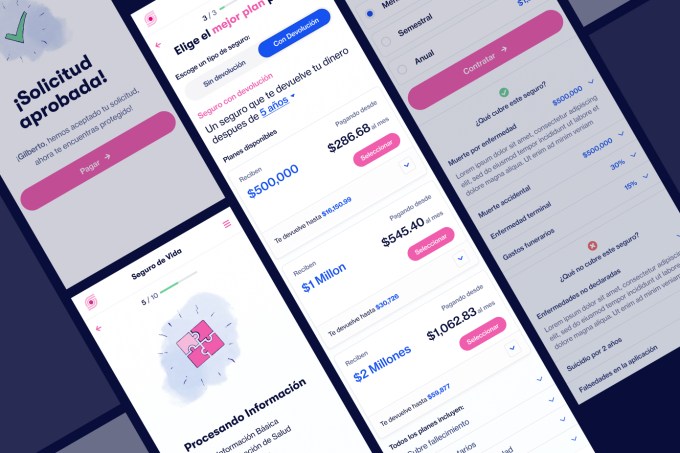

Super.mx, an insurtech startup based in Mexico City, has raised $7.2 million in a Series A round led by ALLVP.

Co-founded in 2019 by a trio of former insurance industry executives, Super.mx’s self-proclaimed mission is to design insurance for “the emerging Latin American middle class,” according to CEO Sebastian Villarreal.

“That means insurance that is easy to buy – it can be bought on a cell phone in minutes – and that pays quickly with no adjusters,” he said. The company has built its offering with proprietary models that are used both on the underwriting side to predict risk and on the claims side to make payments automatically.

Goodwater Capital, Kairos Angels and Bridge Partners also participated in the Series A round in addition to angels such as Joe Schmidt IV, vice president of business development at insurtech Ethos and former investor at Accel and Kyle Nakatsuji, founder and CEO of auto insurance startup Clearcover (and also a former VC). Better Tomorrow Ventures led Super.mx’s $2.4 million seed round, which also saw capital from 500 Startups Mexico, Village Global, Anthemis and Broadhaven Ventures, among others.

Unlike most insurtech startups in Latin America, Villarreal emphasizes that Super.mx is neither an aggregator nor a carrier. Instead, it’s an MGA, or managing general agent.

“This lets us have a ‘best of both worlds’ approach,” Villarreal said. “We handle the entire user experience just like a direct to consumer carrier, but with the breadth of product choice offered by an aggregator.”

That product choice includes property, natural disasters and life insurance. The company soon plans to expand to also offer health insurance.

The founding team brings a variety of insurance experience to the table. Villarreal previously co-founded Chicago-based Kin Insurance (which raised over $150 million in funding from the likes of Flourish Ventures, Commerce Ventures and QED Investors). He was also once head of auto product at Avant, a growth-stage company funded by General Atlantic and Tiger Global, among others.

With over two decades of insurance industry experience, Dario Luna once served as Mexico’s insurance regulator and helped develop Mexico’s disaster risk management strategy. Marco Ahedo has designed parametric insurance products for 19 Caribbean countries. He was also once a solvency expert for life and health insurance lines at MetLife, and has developed financial models for several P&C carriers.

Villarreal lived in the U.S. for a while before deciding to move back to Mexico, which he recognized was home to an “underinsurance problem.”

“That’s actually a very acute problem,” he said. “People in Latin America buy a lot less insurance than they do in the U.S., and people in Mexico, in particular, buy a lot less insurance than they do in other Latin countries.”

Some have blamed the lack of insurance coverage on the country’s culture but Super.mx operates under the belief that this notion is “total BS.”

“It’s not a cultural problem,” Villarreal said. “The problem is that the insurance products that exist in the market just suck. They’re super expensive. They’re really hard to buy, and they pay very little.”

Image Credits: Super.mx

So far, Super.mx has sold “thousands of policies” but is more focused now on increasing the number of products that it’s selling. The company started out by selling earthquake insurance before adding COVID insurance, and more recently, in April, it launched life insurance. Next, it’s going to offer property, renter’s and health insurance.

“It’s really a different strategy than what you would find in the U.S.,” Villarreal said. “In the U.S, when you look at insurtechs, it’s like everyone just does one thing, but here, it’s very different because when someone says ‘I want insurance,’ really what they’re saying is ‘Hey, something happened that makes me nervous that didn’t make me nervous before.’”

That something could be a new child, for example, that prompts a need for life insurance.

“What we’re trying to do is like Lemonade, Roots and Hippo or Kin all rolled into one,” he added. It’s a big, big play.”

Digital adoption in Mexico, and Latin America in general, has increased exponentially in recent years. The bigger hurdle for Super.mx, according to Villarreal, has less to do with technology and more to do with Mexicans getting over what he describes a “deep mistrust” based on bad experiences in the past.

“People are really distrustful and that’s a huge hurdle, but once you show them that you actually are different,” Villarreal told TechCrunch, “that you actually do things in a different way, you get this incredible emotional response.”

Eventually, Super.mx plans to outside of Mexico to other countries in Latin America.

ALLVP’s Federico Antoni said his Mexico City-based firm had been looking for a team building in this space “for years” before investing in Super.mx. The venture firm was impressed with the company’s technical knowledge and industry expertise. It was also drawn to their multi-product approach and “capacity to ship highly complex products to the market quickly” — both of which he believes are “unique” in the region.

Citing statistics from MAPFRE Economics, Antoni pointed out that globally, the insurance market has been growing over the last 10 years. During that time, Latin America expanded faster on average (4.4% vs. 2.4% worldwide), albeit with more volatility. Life insurance has been driving this growth, at 6.1%, over the period.

“Insurtech may be even bigger than fintech. Also, harder,” he told TechCrunch via email. “We knew the team to unlock the market potential would need to be highly competent and highly disruptive.”

Antoni said he is also convinced that Insurtech is the “next frontier” in financial inclusion in Latin America especially as digitization continues to increase.

“Providing risk coverage to individuals and businesses in the region, brings financial stability to families and unlocks economic potential for SMEs,” he said. “Moreover, the insurance incumbents have been unable to address a growing and underserved market.”

Powered by WPeMatico

For kids of a certain age — think 9 to 15 — options for enrichment are somewhat limited to school, sports, and camps, while the ability to make money is largely non-existent.

A new startup called Mighty wants to provide them with a new alternative through a platform it’s building that, like a kind of Shopify for kids, enables younger kids to open their own store online and hopefully learn a bit in the process. In fact, Mighty — led by founders Ben Goldhirsh, who previously founded GOOD magazine, and Dana Mauriello, who spent nearly five years with Etsy and was most recently an advisor to Sidewalk Labs — sees itself as smack dab in the center of fintech, ed tech, and entertainment.

As often happens, the concept derived from the founders’ own experience. In this case, Goldhirsh, who has been living in Costa Rica, began worrying about his two daughters, who attend a small school and he feared might fall behind their stateside peers so began tutoring them after school. He says he was using Khan Academy among other software platforms, but their reaction wasn’t exactly positive.

“They were like, “F*ck you, dad. We just finished school and now you’re going to make us do more school?’”

Unsure of what to do, he encouraged them to sell the bracelets they’d been making online, figuring it would teach them needed math skills, as well as teach them about startup capital, business plans (he made them write one), and marketing. It worked, he says, and as he told friends about this successful “project-based learning effort,” they began to ask if he could help their kids get up and running.

Fast forward and Goldhirsh and Mauriello — who ran a crowdfunding platform that Goldhirsh invested in before she joined Etsy — say they’re now steering a still-in-beta startup that has become home to 3,000 “CEOs” as Mighty calls them.

The interest isn’t surprising. Kids are spending more of their time online than at any point in history. Many of the real-world type businesses that might have once employed young kids are shrinking in size. Aside from babysitting or selling cookies on the corner, it’s also challenging to find a job before high school, given the Department of Labor’s Fair Labor Standards Act, which sets 14 years old as the minimum age for employment. (Even then, many employers worry that their young employees might be more work than is worth it.)

Investor think it’s a pretty solid idea, too. Mighty recently closed on $6.5 million in seed funding led by Animo Ventures, with participation from Maveron, Humbition, Sesame Workshop, Collaborative Fund and NaHCO3, a family office.

Still, building out a platform for kids is tricky. For starters, not a lot of 11-year-olds have the tenacity required to sustain their own business over time. While Goldhirsh likens the business to a “21st century lemonade stand,” running a business that doesn’t dissolve at the end of the afternoon is a very different proposition.

Goldhirsh acknowledges that no kid wants to hear they have to “grind” on their business or to follow a certain trajectory, and he says that Mighty is certainly seeing kids who show up for a weekend to make some money. Still, he insists, many others have an undeniably entrepreneurial spirit and says they tend to stick around. In fact, says Goldhirsh, the company — aided by its new seed funding — has much to do in order to keep its hungriest young CEOs happy.

Many are frustrated, for example, that they currently can’t sell their own homemade items through Mighty. Instead, they are invited to sell items like hats, totes, and stickers that they customize and which are made by Mighty’s current manufacturing partner, Printful, which then ships out the item to the end customer. (The Mighty CEO gets a percentage of the sale, as does Mighty.)

They can also sell items made by global artisans through a partnership that Mighty has struck with Novica, an impact marketplace that also sells through National Geographic.

The idea was to introduce as little friction into the process as possible at the outset, but “our customers are pissed — they want more from us,” says Goldhirsh, explaining that Mighty fully intends to one day enable its smaller entrepreneurs to sell their own items, as well as services (think lawn care), which the platform also does not support currently.

As for how it makes money, Mighty plans to layer in subscription services eventually, as well as collect transaction-based revenue.

It’s intriguing, on the whole, though the startup could need to fend off established players like Shopify to should it begin to gain traction.

It’s also conceivable that parents — if not children’s advocates — could push back on what Mighty is trying to do. Entrepreneurship can be alternately exhilarating and demoralizing, after all; it’s a roller coaster some might not want kids to ride from such a young age.

Mauriello insists they haven’t had that kind of feedback to date. For one thing, she says, Mighty recently launched an online community where its young CEOs can encourage one another and trade sales tips, and she says they are actively engaging there.

She also argues that, like sports or learning a musical instrument, there are lessons to be learned by creating a store on Mighty. Storytelling and how to sell are among them, but as critically, she says, the company’s young customers are learning that “you can fail and pick yourself back up and try again.”

Adds Goldhirsch, “There are definitely kids who are like, ‘Oh, this is harder than I thought it was going to be. I can’t just launch the site and watch money roll in.’ But I think they like the fact that the success they are seeing they are earning, because we’re not doing it for them.”

Powered by WPeMatico

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management software that run the countless small businesses making up the industry.

Kendall Bird and Sage Grazer are old friends who happened to be in the right place at the right time — a strange thing to say about anyone anywhere at the start of 2020, but it’s true. The startup’s pitch of bringing your practice entirely online and offering all-online sessions, bookkeeping, scheduling and everything turned out to be exactly what would soon be needed — though as they tell it, it has actually been needed for some time.

Grazer, a therapist herself, experienced firsthand the unexpected difficulties of getting up and running.

“When I started my practice in 2016, I was really passionate about the clinical work, but I was very overwhelmed by setting up a business, marketing, financial stuff,” she said. “So we wanted to help other therapists through that.”

She and Bird happened to reconnect around that time and the two saw an opportunity to improve things.

“We think about therapists as being a one-on-one thing, but they’re really a small business,” said Bird, who formerly worked in marketing at Snapchat, Google and YouTube. “They’re underserved and undersupported as mental health professionals — they don’t have the back-office support that doctors do, and they’re not trained how to run businesses. It just made sense to build a scalable SaaS solution that lets these people work for themselves.”

The therapy industry, like other medical institutions, has two sides: client-facing and practitioner-facing. While there are a handful of services online that combine these, many essentially recruit therapists as contractors. If you want to run your own practice, you’ll likely be using a combination of specialty scheduling, telehealth, billing and other tools made with medical privacy considerations in mind.

“The therapy tools and services landscape is incredibly fragmented — the average therapist is using 5-7 tools, and most of those are not built for therapy,” said Bird.

And then of course there’s Psychology Today: a periodical that straddles the roles of pop psych and industry rag, but whose chief reason for existing for many is its voluminous therapist listings, which dominate search and provide an overwhelming first stop for anyone looking to find one in their area. But for such a personal and consequential decision these brief listings don’t give wary potential clients the impression they’re making an informed choice.

“We wanted an experience that was more approachable, uses language that doesn’t feel overwhelming or pathologizing,” said Grazer. “There are people going to therapy feeling alone and confused, who don’t identify with a disorder or checking a check box.”

Frame eschews the oversimplified “scroll through therapists near your area code” with a short quiz — not a diagnosis or personality test but just a few basic questions — that winnows down your choices to a handful of local and appropriate therapists, with whom you can instantly set up free introductory video calls. If you find someone you like, the rest of the professional relationship takes place on Frame, though of course soon in-person sessions may return.

For those not quite ready to take the plunge, the company organizes livestreamed sessions between volunteers and therapists to show what a full hour of work might look like. (Whatever courage it may take to confront one’s issues in therapy, it surely takes even more to do so with an audience.)

On the therapist’s side, Frame is meant to be a one-stop shop. Marketing and telehealth sessions are on there, as noted above, but so are things like scheduling, notes, billing, notifications, and so on, all tailored specifically to the needs of the industry. And while the shift to online services has been a long time coming, the company just happened to drop in just as the need went into overdrive.

“We built it before COVID ever existed — launched in March 2020 and had telehealth as an option, thinking ‘oh, well maybe some people will do this.’ The majority of therapists in America weren’t doing sessions online at the time… but after COVID they all are,” Bird said. “And they’re looking for these tools now because they’re seeing the rewards of running a lot of their business through telehealth.”

Many therapists are finding that after resisting the transition for years, they are encountering all kinds of benefits, explained Grazer. Like other industries, the flexibility inherent to shifting in-person meetings to virtual ones has been freeing and in some cases profitable. The change is here to stay.

The site is in a closed beta limited to a part of California at present, since therapists are limited to operating in-state and there are other regulations to consider, not to mention all the usual struggles of putting together a sprawling professional service. But the $3 million funding round, led by Maven Ventures, will help fill out the product and move the company toward a larger audience. Sugar Capital, Struck Capital, Alpha Edison and January Ventures participated in the raise.

The money is “almost exclusively going to engineering.” The goal is to open up the beta, expand to the rest of California, then move out to other states once they have the infrastructure to do so and have responded to feedback from the initial rollout.

“Sage and I are really aligned in the belief that the best way to make therapy more accessible to America is to support therapists,” said Bird.

Powered by WPeMatico

Edtech startup Microverse has tapped new venture funding in its quest to help train students across the globe to code through its online school that requires zero upfront cost, instead relying on an income-share agreement that kicks in when students find a job.

The startup tells TechCrunch it has closed a $12.5 million Series A led by Northzone with additional participation from General Catalyst, All Iron Ventures and a host of angel investors. We last covered the company after it had closed a bout of seed funding from General Catalyst and Y Combinator; this latest round brings the startup’s total funding to just under $16 million.

The company’s vision has seen added pandemic-era traction as larger tech companies have embraced remote work that spans geographic boundaries and time zones. Microverse has now brought English-speaking students from over 188 countries through its program.

Since we last chatted, CEO Ariel Camus says the startup has landed some 300 early graduates in positions at tech companies including Microsoft, VMWare and Huawei. The company says its has above a 95% employment rate for its students within six months of graduation so far, pushing past one of the bigger issues that income-share-agreement-based schools have had stateside — getting graduates employed.

Microverse does have notably less generous terms than counterparts like Lambda School when it comes to when students begin loan repayment, the terms of both are actually quite different, as noted in my previous article:

While Lambda School’s ISA terms require students to pay 17% of their monthly salary for 24 months once they begin earning above $50,000 annually — up to a maximum of $30,000, Microverse requires that graduates pay 15% of their salary once they begin making more than just $1,000 per month, though there is no cap on time, so students continue payments until they have repaid $15,000 in full. In both startups’ cases, students only repay if they are employed in a field related to what they studied, but with Microverse, ISAs never expire, so if you ever enter a job adjacent to your area of study, you are on the hook for repayments. Lambda School’s ISA taps out after five years of deferred repayments.

The startup has made efforts to streamline their online program since launch to ensure that students are being set up to succeed in the full-time, 10-month program. Part of Microverse’s efforts have included condensing lesson segments into shorter time frames to ensure students aren’t starting the program unless they have enough free time to commit. Camus says the startup is receiving thousands of applications per month, of which only a fraction are accepted in an effort to ensure that the small startup isn’t overcommitting itself early on. The startup estimates it will usher 1,000 students through its program this year.

The startup has big plans for the future, including working more closely with tech companies to ensure that students have easier access to job placement once they graduate.

“We have data now that the day we launch a partner program — which we haven’t done yet but we will eventually — it opens up the market by 5x,” Camus tells TechCrunch. “To get 10,000 students per year in a world where 90% of the world’s population doesn’t have access to higher education — it’s not going to be that hard, to be honest, I’m not too worried.”

Powered by WPeMatico

LA-based game studio Singularity 6 has banked more funding as it scales itself up and readies for the launch of its debut title.

The startup tells TechCrunch they’ve raised $30 million in a Series B bout of funding led by FunPlus Ventures with additional participation from Andreessen Horowitz (a16z), LVP, Transcend, Anthos Capital and Mitch Lasky. The studio has now disclosed some $49 million in funding, a sizable sum, but one that showcases how much investors are looking to rally around gaming platform plays in the wake of Roblox’s monster IPO.

In 2019, Singularity 6 raised a $16.5 million Series A led by Andreessen Horowitz. At the time, the studio was mum on details about its upcoming debut title, but we’ve learned more about it since.

The title, Palia, is a community simulation game that seems to be more focused on Animal Crossing-like community mechanics in an MMO environment, rather than endless battles. Last month, the studio showcased a launch trailer of the title which hinted at a good deal of the gameplay. Palia looks to be a medieval Zelda-like environment where users can move between towns in an open world environment while farming and collecting resources to build structures in a shared world.

The company has said in marketing materials that the title is “designed to create community, friendships and a real sense of belonging.” In a statement, a16z partner Jonathan Lai called the upcoming title, “warm and dynamic.”

There are still quite a bit of unanswered questions about the title, which is currently taking sign-ups on its website to be alerted to pre-alpha access. We do know that plenty of VCs are betting millions on the prospect that this multiplayer title could be big.

Powered by WPeMatico