Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Toca Football, a nine-year-old, Costa Mesa, Ca.-based company that operates 14 sports centers across the U.S. that are focused on soccer training, has raised $40 million in Series E funding to roughly double the number of facilities that are now up and running in the U.S., as well as to open a site in the U.K. that CEO Yoshi Maruyama describes as a “highly themed game-experiences-based dining and entertainment facility focused on soccer training.”

Maruyama knows a thing or two about building destinations to which people gravitate. Before joining Toca — which was founded by the American former soccer player Eddie Lewis (“toca” refers to the first touch of the ball in soccer) — Maruyama spent six years as the global head of location-based entertainment for Dreamworks. He spent 14 years before that as an SVP with Universal Parks & Resorts.

Indeed, he was brought into Toca in 2019 to transform it from a manufacturing business that sells Major League Soccer teams a ball-tossing machine that Lewis had developed, to the services business it has become.

On its face, its new model seems like a pretty smart one, given soccer’s growing popularity in the U.S. According to Statista, the number of participants in U.S. high school soccer programs recorded an all-time high in the 2018/19 season, with more than 850,000 playing the sport across the country.

But Toca isn’t built just for kids, even if kids — and their parents –are its primary customers. According to Maruyama, there are several populations that are coming to its various centers throughout the day. In the morning, the centers feature a curriculum for children up to age six to introduce them to soccer; the afternoons feature largely one-on-one soccer training programs where Toca is able to employ its touch trainer; and during the evenings, Toca operates a leagues business for both children and adults.

Some of the centers are huge, by the way. Among Toca’s newest sites, for example, in Naperville, Illinois, outside of Chicago, it has built a 95,000-square-foot facility that features four indoor, full-size soccer fields, as well as one-on-one individual training spaces. (Maruyama suggests the company has been able to take advantage of a depressed commercial real estate market over the last year or so.)

Little wonder that investors see a big opportunity potentially.

The newest round of funding for Toca comes from earlier investors WestRiver Group, RNS TOCA Partners, and D2 Futbol Investors; they were joined by new investors, including angel investor Jared Smith, the co-founder and former COO of Qualtrics.

The company — which plans to expand into Asia as quickly as possible (China has been mandated by the country’s leadership to become “a first-class football superpower” by 2050) — has now raised $105 million in total funding.

Powered by WPeMatico

The number of startups acquiring e-commerce businesses, especially those operating on Amazon, to grow and scale is increasing as more people than ever are shopping online.

The latest such startup to raise capital is Forum Brands, which today announced it has raised $27 million in equity funding for its technology-driven e-commerce acquisition platform.

Norwest Venture Partners led the round, which also included participation from existing backers NFX and Concrete Rose.

Brenton Howland, Ruben Amar and Alex Kopco founded New York-based Forum Brands last summer during the height of the COVID-19 pandemic. Its self-proclaimed goal was to use data to innovate through acquisition.

“We’re buying what we think are A+ high-growth e-commerce businesses that sell predominantly on Amazon and are looking to build a portfolio of standalone businesses that are category leaders, on and off Amazon,” Howland said. “A source of inspiration for us is that we saw how consumer goods and services changed fundamentally for what we think is going to be for decades and decades to come, accelerating the shift toward digital.”

Forum Brands founding team. Image Credits: Forum Brands

Forum’s technology employs “advanced” algorithms and over 60 million data points to populate brand information into a central platform in real time, instantly scoring brands and generating accurate financial metrics.

The M&A team also uses data to contact brand owners “in just three clicks.” But Forum says it already knows which brands meet its acquisition criteria before ever making contact with brand owners.

“The decision to acquire comes within 48 hours and once terms are agreed upon, entrepreneurs get paid in 30 days or less for their brand, with additional income benefits through post-acquisition partnerships,” according to the company.

Its apps leverage analytics to push recommendations to drive growth and financial performance for brands. Then, its multichannel approaches aimed at positioning the brands for “long-term category leadership.”

“We are using a lot of data science and machine learning techniques to build technology that allows us to eventually operate efficiently a large portfolio of digital brands at scale,” Kopco said.

The company is undeterred by the increasingly crowded space based on the belief that the market opportunity is so huge, there’s plenty of room for multiple players.

“We are very much in the day zero consolidation of the e-commerce space, and the market is very, very large,” Amar told TechCrunch. “And based on our data, 98% or 99% of all sellers are still operating independently. So, this is not a winner-takes-all market. There will be multiple winners, and we’ve built a strategy to be one of these winners.”

Norwest Venture Partners’ Stew Campbell believes that the number of sellers who reach a point where they have trouble scaling either due to the lack of resources or time is only going to grow. And Forum Brands intends to capitalize on that.

“There’s a continued need for more liquidity options for the entrepreneurs behind many Amazon-first brands. Forum helps entrepreneurs recognize value, which can be significant too many,” he said. ”After acquisition, the Forum team drives operational efficiencies and scale to create better customer experiences for shoppers on Amazon.”

Campbell emphasizes that his firm was drawn to Forum Brands’ team, which the company also touts as a differentiator.

Co-founder and COO Kopco worked in a variety of product roles for several years at Amazon and Jon Derkits, Forum’s VP of brand growth, is also ex-Amazon. Overall, three-fourths of its operating team are former Amazonians. Co-CEO and co-founder Howland was an investor for two years at Cove Hill Partners and is a former McKinsey consultant. Prior to founding Forum, Co-CEO and co-founder Amar was a growth equity investor at TA Associates.

Campbell says his firm has seen many other models in this market, “but the Forum team blends long-term mindsets and focus on technology, while bringing operational and M&A expertise.”

If this all sounds familiar, it’s because TechCrunch also recently covered the raise of Acquco, which has a similar business model to that of Forum Brands and also involves former Amazon employees. In May, that startup raised $160 million in debt and equity to scale its business. Thrasio is another high-profile player in the space, and has raised $850 million in funding this year. Other startups that have recently attracted venture capital include Branded, which recently launched its own roll-up business on $150 million in funding, as well as Berlin Brands Group, SellerX, Heyday, Heroes and Perch. And, Valoreo, a Mexico City-based acquirer of e-commerce businesses, raised $50 million of equity and debt financing in a seed funding round announced in February.

Also, earlier this month, Moonshot Brands announced a $160 million debt and equity raise to “acquire high-performing Amazon third-party sellers and direct-to-consumer businesses on Shopify and WooCommerce with established brand equity.” That company says that since its founding in 2020, it has achieved a $30 million revenue run rate. Among its investors are Y Combinator, Joe Montana’s Liquid 2 Ventures and the founders of Hippo, Lambda School and Shift.

Powered by WPeMatico

While the digital revolution has transformed nearly every social interaction and communication type in the past couple decades, the humble birthday card has shown surprising resiliency.

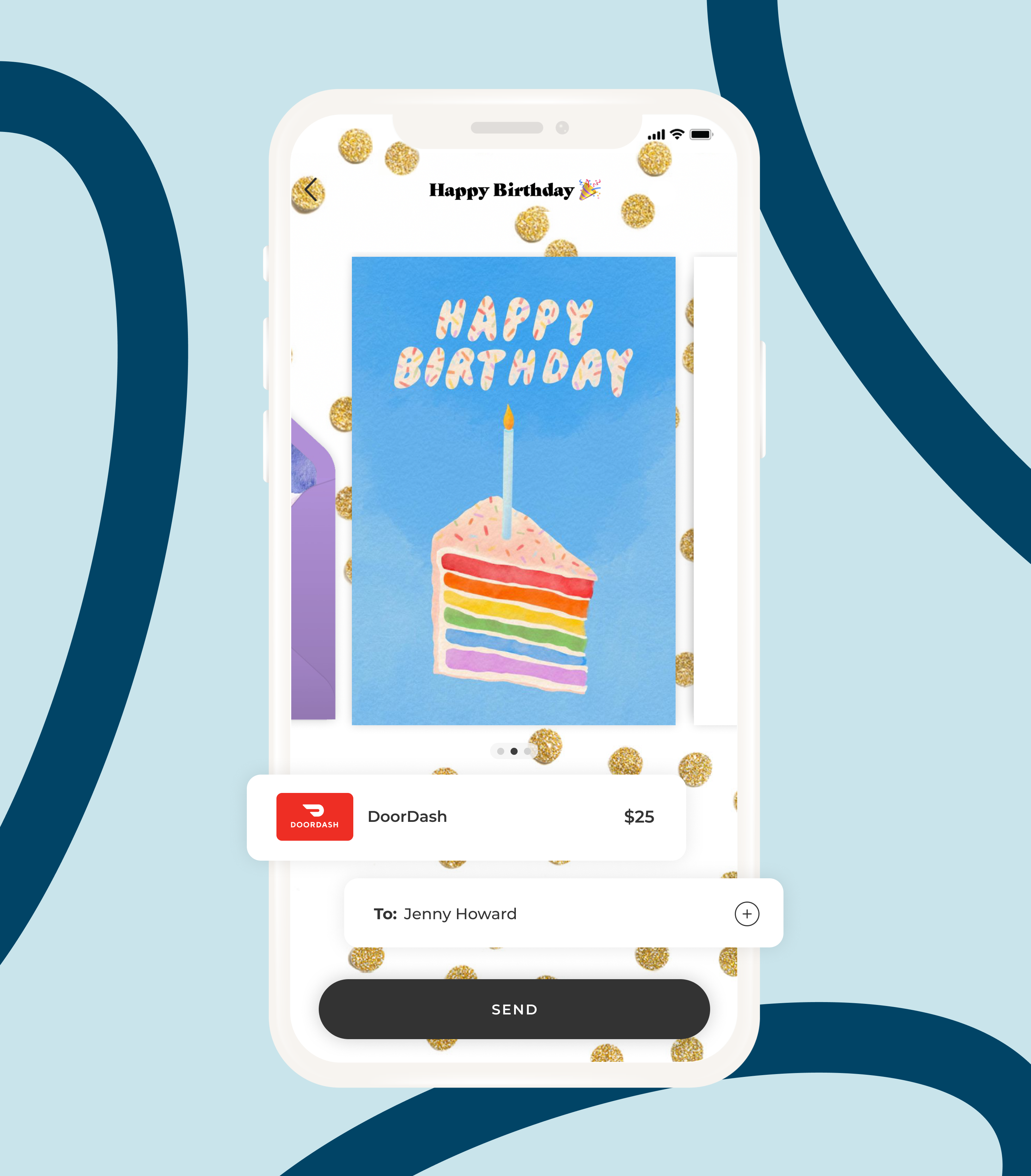

Givingli, a small LA-based startup with an app aiming to challenge how Gen Z sends digital greeting cards, is picking up some seed funding from investors betting on their philosophy around modern gifting. The startup has raised a $3 million seed round led by Reddit co-founder Alexis Ohanian’s Seven Seven Six, while Snap’s Yellow Accelerator also participated in the raise.

The wife and husband co-founding team stumbled into the world of digital greetings and gifts after abandoning physical invitations for their wedding and exploring how the digital greetings space had and hadn’t evolved. They’ve taken a mobile-first approach to tackling greetings for special events and moments where users just want to let someone know they’re thinking of them.

Image Credits: Givingli

“Initially, we thought it would mainly be birthdays and categories like weddings, graduation, etc., and I think we just threw in some ‘just because’ cards, but then that became the most popular category, by far,” CEO Nicole Emrani Green tells TechCrunch. “I think that it’s what kicked off our virality, because obviously with every Givingli sent you’re pulling someone else in and then the conversation continues.”

The app monetizes through a $3.99 monthly premium subscription that gives users access to a greater variety of digital greeting designs from the more than 40 artists that the startup has licensed work from. Alongside paying for premium subscriptions, users can also shop for digital gift cards to send along with their greetings. Givingli’s gift card storefront has more than 150 brands available including Amazon, Spotify, Nike and DoorDash.

A big sell for Givingli’s offering has been its customization. Although users are pushed to select from the hundreds of available greeting cards, they can also spice them up by adding photos or videos in addition to writing text. The aim is to create a moment that rivals messages that can be shared via email, text or on social media services.

“For a generation of digitally native users, it’s not surprising that the ability to like, swipe, upvote or shoot a quick text from our phones have become the predominant ways we connect with others,” said Ohanian in a press release announcing the seed round. “What first attracted me to Givingli is that Nicole and Ben acutely understood this evolution and built a platform that provides the creative tools needed to elevate those interactions and deepen connections. Whether it’s sending a digital birthday gift, or a note just because — it’s clear that Givingli has put snail mail on notice.”

One of the team’s big challenges has been highlighting the visibility of their native app that users download to send greetings. Last fall, the Givingli team debuted a partnership with Snap that brought their gifting service inside Snapchat via a bite-sized Snap Mini app integration. The rollout followed the startup’s participation in Snap’s Yellow Accelerator program.

Emrani Green says that partnership has helped bring more users to their platform, and that more than 5 million people have used Givingli to send greetings since the app launched in 2019.

Powered by WPeMatico

New York-based construction startup Toggle this morning announced that it has raised an $8 million Series A. The round was led by Tribeca Venture Partners and featured Blackhorn Ventures, Point72 Ventures, New York State and Twenty Seven Ventures. It follows a $3 million seed round raised in late-2019.

Robotics in general have been a massively popular investment target during the pandemic. Construction startups have also begun to heat up. Early this month, Dusty announced a $16.5 million raise for its Field Printer device.

Toggle automates an entirely different part of the construction process. The company’s robotics technology specifically targets rebar, using robotics to assemble the foundational building material at a fraction of the time.

“At a time when global construction is accelerating to an unprecedented pace, Toggle offers a way to add capacity while saving time and cost on some of the largest types of projects,” cofounder and CEO Daniel Blank said in a statement, “We are especially grateful for our partners who are helping us to bring new tools and approaches to the fundamental building block of our built environment with a focus on renewable energy and sustainable urban development.”

Toggle says the new round will go toward expanding production on the tech. That includes increasing headcount and upgrading the production space to a new 50,000 square foot facility.

Powered by WPeMatico

Orum, which aims to speed up the amount of time it takes to transfer money between banks, announced today it has raised $56 million in a Series B round of funding.

Accel and Canapi Ventures co-led the round, which also included participation from existing backers Bain Capital Ventures, Inspired Capital, Homebrew, Acrew, Primary, Clocktower and Box Group. The financing comes barely three months after Orum announced a $21 million Series A, and brings its total raised to over $82 million.

Orum CEO Stephany Kirkpatrick launched the company in 2019 after working for several years at LearnVest, a personal finance site founded by Alexa von Tobel that was acquired by Northwestern Mutual in 2015 for an estimated $375 million. Tobel went on to form Inspired Capital, a venture capital firm that put money in Orum’s $5.2 million seed round last August. Prior to that, the firm also provided Orum with an “inspiration check” that was the first money into the business.

“Most Americans are not familiar with the intricacies of ACH [automated clearing house) or why it takes multiple business days to move money between accounts,” Kirkpatrick said. “But none of us can allow money to wait 5-7 days to hit our accounts. It needs to be instant.”

Her mission with Orum is straightforward even if the technology behind it is complex. Put simply, Orum aims to use machine learning-backed APIs to “move money smartly across all payment rails, and in doing so, provide universal financial access.”

Orum’s first embeddable product, Foresight, launched in September of 2020. It’s an automated programming interface designed to give financial institutions a way to move money in real time. The platform uses machine learning and data science to predict when funds are available and to identify any potential risks. Its Momentum product “intelligently” routes funds across payments rails and is powered by banking providers JPMorgan Chase and Silicon Valley Bank.

“They power the back end of our Momentum platform that allows the money to move on a multirail basis,” Kirkpatrick told TechCrunch. “They power our access to real-time payments.”

Orum says it serves a range of enterprise partners, including Alloy, HM Bradley, First Horizon Bank and Zero Financial (which was recently acquired by Avant).

The volume of transactions being conducted with Orum is growing 100% month over month, Kirkpatrick said. Most of its early growth has come from word of mouth.

The remote-first company prides itself on diversity — in both its employee and investor base. For one, 48% of its 55-person headcount are female, and 48% are “nonwhite,” according to Kirkpatrick. Orum also recently joined the Cap Table Coalition — a partnership between high-growth startups and emerging investors who want to work to close the racial wealth gap — to allocate over 10% of its Series B round to underrepresented founders. For example, the financing includes investors such as the Neythri Features Fund, a group of South Asian women investing in the next generation of female founders and diverse teams.

Jeffrey Reitman, partner at Canapi Ventures (a firm whose LPs mostly consist of banks), told TechCrunch that those bank LPs conduct hundreds of millions of ACH transactions annually,

“They need a path to achieving a state where funds can be transferred instantly,” he said. “Orum’s product paves the path for many players in financial services and fintech — and beyond — to partake in faster money movement without compromising key risk principles.”

To Reitman, the company’s major differentiators are its team, which he describes as consisting of “the best group of data scientists and engineers in the space.”

“Many of their customers consider the team to be instrumental in helping to set the risk dials on how they fund transactions by teasing out key data and insights from historical transaction data,” he said. “Second, Orum is building one of the densest and most comprehensive data sets around the risks of money movement. Better data means better risk models, and it will be hard for other offerings to match Orum’s approach to building this rich data set.”

Accel Partner Sameer Gandhi, who joined Orum’s board as part of the latest financing, agrees. He believes that in an 18-month period, Orum has built “game-changing technology and an exceptional team.”

“Orum is tackling financial infrastructure from its foundation,” he said.

The headline was updated post-publication to reflect the correct funding amount.

Powered by WPeMatico

Accel announced Tuesday the close of three new funds totaling $3.05 billion, money that it will be using to back early-stage startups, as well as growth rounds for more mature companies. Notably, the 38-year-old Silicon Valley-based venture firm is doubling down on global investing.

The announcement underscores both the robust confidence investors continue to have for backing startups in the tech sector and the amount of money available to startups these days.

Specifically, today Accel is announcing its 15th early-stage U.S. fund at $650 million; its seventh early-stage European and Israeli fund also at $650 million and its sixth global growth stage fund at $1.75 billion. The latter fund is in addition, and designed to complement, a previously unannounced $2.3 billion global “Leaders” fund that is focused on later-stage investing that Accel closed in December.

Accel expects to invest in about 20 to 30 companies per fund on average, according to Partner Rich Wong. Its average investment in its growth fund will be in the $50 million to $75 million range, and $75 million and $100 million out of its global Leaders fund.

But the firm is also still eager and “excited” to incubate companies, Wong said.

“We’ll still write $500,000 to $1 million seed checks,” he told TechCrunch. “It’s important to us to work with companies from the very beginning and support them through their entire journey.”

Indeed, as TechCrunch recently reported, Accel has a history of backing companies that were previously bootstrapped (and often profitable) -– the latest example being Lower, a Columbus, Ohio-based fintech, which just raised a $100 million Series A.

Interestingly, Accel is often referred to some of these companies by existing portfolio companies (also in the case of Lower, whose CEO was referred to Accel by Galileo Clay Wilkes). More often than not, companies that Accel backs out of its early-stage and growth funds are bootstrapped and located outside of Silicon Valley.

The venture firm has long looked outside of Silicon Valley for opportunities, and has had offices not only in the Bay Area, but in London and Bangalore for years. Part of its investment thesis is to “invest early and locally,” according to Wong. Examples of this philosophy include investments in companies based all over the world — from Mexico to Stockholm to Tel Aviv to Munich.

Since the time of its last fund closure in 2019, the firm has seen 10 portfolio companies go public, including Slack, Austin-based Bumble, Bucharest-based UiPath, CrowdStrike, PagerDuty, Deliveroo and Squarespace, among others.

It also had 40 companies experience an M&A, including Utah-based Qualtrics’s $8 billion acquisition by SAP and Segment’s $3.2 billion acquisition by Twilio. Also, just last week, Rockwell Automation announced it was buying Michigan-based Plex Systems for $2.22 billion in cash. Accel first invested in Plex, which has developed a subscription-based smart manufacturing platform, in 2012.

Recent investments include a number of fintech companies such as LatAm’s Flink, Berlin-based Trade Republic, Unit and Robinhood rival Public. Accel has also backed as existing portfolio companies such as Webflow, a software company that helps businesses build no-code websites and events startup Hopin.

Wong says Accel is “open-minded but thematic” in its investment approach.

Accel Partner Sonali de Rycker, who is based out of London, agrees.

“For example, we’ll look at automation companies, consumer businesses and security companies, but at a global scale. Our goal is to find the best entrepreneurs regardless of where they are,” she said.

That has only been intensified by the recent rise of the smartphone and cloud, Wong said.

“Before, companies were mostly selling to the consumer in their own country,” he added. “But now the size of the market is so dramatically bigger, allowing them to become even larger, which is one of the reasons why I believe we’re seeing investment pace at this speed.”

To support this, it’s notable that Accel’s global Leaders fund is “dramatically” larger than the $500 million Leaders fund the firm closed in 2019.

Also, de Rycker points out, companies are staying private longer so the opportunity to invest in them until they sell or go public is greater.

Accel is also patient. In some cases, the firm’s investors will develop “years-long” relationships with companies they are courting.

“1Password is an example of this approach,” Wong said. “Arun [Mathew] had that relationship for at least six years before that investment was made. Finally, 1Password called and said ‘We’re ready, and we want you to do it.’ ”

And so Accel led the Canadian company’s first external round of funding in its 14-year history — a $200 million Series A — in 2019.

While the firm is open-minded, there are still some industries it has not yet embraced as much as others. For example, Wong said, “We’re not announcing a $2.2 billion crypto fund, but we have done crypto investments, and see some very interesting trends there. We’ll look at where crypto takes us.”

Powered by WPeMatico

Family offices have existed since the 1800s, but they’ve never been so manifold as in recent years. According to a 2019 Global Family Office Report by UBS and Campden Wealth, 68% of the 360 family offices surveyed were founded in 2000 or later.

Their rise owes to numerous factors, including the tech startups that mint new centi-millionaires and billionaires each year, along with the increasingly complex choices that people with so much moolah encounter. Think household administration, legal matters, trust and estate management, personal investments, charitable ventures.

Still, family offices tend to cater to people with investable assets of $1 billion or more, according to KPMG. Even multi-family offices, where resources are shared with other families, are more typically targeting people with at least $20 million to invest. That high bar means there are still a lot of people with a lot of resources who need hand-holding.

Enter Harness Wealth, a three-year-old, New York-based outfit that was founded by David Snider and Katie Prentke English to cater to individuals with increasingly complex financial pictures, including following liquidity events. The two understand as well as anyone how one’s vested interests can abruptly change — and how hard these can be to manage when working full-time.

Snider got his start out of school as an associate with Bain & Company and later as an associate with Bain Capital before becoming the first business hire at the real estate company Compass and getting promoted to COO and CFO after the company’s $25 million Series A raise in 2013. That little company grew, of course, and now, less than four months after its late-March IPO, Compass boasts a market cap of nearly $27 billion.

Indeed, over the years, Snider, who rejoined Bain as an executive-in-residence after 4.5 years with Compass, began to see a big opportunity in bringing together the often siloed businesses of tax planning and estate planning and investment planning, including it because “it resonated with me personally. Despite all these great things on my resume, every six months I found something I could or should have been doing differently with my equity.”

Prentke English is also like a lot of the clients to which Harness Wealth caters today. After spending more than six years at American Express, she spent two years as the CMO of London-based online investment manager Nutmeg. She left the role to start Harness after being introduced to Snider through a mutual friend; in the meantime, Nutmeg was just acquired by JPMorgan Chase.

While there is no shortage of wealth managers to whom such individuals can turn, Harness says it does far more than pair people with the right independent registered investment advisors — which is a key part of its business and part of the secret sauce of its tech platform, it says. It also helps its customers, depending on their needs, connect with a team of pros across an array of verticals — not unlike the access an individual might have if they were to have a family office.

As for how Harness makes money, it shares revenue with the advisers on the platform. Snider says the percentage varies, though it’s an “ongoing revenue share to ensure alignment with our clients.” In other words, he adds, “We only do well if they find long-term success with the advisers on our platform,” versus if Harness merely collected an upfront lead generation fee by pointing new customers to so-so financial planners or tax attorneys.

Ultimately, the company thinks it can replace a lot of the do-it-yourself services available in the market, like Personal Capital and Mint. That confidence is rooted in part in Snider’s experience with Compass, which, in its earlier days, though it could navigate around real estate agents but “found that while people wanted better data insights and a better user interface, they also wanted that coupled with someone who’d had many clients who looked like them,” says Snider.

He adds that Prentke English joined forces with him after discovering that Nutmeg, too, was “running into the limitations of a non-human-powered solution.”

Investors think the thesis makes sense, certainly. Harness just closed on $15 million in Series A funding led by Jackson Square Ventures, a round that brings the company’s total funding to $19 million. (Both new and existing investors include Bain Capital; Torch Capital; Activant; GingerBread Capital; FJ Labs; i2BF Ventures; First Minute Capital; Liquid2 Ventures; Alleycorp, Marc Benioff; Compass founder Ori Allon; and Paul Edgerley, who is the former co-head of Bain Capital Private Equity.

As for what Harness Wealth does with that fresh capital, part of it, interestingly, will be used to develop its own captive business line called Harness Tax. As Snider explains it, more of its clients are finding that tax planning is among their biggest concerns, given all that is happening on the IPO front, with SPACs, with remote work, and also with cryptocurrencies, into which more people are pouring money but around which the tax code has been playing catch-up.

It makes sense, given that tax planning can be time-sensitive and often dictate the overall financial planning strategy. At the same time, it’s fair to wonder whether some of Harness Wealth’s adviser partners will be turned off from working with the outfit if it thinks its partner is evolving into a rival.

Snider insists that Harness Wealth — which currently employs 22 people and is not-yet profitable — has no such designs. “Our goal is only to help people where we can add value, and we saw an opportunity to lean in on tax side.”

Harness has a “a very large population of people who may not understand their tax liabilities” because of the crypto boom in particular, he explains, adding, “We want to make sure we’re front and center” and ready to help as needed.

Powered by WPeMatico

Side, a real estate technology company that works to turn agents and independent brokerages into boutique brands and businesses, has raised “$50 million-plus” in a funding round that more than doubles its valuation to $2.5 billion.

The latest financing comes just three months after the San Francisco-based startup raised $150 million in a Series D funding round led by Coatue Management at a $1 billion valuation. Tiger Global Management led the latest investment, which also included participation from ICONIQ Capital and D1 Capital Partners. With the latest capital infusion, Side’s total raised since its 2017 inception now totals over $250 million. Matrix Partners, Sapphire Ventures, Trinity Ventures and 8VC led its earlier rounds.

Side says that it is now “backed by the three top technology initial public offering (IPO) underwriters” and that the latest funding “sets the stage for a future IPO.”

The startup pulled in between “$30 million and $50 million in revenue” in 2020 (a wide range, we know), and expects to double revenue this year. In 2019, Side represented over $5 billion in annual home sales across all of its partners. Today, the company’s community of agent partners represents over $15 billion in annual production volume. And it’s predicting that by the end of 2021, it will have closed over $20 billion in home sales, positioning the company “as a top 10 national brokerage by volume.”

Today, Side supports more than 1,800 partner agents across California, Texas and Florida. It says it’s seen a 200% year-over-year increase in agent-represented home sales across its three operating markets of California, Texas and Florida. The company plans to enter 15 new states by year’s end.

Guy Gal, Edward Wu and Hilary Saunders founded Side on the premise that most real estate agents are “underserved and under-appreciated” by traditional brokerage models.

CEO Gal said existing brokerages are designed to support “average” agents and, as such, the top-producing agents end up having to do “all of the heavy lifting.”

Side’s white label model works with agents and teams by exclusively marketing their boutique brand, while also providing the required technology and support needed on the back end. The goal is to help partner agents “predictably grow” their businesses and improve their productivity.

“The way to think about Side is the way you think about what Shopify does for e-commerce […] When partnering with Side, top-producing agents, teams and independent brokerages, for the first time in history, gain full ownership of their own brand and business without having to operate a brokerage,” Gal told me at the time of the company’s last raise. “When you spend years solving the problems of this very specific community of agents, you are able to use software to drive enormous efficiency for them in a way that has never been done before.”

Existing brokerages, he argues, actively discourage agents from becoming top producers and teams, because agents who serve fewer clients can be forced into paying much higher commission fees on every transaction, which means the incentives between brokerages and top agents and teams are misaligned.

“Top producers want to grow and differentiate, and brokerages want them to do less business at higher fees and be one more of the same under the same brand,” Gal said. “Side, rather than discouraging and competing with top-producing agents and teams, enables them to grow and scale their own business and brand.”

This story was updated post-publication with an updated valuation figure.

Powered by WPeMatico

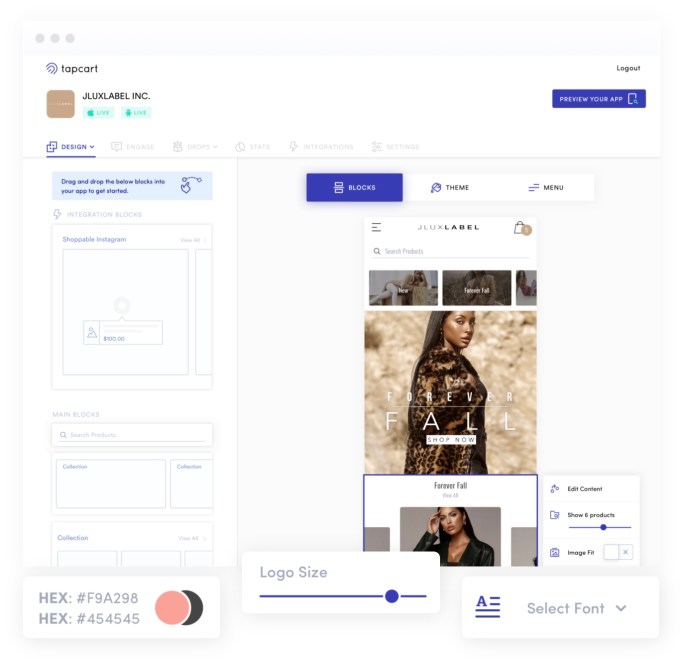

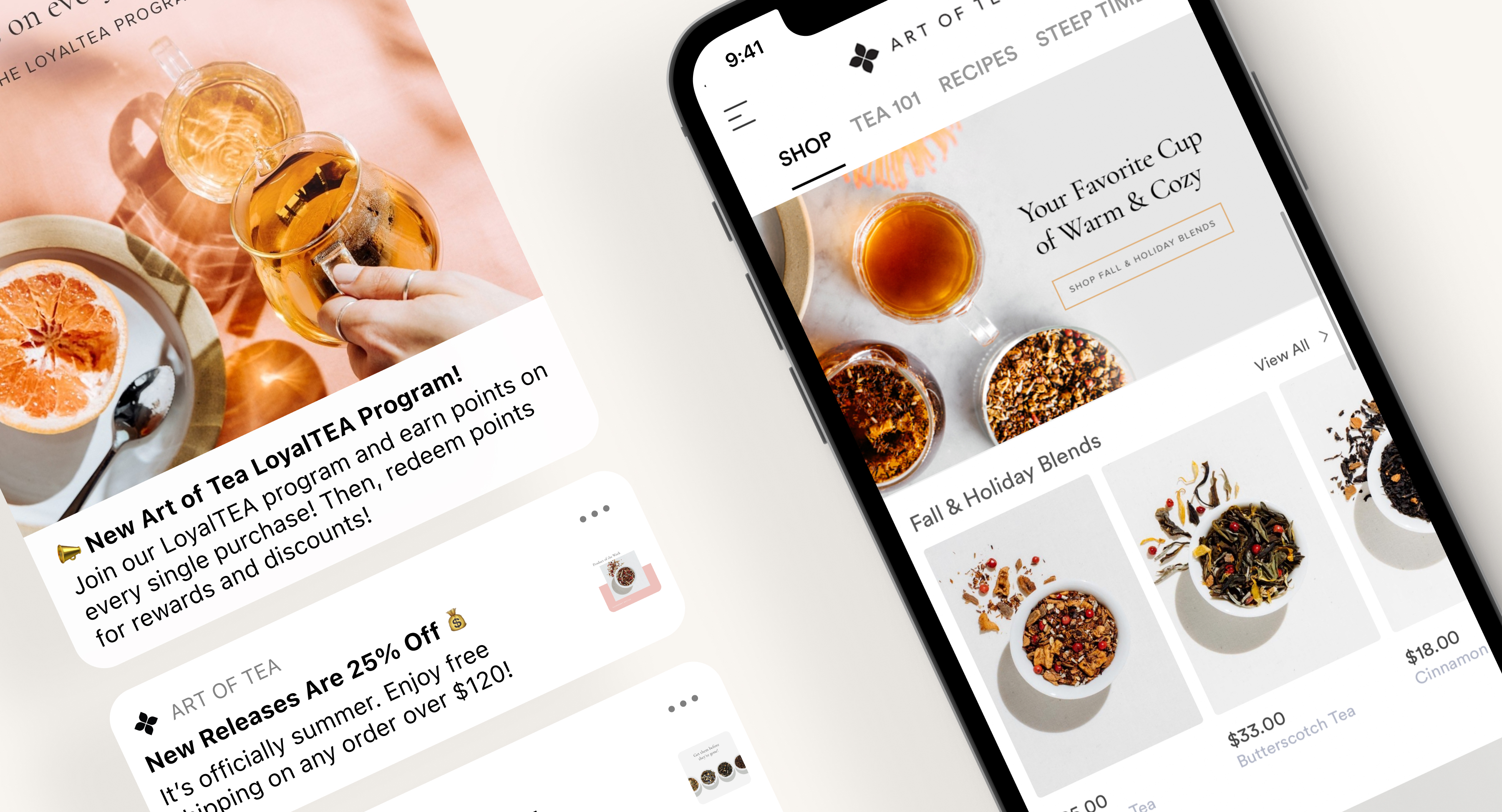

Shopify changed the e-commerce landscape by making it easier for merchants to set up their websites both quickly and affordably. A startup called Tapcart is now doing the same for mobile commerce.

The company, which has referred to itself as the “Shopify for mobile apps,” today powers the shopping apps for top brands, including Fashion Nova, Pier One Imports, The Hundreds, Patta, Culture Kings, and thousands more. Following a year of 3x revenue growth, in part driven by the pandemic, Tapcart is today announcing the close of a $50 million round of Series B funding, led by Left Lane Capital. Having clearly taken notice of Tapcart’s traction with its own merchant base, Shopify is among the round’s participants.

Other investors in the round include SignalFire, Greycroft, Act One Ventures and Amplify LA.

Tapcart’s co-founders, Sina Mobasser and Eric Netsch, have worked in the mobile app industry for years. Mobasser’s previous company, TestMax, offered one of the first test prep courses on iOS, while Netsch had more recently worked on the agency side to create mobile and digital experiences for brands. Together, the two realized the potential in helping online merchants bring their businesses to mobile, as easily as they were able to go online with Shopify.

Tapcart’s founders Sina Mobasser and Eric Netsch at their Santa Monica HQ. Image Credits: Tapcart

“Now, you can launch an app on our platform in a matter of weeks, where historically it would take up to a year if you wanted to custom build an app,” explains Mobasser. “And you can do it for a low monthly fee.”

Tapcart’s platform itself offers a simple drag-and-drop builder that allows anyone to create a mobile app for their existing Shopify store using tools to design their layout, customize the product detail pages, integrate checkout options, include product reviews, and even optionally add other branded content, like blogs, lookbooks, videos (including live video) and more. Everything is synced directly from Shopify to the app in real-time, so the merchant’s inventory, products and collections are all kept up-to-date. That’s a big differentiator from some rivals, which require duplicate sets of data and data transformation.

Tapcart, meanwhile, leverages all of Shopify’s APIs and SDKs to create a native application that works with Shopify’s existing data structures.

Image Credits: Tapcart

This tight integration with Shopify helps Tapcart because it doesn’t have to focus on the e-commerce infrastructure, as the way things are structured around inventory and collections are roughly 90% the same across brands. Instead, Tapcart focuses on the 10% that makes brands stand out from one another, which includes things like branding, content and design. Its CMS allows merchants to create exclusive content, change the colors and fonts, add videos and more to make the app look and feel fully customized.

Beyond the mobile app creation aspect to its business, Tapcart also helps merchants automate their marketing. Through the Tapcart platform, merchants can communicate with their customers in real-time using push notifications that can alert them to new sales, to encourage them to return to abandoned carts, or any other promotions. The marketing campaigns can be automated, as well, which helps merchants schedule their upcoming launches and product drops ahead of time. The company claims these push notifications deliver click-through rates that are 72% higher than a traditional email or SMS text because of their interactivity and branding.

Image Credits: Tapcart

The platform has quickly found traction with SMB to mid-market enterprise customers who have reached the stage of their business where it makes sense for them to double down on customer retention and conversion and optimize their mobile workflow.

“Our sweet spot is when you have maybe a couple hundred customers in your database,” notes Netsch. “That’s a perfect time to now focus less on the paid acquisition portion of your business and more on how to retain and engage those existing customers, [so they’ll] shop more and have a better experience,” he says.

During the past 12 months, over $1.2 billion in merchant sales have flowed through Tapcart’s platform. And in 2020, Tapcart’s recurring revenue increased by 3x, as mobile apps grew even faster during the pandemic, which had increased consumer mobile screen time by 20% year-over-year from 2019. Mobile commerce spending also grew 55% year-over-year, topping $53 billion globally during the holiday shopping season, the company says. Tapcart’s own merchants saw mobile app orders at a rate of more than once-per-second during this time, and it believes these trends will continue even as the pandemic comes to an end.

Today, Tapcart generates revenue by charging a flat SaaS (software-as-a-service) fee, which differentiates it from a number of competitors who charge a percent of the merchant’s total sales.

Image Credits: Tapcart

With the additional funding, Tapcart plans to focus on its goal of becoming a vertically integrated mobile commerce suite of tools, which more recently includes support for iOS App Clips. It will also soon release an upgraded version of its insights analytics platform and will offer scripts that merchants can install on their mobile websites to compare what works on the site versus what works in the app.

Later this year, Tapcart plans to launch a full marketing automation product that will allow brands to automate and personalize their notifications even further. And it plans to invest in market expansions to make its product better designed for mobile, global commerce.

The funding will allow Santa Monica-based Tapcart to hire another 200 people over the next 24 months, up from the 70 it has currently. These will include new additions across time zones and even in markets like Australia and Europe as it moves toward global expansion.

Shopify’s investment will open up a number of new opportunities as well, including on product, engineering, business strategy and partnerships. It will also help to get Tapcart in front of Shopify’s 1.7 million global merchants.

“There’s still quite a lot of merchants that need better mobile experiences, but have yet to really double down on the mobile effort and get something like a native app,” notes Netsch. “There’s a lot of different ways and methods that merchants are experimenting with mobile growth, and we’re trying to offer all of the best parts of that in a single platform. So there’s tons of expansion for Tapcart to do just that with the existing target addressable market,” he says.

“We believe brands must be where their customers are, and today that means being on their phones,” said Satish Kanwar, VP of product acceleration at Shopify, in a statement. “Tapcart helps merchants create mobile-first shopping experiences that customers love, reinforcing Shopify’s mission to make commerce better for everyone. We look forward to seeing Tapcart expand its success on Shopify with the more than 1.7 million merchants on our platform today.”

Powered by WPeMatico

Mercuryo, a startup that has built a cross-border payments network, has raised $7.5 million in a Series A round of funding.

The London-based company describes itself as “a crypto infrastructure company” that aims to make blockchain useful for businesses via its “digital asset payment gateway.” Specifically, it aggregates various payment solutions and provides fiat and crypto payments and payouts for businesses.

Put more simply, Mercuryo aims to use cryptocurrencies as a tool for putting in motion next-gen, cross-border transfers or, as it puts it, “to allow any business to become a fintech company without the need to keep up with its complications.”

“The need for fast and efficient international payments, especially for businesses, is as relevant as ever,” said Petr Kozyakov, Mercuryo’s co-founder and CEO. While there is no shortage of companies enabling cross-border payments, the startup’s emphasis on crypto is a differentiator.

“Our team has a clear plan on making crypto universally available by enabling cheap and straightforward transactions,” Kozyakov said. “Cryptocurrency assets can then be used to process global money transfers, mass payouts and facilitate acquiring services, among other things.”

Image Credits: Left to right: Alexander Vasiliev, Greg Waisman, Petr Kozyakov / MercuryO

Mercuryo began onboarding customers at the beginning of 2019, and has seen impressive growth since with annual recurring revenue (ARR) in April surpassing over $50 million. Its customer base is approaching 1 million, and the company has partnerships with a number of large crypto players including Binance, Bitfinex, Trezor, Trust Wallet, Bithumb and Bybit. In 2020, the company said its turnover spiked by 50 times while run-rate turnover crossed $2.5 billion in April 2021.

To build on that momentum, Mercuryo has begun expanding to new markets, including the United States, where it launched its crypto payments offering for B2B customers in all states earlier this year. It also plans to “gradually” expand to Africa, South America and Southeast Asia.

Target Global led Mercuryo’s Series A, which also included participation from a group of angel investors and brings the startup’s total raised since its 2018 inception to over $10 million.

The company plans to use its new capital to launch a cryptocurrency debit card (spending globally directly from the crypto balance in the wallet) and continuing to expand to new markets, such as Latin America and Asia-Pacific.

Mercuryo’s various products include a multicurrency wallet with a built-in crypto exchange and digital asset purchasing functionality, a widget and high-volume cryptocurrency acquiring and OTC services.

Kozyakov says the company doesn’t charge for currency conversion and has no other “hidden fees.”

“We enable instant and easy cross-border transactions for our partners and their customers,” he said. “Also, the money transfer services lack intermediaries and require no additional steps to finalize transactions. Instead, the process narrows down to only two operations: a fiat-to-crypto exchange when sending a transfer and a crypto-to-fiat conversion when receiving funds.”

Mercuryo also offers crypto SaaS products, giving customers a way to buy crypto via their fiat accounts while delegating digital asset management to the company.

“Whether it be virtual accounts or third-party customer wallets, the company handles most cryptocurrency-related processes for banks, so they can focus more on their core operations,” Kozyakov said.

Mike Lobanov, Target Global’s co-founder, said that as an experiment, his firm tested numerous solutions to buy Bitcoin.

“Doing our diligence, we measured ‘time to crypto’ – how long it takes from going to the App Store and downloading the app until the digital assets arrive in the wallet,” he said.

Mercuryo came first with 6 minutes, including everything from KYC and funding to getting the cryptocurrency, according to Lobanov.

“The second-best result was 20 minutes, while some apps took forever to process our transaction,” he added. “This company is a game-changer in the field, and we are delighted to have been their supporters since the early days.”

Looking ahead, the startup plans to release a product that will give businesses a way to send instant mass payments to multiple customers and gig workers simultaneously, no matter where the receiver is located.

Powered by WPeMatico