Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Seattle-based Edge Delta, a startup that is building a modern distributed monitoring stack that is competing directly with industry heavyweights like Splunk, New Relic and Datadog, today announced that it has raised a $15 million Series A funding round led by Menlo Ventures and Tim Tully, the former CTO of Splunk. Previous investors MaC Venture Capital and Amity Ventures also participated in this round, which brings the company’s total funding to date to $18 million.

“Our thesis is that there’s no way that enterprises today can continue to analyze all their data in real time,” said Edge Delta co-founder and CEO Ozan Unlu, who has worked in the observability space for about 15 years already (including at Microsoft and Sumo Logic). “The way that it was traditionally done with these primitive, centralized models — there’s just too much data. It worked 10 years ago, but gigabytes turned into terabytes and now terabytes are turning into petabytes. That whole model is breaking down.”

He acknowledges that traditional big data warehousing works quite well for business intelligence and analytics use cases. But that’s not real-time and also involves moving a lot of data from where it’s generated to a centralized warehouse. The promise of Edge Delta is that it can offer all of the capabilities of this centralized model by allowing enterprises to start to analyze their logs, metrics, traces and other telemetry right at the source. This, in turn, also allows them to get visibility into all of the data that’s generated there, instead of many of today’s systems, which only provide insights into a small slice of this information.

While competing services tend to have agents that run on a customer’s machine, but typically only compress the data, encrypt it and then send it on to its final destination, Edge Delta’s agent starts analyzing the data right at the local level. With that, if you want to, for example, graph error rates from your Kubernetes cluster, you wouldn’t have to gather all of this data and send it off to your data warehouse where it has to be indexed before it can be analyzed and graphed.

With Edge Delta, you could instead have every single node draw its own graph, which Edge Delta can then combine later on. With this, Edge Delta argues, its agent is able to offer significant performance benefits, often by orders of magnitude. This also allows businesses to run their machine learning models at the edge, as well.

“What I saw before I was leaving Splunk was that people were sort of being choosy about where they put workloads for a variety of reasons, including cost control,” said Menlo Ventures’ Tim Tully, who joined the firm only a couple of months ago. “So this idea that you can move some of the compute down to the edge and lower latency and do machine learning at the edge in a distributed way was incredibly fascinating to me.”

Edge Delta is able to offer a significantly cheaper service, in large part because it doesn’t have to run a lot of compute and manage huge storage pools itself since a lot of that is handled at the edge. And while the customers obviously still incur some overhead to provision this compute power, it’s still significantly less than what they would be paying for a comparable service. The company argues that it typically sees about a 90 percent improvement in total cost of ownership compared to traditional centralized services.

Edge Delta charges based on volume and it is not shy to compare its prices with Splunk’s and does so right on its pricing calculator. Indeed, in talking to Tully and Unlu, Splunk was clearly on everybody’s mind.

“There’s kind of this concept of unbundling of Splunk,” Unlu said. “You have Snowflake and the data warehouse solutions coming in from one side, and they’re saying, ‘hey, if you don’t care about real time, go use us.’ And then we’re the other half of the equation, which is: actually there’s a lot of real-time operational use cases and this model is actually better for those massive stream processing datasets that you required to analyze in real time.”

But despite this competition, Edge Delta can still integrate with Splunk and similar services. Users can still take their data, ingest it through Edge Delta and then pass it on to the likes of Sumo Logic, Splunk, AWS’s S3 and other solutions.

“If you follow the trajectory of Splunk, we had this whole idea of building this business around IoT and Splunk at the Edge — and we never really quite got there,” Tully said. “I think what we’re winding up seeing collectively is the edge actually means something a little bit different. […] The advances in distributed computing and sophistication of hardware at the edge allows these types of problems to be solved at a lower cost and lower latency.”

The Edge Delta team plans to use the new funding to expand its team and support all of the new customers that have shown interest in the product. For that, it is building out its go-to-market and marketing teams, as well as its customer success and support teams.

Powered by WPeMatico

Amazon revolutionized one-click shopping, and it has a nearly $2 trillion market cap to show for the effort.

Now, a 10-person startup founded by JD Maresco, who previously cofounded the public safety app Citizen, says it plans to make it a lot easier for retailers who sell directly to their customers to make re-ordering their products just as fast and simple through its QR codes. Indeed, Maresco’s new startup, Batch, is already working with numerous products and brands that use Shopify, promising their customers “one-tap checkout” when it’s time to reorder an item as long as the retailer has slapped one of Batch’s codes on their items or incorporated the codes directly into their packaging.

For the moment, New York-based Batch is wholly reliant on Apple’s App Clip technology, which produces a lightweight version of an app to save people from having to download and install it before using it. (Users can instead load just a small part of an app on demand, and when they’re done, the App Clip disappears.)

But Maresco — whose company just raised $5 million in seed funding co-led by Coatue and Alexis Ohanian’s Seven Seven Six, with participation from Weekend Fund, Shrug Capital, and the Chainsmokers, among others — says Batch will eventually work on both iOS and Android phones. We talked with him yesterday to learn more about its ambitions to make the physical world “instantly shoppable.” Our chat has been edited lightly for length and clarity.

TC: Citizen and Batch are very different companies. Is there a unifying thread?

JM: I’ve spent a good portion of my career, trying to change the way people think about and interact with their physical environment. With Citizen, we were questioning why everyone doesn’t have immediate access to information about what the police are doing in our neighborhoods. With Batch, we’re asking a simpler question but something that matters to me as a consumer: Why isn’t it easier for me to get more of a product I love and use?

With subscriptions in general, I’ve found myself constantly frustrated because every few weeks I’m emailing to either pause a subscription, or restart it. I wanted an easier way to use my phone to reorder in 10 seconds on the spot. Our phones are capable of much more than we put them to use for and, so we set out to tackle that problem.

TC: Right now, Batch integrates with Shopify alone, correct?

JM: We have a Shopify plugin that brands can connect into the Batch platform, and then we integrate the experience, all the way from the physical world wherever this QR code lives, through the purchase experience on the mobile side of things into their fulfillment on the back end. But we’re also expanding to other e-commerce platforms.

TC: And Batch takes a per-transaction fee from every item that’s purchased using your codes?

JM: We’re developing our pricing model over time, but currently we’re taking a service percentage-based fee.

TC: How are you getting brands to partner with you?

JM: Brands are starting to wake up to this idea that they can actually create a new retail channel off their physical packaging, where a customer can effectively shop throughout their home or their place of work or anywhere where they interact with these products the moment they run out of an item. So we’ve been able to spend time with dozens of brands now, and work with them to actually reengineer their packaging and say, ‘Let’s put QR codes front and center and figure out how to make this a really important customer touchpoint.’

TC: How many brands are using the codes currently?

JM: We’re launching dozens of brands this summer. We’ve had overwhelming demand, to be honest, and we haven’t really even fully launched yet.

TC: These are physical codes that you’re sending off to your retail partners — stickers, magnets. Are you also creating digital QR codes?

JM: We have customers that are integrating QR codes into out-of-home advertisements, into direct mail, into T shirts, into promotional vans, so we’re not just limited to packaging. There’s a wide range of places that you can integrate QR codes for your customers.

TC: It’s interesting that Coatue led your round. We’ve seen the firm delve more into early-stage deals but a seed round seems anomalous. How did you connect with the firm?

JM: We met during the seed process. They reached out to me and I developed a relationship with Andy Chen and Matt Mazzeo and it was a great opportunity to to work with their platform — the way they support the go-to-market motion around B2B companies; they have a great data platform. Alexis [Ohanian’s] experience in the consumer space was really appealing, too.

TC: Your company makes sense, but I wonder what’s special about these codes. What’s to prevent countless other startups from doing what you’re doing?

JM: QR codes are all over the place. The product we’re building makes it really easy for brands to create high converting shopping experiences and a native mobile interface. It’s a combination of our Shopify integration and our native product design experience and the relationships we have with these brands and how we help them with their packaging that’s not something you can spin up overnight.

TC: I have to ask about Citizen, which was in the headlines recently for all the wrong reasons. Is there anything you want to say about the company or the app or some of that recent coverage?

JM: I’m not going to comment on the recent press, but I continue to be proud of what the company is continuing to do to help communities stay safe and understand what police and first responders are doing in their neighborhoods.

Powered by WPeMatico

Making the choice to adopt, or to find an adopting family, is a legally complex, emotionally taxing, expensive and time-consuming process. PairTree aims to make one part at least considerably easier and faster with its online matching platform where expectant mothers and hopeful adopters can find each other without the facilitation of an agency or other organization. The company has just raised a $2.25 million seed round, a rarity in the industry.

The path to adoption is different for everyone, but there are generally some things they have in common: Once the process is started, it can take upwards of $50,000 and over a year-and-a-half to organize a match. While some of this comprises the ordinary legal hurdles involved in any adoption, a big part of it is simply that there are limited opportunities for adoption, and compatibility isn’t guaranteed. As many people considering adoption are doing so on the heels of unsuccessful fertility treatment, it can be a lot to take on and a dispiriting wait.

Erin Quick, CEO and co-founder (with CTO Justin Friberg) of PairTree, said that the modern adoption landscape is marked by the fact that nearly 95 percent of adoptions are open, meaning there is ongoing contact between a biological mother and adopting family.

“They’ll be working together forever, and that makes finding a highly compatible match that much more important,” Quick, herself a happy adopter, told TechCrunch in an interview. But because of the way adoption is generally done — through agencies licensed by states — there are limitations on how far anyone involved can reach.

“It’s so bound by geography,” she said. “It’s regulated at the state level and has been facilitated by state level, not because of state laws — there’s no rule saying you can’t adopt out of state — but because the facilitators are small nonprofits. They bind themselves to their geographic region because that’s what they can serve. We’re building a platform that makes what people are already doing much easier and more efficient.”

That platform is in many ways very much like a dating app, though of course the comparison is not exact and does not reflect the gravity of choosing to adopt. But like in the dating world, in adoption you have a cloud of people looking to connect over something highly dependent on personality and individual needs.

PairTree onboards both expectant mothers and adopters with personality tests — not the light-hearted stuff of OkCupid but a broader, more consequential set of Jungian archetypes that signal a person’s high-level priorities in life. Think “wants to travel and learn” versus “wants to provide and nurture” (not that these are necessarily incompatible) — they serve as important indicators of preferences that might not be so easily summarized with a series of checkboxes. That’s not the only criterion, of course. Other demographic and personal details are also collected.

The adopters are added to a pool through which expectant mothers can sift and, if desired, contact (in this, Quick suggested, PairTree mirrors Bumble, where women must message first). PairTree also does basic due diligence stuff like identify verification and confirmation of other important steps like home studies.

If a likely match is found, all the relevant information is passed to the adoption facilitator, who will be coordinating the other legal and financial steps. PairTree isn’t looking to replace these agencies — in fact Quick said that they have been huge proponents of the platform, since it can shorten wait times and improve outcomes. She said based on their existing successful adoptions that the wait can be cut by half or even two-thirds, and thus the cost (which involves recurring payments as the agency searches and does the legal work) by a similar amount.

“These are small nonprofits; they don’t have a lot of tech chops. When we launched we went to attorneys first, actually, and we were surprised when agencies started reaching out,” she explained.

Agencies have been referring their adopters to PairTree, which has led to a lot of early traction, Quick said. And importantly, they’ve seen great diversity in their early success.

“Adoption has historically been denied by faith-based systems — LGBTQ families and single women have been subject to discrimination,” she noted. And in fact just last week a Supreme Court decision held up the right of religious adoption agencies to deny services to same-sex couples. Quick was proud to say that they have already facilitated adoptions by same-sex couples and single parents.

The company will also set aside 5 percent of its net profits, which hopefully will manifest in volume, for the Lifetime Healing Foundation, which offers counseling and support to birth mothers who have gone though the adoption process.

The $2.25 million seed round was led by Urban Innovation Fund, with Founder Collective, Female Founders Alliance and Techstars participating. It will surprise few to hear that adoption is not a particularly hot industry for venture capital, but rising interest and investment in fertility tech may have shed light on opportunities in adjacent spaces. Adoption is one where significant improvements can be enabled by technology, meaning startups can grow fast while having a positive impact.

The company plans to use the money to expand its product portfolio, pursue more partnerships, and perhaps most importantly for its users, build a native mobile app, since 90 percent of the service’s viewership is mobile.

“We’re grateful to our expert and diverse group of investors who share our vision that adoption should be a viable path to parenting for more people,” said Quick in the release announcing the raise. “Like us, our investors believe in the importance of supporting Biological and Adopting Families along with the Adoptees, because adoption is not a single transaction but a journey they’re taking over the course of a lifetime.”

Powered by WPeMatico

Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel.

This round is notable for a number of reasons. First off, it’s a large Series A even by today’s standards. The financing also marks the previously bootstrapped Lower’s first external round of funding in its seven-year history. Lower is also something that is kind of rare these days in the startup world: profitable. Silicon Valley-based Accel has a history of backing profitable, bootstrapped companies, having also led large Series A rounds for the likes of 1Password, Atlassian, Qualtrics, Webflow, Tenable and Galileo (which went on to be acquired by SoFi).

In fact, Galileo founder Clay Wilkes introduced the VC firm to Dan Snyder, Lower’s founder and CEO. The two companies have a few things in common besides being profitable: they were both bootstrapped for years before taking institutional capital and both have headquarters outside of Silicon Valley.

“We were immediately intrigued because Ohio-based Lower echoes both of these themes,” said Accel partner John Locke, who led the firm’s investment in Lower and is taking a seat on the company’s board as part of the investment. “Like Galileo, Lower will be one of the most successful bootstrapped fintech companies globally. The combination of a company built in a nontraditional region across the globe and a bootstrapped company reminds us of [other] companies we have partnered with for a large Series A.”

There were other unnamed participants in the round, but Accel provided the “majority” of the investment, according to Lower.

Snyder co-founded Lower in 2014 with the goal of making the home-buying process simpler for consumers. The company launched with Homeside, its retail brand that Snyder describes as “a tech-leveraged retail mortgage bank” that works with realtors and builders, among others.

In 2018, the company launched the website for Lower, its direct-to-consumer digital lending brand with the mission of making its platform a one-stop shop where consumers can go online to save for a home, obtain or refinance a mortgage and get insurance through its marketplace. This year, it launched the Lower mobile app with a savings account.

Sitting (L to R): Co-founders Dan Snyder, Grayson Hanes

Standing (L to R): Co-founders Mike Baynes, Chris Miller

Not pictured: Robert Tyson; Image credit: Lower

Over the years, Lower has funded billions of dollars in loans and notched an impressive $300 million in revenue in 2020 after doubling revenue every year, according to Snyder.

“Our history is maybe a little atypical of fintech companies today,” he told TechCrunch. “We’ve had a view going back to the start of the company that we wanted to run it profitably. That’s been one of our pillars, so that’s what we’ve done. Also, we all grew up in the mortgage industry, so we saw firsthand the size of the market, but also how broken it was, so we wanted to change it.”

In launching the direct-to-consumer digital lending brand, the company was working to make the homebuying process more “digital, transparent and easier for consumers to access,” Snyder said.

At the same time, the company didn’t want to lose the human touch.

“We tried to design the app flow in a way where you can get as far along as you can in the application but if you want, at any point in time, to talk or chat with someone, we’re available,” Snyder added.

Image Credits: Lower

Lower’s typical customer is the millennial and now Gen Z who’s aspiring to own their first home, according to Snyder.

“They might be thinking, ‘OK, I might be living in an apartment now, but in the next few years I’m going to meet someone and/or have a child and I want to unlock the investment that is a home,’” he told TechCrunch. “And we’ll help them on that journey.”

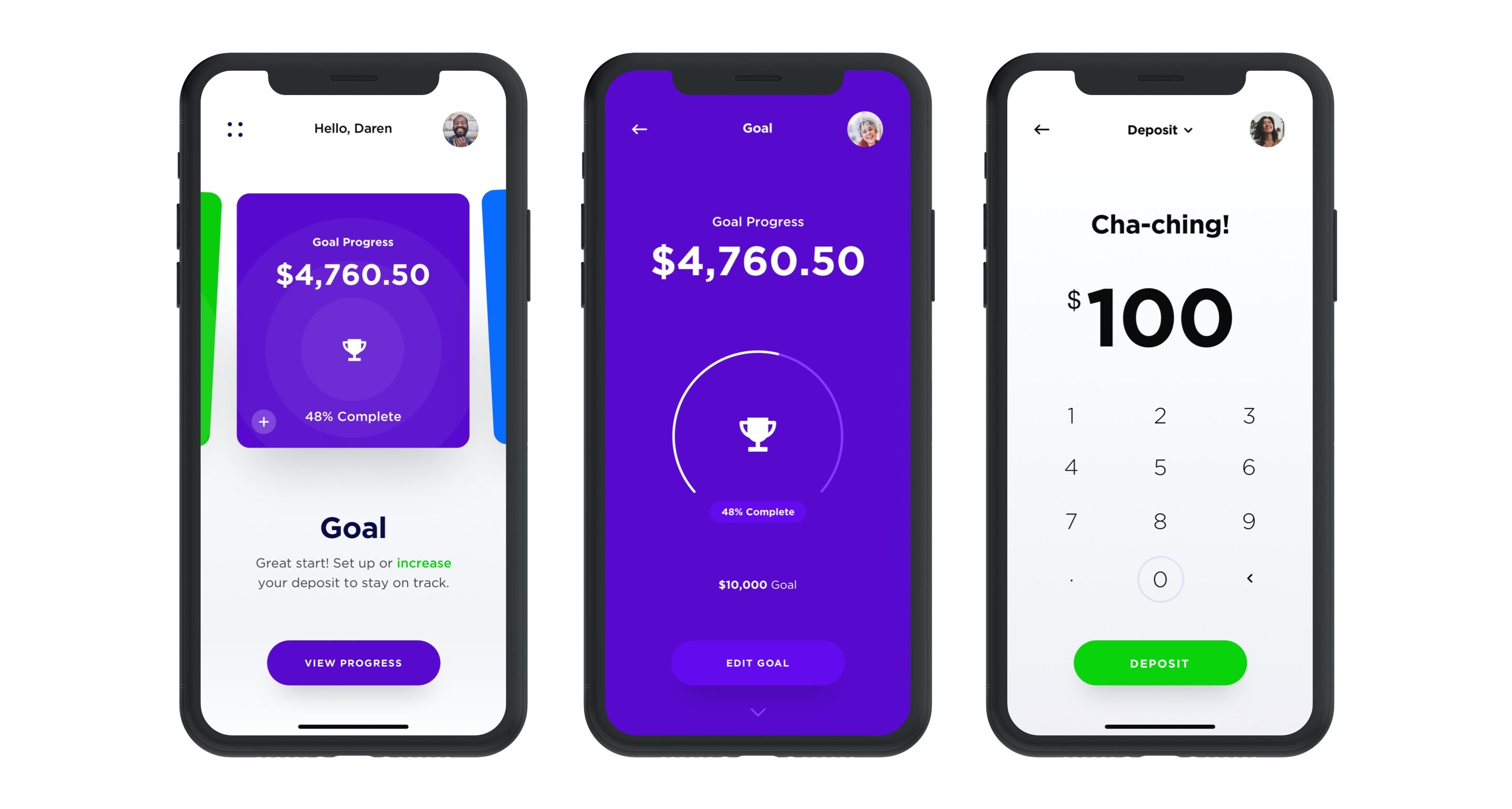

Lower’s recently launched new app offers a deposit account it’s dubbed “HomeFund.” The interest-bearing, FDIC-insured deposit account offers a 0.75% Annual Percentage Yield and is designed to help consumers save for a home with a “dollar-for-dollar match in rewards” up to the first $1,000 saved, Snyder said.

Lower works with more than 35 major insurance carriers nationally, including Nationwide, Liberty Mutual and Allstate. It has more than 1,600 employees, about half of which are based in Lower’s home state. That’s up from about 650 employees in June of 2020.

Looking ahead, the company plans to add more services and has an “aggressive roadmap” for adding new features to its platform. Today, for example, Lower sells primarily to Fannie Mae and Freddie Mac. And while it services the majority of its loans, like many large lenders, it uses a subservicer. That will change, however, in early 2022, when Lower intends to launch its own native servicing platform.

And while the company intends to continue to run profitably, Snyder said he and his co-founders “think the time is now to gain share.”

“We want to become a global brand, raise money and gain market share,” he added. “We’re going to continue to double down on product and build out our capabilities. We are the best-kept secret in fintech and plan to change that with smart branding, advertising and sponsorships.”

And last but not least, Lower is eyeing the public markets as part of its longer-term roadmap.

“Ultimately, we know we can build a great public company,” Snyder told TechCrunch. “We’re of the scale to be a public company right now, but we’re going to keep our heads down and we’re going to keep building for the next few years and then I think we can be in a spot to be a strong public business.”

Accel’s Locke points out that in the U.S., mortgage and home finance are among the largest financial service markets, and they have primarily been handled by large banks.

“For most consumers, getting a mortgage through these banks continues to be an overly complex, slow-moving process,” Locke told TechCrunch. “We believe by providing consumers a great mobile experience, Lower will gain share from incumbent banks, in the same way that companies like Monzo have in banking or Venmo in payments or Trade Republic and Robinhood in stock trading.”

Powered by WPeMatico

Vercel, the company behind the popular open-source Next.js React framework, today announced that it has raised a $102 million Series C funding round led by Bedrock Capital. Existing investors Accel, CRV, Geodesic Capital, Greenoaks Capital and GV also participated in this round, together with new investors 8VC, Flex Capital, GGV, Latacora, Salesforce Ventures and Tiger Global. In total, the company has now raised $163 million and its current valuation is $1.1 billion.

As Vercel notes, the company saw strong growth in recent months, with traffic to all sites and apps on its network doubling since October 2020. The number of sites among the world’s largest 10,000 websites that use Next.js grew 50% in the same time frame, too.

Given the open-source nature of the Next.js framework, not all of these users are obviously Vercel customers, but its current paying customers include the likes of Carhartt, Github, IBM, McDonald’s and Uber.

“For us, it all starts with a front-end developer,” Vercel CEO Guillermo Rauch told me. “Our goal is to create and empower those developers — and their teams — to create delightful, immersive web experiences for their customers.”

With Vercel, Rauch and his team took the Next.js framework and then built a serverless platform that specifically caters to this framework and allows developers to focus on building their front ends without having to worry about scaling and performance.

Older solutions, Rauch argues, were built in isolation from the cloud platforms and serverless technologies, leaving it up to the developers to deploy and scale their solutions. And while some potential users may also be content with using a headless content management system, Rauch argues that increasingly, developers need to be able to build solutions that can go deeper than the off-the-shelf solutions that many businesses use today.

Rauch also noted that developers really like Vercel’s ability to generate a preview URL for a site’s front end every time a developer edits the code. “So instead of just spending all your time in code review, we’re shifting the equation to spending your time reviewing or experiencing your front end. That makes the experience a lot more collaborative,” he said. “So now, designers, marketers, IT, CEOs […] can now come together in this collaboration of building a front end and say, ‘that shade of blue is not the right shade of blue.’”

“Vercel is leading a market transition through which we are seeing the majority of value-add in web and cloud application development being delivered at the front end, closest to the user, where true experiences are made and enjoyed,” said Geoff Lewis, founder and managing partner at Bedrock. “We are extremely enthusiastic to work closely with Guillermo and the peerless team he has assembled to drive this revolution forward and are very pleased to have been able to co-lead this round.”

Powered by WPeMatico

Sohail Prasad and Samvit Ramadurgam are cofounders who met during Y Combinator’s 2012 summer batch and went on to cofound Forge, which helps accredited investors and institutions buy and sell private company shares and which most recently raised $150 million in new funding in May.

Forge — originally known as Equidate — has taken off as demand for private company shares has ballooned. The company, launched in 2014, has now raised $250 million altogether, including from, Deutsche Börse, Temasek, Wells Fargo, BNP Paribas, and Munich Re. It acquired rival SharesPost last year for $160 million in cash and stock. According to the company, it now has more than $14 billion in assets under custody.

Prasad and Ramadurgam — who helped hire Forge CEO Kelly Rodriques back in 2018 — say they’re excited about that success. They still own a stake in the company; they remain non-voting board members.

But after spending 18 months as co-president of Forge at the outset of Rodrigues’s tenure, they left early last year to begin tinkering on a new idea, one that Prasad says is centered around giving a much wider pool of people access to private company shares. Called D/XYZ (pronounced “Destiny”), the idea is to enable any investor — not just the 1% — to invest in startups whose services they use and love.

Unfortunately, the two aren’t offering much more of a curtain raiser than that right now, though Prasad suggests D/XYZ is neither a new fund nor a crowdfunding vehicle. It’s also not selling any tokens, we gather. Instead, Prasad hints at an entirely new product, saying the company is being cautious in how much it shares publicly because it first wants to “get the go-ahead from regulators, as well as to ensure we have a clear path to market,” he says.

In the meantime, the two have raised $5 million in seed funding from numerous founders who like the idea of making private company shares easier for their parents, friends, customers, partners, and everyone else who likes what they’re building. Among the round’s participants is Coinbase cofounder Fred Ehrsam; Plaid cofounder and CEO Zach Perret; Quora and Expo cofounder Charlie Cheever; Superhuman founder and CEO Rahul Vohra; and serial entrepreneur Siqi Chen, who most recently founded a finance software company called Runway.

As for some of the nascent startup’s most obvious competition, Prasad doesn’t sound concerned. Asked, for example, about Carta, a well-funded company that helps private companies and their employees manage and sell their stock and options and that has long talked about democratizing access to private company shares, Prasad says it remains very much a direct competitor instead to Forge given that both cater first and foremost to companies, not individuals.

And what of SPACs, the special purpose acquisition companies that are moving private companies onto the public market faster, allowing (at least in theory) more people to access high-growth companies at earlier stages? It’s a partial solution, says Prasad. But the way he sees it, “SPACs are more a reflection that people want late-stage access to private tech and their best option right now is giving money to a SPAC manager who will hopefully find a promising company to merge with in two years or less.” He calls them a “layer of abstraction.”

Of course, there’s also the question of whether Forge will be a friend of foe if whatever Prasad and Ramadurgam are building succeeds. Could their tech be sold back to their first company? Could Forge come to see them as a rival to its business?

“What we’re doing now is not competitive,” insists Prasad. “It’s more picking up the mantle where we left off. Forge is focused on trading, custody, company solutions and data. It has built what some call boring plumbing.” Now that the plumbing has been erected, it has “enabled a lot of other interesting things to be built, too.”

So is D/XYZ working with Forge in some capacity? Prasad demurs. “Potentially,” he says.

In other words, stay tuned.

Pictured above, left to right: Sohail Prasad and Samvit Ramadurgam.

Powered by WPeMatico

The founders of Holy Grail, a two-year-old startup based in Mountain View, California, are taking a micro approach to solving the outsized problem of capturing carbon.

The startup is prototyping a direct air carbon capture device that is modular and small — a departure from the dozens of projects in the U.S. and abroad that aim to capture CO2 from large, centralized emitters, like power plants or industrial facilities. Holy Grail co-founder Nuno Pereira told TechCrunch that this approach will reduce costs and eliminate the need for permits or project financing.

While Holy Grail has a long development and testing phase ahead, the idea has captured the attention and capital from well-known investors and Silicon Valley founders. Holy Grail recently raised $2.7 million in seed funding from LowerCarbon Capital, Goat Capital, Stripe founder Patrick Collison, Charlie Songhurst, Cruise co-founder Kyle Vogt, Songkick co-founder Ian Hogarth, Starlight Ventures and 35 Ventures. Existing investors Deep Science Ventures, Y Combinator and Oliver Cameron, who co-founded Voyage, the autonomous vehicle acquired by Cruise, also participated.

The carbon capture device is still in the prototype stage, Pereira said, with many specifics — such as the anticipated size of the end product and how long it will likely function — still to be worked out. Cost-effectively separating CO2 from the air is an extremely difficult problem to solve. The company is in the process of filing patents for the technology, so he declined to be too specific about many characteristics of the device, including what it will be made out of. But he did stress that the company is taking a fundamentally different technical approach to carbon capture.

“The current technologies, they are very complex. They are basically either [using] temperature or pressure [to capture carbon],” he said. “There is a lot of things that go into it, compressors, calciners and all these things,” referring to additional parts like mechanical pumps, cryogenic air separators and large quantities of water and energy. Pereira said the company will instead use electricity to control a chemical reaction that binds to the CO2. He added that Holy Grail’s devices are not dependent on scale to achieve cost reductions, either. And they will be modular, so they can be stacked or configured depending on a customer’s requirements.

The scrubbers, as Pereira calls them, will focus on raw capture of CO2 rather than conversion (converting the CO2 into fuels, for example). Pereira instead explained — with a heavy caveat that much about the end product still needs to be figured out — that once a Holy Grail unit is full, it could be collected by the company, though where the carbon will end up is still an open question.

The company will start by selling carbon credits, using its devices as the carbon reducing project. The end goal is selling the scrubbers to commercial customers and eventually even individual consumers. That’s right: Holy Grail wants you to have your own carbon capture device, possibly even right in your backyard. But the company still likely has a long road ahead of it.

“We’re essentially shifting the scaling factor from building a very large mega-ton plant and having the project management and all that stuff to building scrubbers in an assembly line, like a consumer product to be manufactured.”

Pereira said many approaches will be needed to tackle the mammoth problem of reducing the amount of CO2 in the atmosphere. “The problem is just too big,” he said.

The story has been updated to reflect that Holy Grail is based in Mountain View, not Cupertino.

Powered by WPeMatico

Vantage, a service that helps businesses analyze and reduce their AWS costs, today announced that it has raised a $4 million seed round led by Andreessen Horowitz. A number of angel investors, including Brianne Kimmel, Julia Lipton, Stephanie Friedman, Calvin French Owen, Ben and Moisey Uretsky, Mitch Wainer and Justin Gage, also participated in this round.

Vantage started out with a focus on making the AWS console a bit easier to use — and helping businesses figure out what they are spending their cloud infrastructure budgets on in the process. But as Vantage co-founder and CEO Ben Schaechter told me, it was the cost transparency features that really caught on with users.

“We were advertising ourselves as being an alternative AWS console with a focus on developer experience and cost transparency,” he said. “What was interesting is — even in the early days of early access before the formal GA launch in January — I would say more than 95% of the feedback that we were getting from customers was entirely around the cost features that we had in Vantage.”

Like any good startup, the Vantage team looked at this and decided to double down on these features and highlight them in its marketing, though it kept the existing AWS Console-related tools as well. The reason the other tools didn’t quite take off, Schaechter believes, is because more and more, AWS users have become accustomed to infrastructure-as-code to do their own automatic provisioning. And with that, they spend a lot less time in the AWS Console anyway.

“But one consistent thing — across the board — was that people were having a really, really hard time 12 times a year, where they would get a shocking AWS bill and had to figure out what happened. What Vantage is doing today is providing a lot of value on the transparency front there,” he said.

Over the course of the last few months, the team added a number of new features to its cost transparency tools, including machine learning-driven predictions (both on the overall account level and service level) and the ability to share reports across teams.

While Vantage expects to add support for other clouds in the future, likely starting with Azure and then GCP, that’s actually not what the team is focused on right now. Instead, Schaechter noted, the team plans to add support for bringing in data from third-party cloud services instead.

“The number one line item for companies tends to be AWS, GCP, Azure,” he said. “But then, after that, it’s Datadog, Cloudflare, Sumo Logic, things along those lines. Right now, there’s no way to see, P&L or an ROI from a cloud usage-based perspective. Vantage can be the tool where that’s showing you essentially, all of your cloud costs in one space.”

That is likely the vision the investors bought into, as well, and even though Vantage is now going up against enterprise tools like Apptio’s Cloudability and VMware’s CloudHealth, Schaechter doesn’t seem to be all that worried about the competition. He argues that these are tools that were born in a time when AWS had only a handful of services and only a few ways of interacting with those. He believes that Vantage, as a modern self-service platform, will have quite a few advantages over these older services.

“You can get up and running in a few clicks. You don’t have to talk to a sales team. We’re helping a large number of startups at this stage all the way up to the enterprise, whereas Cloudability and CloudHealth are, in my mind, kind of antiquated enterprise offerings. No startup is choosing to use those at this point, as far as I know,” he said.

The team, which until now mostly consisted of Schaechter and his co-founder and CTO Brooke McKim, bootstrapped the company up to this point. Now they plan to use the new capital to build out its team (and the company is actively hiring right now), both on the development and go-to-market side.

The company offers a free starter plan for businesses that track up to $2,500 in monthly AWS cost, with paid plans starting at $30 per month for those who need to track larger accounts.

Powered by WPeMatico

Time is your most valuable asset — as the saying goes — and today a startup called Memory.ai, which is building AI-based productivity tools to help you with your own time management, is announcing some funding to double down on its ambitions: It wants not only to help manage your time, but to, essentially, provide ways to use it better in the future.

The startup, based out of Oslo, Norway, initially made its name with an app called Timely, a tool for people to track time spent doing different tasks. Aimed not just at people who are quantified self geeks, but those who need to track time for practical reasons, such as consultants or others who work on the concept of billable hours. Timely has racked up 500,000 users since 2014, including more than 5,000 paying businesses in 160 countries.

Now, Memory.ai has raised $14 million as it gears up to launch its next apps, Dewo (pronounced “De-Voh”), an app that is meant to help people do more “deep work” by learning about what they are working on and filtering out distractions to focus better; and Glue, described as a knowledge hub to help in the creative process. Both are due to be released later in the year.

The funding is being led by local investors Melesio and Sanden, with participation from Investinor, Concentric and SNÖ Ventures, who backed Memory.ai previously.

“Productivity apps” has always been something of a nebulous category in the world of connected work. They can variously cover any kind of collaboration management software ranging from Asana and Jira through to Slack and Notion; or software that makes doing an existing work task more efficient than you did it before (e.g. Microsoft has described all of what goes into Microsoft 365 — Excel, Word, PowerPoint, etc. — as “productivity apps”); or, yes, apps like those from Memory.ai that aim to improve your concentration or time management.

These days, however, it feels like the worlds of AI and advances in mobile computing are increasingly coming together to evolve that concept once again.

If the first wave of smartphone communications and the apps that are run on smartphone devices — social, gaming, productivity, media, information, etc. — have led to us getting pinged by a huge amount of data from lots of different places, all of the time, then could it be that the second wave is quite possibly going to usher in a newer wave of tools to handle all that better, built on the premise that not everything is of equal importance? No-mo FOMO? We’ll see.

In any case, some bigger platform players also helping to push the agenda of what productivity means in this day and age.

For example, in Apple’s recent preview of iOS 15 (due to come out later this year) the company gave a supercharge to its existing “do not disturb” feature on its phones, where it showed off a new Focus mode, letting users customize how and when they want to receive notifications from which apps, and even which apps they want to have displayed, all organized by different times of day (e.g. work time), place, calendar items and so on.

“Today, iPhone plays so many roles in our lives. It’s where we get information, how people reach us, and where we get things done. This is great, but it means our attention is being pulled in so many different directions and finding that balance between work and life can be tricky,” said Apple’s Craig Federighi in the WWDC keynote earlier this month. “We want to free up space to focus and help you be in the moment.” How well that gets used, and how much other platforms like Google follow suit, will be interesting to see play out. It feels, in any case, like it could be the start of something.

And, serendipitously — or maybe because this is some kind of zeitgeist — this is also playing into what Memory.ai has built and is building.

Mathias Mikkelsen, the Oslo-based founder of Memory.ai, first came up with his idea for Timely (which had also been the original name of the whole startup) when he was working as a designer in the ad industry, one of those jobs that needed to track what he was working on, and for how long, in order to get paid.

He said he knew the whole system as it existed was inefficient: “I just thought it was insane how cumbersome and old it was. But at the same time how important it was for the task,” he said.

The guy had an entrepreneurial itch that he was keen to scratch, and this idea would become the salve to help him. Mikkelsen was so taken with building a startup around time management, that he sold his apartment in Oslo and moved himself to San Francisco to be where he believed was the epicenter of startup innovation. He tells me he lived off the proceeds of his flat for two years “in a closet” in a hacker house, bootstrapping Timely, until eventually getting into an accelerator (500 Startups) and subsequently starting to raise money. He eventually moved back to Oslo after two years to continue growing the business, as well as to live somewhere a little more spacious.

The startup’s big technical breakthrough with Timely was to figure out an efficient way of tracking time for different tasks, not just time worked on anything, without people having to go through a lot of data entry.

The solution: to integrate with a person’s computer, plus a basic to-do schedule for a day or week, and then match up which files are open when to determine how long one works for one client or another. Phone or messaging conversations, for the moment, are not included, and neither are the contents of documents — just the titles of them. Nor is data coming from wearable devices, although you could see how that, too, might prove useful.

The basic premise is to be personalised, so managers and others cannot use Timely to track exactly what people are doing, although they can track and bill for those billable hours. All this is important, as it also will feed into how Dewo and Glue will work.

The startup’s big conceptual breakthrough came around the same time: Getting time tracking or any productivity right “has never been a UI problem,” Mikkelsen said. “It’s a human nature problem.” This is where the AI comes in, to nudge people towards something they identify as important, and nudge them away from work that might not contribute to that. Tackling bigger issues beyond time are essential to improving productivity overall, which is why Memory.ai now wants to extend to apps for carving out time for deep thinking and creative thinking.

While it might seem to be a threat that a company like Apple has identified the same time management predicament that Memory.ai has, and is looking to solve that itself, Mikkelsen is not fazed. He said he thinks of Focus as not unlike Apple’s work on Health: there will be ways of feeding information into Apple’s tool to make it work better for the user, and so that will be Memory.ai’s opportunity to hopefully grow, not cannibalize, its own audience with Timely and its two new apps. It is, in a sense, a timely disruption.

“Memory’s proven software is already redefining how businesses around the world track, plan and manage their time. We look forward to working with the team to help new markets profit from the efficiencies, insights and transparency of a Memory-enabled workforce,” said Arild Engh, a partner at Melesio, in a statement.

Kjartan Rist, a partner at Concentric, added: “We continue to be impressed with Memory’s vision to build and launch best-in-class products for the global marketplace. The company is well on its way to becoming a world leader in workplace productivity and collaboration, particularly in light of the remote and hybrid working revolution of the last 12 months. We look forward to supporting Mathias and the team in this exciting new chapter.”

Powered by WPeMatico

Mobile commerce is where it’s at, and rising investment in so-called conversational commerce startups underscores the opportunity.

Via, a two-year-old, Bay Area-based startup, is among those riding the wave, having identified some trends that are becoming clearer by the month. First, more e-commerce sales will be on mobile phones this year than desktops (as much as 70% by some estimates), people tend to read text messages almost immediately and consumers spend upwards of 30 minutes a day engaging with mobile messaging apps.

Via also insists that unlike an expanding pool of startups that are focused on helping retailers and others broadcast their marketing messages in SMS, there’s room for a player to better address the many other pieces that add up to a happy consumer experience, from delivering coupon codes to starting the returns process.

Indeed, according to co-founder and CEO Tejas Konduru — a Brigham Young grad whose parents immigrated to the U.S. from India and who have themselves worked at tech startups — one insight his now 50-person company had early on was that despite that so many of their customers now use the mobile browser to visit and shop from their stores, many retailers use website builders like Shopify or BigCommerce to “cram everything everything into mobile, leaving only enough space for, like, one picture and a Buy button.” Konduru figured there must be a way to take the shopping experience that all these customers have with brands on their website and make them happen in a quick, mobile-native way.

Via’s solution, he says, is to help those businesses interact with customers on the devices and apps they use most often. “When someone uses Shopify or BigCommerce or any of those platforms,” says Konduru, “we also connect it to Via, and it basically takes the entire shopping experience and allows [customers] to quickly swipe right through a menu or like through a catalog on, for example, Facebook Messenger. Via will also create like a native iOS Android app by taking a website, cloning it into a native iOS Android app, then sell the push notification in-app chat layer. Essentially,” he adds, “anytime someone shops on the phone and they’re not using the browser is what Via is handling.”

The “message” seems to be getting through to the right people. Via, which launched last year, says it now employs 54 people on a full-time basis, has 190 brands as customers and just secured $15 million in Series A funding led by Footwork, the new venture firm co-founded by former Stitch Fix COO Mike Smith and former Shasta Ventures investor Nikhil Basu Trivedi.

Other participants in the round include Peterson Ventures, where Konduru once interned; famed founder Josh James of Domo, where Konduru also once interned; and a long list of other notable individual investors, including Ryan Smith of Qualtrics and Lattice co-founder and CEO Jack Altman.

As for how the company charges, it doesn’t ask for a monthly or yearly fee, as per traditional SaaS companies, but instead charges per interaction, whether that’s an SMS or a voice minute or video or a GIF.

It’s starting to add up, according to Konduru, who says that Via’s average customer is seeing 15 times return on its investment and that from May of 2020 — when the company’s service went live — through December, the company generated $51 million in sales. Konduru declined to say exactly how much Via saw from those transactions, but says the company is on track to reach $10 million in annual recurring revenue this year.

As for how brands get started with Via, it’s pretty simple, by the company’s telling. As long as a company is using a commerce platform — from Shopfiy to WooCommerce to Salesforce — it takes just five minutes or so to produce a mobile app with a menu featuring the types of interactions the brand can enable via Via’s platform, says Konduru.

Konduru, who dabbled in investment banking before deciding to launch Via, says he isn’t surprised by the startup’s fast traction, though he says he has been taken aback by the breadth of conversations the company sees. While he imagined Via would be a strong marketing channel for brands that use the platform to push out notifications about abandoned shopping carts and upcoming deliveries, it’s more of a two-way street than he’d imagined.

“Every month, there are maybe 15,000 people who start the returns process through Via and will get a notification from a channel that Via supports. But suddenly — let’s say the customer gets the wrong T-shirt size — people start communicating with the brand. You see everything from fan appreciation to address changes to messaging about bad discount codes to where’s-my-order type exchanges. That’s something I didn’t expect,” says Konduru, who says that before raising its Series A round, Via raised $4.2 million in seed funding led by Peterson Ventures.

“I thought that people would just look at the notification and, like, move it into the abyss somewhere. Instead, people start interacting with the brand.”

Powered by WPeMatico