Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

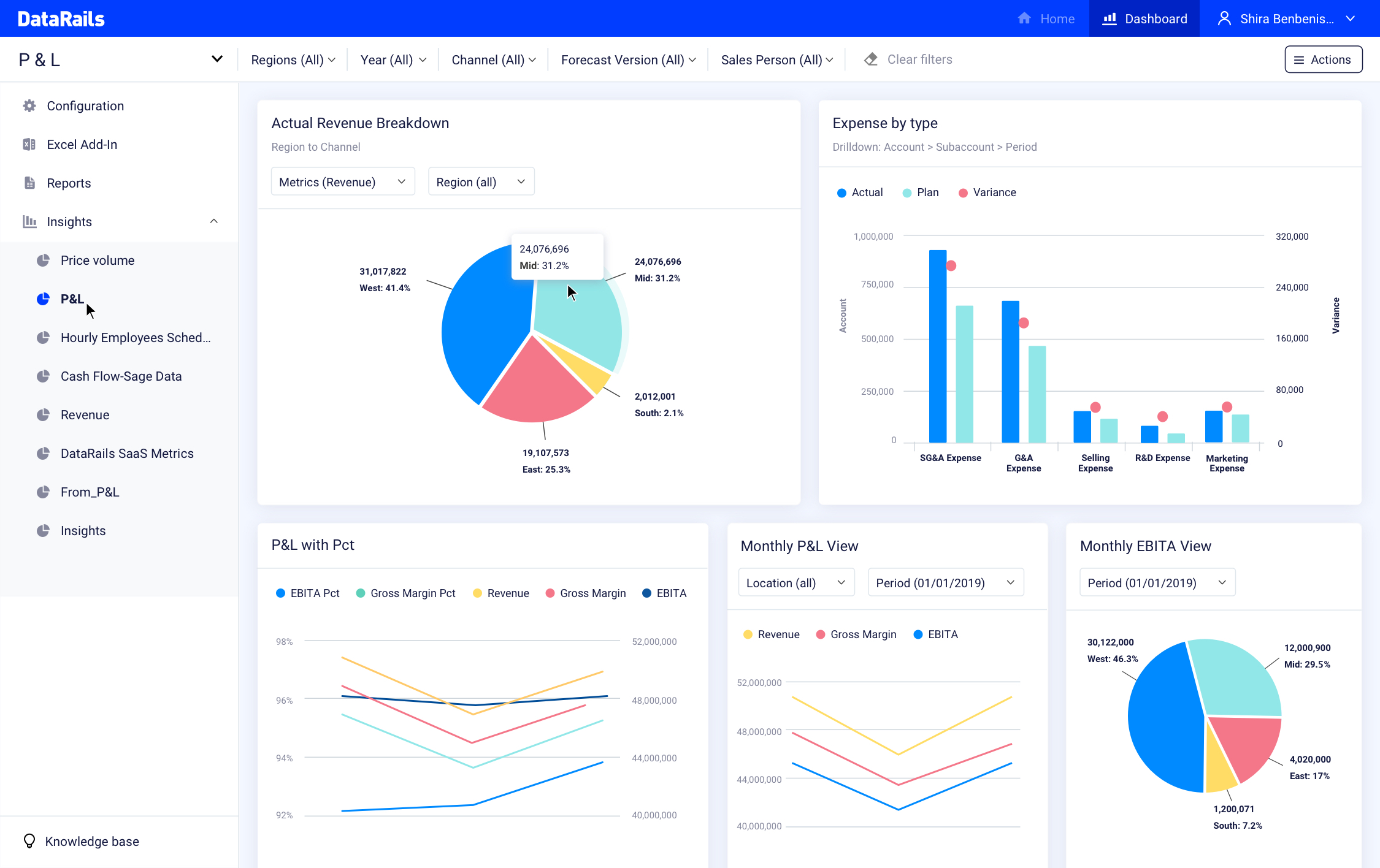

As enterprise startups continue to target interesting gaps in the market, we’re seeing increasingly sophisticated tools getting built for small and medium businesses — traditionally a tricky segment to sell to, too small for large enterprise tools, and too advanced in their needs for consumer products. In the latest development of that trend, an Israeli startup called DataRails has raised $25 million to continue building out a platform that lets SMBs use Excel to run financial planning and analytics like their larger counterparts.

The funding closes out the company’s Series A at $43.5 million, after the company initially raised $18.5 million in April (some at the time reported this as its Series A, but it seems the round had yet to be completed). The full round includes Zeev Ventures, Vertex Ventures Israel and Innovation Endeavors, with Vintage Investment Partners added in this most recent tranche. DataRails is not disclosing its valuation, except to note that it has doubled in the last four months, with hundreds of customers and on target to cross 1,000 this year, with a focus on the North American market. It has raised $55 million in total.

The challenge that DataRails has identified is that on one hand, SMBs have started to adopt a lot more apps, including software delivered as a service, to help them manage their businesses — a trend that has been accelerated in the last year with the pandemic and the knock-on effect that has had for remote working and bringing more virtual elements to replace face-to-face interactions. Those apps can include Salesforce, NetSuite, Sage, SAP, QuickBooks, Zuora, Xero, ADP and more.

But on the other hand, those in the business who manage finances and financial reporting are lacking the tools to look at the data from these different apps in a holistic way. While Excel is a default application for many of them, they are simply reading lots of individual spreadsheets rather than integrated data analytics based on the numbers.

DataRails has built a platform that can read the reported information, which typically already lives in Excel spreadsheets, and automatically translate it into a bigger picture view of the company.

For SMEs, Excel is such a central piece of software, yet such a pain point for its lack of extensibility and function, that this predicament was actually the germination of starting DataRails in the first place,

Didi Gurfinkel, the CEO who co-founded the company with Eyal Cohen (the CPO) said that DataRails initially set out to create a more general-purpose product that could help analyze and visualize anything from Excel.

Image: DataRails

“We started the company with a vision to save the world from Excel spreadsheets,” he said, by taking them and helping to connect the data contained within them to a structured database. “The core of our technology knows how to take unstructured data and map that to a central database.” Before 2020, DataRails (which was founded in 2015) applied this to a variety of areas with a focus on banks, insurance companies, compliance and data integrity.

Over time, it could see a very specific application emerging, specifically for SMEs: providing a platform for FP&A (financial planning and analytics), which didn’t really have a solution to address it at the time. “So we enabled that to beat the market.”

“They’re already investing so much time and money in their software, but they still don’t have analytics and insight,” said Gurfinkel.

That turned out to be fortunate timing, since “digital transformation” and getting more out of one’s data was really starting to get traction in the world of business, specifically in the world of SMEs, and CFOs and other people who oversaw finances were already looking for something like this.

The typical DataRails customer might be as small as a business of 50 people, or as big as 1,000 employees, a size of business that is too small for enterprise solutions, “which can cost tens of thousands of dollars to implement and use,” added Cohen, among other challenges. But as with so many of the apps that are being built today to address those using Excel, the idea with DataRails is low-code or even more specifically no-code, which means “no IT in the loop,” he said.

“That’s why we are so successful,” he said. “We are crossing the barrier and making our solution easy to use.”

The company doesn’t have a huge number of competitors today, either, although companies like Cube (which also recently raised some money) are among them. And others like Stripe, while currently not focusing on FP&A, have most definitely been expanding the tools that it is providing to businesses as part of their bigger play to manage payments and subsequently other processes related to financial activity, so perhaps it, or others like it, might at some point become competitors in this space as well.

In the meantime, Gurfinkel said that other areas that DataRails is likely to expand to cover alongside FP&A include HR, inventory and “planning for anything,” any process that you have running in Excel. Another interesting turn would be how and if DataRails decides to look beyond Excel at other spreadsheets, or bypass spreadsheets altogether.

The scope of the opportunity — in the U.S. alone there are more than 30 million small businesses — is what’s attracting the investment here.

“We’re thrilled to reinvest in DataRails and continue working with the team to help them navigate their recent explosive and rapid growth,” said Yanai Oron, general partner at Vertex Ventures, in a statement. “With innovative yet accessible technology and a tremendous untapped market opportunity, DataRails is primed to scale and become the leading FP&A solution for SMEs everywhere.”

“Businesses are constantly about to start, in the midst of, or have just finished a round of financial reporting — it’s a never-ending cycle,” added Oren Zeev, founding partner at Zeev Ventures. “But with DataRails, FP&A can be simple, streamlined, and effective, and that’s a vision we’ll back again and again.”

Powered by WPeMatico

KeepTruckin, a hardware and software developer that helps trucking fleets manage vehicle, cargo and driver safety, has just raised $190 million in a Series E funding round, which puts the company’s valuation at over $2 billion, according to CEO Shoaib Makani.

G2 Venture Partners, which just raised a $500 million fund to help modernize existing industries, participated in the round, alongside existing backers like Greenoaks Capital, Index Ventures, IVP and Scale Venture Partners and funds managed by BlackRock.

KeepTruckin intends to invest its new capital back into its AI-powered products like its GPS tracking, ELD compliance and dispatch and workflow, but it’s specifically interested in improving its smart dashcam, which instantly detects unsafe driving behaviors like cell phone distraction and close following and alerts the drivers in real time, according to Makani.

The company says Usher Transport, one of its clients, says it has seen a 32% annual reduction in accidents after implementing the Smart Dashcam, DRIVE risk score and Safety Hub, products that the company offers to increase safety.

“KeepTruckin’s special sauce is that we can build complex models (that other edge cameras can’t yet run) and make it run on the edge with low-power, low-memory and low-bandwidth constraints,” Makani told TechCrunch. “We have developed in-house IPs to solve this problem at different environmental conditions such as low-light, extreme weather, occluded subject and distortions.”

This kind of accuracy requires billions of ground truth data points that are trained and tested on KeepTruckin’s in-house machine learning platform, a process that is very resource-intensive. The platform includes smart annotation capabilities to automatically label the different data points so the neural network can play with millions of potential situations, achieving similar performance to the edge device that’s in the field with real-world environmental conditions, according to Makani.

A 2020 McKinsey study predicted the freight industry is not likely to see the kind of YOY growth it saw last year, which was 30% up from 2019, but noted that some industries would increase at higher rates than others. For example, commodities related to e-commerce and agricultural and food products will be the first to return to growth, whereas electronics and automotive might increase at a slower rate due to declining consumer demand for nonessentials.

Since the pandemic, the company said it experienced 70% annualized growth, in large part due to expansion into new markets like construction, oil and gas, food and beverage, field services, moving and storage and agriculture. KeepTruckin expects this demand to increase and intends to use the fresh funds to scale rapidly and recruit more talent that will help progress its AI systems, doubling its R&D team to 700 people globally with a focus on engineering, machine vision, data science and other AI areas, says Makani.

“We think packaging these products into operator-friendly user interfaces for people who are not deeply technical is critical, so front-end and full-stack engineers with experience building incredibly intuitive mobile and web applications are also high priority,” said Makani.

Much of KeepTruckin’s tech will eventually power autonomous vehicles to make roads safer, says Makani, something that’s also becoming increasingly relevant as the demand for trucking continues to outpace supply of drivers.

“Level 4 and eventually level 5 autonomy will come to the trucking industry, but we are still many years away from broad deployment,” he said. “Our AI-powered dashcam is making drivers safer and helping prevent accidents today. While the promise of autonomy is real, we are working hard to help companies realize the value of this technology now.”

Powered by WPeMatico

The biggest tech companies have put a lot of time and money into building tools and platforms for their data science teams and those who work with them to glean insights and metrics out of the masses of data that their companies produce: how a company is performing, how a new feature is working, when something is broken, or when something might be selling well (and why) are all things you can figure out if you know how to read the data.

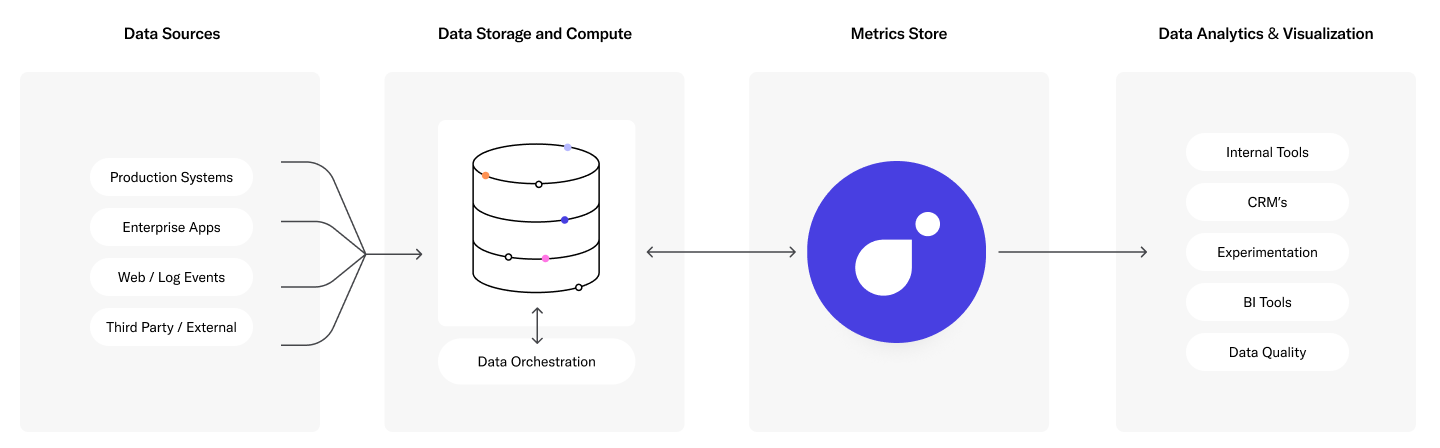

Now, three alums that worked with data in the world of Big Tech have founded a startup that aims to build a “metrics store” so that the rest of the enterprise world — much of which lacks the resources to build tools like this from scratch — can easily use metrics to figure things out like this, too.

Transform, as the startup is called, is coming out of stealth today, and it’s doing so with an impressive amount of early backing — a sign not just of investor confidence in these particular founders, but also the recognition that there is a gap in the market for, as the company describes it, a “single source of truth for business data” that could be usefully filled.

The company is announcing that it has closed, while in stealth, a Series A of $20 million, and an earlier seed round of $4.5 million — both led by Index Ventures and Redpoint Ventures. The seed, the company said, also had dozens of angel investors, with the list including Elad Gil of Color Genomics, Lenny Rachitsky of Airbnb and Cristina Cordova of Notion.

The big breakthrough that Transform has made is that it’s built a metrics engine that a company can apply to its structured data — a tool similar to what Big Tech companies have built for their own use, but that hasn’t really been created (at least until now) for others who are not those Big Tech companies to use, too.

Transform can work with vast troves of data from the warehouse, or data that is being tracked in real time, to generate insights and analytics about different actions around a company’s products. Transform can be used and queried by nontechnical people who still have to deal with data, Handel said.

The impetus for building the product came to Nick Handel, James Mayfield and Paul Yang — respectively Transform’s CEO, COO and software engineer — when they all worked together at Airbnb (previously Mayfield and Yang were also at Facebook together) in a mix of roles that included product management and engineering.

There, they could see firsthand both the promise that data held for helping make decisions around a product, or for measuring how something is used, or to plan future features, but also the demands of harnessing it to work, and getting everyone on the same page to do so.

“There is a growing trend among tech companies to test every single feature, every single iteration of whatever. And so as a part of that, we built this tool [at Airbnb] that basically allowed you to define the various metrics that you wanted to track to understand your experiment,” Handel recalled in an interview. “But you also want to understand so many other things like, how many people are searching for listings in certain areas? How many people are instantly booking those listings? Are they contacting customer service, are they having trust and safety issues?” The tool Airbnb built was Minerva, optimised specifically for the kinds of questions Airbnb might typically have for its own data.

“By locking down all of the definitions for the metrics, you could basically have a data engineering team, a centralized data infrastructure team, do all the calculation for these metrics, and then serve those to the data scientists to then go in and do kind of deeper, more interesting work, because they weren’t bogged down in calculating those metrics over and over,” he continued. This platform evolved within Airbnb. “We were really inspired by some of the early work that we saw happen on this tool.”

The issue is that not every company is built to, well, build tools like these tailored to whatever their own business interests might be.

“There’s a handful of companies who do similar things in the metrics space,” Mayfield said, “really top flight companies like LinkedIn, Airbnb and Uber. They have really started to invest in metrics. But it’s only those companies that can devote teams of eight or 10, engineers, designers who can build those things in house. And I think that was probably, you know, a big part of the impetus for wanting to start this company was to say, not every organization is going to be able to devote eight or 10 engineers to building this metrics tool.”

And the other issue is that metrics have become an increasingly important — maybe the most important — lever for decision making in the world of product design and wider business strategy for a tech (and maybe by default, any) company.

We have moved away from “move fast and break things.” Instead, we now embrace — as Mayfield put it — “If you can’t measure it, you can’t move it.”

Image Credits: Transform (opens in a new window)

Transform is built around three basic priorities, Handel said.

The first of these has to do with collective ownership of metrics: by building a single framework for measuring these and identifying them, their theory is that it’s easier for a company to all get on the same page with using them. The second of these is to use Transform to simply make the work of the data team more efficient and easier, by turning the most repetitive parts of extracting insights into automated scripts that can be used and reused, giving the data team the ability to spend more time analyzing the data rather than just building data sets. And third of all, to provide customers with APIs that they can use to embed the metric-extracting tools into other applications, whether in business intelligence or elsewhere.

The three products it’s introducing today, called Metrics Framework, Metrics Catalog and Metrics API, follow from these principles.

Transform is only really launching publicly today, but Handel said that it’s already working with a small handful of customers (unnamed) in a small beta, enough to be confident that what it’s built works as it was intended. The funding will be used to continue building out the product as well as bring on more talent and hopefully onboard more businesses to using it.

Hopefully might be less a tenuous word than its investors would use, convinced that it’s filling a strong need in the market.

“Transform is filling a critical gap within the industry. Just as we invested in Looker early on for its innovative approach to business intelligence, Transform takes it one step further by providing a powerful yet streamlined single source of truth for metrics,” said Tomasz Tunguz, MD, Redpoint Ventures, in a statement.

“We’ve seen companies across the globe struggle to make sense of endless data sources or turn them into actionable, trusted metrics. We invested in Transform because they’ve developed an elegant solution to this problem that will change how companies think about their data,” added Shardul Shah, a partner at Index Ventures.

Powered by WPeMatico

Databases run the world, but database products are often some of the most mature and venerable software in the modern tech stack. Designers will pixel push, frontend engineers will add clicks to make it more difficult to drop out of a soporific Zoom call, but few companies are ever willing to rip out their database storage engine. Too much risk, and almost no return.

So it’s exceptional when a new database offering breaks through the barriers and redefines the enterprise.

Neo4j, which offers a graph-centric database and related products, announced today that it raised $325 million at a more than $2 billion valuation in a Series F deal led by Eurazeo, with additional capital from Alphabet’s venture wing GV. Eurazeo managing director Nathalie Kornhoff-Brüls will join the company’s board of directors.

That funding makes Neo4j among the most well-funded database companies in history, with a collective fundraise haul of more than half a billion dollars. For comparison, MongoDB, which trades on Nasdaq, raised $311 million in total (according to Crunchbase) before its IPO. Meanwhile, Cockroach Labs of CockroachDB fame has now raised $355 million in funding, including a $160 million round earlier this year at a similar $2 billion valuation.

The past decade has seen a whole new crop of next-generation database models, from scale-out SQL to document to key-value stores to time series and on and on and on. What makes graph databases like Neo4j unique is their focus on the connections between individual data entities. Graph-based data models have become central to modern machine learning and artificial intelligence applications, and are now widely used by data analysts in applications as diverse as marketing to fraud detection.

CEO and co-founder Emil Eifrem said that Neo4j, which was founded back in 2007, has hit its growth stride in recent years given the rising popularity of graph-based analysis. “We have a deep developer community of hundreds of thousands of developers actively building applications with Neo4j in any given month, but we also have a really deep data science community,” he said.

In the past, most business analysis was built on relational databases. Yet, inter-connected complexity is creeping in everywhere, and that’s where Eifrem believes Neo4j has a durable edge. As an example, “any company that ships stuff is tapping into this global fine-grain mesh spanning continent to continent,” he suggested. “All of a sudden the ship captain in the Suez Canal … falls asleep, and then they block the Suez Canal for a week, and then you’ve got to figure out how will this affect my enterprise, how does that cascade across my entire supply chain.” With a graph model, that analysis is a cinch.

Neo4j says that 800 enterprises are customers and 75% of the Fortune 100 are users of the company’s products.

We last checked in with the company in 2020 when it launched 4.0, which offered unlimited scaling. Today, Neo4j comes in a couple of different flavors. It’s a database that can be either self-hosted or purchased as a cloud service offering which it dubs Aura. That’s for the data storage folks. For the data scientists, the company offers Neo4j Graph Data Science Library, a set of comprehensive tools for analyzing graph data. The company offers free (or “community” tiers), affordable starting tiers and full-scale enterprise pricing options depending on needs.

Development continues on the database. This morning at its developers conference, Neo4j demonstrated what it dubbed its “super-scaling technology” on a 200 billion node graph with more than a trillion relationships between them, showing how its tools could offer “real-time” queries on such a large scale.

Unsurprisingly, Eifrem said that the new venture funding will be used to continue doubling down on “product, product, product” but emphasized a few major strategic initiatives as critical for the company. First, he wants to continue to deepen the company’s partnerships with public cloud providers. It already has a deep relationship with Google Cloud (GV was an investor in this round after all), and hopes to continue building relationships with other providers.

It’s also seeing a major uptick in interest from the APAC region. Eifrem said that the company recently opened up an office in Singapore to accelerate its sales in the broader IT market there.

Overall, “We think that graphs can be a significant part of the modern data landscape. In fact, we believe it can be the biggest part of the modern data landscape. And this round, I think, sends a clear signal [that] we’re going for it,” he said.

Erik Nordlander and Tom Hulme of GV were the leads for that firm. In addition, DTCP and Lightrock newly invested and previous investors One Peak, Creandum and Greenbridge Partners joined the round.

Powered by WPeMatico

Companies like Stripe and Twilio have put APIs front and center as an effective way to integrate complex functionality that may not be core to your own technology stack but is a necessary part of your wider business. Today, a company that has taken that model to create an effective way to integrate email, calendars and other tools into other apps using APIs is announcing a big round of funding to expand its business.

Nylas, which describes itself as a communications API platform — enabling more automation particularly in business apps by integrating productivity tools through a few lines of code — has raised $120 million in funding, money that it will be using to continue expanding the kinds of APIs that it offers, with a focus in particular not just on productivity apps, but AI and related tools to bring more automation into workflows.

Nylas is not disclosing its valuation, but this is a very significant step up for the company at a time when it is seeing strong traction.

This is more than double what Nylas had raised up to now ($55 million since being founded in 2015), and when it last raised — a $16 million Series B in 2018 — it said it had “thousands of developers” among its users. Now, that number has ballooned to 80,000, with Nylas processing some 1.2 billion API requests each day, working out to 20 terabytes of data, daily. It also said that revenue growth tripled in the last 12 months.

The Series C is bringing a number of interesting names to Nylas’s cap table. New investor Tiger Global Management is leading the round, with previous backers Citi Ventures, Slack Fund, 8VC and Round13 Capital also participating. Other new backers in this round include Owl Rock Capital, a division of Blue Owl; Stripe co-founders Patrick Collison and John Collison; Klarna CEO Sebastian Siemiatkowski; and Tony Fadell.

As with other companies in the so-called API economy, the gap and opportunity that Nylas has identified is that there are a lot of productivity tools that largely exist in their own silos — meaning when a person wants to use them when working in an application, they have to open a separate application to do so. At the same time, building new, say, tools, or building a bridge to integrate an existing application, can be time-consuming and complex.

Nylas first identified this issue with email. An integration to make it easier to use email and the data housed in it — which works with emails from major providers like Microsoft and Google, as well as other services built with the IMAP protocol — in other apps picked up a lot of followers, leading the company to expand into other areas that today include scheduling and calendaring, a neural API to build in tools like sentiment analysis or productivity or workflow automation; and security integrations to streamline the Google OAuth security review process (used for example in an app geared at developers).

“The fundamental shift towards digital communications and connectivity has resulted in companies across all industries increasingly leaning on developers to solve critical business challenges and build unique and engaging products and experiences. As a result, APIs have become core to modern software development and digital transformation,” Gleb Polyakov, co-founder and CEO of Nylas, said in statement.

“Through our suite of powerful APIs, we’re arming developers with the tools and applications needed to meet customer and market needs faster, create competitive differentiation through powerful and customized user experiences, and generate operational ROI through more productive and intelligently automated processes and development cycles. We’re thrilled to continue advancing our mission to make the world more productive and are honored to have the backing of distinguished investors and entrepreneurs.”

Indeed, the rise of Nylas and the function it fulfills is part of a bigger shift we’ve seen in businesses overall: as organizations become more digitized and use more cloud-based apps to get work done, developers have emerged as key mechanics to help that machine run. A bigger emphasis on APIs to integrate services together is part of their much-used toolkit, one of the defining reasons for investors backing Nylas today.

“Companies are rapidly adopting APIs as a way to automate productivity and find new and innovative ways to support modern work and collaboration,” said John Curtius, a partner at Tiger, in a statement. “This trend has become critical to creating frictionless and meaningful data-driven communications that power digital transformation. We believe Nylas is uniquely positioned to lead the future of the API economy.” Curtius is joining the board with this round.

Corrected to note that Blue Owl is not connected to State Farm.

Powered by WPeMatico

Online job listings were one of the first things to catch on in the first generation of the internet. But that has, ironically, also meant that some of the most-used digital recruitment services around today are also some of the least evolved in terms of tapping into all of the developments that tech has to offer, leaving the door open for some disruption. Today, one of the startups doing just that is announcing a big round of funding to double down on its growth so far.

Beamery, which has built what it describes as a “talent operating system” — a way to manage sourcing, hiring and retaining of people, plus analyzing the bigger talent picture for an organization, a “talent graph” as Beamery calls it, in an all-in-one, end-to-end service — has raised $138 million, money that it plans to use to continue building out more technology, as well as growing its business, which has been expanding quickly and saw 337% revenue growth year over year in Q4.

The Ontario Teachers’ Pension Plan Board (Ontario Teachers’), a prolific tech investor, is leading the round by way of its Teachers’ Innovation Platform (TIP). Other participants in this Series C include several strategic backers who are also using Beamery: Accenture Ventures, EQT Ventures, Index Ventures, M12 (Microsoft’s venture arm) and Workday Ventures (the venture arm of the HR software giant).

Abakar Saidov, co-founder and CEO at London-based Beamery, told TechCrunch in an interview that it is not disclosing valuation, but sources in the know say it’s in the region of $800 million.

The round is coming on the heels of a very strong year for the company.

The “normal” way of doing things in the working world was massively upended with the rise of COVID-19 in early 2020, and within that, recruitment was among one of the most impacted areas. Not only were people applying and interviewing for jobs completely remotely, but in many cases they were getting hired, onboarded and engaged into new jobs without a single face-to-face interaction with a recruiter, manager or colleague.

And that’s before you consider the new set of constraints that HR teams were under in many places: variously, we saw hiring freezes, furloughs, layoffs and budget cuts (often more than one of these per business), and yet work still needed to get done.

All that really paved the way for platforms like Beamery’s — designed not only to be remote-friendly software-as-a-service running in the cloud, but to handle the whole recruiting and talent management process from a single place — to pick up new customers and prove its role as an updated, more user-friendly approach to the task of sourcing and placing talent.

“Traditional HR is very admin-heavy, and when you add in payroll and benefits, the systems that exist are very siloed,” said Saidov in the interview. “The innovation for us has been to move out of that construct and into something that is human, and has a human touch. From a data perspective, we’re creating the underlying system of record for all of the people touching a business. So when you build on top of that, everything looks like a consumer application.”

In the last 12 months, the company said that customers — which are in the area of large enterprises and include COVID vaccine maker AstraZeneca, Autodesk, Nasdaq, several major tech giants and strategic investor Workday — filled 1 million roles through its platform, a figure that includes not just sourcing and placing candidates from outside of an organization’s walls, but also filling roles internally.

The work that Beamery is doing is definitely helping the business not just pull its weight — its last round was a much more modest $28 million, which was raised way back in 2018 — but grow and invest in new services.

The company said it had a year-on-year increase of 462% in jobs posted across its customer base. A year before that (which would have extended into pre-pandemic 2019), the number of candidates pipelined increased by a mere 46%, pointing to acceleration.

Beamery today already offers a pretty wide range of different services.

They include tools to source candidates. This can be done organically by creating your own job boards to be found by anyone curious enough to look, and by leveraging other job boards on other platforms like LinkedIn, the Microsoft-owned professional networking platform that counts “Talent Solutions” — i.e. recruitment — as one of its primary business lines. (Recall Microsoft is one of Beamery’s backers.) It also provides tools to create and manage online recruitment events.

Beamery also offers tools to help people get the word out about a role, with a service akin to programmatic advertising (similar to ZipRecruiter) to populate other job boards, or run more targeted executive recruitment searches. It also provides a way for HR teams to create internal recruitment processes, and also run surveys with existing teams to get a better picture of the state of play.

And it has some analytics tools in place to measure how well recruitment drives, retention and other metrics are evolving to help plan what to do in the future.

The big question for me now is how and if Beamery will bring more into that universe. There have been some interesting startups emerging in the wider world of talent IT (if we could call it that) that could be interesting complements to what Beamery already has, or provide a roadmap for what it might try to build itself.

It includes much more extensive work on internal job boards (such as what Gloat has built); digging much deeper into building accurate pictures of who is at the company and what they do (see: ChartHop); or the many services that are building ways of sourcing and connecting with contractors, which are a huge, and growing, part of the talent equation for companies (see: Turing, Remote, Deel, Papaya Global, Lattice, Factorial and many others).

Beamery already includes contractors alongside full- and part-time roles that can be filled using its platform, but when it comes to managing those contractors, that’s something that Beamery does not do itself, so that could be one area where it might grow, too.

“The key reason enterprises work with us it to consolidate a bunch of workflows,” Saidov said. “HR hates having different systems and everything becomes easier when things interoperate well.” Employing contractors typically involves three elements: sourcing, management and scheduling, so Beamery will likely approach how it grows in that area by determining which piece might be “super core” the centralization of more data, he added.

Another two likely areas he hinted are on Beamery’s roadmap are assessments — that is, providing tools to recruiters who want to measure the skills of applicants for jobs (another startup-heavy area today) — and tools to help recruiters do their jobs better, whether that involves more native communications tools in video and messaging, as well as Gong-like coaching to help them measure and improve screening and interviewing.

It might also consider developing a version for smaller businesses to use.

Questions investors are happy to see considered, it seems, as they invest in what looks like a winner in the bigger race. TIP’s other investments have included ComplyAdvantage, Epic Games, Graphcore, KRY and SpaceX, a long run in a wide field.

“Leading companies worldwide are prioritising recruitment and retention. They are turning to Beamery for a best-in-class talent solution that can be seamlessly integrated with their business,” said Maggie Fanari, MD for TIP in Emea. “Beamery’s best-in-class approach is already recognized by top-tier companies. I’m excited by the company’s vision of to use technology to support long-term talent growth and build better businesses. Beamery is the first company to bring predictive marketing and data science into recruitment. They are a truly innovative company, building a vision that can shape the future of work — the company fits all the criteria we look for in a TIP investment and more.”

Powered by WPeMatico

As the insurance industry adjusts to life in the 21st century (heh), an AI startup that has built computer vision tools to enable remote damage appraisals is announcing a significant round of growth funding.

Tractable, which works with automotive insurance companies to let users take and submit photos of damaged cars that are then “read” to make appraisals, has raised $60 million, a Series D that values Tractable at $1 billion, the company said.

Tractable says it works with more than 20 of the top 100 auto insurers in the world, and it has seen sales grow 600% in the last 24 months, which CEO Alex Dalyac told me translates as “well into eight figures of annual revenue.” He also told me that “we would have grown even faster if it weren’t for COVID.” People staying at home meant far fewer people on the roads, and fewer accidents.

Its business today is based mostly around car accident recovery — where users can take pictures using ordinary smartphone cameras, uploading pictures via a mobile web site (not typically an app).

But Tractable’s plan is to use some of the funding to expand deeper into areas adjacent to that: natural disaster recovery (specifically for appraising property damage), and used car appraisals. It will also use the investment to continue building out its technology, specifically to help build out better, AI-based techniques of processing and parsing pictures that are taken on smartphones — by their nature small in size.

Insight Partners and Georgian Partners co-led the round and it brings the total raised by the company to $115 million.

Dalyac, a deep learning researcher by training who co-founded the company with Razvan Ranca and Adrien Cohen, said that the “opportunity” (if you could call an accident that) Tractable has identified and built to fix is that it’s generally time-consuming and stressful to deal with an insurance company when you are also coping with a problem with your car.

And while a new generation of “insurtech” startups have emerged in recent years that are bringing more modern processes into the equation, typically the incumbent major insurance companies — the ones that Tractable targets — have lacked the technology to improve that process.

It’s not unlike the tension between fintech-fuelled neobanks and the incumbent banks, which are now scrambling to invest in more technology to catch up with the times.

“Getting into an accident can be anything from a hassle to trauma,” Dalyac said. “It can be devastating, and then the process for recovery is pretty damn slow. You’re dealing with so many touch points with your insurance, so many people that need to come and check things out again. It’s hard to keep track and know when things will truly be back to normal. Our belief is that that whole process can be 10 times faster, thanks to the breakthroughs in image classification.”

That process currently also extends not just to taking pictures for claims, but also to help figure out when a car is beyond repair, in which case which parts can be recycled and reused elsewhere, also using Tractable’s computer vision technology. Dalyac noted that this was a popular enough service in the last year that the company helped recycle as many cars “as Tesla sold in 2019.”

Customers that have integrated with Tractable to date include Geico in the U.S., as well as a large swathe of insurers in Japan, specifically Tokio Marine Nichido, Mitsui Sumitomo, Aioi Nissay Dowa and Sompo. Covéa, the largest auto insurer in France, is also a customer, as is Admiral Seguros, the Spanish entity of U.K.’s Admiral Group, as well as Ageas, a top U.K. insurer.

Japan is the company’s biggest market today Dalyac said — the reason being that it has an aging population, but one that is also very strong on mobile usage: combining those two, “automation is more than a value add; it’s a must have,” Dalyac said. He also added that he thinks the U.S. will overtake Japan as Tractable’s biggest market soon.

The new directions into property and other car applications will also open the door to a wider set of use cases beyond working with insurance providers over time. It will also bring Tractable potentially into new competitive environments. There are other companies that have also identified this opportunity.

For example, Hover, which has built a way to create 3D imagery of homes using ordinary smartphone cameras, is also eyeing ways of selling its tech (originally developed to help make estimates on home repairs) to insurance companies.

For now, however, it sounds like the opportunity is a big enough one that the race is more to meet demand than it is to beat competitors to do so.

“Tractable’s accelerating growth at scale is a testament to the power and differentiation of their applied machine learning system, which continues to improve as more businesses adopt it,” said Lonne Jaffe, MD at Insight Partners and Tractable board member, in a statement. “We’re excited to double down on our partnership with Tractable as they work to help the world recover faster from accidents and disasters that affect hundreds of millions of lives.”

Emily Walsh, partner at Georgian Partners added: “Tractable’s industry-leading computer vision capabilities are continuing to fuel incredible customer ROI and growth for the firm. We’re excited to continue to partner with Tractable as they apply their artificial intelligence capabilities to new, multi-billion dollar market opportunities in the used vehicle and natural disaster recovery industries.”

Powered by WPeMatico

Vianai Systems, an AI startup founded by Vishal Sikka, former chief executive of Indian IT services giant Infosys, said on Wednesday it has raised $140 million in a round led by SoftBank Vision Fund 2.

The two-year-old startup said a number of industry luminaries also participated in the new round, which brings its total to-date raise to at least $190 million. The startup raised $50 million in its seed financing round, but there’s no word on the size of its Series A round.

Details about what exactly the Palo Alto-headquartered startup does is unclear. In a press statement, Dr. Vishal Sikka said the startup is building a “better AI platform, one that puts human judgment at the center of systems that bring vast AI capabilities to amplify human potential.” Sikka, 54, resigned from the top role at Infosys in 2017 after months of acrimony between the board and a cohort of founders.

“Vianai helps its customers amplify the transformation potential within their organizations using a variety of advanced AI and ML tools with a distinct approach in how it thoughtfully brings together humans with technology. This human-centered approach differentiates Vianai from other platform and product companies and enables its customers to fulfill AI’s true promise,” the startup said.

The startup claims it has already amassed as its customers many of the world’s largest and most respected businesses, including insurance giant Munich Re.

Its investors include Jim Davidson (co-founder of Silver Lake), Henry Kravis and George Roberts (co-founders of KKR), and Jerry Yang (founding partner of AME and co-founder of Yahoo). Dr. Fei-Fei Li (co-director of the Stanford Institute for Human-Centered AI) has joined Vianai Systems’ advisory board.

“With the AI revolution underway, we believe Vianai’s human-centered AI platform and products provide global enterprises with operational and customer intelligence to make better business decisions,” said Deep Nishar, senior managing partner at SoftBank Investment Advisers, in a statement. “We are pleased to partner with Dr. Sikka and the Vianai team to support their ambition to fulfill AI’s promise to drive fundamental digital transformations.”

Powered by WPeMatico

By its nature, sales is one of the most social faces of a business, so it’s no surprise that there are tools being built for sales teams that are tapping into some of the most interesting dynamics of the world of social networking, and that the startups that are doing this most successfully are making a killing.

In the latest example, a startup out of Canada called Introhive — which has built an AI engine that ingests huge amounts of data from across disparate applications to help companies (and specifically anyone in their organization that is selling to someone) to build better “relationship graphs” for target organizations — is announcing $100 million in funding.

Growth equity firm PSG is leading the round, with The Business Development Bank of Canada (BDC), Evergreen Capital and Mavan Capital Partners also participating.

The company is not disclosing valuation but CEO and co-founder Jody Glidden tells me the company is doing well. It has raised about $150 million to date and is doubling revenues every year for the last several with a platform used by large enterprises — PwC, Colliers International, Wilson Sonsini Goodrich & Rosati, Plante Moran and Clark Nexsen are a few of them. Typical deployments range between 10,000 and 100,000 seats — it’s not just people with “sales” in their job titles using Introhive — and customer retention is currently at 95%.

The idea for Introhive came as many do to enterprise startup founders: they identify something that doesn’t quite work as they want it to, and then start a new company to try to fix it. In the case of Glidden, he and Stewart Walchli were at RIM (the old parent of BlackBerry), which had acquired a previous startup of theirs called Chalk Media.

Although they had just joined a much bigger company (it was 2008, and BlackBerry was still far from being completely killed off by Google and Apple) Glidden said he was surprised to see how hard it was to tap its vast troves of information to find prospective sales leads.

“We realized there were a whole lot of problems with sales people at RIM not able to hit their revenue numbers,” he recalled, and so they started asking themselves some questions. “Are they bringing in right lead data? Are they able to be as intelligent as they can be?” It took some years — four, exactly — and perhaps the rise of Facebook and its focus on the “social graph,” for them to land on how to articulate the problem. They needed to “unlock relationship graph in CRM,” Glidden said.

And Introhive was the company that they formed in 2012 to address that. The company not only provides a way to better leverage CRM-related data to find the best targets for particular products or services, but it also provides analytics to the team to measure how people are doing, and over time also helps predict “winnability”.

But that was not immediate: It took several years to build out its AI platform, Glidden said, with a lot of trial and error to ensure that the data that Introhive ingested was structured correctly to match up with other information to yield productive information.

“We ran into big problems in the first years because there were so many potential systems to tap into, homegrown or otherwise, for certain info. We effectively spent a lot of time building our own version of MuleSoft to fix that,” he said with a laugh. “But since it’s also something we use for our customers we ended up employing hundreds of engineers to build this underpinning layer to understand it all.”

As a result, it took between four and five years for Introhive to make its own first sale, and in the process the whole company almost went under, he recalled. “It took a long time to get that engine running because if you are automating data that is wrong 35% of the time, you won’t keep your customers.”

The machine is more well-oiled today, of course, and is on a roll to bring in more functions to work off the data trove that it has built.

There is something about the service that reminds me a bit of LinkedIn or ZoomInfo — which you may use in your own work, or come across when Googling someone online for some reason (hey — I’m not asking why here) — for providing some kind of data base/org chart of people connected to a business. But to be very clear, the data that Introhive builds for a customer stays with that customer, and doesn’t go anywhere else.

Glidden says that there are no plans to build any kind of “freemium” version of the service, or one that anyone can tap as a SaaS, but rather to remain focused on helping larger enterprises make better sense of their data and how it can better inform the wider concept of sales.

That in itself raises an interesting point about Introhive and business in general. When you consider a company like PwC, there are likely many people who specifically might hold a job title with the word “sales” in it, but just as many whose jobs are predicated on closing deals, consultants and partners for example, who do not, but might just as easily benefit from having better visibility of a “relationship graph” of people connected to buying products at a business they are working with, or want to work with. Sales is more than just about salespeople for many organizations.

And for that reason, you can guess that one interesting aspect of Introhive is if it might evolve these tools over time to tackle other parts of an organization and how it works. Similar to the social graphs of social media, which map out how people can be connected to one another, relationship graphs in the workplace potentially resonate well beyond signing a deal, too. Business intelligence and marketing automation are already in the mix for the company.

“Introhive is on the forefront of helping grow sales and customers through its visionary, AI-powered revenue acceleration platform built for companies of all sizes and complexity. It seamlessly improves business operations across multiple departments by helping teams reduce time on manual inputs and giving them advanced insights on where they can generate more revenue, build more relationships and easily identify what great sales reps are doing that average reps aren’t,” said PSG managing director, Rick Essex. “The team’s acumen and highly capital-efficient model has set the company on a clear path for growth, and we’re proud to partner with them on this journey.”

Powered by WPeMatico

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the world’s second-largest internet market.

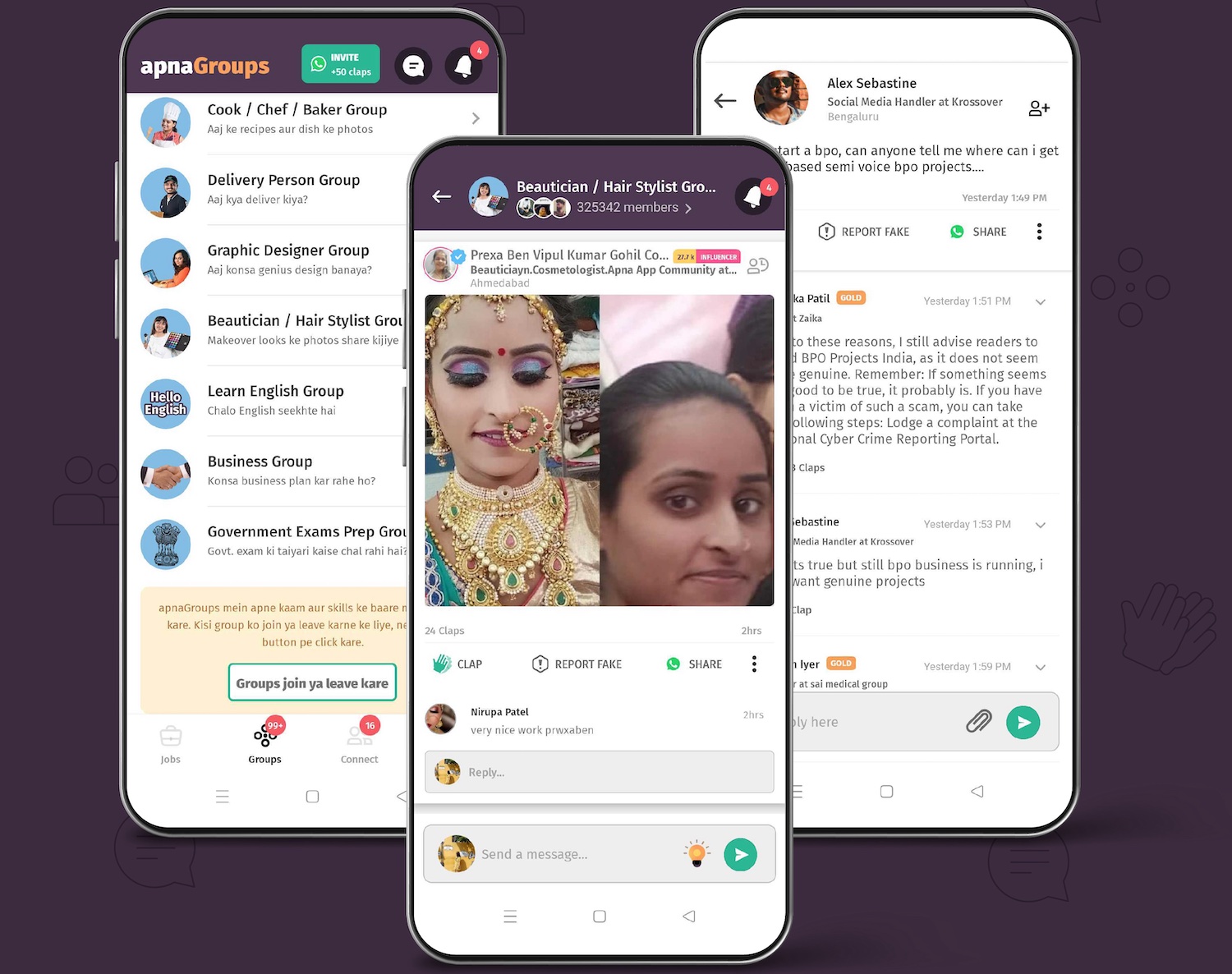

Apna, a startup by an Apple alum, is helping millions of such blue and gray-collar workers upskill themselves, find communities and land jobs. On Wednesday it announced its acceptance by the market has helped it raise $70 million in a new financing round as the startup prepares to scale the 16-month-old app across India.

Insight Partners and Tiger Global co-led Apna’s $70 million Series B round, which valued the startup at $570 million. Existing investors Lightspeed India, Sequoia Capital India, Greenoaks Capital and Rocketship VC also participated in the round, which brings Apna’s to-date raise to over $90 million.

The startup, whose name is inspired from a 2019 Bollywood song, at its core is solving the network gap issue for workers. “Someone born in a privileged family goes to the best school, best college and makes acquaintance with influential people. Many born just a few kilometres away are dealt with a whole different kind of life and never see such opportunities,” said Nirmit Parikh, founder and chief executive of Apna, in an interview with TechCrunch.

Apna is building a scalable networking infrastructure, something that doesn’t currently exist in the market, so that these workers can connect to the right employers and secure jobs. “Apna’s focus on digitizing the process of job discovery, application and employer candidate interaction has the potential to revolutionize the hiring process,” said Griffin Schroeder, a partner at Tiger Global, in a statement.

The workers in India “already have a champion in them, we are just helping them find opportunities,” said Nirmit Parikh, founder and chief executive of Apna. (Apna)

The startup’s eponymous Android app, available in multiple languages, features more than 70 communities today for skilled professionals such as carpenters, painters, field sales agents and many others.

On the app, users connect to each other and help with leads and share tips to improve at their jobs. The app also offers people the opportunity to upskill themselves, practice with their interview performance, and become eligible for even more jobs. The startup said it’s building Masterclass-like skilling modules, outcome or job based skilling, and also enabling peer-to-peer learning via its vertical communities. It plans to launch career counselling and resume building feature.

And that bet is working. The startup has amassed over 10 million users and just last month it facilitated more than 15 million job interviews, said Parikh. All jobs listed on the Apna platform are verified by the startup and free of cost for the candidates.

Apna has partnered with some of India’s leading public and private organizations and is providing support to the Ministry of Minority Affairs of India, National Skill Development Corporation and UNICEF YuWaah to provide better skilling and job opportunities to candidates.

Apna app (Apna)

More than 100,000 recruiters — including Byju’s, Unacademy, Flipkart, Zomato, Licious, Burger King, Dunzo, Bharti-AXA, Delhivery, Teamlease, G4S Global and Shadowfax — in the country today use Apna’s platform, where they have to spend less than five minutes to post job posts and are connect to hyperlocal candidates with relevant skills in within two days.

Apna has built the “market leading platform for India’s workforce to establish digital professional identity, network, access skills training, and find high quality jobs,” said Nikhil Sachdev, managing director, Insight Partners, in a statement.

“Employers are engaging with Apna at a rapid pace to help find high quality talent with low friction which is leading to best in class customer satisfaction scores. We believe that our investment will enable Apna to continue their steep growth trajectory, scale up their operations, and improve access to opportunities for India’s workforce.”

The startup plans to deploy the fresh capital to scale across India and eventually take the app to international markets, said Parikh. Apna, which has recently seen high-profile individuals from firms such as Uber, BCG and Swiggy join the firm, is also actively hiring for several tech roles in the South Asian market.

Apna has built the infrastructure and brand awareness in the market that it can launch in a new city within two days and drive over 10,000 interviews there in less than two days, it said.

“Our first goal is to restart India’s economy in the next couple of months and do whatever we can to help,” said Parikh, who was part of the iPhone product-operations team at Apple.

Powered by WPeMatico