Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

How big is the market in India for a neobank aimed at teenagers? Scores of high-profile investors are backing a startup to find out.

Bangalore-based FamPay said on Wednesday it has raised $38 million in its Series A round led by Elevation Capital. General Catalyst, Rocketship VC, Greenoaks Capital and existing investors Sequoia Capital India, Y Combinator, Global Founders Capital and Venture Highway also participated in the new round, which brings FamPay’s to-date raise to $42.7 million.

TechCrunch reported early this month that FamPay was in talks with Elevation Capital to raise a new round.

Founded by Sambhav Jain and Kush Taneja (pictured above) — both of whom graduated from Indian Institute of Technology, Roorkee in 2019 — FamPay enables teenagers to make online and offline payments.

The thesis behind the startup, said Jain in an interview with TechCrunch, is to provide financial literacy to teenagers, who additionally have limited options to open a bank account in India at a young age. Through gamification, the startup said it’s making lessons about money fun for youngsters.

Unlike in the U.S., where it’s common for teenagers to get jobs at restaurants and other places and understand how to handle money at a young age, a similar tradition doesn’t exist in India.

After gathering the consent from parents, FamPay provides teenagers with an app to make online purchases, as well as plastic cards — the only numberless card of its kind in the country — for offline transactions. Parents credit money to their children’s FamPay accounts and get to keep track of high-ticket spendings.

In other markets, including the U.S., a number of startups including Greenlight, Step and Till Financial are chasing to serve the teenagers, but in India, there currently is no startup looking to solve the financial access problem for teenagers, said Mridul Arora, a partner at Elevation Capital, in an interview with TechCrunch.

It could prove to be a good issue to solve — India has the largest adolescent population in the world.

“If you’re able to serve them at a young age, over a course of time, you stand to become their go-to product for a lot of things,” Arora said. “FamPay is serving a population that is very attractive and at the same time underserved.”

The current offerings of FamPay are just the beginning, said Jain. Eventually the startup wishes to provide a range of services and serve as a neobank for youngsters to retain them with the platform forever, he said, though he didn’t wish to share currently what those services might be.

Image Credits: FamPay

Teens represent the “most tech-savvy generation, as they haven’t seen a world without the internet,” he said. “They adapt to technology faster than any other target audience and their first exposure with the internet comes from the likes of Instagram and Netflix. This leads to higher expectations from the products that they prefer to use. We are unique in approaching banking from a whole new lens with our recipe of community and gamification to match the Gen Z vibe.”

“I don’t look at FamPay just as a payments service. If the team is able to execute this, FamPay can become a very powerful gateway product to teenagers in India and their financial life. It can become a neobank, and it also has the opportunity to do something around social, community and commerce,” said Arora.

During their college life, Jain and Taneja collaborated and built an app and worked at a number of startups, including social network ShareChat, logistics firm Rivigo and video streaming service Hotstar. Jain said their work with startups in the early days paved the idea to explore a future in this ecosystem.

Prior to arriving at FamPay, Jain said the duo had thought about several more ideas for a startup. The early days of FamPay were uniquely challenging to the founders, who had to convince their parents about their decision to do a startup rather than joining firms or startups as had most of their peers from college. Until being selected by Y Combinator, Jain said he didn’t even fully understand a cap table and dilutions.

He credited entrepreneurs such as Kunal Shah (founder of CRED) and Amrish Rau (CEO of Pine Labs) for being generous with their time and guidance. They also wrote some of the earliest checks to the startup.

The startup, which has amassed over 2 million registered users, plans to deploy the fresh capital to expand its user base and product offerings, and hire engineers. It is also looking for people to join its leadership team, said Jain.

Powered by WPeMatico

Location-based services may have had their day as a salient category for hot apps or innovative tech leveraging the arrival of smartphones, but that’s largely because they are now part of the unspoken fabric of how we interact with digital services every day: We rely on location-specific information when we are on search engines, when we are using maps or weather apps, when we are taking and posting photos and more.

Still, there remain a lot of gaps in how location information links up with accurate information, and so today a company that’s made it its business to address that is announcing some funding as it scales up its service.

Uberall, which works with retailers and other brick-and-mortar operators to help them update and provide more accurate information about themselves across the plethora of apps and other services that consumers use to discover them, is announcing $115 million in funding. Alongside that, the Berlin startup is making an acquisition: it’s buying MomentFeed, a location marketing company based out of Los Angeles, to continue scaling its business.

The funding is being led by London-based investor Bregal Milestone, with Level Equity, United Internet and Uberall management also participating. From what we understand from sources, the funding values Uberall at around $500 million, and the deal for MomentFeed was made for between $50 million and $60 million.

The business combination is building way more scale into the platform: Uberall said that together they will manage the online presence for 1.35 million business locations, making the company the biggest in the field, with customers including the gas station operator BP, KFC, clothes and food chain Marks and Spencer, McDonald’s and Pizza Hut.

Florian Hübner, the CEO and co-founder of Uberall, noted in an interview that the companies have quite a lot of overlap, and in fact prior to the deal being made the companies worked together closely in the U.S. market, but all the same, MomentFeed has built some specific technology that will enrich the wider platform, such as a particularly strong tool for measuring sentiment analysis.

“Managing the online presence” is not a company’s website, nor is it its apps, but may nevertheless be its most common digital touchpoints when it comes to actually engaging with consumers online. It includes how those companies appear on local listings services like Yelp or TripAdvisor, or mapping apps like Google’s — which provide not just listings information like addresses and opening hours but also customer reviews — or social apps or location-based advertising. Altogether, when you are considering a company with multiple locations and the multiple touchpoints a consumer might use, it ends up being a complicated mess of places that need to be managed and kept up to date.

“We are the catalyst for this huge ecosystem where we enable the brands to use everything that the other tech platforms are offering in the best possible way,” Hübner told me. The tech platforms, meanwhile, are willing to work with middleware companies like Uberall to make the information on their services more accurate and complete by connecting with businesses when they have not managed to do so directly on their own. (And if you’ve ever been caught out by the wrong opening times on a Google Maps entry, or any other entry or piece of information elsewhere, you know this is an issue.)

And of course expecting any company with potentially hundreds of locations to provide the right details without a tool is also a nonstarter. “Casually updating 100,000 profiles is super hard,” Hübner said.

It also provides services to update information about vaccine and COVID-19 testing clinics, as well as other essential services that also have to contend with the same variations in location, opening hours and customer feedback as any other business on a site like Google Maps.

Altogether, Uberall has built out a platform that essentially connects up all of those end points, so that an Uberall customer can use a dashboard to provide updates that populate automatically everywhere, and also to read and respond to reviews.

Conversely, Uberall also can look out for instances where a company is being unofficially represented, or misrepresented, and locks those down. Alongside those, it has built a location-based marketing service that also serves ads for its customers. It is somewhat akin to social media management tools, which let you manage social media accounts and social media marketing campaigns, except that it’s covering a much more fragmented and disparate set of places where a company might appear online.

The bigger picture here is that just as location-based marketing is a fragmented business, so is the business of providing services to manage it. This move reduces down that field a little more and improves the efficiency of scaling such services.

“As we saw the market trending towards consolidation, we considered several potential companies to merge with. Uberall was by far our most preferred,” said MomentFeed CEO Nick Hedges in a statement. “This combination makes enormous strategic sense for our customers, who represent the who’s-who of leading U.S. omni channel brands. It helps accelerate our already rapid pace of innovation, giving customers an even greater edge in the hyper-competitive world of ’Near Me’ Marketing.” After the deal closes, Hedges will become Uberall’s chief strategy officer and EVP for North America.

“We are thrilled to partner with the Uberall team for this next phase of growth. Our strategic investment will significantly accelerate Uberall’s ambition to become the leading ‘Near Me’ Customer Experience platform worldwide. Uberall’s differentiated full-suite solution is unsurpassed by competition in terms of integration and functionality, providing customers with a real edge to reach, interact with, and convert online customers. We look forward to supporting Florian, Nick and their talented team to deliver on their exciting innovation and expansion roadmap,” said Cyrus Shey, managing partner of Bregal Milestone, in a statement.

Powered by WPeMatico

Sunlight is a great source of energy, but it rarely gets hot enough to fry an egg, let alone melt steel. Heliogen aims to change that with its high-tech concentrated solar technique, and has raised more than a hundred million dollars to test its 1,000-degree solar furnace at a few participating mines and refineries.

We covered Heliogen when it made its debut in 2019, and the details in that article still get at the core of the company’s tech. Computer vision techniques are used to carefully control a large set of mirrors, which reflect and concentrate the sun’s light to the extent that it can reach in excess of 1,000 degrees Celsius, almost twice what previous solar concentrators could do. “It’s like a death ray,” founder Bill Gross explained then.

That lets the system replace fossil fuels and other legacy systems in many applications where such temperatures are required, for example mining and smelting operations. By using a Heliogen concentrator, they could run on sunlight during much of the day and only rely on other sources at night, potentially halving their fuel expenditure and consequently both saving money and stepping toward a greener future.

Both goals hint at why utilities and a major mining and steel-making company are now investors. Heliogen raised a $25 million A-2, led by Prime Movers Lab, but soon also pulled together a much larger “bridge extension round” in their terminology of $83 million that brought in the miner ArcelorMittal, Edison International, Ocgrow Ventures, A.T. Gekko and more.

The money will be used both to continue development of the “Sunlight Refinery,” as Heliogen calls it, and deploy some actual on-site installations that would work in real production workflows at scale. “We are constantly making design and cost improvements to increase efficiency and decrease costs,” a representative of the company told me.

One of those pilot sites will be in Boron, California, where Rio Tinto operates a borates mine and will include Heliogen’s tech as part of its usual on-site processes, according to an MOU signed in March. Another MOU with ArcelorMittal will “evaluate the potential of Heliogen’s products in several of ArcelorMittal’s steel plants.” Facilities are planned in the U.S., MENA and Asia Pacific areas.

Beyond mining and smelting, the technique could be used to generate hydrogen in a zero-carbon way. That would be a big step toward building a working hydrogen infrastructure for next-generation fuel supply, since current methods make it difficult to do without relying on fossil fuels in the first place. And no doubt there are other industrial processes that could benefit from a free and zero-carbon source of high heat.

“We’re being granted the resources to do more projects that address the most carbon-intensive human activities and work toward our goals of lowering the price and emissions of energy for everyone on the planet,” Gross said in a release announcing the round(s). “We thank all of our investors for enabling us to pursue our mission and offer the world technology that will allow it to achieve a post-carbon economy.”

Powered by WPeMatico

Carro, one of the largest automotive marketplaces in Southeast Asia, announced it has hit unicorn valuation after raising a $360 million Series C led by SoftBank Vision Fund 2. Other participants include insurance giant MSIG and Indonesian-based funds like EV Growth, Provident Growth and Indies Capital. About 90% of vehicles sold through Carro are secondhand, and it offers services that cover the entire lifecycle of a car, from maintenance to when it is broken down and recycled for parts.

Founded in 2015, Carro started as an online marketplace for cars, before expanding into more verticals. Co-founder and chief executive officer Aaron Tan told TechCrunch that, roughly speaking, the company’s operations are divided into three sections: wholesale, retail and fintech. Its wholesale business works with car dealers who want to purchase inventory, while its retail side sells to consumers. Its fintech operation offers products for both, including B2C car loans, auto insurance and B2B working capital loans.

Carro’s last funding announcement was in August 2019, when it said it had extended its Series B to $90 million. The company’s latest funding will be used to fund acquisitions, expand its financial services portfolio and develop its AI capabilities, which Carro uses to showcase cars online, develop pricing models and determine how much to charge insurance policyholders.

It also plans to expand retail services in its main markets: Indonesia, Thailand, Malaysia and Singapore. Carro currently employs about 1,000 people across the four countries and claims its revenue grew more than 2.5x during the financial year ending March 2021.

The COVID-19 pandemic helped Carro’s business because people wanted their own vehicles to avoid public transportation and became more receptive to shopping for cars online. Those factors also helped competitors like OLX Autos and Carsome fare well during the pandemic.

The adoption of electric vehicles across Southeast Asia has resulted in a new tailwind for Carro, because people who buy an EV usually want to sell off their combustion engine vehicles. Carro is currently talking to some of the largest electric vehicle countries in the world that want to launch in Southeast Asia.

“For every car someone typically buys in Southeast Asia, there’s always a trade-in. Where do cars go, right? We are a marketplace, but on a very high level, what we’re doing is reusing and recycling. That’s a big part in the environmental sustainability of the business, and something that sets us apart of other players in the region,” Tan said.

Cars typically stay in Carro’s inventory for less than 60 days. Its platform uses computer vision and sound technology to replicate the experience of inspecting a vehicle in-person. When someone clicks on a Carro listing, an AI bot automatically engages with them, providing more details about the cost of the car and answering questions. They also see a 360-degree view of the vehicle, its interior and can virtually start the engine to see how it sounds. Listings also provide information about defects and inspection reports.

Since many customers still want to get an in-person look before finalizing a purchase, Carro recently launched a beta product called Showroom Anywhere. Currently available in Singapore, it allows people to unlock Carro cars parked throughout the city, using QR codes, so they can inspect it at any time of the day, without a salesperson around. The company plans to add test driving to Showroom Anywhere.

“As a tech company, our job is to make sure we automate everything we can,” said Tan. “That’s the goal of the company and you can only assume that our cost structure and our revenue structure will get better along the years. We expect greater margin improvement and a lot more in cost reduction.”

Pricing is fixed, so shoppers don’t have to engage in haggling. Carro determines prices by using machine-learning models that look at details about a vehicle, including its make, model and mileage, and data from Carro’s transactions as well as market information (for example, how much of a particular vehicle is currently available for sale). Carro’s prices are typically in the middle of the market’s range.

Cars come with a three or seven-day moneyback guarantee and 30-day warranty. Once a customer decides to buy a car, they can opt to apply for loans and insurance through Carro’s fintech platform. Tan said Carro’s loan book is about five years old, almost as old as the startup itself, and is currently about $200 million.

Carro’s insurance is priced based on the policyholders driving behavior as tracked by sensors placed in their cars. This allows Carro to build a profile of how someone drives and the likelihood that they have an accident or other incident. For example, someone will get better pricing if they typically stick to speed limits.

“It sounds a bit futuristic,” said Tan. “But it’s something that’s been done in the United States for many years, like GEICO and a whole bunch of other insurers,” including Root Insurance, which recently went public.

Tan said MSIG’s investment in Carro is a “statement that we are really trying to triple down in insurance, because an insurer has so much linkage with what we do. The reason that MSIG is a good partner is that, like ourselves, they believe a lot in data and the difference in what we call ‘new age’ insurance, or data-driven insurance.”

Carro is also expanding its after-sale services, including Carro Care, in all four of its markets. Its after-sale services reach to the very end of a vehicle’s lifecycle and its customers include workshops around the world. For example, if a Toyota Corolla breaks down in Singapore, but its engine is still usable, it might be extracted and shipped to a repair shop in Nairobi, and the rest of its parts recycled.

“One thing I always ask in management meetings, is tell me where do cars go to die in Indonesia? Where do cars go to die in Thailand? There has to be a way, so if there is no way, we’re going to find a way,” said Tan.

In a statement, SoftBank Investment Advisers managing partner Greg Moon said, “Powered by AI, Carro’s technology platform provides consumers with full-stack services and transparency throughout the car ownership process. We are delighted to partner with Aaron and the Carro team to support their ambition to expand into new markets and use AI-powered technology to make the car buying process smarter, simpler and safer.”

Powered by WPeMatico

Fraud protection startup nSure AI has raised $6.8 million in seed funding, led by DisruptiveAI, Phoenix Insurance, AXA-backed venture builder Kamet, Moneta Seeds and private investors.

The round will help the company bolster the predictive AI and machine learning algorithms that power nSure AI’s “first of its kind” fraud protection platform. Prior to this round, the company received $550,000 in pre-seed funding from Kamet in March 2019.

The Tel Aviv-headquartered startup, which currently has 16 employees, provides fraud detection for high-risk digital goods, such as electronic gift cards, airline tickets, software and games. While most fraud detection tools analyze each online transaction in an attempt to decide which purchases to approve and decline, nSure AI’s risk engine leverages deep learning techniques to accurately identify fraudulent transactions.

NSure AI, which is backed by insurance company AXA, said it has a 98% approval rating on average for purchases, compared to an industry average of 80%, allowing retailers to recapture nearly $100 billion a year in revenue lost by declining legitimate customers. The company is so confident in its technology that it will accept liability for any fraudulent transaction allowed by the platform.

Founders Alex Zeltcer and Ziv Isaiah started the company after experiencing the unique challenges faced by retailers of digital assets. The first week of their online gift card business found that 40% of sales were fraudulent, resulting in chargebacks. The founders began to develop their own platform for supporting the sale of high-risk digital goods after no other fraud detection service met their needs.

Zeltcer, co-founder and chief executive, said the investment “enables us to register thousands of new merchants, who can feel confident selling higher-risk digital goods, without accepting fraud as a part of business.”

NSure AI, which currently monitors and manages millions of transactions every month, has approved close to $1 billion in volume since going live in 2019.

Powered by WPeMatico

Andrea Campos has struggled with depression since she was eight years old. Over the years, she’s tried all sorts of therapies — from behavioral to pharmacotherapy.

In 2017, when Campos was in her early 20s, she learned to program and created a system to help manage her mental health. It started as a personal project, but as she talked to more people, Campos realized that many others might benefit from the system as well.

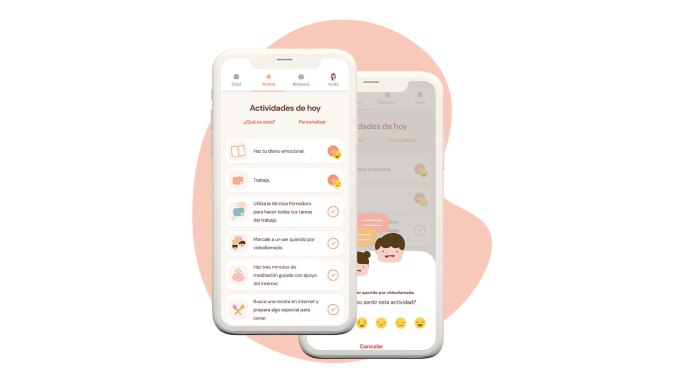

So she built an application to provide access to mental health tools for Spanish-speaking people and began testing it with a small group. At first, Campos herself was her own chatbot, texting with users who were tired of dealing with depression.

“During the month, I was pretending I was an app, and would send these people a list of activities they had to complete during the day, such as writing in a gratitude journal, and then asking them how those activities made them feel,” Campos recalls.

Her thinking was that sometimes with depression and anxiety comes “a lot of avoidance,” where people resist potential treatment out of fear.

The results from her small experiment were encouraging. So, Campos set out to conduct a bigger sample of experiments, and raised about $10,000 via a crowdfunding campaign. With that money, she hired a developer to build a chatbot for her app, which was mostly being used via Facebook Messenger.

Then an earthquake hit Mexico City and that developer lost everything — including his home and computer — and had to relocate.

“I was left with nothing,” Campos says. But that developer introduced her to another, who disappeared with his payment, and again, left Campos, “with nothing.”

“I realized at the beginning of 2019, I was going to have to do this by myself,” Campos said. So she used a site that she described as a “Wix for chatbots,” and created one herself.

After experimenting with the app with a sample of 700 people, Campos was even more encouraged and raised an angel round of funding for Yana, the startup behind her app. (Yana is an acronym for “You Are Not Alone.”) By early 2020, with just three months of runway left, she pivoted to create an app with chatbot integration that wasn’t just limited to use via Facebook Messenger.

Campos ended up launching the app more broadly during the same week that her city in Mexico went into quarantine.

Image Credits: Yana

At first, she said, she saw “normal, steady growth.” But then on October 10, 2020, Apple’s App Store highlighted Yana for International Mental Health Day, and the response was overwhelming.

“It was also my birthday so I was at a spa in a nearby town, relaxing, when I started hearing my cell phone go crazy,” Campos recalls. “Everything went nuts. I had to go back to Mexico City because our servers were exploding since they were not used to having that kind of volume.”

As a result of that exposure, Yana went from having around 80,000 users to reaching 1 million users two weeks later. Soon after that, Google highlighted the app as one of best for personal growth in 2020, and that too led to another spike in users. Today, Yana is about to hit the 5 million-user mark and is also announcing it has raised $1.5 million in funding led by Mexico’s ALLVP, which has also invested in the likes of Cornershop, Flink and Nuvocargo.

When the pandemic hit last year, six of Yana’s nine-person team decided to quarantine together in a “startup house” in Cancun to focus on building the company. Earlier this year, the company had raised $315,000 from investors such as 500 Startups, Magma and Hustle Fund. The company had pitched ALLVP, which was intrigued but wanted to wait until it could write a bigger check.

That time is now, and Yana is now among the top three downloaded apps in Mexico and 12 countries, including Spain, Chile, Ecuador and Venezuela.

With its new capital, Yana is planning to “move away from the depression/anxiety narrative,” according to Campos.

“We want to compete in the wellness space,” she told TechCrunch. “A lot of people were looking for us to deal with crises such as a breakup or a loss but then they didn’t always see a necessity to keep using Yana for longer than the crisis lasted.”

Some of those people would download the app again months later when hit with another crisis.

“We don’t want to be that app anymore,” Campos said. “We want to focus on whole wellness and mental health and transmit something that needs to be built every single day, just like we do with exercise.”

Moving forward, Yana aims to help people with their mental health not just during a crisis but with activities they can do on a daily basis, including a gratitude journal, a mood tracker and meditation — “things that prevent depression and anxiety,” Campos said.

“We want to be a vitamin for our soul, and keeping people mentally healthy on an ongoing basis,” she said. “We also want to include a community inside our application.”

ALLVP’s Federico Antoni is enthusiastic about the startup’s potential. He first met Campos when she was participating in an accelerator program in 2017, and then again recently.

The firm led Yana’s latest round because it “wanted to be on her team.”

“She [Campos] has turned into an amazing leader, and we realized her potential and strength,” he said. “Plus, Yana is an amazing product. When you download it, it’s almost like you can see a soul in there.”

Powered by WPeMatico

In January, former Uber executive Liz Meyerdirk announced that she took over as chief executive of The Pill Club. The company, which offers an online birth control prescription and delivery service to hundreds of thousands of women, had hit record revenues, crossing $100 million in annual run rate for the first time in its four-year history.

She found the bridge between ride-sharing to healthcare to be smoother than some might expect, saying that she focused on how to apply technology “to logistics for an everyday use case, [to know] how that simplifies your everyday life.”

Now, six months into her new job, Meyerdirk announced that her company has raised more capital to capitalize on the momentum in women’s health right now. The Pill Club announced today that it has raised a $41.9 million Series B extension round led by Base 10. Existing investors, including ACME, Base10, GV, Shasta Ventures and VMG, participated in the round, as well as new investors, including Uber’s Dara Khosrowshahi and Honey’s George Ruan and iGlobe.

The extension round comes over two years after the company announced its initial Series B investment, a $51 million financing led by VMG Partners. After reportedly being valued at $250 million, the company declined to provide its latest valuation, other than saying that the extension was an up-round.

When a customer joins The Pill Club, they are given a medical questionnaire and a digital form to input personal information. The company gives them a sense of how much the service will cost, and if the price works, it connects them to a nurse either live or via text.

“In a happy case, you can see a nurse immediately,” she said. “Obviously if it’s midnight, we haven’t figured that out yet.” The nurse walks though different options, since, Meyerdirk added, “contraception is not one size fits all.”

Once a customer makes a decision, The Pill Club can then prescribe birth control through their own pharmacy, which will be delivered to their door within two or three days.

The Pill Club launched in 2016 with an at-home delivery service of birth control. Between 2016 and January 2021, it launched in 43 states plus the District of Columbia. It has added five states in the past six months, and plans to get to 50 states by the end of 2021.

The company makes money from medical visits, insurance reimbursement for prescription drugs and cash patients who aren’t covered by insurance.

The chief executive views a big part of its value proposition as embedding with existing insurance plans of its customers, including Medi-CAL and Family PACT. In the last three months, 16% of The Pill Clubs’ new patients were on Medicaid.

“You’ve got companies like Oscar [Health] that are reimagining health insurance, and you’ve got Ro, Hims and Hers, who are [taking] cash as a primary…way to serve…patients,” she said. “That’s fantastic for those who can afford it, but for us, because so much of our value system is around access to equity, we believe everyone should have the right to get access to birth control.”

The company believes that it has to work within the system of insurance to have true innovation.

“Telemedicine that ignores the reality of insurance is always going to have a limited piece of the pie,” a spokesperson from the company said said. “Cash-only systems simply aren’t a product built for a scale. A truly innovative healthcare platform exists within the realities of the system.”

Long-term, The Pill Club wants to replace the old model of going to a primary care provider for annual visits with ongoing care for women.

“I’m generally healthy [but] I actually do have questions on mammograms…colonoscopies, or anything,” Meyerdirk said. “And being able to have a person other than my mom” to talk to that doesn’t require a trip to the doctor or urgent care is the gap that The Pill Club wants to fill.

“We think it’s too good to be true, when we actually get what we deserve,” Meyerdirk said when describing women’s health. Part of her goal going forward is to think bigger, beyond contraception, and figure out how The Pill Club could bring a digital refresh to other areas of women’s health.

In March, the company launched a dermatology pilot, and also expanded its 2020 period care pilot. A portion of the new capital is earmarked toward launching new services for its members.

The Pill Club also shared the diversity metrics of its 350-person staff as part of its announcement.

The Pill Club has 72% of employees identifying as women, and 28% of employees identifying as male. The executive leadership similarly sees predominantly women, with the ratio being 62.5% women and 37.5% male. As for racial diversity, the overall company identifies as 33% white, 19% Asian, 16% Hispanic or Latino and 14% Black or African American; 13% of employees declined to identify.

“We’re by women for women,” Meyerdirk said. “It’s very, very different when you’re by men, for women.” Her appointment came as The Pill Club’s founder and former chief executive officer Nick Chang stepped down from day to day operations. He didn’t take a board seat, but does still have shares in the company.

Liz Meyerdirk, chief executive of The Pill Club. Image Credits: The Pill Club

The wave of prescription, for-delivery medication is only getting bigger, with The Pill Club joined by startups such as Nurx and SimpleHealth, and bigger corporations such as Walmart and Amazon.

“The idea of creating more choice and flexibility across healthcare is long overdue,” she said. “Everyone deserves to have great options when they consider who can best address their daily needs.”

Editor’s note: A prior version of this story noted that The Pill Club does birth control for pick up. This is incorrect. It delivers birth control through its own pharmacies. A correction has been made to reflect this change.

Powered by WPeMatico

It’s easier than ever to build a product and sell it around the United States, or the world. But if you want to do so without incurring the wrath of any particular state, or nation-state, you’d best have your tax matters in order. This is why Stripe’s news last week that it has built tax-focused tooling to help its customers manage their state bills mattered.

But for SaaS companies, things can be more complicated from a tax perspective. That’s what Anrok, a startup working to build sales tax software for SaaS firms, told TechCrunch.

The company’s CEO, Michelle Valentine, said that modern software companies need specialized help. And her startup is announcing a $4.3 million fundraise today to back its efforts. The capital event was led by Sequoia and Index, the latter firm a place where Valentine used to work.

Anrok delivers its service via an API, and charges based on the total dollar value of sales that it helps a customer manage. Its percentage-fee falls with volume, and you can’t pay more than 0.19% of managed revenue, so it’s pretty cheap regardless, given how strong software gross margins tend to be.

The Anrok founding team: Michelle Valentine, and Kannan Goundan. Via the company.

Valentine said that there are three things that make SaaS tax issues more complex than other products. The first deals with addresses. Software companies have to pay sales tax where customers are located, and often only have partial information. Anrok will help with that problem. The CEO also said that variable SaaS billing makes charging the right amount of tax an interesting issue, and that states have tax laws specifically aimed at the software market that must be navigated.

So, a more mass-market solution might not be the best fit for SaaS companies looking to avoid both trouble with states and the work of handling tax matters themselves.

It’s not hard to see why Anrok was able to raise capital. The company is early-stage with its first customers onboarded, so it’s not posting the sort of revenue growth that investors covet at the later stages. What then were its more fetching attributes? From our perspective, on-demand pricing and a simply gigantic market.

Sure, Anrok is serving SaaS businesses, but it’s doing so using what could be described as a post-SaaS business model; on-demand, or usage-based pricing is an increasingly popular way to charge for software products today, putting Anrok closer to the cutting edge in business-model terms. And the company’s market is essentially every software business out there. That’s a lot of TAM to carve into, something that investors love to see.

Powered by WPeMatico

Beauty and wellness businesses have come roaring back to life with the decline of COVID-19 restrictions, and a startup that’s built a platform that caters to the many needs of small enterprises in the industry today is announcing a big round of funding to grow with them.

Fresha — a multipurpose commerce tool for independent wellness and beauty businesses such as hair, nail and skin salons, yoga instructors and more, based first and foremost around a completely free subscription platform for those businesses to schedule bookings from customers — has picked up $100 million.

Fresha plans to use the funds to expand the list of countries where it operates, to grow the categories of companies that use its services (mental health practitioners is one example; fitness is another) and to build more services complementing what it already provides, helping customers do their work by providing them with more insights and data about what they do already. It will also be making acquisitions to expand its customer base.

General Atlantic is leading this Series C, with Huda Kattan, Michael Zeisser of FMZ Ventures and Jonathan Green of Lugard Road Capital also participating, along with past investors Partech, Target Global and FJ Labs.

Fresha has raised $132 million to date, and it’s not disclosing its valuation. But as a point of reference, when it closed its Series B (as Shedul; the company rebranded in February 2020), it was valued at $105 million.

Chances are that figure is significantly higher now.

Fresha’s current range of services include a free-to-use platform for booking appointments; free software for managing accounts; a payments service that includes both a physical point of sale and digital interface; and a wider marketplace both to provide goods to the businesses (B2B); and for the businesses to sell goods to customers (B2C).

The London-based company has 50,000 business customers and 150,000 stylists and professionals in 120+ countries (mostly in the U.K., the U.S., Canada, Australia, New Zealand and Europe), with some 250 million appointments booked to date.

And while many businesses did have to curtail how they operated (and in some countries had to stop operating altogether), Fresha found that it was attracting a lot of new business in part because of its “free” model that meant customers didn’t have to pay to maintain a booking platform at a time when they weren’t taking bookings, but could use Fresha to generate revenues in other ways (such as through the sale of goods, vouchers for future services and more.)

So in a year when you might have thought that a company based around providing services to industries that were hard hit by COVID would have also been hard-hit, in fact Fresha saw a 30x increase in card payment transactions versus the year before, and more than $12 billion worth of booking appointments made on its platform.

In a market that is very crowded with tech companies building platforms to book beauty (and other) services and to manage the business of independent retailers — they include giants like Lightspeed POS, as well as smaller players like Booksy (which also recently raised) and StyleSeat, but also players like Square and PayPal, and many others — the core of Fresha’s offering is a booking platform built as a totally free product.

Why free? To attract more users to its other services (such as payments, which do come at a price), and because co-founders William Zeqiri (CEO) and Nick Miller (product chief) — pictured above, respectively left and right — think this the only way to build a business like this in a crowded market.

“We believe that software is a commodity,” said Zeqiri in an interview. “A lot of our competitors are beating each other on price to the bottom. We wanted to consolidate the supply side of the software, gather data about the businesses, how they use what they use.”

That data led, first, to identifying the need for and building out software and launching its B2B and B2C marketplaces, and the idea is that it will likely lead to more products as it continues to mature, whether it’s better analytics for its current customers so that they can better price or develop their services accordingly, or entirely new tools for new categories of users.

Meanwhile, the services that it already provides, like payments, have taken off like a shot, not least because they’ve served a need for any virtual transactions, like selling vouchers or items.

Miller noted that while a lot of its customers actually interface with tech with a lot of reluctance — they are the essence of “physical” retailers when you think about it — they also found themselves having to use more digital services simply because of circumstances. “Looking back at what happened, tech adoption accelerated for our customers,” said Miller. He said that current customers usage for the point-of-sale systems and online payments is roughly equal.

Looking ahead, Fresha’s investor list is notable for its strategic mix and might shed some light on how it grows. Kattan, a “beauty influencer” and the founder of Huda Beauty, is investing by way of HB Investments, a strategic venture arm; while Zeisser’s FMZ focuses on “experience economy” investments today, but he himself has a long history working at tech companies building marketplaces, including years with Alibaba as head of its U.S. investment practice. These speak to areas where Fresha is likely interested in expanding its reach — more marketplace activity; and perhaps more social media angles and exposure for its customers at a time when social media really has become a key way for beauty and wellness businesses to market themselves.

“Fresha has emerged as a leader powering the beauty and wellness industry,” said Aaron Goldman, Global co-head of financial services and managing director at General Atlantic, in a statement. “William, Nick and the Fresha team have built a product that is resonating with the market and creating long-term value through the intersection of its payments, software and marketplace offerings. We are thrilled to be partnering with the company and believe Fresha has significant opportunity to further scale its innovative platform.”

“I’ve witnessed firsthand the positive impact Fresha has for beauty entrepreneurs,” added Kattan. “The company is a force for good in the growing community of beauty professionals around the globe, who are increasingly adopting a self-employed approach. By making top business software accessible without any subscription fees, Fresha lets professionals focus on what they do best — offering great experiences for their customers.”

Powered by WPeMatico

Productivity analytics startup Time is Ltd. wants to be the Google Analytics for company time. Or perhaps a sort of “Apple Screen Time” for companies. Whatever the case, the founders reckon that if you can map how time is spent in a company, enormous productivity gains can be unlocked and money better spent.

It’s now raised a $5.6 million late-seed funding round led by Mike Chalfen, of London-based Chalfen Ventures, with participation from Illuminate Financial Management and existing investor Accel. Acequia Capital and former Seal Software chairman Paul Sallaberry are also contributing to the new round, as is former Seal board member Clark Golestani. Furthermore, Ulf Zetterberg, founder and former CEO of contract discovery and analytics company Seal Software, is joining as president and co-founder.

The venture is the latest from serial entrepreneur Jan Rezab, better known for founding SocialBakers, which was acquired last year.

We are all familiar with inefficient meetings, pestering notifications chat, video conferencing tools and the deluge of emails. Time is Ltd. says it plans to address this by acquiring insights and data platforms such as Microsoft 365, Google Workspace, Zoom, Webex, MS Teams, Slack and more. The data and insights gathered would then help managers to understand and take a new approach to measure productivity, engagement and collaboration, the startup says.

The startup says it has now gathered 400 indicators that companies can choose from. For example, a task set by The Wall Street Journal for Time is Ltd. found the average response time for Slack users versus email was 16.3 minutes, comparing to emails which was 72 minutes.

Chalfen commented: “Measuring hybrid and distributed work patterns is critical for every business. Time Is Ltd.’s platform makes such measurement easily available and actionable for so many different types of organizations that I believe it could make work better for every business in the world.”

Rezab said: “The opportunity to analyze these kinds of collaboration and communication data in a privacy-compliant way alongside existing business metrics is the future of understanding the heartbeat of every company — I believe in 10 years time we will be looking at how we could have ignored insights from these platforms.”

Tomas Cupr, founder and Group CEO of Rohlik Group, the European leader of e-grocery, said: “Alongside our traditional BI approaches using performance data, we use Time is Ltd. to help improve the way we collaborate in our teams and improve the way we work both internally and with our vendors — data that Time is Ltd. provides is a must-have for business leaders.”

Powered by WPeMatico