Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Blind has carved out a unique niche in the social-networking world. It’s an app of verified, pseudonymous employees talking to each other about what’s going on at their employers, trading notes on everything from layoffs, to promotions, to policies. Part LinkedIn, part Reddit, part Slack — it’s become widely popular among tech workers at Silicon Valley companies, and even outside the tech industry, with 5 million verified users.

Workplaces have changed dramatically post-COVID-19, with remote work becoming more of a norm, and that has made Blind indispensable for many workers who feel increasingly alienated from their companies and their colleagues.

The company announced this morning a $37 million Series C funding round led by South Korean venture firm Mainstreet Investment along with Cisco Investments and Pavilion Capital, a subsidiary of Singapore sovereign wealth fund Temasek. The company had filed a Form D in late March for roughly $20.5 million, and the $37 million represents the final total fundraised.

We last did a deep dive in the company back in 2018, so what’s changed? Well, first, there’s the pandemic. Co-founder and general manager Kyum Kim says that Blind’s users are now coming to the app all throughout the day. “Usage used to peak during the commute times,” he said. “8-10 a.m. before COVID and then after work, 7 a.m.-10 p.m. was another timeframe that people used to use Blind a lot. But now, it has kind of flattened out [throughout the day].” The new peak is 2 p.m., and, according to Kim, users are logging in 30 times per month over about 13-15 days.

This gets to the first of two areas where Blind is experimenting with revenue generation. As remote work has taken hold, particularly at tech companies, internal messaging channels have become less valuable as sources for clear information from executive leadership. Blind believes it has a better pulse on how employees are feeling about policies and their employers, and is building tools around, for example, pulse surveys to give HR teams better insight than they might get from other services.

“People are just more honest on our platform versus these company-sponsored channels,” Kim said. We’re “probably the only platform where people are coming voluntarily, have visibility into their intentions, how they feel about their company’s policies.” Blind wants to protect the identities of its users, while also offering aggregate insights to companies.

To that end, last week the company brought on Young Yuk as chief product officer. Yuk had been an advisor to Blind for the past four years, while daylighting in senior product roles at Intuit, Yelp and Glassdoor. Kim believes that Yuk’s experience across consumer and enterprise will fit the unique needs of Blind’s business, which combines a consumer social network with B2B products.

For its own users though, the second area of attention is perhaps the most interesting: recruiting. Blind users are obsessed with career paths and compensation, and Kim said that “80% of our search keywords on Blind are company names or company names attached to levels, locations, or teams.” People want to know how to move their careers forward, an area companies are notoriously bad about explaining, and so “people come to Blind to find information from these verified employees.”

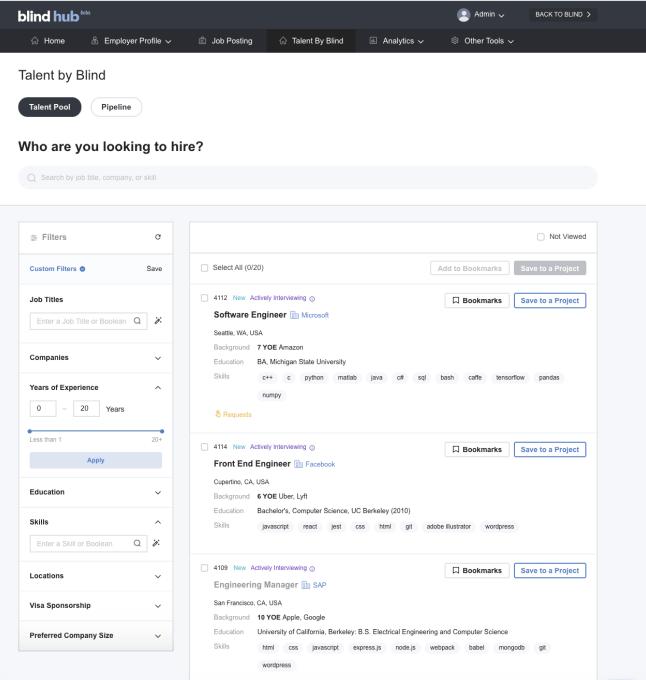

Blind is building what it calls “Talent by Blind,” a platform for capturing this hiring intentionality and selling it to recruiters. The goal is to transfer people whose intentions might be, say, L5 engineer at a big tech company in Seattle to a separate platform that can be used as a top-of-funnel for company recruitment efforts. Blind says a couple of companies are currently using this platform.

“Talent by Blind” is a platform to help transfer potential recruits into the top of the recruiting funnel at companies. Image Credits: Blind

Ultimately, Blind’s path has been one of slow and steady growth. The company claims to be deliberate in that approach, noting that pseudonymous communities often falter when they grow too fast and norms aren’t established early. Unlike more notorious anonymous communities from years past like Secret or YikYak, the company says that its network tends to be quite safe, since employees verify their identities and know that they are speaking directly to their colleagues.

Blind’s team has expanded in recent years. Image Credits: Blind

Revenue approaches remain experimental, but ultimately, the key is that it has the users that companies want to hear from: their own employees and potential future employees. We want to “maintain that integrity with users,” Kim said. “ ‘Ally to employees and advisor to companies’ is the phrase we are trying to go for.”

“It’s been eight years we have been doing this business, [and] we have been focused on the longness,” he said. “There’s a lot of optimism in the company.” He would know — he probably checked Blind.

Powered by WPeMatico

Income-share agreements, or ISAs, are a way to bring flexibility to the often steep financial costs of higher education. The financial model allows a student to learn at zero upfront cost, and then pay any costs through a percentage of future income over time.

While the model has caught fire from a variety of trade schools and bootcamps, it’s a hard service to offer at scale. It required underwriting a risky group of people — and that costs money. Just last week, a leader in the ISA space Lambda School laid off 65 employees amid a broader restructuring.

It’s here that a startup like Blair, which graduated Y Combinator in 2019, could be of use. The startup today helps universities finance and offer income-share agreements, or ISAs, to students. The startup has two services: a capital arm (Blair Capital) for which it secured a $100 million debt facility, and a services arm (Blair Servicing) that helps manage the flow of money, which just got a new tranche of capital to expand

The company told TechCrunch that it has raised a $6.3 million round led by Tiger Global. Other investors include Rainfall and 468 Capital, along with angels such as Teachable’s Ankur Nagpal and Vouch’s Sam Hodges. The raise came on top of a $1.1 million pre-seed round, bringing Blair’s total capital raised to date at $7.4 million.

A big portion of the venture capital money will go toward doubling or tripling Blair’s San Francisco team, said CEO Mike Mahlkow. It is especially investing in engineering and product, as well as a few senior hires in finance, compliance and the service side.

The Blair founding team. Image Credits: Blair

Notably, Blair’s eight person team is fully male. The lack of gender diversity, even as an early-stage startup with a handful of employees, could hurt its competitive advantage, recruiting prospects, and performance over time. About 25 percent of the employees are LGBT and 37.5% identify as non-white.

Blair started as a tool to underwrite students with loans that would pay for college, a sum that would eventually be repaid through an income-share agreement. It was similar to an Affirm for Education, where it could help students get access with low or nonexistent upfront costs.

“The model worked very well until March last year,” Mahlkow said. “And then the debt market was fairly dead, so we needed to shift our focus to a more software-like approach.” Now, Blair focuses on building ISA-based programs for schools, and underwrites loans based on certain programs at certain schools that have historical returns.

Most companies use its servicing piece — aka an operating system for offering ISAs — but a number of companies turn to Blair to help finance the costs of offering an ISA. Either colleges and bootcamps finance the ISA themselves and put it on the balance sheet, or they sell it to a company like Blair to get the money upfront and get repaid eventually.

Blair Servicing takes a percent of money from an ISA once a student is employed post-graduation, and Blair Capital takes a base fee plus a portion for the ISA as well.

While the company did not share exact numbers, it did say it has doubled its customers since February, tripling revenue during the same time period. Of course, a bet from the ever-ravenous Tiger Global is a statement. And, unlike his new investor, Mahlkow plans to keep growth sustainable and lean. Long-term, Blair is betting that outcome-based financing could get traction in more than just a savvy startup bootcamp but in how recruiting and placement works in various industries. The startup is in talks with a sports association and large companies that are working on upskilling and reskilling their workforces. Incentives are key in edtech, and Blair speaking that language as an early-stage startup is key as the sector moves more into the spotlight.

Powered by WPeMatico

This morning Metafy, a distributed startup building a marketplace to match gamers with instructors, announced that it has closed an additional $5.5 million to its $3.15 million seed round. Call it a seed-2, seed-extension or merely a baby Series A; Forerunner Ventures, DCM and Seven Seven Six led the round as a trio.

Metafy’s model is catching on with its market. According to its CEO Josh Fabian, the company has grown from incorporation to gross merchandise volume (GMV) of $76,000 in around nine months. That’s quick.

The startup is building in public, so we have its raw data to share. Via Fabian, here’s how Metafy has grown since its birth:

From the company. As a small tip, if you want the media to care about your startup’s growth rate, share like this!

When TechCrunch first caught wind of Metafy via prior seed investor M25, we presumed that it was a marketplace that was built to allow esports pros and other highly capable gamers teach esports-hopefuls get better at their chosen title. That’s not the case.

Don’t think of Metafy as a marketplace where you can hire a former professional League of Legends player to help improve your laning-phase AD carry mechanics. Though that might come in time. Today a full 0% of the company’s current GMV comes from esports titles. Instead, the company is pursuing games with strong niche followings, what Fabian described as “vibrant, loyal communities.” Like Super Smash Brothers, its leading game today in terms of GMV generated.

Why pursue those titles instead of the most competitive games? Metafy’s CEO explained that his startup has a particular take on its market — that it focuses on coaches as its core customer, over trainees. This allows the startup to focus on its mission of making coaching a full-time gig, or at least one that pays well enough to matter. By doing so, Metafy has cut its need for marketing spend, because the coaches that it onboards bring their own audience. This is where the company is targeting games with super-dedicated user bases, like Smash. They fit well into its build for coaches, onboard coaches, coaches bring their fans, GMV is generated model.

Metafy has big plans, which brings us back to its recent raise. Fabian told TechCrunch any game with a skill curve could wind up on Metafy. Think chess, poker or other games that can be played digitally. To build toward that future, Metafy decided to take on more capital so that it could grow its team.

So what does its $5.5 million unlock for the startup? Per its CEO, Metafy is currently a team of 18 with a monthly burn rate of around $80,000. He wants it to grow to 30 folks, with nearly all of its new hires going into its product org, broadly.

TechCrunch’s perspective is that gaming is not becoming mainstream, but that it has already done so. Building for the gaming world, then, makes good sense, as tools like Metafy won’t suffer from the same boom/bust cycles that can plague game developers. Especially as the startup becomes more diversified in its title base.

Normally we’d close by noting that we’ll get back in touch with the company in a few quarters to see how it’s getting on in growth terms. But because it’s sharing that data publicly, we’ll simply keep reading. More when we have a few months’ more data to chew on.

Powered by WPeMatico

Ace Games, a Turkish mobile gaming company founded by a former Peak Games co-founder, has raised a $7 million seed funding round led by Actera Group. Co-investment has come from San Francisco’s NFX. Former gaming entrepreneurs Kristian Segerstrale, Alexis Bonte and Kaan Gunay also participated. Firat Ileri is a previous investor from the pre-seed round.

The company runs two studios, one focused on casual and one on “hyper-casual” games.

Co-founded by CEO Hakan Bas, the former co-founder and COO at Peak Games, Ace Games has had some success on the U.S. iOS Store with its hyper-casual title, “Mix and Drink.”

In a statement, Bas said: “Ace’s main focus is actually the casual ‘hybrid puzzle’ game that we have been working on for a while now. However, our hyper-casual studio assists the main studio in many aspects like training talent, coming up with creative game mechanics and marketing ideas, generating cash, and creating user base.” Ace’s casual title is to be released late-summer this year and the global launch is expected in early 2022.

Peak Games, Gram Games and Rollic Games were all acquired by Zynga, showing that Turkey is capable of producing decent exits for gaming startups.

VCs such as Index, Balderton, Makers and Griffin have all made M&A deals with Dream Games, Bigger Games and Spyke Games.

Powered by WPeMatico

Una Brands’ co-founders (from left to right): Tobias Heusch, Kiren Tanna and Kushal Patel. Image Credits: Una Brands

One of the biggest funding trends of the past year is companies that consolidate small e-commerce brands. Many of the most notable startups in the space, like Thrasio, Berlin Brands Group and Branded Group, focus on consolidating Amazon Marketplace sellers. But the e-commerce landscape is more fragmented in the Asia-Pacific region, where sellers use platforms like Tokopedia, Lazada, Shopee, Rakuten or eBay, depending on where they are. That is where Una Brands comes in. Co-founder Kiren Tanna, former chief executive officer of Rocket Internet Asia, said the startup is “platform agnostic,” searching across marketplaces (and platforms like Shopify, Magento or WooCommerce) for potential acquisitions.

Una announced today that it has raised a $40 million equity and debt round. Investors include 500 Startups, Kingsway Capital, 468 Capital, Presight Capital, Global Founders Capital and Maximilian Bitner, the former CEO of Lazada who currently holds the same role at secondhand fashion platform Vestiaire Collective.

Una did not disclose the ratio of equity and debt in the round. Like many other e-commerce aggregators, including Thrasio, Una raised debt financing to buy brands because it is non-dilutive. The round will also be used to hire aggressively in order to evaluate brands in its pipeline. Una currently has teams in Singapore, Malaysia and Australia and plans to expand in Southeast Asia before entering Taiwan, Japan and South Korea.

Tanna, who also founded Foodpanda and ZEN Rooms, launched Una along with Adrian Johnston, Kushal Patel, Tobias Heusch and Srinivasan Shridharan. He estimates that there are more than 10 million third-party sellers spread across different platforms in the Asia-Pacific.

“Every single seller in Asia is looking at multiple platforms and not just Amazon,” Tanna told TechCrunch. “We saw a big gap in the market where e-commerce is growing very quickly, but players in the West are not able to look at every platform, so that is why we decided to focus on APAC, launch the business there and acquire sellers who are selling on multiple platforms.”

Una looks for brands with annual revenue between $300,000 to $20 million and is open to many categories, as long as they have strong SKUs and low seasonality (for example, it avoids fast fashion). Its offering prices range from about $600,000 to $3 million.

Tanna said Una will maintain acquisitions as individual brands “because what’s working, we don’t change it.” How it adds value is by doing things that are difficult for small brands to execute, especially those run by just one or two people, like expanding into more distribution channels and countries.

“For example, in Indonesia there are at least five or six important platforms that you should be on, and many times the sellers aren’t doing that, so that’s something we do,” Tanna explained. “The second is cross-border in Southeast Asia, which sellers often can’t do themselves because of regulations around customs, import restrictions and duties. That’s something our team has experience in and want to bring to all brands.”

Amazon FBA roll-up players have the advantage of Amazon Marketplace analytics that allow them to quickly measure the performance of brands in their pipeline of potential acquisitions. Since it deals with different marketplaces and platforms, Una works with much more fragmented sources of data for revenue, costs, rankings and customer reviews. To scale up, the company is currently building technology to automate its valuation process and will also have local teams in each of its markets. Despite working with multiple e-commerce platforms, Tanna said Una is able to complete a deal within five weeks, with an offer usually happening within two or three days.

In countries where Amazon is the dominant e-commerce player, like the United States, many entrepreneurs launch FBA brands with the goal of flipping them for a profit within a few years, a trend that Thrasio and other Amazon roll-up startups are tapping into. But that concept is less common in Una’s markets, so it offers different team deals to appeal to potential sellers. Though Una acquires 100% of brands, it also does profit-sharing models with sellers, so they get a lump sum payment for the majority of their business first, then collect more money as Una scales up the brand. Tanna said Una usually continues working with sellers on a consulting basis for about three to six months after a sale.

“Something that Amazon players know very well is that they can find a product, sell it for four to five years, and then ideally make a multi-million deal exit and build another product or go on holiday,” said Tanna. “That’s something Asian sellers are not as familiar with, so we see this as an education phase to explain how the process works, and why it makes sense to sell to us.”

Powered by WPeMatico

Metacore, a Finnish mobile games company, seems to have an amazing “relationship” with Supercell, another (quite successful) Finnish mobile games company.

Back in September 2020, Metacore raised $17.7 million in equity from Supercell and another $11.8 million line of credit, sometimes also called a debt round. That amazing relationship appears to be ongoing. Because Metacore has now raised yet another debt round from Supercell, but this time for €150 million ($180 million). These guys really like each other.

The simple reason for this is two words: Merge Mansion. This game has been so spectacularly successful that Supercell clearly wants a stake in that success, and it has the cash reserves to make that bet.

The puzzle discovery game has 800,000 daily players, and an annual revenue run rate of more than €45 million, so it’s really on a growth curve.

Why so successful? Well, players have really loved the idea that they can literally merge two items they pick up in the game to make a brand new thing. So for instance, you can merge two rakes and you get another kind of tool that you can then can use somewhere else. This is a very unique mechanic in mobile games.

Supercell is also enamored of Metacore’s games development strategy: It creates games with two- to three-person teams and only adds resources when a game takes off. This innovative approach to game development is at least part of the reason Supercell is doubling down on its investment, not just Merge Mansion itself. It’s a sort of “fail-fast” approach to game-making that is clearly paying dividends.

So why this approach to the latest financing?

I spoke to CEO and co-founder Mika Tammenkoski, who told me: “Yes, it is a credit line. We are more about scaling up the company as we are scaling up revenue. We already have meaningful revenue, we can invest the money, and we can expect a certain kind of return on investment. So this is the cheapest investment that we can get. Equity investment would dilute us. So this makes sense from that point of view. With Supercell, we have a really great partner backing us. They know exactly what is ahead of us. They know exactly the kind of challenges that we have, and that makes us aligned in that sense… We both think long term, we both want to scale the game as big as possible. And with Supercell we get the best terms overall.”

So there you have it. Metacore and Supercell are locked in an embrace which any other outside investor is going to have to invest in big to get a look in on the action.

Powered by WPeMatico

EngineEars today announced a $1 million raise. The company’s first round of funding features investments from Kendrick Lamar, DJ Mustard, Roddy Rich and Slauson and Co. “Quality of sound is still important in music,” Lamar said in a quote provided to TechCrunch. “Ali has always been a progressive thinker. Engineers will transcend the culture.”

The service was launched in 2018 by Grammy winner Derek “MixedByAli” Ali, who has worked on a slew of high-profile tracks from artists including Lamar, Jay Rock, SZA, Nipsey Hussle and Snoop Dogg.

The educational courses turned into a touring curriculum, with 15 workshops in four countries, where Ali says he was able to determine what the community most needed.

“During that time, we really learned what the problem is,” says Ali. “All of the problems entailed tracking payments, being credited, the antiquated business model of file transfers and essentially just helping an independent audio engineer sustain and create a business for themselves.”

EngineEars has since branched out into something more akin to a marketplace for audio engineers. Independent mixers can offer their services and connect with artists and labels, get credit for the tracks they’ve worked on and — perhaps most importantly in the world of freelancing — get paid.

The platform launched an alpha version in January and since has 120 engineers verified by an existing vetting process. The invite-only service has another 2,000 people on its waiting list, according to Ali.

The service is currently working on a feature roadmap based on the requests of existing users and looking toward potential additions like the ability to buy beats, going forward. Other suggested features include contract negotiations for work-for-hire, but much of this is still very much in early stages.

Powered by WPeMatico

As the oldest of 12 children, Bunim Laskin spent much of his teen years looking for ways to help keep his siblings entertained. Noticing that a neighbor’s pool was often empty, Laskin reached out to ask if his family could use her pool. To make it worth her while, he suggested that they could help cover her expenses for maintaining the pool.

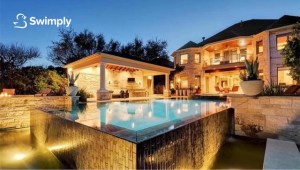

Soon after, five other families had made the same arrangement with her and the pool owner had six families covering 25% of her expenses. This meant that the neighbor was actually making money off her pool. The arrangement sparked a business idea in Laskin’s mind. At the age of 20, he founded Swimply, a marketplace for homeowners to rent out their underutilized pools to local swimmers, with Asher Weinberger.

The Cedarhurst, New York-based company launched a beta in 2018, starting with four pools in the New Jersey area.

“We used Google Earth to find houses, and then knocked on 80 doors with a pool,” CEO Laskin recalls. “We got to 100 pools organically. Word of mouth really helped us grow.” The site was pretty bare bones, he admits, with potential customers only able to view photos of the pools and connect with the pool owner by phone.

That year, Swimply did around 400 reservations and raised $1.2 million from friends and family.

In 2019, Swimply launched what he describes as a “proper” website and app with an automated platform. It grew “four to five times” that year, again mostly organically. In an episode that aired in March 2020, the company appeared on Shark Tank but went home without a deal.

Then the COVID-19 pandemic hit. Swimply, Laskin said, pivoted right into the pandemic.

“We were the perfect solution for people when the world was falling on its head,” he said. The company restructured its offering to ensure that pool owners did not have to interact with guests. “It was the perfect, contact-free, self-serve experience to hang out and be with people you quarantined with.”

The CDC then came out to say that it was safe to swim because chlorine could help kill the virus, and that proved to be a big boon to its business.

“On one end, it was a way for people to have a normal day and on the other, it helped give owners a way to earn an income, at a time when many people were being affected financially,” Laskin told TechCrunch.

Business took off in 2020 with revenue growing 4,000% and now Swimply is announcing a $10 million Series A round. Norwest Venture Partners led the financing, which also included participation from Trust Ventures and a number of angel investors such as Poshmark founder and CEO Manish Chandra; Rob Chesnut, former general counsel and chief ethics officer at Airbnb; Ancestry.com CEO Deborah Liu and Michael Curtis.

Swimply is now operating in a total of 125 U.S. markets, two markets in Canada and five markets in Australia. It plans to use its new capital in part to expand into new markets and toward product development.

Image Credits: Swimply

The way it works is pretty straightforward. Swimply simply connects homeowners that have underutilized backyard spaces and pools with those seeking a way to gather, cool off or exercise, for example. People or families can rent pools by the hour, ranging in price from $15 to $60 per hour (at an average of $45/hour) depending on the amenities. New markets that Swimply has recently expanded to include Portland, Oregon; Raleigh, North Carolina and the California cities of Oakland, San Luis Obispo and Los Gatos.

“The shifting mindset from younger generations about ownership is a huge contributor to increased growth of the Swimply marketplace,” said co-founder Weinberger, who serves as Swimply’s COO. “Swimming is the third most popular activity for adults and number one for children, and yet no other company has tackled the aquatic space to make swimming more affordable and accessible…until now.”

While the company declined to provide hard revenue figures, Laskin said Swimply was seeing “seven digits a month in revenue” and 15,000 to 20,000 reservations a month. Families represent the most popular reservation.

“People can book and pay through our platform, and only 20% of hosts ever meet their guests,” Laskin said. “We’re enabling a new kind of consumer behavior with what we’re doing.”

The company is planning to use its new capital to also rebuild much of its tech infrastructure and boost its customer support team to be more “readily available.”

It is also now offering a complimentary up to $1 million worth of insurance per booking for liability as well as $10,000 for property damage.

Swimply has a little over 20 employees, up 10 times from two people in December of 2020. It plans to double that number over the next few months.

The company’s model has proven quite lucrative for some owners, according to Laskin.

“Last year, there were some owners who earned $10,000 a month. One owner in Denver earned $50,000 last year and he had signed up toward the end of the summer. He should make over $100,000 this year,” Lasken projects.

Its only criteria is that owners offer a clean pool. Eighty-five percent of hosts offer restrooms as well. If they don’t, they are limited to one-hour reservations with a max of five guests. Swimply has also partnered with local pool companies, and if they pay one of its owners a visit and certify that pool, that owner gets a badge on the site “so guests get an additional level of security,” Laskin said.

Ed Yip of Norwest Venture Partners admits that when he first heard of the concept of Swimply, he “didn’t know what to make of it.”

But the more he heard about it, the more excited he got.

“This is the Holy Grail for a consumer investor. We’re not changing consumer behavior, but rather [we] productize the experience and make it safer and easier on both sides,” Yip told TechCrunch.

What also gets the investor excited is the potential for Swimply beyond just swimming pools in the future.

“We’re seeing a ton of demand from hosts wanting to list hot tubs and tennis courts, for example,” Yip said. “So this can turn into a marketplace for shared outdoor resources and that’s a huge market opportunity that adds value on both sides.”

Indeed, the concept of monetizing underutilized space is a growing concept. Earlier this year, we reported on Neighbor, which operates a self-storage marketplace, raising $53 million in a Series B round of funding. Neighbor’s unique model aims to repurpose under-utilized or vacant space — whether it be a person’s basement or the empty floor of an office building — and turn it into storage.

Powered by WPeMatico

Timescale, makers of the open-source TimescaleDB time series database, announced a $40 million Series B financing round today. The investment comes just over two years after it got a $15 million Series A.

Redpoint Ventures led today’s round, with help from existing investors Benchmark, New Enterprise Associates, Icon Ventures and Two Sigma Ventures. The company reports it has now raised approximately $70 million.

TimescaleDB lets users measure data across a time dimension, so anything that would change over time. “What we found is we need a purpose-built database for it to handle scalability, reliability and performance, and we like to think of ourselves as the category-defining relational database for time series,” CEO and co-founder Ajay Kulkarni explained.

He says that the choice to build their database on top of Postgres when it launched four years ago was a key decision. “There are a few different databases that are designed for time series, but we’re the only one where developers get the purpose-built time series database plus a complete Postgres database all in one,” he said.

While the company has an open-source version, last year it decided rather than selling an enterprise version (as it had been), it was going to include all of that functionality in the free version of the product and place a bet entirely on the cloud for revenue.

“We decided that we’re going to make a bold bet on the cloud. We think cloud is where the future of database adoption is, and so in the last year […] we made all of our enterprise features free. If you want to test it yourself, you get the whole thing, but if you want a managed service, then we’re available to run it for you,” he said.

The community approach is working to attract users, with over 2 million monthly active databases, some of which the company is betting will convert to the cloud service over time. Timescale is based in New York City, but it’s a truly remote organization, with 60 employees spread across 20 countries and every continent except Antarctica.

He says that as a global company, it creates new dimensions of diversity and different ways of thinking about it. “I think one thing that is actually kind of an interesting challenge for us is what does D&I mean in a totally global org. A lot of people focus on diversity and inclusion within the U.S., but we think we’re doing better than most tech companies in terms of racial diversity, gender diversity,” he said.

And being remote-first isn’t going to change even when we get past the pandemic. “I think it may not work for every business, but I think being remote first has been a really good thing for us,” he said.

Powered by WPeMatico

With cybercrime on course to be a $6 trillion problem this year, organizations are throwing ever more resources at the issue to avoid being a target. Now, a startup that’s built a platform to help them stress-test the investments that they have made into their security IT is announcing some funding on the back of strong demand from the market for its tools.

Cymulate, which lets organizations and their partners run machine-based attack simulations on their networks to determine vulnerabilities and then automatically receive guidance around how to fix what is not working well enough, has picked up $45 million, funding that the startup — co-headquartered in Israel and New York — will be using to continue investing in its platform and to ramp up its operations after doubling its revenues last year on the back of a customer list that now numbers 300 large enterprises and mid-market companies, including the Euronext stock exchange network as well as service providers such as NTT and Telit.

London-based One Peak Partners is leading this Series C, with previous investors Susquehanna Growth Equity (SGE), Vertex Ventures Israel, Vertex Growth and Dell Technologies Capital also participating.

According to Eyal Wachsman, the CEO and co-founder, Cymulate’s technology has been built not just to improve an organization’s security, but an automated, machine learning-based system to better understand how to get the most out of the security investments that have already been made.

“Our vision is to be the largest cybersecurity ‘consulting firm’ without consultants,” he joked.

The valuation is not being disclosed, but as some measure of what is going on, David Klein, managing partner at One Peak, said in an interview that he expects Cymulate to hit a $1 billion valuation within two years at the rate it’s growing and bringing in revenue right now. The startup has now raised $71 million, so it’s likely the valuation is in the mid-hundreds of millions. (We’ll continue trying to get a better number to have a more specific data point here.)

Cymulate — pronounced “sigh-mulate”, like the “cy” in “cyber” and a pun of “simulate”) is cloud-based but works across both cloud and on-premises environments and the idea is that it complements work done by (human) security teams both inside and outside of an organization, as well as the security IT investments (in terms of software or hardware) that they have already made.

“We do not replace — we bring back the power of the expert by validating security controls and checking whether everything is working correctly to optimize a company’s security posture,” Wachsman said. “Most of the time, we find our customers are using only 20% of the capabilities that they have. The main idea is that we have become a standard.”

The company’s tools are based in part on the MITRE ATT&CK framework, a knowledge base of threats, tactics and techniques used by a number of other cybersecurity services, including a number of others building continuous validation services that compete with Cymulate. These include the likes of FireEye, Palo Alto Networks, Randori, Khosla-backed AttackIQ and many more.

Although Cymulate is optimized to help customers better use the security tools they already have, it is not meant to replace other security apps, Wachsman noted, even if the by-product might become buying fewer of those apps in the future.

“I believe my message every day when talking with security experts is to stop buying more security products,” he said in an interview. “They won’t help defend you from the next attack. You can use what you’ve already purchased as long as you configure it well.”

In his words, Cymulate acts as a “black box” on the network, where it integrates with security and other software (it can also work without integrating, but integrations allow for a deeper analysis). After running its simulations, it produces a map of the network and its threat profile, an executive summary of the situation that can be presented to management and a more technical rundown, which includes recommendations for mitigations and remediations.

Alongside validating and optimising existing security apps and identifying vulnerabilities in the network, Cymulate also has built special tools to fit different kinds of use cases that are particularly relevant to how businesses operate today. They include evaluating remote working deployments, the state of a network following an M&A process, the security landscape of an organization that links up with third parties in supply chain arrangements, how well an organization’s security architecture is meeting (or potentially conflicting) with privacy and other kinds of regulatory compliance requirements, and it has built a “purple team” deployment, where in cases where security teams do not have the resources for running separate “red teams” to stress test something, blue teams at the organization can use Cymulate to build a machine learning-based “team” to do this.

The fact that Cymulate has built the infrastructure to run all of these processes speaks to a lot of potential of what more it could build, especially as our threat landscape and how we do business both continue to evolve. Even as it is, though, the opportunity today is a massive one, with Gartner estimating that some $170 billion will be spent on information security by enterprises in 2022. That’s one reason why investors are here, too.

“The increasing pace of global cyber security attacks has resulted in a crisis of trust in the security posture of enterprises and a realization that security testing needs to be continuous as opposed to periodic, particularly in the context of an ever-changing IT infrastructure and rapidly evolving threats. Companies understand that implementing security solutions is not enough to guarantee protection against cyber threats and need to regain control,” said Klein, in a statement. “We expect Cymulate to grow very fast,” he told me more directly.

Powered by WPeMatico