Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Africa is the last frontier for basically anything. Mobile gaming is no exception. For a continent that is home to more than 1 billion millennials and Gen Zers, mobile gaming has never really picked up, despite the continent witnessing rapid economic growth and smartphone adoption.

Two issues have proved detrimental to this growth: distribution and payments. With fragmented and unresolved distribution and digital payments ecosystems, game studios have found it difficult to serve African consumers and make a ton of money doing so. Carry1st is a mobile games publishing platform fixing this problem, and today it is announcing the close of its $6 million Series A round.

This month last year, we reported that the company had just raised a $2.5 million seed investment. CRE Ventures led that round, but this time, the company, which has offices in Cape Town and New York, brought in a blue-chip group of investors spanning gaming, media and fintech.

U.S. VC firm Konvoy Ventures led the Series A round. The firm is known for its investment in the video gaming industry’s infrastructure, technology, tools and platforms. Riot Games (developer of League of Legends), Tokyo’s Akatsuki Entertainment Technology Fund (the company behind Dragon Ball Z), Raine Ventures and fintech VC TTV Capital participated.

Carry1st was founded by Cordel Robbin-Coker, Lucy Hoffman and Tinotenda Mundangepfupfu in 2018. The company started as a game studio, developing and launching its own mobile games. But a projection on what it could be in the long run made the company switch tactics.

Instead of the studio model (quite popular among gaming companies in Africa), Carry1st sought to become a regional publisher, thereby opening the continent to international studios. Also, the company helps local studios that find it difficult to create games with a global appeal by pairing them with strong operators.

“We learned that African users don’t need their own games; they want to play the best games in the world,” CEO Robbin-Coker told TechCrunch.

COO Hoffman said that the company provides a full-stack publishing platform for its partners. It also handles localization, distribution, user acquisition, monetization, customer experience for studios and licenses their games on exclusive, long-term contracts.

“We fund user acquisition so that the games are played by as many users as possible, and then send our partners a royalty in return for the ability to leverage their IP,” Hoffman said.

L-R: Cordel Robbin-Coker (CEO), Lucy Hoffman (COO) and Tinotenda Mundangepfupfu (CTO). Image Credits: Carry1st

This is somewhat akin to how Tencent-backed Sea Limited (parent company of Garena) took off. The company was the publisher of League of Legends across Southeast Asia but launched its own game, Free Fire. Now, the company has built out the largest consumer payments and e-commerce platform in the region, which is now worth over $130 billion. Carry1st aspires to do the same for Africa.

Although there aren’t many details about its e-commerce activity, Carry1st is tackling payments and difficult monetization issues by partnering with some fintechs like Paystack, Safaricom and Cellulant. These partnerships have been pivotal to developing its in-house payments platform Pay1st, which allows customers to pay in their preferred way. “For global studios, this is the difference between making money and not,” Robbin-Coker added.

Demand for Carry1st has grown rapidly. Since its seed round last year, the company has signed seven games with well-known mobile gaming studios. They include Sweden’s Raketspel (the company has more than 120 million downloads across its portfolio), Cosi Games and Ethiopia’s Qene Games.

All these signups happened in 2020 and the catalyst for this growth has pandemic-induced lockdowns written all over it. The African mobile gaming market has always pointed toward a strong growth market, but being forced indoors surely skyrocketed mobile usage and gaming.

People who might not have previously needed a mobile phone have now come to rely on them to keep in touch with family and friends. For the average user using a smartphone for the first time, there’s a natural tendency to explore the fun things available on their device.

“Typically, the first things people do when they get their first smartphone is to chat with friends and play games. This is the same all over the world — Africa is no different. For that reason, we are seeing more and more mobile gamers across Africa,” remarked Robbin-Coker.

The company has also grown its team from 18 to 26 across 11 countries with recruits from Carlyle, King, Jumia, Rovio, Socialpoint, Ubisoft and Wargaming — a testament to the company’s global ambitions to be a top gaming publisher.

Expanding the team, which cuts across product, engineering and growth departments, is one way Carry1st will put the new investment to use. The company also plans to secure new partnerships with global gaming studios while launching and scaling its existing games like Carry1st Trivia and All-Star Soccer.

User playing a Carry1st game. Image Credits: Carry1st

With this investment, Carry1st has raised a total of $9.5 million. On the caliber of investors brought on, Robbin-Coker said their investment in the company would put them in a place to “delight millions of users across Africa and the globe.”

Carry1st is Konvoy Ventures first foray into the African gaming market (same can be said for Riot Games), and representatives from both teams (Konvoy managing partner Jackson Vaughan and Riot Games head of corporate development Brendan Mulligan) believe the company is unequivocally solving the continent’s distribution and gaming experience problems. Vaughan will also join the company’s board.

Africa’s gaming industry has lacked innovation in times past. While we’ve seen companies try to change the narrative, most have operated as studios. Carry1st is one of the few companies to operate a hybrid model, but the endgame for the company really is to be one of the region’s dominant consumer internet companies.

“We think social games and payments is the best first step to doing so, but we have very large ambitions. If we execute this, we will catalyze massive growth in the digital ecosystem across the region, creating tons of high-quality jobs in the process. We think all of the ingredients are in place — we want to be the catalyst,” Hoffman said.

Powered by WPeMatico

A Solid Power manufacturing engineer holds two 20 ampere hour (Ah) all solid state battery cells for the BMW Group and Ford Motor Company. The 20 ampere hour (Ah) all solid state battery cells were produced on Solid Power’s Colorado-based pilot production line. Source: Solid Power.

Solid state battery systems have long been considered the next breakthrough in battery technology, with multiple startups vying to be the first to commercialization. Automakers have been some of the top investors in the technology, each of them seeking the edge that will make their electric vehicles safer, faster and with increased range.

Ford Motor Company and BMW Group have put their money on battery technology company Solid Power.

The Louisville, Colorado-based SSB developer said Monday its latest $130 million Series B funding round was led by Ford and BMW, the latest signal that the two OEMs see SSBs powering the future of transportation. Under the investment, Ford and BMW are equal equity owners, and company representatives will join Solid Power’s board.

Solid Power received additional investment in the round from Volta Energy Technologies, the venture capital firm spun out of the U.S. Department of Energy’s Argonne National Laboratory.

Solid state batteries are so named because they lack a liquid electrolyte, as Mark Harris explained in an Extra Crunch article earlier this year. Liquid electrolyte solutions are usually flammable and at risk of overheating, so SSBs are considered to be generally safer. The real value of SSBs versus their lithium-ion counterparts is the energy density. Solid Power says its batteries can provide as much as a 50% to 100% increase in energy density compared to rechargeable batteries. Theoretically, electric vehicles with more energy-dense batteries can travel longer distances on a single charge.

This latest round of investment will help Solid Power boost its manufacturing to produce battery cells with the company’s highest ampere hour (Ah) output yet. Under separate joint development agreements with Ford and BMW, it will deliver to the OEMs 100 Ah cells for testing and vehicle integration from 2022.

Until this point, the company has been manufacturing cells with 2 Ah and 20 Ah output. “Hundreds” of 2 Ah battery cells were validated by Ford and BMW late last year, Solid Power said in a statement. Meanwhile, it is currently producing 20 Ah solid state batteries on a pilot basis with standard lithium-ion equipment.

As opposed to the 20 Ah pilot-scale cells — which are composed of 22-layers at 9×20 cm — these 100 Ah cells will have a larger footprint and even more layers, Solid Power spokesman Will McKenna told TechCrunch. (“Layers” refers to the number of double-sided cathodes, McKenna explained — so the 20 Ah cell has 22 cathodes and 22 anodes, with an all-solid electrolyte separator in between each, all in a single cell.)

Unlike Solid Power’s manufacturing, traditional lithium-ion batteries must undergo electrolyte filling and cycling in their production processes. Solid Power says these additional steps account for 5% and 30% of capital expenditure in a typical GWh-scale lithium-ion facility.

This isn’t the first time Solid Power has landed investments from the automakers. The company’s $20 million Series A in 2018 attracted capital from BMW and Ford, as well as Samsung, Hyundai, Volta and others. It’s part of a new wave of companies that have attracted the attention of OEMs. Other notable examples include Volkswagen-backed QuantumScape and General Motors, which has put its money on SES.

Ford is also independently researching advanced battery technologies and is planning to open a $185 million R&D battery lab, the company said last week.

Powered by WPeMatico

Sony and Discord have announced a partnership that will integrate the latter’s popular gaming-focused chat app with PlayStation’s own built-in social tools. It’s a big move and a fairly surprising one given how recently acquisition talks were in the air — Sony appears to have offered a better deal than Microsoft, taking an undisclosed minority stake in the company ahead of a rumored IPO.

The exact nature of the partnership is not expressed in the brief announcement post. The closest we come to hearing what will actually happen is that the two companies plan to “bring the Discord and PlayStation experiences closer together on console and mobile starting early next year,” which at least is easy enough to imagine.

Discord has partnered with console platforms before, though its deal with Microsoft was not a particularly deep integration. This is almost certainly more than a “friends can see what you’re playing on PS5” and more of a “this is an alternative chat infrastructure for anyone on a Sony system.” Chances are it’ll be a deep, system-wide but clearly Discord-branded option — such as “Start a voice chat with Discord” option when you invite a friend to your game or join theirs.

The timeline of early 2022 also suggests that this is a major product change, probably coinciding with a big platform update on Sony’s long-term PS5 roadmap.

While the new PlayStation is better than the old one when it comes to voice chat, the old one wasn’t great to begin with, and Discord is not just easier to use but something millions of gamers already do use daily. And these days, if a game isn’t an exclusive, being robustly cross-platform is the next best option — so PS5 players being able to seamlessly join and chat with PC players will reduce a pain point there.

Of course Microsoft has its own advantages, running both the Xbox and Windows ecosystems, but it has repeatedly fumbled this opportunity and the acquisition of Discord might have been the missing piece that tied it all together. That bird has flown, of course, and while Microsoft’s acquisition talks reportedly valued Discord at some $10 billion, it seems the growing chat app decided it would rather fly free with an IPO and attempt to become the dominant voice platform everywhere rather than become a prized pet.

Sony has done its part, financially speaking, by taking part in Discord’s recent $100 million H round. The amount they contributed is unknown, but perforce it can’t be more than a small minority stake, given how much the company has taken on and its total valuation.

Powered by WPeMatico

Zoomo, the Australian startup with a mission to electrify delivery fleets through e-bike subscriptions, announced a $12 million interim capital raise on Monday.

The company made a name for itself through partnerships with Uber Eats and DoorDash to help delivery workers access e-bikes through weekly subscriptions at discounted rates. Zoomo then grew to offer monthly subscriptions to corporate partners in Australia, the U.S. and London for last-mile delivery, with a fleet that has expanded beyond 10,000 units globally.

Now, the startup hopes to expand its service outward toward continental Europe and other states across the U.S. It currently operates in New York City, San Francisco, Los Angeles and Philadelphia. Zoomo also wants to build up its consumer model, which mainly serves couriers but is extending to commuters, and will invest in the development of its next generation of vehicle offerings.

“We initially built our products to service the demands of gig workers in the food delivery industry,” Mina Nada, Zoomo CEO and co-founder, said in a statement. “Their expectations for quality commercial vehicles, on demand service, flexible financing and tech enabled security features spurred us to innovate. We’re now seeing enterprises and fleet managers benefiting from the platform we have built. Enterprise fleet managers looking for clean and efficient vehicles are choosing us.”

Zoomo’s focus on e-bikes for food delivery makes it unique in the electric bike rental space. Its business model offers a full-stack e-bike, from the hardware and software to same-day servicing and financing options, which especially helps big business partners deploy and manage large fleets of vehicles at scale. It’s a tall order, and Zoomo’s strategy could be leading a new trend in micromobility of being a one-stop shop that promises quick scalability.

German mobility software provider Wunder Mobility recently announced its efforts to offer a souped-up e-moped that’s been co-designed with Chinese consumer manufacturer Yadea for the dockless sharing market. It also launched a new subsidiary to finance the vehicles, along with its software, to shared micromobility providers. Wunder Mobility plans to offer e-scooters and e-bikes for financing in the future, but it doesn’t design its own vehicles or sell them outright. While the business models and target customers don’t perfectly align, the blueprint is the same: Corner a market, provide top-quality hardware and software and make it as accessible as possible.

Coronavirus spurred a demand for delivery in all industries, and we can see companies like FluidTruck and Rivian stepping up to the plate to meet the needs of eco-conscious e-commerce giants with their electric delivery vans. The online food delivery industry is no different, with a market that’s expected to reach $192.16 billion in 2025 at a compound annual growth rate of 11%. But for delivery within cities, e-bikes offer a smarter solution for meeting climate change goals while dodging traffic congestion.

Zoomo’s custom-designed bikes can bear more than 200 kilograms of load via various cargo options, according to a Zoomo spokesperson. For enterprise customers, like health food company Cornucopia, e-cargo delivery vehicles like a Trailer Trike or a Covered Trike are used to deliver goods sustainably. Gorillas, an on-demand grocery delivery company, and Just Eat Takeaway, acquirer of Grubhub and Seamless, are also clients of Zoomo’s.

“At Just Eat Takeaway.com, we want to build a sustainable future for food delivery, and are committed to doing our bit to help keep carbon emissions to a minimum, as well as providing an efficient customer experience from order to delivery,” said a Just Eat Takeaway spokesperson in a statement. “E-Vehicles are an integral part of the Scoober model and we are pleased to work in cooperation with Zoomo.”

Zoomo’s newest funding round, led by Australian VC AirTree, follows an $11 million Series A raised in August 2020, with support in both rounds from the Clean Energy Finance Corporation, Maniv Mobility and Contrarian Ventures. Withrop Square and Wisdom VC, mobility and clean tech-focused investors, also joined this round.

Powered by WPeMatico

Remote work is no longer a new topic, as much of the world has now been doing it for a year or more because of the COVID-19 pandemic.

Companies — big and small — have had to react in myriad ways. Many of the initial challenges have focused on workflow, productivity and the like. But one aspect of the whole remote work shift that is not getting as much attention is the culture angle.

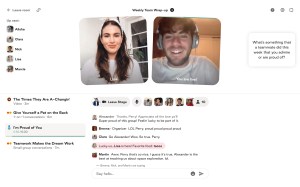

A 100% remote startup that was tackling the issue way before COVID-19 was even around is now seeing a big surge in demand for its offering that aims to help companies address the “people” challenge of remote work. It started its life with the name Icebreaker to reflect the aim of “breaking the ice” with people with whom you work.

“We designed the initial version of our product as a way to connect people who’d never met, kind of virtual speed dating,” says co-founder and CEO Perry Rosenstein. “But we realized that people were using it for far more than that.”

So over time, its offering has evolved to include a bigger goal of helping people get together beyond an initial encounter –– hence its new name: Gatheround.

“For remote companies, a big challenge or problem that is now bordering on a crisis is how to build connection, trust and empathy between people that aren’t sharing a physical space,” says co-founder and COO Lisa Conn. “There’s no five-minute conversations after meetings, no shared meals, no cafeterias — this is where connection organically builds.”

Organizations should be concerned, Gatheround maintains, that as we move more remote, that work will become more transactional and people will become more isolated. They can’t ignore that humans are largely social creatures, Conn said.

The startup aims to bring people together online through real-time events such as a range of chats, videos and one-on-one and group conversations. The startup also provides templates to facilitate cultural rituals and learning & development (L&D) activities, such as all-hands meetings and workshops on diversity, equity and inclusion.

Gatheround’s video conversations aim to be a refreshing complement to Slack conversations, which despite serving the function of communication, still don’t bring users face-to-face.

Image Credits: Gatheround

Since its inception, Gatheround has quietly built up an impressive customer base, including 28 Fortune 500s, 11 of the 15 biggest U.S. tech companies, 26 of the top 30 universities and more than 700 educational institutions. Specifically, those users include Asana, Coinbase, Fiverr, Westfield and DigitalOcean. Universities, academic centers and nonprofits, including Georgetown’s Institute of Politics and Public Service and Chan Zuckerberg Initiative, are also customers. To date, Gatheround has had about 260,000 users hold 570,000 conversations on its SaaS-based, video platform.

All its growth so far has been organic, mostly referrals and word of mouth. Now, armed with $3.5 million in seed funding that builds upon a previous $500,000 raised, Gatheround is ready to aggressively go to market and build upon the momentum it’s seeing.

Venture firms Homebrew and Bloomberg Beta co-led the company’s latest raise, which included participation from angel investors such as Stripe COO Claire Hughes Johnson, Meetup co-founder Scott Heiferman, Li Jin and Lenny Rachitsky.

Co-founders Rosenstein, Conn and Alexander McCormmach describe themselves as “experienced community builders,” having previously worked on President Obama’s campaigns as well as at companies like Facebook, Change.org and Hustle.

The trio emphasize that Gatheround is also very different from Zoom and video conferencing apps in that its platform gives people prompts and organized ways to get to know and learn about each other as well as the flexibility to customize events.

“We’re fundamentally a connection platform, here to help organizations connect their people via real-time events that are not just really fun, but meaningful,” Conn said.

Homebrew Partner Hunter Walk says his firm was attracted to the company’s founder-market fit.

“They’re a really interesting combination of founders with all this experience community building on the political activism side, combined with really great product, design and operational skills,” he told TechCrunch. “It was kind of unique that they didn’t come out of an enterprise product background or pure social background.”

He was also drawn to the personalized nature of Gatheround’s platform, considering that it has become clear over the past year that the software powering the future of work “needs emotional intelligence.”

“Many companies in 2020 have focused on making remote work more productive. But what people desire more than ever is a way to deeply and meaningfully connect with their colleagues,” Walk said. “Gatheround does that better than any platform out there. I’ve never seen people come together virtually like they do on Gatheround, asking questions, sharing stories and learning as a group.”

James Cham, partner at Bloomberg Beta, agrees with Walk that the founding team’s knowledge of behavioral psychology, group dynamics and community building gives them an edge.

“More than anything, though, they care about helping the world unite and feel connected, and have spent their entire careers building organizations to make that happen,” he said in a written statement. “So it was a no-brainer to back Gatheround, and I can’t wait to see the impact they have on society.”

The 14-person team will likely expand with the new capital, which will also go toward helping adding more functionality and details to the Gatheround product.

“Even before the pandemic, remote work was accelerating faster than other forms of work,” Conn said. “Now that’s intensified even more.”

Gatheround is not the only company attempting to tackle this space. Ireland-based Workvivo last year raised $16 million and earlier this year, Microsoft launched Viva, its new “employee experience platform.”

Powered by WPeMatico

Columbus, Ohio-based firm Path Robotics today announced the completion of a $56 million Series B. The round, led by Addition (featuring Drive Capital, Basis Set and Lemnos Lab) brings the robotic welding company’s total funding to $71 million.

Adding another piece to the broader automated manufacturing puzzle, the company is focused on robotic welding. The system uses scanning, computer vision and AI to adjust itself to different parts, understanding that sizing parts is a kind of imperfect science. Add to that the additional difficulty of working with highly reflective metals and you’ve got some interesting robotics problems to solve.

“Current industrial robotics have very little ability to understand their environment and the task at hand. Most robots merely repeat what they are told and have no ability to improve themselves,” CEO Andrew Lonsberry said in a release tied to the news. Our goal is to change this. The future of manufacturing hinges on highly capable robotics.”

The company says it’s looking to address a shortage in the welding workforce, which the American Welding Society says will experience a shortage of around 400,000 by 2024. The pandemic has also driven a number of companies to look for a more localized solution, apparently somewhat curbing the trend of offshoring the industry has seen in recent decades.

Powered by WPeMatico

Four months after leading a $30 million growth round in Bibit, Sequoia Capital India has doubled down on its investment in the Indonesian robo-advisor app. Bibit announced today that the firm led a new $65 million growth round that also included participation from Prosus Ventures, Tencent, Harvard Management Company and returning investors AC Ventures and East Ventures.

This brings Bibit’s total funding to $110 million, including a Series A announced in May 2019. Its latest round will be used on developing and launching new products, hiring and increasing Bibit’s financial education services.

Bibit was launched in 2019 by Stockbit, a stock investing platform and community, and is part of a crop of Indonesian investment apps focused on new investors. Others include SoftBank Ventures-backed Ajaib, Bareksa, Pluang and FUNDtastic. Bibit runs robo-advisor services for mutual funds, investing users’ money based on their risk profiles, and claims that 90% of its users are millennials and first-time investors.

According to Indonesia’s Financial Services Authority (Otoritas Jasa Keuangan), the number of retail investors grew 56% year-over-year in 2020. For mutual funds in particular, Bibit said investors grew 78% year-over-year to 3.2 million, based on data from the Indonesia Stock Exchange and Central Securities Custodian.

Despite the economic impact of COVID-19, interest in stock investing grew as people took advantage of market dips (the Jakarta Composite Index fell in the first quarter of 2020, but is now recovering steadily). Apps like Bibit and its competitors want to make capital investing more accessible with lower fees and minimum investment amounts than traditional brokerages like Mandiri Sekuritas, which also saw an increase in new retail investors and average transaction value last year.

But the percentage of retail investors in Indonesia is still very low, especially compared to markets like Singapore or Malaysia, presenting growth opportunities for investment services.

Apps like Bibit focus on content that helps make capital investing less intimidating to first-time investors. For example, Ajaib also presents its financial educational features as a selling point.

In a press statement, Sequoia Capital India vice president Rohit Agarwal said, “Indonesian mutual fund customers have grown almost 10x in the past five years. Savings via mutual funds is the first step towards investing and Bibit has helped millions of consumers start their investing journey in a responsible manner. Sequoia Capital India is excited to double down on the partnership as the company brings the same customer focus to stock investing with Stockbit.”

Powered by WPeMatico

Platforms like Shopify, Stripe and WordPress have done a lot to make essential business-building tools — like running storefronts, accepting payments and building websites — accessible to businesses with even the most modest budgets. But some very key aspects of setting up a company remain expensive, time-consuming affairs that can be cost-prohibitive for small businesses — but that, if ignored, can result in the failure of a business before it even really gets started.

Trademark registration is one such concern, and Toronto-based startup Heirlume just raised $1.7 million CAD (~$1.38 million) to address the problem with a machine-powered trademark registration platform that turns the process into a self-serve affair that won’t break the budget. Its AI-based trademark search will flag if terms might run afoul of existing trademarks in the U.S. and Canada, even when official government trademark search tools, and even top-tier legal firms, might not.

Heirlume’s core focus is on leveling the playing field for small business owners, who have typically been significantly out-matched when it comes to any trademark conflicts.

“I’m a senior-level IP lawyer focused in trademarks, and had practiced in a traditional model, boutique firm of my own for over a decade serving big clients, and small clients,” explained Heirlume co-founder Julie MacDonell in an interview. “So providing big multinationals with a lot of brand strategy, and in-house legal, and then mainly serving small business clients when they were dealing with a cease-and-desist, or an infringement issue. It’s really those clients that have my heart: It’s incredibly difficult to have a small business owner literally crying tears on the phone with you, because they just lost their brand or their business overnight. And there was nothing I could do to help because the law just simply wasn’t on their side, because they had neglected to register their trademarks to own them.”

In part, there’s a lack of awareness around what it takes to actually register and own a trademark, MacDonell says. Many entrepreneurs just starting out seek out a domain name as a first step, for instance, and some will fork over significant sums to register these domains. What they don’t realize, however, is that this is essentially a rental, and if you don’t have the trademark to protect that domain, the actual trademark owner can potentially take it away down the road. But even if business owners do realize that a trademark should be their first stop, the barriers to actually securing one are steep.

“There was an an enormous, insurmountable barrier, when it came to brand protection for those business owners,” she said. “And it just isn’t fair. Every other business service, generally a small business owner can access. Incorporating a company or even insurance, for example, owning and buying insurance for your business is somewhat affordable and accessible. But brand ownership is not.”

Heirlume brings the cost of trademark registration down from many thousands of dollars to just under $600 for the first, and only $200 for each additional after that. The startup is also offering a very small business-friendly “buy now, pay later” option supported by Clearbanc, which means that even businesses starting on a shoestring can take the step of protecting their brand at the outset.

In its early days, Heirlume is also offering its core trademark search feature for free. That provides a trademark search engine that works across both U.S. and Canadian government databases, which can not only tell you if your desired trademark is available or already held, but also reveal whether it’s likely to be able to be successfully obtained, given other conflicts that might arise that are totally ignored by native trademark database search portals.

Heirlume uses machine learning to identify these potential conflicts, which not only helps users searching for their trademarks, but also greatly decreases the workload behind the scenes, helping them lower costs and pass on the benefits of those improved margins to its clients. That’s how it can achieve better results than even hand-tailored applications from traditional firms, while doing so at scale and at reduced costs.

Another advantage of using machine-powered data processing and filing is that on the government trademark office side, the systems are looking for highly organized, curated data sets that are difficult for even trained people to get consistently right. Human error in just data entry can cause massive backlogs, MacDonell notes, even resulting in entire applications having to be tossed and started over from scratch.

“There are all sorts of data sets for those [trademark requirement] parameters,” she said. “Essentially, we synthesize all of that, and the goal through machine learning is to make sure that applications are utterly compliant with government rules. We actually have a senior-level trademark examiner that came to work for us, very excited that we were solving the problems causing backlogs within the government. She said that if Heirlume can get to a point where the applications submitted are perfect, there will be no backlog with the government.”

Improving efficiency within the trademark registration bodies means one less point of friction for small business owners when they set out to establish their company, which means more economic activity and upside overall. MacDonell ultimately hopes that Heirlume can help reduce friction to the point where trademark ownership is at the forefront of the business process, even before domain registration. Heirlume has a partnership with Google Domains to that end, which will eventually see indication of whether a domain name is likely to be trademarkable included in Google Domain search results.

This initial seed funding includes participation from Backbone Angels, as well as the Future Capital collective, Angels of Many and MaRS IAF, along with angel investors including Daniel Debow, Sid Lee’s Bertrand Cesvet and more. MacDonell notes that just as their goal was to bring more access and equity to small business owners when it comes to trademark protection, the startup was also very intentional in building its team and its cap table. MacDonell, along with co-founders CTO Sarah Ruest and Dave McDonell, aim to build the largest tech company with a majority female-identifying technology team. Its investor make-up includes 65% female-identifying or underrepresented investors, and MacDonnell says that was a very intentional choice that extended the time of the raise, and even led to turning down interest from some leading Silicon Valley firms.

“We want underrepresented founders to be to be funded, and the best way to ensure that change is to empower underrepresented investors,” she said. “I think that we all have a responsibility to actually do something. We’re all using hashtags right now, and hashtags are not enough […] Our CTO is female, and she’s often been the only female person in the room. We’ve committed to ensuring that women in tech are no longer the only woman in the room.”

Powered by WPeMatico

A U.S./Israeli startup, Sorbet — which is tackling what companies do with the financial risks as employees accrue paid time off (PTO) — has raised $6 million in a seed funding round led by Viola Ventures, with participation by Global Founders Capital and Meron Capital.

The economics of paid time off is relatively hidden in the business world, but essentially, Sorbet takes on the burden of this PTO from employers and then allows employees to spend it. This gives the employers far more control over the whole process and the ability to forecast its impact on the business.

Sorbet says that in the U.S., employees use only 72% of PTO balances, even though it’s the most sought-after benefit. But this, effectively, comes out at 768 million unused days off a year, worth around $224 billion. This creates a difficult problem for CFOs and accountants because its creates balance sheet liabilities on the company’s books, says Sorbet. If the employee doesn’t use all of their PTO, the employer can end up owing them a lot of money, which creates a cash flow liability on the company’s books. So Sorbet buys out these PTO liabilities from employees, then loads the cash value of the PTO on prepaid credit cards for the employees.

Speaking to me on a call, CEO and co-founder Veetahl Eilat-Raichel, said: “We researched this whole idea of paid time off and found this huge, massive market failure and inefficiency around the way that PTO is constructed. It’s kind of one of those things where, on the face of it, there’s this boring bureaucratic payroll item that turns into a boring balance sheet item. But under it is a $224 billion problem for U.S. businesses… If you think about it, employers are borrowing money from their employees at the worst terms possible and employees aren’t benefitting either. So everyone’s hurting here.”

She said: “Sorbet assumes the liability on ourselves and so then we can allow the company to control their cash flow and decide when they want to pay us back. They gain a lot of financial value because we are able to be very, very attractive on our funding. So it saves costs, it provides them with complete control of their cash flow and it allows them to give out amazing financial benefits to employees at a time where we can all use some extra cash right now.”

The platform Sorbet has built will, it says, sync with calendars, HR and payroll systems, identify habits and then proactively suggest personalized, pre-approved 3-6 hour “Micro Breaks”, 1-4 day “Micro Vacations” and +1 week Vacations. This, says the startup, increases PTO used by as much as 15%.

Employers can constantly renegotiate the terms of the loan with Sorbet, thus matching future cash flow, insulating themselves against salary raises (wage inflation), and take advantage of other benefits.

The co-founders are Eilat-Raichel, who previously worked at L’Oréal, Lockheed Martin and a fintech entrepreneur; Eliaz Shapira, co-founder and CPO; and Rami Kasterstein, co-founder and board member.

Powered by WPeMatico

Tapping the geothermal energy stored beneath the Earth’s surface as a way to generate renewable power is one of the new visions for the future that’s captured the attention of environmentalists and oil and gas engineers alike.

That’s because it’s not only a way to generate power that doesn’t rely on greenhouse gas emitting hydrocarbons, but because it uses the same skillsets and expertise that the oil and gas industry has been honing and refining for years.

At least that’s what drew the former completion engineer (it’s not what it sounds like) Tim Latimer to the industry and to launch Fervo Energy, the Houston-based geothermal tech developer that’s picked up funding from none other than Bill Gates’ Breakthrough Energy Ventures (that fund… is so busy) and former eBay executive, Jeff Skoll’s Capricorn Investment Group.

With the new $28 million cash in hand, Fervo’s planning on ramping up its projects, which Latimer said would “bring on hundreds of megawatts of power in the next few years.”

Latimer got his first exposure to the environmental impact of power generation as a kid growing up in a small town outside of Waco, Texas near the Sandy Creek coal power plant, one of the last coal-powered plants to be built in the U.S.

Like many Texas kids, Latimer came from an oil family, and got his first jobs in the oil and gas industry before realizing that the world was going to be switching to renewables and the oil industry — along with the friends and family he knew — could be left high and dry.

It’s one reason he started working on Fervo, the entrepreneur said.

“What’s most important, from my perspective, since I started my career in the oil and gas industry, is providing folks that are part of the energy transition on the fossil fuel side to work in the clean energy future,” Latimer said. “I’ve been able to go in and hire contractors and support folks that have been out of work or challenged because of the oil price crash… And I put them to work on our rigs.”

Fervo Energy chief executive, Tim Latimer, pictured in a hardhat at one of the company’s development sites. Image Credits: Fervo Energy

When the Biden administration talks about finding jobs for employees in the hydrocarbon industry as part of the energy transition, this is exactly what they’re talking about.

And geothermal power is no longer as constrained by geography, so there are a lot of abundant resources to tap and the potential for high-paying jobs in areas that are already dependent on geological services work, Latimer said (late last year, Vox published a good overview of the history and opportunity presented by the technology).

“A large percentage of the world’s population actually lives next to good geothermal resources,” Latimer said. “[There are] 25 countries today that have geothermal installed and producing and another 25 where geothermal is going to grow.”

Geothermal power production actually has a long history in the Western U.S. and in parts of Africa where naturally occurring geysers and steam jets pouring from the earth have been obvious indicators of good geothermal resources, Latimer said.

“Fervo’s technology unlocks a new class of geothermal resource that is ready for large-scale deployment. Fervo’s geothermal systems use novel techniques, including horizontal drilling, distributed fiber optic sensing and advanced computational modelling, to deliver more repeatable and cost effective geothermal electricity,” Latimer wrote in an email. “Fervo’s technology combines with the latest advancements in Organic Rankine Cycle generation systems to deliver flexible, 24/7 carbon-free electricity.”

Initially developed with a grant from the TomKat Center at Stanford University and a fellowship funded by Activate.org at the Lawrence Berkeley National Lab’s Cyclotron Road division, Fervo has gone on to score funding from the DOE’s Geothermal Technology Office and ARPA-E to continue work with partners like Schlumberger, Rice University and the Berkeley Lab.

The combination of new and old technology is opening vast geographies to the company to potentially develop new projects.

Other companies are also looking to tap geothermal power to drive a renewable power-generation development business. Those are startups like Eavor, which has the backing of energy majors like bp Ventures, Chevron Technology Ventures, Temasek, BDC Capital, Eversource and Vickers Venture Partners; and other players including GreenFire Energy and Sage Geosystems.

Demand for geothermal projects is skyrocketing, opening up big markets for startups that can nail the cost issue for geothermal development. As Latimer noted, from 2016 to 2019 there was only one major geothermal contract, but in 2020 there were 10 new major power purchase agreements signed by the industry.

For all of these projects, cost remains a factor. Contracts that are being signed for geothermal that are in the $65 to $75 per megawatt range, according to Latimer. By comparison, solar plants are now coming in somewhere between $35 and $55 per megawatt, as The Verge reported last year.

But Latimer said the stability and predictability of geothermal power made the cost differential palatable for utilities and businesses that need the assurance of uninterruptible power supplies. As a current Houston resident, the issue is something that Latimer has an intimate experience with from this year’s winter freeze, which left him without power for five days.

Indeed, geothermal’s ability to provide always-on clean power makes it an incredibly attractive option. In a recent Department of Energy study, geothermal could meet as much as 16% of the U.S. electricity demand, and other estimates put geothermal’s contribution at nearly 20% of a fully decarbonized grid.

“We’ve long been believers in geothermal energy but have waited until we’ve seen the right technology and team to drive innovation in the sector,” said Ion Yadigaroglu of Capricorn Investment Group, in a statement. “Fervo’s technology capabilities and the partnerships they’ve created with leading research organizations make them the clear leader in the new wave of geothermal.”

Fervo Energy drilling site. Image Credits: Fervo Energy

Powered by WPeMatico