Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Getting actionable business information into the hands of users who need it has always been a challenge. If you have to wait for experts to help you find the answers, chances are you’re going to be too late. Enter Tellius, an early-stage startup building a solution to help business users find the information they need when they need it.

Today the company announced an $8 million Series A led by Sands Capital Ventures, with participation from Grotech. Today’s investment brings the total raised to $17 million, according to the company.

CEO and founder Ajay Khanna says the company is attempting to marry two technologies that have traditionally lived in silos: business intelligence and artificial intelligence. He believes that bringing them together can lead to greater wisdom and help close the insight gap.

“Tellius is an AI-driven decision intelligence platform, and what we do is we combine machine learning — AI-driven automation — with a Google-like natural language interface, so combining the left brain and the right brain to enable business teams to get insights on the data,” Khanna told me.

The idea is to let the machine learning teams and the business analysts continue to do their thing, but provide an application where business users can put all of that to work. “We believe that to go from data to decisions, you need to know not only what happened, but why things change and how you can improve your company,” he said.

The product takes aim at three employee groups. The first is the business user, who can simply query the data with a natural language question to get results. The second is a data analyst, who can get more granular by choosing a specific model to base the query on, and finally a data scientist who can enhance the query with Python or Spark code.

It connects to various data sources, including Salesforce and Google Analytics, data lakes like Snowflake, csv files to take advantage of Excel data or cloud storage tools like Amazon S3. It comes in two versions: one that the customer can connect to the cloud infrastructure provider of choice, and one which they run as a service and manage for the customers.

Khanna says that as companies struggled to change the way they do business during the pandemic, they needed the kind of insights his company provides, and business grew 300% last year as a result.

The startup launched in 2016 after Khanna sold a previous company, which allowed him to bootstrap while in stealth. They spent a couple of years building the product and brought the first version of Tellius to market in Q3 2018. That’s when they took a $7.5 million seed round.

Powered by WPeMatico

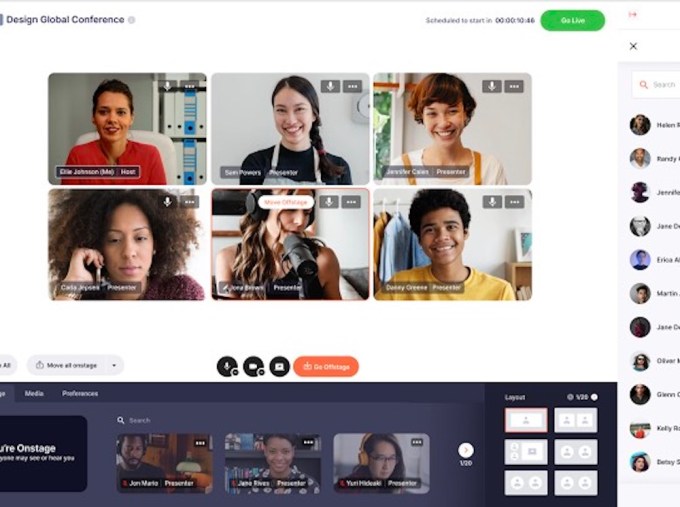

While there’s been plenty of attention and money lavished on virtual event platforms over the past year, Introvoke co-founder and CEO Oana Manolache predicted that we’re only at the beginning of a “third wave of digital transformation.”

In her framing, the first wave came at the beginning of the pandemic, when everyone was using video conferencing tools like Zoom for their virtual events. Next came conference platforms like Hopin (which has been raising money at a mind-boggling clip). But Manolache argued that even Hopin represents a “Band-Aid” that customers are hoping will tide them over until in-person events can resume — particularly when organizers have to point attendees to a third-party platform.

“One size does not fit all,” she said. “The Band-Aid solution that was only supposed to last for a couple months has had big benefits as companies grew their customer base and revenue targets. Now we’ve reached the third wave, as organizations want to bring solutions to their own universe and own their relationship with the audience.”

San Francisco-based Introvoke is a Techstars Accelerator graduate aiming to provide this third-wave solution. It’s announcing today that it has raised $2.7 million in funding led by Struck Capital, while Comcast, Social Leverage, Great Oaks, V1vc, Time CTO Bharat Krish and Resy co-founder Mike Montero also participated.

The startup offers components like virtual stages, chat rooms and networking hubs, all customizable and embeddable on a customer’s website. Manolache said Introvoke (the name comes from the idea of “thought-provoking introductions”) is designed for a hybrid future, which will take multiple forms: “Hybrid is going to mean virtual-only events, in-person only events and events that have in-person and virtual elements.”

Image Credits: Introvoke

Introvoke charges customers based on live event minutes, a model that it says is accessible to companies large and small. Its components can be embedded on websites built with WordPress, Squarespace, Wix, Splash and other platforms, but also on a customer’s internal intranet.

“We’ve been so impressed by the way customers are using the technology — conferences, career fairs, employee engagements,” Manolache said.

She added that as customers like Comcast, Wharton and Ritual Motion have used the platform in private preview mode, they’re beginning to break free of the in-person model. For example, Introvoke events can allow for attendees to chat with each other over weeks or months, not just a few days.

In a statement, Struck Capital founder and Managing Partner Adam B. Struck suggested that virtual events “will continue far beyond the COVID-19 pandemic.”

“Right now, virtual experiences, from conferences and concerts to company all-hands, are generally hosted on third party platforms, which creates a disjointed experience for the brand or organization hosting the event,” he continued. “Virtual enablement should be native to the website and platform of the enterprise itself, and it’s the role of technologists like the Introvoke team to make these experiences as seamless as any in-person event.”

Powered by WPeMatico

After spending much of his career in mission-critical environments, including the Israeli Air Force, Israeli Intelligence and leading development of a cybersecurity product at Microsoft, Amit Rosenzweig turned his attention to autonomous vehicles.

It was a technology that he soon recognized would need what every other mission-critical system requires: humans.

“I understood that there are so many edge cases that will not be solved purely by AI and machine learning, and there must be some kind of human-in-the-loop intervention,” Rosenzweig said in a recent interview. “You don’t have any mission-critical system on the planet — not nuclear power plants, not airplanes — without human supervision. A human must be in the loop or present in some way for autonomous mobility to exist, even in 10 or probably 20 years from now.”

That “human in the loop” conclusion led Rosenzweig to found teleoperations startup Ottopia in 2018. (His brother, Oren Rosenzweig is also in the autonomous vehicle business via the lidar company he co-founded, Innoviz.) Ottopia’s first product is a universal teleoperation platform that allows a human operator to monitor and control any type of vehicle from thousands of miles away. Ottopia’s software is combined with off-the-shelf hardware components like monitors and cameras to create a teleoperations center. The company’s software also includes assistive features, which provide “path” instructions to the AV without having to remotely control the vehicle.

Since launching, the small 25-person company has racked up investors and partners such as BMW, fixed-route AV startup May Mobility and Bestmile. Ottopia said Friday that it has raised $9 million from Hyundai Motor Group as well as Maven and IN Venture, the Israel-focused venture capital arm of Sumitomo Corporation. Existing investors MizMaa and Israeli firm NextGear also participated.

Hyundai and IN Venture also gained board seats. Woongjun Jang, who heads up Hyundai’s autonomous driving center, and IN Venture managing partner Eyal Rosner, are now on Ottopia’s board.

Ottopia has raised a total of $12 million to date, and Rosenzweig has already set his sights on a larger round to help fund the company’s growth.

For now, Rosenzweig is focused on doubling his workforce to 50 people by the end of the year and opening an office in the United States. Rosenzweig said the company is also expanding into other applications of its teleoperations software, including defense, mining and logistics. However, most of Ottopia’s resources will continue to be dedicated to automotive, and specifically the deployment of autonomous cars, trucks and shuttles.

“The motivation is really simple — it’s simple but it’s hard to do — and that’s to make affordable autonomous transportation closer to reality,” Rosenzweig said. “The problem of course is that when an AV does not have any kind of backup or any kind of safety net in the form of teleoperations and it gets stuck, passengers are going to get anxious, ‘what’s going on, why, why is this not moving’.”

The other problem, Rosenzweig noted, is that AVs need to be combined with an efficient transit service. That’s where he sees his newest partner, on-demand shuttle and transit software company Via, coming in.

Under the partnership, which was also announced this week, Via will offer autonomous vehicle fleets that combine its fleet management software with Ottopia’s teleoperations platform. Via is not developing its own self-driving software system. In November 2020, Via announced it had partnered with May Mobility to launch an autonomous vehicle platform that integrates on-demand shared rides, public transportation and transit options for passengers with accessibility needs.

Powered by WPeMatico

With the increase of digital transacting over the past year, cybercriminals have been having a field day.

In 2020, complaints of suspected internet crime surged by 61%, to 791,790, according to the FBI’s 2020 Internet Crime Report. Those crimes — ranging from personal and corporate data breaches to credit card fraud, phishing and identity theft — cost victims more than $4.2 billion.

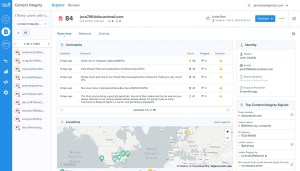

For companies like Sift — which aims to predict and prevent fraud online even more quickly than cybercriminals adopt new tactics — that increase in crime also led to an increase in business.

Last year, the San Francisco-based company assessed risk on more than $250 billion in transactions, double from what it did in 2019. The company has over several hundred customers, including Twitter, Airbnb, Twilio, DoorDash, Wayfair and McDonald’s, as well a global data network of 70 billion events per month.

To meet the surge in demand, Sift said today it has raised $50 million in a funding round that values the company at over $1 billion. Insight Partners led the financing, which included participation from Union Square Ventures and Stripes.

While the company would not reveal hard revenue figures, President and CEO Marc Olesen said that business has tripled since he joined the company in June 2018. Sift was founded out of Y Combinator in 2011, and has raised a total of $157 million over its lifetime.

The company’s “Digital Trust & Safety” platform aims to help merchants not only fight all types of internet fraud and abuse, but to also “reduce friction” for legitimate customers. There’s a fine line apparently between looking out for a merchant and upsetting a customer who is legitimately trying to conduct a transaction.

Sift uses machine learning and artificial intelligence to automatically surmise whether an attempted transaction or interaction with a business online is authentic or potentially problematic.

Image Credits: Sift

One of the things the company has discovered is that fraudsters are often not working alone.

“Fraud vectors are no longer siloed. They are highly innovative and often working in concert,” Olesen said. “We’ve uncovered a number of fraud rings.”

Olesen shared a couple of examples of how the company thwarted fraud incidents last year. One recently involved money laundering through donation sites where fraudsters tested stolen debit and credit cards through fake donation sites at guest checkout.

“By making small donations to themselves, they laundered that money and at the same tested the validity of the stolen cards so they could use it on another site with significantly higher purchases,” he said.

In another case, the company uncovered fraudsters using Telegram, a social media site, to make services available, such as food delivery, with stolen credentials.

The data that Sift has accumulated since its inception helps the company “act as the central nervous system for fraud teams.” Sift says that its models become more intelligent with every customer that it integrates.

Insight Partners Managing Director Jeff Lieberman, who is a Sift board member, said his firm initially invested in Sift in 2016 because even at that time, it was clear that online fraud was “rapidly growing.” It was growing not just in dollar amounts, he said, but in the number of methods cybercriminals used to steal from consumers and businesses.

“Sift has a novel approach to fighting fraud that combines massive data sets with machine learning, and it has a track record of proving its value for hundreds of online businesses,” he wrote via email.

When Olesen and the Sift team started the recent process of fundraising, Insight actually approached them before they started talking to outside investors “because both the product and business fundamentals are so strong, and the growth opportunity is massive,” Lieberman added.

“With more businesses heavily investing in online channels, nearly every one of them needs a solution that can intelligently weed out fraud while ensuring a seamless experience for the 99% of transactions or actions that are legitimate,” he wrote.

The company plans to use its new capital primarily to expand its product portfolio and to scale its product, engineering and sales teams.

Sift also recently tapped Eu-Gene Sung — who has worked in financial leadership roles at Integral Ad Science, BSE Global and McCann — to serve as its CFO.

As to whether or not that meant an IPO is in Sift’s future, Olesen said that Sung’s experience of taking companies through a growth phase such as what Sift is experiencing would be valuable. The company is also for the first time looking to potentially do some M&A.

“When we think about expanding our portfolio, it’s really a buy/build partner approach,” Olesen said.

Powered by WPeMatico

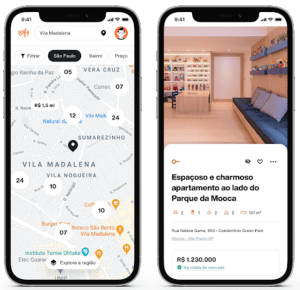

Nearly exactly one month ago, digital real estate platform Loft announced it had closed on $425 million in Series D funding led by New York-based D1 Capital Partners. The round included participation from a mix of new and existing investors such as DST, Tiger Global, Andreessen Horowitz, Fifth Wall and QED, among many others.

At the time, Loft was valued at $2.2 billion, a huge jump from its being just near unicorn territory in January 2020. The round marked one of the largest ever for a Brazilian startup.

Now, today, São Paulo-based Loft has announced an extension to that round with the closing of $100 million in additional funding that values the company at $2.9 billion. This means that the 3-year-old startup has increased its valuation by $700 million in a matter of weeks.

Baillie Gifford led the Series D-2 round, which also included participation from Tarsadia, Flight Deck, Caffeinated and others. Individuals also put money in the extension, including the founders of Better (Zach Frenkel), GoPuff, Instacart, Kavak and Sweetgreen.

Loft has seen great success in its efforts to serve as a “one-stop shop” for Brazilians to help them manage the home buying and selling process.

Image Credits: Loft

In 2020, Loft saw the number of listings on its site increase “10 to 15 times,” according to co-founder and co-CEO Mate Pencz. Today, the company actively maintains more than 13,000 property listings in approximately 130 regions across São Paulo and Rio de Janeiro, partnering with more than 30,000 brokers. Not only are more people open to transacting digitally, more people are looking to buy versus rent in the country.

“We did more than 6x YoY growth with many thousands of transactions over the course of 2020,” Pencz told TechCrunch at the time of the company’s last raise. “We’re now growing into the many tens of thousands, and soon hundreds of thousands, of active listings.”

The decision to raise more capital so soon was due to a variety of factors. For one, Loft has received “overwhelming investor interest” even after “a very, very oversubscribed main round,” Pencz said.

“We have seen a continued acceleration in our market share growth, especially in São Paulo and Rio de Janeiro, the two markets we currently operate in,” he added. “We saw an opportunity to grow even faster with additional capital.”

Pencz also pointed out that Baillie Gifford has relatively large minimum check size requirements, which led to the extension being conducted at a higher price and increased the total round size “by quite a bit to be able to accommodate them.”

While the company was less forthcoming about its financials as of late, it told me last year that it had notched “over $150 million in annualized revenues in its first full year of operation” via more than 1,000 transactions.

The company’s revenues and GMV (gross merchandise value) “increased significantly” in 2020, according to Pencz, who declined to provide more specifics. He did say those figures are “multiples higher from where they were,” and that Loft has “a very clear horizon to profitability.”

Pencz and Florian Hagenbuch founded Loft in early 2018 and today serve as its co-CEOs. The aim of the platform, in the company’s words, is “bringing Latin American real estate into the e-commerce age by developing online alternatives to analogue legacy processes and leveraging data to create transparency in highly opaque markets.” The U.S. real estate tech company with the closest model to Loft’s is probably Zillow, according to Pencz.

In the United States, prospective buyers and sellers have the benefit of MLSs, which in the words of the National Association of Realtors, are private databases that are created, maintained and paid for by real estate professionals to help their clients buy and sell property. Loft itself spent years and many dollars in creating its own such databases for the Brazilian market. Besides helping people buy and sell homes, it offers services around insurance, renovations and rentals.

In 2020, Loft also entered the mortgage business by acquiring one of the largest mortgage brokerage businesses in Brazil. The startup now ranks among the top-three mortgage originators in the country, according to Pencz. When it comes to helping people apply for mortgages, he likened Loft to U.S.-based Better.com.

This latest financing brings Loft’s total funding raised to an impressive $800 million. Other backers include Brazil’s Canary and a group of high-profile angel investors such as Max Levchin of Affirm and PayPal, Palantir co-founder Joe Lonsdale, Instagram co-founder Mike Krieger and David Vélez, CEO and founder of Brazilian fintech Nubank. In addition, Loft has also raised more than $100 million in debt financing through a series of publicly listed real estate funds.

Loft plans to use its new capital in part to expand across Brazil and eventually in Latin America and beyond. The company is also planning to explore more M&A opportunities.

This article was updated post-publication to reflect accurate investor information.

Powered by WPeMatico

The race to decarbonize aviation got a boost this Earth Day with the announcement of a $20.5 million Series A round by Universal Hydrogen, a Los Angeles-based startup aiming to develop hydrogen storage solutions and conversion kits for commercial aircraft.

“Hydrogen is the only viable path for aviation to reach Paris Agreement targets and help limit global warming,” said founder and CEO Paul Eremenko in an interview with TechCrunch. “We are going to build an end-to-end hydrogen value chain for aviation by 2025.”

The round was led by Playground Global, with an investor syndicate including Fortescue Future Industries, Coatue, Global Founders Capital, Plug Power, Airbus Ventures, Toyota AI Ventures, Sojitz Corporation and Future Shape.

The company’s first product will be lightweight modular capsules to transport “green hydrogen,” produced using renewable power to aircraft equipped with hydrogen fuel cells. The capsules will ultimately be available in different sizes for aircraft ranging from VTOL air taxis to long-distance, single-aisle planes.

“We want them to be interchangeable within each class of aircraft, a bit like consumer batteries today,” says Eremenko.

To help kickstart the market for its capsules, Universal Hydrogen is developing one such plane itself, a modified 40-60-seat turboprop capable of regional flights of up to 700 miles. The effort is a collaboration with seed investor Plug Power, which will supply the hydrogen and fuel cells, and magniX, which develops motors for electric aircraft.

Eremenko hopes to have the plane flying paying passengers in a larger, 50-plus seater aircraft by 2025 and ultimately to produce kits for regional airlines to retrofit their own aircraft.

“We want to have a couple of years of service to de-risk hydrogen certification and passenger acceptance before Boeing and Airbus decide on the airplanes they are going to build in the early 2030s,” says Eremenko. “It’s imperative that at least one of them build a hydrogen airplane or aviation is not going to hit its climate goals.”

Universal Hydrogen is not alone in betting on hydrogen. ZeroAvia in the U.K. is developing its own regional fuel cell aircraft on an even more ambitious timeline, and Airbus in particular has been working on hydrogen aircraft concepts.

Eremenko hopes that producing a simple and safe hydrogen logistics network will soon attract new entrants.

“It’s like the Nespresso system. We have to make the first coffee maker or nobody cares about our capsule technology, but we don’t want to be in the coffee maker business. We want other people to build coffee with our capsules.”

Universal Hydrogen will use the Series A funds to grow its current 12-person team to around 40 and accelerate its technology development.

30kW sub-scale demonstration of Universal Hydrogen’s aviation powertrain, with Plug Power’s hydrogen fuel cell and a magniX motor.

Powered by WPeMatico

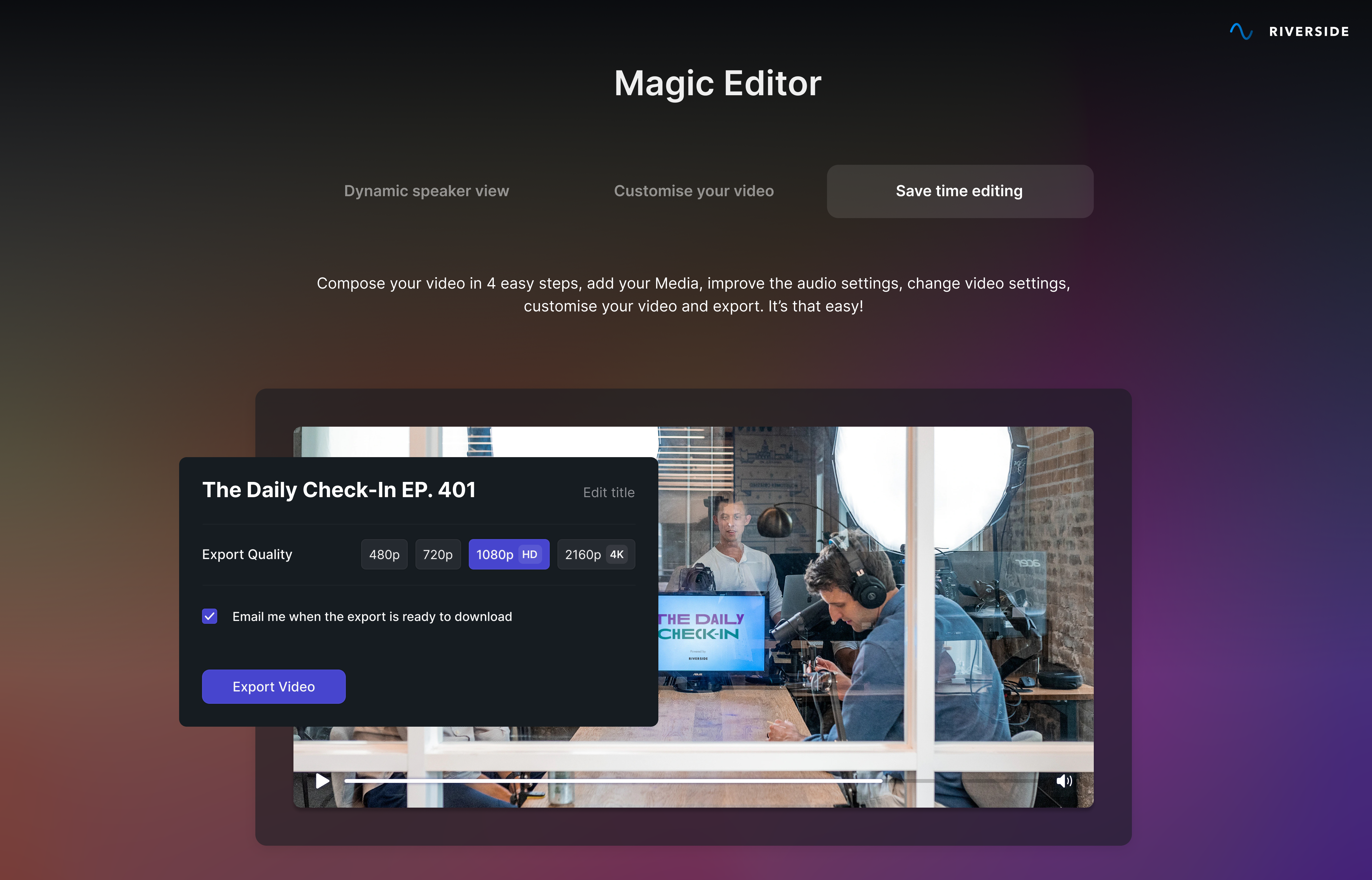

The past year has changed the way we work, on so many levels — a fact from which podcasters certainly weren’t immune. I can say, anecdotally, that as a long-time podcaster, I had thrown in the towel on my long-standing insistence that I do all of my interviews in-person — for what should probably be obvious reasons.

2020 saw many shows shifting to a remote format and experimenting with different remote recording tools, from broad teleconferencing software like Zoom to more bespoke solutions like Zencastr. Tel Aviv-based Riverside.fm (originally from Amsterdam) launched right on time to ride the remote podcasting wave, and today the service is announcing a $9.5 million Series A.

The round is led by Seven Seven Six and features Zeev-ventures.com, Casey Neistat, Marques Brownlee, Guy Raz, Elad Gil and Alexander Klöpping. The company says it plans to use the money to increase headcount and build out more features for the service.

“As many were forced to adapt to remote work and production teams struggled to deliver the same in person quality, from a distance—Gideon and Nadav saw an opportunity to not only solve a great need for creators, but to build an extraordinary product,” Seven Seven Six founder Alexis Ohanian said in a release. “As a creator myself, I can say from experience that Riverside’s quality is unmatched and the new editing capabilities are peerless.”

Riverside.fm is a remote video and audio platform that records lossless audio and 4K video tracks remotely to each user’s system, saving the end result from the kind of technical hiccups that come with spotty internet connections.

Along with the funding round, the company is also rolling out a number of software updates to its platform. At the top of the list is brand new version of its iPhone app, which instantly records and uploads video, a nice extension as more users are looking to record their end on mobile devices.

On the desktop front, “Magic Editor” streamlines the multi-step process of recording, editing and uploading. There’s also a new “Smart Speakerview” feature that automatically switches between speakers for video editing, while not switching for accidental noises like sneezing and coughing.

It’s a hot space that’s only heating up. Given how quickly the company was able to piece their original offering together, it will be interesting to see what they’re able to do with an additional $9.5 million in their coffers.

Powered by WPeMatico

Holoride, the company that’s building an immersive XR in-vehicle media platform, today announced it raised €10 million (approximately $12 million) in its Series A investing round, earning the company a €30 million ($36 million) valuation.

The Swedish ADAS software development company Terranet led the round with €3.2 million (~$3.9 million), followed by a group of Chinese financial and automotive technology investors, organized by investment professional Jingjing Xu, and educational and entertainment game development company Schell Games, which has partnered with holoride in the past to create content.

Holoride will use the fresh funds to search for new developers and other talent both as it prepares to expand into global markets like Europe, the United States and Asia, and in advance of its summer 2022 launch for private passenger cars.

“This goes hand-in-hand with putting more emphasis on the content creator community, and as of summer this year, releasing a lot of tools to help them build content for cars on our platform,” Nils Wollny, holoride’s CEO and founder, told TechCrunch.

The Munich-based company launched at CES in 2019. TechCrunch got to test out its in-car virtual reality system. Our team was surprised, and delighted, to find that holoride had figured out how to quell the motion sickness caused both by being a passenger in a vehicle, and by using a VR headset. The key? Matching the experience users have within the headset to the movement of the vehicle. Once holoride launches, users will be able to download the holoride app to their phones or other personal devices like VR headsets, which will connect wirelessly to the car itself, and extend their reality.

“Our technology has two sides,” said Wollny. “One is the localization, or positioning software, that takes data points from the car and performs real-time synchronization. The other part is what we call our Elastic Software Development Kit. Content creators can build elastic content, which adapts to your travel time and routes. The collaboration with Terranet means their sensors and software stack that allow for a more precise capture and interpretation of the environment at an even faster speed with higher accuracy will enable us in the future for even more possibilities.”

Terranet’s VoxelFlow software, which was originally designed for ADAS applications, will help holoride advance its real-time, in-vehicle XR entertainment. Terranet’s CEO Par-Olof Johannesson, describes VoxelFlow

software, which was originally designed for ADAS applications, will help holoride advance its real-time, in-vehicle XR entertainment. Terranet’s CEO Par-Olof Johannesson, describes VoxelFlow as a new paradigm within computer vision and object identification, wherein a combination of sensors, event cameras and a laser scanner are integrated into a car’s windshield and headlamps in order to calculate the distance, direction and speed of an object.

as a new paradigm within computer vision and object identification, wherein a combination of sensors, event cameras and a laser scanner are integrated into a car’s windshield and headlamps in order to calculate the distance, direction and speed of an object.

Terranet’s VoxelFlow uses computer vision and object identification via a combination of sensors, event cameras and a laser scanner, which are integrated into a car’s windshield and headlamps, in order to calculate the distance, direction and speed of an object. Image Credits: Terranet

uses computer vision and object identification via a combination of sensors, event cameras and a laser scanner, which are integrated into a car’s windshield and headlamps, in order to calculate the distance, direction and speed of an object. Image Credits: Terranet

Holoride, which is manufacturer-agnostic, will be able to use the data points calculated by VoxelFlow in real time if holoride were being used in a vehicle that was built integrated with Terranet’s software. But more important is the ability for holoride to reuse 3D event data for XR applications, giving it to creators so they can create the most interactive experience. Terranet is also looking forward to opening up a new vertical for VoxelFlow

in real time if holoride were being used in a vehicle that was built integrated with Terranet’s software. But more important is the ability for holoride to reuse 3D event data for XR applications, giving it to creators so they can create the most interactive experience. Terranet is also looking forward to opening up a new vertical for VoxelFlow .

.

“We are of course very eager to access holoride’s wide pipeline, as well,” said Johannesson. “This deal is very much about expanding the addressable market and tapping into the heart of the automotive industry, where lead times and turnaround times are usually pretty long.”

Holoride is on a mission to revolutionize the passenger experience by turning dead car time into interactive experiences that can run the gamut of gaming, education, productivity, mindfulness and more. For example, around Halloween 2019, holoride teamed up with Ford and Universal Pictures to immerse riders into the frightening world of the Bride of Frankenstein, replete with monsters jumping out and tasks for riders to perform.

Wollny said holoride always has an eye toward the next step, even though its first product hasn’t gone to market yet. He understands that the future is in autonomous vehicles, and wants to build an essential element of the future tech stack of future cars, cars in which everyone is a passenger.

“Car manufacturers always focus on the buyer of the car or the driver, but not so much on the passenger,” said Wollny. “The passenger is who holoride really focuses on. We want to turn every vehicle into a moving theme park.”

Powered by WPeMatico

Applied XL, a startup creating machine learning tools with what it describes as a journalistic lens, is announcing that it has raised $1.5 million in seed funding.

Emerging from the Newlab Venture Studio last year, the company is led by CEO Francesco Marconi (previously R&D chief at The Wall Street Journal) and CTO Erin Riglin (former WSJ automation editor). Marconi told me that Applied XL started out by working on a number of different data and machine learning projects as it looked for product-market fit — but it’s now ready to focus on its first major industry, life sciences, with a product launching broadly this summer.

He said that Applied XL’s technology consists of “essentially a swarm of editorial algorithms developed by computational journalists.” These algorithms benefit from “the point of view and expertise of journalists, as well as taking into account things like transparency and bias and other issues that derive from straightforward machine learning development.”

Marconi compared the startup to Bloomberg and Dow Jones, suggesting that just as those companies were able to collect and standardize financial data, Applied XL will do the same in a variety of other industries.

He suggested that it makes sense to start with life sciences because there’s both a clear need and high demand. Customers might include competitive intelligence teams at pharmaceutical companies and life sciences funds, which might normally try to track this data by searching large databases and receiving “data vomit” in response.

Update: Marconi provided additional context about the startup’s initial focus via email, writing,”The life science industry has specific information needs currently not being fully met by existing private and public data sources; for example, many existing data providers cannot provide the kind of real-time context life science organizations require to make decisions on clinical development, competitive positioning and commercialization.”

“Our solution for scaling [the ability to spot] newsworthy events is to design the algorithms with the same principles that a journalist would approach a story or an investigation,” Marconi said. “It might be related to the size of the study and the number of patients, it might be related to a drug that is receiving a lot of attention in terms of R&D investment. All of these criteria that a science journalist would bring to clinical trials, we’re encoding that into algorithms.”

Eventually, Marconi said the startup could expand into other categories, building industry “micro models.” Broadly speaking, he suggested that the company’s mission is “measuring the health of people, places and the planet.”

The seed funding was led by Tuesday Capital, with participation from Frog Ventures, Correlation Ventures, Team Europe (the investment arm of Delivery Hero co-founder Lukasz Gadowski) and Ringier executive Robin Lingg.

“With industry leading real-time data pipelining, Applied XL is building the tools and platform for the next generation of data-based decision making that business leaders will rely on for decades,” said Tuesday Capital partner Prashant Fonseka in a statement. “Data is the new oil and the team at Applied XL have figured out how to identify, extract and leverage one of the most valuable commodities in the world.”

Powered by WPeMatico

During the pandemic, having an automated solution for onboarding and updating Apple devices remotely has been essential, and today Kandji, a startup that helps IT do just that, announced a hefty $60 million Series B investment.

Felicis Ventures led the round, with participation from SVB Capital, Greycroft, Okta Ventures and The Spruce House Partnership. Today’s round comes just seven months after a $21 million Series A, bringing the total raised across three rounds to $88.5 million, according to the company.

CEO Adam Pettit says the company has been growing in leaps and bounds since the funding round last October.

“We’ve seen a lot more traction than even originally anticipated. I think every time we’ve put targets up onto the board of how quickly we would grow, we’ve accelerated past them,” he said. He said that one of the primary reasons for this growth has been the rapid move to work from home during the pandemic.

“We’re working with customers across 40+ industries now, and we’re even seeing international customers come in and purchase so everyone now is just looking to support remote workforces and we provide a really elegant way for them to do that,” he said.

While Pettit didn’t want to discuss exact revenue numbers, he did say that it has tripled since the Series A announcement. That is being fueled, in part, he says, by attracting larger companies, and he says they have been seeing more and more of them become customers this year.

As they’ve grown revenue and added customers, they’ve also brought on new employees, growing from 40 to 100 since October. Pettit says that the startup is committed to building a diverse and inclusive culture at the company and a big part of that is making sure you have a diverse pool of candidates from which to choose.

“It comes down to at the onset just making the decision that it’s important to you and it’s important to the company, which we’ve done. Then you take it step by step all the way through, and we start at the back into the funnel where our candidates are coming from.”

That means clearly telling their recruiting partners that they want a diverse candidate pool. One way to do that is being remote and having a broader talent pool with which to work. “We realized that in order to hold true to [our commitment], it was going to be really hard to do that just sticking to the core market of San Diego or San Francisco, and so now we’ve expanded nationally and this has opened up a lot of [new] pools of top tech talent,” he said.

Pettit is thinking hard right now about how the startup will run its offices whenever they are allowed back, especially with some employees living outside major tech hubs. Clearly it will have some remote component, but he says that the tricky part of that will be making sure that the folks who aren’t coming into the office still feel fully engaged and part of the team.

Powered by WPeMatico