Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

When we last heard from BigID at the end of 2020, the company was announcing a $70 million Series D at a $1 billion valuation. Today, it announced a $30 million extension on that deal valuing the company at $1.25 billion just four months later.

This chunk of money comes from private equity firm Advent International, and brings the total raised to more than $200 million across four rounds, according to the company. The late-stage startup is attracting all of this capital by building a security and privacy platform. When I spoke to CEO Dimitri Sirota in September 2019 at the time of the $50 million Series C, he described the company’s direction this way:

We’ve separated the product into some constituent parts. While it’s still sold as a broad-based [privacy and security] solution, it’s much more of a platform now in the sense that there’s a core set of capabilities that we heard over and over that customers want.

Sirota says he has been putting the money to work, and as the economy improves he is seeing more traction for the product set. “Since December, we’ve added employees as we’ve seen broader economic recovery and increased demand. In tandem, we have been busy building a whole host of new products and offerings that we will announce over the coming weeks that will be transformational for BigID,” he said.

He also said that as with previous rounds, he didn’t go looking for the additional money, but decided to take advantage of the new funds at a higher valuation with a firm that he believes can add value overall. What’s more, the funds should allow the company to expand in ways it might have held off on.

“It was important to us that this wouldn’t be a distraction and that we could balance any funding without the need to over-capitalize, which is becoming a bigger issue in today’s environment. In the end, we took what we thought could bring forward some additional product modules and add a sales team focused on smaller commercial accounts,” Sirota said.

Ashwin Krishnan, a principal on Advent’s technology team in New York, says that BigID was clearly aligned with two trends his firm has been following. That includes the explosion of data being collected and the increasing focus on managing and securing that data with the goal of ultimately using it to make better decisions.

“When we met with Dimitri and the BigID team, we immediately knew we had found a company with a powerful platform that solves the most challenging problem at the center of these trends and the data question,” Krishnan said.

Past investors in the company include Boldstart Ventures, Bessemer Venture Partners and Tiger Global. Strategic investors include Comcast Ventures, Salesforce Ventures and SAP.io.

Powered by WPeMatico

Enterprises are adopting an ever-wider range of SaaS applications to work and interface with customers, and that is proving to be a major security concern: It’s not just the prospect of phishing, credential stuffing and other malicious tricks to get into systems that are a worry, but the fact that more applications mean more attack surfaces, and more integrations between apps mean more inadvertent holes that get exposed in the process.

And that is leading to a surge of interest in security applications that can help. Today, a startup called AppOmni — which has built a platform to help monitor SaaS apps and their activity, provide guidance to warn or block when things might go wrong and fix problems when they do occur — is announcing some funding to fuel its growth.

The startup has raised $40 million in a Series B round led by Scale Venture Partners, with Salesforce Ventures and ServiceNow Ventures, as well as previous backers ClearSky, Costanoa Ventures, Inner Loop Capital and Silicon Valley Data Capital also participating.

The funding is coming on the back of a huge year for AppOmni. The company grew 900%, co-founder and CEO Brendan O’Connor told TechCrunch, and it has managed to stay at 100% customer retention — that is, AppOmni has yet to lose a single customer since it was founded.

The company today integrates with more than 100 connectors, platforms used by developers and IT teams at companies to manage the apps that their businesses use, such as tools like Splunk and Sumo Logic. Through this, AppOmni is able to aggregate and normalize event data around those apps, in addition to deeper monitoring in cases where it can integrate with apps themselves (those integrations to date include some of the most popular apps that enterprises use today, including Salesforce and Slack, Zoom, Microsoft 365, Box and GitHub).

As O’Connor describes it, the sheer number of apps that enterprise teams use and adopt has made managing security around them very complex. Partly because of how SaaS is set up for usage by as many people in and outside the organization as possible (to make the apps more useful), AppOmni estimates that some 95% of enterprises “overprovision” permissions for external users.

On top of that, some of the biggest problems occur indirectly, specifically when applications are linked together, creating a flow of sensitive data. AppOmni says that some 55% of companies have sensitive data living in SaaS systems that has been inadvertently exposed to the anonymous internet, sitting there completely unguarded, in this way. (See Zack’s story here for a recent example of how this can play out.)

This is an issue, he said, that is unique to SaaS, which he describes as different architecturally to any software that companies might have used in the past. “There is no operating system, no network that is exposed to customers,” he said.

The idea is that AppOmni provides a dashboard to make that monitoring much less murky. “One of our customers described using AppOmni as being akin to turning a light on in a dark room,” O’Connor said.

O’Connor and his co-founder, Brian Soby (the CTO), have firsthand knowledge of the challenges of securing SaaS applications: both spent years at Salesforce — with O’Connor the company’s SVP and “chief trust officer”, a role he left to join ServiceNow as its security CTO, before leaving there to co-found AppOmni with Soby.

It’s partly that track record, along with AppOmni’s own track record, that has given the startup the attention that it has from investors. Interestingly, Scale came to know AppOmni not over a coffee or a pitch deck, but as one of those satisfied customers, which eventually led the VC to offer to invest.

“Scale Venture Partners became an AppOmni customer in 2020. We know firsthand how powerful and differentiated the AppOmni product when it comes to protecting our sensitive SaaS data, and we’re excited to now be both a customer and an investor,” said Ariel Tseitlin, a partner at Scale Venture Partners, in a statement. “AppOmni’s 9x growth last year, driven by the acquisition of customers across a wide range of industries, proves that AppOmni is the market leader in the increasingly important SaaS Security Management market. We expect the momentum to continue in 2021 and beyond as companies accelerate their shift to cloud applications to support their larger remote workforces.”

The company has raised $53 million to date, and it is not disclosing valuation.

Powered by WPeMatico

Class, an edtech startup that integrates exclusively with Zoom to make remote teaching more elegant, has raised $12.25 million in new financing. The round brings Salesforce Ventures, Sound Ventures and Super Bowl champion Tom Brady onto its capital table.

CEO and founder Michael Chasen said that Marc Benioff, the CEO of Salesforce, approached the company about investing in Class. Salesforce Ventures launched a $100 million Impact Fund in October 2020, a month after Class launched, to back edtech companies and cloud enterprises businesses with an impact lens.

As for Tom Brady entering the edtech world, Chasen said that the famous football player has made tech investments in the past and, “as the father of three is passionate about helping people through education.”

“Tom Brady and I are both fathers to three kids and like all parents, we get the need to add teaching and learning tools to Zoom,” Chasen added.

Class has now raised $58 million in less than a year, with a $30 million Series A in February 2021 and a $16 million seed round in September 2020. Today’s raise is less than its Series A round, which signals it was likely more done strategically to bring on investors than out of necessity.

The money will be used to help roll out Class to K-12 and higher-ed institutions across the world. The startup’s software publicly launched on the Mac a few months ago, and will exit beta for Windows, iPhone, Android and Chromebook in the next few weeks, Chasen said. The larger public launch will help scale the some 7,500 schools that have shown interest in adopting Class.

The big hurdle for Class, and any startup selling e-learning solutions to institutions, is post-pandemic utility. While institutions have traditionally been slow to adopt software due to red tape, Chasen says that both of Class’ customers, higher ed and K-12, are actively allocating budget for these tools. The price for Class ranges between $10,000 to $65,000 annually, depending on the number of students in the classes.

“We have not run into a budgeting problem in a single school,” Chasen said in February. “Higher ed has already been taking this step towards online learning, and they’re now taking the next step, whereas K-12, this is the first step they’re taking.” So far, Class has more than 125 paying clients with even-split between K-12 and higher ed, and 10% of customers using it for corporate teams.

It’s not the only startup that is trying to reinvent Zoom University. A number of companies are trying to serve the same market of students and teachers who are fatigued by current video conferencing solutions which — at best — often look like a gallery view with a chat bar. Three companies that are gaining traction include Engageli, Top Hat and InSpace.

While each startup has its own unique strategy and product, the founders behind them all need to answer the same question: Can they make digital learning a preferred mode of pedagogy and comprehension — and not merely a backup — after the pandemic is over?

As that question continues to get explored, today’s news shows that Class isn’t having any trouble recruiting people to believe the answer is yes. In just nine months, the company has gone from two to more than 150 employees and contractors.

Powered by WPeMatico

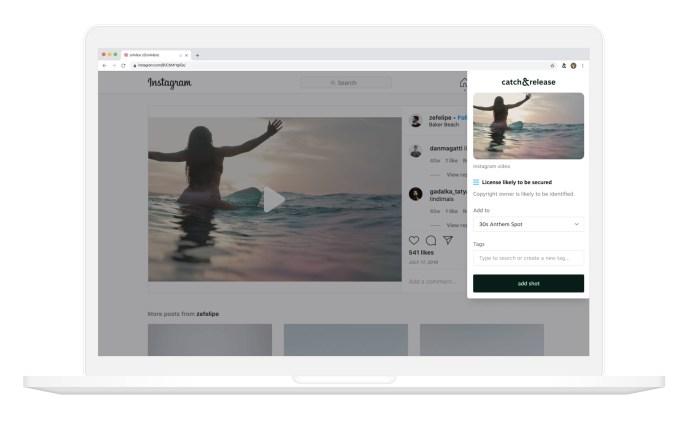

Catch&Release founder and CEO Analisa Goodin told me that she wants to help brands break free from the limitations of stock photography — and that her startup has raised $14 million in Series A funding to achieve that goal.

Goodin explained that the company started out as an image research firm before becoming a product-focused, venture-backed startup in 2015. The Series A was led by Accel (with participation from Cervin Ventures and other existing investors), and it brings Catch&Release’s total funding to $26 million.

Stock media and video services are moving in this direction themselves, for example by introducing their own libraries of user-generated content. Goodin applauded this, and she said Catch&Release isn’t opposed to the use of stock photos — it integrates with these stock marketplaces. At the same time, she suggested that she has a much bigger vision.

“This isn’t just about UGC, this is about tapping into the creative potential of the internet,” she said.

After all, you can now find pretty much any kind of content you can imagine somewhere online, but “a lot of advertising agencies and brands have been trained that if a piece of content comes from the internet, avoid it,” because it’s just “too hard” to figure out how to license it. (And indeed, that’s why I went with a stock photo for the lead image of this post.)

Image Credits: Catch&Release

Catch&Release aims to make that process as simple as possible, first with a browser extension that allows marketers to save any media that they find on the web, anytime they think they might want to use it in their own campaigns (this is the “catch” part of the process). It even presents a “licensability score,” which is a rating based on factors like the person who posted the content, the description and the comments, indicating how likely it is that a marketer will actually be able to license this content.

Then, when someone from a brand or advertising agency decides that they want to use a piece of content, they can send a licensing request with a push of a button (this is the “release”). Catch&Releases also analyzes the content for anything else that needs to be cleared or obscured, such as a company logo.

While we’ve written about other tools for licensing online content, Goodin emphasized that Catch&Release isn’t just about finding photos for a social media campaign. Part of the goal, she said, is to erase the “stigma” around UGC, which now “represents the entire spectrum of culturally relevant content.”

For example, she showed me a Red Lobster commercial that looks like a normal TV ad, but was in fact assembled entirely from footage found online — something that’s been even more useful in the past year, with pandemic-related safety concerns around large shoots. (Catch&Release has also been used to license content for ads promoting TechCrunch’s parent company Verizon.)

Goodin added that the new funding will allow Catch&Release to continue investing in product, engineering and marketing.

“No one has defined the commercial licensing layer for the web,” she said. “What’s got me really excited to build this product is being that layer for the internet, not just for photos and videos, but for writing, art, graphics and building the commercial licensing engine of the web.”

Powered by WPeMatico

Farshad Yousefi and Masoud Jalali used to drive through Palo Alto neighborhoods and marvel at the outrageous home prices. But the drives sparked an idea. They were not in a financial position to purchase a home in those neighborhoods (to be clear, not many people are) either for investment or to live. But what if they could invest in homes in up and coming cities throughout the U.S.?

Then they realized that even that might be a challenge, considering that with all their student debt, affording a down payment would be impossible.

“There was nothing available out there besides a crowdfunding platform, which when we first signed up, took away $1,000 from our account that we didn’t have, and then our capital would be locked up for three to 10 years,” recalls Yousefi.

So the pair started doing research and spoke to 1,000 individuals under the age of 35. Eight out of 10 said they would like to invest in real estate but were deterred by all the barriers to entry.

“There is clearly a large demand for access to real estate,” Yousefi said. “And we wanted to give people a way to invest in it like they can in stocks, via a mobile app.”

And so the idea for Fintor was born.

Yousefi and Jalali founded the company in 2020 with the goal of purchasing homes via an LLC, and turning each into shares through an SEC-approved broker dealer. Individuals can then buy shares of the homes via Fintor’s platform. Its next step is to sign agreements with individual real estate investors or bigger real estate development firms to list their properties on the platform and give people the opportunity to buy shares.

And now Fintor has raised $2.5 million in seed money to continue building out its fractional real estate investing platform. The startup aims to “fractionalize” houses and other residential property, giving people in the U.S. access to investment opportunities “starting with as little as $5.” The company attracted the interest of investors such as 500 Startups, Hustle Fund, Graphene Ventures, Houston-based real estate investor Manny Khoshbin, Mana Ventures and other angel investors such as Cindy Bi, Skyler Fernandes, VU Venture Partners, Minal Hasan, Andrew Zalasin, Alluxo CEO and founder Safa Mahzari, SquareFoot CEO and founder Jonathan Wasserstrum and Teachable CEO and founder Ankur Nagpal.

Image Credits: Fintor

Fintor is eying markets such as Kansas City, South Carolina and Houston, where it already has some properties. It’s looking for homes in the $80,000 to $350,000 price range, and millennials and Gen Zers are its target demographic.

“Fintor can give the same return as the stock market, but at half the risk,” Yousefi said. “As two [Iranian] immigrants, we’ve seen how much this country has to offer and how real estate sits at the top of everything, yet is so inaccessible.”

The pair had originally set out to raise just $1 million but the round was quickly “way oversubscribed,” according to Yousefi, and they ended up raising $2.5 million at triple the original valuation.

Jalali said the company will use machine learning technology to filter and rate properties as it scales its business model.

“We’ll use ML to categorize neighborhoods and to come up with the price of properties to offer to potential sellers,” he added. “Our ultimate goal is to create indexes so that people can invest in multiple properties in a given city. That creates diversification right away.”

Elizabeth Yin, co-founder and general partner of Hustle Fund, believes that Fintor is solving a generational problem with real estate.

“Retail investors have almost no access to great real estate investments today and the best opportunities are reserved for the select few,” she told TechCrunch. “Not to mention that in addition to access, retail investors often need a lot of capital in order to have a diversified portfolio or be accredited to join funds.”

Fintor’s approach to securitize real estate assets will give millions of investors who are not accredited investors access they would otherwise not have had, Yin added.

“Simultaneously, it provides increased liquidity to property owners, while improving the user experience for both parties,” she said. “Effectively this becomes a new asset class, because it’s entirely turnkey and is fractionalized, which opens up many new pockets of investors.”

Powered by WPeMatico

Apple’s introduction of ARKit changed the game for entrepreneurs, not unlike the App Store did on a much, much larger scale back in 2008.

One entrepreneur, Dana Loberg, has capitalized on the launch of ARKit with her startup Leo AR.

Leo is the result of a few pivots. The company first started out as MojiLala, which launched out of betaworks. It was a hassle-free sticker marketplace that allowed artists to upload their stickers and sell them through the platform for end-users to use in a number of locations.

In 2017, MojiLala released a new app called Surreal, which allowed artists to sell virtual objects to end users and lay them over their camera to record fun content. Now as Leo AR, the company is focused on 3D augmented reality objects without losing focus on giving artists an easy-to-use outlet for their virtual wares.

Today, Leo is announcing the raise of a $3 million seed round led by Great Oaks Ventures, with participation from Dennis Phelps of IVP, betaworks, Deutsch Telekom, Quake Capital and other angel investors.

Image Credits: Leo AR

The app operates on a freemium basis, letting end users subscribe to certain artists they like on the platform. Leo takes a 30% cut on those purchases, but Loberg said her main priority beyond generating revenue is ensuring that artists get paid well and are incentivized to create and sell through her platform.

Loberg also shared that the app has exploded in popularity among children, who enjoy creating videos with dinosaurs or dragons in them.

In fact, Leo users have created more than 8 million videos on the platform, and active users add more than 85 3D objects to their scenes and average 10+ minutes in the app when they use it.

Leo not only lets users distribute their content to other platforms like Instagram, but it also has a feed of the best videos created in Leo for others to check out.

Powered by WPeMatico

As AI improves, the possibilities of what we can do with the technology grow exponentially (for better or worse). Synthesia, an AI video generation platform, is looking to make video content creation as simple and efficient as possible, and FirstMark is taking a bet on it making the world better, and not worse.

The company has just announced the close of a $12.5 million Series A funding round led by FirstMark Capital, with participation from angels Christian Bach (CEO, Netlify) and Michael Buckley (VP Communications, Twilio), as well as existing investors LDV Capital, MMC Ventures, Seedcamp, Mark Cuban, Taavet Hinrikus, Martin Varsavsky and TinyVC.

Though Synthesia’s technology could be applied to dozens of use cases, the startup is focused initially on educational content for organizations and enterprises. Think training videos and company- or department-wide video updates.

Here’s how it works: Users can choose from a library of existing actors (who get paid per video in which they appear) or upload their own video to create an avatar. To use their own voice and avatar, Synthesia walks them through instructions on what type of video and audio they should send in.

Users can then type in a script, add other components like text, images, shapes, etc. and ultimately generate the video without any video creation or editing skills whatsoever. It’s also super easy to update or edit the video without having to do any traditional video editing.

The startup is well aware of how this platform could be used nefariously, and has built in multiple layers of security and authentication to ensure that users are aware of how their avatar is being used in videos, with the ability to check the script or the video before it’s generated or published.

Not only can this platform be used for the dozen or so training and educational videos that a company deploys each year, but it can be used in more creative ways. The general principle is that video content is more compelling and engaging than text or other content. So imagine, say, that the weekly emails that come from your manager or CEO with updates on the business came in the form of video. With Synthesia, it’s super easy and low-cost to create that video quickly.

Synthesia has an entry-level plan, which costs $30 per month per seat and offers 10 minutes of video per month. The startup also has an enterprise-level plan that starts at $500 per month and comes with more video minutes and extra functionality.

The company plans to use the funding to fuel customer growth and product development.

Beyond the enterprise video platform, Synthesia is also working on an API that would allow organizations to hook the Synthesia tech into their own systems and distribute that video. Co-founder and CEO Victor Riparbelli showed an example where users could choose a stock and plug in a phone number that would automatically create a video with a daily stock price update and distribute that video to the specified phone number.

The enterprise product, called STUDIO, launched into public beta in the summer of 2020 and has since amassed more than 1000 companies as users.

Powered by WPeMatico

Pragma is building what it calls a “backend as a service,” providing ready-made infrastructure to developers of online, live service games. And it’s announcing today that it has raised $12 million in Series A funding.

The round was led by David Thacker at Greylock, with participation from Zynga founder Mark Pincus, Oculus founder Nate Mitchell and Cloudera founder Amr Awadallah, along with previous investors Upfront Ventures and Advancit Capital. Amy Chang, who sold her business intelligence startup Accompany to Cisco, is joining Pragma’s board of directors.

Co-founder and CEO Eden Chen told me that where Unity and Unreal have built popular frontend game engines, he and his co-founder Chris Cobb (former engineering lead at Riot Games) are hoping Pragma will fill the void for a “de facto backend game engine.”

And while “many companies tried to do this” over the past decade, Chen suggested that this is the right time to launch the platform, thanks to the continued rise of live service games (like League of Legends) that have to be treated as “living, breathing products,” as well as improved tooling around infrastructure platforms like Amazon Web Services.

Image Credits: Pragma

Pragma is launching a starter kit today designed to allow developers to quickly set up and test game loops. Meanwhile, the broader platform is currently in private beta testing with studios including One More Game (started by started by Pat Wyatt, one of Blizzard’s first employees) and Mitchell’s Mountain Top Studios.

Chen said the platform’s features fall into three broad categories — player accounts/social, game loops (including lobbies and matchmaking) and player/game data. Pragma isn’t building all of this from scratch; in some cases, it’s “acting as the integrator” for other platforms like Discord. Chen also noted that while the team plans to build a fully managed solution in the future, the current version is on-premise: “We’re building an instance of Pragma on the studio’s own infrastructure, [so they can] so they can take our code base and customize it to their own preferences.”

Pragma is initially targeting game studios with about 10 to 50 team members. Eventually, Chen hopes the platform could serve larger studios while also supporting “the democratization of these tools, so that a one- to five-person team can really leverage [them] to launch a networked, online game.”

He added, “The vision for us long term is that we really want to be innovating on the social side, creating social features that improve the game and build stronger connections.”

Powered by WPeMatico

Cape Privacy, the early-stage startup that wants to make it easier for companies to share sensitive data in a secure and encrypted way, announced a $20 million Series A today.

Evolution Equity Partners led the round with participation from new investors Tiger Global Management, Ridgeline Partners and Downing Lane. Existing investors Boldstart Ventures, Version One Ventures, Haystack, Radical Ventures and a slew of individual investors also participated. The company has now raised approximately $25 million, including a $5 million seed investment we covered last June.

Cape Privacy CEO Ché Wijesinghe says that the product has evolved quite a bit since we last spoke. “We have really focused our efforts on encrypted learning, which is really the core technology, which was fundamental to allowing the multi-party compute capabilities between two organizations or two departments to work and build machine learning models on encrypted data,” Wijesinghe told me.

Wijesinghe says that a key business case involves a retail company owned by a private equity firm sharing data with a large financial services company, which is using the data to feed its machine learning models. In this case, sharing customer data, it’s essential to do it in a secure way and that is what Cape Privacy claims is its primary value prop.

He said that while the data sharing piece is the main focus of the company, it has data governance and compliance components to be sure that entities sharing data are doing so in a way that complies with internal and external rules and regulations related to the type of data.

While the company is concentrating on financial services for now, because Wijesinghe has been working with these companies for years, he sees uses cases far beyond a single vertical, including pharmaceuticals, government, healthcare telco and manufacturing.

“Every single industry needs this and so we look at the value of what Cape’s encrypted learning can provide as really being something that can be as transformative and be as impactful as what SSL was for the adoption of the web browser,” he said.

Richard Seewald, founding and managing partner at lead investor Evolution Equity Partners likes that ability to expand the product’s markets. “The application in Financial Services is only the beginning. Cape has big plans in life sciences and government where machine learning will help make incredible advances in clinical trials and counter-terrorism for example. We anticipate wide adoption of Cape’s technology across many use cases and industries,” he said.

The company has recently expanded to 20 people and Wijesinghe, who is half Asian, takes DEI seriously. “We’ve been very, very deliberate about our DEI efforts, and I think one of the things that we pride ourselves in is that we do foster a culture of acceptance, that it’s not just about diversity in terms of color, race, gender, but we just hired our first nonbinary employee,” he said,

Part of making people feel comfortable and included involves training so that fellow employees have a deeper understanding of the cultural differences. The company certainly has diversity across geographies with employees in 10 different time zones.

The company is obviously remote with a spread like that, but once the pandemic is over, Wijesinghe sees bringing people together on occasion with New York City as the hub for the company, where people from all over the world can fly in and get together.

Powered by WPeMatico

“Challenger” startups in banking and insurance have upended their industries, and picked up significant business, by building more customer-friendly tools and services — more personalized, easier to access and usually competitively priced — than those typically provided by their bigger, incumbent rivals. Now, a startup out of Romania that is building tools to help the incumbents respond with better services of their own is announcing a significant round of funding as its business grows.

FintechOS, which has built a low-code platform aimed at larger (older) banking and insurance companies to help them build new services and analytics on top of and around their existing infrastructure, has raised €51 million ($61.5 million at today’s rates, but $60 million at the time of the deal closing) in a Series B round of funding.

FintechOS’s opportunity has been to target the wave of incumbents in the insurance and banking industries that have been slowly watching as newer players like Lemonade (in insurance) and a huge plethora of challenger banks (Revolut, N26, Monzo and many others) are swooping in and picking up customers, especially among younger demographics, while they have been unable to respond mostly because their infrastructure is too old and big. Turning a huge ship around, as we have seen, is no small task — a situation that has become only more apparent in the last year of pandemic living and the big shift to digital interactions that resulted from it.

“When we launched FintechOS in 2017, we could already see existing solutions to digital transformation would struggle to deliver tangible results. By contrast, our unique approach has quickly inspired a sea-change in how financial institutions address digitization and engage with their customers,” said Teodor Blidarus, co-founder and CEO at FintechOS, in a statement. “Events over the last year have only increased pressure on our industry to evolve and as a result we’re seeing growing demand for our powerful platforms. Our latest round of funding will help us grow at the pace needed to improve outcomes for financial institutions and their customers globally.”

(It is not the only one. Others out of Europe in the space of bringing new tools to incumbent banks to help them make more modern and competitive products include 10x, Thought Machine, Temenos, Mambu and many more.)

The Series B round of funding is being led by Draper Esprit, with Earlybird, Gapminder Ventures, Launchub and OTB Ventures (which all participated in its Series A in December 2019) also participating. There are other backers in the round that are not being disclosed at this time, the startup added. FintechOS is also not disclosing its valuation. The company, based out of Bucharest, has raised just under $80 million to date.

FintechOS is active today in the U.K. and Europe — where it has been growing at a CAGR of 200% and says its services touch “millions” of people, with some of its key customers including the likes of banking giants Societe Generale and IdeaBank and international insurance brokers Howden. The plan will be to continue investing in those markets, as well as expanding internationally.

And it will be adding more services. Today, the banking platform is designed to help banks launch more retail services for consumers and small and medium business customers, and for insurance companies to build new health, life and general insurance products (there are a lot of synergies in how insurance and financial services companies have been built over the years, and so it’s a natural couplet when it comes to building tools for those industries).

In the financial sector, FintechOS lets banks build in new digital onboarding flows, credit cards and loan products, savings and mortgage products. Insurance products include new approaches to generating and handling quotes, customer onboarding and management and claims automation — which may well bring FintechOS into closer contact and collaboration with the most successful startup to come out of its home country to date, the RPA juggernaut UiPath. In all cases, it helps stitch together data from a bank’s own systems with more modern tooling, and to link that up with yet more modern tools to help process that data more easily.

This is “low code,” but it typically means that the company needs to work with third parties to enable all of this. Partners include the likes of integrators and other global services technicians, such as Microsoft, Deloitte, CapGemini, KPMG and so on. (And the founders of the startup themselves come from consulting backgrounds so they well understand the role these companies play in the process of bringing technology into big businesses.)

FintechOS is tapping into a couple of very big trends that have arguably been the biggest in the financial and related insurance industries.

The first of these is the fact that core services around things like credit/loans, current deposits and savings are not just very complex to build but actually have largely become commoditized — similar to digital payments — and so packaging them up and turning them into services that can be integrated by way of an API makes them more easily accessed without the heavy lifting needed to build them from scratch. This lets companies focus instead on customer service or building more interesting tools around those basic services to customise them (for example AI-based personalization). Disintermediating basic functions from the services built around them is arguably a bigger trend, but it has been especially prevalent in enterprise, which has long been a slow-moving space when it comes to innovation in the back-end, and the front-end.

The second of these is the big swing toward using no-code and low-code tools to empower more people within organizations to get stuck in when they can see something not working as efficiently as it could, and building the workflows themselves to improve that. This also applies to trying out and testing new products — again something that typically has not been done in financial and insurance services but can now be possible with low-code and no-code tools.

“Not only is our technology helping financial institutions become customer centric, but it’s also helping them provide products and services to more people and businesses,” said Sergiu Negut, the other co-founder who is FintechOS’s CFO and COO, in a separate statement. “With so many markets still underserved, the ability to tailor offerings to a segment of one offers the opportunity to increase financial inclusion and adheres to our ideal that easy access to financial services is essential. We’re delighted to be working with investors who share our views on how fintech should be transforming the financial services industry.”

Notably, Draper Esprit also has backed Thought Machine, another big player in the world of fintech that is taking some of the learnings and models that have helped new entrants disrupt incumbents, and is packaging them up as services for incumbents, too. It takes a different approach to doing this, not using low-code but smart contracts, which could be one reason why the VC doesn’t see the investments as conflict of interest. They are also tackling an enormous market, and so at least for now there is room for them, and many others in the space, such as 10x, Temenos, Mambu, Rapyd and many others.

“When we met Teo and Sergiu, we were immediately convinced of their vision: a data led, end-to-end platform, facilitated with a low-code/no-code infrastructure,” Vinoth Jayakumar, partner at Draper Esprit, said in a statement. “Incumbent financial services firms have cost-to-income ratios up to 90%, so we see a huge and increasing need for infrastructure software that allows digitisation at speed, ease and lower cost. Draper Esprit builds enduring partnerships; with the team at FintechOS we hope to build an enduring fintech company that will dramatically change financial services experiences for people all over the world.”

Powered by WPeMatico