Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Fintech startup Payhawk has raised a $20 million funding round. QED Investors is leading the round with existing investor Earlybird Digital East also participating. Payhawk is building a unified system to manage all the money that is going in and out.

Essentially, companies switching to Payhawk can replace several services they already use and that didn’t interact well with each other. Payhawk lets you issue corporate cards for your employees, manage invoices and track payments from a single interface.

After signing up, customers get their own banking details with a dedicated IBAN. You can connect with your existing bank account, load funds to your Payhawk account and start using it in multiple ways.

Compared to other companies working on similar products, Payhawk gives each customer their own IBAN, which means they can receive third-party payments.

One of the key features of Payhawk is that customers can issue virtual and physical cards for employees with different rules. You can set up a team budget, configure an approval workflow for large transactions and let Payhawk handle receipt collection from those card transactions.

You can upload invoices to manage them through Payhawk. The startup tries to automatically extract data from those invoices for easier reconciliation. Payhawk also lets you reimburse employees. The service acts as a single source of truth for your company’s spending. Finally, you can connect Payhawk with your existing ERP system.

As a software-as-a-service solution, you pay a monthly subscription fee that will vary depending on optional features and the number of active cards. Clients include LuxAir, Lotto24, Viking Life, ATU, Gtmhub, MacPaw and By Miles. Overall, the startup has 200 clients.

The company has been growing nicely as revenue doubled in Q1 2021. It currently accepts clients in the European Union and the U.K. but it already plans to expand beyond those markets. Up next, Payhawk plans to launch credit cards, more currencies and tighter integration with corporate bank accounts.

Powered by WPeMatico

We’ve all heard the phrase “passive income” to describe how people can make money by owning rental properties. Many Americans would love to passively earn money, but the process of becoming a landlord can be intimidating and complicated.

I mean, how many people have looked back and wished they hadn’t sold a property after seeing its value rise years after selling it?

And those who are already landlords can get overwhelmed by the complexities of managing properties.

One startup out of Boston, Knox Financial, aims to help people identify and manage residential rentals with its algorithm-based platform, and it’s raised a $10 million Series A to help it further that goal. Boston-based G20 Ventures led the round, which included participation from Greycroft, Pillar VC, 2LVC, and Gaingels.

The investment brings Knox’s total raised since its inception in 2018 to $14.7 million. The company closed on a $3 million seed round in January 2020, led by Greycroft.

Knox co-founder and CEO David Friedman is no stranger to startups. He founded Boston Logic — an integrated marketing platform and online marketing services for real estate offices and agents — in 2004. He sold that company (now under the name Propertybase) to Providence Equity for an undisclosed amount in 2016.

Knox launched its platform in March of 2019, with the goal of offering homeowners who are ready to move “a completely hands-off way” of converting a home they’re moving out of into an investment property. It also claims to help landlords more easily and efficiently manage their rentals.

At the time of its seed round early last year, the company was only operating in the Boston market and had 50 units on its platform. It’s now operating in seven states, has “hundreds” of investment properties on its platform and is overseeing a portfolio of more than $100 million.

So how does it work? Once a property is enrolled on Knox’s “Frictionless Ownership Platform,” the company automates and oversees the property’s finances and taxes, insurance, leasing and legal, tenant and property care, banking and bill pay.

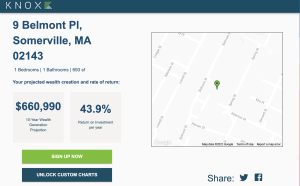

Knox also has developed a rental pricing and projection model for calculating the investment rate of return a property will produce over time.

Image Credits: Knox Financial

“We save investors a lot and almost always make their portfolios more profitable,” Friedman said. “If someone is moving or upsizing, we can turn properties into incredible ROI generators or cash flow.”

The company’s revenue model is simple.

“When a dollar of rent moves through our system, we keep a dime,” Friedman told TechCrunch. “We align our interests with our customers. If there’s no rent coming in, we’re not making money. Or if a tenant doesn’t pay rent, we don’t make money.”

Knox plans to use its new capital to continue expanding geographically and getting the word out to more people.

“We want to become the de facto platform for real estate investment acquisition and ownership,” Friedman said. “And we have to be coast to coast to really do that for everybody. So, we’re still very early in our growth trajectory.”

Bob Hower, co-founder and partner of G20 Ventures, shared that weeks after his college graduation, he had bought a fixer upper with his mother’s help. A week after finishing renovations, he put the house on the market. Over the subsequent five months, he gradually reduced the price as the market softened, and eventually the property sold at a small profit.

“That house now is worth a multiple of what I paid for it,” Hower recalls. “In hindsight, the mistake I made was deciding to sell the house at all.”

That experience helped Hower appreciate what he describes as a “clarity of thinking” in Knox’s business model.

“Had Knox existed decades ago, I’d likely still have that fixer-upper I bought after college,” he said. “Investing platforms such as Betterment have collapsed multiple advising and optimization activities into a simple single-sign-on service, and Knox is the first company to apply this type model to residential real estate investing.”

Powered by WPeMatico

Cannabis financing company Bespoke Financial today announced it raised $8 million in a Series A financing round. Through this round, the company brought new, key investors into its corner as it fights to bring financing solutions to companies in the cannabis space.

Bespoke is a direct lender and provides several financing solutions to companies operating in cannabis. These short-term loans allow the companies to build credit with Bespoke, which then offers better terms on subsequent loans and products. The company says its loan origination volume has grown exponentially, outgrowing forecasts by 25% over the proceeding year. The company has deployed $120 million in gross merchandise volume over 2,000 cannabis license holders, with zero defaults to date.

With this new round of capital, Bespoke intends to launch new financing structures and expand its financing options across various distribution channels.

CEO and co-founder George Mancheil calls this round a pivotal moment for his company and stamp of validation on the direction and products offered by Bespoke Financial. As he tells TechCrunch, this round provides several key partners to the growing startup.

The financing round was co-led by Snoop Dogg’s Casa Verde Capital and Sweat Equity Ventures, along with Ceres Group Holdings, Greenhouse Capital Partners, DoubleLine Capital’s co-founder and former president Philip Barach, and Robert Stavis, an investor based in New York.

This is Sweat Equity Ventures’ (SEV) first investment into a cannabis company. SEV, backed and funded by LinkedIn founder Reid Hoffman, is led by Dan Portillo and works differently from traditional venture funds. SEV works with founders to provide top engineering and business talent to its portfolio companies. In exchange for these services, SEV takes equity from the companies instead of just writing checks.

“This is our firm’s first investment in the cannabis industry, and we are excited to partner with Bespoke as more and more states legalize cannabis use, and the Federal government contemplates nationwide legalization. This partnership combines Bespoke’s finance and cannabis acumen with our team’s expertise scaling innovative tech companies, and will provide cannabis companies greater access to streamlined financing while benefiting investors with increased transparency and enhanced risk surveillance,” says Dan Portillo, managing partner of Sweat Equity Ventures, in a released statement.

Karan Wadhera, managing partner at Casa Verde Capital, says Bespoke Financial addresses real needs in a growing industry. Casa Verde Capital previously invested in Bespoke Capital, including in a $7 million round in 2019.

Bespoke CEO Mancheil tells TechCrunch his company is focused on being more than just a lender; it wants to be a modern financing company that allows it to act as a true partner with the cannabis industry.

With this $8 million in financing, Bespoke Financial has raised $28 million to date. The company was founded in 2019 and, as of this announcement, has 12 employees.

Powered by WPeMatico

If you’ve spent any time on TikTok lately, then you’ve probably seen a number of Popl’s ads. The startup has been successfully leveraging social media to get its modern-day business card alternative in front of a wider audience. Packaged as either a phone sticker, keychain or wristband, Popl uses NFC technology to make sharing contact information as easy as using Apple Pay. To date, Popl has sold somewhere over 700,000 units and has generated $2.7 million in sales for its digital business card technology.

Popl co-founder and CEO Jason Alvarez-Cohen, a UCLA grad with a background in computer science, first realized the potential for NFC business cards through a different use case — a device he encountered in someone’s home while attending a party. But it sparked the idea to use NFC technology for sharing information person-to-person, which would be faster than alternatives, like AirDrop or manual entry. And so, Popl was born.

Image Credits: Popl

Though startup history is littered with would-be “business card killers” that eventually died, what makes Popl different from early contenders is that it combines both an app with a physical product — the Popl accessory. This accessory can be purchased in a variety of form factors, including the popular Popl phone sticker that you can apply right to the back of your phone case (or even the top of your PopSocket), and customized with a photo of your choosing.

“I knew that, in the past, people would tap phones and share information like that. But I learned quickly that you can’t do this just phone-to-phone with pure software,” says Alvarez-Cohen. “So I [wondered to myself], what’s the closest way we can get the phone tapping? And that’s how I came up with this back-of-the-phone product.”

Each Popl accessory is actually an NFC tag which enables the handoff of the user’s contact information. When the phones are close, the recipient will get a notification that alerts them to your shared Popl data.

There are, of course, other ways to quickly exchange contact information. You can easily enter in someone’s digits into your phone’s contacts app directly, for example, which may work better for more casual encounters — like meeting someone at a bar. But Popl lets you share a full business cards’ worth of contact data with just a tap, which makes it better for professional encounters, or any other time you want to share more than just your phone number.

While the Popl tags make for a nice gimmick, the Popl mobile app is what makes the overall service useful. And to be clear, the app is only necessary for the Popl’s owner — the recipient doesn’t need the app installed for Popl to work. They will, however, need to have a phone that can read NFC tags, which can leave out some older devices. Or, as a backup, they’ll need the ability to scan the QR code the app provides as a workaround.

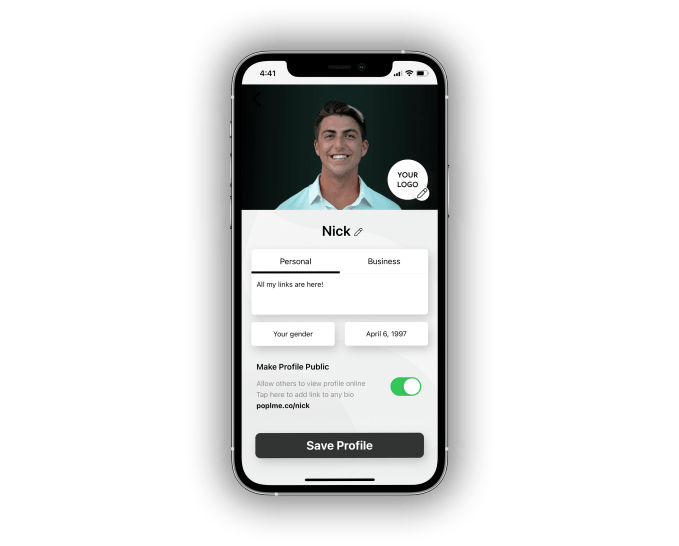

Image Credits: Popl

In the Popl app, you can customize which data you want to share with others — including your contact info, social profiles, website links, etc. — all via an easy-to-use interface. Like some business card apps in the past, you can flip between a personal profile and a business profile in Popl in order to share the appropriate information when out networking. To actually make the exchange of contact information with another person, you simply hold up your phone to theirs and they’ll get a notification directing them to your Popl profile webpage. (The phones don’t have to physically touch or bump together, however. It’s more like Apple Pay, where they have to be near each other.)

From the Popl website, that’s shared via the notification that pops up, the recipient can tap on the various options to connect with the sender — for example, adding them on a social network like LinkedIn or Instagram, grabbing their phone number to send a quick text, or even downloading a full contact card to their phone’s address book, among other things.

Image Credits: Popl

The app’s more clever feature, however, is something Popl calls “Direct.”

This patented feature won’t send over the Popl website where the recipient then has to choose how they want to connect. Instead, it opens the destination app directly. For example, if you have LinkedIn Direct on, the recipient will be taken directly to your profile on LinkedIn when they tap the notification. Or if you put your Contact Card on Direct, it will just pop your address book entry onto the screen so the user can choose to save it to their phone.

For paid users, the app also lets you track your history of Popl connections on a map, so you can recall who you met, where and when, along with other analytics.

Image Credits: Popl

Work on Popl, which is co-founded by Alvarez-Cohen’s UCLA roommate, Nick Eischens, now Popl COO, began in late 2019. The startup then launched in February 2020 — just before the coronavirus lockdowns in the U.S. That could have been a disastrous time for a business designed to help people exchange information during in-person meetings when the world was now shifting to Zoom and remote work. But Alvarez-Cohen says they marketed Popl as a “contactless solution.”

“If I have this, and I have to meet someone for my business, I don’t even have to tap it — you can just hover, and it will still send that information,” Alvarez-Cohen says. “So I’m able to share my business card with you without handing you a business card, which is safe.”

But what really helped to sell Popl were its video demos. One TikTok ad, which I’m sure you’ve seen if you use TikTok at all, features the co-founders’ friend Arev sharing her TikTok profile with a new friend just as she’s leaving the gym.

In the video, the recipient — clearly dumbfounded by the technology after she taps his phone — responds “what? what? Whoa! What? How’d you do that?!”

It’s now been viewed over 80 million times.

Today, Popl’s TikTok videos get high tens of thousands, hundreds of thousands and sometimes still millions of views per video. The company also has an active presence on other social media. For instance, Popl posts regularly to Instagram, where it has over 100,000 followers. Today, the startup’s growth is about 60% driven by Facebook and Instagram marketing and 40% organic, Alvarez-Cohen says.

Now, the company is preparing new products for the post-pandemic era when in-person events return. Though it had before sold Popl’s in bulk for this purpose, it’s now readying an “event bracelet” that just slips on your wrist (and is reusable). The bracelet could be used at any big event — like music festivals or business conferences, where you’re meeting a lot of new people. And because Popl uses NFC, phones have to be close to make the contact info exchange — it won’t just randomly share your info with everyone as you pass by them.

Popl is also fleshing out the business networking side of its app with integrations for Salesforce, Oracle, HubSpot and CSV export, that come with its Popl Pro subscription ($4.99 per month). The in-app subscription is already at $450,000-plus in annual recurring revenue and growing 10% every week, as of early April.

A Y Combinator Winter 2021 participant, Popl is backed by Twitch co-founder Justin Kan (via Goat Capital), YC, Urban Innovation Fund, Cathexis Ventures and others angels, including Wish.com CEO Peter Szulczewski and PlanGrid co-founder Ralph Gootee.

The app is available on iOS and Android, and the Popl accessories are sold on its website and on Target.com.

Update, 4/19/21, 6:45 PM ET: Post updated with a more current revenue figure after publication.

Powered by WPeMatico

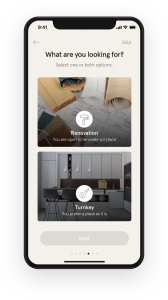

The pandemic-induced lockdowns halted many a home decoration project, but the irony was that our homes became even more important. But where to get ideas to decorate? Home décor experts could no longer visit. Now an LA-based startup is addressing this digitization of the interior design market, but kicking off with a typically LA-oriented, high-end clientele.

The LA-based The Expert — a platform for video consultations with interior designers — has raised a $3 million seed funding round led by Forerunner Ventures, with participation from Sweet Capital, Promus Ventures, Golden Ventures, Jeffrey Katzenberg’s WndrCo, AD 100 designer Brigette Romanek and CEO/founder of goop, Gwyneth Paltrow.

The Expert offers 1:1 video consultations with leading interior designers, it says.

The founders consist of Jake Arnold, a celebrity interior designer (who has worked with John Legend and Rashida Jones and Chrissy Teigen, among others) and YC-alumni, Leo Seigal, who previously founded and sold Represent.com to CustomInk for $100 million in 2015.

After being “inundated” with DMs during lockdown asking for his advice, Arnold says he realized he didn’t have the business model to help non-retainer clients. So he joined Seigal to create The Expert.

The Expert features 85 designers, so far. Clients click on designers’ profiles to see rates and availability, then click to book. Clients can upload any relevant floor plans, images of the home, inspiration ideas, etc. for the designer to review ahead of time. They then join a Zoom link (the platform uses the Zoom API) to meet with an interior designer, and can leave a review afterward.

The company claims it has 700 designers on its waitlist and will hit $1 million of bookings after its first quarter, after launching in early February this year.

The startup has some competition in the form of Modsy and Havenly, but The Expert says it is going for a more high-end experience, where clients are willing to pay $300-$2,500 for an hour of a designers’ time. The startup takes a 20% cut of the transaction.

Co-founder Leo Seigal said: “We were able to attract a crazy roster of designers partly thanks to co-founder Jake who is so highly regarded in the industry, and partly due to a timeliness of offering which is far above anything that has been tried in the home space.”

In a statement, Gwyneth Paltrow said: “I’ve always felt that access to great design – and those who create it – is too rare of a commodity. It’s a game-changer for someone without the budget for a full-time designer to have this roster of talent on speed dial.”

Nicole Johnson, partner at Forerunner, said: “We’ve been thinking through new models for the interior design sector for years at Forerunner, observing room for improvement for the trade and consumers alike. Interior design is arguably the ultimate, best-suited source of home inspiration and commerce enablement for consumers, but the trade is a famously walled garden. The Expert solves for this, connecting anyone, anywhere with the world’s leading interior designers via video consultation—allowing Experts to broaden their reach and monetization in a predictable, rewarding, and low-friction way.”

Pippa Lamb, partner at Sweet Capital, which led their pre-seed investment round last summer said: “The Expert is democratizing access to top creators in the $150B global interior design industry. By partnering with leading talents like Amber Lewis and Leanne Ford, it’s solving both upstream discovery and downstream services: bringing Instagram feeds to life. Leo and his team are visionaries and Sweet Capital has been proud to back them since Day 1.”

Powered by WPeMatico

The online grocery market is poised to get a little more crowded in the next several months, with the launch of a startup led by a veteran founder who has taken big hits from Amazon in the past, but now hopes to come back swinging with the help of an army of robots.

Home Delivery Services, a delivery startup founded by Louis Borders that plans to sell groceries and general merchandise online using a massive, automated system to power the fulfillment and logistics, is today announcing funding of $3 million to finalize the finishing touches on an AI-based robotic demonstration center outside of Indianapolis.

The plan is for the center to showcase the technology that HDS Global has been building over the last several years (plans first emerged as long ago as 2014), robots and other automation under the name RoboFS, that will power a wide fulfillment system extending from stocking, sorting and picking items that will then be delivered, mostly by humans, to consumers, to take on what Borders describes as a $1 trillion grocery market in the U.S.

“The $1 trillion grocery in the U.S. is not well penetrated,” he said, comparing the opportunity to the one that Walmart seized 20 years ago in physical stores. “We want to offer a complete selection of groceries and general merchandise in one order.” The idea is to build warehouses that cover some 150,000 square feet to do $200 million in revenue over millions of SKUs for one-hour deliveries.

A funding round of $3 million — which is coming from Bob DiRumualdo, the chairman of Ulta and CEO of Naples Ventures — might sound a little modest, especially considering the hundreds of millions of dollars that have been collectively raised by online grocery players in the last several months — all of them racing to scale up their businesses in the wake of huge consumer demand for online shopping alternatives to visiting stores in person in the wake of the COVID-19 pandemic.

Borders said in an interview that this small round is primarily to kick off the demo center to show off RoboFS to help bring on new investors and new partners with the proof of concept. It already has a few investor partners (Ingram Micro and Toyota), and the idea will be to add more.

And he confirmed that HDS — which will unveil a different name when it launches commercially, he added — is also working on a much bigger round of funding, likely to close in the next 15 months, to fuel that wider commercial launch. It has raised $38 million to date, he said.

Borders’ name will ring a bell to many in the worlds of retail and technology: He was the founder and head of the Borders book superstores and later started Webvan, a very early mover in the world of online grocery ordering and delivery. Both companies crashed hard in their times and became case studies, and more specifically cautionary tales, around how to build businesses in the digital era: Beware the specter of Amazon, of innovating too early or too late, of being less agile, too inefficient and of not correctly identifying where the puck was going and skating to it.

This time around, the idea is that he’s focusing first and foremost on technology to try to head off those problems in ways that his previous ventures did not. This is one reason why HDS has spent so many years on building the technology: automation, specifically in areas like picking groceries, is one area that has foxed a lot of companies to date — Amazon continues to work on this, and Ocado, a leader in the space, has yet to launch robotic picking, although it says this is coming soon. Borders estimates that bringing in automation can bring down the cost of labor by two-thirds, with people instead focused on delivering and selling at people’s doors.

“When we went out to buy the tech we didn’t see what we wanted,” Borders said. “We’re trying to be smart about technology but the tech was just not there when we decided to build this five years ago. So we started with building that system. This became our opportunity.”

The interesting opportunity is not just to build services that don’t quite exist yet, but to provide a set of infrastructure that can be a viable alternative and supply chain to Amazon — a common goal that brings together players from a lot of disparate yet interconnected areas in the grocery value chain. This is one reason why companies like Toyota and Ingram have come on board to work with the startup.

Given that it’s been so many years in the making and has yet to see the proof of concept, there will continue to be a lot of factors that could not come together, but it’s a play that HDS, Borders and their partners are willing to make.

“Ecommerce has become an essential component in people’s daily lives but what many don’t realize is that it can be exponentially better than what is offered today,” said DiRumualdo in a statement. “I was attracted to working with Louis again and to the company’s big idea approach – an all-new robotic fulfillment system purpose-built for ecommerce – which can deliver a vastly improved experience at lower cost. I am excited to be a part of bringing this vision to life.”

Powered by WPeMatico

Buzzy “social audio” app Clubhouse has raised a Series C funding round, reportedly valuing the company at $4 billion. Clubhouse said the new round of financing was led by Andrew Chen of Andreessen Horowitz, with participation from DST Global, Tiger Global and Elad Gil. This round means Clubhouse has tripled the valuation it attained in January when Andreessen Horowitz led its Series B funding round.

The funding comes as Twitter, Spotify, Facebook, Telegram, Discord and LinkedIn are all prepping similar features to Clubhouse’s live audio streaming rooms, which has attracted attention for hosting live chats with the likes of Elon Musk and Mark Zuckerberg. Indeed, Vox reported that Facebook will announce a series of “social audio” products only today.

But, unusually for such a late stage of funding, the company has not revealed the amount raised. Industry sources say that this is probably because the Series C funding round is “multi-stage” and therefore not officially closed. Alternatively, the company is “hyping” itself ahead of a sale, as is often the case with “hot” startups. Twitter reportedly broke off talks to acquire the startup at a $4 billion valuation, according to Bloomberg.

And despite appearances that this funding round has been timed to coincide with the launch this week of Facebook’s Clubhouse clone, one well-placed source told me “this funding round has been in the works for the last 1.5 months” and that some offers have been “above 2x” the $4 billion valuation. In other words, there are some investors out there who think Clubhouse is worth more than $8 billion.

So far Clubhouse is demurring on all this, and declining to comment more directly to the media. The company disclosed the news about the funding during its weekly “town hall” chat last Sunday night and in a blog post, the company said the fundraising will support a fresh burst of growth for the app.

“While we’ve quadrupled the size of our team this year, stabilized our infrastructure, launched Payments in beta to help creators monetize, and readied Android for launch, there is so much more to do as we work to bring Clubhouse to more people around the world. It’s no secret that our servers have struggled a bit these past few months, and that our growth has outpaced the early discovery algorithms our small team originally built,” said the post.

Noting that “it’s important to us to be building all of this with people who are invested in the community and who represent a diverse set of backgrounds and voices,” Clubhouse has, however, been struck by a wave of problems in the last few days, when anti-Semitic audio rooms seemed to proliferate on the platform. Clubhouse has previously been criticized for its seeming inability to moderate extremism on the app.

The year-old platform, which has reported 10 million weekly active users, has thrived during the pandemic while people were locked down and therefore unable to chat easily in person.

Tech news site The Information first reported details on the Clubhouse funding on Friday.

Powered by WPeMatico

The safety pilot has his hands off the controls during an Xwing demonstration flight. Image Credits: Xwing

Xwing has scored another win two months after it completed its first gate-to-gate autonomous demonstration flight of a commercial cargo aircraft. The company said Thursday it has raised $40 million at a post-money valuation of $400 million.

The company is setting its sights on expansion — not only tripling its engineering team, but eventually running regular fully unmanned commercial cargo flights.

Xwing has been developing a technology stack to convert aircraft, including a widely used Cessna Grand Caravan 208B, to function autonomously. But it’s had to solve a few problems first: “the perception problem, the planning problem and the control problem,” Xwing founder Marc Piette explained to TechCrunch. The company has come up with a whole suite of solutions to solve for these problems, including integrating lidar, radar and cameras on the plane; retrofitting the servomotors that control the rudder, braking and other functions; and ensuring all of these are communicating properly so the plane understands where it is in space and can execute its flight.

The company has already performed close to 200 missions with its AutoFlight system. For all these flights, there’s been a safety pilot on board. In addition, a ground control operator sits in a control center and acts as a go-between from the autonomous aircraft to the human air traffic control operator.

“We don’t anticipate automating [communication with air traffic control], trying to do natural language processing and having a computer make the response to the air traffic controller,” Piette said. “For safety critical applications, we don’t view that as a useful path…but what we do, though, is we have a ground operator in our control room that just talks to air traffic control on behalf of the aircraft. So for the air traffic controller, it’s seamless. As far as they’re concerned, they are just talking to a pilot onboard the aircraft.”

Image Credits: Xwing

For its autonomous flight activities, the company has authorization from the Federal Aviation Administration to fly under an experimental airworthiness certificate for research and development that was expanded in August of last year to include a special flight permit for optionally piloted aircraft (OPA).

The company is looking to eventually remove the safety pilot, but only once full safety redundancies are in place, Piette added. That includes redundancies across all sensors and computer systems. Fortunately for all of us that fly, commercial aviation safety levels are extremely high. It means a high airworthiness standard for aviation startups. Smaller Class III aircraft like the ones Xwing is targeting must demonstrate a risk of one catastrophic failure per hundred million flight hours.

Xwing’s activities have garnered attention from investors. This most recent funding round was led by Blackhorn Ventures, with participation from ACME Capital, Loup Ventures, R7 Partners, Eniac Ventures, Alven Capital and Array Ventures. Including this round, the company has raised $55 million in total capital.

The autonomous flights are only one part of Xwing’s business activities. It’s also been flying manned commercial cargo operations under a contract with a large logistics company signed December 1.

“We set up what’s effectively an airline,” Piette said. By modifying these aircraft with sensors to collect data, Xwing is able to feed this valuable flight time into a training algorithm, and collect other useful data, such as how often the pilots communicate with air traffic controllers and the types of directions the craft receives.

Looking ahead, the company will be significantly scaling its workforce over the next 12 months, in addition to increasing its commercial operations in parallel. On the technology side, Xwing is looking to fly autonomous commercial cargo flights, with a safety pilot onboard, under an experimental ticket and exemption from the FAA. The company will likely reach this milestone also within the next 12 months, Piette said. After that, it would look to remove the safety pilot from the aircraft. Even then, the company would still need to get its systems certified to completely remove any constraints on its movements in airspace.

Powered by WPeMatico

Casa Blanca, which aims to develop a “Bumble-like app” for finding a home, has raised $2.6 million in seed funding.

Co-founder and CEO Hannah Bomze got her real estate license at the age of 18 and worked at Compass and Douglas Elliman Real Estate before launching Casa Blanca last year.

She launched the app last October with the goal of matching home buyers and renters with homes using an in-app matchmaking algorithm combined with “expert agents.” Buyers get up to 1% of home purchases back at closing. Similar to dating apps, Casa Blanca’s app is powered by a simple swipe left or right.

Samuel Ben-Avraham, a partner and early investor of Kith and an early investor in WeWork, led the round for Casa Blanca, bringing its total raise to date to $4.1 million.

The New York-based startup recently launched in the Colorado market and has seen some impressive traction in a short amount of time.

Since launching the app in October, Casa Blanca has “made more than $100M in sales” and is projected to reach $280 million this year between New York and its Denver launch.

Bomze said the app experience will be customized for each city with the goal of creating a personalized experience for each user. Casa Blanca claims to streamline and sort listings based on user preferences and lifestyle priorities.

Image Credits: Casa Blanca

“People love that there is one place to book, manage feedback, schedule and communicate with a branded agent for one cohesive experience,” Bomze said. “We have a breadth of users from first time buyers to people using our platform for $15 million listings.”

Unlike competitors, Casa Blanca applies a direct-to-consumer model, she pointed out.

“While our agents are an integral part of the company, they are not responsible for bringing in business and have more organizational support, which allows them to focus on the individual more and creates a better end-to-end experience for the consumer,” Bomze said.

Casa Blanca currently has over 38 agents in NYC and Colorado, compared to about 15 at this time last year.

“We are in a growth phase and finding a unique opportunity in this climate, in particular, because there are many women exploring new, more flexible job opportunities,” Bomze noted.

The company plans to use its new capital to continue expanding into new markets, nationally and globally; as well as enhancing its technology and scaling.

“As we continue to grow in new markets, the app experience will be curated to each city — for example, in Colorado you can edit your preferences based on access to ski areas — to make sure we’re offering a personalized experience for each user,” Bomze said.

Powered by WPeMatico

Chili Piper, which has a sophisticated SaaS appointment scheduling platform for sales teams, has raised a $33 million B round led by Tiger Global. Existing investors Base10 Partners and Gradient Ventures (Google’s AI-focused VC) also participated. This brings the company’s total financing to $54 million. The company will use the capital raised to accelerate product development. The previous $18 million A round was led by Base10 and Google’s Gradient Ventures nine months ago.

It’s main competitor is Calendly, started 2 1/2 years previously, which recently achieved a $3 billion valuation.

Launched in 2016, Chili Piper’s software for B2B revenue teams is designed to convert leads into attended meetings. Sales teams can also use it to book demos, increase inbound conversion rates, eliminate manual lead routing and streamline critical processes around meetings. It’s used by Intuit, Twilio, Forrester, Spotify and Gong.

Chili Piper has a number of different tools for businesses to schedule and calendar accountments, but its key USP is in its use by “inbound SDR Sales Development Representatives (SDR)”, who are responsible for qualifying inbound sales leads. It’s particularly useful in scheduling calls when customers hit websites and ask for a salesperson to call them back.

Nicolas Vandenberghe, CEO, and co-founder of Chili Piper said: “When we started we sold the house and decided to grow the company ourselves. So all the way until 2019 we bootstrapped. Tiger gave us a valuation that we expected to get at the end of this year, which will help us accelerate things much faster, so we couldn’t refuse it.”

Alina Vandenberghe, CPO and co-founder said: “We’re proud to have so many customers scheduling meetings and optimizing their calendars with Chili Piper’s Instant Booker.”

The husband-and-wife-founded company was fully remote from day one, with 93 employees in 81 cities and 21 countries, long before the pandemic hit.

John Curtius, partner at Tiger Global said: “When we met Nicolas and Alina, we were fired up by their product vision and focus on customer happiness.”

TJ Nahigian, managing partner at Base10 Partners, added: “We originally invested in Chili Piper because we knew customers needed ways to add fire to how they connected with inbound leads. We’ve been absolutely blown away with the progress over the past year, 2020 has been a step-change for this company as business went remote.”

Powered by WPeMatico