Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Cross-border payments startup dLocal has raised $150 million at a $5 billion valuation, less than seven months after securing $200 million at a $1.2 billion valuation.

This means that the five-year-old Uruguayan company has effectively quadrupled its valuation in a matter of months.

Alkeon Capital led the latest round, which also included participation from BOND, D1 Capital Partners and Tiger Global. General Atlantic led its previous round, which closed last September and made dLocal Uruguay’s first unicorn and one of Latin American’s highest-valued startups.

DLocal connects global enterprise merchants with “billions” of emerging market consumers in 29 countries across Asia-Pacific, the Middle East, Latin America and Africa. More than 325 global merchants, including e-commerce retailers, SaaS companies, online travel providers and marketplaces use dLocal to accept over 600 local payment methods. They also use its platform to issue payments to their contractors, agents and sellers. Some of dLocal’s customers include Amazon, Booking.com, Dropbox, GoDaddy, MailChimp, Microsoft, Spotify, TripAdvisor, Uber and Zara.

In conjunction with this latest round, dLocal has named Sumita Pandit to the role of COO. Pandit is former global head of fintech and managing director for JP Morgan, and also worked at Goldman Sachs.

“Sumita is a highly respected and accomplished fintech investment banker, and she’s played a pivotal role advising some of the world’s most successful fintech companies as they’ve scaled to become global leaders,” said dLocal CEO Sebastián Kanovich in a written statement.

Meanwhile, former COO Jacobo Singer has been promoted to president of dLocal.

The company plans to use its new capital to enhance its technology and continue to expand geographically.

Alkeon General Partner Deepak Ravichandran believes that emerging markets represent some of the fastest growth opportunities in digital payments.

“However, as global merchants look to access these markets, they are often faced with a complex web of local payment methods, cross-border regulations, and other operational roadblocks,” he said in a written statement. “dLocal’s unique platform empowers merchants with a single integrated payment solution, to reach billions of customers, accept payments, send payouts, and settle funds globally.”

Powered by WPeMatico

Every tech vendor has to pass security muster with customers, typically a tedious activity involving answering long questionnaires. Kintent, a new startup that wants to automate this process, announced a $4 million seed today led by Tola Capital with help from a bunch of tech industry angel investors.

After company co-founder and CEO Sravish Sridhar sold his previous startup Kinvey, which provided backend as a service to mobile app developers, he took a couple of years off while he decided what to do next. The sale to Progress Software in 2017 gave him that luxury.

He knew firsthand from his experience at Kinvey that companies like his had to adhere to a lot of compliance standards, and the idea for the next company began to form in his head. He wanted to create a new startup that could make it easier to figure out how to become compliant with a given standard, measure the current state of compliance and get recommendations on how to improve. He created Kintent to achieve that goal.

“So the big picture idea is can we build a system of record for trust and our first use case is information security and data privacy compliance, specifically if you’re a company that is building a SaaS business and you’re storing customer data or PHI, which is health information,” Sridhar explained.

The company’s product is called Trust Cloud. He says that they begin by looking at the lay of your technology land in terms of systems and the types of information you are storing, looking at how compliant each system is with whatever standard you are trying to adhere to.

Then based on how you classify your data, the Trust Cloud generates a list of best practices to stay in compliance with your desired standard, and finally it provides the means to keep testing to validate what you’ve done and that you are remaining in compliance.

The company launched in 2019, spent the first part of 2020 developing the product and began selling it last October. Today, it has 35 paying customers. “We’re in the high six figures in revenue. We’ve been growing at about 20-30% month-over-month consistently since we launched in October, and the customers are across 11 verticals already,” he said.

With 14 employees and some money in the bank from this funding round, he is thinking ahead to adding people. He says that diversity has to be more than something you just talk about, and he has made it one of the core founding values of the company, and one he takes very seriously.

“I’m very conscious with every hire that we make that we’re really pushing to extend ourselves to [find] people from different walks of life, different statuses and so on,” he said.

The company is also working on a DEI component for the Trust Cloud, which it will be offering for free, which enables companies to provide a set of diversity metrics to measure against and then report on how well you are doing, and how you can improve your numbers.

Powered by WPeMatico

The gaming sector has never been hotter or had higher expectations from investors who are dumping billions into upstarts that can adjust to shifting tides faster that the existing giants will.

Bay Area-based Manticore Games is one of the second-layer gaming platforms looking to build on the market’s momentum. The startup tells TechCrunch they’ve closed a $100 million Series C funding round, bringing their total funding to $160 million. The round was led by XN, with participation from SoftBank and LVP alongside existing investors Benchmark, Bitkraft, Correlation Ventures and Epic Games.

When Manticore closed its Series B back in September 2019, VCs were starting to take Roblox and the gaming sector more seriously, but it took the pandemic hitting to really expand their expectations for the market. “Gaming is now a bona fide super category,” CEO Frederic Descamps tells TechCrunch.

Manticore’s Core gaming platform is quite similar to Roblox conceptually, the big difference is that the gaming company is aiming to quickly scale up a games and creator platform geared toward the 13+ crowd that may have already left Roblox behind. The challenge will be coaxing that demographic faster than Roblox can expand its own ambitions, and doing so while other venture-backed gaming startups like Rec Room, which recently raised at a $1.2 billion valuation, race for the same prize.

Like other players, Manticore is attempting to build a game discovery platform directly into a game engine. They haven’t built the engine tech from scratch; they’ve been working closely with Epic Games, which makes the Unreal Engine and made a $15 million investment in the company last year.

A big focus of the Core platform is giving creators a true drag-and-drop platform for game creation with a specific focus on “remixing,” allowing users to pick pre-made environments, drop pre-rendered 3D assets into them, choose a game mode and publish it to the web. For creators looking to inject new mechanics or assets into a title, there will be some technical know-how necessary, but Manticore’s team hopes that making the barriers of entry low for new creators means that they can grow alongside the platform. Manticore’s big bet is on the flexibility of their engine, hoping that creators will come on board for the chance to engineer their own mechanics or create their own path toward monetization, something established app stores wouldn’t allow them to.

“Creators can implement their own styles of [in-app purchases] and what we’re really hoping for here is that maybe the next battle pass equivalent innovation will come out of this,” co-founder Jordan Maynard tells us.

This all comes at an added cost; developers earn 50% of revenues from their games, leaving more potential revenue locked up in fees routed to the platforms that Manticore depends on than if they built for the App Store directly, but this revenue split is still much friendlier to creators than what they can earn on platforms like Roblox.

Building cross-platform secondary gaming platforms is host to plenty of its own challenges. The platforms involved not only have to deal with stacking revenue share fees on non-PC platforms, but some hardware platforms that are reticent to allow them all, an area where Sony has been a particular stickler with PlayStation. The long-term success of these platforms may ultimately rely on greater independence, something that seems hard to imagine happening on consoles and mobile ecosystems.

Powered by WPeMatico

As companies embrace the use of data, hiring more data scientists, a roadblock persists around sharing that data. It requires too much copying and pasting and manual work. Hex, a new startup, wants to change that by providing a way to dispense data across the company in a streamlined and elegant way.

Today, the company announced a $5.5 million seed investment, and also announced that it’s opening up the product from a limited beta to be more widely available. The round was led by Amplify Partners, with help from Box Group, XYZ, Data Community Fund, Operator Collective and a variety of individual investors. The company closed the round last July, but is announcing it for the first time today.

Co-founder and CEO Barry McCardel says that it’s clear that companies are becoming more data-driven and hiring data scientists and analysts at a rapid pace, but there is an issue around data sharing, one that he and his co-founders experienced firsthand when they were working at Palantir.

They decided to develop a purpose-built tool for sharing data with other parts of the organization that are less analytically technical than the data science team working with these data sets. “What we do is we make it very easy for data scientists to connect to their data, analyze and explore it in notebooks. […] And then they can share their work as interactive data apps that anyone else can use,” McCardel explained.

Most data scientists work with their data in online notebooks like Jupyter, where they can build SQL queries and enter Python code to organize it, chart it and so forth. What Hex is doing is creating this super-charged notebook that lets you pull a data set from Snowflake or Amazon Redshift, work with and format the data in an easy way, then drag and drop components from the notebook page — maybe a chart or a data set — and very quickly build a kind of app that you can share with others.

Image Credits: Hex

The startup has nine employees, including co-founders McCardel, CTO Caitlin Colgrove and VP of architecture Glen Takahashi. “We’ve really focused on the team front from an early stage, making sure that we’re building a diverse team. And actually today our engineering team is majority female, which is definitely the first time that that’s ever happened to me,” Colgrove said.

She is also part of a small percentage of female founders. A report last year from Silicon Valley Bank found that while the number was heading in the right direction, only 28% of U.S. startups have at least one female founder. That was up from 22% in 2017.

The company was founded in late 2019 and the founders spent a good part of last year building the product and working with design partners. They have a small set of paying customers, and are looking to expand that starting today. While customers still need to work with the Hex team for now to get going, the plan is to make the product self-serve some time later this year.

Hex’s early customers include Glossier, imgur and Pave.

Powered by WPeMatico

Cameo, the celebrity video site you’re probably familiar with if you’ve celebrated a birthday in the last three years, announced this morning that it’s raised a $100M Series C. The round, which was led by Jonathan Turner with e.ventures, puts the site’s value at just north of $1 billion.

Cameo has been building a good deal of steam in recent years, but the service is among those that managed to get a major boost amid the pandemic, as celebrities and normals alike suddenly found themselves with a lot more time on their hands.

“The pandemic put extra stress on the already unstable business models supporting talent across sports and entertainment ecosystems,” CEO Steven Galanis said in a Medium post tied to the news. “It catalyzed a massive shift in awareness and widespread adoption of direct-to-fan models, which has, in turn, created a new foundation for fan engagement. We exist in an entirely different world today — one in which talent actually want to connect more deeply with their fans, and fans expect unprecedented access to the talent they admire most. This funding will help us create the access and connections that will define the future of the ‘connection economy’ on a global scale.”

This latest round more than doubles the service’s total funding, bringing it up to $165 million. Google Ventures, Amazon Alexa Fund, UTA, SoftBank Vision Fund 2, Valor Equity Partners and Counterpoint Global (Morgan Stanley) join existing investors, Lightspeed Venture Partners, Kleiner Perkins, The Chernin Group, Origin Ventures and Spark Capital. There are also some “talent investors” on board, as well, including skateboarding legend Tony Hawk. Because, you know, Cameo.

Cameo says some 80% of its standard video requests are booked as gifts, to celebrate things like birthdays. In total, around two million videos have been created through the offering. But the site is looking to grow into additional categories. Last year it added the ability to book celebrities as guests for Zoom video chats (a very pandemic-focused offering).

Some of the funding will go toward ramping up Cameo for Business (C4B), which brings celebrity videos to events and conferences, as well as ads and sales. Effectively, the service works as a pipeline between businesses and famous people. The company will also be expending its international offering, growing beyond the approximately 20% of videos currently purchased outside the U.S.

Powered by WPeMatico

Meet Stockly, a French startup that keeps the inventory of various e-commerce websites in sync. When you see an out-of-stock item on an e-commerce website, chances are you leave that website and try to find the same item on another site.

If you operate an e-commerce website, Stockly lets you sell items even when they’re currently out of stock. The startup automatically finds a third-party Stockly supplier with that specific item.

The order will go through and be sent by that supplier directly. Stockly tells its partners to use neutral packaging so that the end consumer isn’t confused.

This could be particularly useful for small-scale e-commerce companies that don’t have a healthy marketplace of third-party retailers. For instance, Amazon can already sell you an out-of-stock item if a supplier has listed that specific item on Amazon’s own marketplace. But that’s not the case for most e-commerce websites.

The main challenge for Stockly is that it has to sort through various catalog formats and match the different inventories of different retailers. It is focusing on clothing items at first. When an order is routed through Stockly, it selects a specific supplier based on different criteria, such as logistics, delivery time and historical data.

So far, Stockly has been working with Galeries Lafayette, Go Sport, Foot Shop and others. The startup has recently raised a $6 million (€5.1 million) funding round from Idinvest Partners, Daphni, Techstars, Checkout.com CEO Guillaume Pousaz and various business angels.

With this funding round, the company plans to expand its team to 20 people, add new clients and iterate on its product.

Powered by WPeMatico

Capitolis, which makes technology for capital markets players such as investment and merchant banks, has closed on a $90 million Series C funding round led by Andreessen Horowitz (a16z).

The financing included participation from existing backers Index Ventures, Sequoia Capital, S Capital, Spark Capital, SVB Capital, Citi, J.P. Morgan and State Street, and brings Capitolis’ total funding to date to $170 million. SVB Capital and Spark Capital co-led a $40 million Series B for the company in November 2019.

Capitolis CEO and founder Gil Mandelzis said the startup’s mission since its 2017 inception has been to “fundamentally re-imagine how the capital markets operate” after the last financial crisis and the “bold steps taken by regulators” in its aftermath.

The company says that its advanced workflow technology and proprietary algorithms allows banks, hedge funds and asset managers to eliminate, move or create trading positions by collaborating with other financial institutions. That results in freed up capital, open credit lines and access to capital from a bigger pool of sources, the company claims.

Ultimately, Capitolis’ network software is designed to help financial institutions optimize their balance sheets and reduce risk.

Seventy-five financial institutions currently use the Capitolis platform. The company says it grew its revenue run rate by “sixfold” in 2020. Since 2019, Capitolis has experienced a 230% increase in the number of users of its platform. To date, the startup says it has optimized $9 trillion in terms of gross notional balances.

Alex Rampell, partner at a16z, said that his firm believes that what sets Capitolis apart from other financial services players “is the sheer scale of management’s ambition and the substantial talent, technology and capital milestones they have achieved.”

The New York-based company says it plans to use its new capital toward product development and to boost its customer support and sales staff. It plans to increase its headcount from 90 today to over 150 by year’s end.

Capitolis currently covers foreign exchange products and equity swaps. It says it could expand into others if there is client demand.

This article was updated post-publication with additional information from the company

Powered by WPeMatico

From the early success of Crypto Kitties to the explosive growth of NBA Top Shot, Dapper Labs has been at the forefront of the cryptocurrency collectible craze known as NFTs.

Now the company is reaping the benefits of its trailblazing status with a new $305 million financing led by some of the biggest names in Hollywood, sports and investing.

The new round values the company at a whopping $2.6 billion, according to multiple media reports, and comes at a time when NFTs have captured the popular imagination.

Leading the company’s financing was Coatue, the financial services firm that’s behind many of the biggest later-stage tech deals. But heavy hitters from the entertainment world also took their cut — these are folks like NBA legend Michael Jordan as well as current players and funds including Kevin Durant, Andre Iguodala, Kyle Lowry, Spencer Dinwiddie, Andre Drummond, Alex Caruso, Michael Carter-Williams, Josh Hart, Udonis Haslem, JaVale McGee, Khris Middleton, Domantas Sabonis, Klay Thompson, Nikola Vucevic and Thad Young and Richard Seymour’s 93 Ventures.

Entertainment and music heavyweights including Ashton Kutcher and Guy Oseary’s Sound Ventures, Will Smith and Keisuke Honda’s Dreamers VC, Shawn Mendes and Andrew Gertler’s AG Ventures, Shay Mitchell and 2 Chainz also bought in on the action.

And from the venture world comes other strategic investors like Andreessen Horowitz, The Chernin Group, USV, Version One and Venrock.

The company said it would use the funds to continue building out NBA Top Shot and expanding the updated digital trading card platform to other sports and a broader creator community.

Top Shot has already notched over $500 million in sales for its animated trading cards featuring things like LeBron James dunking, and the sky (at least for now) is seemingly the limit for the collectible applications of blockchain.

It’s like the one thing that cryptocurrency can do really well and it’s been embraced far beyond the world of sports collectibles. The recent $69 million sale of a digital piece of art at Christies also marks a watershed moment for the art world.

“NBA Top Shot is successful because it taps into basketball fandom — it’s a new and more exciting way for people to connect with their favorite teams and players,” said Roham Gharegozlou, CEO of Dapper Labs. “We want to bring the same magic to other sports leagues as well as help other entertainment studios and independent creators find their own approaches in exploring open platforms. NFTs unlock a new model for monetization that benefits the fans much more than advertising or sponsorships.”

Powering the Top Shot system and Dapper Labs’ other offerings is a new blockchain protocol called Flow, which purports to handle mainstream consumer applications at scale, and can support mass adoption.

Flow also allows for transactions using fiat currency and credit cards, and provides a much needed ease of cryptocurrency, and can keep customers safe from the fraud or theft common in cryptocurrency systems, according to a statement from Dapper Labs.

Flow enables NFT marketplaces and other decentralized applications that need to scale to handle mainstream demand without extremely high transaction costs (“gas fees”) or environmental concerns, the company said.

“NBA Top Shot is one of the best demonstrations we’ve seen of how quickly new technology can change the landscape for media and sports fans,” said Kevin Durant, co-founder of Thirty Five Ventures. “We’re excited to follow the progress with everything happening on Flow blockchain and use our platform with the Boardroom to connect with fans in a new way.”

Already companies like Warner Music Group, Ubisoft, Warner Media and the UFC, as well as thousands of third-party developers, artists and other creators, are using the Flow mainnet to sell collectible cards and develop custodial wallets.

Additional investors in the round include: MLB players like Tim Beckham and Nolan Arenado; NFL players Ken Crawley, Thomas Davis, Stefon Diggs, Dee Ford, Malcom Jenkins, Rodney McLeod, Jordan Matthew, Devin McCourty, Jason McCourty, DK Metcalf, Tyrod Taylor and Trent Williams; team ownership, including Vivek Ranadivé (Kings); and notable sports investors Bolt Ventures.

Powered by WPeMatico

Cybersecurity training is one of those things that everyone has to do but not something everyone necessarily looks forward to.

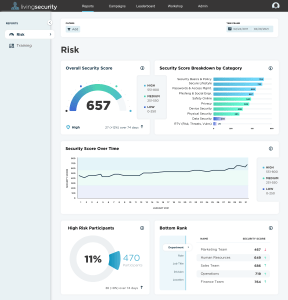

Living Security is an Austin-based startup out to change cybersecurity training something you look forward to, not dread. And the company has just closed on a $14 million Series B to continue its expansion beyond cybersecurity awareness training into human risk management.

Washington, D.C. based-Updata Partners led the financing, which also included participation from existing investors Silverton Partners, Active Capital, Rain Capital and SaaS Venture Partners. The investment comes after its $5 million Series A, led by Austin-based Silverton, raised last April.

Husband and wife Drew and Ashley Rose founded Living Security out of their house in June 2017 with the mission of making cybersecurity training less boring and more effective via gamified learning, with live action immersive storylines, role-based micro modules and reporting.

Living Security launched with its flagship product — Cyber Escape Room. When the pandemic hit, the startup brought its in-person training sessions online through the launch of CyberEscape Online.

With more people working remotely, the need for the type of offering Living Security provides has become even more paramount, considering how many people use personal devices for professional reasons, among other things. Employees are more vulnerable than ever to inadvertently providing entry points into the networks of the enterprises where they work — whether through social engineering, phishing or other methods.

Today, Living Security works with more than 100 large enterprises to train their global workforces to better protect sensitive data and secure their organizations. The startup’s customer list is impressive, and includes large enterprises such as CVS Health, Mastercard, Verizon, MassMutual, Biogen, AmerisourceBergen, Hewlett Packard, JPMorgan and Target.

So it’s not a big surprise that in 2020, Living Security tripled its revenue and employee headcount and more than doubled its customer count. The company declined to provide hard revenue figures, saying only that ARR grew nearly 200% last year.

“We have seen a significant increase in account growth and expansion in existing accounts…largely in part due to the scalability of our digital solution,” CEO Ashley Rose said.

With the success of its escape rooms and gamified training, Living Security’s team then asked themselves how they could make their efforts “more predictable.”

“We added risk management and scoring so program and security owners could become more targeted and focused on the delivery of their training,” Rose said.

So now Living Security aims to use behavioral data and analytics to measure and manage human risk. It plans to take that data and provide “predictive interventions” to employees.

“We’re focused on ‘How do we turn people from our greatest risk, to our greatest assets in cybersecurity?’ ” Rose said. “That’s our big vision for the company.”

Image Credits: Living Security

With its “Unify” human risk management platform, Living Security wants to provide an even more scalable solution. The company also plans to use its new capital toward expanding its geographic reach and scaling both direct and channel sales efforts.

Currently, Living Security has 55 employees, with the goal of having 90 by year’s end.

Deb Walter, director of information security training and awareness at AmerisourceBergen, said she first engaged with Living Security in 2017 when she requested its CyberSecurity Card game.

“I wanted to gamify how I presented training,” she recalls.

Introducing episodic gamification and its “bingeable” content into her training program was a big hit with employees, according to Walter.

“Their new platform is enabling us to deploy an ‘Information security academy’ to encourage associates and contractors to use several modes of training to earn points and track themselves on a leaderboard,” she said.

Updata General Partner Jon Seeber, who is taking a seat on Living Security’s board with the funding, said his firm saw “breakout potential” in the startup’s platform.

“It comes as close as you can to closing the loop between people and the systems on which they’re operating,” he said.

Plus, he said, it does it in a way that avoids the compliance-focused, “check-the-box” mindset that so often dominates employee-focused cybersecurity solutions.

Powered by WPeMatico

Weather intelligence platform ClimaCell today announced that it has raised a $77 million Series D funding round led by private equity firm Stonecourt Capital, with participation by Highline Capital. This brings the company’s total funding to about $185 million. In addition to the new funding, ClimaCell announced that it has changed its name to Tomorrow.io, with “The Tomorrow Companies Inc.” as its new legal name.

Today’s announcement comes only a month after the company announced that it would launch a fleet of small radar-equipped weather satellites to improve its weather monitoring and forecasting capabilities. That’s also, at least in part, where the name change comes from.

Originally, ClimaCell/Tomorrow.io built out a novel technology to collect weather data using wireless network infrastructure and IoT devices. That’s where the “cell” in ClimaCell came from. But as the company’s CEO and co-founder Shimon Elkabetz told me, while the company isn’t abandoning this approach, its focus today is much broader.

“The mission is really to help countries, businesses, organizations, to better manage their weather-related challenges,” he said. “And the ambition was always to be that largest weather enterprise in the world, the most disruptive, the most industry-defining. And I think this is the perfect timing for us to come up with a new name, not only because of the funding but because we were able to explain to ourselves that really, we’re helping others take control of tomorrow, today.”

That’s something Stonecourt partner Rick Davis agrees with. “While the company’s growth has been tremendous since launch, there is a larger opportunity at play here,” he said. “What Tomorrow.io is building, corroborated by their recent announcement of launching radar-equipped satellites into space, is only further proof that this company represents the future of weather forecasting for the entire planet. The privatization of the weather industry is now, and that type of vision is what compels the team here at Stonecourt Capital.”

As Elkabetz noted, Tomorrow.io isn’t a typical investment for a private investment firm like Stonecourt. Last year, the firm acquired 365 Data Centers, but it is also backing the Denver-based freight rail company Alpenglow Rail, for example.

And while many of Tomorrow.io’s customers saw their business decline during the pandemic (the company counts Uber and Delta among its users, for example), Elkabetz tells me that its team focused on diversifying its customer base and managed to sign up a number of large logistics companies, including major railways in the U.S. and Mexico, but also smaller companies in the drone, autonomous driving and electric vehicle space. In total, the company says, it saw a 200% net revenue retention rate and its annual contract value grew 850% during the past two years.

The company plans to use the new funding to launch more satellites, but also to improve its overall product and accelerate its go-to-market activities.

“We’re an interesting company because we’re a SaaS company that is now going to space,” Elkabetz said. “A lot of the Earth observations companies are now scratching their heads and saying, ‘Oh, we can’t just sell observations, it’s not monetizable or becoming a commodity. We now need to become a software company and build the platform and do the analytics.’ Good luck.”

Powered by WPeMatico