Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Eben Bayer has spent the better part of 14 years proving out the power of the humble mushroom as the world’s truly functional food.

As the chief executive and founder of Ecovative Design, Bayer has made replacements for foam packaging, lamps and furniture, leather materials and even meats like bacon from mighty mushroom mycelia (they even grew a tiny home).

Now the company has $60 million in financing to create new applications for its mycelial products and to scale up existing business units.

The core of Ecovative Design’s business is in packaging. That’s where the company has been developing its tech the longest and where its replacements for Styrofoam packaging have had the most commercial traction.

But there’s far more to Ecovative’s mushrooms than that, and the company’s new investors — including Viking Global Investors, with support from Senator Investment Group, AiiM Partners, Trousdale Ventures and other undisclosed backers — want to see just how far the company can go.

Part of the money will be used to build out a discovery platform for new materials and new strains in an effort to make Ecovative the Gingko Bioworks of the mushroom business. Another chunk of change will be used to build out a larger production facility for its mushroom production.

The Gingko analogy may not be that much of a stretch. Using its platform for manufacturing and deep knowledge of fungi, Ecovative has already spun up a food company called Atlast, which raised $7 million to begin building a fake meat empire on the back of a mushroom-made bacon substitute.

A person in a lab coat stands with their back to several trays of Ecovative’s mushroom material growing in trays. Image Credits: Ecovative Design

And the company also has fashion on the brain. A licensing agreement between Ecovative and Bolt Threads helped power that massively funded startup’s push into manufacturing a leather replacement from mushrooms back in 2018.

The deal between the two ended in acrimony and litigation — and now Ecovative is going it alone, looking to be a provider of bulk leather replacements for anything from shoes to belts to buckskin jackets.

“It seems like there’s a need for somebody who could not be a branded supplier, but to be someone who can provide scalable mushroom leather,” said Bayer.

Other companies are working on trying to convince consumers to make the switch to mushrooms or other plant-based leather substitutes. Those are businesses like Mycoworks, which raised $45 million from a slew of celebrities last year to build out its own commercial-scale mycelial manufacturing business. Or Natural Fiber Welding, which is backed by none other than the omnipresent eco-conscious fashion accessory adorning the feet of almost every venture investor — Allbirds (or are Atoms the new thing? I can’t keep up…).

“The demand for new biomaterials in the fashion industry, such as mycelium, far outstrips the current supply. Ecovative is tackling this challenge head-on, committing to building a next-generation platform capable of producing mycelium at scale,” said Katrin Ley, managing director of Fashion for Good, in a statement.

While Ecovative makes small batches of products under brands like Atlast, Bayer wants his company to be more of a white-label material provider than a branded business making shoes, packaging and plant-based meat replacements.

The new financing comes on the heels of Ecovative’s partnership with U.K. packaging licensee Magical Mushroom Company, which recently announced the opening of four more facilities to supply the U.K. and EU markets with green packaging solutions, the company said.

“Mycelium is a unique material that outperforms other sustainable alternatives in industries as diverse as fashion and food,” said Evan Lodes, partner at Senator Investment Group, which first backed Ecovative back in 2019. “Ecovative pioneered the field of mycelium materials, and has invested in the research and development necessary to deliver it at the scale and cost necessary to make a significant impact.”

Powered by WPeMatico

LIVEKINDLY Collective, the shouty parent company behind a family of plant-based food brands, has snagged cash from the global impact investing arm of $103 billion investment firm TPG to close its latest round of funding at $335 million.

The company’s fundraising shows that investors still have high hopes for plant-based food brands and that despite the money that’s flowed to companies like Beyond Meat and Impossible Foods — and the resurgence of older brands in the category like Quorn or Kelloggs’ Morningstar Farms — there’s still a healthy appetite among investors for more brands.

LIVEKINDLY was founded by some heavy hitters from the food industry, including Kees Kruythoff, the former president of Unilever North America; Roger Lienhard, the founder of Blue Horizon; and Jodi Monelle, the chief executive and founder of LIVEKINDLY Media. Food industry veterans like Mick Van Ettinger, a former Unilever employee, and Aldo Uva, a former Nestlé employee, round out the team.

Founded as a rollup for a number of different vegetarian and alternative protein food brands, the LIVEKINDLY Collective is now one of the largest plant-based food companies, by funding.

The company said it would use the money to expand into the U.S. and China and to power additional acquisitions, partnerships and investments in plant-based foods.

The company raised money previously from S2G Ventures and Rabo Corporate Investments, the investment arm of the giant Dutch financial services firm, Rabobank.

Fundamentally, the founding investors behind LIVEKINDLY believe that the technology has a long way to go before it matures. And it’s likely that this latest round will be LIVEKINDLY’s last before an initial public offering of its own.

“We are building a global pureplay in plant-based alternatives — which we believe is the future of food,” said Roger Lienhard, founder and executive chairman of Blue Horizon and founder of LIVEKINDLY Collective. “In just one year, we have raised a significant amount of capital, which testifies to the urgency of our mission and the enormous investment opportunity it represents. We believe the momentum behind plant-based living will continue to grow in both the private and public markets.”

As a result of its investment, Steve Ellis, co-managing partner of The Rise Fund, has joined the LIVEKINDLY Collective board of directors, effective March 1, 2021.

“We are excited to work with LIVEKINDLY Collective and its ecosystem of innovative companies and world-class leaders to meet the growing global demand for healthy, plant-based, clean-label options,” said Ellis. “The company’s unique, mission-driven model operates across the entire value chain, from seed to fork, to drive worldwide adoption of plant-based alternatives and create a healthier planet for all.”

Powered by WPeMatico

The coming wave of electric vehicles will require more than thousands of charging stations. In addition to being installed, they also need to work — and today, that isn’t happening.

If a station doesn’t send out an error or a driver doesn’t report it, network providers might never know there’s even a problem. Kameale C. Terry, who co-founded ChargerHelp!, an on-demand repair app for electric vehicle charging stations, has seen these issues firsthand.

One customer assumed that poor usage rates at a particular station was due to a lack of EVs in the area, Terry recalled in a recent interview. That wasn’t the problem.

“There was an abandoned vehicle parked there and the station was surrounded by mud,” said Terry who is CEO and co-founded the company with Evette Ellis.

Demand for ChargerHelp’s service has attracted customers and investors. The company said it has raised $2.75 million from investors Trucks VC, Kapor Capital, JFF, Energy Impact Partners and The Fund. This round values the startup, which was founded in January 2020, at $11 million post-money.

The funds will be used to build out its platform, hire beyond its 27-person workforce and expand its service area. ChargerHelp works directly with the charging manufacturers and network providers.

“Today when a station goes down there’s really no troubleshooting guidance,” said Terry, noting that it takes getting someone out into the field to run diagnostics on the station to understand the specific problem. After an onsite visit, a technician then typically shares data with the customer, and then steps are taken to order the correct and specific part — a practice that often doesn’t happen today.

While ChargerHelp is couched as an on-demand repair app, it is also acts as a preventative maintenance service for its customers.

The idea for ChargerHelp came from Terry’s experience working at EV Connect, where she held a number of roles, including head of customer experience and director of programs. During her time there, she worked with 12 manufacturers, which gave her knowledge into inner workings and common problems with the chargers.

It was here that she spotted a gap in the EV charging market.

“When the stations went down we really couldn’t get anyone on site because most of the issues were communication issues, vandalism, firmware updates or swapping out a part — all things that were not electrical,” Terry said.

And yet, the general practice was to use electrical contractors to fix issues at the charging stations. Terry said it could take as long as 30 days to get an electrical contractor on site to repair these non-electrical problems.

Terry often took matters in her own hands if issues arose with stations located in Los Angeles, where she is based.

“If there was a part that needed to be swapped out, I would just go do it myself,” Terry said, adding she didn’t have a background in software or repairs. “I thought, if I can figure this stuff out, then anyone can.”

In January 2020, Terry quit her job and started ChargerHelp. The newly minted founder joined the Los Angeles Cleantech Incubator, where she developed a curriculum to teach people how to repair EV chargers. It was here that she met Ellis, a career coach at LACI who also worked at the Long Beach Job Corp Center. Ellis is now the chief workforce officer at ChargerHelp.

Since then, Terry and Ellis were accepted into Elemental Excelerator’s startup incubator, raised about $400,000 in grant money, launched a pilot program with Tellus Power focused on preventative maintenance and landed contracts with EV charging networks and manufacturers such as EV Connect, ABB and SparkCharge. Terry said they have also hired their core team of seven employees and trained their first tranche of technicians.

ChargerHelp takes a workforce-development approach to finding employees. The company only hires in cohorts, or groups, of employees.

The company received more than 1,600 applications in its first recruitment round for electric vehicle service technicians, according to Terry. Of those, 20 were picked to go through training and 18 were ultimately hired to service contracts across six states, including California, Oregon, Washington, New York and Texas. Everyone picked to go through training is paid a stipend and earn two safety licenses.

The startup will begin its second recruitment round in April. All workers are full-time with a guaranteed wage of $30 an hour and are being given shares in the startup, Terry said. The company is working directly with workforce development centers in the areas where ChargerHelp needs technicians.

Powered by WPeMatico

This morning Bunch announced that it has closed a total of $4.4 million in seed capital, including a new $1 million infusion this week. The company’s product, a mobile app, focuses on teaching leadership skills to the younger generations more accustomed to learning in smaller chunks, often on the go.

Don’t roll your eyes, all ye who attended business school. The concept has traction.

Earlier this month TechCrunch covered Arist, for example, a startup that provides corporate training delivered to end-users via text. That company added $2 million to its prior raise, bringing its round to a total of $3.9 million. To see Bunch pick up some extra cash is therefore not too surprising.

TechCrunch caught up with Bunch CEO and co-founder Darja Gutnick and M13 partner and Bunch-backer Karl Alomar to chat about the round and what the startup is up to.

Bunch claims to be an “AI coach” that provides users with daily, short-form tips and tricks to become a better leader. Given that we have all either worked for a manager who could have used some more training, or been that manager ourselves, the idea isn’t a bad one.

As you would expect, Bunch tailors itself to individual users. Gutnick told TechCrunch that her company has partnered with academics to detail different leadership style “archetypes” as part of its foundation. The Bunch system also molds its out to a user’s style and leadership goals.

Notably when TechCrunch last covered Bunch, it was working on something a bit different. Back in 2017, the company was building what we described as “Google Analytics for company culture.” Since then the startup has shifted its focus to individuals instead of companies.

Bunch’s service launched in November, leading to around 13,000 signups by the start of the year. The startup now claims nearly 20,000. And it has big product plans for the next few months. That’s why the company raised more money, and why Alomar and his firm were willing to put more capital into the startup.

What’s ahead that got M13 sufficiently excited that it put more capital into Bunch? Alomar said that community and peer-review features are coming. It was a good time, he explained, to put more money into Gutnick’s company so that it can build, and then raise more capital later on after it gets some more work done.

The company plans to make money via a freemium offering. Gutnick told TechCrunch that related apps in her category tend to struggle with retention, so they charge up front and then don’t mind limited usage later on. She wants to flip that.

And there’s more to come from Bunch, like other categories of content. But the startup wants to focus and get its first niche done right. It now has another million dollars to prove that its early traction isn’t just that.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

One of the biggest pain points for startups and small businesses is keeping up with back office tasks such as bookkeeping and managing taxes.

QuickBooks, it seems, just doesn’t always cut it.

Three-time co-founders Waseem Daher, Jeff Arnold, and Jessica McKellar formed Pilot with the mission of affordably providing back office services to startups and SMBs. With over 1,000 customers, it has gained serious traction over the years. And Pilot has now also received validation from some big-name investors. On Friday, the company announced a $100 million Series C that doubles the company’s valuation to $1.2 billion.

Bezos Expeditions — Amazon founder Jeff Bezos’ personal investment fund — and Whale Rock Capital (a $10 billion hedge fund) co-led the round, which also included participation from Sequoia Capital, Index Ventures, Authentic Ventures and others.

Stripe and Index Ventures co-led Pilot’s $40 million Series B in April 2019. The latest financing brings the company’s total funding raised to over $158 million since its 2017 inception.

The founding team certainly has an impressive track record, having founded and sold two previous companies: Ksplice (to Oracle) and Zupli (to Dropbox).

Pilot’s pitch is about more than just software. The company combines its software with accountants to do things such as provide “CFO Services” to SMBs without a full-stack finance team. It also provides monthly variance analysis for all its bookkeeping customers, essentially serving as a controller for those companies, so they can make better budgeting and spending decisions.

It also helps companies access small business tax credits they may not have otherwise known about.

Last year, Pilot completed more than $3 billion in bookkeeping transactions for its customers, which range from pre-revenue startups to larger companies with more than $30M of revenue a year. Customers include Bolt, r2c and Pathrise, among others.

Pilot has also inked a number of co-marketing partnerships with companies such as American Express, Bill.com, Brex, Carta, Gusto, Rippling, Stripe, SVB, and Techstars.

Ironically, Pilot says it aspires to the “AWS of SMB backoffice.” (In fact, co-founder Waseem Daher started his career as an intern at Amazon). Put simply, Pilot wants to take care of all those back office tasks so companies can focus more on growth and winning business.

Pilot strives to offer an “exceptional customer experience,” which is reflected in the fact that over 80% of the company’s business is driven by customer referrals and organic interest, according to Daher.

Whale Rock Partner Kristov Paulus said that white-glove customer service experience and Pilot’s “carefully-engineered” software make a powerful combination.

“We look forward to supporting Pilot in their vision to make back office services as easy-to-use, scalable, and ubiquitous as AWS has with the cloud,” he said.

Pilot’s model reminds me a lot of that of ScaleFactor’s, an Austin-based startup that raised $100 million in a year before it crashed and burned. But the difference in this case is that Pilot seems to have satisfied customers.

Powered by WPeMatico

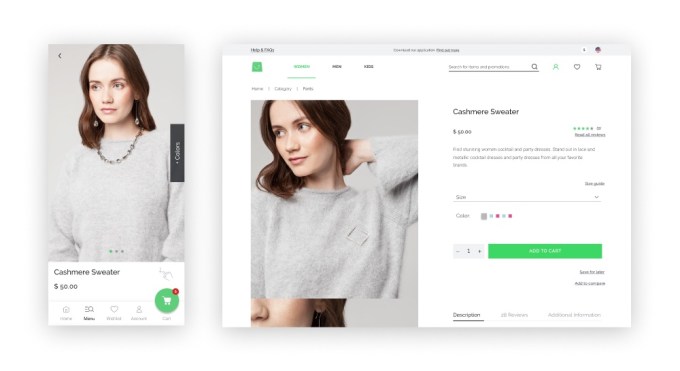

“Headless commerce” is a phrase that gets thrown around lot (I’ve typed it several times today already), but Vue Storefront CEO Patrick Friday has an especially vivid way of using the concept to illustrate his startup’s place in the broader ecosystem.

“Vue Storefront is the bodiless front end,” Friday said. “We are the walking head.”

In other words, while most headless commerce companies are focused on creating back-end infrastructure, Vue powers the front end, namely the progressive web applications with which consumers actually interact. The company describes itself as “the lightning-fast front-end platform for headless commerce.”

Friday said that he and CTO Filip Rakowski created the Vue Storefront technology as an open-source project while working at e-commerce agency Divante, before eventually spinning it out into a separate startup last year. The company was also part of the latest class at accelerator Y Combinator, and it recently raised $1.5 million in seed funding led by SMOK Ventures and Movens VC.

“We had to set up a new entity in the middle of COVID, we had to raise in the middle of COVID and we had to convince the agency to get rid of the product in the middle of COVID,” Friday said. He even recalled signing papers with an investor one morning in early December and doing an interview with Y Combinator that evening.

As they’ve created a business around the core open-source technology, Friday and his team have realized that Vue has more to offer than just building web apps, because it connects e-commerce platforms like Magento and Shopify with headless content management systems like Contentstack and Contentful, payments systems like PayPal and Stripe and other third-party services.

Image Credits: Vue Storefront

In fact, Friday said customers have been telling them, “You are like the glue. Headless was so complex to me, and then I got this Vue Storefront thing to come in on top everything else and be the glue connecting things.”

The platform has been used to create more than 300 stores worldwide. Friday said adoption has accelerated as the pandemic and resulting growth in e-commerce have driven businesses to realize they’re using “this legacy platform, using outdated frameworks and technologies from a good four or five years ago.”

Rakowski added, “We also see that many customers actually come to us deciding that Vue Storefront can be the first step of migration to another platform. We can quickly migrate the front end and write back-end agnostic code.”

Because it had just raised funding, the Vue Storefront team did not participate in the recent YC Demo Day, and it will be presenting at the next Demo Day instead. In the meantime, the company will be holding its own virtual Vue Storefront Summit on April 20.

Powered by WPeMatico

Hub, a productivity platform for technical pre-sales, has formally launched with $1 million in seed funding.

CEO Freddy Mangum and CTO Karl Gainey founded Hub in 2020. The pair both had experience in technical sales and recognized the challenges of using spreadsheets to manage their business.

They researched and surveyed sales engineers at big and small companies alike, discovering that many of these professionals were spending a lot of time doing things like “wrangling data to report to management, forcing individual contributors to enter data into a CRM (customer relationship management) system.”

“Performing these kinds of mundane tasks was taking time away from them actually selling,” said Mangum. “We also came to the conclusion that technical sales professionals have been the unsung heroes of sales, behind the scenes driving enterprise.”

So they set about creating a better way for presales, solution architects and sales engineers to manage their day-to-day technical sales activities.

Then COVID hit, and obviously, as Mangum puts it, digital selling became much more real.

“That really accentuated the need for specific commercial tooling,” he said.

San Francisco-based Hub was born. The company describes its offering as a SaaS application that “securely interconnects and complements popular CRM systems and productivity applications.”

As a personalized productivity platform, Hub is designed to help individual contributors manage the sales process. By gaining greater visibility into every step, the goal is to better analyze and do more accurate forecasting so an organization can better “identify investment areas while taking corrective actions in real time,” Mangum said.

“Our tool can help them automate the mundane tasks and put the focus on high-value tasks to actually win more business,” he added.

Image Credits: Courtesy of Hub

Targeting technical sales professionals is an underserved market, according to Mangum, which presents tremendous opportunity.

Investors in the company include Tom Noonan, general partner of Atlanta-based TechOperators (and former chairman and CEO of Internet Security Systems, which was acquired in 2007 by IBM for $1.3 billion) and SalesLoft CEO and co-founder Kyle Porter.

To Noonan, the pandemic presented the challenge of keeping an enterprise sales force effective while working remotely.

“The biggest concern was not that sales people couldn’t engage with customers. It was how the technical part of the sales cycle was going to be conducted remotely, such as the concepts demonstrations integrations, the modifications, all the things that have to be articulately communicated, and also aligned with the customer’s needs,” he told TechCrunch. “And to me that just made the need for this model of selling that we’re in today.”

Looking ahead, Noonan believes these teams are going to question why they spent so much time on travel and on-site activities.

“More and more customers have actually gotten accustomed to remote interactions and even more importantly, many of the customers are not working in a place of business now either,” he said. “And that leaves a huge challenge for the solution architects, because they are the glue that bridge between a buyer saying that’s interesting, and an organization concluding that the capabilities of whatever system is being sold to them truly meets their needs both from a technical perspective and integration perspective and a functional perspective.”

Hub, he believes, can help address that challenge.

With a diverse founding team (Mangum is a Bolivian immigrant and Gainey is Black), Hub aims to reflect that diversity in its team. Its developers are based in Argentina, for example.

“As someone who graduated from ESL when I came to this country it is important that opportunities not be closed off to people just because of language barriers,” Mangum said.

Powered by WPeMatico

In the trucking industry, “dwell and detention” times are the enemies of efficiency, profits and drivers. More than two billion hours are lost each year due to dwell — the time spent at a distribution yard or facility — and detention — the gap between when unloading or loading is supposed to begin and when it actually does.

Baton, a San Francisco-based startup developed out of 8VC’s incubator program, has developed a business that it believes will solve these long-standing problems for truckers. The company’s name gives a hint at its business model. Baton is developing a network of drop zones, 24-hour facilities it has sub-leased from partners, that are located outside of busy urban centers. Long-haul truckers can pull up and leave their loaded trailers at these drop zones. Baton then partners with local fleets of Class 8 trucks that will arrive at the drop site, grab the load and take the freight to its final destination.

The startup developed a software platform that coordinates vehicles, drop-zones, warehouses and local drivers through a single API. Customers also receive live automated updates via API as loads are delivered.

“In long-haul trucking, there’s a remarkable amount of wasted time,” co-founder Andrew Berberick said in a recent interview. Baton’s pitch is that it eliminates hours wasted with dwell and detention as well as the time spent sitting in traffic. The company says it can also help increase wages for drivers, who are typically paid by the mile and not the hour, as well as cut carbon emissions.

Baton has landed long-haul trucking firms as customers, including CRST, the private freight company that carries loads for some of the country’s largest retailers, including Walmart. And it’s also attracted a variety of strategic investors. The company raised its first $3.3 million from real estate corporation Prologis and 8VC, in a seed round that closed in December 2019. Now, it’s tacking on more capital and investors in a Series A funding round, co-led by 8VC and Maersk Growth, the corporate venture arm of logistics giant AP Moller-Maersk.

Baton raised $10.5 million in the Series A, and now has a post-money valuation of $50 million, co-founders Nate Robert and Berberick told TechCrunch. Prologis, Ryder, Lineage Logistics, Project44 CEO Jett McCandless, KeepTruckin’ CEO Shoaib Makani, Clarendon Capital operating partner John Larkin, I.S.G founder Trace Haggard and Cooley LLC all participated in the round.

Baton has several drop zones in Los Angeles, with plans to open more in the city. Robert and Berberick said their plan is to open zones in Atlanta, Chicago and Dallas in the next 12 to 18 months.

Baton’s short-term aim is to end waste in human-driven trucking operations. But Robert says the business model is well-positioned to handle what he says will be the first viable applications of autonomous trucks. “The answer is on highways only,” Robert said. “And for that to occur you’ll have to have a nationwide network of transfer hubs.”

Baton is already piloting the idea, which Robert called “autonomous relays,” with an unnamed self-driving trucks company on the Arizona-California border.

“As we see automated and eventually electric trucks become standard for certain routes, the network of Baton hubs and the coordination provided by its software will become seen as core infrastructure. Baton makes the transformation to automated trucking possible,” 8VC partner and co-founder Jake Medwell said.

Powered by WPeMatico

Holberton, the education startup that started out as a coding school in San Francisco and today works with partners to run schools in the U.S., Europe, LatAm and Europe, today announced that it has raised a $20 million Series B funding round led by Redpoint eventures. Existing investors Daphni, Imaginable Futures, Pearson Ventures, Reach Capital and Trinity Ventures also participated in this round, which brings Holberton’s total funding to $33 million.

Today’s announcement comes after a messy 2020 for Holberton, and not only because the pandemic put a stop to in-person learning.

The original promise of Holberton was that it provided students — which it selects through a blind admissions process — with a well-rounded software development education akin to a college education for free. In return, students provide a set amount of their salary for the next few years to the school as part of a deferred tuition agreement, up to a maximum of $85,000.

But early last year, California’s Bureau for Private Postsecondary Education (BPPE) directed the school to immediately cease operation, in part because the agency found that Holberton had started offering a new, unapproved program. This program, a nine-month training program augmented by six months of employment, required students to pay the full $85,000 cost of its approved programs. After a hearing, the BPPE allowed Holberton to continue to operate its other programs. A number of students also accused the school of not giving them the education it had promised.

Throughout this period, Holberton continued expanding, though. It opened campuses in Mexico and Peru, for example. Indeed, it doubled the number of schools in its system from nine to 18 in 2020.

But on December 17, 2020, Holberton voluntarily surrendered its operating license in California. The day before, Holberton announced that it would not re-open its campus in San Francisco, which had been shut down since March because of the pandemic. Holberton co-founder Sylvain Kalache argued that the school would be best positioned to achieve its mission by “working with amazing local partners who operate the campuses and deeply understand their markets’ unique needs” and not by operating its own campuses.

It now thinks of itself more as an “OS of Education” that offers franchised campuses and education tools.

In January, California’s attorney general struck down the fraud allegations against the school. “California was the only market in which Holberton faced any regulatory challenges,” Kalache wrote in the company’s first public acknowledgment of the lawsuits. “With this now behind us, we are excited to move forward with our original mission of providing affordable and accessible education to prospective software engineers around the world.”

Clearly, that’s how Holberton’s funders feel about this, too.

“They’ve proven successful in breaking down barriers of cost and access while delivering a world-class curriculum,” said Manoel Lemos, managing partner at Redpoint eventures. “With the concept of ‘OS of Education’ as a service, they provide customers with all the tools they need for success. Customers can be nonprofit impact investors who want to improve local economies, education institutions who want to fill gaps in how they teach in a post-COVID learning environment, or corporations who want to provide the best training possible as education providers themselves or as employee development programs.”

Holberton founder and CEO Julien Barbier tells me that, today, “for the first time since our creation, we have started working with universities to help them create a better experience and add hands-on education on top of their traditional methodology. Everyone’s happy: the school, the students, and the teachers — because they prefer to focus on teaching and not spend huge amounts of time correcting projects.”

He expects to see 5,000 students join this year, up from 500 in 2019, and see the network expand with new schools in the U.S., Europe, LatAm and Africa. He also noted that the company already has customers for its “OS of Education” tools for auto-grading projects and its online programs. Just this week, Holberton Tulsa announced plans to more than double its physical campus in the city.

“Raising funds is helping us support and accelerate our vision of creating this ‘OS of education.’ Many educational entities need help and tools to better support their students and their staff. It is now that they need our help. Again, COVID has accelerated the digital transformation, and clearly, there are a lot of gaps that need to be filled,” he said. “[…] We are now a SaaS company which charges other businesses, universities or non-profits to use our tools and/or contents so that they can run their education/training programs at scale, with a better experience, while increasing the quality of education.”

Powered by WPeMatico

Ryu Games, a startup that helps developers add cash tournaments to their mobile games, announced this morning it has raised $2.3 million in a seed round. The funds came from a number of investors, including Side Door Ventures, MGV Capital, Velo Partners and Citta Ventures.

In addition, 500 Startups participated in the round. To see the accelerator take part in the funding round is not a surprise, as TechCrunch first caught wind of Ryu during its participation in the most recent 500 Startups demo day. At the time, we were enthused by the idea of gamers wagering money to go head-to-head with other players on mobile devices. Investors appear to back our first impression of the company.

The gist behind our bullishness on the company’s idea is that esports is cool. And though your humble servant is sufficiently ancient as to favor PC-based esports, younger folks are into mobile gaming esports. Fair enough. Now mix in the sports-betting frenzy that we’ve seen in the United States, and you have a potentially potent cocktail.

TechCrunch caught up with Ryu Games co-founder and CEO Ross Krasner to dig in a bit more. It turns out that the original esports-y model that we envisioned for Ryu was a bit off. Instead, players will often go toe-to-toe in an asynchronous fashion, betting high scores in a game against one another. So, competitive “StarCraft II” this is not. But “StarCraft” is famously difficult to be even mediocre at, while mobile games are simpler by nature, and thus more popular.

Perhaps your parents will square off against office friends in cash-fueled solitaire tournaments.

The money setup is simple, with Krasner likening it to a poker tournament. You wager a set amount, and then play. Ryu collects a fee for hosting, and then players get to it.

Ryu hopes to be present on a few dozen games this year. One matter that could slow adoption, however, is that games it partners with tend to relaunch a version of their title with Ryu’s SDK built in. The startup bites back against the work that partner-developers have to undertake by cross-promoting titles that use its system. So, if you sign up, you can do more than generate revenue. Your game might also find a new audience.

Like with most seed-stage startups, Ryu Games is more of a bet on the future than proof of a new trend. Let’s see how far it can get with this set of capital, especially as vaccines take larger and larger bites out of the pandemic that has kept us locked up for so very long.

Powered by WPeMatico