Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Work insights platform Fin raised $20 million in Series A funding and brought in Evan Cummack, a former Twilio executive, as its new chief executive officer.

The San Francisco-based company captures employee workflow data from across applications and turns it into productivity insights to improve the way enterprise teams work and remain engaged.

Fin was founded in 2015 by Andrew Kortina, co-founder of Venmo, and Facebook’s former VP of product and Slow Ventures partner Sam Lessin. Initially, the company was doing voice assistant technology — think Alexa but powered by humans and machine learning — and then workplace analytics software in 2020. You can read more about Fin’s origins at the link below.

The new round was led by Coatue, with participation from First Round Capital, Accel and Kleiner Perkins. The original team was talented, but small, so the new funding will build out sales, marketing and engineering teams, Cummack said.

“At that point, the right thing was to raise money, so at the end of last year, the company raised a $20 million Series A, and it was also decided to find a leadership team that knows how to build an enterprise,” Cummack told TechCrunch. “The company had completely pivoted and removed ‘Analytics’ from our name because it was not encompassing what we do.”

Fin’s software measures productivity and provides insights on ways managers can optimize processes, coach their employees and see how teams are actually using technology to get their work done. At the same time, employees are able to manage their workflow and highlight areas where there may be bottlenecks. All combined, it leads to better operations and customer experiences, Cummack said.

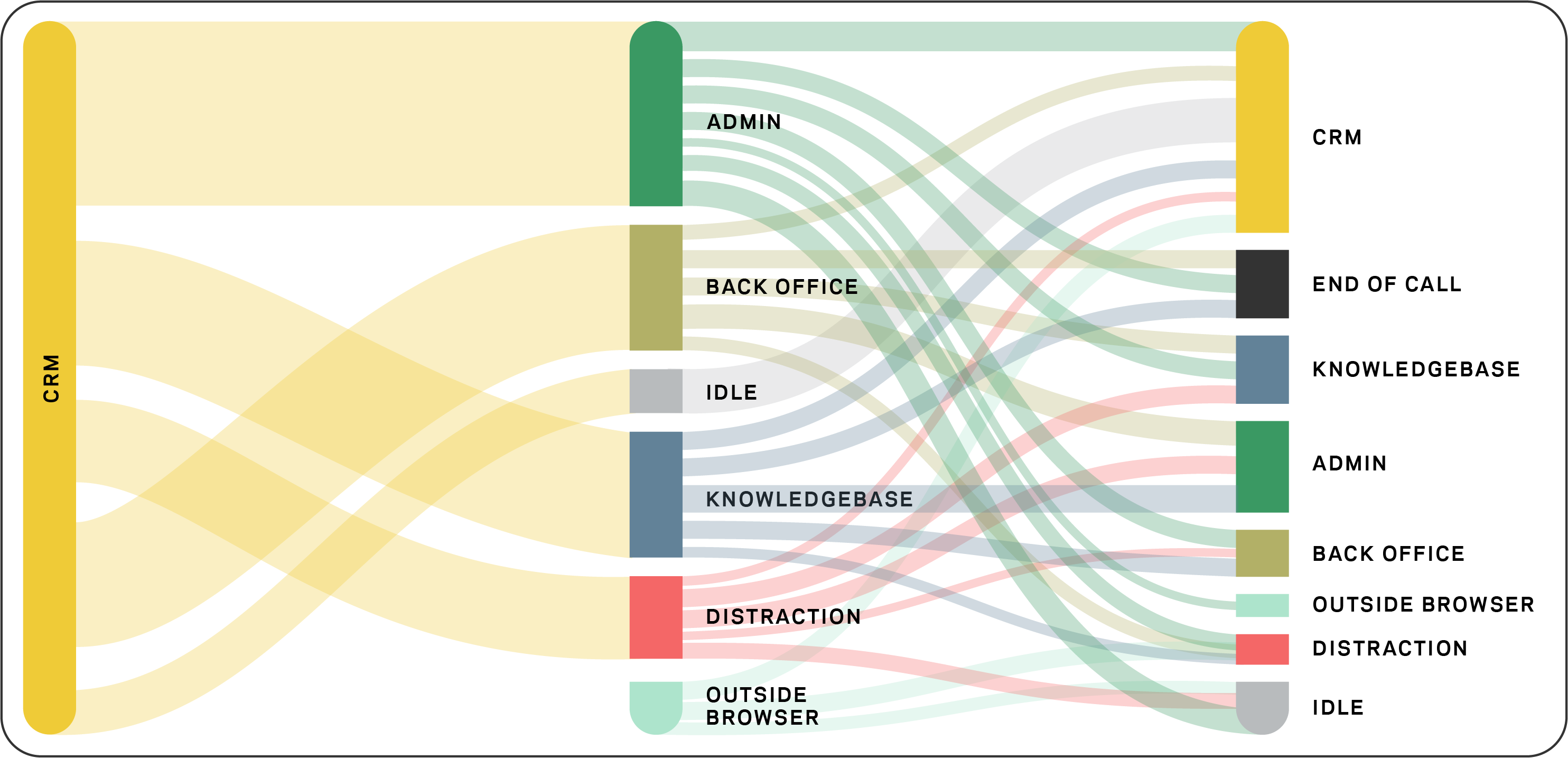

Graphic showing how work is really done. Image Credits: Fin

Fin’s view is that as more automation occurs, the company is looking at a “renaissance of human work.” There will be more jobs and more types of jobs, but people will be able to do them more effectively and the work will be more fulfilling, he added.

Particularly with the use of technology, he notes that in the era before cloud computing, there was a small number of software vendors. Now with the average tech company using over 130 SaaS apps, it allows for a lot of entrepreneurs and adoption of best-in-breed apps so that a viable company can start with a handful of people and leverage those apps to gain big customers.

“It’s different for enterprise customers, though, to understand that investment and what they are spending their money on as they use tools to get their jobs done,” Cummack added. “There is massive pressure to improve the customer experience and move quickly. Now with many people working from home, Fin enables you to look at all 130 apps as if they are one and how they are being used.”

As a result, Fin’s customers are seeing metrics like 16% increase in team utilization and engagement, a 25% decrease in support ticket handle time and a 71% increase in policy compliance. Meanwhile, the company itself is doubling and tripling its customers and revenue each year.

Now with leadership and people in place, Cummack said the company is positioned to scale, though it already had a huge head start in terms of a meaningful business.

Arielle Zuckerberg, partner at Coatue, said via email that she was part of a previous firm that invested in Fin’s seed round to build a virtual assistant. She was also a customer of Fin Assistant until it was discontinued.

When she heard the company was pivoting to enterprise, she “was excited because I thought it was a natural outgrowth of the previous business, had a lot of potential and I was already familiar with management and thought highly of them.”

She believed the “brains” of the company always revolved around understanding and measuring what assistants were doing to complete a task as a way to create opportunities for improvement or automation. The pivot to agent-facing tools made sense to Zuckerberg, but it wasn’t until the global pandemic that it clicked.

“Service teams were forced to go remote overnight, and companies had little to no visibility into what people were doing working from home,” she added. “In this remote environment, we thought that Fin’s product was incredibly well-suited to address the challenges of managing a growing remote support team, and that over time, their unique data set of how people use various apps and tools to complete tasks can help business leaders improve the future of work for their team members. We believe that contact center agents going remote was inevitable even before COVID, but COVID was a huge accelerant and created a compelling ‘why now’ moment for Fin’s solution.”

Going forward, Coatue sees Fin as “a process mining company that is focused on service teams.” By initially focusing on customer support and contact center use case — a business large enough to support a scaled, standalone business — rather than joining competitors in going after Fortune 500 companies where implementation cycles are long and there is slow time-to-value, Zuckerberg said Fin is better able to “address the unique challenges of managing a growing remote support team with a near-immediate time-to-value.”

Powered by WPeMatico

A Canadian startup called Nuula that is aiming to build a super app to provide a range of financial services to small and medium businesses has closed $120 million of funding, money that it will use to fuel the launch of its app and first product, a line of credit for its users.

The money is coming in the form of $20 million in equity from Edison Partners, and a $100 million credit facility from funds managed by the Credit Group of Ares Management Corporation.

The Nuula app has been in a limited beta since June of this year. The plan is to open it up to general availability soon, while also gradually bringing in more services, some built directly by Nuula itself but many others following an embedded finance strategy: business banking, for example, will be a service provided by a third party and integrated closely into the Nuula app to be launched early in 2022. Alongside that, the startup will also be making liberal use of APIs to bring in other white-label services, such as B2B and customer-focused payment services, starting first in the U.S. and then expanding to Canada and the U.K. before expanding further into countries across Europe.

Current products include cash flow forecasting, personal and business credit score monitoring, and customer sentiment tracking; and monitoring of other critical metrics including financial, payments and e-commerce data are all on the roadmap.

“We’re building tools to work in a complementary fashion in the app,” CEO Mark Ruddock said in an interview. “Today, businesses can project if they are likely to run out of money, and monitor their credit scores. We keep an eye on customers and what they are saying in real time. We think it’s necessary to surface for SMBs the metrics that they might have needed to get from multiple apps, all in one place.”

Nuula was originally a side-project at BFS, a company that focused on small business lending, where the company started to look at the idea of how to better leverage data to build out a wider set of services addressing the same segment of the market. BFS grew to be a substantial business in its own right (and it had raised its own money to that end, to the tune of $184 million from Edison and Honeywell). Over time, it became apparent to management that the data aspect, and this concept of a super app, would be key to how to grow the business, and so it pivoted and rebranded earlier this year, launching the beta of the app after that.

Nuula’s ambitions fall within a bigger trend in the market. Small and medium enterprises have shaped up to be a huge business opportunity in the world of fintech in the last several years. Long ignored in favor of building solutions either for the giant consumer market, or the lucrative large enterprise sector, SMBs have proven that they want and are willing to invest in better and newer technology to run their businesses, and that’s leading to a rush of startups and bigger tech companies bringing services to the market to cater to that.

Super apps are also a big area of interest in the world of fintech, although up to now a lot of what we’ve heard about in that area has been aimed at consumers — just the kind of innovation rut that Nuula is trying to get moving.

“Despite the growth in services addressing the SMB sector, overall it still lacks innovation compared to consumer or enterprise services,” Ruddock said. “We thought there was some opportunity to bring new thinking to the space. We see this as the app that SMBs will want to use everyday, because we’ll provide useful tools, insights and capital to power their businesses.”

Nuula’s priority to build the data services that connect all of this together is very much in keeping with how a lot of neobanks are also developing services and investing in what they see as their unique selling point. The theory goes like this: banking services are, at the end of the day, the same everywhere you go, and therefore commoditized, and so the more unique value-added for companies will come from innovating with more interesting algorithms and other data-based insights and analytics to give more power to their users to make the best use of what they have at their disposal.

It will not be alone in addressing that market. Others building fintech for SMBs include Selina, ANNA, Amex’s Kabbage (an early mover in using big data to help loan money to SMBs and build other financial services for them), Novo, Atom Bank, Xepelin and Liberis, biggies like Stripe, Square and PayPal, and many others.

The credit product that Nuula has built so far is a taster of how it hopes to be a useful tool for SMBs, not just another place to get money or manage it. It’s not a direct loaning service, but rather something that is closely linked to monitoring a customers’ incomings and outgoings and only prompts a credit line (which directly links into the users’ account, wherever it is) when it appears that it might be needed.

“Innovations in financial technology have largely democratized who can become the next big player in small business finance,” added Gary Golding, General Partner, Edison Partners. “By combining critical financial performance tools and insights into a single interface, Nuula represents a new class of financial services technology for small business, and we are excited by the potential of the firm.”

“We are excited to be working with Nuula as they build a unique financial services resource for small businesses and entrepreneurs,” said Jeffrey Kramer, Partner and Head of ABS in the Alternative Credit strategy of the Ares Credit Group, in a statement. “The evolution of financial technology continues to open opportunities for innovation and the emergence of new industry participants. We look forward to seeing Nuula’s experienced team of technologists, data scientists and financial service veterans bring a new generation of small business financial services solutions to market.”

Powered by WPeMatico

As companies try to navigate an ever-changing security landscape, it can be challenging to protect everything. Security startup TrueFort has built a zero trust solution focusing on protecting enterprise applications. Today, the company announced a $30 million Series B.

Shasta Ventures led today’s round with participation from new firms Canaan and Ericsson Ventures along with existing investors Evolution Equity Partners, Lytical Ventures and Emerald Development Managers. Under the terms of the agreement Nitin Chopra, managing director at Shasta Ventures, will be joining the company board. Today’s investment brings the total raised to almost $48 million.

CEO and co-founder Sameer Malhotra says that TrueFort protects customers by analyzing at each application and figuring out what normal behavior looks like. Once it understands that, it will flag anything that falls outside of the norm. The company achieves this by gathering data from partners like CrowdStrike and from multiple points within the application and infrastructure.

“Once we get this telemetry, whether it’s networks, endpoints, servers or third-party partners, we then help the customer build a picture of what those applications are doing and what’s normal behavior. We then help them baseline that, and monitor that in real time with response and real-time controls to continue those applications through their normal life cycle,” he said.

Zero trust is a concept where as a matter of policy you assume that you cannot trust any individual or device until the entity proves it belongs on your systems. Malhotra says that customers are becoming more comfortable with the concept and in 2020 the company saw massive 650% YoY revenue growth, with it up 120% YoY this year so far.

“We are seeing the demand, especially as zero trust is becoming a more familiar vernacular amongst the security community […]. Again, it’s having the visibility and understanding, and then being able to then reduce it to the limited number of acceptable relationships or executions,” he said. And he believes that it all comes down to understanding your applications and how they operate.

TrueFort co-founders Nazario Parsacala and Sameer Malhotra. Image Credits: TrueFort

The company currently has 60 employees, with hopes of reaching 85 or 90 by the end of the year. Malhotra says that as they build the employee base, they are driving to make it diverse at every level.

“We look at diversity across our whole management team, all the way from the board down to our different levels. We are quite aggressive in hiring diverse candidates, whether they’re women or LGBTQ or people of color. And we have focused programs where we work with different universities […] to bring on new employees from a diverse talent pool. We also work with different recruiters from that perspective, and our focus is always to look at a different palette and to make sure that we’re as diverse an organization as we can,” he said.

The company was founded in 2015 by Malhotra and his partner Nazario Parsacala, both of whom spent more than 20 years working at big financial services companies — Goldman Sachs and JP Morgan. They worked for a couple of years building the program, launching the first beta in 2017 before bringing the first generally available product to market the following year.

Currently customers can install the solution on prem or in the cloud of their choice, but the company has a SaaS solution in the works as well, that will be ready in the next couple of months.

Powered by WPeMatico

Organizations are swimming in data these days, and so solutions to help manage and use that data in more efficient ways will continue to see a lot of attention and business. In the latest development, SingleStore — which provides a platform to enterprises to help them integrate, monitor and query their data as a single entity, regardless of whether that data is stored in multiple repositories — is announcing another $80 million in funding, money that it will be using to continue investing in its platform, hiring more talent and overall business expansion. Sources close to the company tell us that the company’s valuation has grown to $940 million.

The round, a Series F, is being led by Insight Partners, with new investor Hewlett Packard Enterprise, and previous backers Khosla Ventures, Dell Technologies Capital, Rev IV, Glynn Capital and GV (formerly Google Ventures) also participating. The startup has to date raised $264 million, including most recently an $80 million Series E last December, just on the heels of rebranding from MemSQL.

The fact that there are three major strategic investors in this Series F — HPE, Dell and Google — may say something about the traction that SingleStore is seeing, but so too do its numbers: 300%+ increase in new customer acquisition for its cloud service and 150%+ year-over-year growth in cloud.

Raj Verma, SingleStore’s CEO, said in an interview that its cloud revenues have grown by 150% year over year and now account for some 40% of all revenues (up from 10% a year ago). New customer numbers, meanwhile, have grown by over 300%.

“The flywheel is now turning around,” Verma said. “We didn’t need this money. We’ve barely touched our Series E. But I think there has been a general sentiment among our board and management that we are now ready for the prime time. We think SingleStore is one of the best-kept secrets in the database market. Now we want to aggressively be an option for people looking for a platform for intensive data applications or if they want to consolidate databases to one from three, five or seven repositories. We are where the world is going: real-time insights.”

With database management and the need for more efficient and cost-effective tools to manage that becoming an ever-growing priority — one that definitely got a fillip in the last 18 months with COVID-19 pushing people into more remote working environments. That means SingleStore is not without competitors, with others in the same space, including Amazon, Microsoft, Snowflake, PostgreSQL, MySQL, Redis and more. Others like Firebolt are tackling the challenges of handing large, disparate data repositories from another angle. (Some of these, I should point out, are also partners: SingleStore works with data stored on AWS, Microsoft Azure, Google Cloud Platform and Red Hat, and Verma describes those who do compute work as “not database companies; they are using their database capabilities for consumption for cloud compute.”)

But the company has carved a place for itself with enterprises and has thousands now on its books, including GE, IEX Cloud, Go Guardian, Palo Alto Networks, EOG Resources and SiriusXM + Pandora.

“SingleStore’s first-of-a-kind cloud database is unmatched in speed, scale, and simplicity by anything in the market,” said Lonne Jaffe, managing director at Insight Partners, in a statement. “SingleStore’s differentiated technology allows customers to unify real-time transactions and analytics in a single database.” Vinod Khosla from Khosla Ventures added that “SingleStore is able to reduce data sprawl, run anywhere, and run faster with a single database, replacing legacy databases with the modern cloud.”

Powered by WPeMatico

Marshmallow — a U.K.-based car insurance provider that has made a name for itself in the market by providing a new approach to car insurance aimed at using a wider set of data points and clever algorithms to net a more diverse set of customers and provide more competitive rates — is announcing a milestone today in its life as a startup, as well as in the bigger U.K. tech world.

The London company — co-founded by identical twins Oliver and Alexander Kent-Braham and David Goaté — has raised $85 million in a new round of funding. The Series B valuation is significant on two counts: it catapults Marshmallow to a “unicorn” valuation above $1 billion — specifically, $1.25 billion; and Marshmallow itself becomes one of a very small group of U.K. startups founded by Black people — Oliver and Alexander — to reach that figure.

(To be clear, Marshmallow describes itself as “the first UK unicorn to be founded by individuals that are Black or have Black heritage”, although I can think of at least one that preceded it: WorldRemit, which last month rebranded to Zepz, and is currently valued at $5 billion; co-founder and chairman Ismail Ahmed has been described as the most influential Black Briton.)

Regardless of whether Marshmallow is the first or one of the first, given the dearth of diversity in the U.K. technology industry, in particular in the upper ranks of it, it’s a notable detail worth pointing out, even as I hope that one day it will be less of a rarity.

Meanwhile, Marshmallow’s novel, big-data approach and successful traction in the market speak for themselves. When we covered the company’s most recent funding round before this — a $30 million raise in November 2020 — the startup was valued at $310 million. Now less than a year later, Marshmallow’s valuation has nearly quadrupled, and it has passed 100,000 policies sold in its home country, growing 100% over the last six months.

The plan now, Oliver told me in an interview, will be to deepen its relationships with customers, in part by providing more engagement to make them better drivers, but also potentially selling more services to them, too.

In this, the startup will be tapping into a new approach that other insurtech startups are taking as they rethink traditional insurance models, much like YuLife is positioning its life insurance products within a bigger wellness and personal improvement business. Currently, the average age of Marshmallow’s customers is 20 to 40, Oliver said — and there are thoughts of potentially new products aimed at even younger users. That means there is long-term value in improving loyalty and keeping those customers for many years to come.

Alongside that, Marshmallow will also use the funding to inch closer to its plan to expand to markets outside of the U.K. — a strategy that has been in the works for a while. Marshmallow talked up international expansion in its last round but has yet to announce which markets it will seek to tackle first.

Insurance — and in particular insurance startups — are often thought of together with fintech startups, not least because the two industries have a lot in common: they both operate in areas of assessing and mitigating risk and fraud; they are in many cases discretionary investments on the part of the customers; and they are both highly regulated and require watertight data protection for their users.

Perhaps because so much of the hard work is the same for both, it’s not uncommon to see services built to serve both sectors (FintechOS and Shift Technology being two examples), for fintech companies to dabble in insurance services, and so on.

But in reality, insurance — and specifically car insurance — has seen a massive impact from COVID-19 unique to that industry. Separate reports from EY and the Association of British Insurers noted that 2020 actually saw a lift for many car insurance companies: lockdowns meant that fewer people were driving, and therefore fewer were getting into accidents and making fewer claims.

2021, however, has been a different story: new pricing rules being put into place will likely see a number of providers tip into the red for the year. And the Chartered Insurance Institute points out that it will also be worth watching to see how the low use of cars in one year will impact use going forward: some car owners, especially in urban areas where keeping a car is expensive, will inevitably start to question whether they need to own and insure a car at all.

All of this, ironically, actually plays into the hand of a company like Marshmallow, which is providing a more flexible approach to customers who might otherwise be rejected by more traditional companies, or might be priced out of offerings from them. Interestingly, while neobanks have definitely spurred more traditional institutions to try to update their products to compete, the same hasn’t really happened in insurance — not yet, at least.

“We started with the idea of the power of data and using a wider range of resources [than incumbents], and using that in our pricing led us to be able to offer better rates to more people,” Oliver said, but that hasn’t led to Marshmallow seeing sharper competition from older incumbents. “They are big companies and stuck in their ways. These companies have been around for decades, some for centuries. Change is not happening quickly.”

That leaves a big opportunity for companies like Marshmallow and other newer players like Lemonade, Hippo and Jerry (not an insurance startup per se but also dabbling in the space), and a big opening for investors to back new ideas in an industry estimated to be worth $5 trillion.

“The traction the team has achieved demonstrates the demand for a new kind of insurance provider, one that focuses more on consumer experience and uses the latest technology and data to give fair prices,” said Eileen Burbidge, a partner at Passion Capital, in a statement. “We’ve been proud to support the team’s ambitions since the start, and now look forward to its next chapter in Europe as it continues its mission to change the industry for the better.”

Powered by WPeMatico

San Francisco-based startup Orbit Fab wants to be the go-to source for orbital refueling, and now it has raised over $10 million in its quest to get there. The money will go toward funding a refueling trial that’s due to launch as early as the end of 2022, in which the company plans to send to space two refueling shuttles that will repeatedly perform a three-step dock, transfer fuel and undock process.

The round was led by Asymmetry Ventures, with participation from existing investor SpaceFund and new investors Marubeni Ventures and Audacious Venture Partners. Notably, both Northrop Grumman Corporation and Lockheed Martin Ventures also participated, the first time the two contractor-rivals have done an investment together, Orbit Fab co-founder Jeremy Schiel told TechCrunch.

“We are the tide that raises all boats,” Schiel said. “We don’t give either a competitive edge, but we can as a whole have better alternatives for sustainability in space.”

“Getting [the two primes] to play nice with each other,” as he put it, is key for the company, which wants to position itself as the favored source for space refueling. Orbit Fab, which was a finalist in our TechCrunch Disrupt Battlefield in 2019, has developed a refueling valve it calls RAFTI (Rapid Attachable Fluid Transfer Interface) — but this component must be installed before spacecraft leave Earth, which means that much of the buy-in from major customers like the aerospace contractors must occur before their satellites even enter orbit.

The idea is that spacecraft outfitted with RAFTI would be able to dock with one of Orbit Fab’s refueling shuttles, which would be positioned in low Earth orbit, geostationary orbit and eventually even cis-lunar space. By 2025, Schiel said he hopes every spacecraft will have a RAFTI on it. In the long-term, the company is thinking even bigger: producing fuel in-space, using material mined from asteroids.

“We want to be the Dow Chemical of space,” Schiel said. “We want to be the first customers for lunar miners, asteroid miners, buying up their material that they mined off those bodies, and then convert that to usable propellants that we can produce in-orbit.”

Orbit Fab says orbital refueling will be the bedrock of the burgeoning new space economy, in which goods and spacecraft will need to be transferred from one orbit to another (a maneuver that’s extremely fuel-intensive), or to build out supply chains to return resources to Earth.

“We want to be that supply chain of propellant,” Schiel added.

Powered by WPeMatico

Meetings are an inevitable part of the work day, but as workplaces became more distributed over the past 18 months, Vowel CEO Andy Berman says we are steadily moving toward “death by meeting.”

His virtual meeting platform is the latest to receive venture capital funding — $13.5 million — with the goal of making meetings more useful before, during and after.

Vowel is launching a meeting operating system with tools like real-time transcription; integrated agendas, notes and action items; meeting analytics; and searchable, on-demand recordings of meetings. The company has a freemium business model and will also be rolling out a business plan this fall for $16 per user per month. Extra features will include advanced integrations, security and admin controls.

The Series A was led by David Hornik of Lobby Capital, who was joined by existing investors Amity Ventures and Box Group and a group of individual investors, including Calendly CEO Tope Awotona, Intercom co-founder Des Traynor, Slack VP Ethan Eismann, former Yammer executive Viviana Faga, former InVision president David Fraga and Okta co-founder Frederic Kerrest.

Prior to starting Vowel, Berman was one of the founders of baby monitor company Nanit. The company had teams spread out around the world, and communication was tough as a result. In 2018, the company went looking for a tool that would work for synchronous and asynchronous meetings, but there were still a lot of time zones to manage, he said.

Taking a cue from Nanit’s own baby monitors that were streaming video over 17 hours a day, the idea for Vowel was born, and the company began to focus on the hypothesis that distributed work would be prevalent.

“People initially thought we were crazy, but then the pandemic hit, and everyone was learning how to work remotely,” Berman told TechCrunch. “As we now go back to hybrid work, we see this as an opportunity.”

In 2017, Harvard Business Review reported that executives spent 23 hours in meetings each week. Berman now estimates that the average worker spends half of their time each week in meetings.

Vowel is out to bring Slack, Figma and GitHub components to meetings by recording audio and video that can be paused at any time. Users can add notes and see where those notes fall within a real-time transcription that enables people who arrive late or could not make the meeting to catch up easily. After meetings are over, they can be shared, and Vowel has a search function so that users can go back and see where a particular person or topic was discussed.

The new funding will enable the company to grow its team in product, design and engineering. Vowel plans to hire up to 30 new people over the next year. The company recently closed its beta test and has amassed a 10,000-person waitlist. The public launch will happen in the fall, Berman said.

Workplace productivity and office communication tools are not new concepts, but as Berman explained, became increasingly important when homes became offices over the past 18 months.

Competitors took different approaches to solving these problems: focusing on video conferencing or audio or meeting management with plugins. Berman says an area where many have not succeeded yet is integrating meetings into the typical workflow. That’s where Vowel comes in with its “meeting OS,” he added.

“Our goal is to make meetings more inclusive and worthwhile, which includes the prep, the meeting and the follow-up,” Berman said. “We see the future will be about knowledge management, so the difference between what we are doing is ensuring you can catch up quickly and keep that knowledge base. A Garner report said that 75% of workplace meetings will be recorded by 2025, and that is a trend we are reinventing from the ground up.”

David Hornik, founding partner at Lobby Capital, said he became acquainted with Vowel from its existing investor Amity Ventures. Hornik, who sits on the GitLab board, said GitLab was one of the largest distributed companies in the tech space, prior to the pandemic, and saw first-hand the challenge of making distributed teams functionable.

When Hornik heard about Vowel, he said he “jumped quickly” on the opportunity. His firm typically invests in platform businesses that have the capacity to transform business spaces. Many are pure software, like Splunk or GitLab, while others are akin to Bill.com, which transformed how small businesses manage financial operations, he added.

All of those combine into a company, like Vowel, especially given the company’s vision for a meeting OS to transform a meeting space that hadn’t moved forward in decades, he said.

“This was quickly obvious to me because my day is meetings — an eight-Zoom day is a normal day — I just wish I could remember everything,” Hornik said. “Speaking with early customers using the product, when I asked them what they would do if this ever went away, the first thing they said was ‘cry,’ and, because there was no alternative, would return to Zoom or other tools, but it would be a big setback.”

Powered by WPeMatico

Bringing order and understanding to unstructured information located across disparate silos has been one of the more significant breakthroughs of the big data era, and today a European startup that has built a platform to help with this challenge specifically in the area of life sciences — and has, notably, been used by labs to sequence and so far identify two major COVID-19 variants — is announcing some funding to continue building out its tools to a wider set of use cases, and to expand into North America.

Seqera Labs, a Barcelona-based data orchestration and workflow platform tailored to help scientists and engineers order and gain insights from cloud-based genomic data troves, as well as to tackle other life science applications that involve harnessing complex data from multiple locations, has raised $5.5 million in seed funding.

Talis Capital and Speedinvest co-led this round, with participation also from previous backer BoxOne Ventures and a grant from the Chan Zuckerberg Initiative, Mark Zuckerberg and Dr. Priscilla Chan’s effort to back open source software projects for science applications.

Seqera — a portmanteau of “sequence” and “era”, the age of sequencing data, basically — had previously raised less than $1 million, and quietly, it is already generating revenues, with five of the world’s biggest pharmaceutical companies part of its customer base, alongside biotech and other life sciences customers.

Seqera was spun out of the Centre for Genomic Regulation, a biomedical research center based out of Barcelona, where it was built as the commercial application of Nextflow, open source workflow and data orchestration software originally created by the founders of Seqera, Evan Floden and Paolo Di Tommaso, at the CGR.

Floden, Seqera’s CEO, told TechCrunch that he and Di Tommaso were motivated to create Seqera in 2018 after seeing Nextflow gain a lot of traction in the life science community, and subsequently getting a lot of repeat requests for further customization and features. Both Nextflow and Seqera have seen a lot of usage: the Nextflow runtime has been downloaded more than 2 million times, the company said, while Seqera’s commercial cloud offering has now processed more than 5 billion tasks.

The COVID-19 pandemic is a classic example of the acute challenge that Seqera (and by association Nextflow) aims to address in the scientific community. With COVID-19 outbreaks happening globally, each time a test for COVID-19 is processed in a lab, live genetic samples of the virus get collected. Taken together, these millions of tests represent a goldmine of information about the coronavirus and how it is mutating, and when and where it is doing so. For a new virus about which so little is understood and that is still persisting, that’s invaluable data.

So the problem is not if the data exists for better insights (it does); it is that it’s nearly impossible to use more legacy tools to view that data as a holistic body. It’s in too many places, and there is just too much of it, and it’s growing every day (and changing every day), which means that traditional approaches of porting data to a centralized location to run analytics on it just wouldn’t be efficient, and would cost a fortune to execute.

That is where Segera comes in. The company’s technology treats each source of data across different clouds as a salient pipeline which can be merged and analyzed as a single body, without that data ever leaving the boundaries of the infrastructure where it already exists. Customised to focus on genomic troves, scientists can then query that information for more insights. Seqera was central to the discovery of both the Alpha and Delta variants of the virus, and work is still ongoing as COVID-19 continues to hammer the globe.

Seqera is being used in other kinds of medical applications, such as in the realm of so-called “precision medicine.” This is emerging as a very big opportunity in complex fields like oncology: cancer mutates and behaves differently depending on many factors, including genetic differences of the patients themselves, which means that treatments are less effective if they are “one size fits all.”

Increasingly, we are seeing approaches that leverage machine learning and big data analytics to better understand individual cancers and how they develop for different populations, to subsequently create more personalized treatments, and Seqera comes into play as a way to sequence that kind of data.

This also highlights something else notable about the Seqera platform: it is used directly by the people who are analyzing the data — that is, the researchers and scientists themselves, without data specialists necessarily needing to get involved. This was a practical priority for the company, Floden told me, but nonetheless, it’s an interesting detail of how the platform is inadvertently part of that bigger trend of “no-code/low-code” software, designed to make highly technical processes usable by non-technical people.

It’s both the existing opportunity and how Seqera might be applied in the future across other kinds of data that lives in the cloud that makes it an interesting company, and it seems an interesting investment, too.

“Advancements in machine learning, and the proliferation of volumes and types of data, are leading to increasingly more applications of computer science in life sciences and biology,” said Kirill Tasilov, principal at Talis Capital, in a statement. “While this is incredibly exciting from a humanity perspective, it’s also skyrocketing the cost of experiments to sometimes millions of dollars per project as they become computer-heavy and complex to run. Nextflow is already a ubiquitous solution in this space and Seqera is driving those capabilities at an enterprise level – and in doing so, is bringing the entire life sciences industry into the modern age. We’re thrilled to be a part of Seqera’s journey.”

“With the explosion of biological data from cheap, commercial DNA sequencing, there is a pressing need to analyse increasingly growing and complex quantities of data,” added Arnaud Bakker, principal at Speedinvest. “Seqera’s open and cloud-first framework provides an advanced tooling kit allowing organisations to scale complex deployments of data analysis and enable data-driven life sciences solutions.”

Although medicine and life sciences are perhaps Seqera’s most obvious and timely applications today, the framework originally designed for genetics and biology can be applied to any a number of other areas: AI training, image analysis and astronomy are three early use cases, Floden said. Astronomy is perhaps very apt, since it seems that the sky is the limit.

“We think we are in the century of biology,” Floden said. “It’s the center of activity and it’s becoming data-centric, and we are here to build services around that.”

Seqera is not disclosing its valuation with this round.

Powered by WPeMatico

Berlin-based Mobius Labs has closed a €5.2 million (~$6.1M) funding round off the back of increased demand for its computer vision training platform. The Series A investment is led by Ventech VC, along with Atlantic Labs, APEX Ventures, Space Capital, Lunar Ventures plus some additional angel investors.

The startup offers an SDK that lets the user create custom computer vision models fed with a little of their own training data — as an alternative to off-the-shelf tools which may not have the required specificity for a particular use-case.

It also flags a ‘no code’ focus, saying its tech has been designed with a non-technical user in mind.

As it’s an SDK, Mobius Labs’ platform can also be deployed on premise and/or on device — rather than the customer needing to connect to a cloud service to tap into the AI tool’s utility.

“Our custom training user interface is very simple to work with, and requires no prior technical knowledge on any level,” claims Appu Shaji, CEO and chief scientist.

“Over the years, a trend we have observed is that often the people who get the maximum value from AI are non technical personas like a content manager in a press and creative agency, or an application manager in the space sector. Our no-code AI allows anyone to build their own applications, thus enabling these users to get close to their vision without having to wait for AI experts or developer teams to help them.”

Mobius Labs — which was founded back in 2018 — now has 30 customers using its tools for a range of use cases.

Uses include categorisation, recommendation, prediction, reducing operational expense, and/or “generally connecting users and audiences to visual content that is most relevant to their needs”. (Press and broadcasting and the stock photography sector have unsurprisingly been big focuses to date.)

But it reckons there’s wider utility for its tech and is gearing up for growth.

It caters to businesses of various sizes, from startups to SMEs, but says it mainly targets global enterprises with major content challenges — hence its historical focus on the media sector and video use cases.

Now, though, it’s also targeting geospatial and earth observation applications as it seeks to expand its customer base.

The 30-strong startup has more than doubled in size over the last 18 months. With the new funding it’s planning to double its headcount again over the next 12 months as it looks to expand its geographical footprint — focusing on Europe and the US.

Year-on-year growth has also been 2x but it believes it can dial that up by tapping into other sectors.

“We are working with industries that are rich in visual data,” says Shaji. “The geospatial sector is something that we are focussing on currently as we have a strong belief that vast amounts of visual data is being produced by them. However, these huge archives of raw pixel data are useless on their own.

“For instance, if we want to track how river fronts are expanding, we have to look at data collected by satellites, sort and tag them in order to analyse them. Currently this is being done manually. The technology we are creating comes in a lightweight SDK, and can be deployed directly into these satellites so that the raw data can be detected and then analysed by machine learning algorithms. We are currently working with satellite companies in this sector.”

On the competitive front, Shaji names Clarifai and Google Cloud Vision as the main rivals it has in its sights.

“We realise these are the big players but at the same time believe that we have something unique to offer, which these players cannot: Unlike their solutions, our platform users can be outside the field of computer vision. By democratising the training of machine learning models beyond simply the technical crowd, we are making computer vision accessible and understandable by anyone, regardless of their job titles,” he argues.

“Another core value that differentiates us is the way we treat client data. Our solutions are delivered in the form of a Software Development Kit (SDK), which runs on-premise, completely locally on clients’ systems. No data is ever sent back to us. Our role is to empower people to build applications, and make them their own.”

Computer vision startups have been a hot acquisition target in recent years and some earlier startups offering ‘computer vision as a service’ got acquired by IT services firms to beef up their existing offerings, while tech giants like Amazon and (the aforementioned) Google offer their own computer vision services too.

But Shaji suggests the tech is now at a different stage of development — and primed for “mass adoption”.

“We’re talking about providing solutions that empower clients to build their own applications,” he says, summing up the competitive play. “And that [do that] with complete data privacy, where our solutions run on-premise, and we don’t see our clients data. Coupled with that is the ease of use that our technology offers: It is a lightweight solution that can be deployed on many ‘edge’ devices like smartphones, laptops, and even on satellites.”

Commenting on the funding in a statement, Stephan Wirries, partner at Ventech VC, added: “Appu and the team at Mobius Labs have developed an unparalleled offering in the computer vision space. Superhuman Vision is impressively innovative with its high degree of accuracy despite very limited required training to recognise new objects at excellent computational efficiency. We believe industries will be transformed through AI, and Mobius Labs is the European Deep Tech innovator teaching machines to see.”

Powered by WPeMatico

Quantum Machines, an Israeli startup that is building the classical hardware and software infrastructure to help run quantum machines, announced a $50 million Series B investment today.

Today’s round was led by Red Dot Capital Partners with help from Exor, Claridge Israel, Samsung NEXT, Valor Equity Partners, Atreides Management, LP, as well as TLV Partners, Battery Ventures, 2i Ventures and other existing investors. The company has now raised approximately $83 million, according to Crunchbase data.

While quantum computing in general is in its early days, Quantum Machines has developed a nice niche by building a hardware and software system, what they call The Quantum Orchestration Platform, that helps run the burgeoning quantum machines, leaving it plenty of room to grow as the industry develops.

Certainly Quantum Machines co-founder and CEO Itamar Sivan, who has been working in quantum his entire career, sees the vast potential of this technology. “Quantum computers have the promise of potentially speeding up very substantially computations that are impossible to complete in reasonable time with classical computers, and this is at the highest level the interest in the field right now. Our vision specifically at Quantum Machines is to make quantum computers ubiquitous and disruptive across all industries,” he said.

To achieve that, the company has created a system that relies on classical computers to power quantum computers as they develop. While the company has designed its own silicon for this purpose, it is important to note that it is not building quantum chips. As Sivan explains, the classical computer has a software and hardware layer, but quantum machines have three layers: “The quantum hardware, which is the heart, and on top of that you have classical hardware […] and then on top of that you have software,” he said.

“We focus on the two latter layers. So classical hardware and the software that drives it. Now at the heart of our hardware is in fact a classical processor. So this is I think one of the most interesting parts of the quantum stack,” he explained.

He says that this interaction between classical computing and quantum computing is one that is fundamental to the technology, and it’s a mix that will last well into the future, possibly forever. What Quantum Machines is building is essentially the classical cloud infrastructure required to run quantum computers.

Quantum Machines founding team: Itamar Sivan, Nissim Ofek, Yonatan Cohen. Photo Credit: Quantum Machines

So far the approach has been working quite well, as Sivan reports that governments, researchers, universities and the hyper scaler operators (which could include companies like Amazon, Netflix and Google, although the company has not said they are customers) are all interested in QM’s technology. While it isn’t discussing specific metrics, the company has customers in 15 countries at the moment and is working with some large entities that it couldn’t name.

The money from this round helps validate what the company is doing, enabling it to continue building out the solution, while also investing heavily in research and development, which is essential as the industry is still in early development and much will change over time.

They have been able to create this solution to this point with just 60 employees, and with the new funding should be able to build out the team in a substantial way in the coming years. He says that when it comes to diversity, he comes from an academic background where this is the norm and he has carried this forth to his company as he hires new people. What’s more, the pandemic has allowed him to hire from anywhere and he says that the company has taken advantage of this opportunity.

“First of all, we’re not hiring just in Israel, we’re hiring globally, and we’re not limited to hiring in specific geographies. We have people [from a number of countries],” he said. He adds, “Diversity for me personally means involving as many people as possible in hiring processes. That is the only way to ensure that there is diversity.”

Even throughout the pandemic, the hardware team has been meeting in person in the office with necessary precautions when it has been allowed, but most employees have continued to work from home, and that is an approach he will continue to take even when it’s safe to return to the office on a regular basis.

“Of course, work in a post-COVID era will include a substantial amount of remote work. […] So even in [our] headquarters, we anticipate allowing people to work remotely [if they wish].

Powered by WPeMatico