Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Ketch, a startup aiming to help businesses navigate the increasingly complex world of online privacy regulation and data compliance, is announcing that it has raised $23 million in Series A funding.

The company is also officially coming out of stealth. I actually wrote about Ketch’s free PrivacyGrader tool last year, but now it’s revealing the broader vision, as well as the products that businesses will actually be paying for.

The startup was founded by CEO Tom Chavez and CTO Vivek Vaidya. The pair previously founded Krux, a data management platform acquired by Salesforce in 2016, and Vaidya told me that Ketch is the answer to a question that they’d begun to ask themselves: “What kind of infrastructure can we build that will make our former selves better?”

Chavez said that Ketch is designed to help businesses automate the process of remaining compliant with data regulations, wherever their visitors and customers are. He suggested that with geographically specific regulations like Europe’s GDPR in place, there’s a temptation to comply globally with the most stringent rules, but that’s not necessary or desirable.

“It’s possible to use data to grow and to comply with the regulations,” Chavez said. “One of our customers turned off digital marketing completely in order to comply. This has got to stop […] They are a very responsible customer, but they didn’t know there are tools to navigate this complexity.”

Image Credits: Ketch

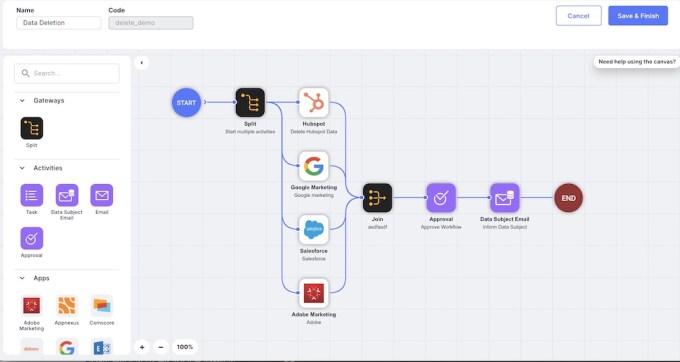

The pair also suggested that things are even more complex than you might think, because true compliance means going beyond the “Hollywood façade” of a privacy banner — it requires actually implementing a customer’s requests across multiple platforms. For example, Vaidya said that when someone unsubscribes to your email list, there’s “a complex workflow that needs to be executed to ensure that the email is not going to continue … and make sure the customer’s choices are respected in a timely manner.”

After all, Chavez noted, if a customer tells you, “I want to delete my data,” and yet they keep getting marketing emails or targeted ads, they’re not going to be satisfied if you say, “Well, I’ve handled that in the four walls of my own business, that’s an issue with my marketing and email partners.”

Chavez also said that Ketch isn’t designed to replace any of a business’ existing marketing and customer data tools, but rather to “allow our customers to configure how they want to comply vis-à-vis what jurisdiction they’re operating in.” For example, the funding announcement includes a statement from Patreon’s legal counsel Priya Sanger describing Ketch as “an easily configurable consent management and orchestration system that was able to be deployed internationally” that “required minimal engineering time to integrate into our systems.”

As for the Series A, it comes from CRV, super{set} (the startup studio founded by Chavez and Vaidya), Ridge Ventures, Acrew Capital and Silicon Valley Bank. CRV’s Izhar Armony and Acrew’s Theresia Gouw are joining Ketch’s board of directors.

And if you’d like to learn more about the product, Ketch is hosting a webinar at 11am Pacific today.

Powered by WPeMatico

You might expect that a startup that makes community building software would be thriving during a pandemic when it’s so difficult for us to be together. And Bevy, a company whose product powers community sites like Salesforce Trailblazers and Google Developers announced it has raised a $40 million Series C this morning, at least partly due to the growth related to that dynamic.

The round was led by Accel with participation from Upfront Ventures, Qualtrics co-founder Ryan Smith and LinkedIn, but what makes this investment remarkable is that it included 25 Black investors representing 20% of the investment.

One of those investors, James Lowery, who is a management consultant and entrepreneur, and was the first Black employee hired at McKinsey in 1968, sees the opportunity for this approach to be a model to attract investment from other under-represented groups.

“I know for a fact because of my friendship and my network that there are a lot of people, if they had the opportunity to invest in opportunities like this, they will do it, and they have the money to do it. And I think we can be the model for the nation,” Lowery said.

Unfortunately, there has been a dearth of Black VC investment in startups like Bevy. In fact, only around 3% of venture capitalists are Black and 81% of VC firms don’t have a single Black investor.

Kobie Fuller, who is general partner at investor Upfront Ventures, a Bevy board member and runs his own community called Valence, says that investments like this can lead to a flywheel effect that can lead to increasing Black investment in startups.

“So for me, it’s about how do we get more Black investors on cap tables of companies early in their lifecycle before they go public, where wealth can be created. How do we get key members of executive teams being Black executives who have the ability to create wealth through options and equity. And how do we also make sure that we have proper representation on the boards of these companies, so that we can make sure that the CEOs and the C suite is held accountable towards the diversity goals,” Fuller said.

He sees a software platform like Bevy that facilitates community as a logical starting point for this approach, and the company needs to look like the broader communities it serves. “Making sure that our workforce is appropriately represented from a perspective of having appropriate level of Black employees to the board to the actual investors is just good business sense,” he said.

But the diversity angle doesn’t stop with the investor group. Bevy CEO and co-founder Derek Anderson says that last May when George Floyd was killed, his firm didn’t have a single person of color among the company’s 27 employees and not a single Black investor in his cap table. He wanted to change that, and he found that in diversifying, it not only was the right thing to do from a human perspective, it was also from a business one.

“We realized that if we really started including people from the Black and brown communities inside of Bevy that the collective bar of a talent was going to go up. We were going to look from a broader pool of candidates, and what we found as we’ve done this is that as the culture has started to change, the customer satisfaction is going up, our profits and our revenues — the trajectory is going up — and I see this thing is completely correlated,” Anderson said.

Last summer the company set a two year goal to get to 20% of employees being Black. While the number of employees is small, Bevy went from zero to 5% in June, and 10% by September. Today it is just under 15% and expects to hit the 20% goal by summer, a year ahead of the goal it set last year.

Bevy grew out of a community called Startup Grind that Anderson started several years ago. Unable to find software to run and manage the community, he decided to build it himself. In 2017, he spun that product into a separate company that became Bevy, and he has raised $60 million, according to the company.

In addition to Salesforce and Google, other large enterprises are using Bevy to power their communities and events, including Adobe, Atlassian, Twilio, Slack and Zendesk.

Today, the startup is valued at $325 million, which is 4x the amount it was valued at when it raised its $15 million Series B in May 2019. It expects to reach $30 million in ARR by the end of this year.

Powered by WPeMatico

As the Ubers of the world continue to scale, a smaller on-demand transportation startup has raised some funding in Germany, underscoring the opportunities that remain for startups in the space targeting specific service niches. Blacklane — the Berlin startup that provides on-demand black-car chauffeur services in Berlin, London, Dubai, Los Angeles, New York, Paris, Singapore and 16 other cities — has closed a round of €22 million ($26 million at current rates). After taking a majority stake in Havn, the Jaguar-hatched electric car service in London, in February, Blacklane said that it will be using this latest round of funding to continue expanding sustainable travel initiatives, and to continue expanding its existing business with more flexible options for riding.

The funding, which is being made at an up round valuation, is a sign of how the company is showing signs of growth after a year in which monthly revenues dropped 99% in the wake of the COVID-19 pandemic and the resulting drop in travel, and specifically people willing to be in small spaces that are shared with others.

“The global travel and mobility industries have suffered, with several players struggling between drastic cuts, hibernation or ceasing operations. Blacklane has taken the opportunity to cater to travelers’ emerging needs,” said Dr. Jens Wohltorf, CEO and co-founder of Blacklane, in a statement. “Thanks to this financing, we will continue to fast-track our innovation, with zero layoffs.”

The company said that the investment is coming from existing investors German automotive giant Daimler, the UAE’s ALFAHIM Group and btov Partners. And while it is coming at an up round, Blacklane is not disclosing any figures, nor has it ever disclosed valuation. Previous backers of the company also include the strategic investment arm of Recruit Holdings, the Japanese HR giant, and it has raised around $100 million to date, including a round of about $45 million in 2018.

The funding is coming after what has been an extremely rough year for travel and transportation startups due to the COVID-19 pandemic, with Blacklane itself seeing monthly revenues drop 99% after the pandemic hit last year, the company tells me.

Some others in the space that diversified into other areas like food delivery or other kinds of transport (e.g. bikes or scooters) were able to offset declines in their more core ride-hailing services, which in the meantime were repositioned as a safer alternative to public transportation. Blacklane, however, had never positioned itself as a ride for “everyman” — its core use case were higher-end rides and airport trips (which had also died a death) — so when movement shut down, Blacklane’s business nosedived.

It was particularly bad timing for Blacklane, considering that in the lead up to the pandemic, it looked to be on course to turn a profit on its focused model. (While financials for 2020 will take a while to be posted, the most recent results for the company showed a net loss of about $18 million in 2018.)

The reason that Blacklane has managed to raise at an up round tells another side of the story, however.

As companies in transport and travel gingerly started to show the smaller signs of recovery last summer, so too did Blacklane. It coupled that with the first steps of diversification itself.

Earlier this month, it added “chauffeur hailing” in 22 cities, an on-demand service that reduced the lead time for an order to under 30 minutes (its previous service was based on more advanced bookings). It also changed its pricing structure to get more competitive on shorter distances, since so many of the airport rides that were the basis of its revenues have yet to return.

In addition to that, Blacklane took a majority stake in Havn, an electric-based car service hatched by Jaguar, for an undisclosed sum, to spearhead a move into more sustainable travel options alongside the fleet of Teslas already operated by Blacklane.

“Worldwide travel restrictions give us a one-time chance to reset our expectations for safe and sustainable trips,” said Wohltorf in a statement. “Blacklane will recover responsibly and continue to grow while caring for both people and the planet.”

Powered by WPeMatico

On the heels of Jumio announcing a $150 million injection this week to continue building out its AI-based ID verification and anti-money laundering platform, another startup in the space is levelling up. Feedzai, which provides banks, others in the financial sector, and any company managing payments online with AI tools to spot and fight fraud — its cornerstone service involves super-quick (3 millisecond) checks happening in the background while transactions are being made — has announced a Series D of $200 million. It said that the new financing is being made at a valuation of over $1 billion.

The round is being led by KKR, with Sapphire Ventures and strategic backer Citi Ventures — both past investors — also participating. Feedzai said it will be using the funds for further R&D and product development, to expand into more markets outside the U.S. — it was originally founded in Portugal but now is based out of San Mateo — and towards business development, specifically via partnerships to integrate and sell its tools.

One of those partners looks to be Citi itself:

“Citi is committed to advancing global payments anchored on transparency, efficiency, and control, and our partnership with Feedzai is allowing us to provide customers with technology that seamlessly balances agility and security,” said Manish Kohli, global head of Payments and Receivables, with Citi’s Treasury and Trade Solutions, in a statement.

This latest round comes nearly four years after Feedzai raised its Series C, a $50 million round led by an unnamed investor and with an undisclosed valuation. Sapphire also participated in that round. It has now raised some $182 million to date.

Feedzai’s funding is happening at a time when the need for fraud protection for those managing transactions online has reached a high watermark, leading to a rush of customers for companies in the field.

Feedzai says that its customers include four of the five largest banks in North America, 80% of the world’s Fortune 500 companies, 154 million individual and business taxpayers in the U.S., and has processed $9 billion in online transactions for two of the world’s most valuable athletic brands. In total its reach covers some 800 million customers of businesses that use its services.

In addition to Citibank, its customers include Fiserv, Santander, SoFi and Standard Chartered’s Mox.

While money laundering, fraud and other kinds of illicit financial activity were already problems then, in the interim, the problem has only compounded, not least because of how much activity has shifted online, accelerating especially in the last year of pandemic-driven lockdowns. That’s been exacerbated also by a general rise in cybercrime — of which financial fraud remains the biggest component and motivator.

Within that bigger trend, solutions based on artificial intelligence have really emerged as critical to the task of identifying and fighting those illicit activities. Not only is that because AI solutions are able to make calculations and take actions and simply process more than non-AI based tools, or humans for that matter, but they are then able to go head to head with much of the fraud taking place, which itself is being built out on AI-based platforms and requires more sophistication to identify and combat.

For banking customers, Feedzai’s approach has been disruptive in part because of how it has conceived of the problem: It has built solutions that can be used across different scenarios, making them more powerful since the AI system is subsequently “learning” from more data. This is in contrast to how many financial service providers had conceived and tackled the issue in the past.

“Until now banks have used solutions based on verticals,” Nuno Sebastiao, co-founder and CEO of Feedzai, said in the past to TechCrunch. “The fraud solution you have for an ATM wouldn’t be the same fraud solution you would use for online banking which wouldn’t be the same fraud solution you would have for a voice call center.” As these companies have refreshed their systems, many have taken a more agnostic approach like the kind Feedzai has built.

The scale of the issue is clear, and unfortunately also something many of us have experienced firsthand. Feedzai says its data indicates that the last quarter of 2020 shows consumers saw a 650% increase in account takeover scams, a 600% in impersonation scams and a 250% increase in online banking fraud attacks versus the first quarter of 2020. (Those periods are, essentially, before-pandemic and during-pandemic comparisons.)

“The past 12 months have accelerated the world’s dependency on electronic financial services – from online banking to mobile payments, and in turn have increased fraud and money laundering activity. Our services are in more demand than ever,” said Sebastiao in a statement today.

Indeed, yesterday, when I covered Jumio’s $150 million round, I said I wouldn’t consider its funding to be an outlier (even though Jumio made clear it was the largest funding to date in its space): the fast follow from Feedzai, with an even higher amount of financing, really does underscore the trend at the moment.

In addition to these two, one of Feedzai’s biggest competitors, Kount, was acquired by credit ratings giant Equifax earlier this year for $640 million to move deeper into the space. (And related to that field, in the area of identity management, which goes hand-in-hand with tools for laundering and fraud, Okta acquired Auth0 for $6.5 billion.)

Other big rounds for startups in the wider space have included ForgeRock ($96 million round), Onfido ($100 million), Payfone ($100 million), ComplyAdvantage ($50 million), Ripjar ($36.8 million) Truework ($30 million), Zeotap ($18 million) and Persona ($17.5 million).

KKR’s involvement in this round is notable as another example of a private equity firm getting in earlier with venture rounds with fast-scaling startups, similar to Great Hill’s investment in Jumio yesterday and a number of other examples. The firm says it’s making this investment out of its Next Generation Technology Growth Fund II, which is focused on making growth equity investment opportunities in the technology space.

“Feedzai offers a powerful solution to one of the biggest challenges we are facing today: financial crime in the digital age. Global commerce depends on future-proof technologies capable of dealing with a rapidly evolving threat landscape. At the same time, consumers rightfully demand a great customer experience, in addition to strong security layers when using banking or payments services,” said Stephen Shanley, managing director at KKR, in a statement

“We believe Feedzai’s platform uniquely meets these expectations and more, and we are looking forward to working with Nuno and the rest of the team to expand their offering even further,” added Spencer Chavez, principal at KKR.

Powered by WPeMatico

For patients and healthcare professionals to properly track and manage illnesses, especially chronic ones, healthcare needs to be decentralized. It also needs to be more convenient, with a patient’s health information able to follow them wherever they go.

Redbird, a Ghanaian health tech startup that allows easy access to convenient testing and ensures that doctors and patients can view the details of those test results at any time, announced today that it has raised a $1.5 million seed investment.

Investors who participated in the round include Johnson & Johnson Foundation, Newton Partners (via the Imperial Venture Fund) and Founders Factory Africa. This brings the company’s total amount raised to date to $2.5 million.

The health tech company was launched in 2018 by Patrick Beattie, Andrew Quao and Edward Grandstaff. As a founding scientist at a medical diagnostics startup in Boston, Beattie’s job was to develop new rapid diagnostic tests. During his time in Accra in 2016, he met Quao, a trained pharmacist in Ghana at a hackathon whereupon talking found out that their interests in medical testing overlapped.

Beattie told TechCrunch that while he saw many exciting new tests in development in the U.S., he didn’t see the same in Ghana. Quao, who is familiar with how Ghanaians use pharmacies as their primary healthcare point, felt perturbed that these pharmacies weren’t doing more than transactional purchases.

They both settled that pharmacies in Ghana needed to imbibe the world of medical testing. Although both didn’t have a tech background, they realized technology was necessary to execute this. So, they enlisted the help of Grandstaff to be CTO of Redbird while Beattie and Quao became CEO and COO, respectively.

L-R: Patrick Beattie (CEO), Andrew Quao (COO) and Edward Grandstaff (CTO). Imge Credits: Redbird

Redbird enables pharmacies in Ghana to add to their pharmacy services rapid diagnostic testing for 10 different health conditions. These tests include anaemia, blood sugar, blood pressure, BMI, cholesterol, Hepatitis B, malaria, typhoid, prostate cancer screening and pregnancy.

Also, Redbird provides pharmacies with the necessary equipment, supplies and software to make this possible. The software — Redbird Health Monitoring — is networked across all partner pharmacies and enables patients to build medical testing records after going through five-minute medical tests offered through these pharmacies.

Rather than employing a SaaS model that Beattie says is not well appreciated by its customers, Redbird’s revenue model is based on the supply of disposable test strips.

“Pharmacies who partner with Redbird gain access to the software and all the ways Redbird supports our partners for free as long as they purchase the consumables through us. This aligns our revenue with their success, which is aligned with patient usage,” said the CEO.

This model is being used with more than 360 pharmacies in Ghana, mainly in Accra and Kumasi. It was half this number in 2019, which Redbird has since doubled despite the pandemic. These pharmacies have recorded over 125,000 tests in the past three years from more than 35,000 patients registered on the platform.

Redbird will use the seed investment to grow its operations within Ghana and expand to new markets that remain undisclosed.

In 2018, Redbird participated in the Alchemist Accelerator just a few months before launch. It was the second African startup after fellow Ghanaian health tech startup mPharma to take part in the six-month program. The company also got into Founders Factory Africa last April.

According to Beattie, most of the disease burden Africans might experience in the future will be chronic diseases. For instance, diabetes is projected to grow by 156% over the next 25 years. This is why he sees decentralized, digitized healthcare as the next leapfrog opportunity for sub-Saharan Africa.

“Chronic disease is exploding and with it, patients require much more frequent interaction with the healthcare system. The burden of chronic disease will make a health system that is highly centralized impossible,” he said. “Like previous leapfrog events, this momentum is happening all over the world, not just in Africa. Still, the state of the current infrastructure means that healthcare systems here will be forced to innovate and adapt before health systems elsewhere are forced to, and therein lies the opportunity,” he said.

But while the promise of technology and data is exciting, it’s important to realize that health tech only provides value if it matches patient behaviors and preferences. It doesn’t really matter what amazing improvements you can realize with data if you can’t build the data asset and offer a service that patients actually value.

Beattie knows this all too well and says Redbird respects these preferences. For him, the next course of action will be to play a larger role in the world’s developing ecosystem where healthcare systems build decentralised networks and move closer to the average patient.

This decentralised approach is what attracted U.S. and South African early-stage VC firm Newtown Partners to cut a check. Speaking on behalf of the firm, Llew Claasen, the managing partner, had this to say.

“We’re excited about Redbird’s decentralised business model that enables rapid diagnostic testing at the point of primary care in local community pharmacies. Redbird’s digital health record platform has the potential to drive significant value to the broader healthcare value chain and is a vital step toward improving healthcare outcomes in Africa. We look forward to supporting the team as they prove out their business model and scale across the African continent.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico

Orca Security, an Israeli cybersecurity startup that offers an agent-less security platform for protecting cloud-based assets, today announced that it has raised a $210 million Series C round at a $1.2 billion valuation. The round was led by Alphabet’s independent growth fund CapitalG and Redpoint Ventures. Existing investors GGV Capital, ICONIQ Growth and angel syndicate Silicon Valley CISO Investment also participated. YL Ventures, which led Orca’s seed round and participated in previous rounds, is not participating in this round — and it’s worth noting that the firm recently sold its stake in Axonius after that company reached unicorn status.

If all of this sounds familiar, that may be because Orca only raised its $55 million Series B round in December, after it announced its $20.5 million Series A round in May. That’s a lot of funding rounds in a short amount of time, but something we’ve been seeing more often in the last year or so.

As Orca co-founder and CEO Avi Shua told me, the company is seeing impressive growth and it — and its investors — want to capitalize on this. The company ended last year beating its own forecast from a few months before, which he noted was already aggressive, by more than 50%. Its current slate of customers includes Robinhood, Databricks, Unity, Live Oak Bank, Lemonade and BeyondTrust.

“We are growing at an unprecedented speed,” Shua said. “We were 20-something people last year. We are now closer to a hundred and we are going to double that by the end of the year. And yes, we’re using this funding to accelerate on every front, from dramatically increasing the product organization to add more capabilities to our platform, for post-breach capabilities, for identity access management and many other areas. And, of course, to increase our go-to-market activities.”

Shua argues that most current cloud security tools don’t really work in this new environment. Many, because they are driven by metadata, can only detect a small fraction of the risks, and agent-based solutions may take months to deploy and still not cover a business’ entire cloud estate. The promise of Orca Security is that it can not only cover a company’s entire range of cloud assets but that it is also able to help security teams prioritize the risks they need to focus on. It does so by using what the company calls its “SideScanning” technology, which allows it to map out a company’s entire cloud environment and file systems.

“Almost all tools are essentially just looking at discrete risk trees and not the forest. The risk is not just about how pickable the lock is, it’s also where the lock resides and what’s inside the box. But most tools just look at the issues themselves and prioritize the most pickable lock, ignoring the business impact and exposure — and we change that.”

It’s no secret that there isn’t a lot of love lost between Orca and some of its competitors. Last year, Palo Alto Networks sent Orca Security a sternly worded letter (PDF) to stop it from comparing the two services. Shua was not amused at the time and decided to fight it. “I completely believe there is space in the markets for many vendors, and they’ve created a lot of great products. But I think the thing that simply cannot be overlooked, is a large company that simply tries to silence competition. This is something that I believe is counterproductive to the industry. It tries to harm competition, it’s illegal, it’s unconstitutional. You can’t use lawyers to take your competitors out of the media.”

Currently, though, it doesn’t look like Orca needs to worry too much about the competition. As GGV Capital managing partner Glenn Solomon told me, as the company continues to grow and bring in new customers — and learn from the data it pulls in from them — it is also able to improve its technology.

“Because of the novel technology that Avi and [Orca Security co-founder and CPO] Gil [Geron] have developed — and that Orca is now based on — they see so much. They’re just discovering more and more ways and have more and more plans to continue to expand the value that Orca is going to provide to customers. They sit in a very good spot to be able to continue to leverage information that they have and help DevOps teams and security teams really execute on good hygiene in every imaginable way going forward. I’m super excited about that future.”

As for this funding round, Shua noted that he found CapitalG to be a “huge believer” in this space and an investor that is looking to invest into the company for the long run (and not just trying to make a quick buck). The fact that CapitalG is associated with Alphabet was obviously also a draw.

“Being associated with Alphabet, which is one of the three major cloud providers, allowed us to strengthen the relationship, which is definitely a benefit for Orca,” he said. “During the evaluation, they essentially put Orca in front of the security leadership at Google. Definitely, they’ve done their own very deep due diligence as part of that.”

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20 percent off tickets right here.

Powered by WPeMatico

Teamflow, founded by ex-Uber manager Flo Crivello, has raised an $11 million Series A just three months after raising a $3.9 million seed for its virtual HQ platform. The latest round in the startup was led by Battery Ventures, with Menlo Ventures leading its previous financing event.

Teamflow’s raise comes just days after competitor Gather announced a $26 million Series A round led by Sequoia Capital. Another company, Branch, has raised a $1.5 million seed round from investors such as Homebrew and Gumroad’s Sahil Lavingia and is currently raising its Series A.

All these startups want to bring into the mainstream a game-like interface for people to toggle through during their work day. The reality is, all three companies (and dozens of others) likely can’t win. The winning difference lies in strategy, Teamflow’s Crivello tells me.

“I think in the early days, the biggest differentiator is going to be UX and our aesthetic,” he said. “A lot of the other players have a very gamified approach, and we’re big fans of that, but we think that people don’t want to have their [work] meetings in a Pokémon game.”

A tour through Teamflow’s office shows that the company is more focused on productivity than gamification. Integrations include a Slack-like chat feature as well as file and image sharing. It is working on an in-platform app store so users can download the integrations that work best with their team, Crivello said. There are games too.

Teamflow’s virtual HQ platform.

This focus has helped Teamflow gain traction with employers instead of event organizers, a more stable source of revenue per the founder. The company currently hosts thousands of teams within startups on its platform, wracking in “hundreds of thousands of dollars in revenue.” Gather, a competitor, recently told TechCrunch that it gets the majority of its revenue from one-off events. Gather’s monthly revenue is currently $400,000, according to founder Philip Wang.

Gather, alternatively, looks and feels very different from Teamflow in that it is closer to the feel of Sims.

Gather’s virtual HQ platform.

Branch’s Dayton Mills said that it has been able to stay competitive through becoming “much more gamified.” It has added levels, in-game currencies and XP to encourage employees to customize their office space.

“Productivity isn’t broken, but culture, fun and social interaction is,” Mills told TechCrunch. “So when it comes to work and play we’re aiming to fix the play part, not the work. Work comes as a side effect.” Branch has not made revenue yet.

The next ambition for Teamflow is expanding its customer base beyond the hip experimental team at startups. Crivello noted that Zoom brings in about 40% of its revenue through enterprise sales, and Teamflow is resultedly “doubling down on enterprise readiness.”

The company will work on being compliant and upholding privacy standards so it can onboard healthcare and biotech companies, what it views as “buttoned up verticals” that might not want the other gamified approaches.

Crivello is clear about his vision for the startup: He wants to make it harder to move out of a virtual office than a physical office. If Teamflow can become an operating system of sorts long-term, adding on applications and bringing in a high quality of standards, it might be able to bring on a broader set of clients.

Powered by WPeMatico

Berlin-based y42 (formerly known as Datos Intelligence), a data warehouse-centric business intelligence service that promises to give businesses access to an enterprise-level data stack that’s as simple to use as a spreadsheet, today announced that it has raised a $2.9 million seed funding round led by La Famiglia VC. Additional investors include the co-founders of Foodspring, Personio and Petlab.

The service, which was founded in 2020, integrates with more than 100 data sources, covering all the standard B2B SaaS tools, from Airtable to Shopify and Zendesk, as well as database services like Google’s BigQuery. Users can then transform and visualize this data, orchestrate their data pipelines and trigger automated workflows based on this data (think sending Slack notifications when revenue drops or emailing customers based on your own custom criteria).

Like similar startups, y42 extends the idea data warehouse, which was traditionally used for analytics, and helps businesses operationalize this data. At the core of the service is a lot of open source and the company, for example, contributes to GitLabs’ Meltano platform for building data pipelines.

“We’re taking the best of breed open-source software. What we really want to accomplish is to create a tool that is so easy to understand and that enables everyone to work with their data effectively,” Y42 founder and CEO Hung Dang told me. “We’re extremely UX obsessed and I would describe us as a no-code/low-code BI tool — but with the power of an enterprise-level data stack and the simplicity of Google Sheets.”

Before y42, Vietnam-born Dang co-founded a major events company that operated in more than 10 countries and made millions in revenue (but with very thin margins), all while finishing up his studies with a focus on business analytics. And that in turn led him to also found a second company that focused on B2B data analytics.

Even while building his events company, he noted, he was always very product- and data-driven. “I was implementing data pipelines to collect customer feedback and merge it with operational data — and it was really a big pain at that time,” he said. “I was using tools like Tableau and Alteryx, and it was really hard to glue them together — and they were quite expensive. So out of that frustration, I decided to develop an internal tool that was actually quite usable and in 2016, I decided to turn it into an actual company. ”

He then sold this company to a major publicly listed German company. An NDA prevents him from talking about the details of this transaction, but maybe you can draw some conclusions from the fact that he spent time at Eventim before founding y42.

Given his background, it’s maybe no surprise that y42’s focus is on making life easier for data engineers and, at the same time, putting the power of these platforms in the hands of business analysts. Dang noted that y42 typically provides some consulting work when it onboards new clients, but that’s mostly to give them a head start. Given the no-code/low-code nature of the product, most analysts are able to get started pretty quickly — and for more complex queries, customers can opt to drop down from the graphical interface to y42’s low-code level and write queries in the service’s SQL dialect.

The service itself runs on Google Cloud and the 25-people team manages about 50,000 jobs per day for its clients. The company’s customers include the likes of LifeMD, Petlab and Everdrop.

Until raising this round, Dang self-funded the company and had also raised some money from angel investors. But La Famiglia felt like the right fit for y42, especially due to its focus on connecting startups with more traditional enterprise companies.

“When we first saw the product demo, it struck us how on top of analytical excellence, a lot of product development has gone into the y42 platform,” said Judith Dada, general partner at LaFamiglia VC. “More and more work with data today means that data silos within organizations multiply, resulting in chaos or incorrect data. y42 is a powerful single source of truth for data experts and non-data experts alike. As former data scientists and analysts, we wish that we had y42 capabilities back then.”

Dang tells me he could have raised more but decided that he didn’t want to dilute the team’s stake too much at this point. “It’s a small round, but this round forces us to set up the right structure. For the Series A, which we plan to be towards the end of this year, we’re talking about a dimension which is 10x,” he told me.

Powered by WPeMatico

It’s clear that automated workflow tooling has become increasingly important for companies. Perhaps that explains why Camunda, a Berlin startup that makes open-source process automation software, announced an €82 million Series B today. That translates into approximately $98 million U.S.

Insight Partners led the round with help from A round investor Highland Europe. When combined with the $28 million A investment from December 2018, it brings the total raised to approximately $126 million.

What’s attracting this level of investment says Jakob Freund, co-founder and CEO at Camunda, is the company is solving a problem that goes beyond pure automation. “There’s a bigger thing going on which you could call end-to-end automation or end-to-end orchestration of endpoints, which can be RPA bots, for example, but also micro services and manual work [by humans],” he said.

He added, “Camunda has become this endpoint agnostic orchestration layer that sits on top of everything else.” That means that it provides the ability to orchestrate how the automation pieces work in conjunction with one another to create this full workflow across a company.

The company has 270 employees and approximately 400 customers at this point, including Goldman Sachs, Lufthansa, Universal Music Group and Orange. Matt Gatto, managing director at Insight Partners, sees a tremendous market opportunity for the company and that’s why his firm came in with such a big investment.

“Camunda’s success demonstrates how an open, standards-based, developer-friendly platform for end-to-end process automation can increase business agility and improve customer experiences, helping organizations truly transform to a digital enterprise,” Gatto said in a statement.

Camunda is not your typical startup. Its history actually dates back to 2008 as a business process management (BPM) consulting firm. It began the Camunda open-source project in 2013, and that was the start of pivoting to become an open-source software company with a commercial component built on top of that.

It took the funding at the end of 2018 because the market was beginning to catch up with the idea, and they wanted to build on that. It’s going so well that the company reports it’s cash-flow positive, and will use the additional funding to continue accelerating the business.

Powered by WPeMatico

Ideally, it is expected of every business to reach its customers effectively. However, that’s not the case, as limiting factors that hinder proper digital communication come into play at different growth stages. Termii, a Nigerian communications platform-as-a-service startup that solves this problem for African businesses, announced today that it has closed a $1.4 million seed round.

The round was co-led by African early-stage VC firm Future Africa and Japanese but Africa-focused VC Kepple Africa Ventures. Other investors include Acuity Ventures, Aidi Ventures, Assembly Capital, Kairos Angels, Nama Ventures, RallyCap Ventures and Remapped Ventures.

Angel investors like Ham Serunjogi, co-founder and CEO of Chipper Cash; Josh Jones, former co-founder and CTO, Dreamhost; and Tayo Oviosu, co-founder and CEO of Paga also participated.

Gbolade Emmanuel and Ayomide Awe launched Termii after Emmanuel’s experience as a digital marketer helped him recognize the need for businesses to have exceptional communication channels. The CEO consulted for these companies and leveraged emails to retain customers, but as he found out that this process was lethargic, he sought other channels as a replacement.

“That got me to start thinking about multichannel messaging. What it meant was that we needed to find how to allow companies to use WhatsApp, voice, SMS effectively,” he said to TechCrunch. “And we had to make the process simple because in the African market, you can’t do complex stuff. You have to be as simple as possible.”

In 2017, the company officially launched and subsequently secured investment from Lagos-based VC Microtraction. Emmanuel says the company found product-market fit two years later after collating enough data from companies in different industries to understand what they really wanted.

Termii found out that in addition to assisting businesses to retain customers, there was a clear need to verify, authenticate and engage them.

“Many of these businesses we started engaging said they required tools to effectively communicate and verify customers because they were losing money at those points. For us, we saw it was a bigger problem,” Emmanuel added.

After making some tweaks, the team began to see an increase in customer numbers, especially amongst fintech startups. Positioning itself in the fast-moving space, Termii created an API-based communication infrastructure that caters to more than 500 fintech startups across the continent. That’s not all. More than 1,000 businesses and developers are also using Termii’s API.

Some of these businesses include uLesson, Yassir, Helium Health, PiggyVest, Bankly, Paga and TeamApt.

Playing in a $3.6 billion B2C communications market estimated to grow 6% annually, Termii runs a B2B2C model. But how does it make money? While a subscription-based model would’ve made sense, the two years spent by the company trying to find PMF made them think otherwise.

So the company leverages a virtual wallet system tied to a bank account and customers can make payments to the platform using mobile money, bank transfer and credit cards. The startup charges these wallets on a per-message basis. It also does the same on every successful customer verification made toward customers’ contacts.

The Termii team. Image Credits: Termii

In early 2020, Termii started seeing immense progress and this coincided with their acceptance into Y Combinator. The growth continued throughout the year, growing its messaging transactions by 1,000% and experiencing a 400% increase in its ARR.

Spilling into this year, Emmanuel says the company’s revenue is growing 60% month-on-month as a result of the surge in online financial transactions, which to date makes up for 68% of the company’s total messaging transactions.

The seed investment that is coming a year after Termii graduated from YC will be used for expansion and launch more messaging offerings across Africa.

Emmanuel says the company has its sights set on North Africa with a physical presence in Algeria for the expansion. The reason lies behind the fact that in this quarter, Nigeria has accounted for 76% of the company’s messaging transactions, while Algeria currently accounts for 15%.

With this new fundraising, the company plans to tap into the wealth of experience from some of its new investors like Oviosu and Serunjogi, who have also taken local companies into expansion phases.

Termii’s round is also noteworthy because it strays away from the usual fintech, mobility, agritech and cleantech sectors that investors typically notice. In fact, there are only a handful of venture-backed communications platform-as-a-service companies on the continent. A notable example is Kenya’s Africa Talking. It might be a stretch to say we might see more funding activity from this segment, but one thing is apparent — investors are willing to place bets on less popular sectors.

Another highlight of Termii’s investment is that while foreign investors continue to dominate rounds in African tech startups, local and Africa-focused firms are beginning to step up by leading some, which is a good sign for the bubbling ecosystem.

This round is also a big step for Future Africa. According to publicly available information, the firm is leading a million-dollar round for the first time since officially launching last year. This achievement is a continuation of its work over the past three quarters, having invested in more than 10 African startups in the last three quarters and 30 startups in general.

Kepple Africa Ventures, the co-lead, is also an active investor and can be argued to be the most early-stage VC firm on the continent — in terms of the number of deals made. So far, the firm has invested in 79 companies across 11 countries.

Speaking on the investment for Kepple Africa, Satoshi Shinada, a partner at the firm, said, “Fragmented and unstable communication channels are one of the biggest challenges for the digitization of businesses in Africa. Emmanuel has proven that with his visionary goals and solid implementation of iterations on the ground, his team is unparalleled to build an innovative solution in this space.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE” at checkout to get 20% off tickets right here.

Powered by WPeMatico