Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

There’s been quite a bit of movement in the additive manufacturing space in recent months. If I had to pinpoint a reason, I would say that — much like robotics (another space I follow fairly closely) — the category has gotten a boost in interest from the pandemic. Medical applications are understandably of interest lately, as is alternative manufacturing.

Desktop Metal, Markforged and new-comer Mantel have all made pretty big announcements in recent weeks, and now Fortify is making the round with a significant raise. The Boston-based startup announced a $20 million Series B equity round, led by Cota Capital with additional participation from Accel Partners, Neotribe Ventures and Prelude Ventures.

Fortify is attempting to stake out a claim in material deposits. Using digital light processing (DLP) tech, the company can mix and print in a variety of different materials, with a wide range of properties. The list includes some useful traits, including electromagnetic and thermal.

Like Mantel, the company looks to be targeting manufacturing tools, including injection molding.

“Fortify has been focused on proving the viability of our product and market opportunity over the past 18+ months, and exceeded our goals set at the beginning of 2020,” CEO Josh Martin said in a release. “This next round will expand our go-to-market footprint in key verticals such as injection mold tooling while enabling us to capture market share in end-use electronic devices.”

Recent months have also found the company enlisting other 3D printing vets. Paul Dresens (ex Desktop Metal) signed on as VP of Engineering, while former GrabCad (a Stratasys acquisition) market exec Rob Stevens has signed on as an advisor.

Powered by WPeMatico

Fort Robotics today announced a $13 million raise. Led by Prime Movers Lab, the round also features Prologis Ventures, Quiet Capital, Lemnos Labs, Creative Ventures, Ahoy Capital, Compound, FundersClub and Mark Cuban.

The Philadelphia-based company was founded in 2018 by Samuel Reeves, who previous headed up Humanistic Robotics. That fellow Pennsylvania startup is focused on landmine and IED-clearing remote operating robotic systems.

The newer company is focused more on safety software, for collaborative robotics and other autonomous systems. Among the other issues being tackled by the company is cybersecurity vulnerability among these sots of workplace robotics. Other issues targeted here include broader system failure and potential human error.

The company says it currently works with 100 companies across a wide spectrum of categories, from warehouse fulfillment and manufacturing to delivery and transportation.

“The world is on the cusp of a new industrial revolution in mobile automation,” Reeves said in a release tied to the news. “With added investment and support, we’ll be able to rapidly scale the company to capitalize on the convergence of trend and opportunity to ensure that robotic systems are safely deployed across all industries.”

We’ve seen a fair bit of investment excitement around robotics in the past year, owing to increased interest in automation during the pandemic. Fort is well-positioned in that respect, with a solution aimed a fairly wide range of different verticals within the category.

Powered by WPeMatico

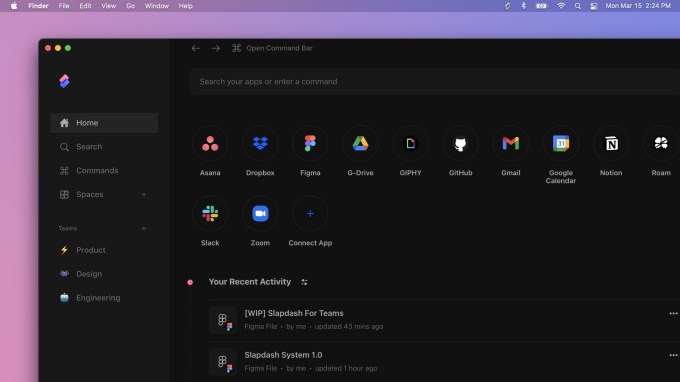

The explosion in productivity software amid a broader remote work boom has been one of the pandemic’s clearest tech impacts. But learning to use a dozen new programs while having to decipher which data is hosted where can sometimes seem to have an adverse effect on worker productivity. It’s all time that users can take for granted, even when carrying out common tasks like navigating to the calendar to view more info to click a link to open the browser to redirect to the native app to open a Zoom call.

Slapdash is aiming to carve a new niche out for itself among workplace software tools, pushing a desire for peak performance to the forefront with a product that shaves seconds off each instance where a user needs to find data hosted in a cloud app or carry out an action. While most of the integration-heavy software suites to emerge during the remote work boom have focused on promoting visibility or re-skinning workflows across the tangled weave of SaaS apps, Slapdash founder Ivan Kanevski hopes that the company’s efforts to engineer a quicker path to information will push tech workers to integrate another tool into their workflow.

The team tells TechCrunch that they’ve raised $3.7 million in seed funding from investors that include S28 Capital, Quiet Capital, Quarry Ventures, UP2398 and Twenty Two Ventures. Angels participating in the round include co-founders at companies like Patreon, Docker and Zynga.

Image Credits: Slapdash

Kanevski says the team sought to emulate the success of popular apps like Superhuman, which have pushed low-latency command line interface navigation while emulating some of the sleek internal tools used at companies like Facebook, where he spent nearly six years as a software engineer.

Slapdash’s command line widget can be pulled up anywhere, once installed, with a quick keyboard shortcut. From there, users can search through a laundry list of indexable apps including Slack, Zoom, Jira and about 20 others. Beyond command line access, users can create folders of files and actions inside the full desktop app or create their own keyboard shortcuts to quickly hammer out a task. The app is available on Mac, Windows, Linux and the web.

“We’re not trying to displace the applications that you connect to Slapdash,” he says. “You won’t see us, for example, building document editing, you won’t see us building project management, just because our sort of philosophy is that we’re a neutral platform.”

The company offers a free tier for users indexing up to five apps and creating 10 commands and spaces; any more than that and you level up into a $12 per month paid plan. Things look more customized for enterprise-wide pricing. As the team hopes to make the tool essential to startups, Kanevski sees the app’s hefty utility for individual users as a clear asset in scaling up.

“If you anticipate rolling this out to larger organizations, you would want the people that are using the software to have a blast with it,” he says. “We have quite a lot of confidence that even at this sort of individual atomic level, we built something pretty joyful and helpful.”

Powered by WPeMatico

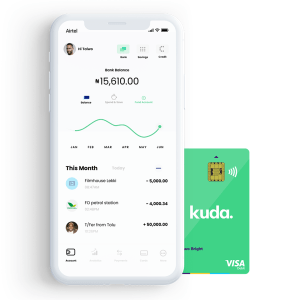

Challenger banks continue to make significant advances in attracting customers away from the big incumbents by providing more modern, user-friendly tools to manage their money. Today, one of the trailblazers in this area, Kuda Technologies, is announcing funding to continue building out its specific ambition: to provide a modern banking service for Africans and the African diaspora, or as co-founder and CEO Babs Ogundeyi describes them, “every African on the planet, wherever you are in the world.”

The company, which currently offers mobile-first banking services in Nigeria, has picked up $25 million in a Series A being led by Valar Ventures, the firm co-founded and backed by Peter Thiel, with Target Global and other unnamed investors participating. This is the first time that Valar — which has invested in a number of fintech startups, including N26, TransferWise, Stash and, just in the last week, BlockFi and BitPanda — has backed an African startup.

Kuda currently provides services for consumers to save and spend money, and it has recently introduced overdrafts (essentially revolving credit for individuals). Ogundeyi said in an interview that the plan is to use these new funds to continue expanding its credit offerings, to build out services for businesses, to add in more integrations and to move into more markets.

The funding is coming on the heels of very strong growth for Kuda, which is co-headquartered in London and Lagos.

When we last wrote about the startup, four months ago, it had just closed a seed round of $10 million led by Target Global. That was, at the time — and I think still is — the largest-ever seed round raised by a startup out of Africa, and thus as much of a milestone for the tech industry there as it was for Kuda itself.

At the time of the seed round, Kuda had registered 300,000 customers: now, that figure has more than doubled to 650,000, and tellingly, that base is spending more money through the Kuda app.

“In November we were doing about $500 million in transactions per month,” Ogundeyi said, for services like bill payments, card transactions and phone top-ups. “We closed February at $2.2 billion.”

Image Credits: Kuda

Kuda, as we described in our profile of the company when covering its seed round, is following in the footsteps of a number of other so-called “neobanks”, building a suite of banking services with a more accessible user interface and a more modern approach: you interact with the bank using a mobile app, and in addition to basic banking services, it provides tools to help people manage their money more intelligently.

But Kuda is also different from many of these, specifically because it taps into some financial practices that are unique to its market.

As Ogundeyi describes it, most people who are employed by companies will have “salary accounts” at banks, where companies pay in a person’s wages on a regular basis. These will typically be at incumbent banks, but they do not offer the same ranges of services to customers. No mobile apps, no facilities to buy mobile top-ups or make other kinds of bill payments, no AI-based calculators to figure out your monthly spend and provide suggestions on how to manage your budget, and so on.

That has opened a gap in the market for others to provide those services in their place. Kuda’s deposits, Ogundeyi said, typically start as basic transfers that people make from those “salary accounts” elsewhere. These start out small, maybe 20% of a person’s wages, but as those users find themselves using Kuda’s payment and other tools more, they are increasing how much they transfer in each payment period.

“As the trust increases you’re naturally more comfortable having money with Kuda,” he said. The next stage from that will be people depositing money directly with Kuda. A small minority already do this, he added, although the startup “has a bit more work to do” to get more companies integrated into its platform. (This is one of the areas that will be developed with this latest round of funding.)

In turn, having more money in Kuda accounts is likely to spur another wave of services being turned on at the startup, such as loans with more competitive interest rates, because they will not just be based on how much money people have but also their spending histories on the platform. “We can offer loans to salaried customers instantly as long as their salary is with Kuda,” he said.

Much of this is being enabled because of how Kuda is built. A lot of challenger banks have tapped into a world of finance and banking APIs built by another wave of fintech startups, partnering with other banks to provide backend deposit and other services: their value-add is in building efficient customer service and tools to help people manage and borrow money in smarter ways.

Kuda, on the other hand, has its own microfinance banking license from the central bank of Nigeria. This means that on top of building those same money management services, Kuda can also issue debit cards (in partnership with Visa and Mastercard), manage payments and transfers, and build all of the services in the stack itself, including those salary account services and loans. (Kuda does have partnerships with incumbent banks, specifically Zenith Bank, Guaranteed Trust and Access Bank, for people to come in for physical deposits and withdrawals when needed.)

While the service is still only live in Nigeria, the “vision is still to serve all Africans in Africa as well as outside of it,” Ogundeyi said.

The first step of that will likely be Nigerians outside of Nigeria — most likely in the U.K., where Kuda already has a headquarters, and where it has a ready market: London alone has been estimated to be home to upwards of 1 million Nigerian immigrants and people of Nigerian descent (the number of U.K. residents actually born in Nigeria is considerably smaller, more like 200,000: that is the diaspora at work).

He added that the startup is also at work on preparing for the next countries on the continent to expand its service, another area where this funding will go: “It will let us fast-track teams, on-the-ground operational teams,” he said.

The bigger picture is that the market for financial services targeting Africans has been on a significant upswing and so we will be seeing a lot more activity coming out of the region, not just from home-grown startups, but also out of other tech companies increasingly doing more business in that part of the world.

Cases in point: In addition to Stripe acquiring Nigerian payments company Paystack last year, just earlier this week, PayPal announced a deal with Flutterwave to bring PayPal services to more merchants in the region — specifically so that PayPal customers can pay merchants in the region using PayPal rails. Square’s CEO, Jack Dorsey, meanwhile, never did make his intended move to the continent — COVID-19 has derailed many plans, as we all know — but it shows that the company is trying not to overlook opportunities there, either.

PayPal, to be clear, has been active in Nigeria since 2014, but partnering with a significant player in the region represents an important step for it: Flutterwave itself earlier this month raised $170 million and became Africa’s latest unicorn, in what is still a pretty small list.

The fact that there is so much more to be done with payments and more financial services leaves the door open wide for Kuda to move in a number of different directions if it chooses. Having customers in two countries, especially with one foot in the developed market and another in an emerging market, for example, gives the company an interesting window into the world of remittances.

Money transfer has been one of the very biggest, and most important financial services for African diasporas — alongside those from many other emerging markets.

Even in cases where people are “unbanked” and have no other financial footprints, they have been turning to remittance services to send money home to their families from abroad. Kuda, with its integrations into people’s salaries, could easily become an efficient, one-stop-shop conduit for that activity too. (That’s one reason, likely, that remittance startup, Remitly, has also moved into starting to offer accounts to its users in originating countries.)

All of this to say that Valar’s making a new kind of bet here, but one laden with possibilities and a differentiated approach compared to the rest of its investment activities.

“Nigeria is at a tipping point in the adoption of digital banking,” noted Andrew McCormack, a general partner and co-founder at Valar, who led its investment here. “With the rapidly growing, youthful population who are open to new financial alternatives, Kuda is well-positioned to benefit and will transform the landscape of African banking. We are excited to lead their Series A and continue on the journey alongside Kuda.”

Powered by WPeMatico

SecurityScorecard has been helping companies understand the security risk of its vendors since 2014 by providing each one with a letter grade based on a number of dimensions. Today, the company announced a $180 million Series E.

The round includes new investors Silver Lake Waterman, T. Rowe Price, Kayne Anderson Rudnick and Fitch Venture, along with existing investors Evolution Equity Partners, Accomplice, Riverwood Capital, Intel Capital, NGP Capital, AXA Venture Partners, GV (Google Ventures) and Boldstart Ventures. The company reports it has now raised $290 million.

Co-founder and CEO Aleksandr Yampolskiy says the company’s mission has not changed since it launched. “The idea that we started the company was a realization that when I was CISO and CTO I had no metrics at my disposal. I invested in all kinds of solutions where I was completely in the dark about how I’m doing compared to the industry and how my vendors and suppliers were doing compared to me,” Yampolskiy told me.

He and his co-founder COO Sam Kassoumeh likened this to a banker looking at a mortgage application and having no credit score to check. The company changed that by starting a system of scoring the security posture of different companies and giving them a letter grade of A-F just like at school.

Today, it has ratings on more than 2 million companies worldwide, giving companies a way to understand how secure their vendors are. Yampolskiy says that his company’s solution can rate a new company not in the data set in just five minutes. Every company can see its own scorecard for free along with advice on how to improve that score.

He notes that the disastrous SolarWinds hack was entirely predictable based on SecurityScorecard’s rating system. “SolarWinds’ score has been lagging below the industry average for quite a long time, so we weren’t really particularly surprised about them,” he said.

The industry average is around 85 or a solid B in the letter grade system, whereas SolarWinds was sitting at 70 or a C for quite some time, indicating its security posture was suspect, he reports.

While Yampolskiy didn’t want to discuss valuation or revenue or even growth numbers, he did say the company has 17,000 customers worldwide, including 7 of the 10 top pharmaceutical companies in the world.

The company has reached a point where this could be the last private fundraise it does before going public, but Yampolskiy kept his cards close on timing, saying it could happen some time in the next couple of years.

Powered by WPeMatico

Saleor, a Poland and U.S.-based startup that offers a “headless” e-commerce platform to make it easier for developers to build better online shopping experiences, has raised $2.5 million in seed funding.

The round is led by Berlin’s Cherry Ventures, with participation from various angels. They include Guillermo Rauch (Vercel CEO and inventor of Next.js), Chris Schagen (former CMO of Contentful) and Kevin Mahaffey (co-founder of Lookout).

Saleor says the injection of capital will be invested in further developing Saleor‘s headless e-commerce platform, including a soon-to-launch cloud product and GraphQL API for front-end engineers.

Founded in 2020 but with a history going back to 2013, years before founders Mirek Mencel and Patryk Zawadzki spun out the product separate from their agency, Saleor is described as an “API-first” e-commerce platform that takes a “headless” approach. The idea is that the platform does the back-end heavy lifting so that developers can focus on the front end where most of the value is created for users.

“Saleor was born of necessity when our agency work at Mirumee Software required more modular, flexible and scalable e-commerce software,” Saleor co-founder Mirek Mencel recalls. “Most solutions for bigger brands came with proprietary baggage like vendor lock-in, slow adoption of new technologies and commercial certification programs. On the open-source side, we didn’t enjoy Magento’s developer experience and felt alternatives weren’t viable at scale”.

And so Saleor was conceived as an open-source platform focused on “technical excellence and quality” that could deliver greater scalability and extensibility than existing proprietary software. By 2016, the product had grown from something Mencel and Zawadzki’s agency used internally into a platform used by developers around the world.

“We could have stopped there, but saw brands pressing for more revolutionary front-end experiences,” Mencel says. “Decoupling Saleor’s core from its presentation layer was the obvious path to revolutionary front-ends. As difficult as it was, we tore down what was a rather good open-source e-commerce platform and rebuilt it API-first”.

Beyond their early headless conviction, the pair also came to the realisation that GraphQL delivered “more power, precision and developer happiness” than REST. Reasoning that most developers prefer “a few things done superbly to many things done well,” they committed exclusively to Saleor’s GraphQL API. “We have never looked back,” says Mencel.

In 2018, the original six-person team shipped Saleor 2.0. Now with a headcount of 20, Mencel says Saleor has a simple vision of developer-first commerce: open-source, GraphQL and “fair-priced” cloud — a vision that Cherry Ventures has clearly bought into.

“We are currently witnessing a paradigm shift with developers switching to headless commerce solutions, allowing more flexible, differentiated shopping experiences,” says Filip Dames, founding partner of Cherry. “Mirek, Patryk, and their team are at the forefront of this development and will enable innovative merchants to build state-of-the-art shopping experiences that scale across all consumer touch points and devices”.

“We decided to pursue venture backing as a way to increase the Saleor core team size and accelerate buildout of Saleor Cloud, which we’ll launch this year,” adds Mencel.

Powered by WPeMatico

Diem, a London, U.K.-based fintech startup, has raised a seed round of $5.5 million led by Fasanara Capital, and angel investor Chris Adelsbach, founder of Outrun Ventures. Additional investors include Andrea Molteni (early investor in Farfetch), Ben Demiri (co-chairman at fashion tech PlatformE) and Nicholas Kirkwood (founder of the eponymous brand).

Diem is a debit card with an app affording instant cash access, traditional banking service benefits (debit card, domestic and international bank transfers), but also allowing consumers to dispose of goods for eventual resale. The idea here is that this feeds into the so-called circular economy, making Diem attractive from an environmental point of view. Some estimates put the amount of worth of goods disposed of in the last 15 years at $6.9 trillion.

Here’s how it works: You have an old item of clothing, phone, book or bag, for instance. You load the item it into the app. The app makes you an offer for what the item is worth. If you accept, cash is loaded into your account immediately. You send the item to Diem, which is then resold. The incentive, therefore, is not to throw away the object and add to landfill, because you have now turned it into cash. Think “neo bank meets people who sell your stuff on eBay.”

Geri Cupi said in a statement: “Diem’s mission is to empower consumers to value, unlock, and enjoy wealth they never knew they had. All of this while fuelling the circular economy and supporting the commitment to sustainability as our key value proposition. DIEM makes it possible for capitalism and sustainability to co-exist.”

Lead Investor and CEO at Fasanara Capital, Francesco Filia, said: “Fasanara is excited to announce our partnership with DIEM and Geri Cupi… [it’s] a new generation fintech powered by principles of circular economy and look forward to support its growth.”

Powered by WPeMatico

One of the biggest gripes about investing apps is that they are not acting responsibly by not educating users properly and allegedly letting them fend for themselves. This can result in people losing a lot of money, as evidenced by the number of lawsuits against Robinhood.

Today, an eight-year-old company that has been focused on nothing but financial education is now offering trading and banking services in the U.S..

Over the years, London-based Invstr has built out an educational platform with features such as an investing academy. It’s created a Fantasy Finance game, which gives users the ability to manage a virtual $1 million portfolio so they can learn more about the markets before risking their own money for real. Via social gamification, Invstr has set out to make the educational process fun.

It has also built a community around users so they can learn from each other (something another Robinhood competitor Gatsby is also doing).

Over 1 million users have downloaded the platform globally.

Invstr, according to CEO and founder Kerim Derhalli, is taking a different approach from competitors by offering education and learning tools upfront. And in addition to giving users the ability to make commission-free stock trades, it’s also giving them a way to digitally bank and invest using their Invstr+ accounts “without ever needing to move money from one place to another.”

Invstr takes it all a step further for subscribers who have access to an “Invstr Score,” performance stats and behavioral analytics among other things.

Derhalli said moving in this direction with the company was part of his business plan from day one.

“I think the most powerful trend in the U.S. is self-directed investing,” Derhalli told TechCrunch. “Younger generations have grown up in an app world and they expect to be autonomous and do things for themselves. Many distrust the banking system, and they don’t want to follow in their parents’ footsteps when it comes to banking and finance. We think this is a massive opportunity.”

In the unveiling of its new offerings, Invstr also announced Wednesday that it has closed on a $20 million Series A in the form of a convertible offering. This builds upon $20 million it previously raised across two seed rounds from investors such as Ventura Capital, Finberg, European angel investor Jari Ovaskainen and Rick Haythornthwaite, former global chairman of Mastercard.

Derhalli said he felt compelled to found Invstr after seeing firsthand how a lack of knowledge and confidence can prevent individuals from starting to invest. He worked for three decades in senior leadership roles at Deutsche Bank, Lehman Brothers, Merrill Lynch and JPMorgan before founding Invstr “so that anyone, anywhere could learn how to invest.”

Invstr is offering its new investing services in partnership with Apex Clearing, which formerly provided execution and settlement services to Robinhood. Its digital banking services are being offered through a partnership with Vast Bank. To address the security piece, Invstr said its user data is also protected by technology from Okta.

The company, which also has offices in New York and Istanbul, plans to use the new capital to launch new brokerage and analytics tools and a portfolio builder.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico

When we think about getting access to an application, we tend to focus on the authentication side — granting or denying people (or devices) entry. But there is another piece to this, and that’s authorization. This is related to what you can do once you are inside the application, and Oso, an early-stage startup, has created an open-source library for developers to make it easier to build authorization in their applications.

Today, the company announced an $8.2 million Series A led by Sequoia with participation from SV Angel, Company Ventures, Highland Capital and numerous angel investors. When combined with a $2.7 million seed round from 2019, it brings the total raised to $10.9 million.

Company co-founder and CEO Graham Neray says that developers have benefited from tools like Stripe and Twilio to normalize the use of third-party APIs to offload parts of the application that aren’t core to the value prop. Oso does the same thing, except for authorization.

“We help developers to speed up their authorization roadmaps by up to 4x, and the way that we do that is by providing this library, which comes with pre-built integrations, guides and an underlying policy language,” Neray explained.

He says that authorization is a misunderstood concept, and as though to confirm this, when I tried to explain Oso to a colleague, his first thought was that it is an Okta competitor. It’s not. As Neray explains, authorization and authentication are related, but are in fact different and require a different set of tools.

While tools like Okta grant you access, authorization determines what buttons can you click, what pages can you see, what data can you access. Most developers handle this manually by writing the authorization code themselves, linking it to Active Directory (or a similar tool) and fashioning a permissions matrix. Oso’s goal is to remove that burden and provide a set of tools to abstract away most of the complexity.

The tool is open source and the startup is concentrating on building a community of users for now to build developer interest. Over time, they fully intend to build a commercial company on top of that, but are still thinking about how that will look.

For now, the company, which launched in 2018, has nine employees with plans to triple that over the next 18 months. Neray and co-founder and CTO Sam Scott are thinking carefully about how to build a diverse, inclusive and equitable company as they grow. That means hiring from underrepresented groups, treating them fairly and making them feel like they belong. Neray says at this point, he is doing all of the hiring.

“I make a concerted effort to ensure that our pipeline is as diverse as I want the team to be — full stop — and that’s the only way to do it,” he said.

He adds that while building a diverse workforce is the morally right thing to do for him and his co-founder, there is also a practical business side to this too. “We don’t want to build an echo chamber with people from the same background, the same thought process and all the same upbringing,” he said.

When the company can return to the office, the plan is to have a home base, but let folks work where they want and how they want. “The plan is we will have an office in New York, and we will have remote team members. So in one form or another it will be hybrid,” Neray said.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico

LA and Bangalore-based space startup Pixxel has closed a $7.3 million seed round, including newly committed capital from Techstars, Omnivore VC and more. The company has also announced a new product focus: hyperspectral imaging. It aims to provide that imaging at the highest resolution commercially available, via a small satellite constellation that will provide 24-hour global coverage once it’s fully operational.

Pixxel’s funding today is an extension of the $5 million it announced it had raised back in August of last year. At the time, the startup had only revealed that it was focusing on Earth imaging, and it’s unveiling its specific pursuit of hyperspectral imaging for the first time today. Hyperspectral imaging uses far more light frequencies than the much more commonly used multispectral imaging used in satellite observation today, allowing for unprecedented insight and detection of previously invisible issues, including migration of pest insect populations in agriculture, or observing gas leaks and other ecological threats.

“We started with analyzing existing satellite images, and what we could do with this immediately,” explained Pixxel co-founder and CEO Awais Ahmed in an interview. “We realized that in most cases, it was not able to even see certain problems or issues that we wanted to solve — for example, we wanted to be able to look at air pollution and water pollution levels. But to be able to do that there were no commercial satellites that would enable us to do that, or even open source satellite data at the resolution that would enable us to do that.”

The potential of hyperspectral imaging on Earth, across a range of sectors, is huge, according to Ahmed, but Pixxel’s long-term vision is all about empowering a future commercial space sector to make the most of in-space resources.

“We started looking at space as a sector for us to be able to work in, and we realized that what we wanted to do was to be able to enable people to take resources from space to use in space,” Ahmed said. That included asteroid mining, for example, and when we investigated that, we found hyperspectral imaging was the imaging tech that would enable us to map these asteroids as to whether they contain these metals or these minerals. So that knowledge sort of transferred to this more short-term problem that we were looking at solving.”

Part of the reason that Pixxel’s founders couldn’t find existing available hyperspectral imaging at the resolutions they needed was that as a technology, it has previously been restricted to internal governmental use through regulation. The U.S. recently opened up the ability for commercial entities to pursue very high-resolution hyperspectral imaging for use on the private market, effectively because they realized that these technical capabilities were becoming available in other international markets anyway. Ahmed told me that the main blocker was still technical, however.

“If we were to build a camera like this even two or three years ago, it would not have been possible because of the miniaturized sensors, the optics, etc.,” he said. “The advances that have happened only happened very recently, so it’s also the fact that this the right time to take it from the scientific domain to the commercial domain.”

Pixxel now aims to have its first hyperspectral imaging satellite launched and operating on orbit within the next few months, and it will then continue to launch additional satellites after that once it’s able to test and evaluate the performance of its first spacecraft in an actual operating environment.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico