Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Aqua Security, a Boston- and Tel Aviv-based security startup that focuses squarely on securing cloud-native services, today announced that it has raised a $135 million Series E funding round at a $1 billion valuation. The round was led by ION Crossover Partners. Existing investors M12 Ventures, Lightspeed Venture Partners, Insight Partners, TLV Partners, Greenspring Associates and Acrew Capital also participated. In total, Aqua Security has now raised $265 million since it was founded in 2015.

The company was one of the earliest to focus on securing container deployments. And while many of its competitors were acquired over the years, Aqua remains independent and is now likely on a path to an IPO. When it launched, the industry focus was still very much on Docker and Docker containers. To the detriment of Docker, that quickly shifted to Kubernetes, which is now the de facto standard. But enterprises are also now looking at serverless and other new technologies on top of this new stack.

“Enterprises that five years ago were experimenting with different types of technologies are now facing a completely different technology stack, a completely different ecosystem and a completely new set of security requirements,” Aqua CEO Dror Davidoff told me. And with these new security requirements came a plethora of startups, all focusing on specific parts of the stack.

What set Aqua apart, Dror argues, is that it managed to 1) become the best solution for container security and 2) realized that to succeed in the long run, it had to become a platform that would secure the entire cloud-native environment. About two years ago, the company made this switch from a product to a platform, as Davidoff describes it.

“There was a spree of acquisitions by CheckPoint and Palo Alto [Networks] and Trend [Micro],” Davidoff said. “They all started to acquire pieces and tried to build a more complete offering. The big advantage for Aqua was that we had everything natively built on one platform. […] Five years later, everyone is talking about cloud-native security. No one says ‘container security’ or ‘serverless security’ anymore. And Aqua is practically the broadest cloud-native security [platform].”

One interesting aspect of Aqua’s strategy is that it continues to bet on open source, too. Trivy, its open-source vulnerability scanner, is the default scanner for GitLab’s Harbor Registry and the CNCF’s Artifact Hub, for example.

“We are probably the best security open-source player there is because not only do we secure from vulnerable open source, we are also very active in the open-source community,” Davidoff said (with maybe a bit of hyperbole). “We provide tools to the community that are open source. To keep evolving, we have a whole open-source team. It’s part of the philosophy here that we want to be part of the community and it really helps us to understand it better and provide the right tools.”

In 2020, Aqua, which mostly focuses on mid-size and larger companies, doubled the number of paying customers and it now has more than half a dozen customers with an ARR of over $1 million each.

Davidoff tells me the company wasn’t actively looking for new funding. Its last funding round came together only a year ago, after all. But the team decided that it wanted to be able to double down on its current strategy and raise sooner than originally planned. ION had been interested in working with Aqua for a while, Davidoff told me, and while the company received other offers, the team decided to go ahead with ION as the lead investor (with all of Aqua’s existing investors also participating in this round).

“We want to grow from a product perspective, we want to grow from a go-to-market [perspective] and expand our geographical coverage — and we also want to be a little more acquisitive. That’s another direction we’re looking at because now we have the platform that allows us to do that. […] I feel we can take the company to great heights. That’s the plan. The market opportunity allows us to dream big.”

Powered by WPeMatico

Wrapbook, a startup that simplifies the payroll process for TV, film and commercial productions, has raised $27 million in Series A funding from noteworthy names in both the tech and entertainment worlds.

The round was led by Andreessen Horowitz, with participation from Equal Ventures and Uncork Capital, as well as from WndrCo (the investment and holding company led by DreamWorks and Quibi founder/co-founder Jeffrey Katzenberg) and from CAA co-founder Michael Ovitz.

“It’s time we bring production financial services into the 21st century,” Katzenberg said in a statement. “We need a technology solution that will address the increasing complexities of production onboarding, pay and insuring cast and crew, only exacerbated by COVID-19, and I believe that Wrapbook delivers.”

Wrapbook co-founder and CEO Ali Javid explained that entertainment payroll has remained a largely old-fashioned, paper-based process, which can be particularly difficult to track as cast and crew move from project to project, up to 30 times in single year. Wrapbook digitizes and simplifies the process — electronically collecting all the forms and signatures needed at the beginning of production, handling payroll itself, creating a dashboard to track payments and also making it easy to obtain the necessary insurance.

Wrapbook founders Cameron Woodward, Ali Javid, Hesham El-Nahhas and Naysawn Naji

Although the startup was founded in 2018, Javid told me that demand has increased dramatically as production resumed during the pandemic, with COVID-19 “totally” changing the industry’s culture and prompting production companies to say, “Hey, if there’s an easier, faster way to do this from my house, then yeah let’s look at it.”

Javid also described the Wrapbook platform as a “a vertical fintech solution that’s growing really fast in an industry that we understand really well and not many others have thought about.” In fact, he said the company’s revenue grew 7x in 2020.

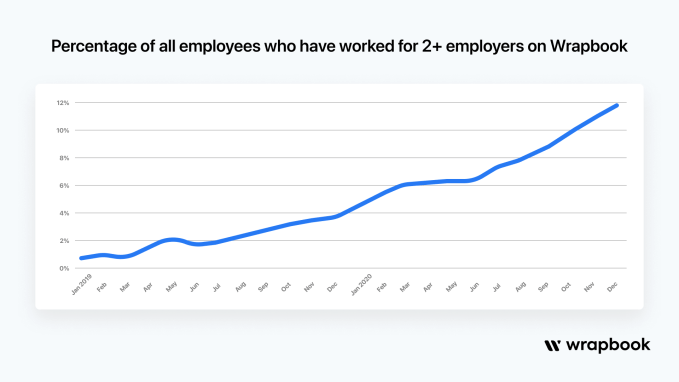

And while Wrapbook’s direct customers are the production companies, co-founder and CMO Cameron Woodward (who previously worked in filmmaking insurance and commercial production) said that the team has also focused on creating a good experience for the cast and crew who get paid through the platform — a growing number of them (12% thus far) have used their Wrapbook profiles to get paid on multiple productions.

Image Credits: Wrapbook

The startup previously raised $3.6 million in seed funding. Looking ahead, Javid and Woodward said that Wrapbook’s solution could eventually be adopted in other project-based industries. But for now, they see plenty of opportunity to continue growing within entertainment alone — they estimated that the industry currently sees $200 billion in annual payments.

“We’re going to double down on what’s working and build things out based on what customers have asked for within entertainment,” Javid said. “To that end, we’re working towards hiring 100 people in the next 12 months.”

Powered by WPeMatico

The vast majority of startups remain focused on consumers, knowledge workers and the opportunities to provide services to those that are already operating completely, or at least partially, in digital environments. But today comes news of funding for a startup building a social network for what is probably one of the least digital business sectors of all: independent, small-hold farmers in the developing world.

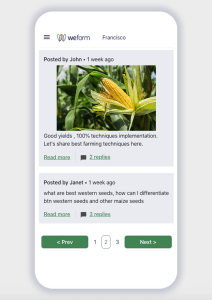

Wefarm, a social networking platform aimed at independent farmers to help them meet each other, exchange ideas and get advice, and sell or trade equipment and supplies, has raised $11 million funding to continue expanding its business, which now has 2.5 million users.

To put that number and the growth opportunity into some perspective, Wefarm estimates there are some 400 million small-hold farmers globally, with a large proportion of them in developing markets.

The funding, an extension to the company’s 2019 Series A, is being led by Octopus Ventures. True Ventures (which led the 2019 round), Rabo Frontier Ventures, LocalGlobe, June Fund and AgFunder also participated. Wefarm has raised $32 million since being founded in 2015.

To date, London-based Wefarm has primarily found traction in countries in East Africa. Its service is available via a website, but most of its users are accessing without any internet use at all, via the company’s SMS interface. The SMS format has now hosted more than 37 million conversations from farmers engaging in around 400 different types of farming (from livestock or dairy to grains and fruits and vegetables) and $29 million in marketplace sales, the company said.

But rolling out SMS services can be slow, in part because it requires Wefarm to strike local deals with carriers over data usage. (That has also meant that the company has tightly controlled growth: if you go to the main site, you’ll see that you can either join a waitlist or join by way of an invitation from an existing member.)

Kenny Ewan, Wefarm’s founder and CEO, said this latest tranche of funding in part will be used to roll out an app (currently in beta) that will help it launch in more countries and pick up more farmers.

“The big step we’re taking is going from SMS to a digital, app-based service, which will remove the digital barrier,” he said in an interview. “We compare it to the shift from sending DVDs in the mail to streaming video online. We feel like the time is right and believe it could take us to the 100 million mark of users.”

Wefarm’s role in helping link up independent farmers — traditionally and by its nature one of the most analog of industries — has taken on an interesting profile particularly in the last year.

The COVID-19 pandemic has thrown a stark light on a number of digital divides in the world, and one of the most distinctive has been in the wider world of business. Entrepreneurs, companies and organizations that had digital strategies in place could hit the ground running to adapt to a “new normal,” with less physical interaction. Those that did not had to scramble to get there to avoid a nosedive in activity.

Image Credits: Wefarm (opens in a new window)

Wefarm was around for years before the COVID-19 pandemic, and in some regards it has always been championing and giving a digital voice to the underdogs.

The wider agricultural industry — globally a multi-trillion-dollar enterprise, accounting for up to 25% of GDP in some markets — has undergone some significant digital transformation, but that has been focused on tools and other technology for the agribusiness sector, which includes the giant conglomerates and multinationals like Cargill, Archer-Daniels-Midland, Bayer (Monsanto’s parent), John Deere and others.

Wefarm’s importance (and often singular presence) as a tool for independent farmers to communicate, trade and generally network with others like them was already playing out before COVID-19. When we covered the company’s previous raise in 2019 (the first part of its Series A, a $13 million round) it had already grown to 1.9 million members. And, as it happens, for many of its users, COVID-19 was in some regards the least of their concerns:

“In reality a lot of people in rural Africa were concerned about the weather, or the effect of a locust plague,” Ewan said. “What we saw was traffic around not COVID, but these topics. They had different preoccupations.”

But the pandemic has had an impact, nevertheless. On the platform itself, as we saw in other e-commerce scenarios, Wefarm emerged as an essential service for trading at a time when in-person meetings were halted. As for Wefarm as a business, Ewan said that it essentially meant that the company’s country expansion plans had completely halted mainly because business development teams could no longer travel as they had before: another reason why launching an app could be a useful growth tool.

(That lack of travel was also potentially helpful to Wefarm: despite that the company still managed to grow by 600,000 more users, Ewan pointed out, underscoring a clear demand for the service among its target audience.)

Going forward, there are other ways in which Wefarm aims to leverage its user base, its network and the data that it potentially can amass from them.

“We see the possibility of providing more analytics and data. Our users want that very much,” Ewan said. “We now know more about small-scale farmers than anyone else, because they talk to us.” Areas that Wefarm is considering to develop over the next two years are whether it can help provide more insight into more workable business models, pricing models and more data on particular aspects like ripening periods.

“By building a highly engaged community of millions of small-holder farmers, Wefarm has created a powerful platform providing greater access to vital knowledge and information, which allows farmers to unlock greater economic potential from their land,” said Kamran Adle, early-stage investor at Octopus Ventures. “In practice that might mean understanding which fertilisers work best, what the market price is for certain goods, or new farming techniques that result in better yields, all of which can make a significant difference to livelihoods. It’s also an enormous market with more than 400 million small-holder farmers globally who collectively spend around $400 billion on farming inputs. There is a huge opportunity for Kenny and the team at Wefarm to achieve incredible scale and we’re excited for the launch of its digital platform which will further accelerate growth.”

Powered by WPeMatico

Each of the big three cloud vendors — Amazon, Microsoft and Google — has a marketplace where software vendors can sell their wares. It seems like an easy enough proposition to throw your software up there and be done with it, but it turns out that it’s not quite that simple, requiring a complex set of business and technical tasks.

Tackle, a startup that wants to help ease the process of getting a product onto one of these marketplaces, announced a $35 million Series B today. Andreessen Horowitz led the investment with help from existing investor Bessemer Venture Partners. The company reports it has now raised $48.5 million.

Company founder Dillon Woods says that at previous jobs, he found that it took several months with a couple of engineers dedicated to the task to get a product onto the AWS marketplace, and he noticed that it was a similar set of tasks each time.

“What I saw [in my previous jobs] was that we were kind of redoing the same work. And I thought everybody out there was probably reinventing the same wheel. And so when I started Tackle, my goal was to create a software platform that would take that time down to one or two days. So it’s really a no-code solution, and it makes it much more of a business decision, rather than this big technical integration project,” Woods told me.

While you may think it’s a pretty simple task to put an app on one of these marketplaces, Woods points out that the AWS user guide explaining the ins and outs is a 700-page pdf. He says that it’s not just the technical complexity of setting up the various API calls to get it connected, there is also the business side of selling in the marketplace, and that requires additional APIs.

“There’s not just the initial sale. There could be things later like upgrades, refunds, cancellations — maybe you need to do overage charges against that same contract. And so there are all of these downstream things that happen that all require API integration, and Tackle takes care of all of that for you,” Woods explained.

CEO John Jahnke says that the company usually starts with one product in one marketplace, which acts as a kind of proof of concept for the customer, then builds up from there. Once customers see what Tackle can do, they can expand usage.

It seems to be working, with the startup reporting that it tripled annual recurring revenue (ARR), although it didn’t want to share a specific number. It also doubled headcount and the number of customers and was responsible for over $200 million in transactions across the three cloud marketplaces.

Jahnke didn’t share the exact number of customers, but he said there were currently hundreds on the platform, including companies like Snowflake, GitHub, New Relic and PagerDuty.

The company currently has 67 employees spread across 25 states, with plans to almost double that by the end of 2021. He says that it’s essential to put systems in place to build a diverse company now.

“How we scale through this next 100% increase in headcount is going to define the mix of the company into the future. If we can get this right right now and continue to extend on the foundation for diversity and inclusion that we started and make it a real part of our conversation at some scale, we think we’ll be set up as we go from 100 employees to 1,000 employees over the long period of time to continue to grow and create opportunities for people wherever they are,” Jahnke said.

Martin Casado, general partner at lead investor a16z, says this type of selling has become essential for businesses and that’s why he wanted to invest in the company. “Cloud marketplaces have become a primary channel for selling software quickly and conveniently. Tackle is the leading player for enabling companies to sell software through the cloud,” he said.

Powered by WPeMatico

Swedish autonomous electric vehicle startup Einride is aiming to continue the momentum sparked by partnerships with Oatly and Lidl by seeking additional capital, TechCrunch has learned.

Einride is seeking $75 million in new financing, while at the same time exploring the potential for a public listing through a special purpose acquisition company, according to people with knowledge of the company’s plans.

SPACs, a mechanism in which a publicly traded shell company merges with a private business, have taken the U.S. capital markets by storm led, in part, by startups focused on the electrification of mobility.

Early successes of public listings for companies like Nikola (despite its dubious claims) helped set the stage for the SPAC boom. Canoo, Fisker Inc, ChargePoint and Lordstown Motors are just a few of the U.S.-based EV companies that have gone public via a SPAC in the past year.

Unlike some newly minted SPAC companies, Einride has some fundamentals. The company has already piloted its technology through a partnership with Oatly, the Swedish oat milk maker.

Oatly began using Einride’s electric trucks on its delivery routes from each of its Swedish production sites in October 2020. Thus far, the trucks have driven over 8,600 km electric and as a result have saved over 10,500 kg of CO2 compared to diesel, according to a statement from the companies.

“Sustainability is at the core of everything we do, and we work hard to lower our emissions across the board. This includes our emissions for transports, which is why we are now shifting to electrical vehicles, which reduces our climate footprint by 87% on these routes,” said Simon Broadbent, supply chain director at Oatly, in a statement at the time.

The deal with Oatly was just the beginning. As the ink dried on that partnership, Einride quickly signed other marquee Swedish businesses including the food shipping and logistics company Lidl and the electronics manufacturer Electrolux.

Big automakers have electric and autonomous plans of their own. Argo, a developer of self-driving technology, is now worth $7.5 billion thanks to an investment from Ford and the VW Group. And VW’s Traton Group is pushing low emission and electrification through a $2.2 billion investment announced in 2019.

Daimler, Paccar, and Volvo all have plans as well.

That’s just scratching the surface of the money that’s pouring in to autonomous, electrified transport. Of course, Tesla is in the game with its own semi truck and, in China, Plus AI, is automating a number of vehicles from Manbang, Suning and FAW Jiefang.

All of this money is aiming to capture a portion of the market for autonomous, electrified vehicles that the consulting firm McKinsey estimated would save the trucking industry over $100 billion. It’s a potentially huge opportunity in the $260 billion U.S. trucking market alone. Worldwide, businesses spend about $1.2 trillion on trucking, according to McKinsey.

The benefits that would accrue to the industry are more than just financial. Trucking is a huge component of the greenhouse gas emissions that come from the transportation sector — which includes road, rail, air and marine transportation. In 2016, trucking and transport broadly contributed to roughly 24% of the world’s total greenhouse gas emissions — and that number has been steadily increasing.

Any reduction in carbon emissions from the transport sector would be a huge step forward on the path toward a more environmentally sustainable future.

No wonder venture investors are falling all over each other to invest in these companies. Einride counts EQT Ventures and NordicNinja VC, a fund backed by Panasonic, Honda, Omron and the Japan Bank for International Cooperation, among its investors. Along with backing from Ericsson Ventures, Norrsken Foundation, Plum Alley Investments and Plug and Play Ventures the startup has raised $32 million to date.

Powered by WPeMatico

This morning Vendr announced a $60 million Series A round, a huge funding event led by Tiger Global, with participation from Y Combinator, Sound Ventures, Craft Ventures, F-Prime Capital and Garage Capital.

The outsized Series A comes after Vendr last raised $4 million in a mid-2020 seed round, with TechCrunch reporting that the company was profitable at the time. Vendr had raised just over $6 million total before this latest round.

TechCrunch had a few questions. First, how the company had managed to attract so much capital so quickly. According to an interview with Vendr CEO Ryan Neu, his startup grew just under 5x in 2020, and was cash flow-positive last year as well. The startup’s model of standing between SaaS buyers and sellers, speeding up transactions while lowering their cost, appears to have fit well into 2020’s twin trends of rising software reliance and a focus on cost control.

Second, how did the company manage to grow so much? Vendr charges its customers between 1% and 5% of their software spend that it manages, which can add up. Neu told TechCrunch that a somewhat standard 500-person company might spend $2 million to $3.5 million on software each year, which by our math would make that company worth no less than $20,000 to $35,000 in revenue for Vendr at 1% of spend. At Vendr’s midpoint 2.5%, those figures rise $50,000 to $87,500.

At those prices, Vendr can stack up annual revenue pretty quickly. But why would Vendr customers pay it to handle their software spend? Savings, effectively. So long as they save more than Vendr charges, they are coming out ahead. And as the startup claims that it can cut the time to buying, its own customers can reduce time spent on securing tooling.

Everyone wins, it seems, except for software sellers. After all, they are the ones losing a chance to get less-sophisticated buyers to pay more for their code, right? Neu said that his company’s model isn’t too bad for selling companies as they close deals much more quickly, at a higher rate of closure. That could save their sales team time, which might help balance the price differential.

Pressed on what Vendr might be able to do for the selling side of the software market given its present-day buyer focus, Neu declined to share any possible plans.

Returning to the round, why did Vendr raise the money at all if it was doing just fine sans new external funding? The company told TechCrunch that it has scaled its staff to 60 from 10 a year ago, and that it wanted a stronger balance sheet. That’s fine. We’d be hard-pressed to find the startup that wouldn’t take such a large check from Tiger, given the valuation gain the raise implies for Vendr, so there isn’t too much mystery to unpack.

A theme that TechCrunch has explored in recent weeks has been the huge depth of the software market. Given the TAM for bits and bytes, Vendr may be able to keep up the hypergrowth that its new round implies its investors will expect. Let’s see how 2021 winds up for the company.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Ann Arbor-based Refraction AI announced today that it has raised a $4.2 million seed round. The startup, which debuted on the TechCrunch Sessions: Mobility stage back in 2019, was founded by a pair of University of Michigan professors (Matthew Johnson-Roberson — now CTO — and Ram Vasudevan) seeking to solve a number of issues posed by many delivery robots.

With an initial prototype built on a bicycle foundation, the company’s REV-1 robot is designed to operate in bike lanes and roads, rather than the standard sidewalk ‘bot. The different approach allows the robot to travel at higher speeds (topping out at 15 miles per hour) and removes some of the messy pedestrian-dodging issues that come with sidewalk use (while introducing some new ones on that narrow sliver of asphalt shared by cyclists).

Refraction is currently testing a small fleet in its native Ann Arbor. The seed round, led by Pillar VC, will be used for R&D, expanding the company’s reach and recruiting more customers, with a focus on grocery store and restaurant deliveries. Other investors include, eLab Ventures, Osage Venture Partners, Trucks Venture Capital, Alumni Ventures Group, Chad Laurans and Invest Michigan.

Another key differentiator is the use of cameras, versus LIDAR. The decision comes with some technological trade-offs, but benefits include a lower price point and the ability for the company to more quickly scale its fleet. The technology is also not easily districted by weather conditions encountered in the upper midwest, though it has limitations, too. As the company puts it, if you’re not comfortable walking out in it, the robot probably won’t be, either.

“Our platform uses technology that exists today in an innovative way, to get people the things they need, when they need them, where they live,” CEO Luke Schneider said in a release tied to the news. “And we’re doing so in a way that reduces business’ costs, makes roads less congested, and eliminates carbon emissions.”

With this new funding, the company plans to expand operations beyond its native Ann Arbor, though no additional test markets have been announced.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion.

Powered by WPeMatico

As the restaurant industry across different cities was massively hit by the pandemic-induced lockdowns last year, food aggregator platforms helped by driving online customers to them.

Koinz is one such startup in Egypt. Its value for food and beverages brands before, during and after the lockdowns has bagged the startup a $4.8 million seed round.

Founded in 2018 by Hussein Momtaz, Ahmed Said and Abdullah Al Khaldi, Koinz set out to solve two major problems in Egypt’s food aggregation industry.

The offline and online food and restaurant experience in the country are totally separate. Most food aggregators who deal with delivery tend to focus on the online customer, and there’s no sophisticated experience for the offline customer.

Next, the unit economics of the food aggregation industry is quite challenging. According to Momtaz, the startup’s CEO, the food aggregation industry usually takes about 25%-30% average commission from F&B players for business to start to make sense.

“This is not because they want to squeeze money from the hands of restaurants or brands,” Momtaz told TechCrunch. “But the cost of acquiring customers and retaining them for the food aggregator itself is very high; that’s why they need very high commissions from the brands or restaurants.”

This is where Koinz comes in. The company developed a mobile app for takeout and delivery orders that manages offline customer experiences while delivering an engagement platform to manage loyalty programs, customer feedback and analytics about the online and offline customer base.

Abdullah Al Khaldi (CRO), Hussein Momtaz (CEO), and Ahmed Said (CTO). Image Credits: Koinz

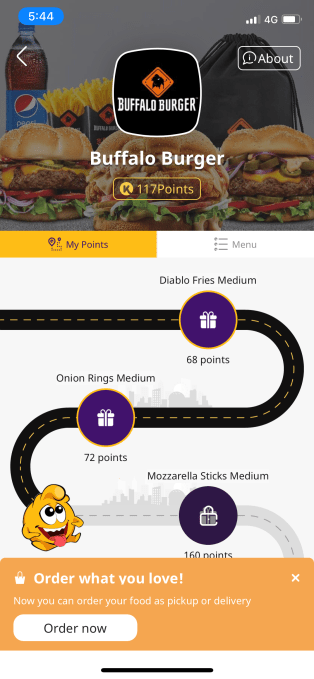

Online food experience for Koinz customers is like a treasure hunt, and Momtaz claims the company’s business model has cracked the industry’s unit economics. This, alongside providing brands with insights, differentiates the platform from other aggregators and makes its customer acquisition cost and retention cost 60% less than most of them.

Here’s how the platform works. When customers visit a brand using for the first time, they enter their phone numbers to instantly receive points for their order via text message. After various restaurant visits and making orders, they accumulate enough points. They’ll need to download the Koinz mobile application to redeem them, thereby converting these offline customers to online ones.

Furthermore, these offline customers can now discover new places to eat, read and leave reviews, and order delivery or takeout.

“None of the small or big brands in the region had something like this before. The offline customer is like a ghost. He walks into the brands, takes his orders and leaves without the brands knowing anything about him. Koinz is changing that,” the CEO remarked.

Building its platform this way, Koinz tries to be different from other online aggregators that erode restaurant owners’ profit margins while delivering limited customer access and interaction. How? By collecting real-time data and leveraging a digital rewarding system designed to drive customers to deepen their relationship with restaurants.

Image Credits: Koinz

Brands can configure their gifts lists and determine for which items customers can redeem their points. For instance, customers in an Egyptian restaurant called Buffalo Burger can exchange 68 points for a Diablo Fries Medium; or wait till they get to 160 points to get a Mozzarella Sticks Medium; or 236 points for a Double Diggler.

Similarly, every brand has its own configuration. A customer cannot get points in Buffalo Burger and redeem them at Hamburgini. Koinz charges subscriptions to the brands for its engagement and feedback platform and collects commission whenever an order is made via its platform, which varies across its markets.

Because of its original business model, Koinz had to iterate several times. Before using phone numbers to collect customers’ information, the company used QR codes and NFC tags. Momtaz says this was highly ineffective, and the move to phone numbers helped skyrocket its growth and value.

The six-man team back in 2018 is now 80, and the platform, which is basically powering the growth of restaurants in the Middle East, claims to have had up to 4 million consumers earn points on its platform. These consumers have redeemed almost 300,000 rewards, while almost 800,000 customers have left reviews.

Since launching in Egypt, Koinz has expanded to Saudi Arabia and the UAE. Like Egypt, these markets have similar dynamics and demographics. They have also witnessed one of the highest rates of new or increased users in online deliveries — restaurant products and groceries — during the pandemic.

Besides, consumers in the Middle East are outpacing the global appetite in food delivery, with 64% ordering in at least once a week compared to 40% made by global consumers. And with the fast-food industry in MENA estimated at nearly $31 billion in 2020 and expected to reach nearly $60 billion by 2025, there’s so much room for Koinz to grow in the region. Momtaz says the company is also considering a move to Sub-Saharan Africa in the near future despite them having distinct demographics.

Entrepreneur and investor Justin Mateen led this seed round. Since leaving Tinder in 2014, Mateen has been an active investor in early-stage companies. Koinz is his first investment in the MENA region. According to him, Koinz’s ability to allow food and beverages brands to understand their customers’ needs and simultaneously increase their profit margins was one of the reasons he invested in the Egyptian-based startup.

“The company’s unique business model will continue to scale as the food delivery space evolves. Hussein’s drive and excitement for what the team is building are what convinced me to lead a round in the Middle East for the first time,” Mateen added.

African-focused VC 4DX Ventures and strategic angel investors from Egypt, Turkey and Saudi Arabia participated as well.

Peter Orth, co-founder and managing director of the firm, said of the investment that with restaurants in the region suffering under the traditional aggregator model, especially during the pandemic, Koinz has quickly become a win-win for both consumers and restaurant owners across the Middle East.

As the three-year-old company plans to use the capital to hire more talent and fuel its expansion across the Middle East, Mateen and Orth will join its board of directors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Planted, a startup pursuing a unique method of creating a vegetarian chicken alternative, has raised an $18 million (CHF 17 million) Series A to expand its product offerings and international footprint. With new kebabs and pulled-style faux meats available and steak-like cuts in the (literal) pipeline, Planted has begun to set its sights outside central Europe.

The company was a spinout from ETH Zurich and made its debut in 2019, but has not rested on the success of its plain chicken recipe. Its approach, which relied on using pea protein and pea fiber extruded to recreate the fibrous structure of chicken for nearly 1:1 replacement in recipes, has proven to be adaptable for different styles and ingredients as well.

“We aim to use different proteins, so that there is diversity, both in terms of agriculture and dietary aspects,” said co-founder Christoph Jenny.

“For example our newly launched planted.pulled consists of sunflower, oat and yellow pea proteins, changing both structure and taste to resemble pulled pork rather than chicken. The great thing about the sunflower proteins, they are upcycled from sunflower oil production. Hence, we are establishing a circular economy approach.”

When I first wrote about Planted, its products were only being distributed through a handful of restaurants and grocery stores. Now the company has a presence in more than 3,000 retail locations across Switzerland, Germany and Austria, and works with restaurant and food service partners as well. No doubt this strong organic (so to speak) growth, and the growth of the meat alternative market in general, made raising money less of a chore.

The cash will be directed, as you might expect for a company at this stage, towards R&D and further expansion.

“The funding will be used to expand our tech stack, to commercialize our prime cuts that are currently produced at lab scale,” said Jenny. “On the manufacturing side we look to significantly increase our current capacity of half a ton per hour to serve the increasing demand coming from international markets, first in neighboring countries and then further into Europe and overseas.”

“We will further invest in our structuring and fermentation platforms. Combining structuring technologies with the biochemical toolboxes of natural microorganisms will allow us to create ultimately new products with transformative character – all clean, natural, healthy and tasty,” said co-founder Lukas Böni in a press release.

No doubt this all will also help lower the price, a goal from the beginning but only possible by scaling up.

As other companies in this space also raise money (incidentally, rather large amounts of it) and expand to other markets, competition will be fierce — but Planted seems to be specializing in a few food types that aren’t as commonly found, at least in the U.S., where sausages, ground “beef” and “chicken” nuggets have been the leading forms of meat alternatives.

No word on when Planted products will make it to American tables, but Jenny’s “overseas” suggests it is at least a possibility fairly soon.

The funding round was co-led by Vorwerk Ventures and Blue Horizon Ventures, with participation from Swiss football (soccer) player Yann Sommer and several previous investors.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Optimizely co-founder Dan Siroker said the idea for his new startup Scribe goes back to a couple of personal experiences — and although Scribe’s first product is focused on Zoom, those experiences weren’t Zoom-related at all.

Instead, Siroker recalled starting to go deaf and then having an “epiphany” the first time he put in a hearing aid, as he recovered a sense he thought he’d lost.

“That really was the spark that got me thinking about other opportunities to augment things your body naturally fails at,” he said.

Siroker added that memory was an obvious candidate, particularly since he also has aphantasia — the inability to visualize mental images, which made it “hard to remember certain things.”

It may jog your own memory if I note that Siroker founded Optimizely with Pete Koomen in 2010, then stepped down from the CEO role in 2017, with the testing and personalization startup acquired by Episerver last year. (And now Episerver itself is rebranding as Optimizely.)

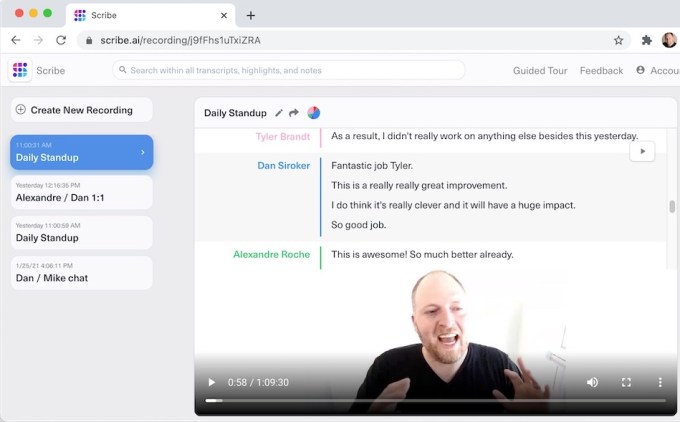

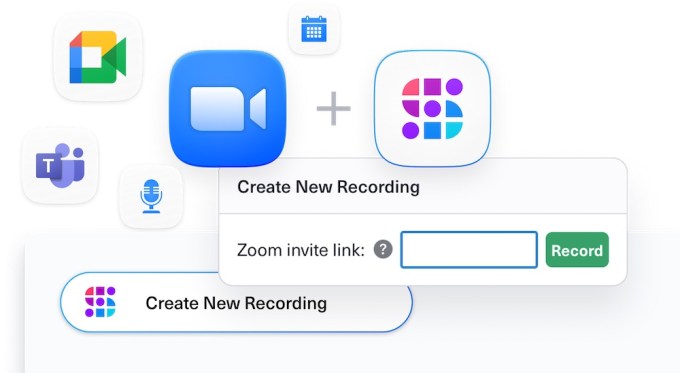

Fast-forward to the present day and Siroker is now CEO at Scribe, which is taking signups for its first product. That product integrates into Zoom meetings and transforms them into searchable, shareable transcripts.

Siroker demonstrated it for me during our Zoom call. Scribe appears in the meeting as an additional participant, recording video and audio while creating a real-time transcript. During or after the meeting, users can edit the transcript, watch or listen to the associated moment in the recording and highlight important points.

From a technological perspective, none of this feels like a huge breakthrough, but I was impressed by the seamlessness of the experience — just by adding an additional participant, I had a full recording and searchable transcript of our conversation that I could consult later, including while I was writing this story.

Image Credits: Scribe

Although Scribe is recording the meeting, Siroker said he wants this to be more like a note-taking replacement than a tape recorder.

“Let’s say you and I were meeting and I came to that meeting with a pen and paper and I’m writing down what you’re saying,” he said. “That’s totally socially acceptable — in some ways, it’s flattering … If instead, I brought a tape recorder and plopped in front of you and hit record — you might actually have this experience — with some folks, that feels very different.”

The key, he argued, is that Scribe recordings and transcripts can be edited, and you can also turn individual components on and off at any time.

“This is not a permanent record,” he said. “This is a shared artifact that we all create as we have a meeting that — just like a Google Doc — you can go back and make changes.”

That said, it’s still possible that Scribe could record some embarrassing comments, and the recordings could eventually get meeting participants in trouble. (After all, leaked company meeting recordings have already prompted a number of news stories.) Siroker said he hopes that’s “not common,” but he also argued that it could create an increased sense of transparency and accountability if it happens occasionally.

Scribe has raised around $5 million in funding, across a round led by OpenAI CEO Sam Altman and another led by First Round Capital.

Image Credits: Scribe

Siroker told me he sees Zoom as just the “beachhead” for Scribe’s ambitions. Next up, the company will be adding support for products like Google Meet and Microsoft Teams. Eventually, he hopes to build a new “hive mind” for organizations, where everyone is “smarter and better” because so many of their conversations and knowledge are now searchable.

“Where we go after that really depends on where we think we can have the biggest positive impact on people’s lives,” he said. “It’s harder to make a case for personal conversations you have with a spouse but … I think if you strike the right balance between value and privacy and control, you could really get people to adopt this in a way that actually is a win-win.”

And if Scribe actually achieves its mission of helping us to record and recall information in a wide variety of contexts, could that have an impact on our natural ability to remember things?

“Yes is the answer, and I think that’s okay,” he responded. “Your brain has limited energy … Remembering the things somebody said a few weeks ago is something a computer can do amazingly. Why waste your precious brain cycles doing that?”

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion.

Powered by WPeMatico