Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

SpineZone is a startup that creates personalized exercise programs and treatment for neck and back pain. The company uses an online platform and in-person clinics to deliver a curriculum that, ideally, helps patients avoid the need for prescription drugs, injections and surgeries, and providers then avoid the cost of all of the above. Co-founded by brothers Kian Raiszadeh and Kamshad Raiszadeh, the company tells TechCrunch that it has raised $12 million in a Series A round led by Polaris Partners and Providence Ventures, with participation from Martin Ventures.

At its core, SpineZone is a virtual physical therapy platform augmented by in-person clinics. The latter bit is important because it takes a video repository, which has health outcomes baked into it, and helps get those same users some real-life support.

Patients can log onto the site, either through smartphone or laptop, and then answer a series of questions around pain and risk factors. Then, patients can go through a series of exercises. These exercises are created in tandem with professionals, and are based on peer-reviewed and evidence-based articles on musculoskeletal health.

Beyond this digital archive of videos, SpineZone offers an in-person clinic option to help patients practice these exercises. Off of this strategy, the startup claims that it has “1 million lives under management.”

SpineZone’s value proposition is that it helps payers and providers, whether that be employers, clinics or health plans such as Cigna or Aetna, avoid placing their patients in surgeries, which are expensive. By taking care of pain issues before they bubble up, SpineZone says that its current partners have been able to have a 50% reduction in surgery rate (it’s worth noting that COVID-19 could also play a role in this because it is high-risk to enter a medical facility).

Partners are happy because footing the bill of a non-operative procedure is remarkably cheaper than a non-operative procedure.

The cost saving that a medical center could endure can be in the millions. For example, the Sharp Community Medical Group saved $3.4 million in cost savings after working with SpineZone for two years.

SpineZone’s business model is a smidge more complicated than your classic SaaS fee. For example, it charges a clinic based on the number of members it serves per month, and also shares in the downside. For example, if SpineZone promises to get a clinic to $12 million in spend from $15 million, and the cost ends up being $17 million, the company will pay the clinic a portion of the difference. Alternatively, if SpineZone got the clinic to $10 million, even below estimates, it shares in the upside.

SpineZone joins a cohort of health tech startups that focus on musculoskeletal conditions. Venture-backed competitors include Peerwell, Force Therapeutics and Hinge Health, which was most recently valued at $3 billion, with plans to go public.

In order to win, many startups, SpineZone including, need value-based care to replace fee-for-service care. Value-based care is the idea that doctors are paid for outcomes instead of the number of times you enter a doctor’s office. The end goal is that this format creates monetary incentives around getting to an outcome faster: If a doctor is going to make $30,000 on fixing a knee, regardless of whether it takes two appointments or 20 appointments, they might as well do a more thorough job upon check-up instead of elongating the process. The flipside of this, of course, is that doctors might optimize for outcome volume and speed rather than the quality of the result itself.

While SpineZone’s early traction is promising, the healthcare ecosystem still has a ways to go before value-based models take precedence. Right now, Kian Raiszadeh estimates that 10 to 20% of revenue in a medical center comes from value-based care. SpineZone is projecting that it will get to 50% of revenue in the near future.

“And that’s the biggest evolution and tallest lift that we’re expecting,” he said.

Early Stage is the premiere ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico

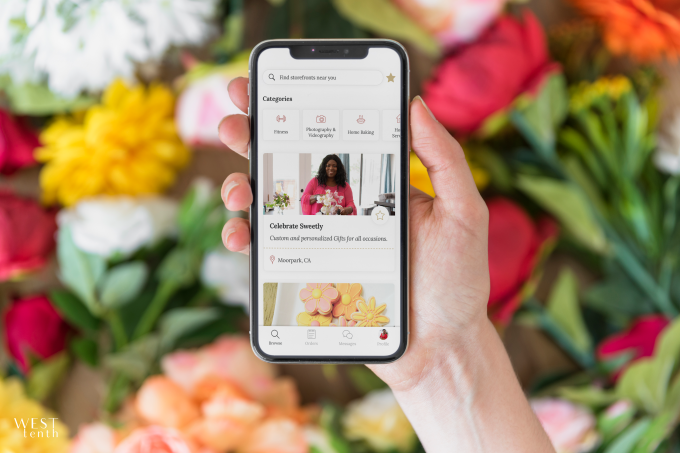

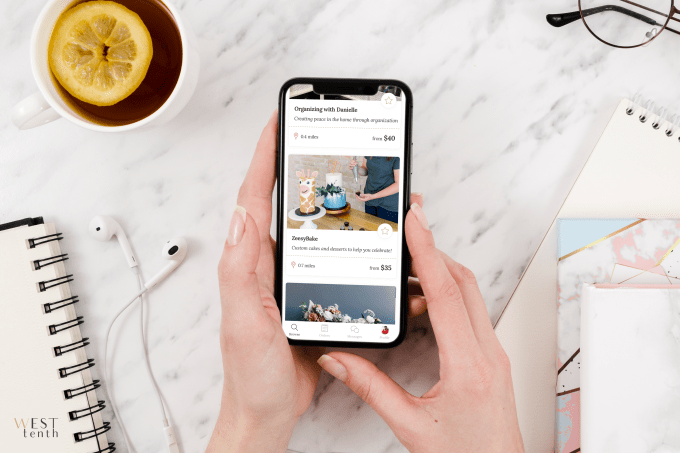

A new digital marketplace called West Tenth, now backed by $1.5 million in seed funding, wants to give women a platform to start and grow their home-based businesses. Through its mobile app, women can promote their business to others in the local community, then field inquiries and requests through the app’s integrated messaging platform, as well as finalize transactions through in-app payments.

The startup was co-founded by Lyn Johnson and Sara Sparhawk, who met when they both worked in finance. Johnson remained in finance, but Sparhawk later moved on to work at Amazon.

Johnson explains that her experience led her to better understand the economic inequality of women in the U.S., where they only own 32 cents to every dollar in financial assets than men own. A large driver of this is that women leave the workforce, often to raise children, which results in years where they don’t have earnings.

“We’re really good as a society at supporting women on the way of out of the workforce to care for their kids, but really terrible at supporting them on the way back in,” Johnson says. “Women know this, and as an alternative to employment that just seems to fail them, they’re starting businesses in droves.”

Image Credits: West Tenth

With West Tenth, the goal is to encourage this sort of entrepreneurship — and more broadly, to help women understand that the many of the talents they’ve developed at home are, in fact, potential businesses.

This includes opportunities like home-based bakers and cooks, photographers, home organizers or designers, home florists, baby sleep consultants, party planning and event services, crafting classes, fitness training, homemade goods, and more.

The company notes that the app isn’t necessarily closed to men, but the current market for U.S. home businesses favors women as they’re more often the partner who chooses to leave work to raise children. However, there are some men on its platform.

Though today many of these entrepreneurs market their home businesses on Facebook, they’re missing opportunities to reach customers if they’re not heavily involved in local groups and responding to requests for recommendations. West Tenth instead centralizes local businesses in one place to make discovery easier.

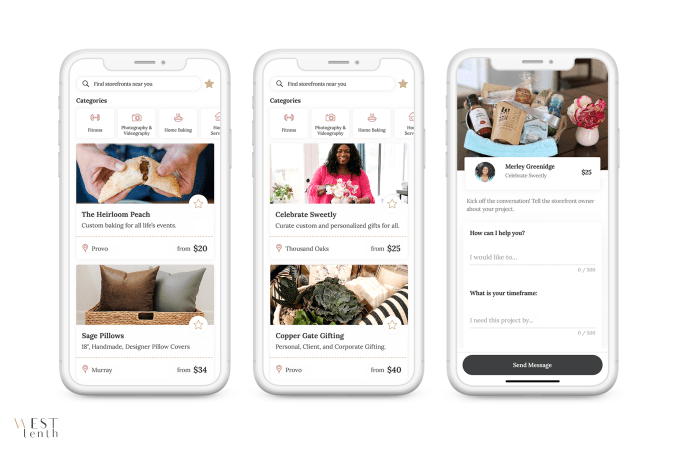

Image Credits: West Tenth

In the app, customers can browse and shop local businesses, filtering by category via buttons at the top of the screen. The results are sorted by distance and offer photos, description, and the starting price for the goods or services offered. Through integrated messaging, users can reach out directly for a quote or more information. Customers can also complete their purchases through the app’s Stripe payments integration. West Tenth takes a 9.5% commission on these sales.

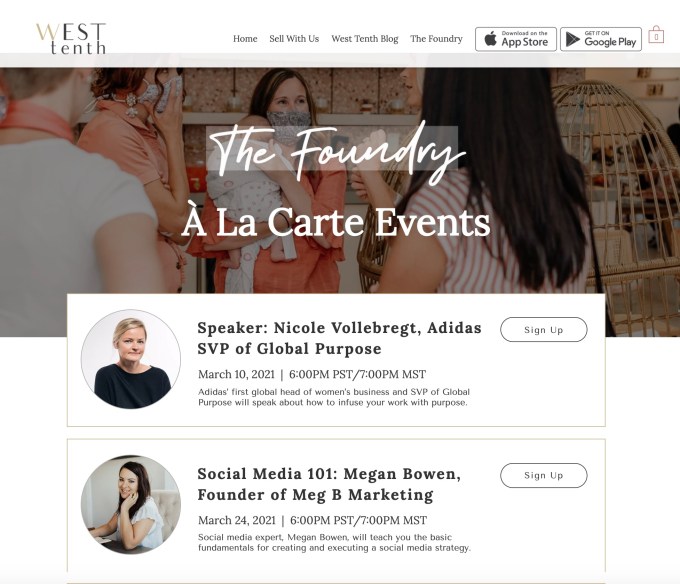

Another key aspect to West Tenth is its education component, The Foundry.

Through a $100 per quarter subscription membership (or $350 per year), business owners will be able to attend bi-monthly events, including classes focused on the fundamentals of setting up home-based businesses, marketing, customer acquisition, and other topics. These classes will also be available à la carte at around $30 apiece, for those who want to pay per session.

In addition, attendees will hear from guest speakers who have experience in the home-based business market, and they’ll be able join mastermind networking groups to exchange ideas with their peers.

Image Credits: West Tenth

This system of combining education and networking with business ownership could potentially help more women become home-based business entrepreneurs instead of joining multi-level marketing (MLM) companies, as is common.

“When we started this, we recognized that MLMs are one of the few kind of industries that’s focused on this demographic of women who’ve left the workforce — which is a huge, untapped talent pool in the U.S.,” notes Johnson. “But they’re really predatory. Only the top 1% of sellers distributors really make money and the rest lose money. And they lose their social capital, as well. What we’re really interested in doing is becoming an alternative to MLMs in many respects,” she adds.

Not surprisingly, MLMs aren’t allowed on the West Tenth platform.

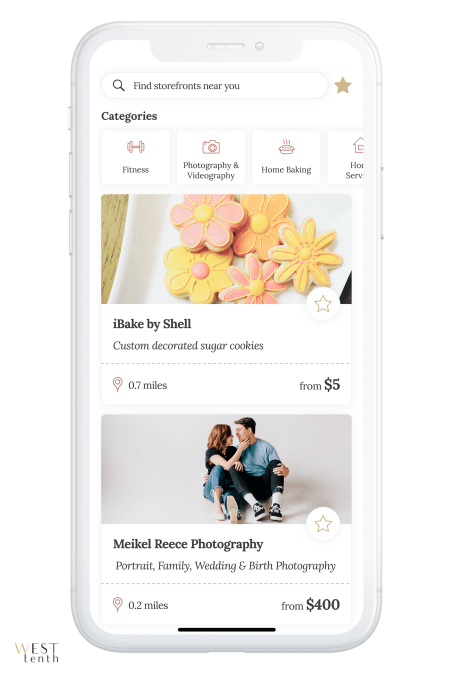

Image Credits: West Tenth

The startup, which completed Kansas City TechStars last summer, has now raised $1.5 million in seed funding to get its platform off the ground. The round was led by Better Ventures along with Stand Together Ventures Lab, Kapital Partners,The Community Fund, Backstage Capital, Wedbush Ventures, and Gaingels.

The funds will be used to develop the product and grow its user base. In time, West Tenth aims to build out product features to better highlight local businesses. This includes shopping elements that will let you see what friends are buying and video demonstrations, among other things.

Since 2019, West Tenth has grown its footprint from just 20 businesses on the app to now over 600, largely in suburban L.A. and Salt Lake City. It’s now aiming to target growth in Phoenix, Boise, and Northern California.

Image Credits: West Tenth

The timing for West Tenth’s expansion is coming on the tail end of the COVID-19 crisis, where things have only gotten worse for women’s traditional employment.

School and daycare closures combined with job losses that greatly impacted women’s roles have now driven more women out of the workforce compared with men. And according to McKinsey, women accounted for nearly 56% of workforce exits since the start of the pandemic, despite making up just 48% of the workforce. This COVID-driven “shecession,” as some have dubbed it, is also disproportionately impacting women of color, studies have found.

“We’ve seen 5 million women exit the workforce — some because they were laid off or furloughed, and a huge chunk because they’re opting out because the caregiving responsibilities just became overwhelming,” says Johnson.

“The thing is when women leave the workforce for caregiving reasons — for some reason we really discount that and we make it even harder for them to return to work. So I think over the next 18 to 24 months, we’ll see a big surge in economic activity in the home with women trying to bring in additional sources of income by running a business from the home,” she says.

The West Tenth app is available on both iOS and Android.

Early Stage is the premiere ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included in each for audience questions and discussion.

Powered by WPeMatico

A startup by an Apple alum that has become home to millions of low-skilled workers in India said on Tuesday it has raised an additional $12.5 million, just five months after securing $8 million from high-profile investors.

One-year-old Apna said Sequoia Capital India and Greenoaks Capital led the $12.5 million Series B investment in the startup. Existing investors Lightspeed India and Rocketship VC also participated in the round. The startup, whose name is Hindi for “ours,” has now raised more than $20 million.

More than 6 million low-skilled workers such as drivers, delivery personnel, electricians and beauticians have joined Apna to find jobs and upskill themselves. But there’s more to this.

An analysis of the platform showed how workers are helping one another solve problems — such as a beautician advising another beautician to perform hair dressing in a particular way that tends to make customers happier and tip more, and someone sharing how they negotiated a hike in their salary from their employer.

“The sole idea of this is to create a network for these workers,” Nirmit Parikh, Apna founder and chief executive told TechCrunch in an interview. “Network gap has been a very crucial challenge. Solving it enables people to unlock more and more opportunities,” he said. Harshjit Sethi, principal at Sequoia India, said Apna was making inroads with “building a professional social network for India.”

The startup has become an attraction for several big firms, including Amazon, Flipkart, Unacademy, Byju’s, Swiggy, BigBasket, Dunzo, BlueStar and Grofers, which have joined as recruiters to hire workers. Apna offers a straightforward onboarding process — thanks to support for multiple local languages — and allows users to create a virtual business card, which is then shown to the potential recruiters. Parikh said Apna’s AI understands the cultural nuances, helping recruiters find the best candidates for their needs.

The past six months have been all about growth at Apna, said Parikh. The app, available on Android, had 1.2 million users in August last year, for instance. During this period, there have been 60 million interactions between recruiters and potential applicants, he said. The platform, which has amassed more than 80,000 employers, has a retention rate of over 95%, said Parikh.

“Apna has taken a jobs-centric approach to upskilling that we are very excited about. Lack of accountability has been the core issue with current skill / vocational learning alternatives for grey and blue-collar workers. Apna has turned the problem on its head by creating net-positive job outcomes for anyone who chooses to upskill on the platform,” said Vaibhav Agrawal, partner at Lightspeed India, in a statement.

Image Credits: Nirmit Parikh

Parikh got the idea of building Apna after he kept hearing about the difficulty his family and friends faced in India in hiring people. This was puzzling to Parikh, as he wondered how could there be a shortage of workers in India when there are hundreds of millions of people actively looking for such jobs. The problem, Parikh realized, was that there wasn’t a scalable networking infrastructure in place to connect workers with employers.

Before creating the startup, Parikh met workers and went undercover as an electrician and floor manager to understand the problems workers were facing. That journey has not ended. The startup talks to over 15,000 users each day to understand what else Apna could do for them.

“One of the things we heard was that users were facing difficulties with interviews. So we started groups to practice them with interviews. We also started upskilling users, which has made us an edtech player. We plan to ramp up this effort in the coming months,” said Parikh, who also started an AI firm more than a decade ago to solve challenges with electricity flux and then another startup to solve for information overload. (The first startup is now being run by family and friends, and the second firm was sold to Intel, Parikh said.)

Parikh said the startup is overwhelmed each day with the response it is getting from its customers and the industry. Each day, he said, people share how they were able to land jobs, or increase their earnings. In recent months, several high-profile executives from companies such as Uber and BCG have joined Apna to scale the startup’s vision, he said, adding that the problem Apna is solving in India exists everywhere and the startup’s hope is to eventually serve people across the globe.

The app currently has no ads, and Parikh said he intends to not change that. “Once you get in the ad business, you start doing things you probably shouldn’t be doing,” he said. The startup instead plans to monetize its platform by charging recruiters, and offering upskill courses. But Parikh maintained that Apna will always offer its courses to users for free. The premium version will target those who need extensive assistance, he said. The startup also plans to expand its team.

As is the case elsewhere, millions of people lost their livelihood in India in the past year as coronavirus shut many businesses and workers migrated to their homes. There are over 250 million blue and grey-collar workers in India, and providing them meaningful employment opportunities is one of the biggest challenges in our country, said Sethi.

Powered by WPeMatico

Skydio has raised $170 million in a Series D funding round led by Andreessen Horowitz’s Growth Fund. That pushes it into unicorn territory, with $340 million in total funding and a post-money valuation north of $1 billion. Skydio’s fresh capital comes on the heels of its expansion last year into the enterprise market, and it intends to use the considerable pile of cash to help it expand globally and accelerate product development.

In July of last year, Skydio announced its $100 million Series C financing, and also debuted the X2, its first dedicated enterprise drone. The company also launched a suite of software for commercial and enterprise customers, its first departure from the consumer drone market where it had been focused prior to that raise since its founding in 2014.

Skydio’s debut drone, the R1, received a lot of accolades and praise for its autonomous capabilities. Unlike other consumer drones at the time, including from recreational drone maker DJI, the R1 could track a target and film them while avoiding obstacles without any human intervention required. Skydio then released the Skydio 2 in 2019, its second drone, cutting off more than half the price while improving on it its autonomous tracking and video capabilities.

Late last year, Skydio brought on additional senior talent to help it address enterprise and government customers, including a software development lead who had experience at Tesla and 3D printing company Carbon. Skydio also hired two Samsara executives at the same time to work on product and engineering. Samsara provides a platform for managing cloud-based fleet operations for large enterprises.

The applications of Skydio’s technology for commercial, public sector and enterprise organizations are many and varied. Already, the company works with public utilities, fire departments, construction firms and more to do work including remote inspection, emergency response, urban planning and more. Skydio’s U.S. pedigree also puts it in prime position to capitalize on the growing interest in applications from the defense sector.

a16z previously led Skydio’s Series A round. Other investors who participated in this Series D include Lines Capital, Next47, IVP and UP.Partners.

Powered by WPeMatico

Japanese space startup Gitai has raised a $17.1 million funding round, a Series B financing for the robotics startup. This new funding will be used for hiring, as well as funding the development and execution of an on-orbit demonstration mission for the company’s robotic technology, which will show its efficacy in performing in-space satellite servicing work. That mission is currently set to take place in 2023.

Gitai will also be staffing up in the U.S., specifically, as it seeks to expand its stateside presence in a bid to attract more business from that market.

“We are proceeding well in the Japanese market, and we’ve already contracted missions from Japanese companies, but we haven’t expanded to the U.S. market yet,” explained Gitai founder and CEO Sho Nakanose in an interview. So we would like to get missions from U.S. commercial space companies, as a subcontractor first. We’re especially interested in on-orbit servicing, and we would like to provide general-purpose robotic solutions for an orbital service provider in the U.S.”

Nakanose told me that Gitai has plenty of experience under its belt developing robots which are specifically able to install hardware on satellites on-orbit, which could potentially be useful for upgrading existing satellites and constellations with new capabilities, for changing out batteries to keep satellites operational beyond their service life, or for repairing satellites if they should malfunction.

Gitai’s focus isn’t exclusively on extra-vehicular activity in the vacuum of space, however. It’s also performing a demonstration mission of its technical capabilities in partnership with Nanoracks using the Bishop Airlock, which is the first permanent commercial addition to the International Space Station. Gitai’s robot, codenamed S1, is an arm–style robot not unlike industrial robots here on Earth, and it’ll be showing off a number of its capabilities, including operating a control panel and changing out cables.

Long-term, Gitai’s goal is to create a robotic workforce that can assist with establishing bases and colonies on the Moon and Mars, as well as in orbit. With NASA’s plans to build a more permanent research presence on orbit at the Moon, as well as on the surface, with the eventual goal of reaching Mars, and private companies like SpaceX and Blue Origin looking ahead to more permanent colonies on Mars, as well as large in-space habitats hosting humans as well as commercial activity, Nakanose suggests that there’s going to be ample need for low-cost, efficient robotic labor – particularly in environments that are inhospitable to human life.

Nakanose told me that he actually got started with Gitai after the loss of his mother – an unfortunate passing he said he firmly believes could have been avoided with the aid of robotic intervention. He began developing robots that could expand and augment human capability, and then researched what was likely the most useful and needed application of this technology from a commercial perspective. That research led Nakanose to conclude that space was the best long-term opportunity for a new robotics startup, and Gitai was born.

This funding was led by SPARX Innovation for the Future Co. Ltd, and includes funding form DcI Venture Growth Fund, the Dai-ichi Life Insurance Company, and EP-GB (Epson’s venture investment arm).

Powered by WPeMatico

Newsela, a SaaS platform for K-12 instructional material backed by the likes of TCV, Kleiner Perkins, Reach Capital and Owl Ventures, announced today that it has raised $100 million in a Series D round. The financing was led by new investor Franklin Templeton, and brings Newsela’s valuation to $1 billion. The new round is larger than the aggregate of Newsela’s prior capital raised to date.

“Hitting $1 billion [in valuation] doesn’t change a thing,” Newsela CEO Matthew Gross told TechCrunch. But the startup is joining Quizlet, ApplyBoard and CourseHero as companies within the sector that have hit the unicorn mark as remote education continues to gain traction.

Newsela has created a platform that strings together a number of different third-party content, such as primary source documents or the latest National Geographic articles. Gross defines it as “material that isn’t purpose-built for education, [but] purpose-built for being interesting and informative.” If Newsela is doing its job right, the content can replace textbooks within a classroom altogether, while helping teachers give fresh, personalized material.

“Textbooks are dead in classrooms, but are well-and-live in district purchasing,” Gross said. The startup is on a mission to distribute its product better, and the money will be used to get it into more classrooms. Part of this, Gross explains, is telling teachers what else it can provide along with textbooks. Analytics has become a big part of Newsela’s business, as remote learning hurts student engagement.

The startup’s paid product is between $6 to $14 per student, which contrasts with textbooks that can cost a school $20 to $40 per student “even on an annualized basis.”

Like other edtech companies, Newsela offered its product for free in the beginning of the pandemic, which gave it a healthy bump of new users.

Newsela estimates that gross bookings have grown 115% over the pandemic, and that revenue grew 81%. It declined to share revenue numbers or if it has hit profitability. There will be more than 11 million students using Newsela licensing by the end of 2021, Gross said.

Newsela estimates that two-thirds of public schools in the United States are using their platform, likely aided by school district flexibility that has grown amid the pandemic.

Powered by WPeMatico

Every business needs to track fundamental financial information, but the data typically lives in a variety of silos, making it a constant challenge to understand a company’s overall financial health. DataJoy, an early-stage startup, wants to solve that issue. The company announced a $6 million seed round today led by Foundation Capital with help from Quarry VC, Partech Partners, IGSB, Bow Capital and SVB.

Like many startup founders, CEO Jon Lee has experienced the frustration firsthand of trying to gather this financial data, and he decided to start a company to deal with it once and for all. “The reason why I started this company was that I was really frustrated at Copper, my last company, because it was really hard just to find the answers to simple business questions in my data,” he told me.

These include basic questions like how the business is doing this quarter, if there are any surprises that could throw the company off track and where are the best places to invest in the business to accelerate more quickly.

The company has decided to concentrate its efforts for starters on SaaS companies and their requirements. “We basically focus on taking the work out of revenue intelligence, and just give you the insights that successful companies in the SaaS vertical depend on to be the largest and fastest growing in the market,” Lee explained.

The idea is to build a product with a way to connect to key business systems, pull the data and answer a very specific set of business questions, while using machine learning to provide more proactive advice.

While the company is still in the process of building the product and is pre-revenue, it has begun developing the pieces to ultimately help companies answer these questions. Eventually it will have a set of connectors to various key systems like Salesforce for CRM, HubSpot and Marketo for marketing, NetSuite for ERP, Gainsight for customer experience and Amplitude for product intelligence.

Lee says the set of connectors will be as specific as the questions themselves and based on their research with potential customers and what they are using to track this information. Ashu Garg, general partner at lead investor Foundation Capital, says that he was attracted to the founding team’s experience, but also to the fact they were solving a problem he sees all the time sitting on the boards of various SaaS startups.

“I spend my life in the board meetings. It’s what I do, and every CEO, every board is looking for straight answers for what should be obvious questions, but they require this intersection of data,” Garg said. He says to an extent, it’s only possible now due to the evolution of technology to pull this all together in a way that simplifies this process.

The company currently has 11 employees, with plans to double that by the middle of this year. As a longtime entrepreneur, Lee says that he has found that building a diverse workforce is essential to building a successful company. “People have found diversity usually [results in a company that is] more productive, more creative and works faster,” Lee said. He said that that’s why it’s important to focus on diversity from the earliest days of the company, while being proactive to make that happen. For example, ensuring you have a diverse set of candidates to choose from when you are reviewing resumes.

For now, the company is 100% remote. In fact, Lee and his co-founder, Chief Product Officer Ken Wong, who previously ran AI and machine learning at Tableau, have yet to meet in person, but they are hoping that changes soon. The company will eventually have a presence in Vancouver and San Mateo whenever offices start to open.

Powered by WPeMatico

Singapore is quickly turning into a hub for food-tech startups, partly because of government initiatives supporting the development of meat alternatives. One of the newest entrants is Next Gen, which will launch its plant-based “chicken” brand, called TiNDLE, in Singaporean restaurants next month. The company announced today that it has raised $10 million in seed funding from investors including Temasek, K3 Ventures, EDB New Ventures (an investment arm of the Singapore Economic Development Board), NX-Food, FEBE Ventures and Blue Horizon.

Next Gen claims this is the largest seed round ever raised by a plant-based food tech company, based on data from PitchBook. This is the first time the startup has taken external investment, and the funding exceeded its original target of $7 million. Next Gen was launched last October by Timo Recker and Andre Menezes, with $2.2 million of founder capital.

Next Gen’s first product is called TiNDLE Thy, an alternative to chicken thighs. Its ingredients include water, soy, wheat, oat fiber, coconut oil and methylcellulose, a culinary binder, but the key to its chicken-like flavor is a proprietary blend of plant-based fats, like sunflower oil, and natural flavors that allows it to cook like chicken meat.

Menezes, Next Gen’s chief operating officer, told TechCrunch that the company’s goal is to be the global leader in plant-based chicken, the way Impossible and Beyond are known for their burgers.

“Consumers and chefs want texture in chicken, the taste and aroma, and that is largely related to chicken fat, which is why we started with thighs instead of breasts,” said Menezes. “We created a chicken fat made from a blend, called Lipi, to emulate the smell, aroma and browning when you cook.”

Both Recker and Menezes have years of experience in the food industry. Recker founded German-based LikeMeat, a plant-based meat producer acquired by the LIVEKINDLY Collective last year. Menezes’ food career started in Brazil at one of the world’s largest poultry exporters. He began working with plant-based meat after serving as general manager of Country Foods, a Singaporean importer and distributor that focuses on innovative, sustainable products.

“It was clear to me after I was inside the meat industry for so long that it was not going to be a sustainable business in the long run,” Menezes said.

Over the past few years, more consumers have started to feel the same way, and began looking for alternatives to animal products. UBS expects the global plant-based protein market to increase at a compounded annual growth rate of more than 30%, reaching about $50 billion by 2025, as more people, even those who aren’t vegans or vegetarians, seek healthier, humane sources of protein.

Millennial and Gen Z consumers, in particular, are willing to reduce their consumption of meat, eggs and dairy products as they become more aware of the environmental impact of industrial livestock production, said Menezes. “They understand the sustainability angle of it, and the health aspect, like the cholesterol or nutritional values, depending on what product you are talking about.”

Low in sodium and saturated fat, TiNDLE Thy has received the Healthier Choice Symbol, which is administered by Singapore’s Health Promotion Board. Next Gen’s new funding will be used to launch TiNDLE Thy, starting in popular Singaporean restaurants like Three Buns Quayside, the Prive Group, 28 HongKong Street, Bayswater Kitchen and The Goodburger.

Over the next year or two, Next Gen plans to raise its Series A round, launch more brands and products, and expand in its target markets: the United States (where it is currently recruiting a growth director to build a distribution network), China, Brazil and Europe. After working with restaurant partners, Next Gen also plans to make its products available to home cooks.

“The reason we started with chefs is because they are very hard to crack, and if chefs are happy with the product, then we’re very sure customers will be, too,” said Menezes.

Powered by WPeMatico

Through all of the last year’s lockdowns, venue closures and other social distancing measures that governments have enacted and people have followed to slow the spread of COVID-19, shopping — and specifically e-commerce — has remained a consistent and hugely important service. It’s not just something that we had to do; it’s been an important lifeline for many of us at a time when so little else has felt normal. Today, one of the startups that saw a big lift in its service as a result of that trend is announcing a major fundraise to fuel its growth.

Wallapop, a virtual marketplace based out of Barcelona, Spain that lets people resell their used items, or sell items like crafts that they make themselves, has raised €157 million ($191 million at current rates), money that it will use to continue growing the infrastructure that underpins its service, so that it can expand the number of people that use it.

Wallapop has confirmed that the funding is coming at a valuation of €690 million ($840 million) — a significant jump on the $570 million valuations sources close to the company gave us in 2016.

The funding is being led by Korelya Capital, a French VC fund backed by Korea’s Naver, with Accel, Insight Partners, 14W, GP Bullhound and Northzone — all previous backers of Wallapop — also participating.

The company currently has 15 million users — about half of Spain’s internet population, CEO Rob Cassedy pointed out to us in an interview earlier today, and has maintained a decent No. 4 ranking among Spain’s shopping apps, according to figures from App Annie.

The startup has also recently been building out shipping services, called Envios, to help people get the items they are selling to the buyers, which has expanded the range from local sales to those that can be made across the country. About 20% of goods go through Envios now, Cassedy said, and the plan is to continue doubling down on that and related services.

Naver itself is a strong player in e-commerce and apps — it’s the company behind Asian messaging giant Line, among other digital properties — and so this is in part a strategic investment. Wallapop will be leaning on Naver and its technology in its own R&D, and on Naver’s side it will give the company a foothold in the European market at a time when it has been sharpening its strategy in e-commerce.

The funding is an interesting turn for a company that has seen some notable fits and starts. Founded in 2013 in Spain, it quickly shot to the top of the charts in a market that has traditionally been slow to embrace e-commerce over more traditional brick-and-mortar retail.

By 2016, Wallapop was merging with a rival, LetGo, as part of a bigger strategy to crack the U.S. market (with more capital in tow).

But by 2018, that plan was quietly shelved, with Wallapop quietly selling its stake in the LetGo venture for $189 million. (LetGo raised $500 million more on its own around that time, but its fate was not to remain independent: it was eventually acquired by yet another competitor in the virtual classifieds space, OfferUp, in 2020, for an undisclosed sum.)

Wallapop has for the last two years focused mainly on growing in Spain rather than running after business further afield, and rather than growing the range of goods that it might sell on its platform — it doesn’t sell food, nor work with retailers in an Amazon-style marketplace play, nor does it have plans to do anything like move into video or selling other kinds of digital services — it has honed in specifically on trying to improve the experience that it does offer to users.

“I spent 12 years at eBay and saw the transition it made to new goods from used goods,” said Cassedy. “Let’s just say it wasn’t the direction I thought we should take for Wallapop. We are laser-focused on unique goods, with the vast majority of that secondhand with some artisan products. It is very different from big box.”

Wallapop’s growth in the past year is the result of some specific trends in the market that were in part fuelled by the COVID-19 pandemic.

People spending more time in their homes have been focused on clearing out space and getting rid of things. Others are keen to buy new items now that they are spending more time at home, but want to spend less on them. In both cases, there has been a push for more sustainability, with people putting less waste into the world by recycling and upcycling goods instead.

At the same time, Facebook hasn’t really made big inroads in the country with its Marketplace, and Amazon has also not appeared as a threat to Wallapop, Cassedy noted.

All of these have had a huge impact on Wallapop’s business, but it wasn’t always this way. Cassedy said that the first lockdown in Spain saw business plummet, as people were restricted to leave their homes.

“It was a roller coaster for us,” he said. “We entered the year with incredible momentum, very strong.”

He noted that the drop started in March, when “not only did it become not okay to leave the house and trade locally but the post office stopped delivering parcels. Our business went off a cliff in March and April.”

Then when the restrictions were lifted in May, things started to bounce back more than ever before, nearly overnight, he said. “The economic uncertainty caused people to seek out more value, better deals, spending less money, and yes they were clearing out closets. We saw numbers bounce back 40-50% growth year-on-year in June.”

The big question was whether that growth was a blip or there to say. He said it has continued into 2021 so far. “It’s a validation of what we see as long-term trends driving the business.”

“The global demand for C2C and resale platforms is growing with renewed commitment in sustainable consumption, especially by younger millennials and Gen Z,” noted Seong-sook Han, CEO of Naver Corp., in a statement. “We agree with Wallapop’s philosophy of conscious consumption and are enthused to support their growth with our technology and develop international synergies.”

“Our economies are switching towards a more sustainable development model; after investing in Vestiaire Collective last year, wallapop is Korelya’s second investment in the circular economy, while COVID-19 is only strengthening that trend. It is Korelya’s mission to back tomorrow’s European tech champions and we believe that NAVER has a proven tech and product edge that will help the company reinforce its leading position in Europe,” added Fleur Pellerin, CEO of Korelya Capital.

Powered by WPeMatico

This morning MealMe.ai, a food search engine, announced that it has closed a $900,000 pre-seed round. Palm Drive Capital led the round, with participation from Slow Ventures and CP Ventures.

TechCrunch first became familiar with MealMe when it presented as part of the Techstars Atlanta demo day last October, mentioning it in a roundup of favorite startups from a group of the accelerator’s startup cohorts.

The company’s product allows users to search for food, or a restaurant. It then displays price points from various food-delivery apps for what the user wants to eat and have delivered. And, notably, MealMe allows for in-app checkout, regardless of the selected provider.

The service could boost pricing and delivery-speed transparency amongst the different apps that help folks eat, like DoorDash and Uber Eats. But Mealme didn’t start out looking to build a search engine. Instead it took a few changes in direction to get there.

MealMe is an example of a startup whose first idea proved only directionally correct. The company began life as a food-focused social network, co-founder Matthew Bouchner told TechCrunch. That iteration of the service allowed users to view posted food pictures, and then find ordering options for what they saw.

While still operating as a social network, MealMe applied to both Y Combinator and Techstars, but wasn’t accepted at either.

The startup discovered that some of its users were posting food pics simply to get the service to tell them which delivery services would be able to bring them what they wanted. From that learning the company focused on building a food search engine, allowing users to search for restaurants, and then vet various delivery options and prices. That iteration of the product got the company into Techstars Atlanta, eventually leading to the demo day that TechCrunch reviewed.

During its time in Techstars, the company adjusted its model to not merely link to DoorDash and others, but to handle checkout inside of its own application. This captures more gross merchandize value (GMV) inside of MealMe, Bouchner explained in an interview. The capability was rolled out in September of 2020.

Since then the company has seen rapid growth, which it measures at around 20% week-on-week. During TechCrunch’s interview with MealMe, the company said that it had reached a GMV run rate of more than $500,000, and was scaling toward the $1 million mark. In the intervening weeks the company passed the $1 million GMV run-rate threshold.

MealMe was slightly coy on its business model, but it appears to make margin between what it charges users for orders and the total revenue it passes along to food delivery apps.

TechCrunch was curious about platform risk at MealMe; could the company get away with offering price comparison and ordering across multiple third-party delivery services without raising the ire of the companies behind those apps? At the time of our interview, Bouchner said that his company had not seen pushback from the services it sends users to. His company’s goal is to grow quickly, become a useful revenue source for the DoorDashes of the world, and then reach out for some of formal agreement, he explained.

“We continue to be a powerful revenue generator and drive thousands of orders to food delivery services per week,” the co-founder said in a written statement. Certainly MealMe found investors more excited by its growth than concerned about Uber Eats or other apps cutting the startup off from their service.

What first caught my eye about MealMe was the realization of how much I would have used it in my early 20s. Perhaps the company can find enough users like my younger self to help it scale to sufficient size that it can go to the major food ordering companies and demand a cut, not merely avoid being cut off.

Powered by WPeMatico