Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Employers today often use perks to attract new talent in the form of discounts and deals, commuter funds, gym memberships, child care, free lunches and more. But the pandemic has impacted what sort of in-office or other in-person perks employees can access. That’s led to booming growth — and now, a fundraise — for a startup called Fringe, which offers companies a personalized marketplace of perks that people really want, like Netflix, Uber, Airbnb, DoorDash, Headspace, Talkspace and over 100 other apps.

The idea for Fringe came about from the co-founders’ work as financial advisors where they regularly found themselves consulting people who were weighing new job options and their associated benefits.

“Companies are spending a lot money on traditional benefits … $800, $1,000 a month per person. But the perceived value for most employees is relatively small, given the cost,” explains Fringe CEO Jordan Peace. “I started thinking about what could [companies] offer employees that would be a pretty low actual cost, but a really high perceived value?”

He landed on the idea of subscription services — things people use all the time in their daily lives, but sometimes feel just out of reach from a budgetary standpoint.

That’s where Fringe comes in.

Employers sign up for access to Fringe’s platform at a starting cost of $5 per employee per month. (The rate may decrease for larger organizations.) They then place the dollars they would normally spend on lifestyle benefits into the Fringe accounts of their employees, where they’re converted to “points” that can be spent on any of the apps and services.

Fringe Platform Walkthrough from Fringe on Vimeo.

Today, the marketplace offers a range of benefits, including streaming services like Netflix, Spotify, Disney+ and Audible, as well as virtual fitness, virtual coaching and wellness, online therapy like Talkspace, food and grocery delivery, like Grubhub, Uber Eats, Instacart, and Shipt, prepackaged meals, child care like UrbanSitter, and more.

In the U.S., there are 135 services partners to choose from, with another couple hundred that are available overseas.

The startup’s business model involves negotiating a discount of anywhere from 10% to up to 60% off these services, which it passes along to the employees through its points back (rebate) system. Initially, it only allowed employees to spend their employer-provided lifestyle benefits dollars on Fringe. But due to user demand, it later opened up to allow employees to spend their own money, too — a feature they wanted specifically because of the points back.

Fringe first launched in 2019 — well ahead of the pandemic — and saw some slow but steady growth. It ended the year with 15 clients, representing a couple hundred employees in total.

But then the COVID-19 pandemic hit, which sent a number of employees to work from home in a radical change to business culture that appears to have lasting impacts.

“After the dust settled from the first few months of COVID, we started getting 10 … 20 times more inbound interest,” Peace says, as companies realized Fringe could be a way to support their employees working from home.

“We were just in the right place at the right time to begin to profit from this changed workplace. And it’s not just a ‘pandemic perk.’ We’re going to get past COVID, and we’re still going to have two-thirds of people working from home. The workplace has changed,” he adds.

Image Credits: Fringe CEO Jordan Peace

By the end of 2020, Fringe had grown its client base to over 70 employers, representing now over 12,000 users on its platform. Today, its pipeline includes companies with between 200 and 2,000 employees — a sweet spot that allows them to move relatively quickly. This client base often includes tech companies, like car-sharing startup Turo or talent management system Cornerstone OnDemand, for example.

This year, Fringe expects to grow to well over 100,000 users on its platform, and increase its own team’s headcount, which is today around 20. It also plans to update its marketplace website to include things like automatic point gifting, charitable giving, new Slack integrations, improved navigation, and more.

As a result of the recent growth, Fringe has raised $2.2 million in new funding, in a round led by Sovereign’s Capital, with participation from Felton Group, Manchester Story, the Center for Innovative Technology and angel investors, including Jaffray Woodriff. As part of this investment, the company also added longtime advisor William Boland, senior director of Corporate Development and Strategy at Mission Lane, to its board of directors.

With the addition of the new funds, the startup’s total raise to date is $4 million.

Fringe believes the advantage of its marketplace is that it can be personalized to the user. Typically, employers determine what benefits to offer by running employee surveys, where the majority wins. That’s why many companies today provide perks like backup child care or discounted gym access. But this system discounts the minority’s needs — people who may not have kids or don’t want to work out. People who wish they could use their benefits dollars in a different way.

In addition to employee perks, Fringe believes that having so many subscriptions under one roof could present other opportunities farther down the line.

Woodriff, for example, sees Fringe’s potential as a big data play, in terms of who is signing up for what subscriptions and why.

“But if you think about the fact that you’ve got a subscription service marketplace … there’s more applications to that than just employee benefits,” Peace explains. “I’d like our Series A to be predicated upon the much greater total addressable market. And so I think we’re going to spend the next year to 18 months laying down concrete plans and building the tech to be ready to roll out a couple of different use cases,” he says.

Powered by WPeMatico

Back when I was a wee lad with a very security-compromised MySQL installation, I used to answer every web request with multiple “SELECT *” database requests — give me all the data and I’ll figure out what to do with it myself.

Today in a modern, data-intensive org, “SELECT *” will kill you. With petabytes of information, tens of thousands of tables (on the small side!), and millions and perhaps billions of calls flung at the database server, data science teams can no longer just ask for all the data and start working with it immediately.

Big data has led to the rise of data warehouses and data lakes (and apparently data lake houses), infrastructure to make accessing data more robust and easy. There is still a cataloguing and discovery problem though — just because you have all of your data in one place doesn’t mean a data scientist knows what the data represents, who owns it or what that data might affect in the myriad web and corporate reporting apps built on top of it.

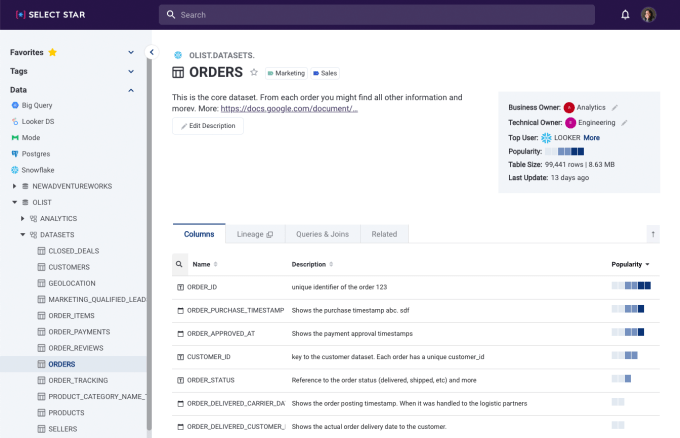

That’s where Select Star comes in. The startup, which was founded about a year ago (in March 2020), is designed to automatically build out metadata within the context of a data warehouse. From there, it offers a full-text search that allows users to quickly find data as well as “heat map” signals in its search results, which can quickly pinpoint which columns of a data set are most used by applications within a company and have the most queries that reference them.

The product is SaaS, and it is designed to allow for quick onboarding by connecting to a customer’s data warehouse or business intelligence (BI) tool.

Select Star’s interface allows data scientists to understand what data they are looking at. Image via Select Star.

Shinji Kim, the sole founder and CEO, explained that the tool is a solution to a problem she has seen directly in corporate data science teams. She formerly founded Concord Systems, a real-time data processing startup that was acquired by Akamai in 2016. “The part that I noticed is that we now have all the data and we have the ability to compute, but now the next challenge is to know what the data is and how to use it,” she explained.

She said that “tribal knowledge is starting to become more wasteful [in] time and pain in growing companies,” and pointed out that large companies like Facebook, Airbnb, Uber, Lyft, Spotify and others have built out their own homebrewed data discovery tools. Her mission for Select Star is to allow any corporation to quickly tap into an easy-to-use platform to solve this problem.

The company raised a $2.5 million seed round led by Bowery Capital, with participation from Background Capital and a number of prominent angels including Spencer Kimball, Scott Belsky, Nick Caldwell, Michael Li, Ryan Denehy and TLC Collective.

Data discovery tools have been around in some form for years, with popular companies like Alation having raised tens of millions of VC dollars over the years. Kim sees an opportunity to compete by offering a better onboarding experience and also automating large parts of the workflow that remain manual for many alternative data discovery tools. With many of these tools, “they don’t do the work of connecting and building the relationship,” between data she said, adding that “documentation is still important, but being able to automatically generate [metadata] allows data teams to get value right away.”

Select Star’s team, with CEO and founder Shinji Kim in top row, middle. Image via Select Star.

In addition to just understanding data, Select Star can help data engineers begin to figure out how to change their databases without leading to cascading errors. The platform can identify how columns are used and how a change to one may affect other applications or even other data sets.

Select Star is coming out of private beta today. The company’s team currently has seven people, and Kim says they are focused on growing the team and making it even easier to onboard users by the end of the year.

Powered by WPeMatico

Aquarium, a startup from two former Cruise employees, wants to help companies refine their machine learning model data more easily and move the models into production faster. Today the company announced a $2.6 million seed led by Sequoia with participation from Y Combinator and a bunch of angel investors, including Cruise co-founders Kyle Vogt and Dan Kan.

When the two co-founders, CEO Peter Gao and head of engineering Quinn Johnson, were at Cruise they learned that finding areas of weakness in the model data was often the problem that prevented it from getting into production. Aquarium aims to solve this issue.

“Aquarium is a machine learning data management system that helps people improve model performance by improving the data that it’s trained on, which is usually the most important part of making the model work in production,” Gao told me.

He says that they are seeing a lot of different models being built across a variety of industries, but teams are getting stuck because iterating on the data set and continually finding relevant data is a hard problem to solve. That’s why Aquarium’s founders decided to focus on this.

“It turns out that most of the improvement to your model, and most of the work that it takes to get it into production is about deciding, ‘Here’s what I need to go and collect next. Here’s what I need to go label. Here’s what I need to go and retrain my model on and analyze it for errors and repeat that iteration cycle,” Gao explained.

The idea is to get a model into production that outperforms humans. One customer, Sterblue, offers a good example. They provide drone inspection services for wind turbines. Their customers used to send out humans to inspect the turbines for damage, but with a set of drone data, they were able to train a machine learning model to find issues. Using Aquarium, they refined their model and improved accuracy by 13%, while cutting the cost of human reviews in half, Gao said.

The Aquarium team. Image: Aquarium

Aquarium currently has seven employees, including the founders, of which three are women. Gao says that they are being diverse by design. He understands the issues of bias inherent in machine learning model creation, and creating a diverse team for this kind of tooling is one way to help mitigate that bias.

The company launched last February and spent part of the year participating in the Y Combinator Summer 2020 cohort. They worked on refining the product throughout 2020, and recently opened it up from beta to generally available.

Powered by WPeMatico

Many companies spend a significant amount of money and resources processing data from logs, traces and metrics, forcing them to make trade-offs about how much to collect and store. Hydrolix, an early-stage startup, announced a $10 million seed round today to help tackle logging at scale, while using unique technology to lower the cost of storing and querying this data.

Wing Venture Capital led the round with help from AV8 Ventures, Oregon Venture Fund and Silicon Valley Data Capital.

Company CEO and co-founder Marty Kagan noted that in his previous roles, he saw organizations with tons of data in logs, metrics and traces that could be valuable to various parts of the company, but most organizations couldn’t afford the high cost to maintain these records for very long due to the incredible volume of data involved. He started Hydrolix because he wanted to change the economics to make it easier to store and query this valuable data.

“The classic problem with these cluster-based databases is that they’ve got locally attached storage. So as the data set gets larger, you have no choice but to either spend a ton of money to grow your cluster or separate your hot and cold data to keep your costs under control,” Kagan told me.

What’s more, he says that when it comes to querying, the solutions out there like BigQuery and Snowflake are not well-suited for this kind of data. “They rely really heavily on caching and bulk column scans, so they’re not really useful for […] these infrastructure plays where you want to do livestream ingest, and you want to be able to do ad hoc data exploration,” he said.

Hydrolix wanted to create a more cost-effective way of storing and querying log data, while solving these issues with other tooling. “So we built a new storage layer which delivers […] SSD-like performance using nothing but cloud storage and diskless spot instances,” Kagan explained. He says that this means that there is no caching or column scales, enabling them to do index searches. “You’re getting the low cost, unlimited retention benefits of cloud storage, but with the interactive performance of fully indexed search,” he added.

Peter Wagner, founding partner at investor Wing Venture Capital, says that the beauty of this tool is that it eliminates trade-offs, while lowering customers’ overall data processing costs. “The Hydrolix team has built a real-time data platform optimized not only to deliver superior performance at a fraction of the cost of current analytics solutions, but one architected to offer those same advantages as data volumes grow by orders of magnitude,” Wagner said in a statement.

It’s worth pointing out that in the past couple of weeks SentinelOne bought high-speed logging platform Scalyr for $155 million, then CrowdStrike grabbed Humio, another high-speed logging tool for $400 million, so this category is getting attention.

The product is currently compatible with AWS and offered through the Amazon Marketplace, but Kagan says they are working on versions for Azure and Google Cloud and expect to have those available later this year. The company was founded at the end of 2018 and currently has 20 employees spread out over six countries, with headquarters in Portland, Oregon.

Powered by WPeMatico

Patch, the carbon offset API developer, has raised $4.5 million in financing to build out its business selling customers a way to calculate their carbon footprint and identify and finance offset projects that capture the equivalent carbon dioxide emissions associated with that footprint.

Confirming TechCrunch reporting, Andreessen Horowitz led the round, which also included previous investors VersionOne Ventures, MapleVC and Pale Blue Dot Ventures.

Patch’s application protocol interface works for both internal and customer-facing operations. The company’s code can integrate into the user experience on a company’s internal site to track things like business flights for employees, recommending and managing the purchase of carbon credits to offset employee travel.

The software allows companies to choose which projects they’d like to finance to support the removal of carbon dioxide from the atmosphere, with projects ranging from the tried and true reforestation and conservation projects to more high-tech early-stage technologies like direct air capture and sequestration projects, the company said.

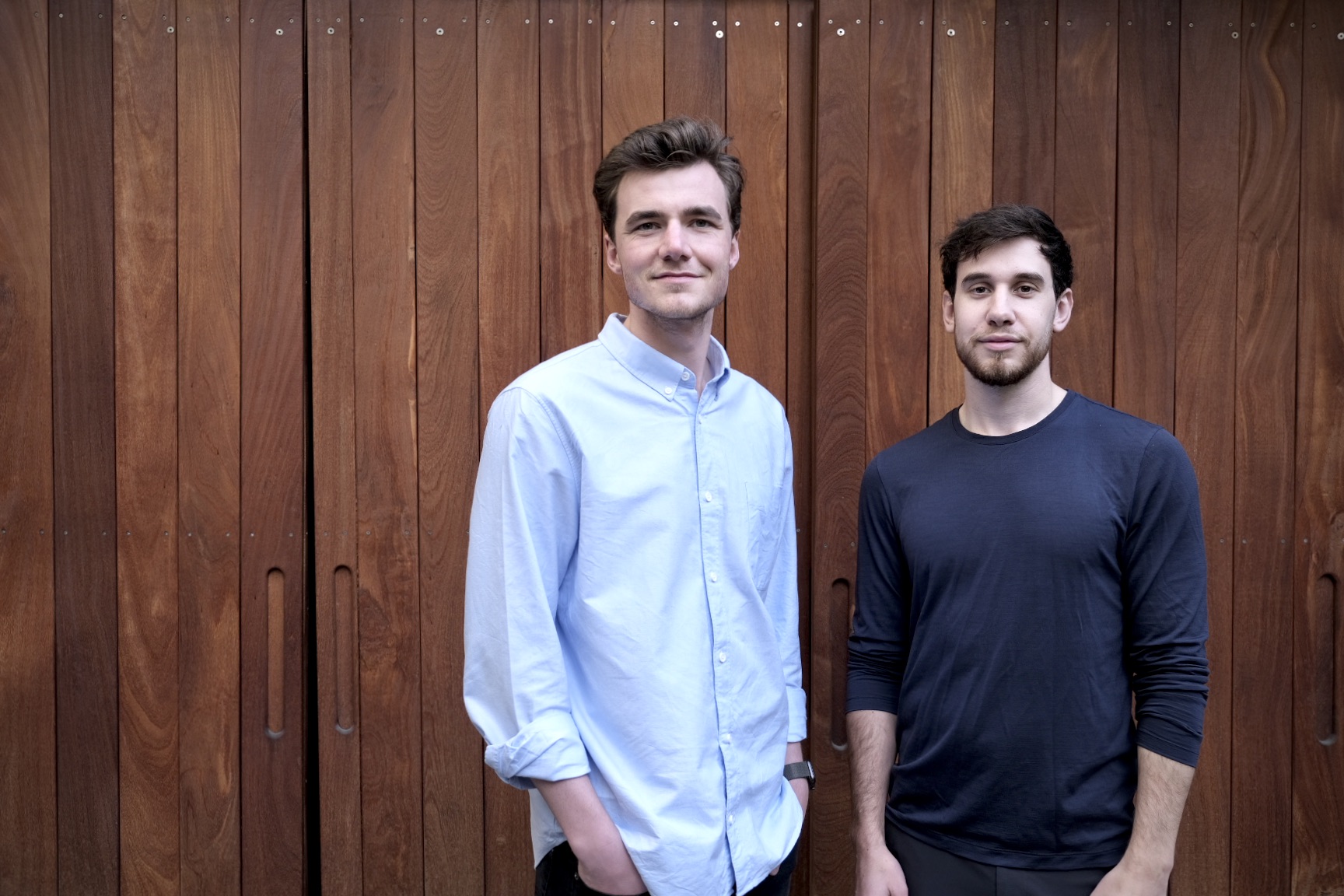

Patch founders Brennan Spellacy and Aaron Grunfeld, two former employees at the apartment rental service Sonder, stressed in an interview that the company’s offset work should not be viewed as an alternative to the decarbonization of businesses that use its service. Rather, they see Patch’s services as a complement to other work companies need to do to transition away from a reliance on fossil fuels in business operations.

Patch co-founders Brennan Spellacy and Aaron Grunfeld. Image Credit: Patch

Patch currently works with 11 carbon removal suppliers and has plans to onboard another 10 before the end of the first quarter, the company said. These are companies like CarbonCure, which injects carbon dioxide into cement and fixes it so that it’s embedded in building materials for as long as a building lasts.

“Carbon removal credits can help to dramatically accelerate the deployment of technologies like CarbonCure’s, which are absolutely critical to helping us reach our global climate targets. Demand for high-quality, permanent credits is sky-rocketing, and listing credits on Patch will help us to attract a broader range of buyers,” said Jennifer Wagner, president of CarbonCure Technologies, in a statement.

It also has around 15 customers already using its service, according to earlier TechCrunch reporting. Those buyers include companies like TripActions and the private equity firm EQT, which intends to extend the integration of Patch’s API from its own operations to those of its portfolio companies down the road, according to Spellacy.

Grunfeld said that the company would be spending the money to hire more staff and developing new products. From its current headcount of six employees, Patch intends to bring on another 24 by the end of the year.

As the company expands, it’s looking to some of the startups providing carbon emissions audit and verification services as a channel that the company’s API can integrate with and sell through. These would be businesses like CarbonChain, Persefoni and another Y Combinator graduate, SINAI Technologies.

“An increasing number of businesses are taking leadership positions in an effort to reduce emissions to try to counteract global warming,” said Jeff Jordan, managing partner at Andreessen Horowitz. “Patch makes it much easier for companies to add carbon removal to their core business processes, aggregating verified carbon-removal supply and offering turn-key access to it to companies through an easy-to-implement API.”

Powered by WPeMatico

Engineering teams face steep challenges when it comes to staying on schedule, and keeping to those schedules can have an impact on the entire organization. Acumen, an Israeli engineering operations startup, announced a $7 million seed investment today to help tackle this problem.

Hetz, 10D, Crescendo and Jibe participated in the round, designed to give the startup the funding to continue building out the product and bring it to market. The company, which has been working with beta customers for almost a year, also announced it was emerging from stealth today.

As an experienced startup founder, Acumen CEO and co-founder Nevo Alva has seen engineering teams struggle as they grow due to a lack of data and insight into how the teams are performing. He and his co-founders launched Acumen to give companies that missing visibility.

“As engineering teams scale, they face challenges due to a lack of visibility into what’s going on in the team. Suddenly prioritizing our tasks becomes much harder. We experience interdependencies [that have an impact on the schedule] every day,” Alva explained.

He says this manifests itself in a decrease in productivity and velocity and ultimately missed deadlines that have an impact across the whole company. What Acumen does is collect data from a variety of planning and communications tools that the engineering teams are using to organize their various projects. It then uses machine learning to identify potential problems that could have an impact on the schedule and presents this information in a customizable dashboard.

The tool is aimed at engineering team leaders, who are charged with getting their various projects completed on time with the goal of helping them understand possible bottlenecks. The software’s machine learning algorithms will learn over time which situations cause problems, and offer suggestions on how to prevent them from becoming major issues.

The company was founded in July 2019 and the founders spent the first 10 months working with a dozen design partners building out the first version of the product, making sure it could pass muster with various standards bodies like SOC-2. It has been in closed private beta since last year and is launching publicly this week.

Acumen currently has 20 employees with plans to add 10 more by the end of this year. After working remotely for most of 2020, Alva says that location is no longer really important when it comes to hiring. “It definitely becomes less and less important where they are. I think time zones are still a consideration when speaking of remote,” he said. In fact, they have people in Israel, the U.S. and eastern Europe at the moment among their 20 employees.

He recognizes that employees can feel isolated working alone, so the company has video meetings every day during which they spend the first part just chatting about non-work stuff as a way to stay connected. Starting today, Acumen will begin its go to market effort in earnest. While Alva recognizes there are competing products out there like Harness and Pinpoint, he thinks his company’s use of data and machine learning really helps differentiate it.

Powered by WPeMatico

The concept of the “marketing cloud” — sold by the likes of Salesforce, Oracle and Adobe — has become a standard way for large tech companies to package together and sell marketing tools to businesses that want to improve how they use digital channels to grow their business.

Some argue, however, that “cloud”, singular, might be a misnomer: typically those tools are not integrated well with each other and effectively are run as separate pieces of software. Today a startup called Blueshift — which claims to offer an end-to-end marketing stack, by having built it from the ground up to include both traditional marketing data as well as customer experience — is announcing some funding, pointing to the opportunity to build more efficient alternatives.

The startup has closed a round of $30 million, a Series C that co-founder and CEO Vijay Chittoor said it will be using to expand to more markets (it’s most active in the U.S. and Europe currently) and also to expand its technology.

“The product already has a unified format, to ingest data from multiple sources and redistribute that out to apps. Now, we want to distribute that data to more last-mile applications,” he said in an interview. “Our biggest initiative is to scale out the notion of us being not just an app but a platform.”

The company’s customers include LendingTree, Discovery Inc., Udacity, BBC and Groupon, and it has seen revenue growth of 858% in the last three years, although it’s not disclosing actual revenues, nor valuation, today.

The round is being led by Fort Ross Ventures, with strong participation also from Avatar Growth Capital. Past investors Softbank Ventures Asia (which led its last round of $15 million), Storm Ventures, Conductive Ventures and Nexus Venture Partners also invested.

The concept for Blueshift came out of Chittoor’s direct experience at Groupon — which acquired his previous startup, social e-commerce company Mertado — and before that a long period at Walmart Labs — which Walmart rebranded after it acquired another startup where Chittoor was an early employee, semantic search company Kosmix.

“The challenges we are solving today we saw firsthand as challenges our customers saw at Groupon and Walmart,” he said. “The connected customer journey is creating a thousand times more data than before, and people and brands are engaging across more touchpoints. Tracking that has become harder with legacy channel-centric applications.”

Blueshift’s approach for solving that has been, he said, “to unify the data and to make decisions at customer level.”

That is to say, although the customer experience today is very fragmented — you might potentially encounter something about a company or brand in multiple places, such as in a physical environment, on various social media platforms, in your email, through a web search, in a vertical search portal, in a marketplace on a site, in an app, and so on — the experience for marketers should not be.

The company addresses this by way of a customer data platform (CDP) it markets as “SmartHub.” Designed for non-technical users although customizable by engineers if you need it to be, users can integrate different data feeds from multiple sources, which then Blueshift crunches and organises to let you view in a more structured way.

That data can then be used to power actions in a number of places where you might be setting up marketing campaigns. And Chittoor pointed out — like other marketing people have — that these days, the focus on that is largely first-party data to fuel that machine, rather than buying in data from third-party sources (which is definitely part of a bigger trend).

“Our mission is to back category-leading companies that are poised to dominate a market. Blueshift clearly stood out to us as the leader in the enterprise CDP space,” said Ratan Singh of Fort Ross Ventures in a statement. “We are thrilled to partner with the Blueshift team as they accelerate the adoption of their SmartHub CDP platform.” Singh is joining Blueshift’s board with this round.

Powered by WPeMatico

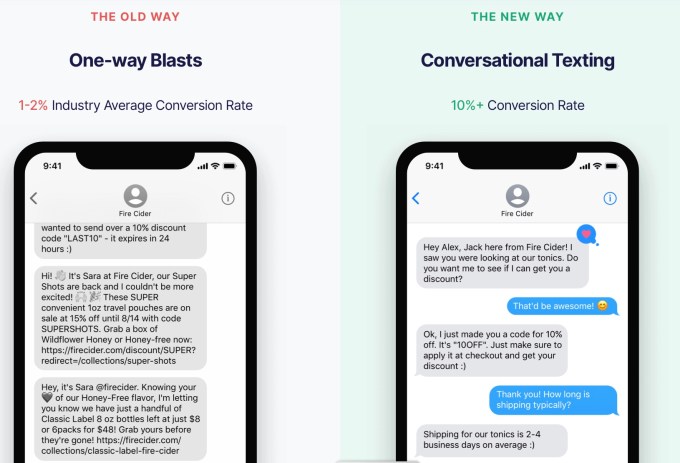

While more businesses are turning to text messages as a marketing channel, Emotive CEO Brian Zatulove argued that most of them are just treating it as another “newsletter blast.”

“The reason the channel performs so well is it’s not saturated,” Zatulove said. But that’s changing, and as it does, companies will have to do more to “cut through the noise.”

That’s what he said Emotive enables, with a platform focused on text marketing that feels like a real conversation with another human being, rather than just another email blast. He compared it to the sales associate who would greet you when you first walked into a department store, pre-COVID.

“The online sales associate really didn’t exist,” he said. “That’s what we’re trying to provide.”

Emotive saw 466% year-over-year revenue growth in 2020 and is announcing today that it has raised $50 million in a Series B funding round that values the company at $400 million. It was led by CRV, with participation from Mucker Capital, TenOneTen Ventures and Stripes.

Image Credits: Emotive

“Never underestimate the importance of building a product that your customers, and your customers’ customers adore,” said CRV general partner Murat Bicer in a statement. “One of the things that struck us about Emotive is the sheer amount of customer love Brian and [co-founder Zachary Wise] get from meal delivery services, manufacturing companies and even toddler shoe brands. Small businesses find it easy to set up campaigns and their customers genuinely prefer communicating with someone over text rather than email.”

Zatulove said he founded the company with Wise after they’d worked together on cannabis loyalty startup Reefer, eventually deciding there was a bigger opportunity after their early successes with text marketing. He explained that while Emotive works with larger customers, its sweet spot is mid-sized e-commerce businesses on Shopify, Magento, BigCommerce and WooCommerce.

Because those businesses usually don’t have any salespeople of their own yet, Emotive serves that function. It can start conversations around shopping cart abandonment and promote sales and new products, resulting in what the company says are 8% to 10% conversion rates (compared to 1% or 2% for a standard text marketing campaign). Zatulove said the platform largely relied on human responders at first, and although it’s become increasingly automated, Emotive still has an internal team handling responses when necessary.

“We never plan on losing that human touch as part of the dialog,” he added. “We see ourselves as a human-to-human marketing platform. That’s our biggest differentiator.”

Emotive had previously raised $8.2 million in funding, according to Crunchbase. Zatulove said this new round will allow the company to continue developing the product, to grow its headcount to more than 200 people and to open offices in Atlanta and Boston. Eventually, it could also expand beyond texting.

“Longer term, we see ourselves more as a conversation platform, not just as a text message platform,” he said.

Powered by WPeMatico

RecargaPay, a Brazil-based fintech that allows users to top off their prepaid cell phones online, announced this morning that they’ve closed their $70 million Series C. The company, which operates solely in Brazil, was launched in 2010 by Miami-based serial entrepreneur Rodrigo Teijeiro, who is co-founder and CEO.

Unlike in the U.S. where most people have a cell phone plan through a major carrier, in Brazil — a country where the minimum wage is currently $1,100 reals per month (roughly $202 USD) — many people must buy calling cards at local shops to add credit to their phones, which allows them to avoid a monthly recurring bill.

“Most people were using prepaid [phones] for control because they didn’t trust the telephone companies — they didn’t want roaming fees or fees for going over etc.,” said Teijeiro. Many of us can relate to the days when we’d come home from an international trip and have an astronomical phone bill because of roaming fees, but imagine if that were a monthly occurrence?

In 2014, Teijeiro and his co-founders — one of whom is his brother, Alvaro, the CTO — turned the RecargaPay website into an app.

“Before RecargaPay, if your cell phone ran out of credits and it was 10 p.m. and you needed to make a phone call, you’d have to go out and find a shop that sold the prepaid cards to add the credits to your phone — it was super inconvenient,” Teijeiro added. Cell phones caught on quickly in Brazil because it has traditionally been difficult to obtain a landline — an ordeal that often took several months to solidify.

RecargaPay originally had operations in various Latin American countries, such as Argentina, Chile, Colombia, Mexico, Peru and Brazil, as well as in Spain and the U.S. But in 2016 the company decided to focus on the Brazilian market, because not only is it the biggest in LatAm, but it also has the highest penetration of credit cards.

“The number one mistake investors make when investing in LatAm is that they think that LatAm is one whole market. But especially in fintech, all the regulations are very different. That’s why it’s hard to scale in LatAm,” he said.

The company makes money by charging a monthly fee of $19.99 reals. When a customer makes an online top-off on the app, they get 4% cash back because the cell phone carriers pay RecargaPay the equivalent amount, which it then passes on to the user.

The company, which is EBITDA positive according to Teijeiro, has raised just over $100 million in capital to date and plans to use the $70 million to “expand its financial services offerings to small businesses and consumers, including further development of its popular subscription program Prime+,” the company said in a statement.

Already, RecargaPay offers much more than the ability to top off your cell phone. Other features include the ability to buy gift cards, apply for and receive microloans, refill your public transportation cards and pay bills. Teijeiro explained that RecargaPay and Nubank, LatAm’s largest digital bank, are not direct competitors, but rather operate in the same ecosystem. A lot of Nubank customers who now have a credit card, thanks to the bank’s no-fee cards, can use RecargaPay to top off their cell phones, he added.

According to a 2020 report by TechnoBlog, a Brazilian media outlet, in 2010 about 83% of cell phones in Brazil were prepaid. Today, that number is smaller, but it’s still a whopping 49%. The change started in 2012 with the advent of smartphones in Brazil and the popularization of WhatsApp. While this may sound insane, previously, Brazilians could only call others who used their same cell phone carrier — if they called people in other networks they’d incur a hefty fee.

To get around this problem, Brazilians bought multiple cell phone chips from different carriers and they would have to top off these chips individually. You’d also have to remember which of your contacts used which carrier — mind-blowing, I know. So when WhatsApp launched, it eliminated that problem altogether, hence its massive penetration in the Brazilian market.

(l-r) Renato Camargo: country manager & CMO; Alvaro Teijeiro: co-founder & CTO; Gustavo Victorica: co-founder & COO; Rodrigo Teijeiro: founder & CEO; Diego Escobar: CFO. Image Credits: RecargaPay

RecargaPay’s Series C was co-led by Miami-based Fuel Venture Capital and Madrid-based IDC Ventures, with additional participation from LUN Partners, Experian Ventures and ATW Partners.

“RecargaPay is a pioneer in the payments sector as one of the first all-in-one platforms to serve such a wide array of everyday needs of Brazilians,” said Maggie Vo, Fuel Venture Capital managing general partner and chief investment officer. “We are thrilled to back a company that is actively improving the lives of so many people by giving them more control over their finances, all the while challenging the status quo of banking systems.”

“Often people think that RecargaPay is for the unbanked, but it’s actually for the unbanked and the banked,” Teijeiro added. “What we always had in mind was to build — in the long-term — a mobile money ecosystem. Our approach was to solve problems one-by-one, and now we have a vertically integrated payment platform that offers financial services.”

Powered by WPeMatico

Real estate tech startup Sunroom Rentals, which leases units on behalf of property managers and apartment owners, has raised $11 million in a Series A round of funding led by Gigafund.

Ben Doherty and Zachary Maurais, former founders of the delivery app Favor, launched Sunroom in May 2018 with the mission of “boosting the profitability” of mid-size property managers and apartment owners by giving them a way to outsource their leasing operations.

The pair sold Favor to Texas grocer H-E-B in 2018 and soon after shifted their focus on building out Sunroom. The Austin-based company has developed an app that it says gives renters a way to tour, apply for and lease a unit “entirely online.” COVID-19 has led to more renters wanting virtual ways to explore and secure rental units. Mobile-first, Maurais noted, is particularly appealing to millennials and Gen Zers.

“Personally, we love to create products that fulfill consumer’s most basic needs,” said Maurais, the company’s president. “With food under our belt, we decided to focus on housing.”

While one might wonder what the parallels between food delivery and housing might be beyond fulfilling consumers’ needs, CEO Doherty said the rental market in 2021 looks a lot like the food delivery market in 2013.

“In 2013, Grubhub had successfully put many restaurant menus online, but most of the transactions and delivery process was still offline,” he told TechCrunch. “We’re in a similar position with the rental market, as the majority of rental listings are online, but touring, applying or leasing units is still done offline.”

Since its launch, Sunroom Rentals has signed more than 2,000 leases and had over 100,000 renters sign up for its services in fast-growing Austin, where it focused its initial efforts.

“According to the U.S. Census, that represents roughly 10% of renters in the greater Austin metro,” Maurais said. “Instead of going shallow and wide nationally, we decided to go deep in markets, in an effort to gain network effects, which was a strategy that worked well for us at Favor.”

Sunroom Rentals claims that it’s leasing units five days faster than the market average. This benefits property managers, Doherty said, because they can grow quicker “while improving leasing performance.”

Looking ahead, the company will use the funding to expand across Texas, including in Houston, San Antonio and Dallas. It will also invest in its partner portal, which aims to give owners and property managers a way to view real-time data on leasing performance.

Sunroom Rentals currently has 18 employees with the goal of more than doubling its headcount this year. It’s in particular looking to hire across its engineering, product and sales departments.

As mentioned above, Gigafund led the Series A financing, which included participation from NextGen Venture Partners, Calpoly Ventures and a slew of angel investors, including Gokul Rajaram (Google & Square) and Homeward’s Tim Heyl, among others. Existing backers include Founders Fund Seed, Draper Associates, Boost VC and Capital Factory (among many others). The round marked Sunroom’s first “priced” round, meaning the first time it’s given up stock.

Jonathan Basset, managing partner at NextGen Venture Partners, believes Sunroom was essentially in the right place at the right time and “on trend with touchless leasing even before COVID hit.”

“I watched them build a profitable consumer marketplace in a competitive market with Favor and was impressed with them as operators,” he said. “These businesses have a surprising amount of similarities and I’m confident they can rise to the challenge.

Last week, TechCrunch reported on the raise of another startup operating in this increasingly crowded space. Seattle-based Knock — a company that has developed tools to give property management companies a competitive edge — raised $20 million in a growth funding round led by Fifth Wall Ventures.

Knock’s goal is to provide CRM tools to modernize front office operations for these companies so they can do things like offer virtual tours and communicate with renters via text, email or social media from “a single conversation screen.” For renters, it offers an easier way to communicate and engage with landlords.

Maurais said the two differ in that Knock is a CRM built for leasing agents with a SAAS model where as Sunroom is a marketplace, where renters match, tour and apply with partnered properties.

“Sunroom also provides a suite of leasing & analytics software to its partners and generates both transactional and subscription revenues,” he added.

Powered by WPeMatico