Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

TheCut, a technology platform designed to handle back-end operations for barbers, raised $4.5 million in new funding.

Nextgen Venture Partners led the round and was joined by Elevate Ventures, Singh Capital and Leadout Capital. The latest funding gives theCut $5.35 million in total funding since the company was founded in 2016, founder Obi Omile Jr. told TechCrunch.

Omile and Kush Patel created the mobile app that provides information and reviews on barbers for potential customers while also managing appointments, mobile payments and pricing on the back end for barbers.

“Kush and I both had terrible experiences with haircuts, and decided to build an app to help find good barbers,” Omile said. “We found there were great barbers, but no way to discover them. You can do a Google search, but it doesn’t list the individual barber. With theCut, you can discover an individual barber and discover if they are a great fit for you and won’t screw up your hair.”

The app also enables barbers, perhaps for the first time, to have a list of clients and keep notes and photos of hair styles, as well as track visits and spending. By providing payments, barbers can also leverage digital trends to provide additional services and extras to bring in more revenue. On the customer side, there is a search function with barber profile, photos of their work, ratings and reviews, a list of service offerings and pricing.

Omile said there are 400,000 to 600,000 barbers in the U.S., and it is one of the fastest-growth markets. As a result, the new funding will be used to hire additional talent, marketing and to grow the business across the country.

“We’ve gotten to a place where we are hitting our stride and seeing business catapulting, so we are in hiring mode,” he added.

Indeed, the company generated more than $500 million in revenue for barbers since its launch and is adding over 100,000 users each month. In addition, the app averages 1.5 million appointment bookings each month.

Next up, Omile wants to build out some new features like a digital store and the ability to process more physical payments by rolling out a card reader for in-person payments. TheCut will also focus on enabling barbers to have more personal relationships with their customers.

“We are building software to empower people to be the best version of themselves, in this case barbers,” he added. “The relationship with customers is an opportunity for the barber to make specific recommendations on products and create a grooming experience.”

As part of the investment, Leadout founder and managing partner Ali Rosenthal joined the company’s board of directors. She said Omile and Patel are the kind of founders that venture capitalists look for — experts in their markets and data-driven technologists.

“They had done so much with so little by the time we met them,” Rosenthal added. “They are creating a passionate community and set of modern, tech-driven features that are tailored to the needs of their customers.”

Powered by WPeMatico

Everything is switching from offline to online mode, spurred by the pandemic, and that also has turned around things for the creative economy. Creative professionals continue to look for ways to monetize their talents and knowledge through online education platforms like CLASS101 that bring stable incomes and improve opportunities.

CLASS101, a Seoul-based online education platform, announced today it has closed $25.8 million (30 billion won) Series B funding to accelerate its growth in South Korea, the U.S. and Japan.

The Series B round was led by Goodwater Capital, with additional participation from previous backers Strong Ventures, KT Investment, Mirae Asset Capital and Klim Ventures.

In 2019, the company raised a $10.3 million (12 billion won) Series A round led by SoftBank Ventures Asia along with Mirae Asset Venture Investment, KT Investment, Strong Ventures and SpringCamp.

Co-founder and CEO of CLASS101 Monde Ko told TechCrunch that the company will use the proceeds to focus on hiring more talent, as well as expanding domestic business and overseas markets in the U.S. and Japan.

Ko and four other co-founders established CLASS101 in 2018, which was pivoted from a tutoring service platform that was founded in 2015, Ko said. It has 350 employees now.

“We will keep supporting creators to monetize their talents and we will also allow creators to expand their revenue streams by selling their goods, digital files and more products via our platform,” Ko said.

When asked about what differentiated it from other peers, CLASS101 provides and ships all the necessary tools and material “Class Kit”, Ko said.

The company offers more than 2,000 classes within a raft of categories, with drawing, crafts, photography, cooking, music and more. It also provides about 230 classes in the U.S. and 220 classes in Japan. There are approximately 100,000 registered creators and 3 million registered users as of August 2021.

CLASS101 launched its platform in the U.S. in 2019 and entered Japan last year. The company opened online classes for kids aged under 14 in 2020.

“CLASS101 is a company that combines the advantages of Patreon and YouTube, offering tailored support for creators while fulfilling users’ learning needs,” co-founder and managing partner at Goodwater Capital Eric Kim said, adding that it is the fastest growing company “in an economic phenomenon in which individuals follow their passions and do what they really enjoy while also making a living from it.”

Powered by WPeMatico

Explosion, a company that has combined an open source machine learning library with a set of commercial developer tools, announced a $6 million Series A today on a $120 million valuation. The round was led by SignalFire, and the company reported that today’s investment represents 5% of its value.

Oana Olteanu from SignalFire will be joining the board under the terms of the deal, which includes warrants of $12 million in additional investment at the same price.

“Fundamentally, Explosion is a software company and we build developer tools for AI and machine learning and natural language processing. So our goal is to make developers more productive and more focused on their natural language processing, so basically understanding large volumes of text, and training machine learning models to help with that and automate some processes,” company co-founder and CEO Ines Montani told me.

The company started in 2016 when Montani met her co-founder, Matthew Honnibal in Berlin where he was working on the spaCy open source machine learning library. Since then, that open source project has been downloaded over 40 million times.

In 2017, they added Prodigy, a commercial product for generating data for the machine learning model. “Machine learning is code plus data, so to really get the most out of the technologies you almost always want to train your models and build custom systems because what’s really most valuable are problems that are super specific to you and your business and what you’re trying to find out, and so we saw that the area of creating training data, training these machine learning models, was something that people didn’t pay very much attention to at all,” she said.

The next step is a product called Prodigy Teams, which is a big reason the company is taking on this investment. “Prodigy Teams is [a hosted service that] adds user management and collaboration features to Prodigy, and you can run it in the cloud without compromising on what people love most about Prodigy, which is the data privacy, so no data ever needs to get seen by our servers,” she said. They do this by letting the data sit on the customer’s private cluster in a private cloud, and then use Prodigy Team’s management features in the public cloud service.

Today, they have 500 companies using Prodigy including Microsoft and Bayer in addition to the huge community of millions of open source users. They’ve built all this with just six early employees, a number that has grown to 17 recently (they hope to reach 20 by year’s end).

She believes if you’re thinking too much about diversity in your hiring process, you probably have a problem already. “If you go into hiring and you’re thinking like, oh, how can I make sure that the way I’m hiring is diverse, I think that already shows that there’s maybe a problem,” she said.

“If you have a company, and it’s 50 dudes in their 20s, it’s not surprising that you might have problems attracting people who are not white dudes in their 20s. But in our case, our strategy is to hire good people and good people are often very diverse people, and again if you play by the [startup] playbook, you could be limited in a lot of other ways.”

She said that they have never seen themselves as a traditional startup following some conventional playbook. “We didn’t raise any investment money [until now]. We grew the team organically, and we focused on being profitable and independent [before we got outside investment],” she said.

But more than the money, Montani says that they needed to find an investor that would understand and support the open source side of the business, even while they got capital to expand all parts of the company. “Open source is a community of users, customers and employees. They are real people, and [they are not] pawns in [some] startup game, and it’s not a game. It’s real, and these are real people,” she said.

“They deserve more than just my eyeballs and grand promises. […] And so it’s very important that even if we’re selling a small stake in our company for some capital [to build our next] product [that open source remains at] the core of our company and that’s something we don’t want to compromise on,” Montani said.

Powered by WPeMatico

YouTravel.Me is the latest startup to grab some venture capital dollars as the travel industry gets back on its feet amid the global pandemic.

Over the past month, we’ve seen companies like Thatch raise $3 million for its platform aimed at travel creators, travel tech company Hopper bring in $175 million, Wheel the World grab $2 million for its disability-friendly vacation planner, Elude raise $2.1 million to bring spontaneous travel back to a hard-hit industry and Wanderlog bag $1.5 million for its free travel itinerary platform.

Today YouTravel.Me joins them after raising $1 million to continue developing its online platform designed for matching like-minded travelers to small-group adventures organized by travel experts. Starta VC led the round and was joined by Liqvest.com, Mission Gate and a group of individual investors like Bas Godska, general partner at Acrobator Ventures.

Olga Bortnikova, her husband Ivan Bortnikov and Ivan Mikheev founded the company in Europe three years ago. The idea for the company came to Bortnikova and Bortnikov when a trip to China went awry after a tour operator sold them a package where excursions turned out to be trips to souvenir shops. One delayed flight and other mishaps along the way, and the pair went looking for better travel experiences and a way to share them with others. When they couldn’t find what they were looking for, they decided to create it themselves.

“It’s hard for adults to make friends, but when you are on a two-week trip with just 15 people in a group, you form a deep connection, share the same language and experiences,” Bortnikova told TechCrunch. “That’s our secret sauce — we want to make a connection.”

Much like a dating app, the YouTravel.Me’s algorithms connect travelers to trips and getaways based on their interests, values and past experiences. Matched individuals can connect with each via chat or voice, work with a travel expert and complete their reservations. They also have a BeGuide offering for travel experts to do research and create itineraries.

Since 2018, CEO Bortnikova said that YouTravel.Me has become the top travel marketplace in Eastern Europe, amassing over 15,900 tours in 130 countries and attracting over 10,000 travelers and 4,200 travel experts to the platform. It was starting to branch out to international sales in 2020 when the global pandemic hit.

“Sales and tourism crashed down, and we didn’t know what to do,” she said. “We found that we have more than 4,000 travel experts on our site and they feel lonely because the pandemic was a test of the industry. We understood that and built a community and educational product for them on how to build and scale their business.”

After a McKinsey study showed that adventure travel was recovering faster than other sectors of the industry, the founders decided to go after that market, becoming part of 500 Startups at the end of 2020. As a result, YouTravel.Me doubled its revenue while still a bootstrapped company, but wanted to enter the North American market.

The new funding will be deployed into marketing in the U.S., hiring and attracting more travel experts, technology and product development and increasing gross merchandise value to $2.7 million per month by the end of 2021, Bortnikov said. The goal is to grow the number of trips to 20,000 and its travel experts to 6,000 by the beginning of next year.

Godska, also an angel investor, learned about YouTravel.Me from a mutual friend. It happened that it was the same time that he was vacationing in Sri Lanka where he was one of very few tourists. Godska was previously involved in online travel before as part of Orbitz in Europe and in Russia selling tour packages before setting up a venture capital fund.

“I was sitting there in the jungle with a bad internet connection, and it sparked my interest,” he said. “When I spoke with them, I felt the innovation and this bright vibe of how they are doing this. It instantly attracted me to help support them. The whole curated thing is a very interesting move. Independent travelers that want to travel in groups are not touched much by the traditional sector.”

Powered by WPeMatico

Pixalate raised $18.1 million in growth capital for its fraud protection, privacy and compliance analytics platform that monitors connected television and mobile advertising.

Western Technology Investment and Javelin Venture Partners led the latest funding round, which brings Pixalate’s total funding to $22.7 million to date. This includes a $4.6 million Series A round raised back in 2014, Jalal Nasir, founder and CEO of Pixalate, told TechCrunch.

The company, with offices in Palo Alto and London, analyzes over 5 million apps across five app stores and more 2 billion IP addresses across 300 million connected television devices to detect and report fraudulent advertising activity for its customers. In fact, there are over 40 types of invalid traffic, Nasir said.

Nasir grew up going to livestock shows with his grandfather and learned how to spot defects in animals, and he has carried that kind of insight to Pixalate, which can detect the difference between real and fake users of content and if fraudulent ads are being stacked or hidden behind real advertising that zaps smartphone batteries or siphons internet usage and even ad revenue.

Digital advertising is big business. Nasir cited Association of National Advertisers research that estimated $200 billion will be spent globally in digital advertising this year. This is up from $10 billion a year prior to 2010. Meanwhile, estimated ad fraud will cost the industry $35 billion, he added.

“Advertisers are paying a premium to be in front of the right audience, based on consumption data,” Nasir said. “Unfortunately, that data may not be authorized by the user or it is being transmitted without their consent.”

While many of Pixalate’s competitors focus on first-party risks, the company is taking a third-party approach, mainly due to people spending so much time on their devices. Some of the insights the company has found include that 16% of Apple’s apps don’t have privacy policies in place, while that number is 22% in Google’s app store. More crime and more government regulations around privacy mean that advertisers are demanding more answers, he said.

The new funding will go toward adding more privacy and data features to its product, doubling the sales and customer teams and expanding its office in London, while also opening a new office in Singapore.

The company grew 1,200% in revenue since 2014 and is gathering over 2 terabytes of data per month. In addition to the five app stores Pixalate is already monitoring, Nasir intends to add some of the China-based stores like Tencent and Baidu.

Noah Doyle, managing director at Javelin Venture Partners, is also monitoring the digital advertising ecosystem and said with networks growing, every linkage point exposes a place in an app where bad actors can come in, which was inaccessible in the past, and advertisers need a way to protect that.

“Jalal and Amin (Bandeali) have insight from where the fraud could take place and created a unique way to solve this large problem,” Doyle added. “We were impressed by their insight and vision to create an analytical approach to capturing every data point in a series of transactions — more data than other players in the industry — for comprehensive visibility to help advertisers and marketers maintain quality in their advertising.”

Powered by WPeMatico

Bright Cellars, a six-year-old subscription-based wine seller has, like many upstarts, evolved over time. While it once sent its club members third-party wines that fit their particular profiles, Milwaukee, Wisconsin-based Bright Cellars says it’s now amassing enough data about its customers that it no longer sells wines made by other brands. Instead, while some of its “original” offerings are admittedly sold by other labels under different names, it is increasingly finding success by directing its winemaker partners to tweak the recipe, so to speak.

“We’re optimizing wine like you might optimize a more digital product,” says co-founder and CEO, Richard Yau, a San Francisco native whose startup entered into a regional accelerator program early on and stayed, though the company is now largely decentralized.

We talked earlier today with Yau about that shift, which investors are supporting with $11.2 million in Series B funding, led by Cleveland Avenue, with participation from earlier backers Revolution Ventures and Northwestern Mutual. (The company has now raised roughly $20 million altogether).

Yau also talked about industry trends that he’s seeing because of all that data collection.

TC: You’re building a portfolio of wines. What does that mean?

RY: We don’t own any land. We’re working primarily with suppliers [as do big companies like Gallo and Constellation], but at a larger scale than before, so we now get to shape what wines taste like and look like, and we can optimize across variables like how sweet should this wine be? How acidic? What do we want its color and brand and label to look like and which segment of our customers will really enjoy this wine the most?

TC: What’s one of your concoctions?

RY: We have a sparkling wine that’s produced in the Champagne method — not a Champagne wine; it’s a domestic wine — using grape varietals that no one uses for sparkling wine, and it’s one of the top-rated wines on our platform. Sparkling wine has been really good for us.

TC: How many subscribers do you have?

RY: We can’t share that, but we saw an acceleration in not just new subscribers throughout the pandemic but also in terms of seeing a larger share of [customers’] wallets going to D2C, and that impacted us pretty positively. Even as things eased up over the summer, we saw that people were cooking and eating at home more [and drinking wine].

TC: What’s the average price of a bottle of wine on the platform?

RY: $20 to $25.

TC: Where are your grape suppliers?

RY: A lot are on the West Coast, in Washington and California, but we also have grape suppliers internationally, including in South America and Europe.

TC: How many wines do you offer, and how long do you trial a wine?

RY: We’ve tested around 600, and at any given time, we’ll have 40 to 50 wines on the platform. We don’t stock everything forever; those that don’t do as well, we basically eliminate.

TC: A lot of D2C brands eventually branch into real-world locations. You aren’t doing that. Why not?

RY: It’s possible that we might at some point, but we like being D2C and it makes a lot of sense in a world where our members now work from home and are home to receive packages. It lines up with e-commerce trends in general. If you’re not buying your groceries at the store anymore, you aren’t buying wines at the store, either.

TC: From where are these bottles shipped?

RY: From a variety of places, but primarily from Santa Rosa [in the Bay Area].

TC: Have you seen the impact the weather is having on California winemakers, some of whom are now spraying sunscreen on their grapes to protect them?

RY: [Climate change] has certainly affected the wine industry. One of the fortunate things about us is we have flexibility in the suppliers we’re working with, so from a business-health perspective, we haven’t been as affected by that. Because a lot of our operations are in California, we did a couple of years ago have some interruptions with distribution where we weren’t able to ship some days; we were also impacted by warm temperatures. But fortunately, so far for this year, we haven’t had any operational or supply-chain disruptions.

TC: Have you been approached by one of legacy firms about a partnership or acquisition?

RY: We’ve had conversations, more in terms of partnerships because we have lots of data and can help them. For example, we can launch a new wine and get feedback almost like a focus group to figure out who likes what. We can split test two different blends for a wine and figure out which does better. That’s where conversations with legacy wine companies have happened.

TC: So they’d pay you for your data.

RY: We’re not opposed to selling data in the future, but we’ve approached it more like, here’s an opportunity to learn about how innovation works at a larger wine company. We don’t expect to be able to do what Constellation does well — with its large salesforce and distributors in every state — but what we can do in a complementary way is understand the consumer.

TC: What have you learned that might surprise outsiders?

RY: Petite sirah [offerings] do as well, if not better than, cabernet and pinot noir on the platform. Cab and pinot are fully 50 times the market size of petite sirah, but we see that our members really like it.

People also like merlot a lot more than they think — pretty much across all demographics. People like to hate merlot, but when we look at red blends that do well . . .

TC: What do people have against merlot?

RY: [Laughs.] Have you ever seen “Sideways?” That has something to do with it, still. Meanwhile, pinot noir remains popular, but people don’t like it as much as [other wine sellers] think.

Powered by WPeMatico

Berlin Brands Group (BBG) — one of the new wave of e-commerce startups hoping to build lucrative economies of scale around buying up smaller brands that sell on marketplaces like Amazon and using technology to run and scale them more efficiently — has picked up a big round of funding to fill out that mission. The startup has closed a round of $700 million, comprising both equity and debt, which it will use in part to continue building its fulfillment and logistics infrastructure, as well as its tech platform, and in part to buy more companies.

BBG confirmed that the investment — one of the biggest to date in the space — boosts its valuation to over $1 billion.

Bain Capital is leading the equity portion of this round. The deal will also see it buy out a previous investor, Ardian, for an undisclosed amount that is separate to the $700 million raise.

This funding round is the second announced by BBG this year. In January it announced it would be investing $302 million off its own balance sheet for M&A, and in April it announced a debt round of $240 million. This latest $700 million is different in that it includes the equity component alongside the equity.

BBG got its start initially developing its own products and selling them on Amazon and other marketplaces — founder and CEO Peter Chaljawski was a DJ in a previous life and started with a focus on audio equipment he developed for himself.

Over time, he saw an opportunity to diversify that into a wider consolidation play, where BBG would also acquire and merge third-party brands into its business, tapping into the opportunity to provide the owners of the third-party businesses an exit route and bring those smaller brands more scale, more marketing nous and more tech to improve the efficiency of their operations.

Today the mix totals 3,700 products and 14 own brands, including Klarstein (kitchen appliances), auna (home electronics and music equipment), Capital Sports (home fitness) and blumfeldt (garden). BBG says it has access to some 1.5 billion e-commerce customers across various marketplaces where it sells goods in Europe, the U.K., the U.S. and Asia. Notably, unlike many others in the same space as BBG, it is focused on more than Amazon, with some 100 channels in 28 countries.

That list of “many others in the same space” is a long one and seemingly growing by the day. Yesterday, two of them — Heroes and Olsam — respectively raised $200 million and $165 million. Others leveraging the opportunity of consolidating merchants that sell via Fulfillment by Amazon include Suma Brands ($150 million), Elevate Brands ($250 million), Perch ($775 million), factory14 ($200 million), Thrasio (currently probably the biggest of them all in terms of reach and money raised and ambitions), Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.

As more startups enter the fray, battling to buy the best of the third-party brands will become more of a challenge, and so the backing of Bain should help BBG shore up against that competition.

“With Bain Capital’s commitment and the additional funding secured, we have set our next milestone on our path to building a global house of brands,” said Chaljawski in a statement. “This allows us to tackle strategic goals of acquiring and developing brands globally, as well as the operational and logistical expansion. Bain Capital’s experience working with founders worldwide will help us continue our evolution as a leading e-commerce company in scaling brands.”

“BBG is a disruptive leader in the rapidly changing consumer goods space. Their ability to develop and scale brands that meet current consumer trends through their highly efficient e-commerce platform gives the company tremendous growth potential in a fast-growing market,” added Miray Topay, MD at Bain Capital Private Equity. “We have partnered with many founder-led management teams and look forward to helping Peter and his team achieve their goal of becoming a global leader in consumer e-commerce”.

Powered by WPeMatico

In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account. However, with legacy institutional investing, most of these have at least some level of fossil fuel involvement, and, let’s face it, very few of us really know. Now a startup plans to change that.

California-based startup Sphere wants to get employees to ask their employers for investment options that are not invested in fossil fuels. To do that it’s offering financial products that make it easier — it says — for employers to offer fossil-free investment options in their 401(k) plans. This could be quite a big movement. Sphere says there are more than $35 trillion in assets in retirement savings in the U.S. as of Q1 2021.

It’s now raised a $2 million funding round led by climate tech-focused VC Pale Blue Dot. Also participating were climate-focused investors including Sundeep Ahuja of Climate Capital. Sphere is also a registered “Public Benefit Corporation,” allowing it to campaign in public about climate change.

Alex Wright-Gladstein, CEO and founder of Sphere said: “We are proud to be partnering with Pale Blue Dot on our mission to reverse climate change by making our money talk. Heidi, Hampus, and Joel have the experience and drive to help us make big changes on the short seven-year time scale that we have to limit warming to 1.5°C.” Wright-Gladstein has also teamed up with sustainable investing veteran Jason Britton of Reflection Asset Management and BITA custom indexes.

Wright-Gladstein said she learned the difficulty of offering fossil-free options in 401(k) plans when running her previous startup, Ayar Labs. She tried to offer a fossil-free option for employees, but found out it took would take three years to get a single fossil-free option in the plan.

Heidi Lindvall, general partner at Pale Blue Dot, said: “We are big believers in Sphere’s unique approach of raising awareness through a social movement while offering a range of low-cost products that address the structural issues in fossil-free 401(k) investing.”

Powered by WPeMatico

Forum Brands, an e-commerce acquisition platform, announced today that it has secured $100 million in debt funding from TriplePoint Capital.

The financing comes just over two months after the startup raised $27 million in an equity funding round led by Norwest Venture Partners.

Brenton Howland, Ruben Amar and Alex Kopco founded New York-based Forum Brands in the summer of 2020, during the height of the COVID-19 pandemic.

“We’re buying what we think are A+ high-growth e-commerce businesses that sell predominantly on Amazon and are looking to build a portfolio of standalone businesses that are category leaders, on and off Amazon,” Howland told me at the time of the company’s last raise. “A source of inspiration for us is that we saw how consumer goods and services changed fundamentally for what we think is going to be for decades and decades to come, accelerating the shift toward digital.”

Since we covered the company in June, Forum Brands says it has acquired several new brands, including Bonza, a seller of pet products, and Simka Rose, a baby-focused brand specializing in eco-friendly products. Simka sells in the U.S. and the EU and is an example of how Forum is expanding globally, Amar said.

Howland and Amar emphasize that the Forum team continues to focus on quality over quantity when evaluating potential acquisitions. Although they meet with 15-20 founders a week, they are selective in which companies they choose to acquire.

“We continue to be a quality-first buyer, and not quantity-driven,” Amar said, noting that the company will still help a company build its brand even if it does not yet meet Forum’s quality threshold or if the founders are just not ready to sell.

The new funds will be used to, naturally, acquire more e-commerce companies. As part of the debt financing, Sajal Srivastava, co-CEO and co-founder of TriplePoint Capital, will be joining Forum’s board of directors.

“We are impressed not only by Forum’s long-term strategy and ability to leverage technology and deep collective e-commerce and M&A experience but also by how Forum cultivates relationships with their sellers both before and after partnering with them,” he said in a written statement.

At the time of its June raise, Forum had about 20 employees. As of today, it has about 40.

Forum’s technology employs “advanced” algorithms and over 100 million data points to populate brand information into a central platform in real time, instantly scoring brands and generating accurate financial metrics.

On August 31, we covered the news that on the heels of Heroes announcing a $200 million raise to double down on buying and scaling third-party Amazon Marketplace sellers, another startup out of London aiming to do the same announced some significant funding of its own. Olsam, a roll-up play that is buying up both consumer and B2B merchants selling on Amazon by way of Amazon’s FBA fulfillment program, closed on $165 million — a combination of equity and debt that it will be using to fuel its M&A strategy, as well as continue building out its tech platform and to hire more talent.

Powered by WPeMatico

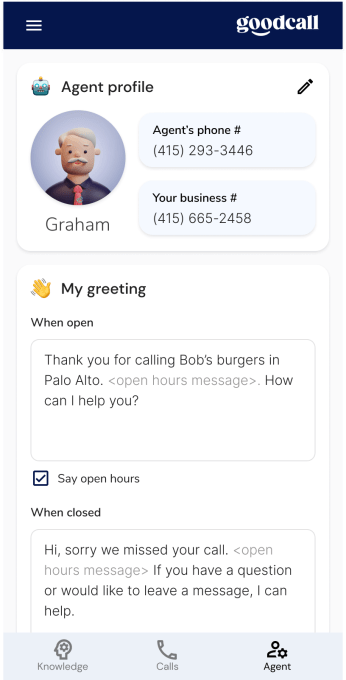

Even without staffing shortages, local merchants have difficulty answering calls while all hands are busy, and Goodcall wants to alleviate some of that burden from America’s 30 million small businesses.

Goodcall’s free cloud-based conversational platform leverages artificial intelligence to manage incoming phone calls and boost customer service for businesses of all sizes. Former Google executive Bob Summers left Google back in January, where he was working on Area 120 — an internal incubator program for experimental projects — to start Goodcall after recognizing the call problem, noting that in fact 60% of the calls that come into merchants go unanswered.

“It’s frustrating for you and for the person calling,” Summers told TechCrunch. “Every missed call is a lost opportunity.”

Goodcall announced its launch Wednesday with $4 million in seed funding led by strategic investors Neo, Foothill Ventures, Merus Capital, Xoogler Ventures, Verissimo Ventures and VSC Ventures, as well as angel investors including Harry Hurst, founder and co-CEO of Pipe.com, and Zillow co-founder Spencer Rascoff.

Goodcall mobile agent. Image Credits: Goodcall

Restaurants, shops and merchants can set up on Goodcall in a matter of minutes and even establish a local phone number to free up an owner’s mobile number from becoming the business’ main line. The service is initially deployed in English and the company has plans to operate in Spanish, French and Hindi by 2022.

Merchants can choose from six different assistant voices and monitor the call logs and what the calls were about. Goodcall can also capture consumer sentiment, Summers said.

The company offers three options, including its freemium service for solopreneurs and business owners, which includes up to 500 minutes per month of Goodcall services for a single phone line. Up to five additional locations and five staff members costs $19 per month for the Pro level, or the Premium level provides unlimited locations and staff for $49 per month.

During the company’s beta period, Goodcall was processing several thousands of calls per month. The new funding will be used to continue to offer the free service, hire engineers and continue product development.

In addition to the funding round, Goodcall is unveiling a partnership with Yelp to tap into its database of local businesses so that those owners and managers can easily deploy Goodcall. Yelp data shows that more than 500,000 businesses opened during the pandemic. The company pulls in from Yelp a merchant’s open hours, location, if they offer Wi-Fi and even their COVID policy.

“We are partnering with Yelp, which has the best data on small businesses, and other large distribution channels to get our product to market,” Summers said. “We are bringing technology into an industry that hasn’t innovated since the 1980s and democratizing conversational AI for small businesses that are the main driver of job creation, and we want to help them grow.”

Powered by WPeMatico