Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

What is working in the office going to look like in a post-COVID-19 world?

That’s something one startup hopes to help companies figure out.

Saltmine, which has developed a web-based workplace design platform, has raised $20 million in a Series A funding round.

Existing backers Jungle Ventures and Xplorer Capital led the financing, which also included participation from JLL Spark, the strategic investment arm of commercial real estate brokerage JLL.

Notably, JLL is not only investing in Saltmine, but is also partnering with the San Francisco-based startup to sell its service directly to its clients — opening up a whole new revenue stream for the four-year-old company.

Saltmine claims its cloud-based technology does for corporate real estate heads what Salesforce did for CROs in digitizing and streamlining the office design process. It saw an 80% spike in ARR (annual recurring revenue) last year while doubling the number of companies it works with, according to CEO and founder Shagufta Anurag. Its more than 35 customers include PG&E, Snowflake, Fidelity and Workday, among others. Its mission, put simply, is to help companies “create the best possible workplaces for their employees.”

Saltmine claims to have a 95% customer retention rate and in 2020 saw 350% year over year growth in monthly active users of its SaaS platform. So far, the square footage of all the office real estate properties designed and analyzed by customers on Saltmine totals 50 million square feet across 1,500 projects.

Saltmine says it offers companies tools to do things like establish social distancing measures in the office. Its platform, the company says, houses all workplace data — including strategy, design, pricing and portfolio analytics — in one place. It combines and analyzes floor plans with project requirements with real-time behavioral data (aggregated through a combination of utilization sensors and employee feedback) to identify companies’ design needs. Besides aiming to improve the workplace design process, Saltmine claims to be able to help companies “optimize their real estate portfolios.”

The pandemic has dramatically increased the need for a digital transformation of how workplaces are designed and reimagined, according to Anurag.

“Given the need for social distancing capabilities and a greater emphasis on work-life balance in many office settings, few workers expect a complete ‘return to normal,’ ” she said. “There is now enormous pressure on corporate heads of real estate to adapt and modify their workplaces.”

Once companies identify their new needs, Saltmine uses “immersive” digital 3D renderings to help them visualize the necessary changes to their real estate properties.

Singapore-based Anurag has previous experience in the design world, having founded Space Matrix, a large interior design firm in Asia, as well as Livspace, a digital home interior design company.

“I saw the same pain points and unmet needs in office real estate that I did in the residential market,” she said. “Real estate is the second-largest cost for companies and has a direct impact on their largest cost — their people.”

Looking ahead, Saltmine plans to use its new capital to (naturally) do some hiring and continue to acquire customers — in particular, seeking to expand its portfolio of Global 2000 companies.

Saltmine has about 125 employees in five offices across Asia, Europe and North America. It expects to have 170 employees by year’s end and to be profitable by the end of fiscal year 2021.

The company’s initial focus has been in North America, but it is now beginning to expand into APAC and Australia.

JLL Technologies’ co-CEO Yishai Lerner said JLL Spark was drawn to Saltmine’s approach of making data and analytics accessible in one place.

“Having a single source of truth for data also facilitates collaboration across teams, which is important, for example, in workspace planning,” he told TechCrunch. “This reduces inefficiencies and improves workflows in today’s fragmented design, build and fit-out market.”

JLL Spark invests in companies that it believes can benefit from its distribution and network — hence the firm’s agreement to sell Saltmine’s software directly to its customers.

“As JLL tenants and clients continue to embrace the future of work, they are seeking technology solutions that keep their buildings running efficiently and effectively,” Lerner said. “Saltmine’s platform checks all of the boxes by streamlining stakeholder collaboration, increasing transparency and simplifying data management.”

Powered by WPeMatico

Whether you’re working on something new according to your Twitter bio, or self-employed, according to your LinkedIn bio, founder Ben Huffman thinks his platform, Contra, will be the best way for independent workers to explain and monetize what they are working on.

Contra is a platform that wants professionals to create profiles that show project-based identities, versus a role-based identity that one would show on LinkedIn. It’s been built for what Huffman thinks is the future: digital knowledge workers, a term he uses to describe independent tech workers who freelance for different companies or gigs.

The early adopters are independent workers who want to work or advise for a product team.

“So you can think about any type of modern-day product team consisting of like a designer, an engineer, a PM, maybe a writer, or maybe someone else distributing content. There’s a high degree of referability amongst these user types,” he said.

Users would showcase the tools they use, projects they’ve led and initiatives they’ve pushed instead of simply writing “Former Stripe Engineer” and calling it a day.

“What you don’t know is what problems they solved at Stripe,” Huffman explained, and Contra wants to give users space to explain that.

A Contra profile looks like a storefront for an independent creators’ business. The first thing you will see is project experience, with the option to toggle between services currently available for sale, recommendations from the referral network and, finally, the About page.

A goal of Contra’s, per Huffman, is to help independent workers create high-signal referral networks so they can land new opportunities and gigs. Whenever a user posts a new project experience to their resume, they can add who they worked with as a collaborator.

It’s different from LinkedIn, where you can add anyone you meet and they become a “connection.” Contra requires you to have work experience with your network, making the referral network high-signal. Contra positions referrals high-up on profiles, reminiscent of the MySpace Top 10.

Referrals as a core mechanism to get jobs could disproportionately hurt Black and brown founders, who have been left out of networks. But Huffman says that Contra doesn’t only rely on referrals, it also helps position someone as more than their resume.

“Most resumes are filtered out by AI today and have historically disadvantaged BPOC candidates,” he said. “With a project focus instead of roles and education credential-focus on the identity, we help undiscovered talent get ahead.”

Huffman, who experienced resume bias first-hand as a college dropout with no-credentials from a rural area, thinks that his tool can combat bias in an effective way. The best-case scenario would be if Contra could help a talented designer based in Minneapolis get an opportunity in a city like San Francisco or New York by showcasing their work.

But Contra has ambition to be more than just the latest startup to aim at LinkedIn, Huffman tells TechCrunch. Beyond being a professional network, it wants to also be a place where independent workers can make money for their services and get inbound customers. He describes Contra as a LinkedIn meets Shopify for independent workers.

In other words, Contra is a profile that independent workers can build and then monetize off of, as well as track engagement on how certain services of theirs might be in more demand than others.

“We’re trying to enable people to monetize the value they create, versus the time they spend in places,” says Huffman. The goal here is to “enable people to build these identities, and give them infrastructure to be successful as an independent worker. Contra integrates with Stripe to bring on payments infrastructure, letting workers actually sell their services on the platform.

From an independent worker’s perspective, the internal view offers analytics to understand what the public is looking at on their profile, from what services are most in demand to what projects get the most attention. The analytics, which are private to everyone except the user, also helps workers understand what the conversion rate is once people come to their platform.

It is free to make money and a profile on Contra, which differentiates it from freelance marketplaces like UpWork and Fiverr, which take a percent cut of earnings. Since Contra doesn’t charge a commission on earnings, it monetizes through a SaaS subscription, $29 a month, that includes benefits such as same-day payouts and higher visibility in the platform to eventually get better opportunities.

A potentially large new competitor might be from LinkedIn itself, which is developing a new service called Marketplaces to help freelancers find and book work. Facebook is also working on a tool related to freelancers. Huffman sees Contra’s focus on professional identity as a competitive advantage, and the fact that the tool might be taking commissions.

“It makes what we are doing that much more relevant,” he said.

Luckily, the startup has raised a $14.5 million Series A round to meet its competition head on. The financing event was led by Unusual Ventures, with participation from Cowboy Ventures and Li Jin’s recently announced Atelier Ventures.

Contra wouldn’t disclose the number of users it currently has but did confirm that the total is “in the six-figure range.”

The cash will be used to increase the speed in which it can ship features, as well as build out an ambassador program, in which it will pay users $1,000 a month to test out the product and support the shift to independent work.

Powered by WPeMatico

This morning Shippo, a software company that provides shipping-related services to e-commerce companies, announced a new $45 million investment. The new capital values the startup at $495 million. TechCrunch is calling the new funding a Series D as it is a priced round that followed its Series C; the company did not award the round a moniker.

Shippo’s 2020 Series C, a $30 million transaction that was announced last April, valued the company at around $220 million. D1 Capital led both Shippo’s Series C and D rounds, implying that it was content to pay around twice as much for the company’s equity in 2021 than it was in 2020. (Recall that investors doubling-down on previous bets as lead investor in successive rounds is no longer considered to be a negative signal concerning startup quality, but a positive indicator.)

Why raise more money so soon after its last round? According to Shippo CEO and founder Laura Behrens Wu, her company made material progress on customer acquisition and partnerships last year. That led to a decision around the time of Shippo’s Q4 board meeting with her investors that it was a good time to put more capital into the company.

In a sense the timing is reasonable. As Shippo scales its customer base, it can negotiate better shipping deals with various providers, which, in turn, help it continue to attract new customers. Behrens Wu noted in an interview with TechCrunch that when her company was helping its early customers ship just a few packages, shipping companies it supports on its platform didn’t want to meet with the startup. Now armed with more volume, Shippo can recycle customer demand into partner leverage, improving its total customer offering.

Behrens Wu said that Shippo had secured such a partnership with UPS before it raised its new round.

Turning to growth, Shippo doubled its platform spend, or “GPV” last year. GPV is the company’s acronym for gross postage volume. It roughly tracks with revenue, TechCrunch confirmed. So Shippo likely doubled its top-line last year. That’s good. Shippo wants to do that again this year, Behrens Wu told TechCrunch. The startup will also double its headcount this year, adding around 150 people.

Now flush with more capital, what’s next for Shippo? Per its CEO, the startup wants to invest more in platforms (where Shippo is baked into a marketplace, for example), international expansion (Shippo only does a “little bit” of international shipping, per Behrens Wu), and double-down on what it considers its core customer base.

TechCrunch was curious about how broad Shippo might take its product from its original home in shipping labels. The startup said that there’s lots of room in the journey of a package, from pre-purchase on, where her company might expand into. However, Behrens Wu cautioned that such a broadening of product work is not an immediate focus at her company.

Let’s see how long the current e-commerce boom lasts and how far this new capital can take Shippo. If it doubles in size again this year we’ll have to start its IPO countdown sometime in mid-2022.

Powered by WPeMatico

As money floods into the electric vehicle market a number of small companies are trying to stake their claim as the go-to provider of charging infrastructure. These companies are developing proprietary ecosystems that work for their own equipment but don’t interoperate.

ChargeLab, which has raised $4.3 million in seed financing led by Construct Capital and Root Ventures, is looking to be the software provider providing the chargers built by everyone else.

“You’ll find everyone in every niche and corner,” says ChargeLab chief executive Zachary Lefevre. Lefevre likens Tesla to Apple with its closed ecosystem and compares ChargePoint and Blink, two other electric vehicle charging companies, to Blackberry — the once dominant smartphone maker. “What we’re trying to do is be Android,” Lefevre said.

That means being the software provider for manufacturers like ABB, Schneider Electric and Siemens. “These guys are hardware makers up and down the value stack,” Lefevre said.

ChargeLab already has an agreement with ABB to be their default software provider as they go to market. The big industrial manufacturer is getting ready to launch their next charging product in North America.

As companies like REEF and Metropolis revamp garages and parking lots to service the next generation of vehicles, ChargeLab’s chief executive thinks that his software can power their EV charging services as they begin to roll out that functionality across the lots they own.

Lefevre got to know the electric vehicle charging market first as a reseller of everyone else’s equipment, he said. The company had raised a pre-seed round of $1.1 million from investors including Urban.us and Notation Capital and has now added to that bank account with another capital infusion from Construct Capital, the new fund led by Dayna Grayson and Rachel Holt, and Root Ventures, Lefevre said.

Eventually the company wants to integrate with the back end of companies like ChargePoint and Electrify America to make the charging process as efficient for everyone, according to ChargeLab’s chief executive.

As more service providers get into the market, Lefevre sees the opportunity set for his business expanding exponentially. “Super open platforms are not going to be building an EV charging system any more than they would be building their own hardware,” he said.

Powered by WPeMatico

It would be an understatement to say that enterprise-focused startups have fared well during the pandemic. As organizations look to go remote, and the way we work has been flipped on its head, quickly growing tech companies that simplify this transition are in high demand.

One such startup has, in fact, raised $61.5 million in the last 12 months alone. Electric, a company looking to put IT departments in the cloud, just announced the close of a $40 million Series C round. This comes after an extension of its Series B in March of 2020, when it raised $14.5 million, and then an additional $7 million from 01 Advisors in May of 2020.

This Series C round was led by Greenspring Associates, with participation from existing investors Bessemer Venture Partners, GGV Capital, 01 Advisors and Primary Venture Partners as well as new investors including Atreides Management and Vintage Investment Partners.

Electric launched in 2016 with a mission to make IT much simpler for small and medium-sized businesses. Rather than bringing on a dedicated IT department, or contracting out high-priced local service providers, Electric’s software allows one admin to manage devices, software subscriptions, permissions and more.

According to founder Ryan Denehy, the vast majority of IT’s work is administration, distribution and maintenance of the broad variety of software programs at any given company. Electric does most of that job on behalf of IT, meaning that a smaller business only needs to worry about desk-side troubleshooting when it comes up, rather than the whole kit and caboodle.

Electric charges a flat price per seat per month, and Denehy says the company more than doubled its customer base in the last year. It now supports around 25,000 users across more than 400 individual customer organizations, which puts Electric just shy of $20 million ARR.

This is the first time Denehy has come anywhere close to sharing revenue numbers publicly, but it’s a good time to flex. The company has recently introduced a new lighter-weight offering that includes all of the same functionality as its more expensive product, but without access to chat functionality.

“The name of the game is just simplicity, simplicity, simplicity,” said Denehy. “Part of this is in response to the fact that people are realizing the permanence of hybrid work. During the pandemic, people stopped paying their landlords but they didn’t stop paying us. So in the summer, we started to focus on how we can create more offerings that we can get in the hands of more businesses and let them start their journey with us.”

Denehy says that a little less than half of Electric’s client base are tech startups, which makes sense considering the company launched in New York in a tech and media-centric ecosystem. As a way to expand into other verticals, Electric acquired Sinu, an IT service provider who happened to have an impressive roster of clients outside of Electric’s comfort zone, such as legal, accounting and nonprofit.

Here’s what Denehy said at the time:

Organic market entry, even in adjacent markets can be extremely time consuming and expensive. Sinu’s team has done an excellent job winning and pleasing customers in a lot of industries where we currently don’t play but probably should. The combination of our two companies is a massive shot in the arm to our national expansion strategy.

Alongside growth, both of the Electric team and its customer base, the company is also investing in expanding its diversity programs and philanthropic efforts.

The Electric team is currently made up of just under 250 full-time employees, with 32.5% women and around 30% of employees being non-white. Specifically, nearly 12% of employees are Black and 10% are Latinx.

Denehy explained that he thinks of the company’s payroll, which is in the tens of millions of dollars, as one of the biggest ways he can make a change in the world.

“We will wait longer to fill a role to make sure that we have the most diverse pipeline of candidates possible,” said Denehy. “A lot of founders will say that nobody applied. Well, the reality is you didn’t look hard enough. We’ve just accepted that it may take us longer to fill certain roles.”

This latest round brings Electric’s total funding to more than $100 million.

Powered by WPeMatico

Spreadsheet software — led by products like Microsoft’s Excel, Google’s Sheets and Apple’s Numbers — continues to be one of the most-used categories of business apps, with Excel alone clocking up more than a billion users just on its Android version. Now, a startup called Rows that’s built on that ubiquity, with a low-code platform that lets people populate and analyze web apps using just spreadsheet interfaces, is announcing funding and launching a freemium open beta of its expanded service.

The Berlin-based startup — which rebranded from dashdash at the end of last year — closed a Series B round of $16 million, money that it is using to continue investing in its platform as well as in sales and marketing. The platform’s move into an open beta comes with some 50 new integrations with other platforms like LinkedIn, Instagram and more, as well as 200 new features (using known spreadsheet shortcuts) to use in them.

The round was led by Lakestar, with past investors Accel (which led its $8 million Series A in 2018) and Cherry Ventures also participating. Christian Reber has also invested in this round. Reber knows a thing or two about software disrupting legacy productivity software — he is the co-founder and CEO of presentation software startup Pitch and the former CEO and founder of Microsoft-acquired Wunderlist — and notably he is joining Rows’ Advisory Board along with the investment.

A little detail about this Series B: CEO Humberto Ayres Pereira, who is based out of Porto, Portugal, where some of the staff is also based, tells us that this round actually was quietly closed over a year ago, in January 2020 — just ahead of the world shutting down amid the COVID-19 pandemic.

The startup chose to announce that round today to coincide with adding more features to its product and moving it into an open beta, he said.

That open beta is free in its most basic form — the free tier is limited to 10 users or less and a minimal amount of integration usage. Paid tiers, which cover more team members and up to 100,000 integration tasks (which are measured by how many times a spreadsheet queries another service), start at $59 per month.

One strong sign of interest in this latest iteration of the software is the lasting popularity of spreadsheets. Another is Rows’ traction to date: in invite-only mode, it picked up 10,000 users off its waitlist, and hundreds of companies, as customers. Currently most of those are free, Ayres Pereira said.

“Our goal is to have 1,000 paying companies as customers in the 12 months,” he said. That process has only just started, he added, with paying numbers in the modest “dozens” for now. He emphasized though that the company is very cash efficient and has, even without raising more funding, two years of runway on the money it has in the bank now.

No-code and low-code software, which let people create and work with apps and other digital content without delving deep into the lines of code that underpin them, have continued to pick up traction in the market in the last several years.

The reason for this is straightforward: non-technical employees may not code, but they are getting increasingly adept at understanding how services function and what can be achieved within an app.

No-code and low-code platforms let them get more hands-on when it comes to customizing and creating the services that they need to use everyday to get their work done, without the time and effort it might take to get an engineer involved.

“People want to create their own tools,” said Ayres Pereira. “They want to understand and test and iterate.” He said that the majority of Rows’ users so far are based out of North America, and typical use cases include marketing and sales teams, as well as companies using Rows spreadsheets as a dynamic interface to manage logistics and other operations.

Stephen Nundy, the partner at Lakestar who led its investment, describes the army of users taking up no-code tools as “citizen developers.”

Rows is precisely the kind of platform that plays into the low-code trend. For people who are already au fait with the kinds of tools that you find in spreadsheets — and something like Excel has hundreds of functions in it — it presents a way of leaning on those familiar functions to trigger integrations with other apps, and to subsequently use a spreadsheet created in Rows to both analyse data from other apps, as well as update them.

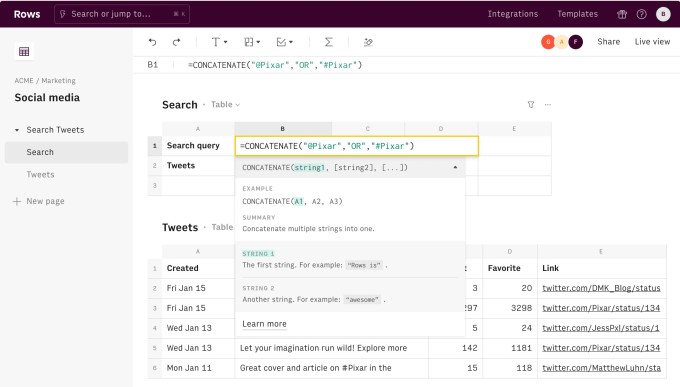

Image: Rows

You might ask, why is it more useful, for example, to look at content from Twitter in Rows rather than Twitter itself? A Rows document might let a person search for a set of Tweets using a certain chain of keywords, and then organise those results based on parameters such as how many “likes” those Tweets received.

Or users responding to a call to action for a promotion on Instagram might then be cross-referenced with a company’s existing database of customers, to analyze how those respondents overlap or present new leads.

You might also wonder why existing spreadsheet products may not have already build functionality like this.

Interestingly, Microsoft did dabble in building a way of linking up Excel with some rudimentary computing functions, in the form of Visual Basic for Applications. This however reached the dubious distinction of topping developers’ “most dreaded” languages list for two years running, and so as you might imagine it has somewhat died a death.

However, it does point to an opportunity for incumbents to disrupt their disruptors.

Apart from those most obvious, entrenched competitors, there have been a number of other startups building tools that are providing similar no- and low-code approaches.

Gyana is focusing more on data science, Tray.io provides a graphical interface to integrate how apps work together, Zapier and Notion also provide simple interfaces to integrate apps and APIs together and Airtable has its own take on reinventing the spreadsheet interface. For now, Ayres Pereira sees these more as compatriots than competitors.

“Yes, we overlap with services like Zapier and Notion,” he said. “But I’d say we are friends. We’re all raising awareness about people being able to do more and not having to be stuck using old tools. It’s not a zero sum game for us.”

When we covered Rows’s Series A two years ago, the startup had built a platform to let people who are comfortable working with data in spreadsheets use that interface to create and populate content in web apps. It had a lot of extensibility, but mainly geared at people still willing to do the work to create those links.

Two years on, while the spreadsheet has remained the anchor, the platform has grown. Ayres Pereira, who co-founded the company with Torben Schulz (both pictured above), said that there are some 50 new integrations now, including ways to analyse and update content on social media platforms like Instagram, YouTube, CrunchBase, Salesforce, Slack, LinkedIn and Twitter, as well as some 200 new features in the platform itself.

While people can import into Rows data from Google Sheets, he noted that the big daddy of them all, Excel, is not supported right now. The reason, he said, is because the vast majority of users of the product use the desktop version, which does not have APIs.

Meanwhile, Rows also has a number of templates available for people to guide them through simple tasks, such as looking up LinkedIn profiles or emails for a list of people, tracking social media counts and so on.

One of the most common aspects of spreadsheets, however, has yet to be built. The interface is still banked around rows and columns, but with no graphical tools to visualize data in different ways such as pie charts or graphs as you might have in a typical spreadsheet program.

It’s for this reason that Rows has yet to exit beta. The feature is one that is requested a lot, Pereira admitted, describing it as “the final frontier.” When Rows is ready to ship with that functionality, likely by Q3 of this year, it will tick over to general “1.0” release, he added.

“Humberto and Torben have really impressed us with their ambition to disrupt the market with a new spreadsheet paradigm that tackles the significant shortcomings of today’s solutions,” said Nundy at Lakestar. “Data integrations are native, the collaboration experience is first class and the ability to share and publish your work as an application is unique and will create more ‘Citizen developers’ to emerge. This is essential to the growing needs of today’s technology literate workforce. The level of interest they’ve received in their private beta is proof of the desirability of platforms like Rows, and we’re excited to be supporting them through their public beta launch and beyond with this investment.” Nundy is also joining Rows’ board with this round.

Powered by WPeMatico

Zomato has raised $250 million, two months after closing a $660 million Series J financing round, as the Indian food delivery startup builds a war-chest ahead of its IPO later this year.

Kora (which contributed $115 million), Fidelity ($55 million), Tiger Global ($50 million), Bow Wave ($20 million) and Dragoneer ($10 million) pumped the new capital into the 12-year-old Gurgaon-headquartered startup, Info Edge, a publicly listed investor in Zomato, disclosed in a filing (PDF) to a local stock exchange. The new investment gives Zomato a post-money valuation of $5.4 billion, up from $3.9 billion in December last year, said Info Edge, which owns 18.4% stake in the Indian startup.

The new investment reinforces the strong confidence investors have in Zomato, which struggled to raise money for much of last year. Zomato, which acquired the Indian food delivery business of Uber early last year, competes with Prosus Ventures-backed Swiggy (valued at about $3.6 billion) in India. Together they work with over 440,000 delivery partners, a larger workforce than that employed by Indian Department of Posts.

A third player, Amazon, also entered the food delivery market in India last year, though its operations are still limited to parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients. With about 50% of the market share, Zomato is the current leader among the three, Bernstein analysts wrote.

“We find the food-tech industry in India to be well positioned to sustained growth with improving unit economics. Take-rates are one of the highest in India at 20-25% and consumer traction is increasing. Market is largely a duopoly between Zomato and Swiggy with 80%+ share,” wrote analysts at Bank of America in a recent report, reviewed by TechCrunch.

Zomato and Swiggy have improved their finances in recent years, which is especially impressive because making money with food delivery is very often more challenging in India. Unlike Western markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $3 to $4, according to research firms.

Both the startups eliminated hundreds of jobs last year as the coronavirus pandemic hit their businesses. Zomato co-founder and chief executive Deepinder Goyal said in December that the food delivery market was “rapidly coming out of COVID-19 shadows.”

“December 2020 is expected to be the highest ever GMV month in our history. We are now clocking ~25% higher GMV than our previous peaks in February 2020. I am supremely excited about what lies ahead and the impact that we will create for our customers, delivery partners and restaurant partners,” he said.

In an email to employees in September last year, Goyal said Zomato was working on its IPO for “sometime in the first half” of 2021 and was raising money to build a war-chest for “future M&A, and fighting off any mischief or price wars from our competition in various areas of our business.”

Powered by WPeMatico

EquityBee, a stock option marketplace startup, has raised $20 million in a Series A round of funding.

Group 11 led the financing, which also included participation from Oren Zeev Ventures, Battery Ventures and ICON Continuity Fund. It brings the company’s total raised to over $28 million since its 2018 inception.

EquityBee CEO and co-founder Oren Barzilai says his company’s mission is to help educate startup employees on the meaning of their stock options, as well as provide them with funds to be able to purchase them.

“I have seen many of my friends and colleagues negotiate a $500 salary increase, but completely disregard their stock options package, from lack of knowledge due to the whole field of startup stock options being opaque,” said Barzilai, who also founded Tapingo, which was acquired by Grubhub in 2018 for $150 million. “As a founder I saw my team members who helped build the company not take part in our success because they left prematurely and didn’t exercise their stock options.”

The way it works is fairly straightforward. EquityBee provides capital to startup employees so they can purchase stock options. The employees get money to cover the cost of exercising their stock options and the taxes. The investors who helped provide the funding so they could do that get a return, or a share of the profit, if there’s “a liquidity event.” EquityBee makes money by charging an upfront fee from the investor on the investment day, as well as any carried interest upon a successful exit or IPO.

Barzilai said that many employees don’t realize they have about 90 days to exercise options before they expire once they leave a company. And even if they do, they may not always have the money to exercise them. That’s where EquityBee wants to help.

The company was originally founded in Israel before launching in the U.S. market, and moved its headquarters to Silicon Valley in February 2020. Since then, it’s funded employees from “hundreds” of companies, including Airbnb, Palantir, DoorDash and Unity, with capital provided by family offices, funds and high-net individuals. Its investor community is made up of 8,000 funds, family offices and high-net worth individuals.

2020 was a good year for EquityBee, according to Barzilai, who says it grew by more than 560% the amount of money it raised to fund employee stock options. It also saw a 360% increase in the number of individual employees funded through its platform.

Looking ahead, the 33-person company plans to use the money toward hiring and expanding product offerings.

Dovi Frances, founding partner of Group 11, said it doubled down on EquityBee after backing the company in its $6.6 million funding round in February 2020 because it’s impressed by what it described as the company’s “perfect product market fit” and triple-digit growth.

WeWork co-founder Adam Neumann led the company’s $1.5 million seed round in September of 2018.

Powered by WPeMatico

Splice, the New York-based, AI-infused, beat-making software service for music producers created by the founder of GroupMe, has managed to sample another $55 million in financing from investors for its wildly popular service.

The GitHub for music producers ranging from Hook N Sling, Mr Hudson SLY, and Steve Solomon to TechCrunch’s own Megan Rose Dickey, Splice gained a following for its ability to help electronic dance music creators save, share, collaborate and remix music.

The company’s popularity has made it from bedroom DJs to the Goldman Sachs boardroom as the financial services giant joined MUSIC, a joint venture between the music executive Matt Pincus and boutique financial services firm Liontree in leading the company’s latest $55 million round. The company’s previous investors include USV, True Ventures, DFJ Growth and Flybridge.

“The music creation process is going through a digital transformation. Artists are flocking to solutions that offer a user-friendly, collaborative, and affordable platform for music creation,” said Stephen Kerns, a VP with Goldman Sachs’ GS Growth, in a statement. “With 4 million users, Splice is at the forefront of this transformation and is beloved by the creator community. We’re thrilled to be partnering with Steve Martocci and his team at Splice.”

Splice’s financing follows an incredibly acquisitive 2020 for the company, which saw it acquiring music technology companies Audiaire and Superpowered.

In addition to the financing, Splice also nabbed Kakul Srivastava, the vice president of Adobe Creative Cloud Experience and Engagement as a director for its board.

The funding news comes on the heels of Splice’s recent acquisitions of music-tech companies Audiaire and Superpowered, creating more ways to improve and inspire the audio and music-making process. Splice is also pleased to announce that Kakul Srivastava has joined the company’s board.

Steve Martocci at TechCrunch Disrupt in 2016. Image Credits: Getty Images

Splice’s beefed up balance sheet comes as new entrants have started vying for a slice of Splice’s music-making market. These are companies like hardware maker Native Instruments, which launched the Sounds.com marketplace last year, and there’s also Arcade by Output that’s pitching a similar service.

Meanwhile, Splice continues to invest in new technology to make producers’ lives easier. In November 2019 it unveiled its artificial intelligence product that lets producers match samples from different genres using machine learning techniques to find the matches.

“My job is to keep as many people inspired to create as possible,” Splice founder and chief executive Steve Martocci told TechCrunch.

It’s another win for the serial entrepreneur who famously sold his TechCrunch Disrupt Hackathon chat app GroupMe to Skype for $85 million just a year after launching.

Powered by WPeMatico

This morning Creatio, a Boston-based software company, announced that it has raised $68 million. Volition Capital, a growth-equity fund, led the round. The deal was a minority investment in the startup.

The deal is notable not merely thanks to its sheer size, but because up until today Creatio had bootstrapped. That’s according to founder and CEO Katherine Kostereva, with whom TechCrunch caught up with last week regarding the investment.

Per Kostereva, her company’s low-code platform helps other companies automate business processes. Creatio’s competitive edge, she said, comes in part from how quickly it can help companies automate; the faster that companies can get from a low-code platform to live apps matters.

Creatio also has a genre focus, namely that it touts its platform’s ability to help automate work in the CRM space — think marketing and sales-related tasks. But its crowning “jewel,” Kostereva said, is Creatio’s underlying low-code automation platform.

The low-code world that Creatio competes in is a broad space that is seeing active investment from the very-early to the very-late stage. For example, last month TechCrunch covered no-code-focused Stacker’s $1.7 million round. And earlier this month TechCrunch wrote about low-code-focused OutSystems’ $150 million raise at a $9.5 billion valuation.

To see another low-code company raise a big check was therefore not too surprising.

TechCrunch was curious where the company and its founder came down on the concept of low-code versus no-code, a topic that is always good to ask players in either space. Kostereva highlighted the importance of citizen developers, folks who can use drag-and-drop interfaces to create apps but who are less adept with code. But she added that with today’s no-code tools one can only build simple things. Creatio, she continued, is more focused on the mid-market and enterprise. As such, it’s just not possible for Creatio to go no-code today. But, her view did appear to be that citizen devs should be able to do more and more in time without code.

It’s a fair perspective, and an encouraging one. The more that folks can do sans code, the more power that can shift into the hands of business orgs that traditionally had to depend on other departments for dev lift.

Back to the money side of things; Creatio has historically targeted breakeven financial results, per its CEO. That means it reinvested in itself as it grew, an arrangement that made us curious as to why the company would raise capital now; why change up a working formula?

In short the company was getting itself ready to accelerate, according to its founder. Kostereva said that she wanted Creatio to have “world-class” numbers for metrics like net retention, revenue growth and net promoter score before it took on external funds.

Was the wait worth it? The company’s net retention was 122% last year, and its NPS score is 34, she disclosed. On the growth side of things, Kostereva said that her company started off doubling and tripling and is still close to doubling. Our read of her comments is that Creatio is probably growing its ARR in the high double digits today.

The company wants to use its capital to invest in sales and marketing to help spread the the word about its business, invest in its partner program, a key growth mechanism, and R&D, it said. So, a little bit of everything.

TechCrunch has recently noticed just how big the software world really is, indexing off the fast that there is enough room for a host of OKR-focused startups to grow and raise external capital without weeding out weaker players. Given how many business processes there are in the world to automate, it may be that Creatio and other low-code platforms that want to help other companies accelerate will enjoy similar market dynamics. Investors, at least, are betting like that’s the case.

Powered by WPeMatico