Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

After online dating’s tremendous 2020 growth that culminated in last week’s epic Bumble IPO, a new entrant has tossed its hat into the dating app ring.

Snack, founded by Kimberly Kaplan, looks to merge the popularity and format of TikTok with the dating world. Kaplan hails from Plenty of Fish, where she was one of the earliest employees at the dating site. She led product, marketing and revenue and was on the executive team that eventually sold PoF to Match Group for $575 million in 2015.

Kaplan said that she noticed a specific user behavior among folks using dating apps, particularly the coveted Gen Z demographic. Essentially, folks would match on Bumble or Tinder and immediately move the connection over to apps like Snap and Instagram, where they would watch each others’ stories and more casually flirt, rather than carrying on in a more high-pressure DM conversation on the dating apps.

Around the same time, TikTok surged in popularity, showing a shift in the average consumer’s attitude toward creating short-form video on the web.

Snack is a video-first dating app that asks users to create a video and post it to a feed. Other users can scroll through a feed (à la Instagram) rather than swipe right or left on individual profiles, and when someone likes a video, it opens up the ability to comment. Once two users have liked each others’ videos, DMs are open.

The app is still in its early days, so there is no location filtering yet to ensure that everyone who joins the app has a full feed of videos to browse through. Kaplan said that Snack is also working on video editing features similar to that of TikTok to let people get super creative with their profiles.

Thus far, Snack has received $3.5 million in funding, led by Kindred Ventures and Coelius Capital, with participation by Golden Ventures, Garage Capital, Panache Ventures and N49P.

Though we’re still a ways away from monetization, Kaplan says her experience in the dating space should be beneficial when looking to generate revenue at Snack, and that the startup will likely follow the same playbook as other dating apps, employing premium subscriptions and potentially ads.

There are 10 people on the Snack team, and Kaplan says that the team is 60% diverse with 40% of employees being visible minorities.

“The biggest challenge is going up against big players that have a lot of capital,” said Kaplan. “Starting out is hard and getting that initial foothold is hard. I fundamentally believe in our product and I see this open opportunity in the market. I very much believe someone will come in and usurp Tinder, and it’s going to be around video.”

Powered by WPeMatico

The last year has been one of financial hardship for billions, and among the specific hardships is the elementary one of paying for utilities, taxes and other government fees — the systems for which are rarely set up for easy or flexible payment. Promise aims to change that by integrating with official payment systems and offering more forgiving terms for fees and debts people can’t handle all at once, and has raised $20 million to do so.

When every penny is going toward rent and food, it can be hard to muster the cash to pay an irregular bill like water or electricity. They’re less likely to be shut off on short notice than a mobile plan, so it’s safer to kick the can down the road… until a few bills add up and suddenly a family is looking at hundreds of dollars of unpaid bills and no way to split them up or pay over time. Same with tickets and other fees and fines.

The CEO and co-founder of Promise, Phaedra Ellis-Lamkins, explained that this (among other places) is where current systems fall down. Unlike buying a TV or piece of furniture, where payment plans may be offered in a single click during online checkout, there frequently is no such option for municipal ticket payment sites or utilities.

“We have found that people struggling to pay their bills want to pay and will pay at extremely high rates if you offer them reminders, accessible payment options and flexibility. The systems are the problem — they are not designed for people who don’t always have a surplus of money in their bank accounts,” she told TechCrunch.

“They assume for example that if someone makes their first payment at 10 PM on the 15th, they will have the same amount of money the next month on the 15th at 10 PM,” she continued. “These systems do not recognize that most people are struggling with their basic needs. Payments may need to be weekly or split up into multiple payment types.”

Even those that do offer plans still see many failures to pay, due at least partly to a lack of flexibility on their part, said Ellis-Lamkins — failure to make a payment can lead to the whole plan being cancelled. Furthermore, it may be difficult to get enrolled in the first place.

“Some cities offer payment plans but you have to go in person to sign up, complete a multiple-page form, show proof of income and meet restrictive criteria,” she said. “We have been able to work with our partners to use self-certification to ease the process as opposed to providing tax returns or other documentation. Currently, we have over a 90% repayment rate.”

Promise acts as a sort of middleman, integrating lightly with the agency or utility, which in turn makes anyone owing money aware of the possibility of the different payment system. It’s similar to how you might see various payment options, including installments, when making a purchase at an online shop.

The user enrolls in a payment plan (the service is mobile-friendly because that’s the only form of internet many people have) and Promise handles that end of it, with reminders, receipts and processing, passing on the money to the agency as it comes in — the company doesn’t cover the cost up front and collect on its own terms. Essentially it’s a bolt-on flexible payment mechanism that specializes in government agencies and other public-facing fee collectors.

Promise makes money by subscription fees (i.e. SaaS) and/or through transaction fees, whichever makes more sense for the given customer. As you might imagine, it makes more sense for a utility to pay a couple bucks to be more sure of collecting $500, than to take its chance on getting none of that $500, or having to resort to more heavy-handed and expensive debt collection methods.

Lest you think this is not a big problem (and consequently not a big market), Ellis-Lamkins noted a recent study from the California Water Boards showing there are 1.6 million people with a total of $1 billion in water debt in the state — one in eight households is in arrears to an average of $500.

Those numbers are likely worse than normal, given the immense financial pressure that the pandemic has placed on nearly all households — but like payment plans in other circumstances, households of many incomes and types find their own reason to take advantage of such systems. And pretty much anyone who’s had to deal with an obtusely designed utility payment site would welcome an alternative.

The new round brings the company’s total raised to over $30 million, counting $10 million it raised immediately after leaving Y Combinator in 2018. The funding comes from existing investors Kapor Capital, XYZ, Bronze, First Round, YC, Village, and others.

Powered by WPeMatico

As the Biden administration works to bring legislation to Congress to address the endemic problem of immigration reform in America, on the other side of the nation a small California startup called SESO Labor has raised $4.5 million to ensure that farms can have access to legal migrant labor.

SESO’s founder Mike Guirguis raised the round over the summer from investors including Founders Fund and NFX. Pete Flint, a founder of Trulia, joined the company’s board. The company has 12 farms it’s working with and is negotiating contracts with another 46. The company’s other co-founder, Jordan Taylor, was the first product hire at Farmer’s Business Network and previously of Dropbox.

Working within the existing regulatory framework that has existed since 1986, SESO has created a service that streamlines and manages the process of getting H-2A visas, which allow migrant agricultural workers to reside temporarily in the U.S. with legal protections.

At this point, SESO is automating the visa process, getting the paperwork in place for workers and smoothing the application process. The company charges about $1,000 per worker, but eventually as it begins offering more services to workers themselves, Guirguis envisions several robust lines of revenue. Eventually, the company would like to offer integrated services for both farm owners and farm workers, Guirguis said.

SESO is currently expecting to bring in 1,000 workers over the course of 2021 and the company is, as of now, pre-revenue. The largest industry player handling worker visas today currently brings in 6,000 workers per year, so the competition, for SESO, is market share, Guirguis said.

The H-2A program was set up to allow agricultural employers who anticipate shortages of domestic workers to bring to the U.S. non-immigrant foreign workers to work on farms temporarily or seasonally. The workers are covered by U.S. wage laws, workers’ compensation and other standards, including access to healthcare under the Affordable Care Act.

Employers who use the visa program to hire workers are required to pay inbound and outbound transportation, provide free or rental housing and provide meals for workers (they’re allowed to deduct the costs from salaries).

H-2 visas were first created in 1952 as part of the Immigration and Nationality Act, which reinforced the national origins quota system that restricted immigration primarily to Northern Europe, but opened America’s borders to Asian immigrants for the first time since immigration laws were first codified in 1924. While immigration regulations were further opened in the sixties, the last major immigration reform package in 1986 served to restrict immigration and made it illegal for businesses to hire undocumented workers. It also created the H-2A visas as a way for farms to hire migrant workers without incurring the penalties associated with using illegal labor.

For some migrant workers, the H-2A visa represents a golden ticket, according to Guirguis, an honors graduate of Stanford who wrote his graduate thesis on labor policy.

“We are providing a staffing solution for farms and agribusiness and we want to be Gusto for agriculture and upsell farms on a comprehensive human resources solution,” says Guirguis of the company’s ultimate mission, referencing payroll provider Gusto.

As Guirguis notes, most workers in agriculture are undocumented. “These are people who have been taken advantage of [and] the H-2A is a visa to bring workers in legally. We’re able to help employers maintain workforce [and] we’re building software to help farmers maintain the farms.”

Farms need the help, if the latest numbers on labor shortages are believable, but it’s not necessarily a lack of H-2A visas that’s to blame, according to an article in Reuters.

In fact, the number of H-2A visas granted for agriculture equipment operators rose to 10,798 from October through March, according to the Reuters report. That’s up 49% from a year ago, according to data from the U.S. Department of Labor cited by Reuters.

Instead of an inability to acquire the H-2A visa, it was an inability to travel to the U.S. that’s been causing problems. Tighter border controls, the persistent global pandemic and travel restrictions that were imposed to combat it have all played a role in keeping migrant workers in their home countries.

Still, Guirguis believes that with the right tools, more farms would be willing to use the H-2A visa, cutting down on illegal immigration and boosting the available labor pool for the tough farm jobs that American workers don’t seem to want.

Photo by Brent Stirton/Getty Images.

David Misener, the owner of an Oklahoma-based harvesting company called Green Acres Enterprises, is one employer who has struggled to find suitable replacements for the migrant workers he typically hires.

“They could not fathom doing it and making it work,” Misener told Reuters, speaking about the American workers he’d tried to hire.

“With H-2A, migrant workers make 10 times more than they would get paid at home,” said Guirguis. “They’re taking home the equivalent of $40 an hour. The H-2A is coveted.”

Guirguis thinks that with the right incentives and an easier onramp for farmers to manage the application and approval process, the number of employers that use H-2A visas could grow to be 30% to 50% of the farm workforce in the country. That means growing the number of potential jobs from 300,000 to 1.5 million for migrants who would be under many of the same legal protections that citizens enjoy while they’re working on the visa.

Interest in the farm labor nexus and issues surrounding it came to the first-time founder through Guirguis’ experience helping his cousin start her own farm. Spending several weekends a month helping her grow the farm with her husband, Guirguis heard his stories about coming to the U.S. as an undocumented worker.

Employers using the program avoid the liability associated with being caught employing illegal labor, something that crackdowns under the Trump administration made more common.

Still, it’s hard to deny the program’s roots in the darker past of America’s immigration policy. And some immigration advocates argue that the H-2A system suffers from the same kinds of structural problems that plague the corollary H-1B visas for tech workers.

“The H-2A visa is a short-term temporary visa program that employers use to import workers into the agricultural fields … It’s part of a very antiquated immigration system that needs to change. The 11.5 million people who are here need to be given citizenship,” said Saket Soni, the founder of an organization called Resilience Force, which advocates for immigrant labor. “And then workers who come from other countries, if we need them, they have to be able to stay … H-2A workers don’t have a pathway to citizenship. Workers come to us afraid of blowing the whistle on labor issues. As much as the H-2A is a welcome gift for a worker it can also be abused.”

Soni said the precarity of a worker’s situation — and their dependence on a single employer for their ability to remain in the country legally — means they are less likely to speak up about problems at work, since there’s nowhere for them to go if they are fired.

“We are big proponents that if you need people’s labor you have to welcome them as human beings,” Soni said. “Where there’s a labor shortage as people come, they should be allowed to stay … H-2A is an example of an outdated immigration tool.”

Guirguis clearly disagrees and said a platform like SESO’s will ultimately create more conveniences and better services for the workers who come in on these visas.

“We’re trying to put more money in the hands of these workers at the end of the day,” he said. “We’re going to be setting up remittance and banking services. Everything we do should be mutually beneficial for the employer and the worker who is trying to get into this program and know that they’re not getting taken advantage of.”

Powered by WPeMatico

Photomath, the popular mobile app that helps you solve equations, has raised a $23 million Series B funding round led by Menlo Ventures. The app is a massive consumer success, and chances are you might already know about it if you have a teenager in your household.

The app lets you point your phone’s camera at a math problem. It recognizes what’s written and gives you a step-by-step explanation to solve the problem. You might think that it’s the perfect app for lazy students.

But there are many different use cases for Photomath. For instance, you can write an equation in your notebook and use Photomath to draw a graph.

Typing an equation on a keyboard is quite difficult. That’s why bridging the gap between the physical world and your smartphone is key to Photomath’s success. You can just grab a pen and write something down on a piece of paper. Essentially, it’s an AR calculator.

GSV Ventures, Learn Capital, Cherubic Ventures and Goodwater Capital are also participating in today’s funding round.

There’s an interesting story behind the app’s success. Photomath was originally designed as a demo app for another company called MicroBlink. At the time, the team was working on text recognition technology. It planned to sell its core technology to other companies that might find it useful.

In 2014, they pitched MicroBlink at TechCrunch Disrupt in London. And things changed drastically overnight as Photomath reached the first spot of the iOS App Store.

Photomath has now attracted more than 220 million downloads. As of this writing, it is still No. 59 in the U.S. App Store, one rank above Tinder. Other companies tried to build competitors, but it seems they didn’t manage to crush the tiny European startup.

The app seems even more relevant as many kids are spending more time studying at home. They can’t simply raise their hand to call on the teacher for some help.

Photomath is free and users can optionally pay for Photomath Plus, a premium version with more features, such as dynamic illustrations and animated tutorials.

Powered by WPeMatico

Census, a startup that helps businesses sync their customer data from their data warehouses to their various business tools like Salesforce and Marketo, today announced that it has raised a $16 million Series A round led by Sequoia Capital. Other participants in this round include Andreessen Horowitz, which led the company’s $4.3 million seed round last year, as well as several notable angles, including Figma CEO Dylan Field, GitHub CTO Jason Warner, Notion COO Akshay Kothari and Rippling CEO Parker Conrad.

The company is part of a new crop of startups that are building on top of data warehouses. The general idea behind Census is to help businesses operationalize the data in their data warehouses, which was traditionally only used for analytics and reporting use cases. But as businesses realized that all the data they needed was already available in their data warehouses and that they could use that as a single source of truth without having to build additional integrations, an ecosystem of companies that operationalize this data started to form.

The company argues that the modern data stack, with data warehouses like Amazon Redshift, Google BigQuery and Snowflake at its core, offers all of the tools a business needs to extract and transform data (like Fivetran, dbt) and then visualize it (think Looker).

Tools like Census then essentially function as a new layer that sits between the data warehouse and the business tools that can help companies extract value from this data. With that, users can easily sync their product data into a marketing tool like Marketo or a CRM service like Salesforce, for example.

“Three years ago, we were the first to ask, ‘Why are we relying on a clumsy tangle of wires connecting every app when everything we need is already in the warehouse? What if you could leverage your data team to drive operations?’ When the data warehouse is connected to the rest of the business, the possibilities are limitless,” Census explains in today’s announcement. “When we launched, our focus was enabling product-led companies like Figma, Canva, and Notion to drive better marketing, sales, and customer success. Along the way, our customers have pulled Census into more and more scenarios, like auto-prioritizing support tickets in Zendesk, automating invoices in Netsuite, or even integrating with HR systems.“

Census already integrates with dozens of different services and data tools and its customers include the likes of Clearbit, Figma, Fivetran, LogDNA, Loom and Notion.

Looking ahead, Census plans to use the new funding to launch new features like deeper data validation and a visual query experience. In addition, it also plans to launch code-based orchestration to make Census workflows versionable and make it easier to integrate them into an enterprise orchestration system.

Powered by WPeMatico

Today, that software is offered as a cloud service should be pretty much considered a given. Certainly any modern tooling is going to be SaaS, and as companies and employees add services, it becomes a management nightmare. Enter Torii, an early-stage startup that wants to make it easier to manage SaaS bloat.

Today, the company announced a $10 million Series A investment led by Wing Venture Capital, with participation from prior investors Entree Capital, Global Founders Capital, Scopus Ventures and Uncork Capital. The investment brings the total raised to $15 million, according to the company. Under the terms of the deal, Wing partner Jake Flomenberg is joining the board.

Uri Haramati, co-founder and CEO, is a serial entrepreneur who helped launch Houseparty and Meerkat. As a serial founder, he says that he and his co-founders saw firsthand how difficult it was to manage their companies’ SaaS applications, and the idea for Torii developed from that.

“We all felt the changes around SaaS and managing the tools that we were using. We were all early adopters of SaaS. We all [took advantage of SaaS] to scale our companies and we felt the same thing: The fact is that you just can’t add more people who manage more software, it just doesn’t scale,” Haramati told me.

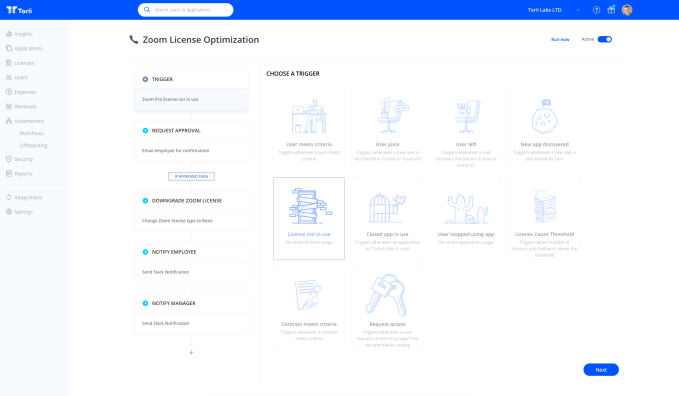

He said they started Torii with the idea of using software to control the SaaS sprawl they were experiencing. At the heart of the idea was an automation engine to discover and manage all of the SaaS tools inside an organization. Once you know what you have, there is a no-code workflow engine to create workflows around those tools for key activities like onboarding or offboarding employees.

Torii Workflow Engine. Image Credits: Torii

The approach seems to be working. As the pandemic struck in 2020, more companies than ever needed to control and understand the SaaS tooling they had, and revenue grew 400% YoY last year. Customers include Delivery Hero, Chewy, Monday.com and Palo Alto Networks.

The company also doubled its employees from a dozen with which they started last year, with plans to get to 60 people by the end of this year. As they do that, as experienced entrepreneurs, Haramati told me they already understood the value of developing a diverse and inclusive workforce, certainly around gender. Today, the team is 25 people with 10 being women and they are working to improve those ratios as they continue to add new people.

Flomenberg invested in Torii because he was particularly impressed with the automation aspect of the company and how it took a holistic approach to the SaaS management problem, rather than attempting to solve one part of it. “When I met Uri, he described this vision. It was really to become the operating system for SaaS. It all starts with the right data. You can trust data that is gathered from [multiple] sources to really build the right picture and pull it together. And then they took all those signals and they built a platform that is built on automation,” he said.

Haramati admits that it’s challenging to scale in the midst of a pandemic, but the company is growing and is already working to expand the platform to include product recommendations and help with compliance and cost control.

Powered by WPeMatico

Artie, a startup looking to rethink the distribution of mobile games, announced today that it has raised $10 million in funding.

There are some big names backing the company — its latest investors include Zynga founder Mark Pincus, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, Scooter Braun’s Raised In Space, Shutterstock founder Jon Oringer, Tyler and Cameron Winklevoss, Susquehanna International Group, Harris Blitzer Sports & Entertainment + The Sixers Lab, Googler Manuel Bronstein and YouTube co-founder Chad Hurley.

This actually represents a pivot from Artie’s original vision of creating augmented reality avatars. CEO Ryan Horrigan said that he and his co-founder/CTO Armando Kirwin ended up building distribution technology that they felt solved “a much bigger problem.”

The problem, in part, is game developers “looking for ways outside of Apple’s App Stores rules and restrictions.” (That’s certainly something Fortnite-maker Epic Games seems to be fighting for.) So Artie’s platform allows users to play mobile games without installing an app, from the browser or wherever links can be shared online.

Image Credits: Artie

Artie isn’t the only startup focused on the idea of app-less mobile gaming, but Horrigan said that while other companies are limited by JavaScript and HTML5, Artie supports Unity, meaning it can build casual (rather than hyper-casual) games, and eventually games that might even go deeper.

“Similar to cloud games, we’re running Unity games on our cloud, but rather than rendering their graphics on the cloud and pushing the video to players, we’re not running graphics on the cloud,” he said. “We’re streaming assets and animations that are highly-optimized and rendered in real-time through the embedded web browser.”

In other words, the goal is to get frictionless distribution outside of app stores, while avoiding some of the issues facing cloud gaming, namely significant infrastructure costs and lag time.

The startup is developing and releasing games of its own, with an Alice in Wonderland game, a beer pong game and more on the schedule for later this year, then a massively multiplayer online game planned for 2022. But the company also plans to release an SDK allowing other developers to distribute through its platform as well.

Horrigan said Artie’s initial games will be free-to-play, monetized through in-game purchases. They’ll use cookies to remember where players were in the game, but players will also be able to create logins.

Artie is also developing games with a major music star and a superhero IP-owner, and he argued that by combining no-code/low-code authoring tools with Artie’s distribution platform, this could become a bigger trend.

“We want to be working with the next generation of influencers to make games using these low-code or no-code solutions, then publish to their audiences directly on YouTube,” he said. “Imagine what a branded game would look like from your favorite hip hop star. We think that’s coming, and we think Artie is the platform to make that happen.”

Powered by WPeMatico

Tens of thousands of students and professionals move out of India each year to pursue higher education and for work. Even after spending months in a new country, they struggle to get a credit card from local banks, and end up paying a premium to access a range of other financial services.

Banks in the U.S., or in most other countries for that matter, rely on local credit scores to determine the worthiness of potential applicants. Even if an individual had a great credit score in India, for instance, that wouldn’t hold any water for banks in a foreign land.

That was the takeaway Raghunandan G, the founder of ride-hailing firm TaxiForSure (sold to local giant Ola), returned to India with after a trip. After months of research and assembling a team, Raghunandan believes he has a solution.

Powered by WPeMatico

Krisp, a startup that uses machine learning to remove background noise from audio in real time, has raised $9M as an extension of its $5M A round announced last summer. The extra money followed big traction in 2020 for the Armenian company, which grew its customers and revenue by more than an order of magnitude.

TechCrunch first covered Krisp when it was just emerging from UC Berkeley’s Skydeck accelerator, and co-founder Davit Baghdasaryan was relatively freshly out of his previous role at Twilio. The company’s pitch when I chatted with them in the shared office back then was simple and remains the core of what they offer: isolation of the human voice from any background noise (including other voices) so that audio contains only the former.

It probably comes as no surprise, then, that the company appears to have benefited immensely from the shift to virtual meetings and other trends accelerated by the pandemic. To be specific, Baghdasaryan told me that 2020 brought the company a 20x increase in active users, a 23x increase in enterprise accounts and 13x improvement of annual recurring revenue.

The rise in virtual meetings — often in noisy places like, you know, homes — has led to significant uptake across multiple industries. Krisp now has more than 1,200 enterprise customers, Baghdasaryan said: banks, HR platforms, law firms, call centers — anyone who benefits from having a clear voice on the line (“I guess any company qualifies,” he added). Enterprise-oriented controls like provisioning and central administration have been added to make it easier to integrate.

B2B revenue recently eclipsed B2C; the latter was likely popularized by Krisp’s inclusion as an option in popular gaming (and increasingly beyond) chat app Discord, though of course users of a free app being given a bonus product for free aren’t always big converters to “pro” tiers of a product.

But the company hasn’t been standing still, either. While it began with a simple feature set (turning background noise on and off, basically) Krisp has made many upgrades to both its product and infrastructure.

Noise cancellation for high-fidelity voice channels makes the software useful for podcasters and streamers, and acoustic correction (removing room echos) simplifies those setups quite a bit as well. Considering the amount of people doing this and the fact that they’re often willing to pay, this could be a significant source of income.

The company plans to add cross-service call recording and analysis; since it sits between the system’s sound drivers and the application, Krisp can easily save the audio and other useful metadata (How often did person A talk versus person B? What office locations are noisiest?). And the addition of voice cancellation — other people’s voices, that is — could be a huge benefit for people who work, or anticipate returning to work, in crowded offices and call centers.

Part of Krisp’s allure is the ability to run locally and securely on many platforms with very low overhead. But companies with machine learning-based products can stagnate quickly if they don’t improve their infrastructure or build more efficient training flows — Lengoo, for instance, is taking on giants in the translation industry with better training as more or less its main advantage.

Krisp has been optimizing and reoptimizing its algorithms to run efficiently on both Intel and ARM architectures, and decided to roll out its own servers for training its models instead of renting from the usual suspects.

“AWS, Azure and Google Cloud turned out to be too expensive,” Baghdasaryan said. “We have invested in building a data center with Nvidia’s latest A100s in them. This will make our experimentation faster, which is crucial for ML companies.”

Baghdasaryan was also emphatic in his satisfaction with the team in Armenia, where he and his co-founder Arto Minasyan are from, and where the company has focused its hiring, including the 25-strong research team. “By the end of 2021 it will be a 45-member team, all in Armenia,” he said. “We are super happy with the math, physics and engineering talent pool there.”

The funding amounts to $14 million if you combine the two disparate parts of the A round, the latter of which was agreed to just three months after the first. That’s a lot of money, of course, but may seem relatively modest for a company with a thousand enterprise customers and revenue growing by more than 2,000% year over year.

Baghdasaryan said they just weren’t ready to take on a whole B round, with all that involves. They do plan a new fundraise later this year when they’ve reached $15 million ARR, a goal that seems perfectly reasonable given their current charts.

Of course startups with this kind of growth tend to get snapped up by larger concerns, but despite a few offers Baghdasaryan says he’s in it for the long haul — and a multibillion dollar market.

The rush to embrace the new virtual work economy may have spurred Krisp’s growth spurt, but it’s clear that neither the company nor the environment that let it thrive are going anywhere.

Powered by WPeMatico

Talkshoplive is a startup that’s worked with stars like Paul McCartney and Garth Brooks, as well as small businesses, to host shopping-focused live videos. Today, it’s announcing that it has raised $3 million in seed funding from Spero Ventures.

CEO Bryan Moore founded the company with his sister Tina in 2018. Moore previously led social media efforts at Twentieth Television (previously known as Twentieth Century Fox) and CBS Television, and he said he was inspired to launch Talkshoplive by the rise of livestreamed shopping experiences in China.

At the same time, Moore said it wasn’t enough to just copy what worked in China: “Small businesses are different here, talent is different, the needs are different.” One of the keys, in his view, is to focus on helping creators and businesses meet their customers where those customers already are — which he also suggested differentiates Talkshoplive from competing services as well.

For one thing, the startup does not require consumers to download any additional apps in order to watch its videos. Instead, it’s created a video player that works on the Talkshoplive website, on the websites of its partners and anywhere else that videos can be embedded. And wherever those videos are played, they also include a one-click buy button.

Moore said Talkshoplive started out with a focus in books and music, working with famous names like Matthew McConaughey, Alicia Keys and Dolly Parton, as well as the aforementioned Brooks and McCartney. For example, Brooks used Talkshoplive to exceed more than 1 million vinyl pre-sales for his “Legacy Collection” box set in 2019.

On the book side, Talkshoplive has worked with publishers including Harper Collins, Penguin Random House, Simon & Schuster and Macmillan. Moore claimed the platform is driving three to nine times the sales an author would see on other e-commerce sites.

At the same time, he emphasized that the startup is also working with more than 3,500 small businesses, and he said that when a small business owner is broadcasting on Talkshoplive, “You’re creating your own microfandom by being able to tell the story … You’re making yourself a brand story, even as a small business.”

He added, “When you’re able to help people move $25,000 in a show — for a small business, that’s a huge deal.”

In this sense, Moore said he sees Talkshoplive as a continuation of his previous work in social media, all connected by the question, “How are you creating human connection in a digital landscape?” The “ultimate goal,” he added, is to turn the platform into a “digital Main Street” for businesses everywhere.

More recently, Talkshoplive has been moving into other categories like food and beauty, and Moore said he’s excited to work with Spero founding partner Shripriya Mahesh (previously an executive at eBay and First Look Media) to “continually evolve our product and create these tools that help us scale faster — and also help benefit these businesses.”

“From the moment we met the Talkshoplive team, we were impressed with their focus on enabling SMB’s with a new, creative, innovative way to build their businesses,” Mahesh said in a statement. “Talkshoplive also innovates on the marketplace model with a way for buyers to truly engage with the sellers, get to know them, and experience shopping in a whole new way. We are incredibly excited by the community that is taking shape at Talkshoplive and are thrilled to be working with Bryan, Tina, and the TSL team as they grow their community and the marketplace.”

Powered by WPeMatico