Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

French startup Homa Games has raised a $15 million seed round led by e.ventures and Idinvest Partners. The company has built several in-house technologies that can take a game from prototype to App Store success. It partners with third-party game studios and has a few in-house game studios as well.

OneRagtime, Jean-Marie Messier, Vladimir Lasocki, John Cheng and Alexis Bonillo are also participating in today’s funding round. This is quite a big funding round, but Homa Games already has some impressive metrics.

For instance, the startup’s games have been downloaded 250 million times overall since the creation of the company in 2018. It has signed an IP partnership with Hasbro to launch a Nerf-themed game that has been working quite well. Other games include Sky Roller, Idle World and Tower Color.

Home Games has developed three products in particular to optimize mobile game creation. Homa Lab helps you learn more about the competitive landscape with market intelligence and testing tools. Homa Belly is an SDK that helps you iterate and manage your game. And Homa Data optimizes monetization using data for both in-app purchases and ads.

Third-party developers can submit their games and choose Homa Games as their publisher. Both companies agree on a revenue-sharing model.

In addition to third-party games, Homa Games has also acquired IRL Team in Toulouse and has in-house game development teams in Skopje, Lisbon and Paris. Overall, there are 80 people working for Homa Games.

Benoist Grossmann from Idinvest Partners and Jonathan Userovici from e.ventures are both joining the board of the company.

Powered by WPeMatico

Four years ago when Zach Jones went to do due diligence on C-Zero, a startup out of Santa Barbara, California commercializing a new approach to producing hydrogen, for the small family office he was working for, he had no idea he’d wind up as the company’s chief executive officer.

Or that the company would wind up raising money from Breakthrough Energy Ventures, the billionaire-backed investment vehicle focused on financing companies developing technologies to reduce greenhouse gas emissions, and some of the world’s largest industrial and oil and gas companies.

At the time, Jones was working for Beryllium Capital, a small investment office out of South Dakota, and had identified a potential investment opportunity in C-Zero, a company commercializing a new way of making hydrogen developed by Eric McFarland, a professor at UCSB.

There was only one problem — McFarland had the research, but didn’t know how to run a company. That’s when Jones stepped in. His firm didn’t make the investment, but when the former Economist science writer took over, the company was able to nab a seed round from PG&E and SoCal Gas, California’s two massive utilities.

The reason for their investments is the same reason Breakthrough Energy Ventures became interested in the young company. Even with renewable energy production coming on line at a breakneck pace, much of the world will still be using fossil fuels for the foreseeable future, and the greenhouse gas emissions from that fossil fuel production needs to go to zero.

C-Zero is developing a technology that converts natural gas to hydrogen, a much cleaner source of fuel, and solid carbon as the only waste stream for use in electrical generation, process heating and the production of commodity chemicals like hydrogen and ammonia.

“Our CTO talks about running a coal mine in reverse,” Jones said.

Night image of an industrial manufacturing plant. Image Credits: Getty Images

The company’s technology is a form of methane pyrolysis, which uses a proprietary chemical catalyst to separate the hydrogen gas from other particles, leaving behind that solid carbon waste. The process, which is neither waste free (there’s that solid carbon) nor renewable (the feedstock is natural gas), is cleaner than current low-cost methods of hydrogen production and far cheaper than the more renewable ways of making hydrogen.

Making renewable hydrogen requires making electricity to send a charge through water to split the liquid into hydrogen and oxygen. And it takes far more energy to pull a hydrogen atom off of an oxygen atom than it does to split that hydrogen from a carbon atom.

“The reason that hydrogen is interesting is that it is a great supplement to intermittent renewables,” said Jones. “It’s really about energy storage… when you look at long duration storage on a daily and seasonal basis… it becomes exorbitantly expensive. Having a chemical fuel is going to be critical part of decarbonizing everything.”

Jones describes the technology as “pre-combustion carbon capture,” and thinks that it could be critical to unlocking the benefits of hydrogen for a range of industrial applications including heavy vehicle fueling, utility power generation and industrial power for manufacturing.

He’s not alone.

“Over $100 billion of commodity hydrogen is produced annually,” said Carmichael Roberts, Breakthrough Energy Ventures, the new lead investor in C-Zero’s $11.5 million funding. “Unfortunately, the overwhelming majority of that production comes from a process called steam methane reforming, which also produces large quantities of CO2. Finding low-cost, low-emission methods of hydrogen production — such as the one C-Zero has created — will be critical to unlocking the molecule’s potential to decarbonize major segments of the agricultural, chemical, manufacturing and transportation sectors.”

Joining the Bill Gates-backed Breakthrough Energy Ventures in the new round is Eni Next (the investment arm of the Italian oil and gas and power company), Mitsubishi Heavy Industries and the hydrogen technology-focused venture firm AP Ventures.

Mitsubishi Heavy Industries already has an application for C-Zero’s technology. The company is in the process of re-powering an existing coal plant to run on a combination of natural gas and hydrogen by 2025. It’s possible that C-Zero’s technology could help get there.

Beyond the lower-cost methods used in manufacturing hydrogen, C-Zero may be one of the first companies that could qualify for new tax credits on carbon sequestration established by the IRS in the U.S. earlier this year. Those credits would give qualifying companies $20 per ton of sequestered solid carbon — the exact waste product from C-Zero’s process.

Even as C-Zero begins commercializing its technology it faces some stiff competition from some of the largest chemical companies in the world.

The German chemicals giant BASF has been developing its own flavor of methane pyrolysis for nearly a decade and has begun building test facilities to scale up production of its own clean hydrogen.

Two other big European corporations are also joining the hydrogen production game as the French chemicals company Air Liquide announced a joint venture with Siemens Energy to work on hydrogen production.

Jones acknowledges that the company’s technology is only a stopgap solution… for now. In the future, as the world moves to renewable natural gas production from waste, he envisions the potential of a potentially circular hydrogen economy.

“In 100 years will this technology be around? If it is it’ll be because we’re using renewable natural gas,” Jones said. There are a lot of steps that need to be traveled to get there, but Jones is confident in the near-term success of the project.

“There’s always going to be a need for a very energy dense fuel. Liquid hydrogen is the most energy dense thing that’s out there outside of something that’s nuclear in nature,” he said. “I think that hydrogen is here to stay. At the end of the day the lowest cost of energy that has the lowest cost for avoided CO2 is what’s going to win.”

Powered by WPeMatico

Unless you’ve got someone’s Amazon Wish List, gift giving today can still be fairly difficult. You don’t necessarily know a friend or family member’s shipping address, their sizes or their particular tastes, at times. A new startup called Goody, backed by a recent $4 million fundraise, wants to help. Through its newly launched mobile gifting app, Goody lets you celebrate your friends, family and other loved ones with a gift or, soon, even just an “IOU” that lets them know you’re thinking of them.

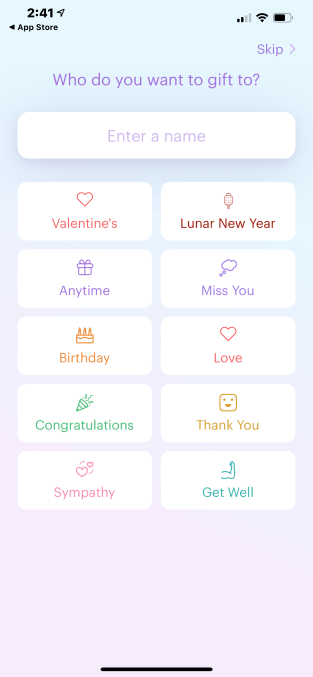

To do so, you first download the Goody mobile app for iOS or Android, then browse across the hundreds of brands and products it offers. You also can filter these by occasion, like birthdays or holidays, or by a specific need, such as gifts to say congratulations or get well.

Image Credits: Goody

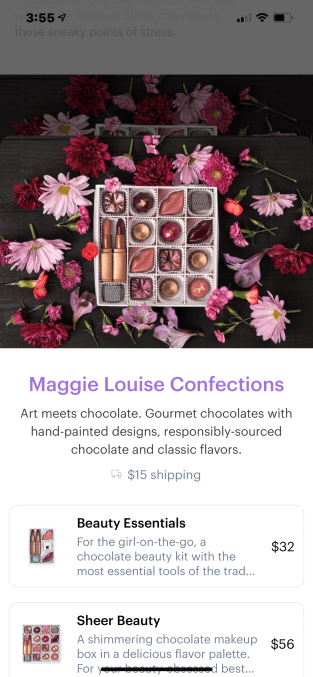

When you find a gift you like, you just enter the recipient’s phone number. Goody then sends a text that lets the recipient know that you’ve sent them something. The recipient clicks the link to accept the gift, which opens a website where they can see what you’ve selected, while also customizing any specific options — like their clothing size, color preferences or what flavor of cupcakes they’d like, for example.

Here, they also provide their shipping address, and the gift is sent. Afterwards, they can choose to send a thank you note, as well.

What makes this experience work is that — unlike some gifting startups in the past — Goody doesn’t require the recipient to download an app, nor do you need to know anything other than a phone number of the person you want to send a gift to.

Image Credits: Goody

The idea for Goody comes from co-founder and serial entrepreneur and startup investor Edward Lando, whose prior company, YC-backed GovPredict, was recently acquired. He was also the first investor in Misfits Market, serves on the board at Atom Finance and is a managing partner at Pareto Holdings, based in Miami, where Lando now lives.

Joining him on Goody are Even.com tech lead Mark Bao and Lee Linden, who notably sold his prior gifting startup Karma Gifts to Facebook back in 2012.

Lando says he was interested in working on the idea because he loves to send gifts, but thinks there’s a lot of friction involved with the process as it stands today. Meanwhile, gifts that are easier to send, like gift cards, can lack a personal touch.

“The most important thing for us is for Goody to feel highly personal,” Lando explains. “If someone sends you something through Goody [it should feel like], wow, they really thought about me — they picked out something for me. We don’t want it to feel like someone is just sending you a dollar value,” he says.

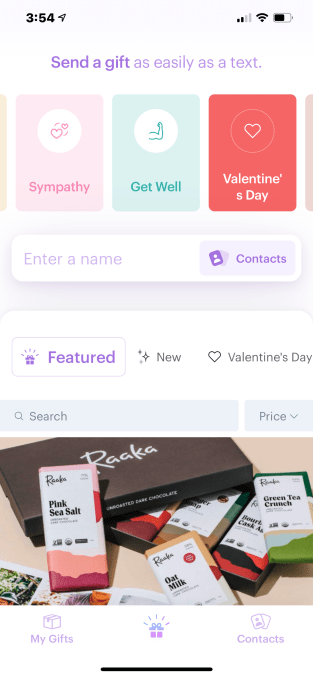

The mobile app launched in mid-December and now works with a couple dozen brand partners. Many of these are in the direct-to-consumer space or are otherwise emerging companies, like non-alcoholic aperitif Ghia, workout experience The Class, pet company Fable, wellness company Moon Juice, Raaka Chocolate and others.

Image Credits: Goody

Goody’s model involves a revenue share with its partners, where its cut increases the more sales its makes on the partner’s behalf.

Brands are interested in working with Goody, Lando explains, because it can help them acquire new customers with little effort on their part.

“There’s so many direct-to-consumer brands these days — thousands of them — selling online — coffee, chocolate, all these cool things,” Lando says. “And for now, their only way of getting discovered is buying ads on Facebook. We’re another way for people to discover them. We’re like a giant shopping mall for people to discover these things,” he adds.

The app, however, wants to be useful to those who also just want to stay in touch with friends and family. On this front, it’s rolling out free gifts this week called “IOUs,” for telling someone you’re thinking of them — for example, by saying something like “I owe you dinner next time I’m in town” or sharing some other more symbolic gift.

The app will also later integrate a calendar that will help you track important occasions, like birthdays and other major life events.

Goody was founded in March 2020 and the app launched in mid-December of the same year. So far, around 10,000 gifts have been sent using its service, Lando says.

In addition to the holiday season, of course, the pandemic may have played a role in Goody’s early traction.

“I think the pandemic has been a big problem for everyone. And one of the things that people frankly don’t talk about enough, in my opinion, is the psychological toll the pandemic is taking on everyone…we are all creatures that enjoy social interaction. It feels good to see other people — especially the people you care about. And when you don’t, it really drains you of energy,” Lando says.

“This is obviously not the same as seeing people in person, but I do think that Goody is a nice injection of warmth and positivity…Everyone who uses it says they feel good after using it, which I think is rare,” Lando notes.

Image Credits: Goody ad in NYC

The startup, meanwhile, has raised a little more than $4 million in early funding from investors including Quiet Capital, Index Ventures, Pareto Holdings, Third Kind Venture Capital, Craft Ventures and the founders of Coinbase (Fred Ehrsam) and Quora (Charlie Cheever), among others.

Goody is a team of nine full-time employees, based in Miami and elsewhere, working remotely. Ahead of Valentine’s Day, the company snagged a spot on a Times Square billboard to advertise its app, in the hopes of gaining new users during one of the bigger gifting holidays of the year.

The app is available as a free download on the App Store and Google Play.

Powered by WPeMatico

InEvent, a startup powering virtual and hybrid events, is announcing that it has raised $2 million in seed funding from Storm Ventures.

That’s just a tiny fraction of the $125 million that online events platform Hopin raised last fall — in fact, a recent Equity episode suggested that Hopin might be the fastest growth story of the current startup era.

CEO Pedro Góes told me that even in a world of more established and better-funded platforms, his team sees an opportunity to break out by focusing on business-to-business events.

“There’s an opening in the space for us to be the leader that we want on B2B,” Góes said. “We don’t intend to compete with platforms in the B2C market.”

Put another way, InEvent is less focused on replicating giant consumer events and more on helping businesses hold virtual events where they can connect with clients and partners. Góes said this is something that he and his co-founders Mauricio Giordano and Vinicius Neris saw in their previous work running a digital agency, where they were often asked to help with events in this vein.

“Since we had a lot of experience with events, we could see where the industry was broken and how to fix it,” he said.

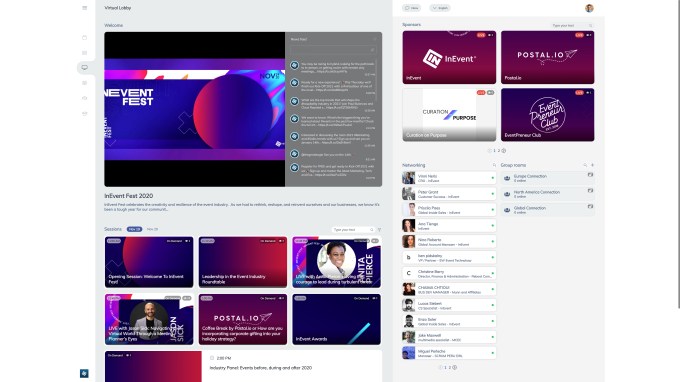

Image Credits: InEvent

Góes suggested that two of the big needs for B2B events are customization and support, so InEvent has created what he described as a “really beautiful” product that can still be customized with the organizer’s branding, and the company also offers 24-hour support.

The platform is a virtual lobby where participants can browse all the programming, a video player, a registration system, the ability to create a conference mobile app and more. Góes said the goal was to build something that was “really flexible,” allowing organizers to run everything from within InEvent while also allowing them to incorporate outside tools, whether that’s video platforms like Zoom or CRM software like Salesforce, Marketo and HubSpot.

InEvent’s founders are from Brazil, but the startup is headquartered in Atlanta and has employees in 13 countries. It says it’s been used by more than 500 customers for global events, including DowDupont, Coca-Cola and Santander.

With the new funding, Góes told me the startup will be able to expand the team (he was proud to note the team’s diversity — 50% of its managers are women, and 50% of its managers come from a Latinx background). It also will continue to develop the product, for example by improving the video player and adding more marketing automation.

And when the pandemic ends and large-scale, in-person conferences become possible again, Góes predicts there will still be plenty of appetite for what InEvent can do, because more events will bring online and in-person elements together.

“We have different clients where we have a website, we have a mobile app, but we also have hardware [to] connect with in-person,” he said. After all, if you’re at a sprawling conference like CES, it might still be convenient to chat with another attendee through the mobile app, rather than traveling two miles to see them face-to-face. “For us, what we are building, the technology for virtual and in-person, is the same thing.”

Powered by WPeMatico

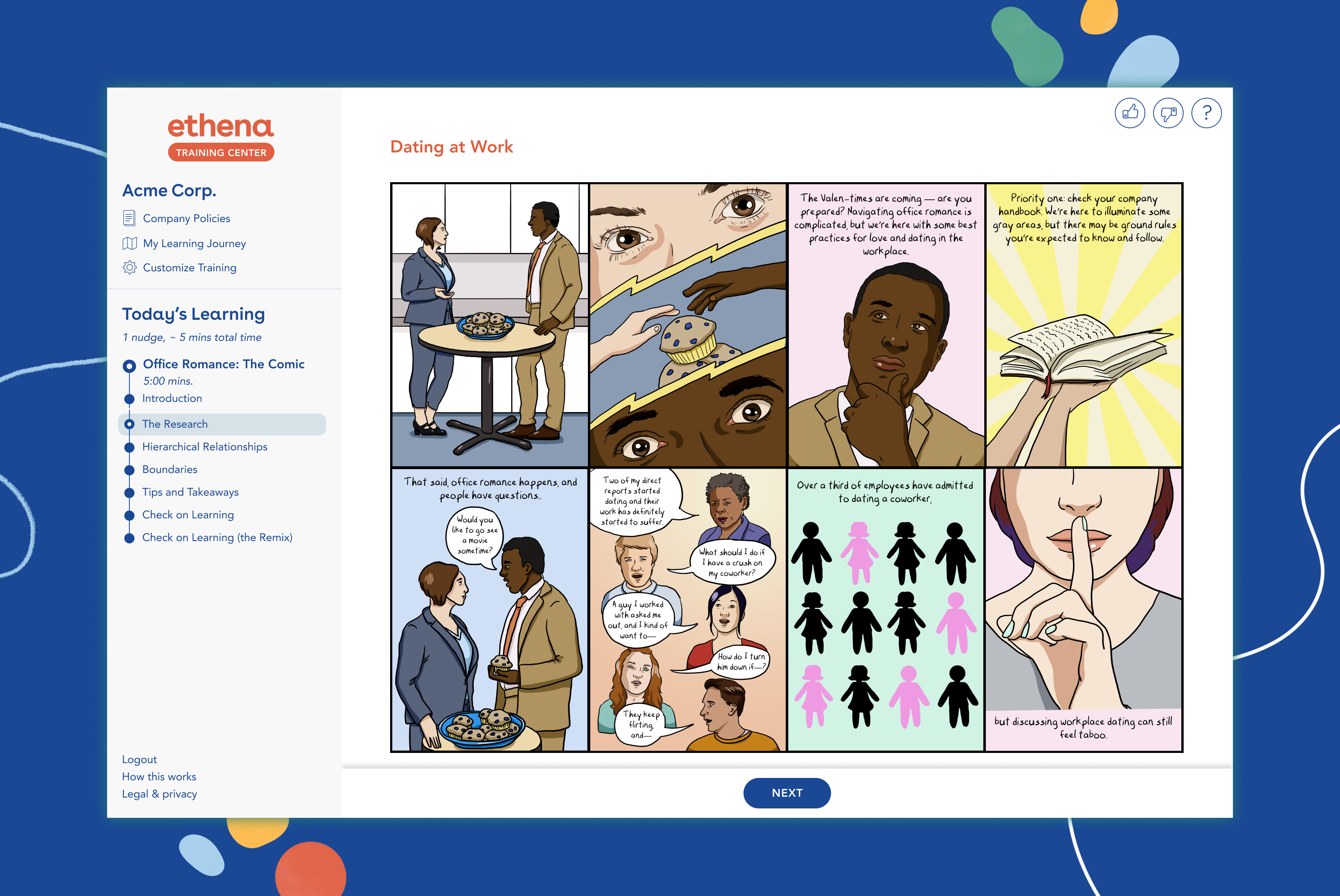

Ethena co-founders Roxanne Petraeus and Anne Solmssen began their company with a clear goal: There needs to be a more modern, and effective, way to deploy anti-harassment training to employees. Ethena’s solution is to send employees bite-sized monthly “nudges” or pings with five-minute lessons, replacing the usual one-hour annual workshop with more flexible learning.

The startup raised $2 million off of that vision in June, and today has announced it has raised follow-on funding with the same exact amount, led by GSV. The startup currently has $5 million in venture capital, with investors including Homebrew, Neo and Village Global.

The follow-on capital comes right after Ethena has had some solid growth itself. The startup closed a couple major contracts with companies including Netflix, Zoom and Zendesk, and tells TechCrunch that more than 20,000 active employees complete its monthly training.

Solid growth and new cash is where the story could stop for now, but Petraeus tells TechCrunch that early momentum has also inspired a shift of sorts in what Ethena is trying to accomplish.

“When we initially launched in Feb 2020, we thought that for our first year, we’d focus entirely on scaling companies because only startups would be interested in an innovative approach to compliance training,” she said. “What’s changed is we’ve learned that even large enterprises want a better approach, deeper impact and are willing to be innovative in a space historically dominated by lawyers and legacy e-learning providers.”

The startup is expanding its offering from anti-sexual harassment training to a wide variety of training courses focused on compliance, from financial compliance to code of conduct measures. The shift wasn’t because of a lack of interest from customers, the co-founder said, but instead demand from existing enterprise customers to offer more than just a singular topic.

“We think taking a specific sector-based approach can actually narrow the impact we’re having,” Petraeus said. “So we are trying to take a really inclusive approach,” from the start on what kind of topics should be treated as more than “just checking off a box.”

Petraeus, an army veteran, says that Ethena’s confidence in effectiveness and outcomes comes from military data on how adults learn.

“We know that traditional training just isn’t effective at behavior change, and there are some studies that show that it’s a pretty big backlash with increased unconscious bias after training versus before.” The startup differentiates from other micro-learning plays in its curriculum.

The curriculum is designed to be consumed over the course of a year instead of in an annual hour-long session. This tiny iteration is enough to give employees a repetitive way to understand the content. “We’re experimenting with things like graphic novels and podcasts to present training,” Petraeus said. “Just making sure whatever we’re doing yesterday is important tomorrow, because I think it’s important for us to be agile content creators.”

But Ethena’s biggest differentiation, Petraeus says, is its content. The pandemic has boasted a whole new sort of situation that employees need help, or proactive guidance, navigating. Petraeus says that Ethena’s monthly cadence gives it flexibility to adopt “modern” scenarios like Slack culture and Zoom etiquette. Ethena’s top performing training nudges in 2020 included lessons on online harassment prevention and mental health inclusivity.

The micro-learning approach has long been popular among edtech companies as a way to sneak or gamify small lessons into a workflow. So far, Ethena says over 90% of 150,000 in-app learner feedback notes are positive, saying the information is engaging and relevant. In Q4, Ethena saw learner growth of more than 250% quarter over quarter.

GSV’s Deborah Quazzo, who led Ethena’s seed and now this follow-on financing, said that it’s “not a coincidence that they’ve picked up some of the best logos in the world at an early stage,” referring to Ethena’s big customers. Quazzo thinks the compliance market has had very limited innovation so far, even though it’s a massive opportunity.

“They are seeing such strong product market fit and customers are pulling them into areas of content extension, so having more room to run faster made total sense,” she said.

Powered by WPeMatico

Getaway CEO Jon Staff said that while the startup’s offerings weren’t designed with a pandemic in mind, they turned out to be well-suited for a time when people were eager to find safe ways to get off Zoom and out of their homes.

Founded in 2015, Getaway builds “Outposts” — collections of tiny cabins in rustic locations within a two-hour drive of major cities like Atlanta, Austin, Los Angeles and New York. Those cabins sound perfect for socially distanced retreats, with guests checking themselves in, each cabin built with its own fire pit and spaced 50 to 150 feet from the others, with no common areas.

Staff told me that rather than promoting traditional tourist activities, Getaway emphasizes disconnecting from all the stresses and distractions of modern life. So its cabins don’t include Wi-Fi, and they also have lockboxes where visitors can hide their phones for the duration of their visits.

“We try to get you to do nothing, quite literally,” he said. “How few moments are there in life when you really have enough free time that you could do nothing? And if not nothing, have a deep conversation with your partner, or take the time to cook a good meal and really enjoy the experience with people who are there sitting next to the campfire with you?”

Staff acknowledged that some investors were skeptical about Getaway’s insistence on building the cabins and Outposts itself. He recalled talking to tech-focused venture capitalists who would ask, “Why isn’t this a platform? Why isn’t it going to be worth $1 billon a year from now?” while potential investors from the real estate world would want to know, “How tall of a skyscraper do you want to build?”

“For a while, I had this anxiety that we don’t fit in any box,” he said. “But I learned to appreciate the benefits of not fitting in any box — that’s where innovation really lies.”

Image Credits: Getaway

And the Getaway approach seemed to resonate in 2020, with bookings increasing 150% year-over-year and the startup’s Outposts operating at nearly 100% occupancy. Today it’s announcing that it has raised $41.7 million in Series C funding — first revealed in a regulatory filing and led by travel and hospitality-focused firm Certares.

Getaway plans to use the funding to expand to at least 17 Outposts this year, up from 12 in 2020 and nine in 2019. The startup has now raised more than $81 million in total funding, according to Crunchbase.

Staff said that eventually, Getaway could also add other products and services, because, “The brand is not about tiny houses or tiny cabins, the brand is about [the fact that] the world is too noisy and too connected over the long haul. Getaway could be doing other things to solve that problem.”

At the same time, he said it’s crucial to remain clear and focused on the experience that Getaway wants to provide.

“We always try to remind ourselves that we are not creating the experience at Getaway,” he said. “You’re creating the experience and, if we’re doing it well, we’re facilitating it, we’re giving you everything you need and nothing you don’t … There’s a lot of freedom to make of it what you want as the guest, but there are also boundaries.”

For example, Staff said that there have been requests to offer Getaway Outposts for work retreats, but that’s not what they’re designed for: “We’re not going to police it, but we’re not going to put in Wi-Fi.”

Powered by WPeMatico

BeyondID, a cloud identity consulting firm, announced a $9 million Series A today led by Tercera. It marked the first investment from Tercera, a firm that launched earlier this month with the goal of investing in service startups like Beyond.

The company focuses on helping clients manage security and identity in the cloud, taking aim specifically at Okta customers. In fact, the firm is a platinum partner for Okta. As they describe their goals, they help clients in a variety of areas, including identity and access management, secure app modernization, Zero Trust security, cloud migration and integration services.

CEO and co-founder Arun Shrestha has a deep background in technology, including working with Okta from its early days. Shrestha came on board in 2012 as the head of customer success. When he began, the startup was in early days, with just 50 customers. When he left five years later just before the IPO, it had more than 3,500.

Along the way, he gained a unique level of expertise in the Okta tool set, and he decided to put that to work to help Okta customers implement and maximize Okta usage, especially in companies with complex implementations. He launched BeyondID in 2018 with the intention of focusing on systems integrations and managing a company’s identity in the cloud.

“We believe we are becoming a managed identity service provider, so managing anything identity, anything related to cybersecurity. We’re helping these companies by being a one-stop shop for companies acquiring, deploying and managing identity services,” Shrestha explained.

It seems to be working. The last couple of years the company revenues grew at 300% and as it matures, and the growth rates settle a bit, it’s still expected to grow between 70 and 100% this year. The firm has 250 customers, including FedEx, Major League Baseball, Bain Capital and Biogen.

It currently has 75 employees serving those customers with plans to grow that number in the next year with the help from today’s investment. As Shrestha adds new employees, he sees building a diverse workforce as a crucial goal for his company.

“Diversity is absolutely critical to our long-term sustainable success, and it’s also the right thing to do,” he said. He says that building an organization that promotes women and people of color is a key goal of his as the leader of the company and something he is committed to.

Chris Barbin, who is managing partner and founder at lead investor Tercera, says that he chose BeyondID as the firm’s first investment because he believes identity is central to the notion of digital transformation. As more companies move to the cloud, they need help understanding how security and identity work differently in a cloud context, and he sees BeyondID playing a critical role in helping clients get there.

“BeyondID is in a rapidly growing space and has an impressive customer list that represents nearly every industry. Arun and the leadership team have a strong vision for the firm, deep ties into Okta and they’re incredibly passionate about what they do,” he said.

Powered by WPeMatico

We often hear about companies working to improve the customer experience, but for IT their customers are the company’s employees. Nexthink, a late-stage startup that wants to help IT serve its internal constituents better, announced a $180 million Series D today on a healthy $1.1 billion valuation.

The firm, which was founded in Lausanne, Switzerland and has offices outside of Boston, received funding from Permira with help from Highland Europe and Index Ventures. The company has now raised more than $336 million, according to Crunchbase data.

As you might imagine, understanding how folks are using a company’s technology choices internally is always going to be useful, but when the pandemic hit and offices closed, having access to this type of data became even more important.

Nexthink CEO and co-founder Pedro Bados says that most monitoring tools are focused on figuring out if the systems are working correctly and finding ways to fix them. Nexthink takes a different approach, looking at how employees are adopting the tools a company is offering.

“What we do at Nexthink is to take the [monitoring] problem from a completely different perspective. We say that we’re going to give your IT department a real-time understanding of how employees are experiencing IT [at your company],” Bados told me.

He says they do this by looking at the problem from the employees’ perspective. “At the end of the day we’re giving all the insights to IT departments to make sure they can improve the digital experience of their employees,” he said.

This could involve querying the user base in the same way that HR and marketing survey tools allow companies to check the pulse of employees or customers. By gathering this type of data, it helps IT understand how employees are using the company’s technology choices.

This software is aimed at larger organizations with at least 5,000 employees. Today, the company has more than 1,000 of these customers, including Best Buy, Fidelity, Liberty Mutual and 3M. What’s more, the company has surpassed $100 million in annual recurring revenue, a success benchmark for SaaS companies like Nexthink.

Nexthink currently has 700 employees with plans to reach 900 by the end of this year, and as a maturing startup, Bados has given a lot of thought on how to build a diverse workforce. Just being spread out in two countries gives an element of geographic diversity, but he says it takes more than that, and it all starts with recruitment.

“The way to make sure we get more diversity is we look at recruitment and make sure that we have a balanced pipeline. That’s something we measure as a company,” he said. They also have a diversity committee, which is charged with delivering diversity training and figuring out ways to hire a more diverse and inclusive workforce.

While the company has a healthy valuation and a good amount of money in the bank, Bados doesn’t see an IPO for at least a couple of years. He says he wants to double or triple the business before taking that step. For now, though, with $180 million in additional runway and a $100 million in ARR, the company is well-positioned for whatever future moves it chooses to make.

Powered by WPeMatico

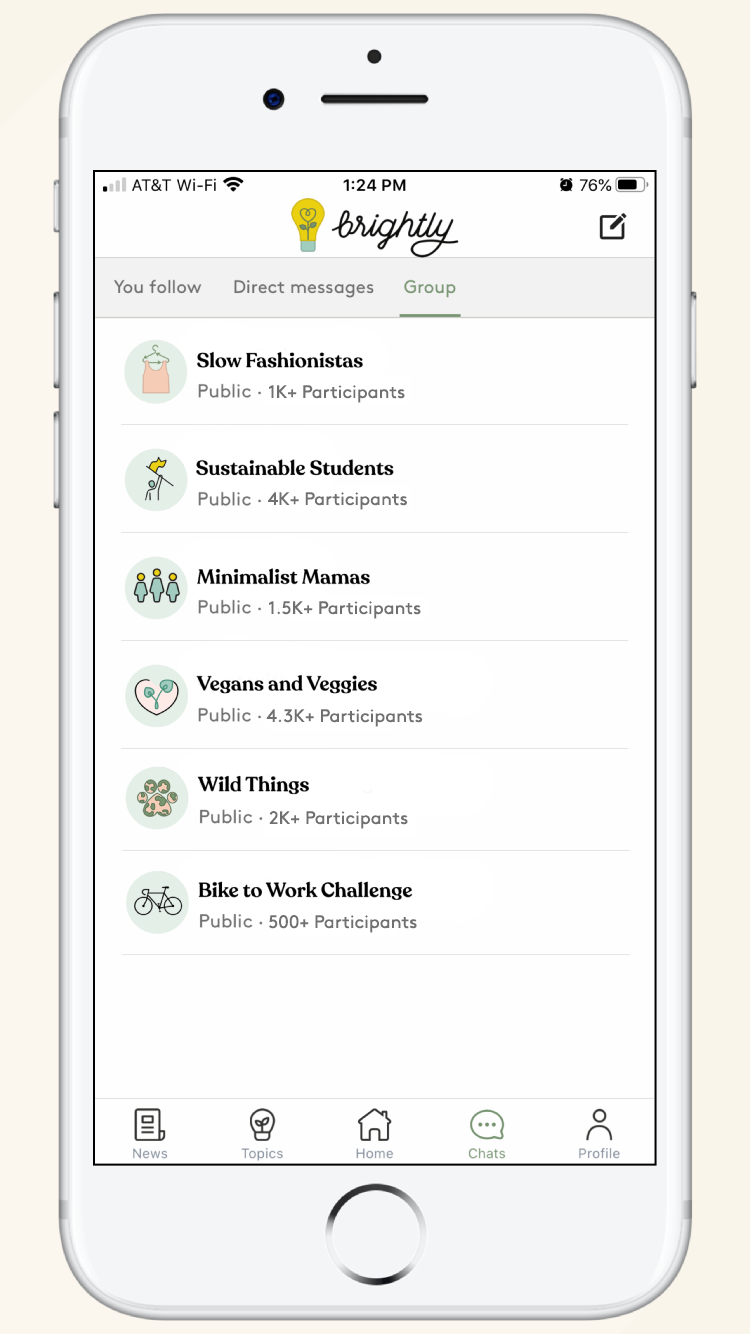

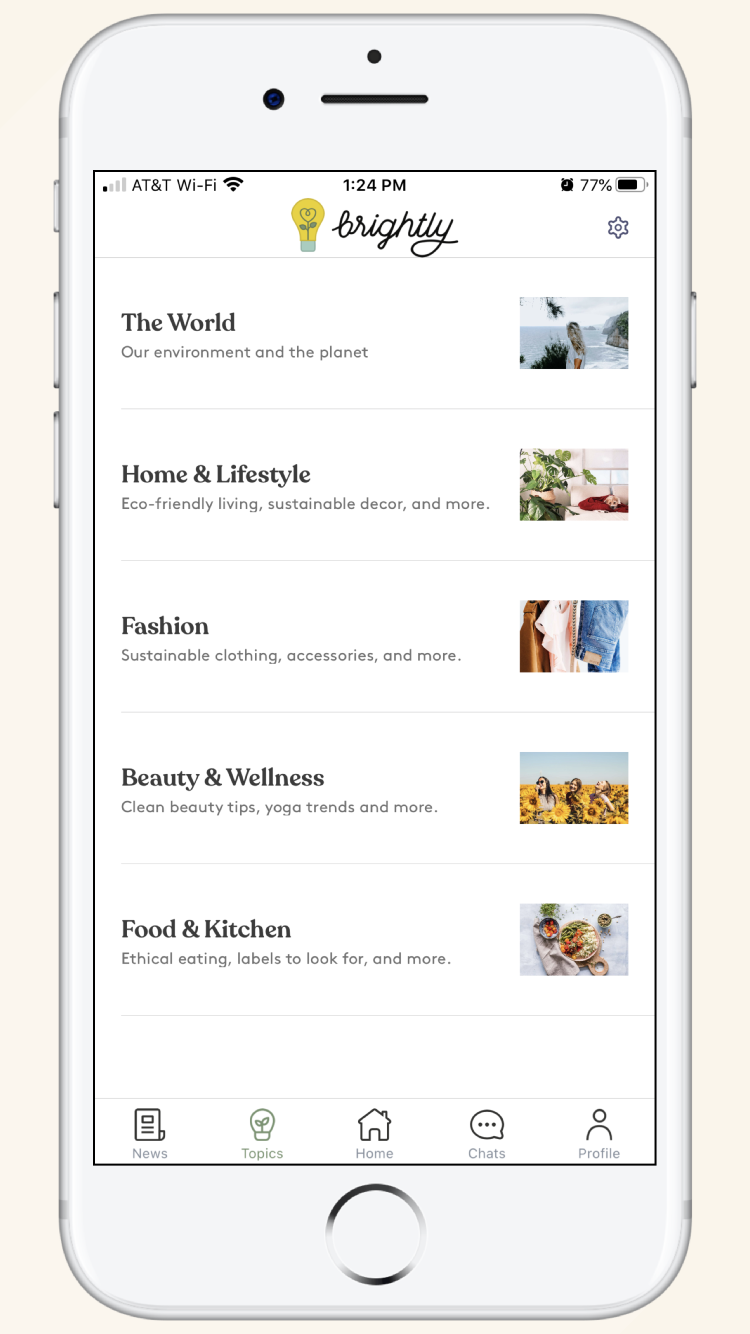

When Laura Wittig and Liza Moiseeva met as guests on a podcast about sustainable fashion, they jibed so well together that they began one of their own: Good Together. Their show’s goal was to provide listeners with a place to learn how to be eco-conscious consumers, but with baby steps.

Wittig thinks the non-judgmental environment (one that doesn’t knock on a consumer for not being zero-waste overnight) is the show’s biggest differentiator. “Then, people were emailing us and asking how they can be on our journey beyond being a listener,” Wittig said. Now, over a year after launching the show, the co-hosts are turning validation from listeners into the blueprint for a standalone business: Brightly.

Brightly is a curated platform that sells vetted eco-friendly goods and shares tips about conscious consumerism. While the startup is launching with more than 200 products from eco-friendly brands, such as Sheets & Giggles and Juice Beauty, the long-term vision is to start their own commerce brand of Brightly-branded products. The starting lineup will include two to four products in the home space.

To get those products out by the holiday season, Brightly tells TechCrunch that it has raised $1 million in venture funding from investors, including Tacoma Venture Fund, Keeler Investments, Odile Roujol (a FAB Ventures backer and former L’Oréal CEO) and Female Founder’s Alliance.

The funding caps off a busy 12 months for Brightly. The startup has gone through Snap’s Yellow accelerator, an in-house effort from the social media company that began in 2018. As part of the program Snap invests $150,000 in each Yellow startup for an equity stake. The company also did Ready Set Raise, an equity-free accelerator put on by Female Founders Alliance, in the fall.

With new funding, Brightly is seeking to take a Glossier-style approach to become the next big brand in commerce: gather a community by recommending great products, then turn the strategy on its head and make your superfans buy in-house products under the same brand.

“We have access to a community of women who are beating our door down to shop directly with us and have exclusive products made for them,” Wittig said.

Brightly wants to be more than a “boring storefront” one could quickly whip up on Shopify or Amazon, Wittig says.

The company’s curation process, which every product goes through before being listed on the platform, is extensive. The startup makes sure that every product is created with sustainable and ethical supply chain processes and sustainable material. The team also interviews every brand’s founders to understand the genesis of any product that lives on the Brightly platform. The co-founders also weigh the durability and longevity of products, adopting what Wittig sees as a “Wirecutter approach.”

“It’s more like, ‘why would we pick an ethically produced leather handbag over something that might be made not from leather but wouldn’t last too long necessarily,’ ” she said. “These are the conversations we have with our audience, because the term eco-friendly is very much our grayscale.”

Image Credits: Brightly

More than 250,000 people come to Brightly, either through their app or website, every day, according to Wittig. The startup monetizes largely through brand partnerships and getting those users in front of paid products.

Image Credits: Brightly

The monetization strategy is similar to what you might find a podcast use: affiliate links or product placement mid-episode. But while the co-founders are relying on this strategy right now, they see the opportunity to create their own e-commerce company as larger and more lucrative.

“The billion-dollar opportunity is not with that,” Wittig said. “The value will be going direct commerce and selling our picks of ethical sustainable goods.”

Marking the transition from podcasting about eco-friendly goods to creating them in-house is a strong pivot. The co-founders consider creating a distribution commerce channel to be a larger opportunity and likely more lucrative than the podcasting business.

Beyond creating a line of their own products, Brightly is thinking about how to partner with white-label sustainable products. Another option, Wittig said, is to partner with big corporations to get products on their shelves with colors and customization for Brightly. An example of an ideal partnership would be Reformation’s recent partnership with Blueland.

Wittig declined to share more details on how they plan to win, but likened the strategy to that of Goop or Glossier, two companies that started with content arms and drew their community into a commerce platform.

“It’s not going to be a Thrive Market where there are hundreds and thousands of sustainable goods on there. It’s going to be much more curated,” she said.

COVID-19 has helped the startup further validate the need for a platform that unites a conscious consumer community.

“We are all so aware of the purchasing power we have,” she said. “As consumers we go out and support small businesses by getting coffee on the go. But before, we did not think twice about getting everything from Amazon.”

The conversation with investors hasn’t been as simple, the co-founder said. Investors continue to be “hands off” about community-based platforms because they are unsure it will work. Wittig says that many bearish investors have placed bets on singular direct-to-consumer brands, such as Away or Blueland.

“Those investors know the rising costs of customer acquisition, and see what happens when you don’t have a community that surrounds our business,” she said.

Brightly is betting that the future of commerce brands has to start with a go-to-market, and then bring in the end-product, instead of the other way. The end goal here for Brightly is attracting, and generating excitement from, Gen Z and millennial shoppers. To do so, Wittig says that Brightly is experimenting with ways to implement socialization aspects into the shopping experience.

Leslie Feinzaig, the founder of Female Founders Alliance, said that what’s special about Brightly is that it “demonstrated demand before building for it.”

“I think a lot of people today could build software to connect people and sell things, but very few people could get thousands of fanatical followers to actually engage with each other and make that software useful,” Feinzaig said. “Brightly built that community with matchsticks and tape.”

Powered by WPeMatico

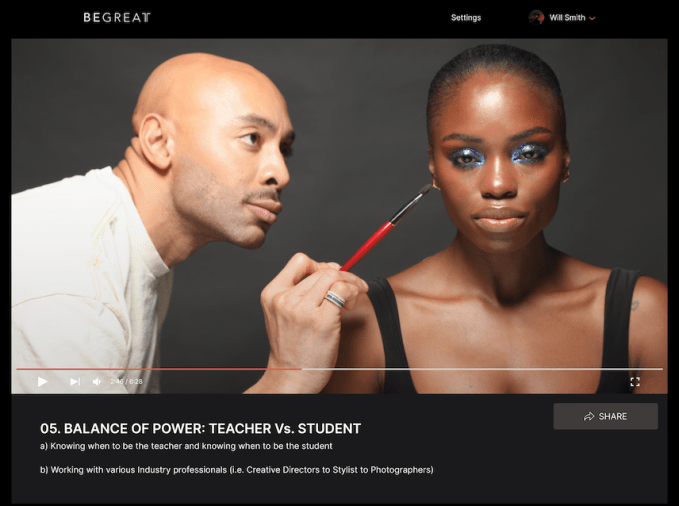

BeGreatTV, an online education platform featuring Black and brown instructors, recently closed a $450K pre-seed round from Stand Together Ventures Lab, Arlan Hamilton, Tiffany Haddish and others.

The goal with BeGreatTV is to enable anyone to learn from talented Black and brown innovators and leaders, founder and CEO Cortney Woodruff told TechCrunch.

“When you think of being a Black or brown person or individual who wants to learn from a Black or brown person, there’s nothing that really exists that gives you a glossary of every business vertical and where you see representation at every level in a well put together way,” Woodruff said. “That alone makes our market a lot larger because there are just so many verticals where no one has really invested in or shown before.”

The courses are designed to teach folks how to execute and succeed in a particular industry, and enable people to better understand the business aspect of industries while also teaching “you how to deal with the socioeconomic and racial injustices that come with being the only one in the room. Whether you are a Black man or woman who wants to get into the makeup industry, there will always be a lot of biases in the world.”

When BeGreatTV launches in a couple of months (the plan is to launch in April), the platform will feature at least 10 courses — each with around 15 episodes — focused on arts, entertainment, beauty and more. At launch, courses will be available from Sir John, a celebrity makeup artist for L’Oréal and Beyoncé’s personal makeup artist, BeGreatTV co-founder Cortez Bryant, who was also Lil Wayne and Drake’s manager, as well as Law Roach, Zendaya’s stylist.

Hamilton and Haddish will also teach their own respective courses on business and entertainment, Woodruff said. So far, BeGreatTV has produced more than 40 episodes that range anywhere from three to 15 minutes each.

Image Credits: BeGreatTV

Each course will cost $64.99, and the plan is to eventually offer an all-access subscription model once BeGreatTV beefs up its offerings a bit more. For instructors, BeGreatTV shares royalties with them.

“Ultimately, the platform can include a more diverse casting of instructors that aren’t just Black and brown,” Woodruff said. But for now, he said, the idea is to “reverse the course of ‘Now this is our first Black instructor’ but ‘now this is the first white instructor’ ” on the platform.

BeGreatTV’s team consists of just 15 people, but includes heavy hitters like Cortez Bryant and actor Jesse Williams. Currently, BeGreatTV is working on closing its seed round and anticipates a six-figure user base by the end the year.

MasterClass is perhaps BeGreatTV’s biggest competitor. With classes taught by the likes of Gordon Ramsay, Shonda Rhimes and David Sedaris, it’s no wonder why MasterClass has become worth more than $800 million. The company’s $180 annual subscription fee accounts for all of its revenue.

“If you benchmark [BeGreatTV] to MasterClass, we are finding individuals that are not only the best at what they do in the world, but often times these individuals have broken barriers because often times they were the first to do it,” Woodruff said. “And do it without having people who look like them.”

Powered by WPeMatico