Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Nathalie Walton almost didn’t become a mother. Her risky pregnancy caused her placenta to burst during childbirth, almost killing her and her son last year. Walton, who feels lucky to have survived, says the haunting experience made her an example of a reality she had long known: To be a pregnant Black woman is to be at risk, regardless of economic background.

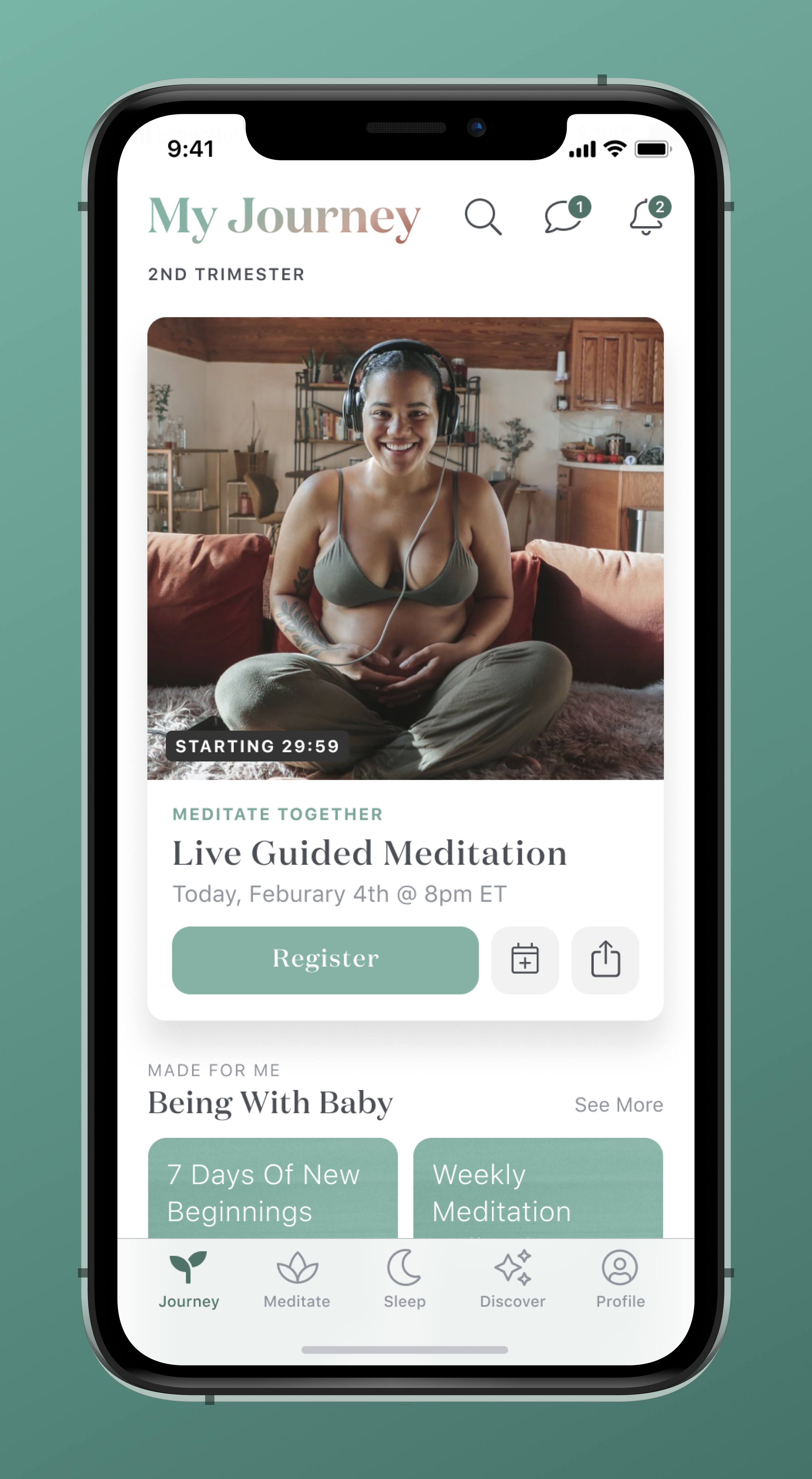

The stress of her pregnancy led Walton to download Expectful, a meditation and sleep app for new mothers. She recalls stabilizing, emotionally and physically, within a week, bringing an otherwise “soft landing” to a volatile pregnancy.

Weeks after delivering her son, Everett, Walton just so happened to hear of an advisory role opening at Expectful. Even though she was mid-maternity leave from her managerial role at Airbnb, she jumped at the opportunity.

“I definitely had a full-time job, I had a newborn baby,” Walton said. But, she says, it was an opportunity to be entrepreneurial in a sector she cared about. Even if it was just for a few months.

And now, Walton is the chief executive of the company. The business is pivoting its product strategy to grow beyond recorded meditations. Walton helped it raise its first millions in venture capital, making her one of the few dozen Black female founders to do so. New financing and the boom of the mental health focus amid the coronavirus pandemic puts Expectful in a coveted spot. And it puts Walton, who is at the helm of a company for the first time, in a pressure-cooker spotlight.

Even in the world of startups, going from user to chief executive in less than a year is a remarkable feat. But it’s not one that she rushed.

Walton graduated from Georgetown and immediately joined the New York banking world. After a few years as an analyst at JP Morgan, though, she became unsatisfied with the work.

“I think I had a quarter-life crisis,” Walton said. Searching for new opportunities, she ended up at a prospective students day at Stanford University in what would become a pivotal moment in her life.

“For the first time, I met entrepreneurs and saw an actual concept that you can pursue a career you like, be successful and make a difference in the world,” she said. Walton eventually applied, and got accepted, to Stanford Graduate School of Business (GSB), a prestigious program that produces founders and top executives. It was then that she realized she wanted to be a chief executive one day.

“I admired them, but I just didn’t see the pathway for me to get there,” she said, of the entrepreneurs she met, who were then largely white and male. “I didn’t have the confidence.”

So, she set that hope aside and pursued intrapreneurship, which would let her join a stable organization and act as a mini-founder within it. Employees in this role are tasked with building a startup within a startup, whether that is rooting an innovative idea or leading an experiential team. Corporations have long embraced this idea to bring momentum to otherwise red-tapey processes.

Walton joined eBay and soon rose to work as the head of business operations and development. Her work helped the company break into 3D printing.

Over the years, this has been the defining characteristic of Walton: join an organization, build a scrappy idea from scratch, and then do it all over again. She has held roles in Airbnb and Google that all required her to have the agility of a founder convincing people on a moonshot vision, and the rigor of a manager who can get a deal done.

She had the same vision heading into an advisory role at Expectful. But when Walton landed a key Expectful partnership with Johnson & Johnson, then-CEO and founder Mark Krassner had an idea.

Before starting Expectful, Krassner experienced the benefits of meditation firsthand. He also saw his mother face depression, which made him realize how meditation could have a positive impact on others. After seeing research that showed how meditation could positively impact a pregnancy, he began thinking of a solution in this cross-section. He eventually started a course on Teachable, a startup that lets anyone create and monetize an online class, with 15 moms and a guided meditation.

Over time, the idea stuck. Krassner eventually turned his course into a 12-person startup. Under his leadership, Expectful grew to profitability and over 13,000 paid users. Its conversion rate from free to paid users was five times higher than industry standards, the company claims.

That said, from the moment Mark Krassner started Expectful, he knew he was an unlikely founder. He doesn’t have any children, so leading a meditation and sleep app for new mothers comes with its own hurdles.

“As a male founder with no kids, it was on my mind from day No. 1,” Krassner said. He eventually wanted to put a female at the head of the company, he says. Walton was the obvious choice.

Walton returned to Airbnb after her maternity leave right as Airbnb had aggressive COVID-19 layoffs. While her job was saved, her team disappeared as part of the cuts. She started looking for jobs, and received lucrative offers from Facebook, Apple, Google and Amazon. When she told Krassner she was leaning toward a lead product manager position at Amazon, he replied with an offer to take over Expectful’s entire business.

“I think it caught her off guard,” Krassner said, who is still a board member at the company. “Usually you don’t think a CEO is looking for [a new CEO] unless things are going to hell in a handbasket.”

Expectful began as a guided meditation library, which will continue to be its core. But now, Walton wants to take advantage of that momentum and evolve the company into a “go-to wellness resource for hopeful, expecting and new parents.”

The language suggests that the startup is evolving in how it markets itself. Right now, the site has a number of references to “motherhood” and women. But Walton says Expectful defines a mother by anyone who identifies themselves as one. While the startup primarily has content geared toward the gestational parent, or the one who gives birth to the child, Walton says they have a “a partner’s library for non-gestational parents that identify as non-gestational mothers, fathers, or however they choose to identify.”

Walton plans to pivot the startup in three phases: content, marketplace and community.

For content, Expectful wants to organize pregnancy-related information. Currently, a lot of information or advice around pregnancy lives in books or in-person classes. But the learning experience, which Walton says is similar to middle school-style lectures, doesn’t feel built for this century.

The next step in her plan is digitizing the service providers that help women through pregnancy. In simpler words, replace the disorganized recommendations in Facebook groups for parents.

“When I went to ask my OB-GYN for recommendations for a doula, she gave me a sheet of paper with the names of 10 doulas,” she said. “You have to text the doula, ask them questions and if they want to meet up — it all feels yucky.” Expectful wants to put all that information in one platform so moms can access tips and recommendations from the ease of their homes.

The end-product here would be a peer-reviewed platform that can help a mom find everything from a therapist to a live-in nanny, with reviews built-in.

Finally, Walton wants to invest in the community. Expectful recently launched Mother Circles, which connects postpartum mothers into support cohorts led by a doula facilitator. The circles include six weekly video calls, a group chat and 500 hours of on-demand doula support.

Image Credits: Expectful

Part of Walton’s focus through all of these priorities is to invest in Black maternal health outcomes. Her own experience, she says, showed her how even a “Stanford-educated wellness junkie” such as herself can be at a high-risk for pregnancy because of her skin color.

It’s a lofty goal, even with the promising growth and strong library of guided meditations. The competition is steep. One of Expectful’s closest competitors is Peanut, a social network for moms used by over 1.2 million people. Mahmee, a digital support network for postpartum mothers, has raised $3 million and views itself as complementary to Expectful. Headspace has launched its own motherhood meditation series, but it is not as comprehensive as Expectful’s.

“I think we’re able to connect with women in a way that some of these other companies aren’t,” Walton said. “People are paying for the service, so they clearly need it.”

While Walton declined to share new user metrics, she said that the company’s revenue has grown 100% since March 2020.

Long-term, Expectful wants to mimic Peloton’s playbook in terms of getting premium content and community to the right audience. Still, growing from a startup to a venture business requires more than just ambition and market fit. It requires the ability to exponentially grow and keep growing.

A handful of investors believe that Walton’s Expectful can do it. Expectful raised $3 million in a seed financing round led by Harlem Capital. Indicator Ventures, Sequoia Scout Fund, Joyance Partners, Break Trail Ventures, Chinagona Ventures, Powerhouse Capital, AVG Basecamp Fund and Babylist also participated. Angel investors included Ellen Pao, Mike Smith and Ashley Mayer. The round also included $1.2 million in convertible SAFE notes, making the financing round a total of $4.2 million.

“Historically when I look at what black women raise fundraising, I feel fortunate that I’ve been able to raise this round,” Walton said.

Harlem Capital founding partner Henri Pierre-Jacques said that “obviously, given our focus we weren’t going to invest in a white male.” Walton’s “founder-market fit” is what made the firm invest, even with the hairy dynamic of an exiting CEO.

Mayer, head of communications at Glossier, was the one who introduced Walton to the woman who told her about the advisory role of Expectful. She says that Nathalie’s “path to entrepreneurship feels inevitable.

“It was always just a question of finding the space where her passions collided,” Mayer said.

As a new mother and new founder, Walton has had a busy balancing act of a year.

“I’m working more now than I have really in the last decade,” she said. “But I’ve never been more fulfilled because, as someone who went through this, and I’m still going through this, I feel so personally the level of pain that so many women suffer through.”

Powered by WPeMatico

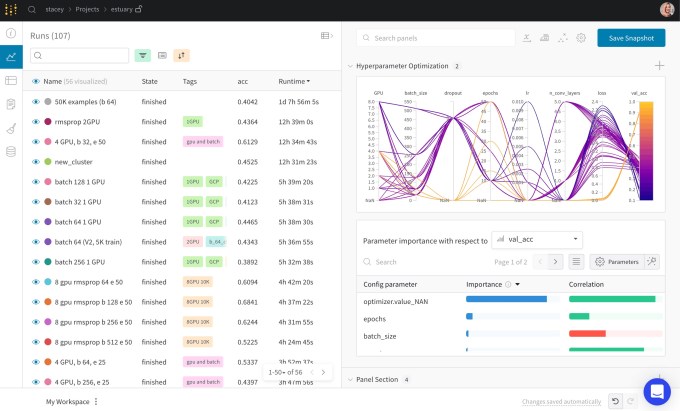

Weights & Biases, a startup building tools for machine learning practitioners, is announcing that it has raised $45 million in Series B funding.

The company was founded by Lukas Biewald, Chris Van Pelt and Shawn Lewis — Biewald and Van Pelt previously founded CrowdFlower/Figure Eight (acquired by Appen). Weights & Biases says it now has more than 70,000 users at more than 200 enterprises.

Biewald (whom I’ve known since college) argued that while machine learning practitioners are often compared to software developers, “they’re more like scientists in some ways than engineers.” It’s a process that involves numerous experiments, and Weights & Biases’ core product allows practitioners to track those experiments, while the company also offers tools around data set versioning, model evaluation and pipeline management.

“If you have a model that’s controlling a self-driving car and the car crashes, you really want to know what happened,” Biewald said. “If you built that model years ago and you’ve run all these experiments since then, it can be hard to systematically trace through what happened” unless you’re using experiment tracking.

He described the startup as “an early leader” in this market, and as competing tools emerge, he said it’s also differentiated because it is “completely focused on the ML practitioner” rather than top-down enterprise sales. Similarly, he said that as machine learning has been adopted more widely, Weights & Biases is occasionally confronted by a “high-class problem.”

Image Credits: Weights & Biases

“We’re not interested in selling to companies that are doing machine learning for machine learning’s sake,” Biewald said. “With some companies, there’s a mandate from the CEO to sprinkle some machine learning in the company. That’s just really depressing to me, to not have any impact. But I would actually say the vast majority of companies that we talk to really do something useful.”

For example, he said agriculture giant John Deere is using the startup’s platform to continually improve the way it uses robotics to spray fertilizer, rather than pesticides, to kill weeds and pests. And there are pharmaceutical companies using the platform for how they model how different molecules will behave.

Weights & Biases previously raised $20 million in funding. The new round was led by Insight Partners, with participation from Coatue, Trinity Ventures and Bloomberg Beta. Insight’s George Mathew is joining the board of directors.

“I’ve never seen a MLOps category leader with such a high NPS and deep customer focus as Weights and Biases,” Mathew said in a statement. “It’s an honor to make my first investment at Insight to serve an ML practitioner user-base that grew 60x these last two years.”

The startup says it will use the funding to continue hiring in engineering, growth, sales and customer success.

Powered by WPeMatico

Pinecone, a new startup from the folks who helped launch Amazon SageMaker, has built a vector database that generates data in a specialized format to help build machine learning applications faster, something that was previously only accessible to the largest organizations. Today the company came out of stealth with a new product and announced a $10 million seed investment led by Wing Venture Capital.

Company co-founder Edo Liberty says that he started the company because of this fundamental belief that the industry was being held back by the lack of wider access to this type of database. “The data that a machine learning model expects isn’t a JSON record, it’s a high dimensional vector that is either a list of features or what’s called an embedding that’s a numerical representation of the items or the objects in the world. This [format] is much more semantically rich and actionable for machine learning,” he explained.

He says that this is a concept that is widely understood by data scientists, and supported by research, but up until now only the biggest and technically superior companies like Google or Pinterest could take advantage of this difference. Liberty and his team created Pinecone to put that kind of technology in reach of any company.

The startup spent the last couple of years building the solution, which consists of three main components. The main piece is a vector engine to convert the data into this machine-learning ingestible format. Liberty says that this is the piece of technology that contains all the data structures and algorithms that allow them to index very large amounts of high dimensional vector data, and search through it in an efficient and accurate way.

The second is a cloud hosted system to apply all of that converted data to the machine learning model, while handling things like index lookups along with the pre- and post-processing — everything a data science team needs to run a machine learning project at scale with very large workloads and throughputs. Finally, there is a management layer to track all of this and manage data transfer between source locations.

One classic example Liberty uses is an eCommerce recommendation engine. While this has been a standard part of online selling for years, he believes using a vectorized data approach will result in much more accurate recommendations and he says the data science research data bears him out.

“It used to be that deploying [something like a recommendation engine] was actually incredibly complex, and […] if you have access to a production grade database, 90% of the difficulty and heavy lifting in creating those solutions goes away, and that’s why we’re building this. We believe it’s the new standard,” he said.

The company currently has 10 people including the founders, but the plan is to double or even triple that number, depending on how the year goes. As he builds his company as an immigrant founder — Liberty is from Israel — he says that diversity is top of mind. He adds that it’s something he worked hard on at his previous positions at Yahoo and Amazon as he was building his teams at those two organizations. One way he is doing that is in the recruitment process. “We have instructed our recruiters to be proactive [in finding more diverse applicants], making sure they don’t miss out on great candidates, and that they bring us a diverse set of candidates,” he said.

Looking ahead to post-pandemic, Liberty says he is a bit more traditional in terms of office versus home, and that he hopes to have more in-person interactions. “Maybe I’m old fashioned but I like offices and I like people and I like to see who I work with and hang out with them and laugh and enjoy each other’s company, and so I’m not jumping on the bandwagon of ‘let’s all be remote and work from home’.”

Powered by WPeMatico

SetSail wants to upend the way sales people get compensated by paying them throughout the sales cycle, rather than a single commission after the sale closes. Today, the startup announced a $26 million Series A.

Insight Partners led the round with participation from existing investors Wing Venture Capital, Team8 and Operator Collective. Today’s investment brings the total raised to $37 million, according to the company.

SetSail connects to your CRM, email, calendar and other systems that have signals about the progress of a particular sale, and then using machine learning looks at points in the sales cycle where it would make sense to reward the sales person for the progress they are making.

As CEO and co-founder Haggai Levi told me at the time of the startup’s $7 million seed round in July, the single commission system discourages risk taking:

“If I’m closing the deal, I’m getting my commission. If I’m not closing the deal, I’m getting nothing. That means from a behavioral point of view, I would take the shortest path to win a deal, and I would take the minimum risk possible. So if there’s a competitive situation I will try to avoid that,” he said in July.

He said the idea of changing the way we think about compensation resonated with sales executives during the pandemic, especially as everyone’s role got altered and teams became distributed because of COVID, but he says while rethinking compensation was certainly a big factor so was SetSail’s ability to connect to all of the sales systems to help build these new approaches to pay.

“I think it’s even beyond just compensation. […] It’s also connecting to all of your data using an end-to-end platform that helps you understand what’s happening between you, your reps and your customers and allowing you to tie that back in using behavioral science to machine learning-based compensation,” he explained.

The company began 2020 with five customers, a reasonable start for an early stage startup, but it ended the year with more than 20 including Cisco, Dropbox and HubSpot. It now has over 5000 sales reps using the platform.

In spite of the growing number of users, Levi says they have no plans to aggregate data, leaving each customer’s data as distinct to build the compensation packages that make sense to them. “We try not to play kind of the data, aggregator role because we want to make sure that every customer’s data is encrypted and secured in a completely different container. The trade off between getting knowledge between customers versus receiving their data is is too high in our opinion,” he said.

The company now has 35 employees with five more hired who will be starting in the next several weeks and plans to reach 70 by the end of the year. They are thinking hard about how to hire a diverse workforce. For starters, Levi says that the company board has two female members. He says hiring in general is a challenge for every CEO, especially early on, and hiring a diverse group even more so, but he says it’s important to be thinking about this from the start because from a gender perspective at least, you are losing half the talent pool if you ignore it.

When the pandemic is over, he sees having at least some in-person office presence in spite of being spread out across San Francisco, New York and Tel Aviv, but it will be probably be a hybrid approach and not require as much office space as they might have rented prior to COVID.

Powered by WPeMatico

Streaming data is not new. Kafka has existed as an open source tool for a decade. Vectorized was founded on the premise that the existing tools were too complex and not designed for today’s streaming requirements. Today the company released its first product, Redpanda, an open source tool designed to make it easier for developers to build streaming data applications.

While it was at it, the startup announced a $15.5 million funding round, which is actually a combination of a previously unannounced $3 million seed round led by Lightspeed Venture Partners and a $12.5 million Series A, which was also from Lightspeed with help from Google Ventures.

Redpanda is an open source tool that is delivered as an “intelligent API” to help “turn data streams into products,” company founder and CEO Alexander Gallego explained. It’s built to be a Kafka replacement, while remaining Kafka-compatible to help deal with backwards compatibility.

At the same time, it takes a more modern approach. Gallego points out that teams building data streaming applications have been getting lost in the complexity and he recognized an opportunity to build a company to simplify that.

“People are drowning in complexity today managing Kafka, ZooKeeper (an open source configuration management tool) and the data lake,” he said, adding “We enable new things that couldn’t be done before for several reasons: one is performance, one is simplicity and the other one is this store procedures.”

He says that the key to developer adoption is making the product free through open source, and having Kafka compatibility so that developers don’t feel like they have to just dump existing projects and start from scratch. While the company is launching with an open source tool, it plans to use the funding to build a hosted version of Redpanda to put it within reach of more organizations. “This funding round in particular is to power our cloud,” he said.

Arif Janmohamed, a partner at Lightspeed Ventures who is leading the investment in Vectorized sees a company looking to improve upon an existing technology with a better approach. “With a simple, elegant solution that doesn’t require any changes to an existing application’s code, Vectorized delivers 10x better performance, a much simpler management paradigm, and new functionality that will unleash the next set of real-time applications for the next decade,” Janmohamed said.

The company has 22 employees today with plans to add another 8 in the first half of this year, mostly engineers to help build the hosted version. As a Latino founder, Gallego is acutely aware of the need for a diverse and inclusive workforce. “What I have found is that being a [Latino] CEO, it attracts more people that look like me, and so that’s been a big thing, and it’s made a difference [in attracting diverse candidates],” he said.

One concrete thing he has done is start a scholarship to encourage under represented groups to become developers. “I started a scholarship where we just give money and mentorship to communities of Latino, Black and female developers, or people that want to transition to software engineering,” he said. While he says he does it without strings attached, he does hope that some of these folks could become part of the tech industry eventually, and perhaps even work at his company.

Powered by WPeMatico

Run:AI, a Tel Aviv-based company that helps businesses orchestrate and optimize their AI compute infrastructure, today announced that it has raised a $30 million Series B round. The new round was led by Insight Partners, with participation from existing investors TLV Partners and S Capital. This brings the company’s total funding to date to $43 million.

At the core of Run:AI’s platform is the ability to effectively virtualize and orchestrate AI workloads on top of its Kubernetes-based scheduler. Traditionally, it was always hard to virtualize GPUs, so even as demand for training AI models has increased, a lot of the physical GPUs often set idle for long periods because it was hard to dynamically allocate them between projects.

The promise behind Run:AI’s platform is that it allows its users to abstract away all of the AI infrastructure and pool all of their GPU resources — no matter whether in the cloud or on-premises. This also makes it easier for businesses to share these resources between users and teams. In the process, IT teams also get better insights into how their compute resources are being used.

Run:AI says that it is currently working with customers in a wide variety of industries, including automotive, finance, defense, manufacturing and healthcare. These customers, the company says, are seeing their GPU utilization increase from 25 to 75% on average.

“The new funds enable Run:AI to grow the company in two important areas: first, to triple the size of our development team this year,” the company’s CEO Omri Geller told me. “We have an aggressive roadmap for building out the truly innovative parts of our product vision — particularly around virtualizing AI workloads — a bigger team will help speed up development in this area. Second, a round this size enables us to quickly expand sales and marketing to additional industries and markets.”

Powered by WPeMatico

Bloomreach, an API company that helps eCommerce customers with search and web site creation, announced a $150 million investment today from Sixth Street Growth. Today’s funding values the company at $900 million.

At the same time, the company announced it has acquired Exponea, a startup that gives Bloomreach a marketing automation component it had been missing. The two companies did not reveal the acquisition price, but along with the pure functionality, the company gains 200 additional employees, which is significant, considering Bloomreach had 300 prior to the acquisition. It also gains 250 net new customers, giving it a total of 750.

“Historically, we have had two major pillars of the business — the search part of it and the content part,” Bloomreach CEO and co-Founder Raj De Datta told TechCrunch. The content management component lets customers build websites, while the search powers the search box, navigation and merchandising. He points out that all of it is powered by an underlying data analysis engine that matches data to people and people to products.

Exponea will give the company more of a complete platform of services, allowing marketers to target and personalize their marketing messages across multiple channels. De Datta says the two companies had similar missions and made a good fit. “We have a common vision and common sort of product direction. […] Both companies are data-driven optimization technologies[…] and both are entrepreneurial product-driven companies,” he said.

It also helped that they had been partnering together for six months prior to the sale, which has now closed. Exponea was founded in 2016 in Slovakia and has raised over $57 million, according to Pitchbook data. The plan is to leave Exponea as a stand-alone product, while finding ways to integrate it more smoothly with the other components in the Bloomreach platform. They expect the integration parts to happen over the next year.

While De Datta did not want to share specific revenue figures, he did say that the company had a record second half as business was pushed online due to the pandemic. Michael McGinn, partner at Sixth Street and co-head at investor Sixth Street Growth doesn’t see the demand for eCommerce abating, even post-COVID, and that will drive a need for more customized online shopping experiences.

“Technology serving more bespoke customer experiences is a rapidly expanding market and we are pleased to join Bloomreach in its leadership of the digital commerce experience and marketing sector,” McGinn said in a statement.

De Datta says the money was used in part to buy Exponea, but he also plans to invest more in engineering to continue building the product line. The ultimate goal is an IPO, but as you would expect, he wasn’t ready to commit to any timeline just yet.

“I wouldn’t say we have a timeline, but our goal is that the company over the course of 2021 should make investments towards that, so that it’s an option for us.”

Powered by WPeMatico

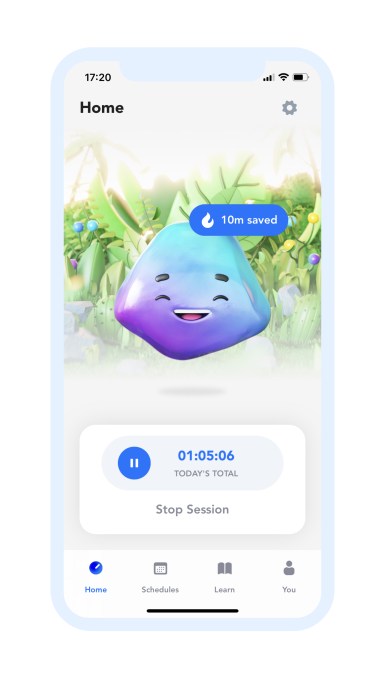

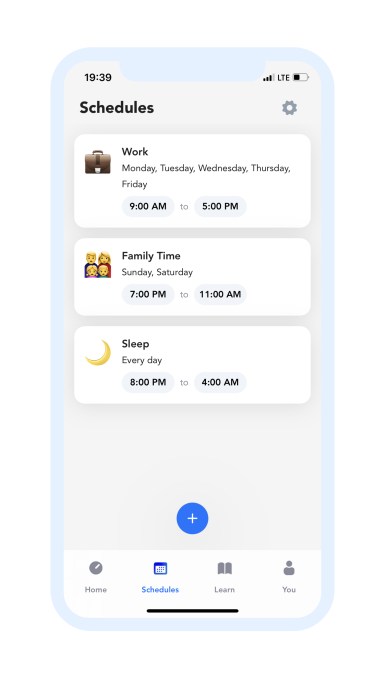

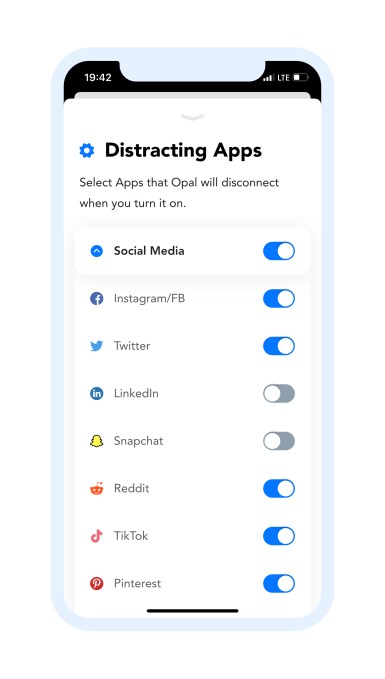

Many people want to develop better screen-time habits, but don’t have a good set of tools to do so. A new startup, Opal, aims to help. The company, now backed by $4.3 million in seed funding, has developed a digital well-being assistant for iOS that allows you to block distracting websites and apps, set schedules around app usage, lock down apps for stricter and more focused quiet periods, and more.

The service works by way of a VPN system that limits your access to apps and sites. But unlike some VPNs on the market, Opal is committed to not collecting any personal data on its users or their private browsing data. Instead, its business model is based on paid subscriptions, not selling user data, it says.

Timed with its public debut, Opal also today announced its initial financing in a round led by Nicolas Wittenborn at Adjacent, a mobile-focused VC fund. Other investors included Harry Stebbings, Steve Schlafman, Alex Zubillaga, Kevin Carter, Thibaud Elziere, Jean-Charles Samuelian-Werve, Alban Denoyel, Isai, Secocha Ventures, Speedinvest, and others.

Image Credits: Opal, founder Kenneth Schlenker

The idea for Opal comes from Paris-based Kenneth Schlenker, a longtime technologist who previously founded and sold an art marketplace startup ArtList and later led mobility company Bird’s expansion in France.

Schlenker, who grew up in a small, quiet village in the Alps, says he got into technology at a young age.

“I sort of got obsessed, like many of us, by the potential of technology and its amazing power of attraction — making connections, learning new things, all sorts of incredible opportunities,” he explains. “But I’ve then spent the last 10 years and more trying to seek a balance between this need for connection and this need for disconnection.”

In more recent years, Schlenker came to realize that others were having the same problem, including those outside the tech industry. That drove him to build Opal, with the goal of helping people better achieve balance in their lives so they could reconnect with loved ones, spend time in nature or just generally go offline to focus on other areas of their lives.

At a basic level, Opal’s VPN allows users to block themselves from using dozens of distracting apps and sites for certain periods of time, including social media, news, productivity apps and more.

Social media, in particular, has been a huge problem in recent years, Schlenker says.

“In particular, Instagram, Facebook and Twitter — social media is where you feel like you’re learning something, and you feel like you’re connecting with people. So it’s good. But on the other hand, it’s very hard to stay intentional,” he explains. “It’s okay to pick up your phone and go to Instagram, but when you ‘wake up’ 30 minutes later, you usually feel really bad. You feel like, ‘where’s the time gone?’, ‘what did I just do?,’ ” he says.

Opal addresses this problem through a handful of features.

Image Credits: Opal

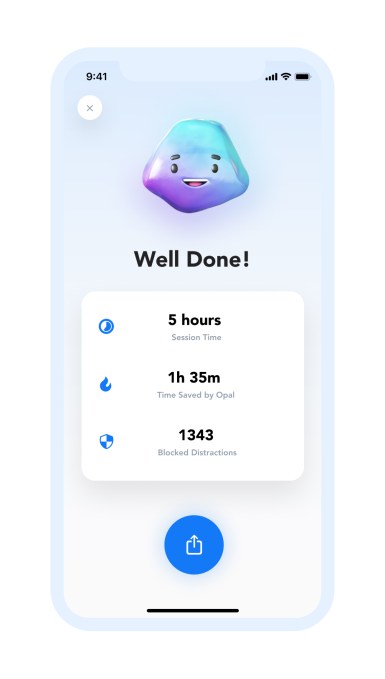

The free service allows you to block distracting websites and apps and take breaks throughout the day. By upgrading to the paid membership, Opal users can schedule time off from apps to establish recurring downtimes — whether that’s for family dinners or working hours, or anything else. They also can use a more extreme version of this feature called Focus Mode, which locks you out of apps in a way that’s not cancelable.

While the company is using a VPN to make this system work, it’s being transparent and straightforward about its data collection practices.

“There is zero private browsing data that leaves your phone,” Schlenker insists. “Anything you do on your phone outside of Opal’s app stays local on your phone and is never stored on any of our servers or any other servers. That’s very important to us,” he says.

From inside Opal’s app, the company claims it only collects usability and crash information — not browsing data. And the usability data is completely anonymized for another layer of privacy. Opal also doesn’t require an email to begin using the app. It only asks for one if you choose to pay.

Image Credits: Opal

These core principles are also documented on Opal’s privacy page, and are why Schlenker believes his app won’t face the challenges that other screen-time apps on the App Store have experienced in the past.

As you may recall, Apple cracked down on the screen time app industry a couple of years ago — a move Apple said was focused on protecting user privacy, but has also been raised as a possible example of anticompetitive behavior. Many of the apps at the time had been using techniques Apple claimed put consumers’ privacy and security at risk, as they gave third-parties elevated access to users’ devices. This was particularly concerning because many of the impacted apps were marketed as parental control services — meaning the end users were often children.

Opal, meanwhile, is targeting adults, and perhaps teenagers, who want to develop better screen-time habits. It is not selling this as a parental control system, however.

Image Credits: Opal

At launch, Opal can block over 100 apps and sites across several categories, including Facebook, Instagram, Snapchat, TikTok, Reddit, Pinterest, YouTube, Netflix, Twitch, Gmail, Outlook, Slack, Robinhood, WhatsApp, WeChat and others, including those in the news, adult and gambling categories.

Users can choose to block the apps for short breaks — 5, 10 or 60 minutes — throughout the day. You can also set an intention and set a timer before using an app, to help you avoid the issue of losing track of time. And you can set focus timers or scheduled times to automatically shut off app usage.

You can track your progress by viewing the “time saved” and you can share your successes across social media. In time, Schlenker plans to add more of a scoring mechanism to Opal that will help you stay accountable to your original goals.

Image Credits: Opal

Though work on the app only began in 2020, Opal began attracting attention as it publicized its plans on Twitter and ran its private beta, which grew from hundreds to thousands of users this year, saving its users an average of two hours per day.

Though Schlenker had connections with many of the angel investors who have since backed Opal, he says the interest from institutional and larger investors was all inbound.

“It was not our intention to raise so much, so early,” Schlenker notes.

The funds will be used to help Opal grow its team, particularly engineering, design as well as product. The company will also soon launch a version of Opal for Chrome and later, Android, and will experiment with more social features around sharing and hosting group sessions.

The app is currently a free download on the App Store with an optional $59.99/year subscription plan.

Powered by WPeMatico

Goalsetter, a platform that helps parents teach their kids financial literacy, announced the raise of a $3.9 million seed round this morning, led by Astia.

PNC Bank, Mastercard, U.S. Bank, Northwestern Mutual Future Ventures, Elevate Capital, Portfolia’s First Step and Rising America Fund and Pipeline Angels also participated in the round. The round also saw participation from a handful of individual investors including Robert F. Smith, Kevin Durant, Chris Paul, Baron Davis, Sterling K. Brown, Ryan Bathe, CC Sabathia and Amber Sabathia.

Goalsetter launched in 2019 out of the Entrepreneurs Roundtable Accelerator. Founded by Tanya Van Court, who lost over $1 million in the 2001 bubble burst, the platform teaches financial literacy to children of all ages, helping them learn economic concepts, lingo and the principles of financial health.

After long stints at Nickelodeon and ESPN, Van Court understands deeply how kids learn and what keeps their attention. She vowed to make sure that her children were never ignorant of what it takes to protect their wealth and create more.

The app also allows parents to give allowances through the app, and even pay out their own specified amount for every quiz question the kid gets right in the app. Plus, family and friends can give “goal cards” instead of gift cards, helping kids save for the things they really want in the future.

The company recently launched a debit card for kids, as well, letting parents control the way the card is used and even lock it until their kids have passed the week’s financial literacy quiz.

Families save an average of $120 a month on the platform, and Van Court says that two families saved over $10,000 in the last year.

The company is also launching a massive campaign next week for Black History Month with the goal of closing the wealth gap among Black children and kids of color through financial education.

“It’s one thing to put a debit card into your teenager’s hands,” said Van Court. “That’s great. That teaches them how to spend money. It’s another thing to teach kids the core concepts about how to build wealth, or to know the difference between putting your money into an investment account, or putting your money into a CD versus a mutual fund versus a savings account. We teach what interest rates are, and what compound interest means. Our focus is on financial education because it’s not enough to teach kids how to spend.”

Goalsetter raised $2.1 million in 2019 and now adds this latest round to that for a total of $6 million raised. This latest round was oversubscribed, giving Van Court the opportunity to be super selective about her investors.

“Every single one of these investors has a demonstrated commitment prior to people marching in the streets in April, to social justice and to investing in diversity and inclusion initiatives and people,” said Van Court. “Every single one of them. That was really important because we were oversubscribed and we had the luxury of being able to pick who our investors were. Every one of the investors that we invited to our table were investors who we knew invited folks who look like us in 2019 and 2018 and 2017 to their table.”

Powered by WPeMatico

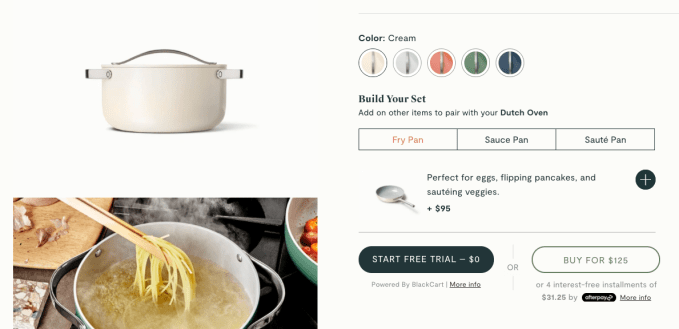

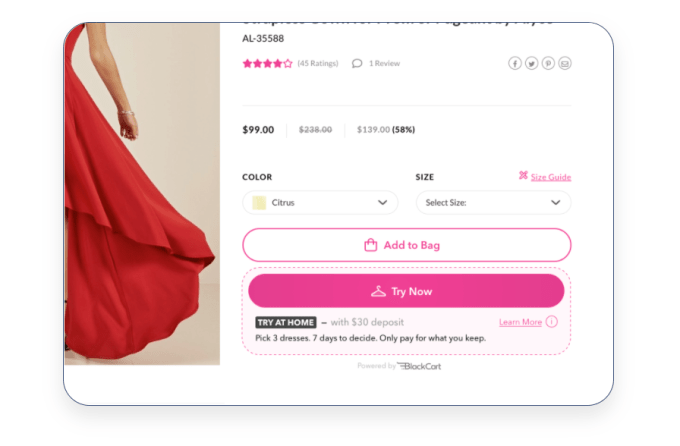

A startup called BlackCart is tackling one of the key challenges with online shopping: an inability to try on or test out the merchandise before making a purchase. That company, which has now closed on $8.8 million in Series A funding, has built a try-before-you-buy platform that integrates with e-commerce storefronts, allowing customers to ship items to their home for free and only pay if they choose to keep the item after a “try on” period has lapsed.

The new round of financing was led by Origin Ventures and Hyde Park Ventures Partners, and saw participation from Struck Capital, Citi Ventures, 500 Startups and several other angel investors, including Christian Sullivan of Republic Labs, Dean Bakes of M3 Ventures, Greg Rudin of Menlo Ventures, Jordan Nathan of Caraway Cookware and First National Bank CFO Nick Pirollo, among others.

The Toronto-based company last year had raised a $2 million seed.

Image Credits: BlackCart

BlackCart founder Donny Ouyang had previously founded online tutoring marketplace Rayku before joining a seed-stage VC fund, Caravan Ventures. But he was inspired to return to entrepreneurship, he says, after experiencing a personal problem with trying to order shoes online.

Realizing the opportunity for a “try before you buy” type of service, Ouyang first built BlackCart in 2017 as a business-to-consumer (B2C) platform that worked by way of a Chrome extension with some 50 different online merchants, largely in apparel.

This MVP of sorts proved there was consumer demand for something like this in online shopping.

Ouyang credits the earlier version of BlackCart with helping the team to understand what sort of products work best for this service.

“I think, in general, for try-before-you-buy, anything that’s moderate to higher price points, lower frequency of purchase, where the customer makes a considered purchase decision — those perform really well,” he says.

Two years later, Ouyang took BlackCart to 500 Startups in San Francisco, where he then pivoted the business to the B2B offering it is today.

Image Credits: BlackCart

The startup now provides a try-before-you-buy platform that integrates with online storefronts, including those from Shopify, Magento, WooCommerce, Big Commerce, SalesForce Commerce Cloud, WordPress and even custom storefronts. The system is designed to be turnkey for online retailers and takes around 48 hours to set up on Shopify and around a week on Magento, for example.

BlackCart has also developed its own proprietary technology around fraud detection, payments, returns and the overall user experience, which includes a button for retailers’ websites.

Because the online shoppers aren’t paying upfront for the merchandise they’re being shipped, BlackCart has to rely on an expanded array of behavioral signals and data in order to make a determination about whether the customer represents a fraud risk. As one example, if the customer had read a lot of helpdesk articles about fraud before placing their order, that could be flagged as a negative signal.

BlackCart also verifies the user’s phone number at checkout and matches it to telco and government data sets to see if their historical addresses match their shipping and billing addresses.

Image Credits: BlackCart

After the customer receives the item, they are able to keep it for a period of time (as designated by the retailer) before being charged. BlackCart covers any fraud as part of its value proposition to retailers.

BlackCart makes money by way of a rev share model, where it charges retailers a percentage of the sales where the customers have kept the products. This amount can vary based on a number of factors, like the fraud multiplier, average order value, the type of product and others. At the low end, it’s around 4% and around 10% on the high end, Ouyang says.

The company has also expanded beyond home try-on to include try-before-you-buy for electronics, jewelry, home goods and more. It can even ship out makeup samples for home try-on, as another option.

Once integrated on a website, BlackCart claims its merchants typically see conversion increases of 24%, average order values climb by 51% and bottom-line sales growth of 27%.

To date, the platform has been adopted by more than 50 medium-to-large retailers, as well as e-commerce startups, like luxury sneaker brand Koio, clothing startup Dia&Co, online mattress startup Helix Sleep and cookware startup Caraway, among others. It’s also under NDA now with a top-50 retailer it can’t yet name publicly, and has contracts signed with 13 others that are waiting to be onboarded.

Soon, BlackCart aims to offer a self-serve onboarding process, Ouyang notes.

“This would be later, end of Q2 or early Q3,” he says. “But I think for us, it will still be probably 80% self-serve, and then larger enterprises will want to be handheld.”

With the additional funding, BlackCart aims to shift to paying the merchant immediately for the items at checkout, then reconciling afterwards in order to be more efficient. This has been one of merchants’ biggest feature requests, as well.

Image Credits: BlackCart; team photo

The funding will also allow BlackCart to expand its remotely distributed 10-person team to around 50 by year-end, including engineers, product specialists, customer support staff and sales.

More broadly, it aims to quickly capitalize on the growth in the e-commerce market, driven by the COVID-19 pandemic.

“[We want to] take advantage of the favorable macroeconomic situation to scale as quickly as possible,” Ouyang explains. “We’re hoping to get to around $250 million in transactions through our platform by the end of 2021. And this would be driven by both engineering and sales hires, and just pushing it up,” he says.

Longer-term, Ouyang envisions adding more consumer-facing features to BlackCart’s platform, like on-demand returns where a courier comes to the house to pick up your return, for example.

“Our firm is excited to partner with BlackCart as it makes try-before-you-buy the standard in online shopping,” said Prashant Shukla of Origin Ventures, who now sits on BlackCart’s board, as result of the new financing. “Its underwriting technology provides merchants with peace of mind, and its best-in-class consumer experience delivers significant sales and conversion lifts. Digital Native generations expect to be able to shop online exactly as they would in a retail store, and BlackCart is the only company providing this experience,” he adds.

Powered by WPeMatico