Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

While there’s been plenty of recent debate around the gig economy, Jarah Euston argued that it’s time to rethink a bigger part of the workforce — hourly workers.

Euston, who was previously an executive at mobile advertising startup Flurry and a co-founder at data operations startup Nexla, told me that although 80 million Americans are paid on an hourly basis, the current system doesn’t work particular well for either employers or workers.

On the employer side, there are usually high rates of turnover and absenteeism, while workers have to deal with unpredictable schedules and often struggle to get assigned all the hours they want. So Euston has launched WorkWhile to create a better system, and she’s also raised $3.5 million in seed funding.

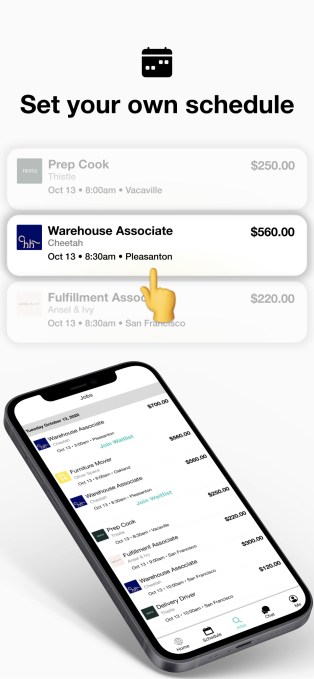

WorkWhile, she explained, is a marketplace that matches hourly workers with open shifts — employers identify the shifts that they want filled, while workers say which hours they want to work. That means employers can grow or shrink their workforce as needed, while the workers only work when they want.

“By pooling the labor force … we can provide the flexibility that both sides want,” Euston said.

Image Credits: WorkWhile

WorkWhile screens workers with one-on-one interviews, background checks and tests based on cognitive science, with the goal of identifying applicants who are qualified and reliable.

Employers pay WorkWhile a service fee, while the platform is free for users. And because the startup aims to build a long-term relationship with its workforce, Euston said it will also invest by providing additional benefits, starting with sick leave credits earned when you work and next-day payments to your debit cards.

“It’s hard to find a job that works with you and doesn’t give you a take it or leave it schedule,” said Michael Zavala, one of the workers on the platform, in a statement. “WorkWhile was exactly what I was looking for with the ability to create your own schedule for full time.”

The startup is launching in the San Francisco Bay Area, Los Angeles, Orange County and Dallas-Forth Worth.

Given the broader economic and employment trends during the pandemic, there should plenty of people looking for more work, while Euston said she’s seen a “feast or famine” situation on the employer side — yes, some companies have had to freeze or cut staff, but others have grown rapidly, including WorkWhile customers including restaurant supplier Cheetah, meal delivery service Thistle and horticultural e-commerce company Ansel & Ivy.

The funding, meanwhile, was led by Khosla Ventures, with participation from Stitch Fix founder and CEO Katrina Lake, Jennifer Fonstad, F7, Siqi Chen, Philipp Brenner, Zouhair Belkoura and Nicholas Pilkington.

“The majority of hourly workers are honest and reliable but some have difficult personal circumstances they need help with,” Vinod Khosla said in a statement. “Companies treat these employees as high turnover and expendable but, if given respect and appropriate support, they can become longer-term, model employees. WorkWhile wants to help solve this problem.”

Powered by WPeMatico

Tap Network is providing a new approach to loyalty rewards programs that it describes as “rewards as a service.”

You may recognize the Tap Network name, as well as its co-founder and CEO Lin Dai, from Hooch, a startup that offered a drink-a-day subscription service before shifting focus to a broader rewards program. Dai told me he “learned a lot from the Hooch experience” but ultimately “decided that Tap is a much bigger opportunity, we’re really looking at rewards in general.”

So Tap Network is a new startup, one that recently raised $4 million in funding from investors including Revelis Capital, Nima Capital, the Forbes family office, Warner Music Group, Access Industries, Bill Tai, Bob Hurst, Edward Devlin and others.

Dai said that normal rewards programs are only accessible to the top 10% or 20% of a company’s customers. So in his view, businesses have an opportunity to “super serve the average customers who 40 years ago might not have been considered important customers, but who today could be building a loyalty behavior pattern.”

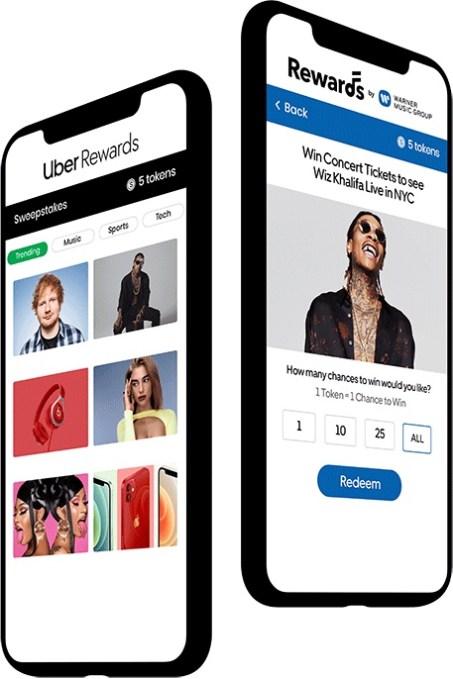

Image Credits: Tap Network

He added that making rewards programs accessible to more customers has an added benefit for many businesses, because “whether it’s a major bank or major travel company, they are starting to accrue billions of dollars that are locked up in these wallets.” Those points might never be redeemed, but they’re still considered liabilities from an accounting perspective.

Tap Network aims to solve this problem by allowing customers to spend those points through a broader network of rewards, which can usually be redeemed at a lower point level. It’s offered as a white-label addition to an existing rewards program, with each program choosing the rewards that might be the best fit for their customers.

For example, Uber recently worked with Tap Network to expand its Uber Rewards program, offering new Tap Network-powered rewards like free Apple Music or HBO Max, as well as the option to donate to causes like World Central Kitchen. And the minimum number of points needed to claim a reward fell from 500 points to 100 points.

Other companies using Tap Network include Warner Music Group (which, as previously mentioned, is also an investor) and privacy-focused browser company Brave.

Dai said that in the future, Tap could even allow consumers to combine rewards points from different programs: “If I want to redeem something, I might be able to take a little bit of my Uber points, a little bit of my Warner points, a little bit of points from another program,” and combine them.

Powered by WPeMatico

Creditas, the Brazilian lending business, has raised $255 million in new financing as financial services startups across Latin America continue to attract massive amounts of cash.

The company’s credit portfolio has crossed 1 billion reals ($196.66 million) and the new round will value the company at $1.75 billion thanks to $570 million raised in outside financing over five rounds.

Creditas is the latest company to benefit from a boom in financial services startup investing across the region. As the year dawned, venture investments into fintech startups in Latin America had grown from $50 million in 2014 to top $2.1 billion in 2020 across 139 deals, according to a report from CB Insights.

Investors in the round include new investors like LGT Lightstone, Tarsadia Capital, Wellington Management, e.ventures and an affiliate of Advent International, Sunley House Capital. Previous investors including SoftBank Vision Fund 1, SoftBank Latin America DFund, VEF, Kaszek and Amadeus Capital Partners also returned to put more money into the company.

“Creditas is still in the early innings of penetrating the huge untapped secured lending market in Brazil and Mexico” says Paulo Passoni, managing partner of SoftBank Latam fund, in a statement.

The company’s growth is a testament both to the need for new lending products across Latin America and the perspicacity of investors like Kaszek Ventures, whose portfolio has included several massive wins from bets on startups tackling financial services in Latin America.

“The journey since our investment in the Series A has been absolutely extraordinary. The team has executed on its vision, and Creditas has evolved into an asset-light ecosystem that resolves key financial needs of its customers throughout their lifetimes,” says Nicolas Szekasy, managing partner of Kaszek Ventures, in a statement.

Another big winner is Redpoint’s e.ventures fund, which has focused on investments in Latin America for the last several years.

“By empowering Brazilians to take control of their lending needs at reasonable rates, Creditas creates a beloved consumer product that will drive significant value for customers and investors. Having been involved since the seed stage through Redpoint e.ventures, we’re thrilled to support the company with our Global Growth Fund as well, as they change the Brazilian fintech landscape,” said Mathias Schilling, co-founder and managing partner of e.ventures.

Creditas has plans to use the cash to expand its home and auto lending as well as a payday lending service based on customers’ salaries and a retail option to sell through buy now, pay later loans based on a customer’s salary.

The company is also looking to expand to other markets, with an eye toward establishing a foothold in the Mexican market.

Founded in 2012, when the founders worked out of a five-square-meter office on Berrini Avenue in São Paulo, the company now boasts a robust business with hundreds of employees and a business resting on a secured lending marketplace and independent home and auto lending operations.

The company also released quarterly results for the first time, showing losses narrowing from 74.9 million Brazilian reals to 40.5 million reals in the year ago quarter.

Powered by WPeMatico

Zomato has raised $660 million in a financing round that it kicked off last year as the Indian food delivery startup prepares to go public next year.

The Indian startup said Tiger Global, Kora, Luxor, Fidelity (FMR), D1 Capital, Baillie Gifford, Mirae and Steadview participated in the round — a Series J — which gives Zomato a post-money valuation of $3.9 billion. Zomato had previously disclosed a fundraise of about $212 million as part of a Series J round from Ant Financial, Tiger Global, Baillie Gifford and Temasek.

Deepinder Goyal, the co-founder and chief executive of Zomato, said the 12-year-old startup is also in the process of closing a $140 million secondary transaction. “As part of this transaction, we have already provided liquidity worth $30m to our ex-employees,” he tweeted.

The startup originally anticipated to close a round of about $600 million by January this year, but several obstacles, including the current pandemic, delayed the fundraise effort. Additionally, Ant Financial, which had originally committed to invest $150 million in this round, only delivered a third of it, Zomato’s investor Info Edge disclosed earlier this year.

The Gurgaon-headquartered startup, which acquired the Indian food delivery business of Uber early this year, competes with Prosus Ventures-backed Swiggy in India. A third player, Amazon, has also emerged in the market, though it currently offers its food delivery service in only parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients — accessed by TechCrunch. With about 50% of the market share, Zomato is the current leader among the three, Bernstein analysts wrote.

Zomato eliminated hundreds of jobs this year to improve its finances and navigate the coronavirus pandemic, which significantly hurt the food delivery business in India in the early months. Goyal said the food delivery market is “rapidly coming out of COVID-19 shadows. December 2020 is expected to be the highest ever GMV month in our history. We are now clocking ~25% higher GMV than our previous peaks in February 2020.” He added, “I am supremely excited about what lies ahead and the impact that we will create for our customers, delivery partners, and restaurant partners.”

In September, Goyal told employees that Zomato was working for its IPO for “sometime in the first half of next year” and was raising money to build a war-chest for “future M&A, and fighting off any mischief or price wars from our competition in various areas of our business.”

Making money with food delivery has been especially challenging in India. Unlike Western markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

“The problem is that there are very few people in India who can afford to place an order from a food delivery firm each day,” said Anand Lunia, a venture capitalist at India Quotient, in an interview with TechCrunch earlier this year.

Powered by WPeMatico

We’ve seen a big wave of proptech startups emerge to reimagine how houses are bought and sold, with some tapping into the opportunity with distressed property, and others exploring the “iBuyer” model where houses are bought and fixed up by a single startup and resold to homeowners who don’t want to invest in a fixer-upper. But the vast majority of homes are still sold the traditional way, by way of a real estate agent working via a broker.

Today, a startup is announcing that it has raised seed funding not to disrupt, but improve that basic model with a more flexible approach that can help agents work in a more modern way, and to ultimately scale out the number of people working as agents in the market.

Avenue 8, which describes itself as a “mobile-first residential real estate brokerage” — providing a new set of tools for agents to source, list and sell homes, and handle the other aspects of the process that fall between those — has raised $4 million. This is a seed round, and Avenue 8 plans to use it to expand further in the cities where it is already active — it’s been in beta thus far in the San Francisco and Los Angeles areas — as well as grow to several more.

The funding is notable because of the backers that the startup has attracted early on. It’s being led by Craft Ventures — the firm co-founded by David Sacks and Bill Lee that has amassed a prolific and impressive portfolio of companies — with Zigg Capital and Good Friends (an early-stage fund from the founders of Warby Parker, Harry’s and Allbirds) also participating.

There has been at least $18 billion in funding raised by proptech companies in the last decade, and with that no shortage of efforts to take the lessons of tech — from cloud computing and mobile technology, through to artificial intelligence, data science and innovations in e-commerce — and apply them to the real estate market.

Michael Martin, who co-founded Avenue 8 with Justin Fichelson, believes that this pace of change, in fact, means that one has to continually consider new approaches.

“It’s important to remember that Compass’s growth strategy was to roll out its technology to traditional brokerages,” he said of one of the big juggernauts in the space (which itself has seen its own challenges). “But if you built it today, it would be fundamentally different.”

And he believes that “different” would look not unlike Avenue 8.

The startup is based around a subscription model for a start, rather than a classic 30/70 split on the sales commissions that respectively (and typically) exist between brokers and agents.

Around that basic model, Avenue 8 has built a set of tools that provides agents with an intuitive way to use newer kinds of marketing and analytics tools both to get the word out about their properties across multiple channels; analytics to measure how their efforts are doing, in order to improve future listings; and access to wider market data to help them make more informed decisions on valuations and sales. It also provides a marketplace of people — valets — who can help stage and photograph properties for listing, and Avenue 8 doesn’t require payments to be made to those partners unless a home sells.

It also provides all of this via a mobile platform — key for people in a profession that often has them on the move.

Targeting agents that have in the past relied essentially on using whatever tools the brokers use — which often were simply their own sites plus some aggregating portals — Avenue 8’s pitch is not just better returns but a better process to get there.

“We’ve heard time and time again that agents struggle to identify and leverage the technology and tools to successfully manage their relationships and properties. Changing buyer/seller expectations have accelerated the digital transformation of most agents’ workflows,” said Ryan Orley, partner at Zigg Capital, in a statement. “Avenue 8 is building and integrating the right software and resources for our new reality.”

What’s also interesting about Avenue 8 is how it can open the door to a wider pool of agents in the longer run.

The real estate market has been noticeably resilient throughout the pandemic, with lower interest rates, a generally lower overall home inventory and people spending more time at home (and wanting a better space) creating a high level of demand. With a number of other industries feeling the pinch, a flexible platform like Avenue 8’s creates a way for people — who have taken and passed the certifications needed to become agents — to register and flexibly work as an agent as much or as little as they choose, creating a kind of “Uber for real estate agents,” as it were.

That scaling opportunity is likely one of the reasons why this has potentially caught the eye of investors.

“Avenue 8’s organic growth is clear evidence that the market demands a mobile-first, digital platform,” said Jeff Fluhr, general partner at Craft Ventures, in a statement. “Michael and Justin have a clear vision for modernizing real estate while keeping agents at the center. Avenue 8’s model helps agents take home more even in today’s environment where commissions are compressing.”

Interestingly, just as Uber’s changed the way that on-demand transportation is ordered and delivered, Avenue 8 is starting to see some interesting traction in terms of its place in the real estate market. Although it was originally targeted at agents with the pitch of being like “a better broker” — providing the services brokers are regulated to provide, but with a more modern wrapper around it — it’s also in some cases attracting brokerages, too. Martin said that it’s already working with a few smaller ones, and ultimately might consider ways of providing its tools to larger ones to manage their businesses better.

Powered by WPeMatico

I was made aware of Surrogate.tv’s work earlier this year when the site released a Mario Kart Live: Home Circuit tournament. Nintendo’s IRL take on its popular racing title was a great showcase for the technology — though, admittedly, there was enough lag in the remote operation to make control something of an issue.

Of course, Mario Kart is just one of the experiences the platform offers. It’s a pretty broad range, all told, from pinball to battling robots to claw machines. The diversity of experience is probably the service’s biggest strength, all told.

Today the Finnish startup announced that it has closed a $2.5 million seed round, led by Supernode Global and followed by PROfounders, Brighteye Ventures and Business Finland. The latest sum joins a $2 million pre-seed announced by the company last year.

The company’s big play is an ultra-low-latency streaming and robotics bundle that lets users remotely control real-world objects in the manner of a streaming gaming service. Another recent example is a partnership with Ubisoft, where users raised miniature Viking ships against strongman Hafþór Björnsson, for some reason. 2020, I guess.

Image Credits: Surrogate.tv

“Previously, such teleoperation technology would be accessible only for very specific, mainly enterprise, applications,” CEO Shane Allen said of the seed raise. “With this second round of funding, we will be able to launch a string of exciting initiatives that will enable people to create experiences that have never been possible before, all using our technology.”

It seems clear that Surrogate.tv is looking to expand beyond its own entertainment site, offering up its teleoperation technology to interested third-parties. It’s something many have no doubt been investigating in a year when in-person events have been largely off limits.

Powered by WPeMatico

When an accident on a building site resulted in the death of their friend, the founders of Safesight were inspired to launch the platform to digitize safety programs for construction. The data from that gave birth to a new insurtech startup this year, Foresight, which covers workers’ compensation. The startup has now released, for the first time, news that it raised a $15 million funding round back in May this year, with participation from Blackhorn Ventures and Transverse Insurance Group. To date, it has raised $20.5 million from industrial technology venture capital firms, led by Brick and Mortar Ventures and Builders VC.

Foresight launched in August of this year but has already covered $30 million in risks. The company says it is now on pace to reach $50 million in underwritten premium in 2021. By leveraging the data from sister company Safesite, the platform says it has been able to reduce workers’ comp incidents by up to 57% in a study conducted by actuarial consulting firm Perr & Knight.

Foresight’s algorithm leverages Safesight data to predict incidents, highlight risks and inform underwriting. By wrapping Safesite risk management technology and services into every policy, Foresight provides a path to lower incident rates and lower premiums for customers.

Of the $57 billion national workers’ compensation market, Foresight focuses on policies ranging from $150,000 to $1 million+ in annual premiums. The company says this segment has been largely overlooked by well-funded insurtech startups such as Next Insurance and Pie, which provide small business policies under $50,000 in annual premiums.

Foresight and Safesite were developed by longtime friends and co-founders David Fontain, Peter Grant and Leigh Appel.

Fontain said: “Foresight strengthens the correlation between safety and savings while providing the fast and easy user experience insurtechs are known for. We leverage purpose-built technology to drive behavioral shifts and provide an irresistible alternative to traditional workers compensation coverage.”

Darren Bechtel, the founder and managing director at Brick & Mortar Ventures, commented: “We first invested in 2016 and have known the founders since 2015 when it was just the two of them, squatting at a couple of empty desks inside another portfolio company’s office. Their initial vision was both elegant and powerful, and the demonstrated impact of their solution on safety performance, even in early interactions with the product, was impossible to ignore.”

Foresight now covers Nevada, Oklahoma, Arizona, Arkansas, Louisiana and New Mexico. The company expects to launch workers’ compensation in the eastern U.S. and a general liability line in early 2021.

Powered by WPeMatico

V7 Labs, the makers of a computer vision platform that helps AI teams “automate” and future-proof their training data workflows as advances in AI continue, has picked up $3 million in funding. Leading the seed round is Amadeus Capital Partners, with participation from Partech, Nathan Benaich’s Air Street Capital and Miele Venture.

Founded in 2018 by Singularity University alumnus Alberto Rizzoli and former R&D lead at RSI, Simon Edwardsson (the same team behind “seeing” app Aipoly), the V7 Labs platform promises to accelerate the creation of high-quality training data by 10-100x. It does this by giving users the ability to build automated image and video data pipelines, organize and version complex data sets, and train and deploy “state-of-the-art” vision AI models.

“For companies to build computer vision solutions that deliver business value, they must continuously collect, label and retrain their models,” explains V7 Labs’ Rizzoli. “When we built Aipoly in 2015, we needed to build and maintain our own tools, whilst keeping up with the rapid state of the art of AI, because no third-party SaaS products were available”.

Fast-forward to today and Rizzoli says that many of the best computer vision companies are now turning to SaaS platforms like V7 to solve this problem. “There’s a lot to think of when building an AI startup, and ‘how can we efficiently store and query 100 different video data sets’ is something you only think of when you’re mid-flight in trying to deliver your service.

“V7 codifies industry best-practices for organizing data, labelling and launching computer vision models for real-world problems”.

Image Credits: V7 Labs

The browser and cloud-based platform claims the ability to quickly upload and render large image/video data sets “without lag,” and enable labelling to be automated (to varying degrees) without the need for prior training data. V7 has also been designed to make it possible to keep track of a very large number of labels per image/video, supporting thousands of annotations per image and millions of images per data set. Crucially, Rizzoli tells me it is possible to train, deploy and run computer vision models within the platform “in a few clicks without having to worry about DevOps”.

“Customers will soon be able to audit those models — and their corresponding training sets — to debug, test data quality, discover failure cases and eliminate any unwanted bias,” he adds, noting that these are all huge unsolved pain-points in the AI industry.

To that end, V7 Labs’ existing 100 or so customers include Tractable, GE Healthcare and Merck. It is growing fastest within medical imaging, in part because it offers support for DICOM annotation and HIPAA compliance, both must-haves in healthcare.

However, measured by the quantity of data processed on the platform, Rizzoli tells me that routine “expert inspections” are the most popular tasks. “These include dozens of companies using AI to look for damage or anomalies in cars, oil rigs, power lines, pipelines or roads,” he says.

Powered by WPeMatico

The coronavirus pandemic has underscored, and often exacerbated, the mental health crisis that exists across the world. Even the spread of remote work is part of the problem: As everyone stays at home, the lack of interaction and watercooler chat has left employees without in-person interaction.

The need for a solution has helped tech-powered mental health solutions raise funding to meet increased demand. In the latest development, it emerged that Lyra Health, a platform that focuses on providing workforces with mental health care, has filed paperwork to raise a $175 million Series E at a $2.25 billion valuation.

The paperwork was uncovered by Prime Unicorn Index. While it is not clear whether the company has closed the round, filings in Delaware usually appear after part or all of the funding has been secured. Prime Unicorn Index notes that the terms surrounding this Series E round include a “pari passu liquidation preference with all other preferred, and conventional convertible, meaning they will not participate with common stock if there are remaining proceeds.” It also noted that Lyra Health’s most recent price per share is $27.47, an up round from the Series D, which priced shares at $14.21.

We are reaching out to the company and investors for a response to the filing. One investor noted that the round has not closed yet.

Past backers of the company include Adams Street Partners, Tenaya Capital, Meritech Capital Partners, IVP and Greylock.

We seem to be in a period of rapid growth rounds getting raised in quick succession for the most promising startups. As with Discord — which confirmed a $100 million round just six months after raising $100 million — Lyra Health also recently raised funding — specifically a $110 million Series D that catapulted it above a $1 billion valuation.

That effectively means the startup doubled its valuation in a handful of months, suggesting rapid growth or key validation. As reported by Forbes, Lyra Health was set to bring in around $100 million in revenue by the end of the year at the time of its prior fundraise.

There have been a number of categories of technology that have seen a bump of usage and interest during this coronavirus pandemic, and sadly — or perhaps usefully, depending on how you look at it — mental health and wellness startups, aimed at helping our well-being in this trying time, have been one of them. Just last week, the meditation app Calm raised $75 million at a $2 billion valuation.

Burlingame, California-based Lyra Health wants to live in offices everywhere. The company helps employers give their employees a suite of safe and confidential tools to support their mental health needs. This is a tricky space to play in, considering that mental health can still feel taboo in workplaces and employees might feel uncomfortable turning to their employers for support. Still, in a world where in-office perks are no longer available, mental health might be a key investment to help startup retention.

Once an employee joins Lyra, the company creates a set of recommendations for the now-patient based on a survey. Lyra Health then can connect patients to its network of thousands of therapists for appointments, consultations and check-ins. The flywheel continues.

During the pandemic, Lyra Health has brought on 80,000 new users, to a total of 1.5 million users last reported.

Tech-enabled mental health care has found tailwinds as the coronavirus pandemic leads to a surge of telehealth, as in-person doctor’s appointments could leave patients at risk. Indeed, Lyra Health started Lyra Blended Care, which pairs video therapy with online lessons and exercises rooted in cognitive behavioral therapy.

Powered by WPeMatico

Social gaming platform Rec Room has scored some new funding as it aims to bring its once VR-centric world to every major gaming platform out there.

The startup has closed a $20 million Series C led by Madrona Venture Group . Existing investors, including First Round Capital, Index, Sequoia and DAG, also participated in the round. They’ve raised just shy of $50 million to date.

The platform has been around for years serving as a social hub and gaming platform for virtual reality users. In recent years, the company has tried to scale its ambitions past being known as the “Roblox of VR” and scale its capabilities to meet its young user base. This year was big for the platform doing just that.

CEO Nick Fajt estimates that the company has tripled its total audience since this time last year as the company has made a concerted drive on new platforms. While a substantial portion of Rec Room’s audience still comes from its bread-and-butter VR audience, the platform’s base of console users has grown substantially in 2020 and, by the end of next year, Fajt expects that mobile will have grown to be Rec Room’s most common point of entry. Meanwhile, mobile Android remains one of the last major gaming platforms on which Rec Room still doesn’t have a home.

One of the company’s big aims heading into the new year is scaling their creation tools, which allow players to build their own experiences inside the game. More than 1 million of the platform’s 10 million registered users have engaged with creator tools, building 4 million distinct rooms on the platform. Next year, Fajt plans to scale up creator payments estimating that by the end of 2021 they’ll have paid out $1 million to their network.

Fajt says he wants creation tools on Rec Room to be more accessible to the general player base than other platforms, including Roblox, aiming to keep tools simple for now and push everyday users to invest time in the creation platform.

Image via Rec Room

“Roblox has an incredible business, that’s certainly no secret,” Fajt tells TechCrunch. “We want breadth of expression over depth of expression; we want anyone who comes into to Rec Room to be able to build.”

Despite the slow maturation of the VR market, Fajt says the company doesn’t plan on moving away from its VR roots anytime soon. The company has just updated its popular battle royale mode Rec Royale for the new Quest 2, as well as on iOS.

Powered by WPeMatico