Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Businesses today feel, more than ever, the imperative to have flexible e-commerce strategies in place, able to connect with would-be customers wherever they might be. That market driver has now led to a significant growth round for a startup that is helping the larger of these businesses, including those targeting the B2B market, build out their digital sales operations with more agile, responsive e-commerce solutions.

Spryker, which provides a full suite of e-commerce tools for businesses — starting with a platform to bring a company’s inventory online, through to tools to analyse and measure how that inventory is selling and where, and then adding voice commerce, subscriptions, click & collect, IoT commerce and other new features and channels to improve the mix — has closed a round of $130 million.

It plans to use the funding to expand its own technology tools, as well as grow internationally. The company makes revenues in the mid-eight figures (so, around $50 million annually) and some 10% of its revenues currently come from the U.S. The plan will be to grow that business as part of its wider expansion, tackling a market for e-commerce software that is estimated to be worth some $7 billion annually.

The Series C was led by TCV — the storied investor that has backed giants like Facebook, Airbnb, Netflix, Spotify and Splunk, as well as interesting, up-and-coming e-commerce “plumbing” startups like Spryker, Relex and more. Previous backers One Peak and Project A Ventures also participated.

We understand that this latest funding values Berlin -based Spryker at more than $500 million.

Spryker today has around 150 customers, global businesses that run the gamut from recognised fashion brands through to companies that, as Boris Lokschin, who co-founded the company with Alexander Graf (the two share the title of co-CEOs) put it, are “hidden champions, leaders and brands you have never heard about doing things like selling silicone isolations for windows.” The roster includes Metro, Aldi Süd, Toyota and many others.

The plan will be to continue to support and grow its wider business building e-commerce tools for all kinds of larger companies, but in particular Spryker plans to use this tranche of funding to double down specifically on the B2B opportunity, building more agile e-commerce storefronts and in some cases also developing marketplaces around that.

One might assume that in the world of e-commerce, consumer-facing companies need to be the most dynamic and responsive, not least because they are facing a mass market and all the whims and competitive forces that might drive users to abandon shopping carts, look for better deals elsewhere or simply get distracted by the latest notification of a TikTok video or direct message.

For consumer-facing businesses, making sure they have the latest adtech, marketing tech and tools to improve discovery and conversion is a must.

It turns out that business-facing businesses are no less immune to their own set of customer distractions and challenges — particularly in the current market, buffeted as it is by the global health pandemic and its economic reverberations. They, too, could benefit from testing out new channels and techniques to attract customers, help them with discovery and more.

“We’ve discovered that the model for success for B2B businesses online is not about different people, and not about money. They just don’t have the tooling,” said Graf. “Those that have proven to be more successful are those that are able to move faster, to test out everything that comes to mind.”

Spryker positions itself as the company to help larger businesses do this, much in the way that smaller merchants have adopted solutions from the likes of Shopify .

In some ways, it almost feels like the case of Walmart versus Amazon playing itself out across multiple verticals, and now in the world of B2B.

“One of our biggest DIY customers [which would have previously served a mainly trade-only clientele] had to build a marketplace because of restrictions in their brick and mortar assortment, and in how it could be accessed,” Lokschin said. “You might ask yourself, who really needs more selection? But there are new providers like Mano Mano and Amazon, both offering millions of products. Older companies then have to become marketplaces themselves to remain competitive.”

It seems that even Spryker itself is not immune from that marketplace trend: Part of the funding will be to develop a technology AppStore, where it can itself offer third-party tools to companies to complement what it provides in terms of e-commerce tools.

“We integrate with hundreds of tech providers, including 30-40 payment providers, all of the essential logistics networks,” Lokschin said.

Spryker is part of that category of e-commerce businesses known as “headless” providers — by which they mean those using the tools do so by way of API-based architecture and other easy-to-integrate modules delivered through a “PaaS” (clould-based Platform as a Service) model.

It is not alone in that category: There have been a number of others playing on the same concept to emerge both in Europe and the U.S. They include Commerce Layer in Italy; another startup out of Germany called Commercetools; and Shogun in the U.S.

Spryker’s argument is that by being a newer company (founded in 2018) it has a more up-to-date stack that puts it ahead of older startups and more incumbent players like SAP and Oracle.

That is part of what attracted TCV and others in this round, which was closed earlier than Spryker had even planned to raise (it was aiming for Q2 of next year) but came on good terms.

“The commerce infrastructure market has been a high priority for TCV over the years. It is a large market that is growing rapidly on the back of e-commerce growth,” said Muz Ashraf, a principal at TCV, to TechCrunch. “We have invested across other areas of the commerce stack, including payments (Mollie, Klarna), underlying infrastructure (Redis Labs) as well as systems of engagement (ExactTarget, Sitecore). Traditional offline vendors are increasingly rethinking their digital commerce strategy, more so given what we are living through, and that further acts as a market accelerant.

“Having tracked Spryker for a while now, we think their solution meets the needs of enterprises who are increasingly looking for modern solutions that allow them to live in a best-of-breed world, future-proofing their commerce offerings and allowing them to provide innovative experiences to their consumers.”

Powered by WPeMatico

It’s been an eventful fall for Perigee CEO and founder Mollie Breen. The former NSA employee participated in the TechCrunch Disrupt Startup Battlefield in September, and she just closed her first seed round on Thanksgiving, giving her a $1.5 million runway to begin building the company.

Outsiders Fund led the round, with participation from Westport, Contour Venture Partners, BBG Ventures, Innospark Ventures and a couple of individual investors.

Perigee wants to secure areas of the company like HVAC systems or elevators that may interact with the company’s network, but which often fall outside the typical network security monitoring purview. Breen says the company’s value proposition is about bridging the gap between network security and operations security. She said this has been a security blind spot for companies, often caught between these two teams. Perigee provides a set of analytics that gives the security team visibility into this vulnerable area.

As Breen explained when we spoke in September around her Battlefield turn, the solution learns normal behavior from the operations systems as it interacts with the network, collecting data like which systems and individuals normally access it. It can then determine when something seems off and cut off an anomalous act, which may be indicative of hacker activity, before it reaches the network.

She says that as a female founder getting funding, she is acutely aware how rare that is, and part of the reason she wanted to publicize this funding round was to show other women who are thinking about starting a company that it’s possible, even if it remains difficult.

She plans to grow the company to about six people in the next 12 months, and Breen says that she thinks deeply about how to build a diverse organization. She says that starts with her investors, and includes considering diversity in terms of gender, race and age. She believes that it’s crucial to start with the earliest employees, and she actively recruits diverse candidates.

“I write a lot of cold emails, particularly around hiring and that’s partly because with job listings it’s all inbound and you can’t necessarily guarantee that that is going to be diverse. And so by writing cold emails and really following up with those people and having those conversations, I have found a way of actually making sure that I’m talking to people from different perspectives,” she said.

As she looks ahead to 2021, she’s thinking about the best approach to office versus remote and she says it will probably be mostly remote with some in-person. “I’m really balancing at this point in time, how do we really make the connections, and make them strong and genuine with a lot of trust and do that with balancing some elements of remote, knowing that is where the industry is going and if you’re going to be a company and in a post-2020 world, you probably need to adopt to some element of remote working,” she said.

Powered by WPeMatico

French fintech startup Lydia has extended its Series B round. Accel is leading the extension with all major existing shareholders also participating. Lydia first raised $45 million in January 2020 — Tencent led that investment. The startup is now raising another $86 million, which means that Lydia has raised $131 million in total as part of its Series B round.

While Lydia wouldn’t discuss the valuation of the round, its co-founder and CEO gave me a hint. “The value of the company has really significantly increased between the two parts of the B round,” he told me.

Interestingly, Amit Jhawar is heading this investment for Accel . He joined Accel as a venture partner in July and he’s going to join Lydia’s board of directors.

Jhawar joined payments company Braintree in 2011 as COO and CFO. Shortly after, Braintree acquired peer-to-peer payment app Venmo. “When we acquired Venmo it was only 15 people. They had just released their mobile app in April of 2012,” Jhawar told me in a phone interview.

PayPal later acquired Braintree and Venmo — Jhawar stuck around until early 2020 to scale Venmo to the huge fintech consumer app that 52 million people use in the U.S. Jhawar believes that peer-to-peer payments represent the beginning of a long-term consumer relationship.

“You know that P2P is successful when they leave money in their account because they’re going to come back,” he said.

Back in 2014, when I first covered Lydia, I called it the Venmo for France — they had only raised €600,000 back then. It seems like Jhawar agrees with that take. Since then, Lydia has grown quite a lot and has expanded beyond peer-to-peer payments in various ways.

With Lydia, you can send money to another user in just a few seconds. You don’t have to enter an account number in your banking app — as long as you know their phone number, they’ll receive your payment.

If you have money in your account, you can choose to spend it directly using a Visa debit card. Lydia lets you generate a virtual card that works with Apple Pay and Google Pay — you can also order a plastic card.

Lydia also supports direct deposit as you get your own IBAN in the app. You can also create money pots and send a link to other users, view your bank accounts in Lydia, donate money to hospitals and charities, get a credit line, etc.

But there’s one killer feature that stands out over the rest. Bank accounts tend to be monolithic and don’t reflect how you use money. “If you look at banks today, they call the main account a checking account. It’s outdated by design,” CEO Cyril Chiche said.

Lydia has created flexible sub-accounts that you can use in many different ways. You can create a second sub-account and set some money aside for your bills. You can create a third one and share it with a few friends because you’re going on a vacation together.

You can move money from one account to another by swiping your finger across the account grid. As you can have multiple contributors and you can change the account associated with your debit card, it means that money flows more naturally. It feels like using a messaging app, not a financial app.

And it’s been working well in France. The company now has more than 4 million users. Transactions have doubled over the past year, which means that usage is accelerating.

“Lydia has the largest P2P network in Europe outside of PayPal and has the potential to grow all across Europe with a mobile-first, customer-focused solution. This will bring demand for incremental consumer financial products and high merchant interest to accept the payment,” Jhawar told me in an email.

And 2020 has been a busy year for Lydia. The company has just released a complete redesign to better position the app as a super app for financial services. All the interactions and all the main tabs have been changed.

Lydia also re-launched its premium offering with two new premium plans that offer you higher limits over the free plan and an insurance package for the most expensive offer. Those plans are more in line with what the app offers today and should contribute to the company’s bottom line. “The next step is bringing Lydia to profitability and it’s something that has always been important for us,” Chiche said in a recent interview.

Behind the scenes, Lydia has also upgraded many core features, such as migrating cards to a new infrastructure, adding alerts to account aggregation, supporting instant SEPA transfers to bank accounts, etc.

In 2021, the company plans to build on top of that new foundation with more financial products. “We’re going to try every single product — credit, savings, investment,” Chiche said.

The company is also slowly expanding to more countries. But it wants to offer a product that feels like a local product with a local card and a local IBAN to increase acceptance rates. Lydia is starting with Portugal.

Powered by WPeMatico

Hightouch, a SaaS service that helps businesses sync their customer data across sales and marketing tools, is coming out of stealth and announcing a $2.1 million seed round. The round was led by Afore Capital and Slack Fund, with a number of angel investors also participating.

At its core, Hightouch, which participated in Y Combinator’s Summer 2019 batch, aims to solve the customer data integration problems that many businesses today face.

During their time at Segment, Hightouch co-founders Tejas Manohar and Josh Curl witnessed the rise of data warehouses like Snowflake, Google’s BigQuery and Amazon Redshift — that’s where a lot of Segment data ends up, after all. As businesses adopt data warehouses, they now have a central repository for all of their customer data. Typically, though, this information is then only used for analytics purposes. Together with former Bessemer Ventures investor Kashish Gupta, the team decided to see how they could innovate on top of this trend and help businesses activate all of this information.

“What we found is that, with all the customer data inside of the data warehouse, it doesn’t make sense for it to just be used for analytics purposes — it also makes sense for these operational purposes like serving different business teams with the data they need to run things like marketing campaigns — or in product personalization,” Manohar told me. “That’s the angle that we’ve taken with Hightouch. It stems from us seeing the explosive growth of the data warehouse space, both in terms of technology advancements as well as like accessibility and adoption. […] Our goal is to be seen as the company that makes the warehouse not just for analytics but for these operational use cases.”

It helps that all of the big data warehousing platforms have standardized on SQL as their query language — and because the warehousing services have already solved the problem of ingesting all of this data, Hightouch doesn’t have to worry about this part of the tech stack either. And as Curl added, Snowflake and its competitors never quite went beyond serving the analytics use case either.

As for the product itself, Hightouch lets users create SQL queries and then send that data to different destinations — maybe a CRM system like Salesforce or a marketing platform like Marketo — after transforming it to the format that the destination platform expects.

Expert users can write their own SQL queries for this, but the team also built a graphical interface to help non-developers create their own queries. The core audience, though, is data teams — and they, too, will likely see value in the graphical user interface because it will speed up their workflows as well. “We want to empower the business user to access whatever models and aggregation the data user has done in the warehouse,” Gupta explained.

The company is agnostic to how and where its users want to operationalize their data, but the most common use cases right now focus on B2C companies, where marketing teams often use the data, as well as sales teams at B2B companies.

“It feels like there’s an emerging category here of tooling that’s being built on top of a data warehouse natively, rather than being a standard SaaS tool where it is its own data store and then you manage a secondary data store,” Curl said. “We have a class of things here that connect to a data warehouse and make use of that data for operational purposes. There’s no industry term for that yet, but we really believe that that’s the future of where data engineering is going. It’s about building off this centralized platform like Snowflake, BigQuery and things like that.”

“Warehouse-native,” Manohar suggested as a potential name here. We’ll see if it sticks.

Hightouch originally raised its round after its participation in the Y Combinator demo day but decided not to disclose it until it felt like it had found the right product/market fit. Current customers include the likes of Retool, Proof, Stream and Abacus, in addition to a number of significantly larger companies the team isn’t able to name publicly.

Powered by WPeMatico

BigID has been on the investment fast track, raising $94 million over three rounds that started in January 2018. Today, that investment train kept rolling as the company announced a $70 million Series D on a valuation of $1 billion.

Salesforce Ventures and Tiger Global co-led the round with participation Glynn Capital and existing investors Bessemer Venture Partners, Scale Venture Partners and Boldstart Ventures. The company has raised almost $165 million in just over two years.

BigID is attracting this kind of investment by building a security and privacy platform. When I first spoke to CEO and co-founder Dimitri Sirota in 2018, he was developing a data discovery product aimed at helping companies coping with GDPR find the most sensitive data, but since then the startup has greatly expanded the vision and the mission.

“We started shifting I think when we spoke back in September from being this kind of best of breed data discovery privacy to being a platform anchored in data intelligence through our kind of unique approach to discovery and insight,” he said.

That includes the ability for BigID and third parties to build applications on top of the platform they have built, something that might have attracted investor Salesforce Ventures. Salesforce was the first cloud company to offer the ability for third parties to build applications on its platform and sell them in a marketplace. Sirota says that so far their marketplace includes just apps built by BigID, but the plan is to expand it to third-party developers in 2021.

While he wasn’t ready to talk about specific revenue growth, he said he expects a material uplift in revenue for this year, and he believes that his investors are looking at the vast market potential here.

He has 235 employees today with plans to boost it to 300 next year. While he stopped hiring for a time in Q2 this year as the pandemic took hold, he says that he never had to resort to layoffs. As he continues hiring in 2021, he is looking at diversity at all levels from the makeup of his board to the executive level to the general staff.

He says that the ability to use the early investments to expand internationally has given them the opportunity to build a more diverse workforce. “We have staff around the world and we did very early […] so we do have diversity within our broader company. But clearly not enough when it came to the board of directors and the executives. So we realized that, and we are trying to change that,” he said.

As for this round, Sirota says like his previous rounds in this cycle he wasn’t necessarily looking for additional money, but with the pandemic economy still precarious, he took it to keep building out the BigID platform. “We actually have not purposely gone out to raise money since our seed. Every round we’ve done has been preemptive. So it’s been fairly easy,” he told me. In fact, he reports that he now has five years of runway and a much more fully developed platform. He is aiming to accelerate sales and marketing in 2021.

The company’s previous rounds included a $14 million Series A in January 2018, a $30 million B in June that year and a $50 million C in September 2019.

Powered by WPeMatico

Just six month after raising its first bit of outside funding, ClickUp has closed $100 million in new funding and reached a $1 billion valuation, a report in Bloomberg first reported.

The company has seen plenty of growth in the past several months to justify that new unicorn status, including doubling the amount of users to 2 million. In a press release the company also detailed it had grown revenue nine times over since the beginning of the year.

This latest $100 million round was led by Canadian firm Georgian with participation from Craft Ventures, which led the startup’s $35 million Series A back in June. The high valuation showcases just how eager investors are to find winners in the productivity software space, which has seen massive customer gains as an industry this year, partially as a result of shifting corporate attitudes toward working from home.

ClickUp is aiming to further capitalize as it scales its team and product. The company of 200 has doubled in size since its last raise and is hoping to double again in the next several months, CEO Zeb Evans tells TechCrunch.

ClickUp sells productivity software, but their main sell has been tying several products in that space into a single platform, aiming to reduce the number of tools their customers use. The team has recently begun integrating tools like email into their platform so that users can complete workflows inside the product.

“It’s not just like a value play of using one app instead of three or four, it’s an efficiency play by saving so much time and frustration from having all the other different solutions,” Evans tells TechCrunch.

Even as the company continues scaling the product through weekly updates to the company’s apps, including a newly revamped iOS app which launched today (Android launches tomorrow), the team is looking toward how they can build for the long-term.

As to how long this cash will last, Evans isn’t making any promises. “I think this will keep us going for a while, though to be honest with you I would’ve said the same thing with the Series A,” Evans says.

Powered by WPeMatico

BoxCast, a Cleveland-based company aiming to make it easy to live stream any event, has raised $20 million in Series A funding.

Co-founder and CEO Gordon Daily said that when the company first launched in 2013, “streaming wasn’t something that everyone understood,” and you needed professional help to live stream anything. BoxCast is supposed to make that process accessible to anyone.

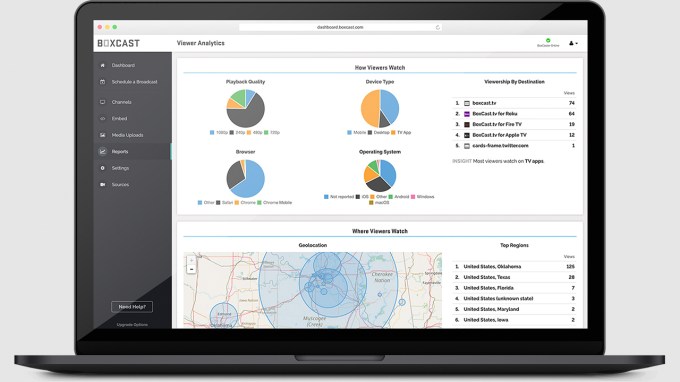

The company has created several different video encoder devices, but Daily said the “small box” is just a one piece of BoxCast platform, which is designed to cover all your live-streaming needs, with support for 1080p broadcasting; streaming to Facebook Live, YouTube and your own website; analytics and more — plus there are add-ons like automatic scoreboard displays and event ticketing.

Pricing starts at $99 per month for the “essential” streaming plan, plus $399 for a BoxCast encoder. (You can also just stream from an iOS device.)

And it’s no surprise that 2020 has been a “watershed moment” for the company, as Daily put it, with BoxCast now live streaming millions of events per year — everything from sports to religious services to virtual safaris offered by Sri Lanka’s tourism board.

BoxCast dashboard

“When you can’t even meet in-person … we knew that there was going to be higher usage,” he said. “What caught me off-guard was the volume increase — it’s new customers, it’s existing customers, at peak times there’s a 10x increase [from pre-pandemic usage].”

And while in-person events will hopefully become more common next year, Daily said live streams will still be a valuable tool to reach audiences who can’t attend, and to promote your business or organization with new kinds of programming.

COO Sam Brenner added that while BoxCast employed fewer than 40 people before the pandemic, the team has grown to 56, and will likely double within the next 12 months.

The Series A was led by Updata Partners, with participation from audio equipment manufacturer Shure.

“The live streaming video market has grown dramatically over the last decade, and COVID-19 has accelerated adoption in recent months. BoxCast offers a unique end-to-end platform that makes live streaming easy,” said Updata’s Carter Griffin in a statement. “We’re excited to partner with Gordon and his team, and look forward to contributing to their vision of making live events accessible to all.”

Powered by WPeMatico

Supabase, a YC-incubated startup that offers developers an open-source alternative to Google’s Firebase and similar platforms, today announced that it has raised a $6 million funding round led by Coatue, with participation from YC, Mozilla and a group of about 20 angel investors.

Currently, Supabase includes support for PostgreSQL databases and authentication tools, with a storage and serverless solution coming soon. It currently provides all the usual tools for working with databases — and listening to database changes — as well as a web-based UI for managing them. The team is quick to note that while the comparison with Google’s Firebase is inevitable, it is not meant to be a 1-to-1 replacement for it. And unlike Firebase, which uses a NoSQL database, Supabase is using PostgreSQL.

Indeed, the team relies heavily on existing open-source projects and contributes to them where it can. One of Supabase’s full-time employees maintains the PostgREST tool for building APIs on top of the database, for example.

“We’re not trying to build another system,” Supabase co-founder and CEO Paul Copplestone told me. “We just believe that already there are well-trusted, scalable enterprise open-source products out there and they just don’t have this usability component. So actually right now, Supabase is an amalgamation of six tools, soon to be seven. Some of them we built ourselves. If we go to market and can’t find anything that we think is going to be scalable — or really solve the problems — then we’ll build it and we’ll open-source it. But otherwise, we’ll use existing tools.”

The traditional route to market for open-source tools is to create a tool and then launch a hosted version — maybe with some additional features — to monetize the work. Supabase took a slightly different route and launched a hosted version right away.

If somebody would want to host the service themselves, the code is available, but running your own PaaS is obviously a major challenge, but that’s also why the team went with this approach. What you get with Firebase, he noted, is that it’s a few clicks to set everything up. Supabase wanted to be able to offer the same kind of experience. “That’s one thing that self-hosting just cannot offer,” he said. “You can’t really get the same wow factor that you can if we offered a hosted platform where you literally [have] one click and then a couple of minutes later, you’ve got everything set up.”

In addition, he also noted that he wanted to make sure the company could support the growing stable of tools it was building and commercializing its tools based on its database services was the easiest way to do so.

Like other Y Combinator startups, Supabase closed its funding round after the accelerator’s demo day in August. The team had considered doing a SAFE round, but it found the right group of institutional investors that offered founder-friendly terms to go ahead with this institutional round instead.

“It’s going to cost us a lot to compete with the generous free tier that Firebase offers,” Copplestone said. “And it’s databases, right? So it’s not like you can just keep them stateless and shut them down if you’re not really using them. [This funding round] gives us a long, generous runway and more importantly, for the developers who come in and build on top of us, [they can] take as long as they want and then start monetizing later on themselves.“

The company plans to use the new funding to continue to invest in its various tools and hire to support its growth.

“Supabase’s value proposition of building in a weekend and scaling so quickly hit home immediately,” said Caryn Marooney, general partner at Coatue and Facebook’s former VP of Global Communications. “We are proud to work with this team, and we are excited by their laser focus on developers and their commitment to speed and reliability.”

Powered by WPeMatico

Parsec, a startup that’s built streaming technology for both work and play, is announcing that it has raised $25 million in Series B funding.

This brings Parsec’s total funding to $33 million, according to Crunchbase. The round was led by Andreessen Horowitz, with the firm’s general partner Martin Casado joining the board. Previous investors Lerer Hippeau, Makers Fund, NextView Ventures and Notation Capital also participated.

CEO Benjy Boxer told me that since he and CTO Chris Dickson founded the company in 2016, the vision has always been “to make it easier for people to connect to their technology, software and content from anywhere, on any device.”

They started out by helping gamers access their gaming PCs from other devices (the Parsec app is currently available for Windows, Mac, Linux, Android, Raspberry Pi and the web).

“From the beginning, we thought that if we could build something that is great for gaming, it will be great for everything,” Boxer said.

But it was a natural transition to other use cases, since some of the people using Parsec to play games in their free time also turned out to work at TV production companies, video game companies or in other jobs where they need access to high-end workstations. That’s why the company launched Parsec for Teams this year, which offers the same low-latency remote experience, while also adding features like encryption, group permissions and collaboration on the same file.

Image Credits: Parsec

“The performance of Parsec is just way above everything else,” Boxer said. “People forget they’re using Parsec.”

Parsec works with major gaming clients like EA, Ubisoft, Blizzard Entertainment and Square Enix, and it’s also being used in industries like architecture, engineering and video broadcast/production/post-production.

And as you might imagine, the need for something like this has only increased during the pandemic. Boxer said customers have found that the platform is saving their employees more than an hour a day by eliminating the commute and giving them high-speed access to their workstations — rather than, say, having to wait an hour for a 100 gigabyte file to download.

And most of those clients anticipate that after the pandemic, their employees will continue for work from home for part of the time.

“So in that scenario, people are bringing their computers back to the office, and they can use Parsec to make sure it’s always accessible to them,” Boxer said.

On the consumer side, he said that where usage was previously heaviest during the weekends, during the pandemic “there’s no spike anymore on the weekends, people are playing all the time.”

Boxer added that the company will continue developing the core platform, leading to improvements for both gaming and enterprise users, while there’s a separate team focused on building administrative and collaborative features.

Powered by WPeMatico

Tive, a Boston-based startup, is building a hardware and software platform to help track the conditions of a shipment like say food or medicine to make sure it is stored under the proper conditions as it moves from farm or factory to market. Today, the company announced a $12 million Series A.

RRE Ventures led the round with help from new investor Two Sigma Ventures and existing investors NextView Ventures, Hyperplane Ventures, One Way Ventures, Fathom Ventures and other unnamed individuals. The company has now raised close to $17 million, according to Crunchbase data.

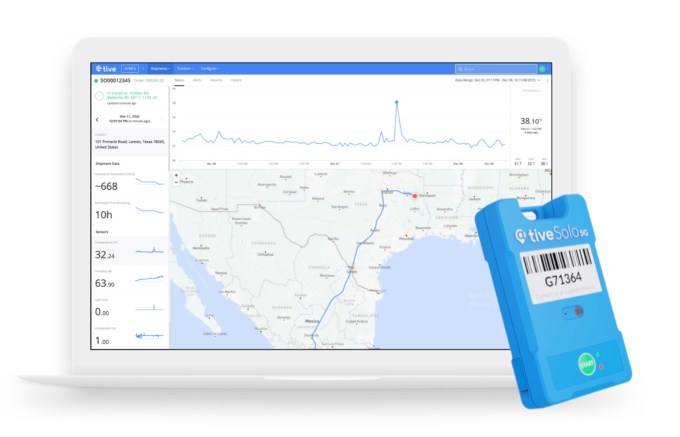

“Tive helps companies all over the world track their shipments in a very specific way,” company co-founder and CEO Krenar Komoni told me. Using a tracking device the company created, customers can press a button, place the tracker on a palette or in a container, and it begins transmitting shipment data like temperature, shock, light exposure, humidity and location data in real time to ensure that the shipment is moving safely to market under proper conditions.

He said that they are the first company to create single-use 5G trackers, meaning the shipping company doesn’t have to worry about managing, maintaining, recharging or returning them (although they encourage that by giving a discount for future orders on returned items).

Tive hardware tracker and data tracking software. Image Credit: Tive

The approach seems to be working. Komoni reports that revenue has grown 570% in 2020 as the product-market fit has become more acute with digitization hitting the supply chain in a big way. He says that in particular customers and investors like the company’s full-stack approach.

“What’s interesting […] and why we are resonating with customers and also why investors like it, is because we’re providing the full stack, meaning the hardware, the software, the platform and the APIs to major transportation management systems,” Komoni explained.

The company has 22 employees and expects to double that number in 2021. As he grows the company, Komoni says that as an immigrant founder, he’s particularly sensitive to diversity and inclusion.

“I’m an immigrant myself. I grew up in Kosovo, came to the U.S. when I was 17 years old, went to high school here in Vermont. I’m a U.S. citizen, but part of who I am is being open to different cultures and different nationalities. It’s just part of my nature,” he says.

The company was founded in 2015 and its facilities are in Boston. It has continued shipping devices throughout the pandemic, and that has meant figuring out how to operate in a safe way with some employees in the building. He expects the company will have more employees operating out of the office as we move past the pandemic. He also has an engineering operation in Kosovo.

Powered by WPeMatico