Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Boost Biomes, the Y Combinator-backed developer of microbiome-based bio-fungicides and bio-pesticides for agricultural applications, has added $2 million in funding and picked up a new strategic investor in Japan’s Universal Materials Incubator.

To date, Boost Biomes has raised more than $7 million in financing to support the development of new products like its bio-fungicide developed from the microorganisms that live in the soil in a symbiotic relationship with plants.

The work that Boost does is primarily on understanding the interactions between microbes and plants in the soil. “The goal is to be the discovery engine and develop new microbial products for use in food and agriculture,” said Boost chief executive and co-founder Jamie Bacher.

The commitment from Japan’s Universal Materials Incubator expands on a $5 million institutional round led by another strategic partner, Yara International, a global crop nutrition company, and venture investors like Viking Global Investors and Y Combinator.

Boost hopes to tackle issues in agriculture like spoilage, bacterial contamination and pathogen infestations, as well as addressing diseases that can affect plant health directly.

Boost is already working with an undisclosed biomanufacturing partner to develop its bio-fungicide.

“UMI’s decision to invest in Boost comes from our evaluation of their team, technology, and the associated market opportunities. We believe that Boost’s platform generates a unique data set that can be exploited for far superior products with many diverse microbiome applications in food and agriculture,” said Yota Hayama, an investor at UMI, in a statement. “These are critical areas to achieve food security and promote sustainable agriculture. We also expect Boost’s huge potential on other areas where microbiomes are utilized.”

Powered by WPeMatico

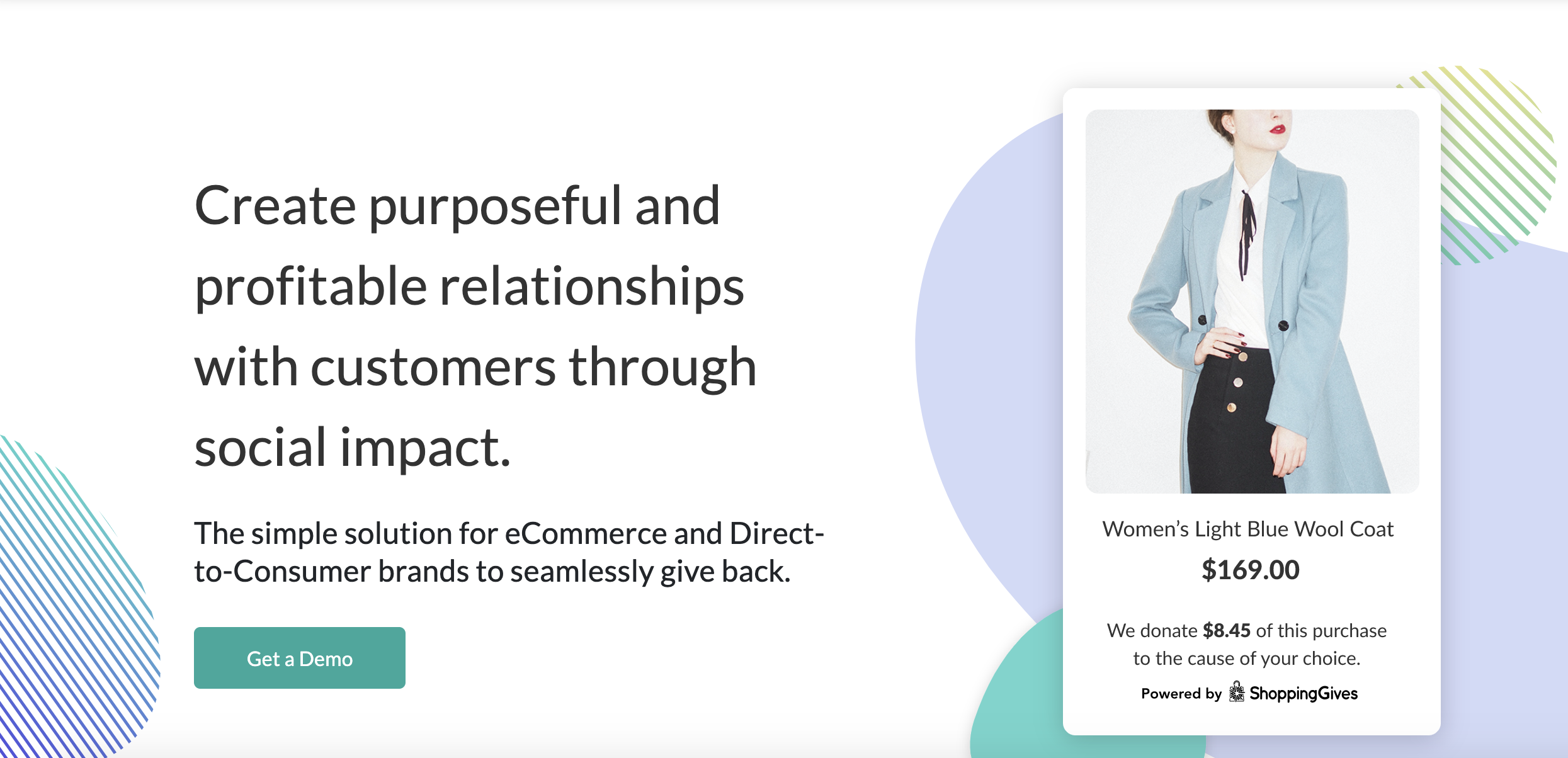

ShoppingGives, a Chicago-based startup pitching retailers a service that can integrate nonprofit donations into their sales and shopping platforms, has raised an undisclosed amount from Serena Williams’ venture capital firm, Serena Ventures, the company said.

ShoppingGives allows retailers to offer a donation on behalf of a shopper to any of over 1.5 million nonprofits that are on its list — all without leaving the retailer’s website.

The company said that retailers can use the donation data to create a more authentic and personalized engagement with customers based on the causes they support.

“ShoppingGives aligned with my values of investing in businesses and entrepreneurs who are making a difference. By creating opportunities to grow social impact with a seamless approach for retailers and brands, ShoppingGives is charting the course for all businesses to stand forth as agents of change in our society,” said Williams in a statement.

The company’s technology helps retailers manage and report donations and is already recommended by Shopify as one of a collection of apps for merchants setting up their online stores. Its service integrates with e-commerce content management systems and is already a partner for the PayPal giving fund.

ShoppingGives has already donated to more than 6,000 nonprofit organizations selected by customers, according to the company. Brands like Kenneth Cole, Natori, White + Warren, Margaux, Solstice Sunglasses, Tomboyx, Fresh Clean Tees, Blind Barber, Huron and Neighborhood Goods use the service already.

Image Credit: ShoppingGives

Powered by WPeMatico

The two founders of Parrot Software, Roberto Cebrián and David Villarreal, first met in high school in Monterrey, Mexico. In the 11 years since, both have pursued successful careers in the tech industry and became family (they’re brothers-in-law).

Now, they’re starting a new business together leveraging Cebrián’s experience running a point-of-sale company and Villarreal’s time working first at Uber and then at the high-growth scooter and bike rental startup, Grin.

Cebrían’s experience founding the point-of-sale company S3 Software laid the foundation for Parrot Software, and its point-of-sale service to manage restaurant operations.

“Roberto has been in the industry for the past six or seven years,” said Villarreal. “And he was telling me that no one has been serving [restaurants] properly… Roberto pitched me the idea and I got super involved and decided to start the company.”

Parrot Software co-founders Roberto Cebrían and David Villarreal. Image Credit: Parrot Software

Like Toast in the U.S., Parrot manages payments, including online and payments and real-time ordering, along with integrations into services that can manage the back-end operations of a restaurant too, according to Villarreal. Those services include things like delivery software, accounting and loyalty systems.

The company is already live in more than 500 restaurants in Mexico and is used by chains including Cinnabon, Dairy Queen, Grupo Costeño and Grupo Pangea.

Based in Monterrey, Mexico, the company has managed to attract a slew of high-profile North American investors, including Joe Montana’s Liquid2 Ventures, Foundation Capital, Superhuman angel fund and Ed Baker, a product lead at Uber. Together they’ve poured $2.1 million into the young company.

Since its launch, Parrot has managed to land contracts in 10 cities, with the largest presence in Northeastern Mexico, around Monterrey, said Villarreal.

The market for restaurant management software is large and growing. It’s a big category that’s expected to reach $6.94 billion in sales worldwide by 2025, according to a report from Grand View Research.

Investors in the U.S. market certainly believe in the potential opportunity for a business like Toast. That company has raised nearly $1 billion in funding from firms like Bessemer Venture Partners, the private equity firm TPG and Tiger Global Management.

Powered by WPeMatico

Lettuce celebrate the rise of indoor agriculture.

In the past few months, AppHarvest, a developer of greenhouse tomato farms, went public through a special purpose acquisition vehicle, vertical farming giant Plenty raised $140 million, and now Gotham Greens, which is developing its own network of greenhouses, is announcing the close of $87 million in new funding.

These new agriculture companies certainly have a green thumb when it comes to raising a cornucopia of capital.

Gotham Greens’ latest round takes the company to a whopping total of $130 million in funding since its launch. Investors in the round included Manna Tree and The Silverman Group.

While AppHarvest has taken to tomatoes in its attempt to ketchup with the leading agricultural companies, Gotham Greens has decided to let its hydroponically grown leafy greens lead the way to riches.

The company said it would use the latest funding to continue developing more greenhouses across the U.S. and bring new vegetables to market.

“Given increasing challenges facing centralized food supply chains, combined with rapidly shifting consumer preferences, Gotham Greens is focused on expanding its regional growing operations and distribution capabilities at one of the most critical periods for America,” said Viraj Puri, the co-founder and chief executive of Gotham Greens, in a statement.

The company already sells its greens in more than 40 states and operates greenhouses in Chicago, Providence, Rhode Island, Baltimore and Denver. From those greenhouses the company distributes to 2,000 retail locations, including Whole Foods Markets, Albertsons stores, Meijer, Target, King Soopers, Harris Teeter, ShopRite and Sprouts.

And Gotham Greens has already begun to expand its product portfolio. The company now sells packaged salads, cooking sauces and salad bowls in addition to its greens.

Assorted packages of Gotham Greens lettuces on a white field. Image Credit: Gotham Greens

Powered by WPeMatico

With nearly half a million customers across Mexico and a network of 30,000 retail locations where representatives can take deposits, the challenger bank albo is already on its way to becoming a dominant player in Mexico’s emerging fintech industry.

And the company has recently raised another $45 million to consolidate its position.

“When your mission is to build the biggest bank in Mexico, you will need a ton of money,” said albo founder Angel Sahagún.

The company received its license to operate as a full depository bank in Mexico, and is slowly working toward being the premier internet-based financial services provider for Mexico’s large and growing middle class, Sahagún said.

“We are targeting a similar target market to Chime,” the albo founder and chief executive said. “We are targeting people who are underbanked and don’t have access to all the financial products in the market.”

Sahagún said the money will be used to expand into lending and insurance products the range of services albo offers. That’s a path that has already produced one multi-billion-dollar business in Nubank, Brazil’s wildly successful fintech company, which planted a flag for a new generation of Latin American startups.

While many challenger banks in the region pursued a strategy targeting upper-class and upper-middle-class consumers, Sahagún said his service had chosen a different path.

The company is trying to bring the middle and low-income Mexican consumers into the banking system by making it easy for them to move from a cash-based world to a digital one. “Where 90% of transactions are cash-based you need a value proposition that fits very well on that cash-based society,” Sahagún said.

It’s why the company set up a network of 30,000 locations, including convenience stores and drug stores, so that it can accept deposits at the places where its customers frequent.

That growth, and the company’s 40% share of the digital banking market in Mexico, according to data from Apptopia cited by the company, is why investors like Valar Ventures, Greyhound Capital, Mountain Nazca and Flourish Ventures were willing to invest as part of the $45 million round.

“albo has proven its ability to drive sustainable growth and is leading the market. This is the team that is going to transform banking in the region and we are proud to be supporting them in that,” said James Fitzgerald of Valar Ventures, in a statement.

Powered by WPeMatico

The Seattle-based startup Recurrent said today it has closed on $3.5 million in financing as it looks to become the Carfax for electric vehicle batteries.

The battery system is arguably the most important part of any electric vehicle and as the market for used electric vehicles expands, independent verification on battery life and range can help car buyers with their purchasing decision, the company said.

Investors include Wireframe Ventures, PSL Ventures, Vulcan Capital, Prelude Ventures, Powerhouse Ventures, Ascend.VC and the American Automobile Association’s (AAA) Washington chapter.

“Used car sales are at least double new car sales every year. With the third anniversary of Tesla’s Model 3 and the rapid introduction of new electric models across all vehicle makers, used EV sales are about to grow substantially,” Paul Straub, managing director of Wireframe Ventures, said in a statement. “The timing is right for a first mover with a strong data and technology advantage to bring confidence and transparency to these transactions.”

The company said it will use the money to invest in continued product development as it refines its third-party condition reports for used electric vehicle shoppers and battery analytics stats for current electric vehicle owners.

Recurrent collects its data from 2,500 volunteer electric vehicle drivers who currently use the Recurrent service for monthly battery reports on their own vehicles

“While there’s clearly a market-driven opportunity here, we’re particularly excited about the potential impact of the Biden administration’s policies on EV adoption,” Emily Kirsch, founder and managing partner of Powerhouse Ventures, said in a statement. “We’ve seen the huge impact that favorable policies are having in the EU and think there’s a lot of upside potential in a similar acceleration in the U.S.”

Powered by WPeMatico

Cybersecurity firm Dragos has raised $110 million in its Series C, almost triple the amount that it raised two years ago in its last round.

Dragos was founded in 2016 to detect and respond to threats facing industrial control systems (ICS), the devices critical to the continued operations of power plants, water and energy supplies, and other critical infrastructure. The company’s threat detection platform — its moneymaker — helps companies with industrial control systems defend against hackers trying to get into important operational systems. Its platform kicks out hackers that could shut down manufacturing lines or control energy supply systems, while its research arm keeps tabs on the hackers that can break into these highly complex and segmented industrial networks in the first place.

The startup’s latest round was led by National Grid Partners and Koch Disruptive Technologies, with both firms adding a member each to Dragos’ board. The round also saw participation from Saudi Aramco Energy Ventures and Hewlett Packard Enterprise, as well as return investors Allegis Cyber, Canaan Partners, DataTribe, Energy Impact Partners and Schweitzer Engineering Labs.

This latest round of funding will help the company with its go-to-market efforts, as well as growing its customer support team with 30 staff and building up its sales and marketing team. Lee said the company’s priority had been to work on its threat platform, and less selling it.

About one-third of the company’s employees work in software engineering to build its threat platform.

Dragos founder and chief executive Robert Lee said the pandemic, which forced vast swathes of the world to work remotely from home under lockdown restrictions, served as a wake-up call for companies with critical infrastructure.

“When you’re talking about critical infrastructure sites and people’s utilities, you need to put your best foot forward on the tech first,” he said.

Many companies were already trying to adapt with the digital age, but Lee said many companies realized they had underinvested in ICS security.

A team photo of Dragos employees. Image Credits: Dragos

Based just outside Washington D.C., Dragos now has over 220 employees and will be adding more, close to doubling its headcount since last year, and adding new offices in Melbourne, Dubai and in the United Kingdom.

Lee said the U.K.’s transition out of the European Union would all but ensure that the new U.K. office could not serve as an EU hub for the company, but that it was necessary to “to go where the problems are.”

Another one of those places is Saudi Arabia, one of the world’s largest oil and gas producers, where Dragos has an office and now draws an investment. Saudi oil and gas manufacturing plants have been the target of several cyberattacks, including the Trisis malware in 2017 that shut down one of the kingdom’s biggest petrochemical plants. But the country has faced extensive criticism for its human rights record by international rights groups. Lee said the company works to protect infrastructure that serves civilians and has actively rejected military contracts that would fall afoul of those values. “I don’t want to put asterisks on that mission,” he said.

Lee told TechCrunch that the company has grown at a rapid pace since it was founded four years ago.

“Our goal was never to get acquired,” he said. Echoing remarks he made last year, Lee said that the company’s plan was to continue growing and investing in the problems that Dragos sees — with an eventual goal to take the company public. “But we’re not rushed,” he said.

“The hallmark of Dragos being successful won’t be a successful IPO,” said Lee. “The hallmark will be having validated and built the market large enough that there can be other companies that come behind us serving the other more niche aspects of the ICS market and building out the community, and making sure our infrastructure is safer.”

Powered by WPeMatico

DealShare, a startup in India that has built an e-commerce platform for middle and lower-income groups of consumers, said on Tuesday it has raised $21 million in a new financing round as it looks to expand its footprint in the world’s second-largest internet market.

WestBridge Capital led the Series C round of the three-year-old startup, which is based in Bangalore. Alpha Wave Incubation, a venture fund managed by Falcon Edge Capital, Z3Partners and existing investors Matrix Partners India and Omidyar Network India also participated in the round, bringing DealShare’s to-date raise to $34 million.

DealShare kickstarted its journey the day Walmart acquired Flipkart, the startup’s founder and chief executive Vineet Rao said at a recent virtual conference. Rao said that even as Amazon and Flipkart had been able to create a market for themselves in the urban Indian cities, much of the nation was still underserved. There was an opportunity for someone to jump in, he said.

The startup began as an e-commerce platform on WhatsApp, where it offered hundreds of products to consumers. It didn’t take long before a major consumer spending pattern was visible, Rao said. People were only interested in buying items that were selling at discounted rates, said Rao.

Over time, that idea has become part of DealShare’s core offering. Today it incentivizes consumers — by offering them discounts and cashbacks — to share deals on products with their friends. The startup, which has since launched its own app and website, now operates in over two dozen cities in India.

Consumers wanted products that were relevant to them and they wanted to buy these items at a price that instilled the most value for their bucks, said Rao. “We focused on locally produced items instead of national brands. Even today, 80% to 90% of items we sell are locally produced,” he said.

“We started building a network of these suppliers. It was very tough because none of these guys fancied joining modern retail like e-commerce. Some of them had tried to work with e-commerce firms before but the experience left a lot to be desired,” he said.

Sandeep Singhal, co-founder and managing director of WestBridge, said in a statement, “Majority of Indian population is currently residing in the non-metros and there is a huge business opportunity in these regions. The buying pattern of low and middle-income group is different especially in smaller markets and DealShare seems to have understood the nuances very well. We are very impressed with how the team has scaled up in the last 2 years, while retaining a sharp focus on low cost, high impact model.”

The startup says it spent the last 18 months to improve its finances and is nearing profitability. Now it plans to invest in its technology stack and expand its platform to 100 cities and towns in five states of India in the next year. It did not disclose how many customers it serves today, but said it is working to reach 10 million customers and clock $339 million in annual GMV.

Powered by WPeMatico

Do people want their at-home fitness to come in video-game form? The incredible popularity of games like Ring Fit Adventure suggests yes.

London-based startup Quell thinks it’s just the beginning for this genre, and they’ve raised a $3 million seed round to help prove it.

At the core of Quell’s gameplay is the “Gauntlet” — a harness, of sorts, that the player slips on to control Quell’s games. As players punch and dodge their way through the world, Gauntlet’s built-in sensors measure things like punch speed and accuracy, while customizable resistance bands keep things challenging.

We initially wrote about Quell back in August, and named it as one of our top startups from the Y Combinator S20 Demo Day.

Investors in this round include Twitch co-founders Kevin Lin and Emmett Shear, AngelList founder Naval Ravikant, WikiHow founder Josh Hannah, TenCent, Khosla Ventures, Heartcore, Social Impact Capital and JamJar Investments. Quell co-founder Doug Stidolph tells me they were initially raising at a valuation of $10 million; by the time they’d closed the final investors in this round, the valuation had increased to $15 million. The company also recently closed a Kickstarter campaign, where it raised £501,341 (around $670,000 USD) from nearly 3,000 backers. With the ongoing pandemic making it scarier and riskier to hit the gym (if your state/county even allows it), interest and demand for home fitness options will just keep going up.

Image Credits: Quell

Quell’s hardware and games are initially being built to work with PC, Mac and mobile devices. That means no console support at first — a bummer, as a big ol’ TV seems like the ideal display for games like this, and consoles are probably the most user-friendly way of getting it there. It’s something the company says it has on its roadmap to hopefully tackle in the future, but the added cost/complexity of the console hardware approval process was a bit too much to take on at launch.

Meanwhile, Quell is building out its own in-house game studio, hiring folks like Peter Cornelius (formerly lead producer at the developer-centric gaming tech company Improbable) as Game Production director. One of the main goals, Quell co-founder Cameron Brookhouse tells me, is to build games that get the player exercising while still being deeply immersive; they want the gameplay to encourage movement intuitively, rather than tossing up prompts that say something like, “OK! Time for jumping jacks!”

The Quell team tells me they expect their first hardware to ship by the end of 2021. They’re currently working on transitioning their prototypes into production, figuring out how to do things like make it easier to adjust resistance or swap the Gauntlet from user to user, and to increase the number of different exercises its sensors can detect and gamify.

Powered by WPeMatico

Finn.auto — which allows people to subscribe to their car instead of owning it, and offsetting their CO₂ emissions — has raised a $24.2 million / €20 million Series A funding round. White Star Capital (which has also invested in Tier Mobility), and the Zalando co-CEOs Rubin Ritter, David Schneider and Robert Gentz, are new investors in this round. All previous investors participated.

The funding comes just under a year since the company launched, after selling just 1,000 car subscriptions. It’s also partnered with Deutsche Post AG and Deutsche Telekom AG.

A number of car manufacturers have launched similar subscription services powered by various providers, such as Drover, LeasePlan and Wagonex.

U.K.-based startup Drover has raised a total of $40 million in funding over five rounds. Their latest Series B funding round was with Shell Ventures and Cherry Ventures . Plus, there are branded services which include Audi on Demand, BMW, Citroën, DS, Jaguar Carpe, Land Rover Carpe, Mini, Volkswagen and Care by Volvo.

Digitally led subscription services have the potential to disrupt the traditional car sales model, and new startups are entering the market all the time.

The finn.auto model is proving to appeal to environment-conscious millennials. For each car subscription, the company is offsetting the CO₂ emissions of its vehicles, meaning subscribers can drive their cars in a climate-neutral manner. It’s now expanding its range of fully electric vehicles and, in cooperation with ClimatePartner, is supporting selected regional climate protection and development projects.

Key to the Munich-based startups’ play is the automation of fleet management processes and customer interactions, meaning it’s much easier and cheaper to run this kind of subscription operation.

Max-Josef Meier, CEO and founder of finn.auto, said: “We are delighted to have been able to bring such high-caliber investors on board and that our existing investors are cementing their confidence with the current round. Mobility with your own car becomes as easy as buying shoes on the internet. We already offer a large selection of different car brands, whose cars can be ordered online on our platform in just five minutes and at flexible runtimes. The delivery is then conveniently made to the front door.”

Nicholas Stocks, general partner at White Star Capital added: “There is a huge opportunity globally to streamline outdated customer experiences in the automotive retail space and become the Amazon of the automotive industry. This is something finn.auto is excellently placed to capitalize on with its offering of convenience, flexibility, value and sustainability.”

Powered by WPeMatico