Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Tecton.ai, the startup founded by three former Uber engineers who wanted to bring the machine learning feature store idea to the masses, announced a $35 million Series B today, just seven months after announcing their $20 million Series A.

When we spoke to the company in April, it was working with early customers in a beta version of the product, but today, in addition to the funding, they are also announcing the general availability of the platform.

As with their Series A, this round has Andreessen Horowitz and Sequoia Capital co-leading the investment. The company has now raised $60 million.

The reason these two firms are so committed to Tecton is the specific problem around machine learning the company is trying to solve. “We help organizations put machine learning into production. That’s the whole goal of our company, helping someone build an operational machine learning application, meaning an application that’s powering their fraud system or something real for them […] and making it easy for them to build and deploy and maintain,” company CEO and co-founder Mike Del Balso explained.

They do this by providing the concept of a feature store, an idea they came up with and which is becoming a machine learning category unto itself. Just last week, AWS announced the Sagemaker Feature store, which the company saw as major validation of their idea.

As Tecton defines it, a feature store is an end-to-end machine learning management system that includes the pipelines to transform the data into what are called feature values, then it stores and manages all of that feature data and finally it serves a consistent set of data.

Del Balso says this works hand-in-hand with the other layers of a machine learning stack. “When you build a machine learning application, you use a machine learning stack that could include a model training system, maybe a model serving system or an MLOps kind of layer that does all the model management, and then you have a feature management layer, a feature store which is us — and so we’re an end-to-end life cycle for the data pipelines,” he said.

With so much money behind the company it is growing fast, going from 17 employees to 26 since we spoke in April, with plans to more than double that number by the end of next year. Del Balso says he and his co-founders are committed to building a diverse and inclusive company, but he acknowledges it’s not easy to do.

“It’s actually something that we have a primary recruiting initiative on. It’s very hard, and it takes a lot of effort, it’s not something that you can just make like a second priority and not take it seriously,” he said. To that end, the company has sponsored and attended diversity hiring conferences and has focused its recruiting efforts on finding a diverse set of candidates, he said.

Unlike a lot of startups we’ve spoken to, Del Balso wants to return to an office setup as soon as it is feasible to do so, seeing it as a way to build more personal connections between employees.

Powered by WPeMatico

When one of AWS’s east coast data centers went down at the end of last month, it had an impact on countless companies relying on its services, including Roku, Adobe and Shipt. When the incident was resolved, the company had to analyze what happened. For most companies, that involves manually pulling together information from various internal tools, not a focused incident platform.

Jeli.io wants to change that by providing one central place for incident analysis, and today the company announced a $4 million seed round led by Boldstart Ventures with participation by Harrison Metal and Heavybit.

Jeli CEO and founder Nora Jones knows a thing or two about incident analysis. She helped build the chaos engineering tools at Netflix, and later headed chaos engineering at Slack. While chaos engineering helps simulate possible incidents by stress-testing systems, incidents still happen, of course. She knew that there was a lot to learn from them, but there wasn’t a way to pull together all of the data around an incident automatically. She created Jeli to do that.

“While I was at Netflix pre-pandemic, I discovered the secret that looking at incidents when they happen — like when Netflix goes down, when Slack goes down or when any other organization goes down — that’s actually a catalyst for understanding the delta between how you think your org works and how your org actually works,” Jones told me.

She began to see that there would be great value in trying to figure out the decision-making processes, the people and tools involved and what companies could learn from how they reacted in these highly stressful situations, how they resolved them and what they could do to prevent similar outages from happening again in the future. With no products to help, Jones began building tooling herself at her previous jobs, but she believed there needed to be a broader solution.

“We started Jeli and began building tooling to help engineers by [serving] the insights to help them know where to look after incidents,” she said. They do this by pulling together all of the data from emails, Slack channels, PagerDuty, Zoom recordings, logs and so forth that captured information about the incident, surfacing insights to help understand what happened without having to manually pull all of this information together.

The startup currently has eight employees, with plans to add people across the board in 2021. As she does this, she is cognizant of the importance of building a diverse workforce. “I am extremely committed to diversity and inclusion. It is something that’s been important and a requirement for me from day one. I’ve been in situations in organizations before where I was the only one represented, and I know how that feels. I want to make sure I’m including that from day one because ultimately it leads to a better product,” she said.

The product is currently in private beta, and the company is working with early customers to refine the platform. The plan is to continue to invite companies in the coming months, then open that up more widely some time next year.

Eliot Durbin, general partner at Boldstart Ventures, says that he began talking to Jones a couple of years ago when she was at Netflix just to learn about this space, and when she was ready to start a company, his firm jumped at the chance to write an early check, even while the startup was pre-revenue.

“When we met Nora we realized that she’s on a lifelong mission to make things much more resilient […]. And we had the benefit of getting to know her for years before she started the company, so it was really a natural continuation to a conversation that we were already in,” Durbin explained.

Powered by WPeMatico

If this year has taught us a lesson about the world of work, it’s that collectively, we weren’t very well-equipped in terms of the technology we use to translate the in-person experience seamlessly to a remote version. That’s led to a rush of companies launching new services to fill that hole — cloud computing and data warehousing startups, collaboration platforms, sales tools and more — and today one of the latest startups in the area of videoconferencing is announcing a round of funding to see its business scale to the next level.

Wonder, a Berlin startup that has built a platform for people to come together in video-based groups to meet up, network and collaborate, while also having a bird’s-eye view of a larger space where they can more serendipitously, or more intentionally, interact with others — not unlike in an office or other business venue — is today announcing that it has raised $11 million (€9 million) in a substantial seed round.

The funding was led by European VC EQT Ventures, with BlueYard Capital — which led a pre-seed round in the startup when it was previously called “YoTribe” — also participating.

It comes on the heels of the young startup seeing some impressive traction this year.

Wonder now has 200,000 monthly users from a pretty diverse set of organizations, including NASA, Deloitte, Harvard and SAP, which are using it for a variety of purposes, from team collaboration through to career fairs. The company will use the funding both to add in more features as requested by current users, as well as to hire more people for its team, co-founder Stephane Roux said in an interview. Those features will include sharing files and other technical services, but they will not be piled on quickly or thickly.

“We think of this less in terms of content and more about people,” he said. “The core experience is about live interaction, not just repositories of stuff. We want to build a place for collaboration and communication. Interesting ways to carve up a group virtually.”

Now, you may be thinking: another workplace video app? Hasn’t this $14 billion space race already been “won” by Zoom (which some of us now use as a verb for videoconferencing, regardless of which app we actually use)? Or Microsoft or Google or BlueJeans, or whatever it is that your organization has inevitably already signed up and paid for?

But it turns out that for all the growth and use that these other platforms have had, they are sorely lacking in their overall experience, as it pertains to what it’s like to be in physical spaces with other people. One of the key points, it turns out, is that a lot of solutions are not really built with the user experience of the larger group in mind.

Wonder is built around the idea of a “shared space” that you enter. That space comes not from a VR experience as you might expect, but something much simpler that takes a tip from more rudimentary but very effective older game dynamics. You get a single window where you can “see” from an aerial view, as it were, all of the other people who are in the same space, and the areas within that space where they might cluster together.

Those clusters could be designed around a specific interest (such as marketing or HR or product) or — if the product is being used at a career fair, for example, at a list of different companies taking part; or — at a conference — different conference sessions, plus an exhibition space.

You can move around all of the clusters, or start your own, or sit in the margins with another person, and when you do come together with one or more people, you can join them in a video chat to interact. In the future, the plan is to do more than just join a video chat; you might also be able to access documents related to that cluster, and more.

The clusters can be “public” for anyone to join, or set to private, as you might have in a physical meeting room. The overall effect is that, without actually being in a physical space, you get the sense of a collective group of people in motion.

The startup was originally the brainchild of Leonard Witteler, who built a version of this last year as a coding project at university before showing it to friends and family and getting positive feedback.

As another co-founder, Pascal Steck, describes it, he, Witteler and Roux, who all knew each other, had been looking to build a startup together, but around a completely different idea — a portal for photographers and other creatives in the wedding industry.

Given how drastically curtailed weddings and other group gatherings have been this year, that didn’t really go anywhere at all. But the three could see an opportunity, a very different one, with the software that Witteler had built while still a student. So in the grand tradition of startups, they pivoted.

Wonder had previously been called YoTribe, which sounds a little like YouTube and also plays on the idea of groups of friends who come together around special interests.

And from how Steck and Roux described it to me in an interview (over Wonder of course), it didn’t sound like the initial idea was to target enterprises at all, but people who found themselves a bit at a loss when music festivals and other events like that suddenly died a death because of COVID-19.

Indeed, they themselves were all too aware of the state of the market for videoconferencing apps: it was very, very crowded.

“The space is very busy and some great products are already out there. But as soon as you zoom into this space” — no pun intended, Steck said — “when it’s about large group meetings, these other tools do not allow for serendipitous conversations or bottom-up gatherings, and the list gets very thin very quickly. Our focus is around improving presentations, but in the case of large groups, there is just not a lot out there. Especially something building an association as we know it to how we do things in the offline world. We think we have a unique spot in the market.

“A meeting for three people can use Zoom or Teams perfectly. There is no need for anything else, but for larger groups, that is not the case and it seems like the market is really open for something like Wonder.”

The name “Wonder” is an interesting choice when the startup rebranded from YoTribe. Wonder’s main meaning is surprise and discovery, but it has long been thought and assumed that “wonder” is also connected to the word “wander”. (In fact, the two are not related etymologically, but have often crossed paths and wandered into each other’s territories over the centuries.) Similarly, the idea with Wonder the app is that you can “wander” around a room, and find who and what you are looking for in the process.

Wonder is not the only upstart video app that has picked up some attention in the last several months. In fact, there has been a wave of them launching or announcing funding (or both) in 2020 to try to address the gaps — or opportunities — that exist as a result of the features from the current leaders.

Other launches have included mmhmm (Phil Libin’s latest startup that adds lots of bells and whistles to make the presentations more than just a talking head); Headroom (founded by ex-Google and ex-Magic Leap entrepreneurs, using AI to get more meaningful insights from the video conversations); Vowel (which lets people search across video chats to follow up items and dig into what people said across different calls); and Descript, Andrew Mason’s audio effort, now also has video features.

But if anything, a lot of these newer tools fail to address the shortcomings of what it’s like being a part of a big group using a video app. In fact, many of these newer entrants highlight another set of challenges, those of the speaker, who is thus graced with better presentation tools in mmhmm, or given way better insights into the audience with Headroom, etc.

In any case, Wonder has found, serendipitously, a lot of traction from people who have identified and lamented the problems with so much else out there today. The app is still free to use, and the plan will be to keep it that way until some time in 2021, Roux said. Ironically, he pointed out that many of its current customers are asking to be charged, not least because it lends using it more credibility, which is important with IT departments and so on. All that might mean the charging plan gets pushed up sooner.

In any case, even if companies are also using something else, they are also adopting Wonder, and that has in turn piqued the interest of investors who are interested to see where it might go next.

“Throughout COVID-19, real-time video has become the default for both private and professional interactions, and hybrid working is here to stay,” said Jenny Dreier, investor at EQT Ventures Berlin, in a statement. “No other video tools come anywhere near as close to replicating real-life interactions as Wonder, so the product has explosive potential, already foreshadowed with the platform’s stellar organic growth. It’s incredibly exciting to be working with the team and to be part of the journey; I can’t wait to be a part of their next chapter.”

Powered by WPeMatico

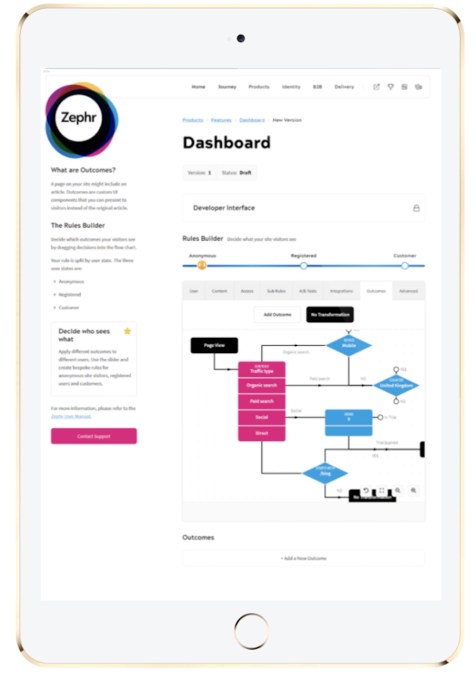

Zephr has raised $8 million in a new funding round led by Bertelsmann Digital Media Investments (owned by media giant Bertelsmann).

The London-headquarted startup’s customers already include publishers like McClatchy, News Corp Australia, Dennis Publishing and PEI Media. CEO James Henderson told me via email that rather than creating “a monolithic product that tries to do a bit of everything,” Zephr is “focused entirely on the experience and journey for the prospect or customer,” driving an average 150% increase in conversion rates and 25% increase in subscription revenue within the first six months.

Henderson added, “By offering the right product, package or message at the right time to the right person, Zephr improves conversion rates, drastically decreases churn and drives new, stable revenue.”

To do this, Zephr largely relies on the publisher’s first-party data about its readers — Henderson said that this data is “by far the most important and powerful type of data that Zephr both uses and generates.” But it also takes advantage of contextual data, such as “time of day, to location, device or consumption patterns.”

He also noted that Zephr is a no-code tool, allowing non-technical members of the marketing, revenue and product teams to use a drag-and-drop editor to create different customer journeys.

Image Credits: Zephr

Asked how the pandemic has affected the startup’s business, Henderson said there were both “positive and negative indicators,” with newsrooms seeing record readership but in some cases also freezing spending.

“As firms prepare for a ‘post-pandemic’ world, we are beginning to see our markets seize the opportunity of all these new potential subscribers and invest in subscription models — and in Zephr.” he said. “In publishing and news media, the old model of dominant advertising revenue is on the way out and we are well-placed to capitalize on that interest.”

The new funding also includes financing from Silicon Valley Bank UK Branch and brings Zephr’s total funding to $11 million. Previous investors include Knight Capital and Nauta Capital.

According to the company’s funding announcement, this money will go toward further product development (with a focus on increased personalization), as well as expansion across the United States, Europe and Asia.

“The recent weakness in the advertising market increased pressure for media companies to diversify revenue streams and aim to introduce or optimize subscription models,” said BDMI Managing Director Urs Cete in a statement. “We recognise Zephr’s excellent technology that empowers publishers to galvanise the online subscription opportunity and create customer journeys that are truly unique.”

Powered by WPeMatico

The world’s food supply must double by the year 2050 to meet the demands of a growing population, according to a report from the United Nations. And as pressure mounts to find new crop land to support the growth, the world’s eyes are increasingly turning to the African continent as the next potential global bread basket.

While Africa has 65% of the world’s remaining uncultivated arable land, according to the African Development Bank, the countries on the continent face significant obstacles as they look to boost the productivity of their agricultural industries.

On the continent, 80% of families depend on agriculture for their livelihoods, but only 4% use irrigation. Many families also lack access to reliable and affordable electricity. It’s these twin problems that Samir Ibrahim and his co-founder at SunCulture, Charlie Nichols, have spent the last eight years trying to solve.

Armed with a new financing model and purpose-built small solar-powered generators and water pumps, Nichols and Ibrahim have already built a network of customers using their equipment to increase incomes by anywhere from five to 10 times their previous levels by growing higher-value cash crops, cultivating more land and raising more livestock.

The company also just closed on $14 million in funding to expand its business across Africa.

“We have to double the amount of food we have to create by 2050, and if you look at where there are enough resources to grow food — all signs point to Africa. You have a lot of farmers and a lot of land, and a lot of resources,” Ibrahim said.

African small farmers face two big problems as they look to increase productivity, Ibrahim said. One is access to markets, which alone is a huge source of food waste, and the other is food security because of a lack of stable growing conditions exacerbated by climate change.

As one small farmer told The Economist earlier this year, “The rainy season is not predictable. When it is supposed to rain it doesn’t, then it all comes at once.”

Ibrahim, who graduated from New York University in 2011, had long been drawn to the African continent. His father was born in Tanzania and his mother grew up in Kenya and they eventually found their way to the U.S. But growing up, Ibrahim was told stories about East Africa.

While pursuing a business degree at NYU Ibrahim met Nichols, who had been working on large-scale solar projects in the U.S., at an event for budding entrepreneurs in New York.

The two began a friendship and discussed potential business opportunities stemming from a paper Nichols had read about renewable energy applications in the agriculture industry.

After winning second place in a business plan competition sponsored by NYU, the two men decided to prove that they should have won first. They booked tickets to Kenya and tried to launch a pilot program for their business selling solar-powered water pumps and generators.

Conceptually solar water-pumping systems have been around for decades. But as the costs of solar equipment and energy storage have declined, the systems that leverage those components have become more accessible to a broader swath of the global population.

That timing is part of what has enabled SunCulture to succeed where other companies have stumbled. “We moved here at a time when [solar] reached grid parity in a lot of markets. It was at a time when a lot of development financiers were funding the nexus between agriculture and energy,” said Ibrahim.

Initially, the company sold its integrated energy generation and water-pumping systems to the middle income farmers who hold jobs in cities like Nairobi and cultivate crops on land they own in rural areas. These “telephone farmers” were willing to spend the $5,000 required to install SunCulture’s initial systems.

Now, the cost of a system is somewhere between $500 and $1,000 and is more accessible for the 570 million farming households across the word — with the company’s “pay-as-you-grow” model.

It’s a spin on what’s become a popular business model for the distribution of solar systems of all types across Africa. Investors have poured nearly $1 billion into the development of off-grid solar energy and retail technology companies like M-kopa, Greenlight Planet, d.light design, ZOLA Electric and SolarHome, according to Ibrahim. In some ways, SunCulture just extends that model to agricultural applications.

“We have had to bundle services and financing. The reason this particularly works is because our customers are increasing their incomes four or five times,” said Ibrahim. “Most of the money has been going to consuming power. This is the first time there has been productive power.”

SunCulture’s hardware consists of 300-watt solar panels and a 440-watt-hour battery system. The batteries can support up to four lights, two phones and a plug-in submersible water pump.

The company’s best-selling product line can support irrigation for a two-and-a-half acre farm, Ibrahim said. “We see ourselves as an entry point for other types of appliances. We’re growing to be the largest solar company for Africa.”

With the $14 million in funding, from investors including Energy Access Ventures (EAV), Électricité de France (EDF), Acumen Capital Partners (ACP) and Dream Project Incubators (DPI), SunCulture will expand its footprint in Kenya, Ethiopia, Uganda, Zambia, Senegal, Togo and Cote D’Ivoire, the company said.

Ekta Partners acted as the financial advisor for the deal, while CrossBoundary provided additional advisory support, including an analysis on the market opportunity and competitive landscape, under the United States Agency for International Development (USAID)’s Kenya Investment Mechanism Program.

Powered by WPeMatico

Latin America’s startup scene has attracted troves of venture investment, lifting highly-valued companies such as Rappi and NuBank into behemoth businesses. Now that the spotlight has arrived, those same startups need more talent than ever before to meet demand.

That’s where one seed-stage Buenos Aires startup wants to help. Henry has created an online computer science school that trains software developers from low-income backgrounds to understand technical skills and get employed. The company was founded by brother-sister duo Luz and Martin Borchardt, as well as Manuel Barna Ferrés, Antonio Tralice and Leonardo Maglia.

The Henry team.

The company claims that there’s an estimated 1 million software engineering job openings in Latin America, but fewer than 100,000 professionals that have training suitable for those roles.

“Higher education is only for 13% of the population in Latin America,” says Martin Borchardt, CEO and co-founder of Henry . “It’s very exclusive, very expensive, and has very low impact skills. So we’re giving these people an opportunity.”

With 90% of graduates coming from no formal higher education background, Henry seeks to help bring more back-end junior developers and full-stack developers into startups. Henry offers a five-month course that goes from Monday to Friday, 9 a.m. to 6 p.m., which focuses on software developer skills. Beyond technical training, Henry gives participants job coaching, resume workshops and up-skilling opportunities post-graduation.

To make the school more affordable, Henry looks to take on the same strategy used by Lambda School, a YC-graduate that has raised over $122 million in known funding: income-share agreements. The set-up would allow for boot camp participants to join the program at zero upfront costs, and then only pay once they get hired at a job.

Lambda School’s ISA terms ask students to pay 17% of their monthly salary for 24 months once they earn $4,167 monthly. The students pay a maximum of $30,000. Henry takes a much smaller slice of the pie, partly because salaries are lower in Latin American than in the United States. Henry asks students to pay 15% of their monthly salary for 24 months once students earn $500 a month.

If a Henry student doesn’t get employed in a job that allows them to make $500 a month within five years after the program completes, they are off the hook for paying back the boot camp.

Henry is also focused on helping more women get into the field of software development. Internally, Henry’s remote team is 20% women, 64% men. The current students reflect the same breakdown.

One issue with coding boot camps is that while it might help a student go from unemployed to employed, the lack of credential and degree might limit career mobility past that first job. For that reason, Henry has created a database of alumni resources, including up-skilling and reskilling opportunities in the latest skill, which will be free of charge for graduates.

Henry needs to execute on job placement to be successful in its field. Currently, more than 80% of students in Henry’s first cohort have found jobs, but it’s too soon in the startups’ trajectory to get a stronger metric on that front. About four Henry graduates have been employed by the startup.

The need for more talent in emerging countries has not gone unnoticed. Microverse, also funded by Y Combinator, is similarly using income-sharing agreements to bring education to the masses in developing countries, including spaces in Latin America. Henry thinks the competitor is approaching the dynamic too broadly.

“They’re focusing on all emerging markets and don’t teach to Spanish speakers,” Borchardt said. Henry, alternatively, focuses on Spanish speakers, over 60% of its market in Latin America.

What if Lambda School, the source of Henry’s inspiration, was to break into Latin America? The founder added that the richly funded company has tried, and failed, to expand into international geographies, including China and Europe, due to fragmentation.

Currently, Henry has graduated 200 students and is working with 600 students across Colombia, Chile, Uruguay and Argentina. It plans to expand into Mexico and to bring on Portuguese instruction.

Now, VCs are giving Henry some cash to do so. After going through Y Combinator’s Summer batch, Henry announced today that it has raised $1.5 million in seed funding in a round led by Accion Venture Lab, Emles Venture Partners and Noveus VC. There were also a number of edtech angel investors from Latin American that participated in the round.

“I love the human interaction within instructors and our staff and students,” Borchardt said. “That is something very powerful of Henry compared to a MOOC. The biggest challenge is how do you scale maintaining those assets that bring you that?”

Powered by WPeMatico

Esports One, a startup bringing the fantasy approach to esports, is announcing that it has raised an additional $4 million in funding.

When I first wrote about Esports One in April, co-founder and COO Sharon Winter described it as the first “all-in-one fantasy platform” in the esports world, allowing you to research players, create fantasy teams and watch games, with an initial focus on the North American and European divisions of League of Legends.

According to the Esports One team, creating this platform required building out a set of data and analytics products, as well as using computer vision technology that can track game activity (and update player stats) without relying on a publisher’s API.

The startup says its user base has been growing by more than 25% month-over-month. It may also have benefited from the pause in professional sports earlier this year, while CEO and co-founder Matt Gunnin told me recently that he also sees fantasy as a way to make video games accessible to a broader audience — he recalled one Esports One user who introduced his sister to League of Legends using the fantasy platform.

“I use the example of growing up and sitting there with my dad, watching a baseball game, he’s telling me everything that’s happening,” Gunnin said. “Now it’s the opposite — parents are sitting and watching their kids.”

Many parents, he suggested, are “never going to pick up a mouse and keyboard and play League of Legends,” but they might play the fantasy version: “That’s an entry point … if we can make it easily accessible to individuals both that are hardcore gamers playing video games and watching League of Legends their entire life, as well as someone who has no idea what’s going on.”

The new funding was led led by XSeed Capital, Eniac Ventures, and Chestnut Street Ventures, bringing Esports One to a total of $7.3 million raised. The company also recently signed a partnership deal with lifestyle company ESL Gaming.

Gunnin said the money will allow the company to grow its Bytes virtual currency, which players use to enter contests and buy customizations — starting next year, players will be able to spend real money to purchase Bytes. In addition, it’s working on native iOS and Android apps (Esports One is currently accessible via desktop and mobile web).

Gunnin and his team also plan to develop fantasy competitions for Rainbow Six: Siege, Rocket League, Valorant and Fortnite.

“As a fairly new player in the esports world, we’ve seen immense determination and grit from Matt, Sharon, and the whole Esports One team to grow into a household name,” said XSeed’s Damon Cronkey in a statement. “I’m excited to be partnering with a company that will deliver new perspectives and features to an evolving industry. We’re eager to see how Esports One grows in 2021.”

Powered by WPeMatico

ANYbotics, the creators of ANYmal, a four-legged autonomous robot platform intended for a variety of industrial uses, has raised a $20 million Swiss Franc (~$22.3 million) round A to continue developing and scaling the business. With similar robots just beginning to break into the mainstream, the market seems ready to take off.

The company spun out of ETH Zurich in 2016, at which point the robot was already well into development. ANYmal is superficially similar to Spot, the familiar quadrupedal robot from Boston Dynamics, but the comparison mustn’t be taken too far. A four-legged robot is a natural form for navigating and interacting with environments built for humans.

ANYbotics is on the third generation of the robot, which has progressively integrated computing units and sensors of increasing sophistication.

“Our current ANYmal C model features three built-in high-end Intel i7 computers that power the robot and customer-applications such as automated inspection tasks,” explained co-founder and CEO Péter Fankhauser in an email to TechCrunch. “The availability of smaller and more performant sensors, propelled by AR/VR and autonomous driving applications, has enabled us to equip the latest ANYmal model with 360-degree situational awareness and long-range scanning capabilities. Where commercially available components are not satisfactory, we invest in our proprietary technologies, which have resulted in core components such as custom motors, docking stations, and inspection payload units.”

The most obvious application for robots like ANYmal is inspection of facilities that would normally involve a human. If a robot can traverse the same paths, climb stairs, open doors and so on, it can do so more frequently and regularly than its human counterparts, who tire and take breaks. It also can monitor and relay its surroundings in detail, using lidar and RGB cameras, among other tools. Humans can then perform the more difficult (and human) work of integrating that information and making decisions based on it. An ANYmal at a factory, power plant, or data center could save costs and shoe leather.

Of course, that’s no use if the bot is fragile; fortunately, that’s not the case.

“In terms of mobility, we have focused on what matters most to our industrial customers: Operational reliability and robustness to harsh environmental conditions,” Fankhauser said. “For example, we design and test ANYmal for day and night usage in indoor and outdoor locations, including offshore platforms with salty air and large temperature ranges. It’s less about agility in these environments but more about reliably and safely performing the tasks multiple times a day over many months without human intervention.”

Swisscom Ventures leads the round, and partner Alexander Schläpfer said that good roots (ETHZ is of course highly respected) and good results from early commercial partnerships more than justified their investment.

“Over 10 years ago, some of our co-founders developed their first walking robots during their studies at ETH Zurich,” said Fankhauser. “Today, the industries are ready to adopt this technology, and we are deploying our robots to our early customers.”

Powered by WPeMatico

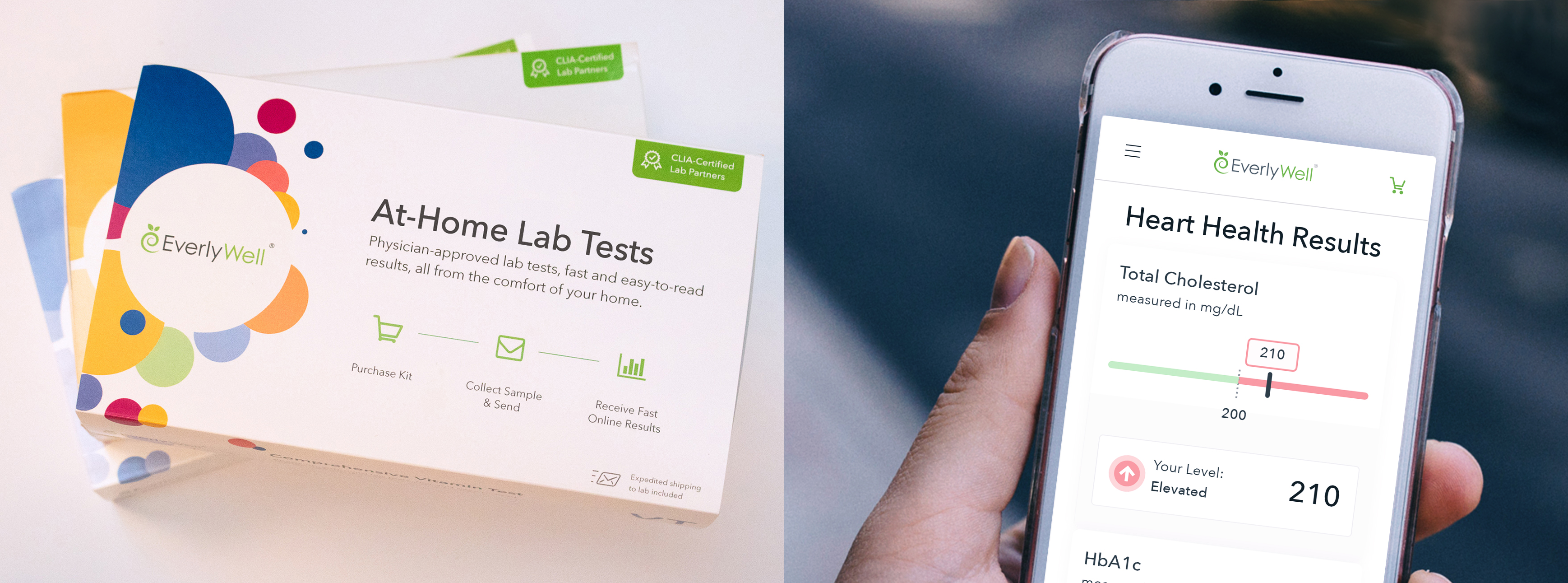

Digital health startup Everlywell has raised a $175 million Series D funding round, following relatively fast on the heels of a $25 million Series C round it closed in February of this year. The Series D included a host of new investors, including BlackRock, The Chernin Group (TCG), Foresite Capital, Greenspring Associates, Morningside Ventures and Portfolio, along with existing investors including Highland Capital Partners, which led the Series C round. The startup has now raised more than $250 million to date.

Everlywell, which launched to the public at TechCrunch Disrupt SF 2016 as a participant in Startup Battlefield, specializes in home healthcare, and specifically on home healthcare tests supported by their digital platform for providing customers with their results and helping them understand the diagnostics, and how to seek the right follow-on care and expert medical advice.

Earlier this year, Everlywell launched an at-home COVID-19 test collection kit — the first of this type of test to receive an emergency authorization from the U.S. Food and Drug Administration (FDA) for its use that allowed cooperation with multiple lab service providers over time. The COVID-19 test kit joins its many other offerings, which include tests for thyroid hormone levels, food and allergen sensitivity, women’s health and fertility, vitamin D deficiency and more. I spoke to Everlywell CEO and founder Julia Cheek about the raise, and she acknowledged that the COVID-19 pandemic was definitely behind the decision to raise such a large amount so quickly again after the close of the Series C, since the company saw a sharp increase in demand coming out of the coronavirus crisis — not only for its COVID-19 test kit, but for at-home digital healthcare options in general.

“We obviously have a very successful COVID-19 test,” she said. “But we’ve also seen three-fourths of our test menu just explode at well over 100% year-over-year growth, and several of our tests are at 4x or 5x growth. That is really representative of this shift in consumer health behavior that will continue in a big way in many different verticals that include testing, and making things more convenient, digitally-enabled, and in the home.”

Like other companies built on solving for a shift to more remote and virtual care options, Cheek said that Everlywell had already anticipated this kind of consumer demand — but COVID-19 has dramatically accelerated the pace of change, which is why the startup put together this round, at this size, this quickly (she says they started the process of putting together the Series D in September).

“We’ve been talking about the digital health movement, and the consumer-directed movement probably for a decade now,” she told me. “I do believe that this will be the watershed moment, unfortunately. But hopefully, we will come out on the other side of the pandemic and say, ‘There are some good things that happened broadly for healthcare.’ That is the hope of what we lean into everyday, and fundamentally, why we went out and raised this amount of capital in this tremendous growth year.”

Image Credits: Everlywell

Everlywell has also expanded availability of its products this year, with distribution in more than 10,000 retail locations across Target, Walgreens, CVS and Kroger stores across the U.S. The company also landed a number of new partnerships on the diagnostic lab and insurance payer side, as well as with major employers — a key customer group as employers shoulder the largest share of healthcare spending in the U.S. due to employee benefit plans. Cheek says that despite their commercial and enterprise customer wins, the focus remains squarely on consumer satisfaction, which is what distinguishes their offering.

“Our COVID-19 test is 75% new people buying our product, and it has an NPS [net promoter score] of 75,” she said. “And then it’s the most highly referred product, and also one of our top tests where people buy other tests. Experience matters here — we know that if someone is a promoter of Everlywell, if they rate us a nine or a 10, on NPS, they are five times more likely to purchase again on the platform.”

That’s not new for Everlywell, according to Cheek — customers have always had a high degree of satisfaction with the company’s products. But what is new is the expanded reach, and the realization among many Americans that virtual care and at-home options are available, and are effective.

“What you have is this lightbulb moment for Americans in a new way that care can be delivered where then they definitely don’t want to go back,” she said. “It’s not just for Everlywell. This is all of these verticals, that have really shifted consumer behavior around healthcare in the home, and I think that will be somewhat permanent. That is the main driver here, and is what we’re seeing, and it’s why Everlywell has resonated so well with so many Americans.”

Powered by WPeMatico

Realizing that modern, complex businesses can no longer be adequately managed using spreadsheet-style programs, the founders of Pigment decided there had to be a better solution. Their business forecasting platform has now raised a substantial Series A of $25.9 million, led by Blossom Capital. Also participating was New York-based FirstMark Capital and Frst, as well as angel investors including Paul Melchiorre, former CEO of business planning giant Anaplan, and David Clarke, the ex-CTO of Workday, another business planning incumbent.

Those last two investors are significant because Paris-based Pigment competes with both Anaplan and Workday. Also of note is the fact that another planning product, Adaptive Insights, was sold to Workday for $1.6 billion.

Pigment has so far secured large-scale enterprise and pre-IPO startup clients for its beta product, including a major European bank — although it declined to name any of its clients so far.

Pigment says it aims to overhaul the painful experience of using error-prone spreadsheets and inflexible software to do business forecasting, instead presenting a dashboard-like approach in real time through charts, simulations and continuous modeling.

Eléonore Crespo, co-founder and co-CEO of Pigment, said in a statement: “We’re a bit like Minecraft for business strategy – with that kind of creative, organic potential for the user. Standard planning solutions are basically mechanical, treating a business like a machine with levers that you just push and pull.”

Ophelia Brown, partner at Blossom Capital, said: “Existing planning software was built around 20th-century models of how to do business. Pigment is a 21st century platform that reflects the way successful companies need to work today – socially and environmentally conscious, proactively scanning the horizon for risks and opportunities, and capable of unlocking new opportunities in an increasingly complex and uncertain world.”

Pigment was founded in 2019 by Crespo, a former data analyst at Google and investor at Index Ventures, and Romain Niccoli, the former CTO and co-founder of Criteo — the adtech company which IPO’d on Nasdaq in 2013.

Powered by WPeMatico