Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

As artificial intelligence continues to weave its way into more enterprise applications, a startup that has built a platform to help businesses, especially non-tech organizations, build more customized AI decision-making tools for themselves has picked up some significant growth funding. Peak AI, a startup out of Manchester, England, that has built a “decision intelligence” platform, has raised $75 million, money that it will be using to continue building out its platform, expand into new markets and hire some 200 new people in the coming quarters.

The Series C is bringing a very big name investor on board. It is being led by SoftBank Vision Fund 2, with previous backers Oxx, MMC Ventures, Praetura Ventures and Arete also participating. That group participated in Peak’s Series B of $21 million, which only closed in February of this year. The company has now raised $119 million; it is not disclosing its valuation.

(This latest funding round was rumored last week, although it was not confirmed at the time and the total amount was not accurate.)

Richard Potter, Peak’s CEO, said the rapid follow-on in funding was based on inbound interest, in part because of how the company has been doing.

Peak’s so-called Decision Intelligence platform is used by retailers, brands, manufacturers and others to help monitor stock levels and build personalized customer experiences, as well as other processes that can stand to have some degree of automation to work more efficiently, but also require sophistication to be able to measure different factors against each other to provide more intelligent insights. Its current customer list includes the likes of Nike, Pepsico, KFC, Molson Coors, Marshalls, Asos and Speedy, and in the last 12 months revenues have more than doubled.

The opportunity that Peak is addressing goes a little like this: AI has become a cornerstone of many of the most advanced IT applications and business processes of our time, but if you are an organization — and specifically one not built around technology — your access to AI and how you might use it will come by way of applications built by others, not necessarily tailored to you, and the costs of building more tailored solutions can often be prohibitively high. Peak claims that those using its tools have seen revenues on average rise 5%, return on ad spend double, supply chain costs reduce by 5% and inventory holdings (a big cost for companies) reduce by 12%.

Peak’s platform, I should point out, is not exactly a “no-code” approach to solving that problem — not yet at least: It’s aimed at data scientists and engineers at those organizations so that they can easily identify different processes in their operations where they might benefit from AI tools, and to build those out with relatively little heavy lifting.

There have also been different market factors that have played a role. COVID-19, for example, and the boost that we have seen both in increasing “digital transformation” in businesses and making e-commerce processes more efficient to cater to rising consumer demand and more strained supply chains have all led to businesses being more open and keen to invest in more tools to improve their automation intelligently.

This, combined with Peak AI’s growing revenues, is part of what interested SoftBank. The investor has been long on AI for a while; but it also has been building out a section of its investment portfolio to provide strategic services to the kinds of businesses in which it invests.

Those include e-commerce and other consumer-facing businesses, which make up one of the main segments of Peak’s customer base.

Notably, one of its recent investments specifically in that space was made earlier this year, also in Manchester, when it took a $730 million stake (with potentially $1.6 billion more down the line) in The Hut Group, which builds software for and runs D2C businesses.

“In Peak we have a partner with a shared vision that the future enterprise will run on a centralized AI software platform capable of optimizing entire value chains,” Max Ohrstrand, senior investor for SoftBank Investment Advisers, said in a statement. “To realize this a new breed of platform is needed and we’re hugely impressed with what Richard and the excellent team have built at Peak. We’re delighted to be supporting them on their way to becoming the category-defining, global leader in Decision Intelligence.”

It’s not clear that SoftBank’s two Manchester interests will be working together, but it’s an interesting synergy if they do, and most of all highlights one of the firm’s areas of interest.

Longer term, it will be interesting to see how and if Peak evolves to extend its platform to a wider set of users at the organizations that are already its customers.

Potter said he believes that “those with technical predispositions” will be the most likely users of its products in the near and medium term. You might assume that would cut out, for example, marketing managers, although the general trend in a lot of software tools has precisely been to build versions of the same tools used by data scientists for these less technical people to engage in the process of building what it is that they want to use.

“I do think it’s important to democratize the ability to stream data pipelines, and to be able to optimize those to work in applications,” Potter added.

Powered by WPeMatico

Independent restaurants don’t typically have the luxury to create their own online food ordering and delivery capabilities or negotiate for lower rates from legacy ordering platforms like the large restaurant chains do.

Here’s where Owner.com comes in. The Palo Alto-based company provides a free online ordering, delivery and marketing platform for independent restaurants that puts them on similar playing fields with the big guys. And unlike the legacy food delivery services, Owner.com restaurants own their customer data and can automate marketing campaigns.

Adam Guild is the company’s 21-year-old co-founder and CEO, a high school dropout and a Thiel Fellow, who originally started by assisting his mother’s dog grooming business that was having difficulties attracting customers. After stepping in with some online marketing methods, her business grew, and is now looking to expand into multiple locations. Guild then wanted to work with a bigger group of people and stumbled across restaurants while helping some clients create online landing pages.

With consumer demand shifting to primarily online ordering and delivery over the past 18 months, online ordering revenue is expected to double from $248 billion in 2020 to $449 billion by 2025. Ordering platforms like Doordash, Uber Eats and Grubhub control 80% of orders and typically charge between 20% and 30% per order to restaurants and additional fees to consumers.

In contrast, Owner.com is free for restaurants and charges customers a 5% convenience fee when they order from the website. Guild explained that larger restaurant chains have the buying power to negotiate lower rates, while independent restaurants do not. With the inability to keep up, some 110,000 restaurants in the U.S. closed in 2020.

Guild initially bootstrapped his company, working with large restaurant chains, like P.F. Chang’s, drive in-store orders. Then the global pandemic hit. He ended up losing all of his revenue and had to let all of his employees go but one. To add to his bad luck, he was then rejected from Y Combinator and other accelerator programs.

“For the first three days, I was depressed,” Guild told TechCrunch. “I had spent two years building a company and now it was dead. In the same way we were disrupted, I began to think there was no better position to be in than a scrappy startup. I didn’t know what the next business would look like, so I started cold-calling restaurant owners, asking how I can be helpful and what type of technology they were looking for. Many of them told me that online ordering sucked, but if they didn’t solve it soon, they would go out of business.”

One pivot and a year later with co-founder Dean Bloembergen, Owner.com closed on $10.7 million in seed funding led by SaaStr Fund, with participation from Redpoint Ventures and Day One Ventures, as well as a group of individual investors including Naval Ravikant, CNBC’s The Profit host Marcus Lemonis, The Kitchen Restaurant Group’s Kimbal Musk, DoNotPay founder Joshua Browder, Figma founder Dylan Field, The Chainsmokers and independent restaurant owners and customers of Owner.com.

Jason Lemkin, founder of SaaStr Fund, said restaurant SaaS was a space in which his firm was interested in investing, but thought it was a bit boring — there were already quite a few vendors in the space, like Toast and Grubhub, and most were just technology solutions. However, when he heard that Owner.com was a break-out company from the monotony, he said he had to take a look.

“The ability to own the customer relationship is that ultimate differentiation,” Lemkin said. “Their ultimate goal is to provide a robust technology platform to increase margins, have people order more and come back often.”

Meanwhile, Guild intends to use the new funding to continue product development and add new features like landing pages, the ability to make reservations and native apps for white-label service.

Since the launch last year, the company has reached a seven-figure run-rate and over 105% monthly revenue retention across over 700 restaurant locations, Guild said. To date, Owner.com has transacted over $18 million and helped its restaurant customers avoid paying $3 million to online order platform fees annually.

“It’s all about empowering the 40% of the restaurant industry that is run by people who started off in entry-level positions, and over the years, worked their way up to own the ‘American Dream,’ ” he added.

Powered by WPeMatico

One of the consequences of rising CO2 levels in our atmosphere is that levels also rise proportionately in the ocean, harming wildlife and changing ecosystems. Heimdal is a startup working to pull that CO2 back out at scale using renewable energy and producing carbon-negative industrial materials, including limestone for making concrete, in the process, and it has attracted significant funding even at its very early stage.

If the concrete aspect seems like a bit of a non sequitur, consider two facts: concrete manufacturing is estimated to produce as much as 8% OF all greenhouse gas emissions, and seawater is full of minerals used to make it. You probably wouldn’t make this connection unless you were in some related industry or discipline, but Heimdal founders Erik Millar and Marcus Lima did while they were working in their respective masters programs at Oxford. “We came out and did this straight away,” he said.

They both firmly believe that climate change is an existential threat to humanity, but were disappointed at the lack of permanent solutions to its many and various consequences across the globe. Carbon capture, Millar noted, is frequently a circular process, meaning it is captured only to be used and emitted again. Better than producing new carbons, sure, but why aren’t there more ways to permanently take them out of the ecosystem?

The two founders envisioned a new linear process that takes nothing but electricity and CO2-heavy seawater and produces useful materials that permanently sequester the gas. Of course, if it was as easy that, everyone would already be doing it.

“The carbon markets to make this economically viable have only just been formed,” said Millar. And the cost of energy has dropped through the floor as huge solar and wind installations have overturned decades-old power economies. With carbon credits (the market for which I will not be exploring, but suffice it to say it is an enabler) and cheap power come new business models, and Heimdal’s is one of them.

The Heimdal process, which has been demonstrated at lab scale (think terrariums instead of thousand-gallon tanks), is roughly as follows. First the seawater is alkalinized, shifting its pH up and allowing the isolation of some gaseous hydrogen, chlorine and a hydroxide sorbent. This is mixed with a separate stream of seawater, causing the precipitation of calcium, magnesium and sodium minerals and reducing the saturation of CO2 in the water — allowing it to absorb more from the atmosphere when it is returned to the sea. (I was shown an image of the small-scale prototype facility but, citing pending patents, Heimdal declined to provide the photo for publication.)

So from seawater and electricity, they produce hydrogen and chlorine gas, calcium carbonate, sodium carbonate and magnesium carbonate, and in the process sequester a great deal of dissolved CO2.

For every kiloton of seawater, one ton of CO2 is isolated, and two tons of the carbonates, each of which has an industrial use. MgCO3 and Na2CO3 are used in, among other things, glass manufacturing, but it’s CaCO3, or limestone, that has the biggest potential impact.

As a major component of the cement-making process, limestone is always in great demand. But current methods for supplying it are huge sources of atmospheric carbon. All over the world industries are investing in carbon reduction strategies, and while purely financial offsets are common, moving forward the preferred alternative will likely be actually carbon-negative processes.

To further stack the deck in its favor, Heimdal is looking to work with desalination plants, which are common around the world where fresh water is scarce but seawater and energy are abundant, for example the coasts of California and Texas in the U.S., and many other areas globally, but especially where deserts meet the sea, like in the MENA region.

Desalination produces fresh water and proportionately saltier brine, which generally has to be treated, as to simply pour it back into the ocean can throw the local ecosystem out of balance. But what if there were, say, a mineral-collecting process between the plant and the sea? Heimdal gets the benefit of more minerals per ton of water, and the desalination plant has an effective way of handling its salty byproduct.

“Heimdal’s ability to use brine effluent to produce carbon-neutral cement solves two problems at once,” said Yishan Wong, former Reddit CEO, now CEO of Terraformation and individually an investor in Heimdal. “It creates a scalable source of carbon-neutral cement, and converts the brine effluent of desalination into a useful economic product. Being able to scale this together is game-changing on multiple levels.”

Terraformation is a big proponent of solar desalination, and Heimdal fits right into that equation; the two are working on an official partnership that should be announced shortly. Meanwhile a carbon-negative source for limestone is something cement makers will buy every gram of in their efforts to decarbonize.

Wong points out that the primary cost of Heimdal’s business, beyond the initial ones of buying tanks, pumps and so on, is that of solar energy. That’s been trending downwards for years and with huge sums being invested regularly there’s no reason to think that the cost won’t continue to drop. And profit per ton of CO2 captured — already around 75% of over $500-$600 in revenue — could also grow with scale and efficiency.

Millar said that the price of their limestone is, when government incentives and subsidies are included, already at price parity with industry norms. But as energy costs drop and scales rise, the ratio will grow more attractive. It’s also nice that their product is indistinguishable from “natural” limestone. “We don’t require any retrofitting for the concrete providers — they just buy our synthetic calcium carbonate rather than buy it from mining companies,” he explained.

All in all it seems to make for a promising investment, and though Heimdal has not yet made its public debut (that would be forthcoming at Y Combinator’s Summer 2021 Demo Day) it has attracted a $6.4 million seed round. The participating investors are Liquid2 Ventures, Apollo Projects, Soma Capital, Marc Benioff, Broom Ventures, Metaplanet, Cathexis Ventures and, as mentioned above, Yishan Wong.

Heimdal has already signed LOIs with several large cement and glass manufacturers, and is planning its first pilot facility at a U.S. desalination plant. After providing test products to its partners on the scale of tens of tons, they plan to enter commercial production in 2023.

Powered by WPeMatico

With so much startup activity in the software-as-a-service (SaaS) space it can be a challenge for businesses to figure out which of these SaaS (SaaSes?) are actually useful and worth continuing to shell out for. Well, Cologne-based startup Sastrify is here to help — offering what it describes as a “highly automated” platform (covering some 20,000+ SaaS solutions) to help other businesses with procurement and management of third-party services.

It may not sound the sexist startup business to be in, but despite only launching earlier this year, Sastrify is already cash-flow positive — and can tout “a high six-digit recurring revenue” just a few months post-launch. Not bad for a startup that was only founded last summer.

Today it’s announcing closing a $7 million seed round from HV Capital and the founders of FlixMobility, Personio and SumUp. That follows a $1.3 million pre-seed raised back in late 2020, ahead of its launch.

Sastrify tells us it has around 50 customers at this stage — including “unicorn startups like Gorillas”. It says its approach works best for growing companies with 100+ employees, and is perhaps especially suited to European tech scale-ups.

On the competitive front the startup points to U.S.-based Vendr and Tropic, which may further explain the regional focus (although it’s not only selling in Europe).

Sastrify’s sales pitch to SMEs includes that current customers have seen an average 6.5x return on their investment — in addition to what it bills as “thousands of working hours” saved from “wasted” activities related to SaaS procurement.

Cost savings are another carrot — which the startup is claiming its customers are “typically” saving around 20-30% of their SaaS cost.

So how does it actually make it easier for businesses to navigate the pros & cons of the smorgasbord of SaaS(es) now out there?

“Our main mantra is: ‘Effective procurement asks the right questions at the right time’,” says co-founder Sven Lackinger, who previously co-founded a SaaS startup himself of course (evopark), exiting that company back in 2018.

“To ensure that we’ve defined and implemented a five-step process into our platform, covering the whole life-cycle of SaaS applications within enterprises. Our clients can search for the suitable SaaS solutions while we guide them through the right evaluation process per use case and tool (e.g. what are similar companies using?).

“We then take over the whole buying process, aka automatically reaching out to different vendors, AI-/OCR-based comparing and benchmarking for offers. Once the tool is implemented, we make sure to track usage frequently (via regular, automated surveys to tool owners) and re-evaluate over time so there is no ongoing waste of licenses.”

“We have a more automated platform [than Vendr and Tropic] and can also resell licenses to our customers directly (e.g. for Google, Microsoft and others) to ensure best prices and fast delivery,” he also tells us. “This allows us to offer a faster and cheaper solution which is more suited to the European market (where the average SaaS expense per company is still smaller than in the US).”

If you’re outsourcing all this other stuff to SaaS providers, why not get a specialist service to stay on top of how you do that too, is the basic idea.

The 30-strong Sastrify team will be using the seed funding to accelerate sales, marketing and product dev so it can expand its SaaS management service to more companies in Europe and beyond.

Commenting on the funding in a statement, Jasper Masemann, partner at HV Capital, added: “Cloud software adoption is massively accelerating and almost every company nowadays uses SaaS products but does not buy and manage them efficiently. Sastrify’s astonishing growth underlines the broad customer value the team has already created. It is early days but Sastrify could create an SAP Arriba with a payment solution for SMB – a massive market just in Europe.”

Powered by WPeMatico

Stonehenge Technology Labs wants consumer packaged goods companies to gain meaningful use from all of the data they collect. It announced $2 million in seed funding for its STOPWATCH commerce enhancement software.

The round was led by Irish Angels, with participation from Bread and Butter Ventures, Gaingels, Angeles Investors, Bonfire Ventures and Red Tail Venture Capital.

CEO Meagan Kinmonth Bowman founded the Arkansas-based company in 2019 after working at Hallmark, where she was tasked with the digital transformation of the company.

“This was not a consequence of them not being good marketers or connected to mom, but they didn’t have the technology to connect their back end with retailers like Amazon, Walmart or Hobby Lobby,” she told TechCrunch. “There are so many smart people building products to connect with consumers. The challenge is the big guys are doing things the same way and not thinking like the 13-year-olds on social media that are actually winning the space.”

Kinmonth Bowman and her team recognized that there was a missing middle layer connecting the world of dotcom with brick and mortar. If the middle layer could be applied to the enterprise resource plans and integrate public and private data feeds, a company could be just as profitable online as it could be in traditional retail, she said.

Stonehenge’s answer to that is STOPWATCH, which takes in over 100 million rows of data per workspace per day, analyzes the data points, adds real-time alerts and provides the right data to the right people at the right time.

Dan Rossignol, a B2B SaaS investor, said the CPG world is also about consumerizing our life, and the global pandemic showed that even at home, people could have a productive day and business. Rossignol likes to invest in underestimated founders and saw in Stonehenge a company that is getting CPGs out from underneath antiquated technologies.

“What Meagan and her team are doing is really interesting,” he added. “At this stage, it is all about the people, and the ability to bet on doing something larger.”

Kinmonth Bowman said she had the opportunity to base the company in Silicon Valley, but chose Bentonville, Arkansas instead to be closer to the more than 1,000 CPG companies based there that she felt were the prime customer base for STOPWATCH.

The platform was originally created as a subsidiary of a consulting company, but in 2018, one of their clients told them they just wanted the software rather than also paying for the consulting piece. The business was split, and Stonehenge went underground for eight months to make a software product specifically for the client.

Kinmonth Bowman admits the technology itself is not that sexy — it is using exact transfer loads to extract data from hundreds of systems into a “lake house,” and then siloing it by retailer and other factors and then presenting the data in different ways. For example, the CEO will want different metrics than product teams.

Over the past year, the company has doubled its revenue and also doubled the amount of contracts. It already counts multiple Fortune 100 companies and emerging brands as some of its early users and plans to use the new funding to hire a sales team and go after some strategic relationships.

Stonehenge is also working on putting together a diverse workforce that mimics the users of the software, Kinmonth Bowman said. One of the challenges has been to get unique talent to move to Arkansas, but she said it is one she is eager to take on.

Meanwhile, Brett Brohl, managing partner at Bread and Butter Ventures, said the Stonehenge team “is just crazy enough, smart and driven” to build something great.

“All of the biggest companies have been around for a long time, but not a lot of large organizations have done a good job digitizing their businesses,” he said. “Even pre-COVID, they were building fill-in-the-blank digital transformations, but COVID accelerated technology and hit a lot of companies in the face. That was made more obvious to end consumers, which puts more pressure on companies to understand the need, which is good for STOPWATCH. It went from paper to Excel spreadsheets to the next cloud modification. The time is right for the next leap and how to use data.”

Powered by WPeMatico

As Synder’s two co-founders Michael Astreiko and Ilya Kisel wrap up their time at Y Combinator, they also announced their seed round of $2 million from TMT Investments.

Though the round was acquired before going into the accelerator program, the Belarus-based pair wanted to wait to publicly share the milestone. As they focus their sights on their next journey of growth and expansion, the new funding will go toward attracting more clients, visibility and sales.

The company bills itself as an easy accounting platform for e-commerce businesses. It was originally founded as CloudBusiness in 2016 and developed accounting automation and management of business finances for small and mid-size businesses.

Astreiko and Kisel started Synder, in 2018 and a year later focused on the company full-time to develop an easy way for commerce companies to shift to omnichannel sales, something Astreiko told TechCrunch can be “a huge pain” due to the complexity of different payment systems and high fees.

“There are a lot of solutions on the market, but you still have to have special knowledge to operate within accounting or commerce,” Kisel said. “For us, the simplicity means that it is worth it if you can have access in several clicks to consolidated inventory, profits and liabilities. Small businesses sometimes are not sharing this information due to competition, but if something is working and easy, they will definitely share it.”

Synder does the heavy lifting for companies by connecting sales channels like Amazon, Shopify, eBay and Etsy into one platform that users can manage with one-click operations. It also created a way to help the accounting stream so that all of the different payment methods can still be used, Kisel said.

The company is already working with 4,000 clients, and will now be fast-tracking their expansion, but will need the right people on board to help the company grow, Astreiko said.

Igor Shoifot, a partner at TMT Investments, said he will join Synder’s board after the company graduates from YC. He likes the simplicity of what the company is doing.

“Often the best solutions are economical, succinct and elegant — you can be onboarded in 10 minutes,” he added. “There is really nobody that really provides a similar solution that was that easy or didn’t require downloading or installing something. I also like their focus on growth, the fact they have no burn and they are making money.”

Synder’s business model is a subscription SaaS model that starts off as a free trial, and users can purchase additional services inside the platform to fit small and large companies.

Its more than 15 employees are spread around Europe, and the company just started hiring in the areas of marketing and sales in the U.S.

Powered by WPeMatico

Embedded fintech company Zeal secured $13 million in Series A funding to continue developing its platform for building individualized payroll products.

Spark Capital led the Series A, with participation from Commerce Ventures and a group of individual investors, including Marqeta CEO Jason Gardner and CRO Omri Dahan, Robinhood founder Vlad Tenev, UltimateSoftware executives Mitch Dauerman and Bob Manne and Namely founder Matt Straz. The latest round now gives the company $14.6 million in total funding, which includes a $1.6 million seed round in 2020, CEO Kirti Shenoy told TechCrunch.

The Bay Area company’s origin was as Puzzl, a payment processing startup for the gig economy, founded in 2018 by Shenoy and CTO Pranab Krishnan. It was part of Y Combinator’s 2019 cohort. The pair had to pivot the company after needing to move some of its thousands of 1099 contractors to W2 employee status.

They went looking for payroll processors that could handle high volumes of payroll automatically, like ADP or Paycor, but found they didn’t match some of the capabilities Shenoy and Krishnan wanted, including to pay workers daily and customize earning components.

To ensure other companies didn’t run into the same problem, they decided to build a payroll API that enables their customers to build their own payroll products, even being able to pay their workers everyday. Traditionally, companies would layer together antiquated third-party payroll tools and spend millions of dollars on consulting fees. Zeal’s API tool modernizes the payroll process and takes on the payroll liability while managing the back-end payment logistics, Shenoy said.

Currently, enterprises use Zeal to pay large volumes of workers and keep payment data on their own native systems, while software platforms that sell business-to-business services use Zeal to build their own payroll product to sell to their customers.

“Our mission is to touch every American paycheck with our tax and payment technology, ensuring that American employees are paid correctly and efficiently,” Krishnan said.

And that is a complex goal: there are 200 million American employees, over $8.8 trillion of payroll is processed annually in the U.S. and the country’s 11,000 tax jurisdictions produce over 25,000 income tax code changes a year.

Meanwhile, Shenoy cited IRS data that showed more than 40% of small and medium businesses pay at least one payroll penalty per year. That was one of the drivers for Zeal’s latest product, the Abacus gross-to-net calculator, which payroll companies can use to ensure they are compliant in paying their income taxes.

The co-founders intend to use the new funding to build out their team and strengthen compliance measures to ensure its track record with enterprises.

“We are starting to win more enterprise deals and moving millions of dollars each day,” Shenoy said. “This has been a legacy space for so long, so companies want to work with a provider to move fast.”

Shenoy predicts that more companies will shift to hyper-customized experiences in the next five to 10 years. Whereas the default was a company like ADP, companies will want to control their own data and build products so their customers can do everything payroll-related from one platform.

As part of the investment, Spark Capital’s partner Natalie Sandman has joined Zeal’s board of directors. The firm previously invested in other embedded fintech companies like Affirm and Marqeta, and she thinks there are new experiences in the sector that APIs can unlock.

Sandman felt the payroll-building pain points herself when she worked at Zenefits. At the time, the company was trying to do the same thing, but there were no APIs to connect with. There were all of these spreadsheets to transfer data, but one wrong deduction would trickle down and cause a tax penalty.

Shenoy and Krishnan are both “customer-obsessed,” she said, and are balancing speed with thoughtfulness when it comes to understanding how their customers want to build payroll products.

She is seeing a macro shift to audience-driven human resources where bringing new employees online will mean embedding them into products that will be more valuable versus the traditional spreadsheet.

“To me, it is a no-brainer that APIs provide flexibility in the way wages and deductions need to be made,” Sandman said. “You can lose trust in your employer. Payroll is at the deepest trust point and where you want transparency and a robust solution to solve that need.”

Powered by WPeMatico

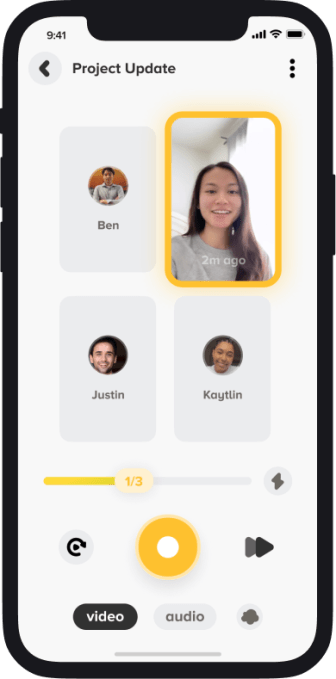

A new startup called Popcorn wants to make work communication more fun and personal by offering a way for users to record short video messages, or “pops,” that can be used for any number of purposes in place of longer emails, texts, Slack messages or Zoom calls. While there are plenty of other places to record short-form video these days, most of these exist in the social media space, which isn’t appropriate for a work environment. Nor does it make sense to send a video you’ve recorded on your phone as an email attachment, when you really just want to check in with a colleague or say hello.

Popcorn, on the other hand, lets you create the short video and then send a URL to that video anywhere you would want to add a personal touch to your message.

For example, you could use Popcorn in a business networking scenario, where you’re trying to connect with someone in your industry for the first time — aka “cold outreach.” Instead of just blasting them a message on LinkedIn, you could also paste in the Popcorn URL to introduce yourself in a more natural, friendly fashion. You also could use Popcorn with your team at work for things like daily check-ins, sharing progress on an ongoing project or to greet new hires, among other things.

Image Credits: Popcorn

Videos themselves can be up to 60 seconds in length — a time limit designed to keep Popcorn users from rambling. Users also can opt to record audio only if they don’t want to appear on video. And you can increase the playback speed if you’re in a hurry. Users who want to receive “pops” could also advertise their “popcode” (e.g. try mine at U8696).

The idea to bring short-form video to the workplace comes from Popcorn co-founder and CEO Justin Spraggins, whose background is in building consumer apps. One of his first apps to gain traction back in 2014 was a Tinder-meets-Instagram experience called Looksee that allowed users to connect around shared photos. A couple years later, he co-founded a social calling app called Unmute, a Clubhouse precursor of sorts. He then went on to co-found 9 Count, a consumer app development shop which launched more social apps like BFF (previously Wink) and Juju.

9 Count’s lead engineer, Ben Hochberg, is now also a co-founder on Popcorn (or rather, Snack Break, Inc. as the legal entity is called). They began their work on Popcorn in 2020, just after the start of the COVID-19 pandemic. But the rapid shift to remote work in the days that followed could now help Popcorn gain traction among distributed teams. Today’s remote workers may never again return to in-person meetings at the office, but they’re also growing tired of long days stuck in Zoom meetings.

With Popcorn, the goal is to make work communication fun, personal and bite-sized, Spraggins says. “[We want to] bring all the stuff we’re really passionate about in consumer social into work, which I think is really important for us now,” he explains.

“You work with these people, but how do you — without scheduling a Zoom — how do you bring the ‘human’ to it?,” Spraggins says. “I’m really excited about making work products feel more social, more like Snapchat than utility tools.”

There is a lot Popcorn would still need to figure out to truly make a business-oriented social app work, including adding enhanced security, limiting spam, offering some sort of reporting flow for bad actors, and more. It will also eventually need to land on a successful revenue model.

Currently, Popcorn is a free download on iPhone, iPad and Mac, and offers a Slack integration so you can send video messages to co-workers directly in the communication software you already use to catch up and stay in touch. The app today is fairly simple, but the company plans to enhance its short videos over time using AR frames that let users showcase their personalities.

The startup raised a $400,000 pre-seed round from General Catalyst (Niko Bonatsos) and Dream Machine (Alexia Bonatsos, previously editor-in-chief at TechCrunch.) Spraggins says the company will be looking to raise a seed round in the fall to help with hires, including in the AR space.

Powered by WPeMatico

If you haven’t noticed yet, the hiring market is a hot one — and getting more complicated as enterprise talent acquisition leaders face technology gaps while assessing candidates. This leads to difficulty in determining compensation.

Enter Compa. The offer management platform provides “deal desk” software for recruiters to more easily manage their compensation strategies to create and communicate offers that are easy to understand and are unbiased.

Charlie Franklin, co-founder and CEO of Compa, told TechCrunch it was frustrating to lose a candidate at the compensation stage, so the company created its software to reduce the challenge of relying on crowdsourcing data or surveys to compare pay.

“Recruiters often lack the data and tools to figure out how much to pay people and communicate that effectively,” Franklin told TechCrunch. “We see talent acquisitions teams like a sales team. If you think of it from that perspective, they need to close a candidate, but to ask the recruiter to operate off of a spreadsheet slows that process down.”

Compa co-founders, from left, Charlie Franklin, Joe Malandruccolo and Taylor Cone. Image Credits: Compa

With Compa, recruiters can input pay expectations and compare recent offers and collaborate with other team members and hiring managers to reach pay consensus quicker. The software automates all of the market intelligence in real time and provides insights about compensation across similar industries and organizations.

The company, based in both California and Massachusetts, emerged from stealth Thursday with $3.9 million in seed funding led by Base10 Partners. Participation in the round also came from Crosscut Ventures and Acadian Ventures, as well as a group of strategic angel investors including 2.12 Angels, Oyster HR CEO Tony Jamous and Scout RFP co-founders Stan Garber and Alex Yakubovich.

Jamison Hill, partner at Base10 Partners, said via email his firm was doing research in the ESG “megatrend,” particularly looking for startups focused on compensation management, when it came across Compa.

He was attracted to the founders’ “clarity and conviction” on the company’s vision, their understanding of the pay gap in the market, how Compa’s solution would “create a new wave of smarter, more-data driven recruiting teams” and how it was enabling employers to use compensation and a positive offer management approach to differentiate itself from competitors.

“They deeply understand the nuances that come with enterprise-level HR teams and bring that expertise to every aspect of Compa’s product offering, which is why we believe Compa can emerge as a leader in this trend and chose to partner with this very special team,” Hill added.

Franklin, who previously led human resources M&A at Workday, founded Compa last year with Joe Malandruccolo, who was on the engineering side at Facebook and Oculus, and Taylor Cone, who has done innovation consulting for organizations like Stanford University.

The company was bootstrapped prior to going after the seed round and will use the capital to expand the team and create additional products that fit into its mission of “making compensation fair and competitive for everyone,” Franklin said.

Going forward, he adds that job offers and compensation need to catch up to how quickly the world is changing. As more people work remotely and companies want to attract a diverse workforce, compensation will be an important factor.

“This is a long-term trend we are seeing in HR — compensation becoming more transparent — not just a spreadsheet shared internally, but a transition from secretive to open and accountable, Franklin said. “Technology is catching up to that, and we have the ability to produce outcomes that drive differences in pay.”

Powered by WPeMatico

BreezoMeter has been on a mission to make environmental health hazard information accessible to as many people as possible. Through its air quality index (AQI) calculations, the Israel-based company can now identify the quality of air down to a few meters in dozens of countries. A partnership with Apple to include its data into the iOS Weather app along with its own popular apps delivers those metrics to hundreds of millions of users, and an API product allows companies to tap into its data set for their own purposes.

Right on the heels of a $30 million Series C round a few weeks ago, the company is radially expanding its product from air quality into the real-time detection of wildfire perimeters with its new product, Wildfire Tracker.

The new product will take advantage of the company’s fusion of sensor data, satellite imagery and local eyewitness reports to be able to identify the edges of wildfires in real time. “People expect accurate wildfire information just as they expect accurate weather or humidity data,” Ran Korber, CEO and co-founder, said. “It has an immediate effect on their life.” He added further that BreezoMeter wants to “try to connect the dots between climate tech and human health.”

Fire danger zones will be indicated with polygonal boundaries marked in red, and as always, air quality data will be viewable in these zones and in surrounding areas.

BreezoMeter’s air quality maps can show the spread of wildfire pollution. Image Credits: BreezoMeter.

Korber emphasized that getting these perimeters accurate across dozens of countries was no easy feat. Sensors can be sparse, particularly in the forests where wildfires ignite. Meanwhile, satellite data that focuses on thermal imaging can be fooled. “We’re looking for abnormalities … many of the times you have these false positives,” Korber said. He gave an example of a large solar panel array which can look very hot with thermal sensors, but obviously isn’t a fire.

The identified fire perimeters will be available for free to consumers on BreezoMeter’s air quality map website, and will shortly come to the company’s apps as well. Later this year, these perimeters will be available from the company’s APIs for commercial customers. Korber hopes the API endpoints will give companies like car manufacturers the ability to forewarn drivers that they are approaching a conflagration.

The new feature is just a continuation of BreezoMeter’s longtime expansion of its product. “When we started, it was just air quality … and only forecasting air pollution in Israel,” Korber said. “Almost every year since then, we expanded the product portfolio to new environmental hazards.” He pointed to the addition of pollen in 2018 and the increasingly global nature of the app.

Wildfire detection is an, ahem, hot area these days for VC investors. For example, Cornea is a startup focused on helping firefighters identify and mitigate blazes, while Perimeter wants to help identify boundaries of wildfires and give explicit evacuation instructions, complete with maps. As Silicon Valley’s home state of California and much of the world increasingly become a tinderbox for fires, expect more investment and products to enter this area.

Powered by WPeMatico