Recent Funding

Auto Added by WPeMatico

Auto Added by WPeMatico

DevOps continues to get a lot of attention as a wave of companies develop more sophisticated tools to help developers manage increasingly complex architectures and workloads. In the latest development, Databand — an AI-based observability platform for data pipelines, specifically to detect when something is going wrong with a datasource when an engineer is using a disparate set of data management tools — has closed a round of $14.5 million.

Josh Benamram, the CEO who co-founded the company with Victor Shafran and Evgeny Shulman, said that Databand plans include more hiring; to continue adding customers for its existing product; to expand the library of tools that it’s providing to users to cover an ever-increasing landscape of DevOps software, where it is a big supporter of open-source resources; as well as to invest in the next steps of its own commercial product. That will include more remediation once problems are identified: that is, in addition to identifying issues, engineers will be able to start automatically fixing them, too.

The Series A is being led by Accel with participation from Blumberg Capital, Lerer Hippeau, Ubiquity Ventures, Differential Ventures and Bessemer Venture Partners. Blumberg led the company’s seed round in 2018. It has now raised around $18.5 million and is not disclosing valuation.

The problem that Databand is solving is one that is getting more urgent and problematic by the day (as evidenced by this exponential yearly rise in zettabytes of data globally). And as data workloads continue to grow in size and use, they continue to become ever more complex.

On top of that, today there are a wide range of applications and platforms that a typical organization will use to manage source material, storage, usage and so on. That means when there are glitches in any one data source, it can be a challenge to identify where and what the issue can be. Doing so manually can be time-consuming, if not impossible.

“Our users were in a constant battle with ETL (extract transform load) logic,” said Benamram, who spoke to me from New York (the company is based both there and in Tel Aviv, and also has developers and operations in Kiev). “Users didn’t know how to organize their tools and systems to produce reliable data products.”

It is really hard to focus attention on failures, he said, when engineers are balancing analytics dashboards, how machine models are performing, and other demands on their time; and that’s before considering when and if a data supplier might have changed an API at some point, which might also throw the data source completely off.

And if you’ve ever been on the receiving end of that data, you know how frustrating (and perhaps more seriously, disastrous) bad data can be. Benamram said that it’s not uncommon for engineers to completely miss anomalies and for them to only have been brought to their attention by “CEO’s looking at their dashboards and suddenly thinking something is off.” Not a great scenario.

Databand’s approach is to use big data to better handle big data: it crunches various pieces of information, including pipeline metadata like logs, runtime info and data profiles, along with information from Airflow, Spark, Snowflake and other sources, and puts the resulting data into a single platform, to give engineers a single view of what’s happening and better see where bottlenecks or anomalies are appearing, and why.

There are a number of other companies building data observability tools — Splunk perhaps is one of the most obvious, but also smaller players like Thundra and Rivery. These companies might step further into the area that Databand has identified and is fixing, but for now Databand’s focus specifically on identifying and helping engineers fix anomalies has given it a strong profile and position.

Accel partner Seth Pierrepont said that Databand came to the VC’s attention in perhaps the best way it could: Accel needed a solution like it for its own internal work.

“Data pipeline observability is a challenge that our internal data team at Accel was struggling with. Even at our relatively small scale, we were having issues with the reliability of our data outputs on a weekly basis, and our team found Databand as a solution,” he said. “As companies in all industries seek to become more data driven, Databand delivers an essential product that ensures the reliable delivery of high-quality data for businesses. Josh, Victor and Evgeny have a wealth of experience in this area, and we’ve been impressed with their thoughtful and open approach to helping data engineers better manage their data pipelines with Databand.”

The company is also used by data teams from large Fortune 500 enterprises to smaller startups.

Powered by WPeMatico

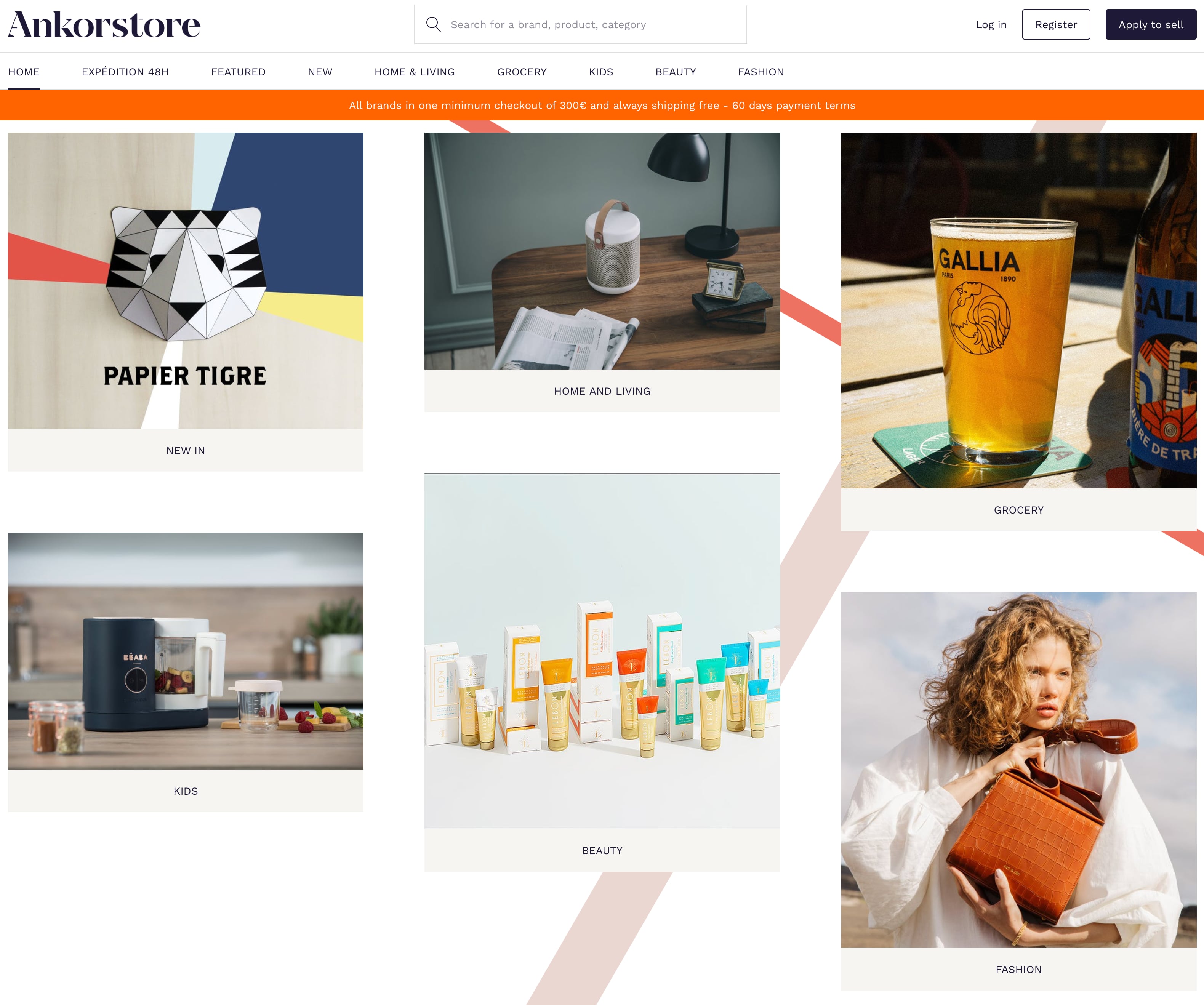

French startup Ankorstore has raised a $29.9 million Series A round (€25 million) with Index Ventures leading the round. Existing investors GFC, Alven and Aglaé are also participating.

Ankorstore is building a wholesale marketplace that connects independent shop owners with brands selling household supplies, maple syrup, headbands, bath salts, stationery items and a lot more. That list alone should remind you of neighborhood stores that sell a ton of cutesy stuff that you don’t necessarily need but that tend to be popular.

The company works with 2,000 brands and 15,000 shops. And the startup isn’t just connecting buyers and sellers, as it has a clear set of rules. For instance, the minimum first order is €100, which means that you can try out new products without ordering hundreds of items at once.

By default, Ankorstore withdraws the money 60 days after placing an order. Brands get paid upon delivery. And of course, buying from several brands through Ankorstore should simplify your admin tasks.

Ankorstore is currently live in eight countries — France, Spain, Austria, Germany, Belgium, Holland, Switzerland and Luxembourg. France is the biggest market followed by Germany. Up next, the startup plans to launch in the U.K. in 2021.

In many ways, Ankorstore reminds me of Faire, the wholesale marketplace that has raised hundreds of millions of dollars in the U.S.

“There are a number of different retail marketplaces connecting retailers with makers and brands. Where we believe we differ is in our clear focus on the independent shop owner, offering the tools and the terms that make it really easy and cost-effective to discover and access some of the most desirable up-and-coming brands,” Ankorstore co-founder Pierre-Louis Lacoste said.

Given that the startup is working with small suppliers, chances are they’re only selling their products in Europe. So there should be enough room for a European leader in that space that I would describe as wholesale Etsy-style marketplaces with a strong focus on curation.

Image Credits: Ankorstore

Powered by WPeMatico

Theodoric Chew, co-founder and chief executive officer of mental health app Intellect

Intellect, a Singapore-based startup that wants to lower barriers to mental health care in Asia, says it has reached more than one million users just six months after launching. Google also announced today that the startup’s consumer app, also called Intellect, is one of its picks for best personal growth apps of 2020.

The company recently closed an undisclosed seed round led by Insignia Ventures Partners . Angel investors including e-commerce platform Carousell co-founder and chief executive officer Quek Siu Rui; former Sequoia partner Tim Lee; and startup consultancy xto10x’s Southeast Asia CEO J.J. Chai also participated.

In a statement, Insignia Ventures Partners principal Samir Chaibi said, “In Intellect, we see a fast-scaling platform addressing a pain that has become very obvious amidst the COVID-19 pandemic. We believe that pairing clinically-backed protocols with an efficient mobile-first delivery is the key to break down the barriers to access for millions of patients globally.”

Co-founder and chief executive officer Theodoric Chew launched Intellect earlier this year because while there is a growing pool of mental wellness apps in the United States and Europe that have attracted more funding during the COVID-19 pandemic, the space is still very young in Asia. Intellect’s goal is to encourage more people to incorporate mental health care into their daily routines by lowering barriers like high costs and social stigma.

Intellect offers two products. One is a consumer app with self-guided programs based on cognitive behavioral therapy techniques that center on issues like anxiety, self-esteem or relationship issues.

The other is a mental health platform for employers to offer as a benefit and includes a recently launched telehealth service called Behavioural Health Coaching that connects users with mental health professionals. The service, which includes one-on-one video sessions and unlimited text messaging, is now a core part of Intellect’s services, Chew told TechCrunch.

Intellect’s enterprise product now reaches 10,000 employees, and its clients include tech companies, regional operations for multinational corporations and hospitals. Most are located in Singapore, Hong Kong, Indonesia and India, and range in size from 100 to more than 3,000 employees.

For many small to mid-sized employers, Intellect is often the first mental health benefit they have offered. Larger clients may already have EAP (employee assistance programs), but Chew said those are often underutilized, with an average adoption rate of 1% to 2%. On the other hand, he said Intellect’s employee benefit program sees an average adoption rate of 30% in the first month after it is rolled out at a company.

Chew added that the COVID-19 pandemic has prompted more companies to address burnout and other mental health issues.

“In terms of larger trends, we’ve seen a huge spike in companies across the region having mental health and wellbeing of their employees being prioritized on their agenda,” said Chew. “In terms of user trends, we see a significantly higher utilization in work stress and burnout, anxiety and relationship-related programs.”

Intellect’s seed round will be used to expand in Asian markets and to help fund clinical research studies it is currently conducting with universities and organizations in Singapore, Australia and the United Kingdom.

Powered by WPeMatico

Materialize, the SQL streaming database startup built on top of the open-source Timely Dataflow project, announced a $32 million Series B investment led by Kleiner Perkins, with participation from Lightspeed Ventures.

While it was at it, the company also announced a previously unannounced $8 million Series A from last year, led by Lightspeed, bringing the total raised to $40 million.

These firms see a solid founding team that includes CEO Arjun Narayan, formerly of Cockroach Labs, and chief scientist Frank McSherry, who created the Timely Dataflow project on which the company is based.

Narayan says that the company believes fundamentally that every company needs to be a real-time company, and it will take a streaming database to make that happen. Further, he says the company is built using SQL because of its ubiquity, and the founders wanted to make sure that customers could access and make use of that data quickly without learning a new query language.

“Our goal is really to help any business to understand streaming data and build intelligent applications without using or needing any specialized skills. Fundamentally what that means is that you’re going to have to go to businesses using the technologies and tools that they understand, which is standard SQL,” Narayan explained.

Bucky Moore, the partner at Kleiner Perkins leading the B round, sees this standard querying ability as a key part of the technology. “As more businesses integrate streaming data into their decision-making pipelines, the inability to ask questions of this data with ease is becoming a non-starter. Materialize’s unique ability to provide SQL over streaming data solves this problem, laying the foundation for them to build the industry’s next great data platform,” he said.

They would naturally get compared to Confluent, a streaming database built on top of the Apache Kafka open-source streaming database project, but Narayan says his company uses straight SQL for querying, while Confluent uses its own flavor.

The company still is working out the commercial side of the house and currently provides a typical service offering for paying customers with support and a service agreement (SLA). The startup is working on a SaaS version of the product, which it expects to release some time next year.

They currently have 20 employees with plans to double that number by the end of next year as they continue to build out the product. As they grow, Narayan says the company is definitely thinking about how to build a diverse organization.

He says he’s found that hiring in general has been challenging during the pandemic, and he hopes that changes in 2021, but he says that he and his co-founders are looking at the top of the hiring funnel because otherwise, as he points out, it’s easy to get complacent and rely on the same network of people you have been working with before, which tends to be less diverse.

“The KPIs and the metrics we really want to use to ensure that we really are putting in the extra effort to ensure a diverse sourcing in your hiring pipeline and then following that through all the way through the funnel. That’s I think the most important way to ensure that you have a diverse [employee base], and I think this is true for every company,” he said.

While he is working remotely now, he sees having multiple offices with a headquarters in NYC when the pandemic finally ends. Some employees will continue to work remotely, with the majority coming into one of the offices.

Powered by WPeMatico

When you launch an application in the public cloud, you usually put everything on one provider, but what if you could choose the components based on cost and technology and have your database one place and your storage another?

That’s what Cast.ai says that it can provide, and today it announced a healthy $7.7 million seed round from TA Ventures, DNX, Florida Funders and other unnamed angels to keep building on that idea. The round closed in June.

Company CEO and co-founder Yuri Frayman says that they started the company with the idea that developers should be able to get the best of each of the public clouds without being locked in. They do this by creating Kubernetes clusters that are able to span multiple clouds.

“Cast does not require you to do anything except for launching your application. You don’t need to know […] what cloud you are using [at any given time]. You don’t need to know anything except to identify the application, identify which [public] cloud providers you would like to use, the percentage of each [cloud provider’s] use and launch the application,” Frayman explained.

This means that you could use Amazon’s RDS database and Google’s ML engine, and the solution decides how to make that work based on your requirements and price. You set the policies when you are ready to launch and Cast will take care of distributing it for you in the location and providers that you desire, or that makes most sense for your application.

The company takes advantage of cloud-native technologies, containerization and Kubernetes to break the proprietary barriers that exist between clouds, says company co-founder Laurent Gil. “We break these barriers of cloud providers so that an application does not need to sit in one place anymore. It can sit in several [providers] at the same time. And this is great for the Kubernetes application because they’re kind of designed with this [flexibility] in mind,” Gil said.

Developers use the policy engine to decide how much they want to control this process. They can simply set location and let Cast optimize the application across clouds automatically, or they can select at a granular level exactly the resources they want to use on which cloud. Regardless of how they do it, Cast will continually monitor the installation and optimize based on cost to give them the cheapest options available for their configuration.

The company currently has 25 employees with four new hires in the pipeline, and plans to double to 50 by the end of 2021. As they grow, the company is trying keep diversity and inclusion front and center in its hiring approach; they currently have women in charge of HR, marketing and sales at the company.

“We have very robust processes on the continuous education inside of our organization on diversity training. And a lot of us came from organizations where this was very visible and we took a lot of those processes [and lessons] and brought them here,” Frayman said.

Frayman has been involved with multiple startups, including Cujo.ai, a consumer firewall startup that participated in TechCrunch Disrupt Battlefield in New York in 2016.

Powered by WPeMatico

Dija, a new U.K.-based startup founded by senior former Deliveroo employees, is closing in on $20 million in funding, TechCrunch has learned.

According to multiple sources, the round, which has yet to close, is being led by Blossom Capital, the early-stage venture capital firm founded by ex-Index and LocalGlobe VC Ophelia Brown. It’s not clear who else is in the running, although I understand it was highly contested and the startup had offers from several top-tier funds. Blossom Capital and Dija declined to comment.

Playing in the convenience store and delivery space, yet to launch Dija is founded by Alberto Menolascina and Yusuf Saban, who both spent a number of years at Deliveroo in senior positions.

Menolascina was previously director of Corporate Strategy and Development at the takeout delivery behemoth and held several positions before that. He also co-founded Everli (formerly Supermercato24), the Instacart-styled grocery delivery company in Italy, and also worked at Just Eat.

Saban is the former chief of staff to CEO at Deliveroo and also worked at investment bank Morgan Stanley.

In other words, both are seasoned operators in food logistics, from startups to scale-ups. Both Menolascina and Saban were also instrumental in Deliveroo’s Series D, E and F funding rounds.

Meanwhile, few details are public about Dija, except that it will offer convenience and fresh food delivery using a “dark” convenience store mode, seeing it build out hyper local fulfilment centers in urban high population areas for super quick delivery. It’s likely akin to Accel and SoftBank-backed goPuff in the U.S. or perhaps startup Weezy in the U.K.

That said, the model is yet to be proven everywhere it’s been tried and will likely be a capital intensive race in which Dija is off to a good start. And, of course, with everybody making the shift to online groceries while in a pandemic, as ever, timing is everything.

Powered by WPeMatico

With $90 million in deposits and $18.25 million in new financing, HMBradley is making moves as the Los Angeles-based entrant into the challenger bank competition.

LA is home to a growing community of financial services startups, and HMBradley is quickly taking its place among the leaders with a novel twist on the banking business.

Unlike most banking startups that woo customers with easy credit and savvy online user interfaces, HMBradley is pitching a better savings account.

The company offers up to 3% interest on its savings accounts, much higher than most banks these days, and it’s that pitch that has won over consumers and investors alike, according to the company’s co-founder and chief executive, Zach Bruhnke.

With climbing numbers on the back of limited marketing, Bruhnke said raising the company’s latest round of financing was a breeze.

“They knew after the first call that they wanted to do it,” Brunke said of the negotiations with the venture capital firm Acrew, a venture firm whose previous exposure to fintech companies included backing the challenger bank phenomenon which is Chime . “It was a very different kind of fundraise for us. Our seed round was a terrible, treacherous 16-month fundraise,” Brunke said.

For Acrew’s part, the company actually had to call Chime’s founder to ensure that the company was okay with the venture firm backing another entrant into the banking business. Once the approval was granted, Brunke said the deal was smooth sailing.

Acrew, Chime and HMBradley’s founders see enough daylight between the two business models that investing in one wouldn’t be a conflict of interest with the other. And there’s plenty of space for new entrants in the banking business, Bruhnke said. “It’s a very, very large industry as a whole,” he said.

As the company grows its deposits, Bruhnke said there will be several ways it can leverage its capital. That includes commercial lending on the back end of HMBradley’s deposits and other financial services offerings to grow its base.

For now, it’s been wooing consumers with one-click credit applications and the high interest rates it offers to its various tiers of savers.

“When customers hit that 3% tier they get really excited,” Bruhnke said. “If you’re saving money and you’re not saving to HMBradley then you’re losing money.”

The money that HMBradley raised will be used to continue rolling out its new credit product and hiring staff. It already poached the former director of engineering at Capital One, Ben Coffman, and fintech thought leader Saira Rahman, the company said.

In October, the company said, deposits doubled month-over-month and transaction volume has grown to over $110 million since it launched in April.

Since launching the company’s cash back credit card in July, HMBradley has been able to pitch customers on 3% cash back for its highest tier of savers — giving them the option to earn 3.5% on their deposits.

The deposit and lending capabilities the company offers are possible because of its partnership with the California-based Hatch Bank, the company said.

Powered by WPeMatico

U.S. challenger bank Current, which has doubled its member base in less than six months, announced this morning it raised $131 million in Series C funding, led by Tiger Global Management. The additional financing brings Current to over $180 million in total funding to date, and gives the company a valuation of $750 million.

The round also brought in new investors Sapphire Ventures and Avenir. Existing investors returned for the Series C, as well, including Foundation Capital, Wellington Management Company and QED.

Current began as a teen debit card controlled by parents, but expanded to offer personal checking accounts last year, using the same underlying banking technology. The service today competes with a range of mobile banking apps, offering features like free overdrafts, no minimum balance requirements, faster direct deposits, instant spending notifications, banking insights, check deposits using your phone’s camera and other now-standard baseline features for challenger banks.

In August 2020, Current debuted a points rewards program in an effort to better differentiate its service from the competition, which as of this month now includes Google Pay.

When Current raised its Series B last fall, it had over 500,000 accounts on its service. Today, it touts over 2 million members. Revenue has also grown, increasing by 500% year-over-year, the company noted today.

“We have seen a demonstrated need for access to affordable banking with a best-in-class mobile solution that Current is uniquely suited to provide,” said Current founder and CEO Stuart Sopp, in a statement about the fundraise. “We are committed to building products specifically to improve the financial outcomes of the millions of hard-working Americans who live paycheck to paycheck, and whose needs are not being properly served by traditional banks. With this new round of funding we will continue to expand on our mission, growth and innovation to find more ways to get members their money faster, help them spend it smarter and help close the financial inequality gap,” he added.

The additional funds will be used to further develop and expand Current’s mobile banking offerings, the company says.

Powered by WPeMatico

Supply chains used to be one of those magical elements of capitalism that seemed to be designed by Apple: they just worked. Minus the occasional salmonella outbreak in your vegetable aisle, we could go about our daily consumer lives never really questioning how our fast-fashion clothes, tech gadgets and medical supplies actually got to our shelves or homes.

Of course, a lot has changed over the past few years. Anti-globalization sentiment has grown as a political force, driving governments like the United States and the United Kingdom to renegotiate free trade agreements and attempt to onshore manufacturing while disrupting the trade status quo. Meanwhile, the COVID-19 pandemic placed huge stress on supply chains — with some entirely breaking in the process.

In short, supply chain managers suddenly went from one of those key functions that no one wants to think about, to one of those key functions that everyone thinks about all the time.

While these specialists have access to huge platforms from companies like Oracle and SAP, they need additional intelligence to understand where these supply chains could potentially break. Are there links in the supply chain that might be more brittle than at first glance? Are there factories in the supply chain that are on alert lists for child labor or environmental violations? What if government trade policy shifts — are we at risk of watching products sit in a cargo container at a port?

New York-headquartered Altana wants to be that intelligence layer for supply chain management, bringing data and machine learning to bear against the complexity of modern capitalism. Today, the company announced that it has raised $7 million in seed financing led by Anne Glover of London-based Amadeus Capital Partners.

The three founders of the startup, CEO Evan Smith, CTO Peter Swartz and COO Raphael Tehranian, all worked together on Panjiva, a global supply chain platform that was founded in 2006, funded by Battery Ventures a decade ago, and sold to S&P Global in early 2018. Panjiva’s goal was to build a “graph” of supply chains that would offer intelligence to managers.

That direct experience informs Altana’s vision, which in many ways is the same as Panjiva’s but perhaps revamped using newer technology and data science. Again, Altana wants to build a supply chain knowledge graph, provide intelligence to managers and create better resilience.

The difference has to do with data. “What we continually found when we were in the data sales business was that you are kind of stuck in that place in the value chain,” Smith said. “Your customers won’t let you touch their data, because they don’t trust you with it, and other proprietary data companies don’t let you work on and manage and transform their data.”

Instead of trying to be the central repository for all data, Altana is “operating downstream” from all of these data sources, allowing companies to build their own supply chain graphs using their own data and whatever other data sources to which they have access.

The company sells into procurement offices, which are typically managed in the CFO’s office. Today, the majority of customers for Altana are government clients such as border control, where “the task is to pick the needles out of the haystack as the ship arrives and you’ve got to pick the illicit shipments from the safe ones and actually facilitate the lawful trade,” Smith said.

The company’s executive chairman is Alan Bersin, who is a former commissioner of the U.S. Customs and Border Protection agency currently working as a policy consultant for Covington & Burling, which has been one of the premier law firms on trade issues like CFIUS during the Trump administration.

Altana allows one-off investigations and simulations, but its major product goal is to offer real-time alerts that give supply chain managers substantive visibility into changes that affect their business. For instance, rather than waiting for an annual labor or environmental audit to find issues, Altana hopes to provide predictive capabilities that allow companies to solve problems much faster than before.

In addition to Amadeus, Schematic Ventures, AlleyCorp and the Working Capital – The Supply Chain Investment Fund also participated.

Powered by WPeMatico

Consumer drones have over the years struggled with an image of being no more than expensive and delicate toys. But applications in industrial, military and enterprise scenarios have shown that there is indeed a market for unmanned aerial vehicles, and today, a startup that makes drones for some of those latter purposes is announcing a large round of funding and a partnership that provides a picture of how the drone industry will look in years to come.

Percepto, which makes drones — both the hardware and software — to monitor and analyze industrial sites and other physical work areas largely unattended by people, has raised $45 million in a Series B round of funding.

Alongside this, it is now working with Boston Dynamics and has integrated its Spot robots with Percepto’s Sparrow drones, with the aim being better infrastructure assessments, and potentially more as Spot’s agility improves.

The funding is being led by a strategic backer, Koch Disruptive Technologies, the investment arm of industrial giant Koch Industries (which has interests in energy, minerals, chemicals and related areas), with participation also from new investors State of Mind Ventures, Atento Capital, Summit Peak Investments and Delek-US. Previous investors U.S. Venture Partners, Spider Capital and Arkin Holdings also participated. (It appears that Boston Dynamics and SoftBank are not part of this investment.)

Israel-based Percepto has now raised $72.5 million since it was founded in 2014, and it’s not disclosing its valuation, but CEO and founder Dor Abuhasira described as “a very good round.”

“It gives us the ability to create a category leader,” Abuhasira said in an interview. It has customers in around 10 countries, with the list including ENEL, Florida Power and Light and Verizon.

While some drone makers have focused on building hardware, and others are working specifically on the analytics, computer vision and other critical technology that needs to be in place on the software side for drones to work correctly and safely, Percepto has taken what I referred to, and Abuhasira confirmed, as the “Apple approach”: vertical integration as far as Percepto can take it on its own.

That has included hiring teams with specializations in AI, computer vision, navigation and analytics as well as those strong in industrial hardware — all strong areas in the Israel tech landscape, by virtue of it being so closely tied with its military investments. (Note: Percepto does not make its own chips: these are currently acquired from Nvidia, he confirmed to me.)

“The Apple approach is the only one that works in drones,” he said. “That’s because it is all still too complicated. For those offering an Android-style approach, there are cracks in the complete flow.”

It presents the product as a “drone-in-a-box”, which means in part that those buying it have little work to do to set it up to work, but also refers to how it works: its drones leave the box to make a flight to collect data, and then return to the box to recharge and transfer more information, alongside the data that is picked up in real time.

The drones themselves operate on an on-demand basis: they fly in part for regular monitoring, to detect changes that could point to issues; and they can also be launched to collect data as a result of engineers requesting information. The product is marketed by Percepto as “AIM”, short for autonomous site inspection and monitoring.

News broke last week that Amazon has been reorganising its Prime Air efforts — one sign of how some more consumer-facing business applications — despite many developments — may still have some turbulence ahead before they are commercially viable. Businesses like Percepto’s stand in contrast to that, with their focus specifically on flying over, and collecting data, in areas where there are precisely no people present.

It has dovetailed with a bigger focus from industries on the efficiencies (and cost savings) you can get with automation, which in turn has become the centerpiece of how industry is investing in the buzz phrase of the moment, “digital transformation.”

“We believe Percepto AIM addresses a multi-billion-dollar issue for numerous industries and will change the way manufacturing sites are managed in the IoT, Industry 4.0 era,” said Chase Koch, president of Koch Disruptive Technologies, in a statement. “Percepto’s track record in autonomous technology and data analytics is impressive, and we believe it is uniquely positioned to deliver the remote operations center of the future. We look forward to partnering with the Percepto team to make this happen.”

The partnership with Boston Dynamics is notable for a couple of reasons: it speaks to how various robotics hardware will work together in tandem in an automated, unmanned world, and it speaks to how Boston Dynamics is pulling up its socks.

On the latter front, the company has been making waves in the world of robotics for years, specifically with its agile and strong dog-like (with names like “Spot” and “Big Dog”) robots that can cover rugged terrain and handle tussles without falling apart.

That led it into the arms of Google, which acquired it as part of its own secretive moonshot efforts, in 2013. That never panned out into a business, and probably gave Google more complicated optics at a time when it was already being seen as too powerful. Then, SoftBank stepped in to pick it up, along with other robotics assets, in 2017. That hasn’t really gone anywhere either, it seems, and just this month it was reported that Boston Dynamics was reportedly facing yet another suitor, Hyundai.

All of this is to say that partnerships with third parties that are going places (quite literally) become strong signs of how Boston Dynamics’ extensive R&D investments might finally pay off with enterprising dividends.

Indeed, while Percepto has focused on its own vertical integration, longer term and more generally there is an argument to be made for more interoperability and collaboration between the various companies building “connected” and smart hardware for industrial, physical applications.

It means that specific industries can focus on the special equipment and expertise they require, while at the same time complementing that with hardware and software that are recognised as best-in-class. Abuhasira said that he expects the Boston Dynamics partnership to be the first of many.

That makes this first one an interesting template. The partnership will see Spot carrying Percepto’s payloads for high-resolution imaging and thermal vision “to detect issues including hot spots on machines or electrical conductors, water and steam leaks around plants and equipment with degraded performance, with the data relayed via AIM.” It will also mean a more thorough picture, beyond what you get from the air. And, potentially, you might imagine a time in the future when the data that the combined devices source results even in Spot (or perhaps a third piece of autonomous hardware) carrying out repairs or other assistance.

“Combining Percepto’s Sparrow drone with Spot creates a unique solution for remote inspection,” said Michael Perry, VP of Business Development at Boston Dynamics, in a statement. “This partnership demonstrates the value of harnessing robotic collaborations and the insurmountable benefits to worker safety and cost savings that robotics can bring to industries that involve hazardous or remote work.”

Powered by WPeMatico